Form 8-K WELLS FARGO & COMPANY/MN For: Feb 02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 2, 2018

WELLS FARGO & COMPANY

(Exact Name of Registrant as Specified in Charter)

Delaware | 001-02979 | No. 41-0449260 | ||

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||

420 Montgomery Street, San Francisco, California 94163

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: 1-866-249-3302

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

[ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

[ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

[ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01 | Other Events |

On February 2, 2018, Wells Fargo & Company (the “Company”) issued a press release announcing it had entered into a consent order with the Board of Governors of the Federal Reserve System regarding the Company’s governance and risk management. The Company also posted a presentation regarding the requirements of the consent order and related matters on its website. A copy of the press release, presentation, and consent order are included as Exhibits 99.1, 99.2 and 99.3 to this report and are incorporated by reference into this Item 8.01.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit No. | Description | Location |

Filed herewith. | ||

Filed herewith. | ||

Filed herewith. | ||

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: | February 2, 2018 | WELLS FARGO & COMPANY | |

By: | /s/ ANTHONY R. AUGLIERA | ||

Anthony R. Augliera | |||

Deputy General Counsel and Secretary | |||

Exhibit 99.1

Media Investors

Arati Randolph John Campbell

Corporate Communications

704-383-6996

[email protected]

@AratiRandolphWF

Mark Folk

Corporate Communications

704-383-7088

[email protected]

@MarkFolkWF

Investor Relations

415-396-0523

[email protected]

Wells Fargo Commits to Satisfying Consent Order

with Federal Reserve

CEO Sloan cites efforts well underway to enhance

company’s compliance and operational risk management program

SAN FRANCISCO, February 2, 2018 – Wells Fargo & Company (NYSE: WFC) announced it is

confident it will satisfy the requirements of the consent order it agreed to today with the Board of

Governors of the Federal Reserve System. Under the consent order, the company will provide plans

to the Federal Reserve within 60 days that detail what already has been done, and is planned, to

further enhance the board’s governance oversight, and the company’s compliance and operational

risk management. The order also provides for third-party reviews of such plans and, until they are

approved and implemented, limits on the growth of the company’s total consolidated assets to the

level as of December 31, 2017.

“We take this order seriously and are focused on addressing all of the Federal Reserve’s concerns,”

said Timothy J. Sloan, Wells Fargo’s president and chief executive officer. “It is important to note

that the consent order is not related to any new matters, but to prior issues where we have already

made significant progress. We appreciate the Federal Reserve’s acknowledgment of our actions to

date. In addition, the order is not related to Wells Fargo’s financial condition -- we remain in a

strong financial position and stand ready to serve the varied financial needs of our customers.”

“Our board is committed to meeting the expectations of our regulators and protecting and serving

the interests of our shareholders, customers, team members and the community,” said Betsy Duke,

independent chair of Wells Fargo’s Board of Directors and a former member of the Board of

Governors of the Federal Reserve. “Every change we’ve made over the past year reflects this and

the valuable feedback of investors and stakeholders. Moving forward, we’ll continue to be focused

on maintaining an appropriate mix of professional experiences and diverse perspectives necessary

to govern a franchise as important as Wells Fargo.”

The Federal Reserve’s consent order – which recognizes that the company already has

implemented improvements in its governance and risk management – includes the following

requirements:

• Within 60 days:

o The company’s board will submit a plan to further enhance the board’s effectiveness

in carrying out its oversight and governance of the company.

o The company will submit a plan to further improve the company’s firm-wide

compliance and operational risk management program.

• After Federal Reserve approval, the company will engage independent third parties to

conduct a review to be completed no later than September 30, 2018 to confirm adoption

and implementation of the plans.

• The asset limitation will remain in effect until third-party reviews have been completed to

the satisfaction of the Federal Reserve.

• After removal of the limits on asset growth, a second third-party review will be conducted to

assess the efficacy and sustainability of the risk management improvements.

“While there is still more work to do, we have made significant improvements over the past year to

our governance and risk management that address concerns highlighted in this consent order,”

Sloan said.

These actions have included:

Board governance:

• Separating the roles of chairman and CEO and amending the company’s by-laws to require

an independent chair.

• Electing six new independent directors in 2017 as five directors retired, bringing to eight

the total number of directors elected since 2015, and planned refreshment of an additional

four directors in 2018, with the retirement of three of those directors occurring by the time

of our 2018 Annual Meeting of Shareholders.

• Enhancing the overall capabilities and experience represented on the board, including

financial services, risk management, cyber, technology, regulatory, human capital

management, finance, accounting, and consumer and social responsibility.

• Reviewing the board’s committee structure and leadership, amending committee charters

to enhance risk oversight, and refreshing the chairs of certain key committees, including the

Risk Committee and Governance and Nominating Committee.

• Conducting a board self-evaluation in 2017 facilitated by Mary Jo White, a senior partner at

Debevoise & Plimpton LLP and former chair of the Securities and Exchange Commission.

The self-evaluation informed the board’s changes in its structure, composition and

governance practices.

Risk management:

• Centralizing critical control functions (including Human Resources, Finance, and

Technology) to improve enterprise visibility, consistency and control.

• Centralizing all risk management functions to accelerate the design and implementation of a

fully integrated operating model for risk management.

• Developing and executing comprehensive plans that addressed our compliance and

operational risk management programs, organizations, processes, technology and controls.

• Hiring external talent for critical risk management leadership roles – chief operational risk

officer, chief compliance officer and head of regulatory relations (newly created).

• Forming new centralized enterprise functions dedicated to key risk control areas, including

the Conduct Management Office (January 2017), Enterprise Data Management function

(September 2017) and Comprehensive Customer Remediation Group (November 2017).

Conference Call

The company will host a live conference call on February 2, 2018, at 4:30 p.m. PT (7:30 p.m. ET) to discuss

the consent order. The live audio webcast will be available at the following address:

https://engage.vevent.com/rt/wells_fargo_ao~9499813.

You also may participate by dialing 855-604-1135 (U.S. and Canada) or 574-990-3591 (International).

A replay of the conference call will be available beginning at 7:30 p.m. PT (10:30 p.m. ET) on Friday,

February 2, 2018, through Friday, February 16. Please dial 800-585-8367 (U.S. and Canada) or 404-537-

3406 (International) and enter Conference ID #9499813. The replay will also be available online at

https://www.wellsfargo.com/about/investor-relations/events/ and

https://engage.vevent.com/rt/wells_fargo_ao~9499813.

About Wells Fargo

Wells Fargo & Company (NYSE: WFC) is a diversified, community-based financial services

company with $2 trillion in assets. Wells Fargo’s vision is to satisfy our customers’ financial needs

and help them succeed financially. Founded in 1852 and headquartered in San Francisco, Wells

Fargo provides banking, investments, mortgage, and consumer and commercial finance through

more than 8,300 locations, 13,000 ATMs, the internet (wellsfargo.com) and mobile banking, and

has offices in 42 countries and territories to support customers who conduct business in the global

economy. With approximately 263,000 team members, Wells Fargo serves one in three households

in the United States. Wells Fargo & Company was ranked No. 25 on Fortune’s 2017 rankings of

America’s largest corporations.

Cautionary Statement about Forward-Looking Statements

This news release contains forward-looking statements about our future financial performance and

business. Because forward-looking statements are based on our current expectations and

assumptions regarding the future, they are subject to inherent risks and uncertainties. Do not

unduly rely on forward-looking statements as actual results could differ materially from

expectations. Forward-looking statements speak only as of the date made, and we do not undertake

to update them to reflect changes or events that occur after that date. For information about factors

that could cause actual results to differ materially from our expectations, refer to our reports filed

with the Securities and Exchange Commission, including the “Forward-Looking Statements”

discussion in Wells Fargo’s most recent Quarterly Report on Form 10-Q as well as to Wells Fargo’s

other reports filed with the Securities and Exchange Commission, including the discussion under

“Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2016, available

on its website at www.sec.gov.

# # #

Wells Fargo Update:

Federal Reserve Consent Order

February 2, 2018

© 2018 Wells Fargo & Company. All rights reserved. Confidential.

Exhibit 99.2

1Wells Fargo Update

Wells Fargo entered into a Consent Order with the Board of Governors of the Federal

Reserve System on February 2, 2018, relating to our governance oversight, and

compliance and operational risk management program, which relates to prior issues

including our sales practices announcement on September 8, 2016

The Federal Reserve acknowledges that Wells Fargo has already taken steps to address

deficiencies in corporate governance and risk management, and has implemented

improvements in both

Within 60 days, the Board and the Company must submit plans to the Federal Reserve

that leverage existing plans and efforts already underway to:

- Further enhance the Board’s effectiveness in carrying out its oversight and governance of the

Company (Governance Plan)

- Further improve the firm wide compliance and operational risk management program (Risk

Management Program Plan)

Once we adopt and implement these two plans as approved by the Federal Reserve, we

will engage independent third parties to conduct an initial risk management review by

September 30, 2018

Until the Governance and Risk Management Program plans are adopted and

implemented, and the first third party review is completed to the satisfaction of the

Federal Reserve, our total asset size will be limited as follows:

- Effective 2Q18, Wells Fargo’s total consolidated assets must be held to the December 31, 2017

level

• We have flexibility to optimize our Balance Sheet while we continue to help our customers succeed

financially (See pages 5 and 6 for additional information)

Subsequently, after the asset cap has been lifted, and we have integrated the risk

management program improvements, we will engage in a second third-party review to

assess the efficacy and sustainability of the improvements

Federal Reserve Consent Order summary

2Wells Fargo Update

Relevant risk management enhancements already underway

Over the last 17 months, we continued our focus and accelerated progress on the

governance, compliance and operational risk issues referenced in the Federal Reserve’s

Consent Order, and we agree with the assessment that our work is not yet complete

- Much of the foundational work has been completed, as issues related to these functions were

previously identified by regulators, or were self-identified

Concurrently, we have made meaningful changes to our operating model that further

strengthen our governance and risk management, which include:

- Strengthened Board governance and oversight

- Centralized control functions

- Improved team member leadership and staff expertise including through external hires

- Increased investment spending and resources to address compliance and operating risk deficiencies

We are building on our progress to date and leveraging our experience in risk management

areas where we have excelled or made substantial improvements (e.g., credit/market risk,

model risk, capital stress testing, liquidity risk management including TLAC, resolution

planning), and we are confident that we are addressing the issues cited in the Consent

Order

As we execute on these plans and manage to the asset cap, we will continue to serve our

customers’ financial needs including saving, borrowing and investing, as we help them

succeed financially

3Wells Fargo Update

Board Leadership Structure Board Composition Governance Practices

Separated the roles of Chairman

and CEO

Amended By-Laws to require an

independent Board Chair

Elected new independent Chair,

Elizabeth “Betsy” Duke (former member

of the Federal Reserve Board of

Governors) effective January 1, 2018

Significant Board refreshment - Elected 6

new independent directors and 5 directors

retired in 2017; planned refreshment of an

additional 4 directors in 2018, with the

retirement of 3 of those directors occurring by

the 2018 Annual Meeting

Majority of independent directors (8) have

been added since 2015

Enhanced skills and experience

represented on Board, including financial

services, risk management, technology/cyber,

regulatory, human capital management,

finance, accounting, consumer and social

responsibility

2017 Board self-evaluation facilitated

by a third party (Mary Jo White,

former Chair of the SEC) following

2017 annual meeting and in advance of

typical year-end timing

Board Chair and Committee Chairs

focused on agenda planning and

managing information flow and

management reporting to the Board

Board continues to work with

management to enhance and focus Board

presentations and materials

Board actions taken to enhance structure and oversight

The Board has made significant changes to its leadership, composition, and governance practices that

resulted from a thoughtful and deliberate process informed by the Board’s comprehensive self-evaluation

process and the Company’s engagement with shareholders and other stakeholders.

Board Composition Evaluation

Robust annual Board and self-

evaluation process includes the

individual contributions of

directors

Succession planning and Board

refreshment

Recruitment of new

directors to complement

the existing skills and

experience of the Board in

areas identified through its

self-evaluation process while

maintaining an appropriate

balance of perspectives and

experience

Key Changes Made to Board Structure, Composition, and Oversight

Reconstitution of Key Committees

Risk Committee

Karen Peetz appointed as new Chair

Added 4 directors (Maria Morris, Karen Peetz, Juan

Pujadas, Suzanne Vautrinot)

Enhanced financial services, compliance, risk,

operational, cyber, and technology experience with

new composition

4 members have risk management expertise

meeting Federal Reserve enhanced prudential

standards for large U.S. bank holding companies

Consolidated oversight of second line of defense

risk management activities under the Risk

Committee

Established 2 subcommittees focused on (1)

compliance risk and (2) technology/cyber risk and

data governance and management

Governance and Nominating Committee

Donald James appointed as new Chair

Added 2 directors (Duke and James)

Enhanced financial services, corporate

governance, and regulatory experience with

new composition

Human Resources Committee

Added 2 directors (Peetz and Ron Sargent)

Enhanced oversight responsibilities to include

human capital management, culture, and ethics

Continues to oversee our incentive

compensation risk management program which

was expanded to include a broader population

of team members and incentive plans

4Wells Fargo Update

Actions taken to strengthen Risk Management organization

Following the centralization of risk management functions in 2017, we designed and are

implementing a fully integrated operating model for risk management that covers all

business groups and enterprise staff groups (including Corporate Risk)

- As a part of this transformation, we are currently executing comprehensive plans that address our

compliance and operational risk management programs, organizations, processes, technology and

controls

Hired external talent to strengthen our capabilities and address deficiencies:

- Chief Operational Risk Officer, Mark D’Arcy, joined February 2017; previously Global Head of

Operational Risk at State Street

- Chief Compliance Officer (CCO), Mike Roemer, joined January 2018; previously CCO at Barclays

- Head of Regulatory Relations (new position), Sarah Dahlgren, joining March 2018; currently a

Partner at McKinsey & Company in their risk practice, and previously a 25 year veteran of the

Federal Reserve Bank of N.Y.

- Hired more than 2,000 new external team members in Risk Management in 2016 and 2017

Established dedicated groups focused on key risk control areas and moved proven senior

talent into new roles leading those groups:

- Established a Conduct Management Office in January 2017, responsible for managing conduct risk

and driving consistency in the way Wells Fargo receives, researches, resolves, and oversees

allegations and customer complaints

- Created an Enterprise Data Management function in September 2017, responsible for defining the

infrastructure, business source systems and governance of all company data

- Formed a Comprehensive Customer Remediation Group in November 2017, responsible for

developing and implementing consistent enterprise standards for remediation across all consumer

products

5Wells Fargo Update

Effective 2Q18, Wells Fargo’s total consolidated assets will be held to the December 31,

2017 period-end level of $2.0 trillion

- Compliance will be measured on a 2-quarter daily average basis, which allows for management of

temporary fluctuations

Asset cap will remain in effect until we have finalized, adopted and implemented the

enhanced plans for governance and risk management to the satisfaction of the Federal

Reserve, and the first third-party review has been completed

Our Balance Sheet scale provides us with flexibility to manage within the asset cap to serve

our customers’ financial needs and generate a competitive Return on Equity (ROE) for

shareholders

- Certain portfolios that have been net interest income-enhancing and ROE beneficial, yet dilutive to

Return on Assets (ROA), have grown as a result of our strong leverage ratio position

- Until the asset cap is removed, we intend to temporarily limit some of these activities by actions

that:

• Can be taken in a relatively short period of time, which will enable us to continue to grow traditional loans and

deposits

• Would be expected to impact only a modest percentage of the total Balance Sheet

• Would be expected to impact only a portion of the portfolios currently under consideration

- Page 6 provides examples of portfolios under consideration for possible Balance Sheet optimization

activities, though the actual actions we take will be dependent upon underlying business trends

and/or strategies

Balance Sheet flexibility should minimize customer impact of the asset cap

With $2.0 trillion in assets, our scale provides us with the flexibility to continue to serve our

customers’ financial needs including saving, borrowing and investing, and to deliver a

competitive ROE for shareholders

6Wells Fargo Update

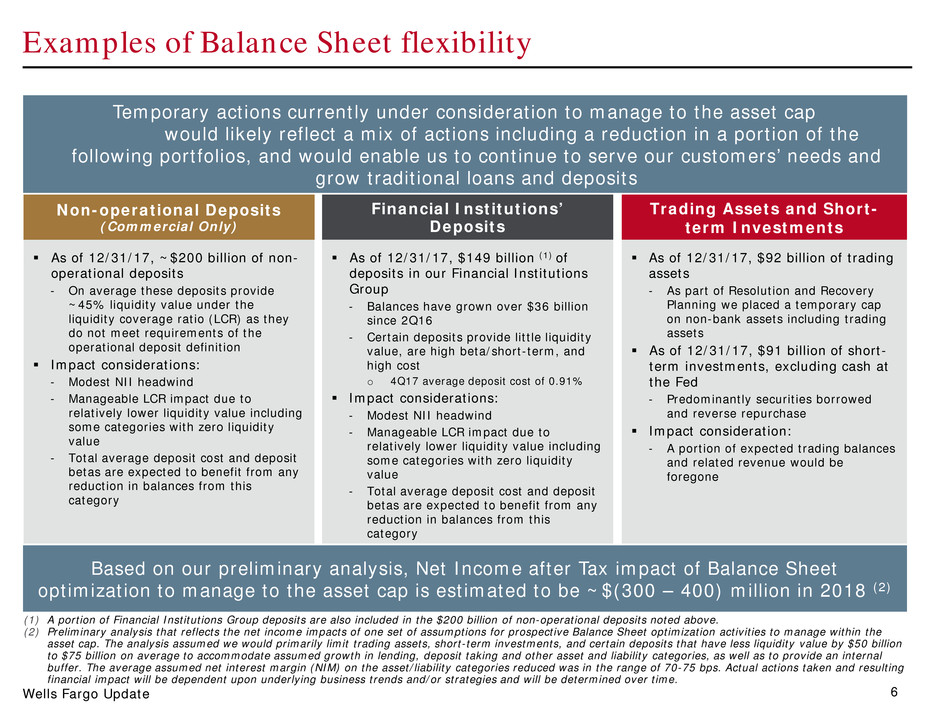

Financial Institutions’

Deposits

Trading Assets and Short-

term Investments

As of 12/31/17, ~$200 billion of non-

operational deposits

- On average these deposits provide

~45% liquidity value under the

liquidity coverage ratio (LCR) as they

do not meet requirements of the

operational deposit definition

Impact considerations:

- Modest NII headwind

- Manageable LCR impact due to

relatively lower liquidity value including

some categories with zero liquidity

value

- Total average deposit cost and deposit

betas are expected to benefit from any

reduction in balances from this

category

As of 12/31/17, $149 billion (1) of

deposits in our Financial Institutions

Group

- Balances have grown over $36 billion

since 2Q16

- Certain deposits provide little liquidity

value, are high beta/short-term, and

high cost

o 4Q17 average deposit cost of 0.91%

Impact considerations:

- Modest NII headwind

- Manageable LCR impact due to

relatively lower liquidity value including

some categories with zero liquidity

value

- Total average deposit cost and deposit

betas are expected to benefit from any

reduction in balances from this

category

As of 12/31/17, $92 billion of trading

assets

- As part of Resolution and Recovery

Planning we placed a temporary cap

on non-bank assets including trading

assets

As of 12/31/17, $91 billion of short-

term investments, excluding cash at

the Fed

- Predominantly securities borrowed

and reverse repurchase

Impact consideration:

- A portion of expected trading balances

and related revenue would be

foregone

Non-operational Deposits

(Commercial Only)

(1) A portion of Financial Institutions Group deposits are also included in the $200 billion of non-operational deposits noted above.

(2) Preliminary analysis that reflects the net income impacts of one set of assumptions for prospective Balance Sheet optimization activities to manage within the

asset cap. The analysis assumed we would primarily limit trading assets, short-term investments, and certain deposits that have less liquidity value by $50 billion

to $75 billion on average to accommodate assumed growth in lending, deposit taking and other asset and liability categories, as well as to provide an internal

buffer. The average assumed net interest margin (NIM) on the asset/liability categories reduced was in the range of 70-75 bps. Actual actions taken and resulting

financial impact will be dependent upon underlying business trends and/or strategies and will be determined over time.

Examples of Balance Sheet flexibility

Based on our preliminary analysis, Net Income after Tax impact of Balance Sheet

optimization to manage to the asset cap is estimated to be ~$(300 – 400) million in 2018 (2)

Temporary actions currently under consideration to manage to the asset cap

would likely reflect a mix of actions including a reduction in a portion of the

following portfolios, and would enable us to continue to serve our customers’ needs and

grow traditional loans and deposits

7Wells Fargo Update

What will the customer impact be?

- We will continue to serve our customers’ financial

needs including saving, borrowing and investing, as

we help them succeed financially

- We have flexibility to manage our Balance Sheet by

optimizing certain activities, which could include

temporarily pulling back from some activities

focused on providing liquidity to market participants

including other financial institutions

Do you have the capacity to address the

requirements, and how long will it take?

- This is priority #1 for the Company, and we will

allocate whatever resources are necessary to

address the issues citied

- We are working on augmenting the plans we

currently have in place for submission to the Federal

Reserve, and after Federal Reserve approval of the

plans we will engage independent third parties to

conduct a review to be completed no later than

September 30, 2018

When do you expect the Federal Reserve to

remove the constraint on your assets?

- There are a number of key deliverables in the

Consent Order.

- The asset cap will remain in effect until we have

adopted and implemented the plans for enhanced

governance and risk management, and the first

third-party review has been completed to the

satisfaction of the Federal Reserve

Are these new issues that have been

identified?

- These are not new issues. They are related to

compliance and operational risk matters that were

previously identified by regulators, or were self-

identified

Are you still committed to your expense

savings plans?

- We are focused on delivering expense savings, and

reinvesting in the business as previously disclosed

- We remain committed to our previously disclosed

2018 expense guidance, as well as our targeted $4

billion in expense savings by year-end 2019

What does this mean for your efficiency, ROE

and ROA targets?

- Updated annual targets will be disclosed at our May

2018 Investor Day, and will consider the impacts of

the 2017 Tax Act, as well as the asset cap

Will you be able to return more capital to

shareholders this year?

- With ~190 bps of capital above our internal

Common Equity Tier 1 target of 10%, as of

12/31/17, we remain committed to returning more

capital to shareholders

Key questions

Key questions and current outlook

8Wells Fargo Update

Key takeaways

We have been focused on the same issues cited by the Federal Reserve, and while we have

made meaningful progress we acknowledge additional work is necessary

We are building on our progress to date, leveraging our experience in risk management in

areas where we have excelled, and are confident that we are addressing the issues

We are committed to meeting the Consent Order requirements and are currently working

on our comprehensive Risk Management Program Plan, while the Board develops the

Governance Plan, for submission to the Federal Reserve within 60 days

We believe that our Balance Sheet scale provides us with the flexibility to manage within

the asset cap, serve our customers’ financial needs including saving, borrowing and

investing, and generate a competitive Return on Equity (ROE)

We take the Consent Order very seriously and we will successfully complete the work that we

have started, as we continue on the path towards building a better Wells Fargo

9Wells Fargo Update

Forward-looking statements and additional information

Forward-looking statements:

This document contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. In

addition, we may make forward-looking statements in our other documents filed or furnished with the SEC, and our management may

make forward-looking statements orally to analysts, investors, representatives of the media and others. Forward-looking statements can

be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” “target,” “projects,” “outlook,”

“forecast,” “will,” “may,” “could,” “should,” “can” and similar references to future periods. In particular, forward-looking statements

include, but are not limited to, statements we make about: (i) the balance sheet optimization strategies described in this document,

including their anticipated effects and our ability to implement those strategies, (ii) when we expect to fulfill our requirements under the

Consent Order, (iii) our expense savings plans, (iv) the future operating or financial performance of the Company; (v) our noninterest

expense and efficiency ratio; (vi) future credit quality and performance, including our expectations regarding future loan losses and

allowance levels; (vii) the appropriateness of the allowance for credit losses; (viii) our expectations regarding net interest income and net

interest margin; (ix) loan growth or the reduction or mitigation of risk in our loan portfolios; (x) future capital or liquidity levels or targets

and our estimated Common Equity Tier 1 ratio under Basel III capital standards; (xi) the performance of our mortgage business and any

related exposures; (xii) the expected outcome and impact of legal, regulatory and legislative developments, as well as our expectations

regarding compliance therewith; (xiii) future common stock dividends, common share repurchases and other uses of capital; (xiv) our

targeted range for return on assets and return on equity; (xv) the outcome of contingencies, such as legal proceedings; and (xvi) the

Company’s plans, objectives and strategies. Forward-looking statements are not based on historical facts but instead represent our current

expectations and assumptions regarding our business, the economy and other future conditions. Investors are urged to not unduly rely on

forward-looking statements as actual results could differ materially from expectations. Forward-looking statements speak only as of the

date made, and we do not undertake to update them to reflect changes or events that occur after that date. For more information about

factors that could cause actual results to differ materially from expectations, refer to the “Forward-Looking Statements” discussion in Wells

Fargo’s press release announcing our fourth quarter 2017 results and in our most recent Quarterly Report on Form 10-Q, as well as to

Wells Fargo’s other reports filed with the Securities and Exchange Commission, including the discussion under “Risk Factors” in our Annual

Report on Form 10-K for the year ended December 31, 2016.

Additional information and where to find it:

Wells Fargo & Company (the “Company”) will file a proxy statement related to items to be voted on at its 2018 annual meeting of

shareholders with the Securities and Exchange Commission (“SEC”). INVESTORS AND SECURITY HOLDERS ARE ADVISED TO READ

THE PROXY STATEMENT WHEN IT BECOMES AVAILABLE, BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. Investors

and security holders may obtain a free copy of the proxy statement (when available) and other documents filed by the Company with the

SEC at the SEC’s web site at www.sec.gov. Free copies of the proxy statement, once available, and the Company's other filings with the

SEC may also be obtained from the Company upon written request to the Office of the Corporate Secretary, Wells Fargo & Company, MAC

D1053-300, 301 S. College Street, Charlotte, North Carolina 28202.

Participants in the solicitation:

The Company and its directors, executive officers, and other members of management and employees may be soliciting proxies from Wells

Fargo shareholders in connection with items to be voted on at the Company’s 2018 annual meeting of shareholders. Information regarding

the persons who may, under the rules of the SEC, be deemed participants in the solicitation of proxies, including a description of their

direct and indirect interest, by security holdings or otherwise, will be set forth in the Company’s proxy statement filed with the SEC.

Exhibit 99.3

UNITED STATES OF AMERICA

BEFORE THE

BOARD OF GOVERNORS OF THE FEDERAL RESERVE SYSTEM

WASHINGTON, D.C.

In the matter of

WELLS FARGO & COMPANY

San Francisco, California

Docket No. 18-007-B-HC

Order to Cease and Desist

Issued Upon Consent Pursuant to

the Federal Deposit Insurance Act,

as Amended

WHEREAS, Wells Fargo & Company, San Francisco, California (“WFC”), a registered

bank holding company, owns and controls Wells Fargo Bank, N.A., San Francisco, California

(the “Bank”), a national bank;

WHEREAS, WFC is a large, complex organization that has a number of separate

business lines and legal entities (collectively, these business lines and legal entities, together with

WFC, referred to herein as the “Firm”);

WHEREAS, the Board of Governors of the Federal Reserve System (the “Board of

Governors”) is the appropriate federal supervisor of WFC;

WHEREAS, consistent with section 252.33(a)(2) of Regulation YY of the Board of

Governors (12 C.F.R. § 252.33(a)(2)), WFC is required to adopt an improved firmwide risk

management program designed to identify and manage risks across the consolidated

organization;

WHEREAS, the board of directors of WFC (the “Board”) is responsible for evaluating

the Firm’s risk management capacity;

2

WHEREAS, the Firm pursued a business strategy that emphasized sales and growth

without ensuring that senior management had established and maintained an adequate risk

management framework commensurate with the size and complexity of the Firm, which resulted

in weak compliance practices;

WHEREAS, the Federal Reserve Bank of San Francisco (the “Reserve Bank”) and Board

of Governors previously identified deficiencies in WFC’s risk management – including

compliance risk management – that WFC has yet to correct fully;

WHEREAS, the Bank consented to the issuance of Consent Orders by the Office of the

Comptroller of the Currency (the “OCC”) and the Consumer Financial Protection Bureau (the

“CFPB”) designed to remedy deficiencies cited by the OCC and the CFPB in the Bank’s

management oversight of sales practices and risk management;

WHEREAS, WFC must continue to implement an effective firmwide risk management

program that is commensurate with WFC’s size, complexity and risk profile to ensure that WFC

operates in a safe and sound manner and complies with all applicable law and regulations;

WHEREAS, it is the common goal of the Board of Governors, the Reserve Bank, and

WFC that WFC’s Board maintain effective corporate governance and oversight over the Firm,

including the establishment and maintenance of robust risk management and compliance

programs on a consolidated basis;

WHEREAS, the Firm has taken steps to review its corporate governance and risk

management, has identified and reported relevant instances of compliance and conduct

deficiencies to the Board of Governors and the Reserve Bank, and has cooperated with the Board

of Governors and the Reserve Bank;

WHEREAS, to address the deficiencies described above, the Firm has implemented and

3

must continue to implement improvements in its governance and risk management in order to

comply with safe and sound banking practices, and applicable laws and regulations;

WHEREAS, the Board of Governors is issuing this Consent Order to Cease and Desist

(“Order”);

WHEREAS, pursuant to delegated authority, the undersigned signatories for WFC are

authorized to enter into this Order on behalf of WFC, and consent to WFC’s compliance with

each and every provision of this Order, and to waive any and all rights that WFC may have with

respect to this Order pursuant to section 8 of the Federal Deposit Insurance Act, as amended (the

“FDI Act”) (12 U.S.C. § 1818), and 12 C.F.R. Part 263, including, but not limited to: (i) the

issuance of a notice of charges on any matters set forth in this Order; (ii) a hearing for the

purpose of taking evidence on any matters set forth in this Order; (iii) judicial review of this

Order; and (iv) challenge or contest, in any manner, the basis, issuance, validity, terms,

effectiveness, or enforceability of this Order or any provision hereof;

NOW, THEREFORE, it is hereby ordered by the Board of Governors that, before the

filing of the notices, or taking of any testimony, or adjudication of or finding on any issues of

fact or law herein, and solely for the purpose of settling this matter without a formal proceeding

being filed and without the necessity for protracted or extended hearings or testimony, pursuant

to sections 8(b)(1) and 8(b)(3) of the FDI Act (12 U.S.C. §§ 1818(b)(1), 1818(b)(3), WFC and its

institution-affiliated parties, as defined in sections 3(u) and 8(b)(3)of the FDI Act (12 U.S.C. §§

1813(u) and 1818(b)(3), shall cease and desist and take affirmative action as follows:

Source of Strength

1. WFC’s Board shall take appropriate steps to fully utilize WFC’s financial and

managerial resources, pursuant to section 38A of the FDI Act (12 U.S.C. § 1831o-1) and section

4

225.4(a) of Regulation Y of the Board of Governors (12 C.F.R. § 225.4(a)), to serve as a source

of strength to the Bank, including, but not limited to, taking steps to ensure that the Bank

complies with the Consent Orders issued by the OCC, dated September 6, 2016, and the CFPB,

dated September 4, 2016.

Board Effectiveness

2. Within 60 days of this Order, the Board shall submit a written plan to further

enhance the Board’s effectiveness in carrying out its oversight and governance of WFC,

acceptable to the Reserve Bank. The plan shall, at a minimum, address, consider, and include:

(a) actions that the Board will take to further improve its effectiveness,

including:

(i) actions to ensure that the Firm’s strategy and risk tolerance are

clear and aligned and within the Firm’s risk management capacity;

(ii) actions to ensure its composition, governance structure, and

practices support its strategy and are aligned with its risk tolerance; and

(iii) a plan to ensure that no roles or responsibilities of the Board are

unfulfilled for an undue period of time following the departure of any member of the Board;

(b) actions that the Board will take to further improve its oversight of senior

management, including holding senior management accountable for implementing and

maintaining the Firm’s strategy in accordance with Board direction and the Firm’s risk tolerance

and capacity, and the Firm’s risk management and control framework (including the

enhancements required in this Order);

5

(c) actions the Board will take to ensure senior management’s ongoing

effectiveness in managing the Firm’s activities and related risks and promoting strong risk

management across the Firm;

(d) actions that the Board will take to ensure senior management establishes,

and thereafter maintains:

(i) an effective and independent firmwide risk management function

that:

(A) covers all material risks facing the Firm;

(B) has the requisite stature, authority, and resources, with

clearly defined roles and responsibilities (as determined pursuant to the review required in

paragraph (c)), and provides for staffing WFC’s risk management function with the appropriate

level of expertise, including with respect to WFC’s operational and compliance risk management

functions; and

(C) with respect to compliance and operational risk

management, maintains a management structure that promotes effective oversight and control of

compliance and operational risks, that is appropriately independent of the related line of

business, and that has separate and independent reporting lines to the Chief Risk Officer and to

the Board or an appropriate committee of the Board;

(ii) an effective risk tolerance program that defines the Firm’s risk

capacity and the tolerances under which it will operate;

(iii) an effective risk identification and escalation framework that

identifies, aggregates, evaluates and appropriately reports material risk issues, plans to address

risks, and progress with respect to those plans;

6

(iv) a comprehensive and effective risk data governance and

management framework;

(e) actions that the Board will take with respect to any additional

enhancements to WFC’s performance management processes that are necessary to ensure that

compensation and other incentives are consistent with risk management objectives and

measurement standards, including, but not limited to, appropriate consequences for violations of

WFC’s policies, applicable laws and regulations, and adverse risk outcomes; and

(f) comprehensive reporting that will enable the Board to oversee

management’s execution of its risk management responsibilities, including, but not limited to,

measures taken to comply with this Order, and provide the Board with sufficient information to

evaluate the effectiveness of the operational and compliance risk management functions.

Risk Management Program

3. Within 60 days of this Order, WFC shall submit a written plan to further improve

its firmwide compliance and operational risk management program, acceptable to the Reserve

Bank. The plan shall, at a minimum, address, consider, and include:

(a) effective testing and validation measures for compliance and operational

risks to ensure business lines, as relevant, follow applicable laws, regulations, policies, and

procedures (including consumer compliance laws, regulations, and supervisory guidance) and to

ensure effective testing of design and execution of operational and compliance risk controls;

(b) specific measures management will take to integrate all applicable

compliance and operational risk requirements into business process and control designs and

related change management initiatives;

7

(c) specific measures to enhance the firmwide operational risk management

program, to include, but not limited to:

(i) a well-controlled key risk indicator program linked to the firm’s

risk identification and risk tolerance processes;

(ii) a stress loss forecasting methodology that adequately quantifies the

firm’s operational risks under stress; and

(d) a review of policies, procedures and practices at WFC and its subsidiary

entities for remediating customers that are harmed by the firm’s products or services or the

misconduct of an employee, and specific measures to address any deficiencies in policies,

procedures, and practices identified by the firmwide review.

Third Party Reviews

4. (a) Following WFC’s adoption and implementation of the plans and

improvements required under Paragraphs 2 and 3 of this Order, WFC shall conduct and complete

by an appropriate date no later than September 30, 2018, an independent review of: (i) the

Board’s improvements in effective oversight and governance of the Firm, and (ii) enhancements

to the Firm’s compliance and operational risk management program, each as required in this

Order (the “Initial Risk Management Review”).

(b) Following WFC’s integration of the improvements required by this Order

into WFC’s business-as-usual practices and operations, the Firm shall conduct a second

independent review to assess the efficacy and sustainability of the improvements (the “Second

Risk Management Review”).

(c) The Initial and Second Risk Management Reviews shall be conducted by

third party expert(s) acceptable to the Reserve Bank. No later than 30 days before the scheduled

8

commencement of each of these reviews, WFC shall submit a plan acceptable to the Reserve

Bank that details the scope of work.

(d) The results of the Initial and Second Risk Management Reviews shall be

submitted to the Reserve Bank and the Board of Governors within 30 days of completion.

(e) Based on the Reserve Bank’s evaluation of the results of the Initial and

Second Risk Management Reviews, the Reserve Bank, with the concurrence of the Director of

the Division of Supervision and Regulation, may direct WFC to conduct additional reviews as

necessary and may require such reviews to be performed by an independent third party or WFC’s

internal audit function.

Limits on Growth

5. (a) As of the last day of the first full calendar quarter following the date of

this Order and the last day of each quarter thereafter, WFC shall not, without the prior written

approval of the Reserve Bank, with the concurrence of the Director of the Division of

Supervision and Regulation, take any action that would cause the average of WFC’s total

consolidated assets reported in line 5 of Schedule HC-K to the form FR Y-9C (Consolidated

Financial Statements for Holding Companies) for the current calendar quarter and the immediate

preceding calendar quarter to exceed the total consolidated assets reported as of December 31,

2017, in line 12 of Schedule HC to the form FR Y-9C (Consolidated Financial Statements for

Holding Companies).

(b) The restrictions of paragraph 5(a) shall continue in force and effect until

WFC:

(i) submits to the Reserve Bank the written plans and programs

described in paragraphs 2 and 3 of this Order;

9

(ii) is notified in writing by the Reserve Bank and the Director of the

Division of Supervision and Regulation, that the aforesaid plans and programs are acceptable;

(iii) the Firm adopts and implements the aforesaid plans and programs

and the Initial Risk Management Review pursuant to Paragraph 4(a) of this Order is completed

to the satisfaction of the Reserve Bank, with the concurrence of the Director of the Division of

Supervision and Regulation; and

(iv) is notified in writing by the Reserve Bank, with the concurrence of

the Director of the Division of Supervision and Regulation, that all of the above-described

conditions have been met.

(c) If WFC does not make progress satisfactory to the Board of Governors in

addressing the deficiencies cited in this Order, the Board of Governors may impose additional

restrictions or limits, or take other action as permitted under applicable law.

Approval, Implementation, and Progress Reports

6. (a) WFC shall submit written plans that are acceptable to the Reserve Bank

and reports within the applicable time periods set forth in paragraphs 2, 3 and 4 of this Order.

The plans shall contain a timeline for full implementation with specific deadlines for the

completion of each component of the plans.

(b) Within 10 days of approval by the Reserve Bank, WFC shall adopt the

approved plans. Upon adoption, WFC shall implement the approved plans and thereafter fully

comply with them.

(c) During the term of this Order, the approved plans shall not be amended or

rescinded without the prior written approval of the Reserve Bank.

10

7. Within 30 days after the end of each calendar quarter following the date of this

Order, the Board or an authorized committee thereof shall submit to the Reserve Bank written

progress reports detailing the form and manner of all actions taken to secure compliance with the

provisions of this Order and the results thereof.

8. The Firm shall continue to fully cooperate with and provide substantial assistance

to the Board of Governors, including but not limited to, the provision of information, testimony,

documents, records, and other tangible evidence and perform analyses as directed by the Board

of Governors in connection with the investigations of whether separate enforcement actions

should be taken against individuals who are or were institution-affiliated parties of the Firm and

who were involved in the conduct underlying this Order. For purposes of clarity and not

limitation, substantial assistance as used in this Order means the Firm will use its best efforts, as

determined by the Board of Governors, to make available for interviews or testimony, as

requested by the Board of Governors, present or former officers, directors, employees, agents

and consultants of the Firm, to the extent permitted by law. This obligation includes, but is not

limited to, sworn testimony pursuant to administrative subpoena as well as interviews with

regulatory authorities. Cooperation under this paragraph shall also include identification of

witnesses who, to the Firm’s knowledge, may have material information regarding the matters

under investigation.

Notices

9 . All communications regarding this Order shall be sent to:

Richard M. Ashton, Esq.

Deputy General Counsel

Patrick M. Bryan, Esq.

Assistant General Counsel

Board of Governors of the Federal Reserve System

20th & C Streets, N.W.

11

Washington, D.C. 20551

(b) Milt Simpson

Vice President

Federal Reserve Bank of San Francisco

101 Market Street

San Francisco, California 94105

(c) C. Allen Parker

General Counsel

Wells Fargo & Company

45 Freemont Street

San Francisco, California 94105

Miscellaneous

10. Notwithstanding any provision of this Order to the contrary, the Reserve Bank

may, in its sole discretion, grant written extensions of time to WFC to comply with any provision

of this Order.

11. The provisions of this Order shall be binding on WFC and each of its

institution-affiliated parties, as defined in sections 3(u) and 8(b)(3) of the FDI Act (12 U.S.C. §§

1813(u) and 1818(b)(3)) in their capacities as such, and their successors and assigns.

12. Each provision of this Order shall remain effective and enforceable until stayed,

modified, terminated, or suspended in writing by the Board of Governors.

13. The provisions of this Order shall not bar, estop, or otherwise prevent the Board

of Governors, the Reserve Bank, or any other federal or state agency from taking any other

action affecting WFC, any of its subsidiaries, or any of their current or former institution-

affiliated parties and their successors and assigns.

14. Nothing in this Order, express or implied, shall give to any person or entity, other

than the parties hereto and their successors hereunder, any legal or equitable right, remedy, or

claim under this Order.

12

By Order of the Board of Governors of the Federal Reserve System effective this

day of , 2018.

As the duly elected and acting

Board of Directors of,

WELLS FARGO & COMPANY BOARD OF GOVERNORS OF THE

FEDERAL RESERVE SYSTEM

By: /s/ TIMOTHY J. SLOAN By: ___________________________

Timothy J. Sloan Ann E. Misback

Secretary of the Board

By: /s/ ELIZABETH A. DUKE

Elizabeth A. Duke

By: /s/ JOHN D. BAKER II

John D. Baker II

By: /s/ JOHN S. CHEN

John S. Chen

By: /s/ CELESTE A. CLARK

Celeste A. Clark

By: /s/ THEODORE F. CRAVER, JR.

Theodore F. Craver, Jr.

13

By: /s/ LLOYD H. DEAN

Lloyd H. Dean

By: /s/ ENRIQUE HERNANDEZ, JR.

Enrique Hernandez, Jr.

By: /s/ DONALD M. JAMES

Donald M. James

By: /s/ MARIA R. MORRIS

Maria R. Morris

By: /s/ KAREN PEETZ

Karen B. Peetz

by Allen Parker

Attorney-in-Fact

By: /s/ FEDERICO F. PENA

Federico F. Pena

By: /s/ JUAN A. PUJADAS

Juan A. Pujadas

By: /s/ JAMES H. QUIGLEY

James H. Quigley

14

By: /s/ RONALD L. SARGENT

Ronald L. Sargent

By: /s/ SUZANNE M. VAUTRINOT

Suzanne M. Vautrinot