Form 8-K CIENA CORP For: Dec 07

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 | ||

FORM 8‑K | ||

CURRENT REPORT Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | ||

Date of report (Date of earliest event reported): December 7, 2017 | ||

Ciena Corporation (Exact Name of Registrant as Specified in Its Charter) | ||

Delaware (State or Other Jurisdiction of Incorporation) | ||

001-36250 | 23-2725311 | |

(Commission File Number) | (IRS Employer Identification No.) | |

7035 Ridge Road, Hanover, MD | 21076 | |

(Address of Principal Executive Offices) | (Zip Code) | |

(410) 694-5700 | ||

(Registrant's Telephone Number, Including Area Code) | ||

Not Applicable | ||

(Former Name or Former Address, if Changed Since Last Report) | ||

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | ||

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||

ITEM 2.02 – RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On December 7, 2017, Ciena Corporation ("Ciena") issued a press release announcing its financial results for its fourth quarter ended October 31, 2017. The text of the press release is furnished as Exhibit 99.1 to this Report. As discussed in this press release, Ciena will be hosting an investor call to discuss its results of operations for its fourth quarter ended October 31, 2017.

In conjunction with the issuance of this press release, Ciena posted to the quarterly results page of the Investors section of www.ciena.com an audio recording of management commentary providing greater context for Ciena's performance to date and its strategy, as well as certain long-term financial targets, and an accompanying investor presentation. A transcript of the recording and related investor presentation are furnished as Exhibits 99.2 and 99.3 to this Report.

The information in Exhibits 99.1, 99.2 and 99.3 and Item 2.02 of this Report shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, and shall not be incorporated by reference into any registration statement pursuant to the Securities Act of 1933, as amended. Investors are encouraged to review the “Investors” page of our website at www.ciena.com because, as with the other disclosure channels that we use, from time to time we may post material information exclusively on that site.

ITEM 8.01 – OTHER EVENTS

On December 7, 2017, Ciena announced that its Board of Directors has authorized a program to repurchase up to $300 million of the company’s common stock through the end of fiscal 2020. Ciena may purchase shares at management’s discretion in the open market, in privately negotiated transactions, in transactions structured through investment banking institutions, or a combination of the foregoing. Ciena may also, from time to time, enter into Rule 10b5-1 plans to facilitate repurchases of its shares under this authorization. The amount and timing of repurchases are subject to a variety of factors including liquidity, cash flow, stock price, and general business and market conditions. The program may be modified, suspended or discontinued at any time.

The text of the press release is attached as Exhibit 99.4 to this Report.

ITEM 9.01 – FINANCIAL STATEMENTS AND EXHIBITS

(d) | The following exhibit is being filed herewith: | |||

Exhibit Number | Description of Document | |||

Exhibit 99.1 | ||||

Exhibit 99.2 | ||||

Exhibit 99.3 | ||||

Exhibit 99.4 | ||||

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized. |

Ciena Corporation | ||

Date: December 7, 2017 | By: | /S/ James E. Moylan, Jr. |

James E. Moylan, Jr. | ||

Senior Vice President and Chief Financial Officer | ||

FOR IMMEDIATE RELEASE

Ciena Reports Fiscal Fourth Quarter 2017 and Year-End Financial Results

HANOVER, Md. - December 7, 2017 - Ciena® Corporation (NYSE: CIEN), a network strategy and technology company, today announced unaudited financial results for its fiscal fourth quarter and year ended October 31, 2017.

“Our fourth quarter and fiscal 2017 results reinforce our continued ability to adapt to changing market conditions by growing revenue and expanding profitability as we outperform the industry,” said Gary B. Smith, president and CEO, Ciena. “We are confident that our long-term strategy to scale and diversify our existing business and to expand our addressable market will enable us to continue to grow and generate cash.”

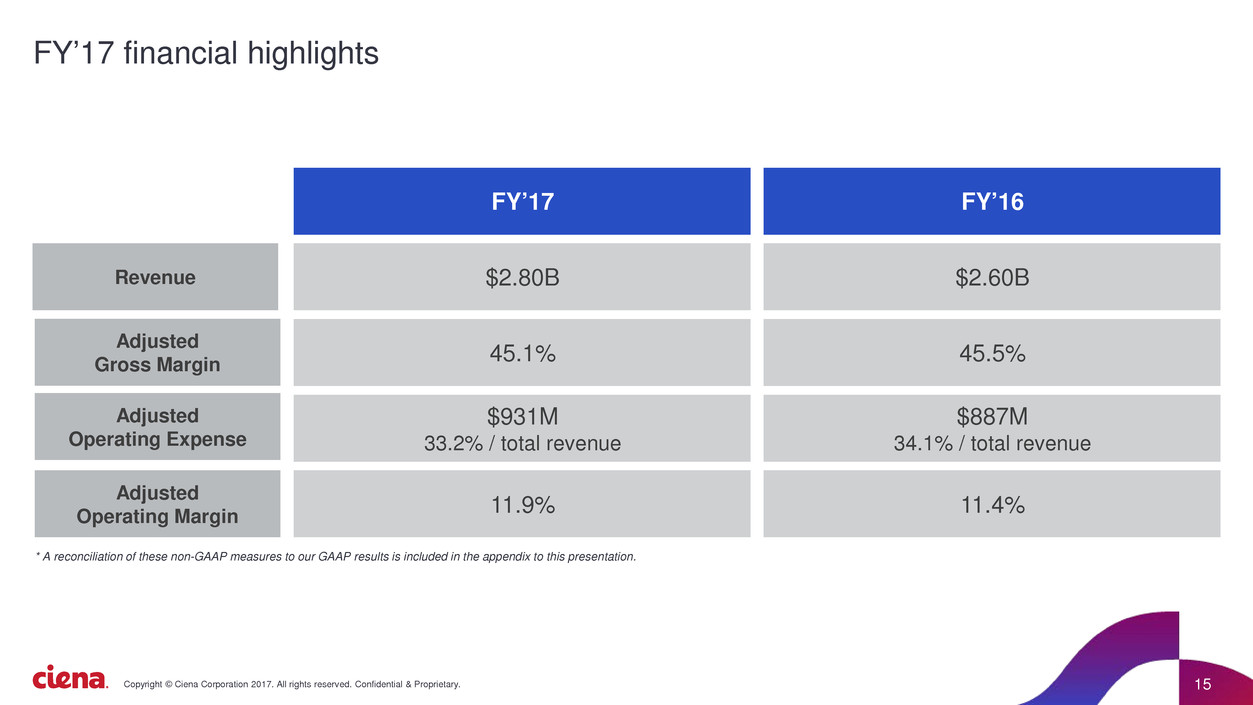

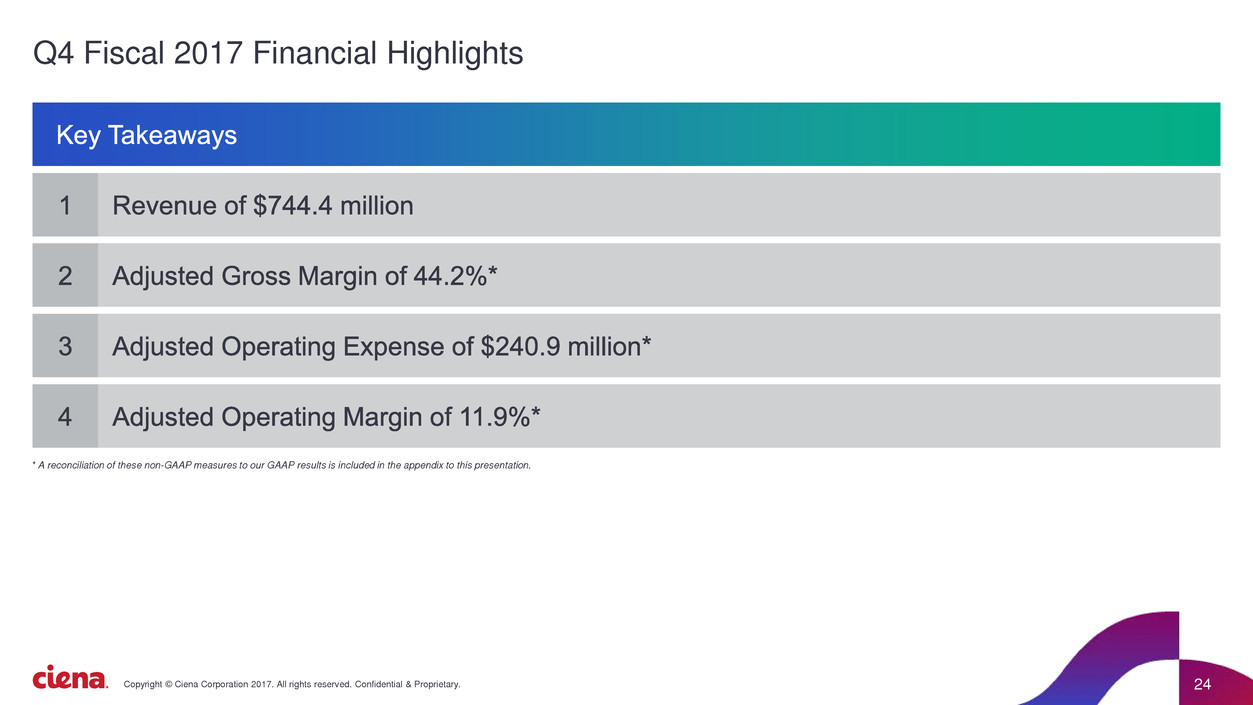

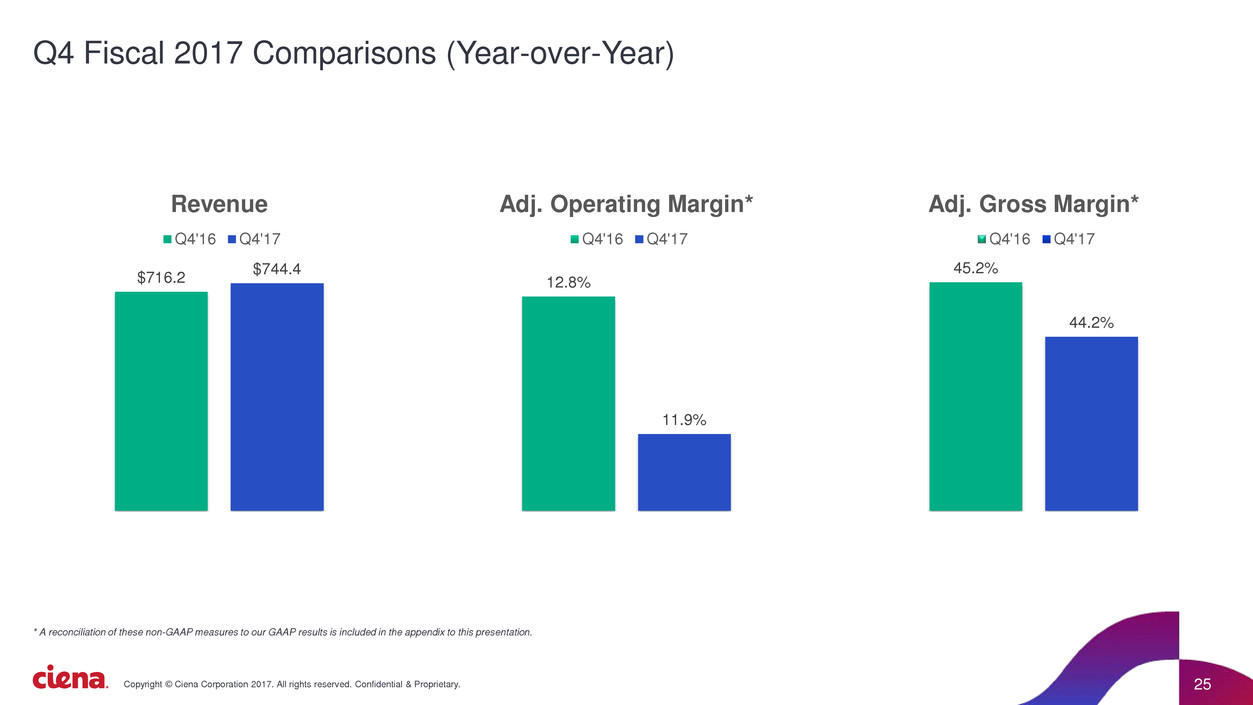

For the fiscal fourth quarter 2017, Ciena reported revenue of $744.4 million as compared to $716.2 million for the fiscal fourth quarter 2016. For fiscal year 2017, Ciena reported revenue of $2.80 billion, as compared to $2.60 billion for fiscal year 2016.

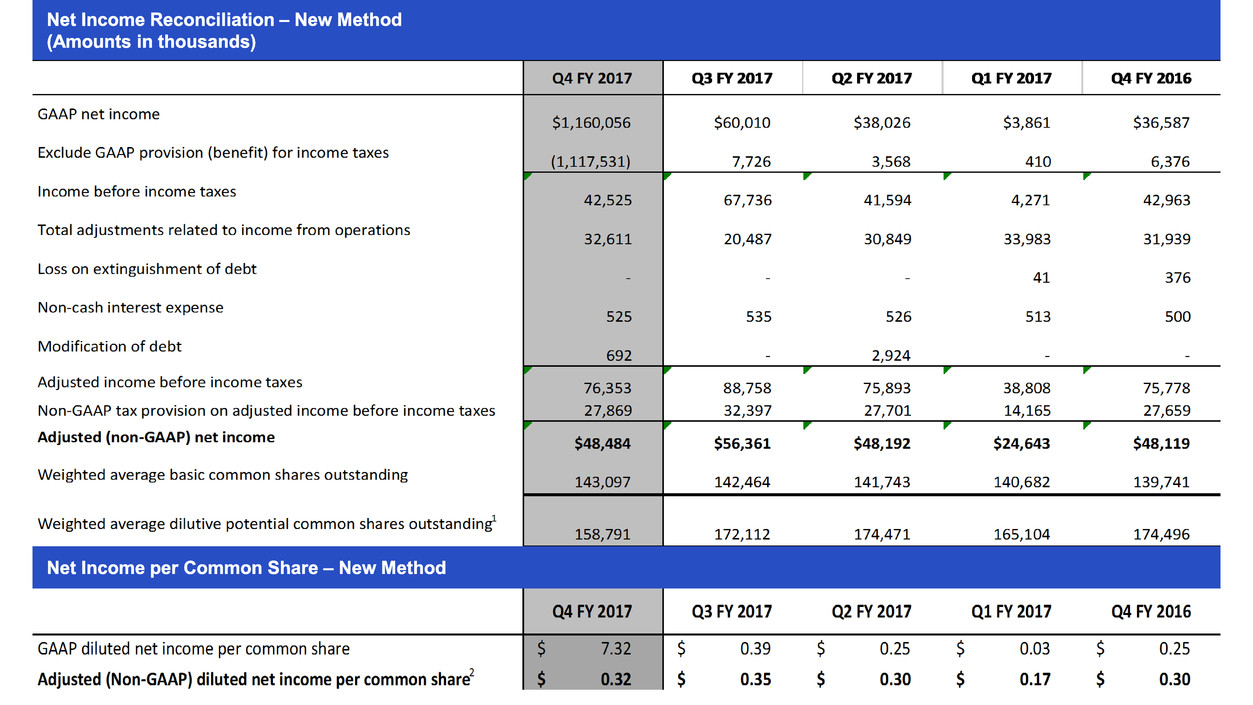

Ciena's fiscal fourth quarter and fiscal year 2017 results reflect a tax benefit of $1.13 billion related to the reversal of a deferred tax asset valuation allowance. As a result, on the basis of generally accepted accounting principles (GAAP), Ciena's net income for the fiscal fourth quarter 2017 was $1.16 billion, or $7.32 per diluted common share, which compares to a GAAP net income of $36.6 million, or $0.25 per diluted common share, for the fiscal fourth quarter 2016. For fiscal year 2017, Ciena had a GAAP net income of $1.26 billion, or $7.53 per diluted common share, which compares to a GAAP net income of $72.6 million or $0.51 per diluted common share for fiscal year 2016.

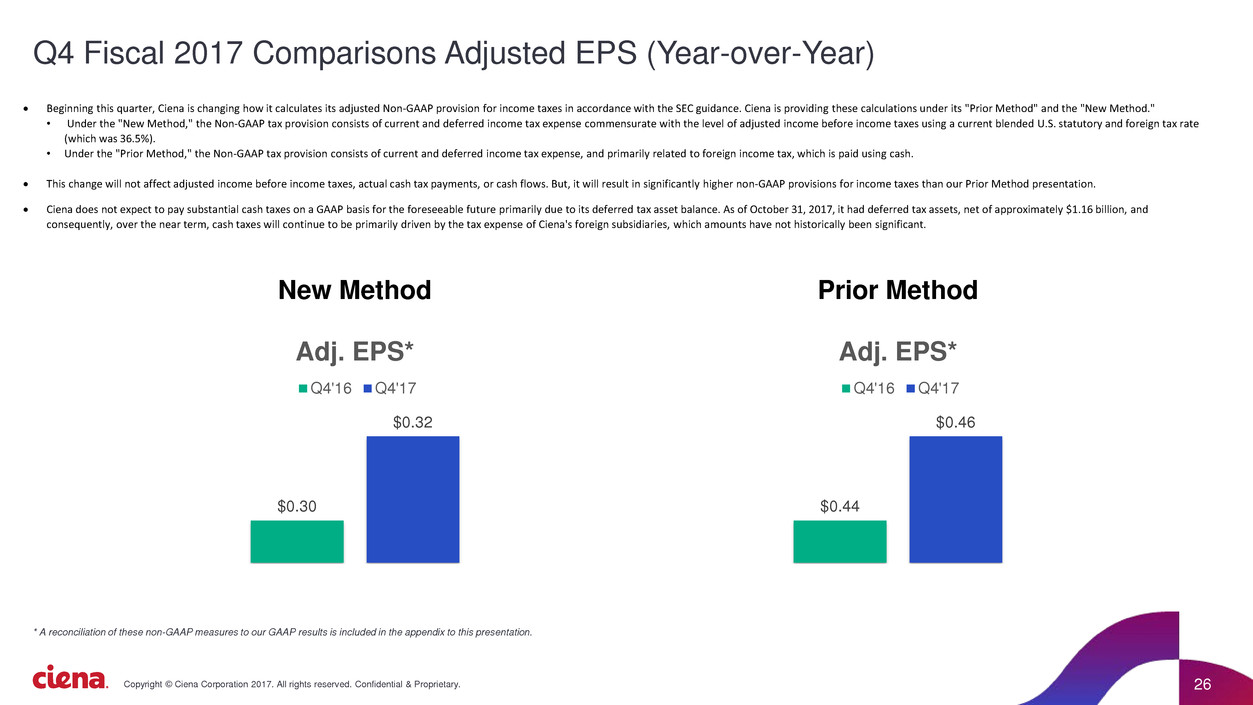

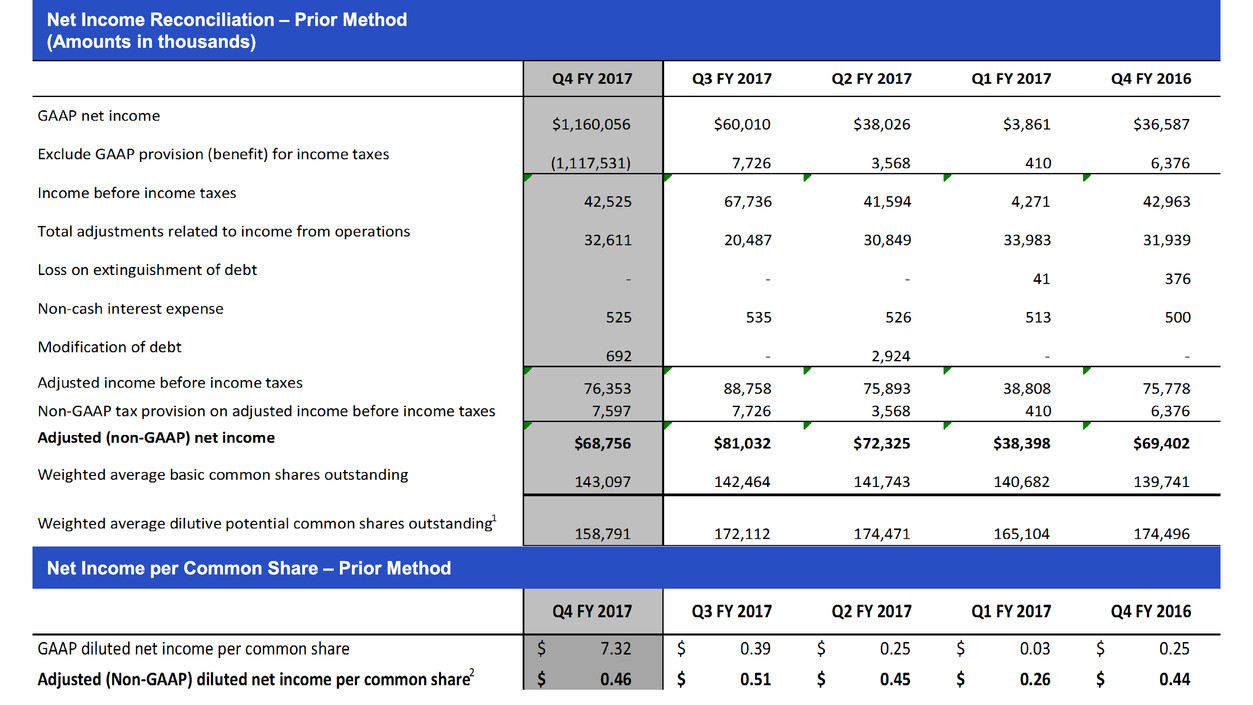

Consistent with Ciena's historical non-GAAP presentation ("Prior Method"), Ciena's adjusted (non-GAAP) net income for the fiscal fourth quarter 2017 was $68.8 million, or $0.46 per diluted common share, which compares to an adjusted (non-GAAP) net income of $69.4 million, or $0.44 per diluted common share, for the fiscal fourth quarter 2016. For fiscal year 2017, Ciena's adjusted (non-GAAP) net income was $260.5 million, or $1.68 per diluted common share, as compared to an adjusted (non-GAAP) net income of $214.6 million, or $1.38 per diluted common share for fiscal year 2016.

Beginning this quarter, Ciena is changing how it calculates its adjusted (non-GAAP) provision for income taxes in accordance with the SEC's interpretive guidance on non-GAAP financial measures. In order to assist investors in understanding the change, Ciena is providing its calculations of adjusted (non-GAAP) net income under its "Prior Method" and the "New Method" in Appendix B. Under the "New Method," the Non-GAAP tax provision consists of current and deferred income tax expense commensurate with the level of adjusted (non-GAAP) income before income taxes using a current blended U.S. and foreign statutory tax rate (which was 36.5%). Under the "Prior Method," the Non-GAAP tax provision consisted of current and deferred income tax expense, primarily related to

foreign income tax, which is paid using cash. This change in calculation methodology will not affect Ciena's adjusted (non-GAAP) income before income taxes, actual cash tax payments, or cash flows, but will result in significantly higher non-GAAP provisions for income taxes than our "Prior Method" presentation. However, Ciena does not expect to pay substantial cash taxes for the foreseeable future primarily due to its deferred tax asset balance. As of October 31, 2017, Ciena has deferred tax assets, net, of approximately $1.16 billion and, consequently, over the near term Ciena's cash taxes will continue to be primarily driven by the tax expense of its foreign subsidiaries, which amounts have not historically been significant.

Ciena's adjusted "New Method" (non-GAAP) net income for the fiscal fourth quarter 2017 was $48.5 million, or $0.32 per diluted common share, which compares to an adjusted (non-GAAP) net income of $48.1 million, or $0.30 per diluted common share, for the fiscal fourth quarter 2016. For fiscal year 2017, Ciena's adjusted (non-GAAP) net income was $177.7 million, or $1.14 per diluted common share, as compared to an adjusted (non-GAAP) net income of $145.3 million or $0.93 per diluted common share for fiscal year 2016.

Authorization of Share Repurchase Program

In a separate press release today, Ciena announced that its Board of Directors has authorized a program to repurchase up to $300 million of the company’s common stock through the end of fiscal 2020.

Supplemental Materials and Live Web Broadcast of Unaudited Fiscal Fourth Quarter 2017 Results

Today, Thursday, December 7, 2017, in conjunction with the issuance of this press release, Ciena has posted to the quarterly results page of the Investors section of www.ciena.com an audio recording of management commentary that provides greater context for Ciena's performance to date and its strategy, as well as certain long-term financial targets. Ciena has also posted a transcript of the recording and a related investor presentation to this page. Consistent with past practice, Ciena’s management will host a discussion with investors and financial analysts of its unaudited fiscal fourth quarter 2017 results and fiscal first quarter 2018 outlook. The live audio web broadcast beginning at 8:30 a.m. Eastern will be accessible via www.ciena.com. An archived replay of the live broadcast will be available shortly following its conclusion on the Investor Relations page of Ciena's website at www.ciena.com/investors.

Fiscal Fourth Quarter 2017 Performance Summary

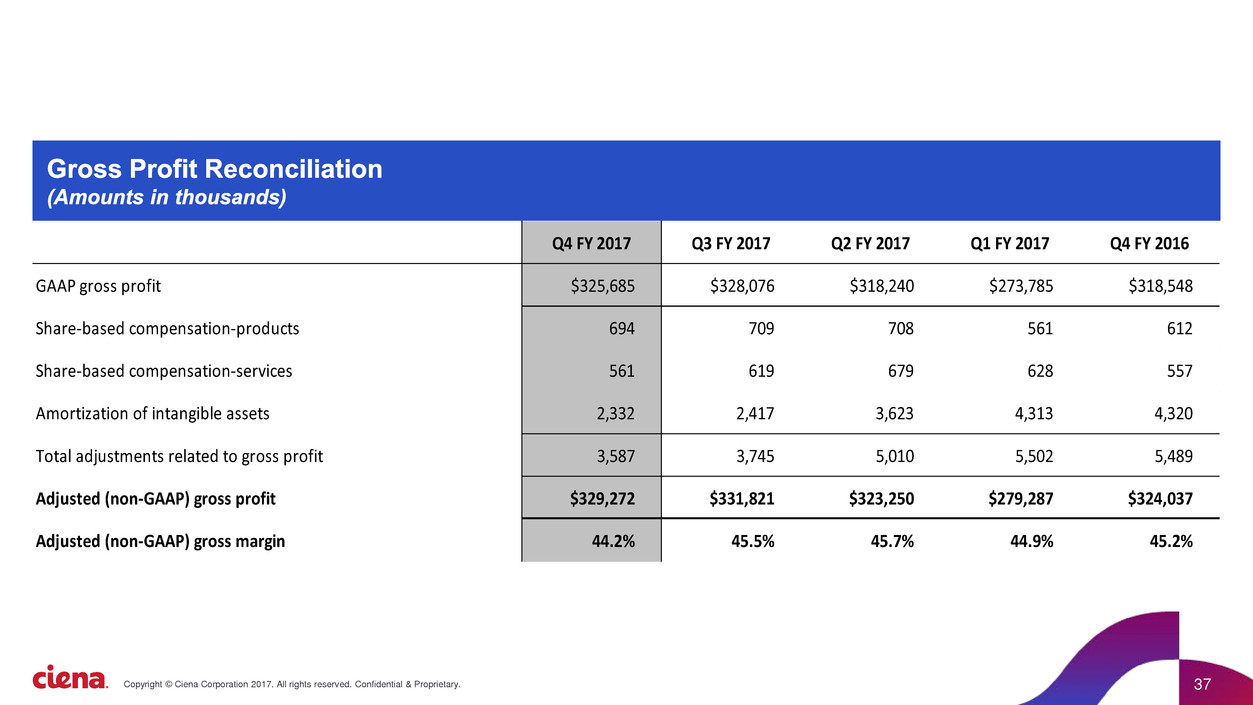

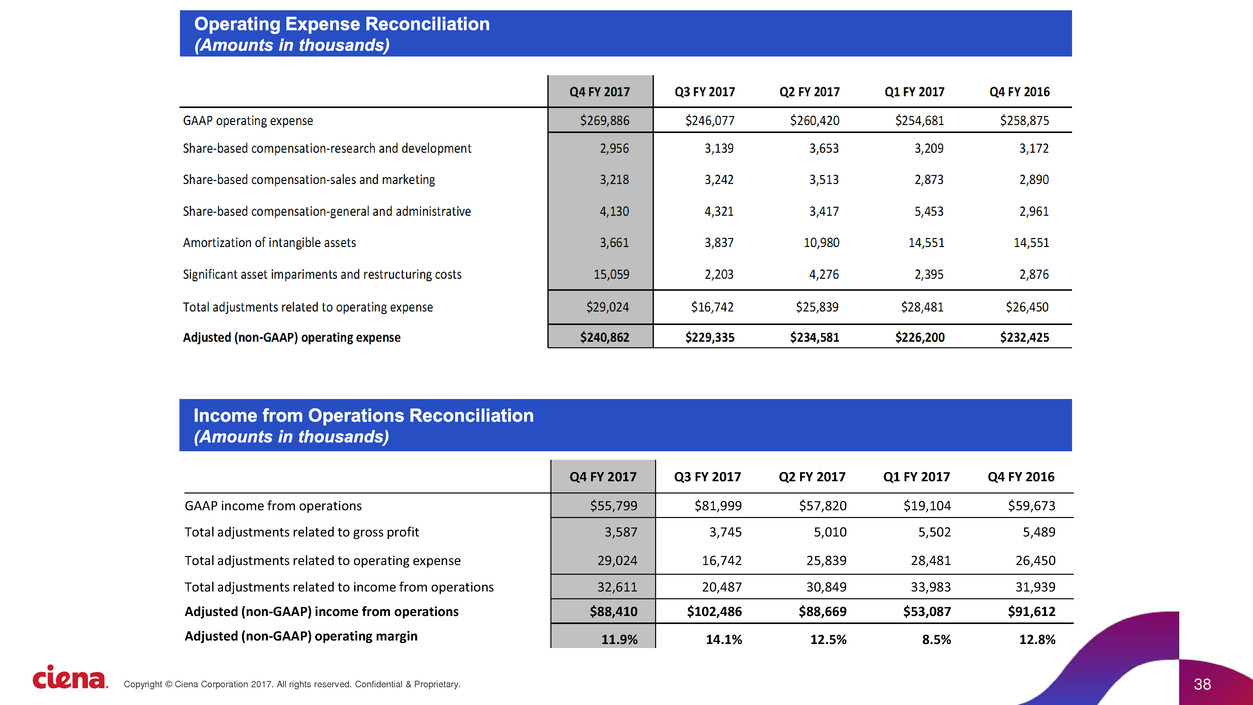

The tables below (in millions, except percentage data) provide comparisons of certain quarterly results to prior periods, including sequential quarterly and year over year changes. A reconciliation between the GAAP and adjusted (non-GAAP) measures contained in this release is included in Appendix A and B to this release.

GAAP Results (unaudited) | ||||||||||||||||||

Q4 | Q3 | Q4 | Period Change | |||||||||||||||

FY 2017 | FY 2017 | FY 2016 | Q-T-Q* | Y-T-Y* | ||||||||||||||

Revenue | $ | 744.4 | $ | 728.7 | $ | 716.2 | 2.2 | % | 3.9 | % | ||||||||

Gross margin | 43.7 | % | 45.0 | % | 44.5 | % | (1.3 | )% | (0.8 | )% | ||||||||

Operating expense | $ | 269.9 | $ | 246.1 | $ | 258.9 | 9.7 | % | 4.2 | % | ||||||||

Operating margin | 7.5 | % | 11.3 | % | 8.3 | % | (3.8 | )% | (0.8 | )% | ||||||||

Non-GAAP Results (unaudited) | ||||||||||||||||||

Q4 | Q3 | Q4 | Period Change | |||||||||||||||

FY 2017 | FY 2017 | FY 2016 | Q-T-Q* | Y-T-Y* | ||||||||||||||

Revenue | $ | 744.4 | $ | 728.7 | $ | 716.2 | 2.2 | % | 3.9 | % | ||||||||

Adj. gross margin | 44.2 | % | 45.5 | % | 45.2 | % | (1.3 | )% | (1.0 | )% | ||||||||

Adj. operating expense | $ | 240.9 | $ | 229.3 | $ | 232.4 | 5.1 | % | 3.7 | % | ||||||||

Adj. operating margin | 11.9 | % | 14.1 | % | 12.8 | % | (2.2 | )% | (0.9 | )% | ||||||||

* Denotes % change, or in the case of margin, absolute change

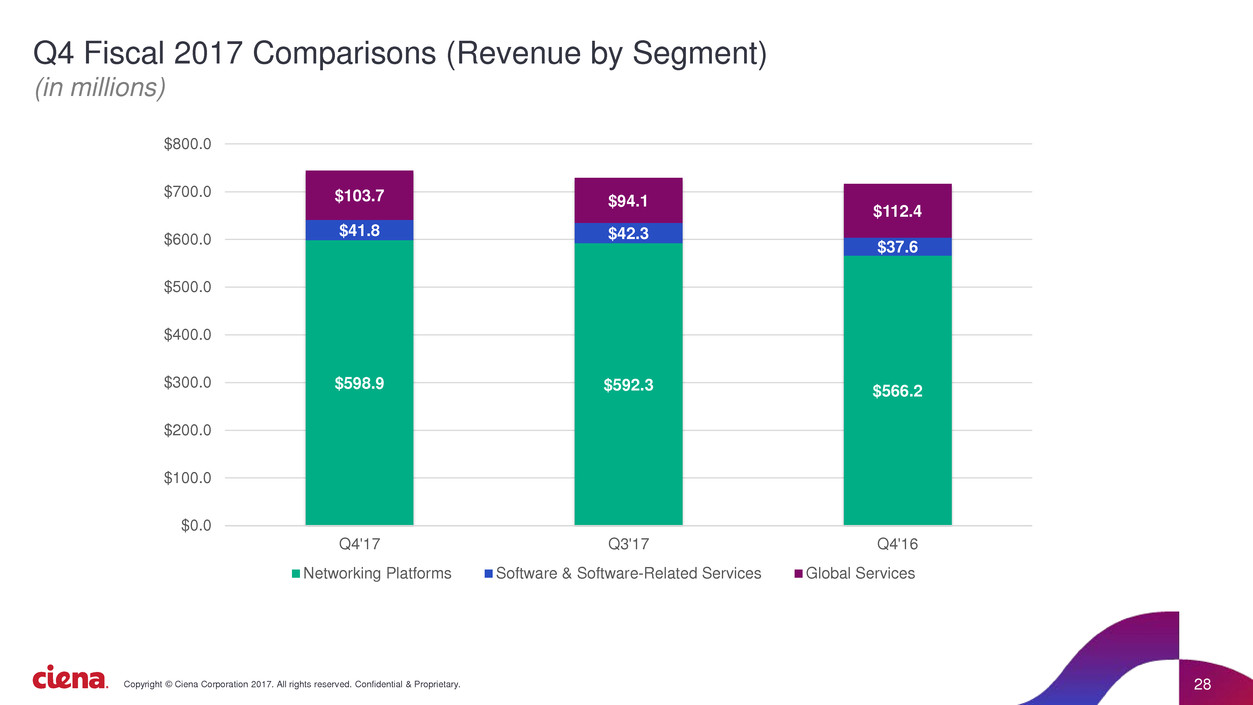

Revenue by Segment (unaudited) | ||||||||||||||||||

Q4 FY 2017 | Q3 FY 2017 | Q4 FY 2016 | ||||||||||||||||

Revenue | % | Revenue | % | Revenue | % | |||||||||||||

Networking Platforms | ||||||||||||||||||

Converged Packet Optical | $ | 504.7 | 67.8 | $ | 506.5 | 69.5 | $ | 488.0 | 68.1 | |||||||||

Packet Networking | 92.5 | 12.5 | 82.1 | 11.3 | 72.4 | 10.1 | ||||||||||||

Optical Transport | 1.7 | 0.2 | 3.7 | 0.5 | 5.8 | 0.8 | ||||||||||||

Total Networking Platforms | 598.9 | 80.5 | 592.3 | 81.3 | 566.2 | 79.0 | ||||||||||||

Software and Software-Related Services | ||||||||||||||||||

Software Platforms | 17.3 | 2.3 | 18.4 | 2.5 | 16.3 | 2.3 | ||||||||||||

Software-Related Services | 24.5 | 3.3 | 23.9 | 3.3 | 21.3 | 3.0 | ||||||||||||

Total Software and Software-Related Services | 41.8 | 5.6 | 42.3 | 5.8 | 37.6 | 5.3 | ||||||||||||

Global Services | ||||||||||||||||||

Maintenance Support and Training | 56.2 | 7.5 | 57.9 | 7.9 | 59.8 | 8.3 | ||||||||||||

Installation and Deployment | 33.5 | 4.5 | 27.4 | 3.8 | 38.6 | 5.4 | ||||||||||||

Consulting and Network Design | 14.0 | 1.9 | 8.8 | 1.2 | 14.0 | 2.0 | ||||||||||||

Total Global Services | 103.7 | 13.9 | 94.1 | 12.9 | 112.4 | 15.7 | ||||||||||||

Total | $ | 744.4 | 100.0 | $ | 728.7 | 100.0 | $ | 716.2 | 100.0 | |||||||||

Additional Performance Metrics for Fiscal Fourth Quarter 2017

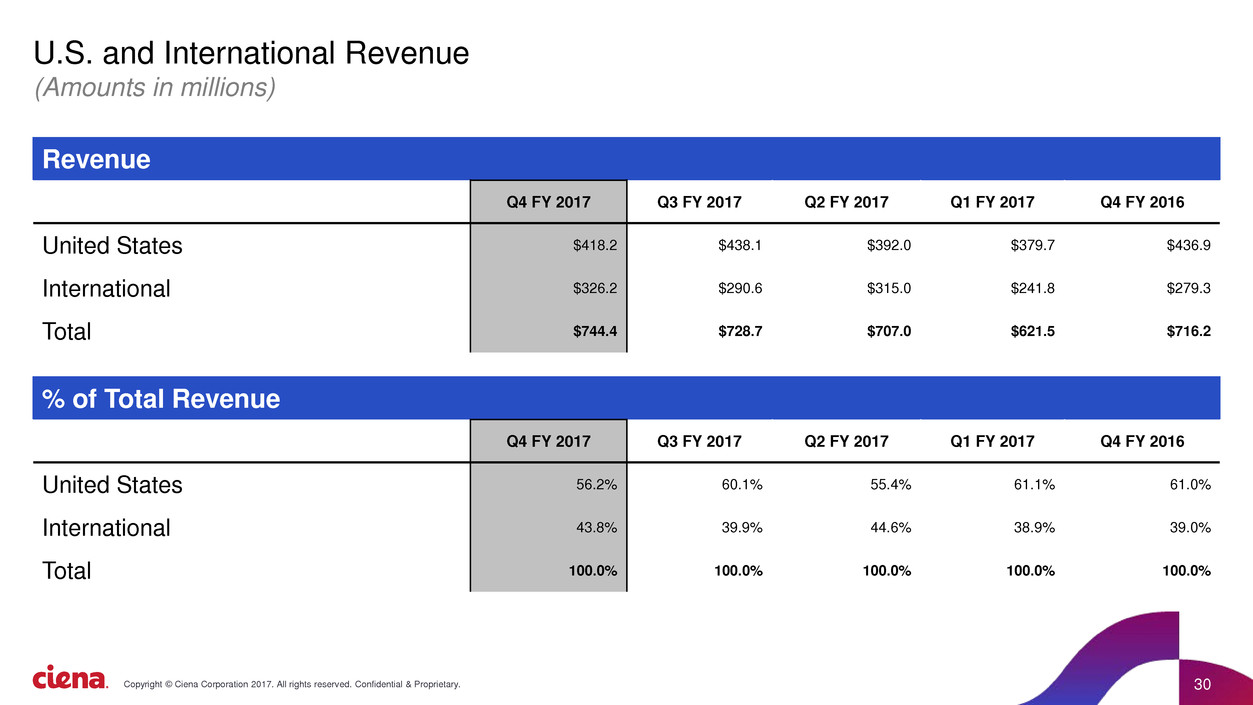

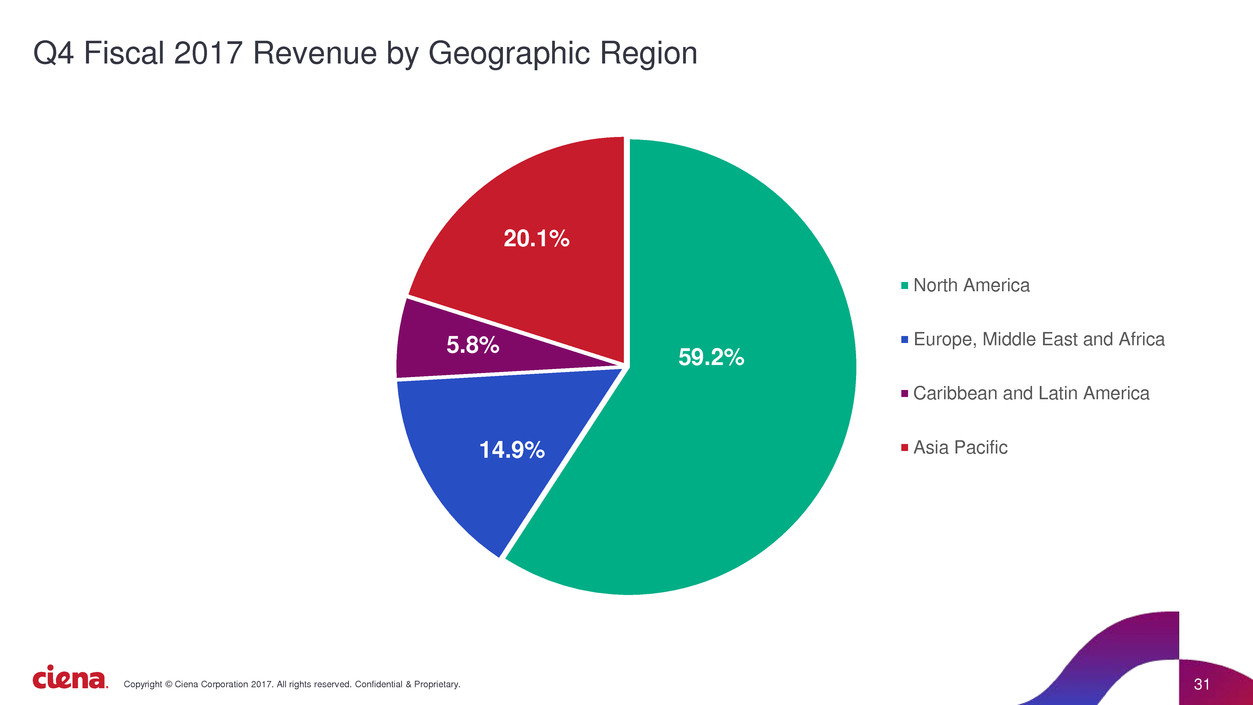

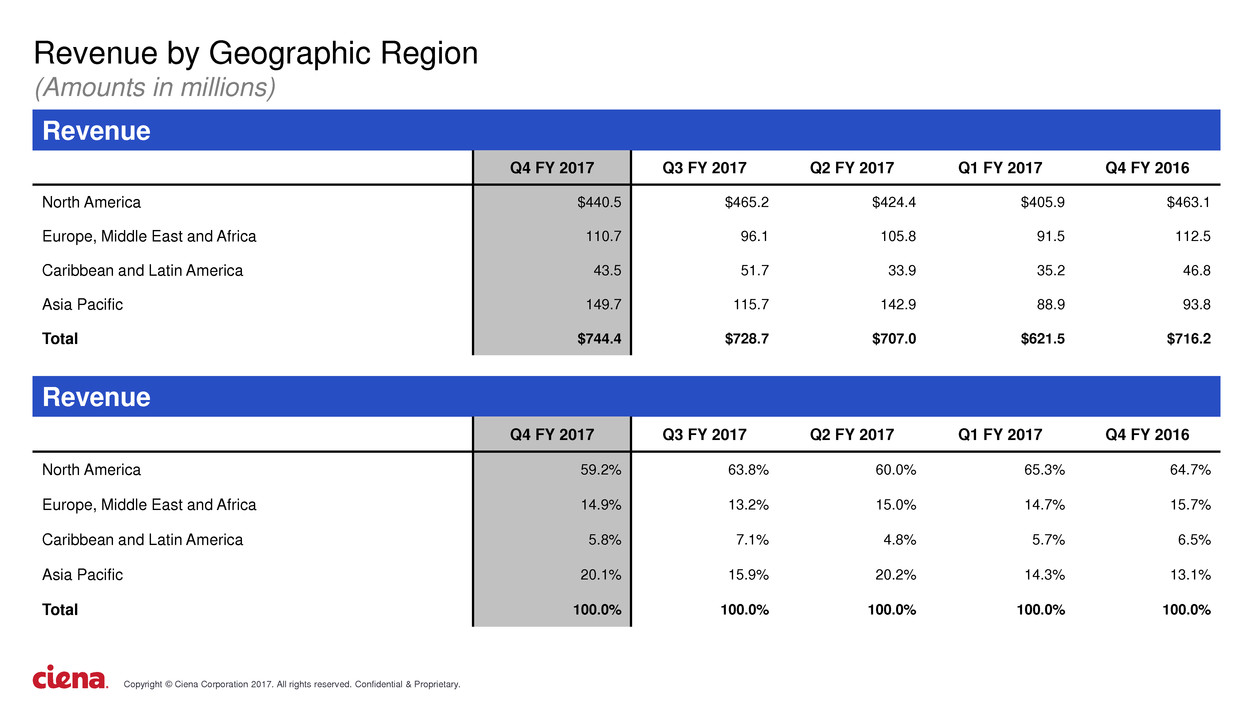

Revenue by Geographic Region (unaudited) | ||||||||||||||||||

Q4 FY 2017 | Q3 FY 2017 | Q4 FY 2016 | ||||||||||||||||

Revenue | % | Revenue | % | Revenue | % | |||||||||||||

North America | $ | 440.5 | 59.2 | $ | 465.2 | 63.8 | $ | 463.1 | 64.7 | |||||||||

Europe, Middle East and Africa | 110.7 | 14.9 | 96.1 | 13.2 | 112.5 | 15.7 | ||||||||||||

Caribbean and Latin America | 43.5 | 5.8 | 51.7 | 7.1 | 46.8 | 6.5 | ||||||||||||

Asia Pacific | 149.7 | 20.1 | 115.7 | 15.9 | 93.8 | 13.1 | ||||||||||||

Total | $ | 744.4 | 100.0 | $ | 728.7 | 100.0 | $ | 716.2 | 100.0 | |||||||||

• | U.S. customers contributed 56% of total revenue |

• | Two 10%-plus customers represented a total of 27.6% of revenue |

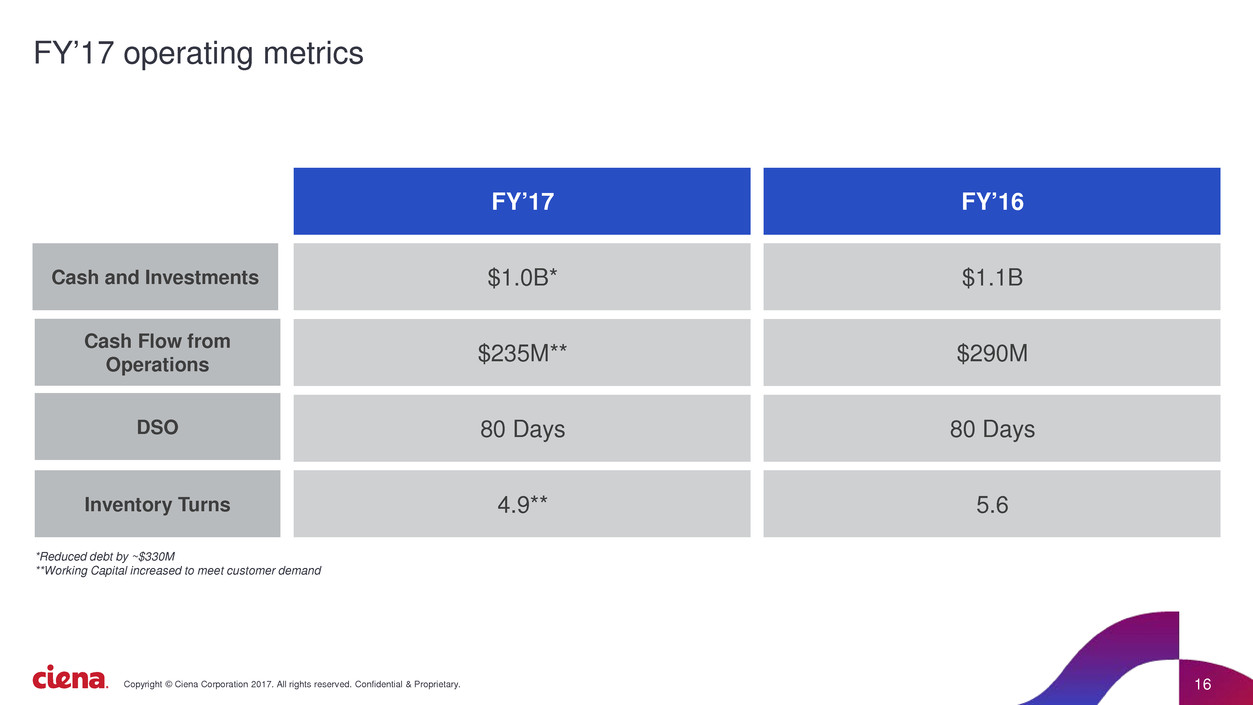

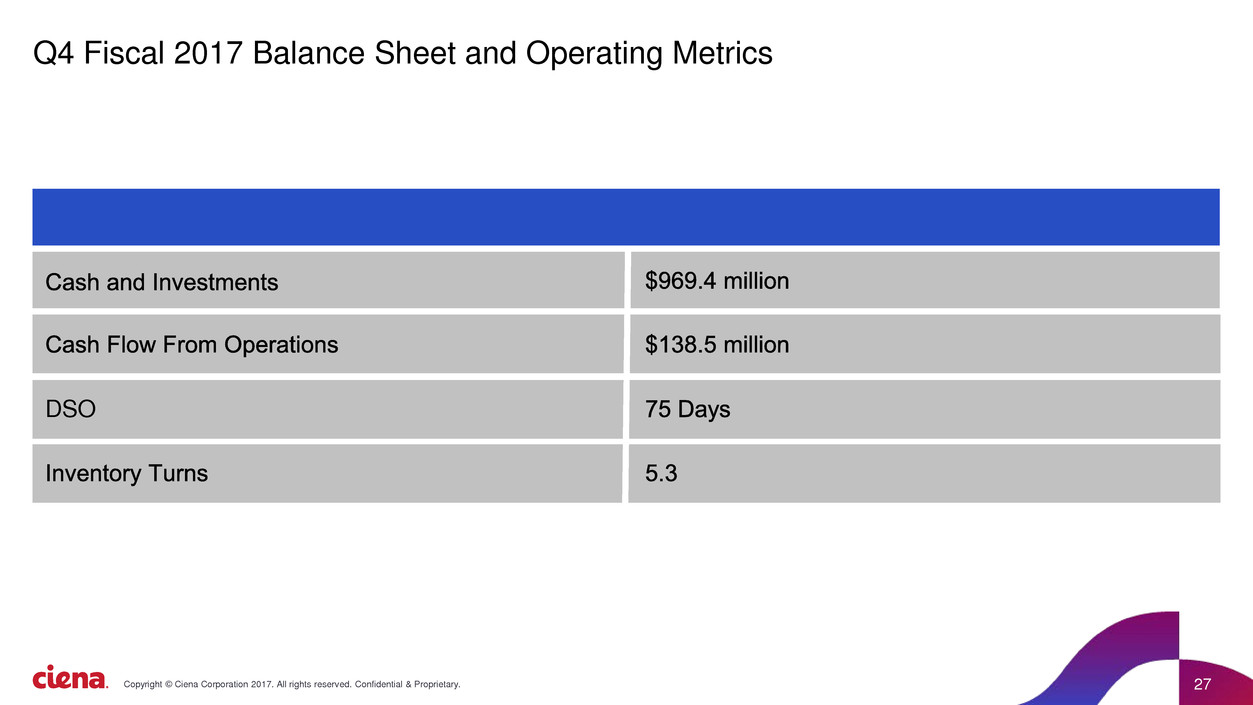

• | Cash and investments totaled $969.4 million |

• | Cash flow from operations totaled $138.5 million |

• | Average days' sales outstanding (DSOs) were 75 |

• | Accounts receivable balance was $622.2 million |

• | Inventories totaled $267.1 million, including: |

◦ | Raw materials: $52.9 million |

◦ | Work in process: $18.6 million |

◦ | Finished goods: $185.5 million |

◦ | Deferred cost of sales: $61.3 million |

◦ | Reserve for excess and obsolescence: $(51.2) million |

• | Product inventory turns were 5.3 |

• | Headcount totaled 5,737 |

Notes to Investors

Forward-Looking Statements. You are encouraged to review the Investors section of our website, where we routinely post press releases, SEC filings, recent news, financial results, supplemental financial information, and other announcements. From time to time we exclusively post material information to this website along with other disclosure channels that we use. This press release contains certain forward-looking statements that involve risks and uncertainties. These statements are based on current expectations, forecasts, assumptions and other information available to the Company as of the date hereof. Forward-looking statements include statements regarding Ciena's expectations, beliefs, intentions or strategies regarding the future and can be identified by forward-looking words such as "anticipate," "believe," "could," "estimate," "expect," "intend," "may," "should," "will," and "would" or similar words. Forward-looking statements in this release include: "Our fourth quarter and fiscal 2017 results reinforce our continued ability to adapt to changing market conditions by growing revenue and expanding profitability as we outperform the industry." and "We are confident that our long-term strategy to scale and diversify our existing business and to expand our addressable market will enable us to continue to grow and generate cash."

Ciena's actual results, performance or events may differ materially from these forward-looking statements made or implied due to a number of risks and uncertainties relating to Ciena's business, including: the effect of broader economic and market conditions on our customers and their business; changes in network spending or network strategy by large communication service providers; seasonality and the timing and size of customer orders, including our ability to recognize revenue relating to such sales; the level of competitive pressure we encounter; the product, customer and geographic mix of sales within the period; supply chain disruptions and the level of success relating to efforts to optimize Ciena's operations; changes in foreign currency exchange rates affecting revenue and operating expense; and the other risk factors disclosed in Ciena's Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (SEC) on September 6, 2017 and Ciena's Annual Report on Form 10-K to be

filed with the SEC. Ciena assumes no obligation to update any forward-looking information included in this press release.

Non-GAAP Presentation of Quarterly and Annual Results. This release includes non-GAAP measures of Ciena's gross profit, operating expense, income from operations, and measure of net income and net income per share, in each case, under our "Prior Method" and "New Method" as described above. In evaluating the operating performance of Ciena's business, management excludes certain charges and credits that are required by GAAP. These items share one or more of the following characteristics: they are unusual and Ciena does not expect them to recur in the ordinary course of its business; they do not involve the expenditure of cash; they are unrelated to the ongoing operation of the business in the ordinary course; or their magnitude and timing is largely outside of Ciena's control. Management believes that the non-GAAP measures below provide management and investors useful information and meaningful insight to the operating performance of the business. The presentation of these non-GAAP financial measures should be considered in addition to Ciena's GAAP results and these measures are not intended to be a substitute for the financial information prepared and presented in accordance with GAAP. Ciena's non-GAAP measures and the related adjustments may differ from non-GAAP measures used by other companies and should only be used to evaluate Ciena's results of operations in conjunction with our corresponding GAAP results. Under the "Prior Method" of calculating adjusted (non-GAAP) net income and net income per share, the Non-GAAP tax provision consists of current and deferred income tax expense, primarily related to foreign income tax, which is paid using cash. Under the "New Method" of calculating adjusted (non-GAAP) net income and net income per share, the Non-GAAP tax provision consists of current and deferred income tax expense commensurate with the level of adjusted (non-GAAP) income before income taxes using a current blended U.S. and foreign statutory tax rate (which was 36.5%). As such, the tax provision in our adjusted (non-GAAP) net income is presented as a separate and comparative reconciling item. To the extent not previously disclosed in a prior Ciena financial results press release, the Appendix A and B to this press release sets forth a complete GAAP to non-GAAP reconciliation of the non-GAAP measures contained in this release.

About Ciena. Ciena (NYSE: CIEN) is a network strategy and technology company. We translate best-in-class technology into value through a high-touch, consultative business model - with a relentless drive to create exceptional experiences measured by outcomes. For updates on Ciena, follow us on Twitter @Ciena, LinkedIn, the Ciena Insights blog, or visit www.ciena.com.

CIENA CORPORATION

CONDENSED UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

Quarter Ended October 31, | Year Ended October 31, | |||||||||||||||

2017 | 2016 | 2017 | 2016 | |||||||||||||

Revenue: | ||||||||||||||||

Products | 616,216 | 582,455 | 2,318,581 | 2,117,472 | ||||||||||||

Services | 128,233 | 133,736 | 483,106 | 483,101 | ||||||||||||

Total revenue | 744,449 | 716,191 | 2,801,687 | 2,600,573 | ||||||||||||

Cost of goods sold: | ||||||||||||||||

Products | 352,992 | 324,663 | 1,308,295 | 1,176,304 | ||||||||||||

Services | 65,772 | 72,980 | 247,606 | 262,693 | ||||||||||||

Total cost of goods sold | 418,764 | 397,643 | 1,555,901 | 1,438,997 | ||||||||||||

Gross profit | 325,685 | 318,548 | 1,245,786 | 1,161,576 | ||||||||||||

Operating expenses: | ||||||||||||||||

Research and development | 119,108 | 112,448 | 475,329 | 451,794 | ||||||||||||

Selling and marketing | 95,877 | 96,853 | 356,169 | 349,731 | ||||||||||||

General and administrative | 36,181 | 32,147 | 142,604 | 132,828 | ||||||||||||

Amortization of intangible assets | 3,661 | 14,551 | 33,029 | 61,508 | ||||||||||||

Acquisition and integration costs | — | — | — | 4,613 | ||||||||||||

Significant asset impairments and restructuring costs | 15,059 | 2,876 | 23,933 | 4,933 | ||||||||||||

Total operating expenses | 269,886 | 258,875 | 1,031,064 | 1,005,407 | ||||||||||||

Income from operations | 55,799 | 59,673 | 214,722 | 156,169 | ||||||||||||

Interest and other income (loss), net | 652 | (1,339 | ) | (2,744 | ) | (12,795 | ) | |||||||||

Interest expense | (13,926 | ) | (15,371 | ) | (55,852 | ) | (56,656 | ) | ||||||||

Income before income taxes | 42,525 | 42,963 | 156,126 | 86,718 | ||||||||||||

Provision (benefit) for income taxes | (1,117,531 | ) | 6,376 | (1,105,827 | ) | 14,134 | ||||||||||

Net income | $ | 1,160,056 | $ | 36,587 | $ | 1,261,953 | $ | 72,584 | ||||||||

Net Income per Common Share | ||||||||||||||||

Basic net income per common share | $ | 8.11 | $ | 0.26 | $ | 8.89 | $ | 0.52 | ||||||||

Diluted net income per potential common share1 | $ | 7.32 | $ | 0.25 | $ | 7.53 | $ | 0.51 | ||||||||

Weighted average basic common shares outstanding | 143,097 | 139,741 | 141,997 | 138,312 | ||||||||||||

Weighted average diluted potential common shares outstanding 2 | 158,791 | 165,298 | 169,919 | 150,704 | ||||||||||||

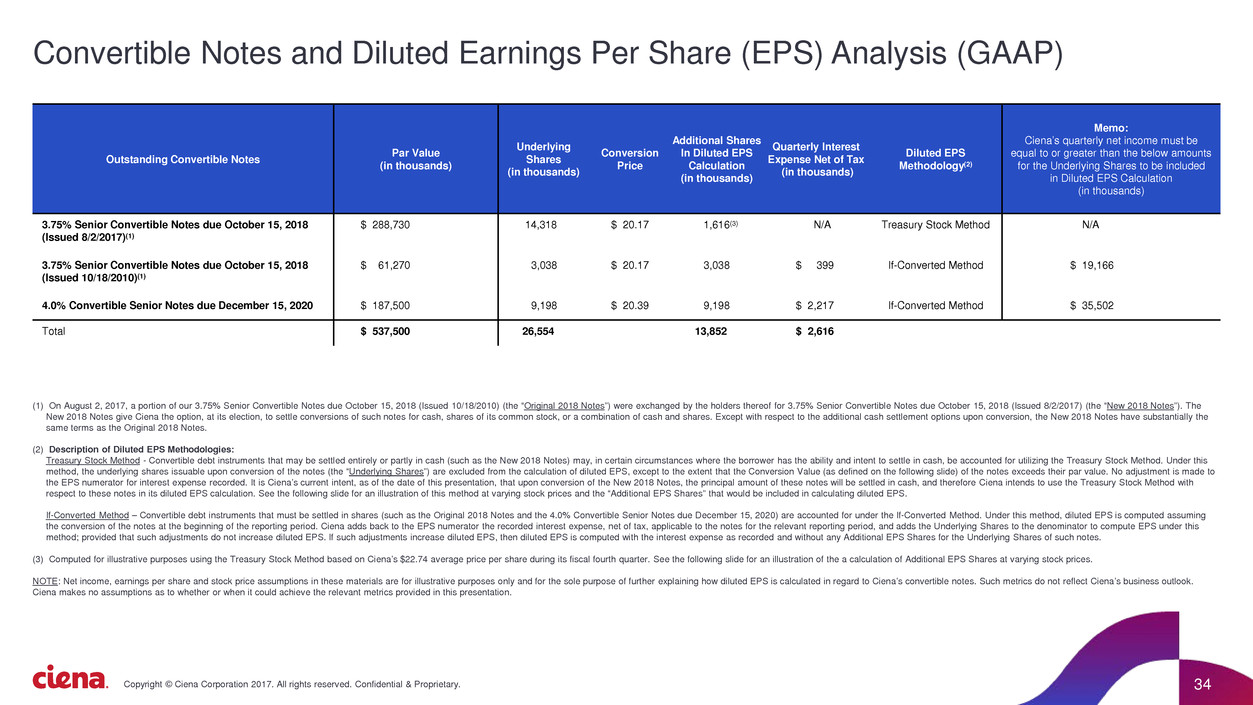

1. The calculation of GAAP diluted net income per common share for the fourth quarter of fiscal 2017 requires adding back interest expense of approximately $0.4 million associated with Ciena's "Original" 3.75% convertible senior notes, due October 15, 2018 and approximately $2.3 million associated with Ciena's 4.0% convertible senior notes, due December 15, 2020 to the GAAP net income in order to derive the numerator for the diluted earnings per common share calculation.

The calculation of GAAP diluted net income per common share for fiscal 2017 requires adding back interest expense of approximately $0.9 million associated with Ciena's 0.875% convertible senior notes which were paid at maturity during the third quarter of fiscal 2017, approximately $7.2 million associated with Ciena's "Original" 3.75% convertible senior notes, due October 15, 2018 and approximately $8.7 million associated with Ciena's 4.0% convertible senior notes, due December 15, 2020 to the GAAP net income in order to derive the numerator for the diluted earnings per common share calculation.

The calculation of GAAP diluted net income per common share for the fourth quarter of fiscal 2016 requires adding back interest expense of approximately $0.7 million associated with Ciena's 0.875% convertible senior notes, which were paid at maturity during the third quarter of fiscal 2017, and approximately $3.6 million associated with Ciena's "Original" 3.75% convertible senior notes, due October 15, 2018, to the GAAP net income in order to derive the numerator for the diluted earnings per common share calculation.

The calculation of GAAP diluted net income per common share for fiscal 2016 requires adding back interest expense of approximately $4.8 million associated with Ciena's 0.875% convertible senior notes, which were paid at maturity during the third quarter of fiscal 2017 to the GAAP net income in order to derive the numerator for the diluted earnings per common share calculation.

2. Weighted average dilutive potential common shares outstanding used in calculating GAAP diluted net income per common share for the fourth quarter of fiscal 2017 includes 1.2 million shares underlying certain stock options and restricted stock units, 1.6 million shares underlying Ciena's "New" 3.75% convertible senior notes, due October 15, 2018, 3.7 million shares underlying Ciena's "Original" 3.75% convertible senior notes, due October 15, 2018, and 9.2 million share underlying Ciena's 4.0% convertible senior notes, due December 15, 2020.

Weighted average dilutive potential common shares outstanding used in calculating GAAP diluted net income per common share for fiscal 2017 includes 1.4 million shares underlying certain stock options and restricted stock units, 0.4 million shares underlying Ciena's "New" 3.75% convertible senior notes, due October 15, 2018, 3.0 million shares underlying Ciena's 0.875% convertible senior notes, which were paid at maturity during the third quarter of fiscal 2017, 13.9 million shares underlying Ciena's "Original" 3.75% convertible senior notes, due October 15, 2018, and 9.2 million share underlying Ciena's 4.0% convertible senior notes, due December 15, 2020.

Weighted average dilutive potential common shares outstanding used in calculating GAAP diluted net income per common share for the fourth quarter of fiscal 2016 includes 1.6 million shares underlying certain stock options and restricted stock units, 6.6 million shares underlying Ciena's 0.875% convertible senior notes, which were paid at maturity during the third quarter of fiscal 2017 and 17.4 million shares underlying Ciena's "Original" 3.75% convertible senior notes, due October 15, 2018.

Weighted average dilutive potential common shares outstanding used in calculating GAAP diluted net income per common share for fiscal 2016 includes 1.3 million shares underlying certain stock options and restricted stock units and 11.1 million shares underlying Ciena's 0.875% convertible senior notes, which were paid at maturity during the third quarter of fiscal 2017.

CIENA CORPORATION

CONDENSED UNAUDITED CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

October 31, | |||||||

2017 | 2016 | ||||||

ASSETS | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 640,513 | $ | 777,615 | |||

Short-term investments | 279,133 | 275,248 | |||||

Accounts receivable, net | 622,183 | 576,235 | |||||

Inventories | 267,143 | 211,251 | |||||

Prepaid expenses and other | 197,339 | 172,843 | |||||

Total current assets | 2,006,311 | 2,013,192 | |||||

Long-term investments | 49,783 | 90,172 | |||||

Equipment, building, furniture and fixtures, net | 308,465 | 288,406 | |||||

Goodwill | 267,458 | 266,974 | |||||

Other intangible assets, net | 100,997 | 146,711 | |||||

Deferred tax asset, net | 1,155,104 | 1,116 | |||||

Other long-term assets | 63,593 | 67,004 | |||||

Total assets | $ | 3,951,711 | $ | 2,873,575 | |||

LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||

Current liabilities: | |||||||

Accounts payable | $ | 260,098 | $ | 235,942 | |||

Accrued liabilities and other short-term obligations | 322,934 | 310,353 | |||||

Deferred revenue | 102,418 | 109,009 | |||||

Current portion of long-term debt | 352,293 | 236,241 | |||||

Total current liabilities | 1,037,743 | 891,545 | |||||

Long-term deferred revenue | 82,589 | 73,854 | |||||

Other long-term obligations | 111,349 | 124,394 | |||||

Long-term debt, net | 583,688 | 1,017,441 | |||||

Total liabilities | $ | 1,815,369 | $ | 2,107,234 | |||

Stockholders’ equity: | |||||||

Preferred stock — par value $0.01; 20,000,000 shares authorized; zero shares issued and outstanding | — | — | |||||

Common stock — par value $0.01; 290,000,000 shares authorized; 143,043,227 and 139,767,627 shares issued and outstanding | 1,430 | 1,398 | |||||

Additional paid-in capital | 6,810,182 | 6,715,478 | |||||

Accumulated other comprehensive loss | (11,017 | ) | (24,329 | ) | |||

Accumulated deficit | (4,664,253 | ) | (5,926,206 | ) | |||

Total stockholders’ equity | 2,136,342 | 766,341 | |||||

Total liabilities and stockholders’ equity | $ | 3,951,711 | $ | 2,873,575 | |||

CIENA CORPORATION

CONDENSED UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

Year Ended October 31, | |||||||

2017 | 2016 | ||||||

Cash flows from operating activities: | |||||||

Net income | $ | 1,261,953 | $ | 72,584 | |||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||

Depreciation of equipment, furniture and fixtures, and amortization of leasehold improvements | 77,189 | 63,394 | |||||

Share-based compensation costs | 48,360 | 51,993 | |||||

Amortization of intangible assets | 45,713 | 78,298 | |||||

Deferred taxes | (1,126,732 | ) | (1,116 | ) | |||

Provision for doubtful accounts | 18,221 | 1,701 | |||||

Provision for inventory excess and obsolescence | 35,459 | 33,713 | |||||

Provision for warranty | 7,965 | 15,483 | |||||

Other | 22,417 | 24,929 | |||||

Changes in assets and liabilities: | |||||||

Accounts receivable | (66,123 | ) | (26,074 | ) | |||

Inventories | (91,567 | ) | (53,000 | ) | |||

Prepaid expenses and other | (33,834 | ) | 30,047 | ||||

Accounts payable, accruals and other obligations | 33,897 | 7,153 | |||||

Deferred revenue | 1,964 | (9,585 | ) | ||||

Net cash provided by operating activities | 234,882 | 289,520 | |||||

Cash flows used in investing activities: | |||||||

Payments for equipment, furniture, fixtures and intellectual property | (94,600 | ) | (107,185 | ) | |||

Restricted cash | (54 | ) | 11 | ||||

Purchase of available for sale securities | (299,038 | ) | (365,191 | ) | |||

Proceeds from maturities of available for sale securities | 335,075 | 230,612 | |||||

Settlement of foreign currency forward contracts, net | (2,810 | ) | (18,506 | ) | |||

Purchase of cost method investment | — | (4,000 | ) | ||||

Acquisition of business, net of cash acquired | — | (32,000 | ) | ||||

Net cash used in investing activities | (61,427 | ) | (296,259 | ) | |||

Cash flows from financing activities: | |||||||

Proceeds from issuance of long-term debt, net | — | 248,750 | |||||

Payment of long-term debt | (233,554 | ) | (266,116 | ) | |||

Payment for modification of term loans | (93,625 | ) | — | ||||

Payment of debt and equity issuance costs | (722 | ) | (3,987 | ) | |||

Payment of capital lease obligations | (3,562 | ) | (5,966 | ) | |||

Proceeds from issuance of common stock | 20,412 | 23,091 | |||||

Net cash used in financing activities | (311,051 | ) | (4,228 | ) | |||

Effect of exchange rate changes on cash and cash equivalents | 494 | (2,389 | ) | ||||

Net decrease in cash and cash equivalents | (137,102 | ) | (13,356 | ) | |||

Cash and cash equivalents at beginning of fiscal year | 777,615 | 790,971 | |||||

Cash and cash equivalents at end of fiscal year | $ | 640,513 | $ | 777,615 | |||

Supplemental disclosure of cash flow information | |||||||

Cash paid during the fiscal year for interest | $ | 47,235 | $ | 46,897 | |||

Cash paid during the fiscal year for income taxes, net | $ | 33,166 | $ | 15,268 | |||

Non-cash investing and financing activities | |||||||

Purchase of equipment in accounts payable | $ | 6,214 | $ | 15,030 | |||

Equipment acquired under capital leases | $ | — | $ | 5,322 | |||

Building subject to capital lease | $ | 50,370 | $ | 8,993 | |||

Construction in progress subject to build-to-suit lease | $ | — | $ | 39,914 | |||

APPENDIX A- Reconciliation of Adjusted (Non- GAAP) Measurements (unaudited) | ||||||||||||||||

Quarter Ended | Year Ended | |||||||||||||||

October 31, | October 31, | |||||||||||||||

2017 | 2016 | 2017 | 2016 | |||||||||||||

Gross Profit Reconciliation (GAAP/non-GAAP) | ||||||||||||||||

GAAP gross profit | $ | 325,685 | $ | 318,548 | $ | 1,245,786 | $ | 1,161,576 | ||||||||

Share-based compensation-products | 694 | 612 | 2,672 | 2,457 | ||||||||||||

Share-based compensation-services | 561 | 557 | 2,487 | 2,479 | ||||||||||||

Amortization of intangible assets | 2,332 | 4,320 | 12,685 | 16,401 | ||||||||||||

Total adjustments related to gross profit | 3,587 | 5,489 | 17,844 | 21,337 | ||||||||||||

Adjusted (non-GAAP) gross profit | $ | 329,272 | $ | 324,037 | $ | 1,263,630 | $ | 1,182,913 | ||||||||

Adjusted (non-GAAP) gross profit percentage | 44.2 | % | 45.2 | % | 45.1 | % | 45.5 | % | ||||||||

Operating Expense Reconciliation (GAAP/non-GAAP) | ||||||||||||||||

GAAP operating expense | $ | 269,886 | $ | 258,875 | $ | 1,031,064 | $ | 1,005,407 | ||||||||

Share-based compensation-research and development | 2,956 | 3,172 | 12,957 | 13,870 | ||||||||||||

Share-based compensation-sales and marketing | 3,218 | 2,890 | 12,846 | 15,138 | ||||||||||||

Share-based compensation-general and administrative | 4,130 | 2,961 | 17,321 | 17,342 | ||||||||||||

Share-based compensation-acquisition related | — | — | — | 714 | ||||||||||||

Amortization of intangible assets | 3,661 | 14,551 | 33,029 | 61,508 | ||||||||||||

Acquisition and integration costs, excluding share-based compensation | — | — | — | 3,899 | ||||||||||||

Significant asset impairments and restructuring costs | 15,059 | 2,876 | 23,933 | 4,933 | ||||||||||||

Settlement of patent litigation | — | — | — | 1,200 | ||||||||||||

Total adjustments related to operating expense | $ | 29,024 | $ | 26,450 | $ | 100,086 | $ | 118,604 | ||||||||

Adjusted (non-GAAP) operating expense | $ | 240,862 | $ | 232,425 | $ | 930,978 | $ | 886,803 | ||||||||

Income from Operations Reconciliation (GAAP/non-GAAP) | ||||||||||||||||

GAAP income from operations | $ | 55,799 | $ | 59,673 | $ | 214,722 | $ | 156,169 | ||||||||

Total adjustments related to gross profit | 3,587 | 5,489 | 17,844 | 21,337 | ||||||||||||

Total adjustments related to operating expense | 29,024 | 26,450 | 100,086 | 118,604 | ||||||||||||

Total adjustments related to income from operations | 32,611 | 31,939 | 117,930 | 139,941 | ||||||||||||

Adjusted (non-GAAP) income from operations | $ | 88,410 | $ | 91,612 | $ | 332,652 | $ | 296,110 | ||||||||

Adjusted (non-GAAP) operating margin percentage | 11.9 | % | 12.8 | % | 11.9 | % | 11.4 | % | ||||||||

APPENDIX B- Reconciliation of Adjusted (Non- GAAP) Measurements (unaudited) | ||||||||||||||||||||||||||||||||

(New Method) | (Prior Method) | |||||||||||||||||||||||||||||||

Quarter Ended | Year Ended | Quarter Ended | Year Ended | |||||||||||||||||||||||||||||

October 31, | October 31, | October 31, | October 31, | |||||||||||||||||||||||||||||

2017 | 2016 | 2017 | 2016 | 2017 | 2016 | 2017 | 2016 | |||||||||||||||||||||||||

Net Income Reconciliation (GAAP/non-GAAP) | ||||||||||||||||||||||||||||||||

GAAP net income | $ | 1,160,056 | $ | 36,587 | $ | 1,261,953 | $ | 72,584 | $ | 1,160,056 | $ | 36,587 | $ | 1,261,953 | $ | 72,584 | ||||||||||||||||

Exclude GAAP provision (benefit) for income taxes | (1,117,531 | ) | 6,376 | (1,105,827 | ) | 14,134 | (1,117,531 | ) | 6,376 | (1,105,827 | ) | 14,134 | ||||||||||||||||||||

Income before income taxes | 42,525 | 42,963 | 156,126 | 86,718 | 42,525 | 42,963 | 156,126 | 86,718 | ||||||||||||||||||||||||

Total adjustments related to income from operations | 32,611 | 31,939 | 117,930 | 139,941 | 32,611 | 31,939 | 117,930 | 139,941 | ||||||||||||||||||||||||

Loss on extinguishment of debt | — | 376 | 41 | 226 | — | 376 | 41 | 226 | ||||||||||||||||||||||||

Non-cash interest expense | 525 | 500 | 2,099 | 1,881 | 525 | 500 | 2,099 | 1,881 | ||||||||||||||||||||||||

Modification of debt | 692 | — | 3,616 | — | 692 | — | 3,616 | — | ||||||||||||||||||||||||

Adjusted income before income taxes | 76,353 | 75,778 | 279,812 | 228,766 | 76,353 | 75,778 | 279,812 | 228,766 | ||||||||||||||||||||||||

Non-GAAP tax provision on adjusted income before income taxes | 27,869 | 27,659 | 102,131 | 83,500 | 7,597 | 6,376 | 19,301 | 14,134 | ||||||||||||||||||||||||

Adjusted (non-GAAP) net income | $ | 48,484 | $ | 48,119 | $ | 177,681 | $ | 145,266 | $ | 68,756 | $ | 69,402 | $ | 260,511 | $ | 214,632 | ||||||||||||||||

Weighted average basic common shares outstanding | 143,097 | 139,741 | 141,997 | 138,312 | 143,097 | 139,741 | 141,997 | 138,312 | ||||||||||||||||||||||||

Weighted average dilutive potential common shares outstanding 1 | 158,791 | 174,496 | 169,919 | 177,258 | 158,791 | 174,496 | 169,919 | 177,258 | ||||||||||||||||||||||||

Net Income per Common Share | ||||||||||||||||||||||||||||||||

GAAP diluted net income per common share | $ | 7.32 | $ | 0.25 | $ | 7.53 | $ | 0.51 | $ | 7.32 | $ | 0.25 | $ | 7.53 | $ | 0.51 | ||||||||||||||||

Adjusted (non-GAAP) diluted net income per common share 2 | $ | 0.32 | $ | 0.30 | $ | 1.14 | $ | 0.93 | $ | 0.46 | $ | 0.44 | $ | 1.68 | $ | 1.38 | ||||||||||||||||

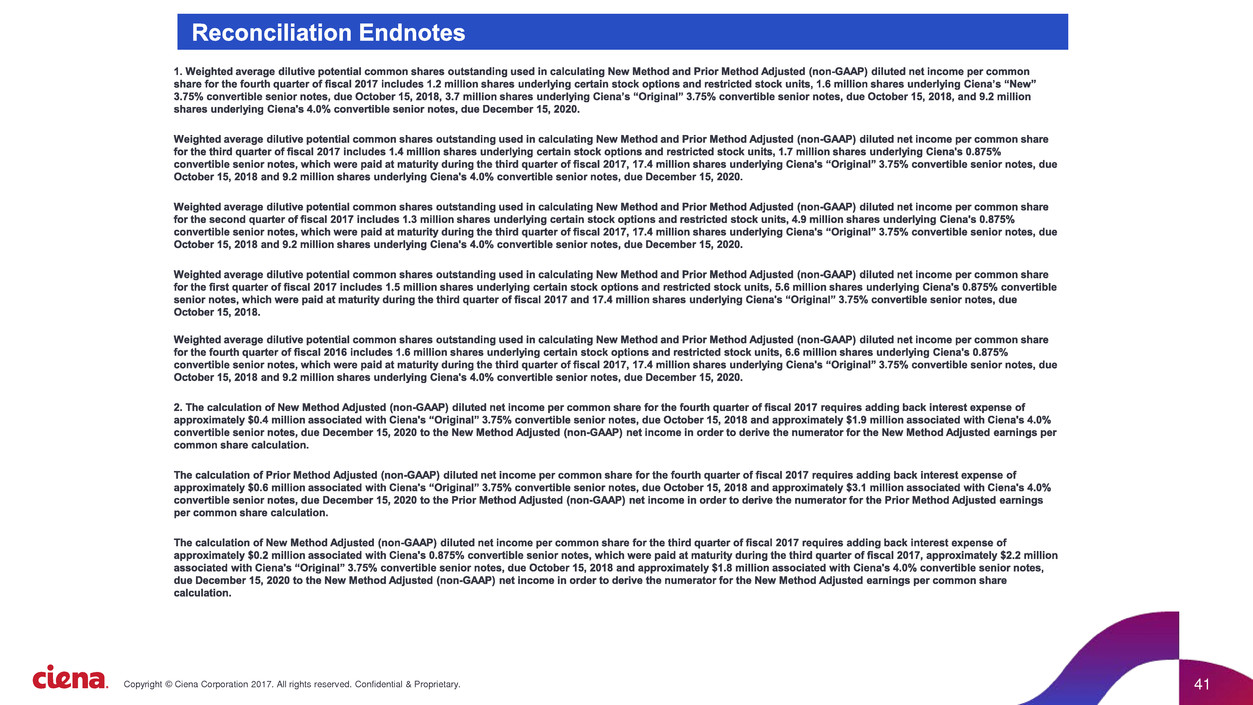

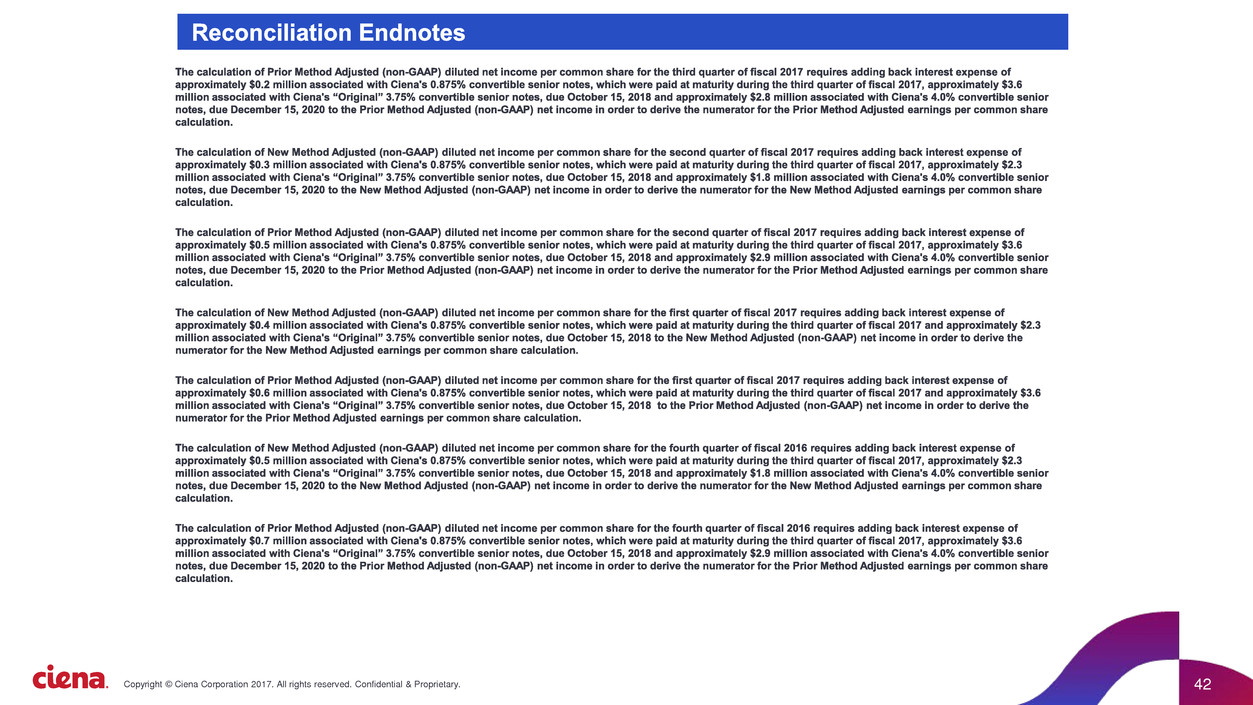

1. Weighted average dilutive potential common shares outstanding used in calculating New Method and Prior Method adjusted (non-GAAP) diluted net income per common share for the fourth quarter of fiscal 2017 includes 1.2 million shares underlying certain stock options and restricted stock units, 1.6 million shares underlying Ciena's "New" 3.75% convertible senior notes, due October 15, 2018, 3.7 million shares underlying Ciena's "Original" 3.75% convertible senior notes, due October 15, 2018, and 9.2 million shares underlying Ciena's 4.0% convertible senior notes, due December 15, 2020.

Weighted average dilutive potential common shares outstanding used in calculating New Method and Prior Method adjusted (non-GAAP) diluted net income per common share for the fourth quarter of fiscal 2016 includes 1.6 million shares underlying certain stock options and restricted stock units, 6.6 million shares underlying Ciena's 0.875% convertible senior notes, which were paid at maturity during the third quarter of fiscal 2017, 17.4 million shares underlying Ciena's "Original" 3.75% convertible senior notes, due October 15, 2018 and 9.2 million shares underlying Ciena's 4.0% convertible senior notes, due December 15, 2020.

Weighted average dilutive potential common shares outstanding used in calculating New Method and Prior Method adjusted (non-GAAP) diluted net income per common share for fiscal 2017 includes 1.4 million shares underlying certain stock options and restricted stock units, 0.4 million shares underlying Ciena's "New" 3.75% convertible senior notes, due October 15, 2018, 3.0 million shares underlying Ciena's 0.875% convertible senior notes, which were paid at maturity during the third quarter of fiscal 2017, 13.9 million shares underlying Ciena's "Original" 3.75% convertible senior notes, due October 15, 2018, and 9.2 million share underlying Ciena's 4.0% convertible senior notes, due December 15, 2020.

Weighted average dilutive potential common shares outstanding used in calculating New Method and Prior Method adjusted (non-GAAP) diluted net income per common share for fiscal 2016 includes 1.3 million shares underlying certain stock options and restricted stock units, 11.1 million shares underlying Ciena's 0.875% convertible senior notes, which were paid at maturity during the third quarter of fiscal 2017, 17.4 million shares underlying Ciena's "Original" 3.75% convertible senior notes, due October 15, 2018, and 9.2 million share underlying Ciena's 4.0% convertible senior notes, due December 15, 2020.

2. The calculation of New Method adjusted (non-GAAP) diluted net income per common share for the fourth quarter of fiscal 2017 requires adding back interest expense of approximately $0.4 million associated with Ciena's "Original" 3.75% convertible senior notes, due October 15, 2018 and approximately $1.9 million associated with Ciena's 4.0% convertible senior notes, due December 15, 2020 to the New Method adjusted (non-GAAP) net income in order to derive the numerator for the New Method adjusted earnings per common share calculation.

The calculation of Prior Method adjusted (non-GAAP) diluted net income per common share for the fourth quarter of fiscal 2017 requires adding back interest expense of approximately $0.6 million associated with Ciena's "Original" 3.75% convertible senior notes, due October 15, 2018 and approximately $3.1 million associated with Ciena's 4.0% convertible senior notes, due December 15, 2020 to the Prior Method adjusted (non-GAAP) net income in order to derive the numerator for the Prior Method adjusted (non-GAAP) earnings per common share calculation.

The calculation of New Method adjusted (non-GAAP) diluted net income per common share for the fourth quarter of fiscal 2016 requires adding back interest expense of approximately $0.5 million associated with Ciena's 0.875% convertible senior notes, which were paid at maturity during the third quarter of fiscal 2017, approximately $2.3 million associated with Ciena's "Original" 3.75% convertible senior notes, due October 15, 2018 and approximately $1.8 million associated with Ciena's 4.0% convertible senior notes, due December 15, 2020 to the New Method adjusted (non-GAAP) net income in order to derive the numerator for the New Method adjusted (non-GAAP) earnings per common share calculation.

The calculation of Prior Method adjusted (non-GAAP) diluted net income per common share for the fourth quarter of fiscal 2016 requires adding back interest expense of approximately $0.7 million associated with Ciena's 0.875% convertible senior notes, which were paid at maturity during the third quarter of fiscal 2017, approximately $3.6 million associated with Ciena's "Original" 3.75% convertible senior notes, due October 15, 2018 and approximately $2.9 million associated with Ciena's 4.0% convertible senior notes, due December 15, 2020 to the Prior Method adjusted (non-GAAP) net income in order to derive the numerator for the Prior Method adjusted (non-GAAP) earnings per common share calculation.

The calculation of New Method adjusted (non-GAAP) diluted net income per common share for fiscal 2017 requires adding back interest expense of approximately $0.9 million associated with Ciena's 0.875% convertible senior notes, which were paid at maturity during the third quarter of fiscal 2017, approximately $7.2 million associated with Ciena's "Original" 3.75% convertible senior notes, due October 15, 2018 and approximately $7.4 million associated with Ciena's 4.0% convertible senior notes, due December 15, 2020 to the New Method adjusted (non-GAAP) net income in order to derive the numerator for the New Method adjusted (non-GAAP) earnings per common share calculation.

The calculation of Prior Method adjusted (non-GAAP) diluted net income per common share for fiscal 2017 requires adding back interest expense of approximately $1.3 million associated with Ciena's 0.875% convertible senior notes, which were paid at maturity during the third quarter of fiscal 2017, approximately $11.4 million associated with Ciena's "Original" 3.75% convertible senior notes, due October 15, 2018 and approximately $11.6 million associated with Ciena's 4.0% convertible senior notes, due December 15, 2020 to the Prior Method adjusted (non-GAAP) net income in order to derive the numerator for the Prior Method adjusted (non-GAAP) earnings per common share calculation.

The calculation of New Method adjusted (non-GAAP) diluted net income per common share for fiscal 2016 requires adding back interest expense of approximately $3.0 million associated with Ciena's 0.875% convertible senior notes, due June 15, 2017, approximately $9.1 million associated with Ciena's "Original" 3.75% convertible senior notes, due October 15, 2018 and approximately $7.2 million associated with Ciena's 4.0% convertible senior notes, due December 15, 2020 to the New Method adjusted (non-GAAP) net income in order to derive the numerator for the New Method adjusted (non-GAAP) earnings per common share calculation.

The calculation of Prior Method adjusted (non-GAAP) diluted net income per common share for fiscal 2016 requires adding back interest expense of approximately $4.8 million associated with Ciena's 0.875% convertible senior notes, due June 15, 2017, approximately $14.3 million associated with Ciena's "Original" 3.75% convertible senior notes, due October 15, 2018 and approximately $11.4 million associated with Ciena's 4.0% convertible senior notes, due December 15, 2020 to the Prior Method adjusted (non-GAAP) net income in order to derive the numerator for the Prior Method adjusted (non-GAAP) earnings per common share calculation.

* * *

The adjusted (non-GAAP) measures above and their reconciliation to Ciena's GAAP results for the periods presented reflect adjustments relating to the following items:

• | Share-based compensation expense - a non-cash expense incurred in accordance with share-based compensation accounting guidance. |

• | Acquisition and integration costs - consist of financial, legal and accounting advisors, facilities and systems consolidation costs, and severance and other employment-related costs related to our recent acquisitions of Cyan and TeraXion. Ciena does not believe that these costs are reflective of its ongoing operating expense following its completion of these integration activities. |

• | Amortization of intangible assets - a non-cash expense arising from the acquisition of intangible assets, principally developed technologies and customer-related intangibles, that Ciena is required to amortize over the expected useful life. |

• | Significant asset impairments and restructuring costs - costs incurred as a result of restructuring activities taken to align resources with perceived market opportunities and a significant asset impairment for a trade receivable for a customer in the Asia Pacific region. |

• | Settlement of patent litigation - included in general and administrative expense is a $1.2 million patent litigation settlement during the second quarter of fiscal 2016. |

• | Loss on extinguishment of debt - losses related to certain private repurchase transactions during fiscal 2016 and 2017 of Ciena's then outstanding 0.875% convertible senior notes, due June 15, 2017. |

• | Non-cash interest expense - a non-cash debt discount expense amortized as interest expense during the term of Ciena's 4.0% senior convertible notes due December 15, 2020 relating to the required separate accounting of the equity component of these convertible notes. |

• | Modification of debt - costs incurred as a result of the modification of debt to refinance then existing term loans and an exchange offer for Ciena's "Original" 3.75% convertible senior notes, due October 15, 2018. |

• | Non-GAAP tax provision - Beginning this quarter, Ciena is changing how it calculates its adjusted (non-GAAP) provision for income taxes in accordance with the SEC guidance on non-GAAP financial measures. Under the "New Method," the Non-GAAP tax provision consists of current and deferred income tax expense commensurate with the level of adjusted income before income taxes using a current blended U.S. and foreign statutory tax rate (which was 36.5%). This rate may be subject to change in the future, including as a result of changes in tax policy or tax strategy. Under the "Prior Method," the Non-GAAP tax provision consists of current and deferred income tax expense, and primarily related to foreign income tax, which is paid using cash. This change in calculation methodology will not affect Ciena's adjusted income before income taxes, actual cash tax payments, or cash flows, but will result in significantly higher non-GAAP provisions for income taxes compared to our "Prior Method" Non-GAAP presentation. Ciena, however, does not expect to pay substantial cash taxes for the foreseeable future primarily due to Ciena's deferred tax asset balance. Ciena's foreign and domestic income tax expense which will be paid using cash was $7.6 million and $6.4 million for the fourth quarter of fiscal 2017 and 2016, respectively, and $19.3 million and $14.1 million for the fiscal 2017 and 2016, respectively. As of October 31, 2017, Ciena has deferred tax assets, net of approximately $1.16 billion, and consequently, over the near term, Ciena's cash taxes will continue to be primarily related to the tax expense of Ciena's foreign subsidiaries, which amounts have not historically been significant. |

TRANSCRIPT OF PRE-RECORDED MANAGEMENT CALL

FOURTH QUARTER AND FISCAL YEAR ENDED

OCTOBER 31, 2017

December 7, 2017

Investors should also review the Important Notes to Investors immediately following this transcript.

Ciena Corporation (Pre-Recorded Earnings) December 7, 2017 |

Corporate Speakers:

• | Gregg Lampf; Ciena Corporation; Vice President, Investor Relations |

• | Gary Smith; Ciena Corporation; President & CEO |

• | Jim Moylan; Ciena Corporation; SVP Finance, CFO |

PRESENTATION |

Operator: Welcome to Ciena’s 2017 Fourth Quarter and Year End Review.

I would now like to hand the floor over to Gregg Lampf, Vice President of Investor Relations. Please go ahead, sir.

Opening Remarks (Gregg Lampf)

Gregg Lampf: Thank you, Karen. Good morning and welcome to Ciena’s 2017 Fourth Quarter and Year End Review.

This morning’s report will follow a different format than usual. Our prepared remarks have been recorded and transcribed, and are being made available in advance of our live call.

While our comments today will touch briefly on market dynamics and our Q4 financial results, we intend to focus more on our current strategy and long term strategic plans. Specifically, we will discuss where we see the business going over the next three years, the strategic drivers that will get us there, and some longer term financial targets that we set for the company in the context of those drivers.

We have posted to the investors section of Ciena.com an accompanying investor presentation that reflects this discussion as well as certain highlighted items from the quarter and fiscal year.

We believe this approach will give you a clear understanding of how we intend to manage the business through the next phase of our transformation and what to expect from Ciena over the next three years.

Before turning the call over to Gary, I’ll remind you that during this call, we’ll be making certain forward-looking statements. Such statements, including our guidance and long-term financial objectives, are based on current expectations, forecasts and assumptions regarding the company and its markets that include risks and uncertainties that could cause actual results to differ materially from the statements discussed today.

These statements should be viewed in a context of the risk factors detailed in our most recent 10-Q filing, and in our upcoming 10-K filing. Our 10-K is required to be filed with the FCC by December 27th, and we expect to file by that date.

Ciena assumes no obligation to update the information discussed in this conference call, whether as a result of new information, future events or otherwise.

Today’s discussion includes certain adjusted or non-GAAP measures of Ciena’s results of operations. As Jim will review, there are important changes to our GAAP and non-GAAP tax provision that you need to be mindful of when comparing periods. A detailed reconciliation of our non-GAAP measures to our GAAP results, along with a

comparison of our new method and prior method of calculating taxes for non-GAAP earnings is included in today’s press release available of Ciena.com.

With that, I’ll turn it over to Gary.

Introduction

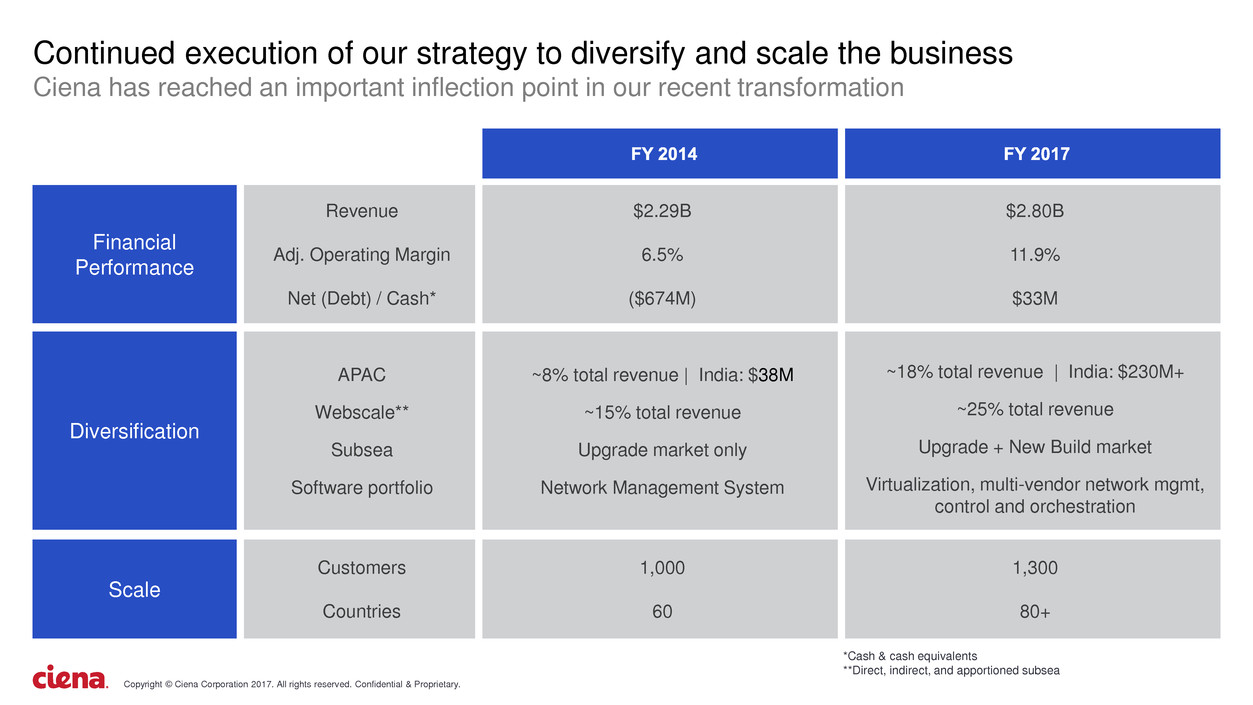

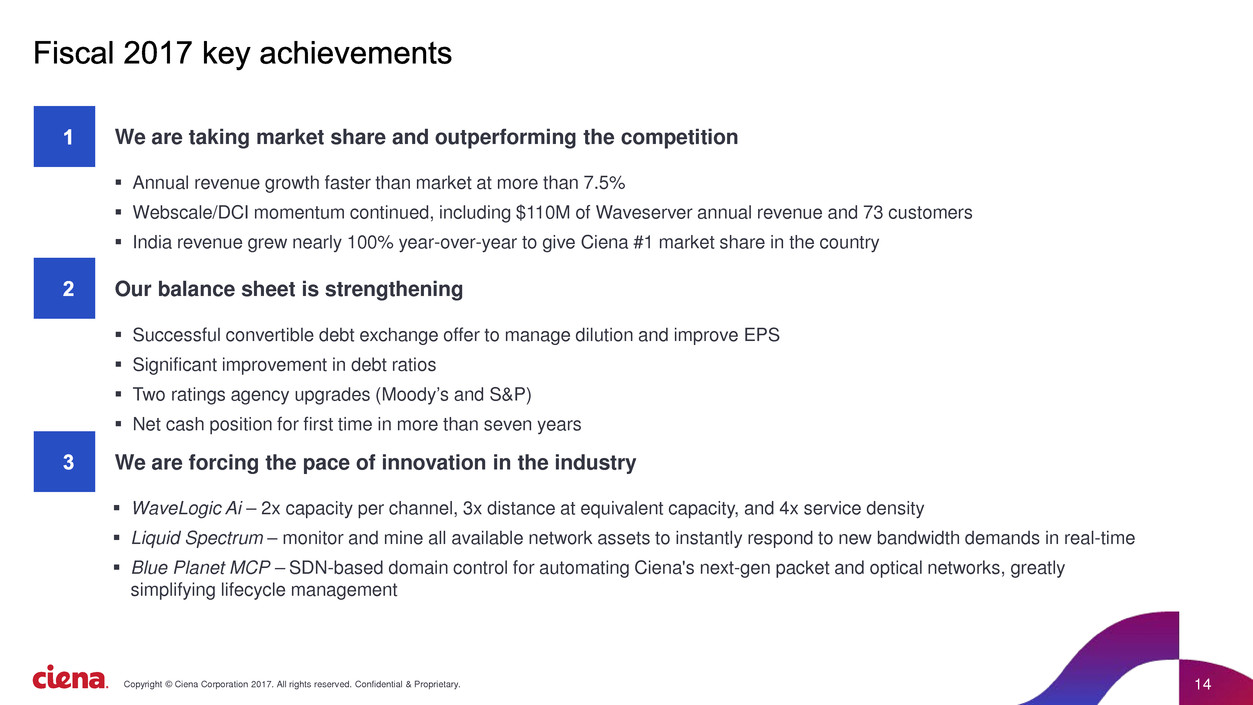

Gary Smith: Thanks, Gregg. Last month, we celebrated the 25th anniversary of the founding of Ciena, marking a significant milestone in our history. Perhaps, more importantly, we’ve reached an important inflection point in our business, following several years of focus on transforming the company.

A few years ago, we were primarily a hardware company that specialized in a single technology, with a very concentrated customer base, a highly leveraged balance sheet and operating losses.

As the sector has evolved, we have executed on a clear vision to build from our small platform to create a powerful long-term leader in our field.

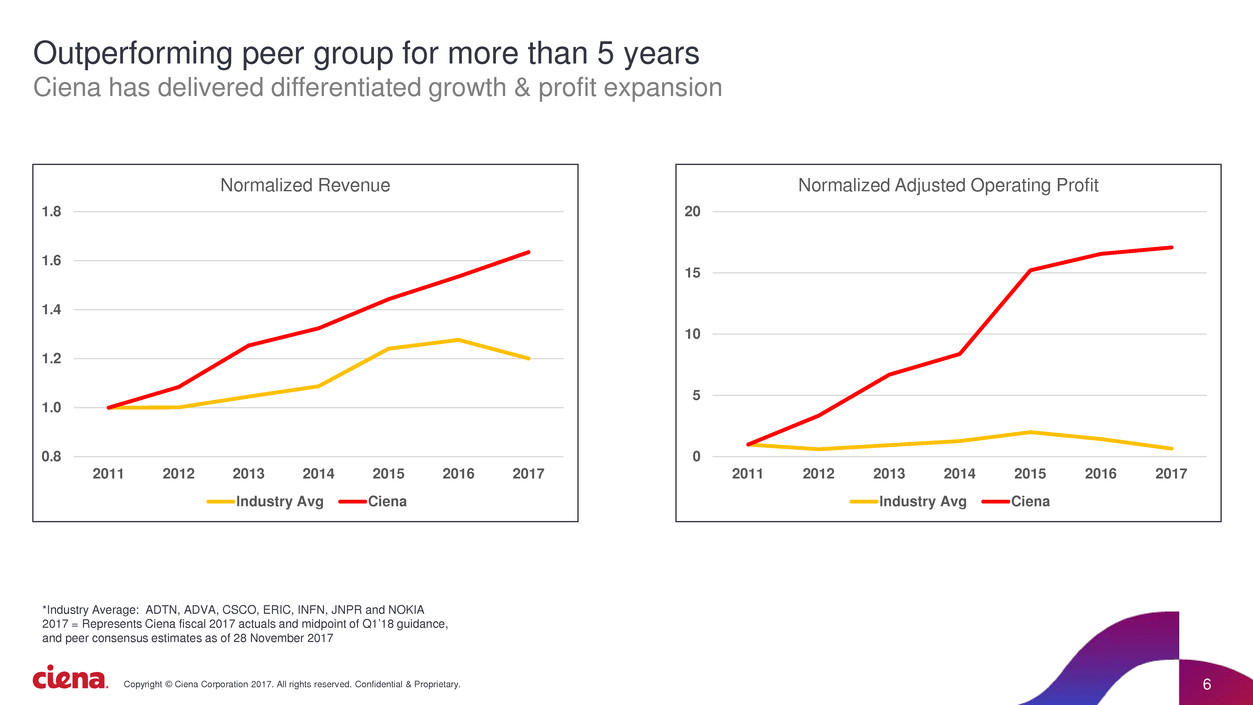

Today, we are a global market leader with scale. We have a diversified portfolio, we sell into a broad set of geographies and customers, and across a wide range of applications. And the business we’ve built is consistently delivering industry-leading growth and profitability with a strengthening balance sheet and meaningful cash generation.

The strong fiscal fourth quarter and year-end financial results were reported today are just the most recent evidence of this transformation, and of our ability to consistently outperform the industry and our peers, despite a challenging set of industry dynamics and competitive forces.

Strategy

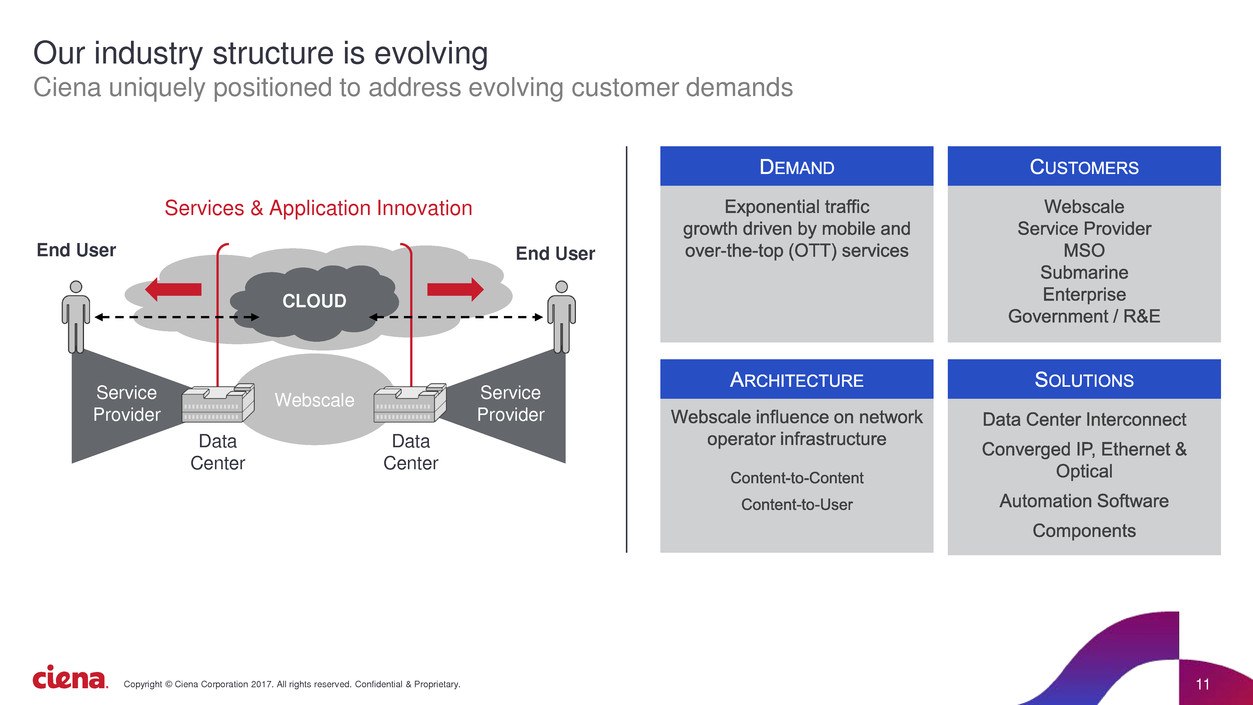

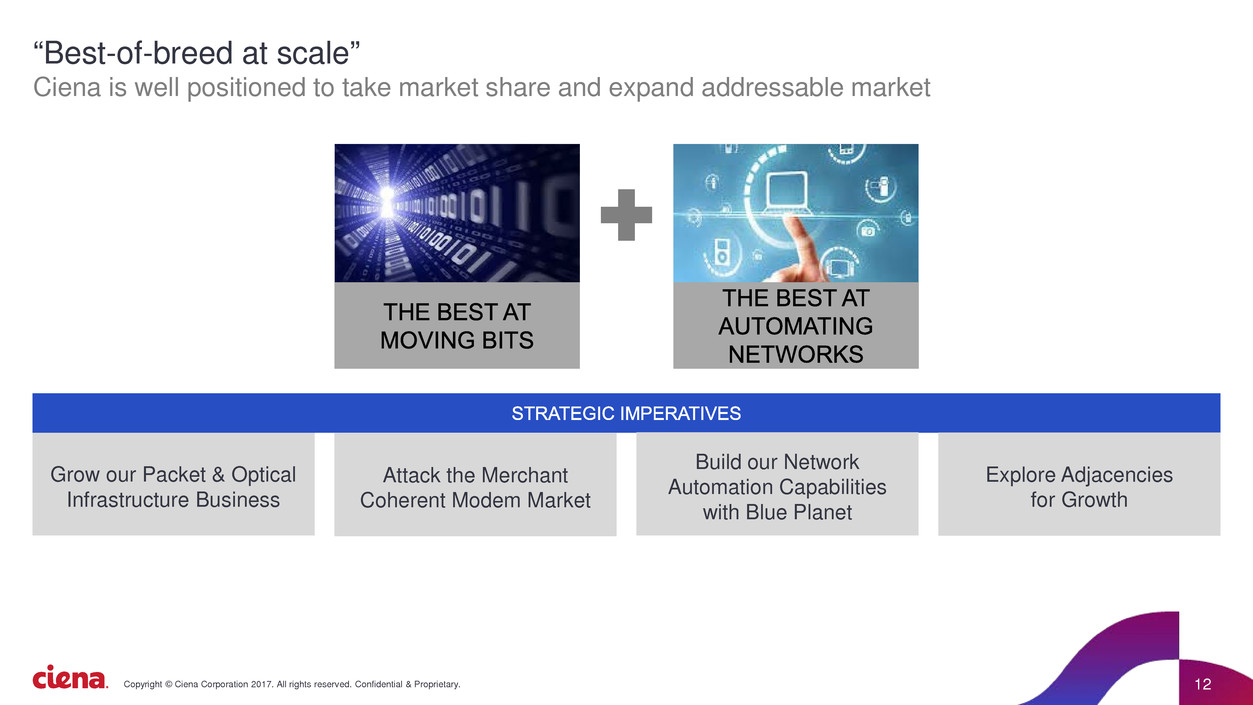

In this environment, we’ve executed against a very deliberate strategy of being best-of-breed at scale, ensuring that we are the best in the world at moving bits and automating networks. And we do that by enabling choice for our customers for open, leading technology that interconnects the world.

This strategy is underpinned by our approach to vertical integration; essentially ensuring that we control the key technologies in our integrated systems and offer a compelling portfolio across systems, components, software, and services that address customers’ preferred consumption models. We are unique in this complete capability.

Our strategy has been to scale and diversify our existing business by penetrating a broad set of higher growth geographies, customer types, and applications, and to expand our addressable market with logical extensions of our core competences.

Leveraging our global scale, technology leadership, and vertical integration, we’ve also forced the pace of innovation in our industry, and are delivering greater value to our customers.

As a result, we’ve captured additional market share and delivered differentiated financial performance that stands in stark contrast to other vendors, both the smaller niche players who lack the investment capacity to maintain forward innovation and who continue to atrophy, and the large generalists who face competing investment priorities within their portfolios and an inability to keep up with the pace of innovation.

Strategic Drivers

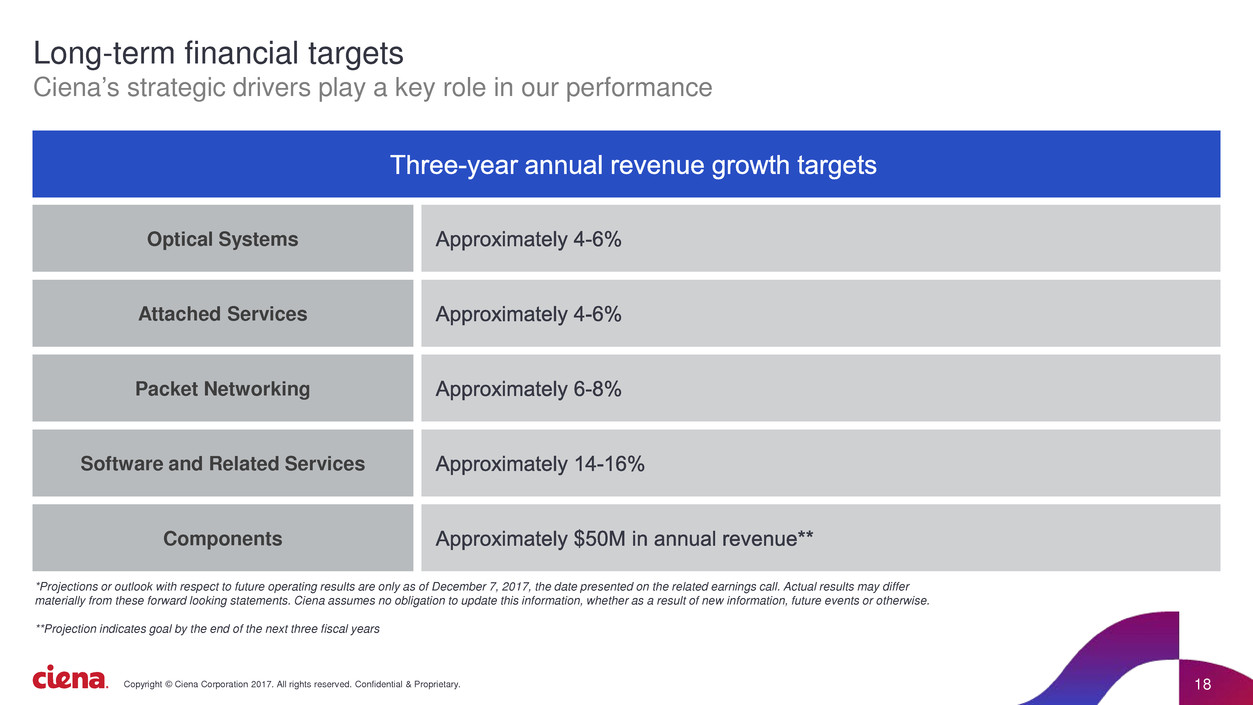

There are several drivers playing a key role in our market share opportunities and our access to new and emerging markets. We’ve established specific financial targets for each of these drivers over the next three years, and these are based on our expectations and current assumptions about market growth.

Our primary strategic driver remains our optical systems business, which represents the majority of our current addressable market. We are the only company in the industry that can successfully address the key applications of today and tomorrow, including long-haul, ultra long-haul, submarine, metro, converged packet access and data center interconnect.

The cornerstone for future growth of this business is our next generation coherent modem technology. And, our latest version WaveLogic Ai, is now generally available in our 6500 and Waveserver platforms, both of which are already shipping to customers.

Highlighting our ability to automate the network is Liquid Spectrum a unique capacity-on-demand solution that combines WaveLogic Ai, a reconfigurable photonic layer and our Blue Planet software. We are seeing very high levels of interest in this solution and beginning to get market traction for this integrated value proposition.

Based on our strong market position and the opportunities for growth afforded by these new offerings, we’re confident that we will continue to grow revenue and capture additional market share in our optical systems business.

Accordingly, we are targeting annual revenue growth for our optical systems business of approximately 4% to 6% over the next three years.

An important element of our optical systems business is our global network services business, or our attached services if you will. These include network planning and engineering, deployment, training, support and managed services.

Today, this part of our business comprises approximately 15% of our total revenue. Based on industry trends and customer buying patterns, we believe there is an opportunity to grow this high margin business within our overall product mix.

As such, we recently appointed a new leadership team for our global services business and have begun a multiyear transformation process to improve our delivery capability, expand our portfolio and drive greater incremental value for our customers in new ways.

As a result of this transformation, we are targeting annual revenue growth for our attached services business of approximately 4% to 6%, with higher gross margin, over the course of the next three years.

Beyond our optical business we continue to explore and invest in technologies, applications and business models that can serve to expand our addressable market including a packet networking, software and component elements.

Our packet networking business has been a strategic imperative for us for some time as you know.

We had a strong performance from our packet portfolio in fiscal 2017, diversifying our customer base and applications for these solutions with record revenue and a number of significant customer wins.

As a result, this business is now contributing in a meaningful way and we are very excited about the packet opportunity going forward.

To address broadband and subscriber growth around the world we’ve been investing in the convergence of optical and packet technologies deeper into the network, specifically by expanding into IP with our packet access and aggregation platforms.

Adding capabilities to our portfolio to get closer to the network edge will enable us to play a strategic role in our customers’ network densification initiatives, such as 5G and Fiber Deep.

As a result, we are targeting annual revenue growth for our packet networking portfolio of approximately 6% to 8% over the next three years.

We see our Blue Planet software business and the network automation it enables as another driver of our growth, competitive differentiation and expanding profitability.

As a reminder, Blue Planet encompasses our overall software business and related services, which is inclusive of domain management, orchestration software and apps, subscription services and associated professional services. This business totaled more than $160 million in revenue in 2017.

Two years since acquiring Cyan, we’ve had extensive Blue Planet engagements around the world and have had the opportunity to learn even more about the nascent NFV and orchestration space. We’ve taken those learnings on board to hone the focus and go-to-market strategy of our software business around the automation of packet optical infrastructure.

Specifically, we are focused on accelerating the transition from our legacy network management software platform to our Blue Planet network domain controller platform, positioning us to automate the transport domain as a whole. This also serves as a strong beachhead for our orchestration platform for Blue Planet.

In addition, we are concentrating on our Blue Planet analytics platform, which became generally available this year and is showing solid early customer adoption.

We are making good progress in executing on our new priorities in software and related services. As such, even while the industry ecosystem to drive network automation is still developing, we continue to believe that Blue Planet will serve as a competitive differentiator in the marketplace.

Accordingly, we are targeting annual revenue growth for our total software and associated services business of approximately 14% to 16% over the next three years.

Finally, we see the component space as a new strategic driver for our business.

You’ve already seen our announcement earlier this year that we’re making our coherent modem technology available to the market through three leading optical component vendors.

This strategic move positions us to secure a larger portion of the world’s wavelengths and to gain access to new geographies and market segments.

This business, which we are now calling our Optical Microsystems Division, is focused on enabling our market leading WaveLogic-based coherent modem technology to be consumed directly by end users or indirectly by integrating into a third party transport, switching or routing platform.

As expected, we are focused at this early stage on driving the initial business development efforts with our current partners and enabling development work on the new module. These efforts are on track with alpha units now in the hands of our partners and some of their potential customers.

We continue to believe that we can become a meaningful participant in this $1 billion dollar plus market over the next few years by offering flexibility and choice in modem technology to a wide range of customers.

Indeed, our expectations for this business haven’t changed and we still believe that we’re positioned to generate initial revenue toward the end of calendar 2018.

Given that our entry in this nascent market is in its early stages, we want to be realistic in setting longer term financial expectations for this business. Accordingly, we are targeting to generate approximately $50 million in revenue annually from our Optical Microsystems by the end of the next three years.

When viewing these strategic drivers together, again it is worth noting that we are the only vendor able to address the systems, services, software and components markets. As such, we are delivering innovations ahead of the competition that directly address the changing business and consumption models of our customers.

Essentially, we are leveraging our core technical leadership and relationships across a diversified range of market segments.

Key Market Verticals and Geographies

Peeling back on our strategy even a layer further, there are important market verticals and geographies that intersect with one or more of these strategic drivers.

In particular, our service provider customers are now placing greater importance on partnering with strategic suppliers who have this combination of scale, focus and capability to deliver innovation across a complete range of optical applications. In contrast to our competitors, we are well positioned to meet those requirements and provide greater value to our customers.

This has resulted recently in several significant new wins around the world, including some new tier one service providers, many of which represent share gains at the expense of our competitors.

When combined with the expected long-term build out of next-gen metro networks, we see the opportunity to continue taking share with service providers and we intend to press down our advantage in the market against weakening competitors.

We are equally optimistic about the web scale space or global content network provider customers over the next several years.

With number one market share with this important customer segment already, we continue to expand our global footprint and relationships with the large US based providers, including by connecting their data centers in the US, submarine and international markets, where we bring the unique ability to traverse all segments through our global tier 1 customer base.

And we are beginning to develop relationships with those content providers that are based outside of the US.

As a testament to our early success, we exceeded our revenue goal for Waveserver in fiscal 2017; ultimately delivering approximately $110 million dollars for this purpose-built DCI platform and securing number one market share in every application of the optical DCI market.

In the submarine space, we’ve gone from zero to number one market share in the cable upgrade market in the span of only six years and we continue to build upon this success.

We are winning new submarine cable upgrade business, including through expanding our relationships with our global content providers, who are an increasingly important customer segment in the submarine market.

And we are complementing that success with new cable build opportunities through our partnership with TE SubCom.

From a geographic standpoint, Asia-Pacific has become our fastest growing region in recent years. Whilst it is a highly competitive region in our industry, we have outstanding market traction and several new customer wins, including in Japan and South Korea.

In fact, we believe that certain long-standing local preferences for domestic vendors may be eroding in some Asian countries and we are well positioned to take advantage of that shift.

We are also looking to enter several new countries in the region during the next couple of years.

Accordingly, while there may be quarterly ebbs and flows, we expect our growth in APAC to be robust over the next several years.

India in particular has been an outstanding success story for Ciena. We now have number one market share in this important country and more than 20% of our global workforce is now based in India.

This market is in the very early stages of modernizing a massive network infrastructure to support its 1.2 billion people and is the fastest growing market for the internet in the world. Indeed, India is the fastest growing country in the world for our business.

We are deploying our complete portfolio and full range of applications across a broad set of customers in India, including every major service provider, content network and the national government.

We are clearly seeing the benefits of our early commitment to the India market more than 12 years ago and with nearly 100% year over year revenue growth in fiscal 2017.

Summary

The relentless execution of our strategy has truly enabled us to come of age. While our industry can be challenging and dynamic for sure, our improving annual results prove that we can adapt to changing market conditions, develop new markets and grow both top and bottom lines.

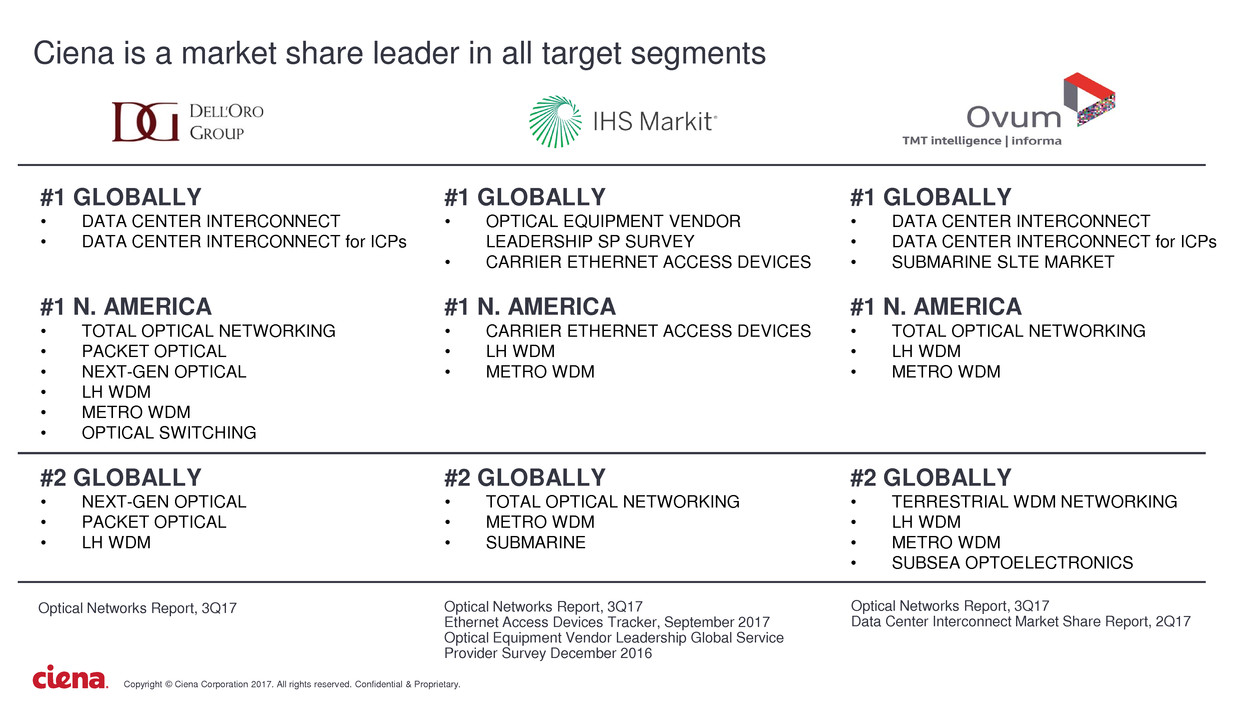

Our once single-threaded optical product is now a broad networking platform and supported by adjacent technologies that form a highly complementary portfolio. We are a market leader with number one or number two share in every market segment in which we participate.

We have scaled to more than 1,300 customers in over 80 countries around the world, spanning service providers to global content networks, MSOs, Fortune 2000 Enterprises, governments and other private network operators.

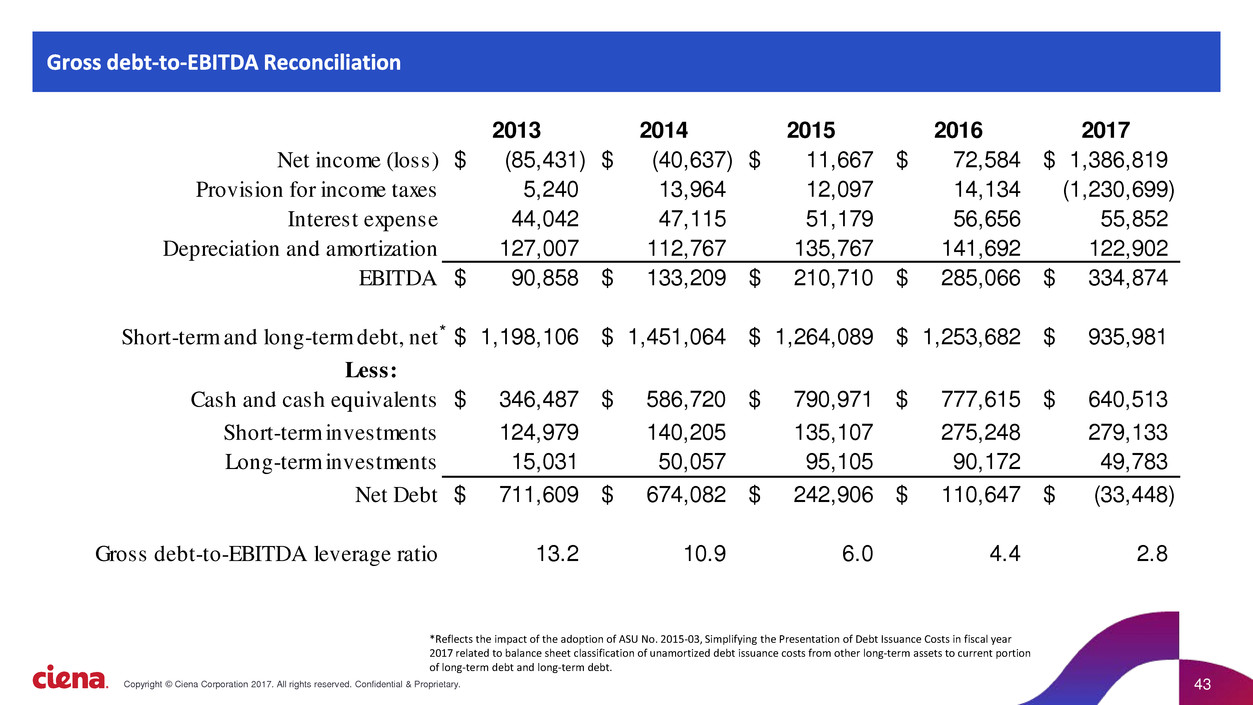

Our strategy has also enabled us to achieve our desired combination of financial performance in recent years, including: above industry average revenue growth with an 8% CAGR over the past five years: adjusted EPS growth of over 30% CAGR over the past four years: a significant improved balance sheet with a decrease in gross debt to EBITDA leverage ratio from 12x to 2.5x: and, increased cash generation, having generated $150 to $200 million of free cash flow over each of the past two years.

In short, we have transformed our business in recent years and believe that we are now the only western systems vendor that is both growing and profitable.

The point is that we have a proven a durable model that can deliver strong financial results in a challenging market. We believe the execution of our strategy positions us to continue outperforming the industry and delivering consistent value for our long-term investors.

Jim?

Introduction (Jim Moylan)

Jim Moylan: Thank you Gary. Having provided that detail on our strategic drivers and key market verticals, our intent to continue exerting our influence across the industry is clear, as is our path to building a bigger more resilient and more profitable business.

To that end, I will offer detail on several financial related matters, as well as provide new long-term targets for the company’s financial performance. Let’s begin with our Q4 performance.

Q4 2017 Highlights

Overall, we delivered a strong quarter. Total revenue was $744 million dollars towards the high end of our guidance range. We achieved strong order flow in Q4, significantly higher than revenue, which enabled us to close the quarter in the fiscal year with backlog of $1.1 billion.

Q4 adjusted gross margin came in at 44.2 %. This was down slightly from recent quarters, largely as a result of several new tier 1 customer wins that are now coming to revenue. As we’ve said, the early stage of these deployments often carry corresponding lower gross margins. We expect this dynamic to continue for the next couple of quarters as we continue to press down on the market and to leverage our competitive advantage by aggressively targeting market share through new footprint opportunities around the globe.

Operating expense in the quarter was $241 million and we achieved $88 million in adjusted operating income in Q4 or $11.9 % adjusted operating margin.

We will provide guidance for our fiscal first quarter of 2018 during today’s live call with the investment community.

Tax Matters

Before going through our long-term targets including with the respect to profitably, I want to spend a moment to discuss how they are affected by tax matters.

Today’s press release details important changes that impact how taxes are going to be reflected in our results. You should view these changes as a strong indicator of our positive sentiments about the future and further evidence of the company hitting an inflection point in our transformation.

As many of you know we have large deferred tax assets resulting from net operating losses accumulated organically and by acquisition. However in recent years, we have provided a valuation allowance against these tax assets on our books because in our judgment it was not certain that such tax assets would be realized.

Based on our projections a sustained future taxable income and expectation for increasing profitability in 2018 and beyond. We determined that it is appropriate to reverse the majority of the valuation allowance against these assets because we now expect that we will utilize these tax assets to reduce future taxes.

As you’ve seen in our press release, this resulted in a one-time tax benefit of $1.1 billion dollars on our Q4 income statement, substantially increasing our GAAP net income and EPS for Q4 and fiscal 2017.

Going forward, as required by GAAP we will be making a full US tax provision of approximately 36% to 37% against our GAAP net income. This will be a change in the presentation of our income statement.

However it is important to note that we do not expect to pay cash taxes in the US for the foreseeable future, again due to the utilization of our deferred tax assets.

In addition, as shown in our press release, we are changing how we calculate our provision for income taxes in our non-GAAP net income. We are making this change in accordance with recent SEC guidance.

Historically we have only provided cash taxes paid on our non-GAAP earnings and EPS. Going forward we will provide a full 36% to 37% tax rate against non-GAAP earnings and EPS.

This change will not affect our adjusted income before income taxes, our actual cash tax payments or our cash flows. But it will, of course, result in significantly higher non-GAAP provisions for income taxes.

This, in turn, will impact our adjusted net income and adjusted earnings per share and will require you to adjust your models for fiscal 2018 accordingly.

You will note that we provided our calculation for the fourth quarter and fiscal 2017 under both the prior method and the new method in an appendix to our press release.

To be clear, this non-cash tax provision against our non-GAAP net income is required by the SEC. And our cash flows will be the same as they would be before this provision.

But to summarize, overall you should view all of these changes to our financial statement presentation of tax expense as a reflection of our increasing optimism and confidence in our future.

Long-Term Financial Targets

Turning now to our long-term outlook. We believe that we are uniquely positioned in the industry to continue delivering a combination of top-line growth, profitability and cash generation. And our longer-term strategic plan is designed around that construct.

With that confidence, we are now in a position to provide some longer financial targets that we believe are achievable in the next few years. We expect to continue growing our revenue faster than the market.

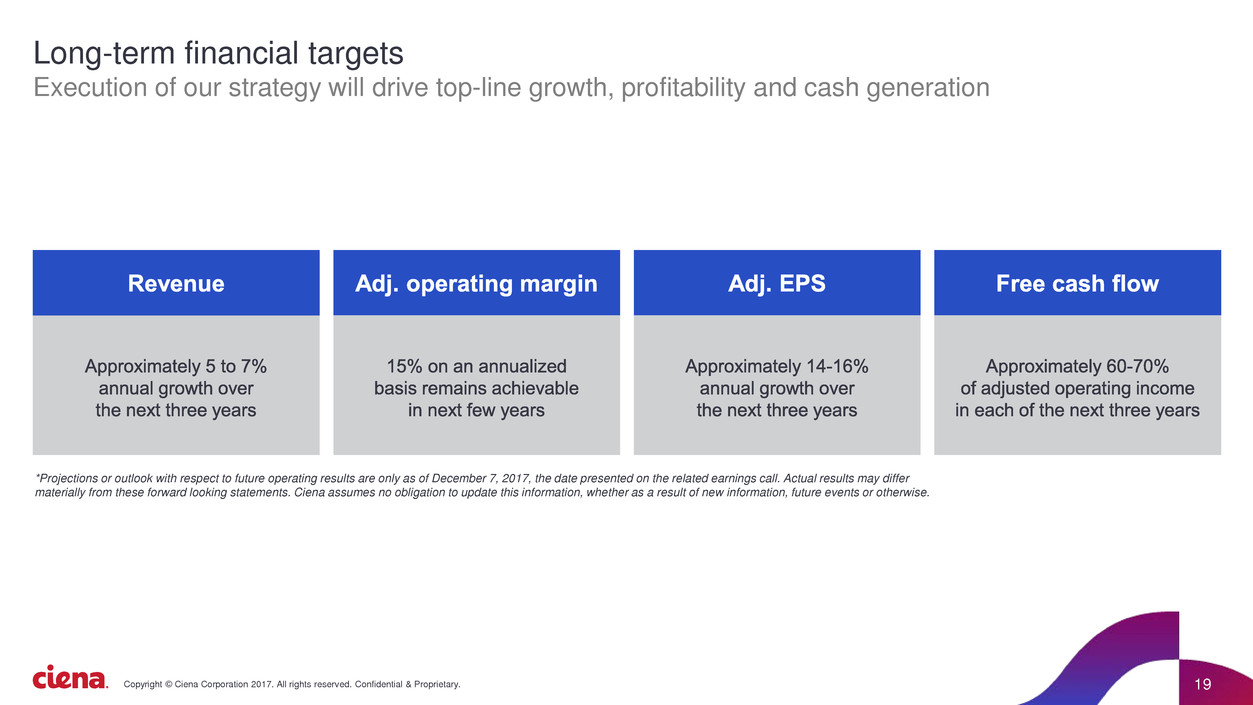

Based on our current estimates of market growth, if we combine all of our expectations regarding future revenue, which Gary cited, we expect to grow our annual revenue approximately 5% to 7% per year over the next three years.

Also, as we previously indicated, we have a long-term target of achieving 15% adjusted operating margin on an annualized basis. And that still remains an important and achievable goal.

We also expect to grow our adjusted earnings per share at an average of approximately 14% to 16% per year over the next three years. This performance includes the effect of our new method of reporting taxes in the calculation.

And we expect annual free cash flow generation to be approximately 60% to 70% of adjusted operating income over each of the next three years.

Capital Allocation

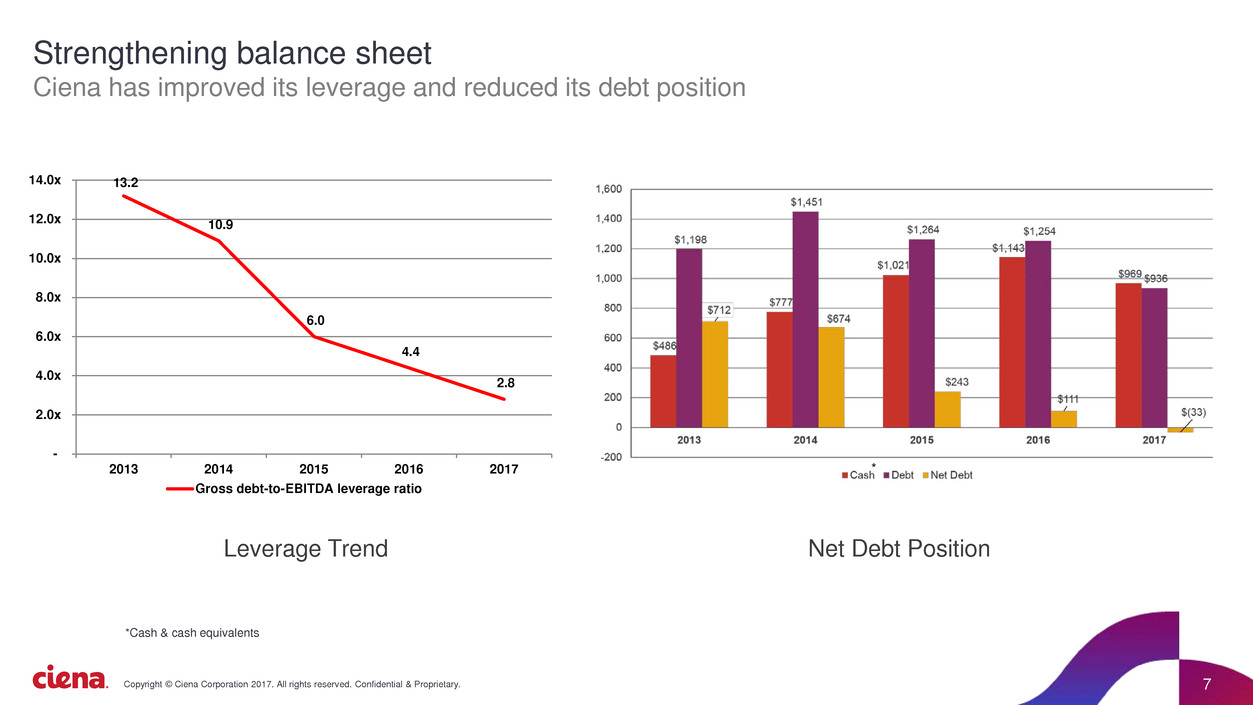

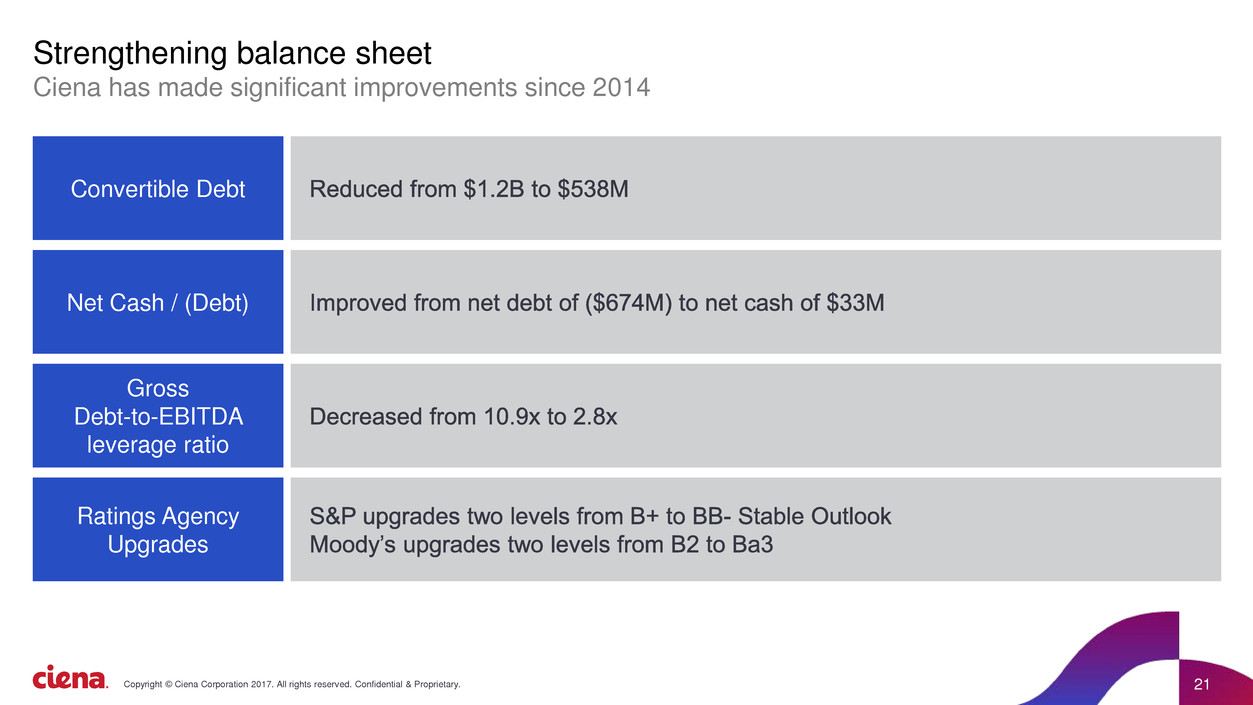

More specifically, with respect to our balance sheet, we've made substantial progress over the past five years.

We have reduced our convertible note balance from $1.4 billion to $540 million. We've improved our net debt position form $712 million to an actual net cash position of $33 million. And we substantially decreased our gross debt to EBITDA to leverage ratio from 12x to about 2.5x.

The combination of these two items resulted in two ratings upgrades over the past year from both Moody's and S&P.

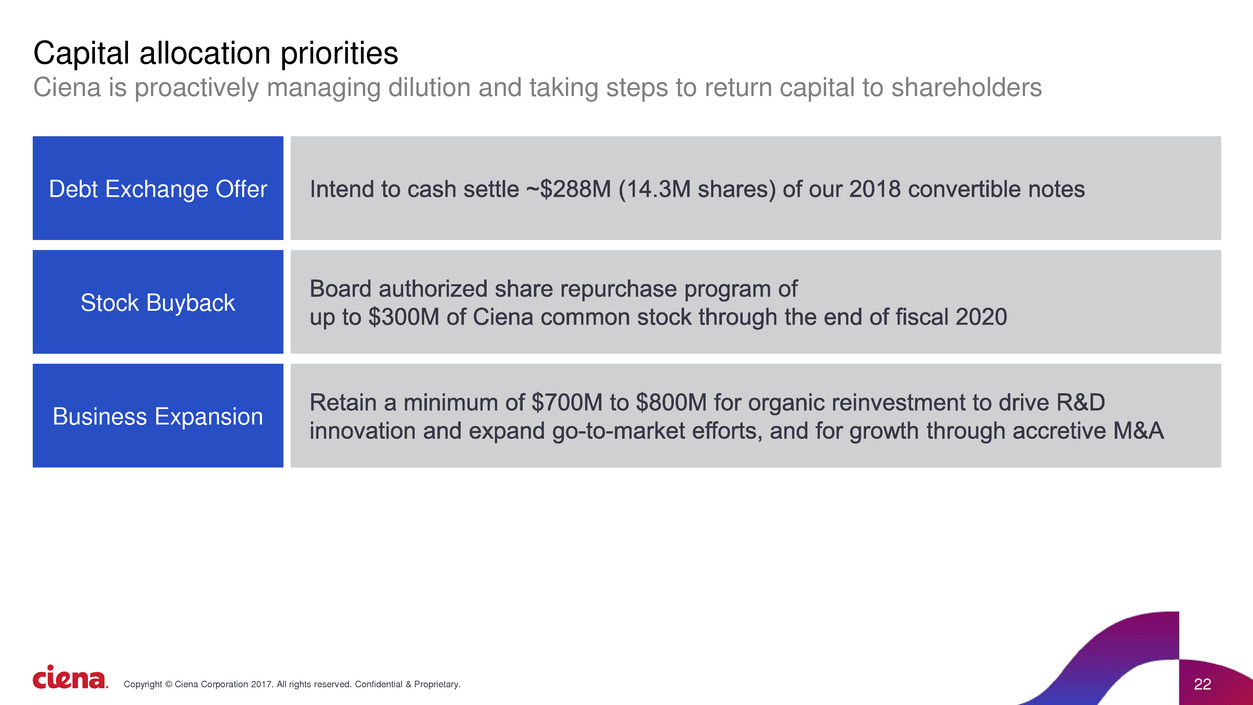

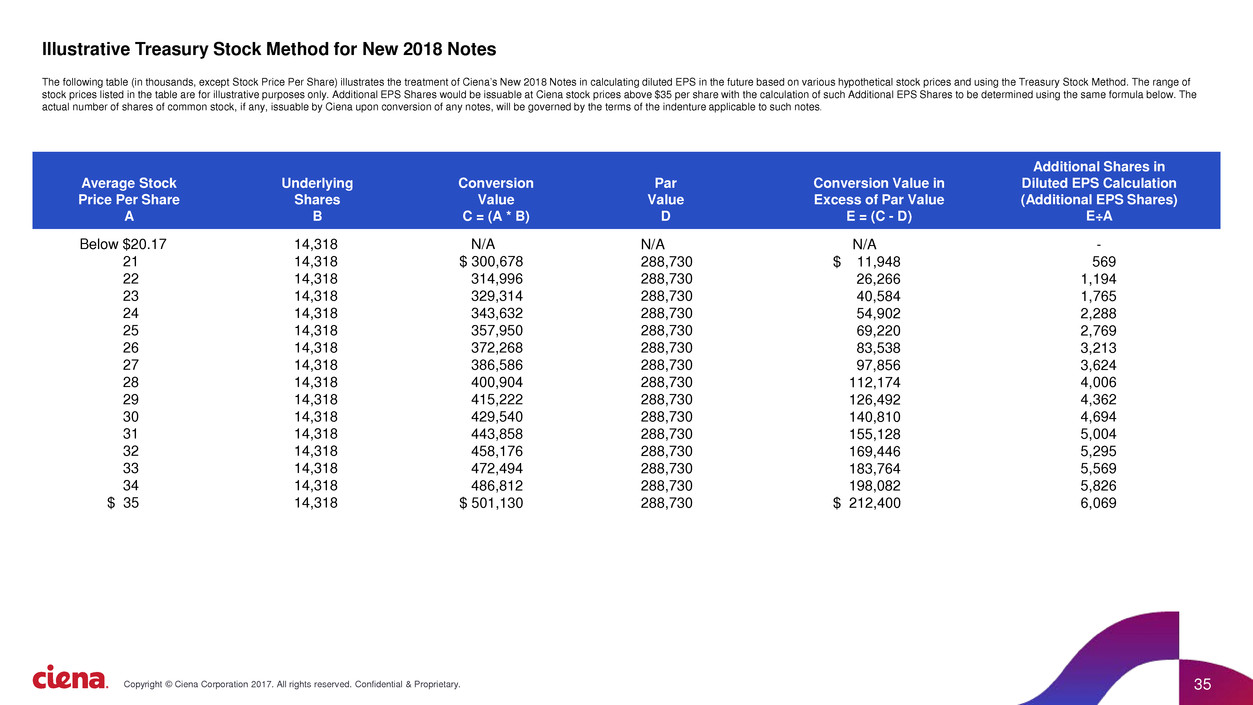

We've also been proactive in managing dilution. This summer, we completed an exchange offer for our 2018 convertible notes, which provided us the option to cash settle the majority of those notes at maturity.

And we have since disclosed our intent to use cash-on-hand to settle approximately $288 million of these notes when they come due in October of 2018.

Given our current balance sheet and our expectations for cash generation over the next three years, we are now in a better position to incorporate the return of capital to shareholders as part of our overall strategic and operational plans.

As reflected in a separate press release this morning, I'm pleased to announce that our board of directors authorized a program to repurchase our common stock, through purchases on the open market or in privately negotiated transactions through the end of fiscal 2018.

The timing of these purchases will be based on our stock price, general business and market conditions, our liquidity and cash flow and other factors. We intend to finance the share repurchase program with cash-on-hand or cash generated from operations.

These actions reflect our continued confidence in our long-term growth strategy and our strong balance sheet and cash flow generation.

As we think broadly about capital allocation, we still believe it is important to retain a meaningful percentage of our capital for the business and to maintain a healthy balance sheet and leverage level.

First for organic reinvestment to sustain and drive our R&D innovation engine and expanding our go-to-market efforts, which is clearly creating value as we use this competitive advantage to grow revenue and take market share.

Second, for opportunities to grow through accretive M&A.

It is our intent to retain minimum liquidity in the range of $700 to $800 million for these purposes.

However, we are committed to driving shareholder value over the long-term and intend to continue to incorporate the return of capital to shareholders in our plans as the business continues to grow and generate cash.

Closing Commentary

In closing, we are pleased with the maturity and strength of our business. It allows us to confidently provide greater clarity on our view of the current operating environment and, importantly, share our longer-term goals and how we plan to manage the business over the next several years.

As we've said before, given industry dynamics and other factors, our overall financial performance and individual financial metrics may vary from quarter to quarter. However, we continue to manage the business for the longer-term.

When viewed over longer periods, it is clear that we have delivered consistent financial performance with respect to top-line growth, profitability and cash generation and we expect to continue to do so in the future.

The combination of our leading technology and global scale has afforded us indisputable strong market leadership position and we continue to see our competition struggle to keep pace.

We intend to take full advantage of those dynamics and to continue executing on our strategy to grow both our top and bottom-lines and to generate cash. We have proven our ability to do that time and time again and today we've never felt more confident about our future.

Thank you for your support and interest in Ciena.

IMPORTANT NOTES TO INVESTORS

Forward-Looking Statements