Form DEF 14A COOPER COMPANIES INC For: Mar 19

Table of Contents

SCHEDULE 14A

(RULE 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE SECURITIES

EXCHANGE ACT OF 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ Preliminary Proxy Statement |

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

|

☒ Definitive Proxy Statement |

||

| ☐ Definitive Additional Materials |

||

| ☐ Soliciting Material Under Rule 14a-12 |

THE COOPER COMPANIES, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials: |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

February 2, 2018

Dear Stockholder:

You are cordially invited to join us at the 2018 Annual Meeting of Stockholders (the “Annual Meeting”) of The Cooper Companies, Inc., which will be held at 8:00 a.m. (PDT) on March 19, 2018 at The Rose Hotel, 807 Main Street, Pleasanton, California. At the Annual Meeting we will ask our stockholders to vote on the proposals detailed in our Proxy Statement and related materials.

We will be providing access to our proxy materials electronically under the U.S. Securities and Exchange Commission’s “notice and access” rules. As a result, beginning on or about February 7, 2018, we are mailing to many of our stockholders a Notice of Internet Availability of Proxy Materials instead of a paper copy of this Proxy Statement and our 2017 Annual Report on Form 10-K (the “Annual Report”). This approach conserves natural resources and reduces our printing and distribution costs, while providing a timely and convenient method of accessing the materials and voting.

The Notice contains instructions on how to access our materials through the internet and also contains instructions on how to receive a paper copy of our proxy materials, including this proxy statement, our 2017 Annual Report, and a form of proxy card or voting instruction card. All stockholders who do not receive a Notice, including stockholders who have previously requested to receive paper copies of proxy materials, will receive a paper copy of the proxy materials by mail.

Your vote is important. Regardless of whether you plan to participate in the Annual Meeting, we hope you will vote as soon as possible. You may vote by proxy by following the instructions on the proxy card or voting instruction card. Voting may be done over the internet, by telephone, or by mail (if you received paper copies of the proxy materials). Voting by proxy will ensure your representation at the Annual Meeting regardless of whether you attend.

We look forward to seeing you at the Annual Meeting.

Sincerely,

A. Thomas Bender

Chairman of the Board of Directors

Table of Contents

THE COOPER COMPANIES, INC.

6140 Stoneridge Mall Road, Suite 590

Pleasanton, CA 94588

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| Meeting Date: | Monday, March 19, 2018 | |

| Meeting Time: | 8:00 a.m. (PDT) | |

| Location: | The Boardroom at the Rose Hotel, 807 Main Street, Pleasanton, California | |

| Admission: | All stockholders are cordially invited to attend the Annual Meeting in person. | |

| Agenda: | 1. Elect the nine directors named in the Proxy Statement;

2. Ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending October 31, 2018;

3. Hold an advisory vote on the compensation of our Named Executive Officers;

4. Consider a stockholder proposal regarding a “net-zero” greenhouse gas emissions report; and

5. Transact any other business that may properly come before the meeting. | |

Stockholders of record at the close of business on Tuesday, January 23, 2018, or their legal proxy holders, will be entitled to vote at the Annual Meeting.

On or about February 7, 2018, we will mail either (1) a Notice of Internet Availability of Proxy Materials (the “Notice”) or (2) a copy of this Proxy Statement and our Annual Report for the fiscal year ended October 31, 2017. The Notice will also contain instructions on how to request a paper copy of our proxy materials.

You may vote by following the instructions on the Notice or by using the proxy card accompanying the paper copy of materials. If phone or internet voting is available to you, instructions will be included on your proxy card.

YOUR VOTE IS IMPORTANT TO US. Regardless of whether you plan to attend the Annual Meeting, we encourage you to vote your shares as soon as possible to ensure that your vote is recorded. We look forward to your participation.

By Order of the Board of Directors

Carol R. Kaufman

Secretary

Dated: February 2, 2018

Table of Contents

|

|

1 | |||

|

|

1 | |||

|

|

2 | |||

|

|

4 | |||

|

|

5 | |||

|

|

7 | |||

|

|

7 | |||

|

|

8 |

|

|

10 | |||

|

|

10 | |||

|

|

13 | |||

|

|

14 | |||

|

|

16 | |||

|

|

16 | |||

|

|

17 | |||

|

|

19 | |||

|

|

21 | |||

|

|

21 | |||

|

|

40 | |||

|

|

40 | |||

|

|

42 | |||

|

|

44 | |||

|

|

47 | |||

|

|

48 | |||

|

|

49 | |||

|

|

50 | |||

|

|

53 | |||

|

PROPOSAL 2 — RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

60 | |||

|

|

61 | |||

|

PROPOSAL 4 — STOCKHOLDER PROPOSAL REGARDING A “NET-ZERO” GREENHOUSE GAS EMISSIONS REPORT |

63 | |||

|

|

67 | |||

|

|

67 |

Table of Contents

THE COOPER COMPANIES, INC.

6140 Stoneridge Mall Road, Suite 590

Pleasanton, CA 94588

Our 2018 Annual Meeting will be held at 8:00 a.m. (PDT) on March 19, 2018 in the Boardroom at The Rose Hotel, 807 Main Street, Pleasanton, California.

This Proxy Statement was provided to all stockholders of record at Tuesday, January 23, 2018 and is presented on our behalf by order of the Board of Directors. It contains information about our Company and the proposals to be presented at the Annual Meeting. We have also furnished our 2017 Annual Report to all stockholders of record. The Annual Report contains our financial statements for the fiscal year ended October 31, 2017 and other useful information, but it is not part of the materials for the solicitation of proxies.

PROPOSALS TO BE PRESENTED AT THE ANNUAL MEETING

The following proposals are presented for consideration by our stockholders.

|

PROPOSAL 1: |

ELECTION OF NINE DIRECTORS IDENTIFIED BELOW (page 53) | |

|

Our Board

Recommends:

|

|

PROPOSAL 2: |

RATIFICATION OF KPMG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (page 60) | |

|

Our Board

Recommends:

|

|

PROPOSAL 3: |

ADVISORY VOTE ON EXECUTIVE COMPENSATION (page 61) | |

|

Our Board

Recommends:

|

|

PROPOSAL 4: |

STOCKHOLDER PROPOSAL REGARDING A “NET-ZERO” GREENHOUSE GAS EMISSIONS REPORT (page 63) | |

|

Our Board

Recommends:

|

Detailed information regarding each proposal is presented in this Proxy Statement starting on page 53. Additional information about the Company, our Board and its committees, equity ownership, compensation of officers and directors, and other matters can be found starting on page 10.

You may also find useful information about the Company on our website at http://www.coopercos.com. Information contained on our website is not, and should not be considered, a part of this Proxy Statement or any other filing or report filed with or furnished to with the Securities and Exchange Commission (the “SEC”).

|

1 | P a g e |

Table of Contents

We are not aware of any other business to be brought before the meeting. If any additional business is properly brought before the meeting, the designated officers serving as proxies will vote in accordance with their best judgment.

Your vote is important to us. Regardless of whether you plan to attend the meeting, we encourage you to read this Proxy Statement and the accompanying materials and to vote your shares as soon as possible to ensure that your vote is recorded. We look forward to your participation.

Who is entitled to vote at the Annual Meeting?

Our Record Date for the Annual Meeting is January 23, 2018. All stockholders who owned our stock at the close of business on the Record Date are entitled to receive proxy materials and to vote at the Annual Meeting and any continuations, adjournments or postponements thereof.

As of the Record Date, there were 49,021,383 shares of our common stock outstanding and entitled to vote at the Annual Meeting.

How many votes do I have?

Each outstanding share of our common stock is entitled to one vote at the Annual Meeting. You have one vote per share that you owned at the close of business on the Record Date.

How do I vote my shares?

You can vote your shares in person at the Annual Meeting or vote by proxy. The method of voting by proxy differs for shares held as a record holder and shares held in “street name.” If you hold your shares of common stock as a record holder you may vote your shares by following the instructions on the Notice, or by completing, dating, and signing the proxy card included with this Proxy Statement and promptly returning it in the pre-addressed, postage paid envelope provided to you. If phone or internet voting is available to you, instructions are included in the Notice or on your proxy card.

If you hold your shares of common stock in “street name,” which means your shares are held of record by a broker, bank, or other nominee, you will receive the proxy materials from your broker, bank, or other nominee with instructions on how to vote your shares. Your broker, bank, or other nominee may allow you to deliver your voting instructions by phone or through the internet. If you wish to vote your shares in person you may do so by attending the Annual Meeting and requesting a ballot.

|

2 | P a g e |

Table of Contents

What happens if I vote my shares by proxy?

When you return a completed proxy card, or vote your shares by telephone or internet, you authorize our officers listed on the proxy card to vote your shares on your behalf as you direct.

If you sign and return a proxy card, but do not provide instructions on how to vote your shares, the designated officers will vote on your behalf as recommended by the Board:

| • | Shares will be voted FOR each of the individuals nominated to serve as directors; |

| • | Shares will be voted FOR ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending October 31, 2018; |

| • | Shares will be voted FOR the compensation of our Named Executive Officers as described in this Proxy Statement; and |

| • | Shares will be voted AGAINST the stockholder proposal regarding a “net-zero” greenhouse gas emissions report. |

Can I change or revoke my vote after I return my proxy card or voting instructions?

If you choose to vote your shares by proxy, you may revoke or change your vote at any time prior to the casting of votes at the Annual Meeting. To revoke or change your vote, you may take any of the following actions:

| 1. | Execute and submit a new proxy card; |

| 2. | Submit new voting instructions through telephonic or internet voting, if available to you; |

| 3. | Notify Carol R. Kaufman, Secretary of the Company, in writing that you wish to revoke your proxy; or |

| 4. | Vote your shares in person at the Annual Meeting. |

Attending the Annual Meeting in person will not automatically revoke your proxy.

How many votes must be present to hold the Annual Meeting?

In order to conduct business and have a valid vote at the Annual Meeting a quorum must be present in person or represented by proxies. A quorum is defined as a majority of the shares outstanding on the Record Date and entitled to vote. In accordance with Delaware law and our Bylaws, broker “non-votes” and proxies reflecting abstentions will be considered present and entitled to vote for purposes of determining whether a quorum is present.

What are broker “non-votes”?

Broker “non-votes” occur when a broker is not permitted to vote on behalf of shares it holds for a beneficial owner and the beneficial owner does not provide voting instructions. Shares held in a

|

3 | P a g e |

Table of Contents

broker’s name may be voted by the broker, but only in accordance with the rules of the New York Stock Exchange. Under those rules, the broker must follow the instructions of the beneficial owner. If instructions are not provided, NYSE rules determine whether the broker may vote the shares based on its own judgment or is required to withhold its vote. This determination depends on the proposal being voted on. For the proposals to be presented at the Annual Meeting, broker discretionary voting is only permitted for the ratification of our independent registered public accounting firm.

Stockholder Proposals and Nominations for Director

SEC rules and our Bylaws permit stockholders to nominate directors for election and to propose other business to be considered by stockholders at the Annual Meeting under various mechanisms.

To be considered at the 2019 Annual Meeting, director nominations or other proposals must be submitted in writing to:

Carol R. Kaufman, Secretary

The Cooper Companies, Inc.

6140 Stoneridge Mall Road, Suite 590

Pleasanton, CA 94588

| Proposals to be Presented Under Rule 14a-8: |

No later than October 10, 2018. |

| Nominations and Proposals Submitted Under Bylaw Provisions: |

No earlier than November 19, 2018 |

and no later than December 19, 2018.

In the event that we set the date for the 2019 Annual Meeting more than 30 days before or more than 70 days after March 19, 2019, submissions may be made no earlier than the close of business on the 120th day prior to the announced meeting date and no later than the close of business on the later of the 90th day prior to the announced meeting date and the 10th day following our first public disclosure of the date of the meeting.

| Other Director Nomination Proposals: |

No earlier than November 19, 2018 |

and no later than December 19, 2018.

The Corporate Governance and Nominating Committee will consider director nominees suggested by stockholders on the same terms as nominees selected by the Committee. See page 10 for information about the Committee’s criteria for director nominations.

The person recommending the nominee must be a stockholder entitled to vote at the 2019 Annual Meeting. To be considered, recommendations must include:

| (i) | the nominee’s written consent to being named in the Proxy Statement and to serve as a director if elected; |

| (ii) | the name and address of the stockholder submitting the recommendation or the beneficial owner on whose behalf the proposed candidate is being suggested for nomination; |

| (iii) | a statement of the proposed nominee’s qualifications to serve as director; and |

|

4 | P a g e |

Table of Contents

| (iv) | the class and number of our shares owned by the stockholder or beneficial owner submitting the recommendation. |

If we increase the number of directors to be elected at the 2019 Annual Meeting with less than 100 days’ notice prior to March 19, 2019, stating the size of the increase and naming all the nominees for director, then stockholder nominations for directors will be considered if the proposal is delivered to our Secretary at our principal offices no later than 10 days after we make a public announcement of the increased board size. This only applies to nominations for positions created by the increase and does not apply to nominations for current positions.

Why did I receive a one-page notice in the mail regarding the internet availability of proxy materials instead of a full set of proxy materials?

The SEC permits us to provide our proxy materials electronically if you have not previously requested to receive only printed materials on an ongoing basis. Accordingly, on or about February 7, 2018, we will mail a Notice of Internet Availability of Proxy Materials (“the Notice”). The Notice includes instructions on how to access the proxy materials over the internet or to request a printed copy.

The Notice was sent to our stockholders of record at January 23, 2018. All stockholders receiving the Notice have the ability to access the proxy materials electronically through the website referred to in the Notice, and they also have the option to request a printed set of the proxy materials. We encourage stockholders to take advantage of the availability of proxy materials on the internet.

Can I vote my shares by filling out and returning the Notice of Internet Availability of Proxy Materials?

No. The Notice only identifies the items to be voted on at the Annual Meeting. You cannot vote by marking the Notice and returning it. The Notice provides instructions on how to cast your vote.

Who pays for the proxy solicitation and how will the Company solicit votes?

We pay all costs associated with the solicitation of proxies, including any costs incurred by brokers and other fiduciaries to forward proxy solicitation materials to beneficial owners.

We may solicit proxies in person or by mail, telephone, facsimile, or e-mail. Proxies may be solicited on our behalf by any of our directors, officers, or employees. Additionally, we have retained the firm of D.F. King & Co., Inc. to assist with the solicitation of proxies and will pay a fee of $16,500 for this service, plus reasonable costs and expenses.

|

5 | P a g e |

Table of Contents

How can I communicate with the Board of Directors?

Any interested party can contact our Board to provide comments, to report concerns, or to ask a question, at the following address:

Carol R. Kaufman

Executive Vice President, Secretary, Chief Administrative Officer & Chief Governance Officer

The Cooper Companies, Inc.

6140 Stoneridge Mall Road, Suite 590

Pleasanton, CA 94588

Communications are distributed to the Board, or to any individual directors as appropriate, depending on the facts and circumstances outlined in the communication. You may also communicate online with our Board of Directors as a group through our website. Please refer to our website at http://www.coopercos.com for any changes in this process.

|

6 | P a g e |

Table of Contents

The following table contains information regarding all individuals or groups who have advised us that they own more than five percent (5%) of the outstanding shares of our common stock. Information presented is as of January 23, 2018.

| Name & Address of Beneficial Owner | Aggregate Number of Shares Beneficially Held |

Percentage of Shares | ||

|

T. Rowe Price Associates, Inc. (1) 100 E. Pratt Street Baltimore, MD 21202 |

5,636,279 | 11.500% | ||

|

Vanguard Group, Inc. (2) 100 Vanguard Blvd. Malvern, PA 19355 |

4,938,181 | 10.100% | ||

|

Massachusetts Financial Services Company (3) 111 Huntington Avenue Boston, MA 02199 |

3,948,756 | 8.100% | ||

|

BlackRock, Inc. (4) 55 East 52nd Street New York, NY 10022 |

3,024,777 | 6.200% | ||

|

State Street Corporation (5) One Lincoln Street Boston, Massachusetts 02111 |

2,658,640 | 5.450% |

| (1) | Based on information disclosed in a Schedule 13G/A filed by T. Rowe Price Associates, Inc. on January 10, 2018. According to this Schedule 13G/A, T. Rowe Price Associates beneficially owns and has the sole power to dispose of or direct the disposition of all 5,636,279 of these shares and has the sole power to vote or to direct the vote of 1,689,033 of these shares. |

| (2) | Based on information disclosed in a Schedule 13G/A filed by The Vanguard Group, Inc. on July 10, 2017. According to this Schedule 13G/A, The Vanguard Group beneficially owns and has the sole power to dispose of or direct the disposition of 4,854,366 of these shares and has the shared power to dispose of or direct the disposition of 83,815 of these shares; and has the sole power to vote or to direct the vote of 73,522 of these shares and has shared power to vote 11,137 of these shares. |

| (3) | Based on information disclosed in a Schedule 13G/A filed by Massachusetts Financial Services Company (“MFS”) on February 13, 2017. MFS beneficially owns and has the sole power to dispose of or direct the disposition of all 3,948,756 of these shares and the sole power to vote or direct the vote of 3,510,937 of these shares. |

| (4) | Based on information disclosed in a Schedule 13G/A filed by BlackRock, Inc. on January 23, 2017. According to this Schedule 13G/A, BlackRock, Inc., directly and through its subsidiaries, beneficially owns, and has the sole power to dispose of or direct the disposition of all 3,024,777 of these shares and has the sole power to vote or direct the vote of 2,628,831 of these shares. |

| (5) | Based on information disclosed in a Schedule 13G filed by State Street Corporation on February 9, 2017. State Street Corporation has the shared power to dispose of or direct the disposition of and to vote or direct the voting of all 2,658,640 of these shares. |

|

7 | P a g e |

Table of Contents

The following table contains information regarding ownership of our common stock by each of our directors, the executives named in the Summary Compensation Table, and all of the current directors and executive officers as a group. The figures in this table represent sole voting and investment power except where otherwise indicated.

|

Common Stock Beneficially Owned as of January 23, 2018 | ||||||||||

| Name of Beneficial Owner | Number of Shares |

Percentage of Shares | ||||||||

|

A. Thomas Bender

|

|

38,971

|

|

|

(1)

|

|

*

| |||

|

Colleen E. Jay

|

|

3,836

|

|

|

(2)

|

|

*

| |||

|

Michael H. Kalkstein

|

|

36,626

|

|

|

(3)

|

|

*

| |||

|

Carol R. Kaufman

|

|

86,605

|

|

|

(4)

|

|

*

| |||

|

William A. Kozy

|

|

4,106

|

|

|

(5)

|

|

*

| |||

|

Jody S. Lindell

|

|

54,687

|

|

|

(6)

|

|

*

| |||

|

Daniel G. McBride

|

|

77,799

|

|

|

(7)

|

|

*

| |||

|

Gary S. Petersmeyer

|

|

7,448

|

|

|

(8)

|

|

*

| |||

|

Agostino Ricupati

|

|

6,001

|

|

|

(9)

|

|

*

| |||

|

Allan E. Rubenstein, M.D.

|

|

5,568

|

|

*

| ||||||

|

Robert S. Weiss

|

|

330,878

|

|

|

(10)

|

|

*

| |||

|

Albert G. White III

|

|

74,012

|

|

|

(11)

|

|

*

| |||

|

Stanley Zinberg, M.D.

|

|

35,968

|

|

|

(12)

|

|

*

| |||

|

All current directors and executive officers as a group (14 persons)

|

|

777,798

|

|

1.6%

| ||||||

| * | Less than 1% ownership. |

| (1) | Includes 22,100 shares which Mr. Bender could acquire upon the exercise of currently exercisable stock options. |

| (2) | Includes 1,766 shares which Ms. Jay could acquire upon the exercise of currently exercisable stock options. |

| (3) | Includes 26,591 shares which Mr. Kalkstein could acquire upon the exercise of currently exercisable stock options; all of these exercisable options are held by an estate planning trust in which Mr. Kalkstein maintains 50% or greater control. |

| (4) | Includes 41,679 shares which Ms. Kaufman could acquire upon the exercise of currently exercisable stock options. |

| (5) | Includes 1,766 shares which Mr. Kozy could acquire upon the exercise of currently exercisable stock options. |

| (6) | Includes 34,091 shares which Ms. Lindell could acquire upon the exercise of currently available stock options; all of Ms. Lindell’s exercisable options are held by estate planning trusts in which Ms. Lindell maintains 50% or greater control. |

| (7) | Includes 46,317 shares which Mr. McBride could acquire upon the exercise of currently exercisable stock options. |

|

8 | P a g e |

Table of Contents

| (8) | Includes 5,864 shares which Mr. Petersmeyer could acquire upon the exercise of currently available stock options; all of these exercisable options are held by an estate planning trust in which Mr. Petersmeyer maintains 50% or greater control. |

| (9) | Includes 4,190 shares which Mr. Ricupati could acquire upon the exercise of currently exercisable stock options. |

| (10) | Includes 187,814 shares which Mr. Weiss could acquire upon the exercise of currently exercisable stock options. |

| (11) | Includes 37,881 shares which Mr. White could acquire upon the exercise of currently exercisable stock options. |

| (12) | Includes 26,591 shares which Dr. Zinberg could acquire upon the exercise of currently exercisable stock options; all of Dr. Zinberg’s exercisable options are held by estate planning trusts in which Dr. Zinberg maintains 50% or greater control. |

|

9 | P a g e |

Table of Contents

| Our Board of Directors has nine members, each of whom stands for election annually. All of our directors, except Mr. Weiss, have been determined by the Board to be independent. In making this determination, the Board has affirmed that each of the independent directors meets the objective requirements for independence set forth by the NYSE and the SEC, |

Board Facts: ❖ Board size: 9 directors • 8 independent directors • Separate Lead Director & Chairman ❖ All directors are elected annually ❖ Majority vote required for election

| |||

| and that each has no relationship to the Company, either directly or indirectly, other than as a stockholder of the Company or through their service on the Board. The Board and its committees conduct regular self-evaluations and review director independence and committee composition to ensure continued compliance with regulations. | ||||

Directors who are not also employees, or Non-Employee Directors, are compensated for their services as described in Director Compensation on page 53. Mr. Weiss serves as our Chief Executive Officer and receives no additional compensation for his service on the Board. His compensation is discussed in more detail in our Compensation Discussion & Analysis and executive compensation disclosures starting on page 21.

Under our Corporate Governance Principles, directors are not permitted to serve on the boards of more than two other public companies while they serve on our Board. We do not limit service on private company boards of directors or with non-profit organizations.

Identification of Candidates

The Corporate Governance and Nominating Committee is responsible for identification and selection of qualified candidates for nomination to the Board. The Committee believes that nominees for election to the Board must possess certain minimum qualifications and attributes.

To be nominated for election, an individual must:

| (i) | meet the objective independence requirements set forth by the SEC and NYSE (other than executive nominees); |

| (ii) | exhibit strong personal integrity, character, and ethics and a commitment to ethical business and accounting practices; |

| (iii) | not serve on more than two other public company boards; |

| (iv) | not be involved in on-going litigation with us or be employed by an entity which is engaged in such litigation; and |

| (v) | not be the subject of any on-going criminal investigations, including investigations for fraud or financial misconduct. |

The Corporate Governance and Nominating Committee does not currently maintain a separate diversity policy regarding nominees for director. Instead the Committee relies on diversity as one of many factors in the consideration of director nominees who meet these stated criteria.

|

10 | P a g e |

Table of Contents

The Corporate Governance and Nominating Committee will consider suggestions from stockholders for nominees for election as directors at our Annual Meetings on the same terms as nominees selected by the Committee. Stockholder suggestions must be received on a timely basis and meet the criteria set forth in the information on Stockholder Proposals and Nominations for Director on page 4.

As of the date of this Proxy Statement, no stockholder suggestions for director nominees have been received by the Corporate Governance and Nominating Committee. Except as set forth above, the Corporate Governance and Nominating Committee does not currently have a formal process for identifying and evaluating nominees for directors, including nominees recommended by stockholders.

Board Leadership Structure

We maintain separate positions for the Chairman and Chief Executive Officer (CEO). We also maintain an independent Lead Director position, which is currently held by Dr. Allan E. Rubenstein.

We feel this division provides a balance between the independence of our directors and the experience of our officers. Our current Chairman has significant business experience with the Company, but has also been affirmatively determined to be independent by our Board. We feel that maintaining an independent Chair provides for strong, knowledgeable leadership of the Board separate from the CEO position’s immediate, day-to-day involvement with the Company.

Board Committees

The Board maintains four standing committees as described below. Committee membership is determined by the Board and reviewed regularly.

As required by the SEC and NYSE, all members of our Corporate Governance and Nominating Committee, Audit Committee, and Organization and Compensation Committee are independent directors. At the Board’s discretion, other committees may include directors who have not been determined to be independent. Currently the Board maintains one committee, the Science and Technology Committee, which has non-independent director membership.

| Audit | Corporate Governance & Nominating |

Organization & Compensation |

Science & Technology | |||||

|

A. Thomas Bender (Chairman) |

◆ | |||||||

|

Allan E. Rubenstein, M.D. (Lead Director) |

❖ |

◆ | ||||||

|

Colleen E. Jay |

◆ |

◆ |

||||||

|

Michael H. Kalkstein |

◆ |

◆ |

❖ |

|||||

|

William A. Kozy |

◆ |

◆ | ||||||

|

Jody S. Lindell |

❖ |

◆ |

||||||

|

Gary S. Petersmeyer |

◆ |

◆ |

◆ | |||||

|

Robert S. Weiss |

◆ | |||||||

|

Stanley Zinberg, M.D. |

◆ |

❖ |

| ❖ | - Committee Chair |

|

11 | P a g e |

Table of Contents

Each committee maintains a written charter detailing its authority and responsibilities. These charters are updated periodically as legislative and regulatory developments and business circumstances warrant. The committee charters are available in their entirety on our website at http://www.coopercos.com.

The Audit Committee provides advice with respect to our financial matters and assists the Board in fulfilling its oversight responsibilities regarding: (i) the quality and integrity of our financial statements, (ii) our compliance with legal and regulatory requirements, (iii) review of our potential risk factors, (iv) the qualifications, independence, and performance of the independent registered public accounting firm serving as auditors of the Company, (v) retention and engagement of the independent registered public accounting firm, and (vi) the performance of the Company’s Internal Audit function and internal controls. The Audit Committee advises and makes recommendations to the Board regarding our financial, investment, and accounting procedures and practices.

The Organization and Compensation Committee reviews and approves all aspects of the compensation paid to our Chief Executive Officer and all executives identified by the Organization and Compensation Committee as officers under Section 16(a) of the Exchange Act. The Organization and Compensation Committee also approves all compensation for employees whose total combined annual base salary plus target non-equity incentive bonus is $500,000 or greater, regardless of whether they have been designated as officers under Section 16(a). Members of the Organization and Compensation Committee are not eligible to participate in any of our executive compensation programs.

The Organization and Compensation Committee also approves the composition of our designated comparative peer group for compensation review, approves all awards under our equity and non-equity incentive bonus plans, and has approval authority for all agreements providing for the payment of benefits following a change in control of the Company, severance following a termination of employment, or any other special arrangement with the executive officers or employees which would affect their compensation. The Organization and Compensation Committee also oversees succession planning, diversity & inclusion, and management development programs designed to strengthen our internal pool of candidates for executive level positions and promote mentoring of senior level employees.

The Corporate Governance and Nominating Committee develops, implements, and maintains the corporate governance standards by which we conduct business, and advises and makes recommendations to the Board concerning our primary governance policies. The Corporate Governance and Nominating Committee meets with the Chief Executive Officer and senior corporate staff as it deems appropriate to fulfill its obligations with regard to our corporate governance standards. The Corporate Governance and Nominating Committee also performs the functions described under Identification of Candidates on page 10.

The Science and Technology Committee evaluates new and existing technologies. The Science and Technology Committee’s primary functions are to: (i) discuss technology that falls outside the usual scope of current business, (ii) periodically review our research and development projects and

|

12 | P a g e |

Table of Contents

portfolio, (iii) annually review our key technologies and assess the position of these technologies versus third party products and processes, and (iv) provide information and guidance to the Board on matters relating to science and technology. The Science and Technology Committee functions on an ad hoc basis.

Meetings

The Board and its committees met as follows during our most recent fiscal year:

|

Number of Meetings

| ||

| Board of Directors |

11 | |

| Audit Committee |

10 | |

| Organization & Compensation Committee |

7 | |

| Corporate Governance & Nominating Committee |

3 | |

| Science & Technology Committee |

5 |

The Non-Employee Directors hold executive sessions in connection with regular meetings of the Board and more often as they deem appropriate. Either Mr. Bender, as Chair, or Dr. Rubenstein, as Lead Director, presides over executive sessions.

During the 2017 fiscal year, each director attended at least 85% of the board meetings and meetings of committees on which the director served. Currently we do not maintain a formal policy regarding director attendance at the Annual Meeting.

We have an ongoing commitment to good governance and business practices. In furtherance of this commitment, we regularly monitor developments in the area of corporate governance and review our policies and procedures in light of such developments. We seek to comply with the rules and regulations promulgated by the SEC and the NYSE and implement other corporate governance practices we believe are in the best interest of the Company and its stockholders. In keeping with this commitment, our corporate Bylaws include a majority voting standard for the election of our directors and we maintain various corporate policies that reflect our dedication to good governance. We have also allowed our shareholder rights plan to expire by its terms as of the end of the 2017 fiscal year. We believe that the policies currently in place enhance our stockholders’ interests.

Corporate Governance Principles

The Board has approved a set of Corporate Governance Principles for the Company. The Principles are available in their entirety on our website at http://www.coopercos.com. The Principles set out our standards for director qualifications, director responsibilities, Board committees, director access to officers and employees, director orientation and continuing education, and performance evaluations of the Chief Executive Officer and of the Board and its committees.

The Principles also address compensation and stock ownership requirements for our Non-Employee Directors. These topics are discussed in more detail in the section on Director Compensation starting on page 50.

|

13 | P a g e |

Table of Contents

Ethics and Business Conduct Policy

We have adopted an Ethics and Business Conduct Policy, or Ethics Policy, which is available in its entirety on our website at http://www.coopercos.com. All our employees, officers, and directors, including the Chief Executive Officer and Chief Financial Officer, are required to adhere to the Ethics Policy in discharging their work-related responsibilities. Employees are encouraged to report any conduct that they believe in good faith to be an actual or apparent violation of the Ethics Policy.

The Ethics Policy includes provisions relating to: (i) conflicts of interest, (ii) the protection and proper use of Company assets, (iii) relationships with customers, suppliers, competitors and associates, (iv) government relations and anti-corruption regulations, and (v) compliance with laws and regulations, including laws and regulations relating to insider trading, equal employment opportunity, harassment, health and safety.

The Ethics Policy is translated into multiple languages to facilitate readability for our employees and all employees receive a copy of the Ethics Policy both at their date of hire and annually. The Ethics Policy is also posted on our internal web pages for ease of access.

Amendments to the Ethics Policy and any waivers from the Ethics Policy granted to directors or executive officers will be made available through our website. As of the date of this proxy statement, no waivers or requests have been requested or granted.

Stock Trading Policy: Hedging & Pledging

We have implemented a Stock Trading Policy that applies to our senior executives, including our Named Executive Officers, and all members of the Board of Directors. Under this Policy, trading in Company securities is prohibited except during specifically designated windows. Additionally, executives and members of the Board are prohibited from engaging in various trading practices which would suggest speculation in our securities, including short sales, puts, calls, forward sales, equity swaps, or other hedging transactions. Our policy does permit executives and members of the Board to pledge securities as collateral, but only upon prior notice to, and approval from, the Company.

Procedures for Handling Accounting Complaints

The Audit Committee has established procedures for receipt and handling of potential complaints we may receive regarding accounting, internal accounting controls, or auditing matters, and to allow for the confidential, anonymous submission by our employees of concerns regarding accounting or auditing matters. In furtherance of this goal, we have established a confidential reporting system managed by an independent third-party vendor through which employees may report concerns about our business practices. The reporting system provides both a telephone hotline and online reporting options in multiple languages.

Board of Directors’ Role in Risk Oversight

Our Board of Directors recognizes the importance of appropriate oversight of potential business risks in running a successful operation and meeting its fiduciary obligations to our business and our stockholders. While our management team has responsibility for the day-to-day assessment and management of potential business risks, the Board maintains responsibility for creating an appropriate culture of risk management and setting the proper “tone at the top.”

|

14 | P a g e |

Table of Contents

In this function, the Board, directly and through its committees, takes an active role in overseeing our aggregate risk potential and in assisting management with addressing specific risks, including competitive, legal, regulatory, operational, and financial risks. Each committee of the Board regularly reviews risks related to its area of focus as follows:

| • | The Audit Committee reviews potential risks within our financial operations, information technology systems, and internal controls; |

| • | The Corporate Governance and Nominating Committee reviews potential risks in relation to general governance and compliance matters; |

| • | The Organization and Compensation Committee reviews risks associated with retention of key executives, how our compensation practices influence executive risk taking, and matters of succession planning; and |

| • | The Science and Technology Committee reviews potential risks in connection with current technology and potential technology investments. |

Each committee reports regularly to the Board on these topics and contributes to the overall Board review of potential business risks.

The Board believes that its current leadership structure and majority independent membership facilitate risk oversight by combining experienced leadership with independent direction from the Board and committees. Both our Chairman and our CEO have in-depth understanding of our history and specific challenges we face as a business. Our CEO’s experience allows him to promptly identify and raise key business risks to the Board and our Chairman’s history with the Company provides the Board with an independent voice who can also provide insight into management decisions and market dynamics based on our specific business operations. The Board believes that the balance between our Chairman, CEO, Lead Director, and the independent committees of the Board enhances our risk oversight process and appropriately limits levels of risk within our enterprise.

Additionally, we maintain both an internal Risk Committee and a Chief Governance Officer position. Our Risk Committee is composed of members of senior management and is responsible for the review of our potential and identified business risks. Regular reports from the Risk Committee are presented to the Board of Directors. The Chief Governance Officer holds responsibility for ensuring compliance training and communication of key policies to our employees. The Board feels that the appointment of executive officers that are directly responsible for monitoring risk and compliance issues ensures active positions dedicated to the identification of potential business risks and enhances the “tone at the top” message of the importance of risk oversight, governance, and compliance.

Risk and Executive Compensation

Our Organization and Compensation Committee reviews and assesses the possible risks related to our executive compensation programs. Based on this assessment, the Organization and Compensation Committee has concluded that our compensation program structure does not create unreasonable risk or the likelihood of a material adverse impact on the Company. In making this determination, the Organization and Compensation Committee considered possible compensation-based risks and means by which potential risks may be mitigated, including through the operation of our internal control structure and the Committee’s oversight. The Organization and Compensation Committee also considered the structure of our compensation plans, including the use of a combination of short- and long-term compensation programs, equity ownership guidelines for our senior executives, capped bonus targets under short-term incentive plans, and clawback provisions for short-term bonus awards.

|

15 | P a g e |

Table of Contents

Management Succession Planning

At least annually, and more often as deemed appropriate, the Organization and Compensation Committee meets with management to discuss succession plans for our executive management, including our CEO. Succession plans are designed to allow for an orderly transition of the top executive posts either in the ordinary course of business or in response to emergency situations. Management develops and presents plans for identification, mentoring, and continuing development of potential internal candidates for executive leadership positions. The Committee provides oversight, input, and recommendations with regard to the criteria to be used for identification of potential candidates for succession to leadership positions. The Committee also meets with individual members of management occasionally throughout the year to assess leadership development within the executive team.

We review all relationships and transactions in which the Company and our directors and executive officers or their immediate family members are participants. The Company’s legal and governance staff is primarily responsible for monitoring and obtaining information from the directors and executive officers with respect to related party transactions and for then determining, based on the facts and circumstances, whether the Company or a related party has a direct or indirect material interest in the transaction.

KPMG LLP, as our independent registered public accounting firm, reviews our controls around the identification and reporting of related party transactions as required by current accounting standards.

The Corporate Governance and Nominating Committee of our Board reviews and approves or ratifies all transactions between the Company and related parties that are required to be disclosed under SEC rules, and we disclose such transactions in our Proxy Statement.

We have determined that there were no material related party transactions during the 2017 fiscal year.

Compensation Committee Interlocks and Insider Participation

During the 2017 fiscal year, all of the members of the Organization and Compensation Committee were independent directors, no member was an employee or former employee of the Company, and no Committee member had any relationship requiring disclosure as a related party transaction. Also, none of our executive officers served on the compensation committee (or its equivalent) or board of directors of another entity whose executive officer served on the Organization and Compensation Committee.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our executive officers, directors, and anyone owning more than ten percent of a registered class of our equity securities to file reports with the SEC detailing their ownership and any changes in ownership. SEC regulations also require these persons to provide us with a copy of all reports filed.

Based solely on our review of the copies of reports and related amendments we have received, we believe that during and with respect to the 2017 fiscal year, all Section 16(a) filing requirements applicable to our officers, directors and greater-than-ten-percent owners were met.

|

16 | P a g e |

Table of Contents

Our Audit Committee currently has four members: Jody S. Lindell (Chair), Michael H. Kalkstein, William A. Kozy, and Gary S. Petersmeyer. Our Board has determined that all members of the Audit Committee are independent directors and are financially literate as required by the NYSE. Our Board has also determined that Ms. Lindell meets the qualifications of an audit committee financial expert as defined by the SEC.

The Audit Committee operates under a written charter adopted by the Board in December 2003 and most recently amended in March 2017. The Audit Committee’s charter is available in its entirety on our website at http://www.coopercos.com.

The Audit Committee’s primary duties and responsibilities relate to:

| • | The reliability and integrity of our accounting policies and financial reporting and financial disclosure practices; |

| • | Establishment and maintenance of processes by management to assure that an adequate and effective system of internal controls exists within the Company; and |

| • | Engagement, retention, and termination of our independent registered public accounting firm. |

The Audit Committee provides advice with respect to our financial matters and assists the Board in fulfilling its oversight responsibilities regarding: (i) the quality and integrity of our financial statements, (ii) our compliance with legal and regulatory requirements, (iii) review of our potential risk factors, (iv) the qualifications, independence and performance of KPMG LLP (“KPMG”), in its role as our independent registered public accounting firm, (v) retention and engagement of KPMG, and (vi) the performance of our internal audit function and review of our internal controls.

Management is responsible for the Company’s internal controls and the financial reporting process. The Committee has engaged Ernst & Young LLP (“EY”) to assist in the assessment of the Company’s internal controls over financial reporting and to provide internal audit services. Such services provided by EY are jointly directed by management and the Audit Committee.

KPMG, as the Company’s independent registered public accounting firm, is responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States) and to issue a report on the audit process. The Audit Committee’s responsibility is to monitor and oversee these processes. In this context, the Audit Committee has met and held discussions with management and KPMG regarding the fair and complete presentation of the Company’s financial results.

The Audit Committee held 10 meetings during the 2017 fiscal year, including regular meetings in conjunction with the close of each fiscal quarter, during which the Audit Committee reviewed and discussed the Company’s financial statements with management and KPMG. These Audit Committee meetings routinely include executive sessions of the committee, as well as private sessions with each of KPMG, Internal Audit, EY, and management.

The Audit Committee reviewed and discussed the audited consolidated financial statements of the Company for the fiscal year ended October 31, 2017 with management and KPMG, and management

|

17 | P a g e |

Table of Contents

represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with United States generally accepted accounting principles (GAAP). The Audit Committee discussed with KPMG the matters required to be discussed by the Public Company Accounting Oversight Board Auditing Standard No. 16 “Communication with Audit Committees.”

The Audit Committee also reviewed and discussed with KPMG, Internal Audit, EY, and management the processes and procedures associated with our assessment of internal controls over financial reporting, including management’s assessment of such controls.

The Audit Committee maintains policies and procedures for the pre-approval of work performed by KPMG. Under its charter, the Audit Committee must approve all engagements in advance. All engagements with estimated fees above $150,000 require consideration and approval by the full Audit Committee. The Chair of the Audit Committee has the authority to approve on behalf of the full Audit Committee all engagements with fees estimated to be below $150,000. Management recommendations are considered in connection with such engagements, but management has no authority to approve engagements.

In the 2017 fiscal year, the Audit Committee received both the written disclosures and the letter from KPMG that are mandated by applicable requirements regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence and the Audit Committee discussed KPMG’s independence from the Company with the lead engagement partner. The Audit Committee or its Chair approved all audit services provided by KPMG for the fiscal year ended October 31, 2017. The total fees paid or payable to KPMG for the last two fiscal years are as follows:

| Fiscal Year Ended | ||||

| October 31, 2017 | October 31, 2016 | |||

| Audit Fees |

$4,539,800 | $4,140,000 | ||

| Audit Related Fees |

$-0- | $-0- | ||

| Tax Fees |

$-0- | $-0- | ||

| All Other Fees |

$-0- | $-0- | ||

Based on the Audit Committee’s discussions with KPMG, Internal Audit, EY, and management, the Audit Committee’s review of the representations of management, the certifications of the Chief Executive Officer and Chief Financial Officer, and the written disclosures and the letter from KPMG to the Audit Committee, the Audit Committee recommended to the Board that our audited consolidated financial statements be included in our Annual Report on Form 10-K for the fiscal year ended October 31, 2017 for filing with the SEC.

THE AUDIT COMMITTEE

Jody S. Lindell (Chair)

Michael H. Kalkstein

William A. Kozy

Gary S. Petersmeyer

|

18 | P a g e |

Table of Contents

EXECUTIVE OFFICERS OF THE COMPANY

Set forth below is information regarding our current executive officers and other senior employees named in this Proxy Statement who are not also directors. The individuals listed below served in the positions set forth as of the date the Notice was mailed.

|

DANIEL G. MCBRIDE |

AGE: 53 |

|||

| EXECUTIVE VICE PRESIDENT & CHIEF OPERATING OFFICER / PRESIDENT OF COOPERVISION, INC. |

||||

Mr. McBride has served as Executive Vice President and Chief Operating Officer since November 2013 and as the President of CooperVision, our contact lens subsidiary since February 2014. He previously served as our Chief Risk Officer from July 2011 through October 2013, as our General Counsel from November 2007 through January 2014, and as Vice President from July 2006 through October 2013. He also served as Senior Counsel from February 2005 through November 2007. Prior to joining Cooper, Mr. McBride was an attorney with Latham & Watkins LLP from October 1998 to February 2005, concentrating on mergers and acquisitions and corporate finance matters.

|

ALBERT G. WHITE III |

AGE: 48 |

|||

| EXECUTIVE VICE PRESIDENT, CHIEF FINANCIAL OFFICER & CHIEF STRATEGY OFFICER / CHIEF EXECUTIVE OFFICER OF COOPER MEDICAL, INC. |

||||

Mr. White has served as Chief Financial Officer since November 2016. He also serves as Executive Vice President and Chief Strategy Officer, positions he has held since December 2015 and July 2011, respectively. Since August 2015, Mr. White also oversees and directs our women’s healthcare business and is currently Chief Executive Officer of Cooper Medical, Inc., the parent company to CooperSurgical, Inc. Previously, he served as Vice President, Investor Relations from November 2007 through March 2013 and as Vice President and Treasurer from April 2006 through December 2012. Prior to joining the Company, Mr. White was a Director with KeyBanc Capital Markets for three years and held a number of leadership positions within KeyBank National Association over the prior eight years.

|

CAROL R. KAUFMAN |

AGE: 68 |

|||

|

EXECUTIVE VICE PRESIDENT, SECRETARY, CHIEF ADMINISTRATIVE OFFICER & CHIEF GOVERNANCE OFFICER |

||||

Ms. Kaufman has served as Executive Vice President since July 2012 and Chief Governance Officer since March 2013. She previously served as Senior Vice President of Legal Affairs from December 2004 to July 2012. She has also served as Vice President and Chief Administrative Officer since October 1995 and as Vice President of Legal Affairs and Secretary since March 1996. From January 1989 through September 1995, she served as Vice President, Secretary and Chief Administrative Officer of Cooper Development Company, a healthcare and consumer products company. She previously held a variety of financial positions with Cooper Laboratories, Inc. (our former parent) since joining that company in 1971. Ms. Kaufman currently serves as a director for Insperity, Inc. (NYSE: NSP), a publicly traded provider of human resources outsourcing options, and is a member of its nominating and corporate governance and compensation committees. She is also a member of the western region advisory board for FM Global, the world’s largest property insurer. She formerly

|

19 | P a g e |

Table of Contents

served as a director of Chindex International, Inc. (NASDAQ: CHDX) and as a member of its audit and compensation committees and chaired the nominating and corporate governance committees. She also served as a member of the Special Transaction Committee in connection with sale of Chindex to TPG in 2014.

|

RANDAL L. GOLDEN, ESQ. |

AGE: 56 |

|||

| VICE PRESIDENT & GENERAL COUNSEL | ||||

Mr. Golden has served as Vice President since November 2014 and as our General Counsel from February 2014. He previously served as our Assistant General Counsel from May 2013 through January 2014. He also served as senior counsel from March 2010, when he joined the Company, until May 2013. Prior to joining Cooper, he served as Senior Director & Legal Counsel at Align Technology, Inc. from 2005 through 2010 and as Director of Legal Affairs & Senior Counsel with Nokia, Inc. from 2000 to 2005. Mr. Golden also held various associate and senior legal positions prior to 2000, focusing on litigation and commercial and business law.

|

AGOSTINO RICUPATI |

AGE: 51 |

|||

| SENIOR VICE PRESIDENT, FINANCE & TAX AND CHIEF ACCOUNTING OFFICER | ||||

Mr. Ricupati has served as our Chief Accounting Officer since October 2017 and as Senior Vice President, Finance & Tax since July 2017. Mr. Ricupati previously served as Vice President, Tax for the Company from July 2013 to July 2017. Prior to joining Cooper, he served as International Tax Director for Intel Corp. (NASDAQ: INTC) from 2010 to 2013 and in various other senior finance and tax positions over the past 20 years. He holds a masters degree from DePaul University and is a Certified Public Accountant.

|

20 | P a g e |

Table of Contents

REPORT OF THE ORGANIZATION AND COMPENSATION COMMITTEE

The Organization and Compensation Committee of the Board has reviewed and discussed the Compensation Discussion and Analysis with management. Based on this review and discussion, the Organization and Compensation Committee has recommended to the Board that the Compensation Discussion and Analysis be included in this Proxy Statement and incorporated by reference in our Annual Report on Form 10-K for the fiscal year ended October 31, 2017.

ORGANIZATION AND COMPENSATION COMMITTEE

Michael H. Kalkstein (Chair)

Colleen E. Jay

Jody S. Lindell

Gary S. Petersmeyer

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis describes our philosophy, strategies, policies and practices for compensating our Named Executive Officers (“NEOs”).

The Organization and Compensation Committee of our Board of Directors (referred to below as the “OCC”) oversees our executive compensation program and regularly reviews our program to ensure that we maintain an effective link between pay and performance. The OCC continually monitors for compensation-related risks that could have a material adverse effect on the Company.

This oversight responsibility is described in more detail throughout this Compensation Discussion and Analysis, which also includes information regarding our compensation governance policies and practices, the outcome of our most recent stockholder advisory vote on NEO compensation (the “Say-on-Pay” vote), the use of compensation consultants, and the selection and composition of our peer group.

Our Named Executive Officers

Our NEOs for the 2017 fiscal year are listed below with the titles they held at the end of the fiscal year.

| 2017 Named Executive Officers | ||

| Name

|

Title

| |

|

Robert S. Weiss |

President & Chief Executive Officer | |

|

Daniel G. McBride |

Executive Vice President & Chief Operating

Officer / President of CooperVision, Inc. | |

|

Albert G. White III |

Executive Vice President, Chief Financial Officer & Chief Strategy Officer / Chief Executive Officer of Cooper Medical, Inc. | |

| Carol R. Kaufman |

Executive Vice President, Secretary, Chief Administrative Officer & Chief Governance Officer | |

|

Agostino Ricupati |

Senior Vice President, Finance & Tax and Chief Accounting Officer | |

|

21 | P a g e |

Table of Contents

The Year in Review

Financial and Operational Highlights

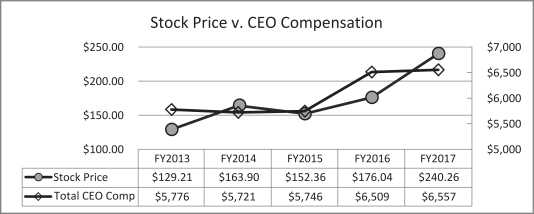

We reported strong financial results for fiscal 2017, with record revenue growth, earnings per share, and free cash flow, and both CooperVision and CooperSurgical successfully closed strategic acquisitions that will create growth for their businesses and continue to expand our global presence. In addition to overall robust financial results, we had a number of other important achievements worthy of note this past year, including:

| ✓ CooperVision, our contact lens business, closed multiple acquisitions that will expand our global sales presence and develop our specialty lens business to include orthokeratology products for myopia management.

✓ Single use silicone hydrogel contact lens products grew 44% (in constant currency) and CooperVision achieved #1 market share position in both Australia/New Zealand and the UK/Ireland. |

2017 Financial Highlights

| |||||||||

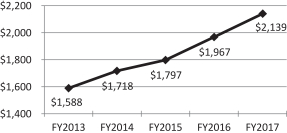

| Revenue:* | $2.139 billion | Up 7% | ||||||||

| CooperVision: | $1.674 billion | Up 7% | ||||||||

| CooperSurgical: | $464.9 million | Up 4% | ||||||||

| EPS: | $7.52 | Up 35% | ||||||||

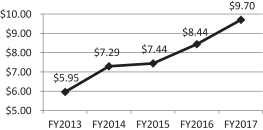

| Non-GAAP EPS: | $9.70 | Up 15% | ||||||||

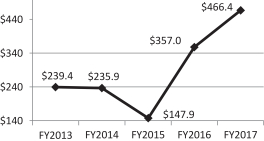

| Free Cash Flow: | $466.4 million | Up 31% | ||||||||

| Stock Price (10/31): | $240.26 | Up 36% | ||||||||

| * Increases presented pro forma, constant currency | ||||||||||

| ✓ | CooperVision launched custom products and new private label arrangements with key customers in the U.S. and internationally and improved our e-commerce services for eye care professionals through EyeCare Prime, including expansion into Europe. |

| ✓ | CooperSurgical, our women’s healthcare business, closed a number of strategic acquisitions to expand its invitro fertilization and fertility business globally, including its largest acquisition to-date with the purchase of the Paragard® IUD product from Teva Pharmaceuticals. |

| ✓ | CooperSurgical restructured its global organization and acquired new facilities in Costa Rica in order to consolidate manufacturing. |

| ✓ | We negotiated a new $1.425 billion term loan, which financed the Paragard® acquisition for CooperSurgical and which will allow greater flexibility for general corporate purposes, including reducing debt on our revolving loan facilities and financing additional acquisitions. |

| ✓ | We were named one of the “Top Workplaces” by the Bay Area Newsgroup (8th consecutive year) and executives from CooperVision were recognized for their individual accomplishments, including recognition by the Optometric Center of New York, Financial Executives International, and Vision Monday, and the CooperVision business received five honors at the 2017 Prism Awards. |

| ✓ | CooperVision manufacturing in Puerto Rico received the Environmental Innovative Project of the Year Award, as well as 12 other Environmental Sustainability and Occupational Health & Safety Honors, from the Puerto Rico Manufacturers Association at the 2017 Environmental Health and Safety Summit. |

| ✓ | CooperVision manufacturing in Scottsville, New York was honored as the 2017 Manufacturing Innovation award recipient for the large company category by the Rochester Business Journal and the Rochester Technology and Manufacturing Association. |

|

22 | P a g e |

Table of Contents

| ✓ | Our corporate wellness program received recognition as one of the Healthiest Employers in the Bay Area by the San Francisco Business Times and the Silicon Valley/San Jose Business Journal (7th consecutive year) and we received recognition from the American Heart Association as a “Fit-Friendly Company” at all of our U.S. locations. |

Puerto Rico Recovery Effort

Hurricane Maria struck Puerto Rico in September 2017, impacting the CooperVision manufacturing facility on the island. Our local management team implemented disaster recovery procedures and were able to restore limited operations within one week of the storm and near-full function of our facility within a month. CooperVision also immediately implemented support measures for our employees affected by the hurricane, including providing clean drinking water, emergency kits, and laundry facilities for employees in the immediate aftermath of the storm.

CooperVision continues to work to address the needs of our employees affected by the storm and to assist with local relief efforts. We have established the Puerto Rico Relief Fund, a charitable donation organization which contributes directly to our employees affected by the hurricane and to surrounding communities. Local management has also worked closely with regional utilities, providing technical labor, logistics support, and equipment, to assist with maintaining service to our facility and the surrounding area.

Executive Compensation Highlights

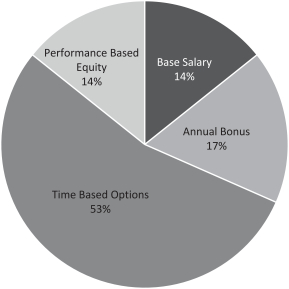

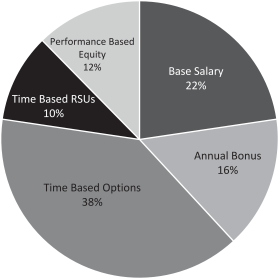

For fiscal 2017 the compensation for our NEOs, including Mr. Weiss, was provided as follows:

| • | Base Salary: Base salaries were increased by 3-6% in fiscal 2017, with the exception of Messrs. White and Ricupati. Mr. White’s salary was increased by 10% in connection with his promotion to Chief Financial Officer at the beginning of the 2017 fiscal year. Mr. Ricupati’s salary was increased by a total of 11% in connection with his promotions to Senior Vice President, Finance in July 2017 and Chief Accounting Officer in October 2017. |

| • | Annual Cash Incentives: Cash bonuses under the 2017 Incentive Payment Plan were paid at between 107-123% of target for our NEOs. (Discussed in more detail below starting on page 31.) |

| • | Performance Based Equity: |

| ○ | Performance Share Awards granted in fiscal 2015 were certified at Target achievement based on 12% annualized growth in earnings per share (EPS) and, accordingly, the NEOs received 100% of target shares under these awards. (Discussed in more detail below starting on page 35.) |

| ○ | Performance Share Awards granted in fiscal 2017 require achievement of 9% annualized growth in EPS over the 2017—2019 fiscal years to meet Threshold payment and 12% or 15% annualized growth to meet Target and Outstanding achievement, respectively. |

| • | Time Based Equity: Fiscal 2017 equity grants were made at the beginning of the fiscal year in the form of stock options and Restricted Stock Units (RSUs) vesting ratably over 5 years. (Discussed in more detail starting on page 36.) |

|

23 | P a g e |

Table of Contents

Compensation Objectives / Pay for Performance

| Our executive compensation program is designed to provide competitive compensation packages to: 1) attract and retain top-tier talent; and 2) closely link potential compensation with our financial performance. To meet these objectives our program emphasizes certain principles: |

Annual Measures

|

Long-Term Measures

| ||||

|

Revenue

|

EPS measured over three-year period

| |||||

|

Cash Flow

|

||||||

|

Non-GAAP EPS

|

| (i) | Connect executive compensation to financial measures that correlate strongly with stockholder returns; |

| (ii) | Balance short-term operational goals and long-term strategic objectives; |

| (iii) | Reward achievement of challenging corporate objectives without encouraging inappropriate risk-taking; |

| (iv) | Recognize the significant role our executive officers play in our overall performance and the responsibilities associated with their roles; and |

| (v) | Maintain sufficient flexibility to allow recognition of significant individual achievements by our executive officers. |

The compensation packages for our NEOs are designed to reward achievement of both short-term and long-term goals, as reflected in specific financial measures, and continued service to the Company. Encouraging long-term service and continued financial achievement has created strong results for us and we have maintained steady growth and returns for our stockholders (see below).

We consider our executive compensation program design to be integral to our success and believe the selected performance measures serve as significant indicators for our continued success.

| Revenue (in millions)

.

|

Non-GAAP EPS

| |

| Cash Flow (in millions)

|

Stock Price

|

|

24 | P a g e |

Table of Contents

Compensation Governance

The OCC works closely with its independent compensation consultant and management to ensure that we maintain sound governance and compensation policies and practices. In designing and overseeing our executive compensation program, we strive to employ best practices.

|

THINGS WE DO: | ||||||||

|

| ||||||||

|

Entirely independent OCC |

|

Thorough assessment of individual and Company performance and linkage to compensation

| |||||

|

|

| |||||||

|

Independent compensation consultant, retained by and reporting only to the OCC |

|

Limited use of employment and change-in-control agreements; all change-in-control payments and benefits subject to “double-trigger” requirements

| |||||

|

|

| |||||||

|

A majority of NEO compensation is “at risk” |

|

Robust succession planning process with annual review by the OCC

| |||||

|

|

| |||||||

|

Stock ownership guidelines applicable to our NEOs, with our CEO required to hold five times his annual base salary

|

|

Perquisites are limited in scope and have specific business rationale | |||||

|

|

| |||||||

|

Annual review of executive compensation program and individual compensation packages

|

|

Compensation recovery (“clawback”) provision incorporated in our annual incentive plan | |||||

|

THINGS WE DON’T DO: | ||||||||

|

| ||||||||

| ❖ | No loans to NEOs |

❖ | No tax gross-ups for NEOs

| |||||

|

|

| |||||||

| ❖ | No Supplemental Executive Retirement Plan or other exceptional deferred compensation options. Also no defined benefit or other actuarial plans which are not available generally to our employees

|

❖ | No hedging or speculative transactions in Company securities; no purchases of Company securities on margin | |||||

|

|

| |||||||

| ❖ | No stock option repricing, reload options, or option exchanges without stockholder approval |

❖ | No related party transactions without approval from our Corporate Governance and Nominating Committee | |||||

|

25 | P a g e |

Table of Contents

In addition to these policies and practices, the OCC stays informed and regularly assesses the alignment between our compensation packages and our performance as follows:

| • | Regular updates on our business results from management; |

| • | Review of our quarterly financial statements, management projections, and long-range plans; |

| • | Review of information regarding our peer group, including reported revenues, profit levels, market capitalization, stockholder returns, compensation components, and disclosed governance policies and practices; and |

| • | Review of broader, general industry compensation data relative to other companies of our size. |

The OCC considers management input, the advice of compensation consultants, and publicly available peer information to be valuable tools in its evaluation of the relationship between executive compensation and Company performance.

2017 Say-on-Pay Vote

The OCC considers the outcome of our annual “Say-on-Pay” vote in determining the design of our executive compensation program and the composition and levels of individual compensation packages.

At our 2017 Annual Meeting of Stockholders, 94% of the votes cast on our Say-on-Pay proposal were voted in favor of the compensation program for our NEOs. The OCC views this result as a strong affirmation of our program structure and considered these results when developing the compensation packages for fiscal 2017 as described in this Compensation Discussion and Analysis.

We also presented a proposal regarding the frequency with which Say-on-Pay proposals are presented to our stockholders, and 91% of votes cast were voted in favor of continuing the annual presentation of our Say-on-Pay vote. As a result of this positive result, the OCC made no significant changes in our compensation program structure and will continue to present a Say-on-Pay vote to our stockholders annually.

Stock Ownership Guidelines

| We maintain guidelines for stock ownership by our NEOs and certain other senior executives. Under these guidelines the designated executives are expected to hold a portion of the shares acquired upon the exercise of stock options or vesting of full-value stock awards if their ownership level is below the established guidelines. |

Name | Target Value | Hold on Vest/Exercise | |||

| Robert S. Weiss

|

5x base salary

|

100%

| ||||

| Daniel G. McBride Albert G. White III Carol R. Kaufman

|

2x base salary | 50% | ||||

| Agostino Ricupati

|

1x base salary | 25% |

The OCC reviewed the guidelines in fiscal 2017 and increased the recommended ownership for Mr. Weiss from 3 times his base salary to 5 times his base salary.

All NEOs were in compliance with the applicable ownership guidelines during fiscal 2017.

|

26 | P a g e |

Table of Contents

Use of Compensation Consultants

The OCC retains Compensia, a national compensation consulting firm, to provide advice on compensation of our executive officers and the non-employee members of our Board of Directors. Under this engagement, Compensia reports directly to the OCC and does no other work for the Company. The OCC also maintains sole authority to determine the terms of Compensia’s retention and services. A representative of the firm generally attends OCC meetings. Management interaction with Compensia is generally limited to communication of information provided by management to the OCC.