Form 425 DYNEGY INC. Filed by: Vistra Energy Corp.

Filed by Vistra Energy Corp.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Dynegy Inc.

Commission File Number: 001-33443

Vistra Energy Corp. (“Vistra”) issued the following presentation on its website at www.vistraenergy.com relating to financial results for the year ended 2017 and describes certain aspects of the proposed combined company as contemplated by that certain Agreement and Plan of Merger, dated as of October 29, 2017 (the “Merger Agreement”), by and between Vistra and Dynegy Inc.

Vistra Energy 2017 Results February 26, 2018

Safe Harbor Statements Cautionary Note Regarding Forward-Looking Statements The information presented herein includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements, which are based on current expectations, estimates and projections about the industry and markets in which Vistra Energy operates and beliefs of and assumptions made by Vistra Energy’s management, involve risks and uncertainties, which are difficult to predict and are not guarantees of future performances, that could significantly affect the financial results of Vistra Energy or the combined company. All statements, other than statements of historical facts, are forward-looking statements. These statements are often, but not always, made through the use of words or phrases such as “may,” “might,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “shall,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “project,” “forecast,” “goal,” “target,” “would,” “guidance,” and “outlook,” or the negative variations of those words or other comparable words of a future or forward-looking nature. Readers are cautioned not to place undue reliance on forward-looking statements. Although Vistra Energy believes that in making any such forward-looking statement, Vistra Energy’s expectations are based on reasonable assumptions, any such forward-looking statement involves uncertainties and risks that could cause results to differ materially from those projected in or implied by any such forward-looking statement, including but not limited to (i) the failure to consummate or delay in consummating the proposed merger transaction between Vistra Energy and Dynegy; (ii) the risk that a condition to closing of the proposed transaction may not be satisfied; (iii) the risk that a regulatory approval that may be required for the proposed transaction is delayed, is not obtained, or is obtained subject to conditions that are not anticipated or that cause the parties to abandon the proposed transaction; (iv) the effect of the announcement of the proposed transaction on Vistra Energy’s relationship with its customers and its operating results and businesses generally (including the diversion of management time on transaction-related issues); (v) the risk that the credit ratings of the combined company or its subsidiaries are different from what Vistra Energy expects; (vi) adverse changes in general economic or market conditions (including changes in interest rates) or changes in political conditions or federal or state laws and regulations; (vii) the ability of the combined company to execute upon the strategic and performance initiatives contemplated herein (including the risk that Vistra Energy’s businesses will not be integrated successfully or that the cost savings, synergies and growth from the proposed transaction will not be fully realized or may take longer to realize than expected); (viii) there may be changes in the trading prices of Vistra Energy’s and Dynegy’s common stock prior to the closing of the proposed transaction; and (ix) those additional risks and factors discussed in reports filed with the SEC by Vistra Energy from time to time, including (a) the uncertainties and risks discussed in the sections entitled “Risk Factors” and “Special Note Regarding Forward-Looking Statements” in Vistra Energy’s prospectus filed with the SEC pursuant to Rule 424(b) of the Securities Act on May 9, 2017 (as supplemented), and (b) the uncertainties and risks discussed in the sections entitled “Risk Factors” and “Forward-Looking Statements” in the Dynegy’s annual report on Form 10-K for the fiscal year ended December 31, 2017. Any forward-looking statement speaks only at the date on which it is made, and except as may be required by law, Vistra Energy undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which it is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible to predict all of them; nor can Vistra Energy assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. Disclaimer Regarding Industry and Market Data Certain industry and market data used in this presentation is based on independent industry publications, government publications, reports by market research firms or other published independent sources, including certain data published by ERCOT, the PUCT and NYMEX. We did not commission any of these publications, reports or other sources. Some data is also based on good faith estimates, which are derived from our review of internal surveys, as well as the independent sources listed above. Industry publications, reports and other sources generally state that they have obtained information from sources believed to be reliable, but do not guarantee the accuracy and completeness of such information. While we believe that each of these publications, reports and other sources is reliable, we have not independently investigated or verified the information contained or referred to therein and make no representation as to the accuracy or completeness of such information. Forecasts are particularly likely to be inaccurate, especially over long periods of time, and we often do not know what assumptions were used in preparing such forecasts. Statements regarding industry and market data used in this presentation involve risks and uncertainties and are subject to change based on various factors, including those discussed above under the heading “Cautionary Note Regarding Forward-Looking Statements”.

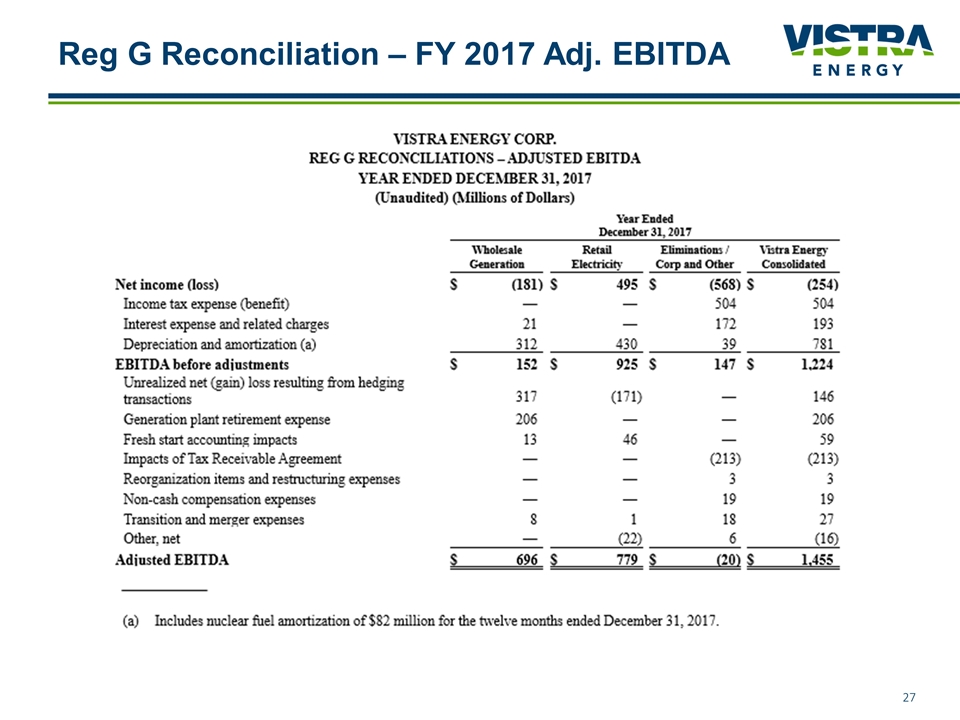

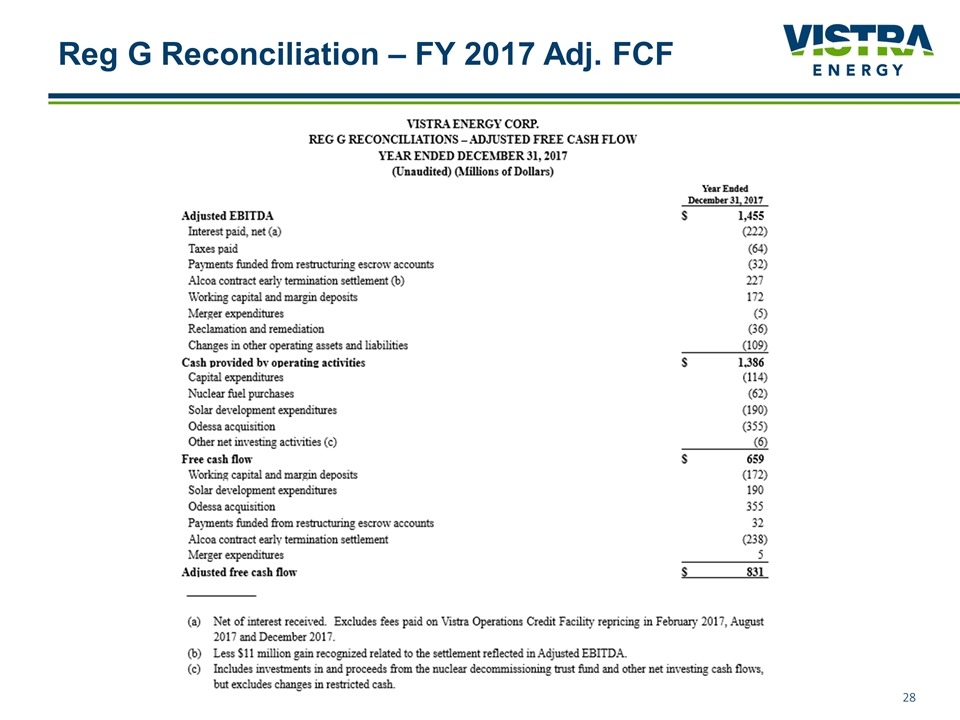

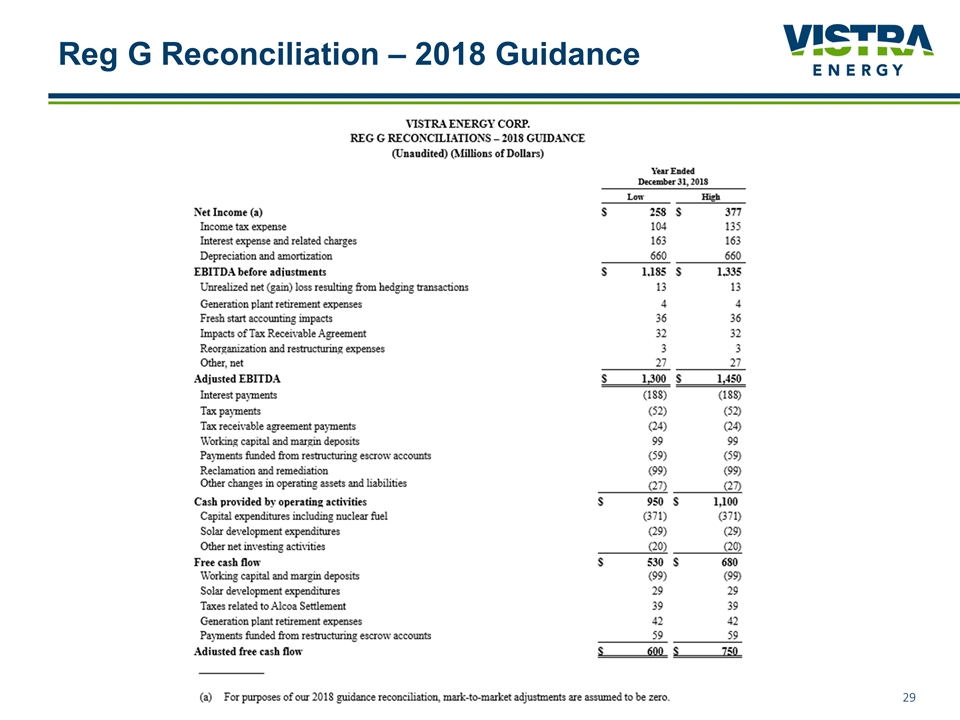

Safe Harbor Statements, Continued Information About Non-GAAP Financial Measures and Items Affecting Comparability “Adjusted EBITDA” (EBITDA as adjusted for unrealized gains or losses from hedging activities, tax receivable agreement obligations, reorganization items, and certain other items described from time to time in Vistra Energy’s earnings releases), “adjusted free cash flow” (cash from operating activities excluding changes in margin deposits and working capital and adjusted for capital expenditures, other net investment activities, preferred stock dividends, and other items described from time to time in Vistra Energy’s earnings releases), “Ongoing Operations adjusted EBITDA” (adjusted EBITDA less adjusted EBITDA from new Asset Closure segment) and “free cash flow from Ongoing Operations” (adjusted free cash flow less cash flow from operating activities from new Asset Closure segment), are “non-GAAP financial measures.” A non-GAAP financial measure is a numerical measure of financial performance that excludes or includes amounts so as to be different than the most directly comparable measure calculated and presented in accordance with GAAP in Vistra Energy’s consolidated statements of operations, comprehensive income, changes in stockholders’ equity and cash flows. Non-GAAP financial measures should not be considered in isolation or as a substitute for the most directly comparable GAAP measures. Vistra Energy’s non-GAAP financial measures may be different from non-GAAP financial measures used by other companies. Vistra Energy uses adjusted EBITDA as a measure of performance and believes that analysis of its business by external users is enhanced by visibility to both net income prepared in accordance with GAAP and adjusted EBITDA. Vistra Energy uses adjusted free cash flow as a measure of liquidity and believes that analysis of its ability to service its cash obligations is supported by disclosure of both cash provided by (used in) operating activities prepared in accordance with GAAP as well as adjusted free cash flow. Vistra Energy uses Ongoing Operations adjusted EBITDA and free cash flow from ongoing operations as a measure of performance and Vistra Energy’s management and board of directors have found it informative to view the Asset Closure segment as separate and distinct from Vistra Energy’s ongoing operations. The schedules in the appendix to this presentation reconcile the non-GAAP financial measures to the most directly comparable financial measures calculated and presented in accordance with U.S. GAAP. Additional Information About the Transaction and Where to Find It This communication relates to the proposed merger pursuant to the terms of the Agreement and Plan of Merger, dated as of October 29, 2017, by and between Vistra Energy and Dynegy. The proposed transaction will be submitted to the respective stockholders of Dynegy and Vistra Energy for their consideration. In connection with the proposed merger, Vistra Energy has filed with the SEC a registration statement on Form S-4 that includes a joint proxy statement of Vistra Energy and Dynegy that also constitutes a prospectus of Vistra Energy (the “joint proxy statement”), which joint proxy statement which has been mailed or otherwise disseminated to Vistra Energy stockholders and Dynegy stockholders. Vistra Energy and Dynegy also plan to file other relevant documents with the SEC regarding the proposed transaction. INVESTORS ARE URGED TO READ THE JOINT PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT VISTRA ENERGY, DYNEGY, THE PROPOSED MERGER AND RELATED MATTERS. You may obtain a free copy of the joint proxy statement and other relevant documents (if and when they become available) filed by Vistra Energy and Dynegy with the SEC at the SEC’s website at www.sec.gov. Copies of the documents filed by Vistra Energy with the SEC will be available free of charge on Vistra Energy’s website at www.vistraenergy.com or by contacting Vistra Energy Investor Relations at 214-812-0046 or at [email protected]. Copies of the documents filed by Dynegy with the SEC will be available free of charge on Dynegy’s website at www.dynegy.com or by contacting Dynegy Investor Relations at (713) 507-6466 or at [email protected]. Certain Information Regarding Participants in the Solicitation Vistra Energy and Dynegy and certain of their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed merger. You can find information about Vistra Energy’s directors and executive officers in Vistra Energy’s prospectus filed with the SEC pursuant to Rule 424(b) of the Securities Act on May 9, 2017 (as supplemented), and on its website at www.vistraenergy.com. You can find information about Dynegy’s directors and executive officers in its proxy statement for its 2017 annual meeting of stockholders, which was filed with the SEC on March 30, 2017, and on its website at www.dynegy.com. Additional information regarding the interests of such potential participants will be included in the joint proxy statement and other relevant documents filed with the SEC if and when they become available. You may obtain free copies of these documents from Vistra Energy or Dynegy using the sources indicated above. No Offer of Solicitation This document and related presentation shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Agenda Welcome and Safe Harbor Molly Sorg, Vice President, Investor Relations 2017 Highlights and Operational Review Curt Morgan, President and Chief Executive Officer & Jim Burke, Chief Operating Officer Q4 Hot Topics Sara Graziano, SVP Corporate Development 2017 Financial Review Bill Holden, Chief Financial Officer Q&A

2017 Highlights & Operational Review Curt Morgan, President and Chief Executive Officer Jim Burke, Chief Operating Officer

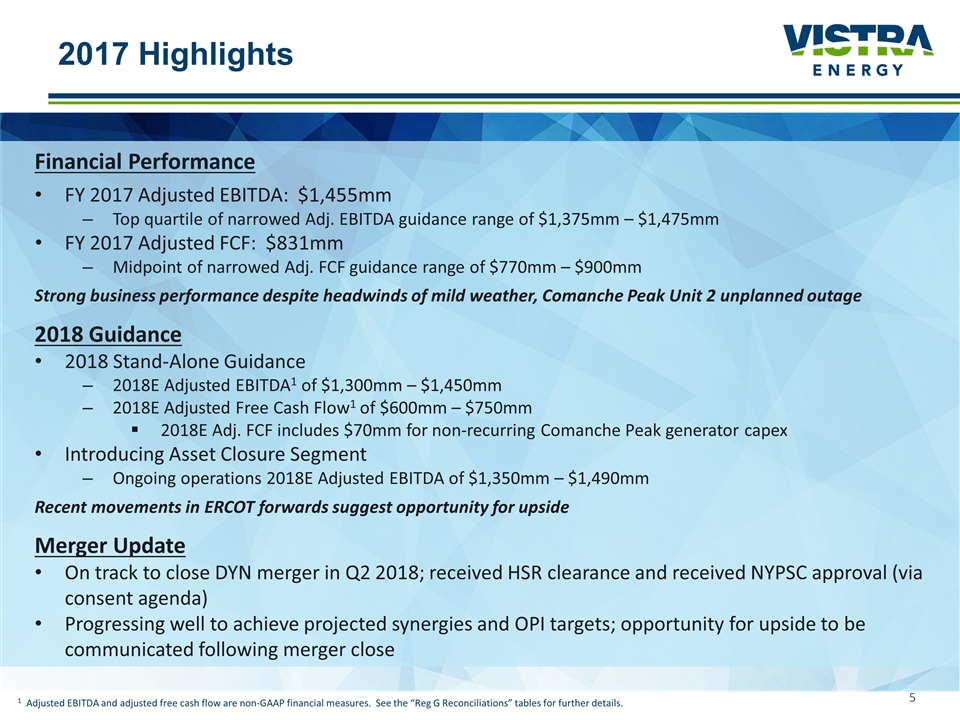

2017 Highlights Financial Performance FY 2017 Adjusted EBITDA: $1,455mm Top quartile of narrowed Adj. EBITDA guidance range of $1,375mm – $1,475mm FY 2017 Adjusted FCF: $831mm Midpoint of narrowed Adj. FCF guidance range of $770mm – $900mm Strong business performance despite headwinds of mild weather, Comanche Peak Unit 2 unplanned outage 2018 Guidance 2018 Stand-Alone Guidance 2018E Adjusted EBITDA1 of $1,300mm – $1,450mm 2018E Adjusted Free Cash Flow1 of $600mm – $750mm 2018E Adj. FCF includes $70mm for non-recurring Comanche Peak generator capex Introducing Asset Closure Segment Ongoing operations 2018E Adjusted EBITDA of $1,350mm – $1,490mm Recent movements in ERCOT forwards suggest opportunity for upside Merger Update On track to close DYN merger in Q2 2018; received HSR clearance and received NYPSC approval (via consent agenda) Progressing well to achieve projected synergies and OPI targets; opportunity for upside to be communicated following merger close 1 Adjusted EBITDA and adjusted free cash flow are non-GAAP financial measures. See the “Reg G Reconciliations” tables for further details.

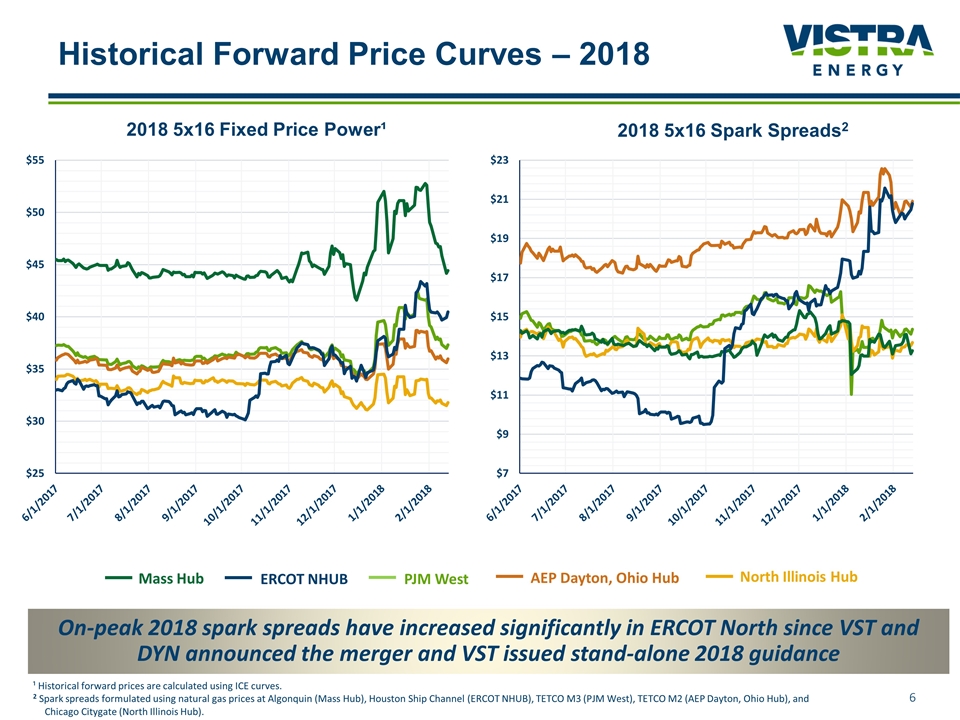

Historical Forward Price Curves – 2018 On-peak 2018 spark spreads have increased significantly in ERCOT North since VST and DYN announced the merger and VST issued stand-alone 2018 guidance ¹ Historical forward prices are calculated using ICE curves. 2 Spark spreads formulated using natural gas prices at Algonquin (Mass Hub), Houston Ship Channel (ERCOT NHUB), TETCO M3 (PJM West), TETCO M2 (AEP Dayton, Ohio Hub), and Chicago Citygate (North Illinois Hub). Mass Hub PJM West ERCOT NHUB North Illinois Hub AEP Dayton, Ohio Hub 2018 5x16 Fixed Price Power¹ 2018 5x16 Spark Spreads2

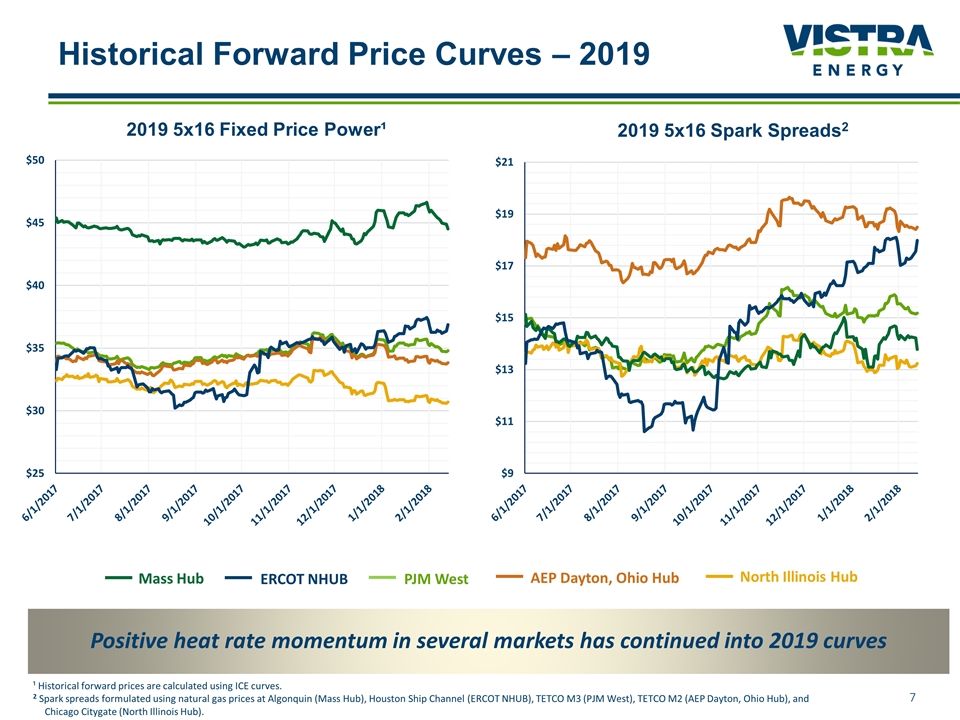

Historical Forward Price Curves – 2019 Positive heat rate momentum in several markets has continued into 2019 curves 2019 5x16 Fixed Price Power¹ 2019 5x16 Spark Spreads2 ¹ Historical forward prices are calculated using ICE curves. 2 Spark spreads formulated using natural gas prices at Algonquin (Mass Hub), Houston Ship Channel (ERCOT NHUB), TETCO M3 (PJM West), TETCO M2 (AEP Dayton, Ohio Hub), and Chicago Citygate (North Illinois Hub). Mass Hub PJM West ERCOT NHUB North Illinois Hub AEP Dayton, Ohio Hub

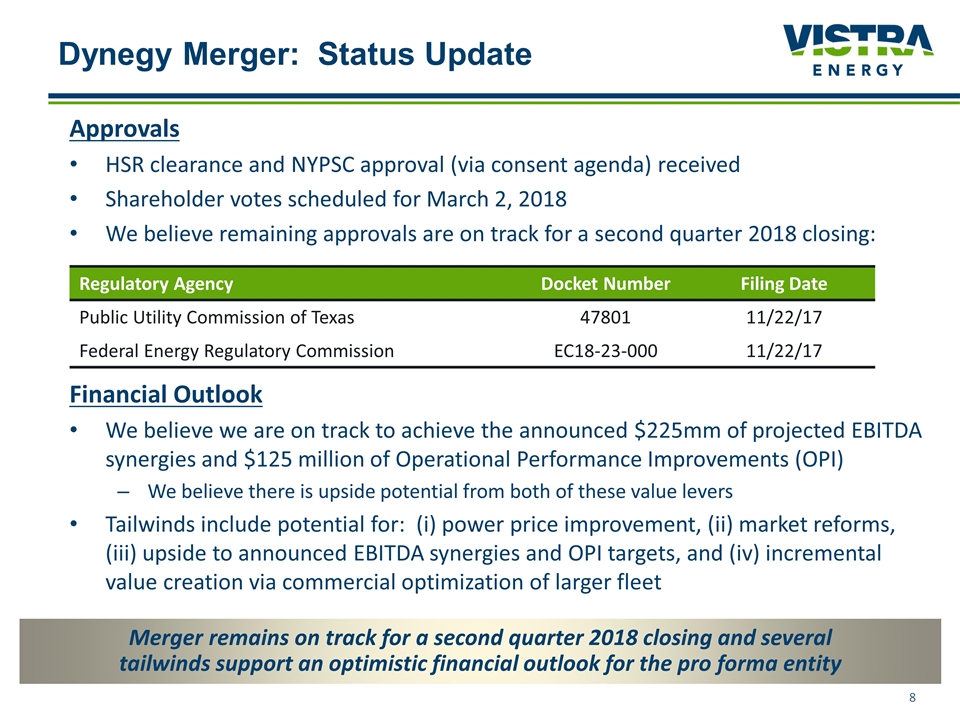

Dynegy Merger: Status Update Approvals HSR clearance and NYPSC approval (via consent agenda) received Shareholder votes scheduled for March 2, 2018 We believe remaining approvals are on track for a second quarter 2018 closing: Merger remains on track for a second quarter 2018 closing and several tailwinds support an optimistic financial outlook for the pro forma entity Regulatory Agency Docket Number Filing Date Public Utility Commission of Texas 47801 11/22/17 Federal Energy Regulatory Commission EC18-23-000 11/22/17 Financial Outlook We believe we are on track to achieve the announced $225mm of projected EBITDA synergies and $125 million of Operational Performance Improvements (OPI) We believe there is upside potential from both of these value levers Tailwinds include potential for: (i) power price improvement, (ii) market reforms, (iii) upside to announced EBITDA synergies and OPI targets, and (iv) incremental value creation via commercial optimization of larger fleet

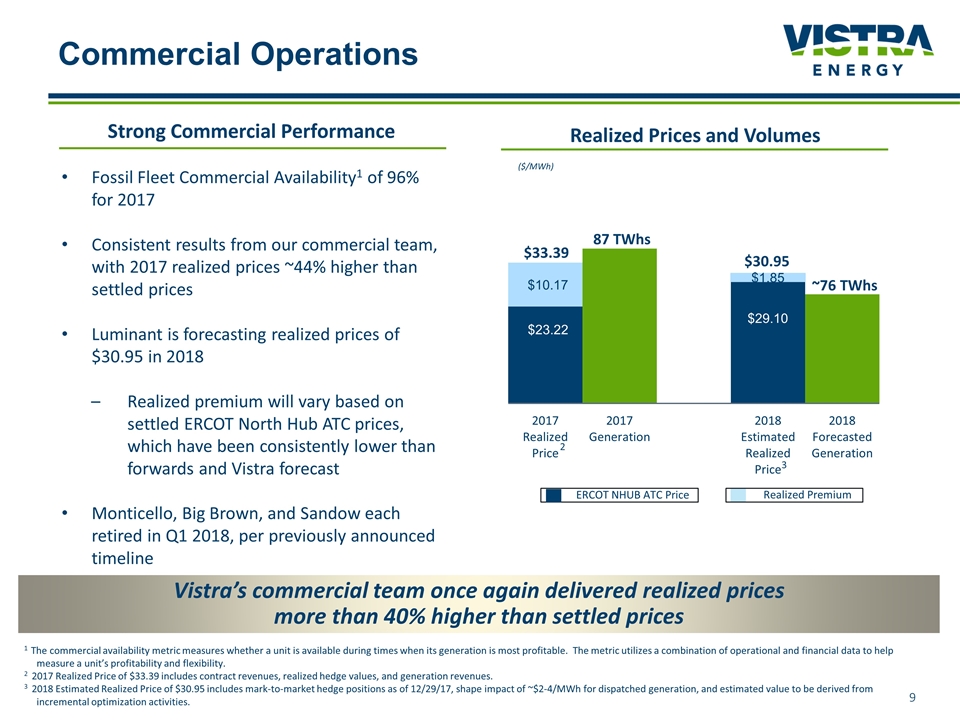

Commercial Operations Strong Commercial Performance Vistra’s commercial team once again delivered realized prices more than 40% higher than settled prices Fossil Fleet Commercial Availability1 of 96% for 2017 Consistent results from our commercial team, with 2017 realized prices ~44% higher than settled prices Luminant is forecasting realized prices of $30.95 in 2018 Realized premium will vary based on settled ERCOT North Hub ATC prices, which have been consistently lower than forwards and Vistra forecast Monticello, Big Brown, and Sandow each retired in Q1 2018, per previously announced timeline Realized Prices and Volumes ERCOT NHUB ATC Price Realized Premium 1 The commercial availability metric measures whether a unit is available during times when its generation is most profitable. The metric utilizes a combination of operational and financial data to help measure a unit’s profitability and flexibility. 2 2017 Realized Price of $33.39 includes contract revenues, realized hedge values, and generation revenues. 3 2018 Estimated Realized Price of $30.95 includes mark-to-market hedge positions as of 12/29/17, shape impact of ~$2-4/MWh for dispatched generation, and estimated value to be derived from incremental optimization activities. $33.39 $30.95 87 TWhs ~76 TWhs ($/MWh)

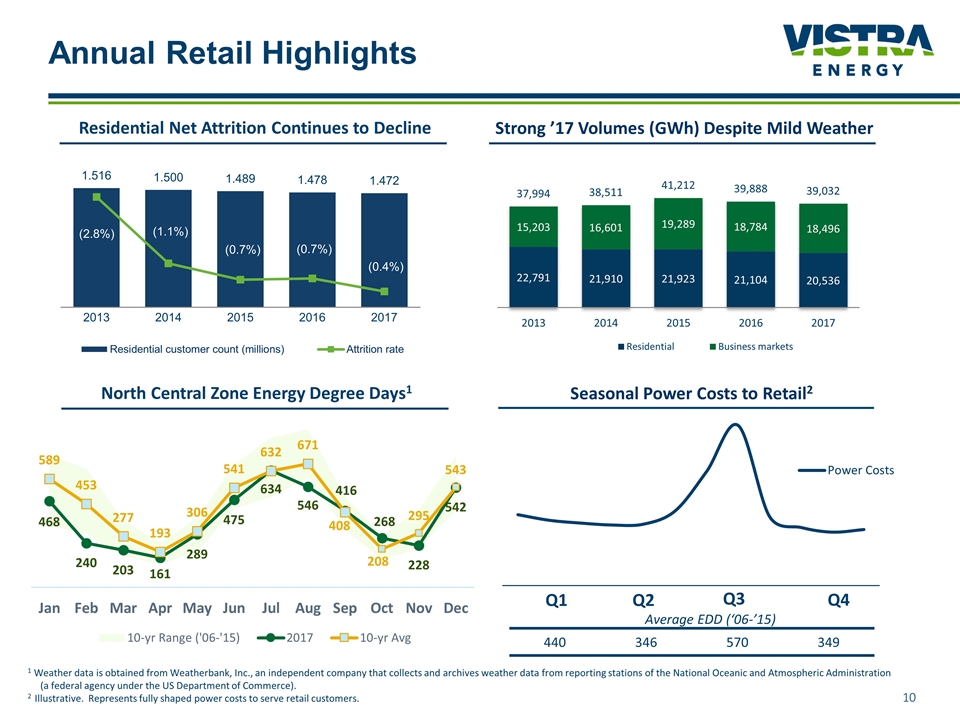

Annual Retail Highlights Residential Net Attrition Continues to Decline Strong ’17 Volumes (GWh) Despite Mild Weather North Central Zone Energy Degree Days1 1 Weather data is obtained from Weatherbank, Inc., an independent company that collects and archives weather data from reporting stations of the National Oceanic and Atmospheric Administration (a federal agency under the US Department of Commerce). 2 Illustrative. Represents fully shaped power costs to serve retail customers. Seasonal Power Costs to Retail2 440 346 570 349 Average EDD (‘06-’15) Q1 Q2 Q3 Q4

Q4 Hot Topics Sara Graziano, SVP Corporate Development

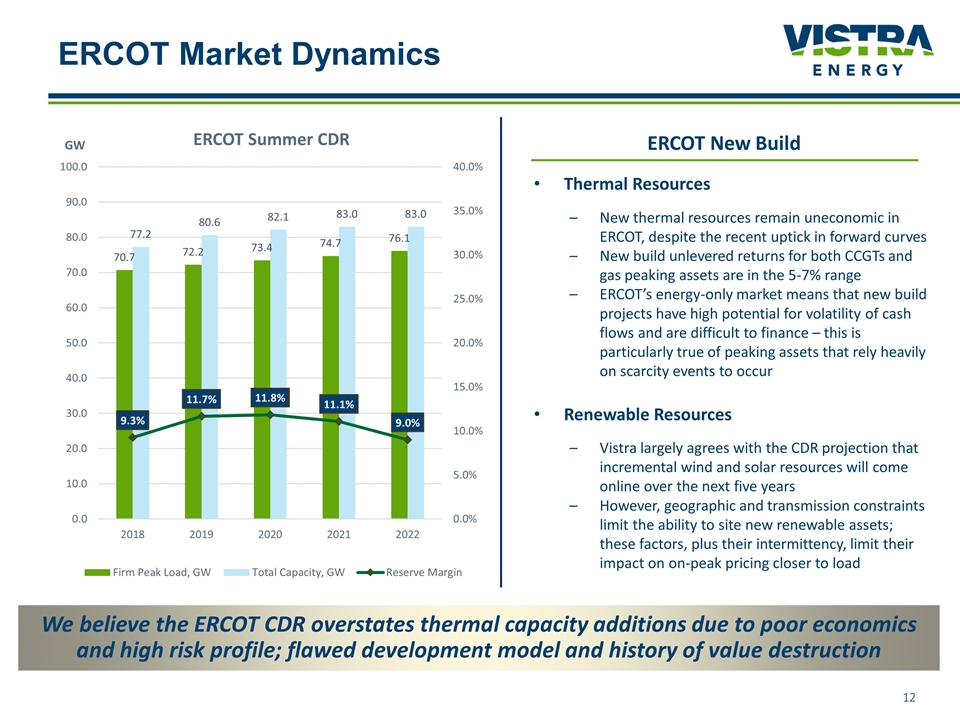

ERCOT Market Dynamics We believe the ERCOT CDR overstates thermal capacity additions due to poor economics and high risk profile; flawed development model and history of value destruction 1 ERCOT New Build Thermal Resources New thermal resources remain uneconomic in ERCOT, despite the recent uptick in forward curves New build unlevered returns for both CCGTs and gas peaking assets are in the 5-7% range ERCOT’s energy-only market means that new build projects have high potential for volatility of cash flows and are difficult to finance – this is particularly true of peaking assets that rely heavily on scarcity events to occur Renewable Resources Vistra largely agrees with the CDR projection that incremental wind and solar resources will come online over the next five years However, geographic and transmission constraints limit the ability to site new renewable assets; these factors, plus their intermittency, limit their impact on on-peak pricing closer to load 1

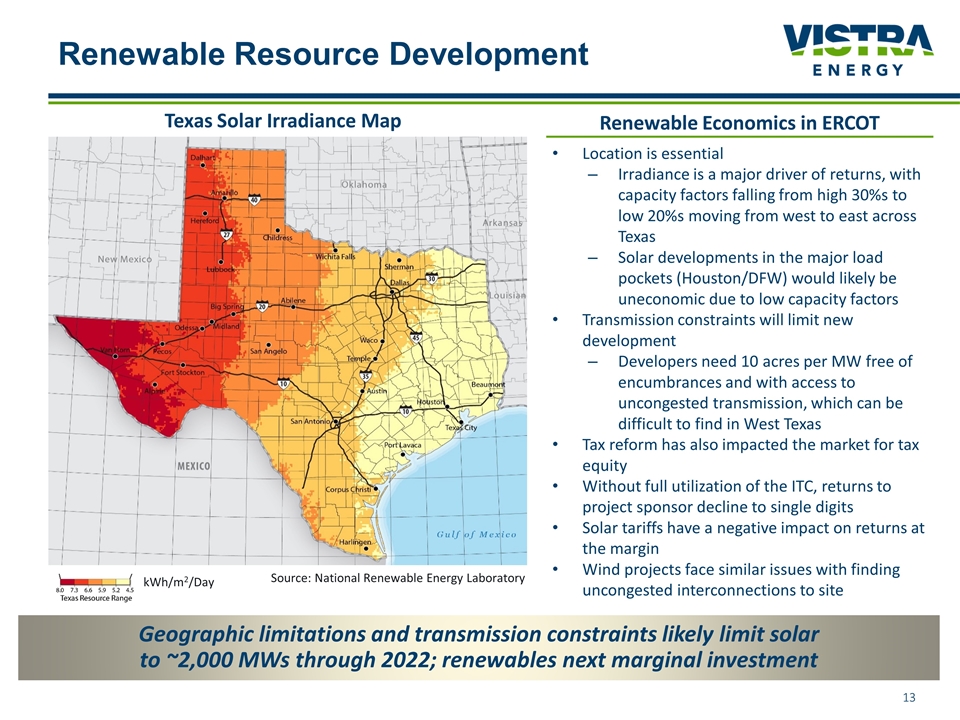

Renewable Resource Development Geographic limitations and transmission constraints likely limit solar to ~2,000 MWs through 2022; renewables next marginal investment Location is essential Irradiance is a major driver of returns, with capacity factors falling from high 30%s to low 20%s moving from west to east across Texas Solar developments in the major load pockets (Houston/DFW) would likely be uneconomic due to low capacity factors Transmission constraints will limit new development Developers need 10 acres per MW free of encumbrances and with access to uncongested transmission, which can be difficult to find in West Texas Tax reform has also impacted the market for tax equity Without full utilization of the ITC, returns to project sponsor decline to single digits Solar tariffs have a negative impact on returns at the margin Wind projects face similar issues with finding uncongested interconnections to site Renewable Economics in ERCOT kWh/m2/Day Source: National Renewable Energy Laboratory Texas Solar Irradiance Map

2017 Financial Review Bill Holden, Chief Financial Officer

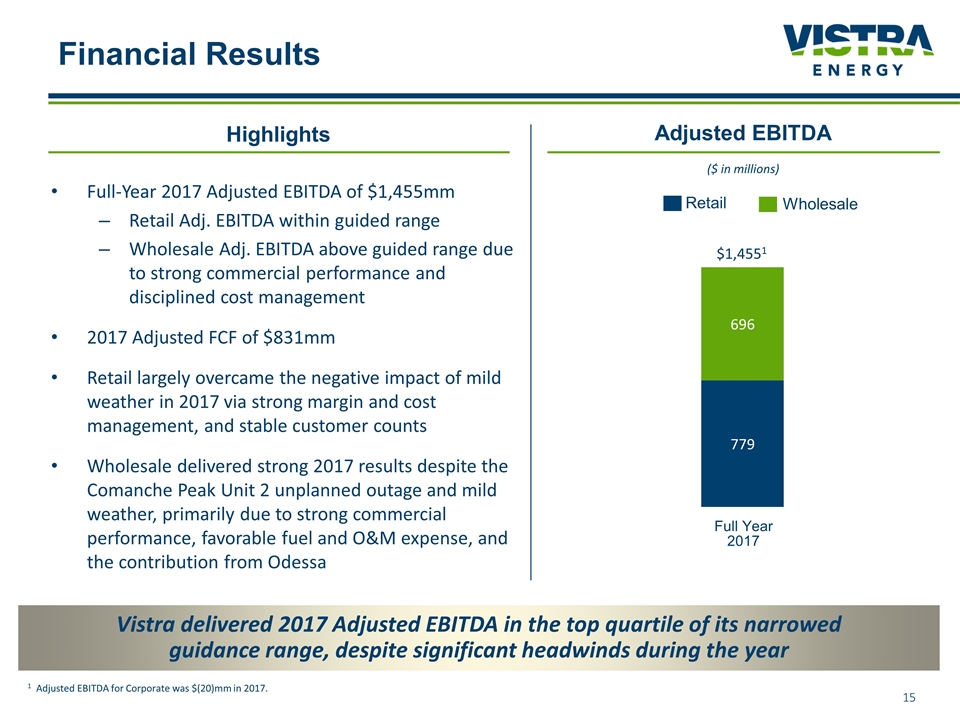

Financial Results Full-Year 2017 Adjusted EBITDA of $1,455mm Retail Adj. EBITDA within guided range Wholesale Adj. EBITDA above guided range due to strong commercial performance and disciplined cost management 2017 Adjusted FCF of $831mm Retail largely overcame the negative impact of mild weather in 2017 via strong margin and cost management, and stable customer counts Wholesale delivered strong 2017 results despite the Comanche Peak Unit 2 unplanned outage and mild weather, primarily due to strong commercial performance, favorable fuel and O&M expense, and the contribution from Odessa Highlights Adjusted EBITDA ($ in millions) 1 Adjusted EBITDA for Corporate was $(20)mm in 2017. Vistra delivered 2017 Adjusted EBITDA in the top quartile of its narrowed guidance range, despite significant headwinds during the year Full Year 2017 $1,4551 Wholesale Retail

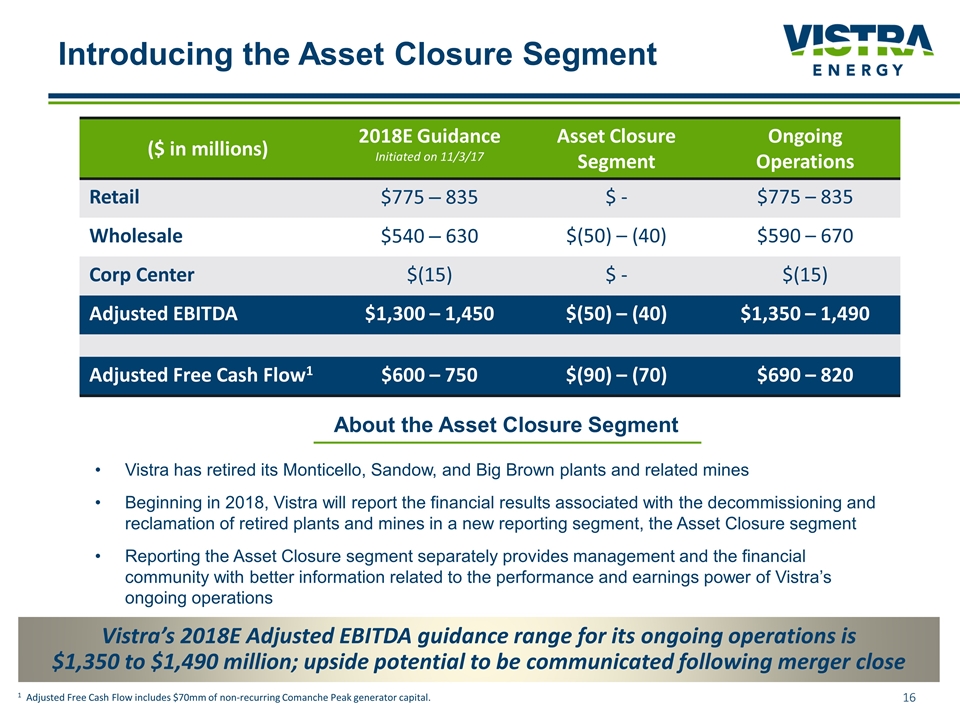

Introducing the Asset Closure Segment Vistra has retired its Monticello, Sandow, and Big Brown plants and related mines Beginning in 2018, Vistra will report the financial results associated with the decommissioning and reclamation of retired plants and mines in a new reporting segment, the Asset Closure segment Reporting the Asset Closure segment separately provides management and the financial community with better information related to the performance and earnings power of Vistra’s ongoing operations ($ in millions) 2018E Guidance Initiated on 11/3/17 Asset Closure Segment Ongoing Operations Retail $775 – 835 $ - $775 – 835 Wholesale $540 – 630 $(50) – (40) $590 – 670 Corp Center $(15) $ - $(15) Adjusted EBITDA $1,300 – 1,450 $(50) – (40) $1,350 – 1,490 Adjusted Free Cash Flow1 $600 – 750 $(90) – (70) $690 – 820 About the Asset Closure Segment Vistra’s 2018E Adjusted EBITDA guidance range for its ongoing operations is $1,350 to $1,490 million; upside potential to be communicated following merger close 1 Adjusted Free Cash Flow includes $70mm of non-recurring Comanche Peak generator capital.

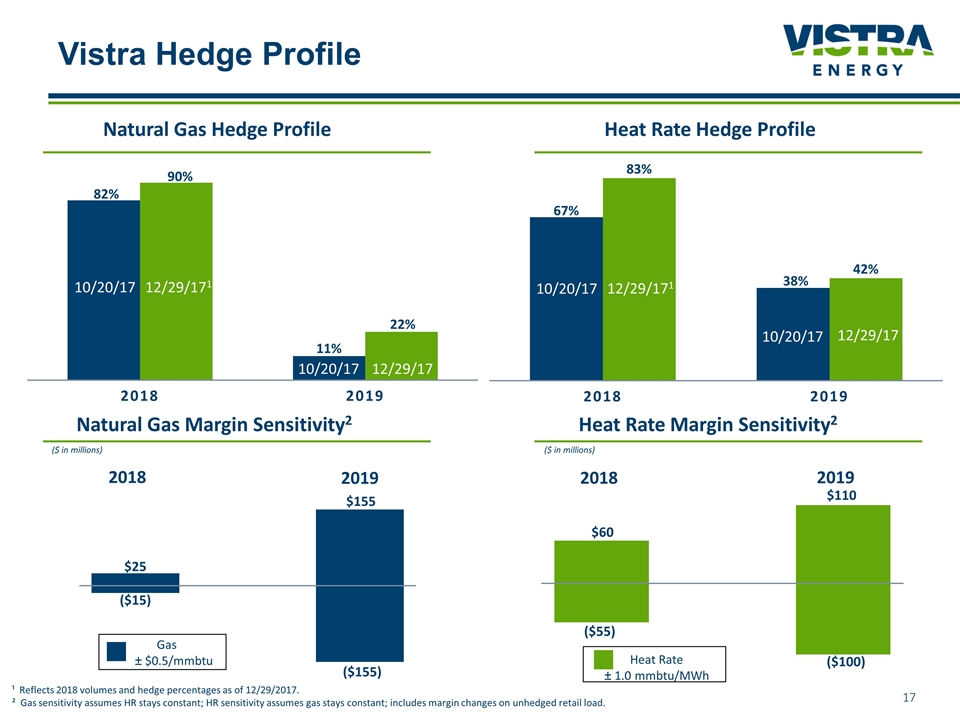

Vistra Hedge Profile 6/30/17 6/30/17 6/30/17 10/20/17¹ 6/30/17 ¹ Reflects 2018 volumes and hedge percentages as of 12/29/2017. ² Gas sensitivity assumes HR stays constant; HR sensitivity assumes gas stays constant; includes margin changes on unhedged retail load. 10/20/17 10/20/17 10/20/17¹ Gas ± $0.5/mmbtu Heat Rate ± 1.0 mmbtu/MWh Natural Gas Hedge Profile Heat Rate Hedge Profile Natural Gas Margin Sensitivity2 Heat Rate Margin Sensitivity2 ($ in millions) ($ in millions) 2018 2019 2018 2019 12/29/17 12/29/171 10/20/17 10/20/17 12/29/171 10/20/17 12/29/17 10/20/17

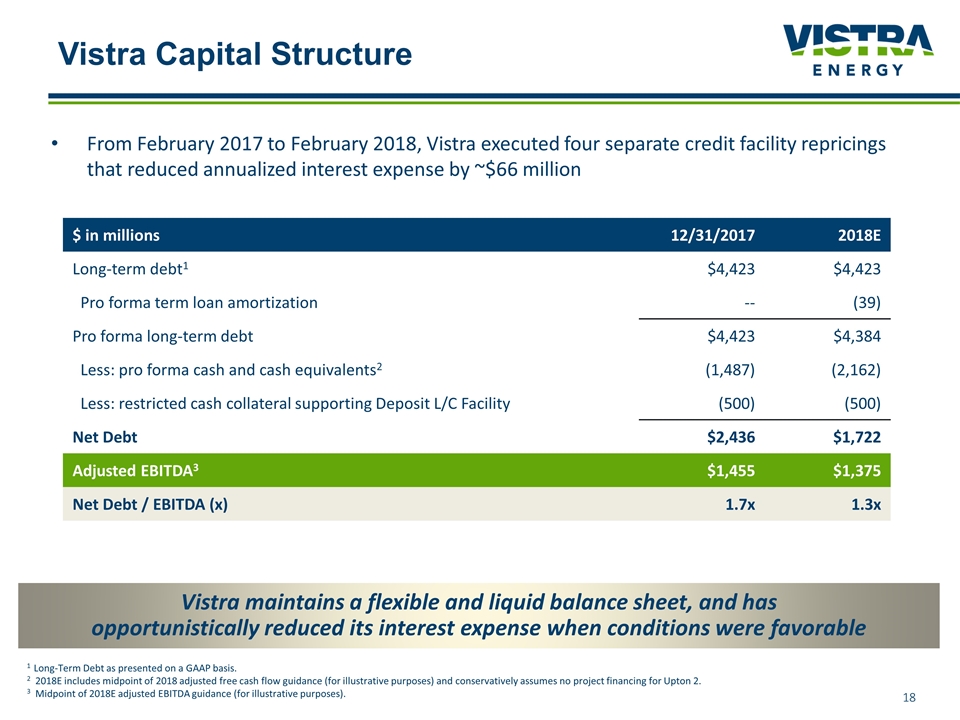

Vistra Capital Structure $ in millions 12/31/2017 2018E Long-term debt1 $4,423 $4,423 Pro forma term loan amortization -- (39) Pro forma long-term debt $4,423 $4,384 Less: pro forma cash and cash equivalents2 (1,487) (2,162) Less: restricted cash collateral supporting Deposit L/C Facility (500) (500) Net Debt $2,436 $1,722 Adjusted EBITDA3 $1,455 $1,375 Net Debt / EBITDA (x) 1.7x 1.3x 1 Long-Term Debt as presented on a GAAP basis. 2 2018E includes midpoint of 2018 adjusted free cash flow guidance (for illustrative purposes) and conservatively assumes no project financing for Upton 2. 3 Midpoint of 2018E adjusted EBITDA guidance (for illustrative purposes). Vistra maintains a flexible and liquid balance sheet, and has opportunistically reduced its interest expense when conditions were favorable From February 2017 to February 2018, Vistra executed four separate credit facility repricings that reduced annualized interest expense by ~$66 million

Q&A

Appendix

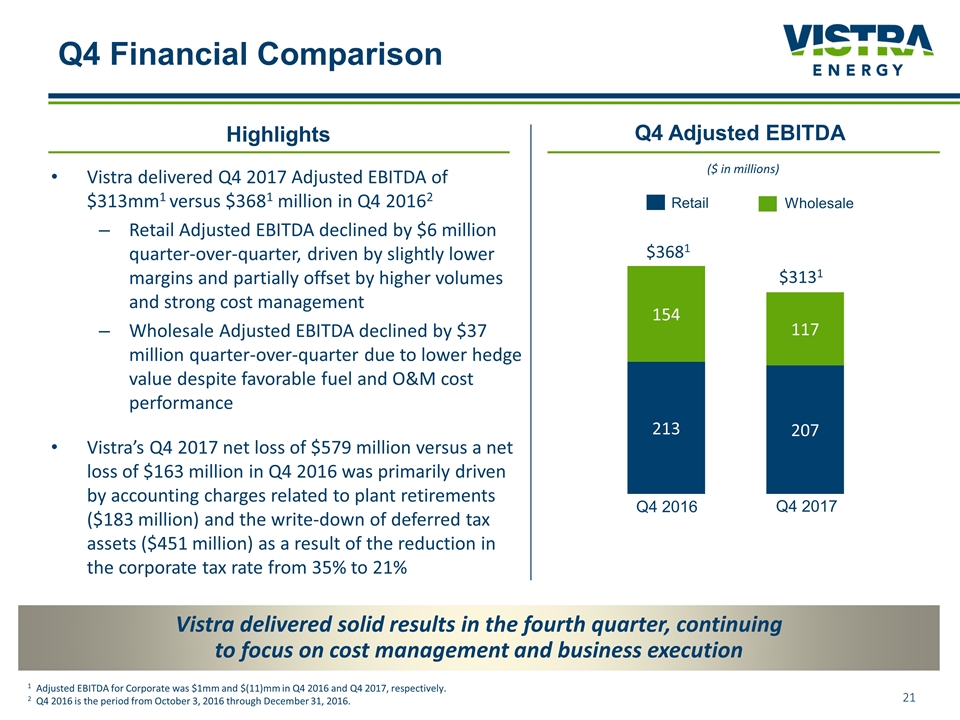

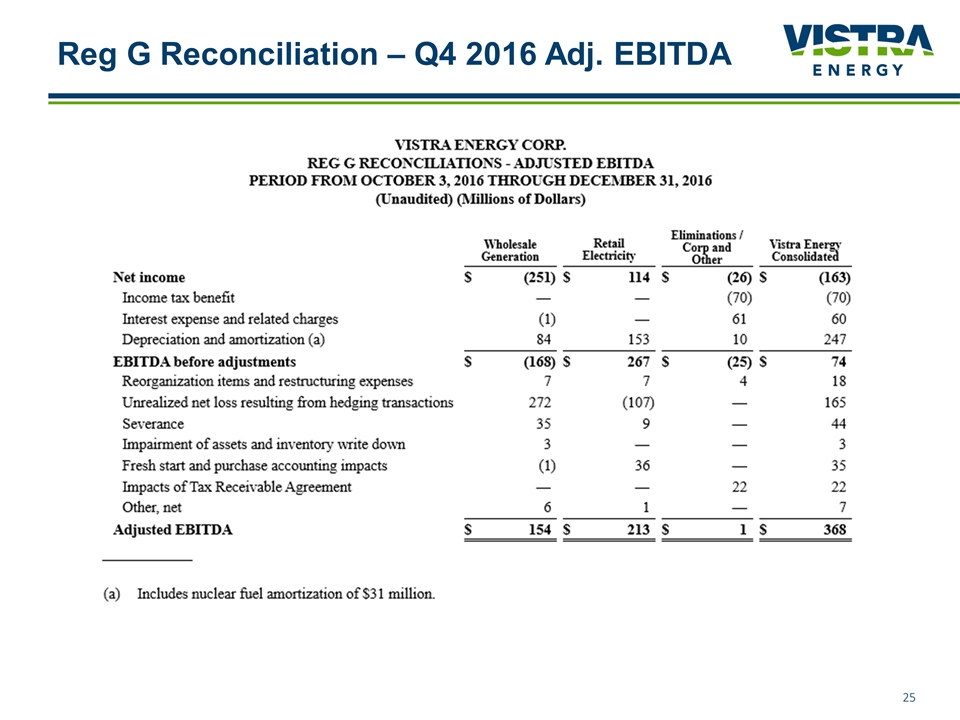

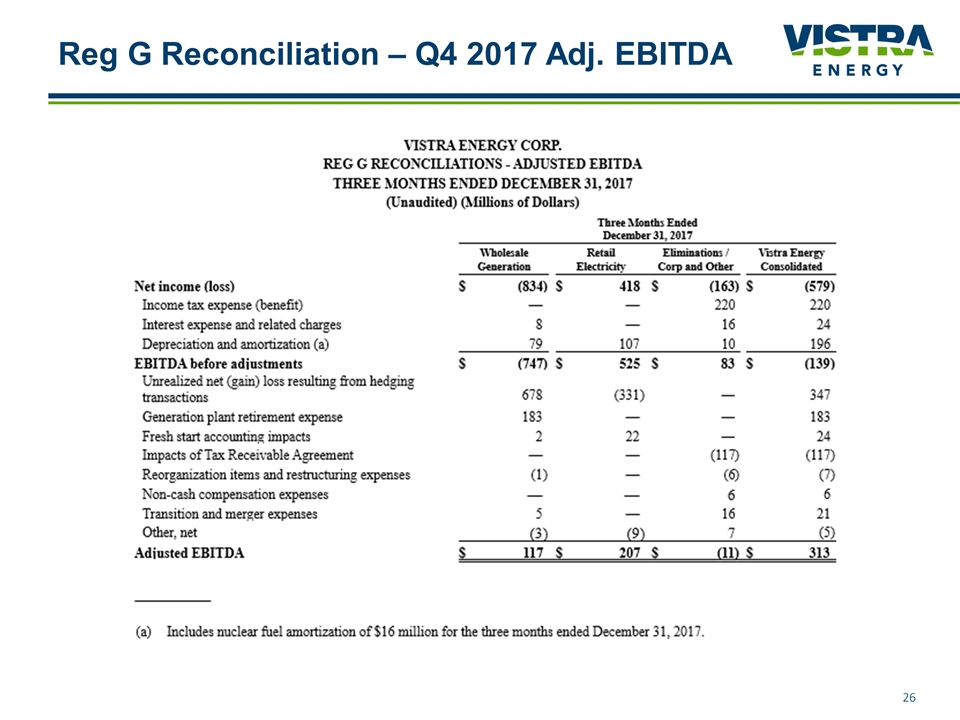

Q4 Financial Comparison Vistra delivered Q4 2017 Adjusted EBITDA of $313mm1 versus $3681 million in Q4 20162 Retail Adjusted EBITDA declined by $6 million quarter-over-quarter, driven by slightly lower margins and partially offset by higher volumes and strong cost management Wholesale Adjusted EBITDA declined by $37 million quarter-over-quarter due to lower hedge value despite favorable fuel and O&M cost performance Vistra’s Q4 2017 net loss of $579 million versus a net loss of $163 million in Q4 2016 was primarily driven by accounting charges related to plant retirements ($183 million) and the write-down of deferred tax assets ($451 million) as a result of the reduction in the corporate tax rate from 35% to 21% Highlights Q4 Adjusted EBITDA ($ in millions) $3681 1 Adjusted EBITDA for Corporate was $1mm and $(11)mm in Q4 2016 and Q4 2017, respectively. 2 Q4 2016 is the period from October 3, 2016 through December 31, 2016. Vistra delivered solid results in the fourth quarter, continuing to focus on cost management and business execution $3131 Q4 2016 Q4 2017 Wholesale Retail

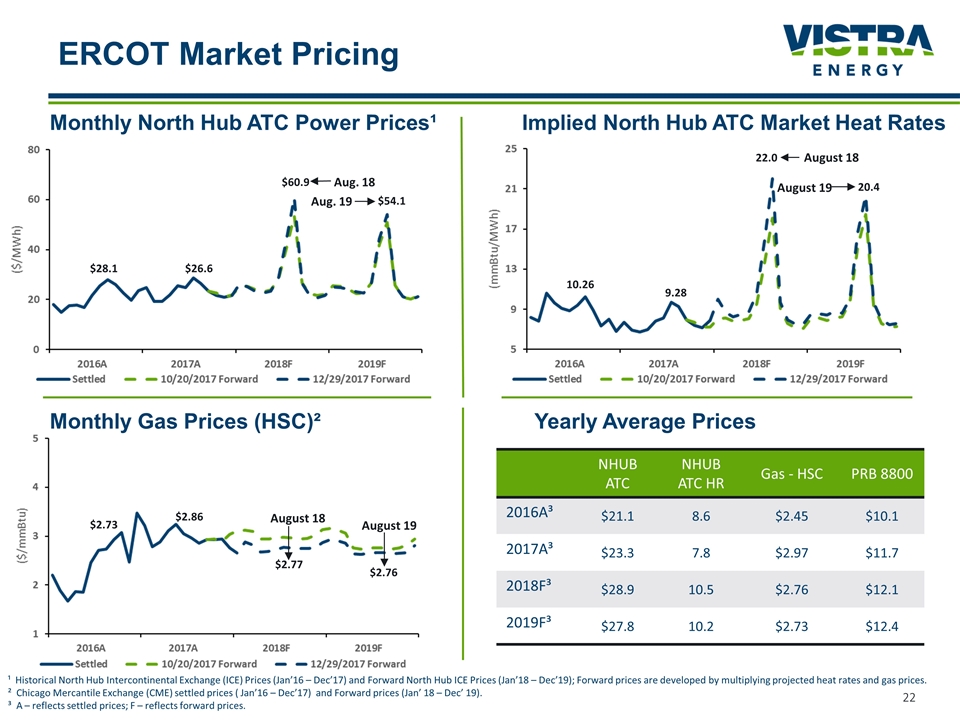

ERCOT Market Pricing $60.91 ¹ Historical North Hub Intercontinental Exchange (ICE) Prices (Jan’16 – Dec’17) and Forward North Hub ICE Prices (Jan’18 – Dec’19); Forward prices are developed by multiplying projected heat rates and gas prices. ² Chicago Mercantile Exchange (CME) settled prices ( Jan’16 – Dec’17) and Forward prices (Jan’ 18 – Dec’ 19). ³ A – reflects settled prices; F – reflects forward prices. Monthly North Hub ATC Power Prices¹ Implied North Hub ATC Market Heat Rates Monthly Gas Prices (HSC)² Yearly Average Prices NHUB ATC NHUB ATC HR Gas - HSC PRB 8800 2016A³ $21.1 8.6 $2.45 $10.1 2017A³ $23.3 7.8 $2.97 $11.7 2018F³ $28.9 10.5 $2.76 $12.1 2019F³ $27.8 10.2 $2.73 $12.4 $54.116 $28.116 $26.616 $2.7316 $2.86 $2.77 $2.76 10.2616 9.2816 22.016 20.4 Aug. 18 August 18 August 18 Aug. 19 August 19 August 19

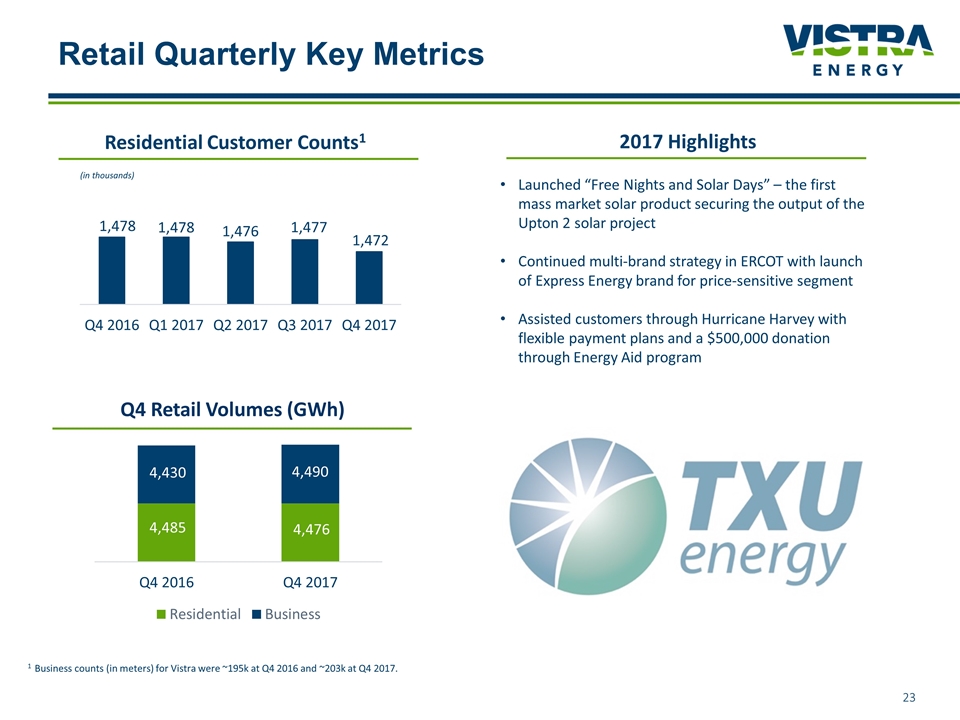

Residential Customer Counts1 Retail Quarterly Key Metrics Q4 Retail Volumes (GWh) (in thousands) 1 Business counts (in meters) for Vistra were ~195k at Q4 2016 and ~203k at Q4 2017. Launched “Free Nights and Solar Days” – the first mass market solar product securing the output of the Upton 2 solar project Continued multi-brand strategy in ERCOT with launch of Express Energy brand for price-sensitive segment Assisted customers through Hurricane Harvey with flexible payment plans and a $500,000 donation through Energy Aid program 2017 Highlights

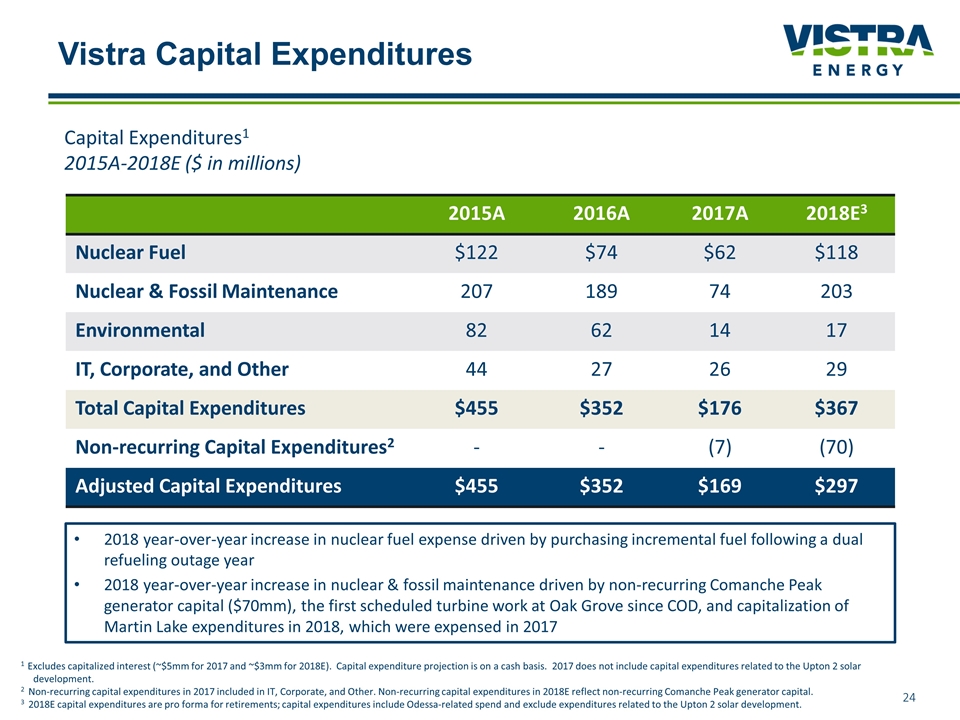

2015A 2016A 2017A 2018E3 Nuclear Fuel $122 $74 $62 $118 Nuclear & Fossil Maintenance 207 189 74 203 Environmental 82 62 14 17 IT, Corporate, and Other 44 27 26 29 Total Capital Expenditures $455 $352 $176 $367 Non-recurring Capital Expenditures2 - - (7) (70) Adjusted Capital Expenditures $455 $352 $169 $297 1 Excludes capitalized interest (~$5mm for 2017 and ~$3mm for 2018E). Capital expenditure projection is on a cash basis. 2017 does not include capital expenditures related to the Upton 2 solar development. 2 Non-recurring capital expenditures in 2017 included in IT, Corporate, and Other. Non-recurring capital expenditures in 2018E reflect non-recurring Comanche Peak generator capital. 3 2018E capital expenditures are pro forma for retirements; capital expenditures include Odessa-related spend and exclude expenditures related to the Upton 2 solar development. Capital Expenditures1 2015A-2018E ($ in millions) Vistra Capital Expenditures 2018 year-over-year increase in nuclear fuel expense driven by purchasing incremental fuel following a dual refueling outage year 2018 year-over-year increase in nuclear & fossil maintenance driven by non-recurring Comanche Peak generator capital ($70mm), the first scheduled turbine work at Oak Grove since COD, and capitalization of Martin Lake expenditures in 2018, which were expensed in 2017

Reg G Reconciliation – Q4 2016 Adj. EBITDA

Reg G Reconciliation – Q4 2017 Adj. EBITDA

Reg G Reconciliation – FY 2017 Adj. EBITDA

Reg G Reconciliation – FY 2017 Adj. FCF

Reg G Reconciliation – 2018 Guidance