Form DEFA14A WELLS FARGO & COMPANY/MN

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant

Filed by a Party other than the Registrant

Check the appropriate box:

Preliminary Proxy Statement

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

Definitive Proxy Statement

Definitive Additional Materials

Soliciting Material under §240.14a-12

Wells Fargo & Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

No fee required.

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount

on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

Fee paid previously with preliminary materials.

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the

offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and

the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

Wells Fargo Update:

Federal Reserve Consent Order

February 2, 2018

© 2018 Wells Fargo & Company. All rights reserved. Confidential.

1Wells Fargo Update

Wells Fargo entered into a Consent Order with the Board of Governors of the Federal

Reserve System on February 2, 2018, relating to our governance oversight, and

compliance and operational risk management program, which relates to prior issues

including our sales practices announcement on September 8, 2016

The Federal Reserve acknowledges that Wells Fargo has already taken steps to address

deficiencies in corporate governance and risk management, and has implemented

improvements in both

Within 60 days, the Board and the Company must submit plans to the Federal Reserve

that leverage existing plans and efforts already underway to:

- Further enhance the Board’s effectiveness in carrying out its oversight and governance of the

Company (Governance Plan)

- Further improve the firm wide compliance and operational risk management program (Risk

Management Program Plan)

Once we adopt and implement these two plans as approved by the Federal Reserve, we

will engage independent third parties to conduct an initial risk management review by

September 30, 2018

Until the Governance and Risk Management Program plans are adopted and

implemented, and the first third party review is completed to the satisfaction of the

Federal Reserve, our total asset size will be limited as follows:

- Effective 2Q18, Wells Fargo’s total consolidated assets must be held to the December 31, 2017

level

• We have flexibility to optimize our Balance Sheet while we continue to help our customers succeed

financially (See pages 5 and 6 for additional information)

Subsequently, after the asset cap has been lifted, and we have integrated the risk

management program improvements, we will engage in a second third-party review to

assess the efficacy and sustainability of the improvements

Federal Reserve Consent Order summary

2Wells Fargo Update

Relevant risk management enhancements already underway

Over the last 17 months, we continued our focus and accelerated progress on the

governance, compliance and operational risk issues referenced in the Federal Reserve’s

Consent Order, and we agree with the assessment that our work is not yet complete

- Much of the foundational work has been completed, as issues related to these functions were

previously identified by regulators, or were self-identified

Concurrently, we have made meaningful changes to our operating model that further

strengthen our governance and risk management, which include:

- Strengthened Board governance and oversight

- Centralized control functions

- Improved team member leadership and staff expertise including through external hires

- Increased investment spending and resources to address compliance and operating risk deficiencies

We are building on our progress to date and leveraging our experience in risk management

areas where we have excelled or made substantial improvements (e.g., credit/market risk,

model risk, capital stress testing, liquidity risk management including TLAC, resolution

planning), and we are confident that we are addressing the issues cited in the Consent

Order

As we execute on these plans and manage to the asset cap, we will continue to serve our

customers’ financial needs including saving, borrowing and investing, as we help them

succeed financially

3Wells Fargo Update

Board Leadership Structure Board Composition Governance Practices

Separated the roles of Chairman

and CEO

Amended By-Laws to require an

independent Board Chair

Elected new independent Chair,

Elizabeth “Betsy” Duke (former member

of the Federal Reserve Board of

Governors) effective January 1, 2018

Significant Board refreshment - Elected 6

new independent directors and 5 directors

retired in 2017; planned refreshment of an

additional 4 directors in 2018, with the

retirement of 3 of those directors occurring by

the 2018 Annual Meeting

Majority of independent directors (8) have

been added since 2015

Enhanced skills and experience

represented on Board, including financial

services, risk management, technology/cyber,

regulatory, human capital management,

finance, accounting, consumer and social

responsibility

2017 Board self-evaluation facilitated

by a third party (Mary Jo White,

former Chair of the SEC) following

2017 annual meeting and in advance of

typical year-end timing

Board Chair and Committee Chairs

focused on agenda planning and

managing information flow and

management reporting to the Board

Board continues to work with

management to enhance and focus Board

presentations and materials

Board actions taken to enhance structure and oversight

The Board has made significant changes to its leadership, composition, and governance practices that

resulted from a thoughtful and deliberate process informed by the Board’s comprehensive self-evaluation

process and the Company’s engagement with shareholders and other stakeholders.

Board Composition Evaluation

Robust annual Board and self-

evaluation process includes the

individual contributions of

directors

Succession planning and Board

refreshment

Recruitment of new

directors to complement

the existing skills and

experience of the Board in

areas identified through its

self-evaluation process while

maintaining an appropriate

balance of perspectives and

experience

Key Changes Made to Board Structure, Composition, and Oversight

Reconstitution of Key Committees

Risk Committee

Karen Peetz appointed as new Chair

Added 4 directors (Maria Morris, Karen Peetz, Juan

Pujadas, Suzanne Vautrinot)

Enhanced financial services, compliance, risk,

operational, cyber, and technology experience with

new composition

4 members have risk management expertise

meeting Federal Reserve enhanced prudential

standards for large U.S. bank holding companies

Consolidated oversight of second line of defense

risk management activities under the Risk

Committee

Established 2 subcommittees focused on (1)

compliance risk and (2) technology/cyber risk and

data governance and management

Governance and Nominating Committee

Donald James appointed as new Chair

Added 2 directors (Duke and James)

Enhanced financial services, corporate

governance, and regulatory experience with

new composition

Human Resources Committee

Added 2 directors (Peetz and Ron Sargent)

Enhanced oversight responsibilities to include

human capital management, culture, and ethics

Continues to oversee our incentive

compensation risk management program which

was expanded to include a broader population

of team members and incentive plans

4Wells Fargo Update

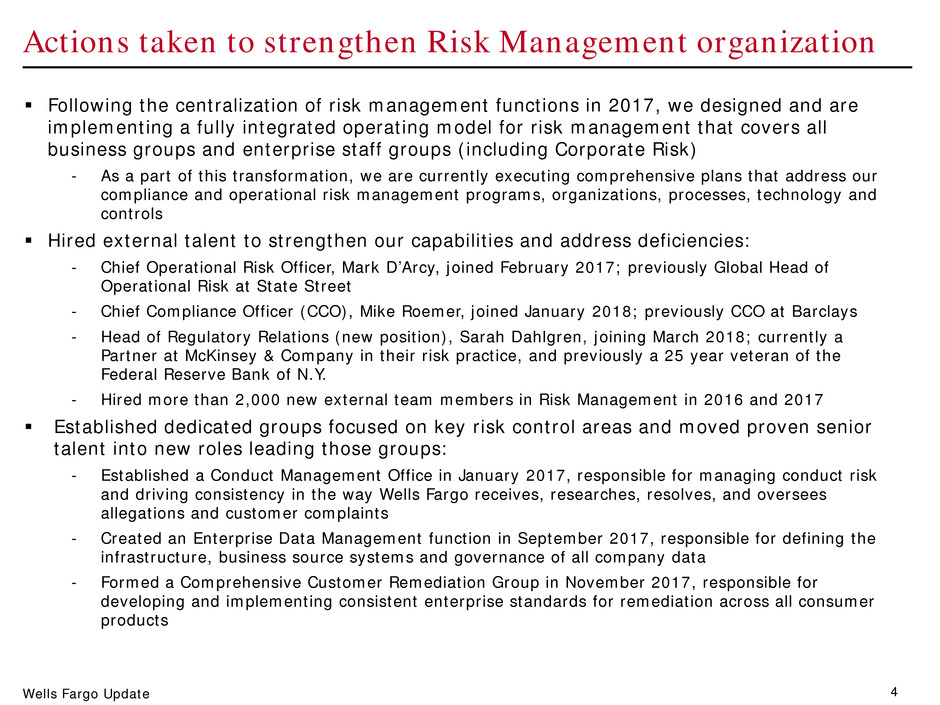

Actions taken to strengthen Risk Management organization

Following the centralization of risk management functions in 2017, we designed and are

implementing a fully integrated operating model for risk management that covers all

business groups and enterprise staff groups (including Corporate Risk)

- As a part of this transformation, we are currently executing comprehensive plans that address our

compliance and operational risk management programs, organizations, processes, technology and

controls

Hired external talent to strengthen our capabilities and address deficiencies:

- Chief Operational Risk Officer, Mark D’Arcy, joined February 2017; previously Global Head of

Operational Risk at State Street

- Chief Compliance Officer (CCO), Mike Roemer, joined January 2018; previously CCO at Barclays

- Head of Regulatory Relations (new position), Sarah Dahlgren, joining March 2018; currently a

Partner at McKinsey & Company in their risk practice, and previously a 25 year veteran of the

Federal Reserve Bank of N.Y.

- Hired more than 2,000 new external team members in Risk Management in 2016 and 2017

Established dedicated groups focused on key risk control areas and moved proven senior

talent into new roles leading those groups:

- Established a Conduct Management Office in January 2017, responsible for managing conduct risk

and driving consistency in the way Wells Fargo receives, researches, resolves, and oversees

allegations and customer complaints

- Created an Enterprise Data Management function in September 2017, responsible for defining the

infrastructure, business source systems and governance of all company data

- Formed a Comprehensive Customer Remediation Group in November 2017, responsible for

developing and implementing consistent enterprise standards for remediation across all consumer

products

5Wells Fargo Update

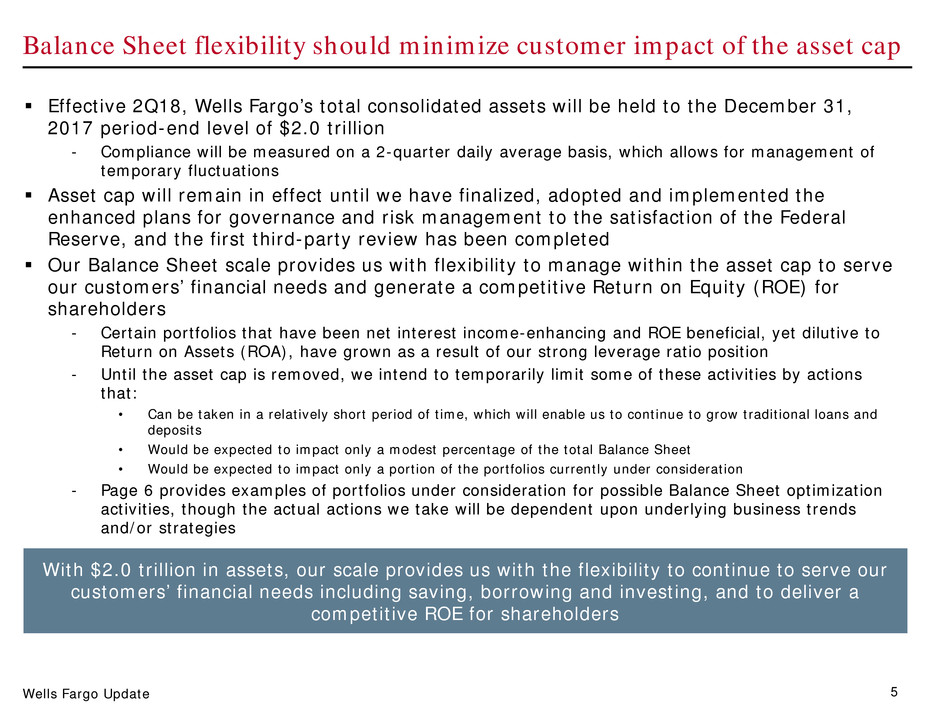

Effective 2Q18, Wells Fargo’s total consolidated assets will be held to the December 31,

2017 period-end level of $2.0 trillion

- Compliance will be measured on a 2-quarter daily average basis, which allows for management of

temporary fluctuations

Asset cap will remain in effect until we have finalized, adopted and implemented the

enhanced plans for governance and risk management to the satisfaction of the Federal

Reserve, and the first third-party review has been completed

Our Balance Sheet scale provides us with flexibility to manage within the asset cap to serve

our customers’ financial needs and generate a competitive Return on Equity (ROE) for

shareholders

- Certain portfolios that have been net interest income-enhancing and ROE beneficial, yet dilutive to

Return on Assets (ROA), have grown as a result of our strong leverage ratio position

- Until the asset cap is removed, we intend to temporarily limit some of these activities by actions

that:

• Can be taken in a relatively short period of time, which will enable us to continue to grow traditional loans and

deposits

• Would be expected to impact only a modest percentage of the total Balance Sheet

• Would be expected to impact only a portion of the portfolios currently under consideration

- Page 6 provides examples of portfolios under consideration for possible Balance Sheet optimization

activities, though the actual actions we take will be dependent upon underlying business trends

and/or strategies

Balance Sheet flexibility should minimize customer impact of the asset cap

With $2.0 trillion in assets, our scale provides us with the flexibility to continue to serve our

customers’ financial needs including saving, borrowing and investing, and to deliver a

competitive ROE for shareholders

6Wells Fargo Update

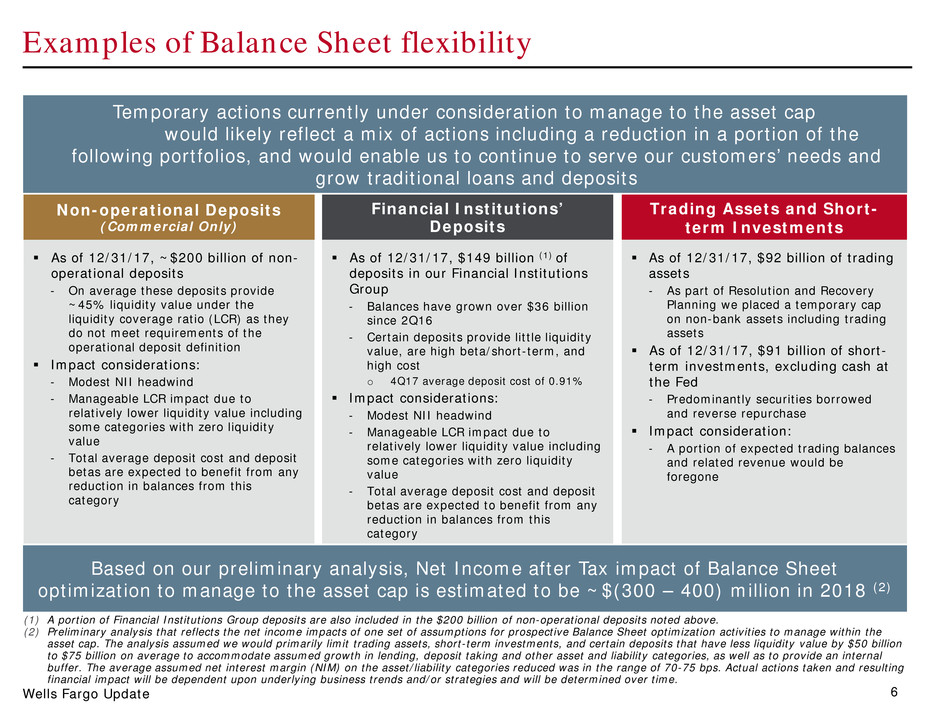

Financial Institutions’

Deposits

Trading Assets and Short-

term Investments

As of 12/31/17, ~$200 billion of non-

operational deposits

- On average these deposits provide

~45% liquidity value under the

liquidity coverage ratio (LCR) as they

do not meet requirements of the

operational deposit definition

Impact considerations:

- Modest NII headwind

- Manageable LCR impact due to

relatively lower liquidity value including

some categories with zero liquidity

value

- Total average deposit cost and deposit

betas are expected to benefit from any

reduction in balances from this

category

As of 12/31/17, $149 billion (1) of

deposits in our Financial Institutions

Group

- Balances have grown over $36 billion

since 2Q16

- Certain deposits provide little liquidity

value, are high beta/short-term, and

high cost

o 4Q17 average deposit cost of 0.91%

Impact considerations:

- Modest NII headwind

- Manageable LCR impact due to

relatively lower liquidity value including

some categories with zero liquidity

value

- Total average deposit cost and deposit

betas are expected to benefit from any

reduction in balances from this

category

As of 12/31/17, $92 billion of trading

assets

- As part of Resolution and Recovery

Planning we placed a temporary cap

on non-bank assets including trading

assets

As of 12/31/17, $91 billion of short-

term investments, excluding cash at

the Fed

- Predominantly securities borrowed

and reverse repurchase

Impact consideration:

- A portion of expected trading balances

and related revenue would be

foregone

Non-operational Deposits

(Commercial Only)

(1) A portion of Financial Institutions Group deposits are also included in the $200 billion of non-operational deposits noted above.

(2) Preliminary analysis that reflects the net income impacts of one set of assumptions for prospective Balance Sheet optimization activities to manage within the

asset cap. The analysis assumed we would primarily limit trading assets, short-term investments, and certain deposits that have less liquidity value by $50 billion

to $75 billion on average to accommodate assumed growth in lending, deposit taking and other asset and liability categories, as well as to provide an internal

buffer. The average assumed net interest margin (NIM) on the asset/liability categories reduced was in the range of 70-75 bps. Actual actions taken and resulting

financial impact will be dependent upon underlying business trends and/or strategies and will be determined over time.

Examples of Balance Sheet flexibility

Based on our preliminary analysis, Net Income after Tax impact of Balance Sheet

optimization to manage to the asset cap is estimated to be ~$(300 – 400) million in 2018 (2)

Temporary actions currently under consideration to manage to the asset cap

would likely reflect a mix of actions including a reduction in a portion of the

following portfolios, and would enable us to continue to serve our customers’ needs and

grow traditional loans and deposits

7Wells Fargo Update

What will the customer impact be?

- We will continue to serve our customers’ financial

needs including saving, borrowing and investing, as

we help them succeed financially

- We have flexibility to manage our Balance Sheet by

optimizing certain activities, which could include

temporarily pulling back from some activities

focused on providing liquidity to market participants

including other financial institutions

Do you have the capacity to address the

requirements, and how long will it take?

- This is priority #1 for the Company, and we will

allocate whatever resources are necessary to

address the issues citied

- We are working on augmenting the plans we

currently have in place for submission to the Federal

Reserve, and after Federal Reserve approval of the

plans we will engage independent third parties to

conduct a review to be completed no later than

September 30, 2018

When do you expect the Federal Reserve to

remove the constraint on your assets?

- There are a number of key deliverables in the

Consent Order.

- The asset cap will remain in effect until we have

adopted and implemented the plans for enhanced

governance and risk management, and the first

third-party review has been completed to the

satisfaction of the Federal Reserve

Are these new issues that have been

identified?

- These are not new issues. They are related to

compliance and operational risk matters that were

previously identified by regulators, or were self-

identified

Are you still committed to your expense

savings plans?

- We are focused on delivering expense savings, and

reinvesting in the business as previously disclosed

- We remain committed to our previously disclosed

2018 expense guidance, as well as our targeted $4

billion in expense savings by year-end 2019

What does this mean for your efficiency, ROE

and ROA targets?

- Updated annual targets will be disclosed at our May

2018 Investor Day, and will consider the impacts of

the 2017 Tax Act, as well as the asset cap

Will you be able to return more capital to

shareholders this year?

- With ~190 bps of capital above our internal

Common Equity Tier 1 target of 10%, as of

12/31/17, we remain committed to returning more

capital to shareholders

Key questions

Key questions and current outlook

8Wells Fargo Update

Key takeaways

We have been focused on the same issues cited by the Federal Reserve, and while we have

made meaningful progress we acknowledge additional work is necessary

We are building on our progress to date, leveraging our experience in risk management in

areas where we have excelled, and are confident that we are addressing the issues

We are committed to meeting the Consent Order requirements and are currently working

on our comprehensive Risk Management Program Plan, while the Board develops the

Governance Plan, for submission to the Federal Reserve within 60 days

We believe that our Balance Sheet scale provides us with the flexibility to manage within

the asset cap, serve our customers’ financial needs including saving, borrowing and

investing, and generate a competitive Return on Equity (ROE)

We take the Consent Order very seriously and we will successfully complete the work that we

have started, as we continue on the path towards building a better Wells Fargo

9Wells Fargo Update

Forward-looking statements and additional information

Forward-looking statements:

This document contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. In

addition, we may make forward-looking statements in our other documents filed or furnished with the SEC, and our management may

make forward-looking statements orally to analysts, investors, representatives of the media and others. Forward-looking statements can

be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” “target,” “projects,” “outlook,”

“forecast,” “will,” “may,” “could,” “should,” “can” and similar references to future periods. In particular, forward-looking statements

include, but are not limited to, statements we make about: (i) the balance sheet optimization strategies described in this document,

including their anticipated effects and our ability to implement those strategies, (ii) when we expect to fulfill our requirements under the

Consent Order, (iii) our expense savings plans, (iv) the future operating or financial performance of the Company; (v) our noninterest

expense and efficiency ratio; (vi) future credit quality and performance, including our expectations regarding future loan losses and

allowance levels; (vii) the appropriateness of the allowance for credit losses; (viii) our expectations regarding net interest income and net

interest margin; (ix) loan growth or the reduction or mitigation of risk in our loan portfolios; (x) future capital or liquidity levels or targets

and our estimated Common Equity Tier 1 ratio under Basel III capital standards; (xi) the performance of our mortgage business and any

related exposures; (xii) the expected outcome and impact of legal, regulatory and legislative developments, as well as our expectations

regarding compliance therewith; (xiii) future common stock dividends, common share repurchases and other uses of capital; (xiv) our

targeted range for return on assets and return on equity; (xv) the outcome of contingencies, such as legal proceedings; and (xvi) the

Company’s plans, objectives and strategies. Forward-looking statements are not based on historical facts but instead represent our current

expectations and assumptions regarding our business, the economy and other future conditions. Investors are urged to not unduly rely on

forward-looking statements as actual results could differ materially from expectations. Forward-looking statements speak only as of the

date made, and we do not undertake to update them to reflect changes or events that occur after that date. For more information about

factors that could cause actual results to differ materially from expectations, refer to the “Forward-Looking Statements” discussion in Wells

Fargo’s press release announcing our fourth quarter 2017 results and in our most recent Quarterly Report on Form 10-Q, as well as to

Wells Fargo’s other reports filed with the Securities and Exchange Commission, including the discussion under “Risk Factors” in our Annual

Report on Form 10-K for the year ended December 31, 2016.

Additional information and where to find it:

Wells Fargo & Company (the “Company”) will file a proxy statement related to items to be voted on at its 2018 annual meeting of

shareholders with the Securities and Exchange Commission (“SEC”). INVESTORS AND SECURITY HOLDERS ARE ADVISED TO READ

THE PROXY STATEMENT WHEN IT BECOMES AVAILABLE, BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. Investors

and security holders may obtain a free copy of the proxy statement (when available) and other documents filed by the Company with the

SEC at the SEC’s web site at www.sec.gov. Free copies of the proxy statement, once available, and the Company's other filings with the

SEC may also be obtained from the Company upon written request to the Office of the Corporate Secretary, Wells Fargo & Company, MAC

D1053-300, 301 S. College Street, Charlotte, North Carolina 28202.

Participants in the solicitation:

The Company and its directors, executive officers, and other members of management and employees may be soliciting proxies from Wells

Fargo shareholders in connection with items to be voted on at the Company’s 2018 annual meeting of shareholders. Information regarding

the persons who may, under the rules of the SEC, be deemed participants in the solicitation of proxies, including a description of their

direct and indirect interest, by security holdings or otherwise, will be set forth in the Company’s proxy statement filed with the SEC.