Form DEF 14A Medley Capital Corp For: Feb 13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

Information Required in Proxy Statement

Schedule 14A Information

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(RULE 14a-101)

Information Required in Proxy Statement

Schedule 14A Information

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant | x | |

Filed by a Party other than the Registrant | o | |

Check the appropriate box:

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

x | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material Pursuant to §240.14a-12 | |

Medley Capital Corporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x | No fee required. | |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

(1) | Title of each class of securities to which transaction applies: | |

(2) | Aggregate number of securities to which transaction applies: | |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

(4) | Proposed maximum aggregate value of transaction: | |

(5) | Total fee paid: | |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |

(1) | Amount Previously Paid: | |

(2) | Form, Schedule or Registration Statement No.: | |

(3) | Filing Party: | |

(4) | Date Filed: | |

MEDLEY CAPITAL CORPORATION

280 Park Avenue, 6th Floor East

New York, New York 10017

(212) 759-0777

280 Park Avenue, 6th Floor East

New York, New York 10017

(212) 759-0777

December 21, 2017

Dear Stockholder:

You are cordially invited to participate in the 2018 Annual Meeting of Stockholders (the “Meeting”) of Medley Capital Corporation (the “Company” or “Medley Capital”) to be held on February 13, 2018 at 10:00 a.m., Eastern Time. You will be able to participate in the Meeting, vote and submit your questions via live webcast by visiting www.virtualshareholdermeeting.com/MCC2018. Prior to the Meeting, you will be able to vote electronically at www.proxyvote.com.

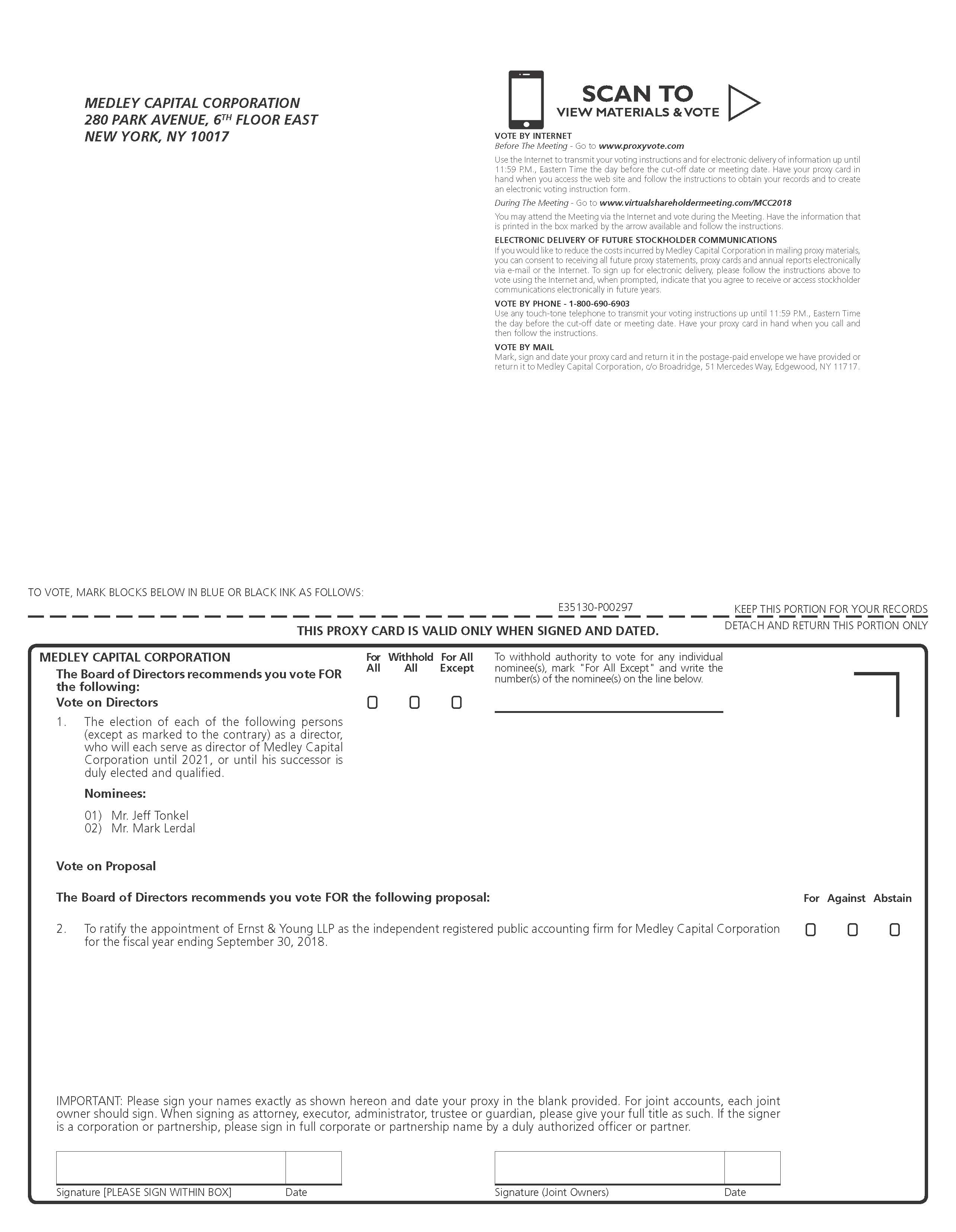

The Notice of Annual Meeting of Stockholders and Proxy Statement accompanying this letter provide an outline of the business to be conducted at the Meeting. At the Meeting, you will be asked to: (i) elect two directors of the Company, each to serve for a term of three years, or until his successor is duly elected and qualified; (ii) ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2018, and (iii) to transact such other business that may properly come before the Meeting. Details of the business to be conducted at the Meeting are set forth in the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement. I, along with other members of the Company’s management, will be available to respond to stockholders’ questions.

It is important that your shares be represented at the Meeting. If you are unable to participate in the Meeting during the scheduled time, I urge you to complete, date and sign the enclosed proxy card and promptly return it in the envelope provided. If you prefer, you can save time by voting through the Internet or by telephone as described in the proxy statement and on the enclosed proxy card.

We look forward to your participation in the Meeting. Your vote and participation in the governance of the Company is very important to us.

Sincerely yours, | |

/s/ Brook Taube | |

Brook Taube | |

Chairman and Chief Executive Officer | |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held on February 13, 2018.

Our Proxy Statement and Annual Report on Form 10-K for the fiscal year ended September 30, 2017, are available on the Internet through our website at http://www.medleycapitalcorp.com.

The following information applicable to the Meeting may be found in the Proxy Statement and accompanying proxy card:

•The date, time and location of the Meeting;

•A list of the matters intended to be acted on and our recommendations regarding those matters; and

•Any control/identification numbers that you need to access your proxy card.

MEDLEY CAPITAL CORPORATION

280 Park Avenue, 6th Floor East

New York, New York 10017

(212) 759-0777

280 Park Avenue, 6th Floor East

New York, New York 10017

(212) 759-0777

NOTICE OF 2018 ANNUAL MEETING OF STOCKHOLDERS

To be Held on

February 13, 2018, 10:00 a.m., Eastern Time

To be Held on

February 13, 2018, 10:00 a.m., Eastern Time

To the Stockholders of Medley Capital Corporation:

The 2018 Annual Meeting of Stockholders (the “Meeting”) of Medley Capital Corporation (the “Company”) will be held on Tuesday, February 13, 2018, at 10:00 a.m., Eastern Time. You can participate in the Meeting online, vote your shares electronically and submit questions during the Meeting by visiting www.virtualshareholdermeeting.com/MCC2018. You must have your Control Number in order to access the Meeting. The Meeting will be held for the following purposes:

1. | To elect two directors of the Company, each to serve for a term of three years, or until his successor is duly elected and qualified; |

2. | To ratify the appointment of Ernst & Young LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2018; and |

3. | To transact such other business as may properly come before the Meeting. |

You have the right to receive notice of and to vote at the Meeting if you were a stockholder of record at the close of business on December 19, 2017. If you are unable to attend virtually, please sign the enclosed proxy card and return it promptly in the self-addressed envelope provided or vote by telephone or through the Internet. Please refer to the voting instructions provided on your proxy card. In the event there are not sufficient votes for a quorum or to approve the proposals at the time of the Meeting, the Meeting may be adjourned in order to permit further solicitation of proxies by the Company. Thank you for your support of the Company.

By order of the Board of Directors, | |

/s/ Brook Taube | |

Brook Taube | |

Chairman of the Board | |

New York, New York

December 21, 2017

December 21, 2017

This is an important meeting. To ensure proper representation at the Meeting, please complete, sign, date and return the proxy card in the enclosed self-addressed envelope or vote by telephone or through the Internet. Even if you vote your shares prior to the Meeting, you still may participate in the Meeting and vote your shares at the time of the Meeting if you wish to change your vote.

MEDLEY CAPITAL CORPORATION

280 Park Avenue, 6th Floor East

New York, New York 10017

(212) 759-0777

280 Park Avenue, 6th Floor East

New York, New York 10017

(212) 759-0777

PROXY STATEMENT

2018 Annual Meeting of Stockholders

To Be Held on February 13, 2018

2018 Annual Meeting of Stockholders

To Be Held on February 13, 2018

This Proxy Statement is furnished in connection with the solicitation of proxies by the board of directors of Medley Capital Corporation (the “Company,” “Medley Capital,” “we,” “us,” or “our”) for use at the Company’s 2018 Annual Meeting of Stockholders (the “Meeting”) to be held on Tuesday, February 13, 2018, at 10:00 a.m., Eastern Time. You can virtually attend the Meeting online, vote your shares electronically and submit questions during the Meeting, by visiting www.virtualshareholdermeeting.com/MCC2018, and at any postponements or adjournments thereof. This Proxy Statement, the accompanying proxy card and the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2017, are first being sent to stockholders on or about January 3, 2018.

We encourage you to vote your shares, either by voting via the Internet while virtually attending the Meeting, by telephone, or by granting a proxy (i.e., authorizing someone to vote your shares). If you properly sign and date the accompanying proxy card, or by telephone or through the Internet, and the Company receives your vote in time for voting at the Meeting, the persons named as proxies will vote your shares in the manner that you specify. If you give no instructions on the proxy card, the shares covered by the proxy card will be voted FOR the election of the nominees as directors and FOR the ratification of appointment of Ernst & Young LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2018.

If you are a “stockholder of record” (i.e., you hold shares directly in your name), you may revoke a proxy at any time before it is exercised by notifying the proxy tabulator, Broadridge Financial Solutions, Inc. (“Broadridge”), in writing, by submitting a properly executed, later-dated proxy, or by virtually attending the Meeting online and voting your shares during the Meeting. Please send your notification to Medley Capital Corporation, c/o Broadridge Financial Solutions, Inc., 51 Mercedes Way, Edgewood, NY 11717. Any stockholder of record participating in the Meeting may vote at such time whether or not he or she has previously voted his or her shares.

If you hold shares of common stock through a broker, bank or other nominee, you must follow the voting instructions you receive from your broker, bank or nominee. If you hold shares of common stock through a broker, bank or other nominee and you want to vote in person at the Meeting, you must obtain a legal proxy from the record holder of your shares and present it at the Meeting. If you do not submit voting instructions to your broker, bank or other nominee, your broker, bank or other nominee will not be permitted to vote your shares on any proposal considered at the Meeting.

Stockholders of record may also vote via the Internet or by telephone. Specific instructions to be followed by stockholders of record interested in voting via the Internet or by telephone are shown on the enclosed proxy card. The Internet and telephone voting procedures are designed to authenticate the stockholder’s identity and to allow stockholders to vote their shares and confirm that their instructions have been properly recorded.

Purpose of Meeting

At the Meeting, you will be asked to vote on the following proposals:

1. | To elect two directors of the Company, each to serve for a term of three years, or until his successor is duly elected and qualified; |

2. | To ratify the appointment of Ernst & Young LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2018; and |

3. | To transact such other business as may properly come before the Meeting. |

Record Date and Voting Securities

The record date for the Meeting is the close of business on December 19, 2017, (the “Record Date”). You may cast one vote for each share of common stock that you owned as of the Record Date. There were 54,474,211 shares of the Company’s common stock outstanding on the Record Date.

Quorum Required

A quorum must be present at the Meeting for any business to be conducted. The presence at the Meeting, online or by proxy, of the holders entitled to cast a majority of the shares of common stock of the Company entitled to be cast on the Record Date will constitute a quorum. Abstentions will be treated as shares present for quorum purposes. Shares for which brokers have not received voting instructions from the beneficial owner of the shares and do not have discretionary authority to vote the shares on certain proposals (which are considered “Broker Non-Votes” with respect to such proposals) will be treated as shares present for quorum purposes. However, abstentions and Broker Non-Votes are not counted as votes cast.

If a quorum is not present at the Meeting, the stockholders who are represented may adjourn the Meeting until a quorum is present. The persons named as proxies will vote those proxies for such adjournment, unless the proxies are marked to be voted against any proposal for which an adjournment is sought, to permit the further solicitation of proxies.

Vote Required

Election of Directors. The election of a director requires the affirmative vote of a plurality of the votes cast at the Meeting or by proxy. Stockholders may not cumulate their votes. If you vote “Withhold Authority” with respect to a nominee, your shares will not be voted with respect to the person indicated. If you give no instructions on the proxy card, the shares covered by the proxy card will be voted FOR the election of the nominees as directors. Abstentions and Broker Non-Votes are not counted as votes cast for purposes of the election of directors and, therefore, will have no effect on the outcome of such election.

Ratification of Independent Registered Public Accounting Firm. The affirmative vote of a majority of the votes cast at the Meeting or by proxy is required to ratify the appointment of Ernst & Young LLP to serve as the Company’s independent registered public accounting firm. Abstentions will not be included in determining the number of votes cast and, as a result, will have no effect on this proposal. Because brokers will have discretionary authority to vote for the ratification of the appointment of the Company’s independent registered public accounting firm in the event that they do not receive voting instructions from the beneficial owner of the shares, your broker will be permitted to vote your shares for this proposal. If you give no instructions on the proxy card, the shares covered by the proxy card will be voted FOR the ratification of appointment of Ernst & Young LLP to serve as the Company’s independent registered public accounting firm for the 2018 fiscal year.

Additional Solicitation. If there are not enough votes to approve any proposals at the Meeting, the stockholders who are represented may adjourn the Meeting to permit the further solicitation of proxies. The persons named as proxies will vote those proxies for such adjournment, unless the proxies are marked to be voted against any proposal for which an adjournment is sought, to permit the further solicitation of proxies.

Also, a stockholder vote may be taken on one or more of the proposals in this Proxy Statement prior to any such adjournment if there are sufficient votes for approval of such proposal(s).

Information Regarding This Solicitation

The Company will bear the expense of the solicitation of proxies for the Meeting, including the cost of preparing, printing and mailing this Proxy Statement, the accompanying Notice of Annual Meeting of Stockholders, and proxy card. If brokers, trustees, or fiduciaries and other institutions or nominees holding shares in their names, or in the name

of their nominees, which are beneficially owned by others, forward the proxy materials to, and obtain proxies from, such beneficial owners, we will reimburse such persons for their reasonable expenses in so doing.

In addition to the solicitation of proxies by the use of the mail, proxies may be solicited in person and/or by telephone or facsimile transmission by directors, officers or employees of the Company and/or officers or employees of MCC Advisors, LLC (“MCC Advisors”), the Company’s registered investment adviser and administrator. MCC Advisors is located at 280 Park Avenue, 6th Floor East, New York, New York 10017. No additional compensation will be paid to directors, officers or regular employees of the Company or MCC Advisors for such services.

Stockholders may also provide their voting instructions by telephone or through the Internet. These options require stockholders to input the Control Number which is located on each proxy card. After inputting this number, stockholders will be prompted to provide their voting instructions. Stockholders will have an opportunity to review their voting instructions and make any necessary changes before submitting their voting instructions and terminating their telephone call or submitting instructions via the Internet. Stockholders who vote via the Internet, in addition to confirming their voting instructions prior to submission, will also receive an e-mail confirming their instructions upon request.

Any proxy given pursuant to this solicitation may be revoked by notice from the person giving the proxy at any time before it is exercised. Any such notice of revocation should be provided in writing and signed by the stockholder in the same manner as the proxy being revoked and delivered to the Company’s proxy tabulator.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth, as of the Record Date, the beneficial ownership of each current director, the nominees for director, the Company’s executive officers, each person known to us to beneficially own 5% or more of the outstanding shares of our common stock, and the executive officers and directors as a group.

Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission (“SEC”) and includes voting or investment power with respect to the securities. Ownership information for those persons who beneficially own 5% or more of our shares of common stock is based upon reports filed by such persons with the SEC and other information obtained from such persons, if available.

Unless otherwise indicated, the Company believes that each beneficial owner set forth in the table below has sole voting and investment power and has the same address as the Company. The Company’s directors are divided into two groups — interested directors and independent directors. Interested directors are “interested persons” of the Company as defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended (the “1940 Act”). The address of all executive officers and directors is c/o Medley Capital Corporation, 280 Park Avenue, 6th Floor East, New York, NY 10017.

Name and Address of Beneficial Owner | Number of Shares Owned Beneficially(1) | Percentage of Class(2) | ||||

Interested Directors | ||||||

Brook Taube | 7,946,938 | (3) | 14.6 | % | ||

Seth Taube | 7,934,448 | (4) | 14.6 | % | ||

Jeff Tonkel | 15,000 | *% | ||||

Independent Directors | ||||||

Arthur S. Ainsberg | 3,000 | *% | ||||

Karin Hirtler-Garvey | 3,000 | *% | ||||

John E. Mack | 1,000 | *% | ||||

Mark Lerdal | — | *% | ||||

Executive Officers | ||||||

Richard T. Allorto, Jr. | 20,000 | *% | ||||

John D. Fredericks | 4,000 | *% | ||||

All executive officers and directors as a group (9 persons) | 8,170,448 | 15.0 | % | |||

* Represents less than one percent.

(1) | Beneficial ownership has been determined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Assumes the beneficial owners have made no other purchases or sales of our common stock since the most recently available SEC filings. This assumption has been made under the rules and regulations of the SEC and does not reflect any knowledge that we have with respect to the present intent of the beneficial owners of our common stock listed in this table. |

(2) | Based on a total of 54,474,211 shares of the Company’s common stock issued and outstanding on the Record Date. |

(3) | Medley Seed Funding I LLC, a limited liability company controlled by Medley LLC, beneficially owns 7,756,938 of the reported shares. Brook Taube, together with Seth Taube, controls Medley LLC. Brook Taube disclaims beneficial ownership of such shares of common stock except to the extent of his pecuniary interest therein. In addition,190,000 of the reported shares are held by a trust for the benefit of Brook Taube's family, for which he serves as a trustee. |

(4) | Medley Seed Funding I LLC, a limited liability company controlled by Medley LLC, beneficially owns 7,756,938 shares of the reported shares. Seth Taube, together with Brook Taube, controls Medley LLC. Seth Taube disclaims beneficial ownership of such shares of common stock except to the extent of his pecuniary interest therein. In addition, 142,510 of the reported shares are held by a trust for the benefit of Seth Taube's family, for which he serves as a trustee, and 35,000 of the reported shares are held by The Seth and Angie Taube Foundation, Inc., which is a 501(c)(3) charitable organization. |

Set forth below is the dollar range of equity securities beneficially owned by each of our directors as of the Record Date. We are not part of a “family of investment companies,” as that term is defined in the 1940 Act.

Name of Director | Dollar Range of Equity Securities Beneficially Owned(1)(2) | |

Interested Directors | ||

Brook Taube | over $1,000,000 | |

Seth Taube | over $1,000,000 | |

Jeff Tonkel | $50,001 – $100,000 | |

Independent Directors | ||

Arthur S. Ainsberg | $10,001 – $50,000 | |

Karin Hirtler-Garvey | $10,001 – $50,000 | |

John E. Mack | $1 – $10,000 | |

Mark Lerdal | None | |

(1) | The dollar ranges are: None, $1 – $10,000, $10,001 – $50,000, $50,001 – $100,000, $100,001 – $500,000, $500,001 – $1,000,000 or over $1,000,000. |

(2) | The dollar range of equity securities beneficially owned in us is based on the closing price for our common stock of $5.30 on the Record Date on the New York Stock Exchange. Beneficial ownership has been determined in accordance with Rule 16a-1(a)(2) of the Exchange Act. |

PROPOSAL I: ELECTION OF DIRECTORS

Our business and affairs are managed under the direction of our board of directors. Pursuant to our charter and bylaws, the board of directors is divided into three classes, designated Class I, Class II, and Class III. At the Meeting, Class I directors shall be elected for a three-year term. Directors are elected for a staggered term of three years each, with a term of office of one of the three classes of directors expiring each year. Each director will hold office for the term to which he or she is elected or until his or her successor is duly elected and qualified.

Mr. Jeff Tonkel and Mr. Mark Lerdal have been nominated for re-election for a three year term expiring in 2021. If elected, Mr. Lerdal will continue to serve on the Company’s Audit Committee and Compensation Committee. Messrs. Tonkel and Lerdal are not being proposed for election pursuant to any agreement or understanding between any of them and the Company.

Required Vote

The election of a director requires the affirmative vote of a plurality of the votes cast at the Meeting or by proxy. A stockholder can vote for or withhold his or her vote from each nominee. If a stockholder withholds his or her vote for a nominee, such shares will not be voted with respect to the nominee indicated. If any of the nominees should decline or be unable to serve as a director, it is intended that the proxy will vote for the election of such person as is nominated by the board of directors as a replacement. The board of directors has no reason to believe that any of the persons named below will be unable or unwilling to serve.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF THE NOMINEES NAMED IN THIS PROXY STATEMENT.

Information about the Nominees and Directors

As described below under “Committees of the Board of Directors — Nominating and Corporate Governance Committee,” the board of directors has identified certain desired attributes for director nominees. Each of our directors and each director nominee has demonstrated high character and integrity, superior credentials and recognition in his or her respective field and the relevant expertise and experience upon which to be able to offer advice and guidance to our management. Each of our directors and each director nominee also has sufficient time available to devote to the affairs of the Company, is able to work with the other members of the board of directors and contribute to the success of the Company and can represent the long-term interests of the Company’s stockholders as a whole. Our directors and the director nominees have been selected such that the board of directors represents a range of backgrounds and experience.

Certain information, as of the Record Date, with respect to the nominees for election at the Meeting, as well as each of the current directors, is set forth below, including their names, ages, a brief description of their recent business experience, including present occupations and employment, certain directorships that each person holds, the year in which each person became a director of the Company, and a discussion of their particular experience, qualifications, attributes or skills that lead us to conclude, as of the Record Date, that such individual should serve as a director of the Company, in light of the Company’s business and structure.

Nominees for Class I Directors — Term Expiring 2018

Name, Address and Age(1) | Position(s) Held with Company | Terms of Office and Length of Time Served | Principal Occupation(s) During Past 5 Years | Other Directorships Held by Director or Nominee for Director During Past 5 Years | ||||

Interested Director | ||||||||

Jeff Tonkel, 47 | Director | Class I Director since 2014; Term expires 2018 | President of Medley Management, Inc.; President of Sierra Income Corporation | None | ||||

Mr. Tonkel is an “interested person” of the Company as defined in the 1940 Act due to his position as a Managing Partner of MCC Advisors. Mr. Tonkel also serves as President of Sierra Income Corporation. Prior to Medley, Mr. Tonkel was a Managing Director with JP Morgan serving as CFO of a global financing and markets business. Prior to JP Morgan, Mr. Tonkel was a Managing Director of Principal Investments with Friedman Billings Ramsey where he focused on Merchant Banking and Corporate Development investments in the specialty finance, real estate and diversified industrial sectors. Mr. Tonkel began his investment career with Summit Partners. Mr. Tonkel received a BA from Harvard University and an MBA from Harvard Business School.

Name, Address and Age(1) | Position(s) Held with Company | Terms of Office and Length of Time Served | Principal Occupation(s) During Past 5 Years | Other Directorships Held by Director or Nominee for Director During Past 5 Years | ||||

Independent Director | ||||||||

Mark Lerdal, 58 | Director | Class I Director since 2017; Term expires 2018 | Executive Chairman of Leaf Clean Energy | TerraForm Global, Inc.; Trading Emissions plc. | ||||

Mr. Lerdal is not an “interested person” of the Company as defined in the 1940 Act. Mr. Lerdal has served as the Executive Chairman of Leaf Clean Energy, a closed-end listed fund in the renewable energy sector, since March of 2014. He also serves on the boards of TerraForm Global, Inc. and Trading Emissions plc. Additionally, he serves as an operating partner at two private infrastructure funds. He has been active in the energy and finance industries for over 30 years. He earned a AB in Economics from Stanford University and a JD from Northwestern University.

Current Directors — Not up for Election at the Meeting

Class II Directors — Term Expiring 2019

Name, Address and Age(1) | Position(s) Held with Company | Terms of Office and Length of Time Served | Principal Occupation(s) During Past 5 Years | Other Directorships Held by Director or Nominee for Director During Past 5 Years | ||||

Interested Director | ||||||||

Seth Taube, 47 | Director | Class II Director since 2011; Term expires 2019 | Co-Chief Executive Officer of Medley Management, Inc.; Managing Partner of MCC Advisors and Senior Portfolio Manager of the private investment funds managed by Medley; Chief Executive Officer and Chairman of the board of directors of Sierra Income Corporation, a non-traded business development company; previously, a Partner at CN Opportunity Fund | Chairman and Director of Sierra Income Corporation and Sierra Total Return Fund | ||||

Mr. Taube is an “interested person” of the Company as defined in the 1940 Act due to his positions as a Managing Partner of MCC Advisors since our inception and Senior Portfolio Manager of the private investment funds managed by Medley LLC (“Medley”) since 2007. In addition, Mr. Taube has served as Chief Executive Officer and Chairman of the board of directors of Sierra Income Corporation, a non-traded business development company, since its inception on June 16, 2011, and previously served as its President. Mr. Taube also has served as the Chief Executive Officer and Chairman of the board of directors of Sierra Total Return Fund, a closed-end management investment company that is operated as an interval fund since its inception on August 18, 2016. Mr. Taube also serves as Chief Executive Officer of SIC Advisors LLC, which serves as the investment adviser to Sierra Income Corporation, as well as serves on the board of Sierra Total Return Fund and on the investment committee of STRF Advisors, the investment adviser to Sierra Total Return Fund. In addition to serving on our board of directors, Mr. Taube currently serves on the board of Sierra Income Corporation. Prior to forming Medley, Mr. Taube was a Partner with CN Opportunity Fund, T3 Group, and Griphon Capital Management. Mr. Taube previously worked with Tiger Management and Morgan Stanley & Co. Through his depth of experience in managerial positions in investment management, leveraged finance and financial services, as well as his intimate knowledge of the business and operations of MCC Advisors and the private investment funds managed by Medley, Mr. Taube brings extensive knowledge of private equity and investment banking. Mr. Taube’s previous service on the Company’s board also provides him with a specific understanding of our Company, its operations, and the business and regulatory issues facing business development companies. Mr. Taube’s position as Managing Partner of MCC Advisors provides the board of directors with a direct line of communication to and valuable insight of an experienced financial manager with direct knowledge of the operations of the Company and MCC Advisors, respectively.

Name, Address and Age(1) | Position(s) Held with Company | Terms of Office and Length of Time Served | Principal Occupation(s) During Past 5 Years | Other Directorships Held by Director or Nominee for Director During Past 5 Years | ||||

Independent Director | ||||||||

Arthur S. Ainsberg, 70 | Director | Class II Director, since 2011; Term expires 2019 | President of Ainsberg Associates | AG Mortgage Investment Trust; former director of Nomura Securities International, Inc.; Nomura Global Financial Products, Inc.; Nomura Holding America, Inc.; and National Financial Partners Corporation | ||||

Mr. Ainsberg is not an “interested person” of the Company as defined in the 1940 Act. Mr. Ainsberg has over 40 years of experience in the financial services industry and a deep understanding of public and accounting matters for financial service companies. In May 2013, Mr. Ainsberg was named to the board of directors of AG Mortgage Investment Trust. AG is a NYSE company, structured as a REIT, investing in various types of mortgage investments. Mr. Ainsberg served as a director, Chairman of the Audit Committee and member of the Compliance Committee of Nomura Securities International, Inc. (the U.S. based broker-dealer of The Nomura Group) from 1996 through December 2014. In September 2012, Mr. Ainsberg was named to the board of directors of Nomura Global Financial Products, Inc. and in July 2013, he was named to the board of directors of Nomura Holding America, Inc., and served on each board through December 2014. From July 2003 through May 2012, Mr. Ainsberg served as a director for National Financial Partners Corporation, an independent financial services distribution company. From August 2009 through June 2011, Mr. Ainsberg served as Chief Operating Officer of Lehman Brothers Inc. in liquidation, the largest and most complex bankruptcy in the United States. Prior to this engagement, Mr. Ainsberg served as the Independent Consultant for Morgan Stanley & Co. from December 2003 until July 2009, under the Global Research Analyst Settlement, and was responsible for selecting and monitoring the providers of independent research for the clients of Morgan Stanley. Previously, Mr. Ainsberg was Chief Operating Officer at two investment partnerships, Brahman Capital Corp. from 1996 to 2000 and Bessent Capital Corp. during 2001. He also served as Chairman of the New York State Board for Public Accountancy from 1999 to 2000 and was a member of that board from 1993 to 2001. From 1998 to 2000, he was also a member of the Board of District 10 of the National Association of Securities Dealers. Mr. Ainsberg is also the author of Shackleton: Leadership Lessons from Antarctica (2008) and the co-author of Breakthrough: Elizabeth Hughes, the Discovery of Insulin, and the Making of a Medical Miracle (2010). Mr. Ainsberg has extensive experience in the financial services industry and a deep understanding of public and financial accounting matters for financial services companies. He also brings to the Board of Directors a valuable perspective from his experience as a board member of a large U.S. broker-dealer.

Class III Directors — Term Expiring 2020

Name, Address and Age(1) | Position(s) Held with Company | Terms of Office and Length of Time Served | Principal Occupation(s) During Past 5 Years | Other Directorships Held by Director or Nominee for Director During Past 5 Years | ||||

Interested Director | ||||||||

Brook Taube, 47 | Director; Chairman of the Board; President; and Chief Executive Officer | Class III Director since 2011; Term expires 2020 | Co-Chief Executive Officer of Medley Management, Inc.; Managing Partner of MCC Advisors and Senior Portfolio Manager of Medley; previously, a Partner at CN Opportunity Fund | Director of Sierra Income Corporation; New Amsterdam Symphony Orchestra; and Sierra Total Return Fund | ||||

Mr. Brook Taube is an “interested person” of the Company as defined in the 1940 Act due to his positions as Chief Executive Officer and President of the Company, Managing Partner of MCC Advisors and Senior Portfolio Manager of the private investment funds managed by Medley since 2007. In addition to serving on our board of directors, Mr. Brook Taube currently serves on the board of Sierra Income Corporation and on the investment committee for SIC Advisors, the investment adviser to Sierra Income Corporation, as well as serves on the board of Sierra Total Return Fund and on the investment committee of STRF Advisors, the investment adviser to Sierra Total Return Fund. Mr. Taube’s intimate knowledge of the business and operations of MCC Advisors, extensive familiarity with the financial industry and the investment management process in particular, and experience as a director of another business development company not only gives the board of directors valuable insight but also positions him well to continue to serve as the Chairman of our board of directors. Mr. Taube’s positions as Chief Executive Officer of the Company, Managing Partner of MCC Advisors and member of its Investment Committee provides the board with a direct line of communication to, and direct knowledge of the operations of, the Company and MCC Advisors, respectively.

Name, Address and Age(1) | Position(s) Held with Company | Terms of Office and Length of Time Served | Principal Occupation(s) During Past 5 Years | Other Directorships Held by Director or Nominee for Director During Past 5 Years | ||||

Independent Director | ||||||||

Karin Hirtler-Garvey, 61 | Director | Class III Director since 2011; Term expires 2020 | Chief Risk Executive of Ally Financial Services (formerly GMAC) from May 2009 – December 2011; previously, a principal at a real estate development venture | Chairman of Aeropostale Inc., and Director of USAA Federal Savings Bank, Victory Capital Management; and Western World Insurance; Validus Holdings Limited; and ARO Liquidation Inc. | ||||

Ms. Hirtler-Garvey is not an “interested person” of the Company as defined in the 1940 Act. From May 2009 to December 2011, Ms. Hirtler-Garvey was the Chief Risk Executive for Ally Financial Inc. From March 2009 to December 2011, Ms. Hirtler-Garvey was a principal in a start-up real estate development venture based in New Jersey. From 1995 to 2005, Ms. Hirtler-Garvey held various senior level management positions at Bank of America, including Chief Operating Officer, Global Markets, President of Trust and Credit Banking Products, and Chief Financial Officer/Chief Operating Officer for the Wealth and Investment Management division. Ms. Hirtler-Garvey also serves as a director of USAA Federal Savings Bank, a privately held consumer bank, since December 2011 where she chairs the Risk Committee, and as a director of Victory Capital Management, a privately held asset management firm, since October 2014 where she chairs the Audit Committee. Ms. Hirtler-Garvey also served as a director of Western World Insurance Co. from December 2006 to September 2014. As of April 2015, she has since re-joined her post as Director and also chairs the Audit Committee. In August 2017 she was appointed as a director of Validus Holdings Limited, the publicly-traded parent company of Western World. Ms. Hirtler-Garvey also serves on the board of ARO Liquidation Inc., the

successor company to Aeropostale, Inc., where she has served as the Chairman of the Board of Directors since February 2012. Prior to being appointed, Ms. Hirtler-Garvey served on the board of Aeropostale since August 2005 where she was the lead independent director and served as a member of the Nominating and Corporate Governance Committee and Chairperson of the Audit Committee. Ms. Hirtler-Garvey is a Certified Public Accountant.

Name, Address and Age(1) | Position(s) Held with Company | Terms of Office and Length of Time Served | Principal Occupation(s) During Past 5 Years | Other Directorships Held by Director or Nominee for Director During Past 5 Years | ||||

Independent Director | ||||||||

John E. Mack, 70 | Director | Class III Director since 2011; Term expires 2020 | Retired | Incapital Holdings LLC, Searchlight Minerals Corp., Tiptree Financial Inc., GlobalMin Ventures Inc.; and former Vice Chairman of Islandsbanki hf located in Reykjavik, Iceland; and former Director of Residential Capital LLC | ||||

Mr. Mack is not an “interested person” of the Company as defined in the 1940 Act. Mr. Mack has over 40 years of international banking and financial business management experience. From November 2002 through September 2005, Mr. Mack served as Senior Managing Executive Officer and Chief Financial Officer of Shinsei Bank, Limited of Tokyo, Japan. Prior to joining Shinsei Bank and for more than twenty-five years, Mr. Mack served in senior management positions at Bank of America and its predecessor companies, including twelve years as Corporate Treasurer of NationsBank Corporation and NCNB Corporation. From November 2011 through December 2013, Mr. Mack was a member of the board of directors of Residential Capital LLC, and from January 2010 through March 2015, Mr. Mack was Vice-Chairman and a director of Islandsbanki hf located in Reykjavik, Iceland. Mr. Mack is currently a member of the board of directors of Incapital Holdings LLC, Searchlight Minerals Corp., Tiptree Financial Inc. and GlobalMin Ventures Inc. Mr. Mack holds an MBA from the University of Virginia Darden School of Business and received his bachelor’s degree in Economics from Davidson College. Mr. Mack has served in senior management positions at large financial institutions and has extensive experience in finance, accounting and regulatory issues. In addition, his tenure in the financial services industry and service as a director of both public and private companies provide industry-specific knowledge and expertise to the board of directors.

(1) | The business address of the director nominees and other directors is c/o Medley Capital Corporation, 280 Park Avenue, 6th Floor East, New York, NY 10017. |

Information About Executive Officers Who Are Not Directors

The following information, as of the Record Date, pertains to our executive officers who are not directors of the Company.

Name, Address, and Age(1) | Position(s) Held with Company | Principal Occupation(s) During Past 5 Years | ||

Richard T. Allorto, Jr., 46 | Chief Financial Officer and Secretary | Chief Financial Officer of Medley Management, Inc.; previously, Chief Compliance Officer of Medley Capital Corporation; Chief Financial Officer, Chief Compliance Officer (previously) and Secretary of Sierra Income Corporation; Chief Financial Officer of MCC Advisors; previously Chief Financial Officer of GSC Investment Corp. | ||

John D. Fredericks, 53 | Chief Compliance Officer | General Counsel of Medley Management, Inc.; Chief Compliance Officer of Sierra Income Corporation; previously, a Partner at Winston & Strawn, LLP. | ||

(1) | The business address of the executive officers is c/o Medley Capital Corporation, 280 Park Avenue, 6th Floor East, New York, NY 10017. |

Mr. Allorto is the Chief Financial Officer and Secretary of the Company. Mr. Allorto is also the Chief Financial Officer of Medley and is responsible for the financial operations of the various private funds managed by Medley. Prior to joining Medley, Mr. Allorto held various accounting and finance positions at GSC Group, Inc., a registered investment advisor, including, most recently as Chief Financial Officer of a publicly traded business development company that was externally managed by GSC Group. Prior to GSC Group, Mr. Allorto was an Audit Supervisor at Arthur Andersen. Mr. Allorto received a B.S. in Accounting from Seton Hall University and is a licensed CPA.

Mr. Fredericks is the Chief Compliance Officer of the Company. Mr. Fredericks is also the Chief Compliance Officer of Sierra Income Corporation and Sierra Total Return Fund, as well as General Counsel of Medley Management, Inc. Prior to joining Medley, Mr. Fredericks was a partner with Winston & Strawn, LLP, where he was a member of the firm’s restructuring and insolvency and corporate lending groups. Before joining Winston & Strawn, LLP, Mr. Fredericks was a partner with Murphy Sheneman Julian & Rogers and an associate at Murphy, Weir & Butler. Mr. Fredericks was admitted to the California State Bar in 1993. Mr. Fredericks received a BA from the University of California Santa Cruz and a JD from University of San Francisco.

Director Independence

In accordance with rules of the New York Stock Exchange (“NYSE”), our board of directors annually determines each director’s independence. We do not consider a director independent unless the board of directors has determined that he or she has no material relationship with us. We monitor the relationships of our directors and officers through the activities of our Nominating and Corporate Governance Committee and through a questionnaire each director completes no less frequently than annually and updates periodically as information provided in the most recent questionnaire changes.

Our governance guidelines require any director who has previously been determined to be independent to inform the Chairman of the board of directors and the Chairman of the Nominating and Corporate Governance Committee of any change in circumstance that may cause his or her status as an independent director to change. The board of directors limits membership on the Audit Committee and the Nominating and Corporate Governance Committee to independent directors.

In order to evaluate the materiality of any such relationship, the board uses the definition of director independence set forth in the NYSE Listed Company Manual. Section 303A.00 of the NYSE Listed Company Manual provides that business development companies ("BDCs"), such as the Company, are required to comply with all of the provisions of Section 303A applicable to domestic issuers other than Sections 303A.02, the section that defines director independence. Section 303A.00 provides that a director of a BDC shall be considered to be independent if he or she is not an “interested person” of the Company, as defined in Section 2(a)(19) of the 1940 Act. Section 2(a)(19) of the 1940 Act defines an “interested person” to include, among other things, any person who has, or within the last two years had, a material business or professional relationship with the Company.

The board of directors has determined that each of the directors and director nominees is independent and has no material relationship with the Company, except as a director and stockholder of the Company, with the exception of Brook Taube, Seth Taube and Jeff Tonkel. Messrs. Brook Taube, Seth Taube and Jeff Tonkel are interested persons of the Company due to their positions as members of management of MCC Advisors.

Board Leadership Structure

Our board of directors monitors and performs an oversight role with respect to the business and affairs of the Company, including with respect to investment practices and performance, compliance with regulatory requirements and the services, expenses and performance of service providers to the Company. Among other things, our board of directors approves the appointment of our investment adviser and officers, reviews and monitors the services and activities performed by our investment adviser and executive officers and approves the engagement, and reviews the performance of, our independent registered public accounting firm.

Under the Company’s bylaws, our board of directors may designate a Chairman to preside over the meetings of the board of directors and meetings of the stockholders and to perform such other duties as may be assigned to him or her by the board of directors. We do not have a fixed policy as to whether the Chairman of the board of directors should be an independent director and believe that we should maintain the flexibility to select the Chairman and reorganize the leadership structure, from time to time, based on the criteria that is in the best interests of the Company and its stockholders at such times.

Presently, Mr. Brook Taube serves as the Chairman of our board of directors. Mr. Brook Taube is an “interested person” of the Company as defined in Section 2(a)(19) of the 1940 Act because he is Chief Executive Officer and President of the Company, serves on the Investment Committee and is the Managing Member of MCC Advisors. We believe that Mr. Taube’s history with the Company, familiarity with its investment platform, and extensive knowledge of the financial services industry qualify him to serve as the Chairman of our board of directors. We believe that the Company is best served through this existing leadership structure, as Mr. Taube’s relationship with MCC Advisors provides an effective bridge and encourages an open dialogue between management and the board of directors, ensuring that both groups act with a common purpose.

The currently designated lead independent director of our board of directors is Arthur Ainsberg. We are aware of the potential conflicts that may arise when a non-independent director is Chairman of the board of directors, but believe these potential conflicts are offset by our strong corporate governance policies. Our corporate governance policies include regular meetings of the independent directors in executive session without the presence of interested directors and management, the establishment of the Audit Committee and the Nominating and Corporate Governance Committee comprised solely of independent directors, and the appointment of a Chief Compliance Officer, with whom the independent directors meet regularly without the presence of interested directors and other members of management, for administering our compliance policies and procedures.

We recognize that different board leadership structures are appropriate for companies in different situations. We re-examine our corporate governance policies on an ongoing basis to ensure that they continue to meet the Company’s needs.

Board of Directors Role In Risk Oversight

Our board of directors performs its risk oversight function primarily through (a) its three standing committees, which report to the entire board of directors and are comprised solely of independent directors, and (b) active monitoring of our Chief Compliance Officer and our compliance policies and procedures.

As described below in more detail under “Committees of the Board of Directors,” the Audit Committee and the Nominating and Corporate Governance Committee assist the board of directors in fulfilling its risk oversight responsibilities. The Audit Committee’s risk oversight responsibilities include overseeing the Company’s accounting and financial reporting processes, the Company’s systems of internal controls regarding finance and accounting, and audits of the Company’s financial statements. The Nominating and Corporate Governance Committee’s risk oversight

responsibilities include selecting, researching and nominating directors for election by our stockholders, developing and recommending to the board of directors a set of corporate governance principles, and overseeing the evaluation of the board of directors and our management.

Our board of directors also performs its risk oversight responsibilities with the assistance of the Chief Compliance Officer. Every quarter, the board of directors reviews a written report from the Chief Compliance Officer discussing the adequacy and effectiveness of the compliance policies and procedures of the Company and its service providers. The Chief Compliance Officer’s quarterly report addresses the following: (a) the operation of the compliance policies and procedures of the Company and its service providers since the last report; (b) any material changes to such policies and procedures since the last report; (c) any recommendations for material changes to such policies and procedures as a result of the Chief Compliance Officer’s quarterly review; and (d) any compliance matter that has occurred since the date of the last report about which the board of directors would reasonably need to know to oversee our compliance activities and risks. In addition, the Chief Compliance Officer meets separately in executive session with the independent directors at least once each year.

We believe that our board of directors' role in risk oversight is effective and appropriate given the extensive regulation to which we are already subject as a BDC. As a BDC, we are required to comply with certain regulatory requirements that control the levels of risk in our business and operations. For example, our ability to incur indebtedness is limited such that our asset coverage must equal at least 200% immediately after each time we incur indebtedness, we generally have to invest at least 70% of our total assets in “qualifying assets.”

We recognize that different board roles in risk oversight are appropriate for companies in different situations. We re-examine the manner in which the board of directors administers its oversight function on an ongoing basis to ensure that it continues to meet the Company’s needs.

Committees of the Board of Directors

An Audit Committee, a Nominating and Corporate Governance Committee and a Compensation Committee have been established by our board of directors. During the fiscal year of 2017, our board of directors held six board meetings, five Audit Committee meetings, two Nominating and Corporate Governance Committee meeting and one Compensation Committee meeting. All directors attended at least 75% of the aggregate number of meetings of the board of directors and of the respective committees on which they serve. We require each director to make a diligent effort to attend all board and committee meetings as well as each annual meeting of our stockholders.

Audit Committee. The Audit Committee operates pursuant to a charter approved by our board of directors, a copy of which is available on our website at http://www.medleycapitalcorp.com. The charter sets forth the responsibilities of the Audit Committee. The Audit Committee’s responsibilities include selecting the independent registered public accounting firm for the Company, reviewing with such independent registered public accounting firm the planning, scope and results of its audit of the Company’s financial statements, pre-approving the fees for services performed, reviewing with the independent registered public accounting firm the adequacy of internal control systems, reviewing the Company’s annual financial statements and periodic filings and receiving the Company’s audit reports and financial statements. The Audit Committee also establishes guidelines and makes recommendations to our board of directors regarding the valuation of our investments. The Audit Committee is responsible for aiding our board of directors in determining the fair value of debt and equity securities that are not publicly traded or for which current market values are not readily available. The board of directors and the Audit Committee utilize the services of nationally recognized third-party valuation firms to help determine the fair value of these securities. The Audit Committee is currently composed of Messrs. John E. Mack, Arthur S. Ainsberg, and Mark Lerdal and Ms. Karin Hirtler-Garvey. All of them are considered independent under the rules of the NYSE corporate governance listing standards and are not “interested persons” of the Company as that term is defined in Section 2(a)(19) of the 1940 Act. Mr. Mack serves as Chairman of the Audit Committee. Our board of directors has determined that Mr. Mack is an “audit committee financial expert” as that term is defined under Item 407 of Regulation S-K, as promulgated under the Exchange Act. Mr. Mack meets the current independence and experience requirements of Rule 10A-3 of the Exchange Act.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee operates pursuant to a charter approved by our board of directors, a copy of which is available on our website at http://www.medleycapitalcorp.com. The members of the Nominating and Corporate Governance Committee are Messrs. Arthur S. Ainsberg, and John E. Mack and Ms. Karin Hirtler-Garvey. All members of the Nominating and Corporate Governance Committee are considered independent under the rules of the NYSE and are not “interested persons” of the Company as that term is defined in Section 2(a)(19) of the 1940 Act. Mr. Ainsberg serves as Chairman of the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee is responsible for selecting, researching and nominating directors for election by our stockholders, selecting nominees to fill vacancies on the board of directors or a committee thereof, developing and recommending to the board of directors a set of corporate governance principles and overseeing the evaluation of the board of directors and our management. The Nominating and Corporate Governance Committee currently does not consider nominees recommended by our stockholders.

The Nominating and Corporate Governance Committee seeks candidates who possess the background, skills and expertise to make a significant contribution to the board of directors, the Company and its stockholders. In considering possible candidates for election as a director, the Nominating and Corporate Governance Committee takes into account, in addition to such other factors as it deems relevant, the desirability of selecting directors who:

• | are of high character and integrity; |

• | are accomplished in their respective fields, with superior credentials and recognition; |

• | have relevant expertise and experience upon which to be able to offer advice and guidance to management; |

• | have sufficient time available to devote to the affairs of the Company; |

• | are able to work with the other members of the board of directors and contribute to the success of the Company; |

• | can represent the long-term interests of the Company’s stockholders as a whole; and |

• | are selected such that with the other members of the board of directors represent a range of backgrounds and experience. |

The Nominating and Corporate Governance Committee has not adopted a formal policy with regard to the consideration of diversity in identifying director nominees. In determining whether to recommend a director nominee, the Nominating and Corporate Governance Committee considers and discusses diversity, among other factors, with a view toward the needs of the board of directors as a whole. The Nominating and Corporate Governance Committee generally conceptualizes diversity expansively to include, without limitation, concepts such as race, gender, national origin, differences of viewpoint, professional experience, education, skill and other qualities that contribute to the board of directors, when identifying and recommending director nominees. The Nominating and Corporate Governance Committee believes that the inclusion of diversity as one of many factors considered in selecting director nominees is consistent with the Nominating and Corporate Governance Committee’s goal of creating a board of directors that best serves the needs of the Company and the interest of its shareholders.

Compensation Committee. The Compensation Committee operates pursuant to a charter approved by our board of directors, a copy of which is available on our website at http://www.medleycapitalcorp.com. The Compensation Committee is responsible for reviewing and approving the reimbursement by the Company of the compensation of the Company’s Chief Financial Officer and his staff, and the Company’s Chief Compliance Officer and his staff. The current members of the Compensation Committee are Ms. Karin Hirtler-Garvey and Messrs. John E. Mack and Mark Lerdal, none of whom is an interested person of the Company for purposes of the 1940 Act and each of whom is independent for purposes of the NYSE corporate governance listing standards.

Ms. Karin Hirtler-Garvey serves as the Chairman of the Compensation Committee. As discussed below, none of our executive officers are compensated by the Company. The Compensation Committee met one time during the 2017 fiscal year.

Communication with the Board of Directors

Stockholders with questions about the Company are encouraged to contact the Company’s investor relations department. However, if stockholders believe that their questions have not been addressed, they may communicate with the Company’s board of directors by sending their communications to Investor Relations, c/o Medley Capital Corporation, 280 Park Avenue, 6th Floor East, New York, NY 10017. All stockholder communications received in this manner will be delivered to one or more members of the board of directors.

Code of Ethics

The Company has adopted a Code of Ethics which applies to, among others, our senior officers, including our Chief Executive Officer and our Chief Financial Officer, as well as every officer, director, employee and access person (as defined within the Company’s Code of Ethics) of the Company. The Company’s Code of Ethics can be accessed via our website at http://www.medleycapitalcorp.com. The Company intends to disclose any amendments to or waivers from any required provision of the Code of Ethics on Form 8-K.

Compensation of Directors

The following table sets forth compensation of the Company’s directors, for the year ended September 30, 2017:

Name | Fees Earned or Paid in Cash(1) | Stock Awards(2) | All Other Compensation | Total | ||||||||||

Interested Directors | ||||||||||||||

Brook Taube | — | — | — | — | ||||||||||

Seth Taube | — | — | — | — | ||||||||||

Jeff Tonkel | — | — | — | — | ||||||||||

Independent Directors(3) | ||||||||||||||

Arthur S. Ainsberg | $ | 148,000 | — | — | $ | 148,000 | ||||||||

Karin Hirtler-Garvey | $ | 151,000 | — | — | $ | 151,000 | ||||||||

John E. Mack | $ | 165,000 | — | — | $ | 165,000 | ||||||||

Mark Lerdal | $ | 36,202 | — | — | $ | 36,202 | ||||||||

(1) | For a discussion of the independent directors’ compensation, see below. |

(2) | We do not maintain a stock or option plan, non-equity incentive plan or pension plan for our directors. However, our independent directors have the option to receive all or a portion of the directors’ fees to which they would otherwise be entitled in the form of shares of our common stock issued at a price per share equal to the greater of our then current net asset value per share or the market price at the time of payment. No shares were issued to any of our independent directors in lieu of cash during 2017. |

(3) | On June 19, 2017, Mr. Robert Lyons informed the board of directors that he would resign as an independent director of the board, and not stand at the Company's 2018 Annual Meeting of the Stockholders. Therefore, effective June 19, 2017, Mr. Lyons was no longer a member of the board of directors. In connection with his service as a member of the company's board of directors during the fiscal year ended September 30, 2017 (from October 1, 2016 through June 19, 2017), Mr. Lyons received $105,875 in compensation. |

As compensation for serving on our board of directors, each independent director receives an annual fee of $90,000. Independent directors also receive $3,000 plus reimbursement of reasonable out-of-pocket expenses incurred in connection with attending each board meeting and receive $2,500 plus reimbursement of reasonable out-of-pocket expenses incurred in connection with attending each committee meeting. In addition, the Chairman of the Audit Committee receives an annual fee of $25,000 and each chairperson of any other committee receives an annual fee of $10,000, and other members of the Audit Committee and any other standing committees receive an annual fee of $12,500 and $6,000, respectively, for their additional services in these capacities.

Our independent directors also have the option to receive all or a portion of the directors’ fees to which they would otherwise be entitled in the form of shares of our common stock issued at a price per share equal to the greater of our then current net asset value per share or the market price at the time of payment. No shares were issued to any of our independent directors in lieu of cash during the year ended September 30, 2017. In addition, no compensation was paid to directors who are “interested persons” of the Company as that term is defined in Section 2(a)(19) of the 1940 Act.

Compensation of Executive Officers

None of our officers will receive direct compensation from us. The compensation of our Chief Financial Officer and Chief Compliance Officer is paid by our administrator, subject to reimbursement by the Company of an allocable portion of such compensation for services rendered by him to us.

Indemnification Agreements

We have entered into indemnification agreements with our directors. The indemnification agreements are intended to provide our directors the maximum indemnification permitted under Delaware law and the 1940 Act. Each indemnification agreement provides that the Company shall indemnify the director who is a party to the agreement (an “Indemnitee”), including the advancement of legal expenses, if, by reason of his or her corporate status, the Indemnitee is, or is threatened to be, made a party to or a witness in any threatened, pending, or completed proceeding, to the maximum extent permitted by Delaware law and the 1940 Act.

Certain Relationships and Transactions with Related Persons

Investment Management Agreement. We have entered into an Investment Management Agreement with MCC Advisors, our investment adviser. Mr. Brook Taube, our Chairman, Chief Executive Officer and President, is a Managing Partner of, and has financial and controlling interests in, MCC Advisors. In addition, Messrs. Seth Taube and Jeff Tonkel, members of our board of directors, and Mr. Richard T. Allorto, Jr., our Chief Financial Officer, serve as Managing Partners and Chief Financial Officer, respectively, for MCC Advisors. Messrs. Seth Taube, Jeff Tonkel and Richard T. Allorto, Jr. also have financial interests in MCC Advisors.

Co-Investment Opportunities. MCC Advisors and its affiliates may also manage other funds in the future that may have investment mandates that are similar, in whole or in part, with ours. MCC Advisors also focuses on investing primarily in senior secured loans, including first lien, unitranche and second lien debt instruments. MCC Advisors and its affiliates may determine that an investment is appropriate for us and for one or more of its affiliated funds. In such event, depending on the availability of such investment and other appropriate factors, MCC Advisors or its affiliates may determine that we should co-invest with one or more other funds. The Company obtained an exemptive order from the SEC on November 25, 2013 (the “Prior Exemptive Order”). On March 29, 2017, the Company, MCC Advisors and certain other affiliated funds and investment advisers received an exemptive order (the “Exemptive Order”) that supersedes the Prior Exemptive Order and allows affiliated registered investment companies to participate in co-investment transactions with us that would otherwise have been prohibited under Section 17(d) and 57(a)(4) of the 1940 Act and Rule 17d-1 thereunder. On October 4, 2017, the Company, MCC Advisors and certain of our affiliates received an exemptive order that supersedes the Exemptive Order (the “New Exemptive Order”) and allows, in addition to the entities already covered by the Exemptive Order, Medley LLC and its subsidiary, Medley Capital LLC, to the extent they hold financial assets in a principal capacity, and any direct or indirect, wholly- or majority-owned subsidiary of Medley LLC that is formed in the future, to participate in co-investment transactions with us that would otherwise be prohibited by either or both of Sections 17(d) and 57(a)(4) of the 1940 Act. The terms of the New Exemptive Order

are otherwise substantially similar to the Exemptive Order. Co-investment under the Exemptive Order is subject to certain conditions, including the condition that, in the case of each co-investment transaction, our board of directors determines that it would to be in our best interest to participate in the transaction. However, neither we nor the affiliated funds are obligated to invest or co-invest when investment opportunities are referred to us or them.

We may, however, co-invest with MCC Advisors and its affiliates’ other clients in certain circumstances where doing so is consistent with applicable law and SEC staff interpretations and MCC Advisors’ allocation policy. For example, we may co-invest with such accounts consistent with guidance promulgated by the SEC staff permitting us and such other accounts to purchase interests in a single class of privately placed securities so long as certain conditions are met, including that MCC Advisors, acting on our behalf and on behalf of other clients, negotiates no term other than price.

License Agreement. We have entered into a License Agreement with Medley Capital LLC, pursuant to which Medley Capital LLC has agreed to grant us a non-exclusive, royalty-free license to use the name “Medley.” In addition, pursuant to the terms of an Administration Agreement, MCC Advisors provides us with the office facilities and administrative services necessary to conduct our day-to-day operations.

Section 16(a) Beneficial Ownership Reporting Compliance

Pursuant to Section 16(a) of the Exchange Act, the Company’s directors and executive officers, and any persons holding more than 10% of its common stock, are required to report their beneficial ownership and any changes therein to the SEC and the Company. Specific due dates for those reports have been established, and the Company is required to report herein any failure to file such reports by those due dates. Based solely on a review of the copies of such reports and written representations delivered to the Company by such persons, we believe that there were no violations of Section 16(a) by such persons during the Company’s fiscal year ended September 30, 2017.

PROPOSAL II: RATIFICATION OF APPOINTMENT

OF ERNST & YOUNG LLP AS OUR INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM FOR THE 2018 FISCAL YEAR

OF ERNST & YOUNG LLP AS OUR INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM FOR THE 2018 FISCAL YEAR

The Audit Committee and the independent directors of the board of directors have appointed Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2018, subject to ratification or rejection by the stockholders of the Company.

Ernst & Young LLP has advised us that neither the firm nor any present member or associate of it has any material financial interest, direct or indirect, in the Company or its affiliates. It is expected that a representative of Ernst & Young LLP will be present at the Meeting and will have an opportunity to make a statement if he or she chooses and will be available to answer questions.

The following table (in thousands) displays fees for professional services by Ernst & Young LLP for the fiscal years ended September 30, 2017 and 2016:

Fiscal Year Ended September 30, 2017 | Fiscal Year Ended September 30, 2016 | |||||||

Audit Fees | $ | 994 | $ | 1,189 | ||||

Audit Related Fees | — | — | ||||||

Tax Fees | 66 | 59 | ||||||

All Other Fees | — | — | ||||||

$ | 1,060 | $ | 1,248 | |||||

Audit Fees: Audit fees include fees for services that normally would be provided by Ernst & Young LLP in connection with statutory and regulatory filings or engagements and that generally only an independent registered

public accounting firm can provide. In addition to fees for the audit of our annual financial statements, the audit of the effectiveness of our internal control over financial reporting and the review of our quarterly financial statements in accordance with standards of the Public Company Accounting Oversight Board (United States) (“PCAOB”), this category contains fees for comfort letters, statutory audits, consents, and assistance with and review of documents filed with the SEC.

Audit-Related Fees: Audit-related services consist of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements and are not reported under “Audit Fees.” These services include attest services that are not required by statute or regulation and consultations concerning financial accounting and reporting standards.

Tax Services Fees: Tax services fees consist of fees billed for professional tax services. These services also include assistance regarding federal, state and local tax compliance.

All Other Fees: Other fees would include fees for products and services other than the services reported above.

Audit Committee Report

The Audit Committee operates under a written charter adopted by our board of directors. The Audit Committee is currently composed of Messrs. John E. Mack, Arthur S. Ainsberg, and Mark Lerdal and Ms. Karin Hirtler-Garvey, each of whom is an independent director.

Management is responsible for the Company’s internal control over financial reporting and the financial reporting process. The Company’s independent registered public accounting firm is responsible for performing an audit of the Company’s financial statements in accordance with standards of the PCAOB, and expressing an opinion on the conformity of the Company’s financial statements to U.S. generally accepted accounting principles (“GAAP”). The Audit Committee’s responsibility is to monitor and oversee these processes. The Audit Committee is also directly responsible for the appointment, compensation and oversight of the Company’s independent registered public accounting firm.

Pre-Approval Policy

The Audit Committee has established a pre-approval policy that describes the permitted audit, audit-related, tax and other services to be provided by Ernst & Young LLP, the Company’s independent registered public accounting firm. The policy requires that the Audit Committee pre-approve the audit and non-audit services performed by the independent registered public accounting firm in order to assure that the provision of such services does not impair the firm’s independence.

Any requests for audit, audit-related, tax and other services that have not received general pre-approval must be submitted to the Audit Committee for specific pre-approval, irrespective of the amount, and cannot commence until such approval has been granted. Normally, pre-approval is provided at regularly scheduled meetings of the Audit Committee. However, the Audit Committee may delegate pre-approval authority to one or more of its members. The member or members to whom such authority is delegated must report any pre-approval decisions to the Audit Committee at its next scheduled meeting. The Audit Committee does not delegate its responsibilities to pre-approve services performed by the independent registered public accounting firm to management.

Review with Management

The Audit Committee has reviewed, and discussed with management, the Company’s audited financial statements. Management has represented to the Audit Committee that the Company’s financial statements were prepared in accordance with GAAP.

Review and Discussion with Independent Registered Public Accounting Firm

The Audit Committee reviewed and discussed the Company’s audited financial statements with management and Ernst & Young LLP, the Company’s independent registered public accounting firm, with and without management present. The Audit Committee included results of Ernst & Young LLP’s audits, the Company’s internal controls, and the quality of the Company’s financial reporting. The Audit Committee also reviewed the Company’s procedures and internal control processes designed to ensure full, fair and adequate financial reporting and disclosures, including procedures for certifications by the Company’s Chief Executive Officer and Chief Financial Officer that are required in periodic reports filed by the Company with the SEC. The Audit Committee concluded that the Company’s internal control system is adequate and that the Company employs appropriate accounting and auditing procedures.

The Audit Committee also discussed with Ernst & Young LLP matters relating to Ernst & Young LLP’s judgments about the quality, as well as the acceptability, of the Company’s accounting principles as applied in its financial reporting and as required by PCAOB Auditing Standard AS1301, Communications with Audit Committees. In addition, the Audit Committee has discussed with Ernst & Young LLP its independence from management and the Company, as well as the matters in the written disclosures received from Ernst & Young LLP and required by PCAOB Rule 3520 (Auditor Independence). The Audit Committee received a letter from Ernst & Young LLP confirming its independence and discussed it with them. The Audit Committee discussed and reviewed with Ernst & Young LLP the Company’s critical accounting policies and practices, internal controls, other material written communications to management, and the scope of Ernst & Young LLP’s audits and all fees paid to Ernst & Young LLP during the fiscal year. The Audit Committee has adopted guidelines requiring review and pre-approval by the Audit Committee of audit and non-audit services performed by Ernst & Young LLP for the Company. The Audit Committee has reviewed and considered the compatibility of Ernst & Young LLP’s performance of non-audit services with the maintenance of Ernst & Young LLP’s independence as the Company’s independent registered public accounting firm.

Conclusion

Based on the Audit Committee’s review and discussions with management and the independent registered public accounting firm referred to above, the Audit Committee’s review of the Company’s audited financial statements, the representations of management and the report of Ernst & Young LLP to the Audit Committee, the Audit Committee recommended to the board of directors that the audited financial statements as of and for the year ended September 30, 2017, be included in the Company’s Annual Report on Form 10-K for the year ended September 30, 2017, for filing with the SEC. The Audit Committee also recommended the selection of Ernst & Young LLP to serve as the independent registered public accounting firm of the Company for the year ending September 30, 2018.

Respectfully Submitted,

The Audit Committee

The Audit Committee

John E. Mack

Arthur S. Ainsberg

Mark Lerdal

Karin Hirtler-Garvey

Arthur S. Ainsberg

Mark Lerdal

Karin Hirtler-Garvey

Required Vote