Form 425 AETNA INC /PA/ Filed by: CVS HEALTH Corp

Fixed Income Presentation February 2018 Filed by CVS Health Corporation Pursuant to Rule 425 under the Securities Act of 1933 And deemed filed pursuant to Rule 14a-12 Under the Securities Exchange Act of 1934 Subject Company: Aetna Inc. Commission File No.: 001-16095 Date: February 26, 2018

No Offer or Solicitation This communication is for informational purposes only and not intended to and does not constitute an offer to subscribe for, buy or sell, the solicitation of an offer to subscribe for, buy or sell or an invitation to subscribe for, buy or sell any securities or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law. Additional Information and Where to Find It In connection with the proposed transaction between CVS Health Corporation (“CVS Health”) and Aetna Inc. (“Aetna”), on February 9, 2018, CVS Health filed with the Securities and Exchange Commission (the “SEC”) an amendment to the registration statement on Form S-4 that was originally filed on January 4, 2018. The registration statement includes a joint proxy statement of CVS Health and Aetna that also constitutes a prospectus of CVS Health. The registration statement was declared effective by the SEC on February 9, 2018, and CVS Health and Aetna commenced mailing the definitive joint proxy statement/prospectus to stockholders of CVS Health and shareholders of Aetna on or about February 12, 2018. INVESTORS AND SECURITY HOLDERS OF CVS HEALTH AND AETNA ARE URGED TO READ THE DEFINITIVE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain free copies of the registration statement and the definitive joint proxy statement/prospectus and other documents filed with the SEC by CVS Health or Aetna through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by CVS Health are available free of charge within the Investors section of CVS Health’s Web site at http://www.cvshealth.com/investors or by contacting CVS Health’s Investor Relations Department at 800-201-0938. Copies of the documents filed with the SEC by Aetna are available free of charge on Aetna’s internet website at http://www.Aetna.com or by contacting Aetna’s Investor Relations Department at 860-273-0896. Important Information 1

Participants in Solicitation CVS Health, Aetna, their respective directors and certain of their respective executive officers may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of CVS Health is set forth in its Annual Report on Form 10-K for the year ended December 31, 2017, which was filed with the SEC on February 14, 2018, its proxy statement for its 2017 annual meeting of stockholders, which was filed with the SEC on March 31, 2017, and certain of its Current Reports on Form 8-K. Information about the directors and executive officers of Aetna is set forth in its Annual Report on Form 10-K for the year ended December 31, 2017, which was filed with the SEC on February 23, 2018, its proxy statement for its 2017 annual meeting of shareholders, which was filed with the SEC on April 7, 2017, and certain of its Current Reports on Form 8-K. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, are contained in the definitive joint proxy statement/prospectus filed with the SEC and other relevant materials to be filed with the SEC when they become available. Cautionary Statement Regarding Forward-Looking Statements The Private Securities Litigation Reform Act of 1995 (the “Reform Act”) provides a safe harbor for forward-looking statements made by or on behalf of CVS Health or Aetna. This communication may contain forward-looking statements within the meaning of the Reform Act. You can generally identify forward-looking statements by the use of forward-looking terminology such as “anticipate,” “believe,” “can,” “continue,” “could,” “estimate,” “evaluate,” “expect,” “explore,” “forecast,” “guidance,” “intend,” “likely,” “may,” “might,” “outlook,” “plan,” “potential,” “predict,” “probable,” “project,” “seek,” “should,” “view,” or “will,” or the negative thereof or other variations thereon or comparable terminology. These forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond CVS Health’s and Aetna’s control. Important Information 2

Statements in this communication regarding CVS Health and Aetna that are forward-looking, including CVS Health’s and Aetna’s projections as to the closing date for the pending acquisition of Aetna (the “transaction”), the extent of, and the time necessary to obtain, the regulatory approvals required for the transaction, the anticipated benefits of the transaction, the impact of the transaction on CVS Health’s and Aetna’s businesses, the expected terms and scope of the expected financing for the transaction, the ownership percentages of CVS Health’s common stock of CVS Health stockholders and Aetna shareholders at closing, the aggregate amount of indebtedness of CVS Health following the closing of the transaction, CVS Health’s expectations regarding debt repayment and its debt to capital ratio following the closing of the transaction, CVS Health’s and Aetna’s respective share repurchase programs and ability and intent to declare future dividend payments, the number of prescriptions used by people served by the combined companies’ pharmacy benefit business, the synergies from the transaction, and CVS Health’s, Aetna’s and/or the combined company’s future operating results, are based on CVS Health’s and Aetna’s managements’ estimates, assumptions and projections, and are subject to significant uncertainties and other factors, many of which are beyond their control. In particular, projected financial information for the combined businesses of CVS Health and Aetna is based on estimates, assumptions and projections and has not been prepared in conformance with the applicable accounting requirements of Regulation S-X relating to pro forma financial information, and the required pro forma adjustments have not been applied and are not reflected therein. None of this information should be considered in isolation from, or as a substitute for, the historical financial statements of CVS Health and Aetna. Important risk factors related to the transaction could cause actual future results and other future events to differ materially from those currently estimated by management, including, but not limited to: the timing to consummate the proposed transaction; the risk that a regulatory approval that may be required for the proposed transaction is delayed, is not obtained or is obtained subject to conditions that are not anticipated; the risk that a condition to the closing of the proposed transaction may not be satisfied; the outcome of litigation related to the transaction; the ability to achieve the synergies and value creation contemplated; CVS Health’s ability to promptly and effectively integrate Aetna’s businesses; and the diversion of and attention of management of both CVS Health and Aetna on transaction-related issues. . Important Information 3

In addition, this communication may contain forward-looking statements regarding CVS Health’s or Aetna’s respective businesses, financial condition and results of operations. These forward-looking statements also involve risks, uncertainties and assumptions, some of which may not be presently known to CVS Health or Aetna or that they currently believe to be immaterial also may cause CVS Health’s or Aetna’s actual results to differ materially from those expressed in the forward-looking statements, adversely impact their respective businesses, CVS Health’s ability to complete the transaction and/or CVS Health’s ability to realize the expected benefits from the transaction. Should any risks and uncertainties develop into actual events, these developments could have a material adverse effect on the transaction and/or CVS Health or Aetna, CVS Health’s ability to successfully complete the transaction and/or realize the expected benefits from the transaction. Additional information concerning these risks, uncertainties and assumptions can be found in CVS Health’s and Aetna’s respective filings with the SEC, including the risk factors discussed in “Item 1.A. Risk Factors” in CVS Health’s and Aetna’s most recent Annual Reports on Form 10-K, as updated by their Quarterly Reports on Form 10-Q and future filings with the SEC. You are cautioned not to place undue reliance on CVS Health’s and Aetna’s forward-looking statements. These forward-looking statements are and will be based upon management’s then-current views and assumptions regarding future events and operating performance, and are applicable only as of the dates of such statements. Neither CVS Health nor Aetna assumes any duty to update or revise forward-looking statements, whether as a result of new information, future events or otherwise, as of any future date. Important Information 4

Non-GAAP Financial Measures This presentation includes non-GAAP financial measures. For reconciliations of non-GAAP financial measures used in this presentation to the most directly comparable GAAP measures, please refer to the appendix. This communication shall not constitute or form part of an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification of such securities under the securities laws of any such jurisdiction. CVS has filed a registration statement (including a prospectus) with the SEC. If CVS were to conduct an offering of securities in the future, a preliminary prospectus supplement and accompanying prospectus and other documents filed with the SEC relating to that offering would be able to be obtained from the underwriters of that offering or any dealer participating in that offering or from CVS at 800-201-0938. You would also be able to get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Important Information 5

Agenda CVS Health – Aetna Transaction Summary Overview of CVS Health Overview of Aetna Financial Overview

CVS Health – Aetna Transaction Summary

CVS Health – Aetna: Compelling Strategic Combination Highly diversified, strong and stable cash flows Creates a leading health care platform with unmatched suite of services Improved quality of care through enhanced data integration / predictive analytics High-touch connectivity to consumers as go-to local health care access point Drives efficiencies and lower cost of care through an integrated model Committed to sustaining a strong investment grade capital structure with disciplined financial policies Significant synergy potential 6

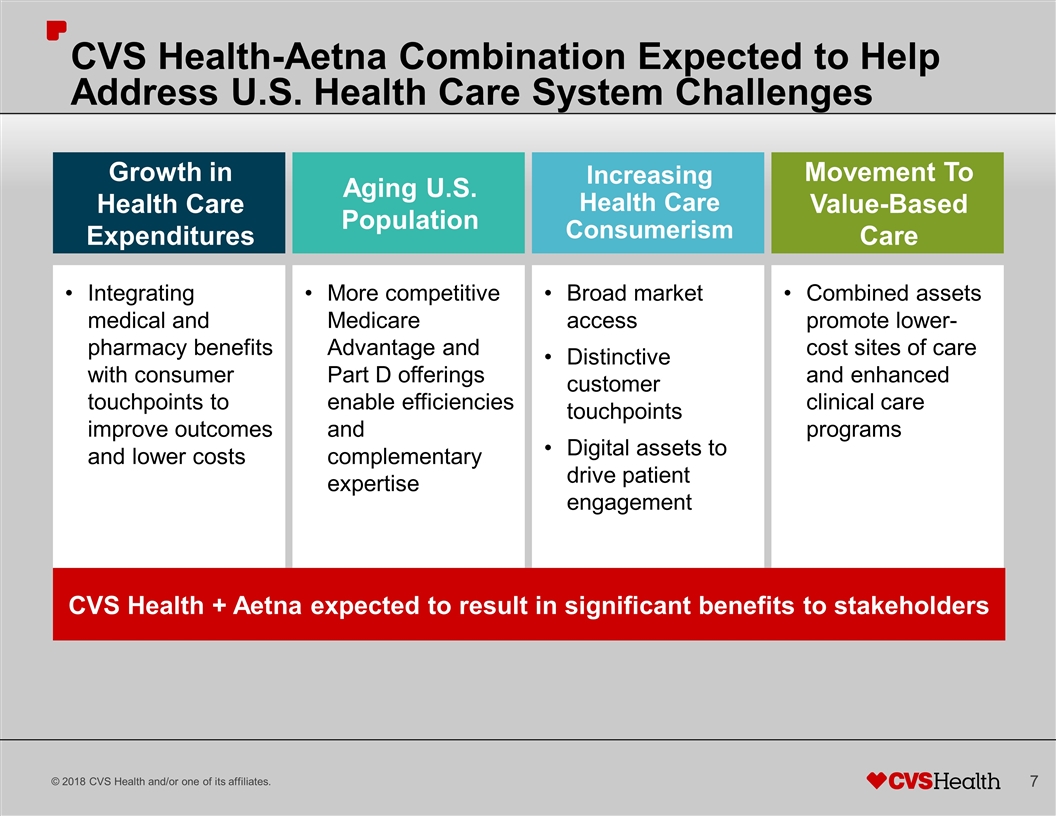

CVS Health-Aetna Combination Expected to Help Address U.S. Health Care System Challenges Growth in Health Care Expenditures Increasing Health Care Consumerism Movement To Value-Based Care Integrating medical and pharmacy benefits with consumer touchpoints to improve outcomes and lower costs Broad market access Distinctive customer touchpoints Digital assets to drive patient engagement Combined assets promote lower-cost sites of care and enhanced clinical care programs Aging U.S. Population More competitive Medicare Advantage and Part D offerings enable efficiencies and complementary expertise CVS Health + Aetna expected to result in significant benefits to stakeholders 7

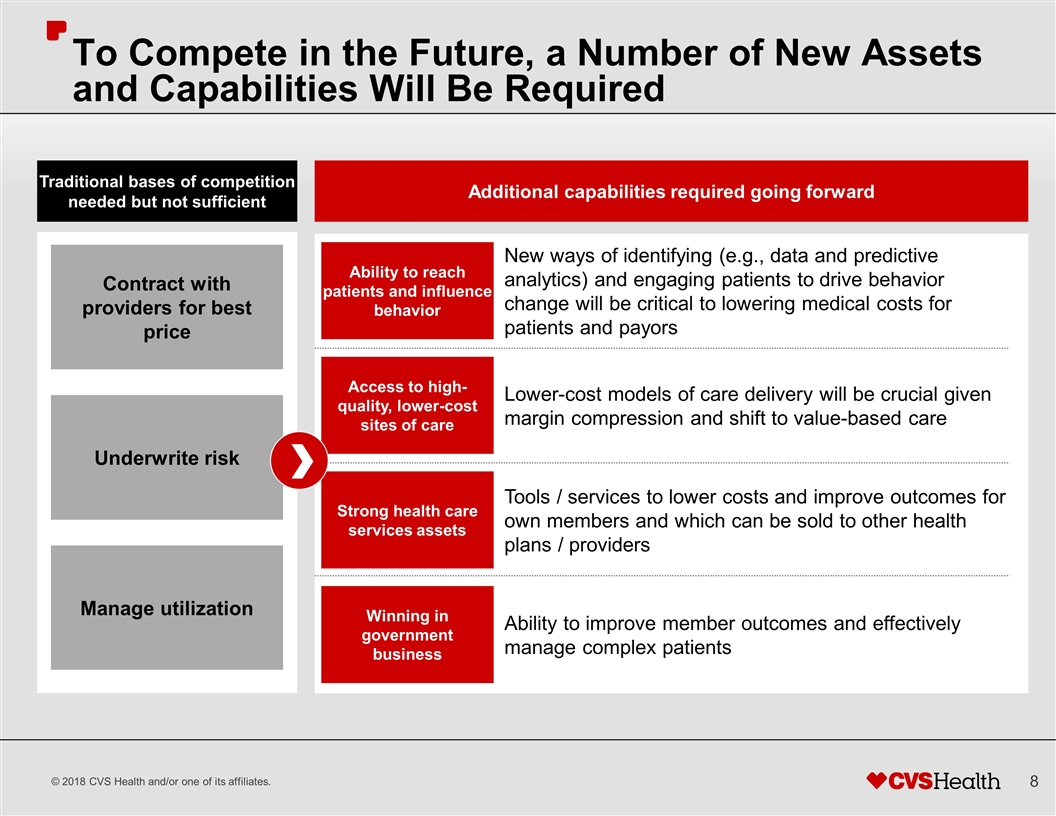

To Compete in the Future, a Number of New Assets and Capabilities Will Be Required Additional capabilities required going forward Access to high-quality, lower-cost sites of care Lower-cost models of care delivery will be crucial given margin compression and shift to value-based care Winning in government business Ability to improve member outcomes and effectively manage complex patients Ability to reach patients and influence behavior New ways of identifying (e.g., data and predictive analytics) and engaging patients to drive behavior change will be critical to lowering medical costs for patients and payors Strong health care services assets Tools / services to lower costs and improve outcomes for own members and which can be sold to other health plans / providers Contract with providers for best price Underwrite risk Manage utilization Traditional bases of competition needed but not sufficient 8

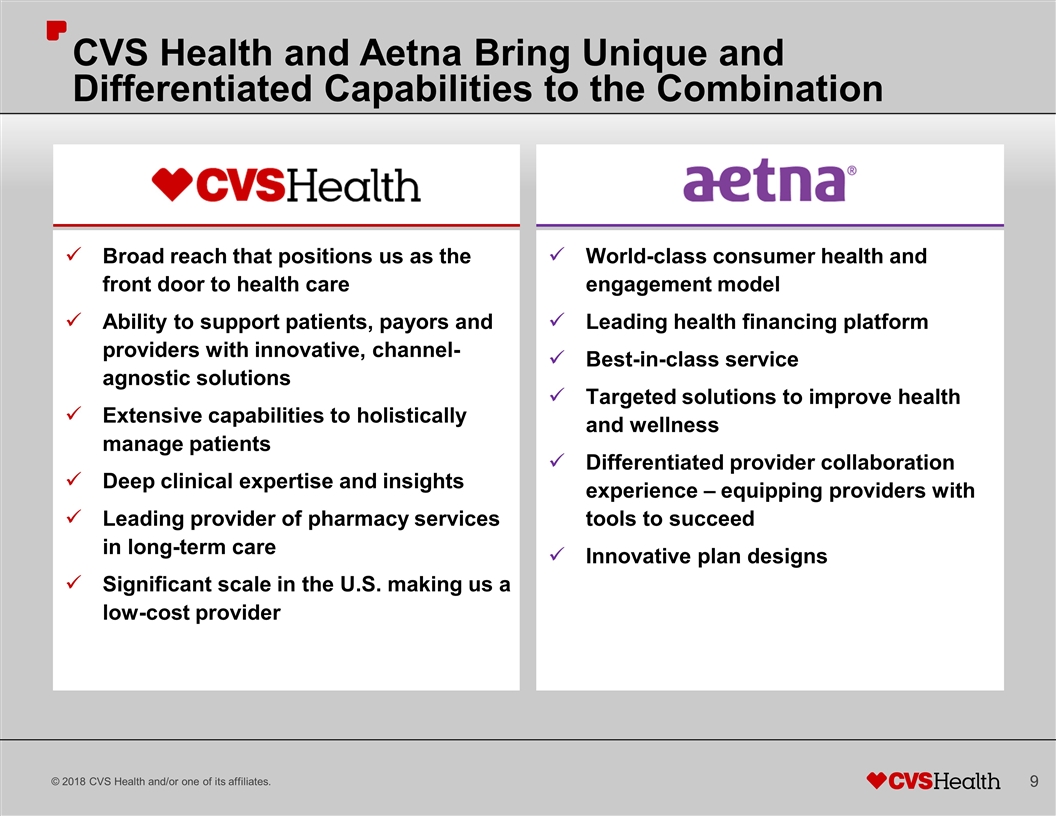

World-class consumer health and engagement model Leading health financing platform Best-in-class service Targeted solutions to improve health and wellness Differentiated provider collaboration experience – equipping providers with tools to succeed Innovative plan designs Broad reach that positions us as the front door to health care Ability to support patients, payors and providers with innovative, channel-agnostic solutions Extensive capabilities to holistically manage patients Deep clinical expertise and insights Leading provider of pharmacy services in long-term care Significant scale in the U.S. making us a low-cost provider CVS Health and Aetna Bring Unique and Differentiated Capabilities to the Combination 9

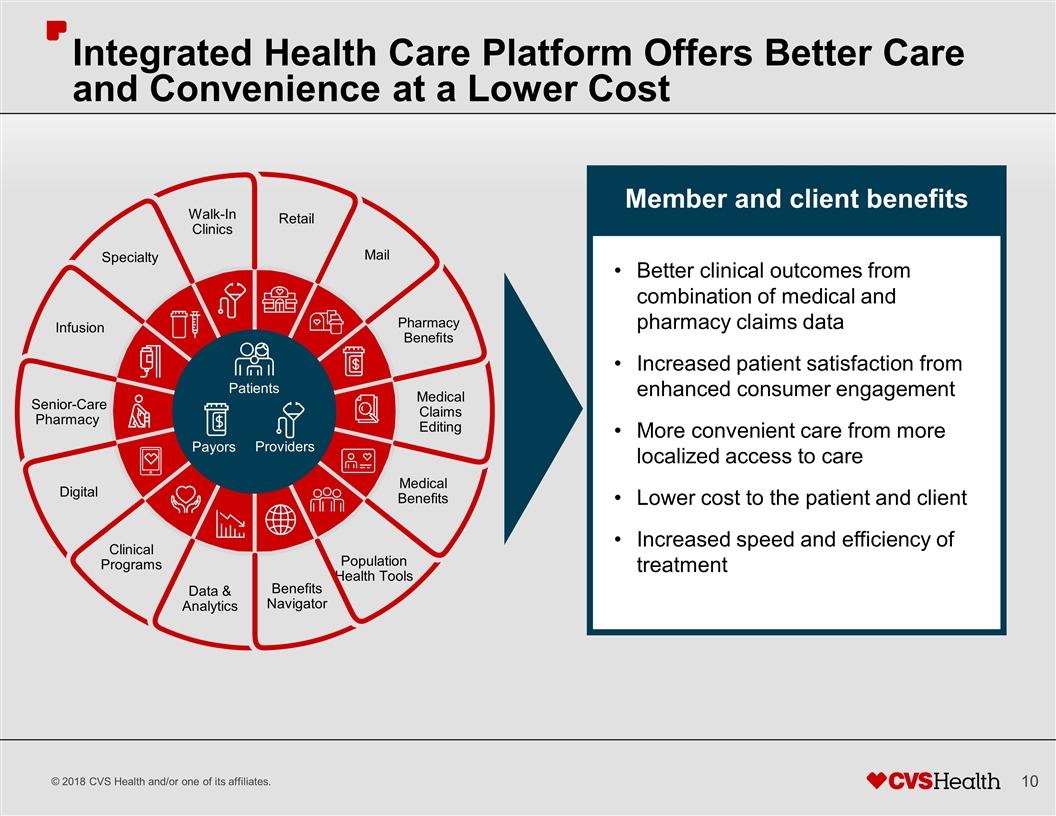

Better clinical outcomes from combination of medical and pharmacy claims data Increased patient satisfaction from enhanced consumer engagement More convenient care from more localized access to care Lower cost to the patient and client Increased speed and efficiency of treatment Member and client benefits Integrated Health Care Platform Offers Better Care and Convenience at a Lower Cost Quality Patients Payors Providers Retail Senior-Care Pharmacy Mail Pharmacy Benefits Specialty Population Health Tools Medical Benefits Digital Clinical Programs Walk-In Clinics Infusion Data & Analytics Benefits Navigator Medical Claims Editing 10

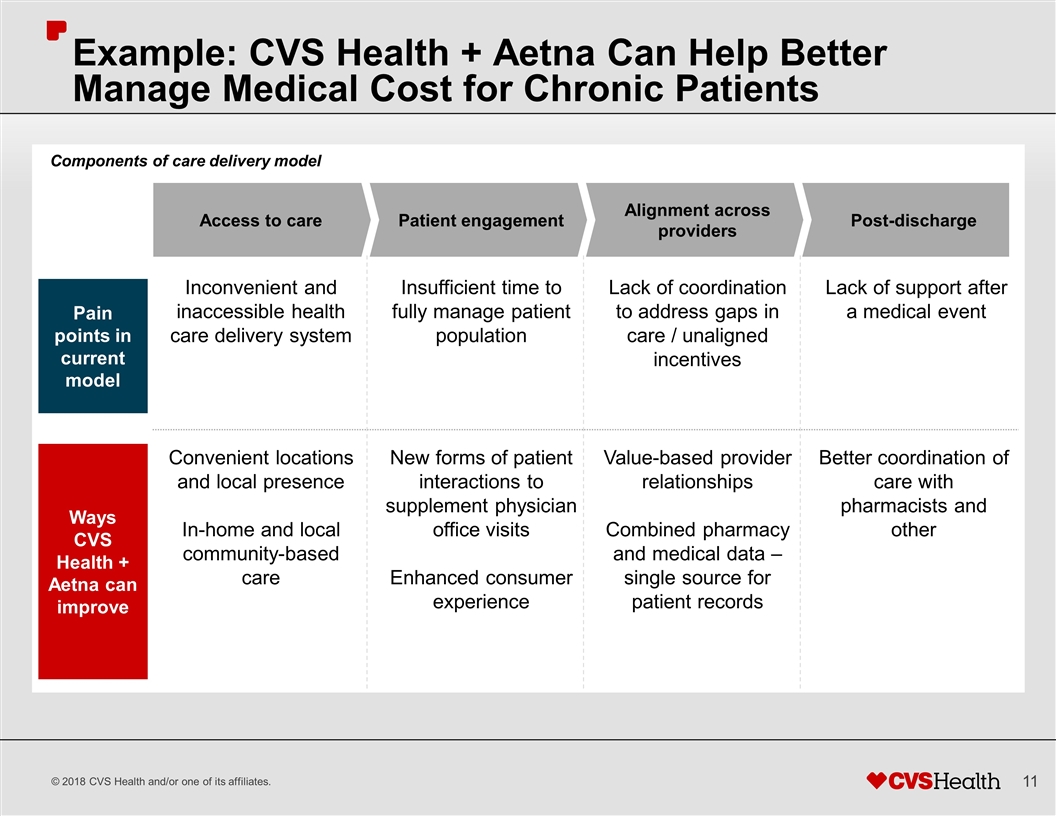

Example: CVS Health + Aetna Can Help Better Manage Medical Cost for Chronic Patients Pain points in current model Ways CVS Health + Aetna can improve Components of care delivery model Inconvenient and inaccessible health care delivery system Insufficient time to fully manage patient population Lack of support after a medical event Lack of coordination to address gaps in care / unaligned incentives Convenient locations and local presence In-home and local community-based care New forms of patient interactions to supplement physician office visits Enhanced consumer experience Better coordination of care with pharmacists and other Value-based provider relationships Combined pharmacy and medical data – single source for patient records Patient engagement Alignment across providers Access to care Post-discharge 11

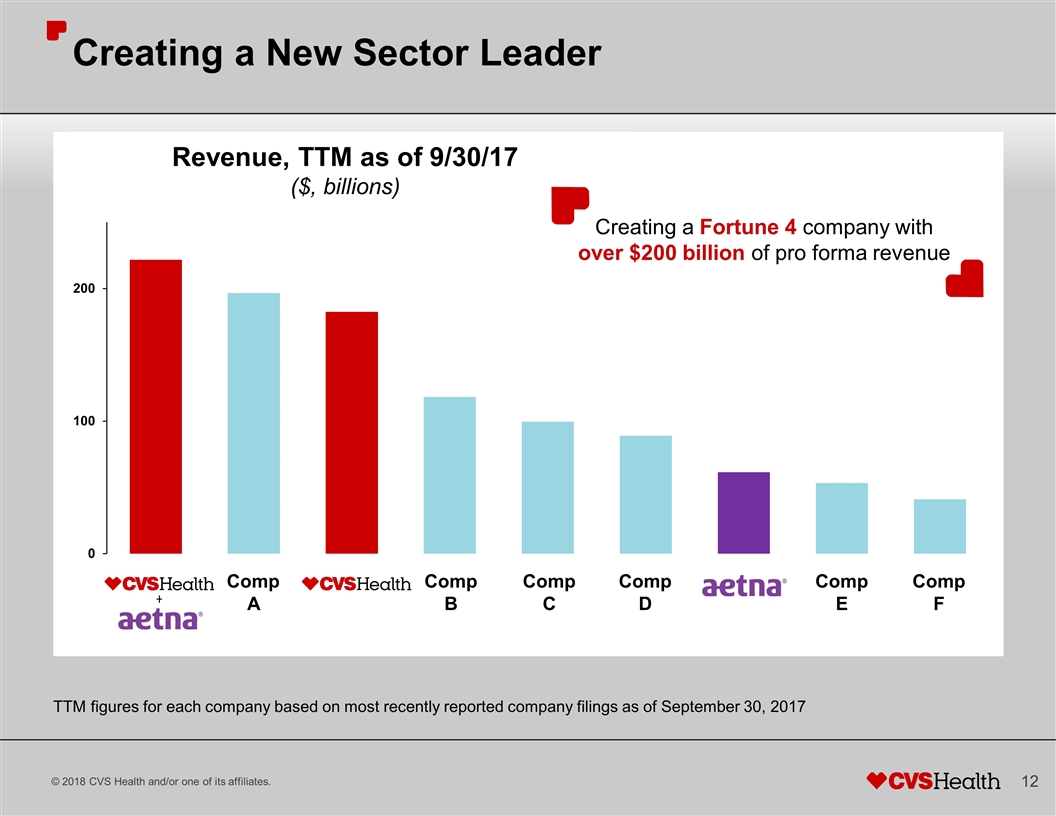

Revenue, TTM as of 9/30/17 ($, billions) Comp A Comp B Comp C Comp D Comp E Comp F Creating a Fortune 4 company with over $200 billion of pro forma revenue Creating a New Sector Leader TTM figures for each company based on most recently reported company filings as of September 30, 2017 12

Overview of CVS Health

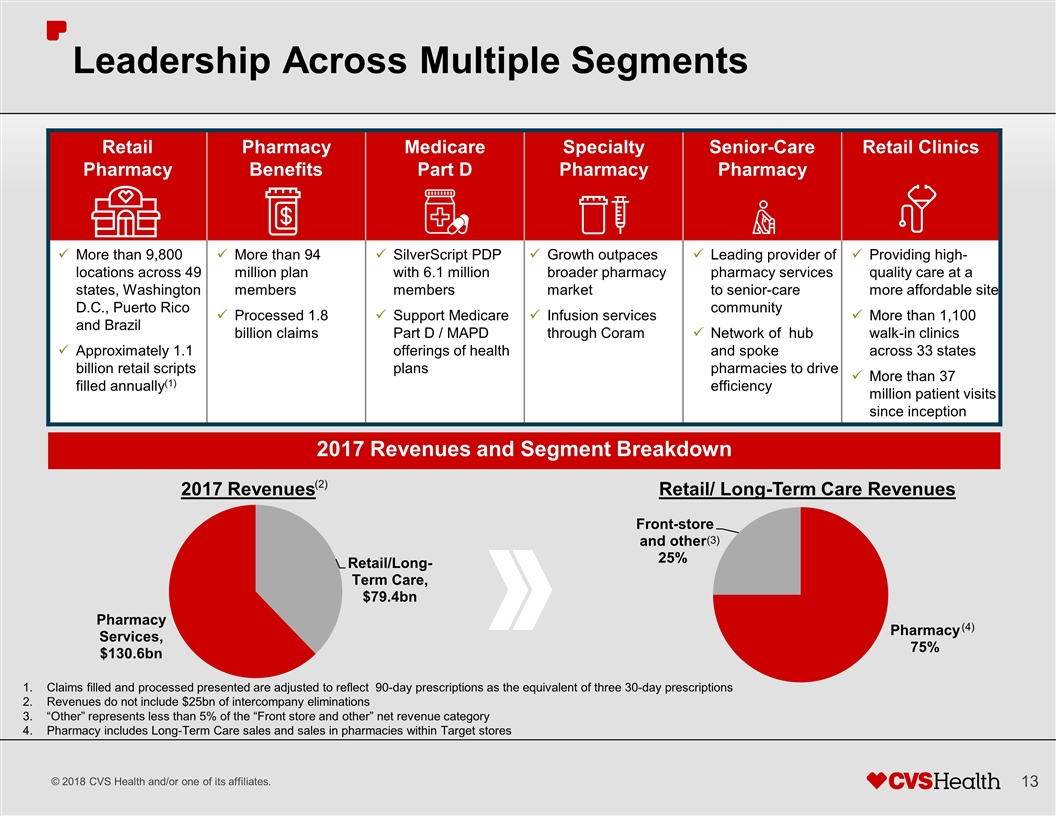

Leadership Across Multiple Segments Retail Pharmacy Pharmacy Benefits Medicare Part D Specialty Pharmacy Senior-Care Pharmacy Retail Clinics More than 9,800 locations across 49 states, Washington D.C., Puerto Rico and Brazil Approximately 1.1 billion retail scripts filled annually(1) More than 94 million plan members Processed 1.8 billion claims SilverScript PDP with 6.1 million members Support Medicare Part D / MAPD offerings of health plans Growth outpaces broader pharmacy market Infusion services through Coram Leading provider of pharmacy services to senior-care community Network of hub and spoke pharmacies to drive efficiency Providing high-quality care at a more affordable site More than 1,100 walk-in clinics across 33 states More than 37 million patient visits since inception 2017 Revenues and Segment Breakdown 2017 Revenues Retail/ Long-Term Care Revenues Claims filled and processed presented are adjusted to reflect 90-day prescriptions as the equivalent of three 30-day prescriptions Revenues do not include $25bn of intercompany eliminations “Other” represents less than 5% of the “Front store and other” net revenue category Pharmacy includes Long-Term Care sales and sales in pharmacies within Target stores (2) (4) (3) 13

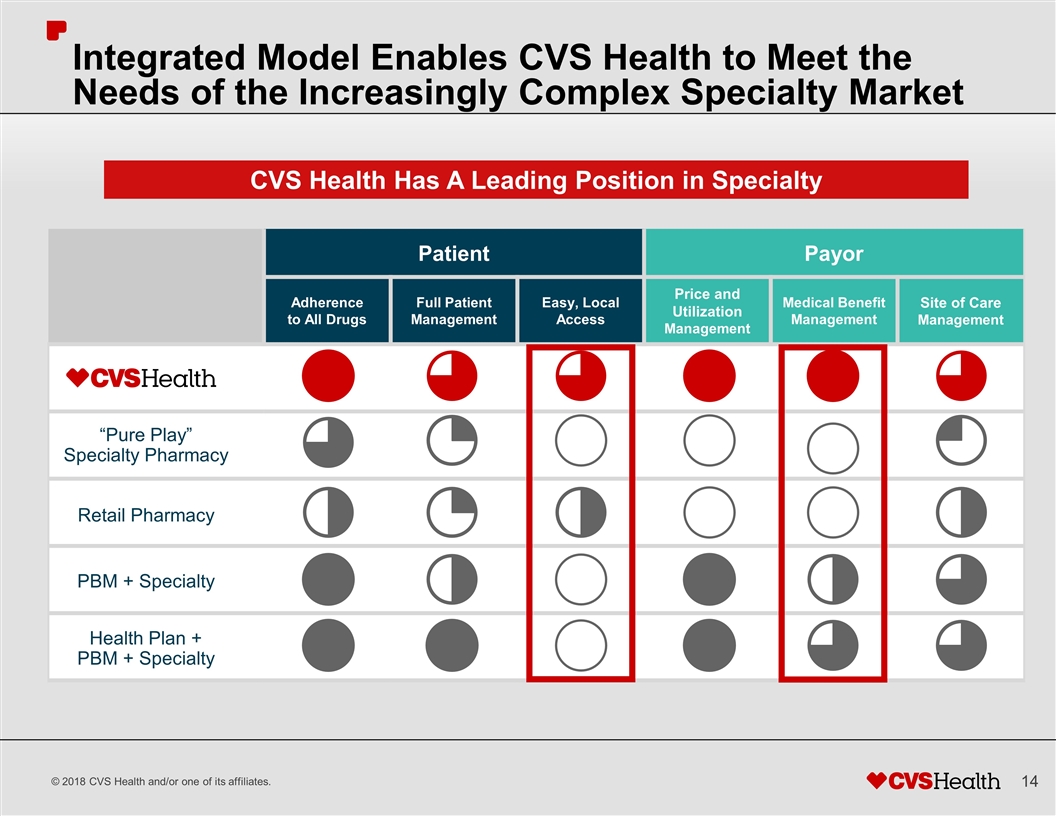

Integrated Model Enables CVS Health to Meet the Needs of the Increasingly Complex Specialty Market Patient Payor Adherence to All Drugs Full Patient Management Easy, Local Access Price and Utilization Management Medical Benefit Management Site of Care Management PBM + Specialty Health Plan + PBM + Specialty “Pure Play” Specialty Pharmacy Retail Pharmacy CVS Health Has A Leading Position in Specialty 14

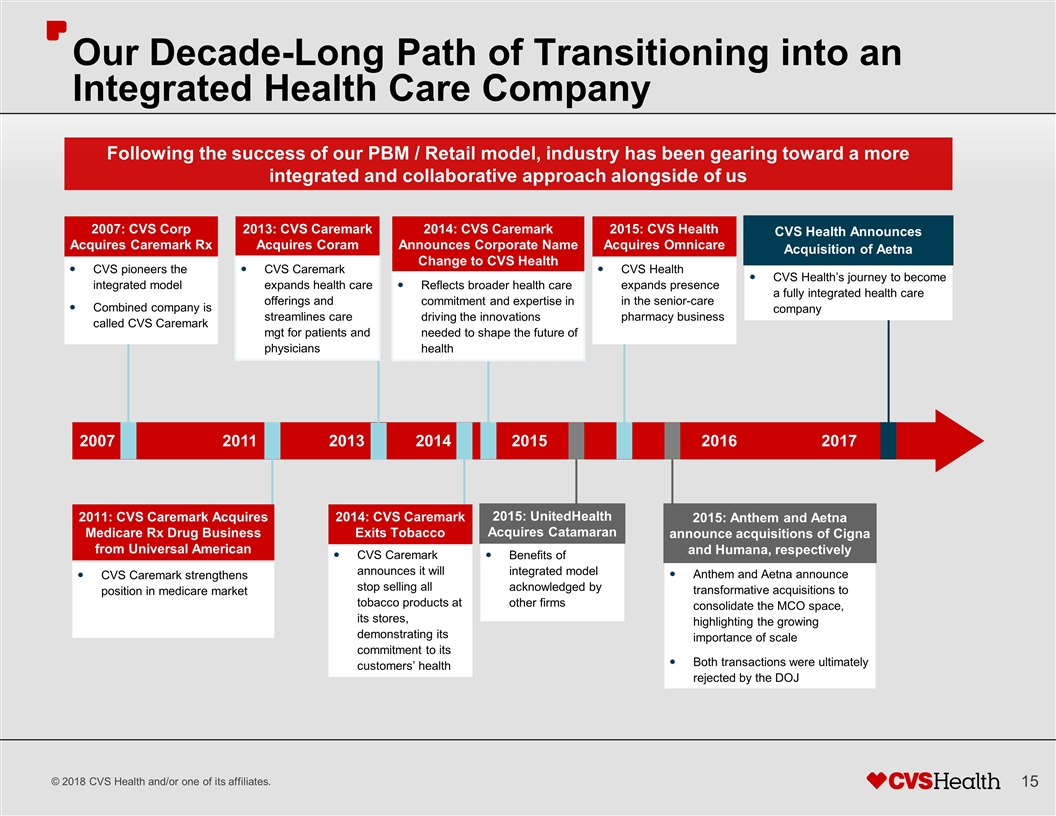

2015 2014 2013 2011 2007 2017 Our Decade-Long Path of Transitioning into an Integrated Health Care Company 2007: CVS Corp Acquires Caremark Rx CVS pioneers the integrated model Combined company is called CVS Caremark CVS Caremark strengthens position in medicare market 2011: CVS Caremark Acquires Medicare Rx Drug Business from Universal American CVS Health’s journey to become a fully integrated health care company CVS Health Announces Acquisition of Aetna Following the success of our PBM / Retail model, industry has been gearing toward a more integrated and collaborative approach alongside of us 2013: CVS Caremark Acquires Coram CVS Caremark expands health care offerings and streamlines care mgt for patients and physicians CVS Caremark announces it will stop selling all tobacco products at its stores, demonstrating its commitment to its customers’ health 2014: CVS Caremark Exits Tobacco 2015: CVS Health Acquires Omnicare CVS Health expands presence in the senior-care pharmacy business 2014: CVS Caremark Announces Corporate Name Change to CVS Health Reflects broader health care commitment and expertise in driving the innovations needed to shape the future of health Anthem and Aetna announce transformative acquisitions to consolidate the MCO space, highlighting the growing importance of scale Both transactions were ultimately rejected by the DOJ 2015: Anthem and Aetna announce acquisitions of Cigna and Humana, respectively Benefits of integrated model acknowledged by other firms 2015: UnitedHealth Acquires Catamaran 2016 15

Overview of Aetna

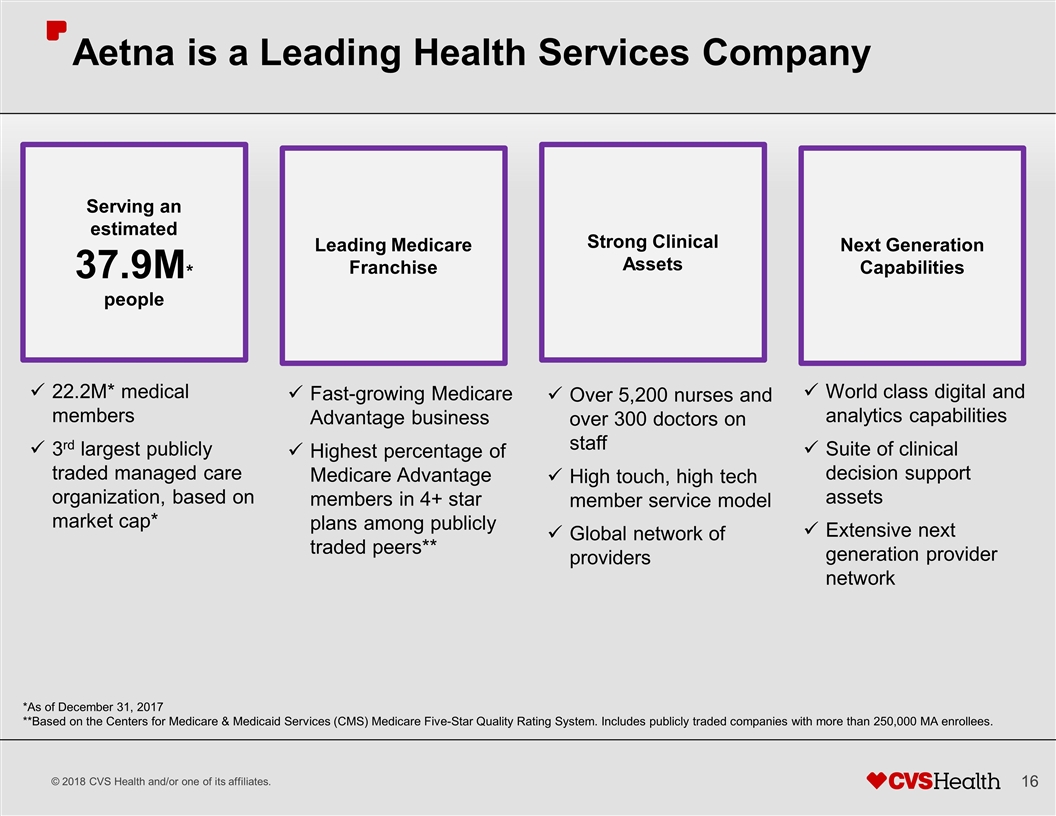

Serving an estimated 37.9M* people Leading Medicare Franchise Strong Clinical Assets Next Generation Capabilities *As of December 31, 2017 **Based on the Centers for Medicare & Medicaid Services (CMS) Medicare Five-Star Quality Rating System. Includes publicly traded companies with more than 250,000 MA enrollees. 22.2M* medical members 3rd largest publicly traded managed care organization, based on market cap* Fast-growing Medicare Advantage business Highest percentage of Medicare Advantage members in 4+ star plans among publicly traded peers** Over 5,200 nurses and over 300 doctors on staff High touch, high tech member service model Global network of providers World class digital and analytics capabilities Suite of clinical decision support assets Extensive next generation provider network Aetna is a Leading Health Services Company 16

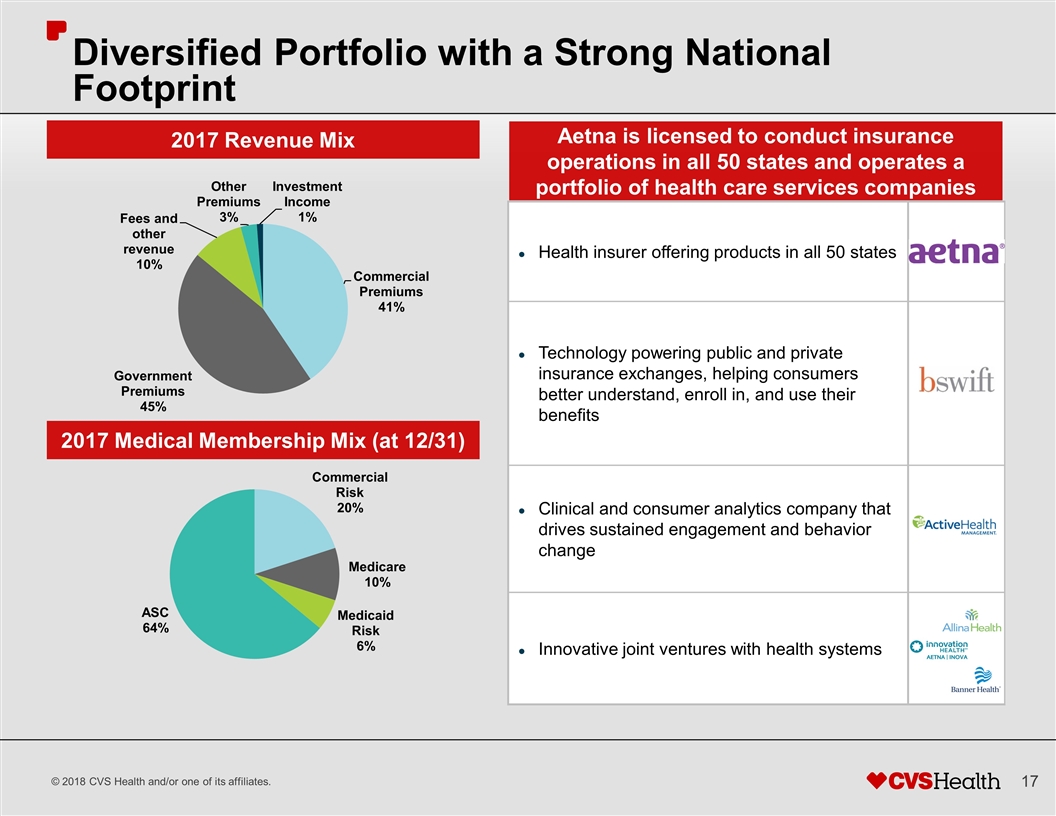

2017 Revenue Mix 2017 Medical Membership Mix (at 12/31) Health insurer offering products in all 50 states Technology powering public and private insurance exchanges, helping consumers better understand, enroll in, and use their benefits Clinical and consumer analytics company that drives sustained engagement and behavior change Innovative joint ventures with health systems Aetna is licensed to conduct insurance operations in all 50 states and operates a portfolio of health care services companies Diversified Portfolio with a Strong National Footprint 17

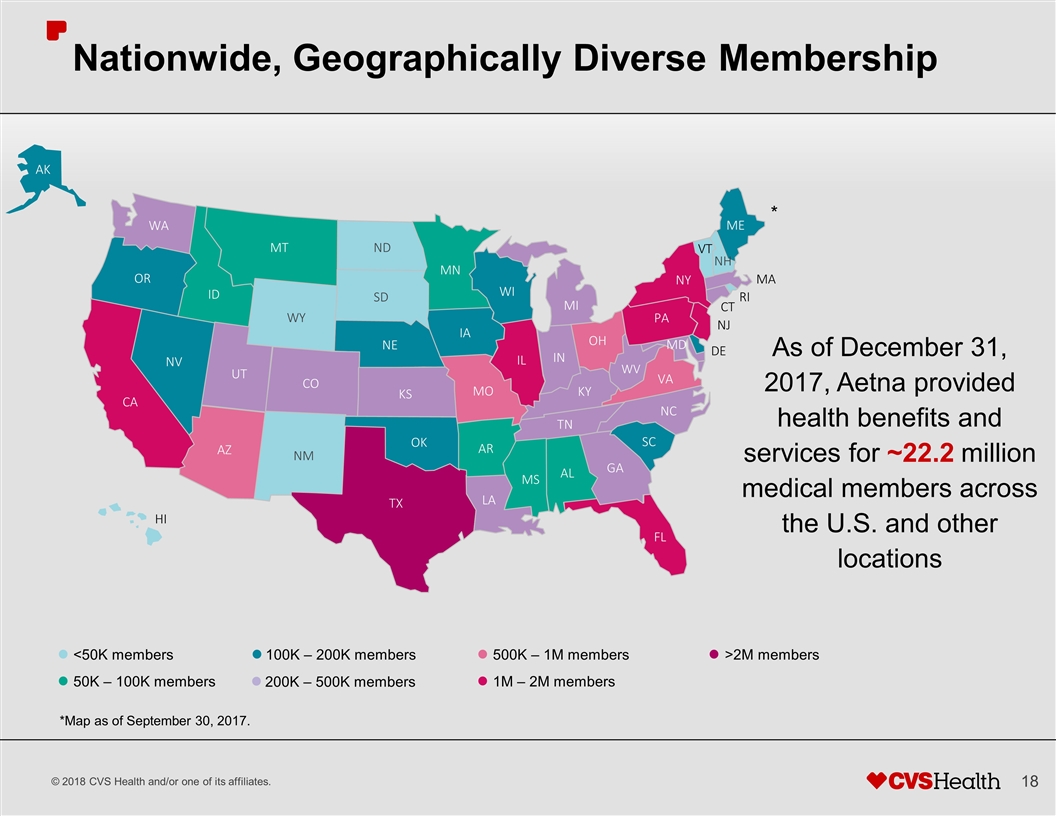

Nationwide, Geographically Diverse Membership AZ TX LA FL IL KY OH MI WV PA NY NJ VA CA MD WA OR MT ID NV UT WY ND SD NE KS OK NM CO MN IA MO AR MS AL GA SC NC TN IN WI ME VT NH MA RI CT DE HI AK As of December 31, 2017, Aetna provided health benefits and services for ~22.2 million medical members across the U.S. and other locations 500K – 1M members 1M – 2M members >2M members <50K members 50K – 100K members 200K – 500K members 100K – 200K members * *Map as of September 30, 2017. 18

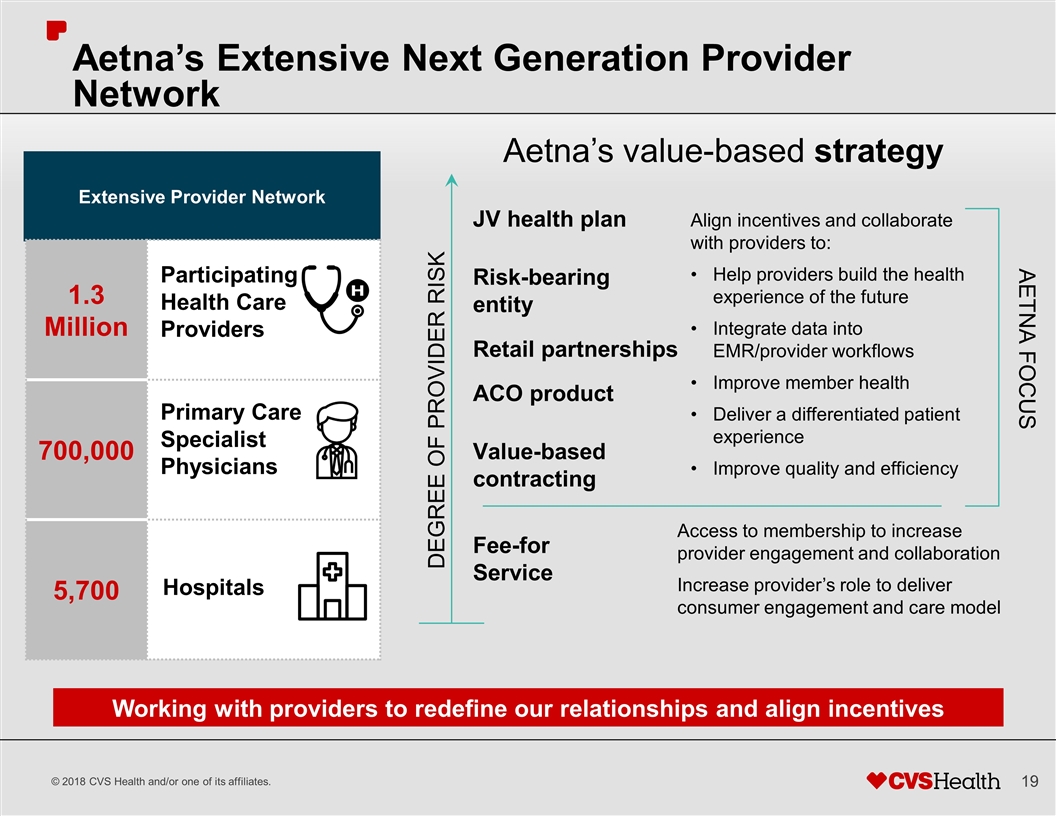

Access to membership to increase provider engagement and collaboration Increase provider’s role to deliver consumer engagement and care model Align incentives and collaborate with providers to: Help providers build the health experience of the future Integrate data into EMR/provider workflows Improve member health Deliver a differentiated patient experience Improve quality and efficiency JV health plan Risk-bearing entity ACO product Value-based contracting Retail partnerships Fee-for Service Degree of provider risk Aetna focus Aetna’s value-based strategy Extensive Provider Network 1.3 Million 700,000 5,700 Participating Health Care Providers Primary Care Specialist Physicians Hospitals Working with providers to redefine our relationships and align incentives Aetna’s Extensive Next Generation Provider Network 19

Financial Overview

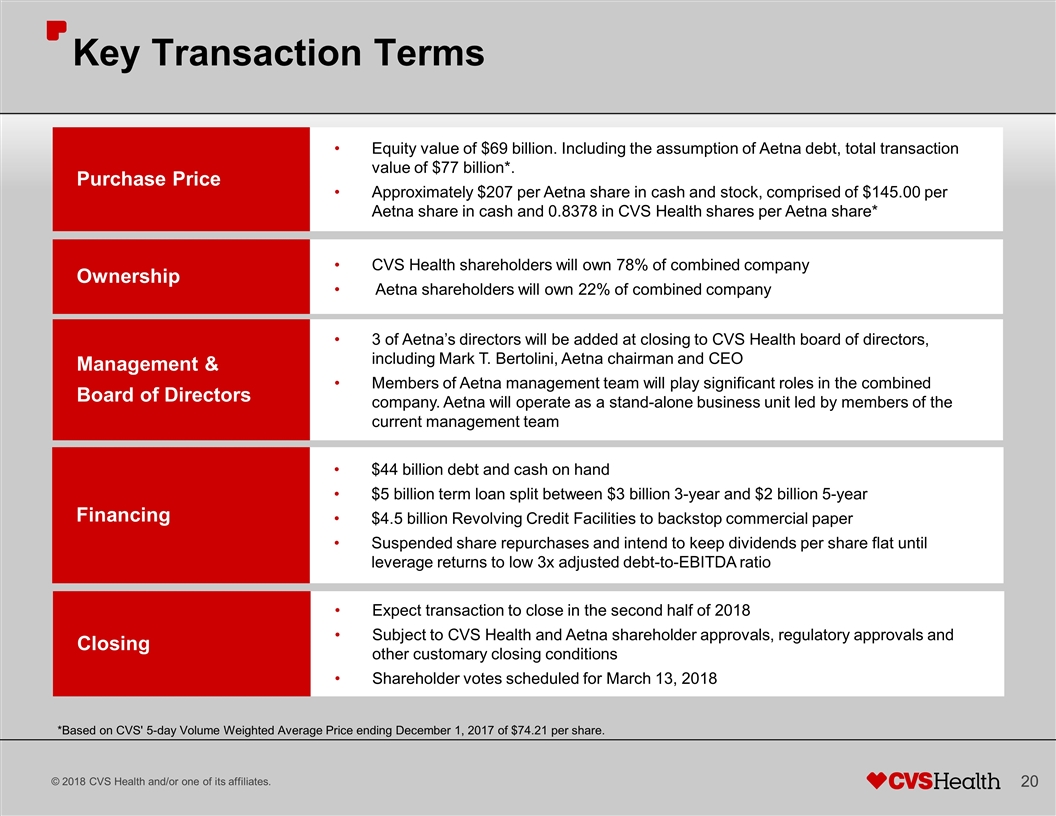

Equity value of $69 billion. Including the assumption of Aetna debt, total transaction value of $77 billion*. Approximately $207 per Aetna share in cash and stock, comprised of $145.00 per Aetna share in cash and 0.8378 in CVS Health shares per Aetna share* Purchase Price CVS Health shareholders will own 78% of combined company Aetna shareholders will own 22% of combined company Ownership 3 of Aetna’s directors will be added at closing to CVS Health board of directors, including Mark T. Bertolini, Aetna chairman and CEO Members of Aetna management team will play significant roles in the combined company. Aetna will operate as a stand-alone business unit led by members of the current management team Management & Board of Directors $44 billion debt and cash on hand $5 billion term loan split between $3 billion 3-year and $2 billion 5-year $4.5 billion Revolving Credit Facilities to backstop commercial paper Suspended share repurchases and intend to keep dividends per share flat until leverage returns to low 3x adjusted debt-to-EBITDA ratio Financing *Based on CVS' 5-day Volume Weighted Average Price ending December 1, 2017 of $74.21 per share. Expect transaction to close in the second half of 2018 Subject to CVS Health and Aetna shareholder approvals, regulatory approvals and other customary closing conditions Shareholder votes scheduled for March 13, 2018 Closing Key Transaction Terms 20

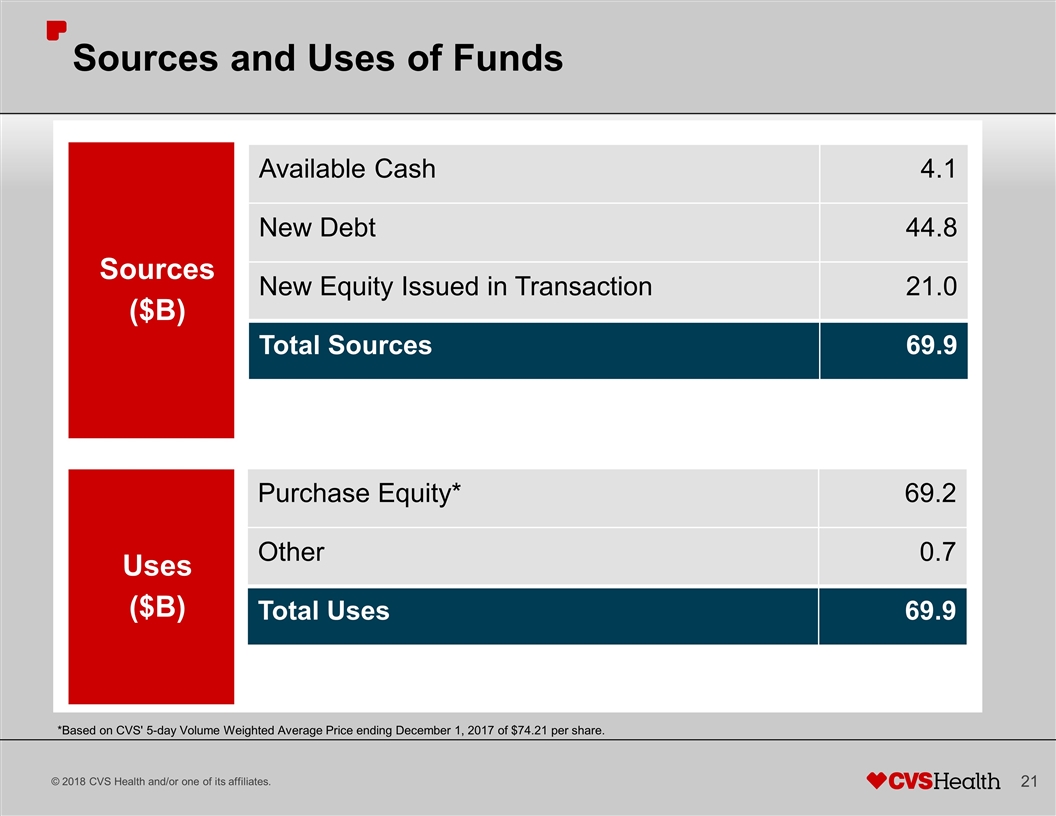

Sources ($B) Uses ($B) Available Cash 4.1 New Debt 44.8 New Equity Issued in Transaction 21.0 Total Sources 69.9 Purchase Equity* 69.2 Other 0.7 Total Uses 69.9 Sources and Uses of Funds *Based on CVS' 5-day Volume Weighted Average Price ending December 1, 2017 of $74.21 per share. 21

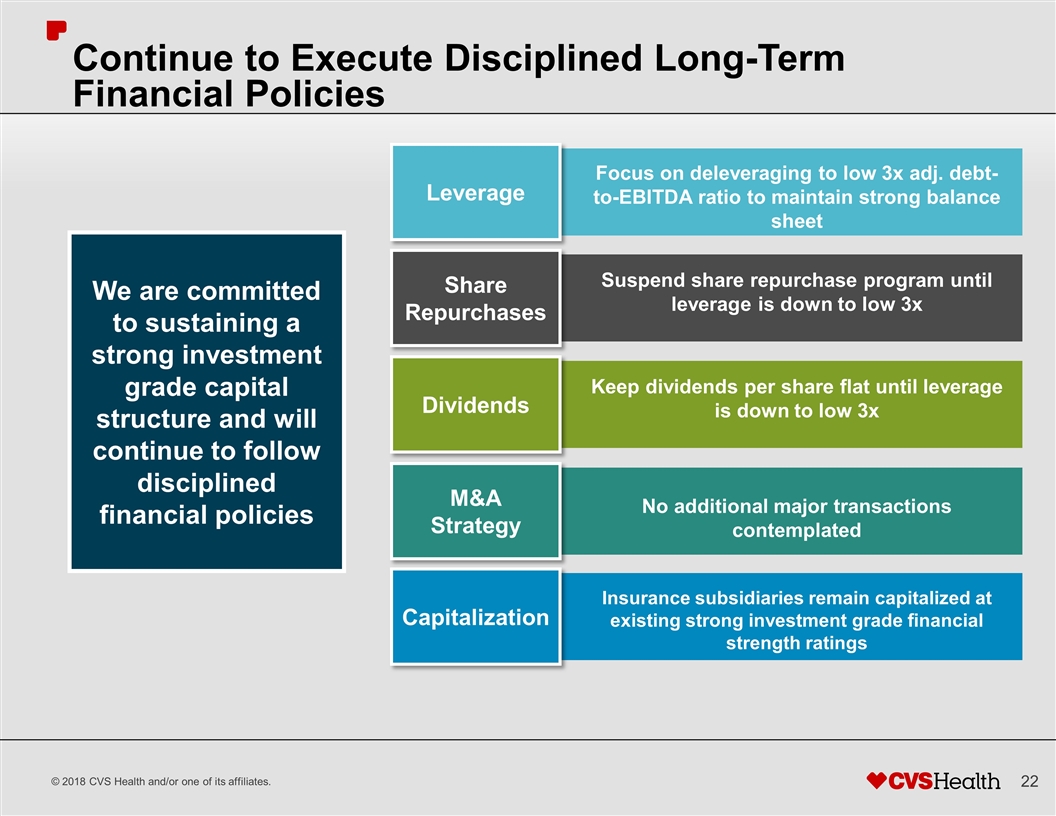

Leverage Focus on deleveraging to low 3x adj. debt-to-EBITDA ratio to maintain strong balance sheet Share Repurchases Suspend share repurchase program until leverage is down to low 3x Dividends Keep dividends per share flat until leverage is down to low 3x M&A Strategy No additional major transactions contemplated Capitalization Insurance subsidiaries remain capitalized at existing strong investment grade financial strength ratings We are committed to sustaining a strong investment grade capital structure and will continue to follow disciplined financial policies Continue to Execute Disciplined Long-Term Financial Policies 22

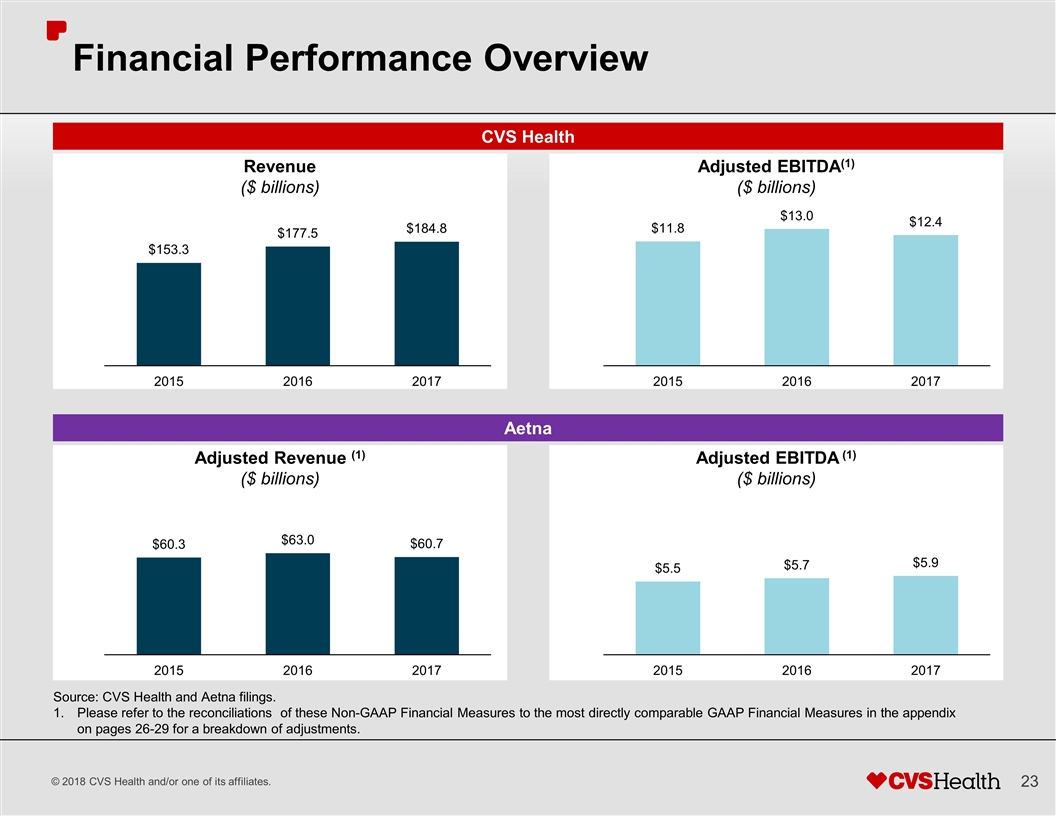

CVS Health Revenue ($ billions) Adjusted EBITDA(1) ($ billions) Aetna Adjusted Revenue (1) ($ billions) Adjusted EBITDA (1) ($ billions) Financial Performance Overview Source: CVS Health and Aetna filings. Please refer to the reconciliations of these Non-GAAP Financial Measures to the most directly comparable GAAP Financial Measures in the appendix on pages 26-29 for a breakdown of adjustments. 23

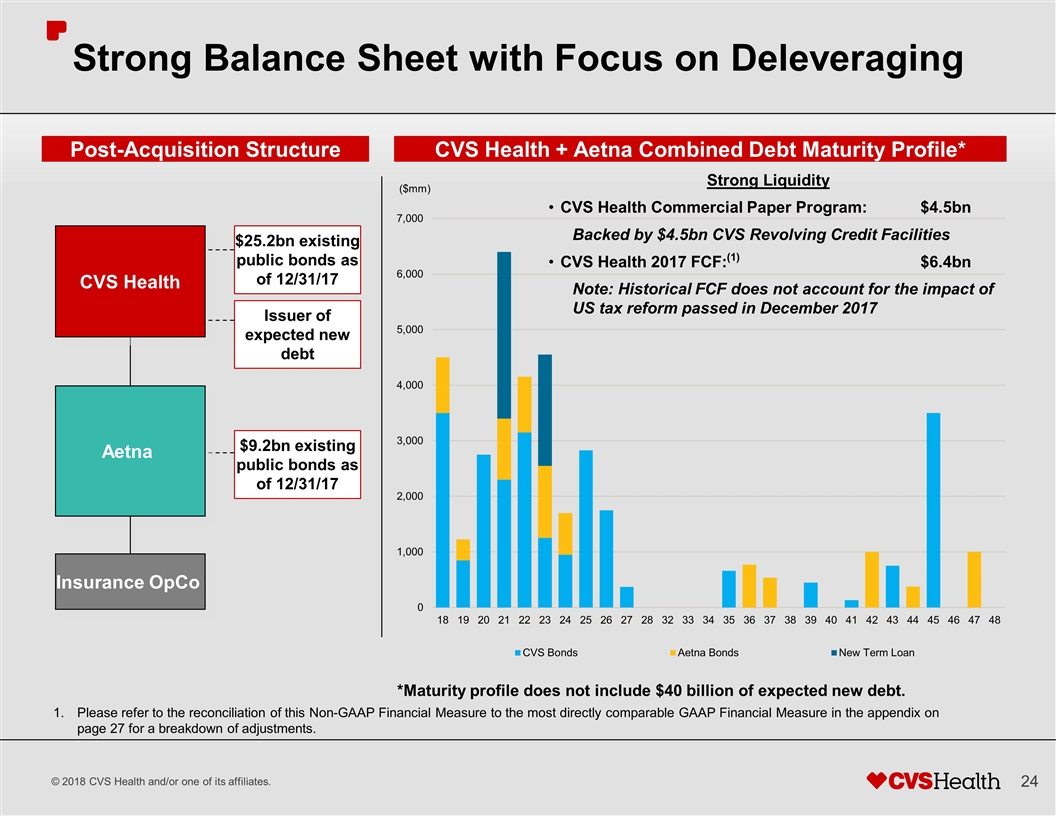

Aetna CVS Health Post-Acquisition Structure $25.2bn existing public bonds as of 12/31/17 $9.2bn existing public bonds as of 12/31/17 Issuer of expected new debt Insurance OpCo CVS Health + Aetna Combined Debt Maturity Profile* Strong Liquidity CVS Health Commercial Paper Program:$4.5bn Backed by $4.5bn CVS Revolving Credit Facilities CVS Health 2017 FCF: $6.4bn Note: Historical FCF does not account for the impact of US tax reform passed in December 2017 Strong Balance Sheet with Focus on Deleveraging *Maturity profile does not include $40 billion of expected new debt. (1) Please refer to the reconciliation of this Non-GAAP Financial Measure to the most directly comparable GAAP Financial Measure in the appendix on page 27 for a breakdown of adjustments. 24

CVS Health – Aetna: Compelling Strategic Combination Highly diversified, strong and stable cash flows Creates a leading health care platform with unmatched suite of services Improved quality of care through enhanced data integration / predictive analytics High-touch connectivity to consumers as go-to local health care access point Drives efficiencies and lower cost of care through an integrated model Committed to sustaining a strong investment grade capital structure with disciplined financial policies Significant synergy potential 25

Appendix

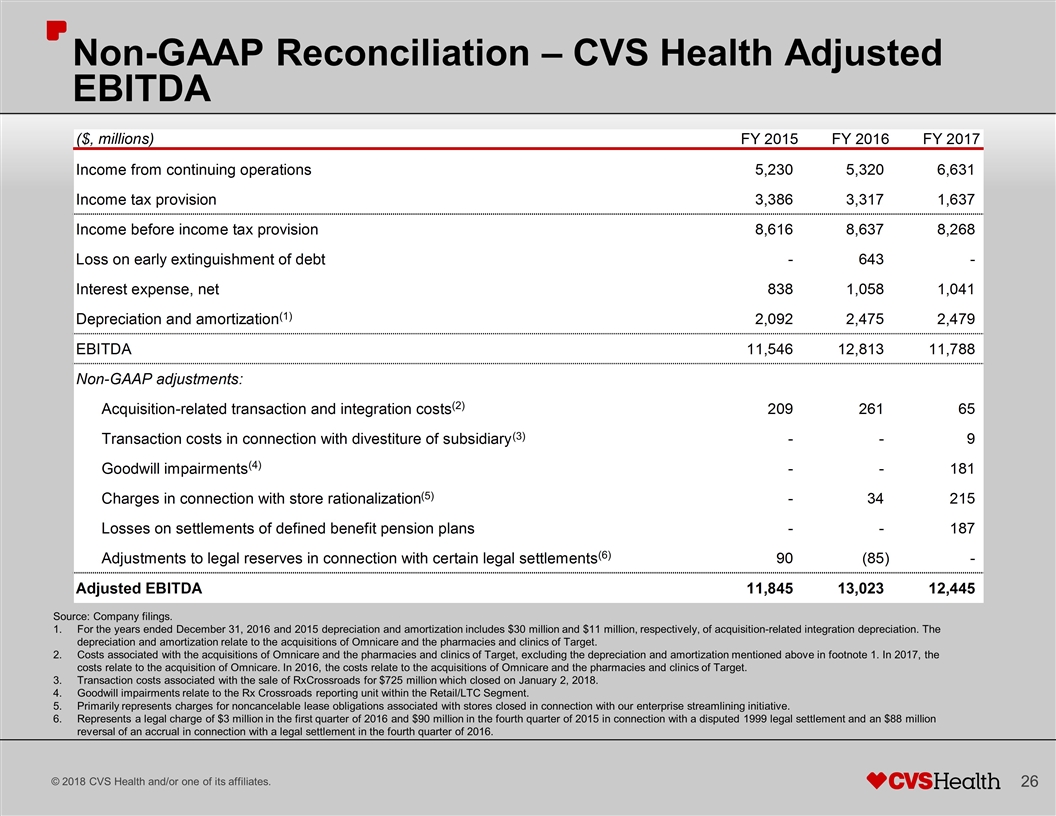

Non-GAAP Reconciliation – CVS Health Adjusted EBITDA Source: Company filings. For the years ended December 31, 2016 and 2015 depreciation and amortization includes $30 million and $11 million, respectively, of acquisition-related integration depreciation. The depreciation and amortization relate to the acquisitions of Omnicare and the pharmacies and clinics of Target. Costs associated with the acquisitions of Omnicare and the pharmacies and clinics of Target, excluding the depreciation and amortization mentioned above in footnote 1. In 2017, the costs relate to the acquisition of Omnicare. In 2016, the costs relate to the acquisitions of Omnicare and the pharmacies and clinics of Target. Transaction costs associated with the sale of RxCrossroads for $725 million which closed on January 2, 2018. Goodwill impairments relate to the Rx Crossroads reporting unit within the Retail/LTC Segment. Primarily represents charges for noncancelable lease obligations associated with stores closed in connection with our enterprise streamlining initiative. Represents a legal charge of $3 million in the first quarter of 2016 and $90 million in the fourth quarter of 2015 in connection with a disputed 1999 legal settlement and an $88 million reversal of an accrual in connection with a legal settlement in the fourth quarter of 2016. (1) (2) (3) (4) (5) (6) 26

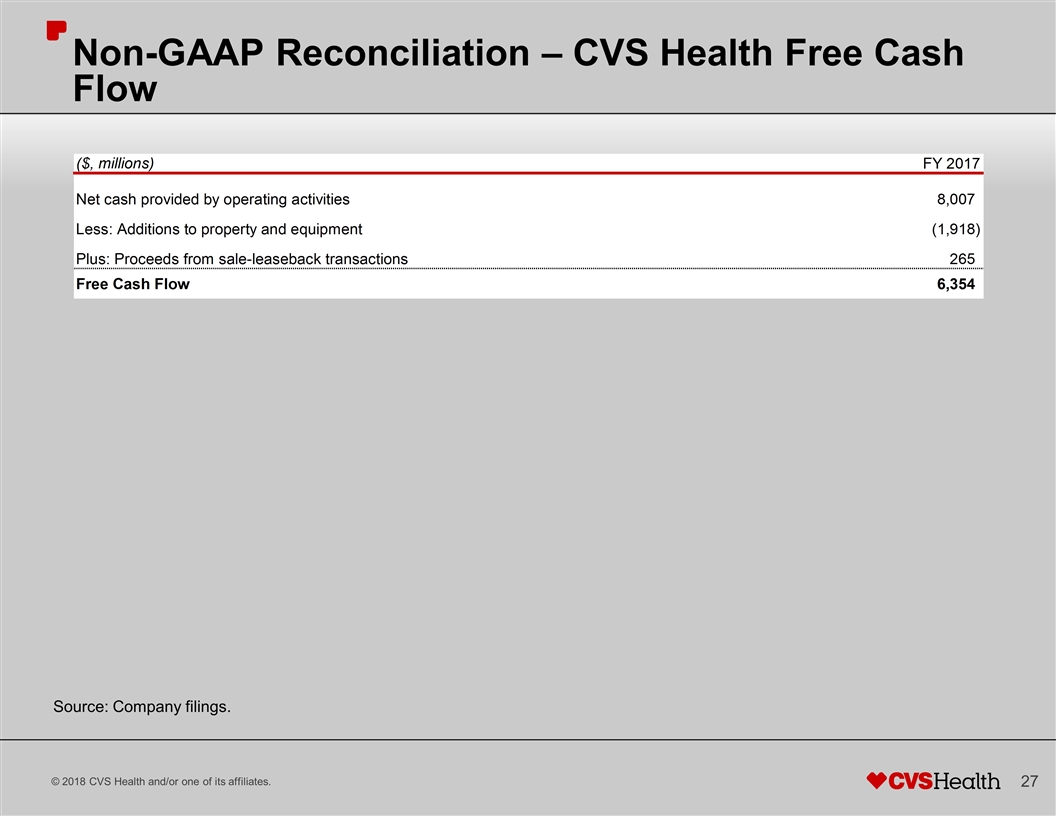

Non-GAAP Reconciliation – CVS Health Free Cash Flow Source: Company filings. 27

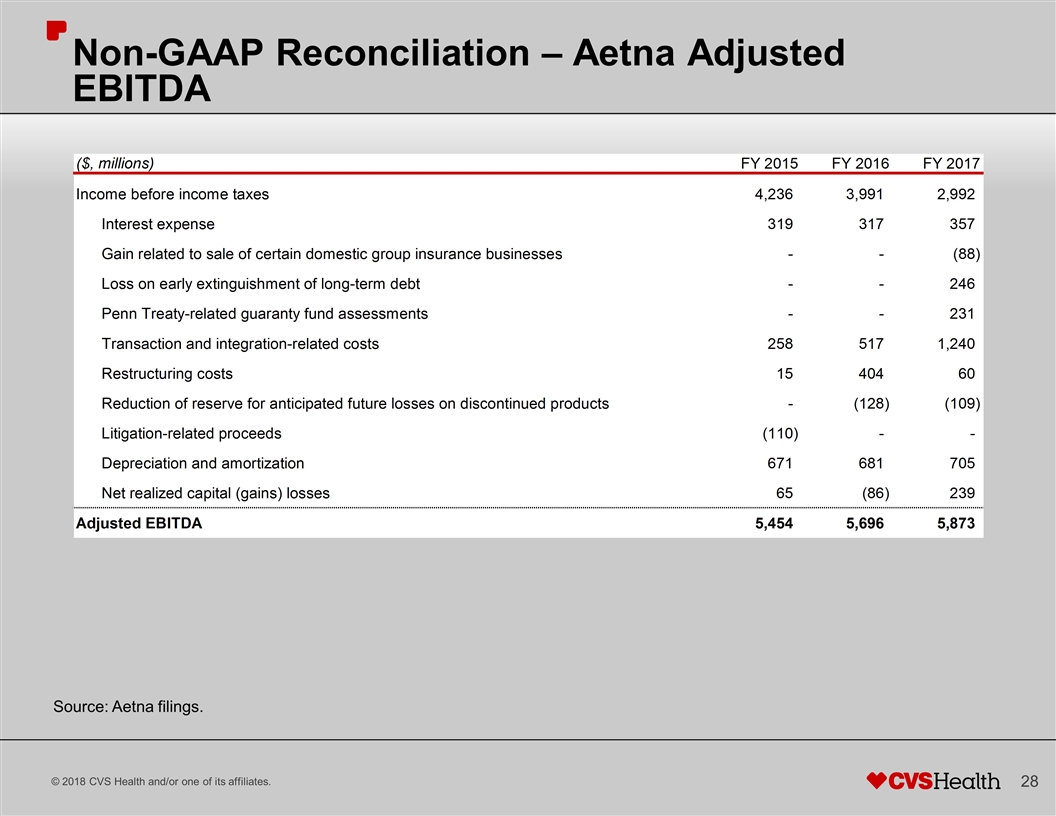

Non-GAAP Reconciliation – Aetna Adjusted EBITDA Source: Aetna filings. 28

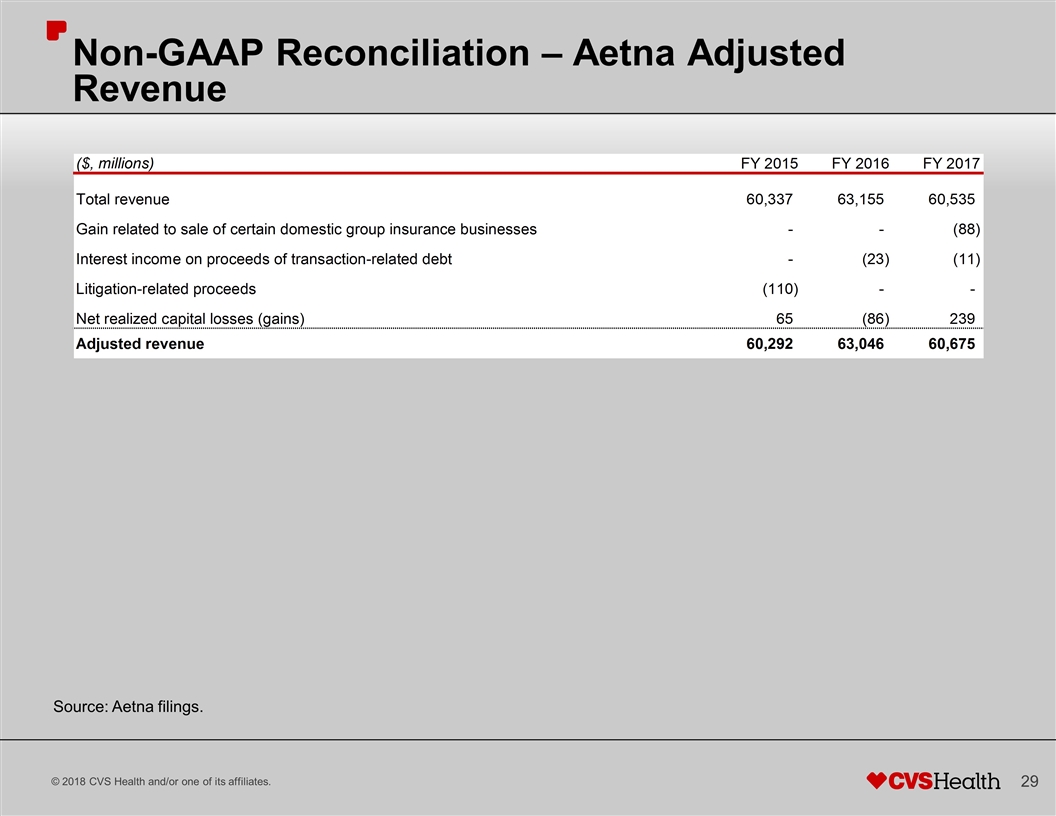

Non-GAAP Reconciliation – Aetna Adjusted Revenue Source: Aetna filings. 29