Form 10-K/A Spectrum Brands Holdings For: Sep 30 Filed by: SB/RH Holdings, LLC

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No.2

|

|

|

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended September 30, 2017

OR

|

|

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from __________ to ___________

|

|

|

||||

|

Commission File No. |

|

Name of Registrant, State of Incorporation, Address of Principal Offices, and Telephone No. |

|

IRS Employer Identification No. |

|

|

||||

|

001-34757 |

|

Spectrum Brands Holdings, Inc. (a Delaware corporation) 3001 Deming Way Middleton, WI 53562 (608) 275-3340 www.spectrumbrands.com

|

|

27-2166630 |

|

333-192634-03 |

|

SB/RH Holdings, LLC (a Delaware limited liability company) 3001 Deming Way Middleton, WI 53562 (608) 275-3340

|

|

27-2812840 |

Securities registered pursuant to Section 12(b) of the Act:

|

Registrant |

Title of each class |

Name of each exchange on which registered |

||

|

Spectrum Brands Holdings, Inc. |

Common Stock, Par Value $0.01 |

New York Stock Exchange |

||

|

SB/RH Holdings, LLC |

None |

None |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrants are well-known seasoned issuers, as defined in Rule 405 of the Securities Act.

|

|

Spectrum Brands Holdings, Inc. |

Yes |

☒ |

No |

☐ |

|

|

|

SB/RH Holdings, LLC |

Yes |

☐ |

No |

☒ |

|

Indicate by check mark if the registrants are not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

|

|

|

|

|

|

|

|

|

|

Spectrum Brands Holdings, Inc. |

Yes |

☐ |

No |

☒ |

|

|

|

SB/RH Holdings, LLC |

Yes |

☐ |

No |

☒ |

|

Indicate by check mark whether the registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

|

|

|

|

|

|

|

|

|

Spectrum Brands Holdings, Inc. |

Yes |

☒ |

No |

☐ |

|

|

|

SB/RH Holdings, LLC |

Yes |

☒ |

No |

☐ |

|

Indicate by check mark whether the registrants have submitted electronically and posted on their corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

|

|

|

|

|

|

|

|

|

Spectrum Brands Holdings, Inc. |

Yes |

☒ |

No |

☐ |

|

|

|

SB/RH Holdings, LLC |

Yes |

☒ |

No |

☐ |

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

|

|

||||||

|

|

|

|

|

|

|

|

|

|

Spectrum Brands Holdings, Inc. |

|

☒ |

|

|

|

|

|

SB/RH Holdings, LLC |

|

☒ |

|

|

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Registrant |

|

Large Accelerated Filer |

|

Accelerated filer |

|

Non-accelerated filer |

|

Smaller reporting company |

|

Spectrum Brands Holdings, Inc. |

|

X |

|

|

|

|

|

|

|

SB/RH Holdings, LLC |

|

|

|

|

|

X |

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

|

|

|

|

|

|

|

|

|

Spectrum Brands Holdings, Inc. |

Yes |

☐ |

No |

☒ |

|

|

|

SB/RH Holdings, LLC |

Yes |

☐ |

No |

☒ |

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the securities Act of 1933 (§232.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

|

|

|

Spectrum Brands Holdings, Inc. |

Yes |

☐ |

No |

☒ |

|

|

|

SB/RH Holdings, LLC |

Yes |

☐ |

No |

☒ |

|

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 31(a) of the Exchange Act.

|

|

Spectrum Brands Holdings, Inc. |

|

☐ |

|

|

SB/RH Holdings, LLC |

|

☐ |

The aggregate market value of the voting stock held by non-affiliates of Spectrum Brands Holdings, Inc. was approximately $3,333,769,931 based upon the closing price on the last business day of the registrant's most recently completed second fiscal quarter (April 2, 2017). As of November 14, 2017, there were outstanding 57,626,070 shares of Spectrum Brands Holdings, Inc.’s Common Stock, par value $0.01 per share.

SB/RH Holdings, LLC meets the conditions set forth in General Instruction I(1)(a) and (b) of Form 10-K/A and has therefore omitted the information otherwise called for by Items 10 to 13 of Form 10-K/A as allowed under General Instruction I(2)(c).

EXPLANATORY NOTE

Spectrum Brands Holdings, Inc and SB/RH Holdings LLC, are filing this Amendment No. 2 (the “Form 10-K/A”) to our Annual Report on Form 10-K for the fiscal year ended September 30, 2017 that we filed with the Securities and Exchange Commission (“SEC”) on November 16, 2017 (the “Form 10-K”), for the sole purpose of including the information required by Part III of Form 10-K.

As required by Rule 12b-15, in connection with this Form 10-K/A, the Company’s Principal Executive Officer and Principal Financial officer are providing Rule 13a-14(a) certifications included herein.

Except as explicitly set forth herein, this Form 10-K/A does not purport to modify or update the disclosures in, or exhibits to original Form 10-K, or to update the original Form 10-K to reflect events occurring after the date of such filing.

1

PART III

ITEM 10.DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

BOARD OF DIRECTORS

The Board of Directors currently consists of eight members, as determined in accordance with our Second Amended and Restated By-Laws (our “By-Laws”). David M. Maura is our Executive Chairman of the Board of Directors. In accordance with our Amended and Restated Certificate of Incorporation (our “Charter”), the Board of Directors is divided into three classes (designated Class I, Class II, and Class III, respectively), with each class consisting of up to three directors. The current term of office of the Class II directors expires at the annual meeting of stockholders to be held in 2018. The Class III and Class I directors are serving terms that expire at the annual meeting of stockholders to be held in 2019 and 2020, respectively. The three classes are currently comprised of the following directors:

|

· |

Class II consists of David M. Maura, Terry L. Polistina, and Hugh R. Rovit, who will serve until the annual meeting of stockholders to be held in 2018; |

|

· |

Class III consists of Ehsan Zargar, Norman S. Matthews, and Joseph S. Steinberg who will serve until the annual meeting of stockholders to be held in 2019; and |

|

· |

Class I consists of Kenneth C. Ambrecht and Andreas Rouvé, who will serve until the annual meeting of stockholders to be held in 2020. |

David M. Maura, age 45, has served as our Executive Chairman, effective as of January 20, 2016. Prior to such appointment, Mr. Maura served as Chairman of the Board of Directors since July 2011 and served as interim Chairman of the Board and as one of our directors since June 2010. Mr. Maura was a Managing Director and the Executive Vice President of Investments at HRG from October 2011 until November 2016, and has been a member of HRG’s board of directors since May 2011. Mr. Maura previously served as a Vice President and Director of Investments of Harbinger Capital Partners LLC from 2006 until 2012, where he was responsible for investments in consumer products, agriculture and retail sectors. Prior to joining Harbinger Capital in 2006, Mr. Maura was a Managing Director and Senior Research Analyst at First Albany Capital, Inc., where he focused on distressed debt and special situations, primarily in the consumer products and retail sectors. Prior to First Albany, Mr. Maura was a Director and Senior High Yield Research Analyst in Global High Yield Research at Merrill Lynch & Co. Previously, Mr. Maura was a Vice President and Senior Analyst in the High Yield Group at Wachovia Securities, where he covered various consumer product, service, and retail companies. Mr. Maura began his career at ZPR Investment Management as a Financial Analyst. Mr. Maura currently serves as Chairman, President and Chief Executive Officer of Mosaic Acquisition Corp., since October 2017. He is a member of the board of directors of HRG but announced on December 15, 2017 his intention to resign from such board effective as of December 31, 2017. He previously has served on the boards of directors of Ferrous Resources, Ltd., Russell Hobbs, Inc., and Applica, Inc. Mr. Maura received a B.S. in Business Administration from Stetson University and is a CFA charterholder. Mr. Maura’s broad experience in M&A, the consumer products and retail sector, finance and investments, and his role in the Company’s strategy and growth since 2010, led the Board to conclude that he should be a member of the Board of Directors.

Terry L. Polistina, age 54, has served as one of our directors since June 2010. Prior to that time, he had served as a director of SBI from August 2009 to June 2010. Mr. Polistina served as our President, Small Appliances since June 2010 and became President – Global Appliances in October 2010 and left the Company in September 2013. Prior to that time, Mr. Polistina served as the CEO and President of Russell Hobbs. Mr. Polistina served as Chief Operating Officer at Applica, Inc. in 2006 to 2007 and Chief Financial Officer from 2001 to 2007, at which time Applica, Inc. combined with Russell Hobbs. Mr. Polistina also served as a Senior Vice President of Applica, Inc. since June 1998. Mr. Polistina is also a director of Entic, Inc. Mr. Polistina received an undergraduate degree in finance from the University of Florida and holds a Masters of Business Administration from the University of Miami. Mr. Polistina is the Chairman of our Audit Committee and is a member of our Compensation Committee. Mr. Polistina’s experience in senior management roles at several global consumer products companies and his financial expertise led the Board of Directors to conclude that he should be a member of the Board of Directors.

Hugh R. Rovit, age 57, has served as one of our directors since June 2010. Prior to that time, he had served as a director of SBI from August 2009 to June 2010. Mr. Rovit is presently Chief Executive Officer of Ellery Homestyles, a leading supplier of branded and private label home fashion products to major retailers, offering curtains, bedding, throws and specialty products. Previously, Mr. Rovit served as Chief Executive Officer of Sure Fit Inc., a marketer and distributor of home furnishing products from 2006 through 2012, and was a Principal at a turnaround management firm Masson & Company from 2001 through 2005. Previously, Mr. Rovit held the positions of Chief Financial Officer of Best Manufacturing, Inc., a manufacturer and distributor of institutional service apparel and textiles, from 1998 through 2001 and Chief Financial Officer of Royce Hosiery Mills, Inc., a manufacturer and distributor of men’s and women’s hosiery, from 1991 through 1998. Mr. Rovit is a director of Xpress Retail and previously has served as a director of Nellson Nutraceuticals, Inc., Kid Brands Inc., Atkins Nutritional, Inc., Oneida, Ltd., Cosmetic Essence, Inc. and Twin Star International. Mr. Rovit received his Bachelor of Arts degree cum laude from Dartmouth College and has a Masters of Business Administration from the Harvard Business School. Mr. Rovit is a member of our Audit Committee. Mr. Rovit’s experience with the operations and management

1

of various consumer products companies and his financial expertise led the Board of Directors to conclude that he should be a member of the Board of Directors.

|

|

|

|

Ehsan Zargar, age 40, has served as one of our directors since August 2017. Mr. Zargar has served as Executive Vice President and Chief Operating Officer of HRG, effective as of January 2017, as General Counsel since April 2015, and as Corporate Secretary since February 2012. In his current role, Mr. Zargar is responsible for leading and carrying out HRG’s strategic and tactical initiatives, including M&A and capital raising activities. Mr. Zargar is also responsible for providing HRG’s Board and senior management with advice on HRG’s strategies and for their implementation. In addition, Mr. Zargar is responsible for overseeing HRG’s legal and risk management function. Mr. Zargar joined HRG in June 2011 as a member of the legal department and since then has served in positions of increasing responsibility. Prior to HRG, Mr. Zargar worked in the New York office of Paul, Weiss, Rifkind, Wharton & Garrison LLP from November 2006 to June 2011. Previously, Mr. Zargar practiced law at another major law firm focusing on general corporate matters. Mr. Zargar received a law degree from Faculty of Law at the University of Toronto and a B.A. from the University of Toronto. Mr. Zargar’s background in legal, corporate governance, M&A and capital raising activities, as well as his leadership position at HRG, led the Board to conclude that he should be a member of the Board of Directors.

Norman S. Matthews, age 84, has served as one of our directors since June 2010. Prior to that time, he had served as a director of SBI since August 2009. Mr. Matthews has over three decades of experience as a business leader in marketing and merchandising, and is currently an independent business consultant. As former President of Federated Department Stores, he led the operations of one of the nation’s leading department store retailers with over 850 department stores, including those under the names of Bloomingdales, Burdines, Foley’s, Lazarus and Rich’s, as well as various specialty store chains, discount chains and Ralph’s Grocery. In addition to his senior management roles at Federated Department Stores, Mr. Matthews also served as Senior Vice President and General Merchandise Manager at E.J. Korvette and Senior Vice President of Marketing and Corporate Development at Broyhill Furniture Industries. Mr. Matthews is a Princeton University graduate, and earned his Master’s degree in Business Administration from Harvard Business School. He also currently serves on the Boards of Directors at Party City and The Children’s Place Retail Stores, Inc., and previously has served as a director of Henry Schein, Inc., Sunoco, The Progressive Corporation, Toys R’ Us, Duff & Phelps Corporation, and Federated Department Stores. He is also a trustee emeritus at the American Museum of Natural History. Mr. Matthews is the Chairman of our Nominating and Corporate Governance Committee and is a member of our Compensation Committee. Mr. Matthews’ extensive experience with the operations of various notable consumer products retailers led the Board of Directors to conclude that he should be a member of the Board of Directors.

Joseph S. Steinberg, age 73, has served as one of our directors since February 2015. Since December 2014, Mr. Steinberg has served as the Chairman of the board of directors of our majority shareholder, HRG, and, since April 2017, he has served as HRG’s Chief Executive Officer. Mr. Steinberg is Chairman of the board of directors of Leucadia National Corporation (“Leucadia”), which is a significant stockholder of HRG. He has served as a director of Leucadia since December 1978 and as President from January 1979 until March 2013, when he became the Chairman of the Leucadia board of directors. Mr. Steinberg has served as Chairman of the board of directors of HomeFed Corporation since 1999 and as a HomeFed director since 1998. Mr. Steinberg also serves on the board of directors of Crimson Wine Group, Ltd. Mr. Steinberg has served as a director of Jefferies Group, LLC since April 2008. Mr. Steinberg previously served as a director of Mueller Industries, Inc. from September 2011 to September 2012. Mr. Steinberg’s managerial and investing experience in a broad range of businesses led the Board of Directors to conclude that he should be a member of the Board of Directors.

Kenneth C. Ambrecht, age 72, has served as one of our directors since June 2010. Prior to that time, he had served as a director of SBI from August 2009 to June 2010. Since December 2005, Mr. Ambrecht has served as a principal of KCA Associates LLC, through which he provides advice on financial transactions. From July 2004 to December 2005, Mr. Ambrecht served as a Managing Director with the investment banking firm First Albany Capital, Inc. Prior to that, Mr. Ambrecht was a Managing Director with Royal Bank Canada Capital Markets. Prior to that post, Mr. Ambrecht worked with the investment bank Lehman Brothers as Managing Director with its capital market division. Mr. Ambrecht is also a member of the Board of Directors of American Financial Group, Inc. During the past five years, Mr. Ambrecht has also served as a director of Dominion Petroleum Ltd. and Fortescue Metals Group Limited. Mr. Ambrecht serves as the Chairman of our Compensation Committee and is a member of our Audit and our Nominating and Corporate Governance Committees. Mr. Ambrecht’s experience in banking and capital markets led the Board of Directors to conclude that he should be a member of the Board of Directors.

Andreas Rouvé, age 56, has served as one of our directors since October 2015. Mr. Rouvé was appointed our Chief Executive Officer, effective April 1, 2015, and he previously held the position of Chief Operating Officer of the Company, effective February 2014, until his appointment as Chief Executive Officer. Mr. Rouvé previously held the position of President of the Company’s international activities beginning in January 2013. Prior to that post, commencing in 2007, he served as Senior Vice President and Managing Director of Spectrum Brands’ European Battery and Personal Care business and subsequently led the integration of the Home Appliances and Pet Supplies European businesses in 2010-2011. Mr. Rouvé joined Spectrum Brands in 2002 as Chief Financial Officer of the European Battery division. Prior to that, he worked 13 years with VARTA AG in a variety of management positions, including Chief Financial Officer of VARTA Portable Batteries from 1999 to 2002, Managing Director Asia from 1997 to 1999, and Director of Finance of 3C Alliance L.L.P., a U.S. joint venture of VARTA, Duracell, and Toshiba, from 1995 to 1997. Mr. Rouvé holds a Master’s of Business Administration (Diplom-Kaufmann) from the University of Mannheim (Germany) and a Doctor of Economics and Social Science (Dr.

2

rer. soc. oec.) from the University of Linz (Austria). Mr. Rouvé’s extensive experience with the global operations of the Company since 2002 and his service as Chief Executive Officer led the Board of Directors to conclude that he should be a member of the Board of Directors.

EXECUTIVE OFFICERS WHO ARE NOT DIRECTORS

In addition to those directors named above who are also executive officers of the Company, set forth below is certain information concerning non-director employees who serve as executive officers of the Company. Our executive officers serve at the discretion of the Board of Directors. Except for SBI, none of the corporations or other organizations referred to below with which an executive officer has been employed or otherwise associated is a parent, subsidiary, or other affiliate of the Company.

Mr. Douglas L. Martin, age 55, was appointed our Executive Vice President and Chief Financial Officer in September 2014. Prior to joining the Company, Mr. Martin served from September 2012 to August 2014 as Executive Vice President and Chief Financial Officer of Newell Brands, Inc. (formerly known as Newell Rubbermaid Inc.), a global marketer of consumer and commercial products, including writing, home solutions, tools, commercial products, and baby and parenting brands. Mr. Martin was employed by Newell Brands, Inc. since 1987, serving in a variety of senior financial roles, including Deputy Chief Financial Officer from February 2012 to September 2012, Vice President of Finance – Newell Consumer from November 2011 to February 2012, Vice President of Finance – Office Products from December 2007 to November 2011, and Vice President and Treasurer from June 2002 to December 2007. Mr. Martin began his career with KPMG LLP, holds a bachelor’s degree in accounting from Rockford College, Illinois, and is a Certified Public Accountant.

Mr. Nathan E. Fagre, age 62, was appointed our Vice President, General Counsel and Secretary in January 2011, and was promoted to Senior Vice President, General Counsel and Secretary in May 2012. In this role, Mr. Fagre serves as the chief legal officer of the Company and also manages the environmental, health, safety and sustainability functions, insurance and risk matters, and government affairs. He previously had served as Senior Vice President, General Counsel and Secretary for ValueVision Media, Inc. from May 2000 until January 2011. Prior to that time, he had served as Senior Vice President, General Counsel and Secretary for the exploration and production division of Occidental Petroleum Corporation, from May 1995 until April 2000. Before joining Occidental Petroleum Corporation, Mr. Fagre had been in private law practice with Sullivan & Cromwell, LLP and Gibson, Dunn & Crutcher, LLP. Mr. Fagre graduated with a bachelor’s degree from Harvard College in 1977, received a master of philosophy (M.Phil.) degree in international relations from Oxford University in 1979, and received a J.D. from Harvard Law School in 1982.

Ms. Stacey L. Neu, age 51, was appointed to her current role as the Company’s head of human resources in April of 2010. Prior to this appointment, she held senior leadership roles for several businesses at the Company including the Battery business, Appliances business, and the Home & Garden business. She was originally hired by Spectrum in October of 2005 to oversee the Talent Management function and lead the people integration efforts related to the acquisition of United Industries. Before joining Spectrum, Ms. Neu was employed for six years at Charter Communications in various human resources leadership roles culminating in her appointment to Vice President Corporate Human Resources from 2003 to 2005. Ms. Neu holds a Bachelor of Science Degree in Business from the University of Phoenix.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors, officers, and persons who own more than 10% of a registered class of our equity securities to file reports of ownership and changes in ownership with the SEC. Based solely upon review of Forms 3, 4, and 5 (and amendments thereto) furnished to us during or in respect of Fiscal 2017 and written representations from certain reporting persons, we believe that all Section 16(a) filing requirements applicable to our directors, executive officers, and 10% stockholders were satisfied in a timely manner during Fiscal 2017.

CORPORATE GOVERNANCE

Board Activities

During our fiscal year ended September 30, 2017 (“Fiscal 2017”), our Board of Directors held four regular meetings and acted by unanimous written consent on four occasions. The non-management directors met separately in executive sessions on four occasions immediately following each of the regular board meetings. The chairmen of each of the committees of the Board of Directors rotate service as the presiding director in the executive sessions of the Board of Directors. All of our directors attended more than 75 percent of the meetings of the Board of Directors and all of the meetings of any committee on which he served during Fiscal 2017.

Our Board of Directors has affirmatively determined that none of the following directors has a material relationship with the Company (either directly or as a partner, stockholder, or officer of an organization that has a relationship with the Company): Kenneth C. Ambrecht, Norman S. Matthews, Terry L. Polistina and Hugh R. Rovit. Our Board of Directors has adopted the definition of “independent director” set forth under Section 303A.02 of the New York Stock Exchange Listed Company Manual (the “NYSE Listed

3

Company Manual”) to assist it in making determinations of independence. The Board of Directors has determined that the directors referred to above currently meet these standards and qualify as independent. The Board of Directors has made no determination with respect to the remaining directors.

All of our directors attended our 2017 annual meeting of stockholders, and we expect all continuing members of our Board of Directors to attend the annual meeting in 2018.

Our Board of Directors evaluates the appropriate leadership structure for the Company on an ongoing basis, including whether or not one individual should serve as both Chief Executive Officer and Chairman of our Board of Directors. While the Board of Directors has not adopted a formal policy, we currently separate the positions of Chief Executive Officer and Chairman of our Board of Directors. Andreas Rouvé currently serves as our President and Chief Executive Officer, and Mr. Maura currently serves as our Executive Chairman. The Board of Directors believes that the respective roles of Mr. Rouvé and Mr. Maura best utilize their skills and qualifications in the service of the Company at this time. The Board retains the ability to adjust its leadership structure as the needs of the business change.

Committees Established by our Board of Directors

The Board of Directors has designated three principal standing committees: the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee. The functions of each such committee and the number of meetings held in Fiscal 2017 are noted below.

Audit Committee. The Audit Committee has been established in accordance with Section 303A.06 of the NYSE Listed Company Manual and Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), for the overall purpose of overseeing the Company’s accounting and financial reporting processes and audits of our financial statements. The Audit Committee is responsible for monitoring (i) the integrity of our financial statements, (ii) the independent registered public accounting firm’s qualifications and independence, (iii) the performance of our internal audit function and independent auditors, and (iv) our compliance with legal and regulatory requirements. The responsibilities and authority of the Audit Committee are described in further detail in the Charter of the Audit Committee of the Board of Directors of Spectrum Brands Holdings, Inc., as adopted by the Board of Directors in June 2010, a copy of which is available at our Internet website at www.spectrumbrands.com under “Investor Relations – Corporate Governance.”

The current members of our Audit Committee are Kenneth C. Ambrecht, Hugh R. Rovit, and Terry L. Polistina. Our Audit Committee held four regular meetings during Fiscal 2017. All of the members of the Audit Committee attended all meetings. Each of the members of the Audit Committee qualifies as independent, as such term is defined in Section 303A.02 of the NYSE Listed Company Manual, Section 10A(m)(3)(B) of the Exchange Act, and Exchange Act Rule 10A-3(b).

Mr. Polistina is the Chairperson of our Audit Committee. The Board has determined that Mr. Polistina is an Audit Committee Financial Expert. Mr. Polistina possesses the attributes of an “audit committee financial expert” set forth in the rules promulgated by the SEC in furtherance of Section 407 of the Sarbanes-Oxley Act of 2002.

Compensation Committee. Our Compensation Committee is responsible for (i) overseeing our compensation and employee benefits plans and practices, including our executive compensation plans and our incentive-compensation and equity-based plans, (ii) evaluating and approving the performance of the Executive Chairman and the CEO and other executive officers in light of those goals and objectives, and (iii) reviewing and discussing with management our compensation discussion and analysis disclosure and compensation committee reports in order to comply with our public reporting requirements. The responsibilities and authority of the Compensation Committee are described in further detail in the Charter of the Compensation Committee of the Board of Directors of Spectrum Brands Holdings, Inc., as adopted by the Board of Directors in November 2016, a copy of which is available at our Internet website at www.spectrumbrands.com under “Investor Relations – Corporate Governance.” The report of the Compensation Committee for Fiscal 2017 is included elsewhere in this Form 10-K/A.

The current members of our Compensation Committee are Kenneth C. Ambrecht, Norman S. Matthews, and Terry L. Polistina. Our Compensation Committee held four regular meetings and acted by unanimous written consent on three occasions during Fiscal 2017. All committee members attended all meetings. Mr. Ambrecht is the Chairperson of our Compensation Committee. As a controlled company under Section 303A.00 of the NYSE Listed Company Manual, our Compensation Committee is not required to comply with the independence requirements set forth in Section 303A.05 of the NYSE Listed Company Manual. However, we have made a determination that all of the members of our Compensation Committee qualify as independent, as such term is defined in Section 303A.02 of the NYSE Listed Company Manual.

Nominating and Corporate Governance Committee. Our Nominating and Corporate Governance Committee is responsible for (i) identifying and recommending to the Board of Directors individuals qualified to serve as our directors and on our committees of the Board of Directors, (ii) advising the Board of Directors with respect to board composition, procedures and committees, (iii) developing

4

and recommending to the Board of Directors a set of corporate governance principles applicable to the Company, and (iv) overseeing the evaluation process of the Board of Directors, our Executive Chairman, and our Chief Executive Officer. The responsibilities and authority of the Nominating and Corporate Governance Committee are described in further detail in the Charter of the Nominating and Corporate Governance Committee of the Board of Directors of Spectrum Brands Holdings, Inc., as adopted by the Board of Directors in January 2017, a copy of which is available at our Internet website at www.spectrumbrands.com under “Investor Relations – Corporate Governance.”

The current members of our Nominating and Corporate Governance Committee are Kenneth C. Ambrecht and Norman S. Matthews. Our Nominating and Corporate Governance Committee held two regular meetings and acted by unanimous written consent on one occasion during Fiscal 2017. Mr. Matthews is the Chairperson of our Nominating and Corporate Governance Committee. As a controlled company under Section 303A.00 of the NYSE Listed Company Manual, our Nominating and Corporate Governance Committee is not required to comply with the independence requirements set forth in Section 303A.04 of the NYSE Listed Company Manual. However, we have made a determination that all of the members of our Nominating and Corporate Governance Committee qualify as independent, as such term is defined in Section 303A.02 of the NYSE Listed Company Manual.

Special Committee. In Fiscal 2017, the Board of Directors formed a Special Committee of independent directors in light of HRG’s announcement in November 2016 of its decision to commence an exploration of strategic alternatives.

Risk Management and the Board’s Role

The Company’s risk assessment and management function is led by the Company’s senior management, which is responsible for day-to-day management of the Company’s risk profile, with oversight from the Board of Directors and its Committees. Central to the Board of Directors’ oversight function is our Audit Committee. In accordance with the Audit Committee Charter, the Audit Committee is responsible for the oversight of the financial reporting process and internal controls. In this capacity, the Audit Committee is responsible for discussing guidelines and policies governing the process by which senior management of the Company and the relevant departments of the Company, including the internal audit department, assess and manage the Company’s exposure to risk, as well as the Company’s major financial risk exposures and the steps management has taken to monitor and control such exposures.

The Company has implemented an annual formalized risk assessment process. In accordance with the Company’s process, a committee (the “Governance Risk and Compliance Committee”) of certain members of senior management has the responsibility to identify, assess, and oversee the management of risk for the Company. This committee obtains input from other members of management and subject matter experts as needed. Management uses the collective input received to measure the potential likelihood and impact of key risks and to determine the adequacy of the Company’s risk management strategy. Periodically representatives of this committee report to the Audit Committee on its activities and the Company’s risk exposure.

Availability of Corporate Governance Guidelines, Committee Charters, and Codes of Ethics

Copies of our (i) Corporate Governance Guidelines, (ii) charters for our Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee, (iii) Code of Business Conduct and Ethics, and (iv) Code of Ethics for the Principal Executive Officer and Senior Financial Officers are available at our Internet website at www.spectrumbrands.com under “Investor Relations – Corporate Governance.” Any stockholder may obtain copies of these documents by sending a written request to Spectrum Brands Holdings, Inc., 3001 Deming Way Middleton, WI 53562, Attention: Vice President, Investor Relations, by calling us at (608) 275-3340, or by writing to us via e-mail at [email protected]. None of the information posted on our website is incorporated by reference into this Form 10-K/A.

5

ITEM 11.EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis section sets forth a description of our practices regarding executive compensation matters with respect to our named executive officers. You should read this section together with the executive compensation tables and narratives which follow, as these sections inform one another.

Executive Summary

Our compensation programs are administered by the Compensation Committee of the Board of Directors. Our compensation programs are designed to attract and retain highly qualified executives, to align the compensation paid to executives with the business strategies of our Company, and to align the interests of our executives with the interests of our stockholders. These programs are based on our “pay-for-performance” philosophy in which variable compensation represents a majority of an executive’s potential compensation.

In terms of our Fiscal 2017 performance against the targets set by the Compensation Committee at the beginning of Fiscal 2017, we did not achieve the Company-wide adjusted EBITDA target at the 100 percent level, but did exceed the minimum threshold level. With respect to the free cash flow performance metric for Fiscal 2017, we slightly exceeded the target at the 100 percent level. Further details on the applicable targets and actual performance are set forth below, as well as the specific definitions of the performance metrics. During Fiscal 2017, management continued its focus on investing in future growth through footprint optimization in the Global Auto Care and Hardware & Home Improvement divisions, greater investment in new product development and marketing, integration of two new acquisitions in the Pet business unit, and acceleration of growth in e-commerce.

The actions and decisions of the Compensation Committee during Fiscal 2017 regarding the compensation of the named executive officers (“NEOs”) of the Company continued our philosophy of pay-for-performance and our focus on the company-wide goals of increasing growth, free cash flow generation, and building for superior long-term shareholder returns.

In establishing our compensation programs, our Compensation Committee obtains the advice of its independent compensation consultant, Lyons, Benenson & Company Inc. (“LB & Co.”), and evaluates the Company’s programs with reference to a peer group of 15 companies, as specified in the section titled “Role of Committee-Retained Consultants.”

At our 2017 Annual Meeting of Stockholders (the “2017 Annual Meeting”), our stockholders approved, on an advisory basis, the compensation of the Company’s NEOs as disclosed in the Compensation Discussion and Analysis, compensation tables, and related narrative disclosure in the proxy statement for the 2017 Annual Meeting. Our compensation practices as discussed herein are materially consistent with those discussed in the proxy statement for the 2017 Annual Meeting. Additionally, at our 2017 Annual Meeting of Stockholders, our stockholders held a separate vote, on an advisory basis, relating to the frequency of the advisory vote on the compensation of the Company’s NEOs, pursuant to which our stockholders indicated their preference that such vote be held every year, which was the frequency recommended by the Board of Directors. At the upcoming Annual Meeting, we are conducting a stockholder advisory vote on executive compensation.

Our Named Executive Officers

The Company’s NEOs during Fiscal 2017 consisted of the following persons:

|

· |

David M. Maura, Executive Chairman of the Board of Directors |

|

· |

Andreas Rouvé, Chief Executive Officer and President |

|

· |

Douglas L. Martin, Executive Vice President and Chief Financial Officer |

|

· |

Nathan E. Fagre, Senior Vice President, General Counsel and Secretary |

|

· |

Stacey L. Neu, Senior Vice President, Human Resources |

Our Compensation Committee

The Compensation Committee is responsible for developing, adopting, reviewing, and maintaining the Company’s executive compensation programs in order to ensure that they continue to benefit the Company.

Background on Compensation Considerations

The Compensation Committee pursues several objectives in determining its executive compensation programs. It seeks to attract and retain highly qualified executives and ensure continuity of senior management for the Company as a whole and for each of the Company’s business segments, to the extent consistent with the overall objectives and circumstances of the Company. It seeks to align the compensation paid to our executives with the overall business strategies of the Company while leaving the flexibility necessary to

6

respond to changing business priorities and circumstances. It also seeks to align the interests of our executives with those of our stockholders and seeks to reward our executives when they perform in a manner that creates value for our stockholders. In order to carry out this function, the Compensation Committee:

|

· |

Considers the advice of the independent compensation consultant engaged to advise on executive compensation issues and program design, including advising on the Company’s compensation program as it compares to similar companies; |

|

· |

Reviews compensation summaries for each NEO at least once a year, including the compensation and benefit values offered to each executive, accumulated value of equity and other past compensation awards, and other contributors to compensation; |

|

· |

Consults with our Executive Chairman, Chief Executive Officer, and other management personnel and Company consultants, including our Senior Vice President, Human Resources, in regards to compensation matters and periodically meets in executive session without management to evaluate management’s input; and |

|

· |

Solicits comments and concurrence from other board members regarding its recommendations and actions at the Company’s regularly scheduled board meetings. |

Philosophy on Performance Based Compensation

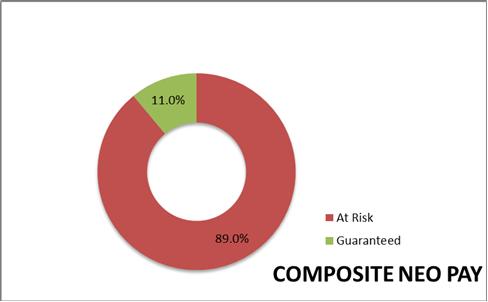

The Compensation Committee has designed the Company’s executive compensation programs so that, at target levels of performance, a significant portion of the value of each executive’s annual compensation (consisting of salary and incentive awards) is based on the Company’s achievement of performance objectives set by the Compensation Committee. We believe that a combination of annual fixed base pay and incentive performance-based pay provides our NEOs with an appropriate mix of current cash compensation and performance compensation. However, in applying these compensation programs to both individual and Company circumstances, the percentage of annual compensation based on the Company’s achievement of performance objectives set by the Compensation Committee varies by individual, and the Compensation Committee is free to design compensation programs that provide for target-level performance-based compensation to be an amount greater than, equal to, or less than 50% of total annual compensation. For example, for Fiscal 2018, the percentage of annual compensation at target based on the Company’s achievement of performance objectives (set by the Compensation Committee) for the NEOs was 89% for the five executives as a group. In addition, to highlight the alignment of the incentive plans with stockholder interests, all of the Company’s equity-based incentive programs are completely performance-based plans.

The remainder of each executive’s compensation is made up of amounts that do not vary based on performance. For all NEOs, these non-performance based amounts are set forth in such executive’s employment agreement or written terms of employment, as described below, subject to annual review and potential increase by the Compensation Committee. These amounts are determined by the Compensation Committee taking into account current market conditions, the Company’s financial condition at the time such compensation levels are determined, compensation levels for similarly situated executives with other companies, experience level, and the duties and responsibilities of such executive’s position.

A component of incentive compensation also consists of multi-year programs. We believe that awards that have multi-year performance periods and that vest over time enhance the stability of our senior management team and provide greater incentives for our NEOs to remain at the Company.

Role of Committee-Retained Consultants

In Fiscal 2017, our Compensation Committee continued to retain an outside consultant, LB & Co., to assist us in formulating and evaluating executive and director compensation programs. During the past year, the Compensation Committee, directly or through our Senior Vice President, Human Resources, periodically requested LB & Co. to:

|

· |

Provide comparative market data for our peer group, and other groups on request, with respect to compensation matters; |

|

· |

Analyze our compensation and benefit programs relative to our peer group; |

|

· |

Review the plan designs, including the performance metrics selected, for our various incentive plans and make

7

|

recommendations to the Compensation Committee on appropriate plan designs to support the Company’s overall strategic objectives; |

|

· |

Advise the Compensation Committee on compensation matters and management proposals with respect to compensation matters; |

|

· |

Assist in the preparation of the compensation discussion and analysis disclosure set forth in this From 10-K/A and the compensation tables provided herewith; and |

|

· |

On request, participate in meetings of the Compensation Committee. |

In order to encourage an independent view point, the Compensation Committee and its members had access to LB & Co. at any time without management present and have consulted from time to time with LB & Co. without management present.

LB & Co., with input from management and the Compensation Committee, developed a peer group of companies based on a variety of criteria, including type of business, revenue, assets and market capitalization. The composition of this peer group is reviewed annually by the Compensation Committee and the compensation consultant and, if appropriate, revised, based on changes in business orientation of peer group companies, changes in financial size or performance of the Company and the peer group companies, and merger, acquisition, spin-off or bankruptcy of companies in the peer group. At the end of Fiscal 2017, the peer group utilized consisted of 15 companies, comprised of Central Garden and Pet Company, Church & Dwight Co., Inc., The Clorox Company, Edgewell Personal Care Company, Energizer Holdings, Inc., Fortune Brands Home & Security, Inc., Hanesbrands, Inc., Hasbro, Inc., Helen of Troy Limited, Mattel, Inc., Newell Brands, Inc., Nu Skin Enterprises, Inc., The Scotts Miracle-Gro Company, Stanley Black & Decker, Inc., and Tupperware Brands Corporation. There was no change in the composition of the peer group companies from Fiscal 2016 to Fiscal 2017. While the Compensation Committee does not target a particular range for total compensation as compared to our peer group, it does take this information into account when establishing compensation programs.

No fees were paid to LB & Co. for services other than executive and director compensation consulting during Fiscal 2017. In accordance with SEC rules, our Compensation Committee considered the independence of LB & Co., including an assessment of the following factors: (i) other services provided to the Company by the consultant; (ii) fees paid as a percentage of the consulting firm’s total revenue; (iii) policies or procedures maintained by the consulting firm that are designed to prevent a conflict of interest; (iv) any business or personal relationships between the individual consultants involved in the engagement and any member of our Compensation Committee; (v) any Company stock owned by individual consultants involved in the engagement; and (vi) any business or personal relationships between our executive officers and the consulting firm or the individual consultants involved in the engagement. Our Compensation Committee has concluded that no conflict of interest exists that prevented LB & Co. from independently representing our Compensation Committee during Fiscal 2017.

Use of Employment Agreements

Current Employment and Severance Agreements

The Compensation Committee periodically evaluates the appropriateness of entering into employment agreements or other written agreements with members of the Company’s senior management to govern compensation and other aspects of the employment relationship. The Company limits the use of employment agreements and instead uses severance agreements for most executives. With respect to the NEOs, at the direction of the Compensation Committee, the Company has entered into written employment agreements with the following executive officers who were serving at the end of Fiscal 2017: (i) an Employment Agreement dated January 20, 2016, and as amended on September 26, 2017, with Mr. Maura (the “Maura Employment Agreement”); (ii) an Employment Agreement dated March 16, 2015, and as amended and restated on December 15, 2016, with Mr. Rouvé (the “Rouvé Employment Agreement”); and (iii) an Employment Agreement dated September 1, 2014, and as amended and restated on December 15, 2016, with Mr. Martin (the “Martin Employment Agreement”). The Maura, Rouvé, and Martin Employment Agreements are with both SBI and the Company. In addition, Mr. Rouvé continues to be a party to a Pension Agreement between VARTA Gerätebatterie GMBH and Mr. Rouvé dated May 17, 1989, including the supplement of July 1, 1999, which was assumed by the Company and governs certain pension payments Mr. Rouvé is entitled to receive. Finally, SBI is a party to Severance Agreements with each of Mr. Fagre and Ms. Neu dated as of November 19, 2012 and September 1, 2009, respectively, and each as amended and restated on December 15, 2016, which govern severance, confidentially, non-competition, and certain other post-employment matters in connection with termination of Mr. Fagre’s and Ms. Neu’s respective employment. The Severance Agreement with Mr. Fagre is referred to herein as the “Fagre Severance Agreement” and the Severance Agreement with Ms. Neu is referred to herein as the “Neu Severance Agreement.”

Term and Renewal

The term of the Maura Employment Agreement expires on October 1, 2018, the current term of the Rouvé Employment Agreement expires on April 1, 2018, and the current renewal term of the Martin Employment Agreement expires on March 1, 2018. The Maura and Rouvé Employment Agreements each provide that upon the expiration of the initial term of the agreement (and any subsequent renewal term), the term of the agreement will automatically be extended for successive one year renewal periods, unless either party provides the other with notice of non-renewal at least 90 days prior to the commencement of the applicable renewal term. The Martin Employment

8

Agreement provides that upon expiration of the current term (and any subsequent renewal term), unless earlier terminated in accordance with such agreement, the agreement will automatically renew for an additional one-year period on March 1st of each year.

Early Termination of Agreements

The Maura, Rouvé, and Martin Employment Agreements each permit the Company to terminate the executive’s employment upon written notice in the event of “cause” (as defined below under the heading “Termination and Change in Control Provisions”). In the case of each executive, if the behavior giving rise to “cause” is the executive’s willful failure or refusal to perform his duties or refusal to follow the direction of the Board of Directors (and, in the case of Mr. Martin, the direction of the Chief Executive Officer), or the executive’s material breach of his employment agreement or any other agreement with the Company, then Mr. Maura, Mr. Rouvé, and Mr. Martin, as applicable, will have 30 days to cure such behavior following notice.

Each of the Maura, Rouvé, and Martin Employment Agreements permit the Company to terminate the applicable executive’s employment without “cause” for any reason upon 90 days’ prior written notice or immediately with payment of base salary in lieu of notice thereof.

The Maura, Rouvé, and Martin Employment Agreements each permit the Company to terminate the executive’s employment upon 30 days’ written notice in the event that the executive is unable to perform his duties for a period of at least six consecutive months by reason of any mental, physical, or other disability. Each agreement also terminates immediately upon the death of the executive.

Each of the Maura, Rouvé, and Martin Employment Agreements allows the applicable executive to voluntarily terminate his employment for any reason upon 90 days’ prior written notice.

The Maura, Rouvé, and Martin Employment Agreements also provide that if the applicable executive resigns upon the occurrence of specified circumstances that would constitute “good reason” (as defined below under the heading “Termination and Change in Control Provisions”), the executive’s resignation will be treated as a termination by the Company without “cause” and entitle the executive to the payments and benefits due with respect to a termination without “cause” under his respective employment agreement. In order to constitute “good reason” under the respective employment agreements, certain specific notice requirements and cure periods must be satisfied. In this regard, each of Mr. Maura, Mr. Rouvé, and Mr. Martin would have 90 days following the occurrence of the facts or circumstances giving rise to “good reason” to give written notice to the Company of his intent to terminate for “good reason,” and the Company will have 30 days thereafter to cure such facts or circumstances.

Both the Fagre and Neu Severance Agreements permit the Company to terminate Mr. Fagre’s or Ms. Neu’s employment, as applicable, at any time upon written notice for any reason. However, in order for such termination by the Company to be treated as a termination for “cause” (as defined below under the heading “Termination and Change in Control Provisions”) as a result of Mr. Fagre’s or Ms. Neu’s, as applicable, (i) willful failure or refusal to perform his or her duties and responsibilities to the Company or any of its affiliates, or (ii) breach of any of the terms of his or her severance agreement or any other agreement between Mr. Fagre or Ms. Neu, on the one hand, and the Company on the other, Mr. Fagre or Ms. Neu, as applicable, must not have remedied or cured such failure, refusal, or breach within a 30-day cure period. Mr. Fagre and Ms. Neu, as applicable, may also terminate his or her respective employment with the Company at any time upon written notice.

The amounts and benefits payable to each such executive upon the termination of such executive’s employment in accordance with their employment or severance agreements, as applicable, are further described under the heading “Termination and Change in Control Provisions” .

Compensation Components

For Fiscal 2017, the basic elements of our executive compensation program, as designed by the Compensation Committee, were:

|

· |

Base salary; |

|

· |

A performance-based annual cash incentive program tied to achievement of performance goals in Fiscal 2017, referred to as our Management Incentive Plan (“MIP”); |

|

· |

A performance based annual equity incentive program tied to achievement of performance goals in Fiscal 2017 and, with respect to 50% of any award earned, continued employment through the end of Fiscal 2018, referred to as the Equity Incentive Plan (“EIP”); and |

|

· |

A two-year performance based equity incentive program tied to achievement of superior results by the end of Fiscal 2018 and, with respect to 50% of any award earned, continued employment through the end of Fiscal 2019, referred to as the Spectrum S3B Plan. |

In addition, based on individual circumstances, title, position, and responsibilities, each NEO received certain other compensation components and perquisites as described herein.

9

Base Salary

The annual base salaries for Messrs. Maura, Rouvé, and Martin were initially set forth in each executive’s employment agreement, subject to subsequent increases by the Compensation Committee. Mr. Fagre’s base salary was initially set by the Chief Executive Officer at the time he joined the Company in January 2011. Ms. Neu’s base salary was initially set by the Chief Executive Officer at the time of her appointment as the head of Human Resources in April 2010. In determining the initial annual base salary for each NEO or in making any subsequent increases, the Compensation Committee considered current market conditions, the Company’s financial condition at the time such compensation levels were determined, compensation levels for similarly situated executives at other companies, experience level, and the duties and responsibilities of such executive’s position. Base salary level is subject to evaluation from time to time by the Compensation Committee to determine whether any increase is appropriate. The Compensation Committee reviewed the current salaries of the NEOs during Fiscal 2017 and determined to make no changes in the salary levels. As of the end of Fiscal 2017, the annual base salaries for the NEOs serving at the end of Fiscal 2017 were as follows:

|

Named Executive |

|

Annual Base Salary at FYE $ |

|

David M. Maura |

|

$700,000 |

|

Andreas Rouvé |

|

$735,000 |

|

Douglas L. Martin |

|

$550,000 |

|

Nathan E. Fagre |

|

$375,000 |

|

Stacey L. Neu |

|

$275,000 |

Management Incentive Plan

General Description

Our management personnel, including our NEOs, participate in the Company’s annual performance-based cash bonus program referred to as the Management Incentive Plan (or the “MIP”), which is designed to compensate executives and other managers based on achievement of annual corporate, business segment, and/or divisional financial goals. Under the MIP, each participant has the opportunity to earn a threshold, target, or maximum bonus amount that is contingent upon achieving the performance goals set by the Compensation Committee and reviewed by the Board of Directors. Particular performance objectives (such as increasing adjusted EBITDA) are established prior to or during the first quarter of the relevant fiscal year and reflect the Compensation Committee’s views at that time of the critical indicators of Company success in light of the Company’s primary business priorities.

The specific financial targets with respect to performance goals are then set by the Compensation Committee based on the Company’s annual operating plan, as approved by our Board of Directors. The annual operating plan includes performance targets for the Company as a whole as well as for each business segment. In the case of divisional managers within those business segments, divisional level performance targets have also been established.

Fiscal 2017 MIP Program

The Fiscal 2017 MIP program supported the corporate goals of increasing EBITDA growth and free cash flow described above under the heading “Philosophy on Performance Based Compensation.” The performance goals for Fiscal 2017 were Adjusted EBITDA and Free Cash Flow (as defined below), with the performance targets for each of Messrs. Maura, Rouvé, Martin, and Fagre, and for Ms. Neu equal to those established for the Company as a whole and were not subdivided with regard to the performance of specific business segments or units.

For Fiscal 2017, “Adjusted EBITDA” was defined as earnings (defined as net income (loss) of the Company) before interest, taxes, depreciation, and amortization and excluding restructuring, acquisition, and integration charges, and other one-time charges. “Free Cash Flow” was defined as net cash provided by operating activities, less capital expenditures, plus one-time Board approved additions (such as acquisition costs or debt refinancing costs).

The target Fiscal 2017 MIP award levels achievable at target for each participating NEO were as follows:

|

Named Executive |

|

MIP Target as % of Annual Base |

|

David M. Maura |

|

125% |

|

Andreas Rouvé |

|

125% |

|

Douglas L. Martin |

|

90% |

|

Nathan E. Fagre |

|

60% |

|

Stacey L. Neu |

|

60% |

The Fiscal 2017 MIP plan design had a minimum financial threshold for each of Adjusted EBITDA and Free Cash Flow, below which no payout would be earned with respect to that objective. The achievement of the goals of Adjusted EBITDA and Free Cash Flow were determined and earned independently of one another. In addition, the Compensation Committee provided the Chief Executive Officer

10

with the discretionary authority to issue up to a total of $17 million in equity awards to designated participants in lieu of any cash bonuses earned under the Fiscal 2017 MIP. Acquisitions by the Company were included from the date of acquisition, subject to negative discretion of the Compensation Committee. The table below reflects for each NEO the percentage of his or her target award achievable pursuant to the performance goals, the performance required to achieve the threshold, target, and maximum payouts based on those performance goals, and the actual 2017 payout achieved.

|

|

|

|

|

|

|

Performance Required to Achieve Bonus % as Indicated ($ in millions) |

|

|

||||||

|

NEO |

|

Performance Metric |

|

Weight (% of Target Bonus) |

|

Threshold (50%) |

|

Target (100%) |

|

Maximum (200%) |

|

Maximum (250%) |

|

Calculated 2017 Payout Factor (% of Target Bonus) |

|

David M. Maura Andreas Rouvé |

|

Consolidated Adjusted EBITDA Consolidated Free Cash Flow |

|

75% 25% |

|

$952.90 $535.50 |

|

$982.00 $586.00 |

|

$1,031.10 $638.74 |

|

$1,055.65 $665.11 |

|

50.00% 101.33% |

|

Douglas L. Martin Nathan E. Fagre Stacey L. Neu

|

|

Consolidated Adjusted EBITDA Consolidated Free Cash Flow |

|

75% 25% |

|

$952.90 $535.50 |

|

$982.00 $586.00 |

|

$1,031.10 $638.74 |

|

– – |

|

50.00% 101.33% |

Fiscal 2018 MIP Program

The Fiscal 2018 MIP program continues to follow the plan design from previous years with the same corporate goals of increasing EBITDA growth and Free Cash Flow and adds the corporate goal of increasing net sales. The Compensation Committee established the new weightings with the Adjusted EBITDA having a weighting of 50%, Net Sales having a weighting of 20%, and Free Cash Flow having a weighting of 30%. The performance targets for each of Messrs. Maura, Rouvé, Martin, and Fagre, and for Ms. Neu are equal to those established for the Company as a whole and were not subdivided with regard to the performance of specific business segments or units.

Beginning in Fiscal 2018, the Board approved an incremental investment program of up to $20 million to support long-term growth initiatives at the Company in the areas of product innovation, R&D, and marketing and sales. This initiative is referred to as “Project Alpha.” Under this program, the Adjusted EBITDA and Free Cash Flow targets for Fiscal 2018 (for both MIP and EIP) will be reduced by up to $20 million, for each dollar of actual spending on Board-approved Project Alpha investments. This spending will also be excluded from the calculation of Adjusted Diluted EPS under the S3B Plan discussed below.

For purposes of determining achievement of the targets under the 2018 MIP Program, the Compensation Committee established the following definitions:

“Adjusted EBITDA” is defined as earnings (defined as net income (loss) of the Company) before interest, taxes, depreciation, and amortization and excluding restructuring, acquisition, and integration charges, and other one-time charges. The result of the formula in the preceding sentence shall then be adjusted so as to negate the effects of acquisitions or dispositions; provided, however that Adjusted EBITDA resulting from businesses or products lines acquired (in Board approved transactions) during the performance period will be included in the calculation from the date of acquisition, subject to negative discretion of the Compensation Committee.

“Free Cash Flow” is defined as Adjusted EBITDA plus or minus changes in current and long term assets and liabilities, less cash payments for taxes, restructuring and interest, but excluding outlays or proceeds from acquisitions or dispositions. Any reductions in Free Cash Flow resulting from transaction costs or financing fees incurred in connection with any Board approved acquisition or refinancing (in each case during the performance period) will be added back to Free Cash Flow, subject to negative discretion of the Compensation Committee.

“Net Sales” is defined as the amount of revenue generated less returns, cash discounts, trade rebates, and other trade spend or consumer offers that result in a reduction of revenue in accordance with generally accepted accounting principles in the U.S. GAAP. Net Sales achievement will be net of FX currency translation impact (e.g. achievement will exclude positive or negative impact(s) as a result of converting local currency sales into U.S. dollars), will include amounts in the annual operating plan relating to acquisitions completed in the prior year and will exclude amounts from acquisitions completed in the current year.

11

The target Fiscal 2018 MIP award levels achievable at target for each participating NEO are as follows:

|

Named Executive |

|

MIP Target as % of Annual Base |

|

David M. Maura |

|

125% |

|

Andreas Rouvé |

|

125% |

|

Douglas L. Martin |

|

90% |

|

Nathan E. Fagre |

|

60% |

|

Stacey L. Neu |

|

60% |

The Fiscal 2018 MIP plan design has a minimum financial threshold for each of Adjusted EBITDA, Net Sales, and Free Cash Flow, below which no payout will be earned with respect to that objective. The achievement of the goals of Adjusted EBITDA, Net Sales, and Free Cash Flow are determined and earned independently of one another. In addition, the Compensation Committee provided the Chief Executive Officer with the discretionary authority to issue up to a total of $17 million in equity awards to designated participants in lieu of any cash bonuses earned under the Fiscal 2018 MIP.

Spectrum S2B Plan

During 2015, the Compensation Committee, in consultation with members of management, its independent compensation consultant, and outside counsel for the Compensation Committee, designed a two-year superior achievement incentive compensation program for the Company’s NEOs and other members of the Company’s management team and key employees. The program is referred to as the “Spectrum S2B Plan” or “Spectrum S2B,” because the program reflected a strategy to achieve an additional $2 billion of value creation (as measured by stock market capitalization of the Company) by the end of Fiscal 2016. The purpose of the Spectrum S2B Plan was to incentivize senior management to drive the Company’s performance in excess of key financial performance metrics over a two-year performance period consisting of Fiscal 2015 and Fiscal 2016. Awards under the Spectrum S2B Plan were granted pursuant to the Company’s 2011 Plan.

The Spectrum S2B Plan had the following key performance targets: (1) achieving Adjusted EBITDA of at least $800 million in Fiscal 2016; (2) achieving Cumulative Free Cash Flow during Fiscal 2015 and 2016 of at least $800 million; and (3) achieving Adjusted Diluted Earnings Per Share (EPS) in Fiscal 2016 of at least $5.00 per share. In terms of potential award payouts for plan participants, 40% of the award was based on Adjusted EBITDA, 40% on Cumulative Free Cash Flow, and 20% on Adjusted Diluted EPS. In addition, there would be no payout with respect to a given metric if the performance target was not fully achieved as of September 30, 2016.

Participants in the Spectrum S2B Plan had the opportunity to earn additional award amounts based on achievement in excess of the performance targets. The overachievement performance targets and weighting were as follows: (1) 40% of the overachievement award was based on Adjusted EBITDA of $835 million as of September 30, 2016, with linear interpolation of the award if Adjusted EBITDA was between $800 million and $835 million for Fiscal 2016; (2) 40% was based on Cumulative Free Cash Flow of $875 million for Fiscal 2015 and 2016 combined, with linear interpolation of the award if such metric was between $800 million and $875 million for Fiscal 2015 and 2016 combined; and (3) 20% was based on Adjusted Diluted EPS of $5.25 per share for Fiscal 2016, with linear interpolation of the award if such metric was between $5.00 and $5.25 per share for Fiscal 2016. The maximum payout under each of the performance measures would be reduced by 50% if the performance on the remaining measures was less than 90% of target on each.

For purposes of determining achievement of the targets under the Spectrum S2B Plan, the Compensation Committee established the following definitions:

“Adjusted Diluted EPS” means GAAP diluted income per share adjusted for the following items as they relate to the calculation of net income: acquisition and integration related charges, restructuring and related charges, one-time debt refinancing costs, inventory fair-value adjustments related to acquisitions, discontinued operations, stock-based compensation amortization related to the Spectrum S2B Plan, the 2015 Equity Incentive Plan, and the 2016 Equity Incentive Plan, and normalizing the consolidated tax rate at 35 percent.

“Adjusted EBITDA” means earnings before interest, taxes, depreciation, and amortization and excluding restructuring, acquisition, and integration charges, discontinued operations, and other one-time charges. The result of the formula in the preceding sentence was then adjusted so as to negate the effects of acquisitions or dispositions; provided, however that Adjusted EBITDA resulting from businesses or products lines acquired (in Board-approved transactions) during the Spectrum S2B performance period may be included in the calculation from the date of acquisition subject to Compensation Committee approval.

“Cumulative Free Cash Flow” means the cumulative amount during the Spectrum S2B performance period of Adjusted EBITDA plus or minus changes in current and long term assets and liabilities, less cash payments for taxes, restructuring, and interest, but excluding proceeds from acquisitions or dispositions. Any reductions in Cumulative Free Cash Flow resulting from transaction costs or financing fees incurred in connection with any Board-approved acquisition, disposition, or refinancing (in each case during the Spectrum S2B performance period) may be added back to Cumulative Free Cash Flow.

12

Under the plan design, awards were denominated in dollars for achieving 100% of the performance goals, but were payable in RSUs or shares of restricted stock based on the fair market value of the Company’s shares as of the last day of the performance period. Accordingly, each participant was granted a target dollar value. If the above performance criteria were satisfied as of September 30, 2016, then 50% of the award was required to be paid in RSUs or restricted stock within 74 days after the end of Fiscal 2016, and 50% was required to be paid in RSUs or restricted stock which vest one year after the first vesting date, subject to continued employment and any other applicable terms in the underlying award agreement. The Company’s NEOs are required to retain at least 50% of the shares they receive upon vesting (net of any shares withheld by the Company upon vesting for tax purposes) for one year after vesting. There were approximately 175 participants in the Spectrum S2B Plan

The Company’s Board of Directors, upon the recommendation of the Compensation Committee, approved the following award opportunities under the Spectrum S2B Plan for Messrs. Rouvé, Martin, and Fagre and Ms. Neu. Upon Mr. Maura’s appointment in January 2016 as Executive Chairman, the Board of Directors, upon the recommendation of the Compensation Committee, also approved the award opportunity for Mr. Maura as set forth below.

|

|

|

Value of RSUs or Restricted Stock Granted (in $) |

||||

|

Name |

|

Award at Target |

|

Additional Award at Maximum Overachievement |

|

Total |

|

David M. Maura |

|

$3,000,000 |

|

$1,500,000 |

|

$4,500,000 |

|

Andreas Rouvé |

|

$3,000,000 |

|

$1,500,000 |

|

$4,500,000 |

|

Douglas L. Martin |

|

$2,000,000 |

|

$840,000 |

|

$2,840,000 |

|

Nathan E. Fagre |

|

$750,000 |

|

$262,500 |

|

$1,012,500 |

|

Stacey L. Neu |

|

$400,000 |

|

$140,000 |

|

$540,000 |

Based on performance results for the Spectrum S2B Plan performance period, Mr. Maura earned $4,500,000, which was converted into 32,682 RSUs; Mr. Rouvé earned $4,500,000, which was converted into 32,682 RSUs; Mr. Martin earned $2,840,000, which was converted into 20,626 RSUs; Mr. Fagre earned $1,012,500, which was converted into 7,353 RSUs; and Ms. Neu earned $540,000, which was converted into 3,922 RSUs, in each case 50% of which were vested on December 1, 2016 and 50% of which vested on December 1, 2017.

Spectrum S3B Pla

During Fiscal 2016, the Compensation Committee, in consultation with members of management, its independent compensation consultant, and outside counsel for the Compensation Committee reviewed and evaluated the success of the Spectrum S2B Plan in light of its original objectives of incentivizing senior management to drive the Company’s performance in excess of key financial performance metrics during Fiscal 2015 and Fiscal 2016. The Compensation Committee determined the Spectrum S2B Plan succeeded in driving accelerated growth of stockholder value during the 2-year performance period. As a result, the Compensation Committee designed a successor multi-year superior achievement incentive compensation program for the Company’s NEOs and other members of the Company’s management team and key employees that similarly is intended to promote significant stockholder value creation. This successor program is referred to as the “Spectrum S3B Plan” or “Spectrum S3B.” The purpose of the Spectrum S3B Plan is to incentivize senior management to drive the Company’s performance in excess of key financial performance metrics over a two-year performance period consisting of Fiscal 2017 and Fiscal 2018. Awards under the Spectrum S3B Plan were granted pursuant to the Company’s 2011 Plan.

The Compensation Committee determined that the performance metrics for the Spectrum S3B Plan are Adjusted Diluted EPS and Return on Assets. The specific performance targets for Adjusted Diluted EPS and Return on Assets for the two-year performance period are based on the financial goals in the Company’s three-year strategic plan that covers this time period. In terms of potential award payouts for plan participants, 50% of the award is based on Adjusted Diluted EPS and 50% on ROA. In addition, there would be no payout with respect to a given metric if the performance target was not fully achieved as of September 30, 2018. The maximum payout is 125% of the target award.

Participants in the Spectrum S3B Plan have the opportunity to earn additional award amounts based on achievement in excess of the performance targets. The additional award opportunity is based on the Company realizing aggressive targets above those set forth in the strategic plan, as determined separately for the Adjusted Diluted EPS metric and the Return on Assets metric. Under the Spectrum S3B Plan, maximum payouts under each of the performance metrics will be forfeited if the performance on the remaining metric is less than 90% of target. As described above under the heading “Fiscal 2018 MIP Program,” the actual incremental investment plan spending will be excluded from the Adjusted Diluted EPS calculations.

For purposes of determining achievement of the targets under the Spectrum S3B Plan, the Compensation Committee established the following definitions:

13

“Adjusted Diluted EPS” means GAAP diluted income per share adjusted for the following items as they relate to the calculation of net income: acquisition and integration related charges, restructuring and related charges, one-time debt refinancing costs, inventory fair-value adjustments related to acquisitions, discontinued operations, stock-based compensation amortization related to the Spectrum S3B Plan above or below the amounts reflected in the plan targets, and normalizing the consolidated tax rate at 35 percent.