Form 8-K Wesco Aircraft Holdings, For: Nov 29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): November 29, 2017

Wesco Aircraft Holdings, Inc.

(Exact name of registrant as specified in its charter)

DELAWARE | 001-35253 | 20-5441563 | ||

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||

24911 Avenue Stanford

Valencia, California 91355

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (661) 775-7200

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

1

Item 7.01 Regulation FD Disclosure.

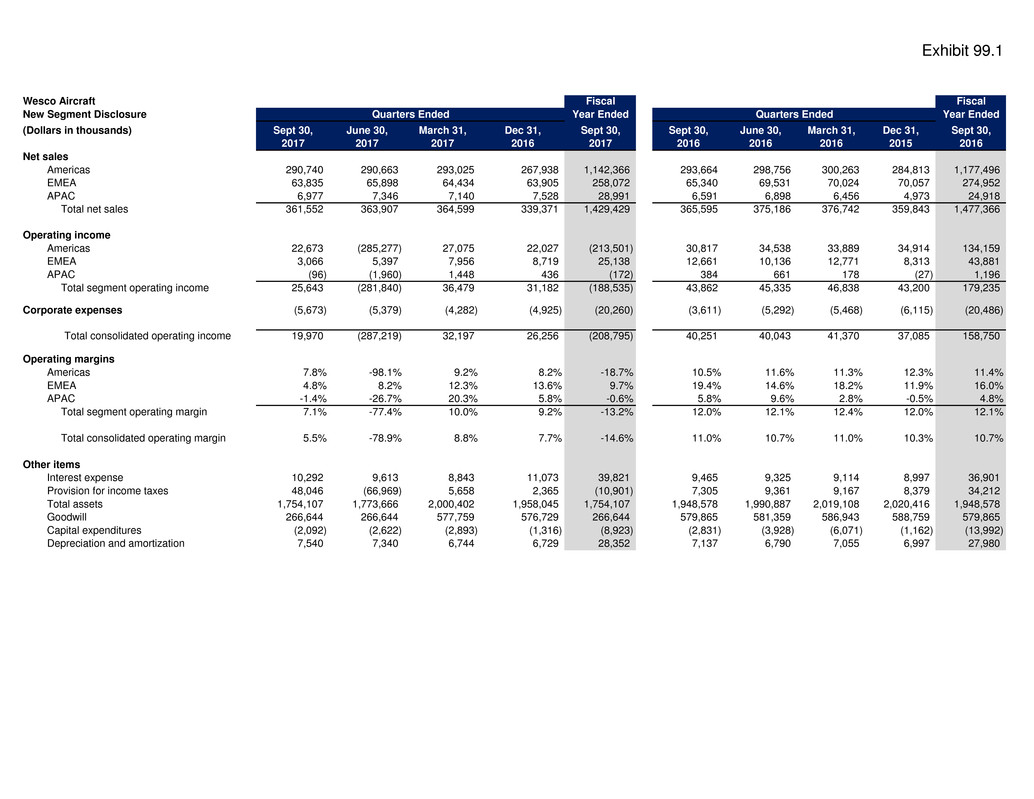

On November 29, 2017, the Company posted supplemental quarterly financial information by segment for the fiscal years ended September 30, 2016 and 2017 on the Investor Relations section of its website (www.wescoair.com), which materials are attached as Exhibit 99.1 hereto.

The information in this Current Report on Form 8-K (including Exhibit 99.1) is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit Number | Description | |

99.1 | ||

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

WESCO AIRCRAFT HOLDINGS, INC. | |||

Date: | November 29, 2017 | By: | /s/ Kerry A. Shiba |

Kerry A. Shiba Executive Vice President and Chief Financial Officer | |||

3

Wesco Aircraft Fiscal Fiscal

New Segment Disclosure Year Ended Year Ended

(Dollars in thousands) Sept 30, June 30, March 31, Dec 31, Sept 30, Sept 30, June 30, March 31, Dec 31, Sept 30,

2017 2017 2017 2016 2017 2016 2016 2016 2015 2016

Net sales

Americas 290,740 290,663 293,025 267,938 1,142,366 293,664 298,756 300,263 284,813 1,177,496

EMEA 63,835 65,898 64,434 63,905 258,072 65,340 69,531 70,024 70,057 274,952

APAC 6,977 7,346 7,140 7,528 28,991 6,591 6,898 6,456 4,973 24,918

Total net sales 361,552 363,907 364,599 339,371 1,429,429 365,595 375,186 376,742 359,843 1,477,366

Operating income

Americas 22,673 (285,277) 27,075 22,027 (213,501) 30,817 34,538 33,889 34,914 134,159

EMEA 3,066 5,397 7,956 8,719 25,138 12,661 10,136 12,771 8,313 43,881

APAC (96) (1,960) 1,448 436 (172) 384 661 178 (27) 1,196

Total segment operating income 25,643 (281,840) 36,479 31,182 (188,535) 43,862 45,335 46,838 43,200 179,235

Corporate expenses (5,673) (5,379) (4,282) (4,925) (20,260) (3,611) (5,292) (5,468) (6,115) (20,486)

Total consolidated operating income 19,970 (287,219) 32,197 26,256 (208,795) 40,251 40,043 41,370 37,085 158,750

Operating margins

Americas 7.8% -98.1% 9.2% 8.2% -18.7% 10.5% 11.6% 11.3% 12.3% 11.4%

EMEA 4.8% 8.2% 12.3% 13.6% 9.7% 19.4% 14.6% 18.2% 11.9% 16.0%

APAC -1.4% -26.7% 20.3% 5.8% -0.6% 5.8% 9.6% 2.8% -0.5% 4.8%

Total segment operating margin 7.1% -77.4% 10.0% 9.2% -13.2% 12.0% 12.1% 12.4% 12.0% 12.1%

Total consolidated operating margin 5.5% -78.9% 8.8% 7.7% -14.6% 11.0% 10.7% 11.0% 10.3% 10.7%

Other items

Interest expense 10,292 9,613 8,843 11,073 39,821 9,465 9,325 9,114 8,997 36,901

Provision for income taxes 48,046 (66,969) 5,658 2,365 (10,901) 7,305 9,361 9,167 8,379 34,212

Total assets 1,754,107 1,773,666 2,000,402 1,958,045 1,754,107 1,948,578 1,990,887 2,019,108 2,020,416 1,948,578

Goodwill 266,644 266,644 577,759 576,729 266,644 579,865 581,359 586,943 588,759 579,865

Capital expenditures (2,092) (2,622) (2,893) (1,316) (8,923) (2,831) (3,928) (6,071) (1,162) (13,992)

Depreciation and amortization 7,540 7,340 6,744 6,729 28,352 7,137 6,790 7,055 6,997 27,980

Quarters Ended Quarters Ended