Form SUPPL NEOVASC INC

Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS

Filed

pursuant to General Instruction II.L. of Form F-10

File No. 333-211325

PROSPECTUS SUPPLEMENT

To Short Form Base Shelf Prospectus dated June 9, 2016

New Issue |

November 10, 2017 |

NEOVASC INC.

US$37,487,497

Series A Units Consisting of (I) One Common Share, (II) One Series A Warrant to Purchase One Common Share, (III) One Series B Warrant to Purchase One Common

Share and (IV) 0.40 Series C Warrants to Purchase a Unit Comprised of One Common Share, One Series A Warrant and One Series B Warrant

Series B Units Consisting of (I) either One Common Share or One Series D Warrant to Purchase One Common Share, (II) One Series A Warrant to Purchase One Common Share, (III) One Series B Warrant to Purchase One Common Share, (IV) 0.40 Series C Warrants to Purchase a Unit Comprised of One Common Share, One Series A Warrant and One Series B Warrant, and (V) 1.1765 Series F Warrants to Purchase One Common Share

US$1.46 per Unit

This prospectus supplement is hereby qualifying for distribution 6,609,588 Series A units (the "Series A Units") of Neovasc Inc. (the "Company", "Neovasc" or "We") and 19,066,780 Series B units (the "Series B Units" and together with the Series A Units, the "Units") of the Company, at a price of US$1.46 per Unit (the "Offering"), pursuant to the accompanying short form base shelf prospectus dated June 9, 2016. The Series B Units are being offered in lieu of Series A Units only to those purchasers who will be purchasing securities in the concurrent private placement more fully described elsewhere herein. See "Description of Securities Being Distributed Under the Concurrent Private Placement."

Each Series A Unit is comprised of (i) one common share of the Company (each, a "Unit Share"), (ii) one Series A common share purchase warrant of the Company (each, a "Series A Warrant"), (iii) one Series B common share purchase warrant of the Company (each, a "Series B Warrant") and (iv) 0.40 Series C warrants (each, a "Series C Warrant"), with each whole Series C Warrant exercisable to purchase a unit (each, a "Series C Unit") comprised of one common share of the Company, one Series A Warrant and one Series B Warrant. Each Series B Unit is comprised of (i) either one Unit Share or one pre-funded Series D common share purchase warrant of the Company (each, a "Series D Warrant"), (ii) one Series A Warrant, (iii) one Series B Warrant, (iv) 0.40 Series C Warrants, and (v) 1.1765 Series F common share purchase warrants of the Company (each, a "Series F Warrant"). The Series A Warrants, Series B Warrants, Series C Warrants, Series D Warrants and Series F Warrants are collectively referred to herein as, the "Warrants"). Each Series A Warrant will entitle the holder to purchase one common share of the Company (each, a "Series A Warrant Share") at an exercise price of US$1.61 per Series A Warrant Share for a period of five years following issuance. Each Series B Warrant will entitle the holder to purchase one common share of the Company (each, a "Series B Warrant Share") at an exercise price of US$1.61 per Series B Warrant Share for a period of two years following issuance. Each Series C Warrant will entitle the holder to purchase a Series C Unit comprised of a common share of the Company (each a "Series C Unit Share"), a Series A Warrant and a Series B Warrant, at an exercise price of US$1.46 per Series C Unit for a period of two years following issuance. Each Series D Warrant will entitle the holder to purchase one common share of the Company (each, a "Series D Warrant Share") at an exercise price of US$1.46 per Series D Warrant Share, all of which will be pre-funded except for a nominal exercise price of $0.01 per Series D Warrant Share for a period of five years following issuance. Each Series F Warrant will entitle the holder to purchase one common share of the Company (each, a "Series F Warrant Share" and together with the Series A Warrant Shares, Series B Warrant Shares, Series C Unit Shares, and Series D Warrant Shares, the "Warrant Shares") at an exercise price of US$1.61 per Series F Warrant Share for a period of two years following issuance. The Warrant Shares and Series C Units are subject to adjustment, at any time prior to their expiry. In certain circumstances each Series A Warrant, Series B Warrant, Series D and Series F Warrant may be exercised on a "net" or "cashless" basis. The Series A Units and Series B Units will separate into Unit Shares and Warrants immediately upon distribution. See "Description of Securities Being Distributed".

Canaccord Genuity Inc. ("Canaccord" or the "Underwriter") is acting as sole bookrunner in respect of the Offering pursuant to an underwriting agreement (the "Underwriting Agreement") dated as of November 9, 2017, between the Company and the Underwriter. See "Plan of Distribution". This prospectus supplement qualifies the distribution of the Units from Canada to the

United States. The Underwriter will only sell the Units in the United States either directly or through its duly registered U.S. broker dealer affiliates or agents. No Units will be sold to Canadian purchasers.

The outstanding common shares of the Company (the "Common Shares") are listed on the Nasdaq Capital Market (the "Nasdaq") and on the Toronto Stock Exchange (the "TSX") under the symbol "NVCN". On November 9, 2017, the last trading day before filing of this prospectus supplement, the closing price of the Common Shares was US$1.46 on the Nasdaq and C$1.86 on the TSX.

Investing in our securities involves a high degree of risk. You should carefully read the "Risk Factors" section in this prospectus supplement and the accompanying base shelf prospectus, as well as the information under the heading "Cautionary Note Regarding Forward-Looking Statements" in this prospectus supplement and consider such notes and information in connection with an investment in any securities.

Price: US$1.46 per Unit

| |

Public Offering Price |

Underwriting Commission |

Net Proceeds to the Company(1) |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

Per Unit |

US$1.46 | US$0.0876 | US$1.3724 | |||||||

Total(2) |

US$37,487,497 | US$2,249,250 | US$35,238,247 | |||||||

Notes:

- (1)

- After

deducting the 6.0% commission to be paid to the Underwriter (the "Underwriting Commission"), but

before deducting the Company's expenses of the Offering, which are estimated at US$1.5 million and will be paid by the Company from the proceeds of the Offering. We refer you to the section

entitled "Plan of Distribution" for additional information regarding total Underwriting

Commission.

- (2)

- Total gross proceeds includes an aggregate of US$35,738 that will be funded upon the exercise of all of the Series D Warrants sold in the Offering.

The Company has not granted to the Underwriter any over-allotment option.

The Company has applied to list the Unit Shares and the Warrant Shares on the TSX and has submitted a notification of listing to list the Unit Shares and the Warrant Shares on the Nasdaq. Listing on the TSX and the Nasdaq will be subject to the Company fulfilling all of the listing requirements of the TSX and the Nasdaq. See "Plan of Distribution". There is no established public trading market for the Warrants, we do not expect a market to develop, and purchasers may not be able to resell Warrants purchased under this prospectus supplement and the accompanying prospectus. In addition, we do not intend to apply for listing of the Warrants on any securities exchange or other nationally recognized trading system. This may affect the pricing of the Warrants in the secondary market, the transparency and availability of trading prices, the liquidity of the Warrants, and the extent of issuer regulation. See "Risk Factors".

The Underwriter, as principal, conditionally offers the Units subject to prior sale, if as and when issued by us and accepted by the Underwriter, in accordance with the conditions contained in the Underwriting Agreement and subject to the approval of certain legal matters on behalf of Neovasc by Blake, Cassels & Graydon LLP, with respect to Canadian legal matters, and by Skadden, Arps, Slate, Meagher & Flom LLP, and Wilson Sonsini Goodrich & Rosati, with respect to U.S. legal matters, and on behalf of the Underwriter by Stikeman Elliott LLP, with respect to Canadian legal matters, and by Goodwin Procter LLP, with respect to U.S. legal matters. The Underwriter reserves the right to withdraw, cancel or modify offers to the public and to reject orders in whole or in part. Subject to the terms and conditions set forth in the Underwriting Agreement, the Underwriter has agreed to purchase all of the Units sold under the Underwriting Agreement if any of these Units are purchased. In connection with the Offering, the Underwriter may, subject to applicable laws, engage in transactions that stabilize the price of the Common Shares. See "Plan of Distribution".

The offering price of the Units was determined by arm's length negotiation between the Company and the Underwriter. If all of the Units are not sold at the public offering price, the Underwriter may change the offering price and the other selling terms. See "Plan of Distribution".

The Company will also be completing, concurrent with the Offering, a brokered private placement (the "Concurrent Private Placement"), through Canaccord Genuity Inc. acting as placement agent, of US$32,750,000 aggregate principal amount of senior secured convertible notes of the Company (the "Notes") and Series E warrants to purchase one common share of the Company (the "Series E Warrants"). The Notes will have an 18-month term, will be issued at an original issue price of US$850 per US$1,000 principal amount of Notes, and carry an interest rate of 0% per annum (increasing to 15% upon an event of default) from the closing date of the Concurrent Private Placement. Interest on the Notes will commence accruing on the date of issue, will be computed on the basis of a 360-day year and twelve 30-day months and will be payable in cash on January 1, 2018 and on the first day of each calendar quarter thereafter up to, and including, the maturity date. The Series E Warrants will have the same terms and conditions as the Series A Warrants, as more fully described under the heading "Description of Securities Being Distributed under the Offering". Completion of the Offering and the Concurrent Private Placement are each conditional upon completion of the other. See "Description of Securities Being Distributed under the Concurrent Private Placement."

It is expected that the Unit Shares will be delivered in book-entry form only through the facilities of the Depository Trust Company at the closing of the Offering, which is anticipated to be on or about November 17, 2017 or such other date as may be agreed upon between the Company and the Underwriter (the "Closing Date"). Certificates representing the Warrants will be in definitive form and available for delivery to purchasers at closing of the Offering. The Company expects that delivery of the Unit Shares and the

Warrants will be made against payment therefor on or about the Closing Date. Investors who wish to trade Unit Shares or Warrants prior to the Closing Date should consult their own advisors. See "Plan of Distribution."

The total gross proceeds from the Offering will be US$37,487,497. The Company estimates that the net proceeds from the Offering to the Company will be approximately US$33.74 million, after deducting the Underwriting Commission of US$2,249,250 and the Company's expenses of the Offering, which are estimated to be US$1.5 million and will be paid by the Company from the proceeds of the Offering. See "Plan of Distribution".

Certain of the Company's directors reside outside of Canada and have appointed an agent for service of process in Canada. See "Agent for Service of Process".

We are permitted under a multijurisdictional disclosure system adopted by the securities regulatory authorities in Canada and the United States to prepare this prospectus supplement and the accompanying base shelf prospectus in accordance with the disclosure requirements of Canada. Prospective investors in the United States should be aware that such requirements are different from those of the United States. The financial statements incorporated by reference in this prospectus supplement and the accompanying base shelf prospectus have been prepared in accordance with International Financial Reporting Standards, as issued by the International Accounting Standards Board, and are subject to Canadian auditing and auditor independence standards. As a result, our financial statements may not be comparable to financial statements of United States companies.

Owning our securities may subject you to tax consequences both in Canada and the United States, including the Canadian federal income tax consequences applicable to a foreign controlled Canadian corporation that acquires Unit Shares, Warrants or the Warrant Shares. This prospectus supplement and the accompanying base shelf prospectus may not describe these tax consequences fully. You should read the tax discussion in this prospectus supplement and consult your own tax advisor with respect to your own particular circumstances.

Your ability to enforce civil liabilities under the United States federal securities laws may be affected adversely because we are incorporated in Canada, some of our officers and directors and the experts named in this prospectus supplement and the accompanying base shelf prospectus are Canadian residents, and a substantial portion of our assets and the assets of those officers, directors and experts are located outside of the United States.

NEITHER THE U.S. SECURITIES AND EXCHANGE COMMISSION ("SEC"), NOR ANY STATE SECURITIES REGULATOR HAS APPROVED OR DISAPPROVED THE SECURITIES OFFERED HEREBY OR DETERMINED IF THIS PROSPECTUS SUPPLEMENT OR THE ACCOMPANYING BASE SHELF PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

Our head office is located at Suite 5138 – 13562 Maycrest Way, Richmond, British Columbia, V6V 2J7, Canada, and our registered office is located at Suite 2600 – 595 Burrard Street, Vancouver, British Columbia, V7X 1L3, Canada.

Investors should rely only on current information contained in or incorporated by reference into this prospectus supplement and the accompanying base shelf prospectus as such information is accurate only as of the date of the applicable document. We have not authorized anyone to provide investors with different information. Information contained on our website shall not be deemed to be a part of this prospectus supplement or the accompanying base shelf prospectus or incorporated by reference herein and therein and should not be relied upon by prospective investors for the purpose of determining whether to invest in the securities. We will not make an offer of these securities in any jurisdiction where the offer or sale is not permitted. Investors should not assume that the information contained or incorporated by reference in this prospectus supplement and the accompanying base shelf prospectus is accurate as of any date other than the date on the face page of this prospectus supplement, the accompanying base shelf prospectus or the date of any documents incorporated by reference herein or therein, as applicable.

S-2

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is the prospectus supplement, which describes the terms of the Offering and adds to and updates information contained in the accompanying base shelf prospectus and the documents incorporated by reference therein. The second part is the accompanying base shelf prospectus, which gives more general information, some of which may not apply to the Unit Shares, Warrants or Warrant Shares. This prospectus supplement is deemed to be incorporated by reference into the accompanying base shelf prospectus solely for the purpose of the Offering. If information in this prospectus supplement is inconsistent with the accompanying base shelf prospectus or the information incorporated by reference, you should rely on this prospectus supplement. You should read both this prospectus supplement and the accompanying base shelf prospectus, together with the additional information about us to which we refer you in the section of this prospectus supplement entitled "Where You Can Find More Information."

You should rely only on the information contained in or incorporated by reference into this prospectus supplement and the accompanying base shelf prospectus. The Company has not authorized anyone to provide you with different information.

You should assume that the information contained in this prospectus supplement, the accompanying base shelf prospectus and the documents incorporated by reference herein and therein is accurate only as of their respective dates, regardless of the time of delivery of this prospectus supplement and the accompanying base shelf prospectus. Our business, financial condition, results of operations and prospects may have changed since those dates.

Market data and certain industry forecasts used in this prospectus supplement and the documents incorporated by reference in this prospectus supplement and the accompanying base shelf prospectus were obtained from market research, publicly available information and industry publications. We believe that these sources are generally reliable, but the accuracy and completeness of this information is not guaranteed. We have not independently verified such information, and we do not make any representation as to the accuracy of such information.

In this prospectus supplement and the accompanying base shelf prospectus, unless otherwise indicated, all dollar amounts and references to "US$" are to U.S. dollars and references to "C$" are to Canadian dollars. This prospectus supplement and the underlying base shelf prospectus and the documents incorporated by reference herein and therein contain translations of some Canadian dollar amounts into U.S. dollars solely for your convenience. See "Exchange Rate Information".

In this prospectus supplement and the accompanying base shelf prospectus, unless the context otherwise requires, references to "we", "us", "our" or similar terms, as well as references to "Neovasc" or the "Company", refer to Neovasc Inc., either alone or together with our subsidiaries.

The names Neovasc®, Tiara™ ("Tiara") and Neovasc Reducer™ ("Reducer") are our trademarks. Other trademarks, product names and company names appearing in this prospectus supplement and the accompanying base shelf prospectus and documents incorporated by reference in this prospectus supplement and the accompanying base shelf prospectus are the property of their respective owners.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement and the accompanying base shelf prospectus, including the documents incorporated by reference herein and therein, contain forward-looking statements within the meaning of applicable Canadian securities legislation and the U.S. Private Securities Litigation Reform Act of 1995 that may not be based on historical fact, including, without limitation, statements containing the words "believe", "may", "plan", "will", "estimate", "continue", "anticipate", "intend", "expect" and similar expressions. Forward-looking statements are necessarily based on estimates and assumptions made by us in light of our experience and perception of historical trends, current conditions and expected future developments, as well as the factors we believe are appropriate. Forward-looking statements in this prospectus supplement and the accompanying base

S-3

shelf prospectus and the documents incorporated by reference herein and therein include, but are not limited to, statements relating to:

- •

- our anticipated use of proceeds from the sale of the Units;

- •

- the conduct or possible outcomes of any actual or threatened legal proceedings, including the Company's ongoing litigation

with CardiAQ and the damages and interest awards affirmed by the U.S. Court of Appeals immediately due and payable on November 13, 2017 as described under the heading

"Legal Proceedings" in the AIF and "The Company — Recent

Developments" in this prospectus supplement;

- •

- our ability to continue as a going concern;

- •

- the amount of estimated additional litigation expenses required to defend the Company in lawsuits filed by CardiAQ;

- •

- our need for significant additional financing and our estimates regarding our capital requirements and future revenues,

expenses and profitability;

- •

- our intention to expand the indications for which we may market the Tiara (which does not have regulatory approval and is

not commercialized) and the Reducer (which has CE Mark approval for sale in the European Union), including our COSIRA-II trial in the United States relating to the Reducer;

- •

- clinical development of our products, including the results of current and future clinical trials and studies;

- •

- our intention to apply for CE Mark approval for the Tiara in the next one to two years;

- •

- the anticipated timing and locations of the first implantations in the TIARA-II trial and our intention to initiate

additional investigational sites in 2017 as required approvals are obtained;

- •

- our plans to develop and commercialize products, including the Tiara, and the timing and cost of these development

programs;

- •

- our strategy to refocus our business towards development and commercialization of the Reducer and the Tiara;

- •

- our ability to replace declining revenues from the tissue business with revenues from the Reducer and the Tiara in a

timely manner;

- •

- whether we will receive, and the timing and costs of obtaining, regulatory approvals for the Tiara and the Reducer;

- •

- the cost of post-market regulation if we receive necessary regulatory approvals;

- •

- our ability to enroll patients in our clinical trials, studies and compassionate use cases in Canada, the

United States and in Europe;

- •

- our intention to continue directing a significant portion of our resources into sales expansion;

- •

- the expected decline of consulting services revenue in the long-term as our consulting customers become contract

manufacturing customers or cease being customers;

- •

- our ability to get our products approved for use;

- •

- the benefits and risks of our products as compared to others;

- •

- our estimates of the size of the potential markets for our products including the anticipated market opportunity for

the Reducer;

- •

- our potential relationships with distributors and collaborators with acceptable development, regulatory and

commercialization expertise and the benefits to be derived from such collaborative efforts;

- •

- sources of revenues and anticipated revenues, including contributions from distributors and other third parties, product sales, license agreements and other collaborative efforts for the development and commercialization of products;

S-4

- •

- our creation of an effective direct sales and marketing infrastructure for approved products we elect to market and

sell directly;

- •

- the rate and degree of market acceptance of our products;

- •

- the timing and amount of reimbursement for our products; and

- •

- the impact of foreign currency exchange rates.

Forward-looking statements are based on estimates and assumptions made by the Company in light of its experience and its perception of historical trends, current conditions and expected future developments, as well as other factors that the Company believes are appropriate in the circumstances. Many factors could cause the Company's actual results, performance or achievements to differ materially from those expressed or implied by the forward-looking statements, including, without limitation:

- •

- risks relating to our litigation with CardiAQ, including the Company's ability to successfully satisfy the damages and

interest awards affirmed by the U.S. Court of Appeals due and payable on November 13, 2017, which create material uncertainty and which cast substantial doubt on our ability to continue

as a going concern;

- •

- the substantial doubt about our ability to continue as a going concern.

- •

- risks relating to our need for significant additional future capital and our ability to raise additional funding on

satisfactory terms or at all;

- •

- risks relating to claims by third parties alleging infringement of their intellectual property rights;

- •

- our ability to establish, maintain and defend intellectual property rights in our products;

- •

- risks relating to results from clinical trials of our products, which may be unfavorable or perceived

as unfavorable;

- •

- our history of losses and significant accumulated deficit;

- •

- risks relating to immediate dilution of your securities;

- •

- risks relating to the Warrants and Notes resulting in additional and significant dilution to our shareholders;

- •

- risks relating to the possibility that our Common Shares may be delisted from the Nasdaq or the TSX, which could affect

their market price and liquidity;

- •

- risks associated with product liability claims, insurance and recalls;

- •

- risks relating to competition in the medical device industry, including the risk that one or more competitors may develop

more effective or more affordable products;

- •

- risks relating to our ability to achieve or maintain expected levels of market acceptance for our products, as well as our

ability to successfully build our in-house sales capabilities or secure third-party marketing or distribution partners;

- •

- our ability to convince public payors and hospitals to include our products on their approved products lists;

- •

- risks relating to new legislation, new regulatory requirements and the efforts of governmental and third party payors to

contain or reduce the costs of healthcare;

- •

- risks relating to increased regulation, enforcement and inspections of participants in the medical device industry,

including frequent government investigations into marketing and other business practices;

- •

- risks associated with the extensive regulation of our products and trials by governmental authorities, as well as the cost

and time delays associated therewith;

- •

- risks associated with post-market regulation of our products;

S-5

- •

- health and safety risks associated with our products and our industry;

- •

- risks associated with our manufacturing operations, including the regulation of our manufacturing processes by

governmental authorities and the availability of two critical components of the Reducer;

- •

- risk of animal disease associated with the use of our products;

- •

- risks relating to the manufacturing capacity of third-party manufacturers for our products, including risks of supply

interruptions impacting the Company's ability to manufacture its own products;

- •

- risks relating to breaches of anti-bribery laws by our employees or agents;

- •

- risks associated with future changes in financial accounting standards and new accounting pronouncements;

- •

- our dependence upon key personnel to achieve our business objectives;

- •

- our ability to maintain strong relationships with physicians;

- •

- risks relating to the sufficiency of our management systems and resources in periods of significant growth;

- •

- risks associated with consolidation in the health care industry, including the downward pressure on product pricing and

the growing need to be selected by larger customers in order to make sales to their members or participants;

- •

- our ability to successfully identify and complete corporate transactions on favorable terms or achieve anticipated

synergies relating to any acquisitions or alliances;

- •

- anti-takeover provisions in our constating documents which could discourage a third party from making a takeover bid

beneficial to our shareholders;

- •

- risks relating to conflicts of interests among the Company's officers and directors as a result of their involvement with

other issuers;

- •

- risks relating to the influence of significant shareholders of the Company over our business operations and

share price;

- •

- risks relating to adverse U.S. consequences if we are or become a "passive foreign investment company" under the

U.S. Internal Revenue Code;

- •

- risks relating to it being more expensive for us to raise capital in the future and dilution to investors;

- •

- our Common Share price being volatile;

- •

- difficulty enforcing actions against us, certain of our directors and officers or experts under U.S. federal

securities laws;

- •

- risks relating to the sale of a significant number of Common Shares;

- •

- risks relating to the restrictions on the Company entering into certain transactions;

- •

- risks relating to the exercise of Warrants, which may encourage short sales by third parties;

- •

- risks relating to the Warrants not being listed on any exchange;

- •

- risks relating to the holders of Warrants having no rights as shareholders;

- •

- risks relating to the Warrants having no value;

- •

- risks relating to our broad discretion in the use of proceeds; and

- •

- our intention not to pay dividends.

Forward-looking statements reflect our current views with respect to future events and are subject to risks and uncertainties and are necessarily based upon a number of estimates and assumptions that, while considered reasonable by us, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies, many of which, with respect to future events, are subject to change. The

S-6

material factors and assumptions used by us to develop such forward-looking statements include, but are not limited to:

- •

- the approval of this Offering and the Concurrent Private Placement by the United States District Court for the

District of Massachusetts;

- •

- our ability to continue as a going concern by using a portion of the net proceeds of this Offering and the Concurrent

Private Placement to satisfy the remaining balance of damages and interest accruals affirmed by the U.S. Court of Appeals;

- •

- our ability to comply with the listing requirements of the Nasdaq and the TSX;

- •

- the expected size and completion of the Concurrent Private Placement;

- •

- capital will be available on terms that are favorable to us;

- •

- our regulatory and clinical strategies will continue to be successful;

- •

- our current positive interactions with regulatory agencies will continue;

- •

- recruitment to clinical trials and studies will continue;

- •

- the time required to enroll, analyze and report the results of our clinical studies will be consistent with projected

timelines;

- •

- current and future clinical trials and studies will generate the supporting clinical data necessary to achieve approval of

marketing authorization applications;

- •

- the regulatory requirements for approval of marketing authorization applications will be maintained;

- •

- our current good relationships with our suppliers and service providers will be maintained;

- •

- our estimates of market size and reports reviewed by us are accurate;

- •

- our efforts to develop markets and generate revenue from the Reducer will be successful; and

- •

- genericisation of markets for the Tiara and the Reducer will develop.

By their very nature, forward-looking statements or information involve known and unknown risks, uncertainties and other factors that may cause our actual results, events or developments, or industry results, to be materially different from any future results, events or developments expressed or implied by such forward-looking statements or information. In evaluating these statements, prospective purchasers should specifically consider various factors, including the risks outlined herein and in the accompanying base shelf prospectus and in documents incorporated by reference herein and therein, under the heading "Risk Factors". Should one or more of these risks or uncertainties or a risk that is not currently known to us materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein. These forward-looking statements are made as of the date of this prospectus supplement or, in the case of documents incorporated by reference in this prospectus supplement, as of the date of such documents, and we do not intend, and do not assume any obligation, to update these forward-looking statements, except as required by law. Investors are cautioned that forward- looking statements are not guarantees of future performance and investors are cautioned not to put undue reliance on forward-looking statements due to their inherent uncertainty.

DOCUMENTS INCORPORATED BY REFERENCE

This prospectus supplement is deemed to be incorporated by reference into the accompanying base shelf prospectus solely for the purposes of the Offering. Information has been incorporated by reference in this prospectus supplement from documents filed with securities commissions or similar authorities in Canada. Copies of the documents incorporated by reference in this prospectus supplement and not delivered with this prospectus supplement may be obtained on request without charge from Chris Clark, the Company Secretary of Neovasc, at Suite 5138 – 13562 Maycrest Way, Richmond, British Columbia, V6V 2J7, Canada, telephone: (604) 270-4344 or by accessing the disclosure documents through the Internet on the Canadian System for

S-7

Electronic Document Analysis and Retrieval ("SEDAR"), at www.sedar.com. Documents filed with, or furnished to, the SEC are available through the SEC's Electronic Data Gathering and Retrieval System ("EDGAR"), at www.sec.gov.

The following documents, filed with the securities commissions or similar regulatory authorities in certain provinces of Canada and filed with, or furnished to, the SEC are specifically incorporated by reference into, and form an integral part of, this prospectus supplement and the accompanying base shelf prospectus:

- •

- our annual information form for the fiscal year ended December 31, 2016, dated as of March 23, 2017

(the "AIF");

- •

- our audited annual consolidated financial statements for the fiscal years ended December 31, 2016 and 2015,

together with the notes thereto and the auditor's report thereon;

- •

- our management's discussion and analysis of financial condition and results of operations for the fiscal years ended

December 31, 2016 and 2015;

- •

- our unaudited consolidated condensed interim financial statements for the three and six month periods ended

June 30, 2017, as filed on SEDAR on August 10, 2017;

- •

- our management's discussion and analysis of our financial condition and results of operations for the three and six months

ended June 30, 2017, as filed on SEDAR on August 10, 2017; and

- •

- our management information circular dated May 8, 2017, distributed in connection with our annual general meeting of shareholders held on June 13, 2017.

Any documents of the type described in Section 11.1 of Form 44-101F1 Short Form Prospectuses filed by the Company with a securities commission or similar authority in any province of Canada subsequent to the date of this prospectus supplement and before withdrawal or completion of the Offering will be deemed to be incorporated by reference into this prospectus supplement.

In addition, to the extent that any document or information incorporated by reference into this prospectus supplement is filed with, or furnished to, the SEC pursuant to the Securities Exchange Act of 1934, as amended (the "Exchange Act"), after the date of this prospectus supplement, such document or information will be deemed to be incorporated by reference as an exhibit to the registration statement of which this prospectus supplement forms a part (in the case of a report on Form 6-K, if and to the extent expressly provided therein).

Any statement contained in this prospectus supplement or in the accompanying base shelf prospectus, or in a document incorporated or deemed to be incorporated by reference herein or therein will be deemed to be modified or superseded for purposes of this prospectus supplement to the extent that a statement contained herein or therein or in any other subsequently filed document that also is or is deemed to be incorporated by reference herein or therein modifies or supersedes such statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement is not to be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of material fact or an omission to state a material fact that is required to be stated or is necessary to make a statement not misleading in light of the circumstances in which it was made. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus supplement or the accompanying base shelf prospectus.

Upon our filing a new annual information form and the related annual financial statements and management's discussion and analysis with applicable securities regulatory authorities during the currency of this prospectus supplement and the accompanying base shelf prospectus, the previous annual information form, the previous annual financial statements and management's discussion and analysis and all quarterly financial statements and the related management's discussion and analysis, supplemental information, material change reports and information circulars filed prior to the commencement of our financial year in which the new annual information form is filed will be deemed no longer to be incorporated for purposes of future offers and sales of our securities under this prospectus supplement.

S-8

References to our website in any documents that are incorporated by reference into this prospectus supplement and the accompanying base shelf prospectus do not incorporate by reference the information on such website into this prospectus supplement or the accompanying base shelf prospectus, and we disclaim any such incorporation by reference.

DOCUMENTS FILED AS PART OF THE REGISTRATION STATEMENT

The following documents have been or will be filed with the SEC as part of the registration statement of which this prospectus supplement and the accompanying base shelf prospectus forms a part: (i) the documents listed under the heading "Documents Incorporated by Reference"; (ii) powers of attorney from our directors and officers; (iii) the consent of Grant Thornton LLP; and (iv) the Underwriting Agreement described under the heading "Plan of Distribution".

The following table sets forth for each period indicated: (i) the daily average exchange rate in effect at the end of the period; (ii) the high and low daily average exchange rate during such period; and (iii) the daily average exchange rate for such period, for one Canadian dollar, expressed in U.S. dollars, as quoted by the Bank of Canada.

| |

Six Months Ended June 30, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2017 | 2016 | 2015 | |||||||

| |

US$ |

US$ |

US$ |

|||||||

Closing |

0.7706 | 0.7705 | 0.8011 | |||||||

High |

0.7706 | 0.8025 | 0.8621 | |||||||

Low |

0.7276 | 0.6808 | 0.7793 | |||||||

Average |

0.7496 | 0.7527 | 0.8101 | |||||||

| |

Year Ended December 31, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2016 | 2015 | 2014 | |||||||

| |

US$ |

US$ |

US$ |

|||||||

Closing |

0.7441 | 0.7232 | 0.8605 | |||||||

High |

0.8025 | 0.8621 | 0.9444 | |||||||

Low |

0.6808 | 0.7144 | 0.8569 | |||||||

Average |

0.7554 | 0.7830 | 0.9057 | |||||||

On November 9, 2017, the daily average exchange rate as quoted by the Bank of Canada was C$1.00 = US$0.7879.

S-9

Neovasc was incorporated on November 2, 2000 under the laws of the Province of British Columbia and was continued to federal jurisdiction under the Canada Business Corporations Act ("CBCA") on April 19, 2002. Neovasc has five wholly owned subsidiaries, three of which are material: (i) Neovasc Tiara Inc. ("NTI"), a corporation incorporated under the federal laws of Canada; (ii) Neovasc Medical Ltd. ("NML"), a corporation incorporated under the laws of Israel; and (iii) Neovasc Medical Inc. ("NMI"), a corporation incorporated under the laws of British Columbia.

Our registered office is located at Suite 2600 – 595 Burrard Street, Vancouver, British Columbia, V7X 1L3, Canada and our head office and principal place of business are located at Suite 5138 – 13562 Maycrest Way, Richmond, British Columbia, V6V 2J7, Canada.

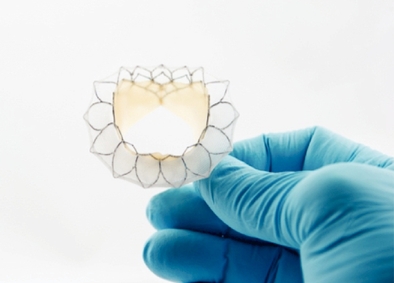

Neovasc is a specialty medical device company that develops, manufactures and markets products for the rapidly growing cardiovascular marketplace. Its products include the Tiara technology in development for the transcatheter treatment of mitral valve disease and the Reducer for the treatment of refractory angina.

In 2009, Neovasc started initial activities to develop novel technologies for catheter-based treatment of mitral valve disease. Based on the early positive results of these activities, the Company formally launched a program to develop the Tiara. Neovasc established a separate entity, NTI, in March 2013 to develop and own the intellectual property related to the Tiara (Neovasc has transferred all intellectual property related to the Tiara to NTI). On February 3, 2014, Neovasc announced the first human implant of the Tiara under special access compassionate use exemptions. Subsequently 25 additional patients have been implanted with the Tiara bringing the total number of patients treated with the device to 26 as of this date. In December 2014, the Company announced that it had received approval from the U.S. Food and Drug Administration (the "FDA") to initiate the TIARA-I study in the United States. The TIARA-I study is a multinational, multicenter early feasibility study being conducted to assess the safety and performance of the Tiara and implantation procedure in high risk surgical patients suffering from severe Mitral Regurgitation. The study will include up to 15 patients enrolled at centers in the United States and up to 15 patients at centers in Canada and Europe. The first European patient was enrolled in the study in Antwerp, Belgium in late 2014 and the first patient in the United States was enrolled in mid-2015. The Tiara is currently available in two sizes (35mm and 40 mm); additional sizes are under development (45mm). Following completion of the TIARA-I study the Company intends to continue advancing the Tiara to commercialization and will be undertaking additional studies to support authorization to affix the CE Mark and FDA approval as appropriate. On November 28, 2016, the Company announced that it had received both regulatory and ethics committee approval to initiate the Tiara Transcatheter Mitral Valve Replacement Study (TIARA-II) in Italy. The TIARA-II study is a 115 patient, non-randomized, prospective clinical study evaluating the Tiara's safety and performance. It is expected that data from this study will be used to file for CE Mark approval. The first implantations in the TIARA-II trial were conducted by the medical team at San Raffaele Hospital in Milan, Italy in the first half of 2017. The Company is initiating additional investigational sites in Italy, Germany, the UK and other countries as required approvals are obtained.

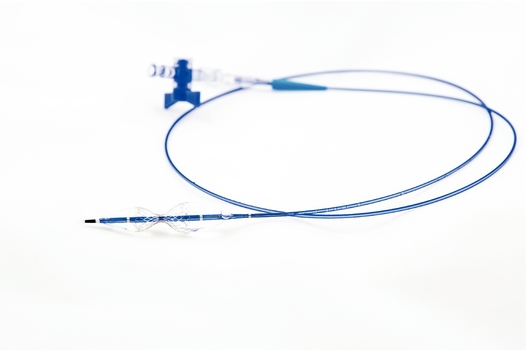

In July 2008, Neovasc acquired NML, a pre-commercial vascular device company based in Israel. NML developed and owned intellectual property related to a novel catheter-based treatment for refractory angina, a debilitating condition resulting from inadequate blood flow to the heart muscle. The Company estimates that there are approximately 600,000 to 1.8 million Americans, with 50,000 to 100,000 new cases per year in the United States who are potential candidates for this treatment. The Company has completed development of the Reducer and obtained authorization to affix the CE Mark, which allows for marketing of the Reducer in the European marketplace. The Company initiated commercial sales of the Reducer in early 2015. In March 2014 the Company announced that results of its Coronary Sinus Reducer for Treatment of Refractory Angina ("COSIRA") trial had been presented at the ACC.14 medical conference. The COSIRA trial was a sham-controlled randomized, double-blinded study of the Reducer device in 104 patients with moderate to severe refractory angina. The results presented at ACC.14 confirmed that the COSIRA trial had met its primary endpoint demonstrating the efficacy of the Reducer device with statistical significance. The COSIRA trial results were published in the New England Journal of Medicine in February 2015. On November 6, 2017, Neovasc announced that it has received approval of the FDA to initiate the COSIRA-II IDE pivotal clinical trial. The

S-10

trial's purpose will be to demonstrate the safety and effectiveness of Neovasc's novel Reducer system for treatment of patients with refractory angina. Once completed, the trial data is intended to support an application to the FDA for approval to begin marketing Reducer in the United States. See "Use of Proceeds" for further information about the COSIRA-II trial.

Neovasc's business operations started in March 2002, with the acquisition of NMI. NMI manufactured a line of collagen-based surgical patch products made for use in cardiac reconstruction and vascular repair procedures as well as other surgeries. Neovasc, through NMI, also sells biological tissue to industry partners and other customers who incorporate this tissue into their own products such as transcatheter heart valves. Neovasc's biological products are made from chemically treated biocompatible pericardial tissue. In 2012, Neovasc sold the rights to manufacture a specific line of conventional surgical patch products to LeMaitre Vascular, Inc. for US$4.6 million, but retained rights to the underlying tissue technology for all other uses. Neovasc has refocused its use of this treated pericardial tissue to constitute key components in third-party medical products, such as transcatheter heart valves. The Company also provides customers with consulting services related to the development of these products with specific expertise related to the transcatheter heart valve field as well as contract manufacturing services for these valves at all stages of development through to commercial scale production.

The Company's core strategy is to focus on the continued development and commercialization of its products, the Tiara and the Reducer, providing minimally invasive medical devices for a cardiovascular market that the Company believes is both growing and under-served by current treatment solutions.

Recent Developments

On September 1, 2017, the United States Court of Appeals for the Federal Circuit issued an opinion and judgment affirming the judgment of the United States District Court for the District of Massachusetts in the ongoing lawsuit with CardiAQ. That judgment affirmed the money judgment against Neovasc and the decision on inventorship. It also affirmed the District Court's rejection of CardiAQ's claim for an injunction against Neovasc. On October 2, 2017, Neovasc filed a petition for rehearing at the Court of Appeals seeking to reverse the money judgment and inventorship decisions. On the same day, CardiAQ also filed a petition for rehearing on the denial of the injunction. On November 3, 2017, the Court of Appeals denied the petition for rehearing filed by CardiAQ and denied the petition for rehearing filed by Neovasc. The mandate of the court will issue on November 13, 2017 and the appeals process has been exhausted. The full judgment of approximately US$112 million, of which approximately US$70 million is already held in a trust account, will become enforceable on November 13, 2017. We must pay the damages and interest awards, including funding the remaining approximately US$42 million not held in trust, which exceeds our current cash resources. We intend to use a portion of the net proceeds of this Offering and the Concurrent Private Placement to satisfy the remaining balance of the awards not held in trust. Pursuant to the stay agreement the consummation of the Offering and the Concurrent Private Placement are subject to approval by the District Court.

On December 14, 2016, a hearing took place in Munich, Germany regarding the German lawsuit. Based on this hearing, and the underlying exchange of written submissions, the Munich court entered a judgment on June 16, 2017, granting co-ownership of the European patent application in question to CardiAQ. There are no monetary damages connected to this order, nor is there such a request from CardiAQ pending in the German litigation. Neovasc filed a notice of appeal against the decision with the Appeals Court of Munich on July 14, 2017. On July 20, 2017, CardiAQ filed a notice of appeal with the same court. Both parties substantiated their respective appeals, and by way of case management order of October 18, 2017, the Appeals Court of Munich has now provisionally set the hearing date in this matter for April 12, 2018. There is likely to be further exchanges of written submissions between the parties in the run-up to that hearing.

S-11

Investing in the Units is speculative and involves a high degree of risk. The following risk factors, as well as risks currently unknown to us, could materially adversely affect our future business, operations and financial condition and could cause them to differ materially from the estimates described in forward-looking information relating to the Company, or its business, property or financial results, each of which could cause purchasers of Units to lose part or all of their investment. In addition to the other information contained in this prospectus supplement, the accompanying base shelf prospectus and the documents incorporated by reference herein and therein, prospective investors should carefully consider the factors set out under "Risk Factors" in the accompanying base shelf prospectus, the AIF and the factors set out below in evaluating Neovasc and its business before making an investment in the Units.

Risks relating to the Company

The Company is subject to lawsuits that have diverted its resources and will result in the payment of significant damages and other remedies.

The Company is engaged in litigation with CardiAQ, as further described below. Litigation resulting from CardiAQ's claims has been, and is expected to continue to be, costly and time-consuming and have diverted the attention of management and key personnel from our business operations. On November 13, 2017, the approximately US$112 million owed in the U.S. Court of Appeals litigation with CardiAQ, including the approximately US$70 million already held in a trust account, will become due and payable. These monetary damages exceed our resources and could have a material adverse effect on the Company and its financial position. These circumstances create material uncertainty and cast substantial doubt about the Company's ability to continue as a going concern. This Offering and the Concurrent Private Placement are being undertaken to enable the Company to continue to operate its business and fund the remaining approximately US$42 million damages and interest awards not held in trust.

On June 6, 2014, Neovasc was named in a lawsuit filed by CardiAQ in the United States District Court for the District of Massachusetts concerning intellectual property rights ownership, unfair trade practices and a breach of contract relating to Neovasc's transcatheter mitral valve technology, including the Tiara. On May 19, 2016, a jury awarded US$70 million in favour of CardiAQ on certain trade secret claims. On October 31, 2016, a judge awarded an additional US$21 million in enhanced damages to the jury's award and ordered that certain CardiAQ employees be listed as inventors on a Neovasc patent related to the Tiara. On January 18, 2017, a judge granted CardiAQ's motion for pre- and post-judgment interest, all as more particularly described in the section titled "Legal Proceedings" in the AIF. The Company sought an expedited appeal of the judgment, including the underlying damages award upon which these figures were calculated and the decision on inventorship, before the United States Court of Appeals for the Federal Circuit. On September 1, 2017, the Court of Appeals entered an opinion and judgement affirming the District Court's decision on money judgement, inventorship and rejection of an injunction. Payment of the damages and interest awards is currently stayed pending completion of the appeal pursuant to a court order of December 23, 2016. Under the terms of the stay, Neovasc deposited US$70 million into a joint escrow account and entered into a general security agreement related to the remaining damages awarded by the court. The Court subsequently ordered that US$70 million to be transferred to a CardiAQ trust account. Neovasc will also require court approval for transactions outside the course of normal business, including this Offering and the Concurrent Private Placement, until such time that the Company posts the remaining amount of money judgment into the joint escrow account. On October 2, 2017, Neovasc filed a petition for rehearing at the Court of Appeals seeking to reverse the money judgment and inventorship decisions. On the same day, CardiAQ also filed a petition for rehearing on the denial of the injunction. On November 3, 2017, the Court of Appeals denied the petition for rehearing filed by CardiAQ and denied the petition for rehearing filed by the Company. The mandate of the court will issue on November 13, 2017 and the appeals process has been exhausted. The full judgment of approximately US$112 million, of which approximately US$70 million is already held in trust, will become enforceable on November 13, 2017. Neovasc must pay the damages and interest awards, including funding the remaining approximately US$42 million not held in trust, which exceeds the Company's current cash resources. See "The Company — Recent Developments".

S-12

On June 23, 2014, CardiAQ also filed a complaint against Neovasc in Germany requesting that Neovasc assign its right to one of its European patent applications to CardiAQ. On July 7, 2014, the Company was made aware through a press release issued by CardiAQ of a stay in proceedings for Neovasc's European patent application that is the subject of the German lawsuit. This stay of proceedings was granted without an opportunity for Neovasc to respond to CardiAQ's allegations. The Company requested that the stay be lifted, but the request was denied by the European Patent office pending resolution of the German lawsuit. On December 14, 2016, a hearing took place in Munich, Germany regarding the German lawsuit. Based on this hearing, and the underlying exchange of written submissions, the Munich court entered a judgment on June 16, 2017, granting co-ownership of the European patent application in question to CardiAQ. There are no monetary damages connected to this order, nor is there such a request from CardiAQ pending in the German litigation. Neovasc filed a notice of appeal against the decision with the Appeals Court of Munich on July 14, 2017. On July 20, 2017, CardiAQ filed a notice of appeal with the same court. Both parties have in the meantime substantiated their respective appeals, and by way of case management order of October 18, 2017, the Appeals Court of Munich has now provisionally set the hearing date in this matter for April 12, 2018. There is likely to be further exchanges of written submissions between the parties in the run-up to that hearing.

On March 24, 2017, CardiAQ filed a complaint against Neovasc in the United States District Court for the District of Massachusetts. This lawsuit is related to the ongoing litigation with CardiAQ and concerns inventorship of two patents related to the Tiara. On October 4, 2017 CardiAQ amended the complaint to add an additional claim for inventorship of a third patent related to the Tiara. The complaint does not seek any money damages. The Company does not believe this additional lawsuit will have a material impact on the outcome of the Company's litigation with CardiAQ. The Company's deadline to submit a response to this complaint expires on November 16, 2017.

When the Company assesses that it is more likely that a present obligation exists at the end of the reporting period and that the possibility of an outflow of economic resources embodying economic benefits is probable, a provision is recognized and contingent liability disclosure is required. As at June 30, 2017, the Company has fully provided for the damages awards described above.

There is substantial doubt about our ability to continue as a going concern.

Our audited consolidated financial statements for the year ended December 31, 2016 were prepared under the assumption that we would continue our operations as a going concern. Our independent registered public accounting firm has included a "going concern" emphasis of matter paragraph in its report on our audited consolidated financial statements for the year ended December 31, 2016. This Offering and the Concurrent Private Placement are being undertaken to enable the Company to continue to operate its business after November 13, 2017, when the damages and interest awards totalling approximately US$112 million in connection with the CardiAQ U.S. Court of Appeals litigation become due and payable (see "Legal Proceedings" in the AIF and "The Company — Recent Developments" in this prospectus supplement for additional information). Litigation is inherently uncertain. The Company is faced with significant monetary damages that exceed its resources and will have a material adverse effect on the Company and its financial position. These circumstances create material uncertainty and cast substantial doubt about the Company's ability to continue as a going concern. Following payment of any such monetary awards from the proceeds of the Offering and the Concurrent Private Placement, the Company will require additional financing to continue to operate its business. There can be no assurance that such financing will be available on favorable terms, or at all, and the issuance of the Warrants and the Notes, which contain, among other things, provisions relating to future-priced conversion or exercise formula and full-ratchet anti-dilution, as well as every future exercise of the Class C Warrants, will make investment in our Common Shares less attractive to many investors, which may make it difficult to raise additional funding from equity issuances in the future while the Warrants and the Notes remain outstanding. The audited consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

We have significant additional future capital needs and there are uncertainties as to our ability to raise additional funding.

We will require significant additional capital resources to expand our business, in particular the further development of our medical devices. Technical innovations often require substantial time and investment before

S-13

we can determine commercial viability. Advancing our products, market expansion of our currently marketed products or acquisition and development of any new products or medical devices will require considerable resources and additional access to capital markets. In addition, our future cash requirements may vary materially from those now expected. For example, our future capital requirements may increase if:

- •

- we experience more competition for our medical devices from other medical device companies or in more markets than

anticipated;

- •

- we experience delays or unexpected increases in costs in connection with obtaining regulatory approvals for our products

in the various markets where we hope to sell our products;

- •

- we experience unexpected or increased costs relating to preparing, filing, prosecuting, maintaining, defending and

enforcing patent claims, or other lawsuits, brought by either us or our competition;

- •

- we experience scientific progress sooner than expected in our discovery, research and development projects, if we expand

the magnitude and scope of these activities, or if we modify our focus as a result of our discoveries;

- •

- we experience setbacks in our progress with pre-clinical studies and clinical trials are delayed;

- •

- we are required to perform additional pre-clinical studies and clinical trials; or

- •

- we elect to develop, acquire or license new technologies, products or businesses.

We could potentially seek additional funding through corporate collaborations and licensing arrangements, through public or private equity or debt financing, or through other transactions. However, if sales are slow to increase or if capital market conditions in general, or with respect medical device companies such as ours, are unfavourable, our ability to obtain significant additional funding on acceptable terms, if at all, will be negatively affected. As described above, the Company will also require court approval for transactions outside the course of normal business, including this Offering and the Concurrent Private Placement, until the U.S. Court of Appeals litigation with CardiAQ is concluded or the Company posts the remaining amount of money judgment against the Company in that matter into the joint escrow account. The issuance of the Warrants and the Notes which contain, among other things, provisions relating to future-priced conversion or exercise formula and full-ratchet anti-dilution, as well as every future exercise of the Class C Warrants, will make investment in our Common Shares less attractive to many investors, which may make it difficult to raise additional funding from equity issuances in the future. Additional financing that we may pursue may involve the sale of our common shares or financial instruments that are exchangeable for, or convertible into, our common shares which could result in significant dilution to our shareholders.

If sufficient capital is not available, or if a transaction is not approved by the court in the U.S. Court of Appeals litigation with CardiAQ, we may be required to delay our business expansion or our research and development projects, either of which could have a material adverse effect on our business, financial condition, prospects or results of operations.

Third parties may claim we are infringing their intellectual property and we could suffer significant litigation or licensing expenses or be prevented from selling products.

We may be involved in substantial litigation regarding patent and other intellectual property rights in the medical device industry, other than the CardiAQ U.S. Court of Appeals litigation. We may be subject to challenges by third parties regarding our intellectual property, including, among others, claims regarding validity, enforceability, scope and effective term. From time to time, we have been and may in the future be forced to defend against claims and legal actions alleging infringement of the intellectual property rights of others, and such intellectual property litigation is typically costly and time-consuming. In particular, see "Legal Proceedings" in the AIF and "The Company — Recent Developments" for summaries of recent claims brought against us. Adverse determinations in any such litigation could result in significant liabilities to third parties or injunctions, or could require us to seek licenses from third parties and, if such licenses are not available on commercially reasonable terms, prevent us from manufacturing, selling or using certain products, any one of which could have a material adverse effect on us. In addition, some licenses may be non-exclusive, which could provide our competitors access to the same technologies.

S-14

Third parties could also obtain patents that may require us to either redesign products or, if possible, negotiate licenses from such third parties. Such licenses may materially increase our expenses. If we are unable to redesign products or obtain a license, we might have to exit a particular product offering.

The success of our business depends in part on our ability to obtain and maintain intellectual property protection for our technology and know-how, and operate without infringing the intellectual property rights of other companies. It is possible that as a result of future litigation our products currently marketed or under development may be found to infringe or otherwise violate third party intellectual property rights. Intellectual property litigation proceedings, if instituted against us, could result in substantial costs, inability to market our products including the Tiara, loss of our proprietary rights and diversion of our management's and technical team's attention and resources.

Our inability to protect our intellectual property could have a material adverse effect on our business.

Our success and competitive position are dependent in part upon our proprietary intellectual property. We rely on a combination of patents and trade secrets to protect our proprietary intellectual property, and we expect to continue to do so. Although we seek to protect our proprietary rights through a variety of means, we cannot guarantee that the protective steps we have taken are adequate to protect these rights. Patents issued to or licensed by us in the past or in the future may be challenged and held invalid. The scope of our patent claims also may vary between countries, as individual countries have distinctive patent laws. In addition, as our patents expire, we may be unsuccessful in extending their protection through patent term extensions. The expiration of, or the failure to maintain or extend our patents, could have a material adverse effect on us.

We also rely on confidentiality agreements with certain employees, consultants and other third parties to protect, in part, trade secrets and other proprietary information. These agreements could be breached and we may not have adequate remedies for such a breach. In addition, others could independently develop substantially equivalent proprietary information or gain access to our trade secrets or proprietary information.

We may spend significant resources to enforce our intellectual property rights and such enforcement could result in litigation. Intellectual property litigation is complex and can be expensive and time-consuming. However, our efforts in this regard may not be successful. We also may not be able to detect infringement. In addition, competitors may design around our technology or develop competing technologies. Patent litigation can result in substantial cost and diversion of effort. Intellectual property protection may also be unavailable or limited in some foreign countries, enabling our competitors to capture increased market position. The invalidation of key intellectual property rights or an unsuccessful outcome in lawsuits filed to protect our intellectual property could have a material adverse effect on our financial condition, results of operations or prospects.

Our products are continually the subject of clinical trials conducted by us, our competitors, or other third parties, the results of which may be unfavorable, or perceived as unfavorable, and could have a material adverse effect on our business, financial condition, and results of operations.

The regulatory approval process for new products and new indications for existing products requires extensive clinical trials and procedures, including early clinical experiences and regulatory studies. Unfavorable or inconsistent clinical data from current or future clinical trials or procedures conducted by us, our competitors, or third parties, or perceptions regarding this clinical data, could adversely affect our ability to obtain necessary approvals and the market's view of our future prospects. Such clinical trials and procedures are inherently uncertain and there can be no assurance that these trials or procedures will be completed in a timely or cost-effective manner or result in a commercially viable product. Failure to successfully complete these trials or procedures in a timely and cost-effective manner could have a material adverse effect on our prospects. Clinical trials or procedures may experience significant setbacks even after earlier trials have shown promising results. Further, preliminary results from clinical trials or procedures may be contradicted by subsequent clinical analysis. In addition, results from our clinical trials or procedures may not be supported by actual long-term studies or clinical experience. If preliminary clinical results are later contradicted, or if initial results cannot be supported by actual long-term studies or clinical experience, our business could be adversely affected. Clinical

S-15

trials or procedures may be suspended or terminated by us or regulatory authorities at any time if it is believed that the trial participants face unacceptable health risks.

A number of companies in the medical device industry have suffered significant setbacks in advanced clinical trials, even after positive results in earlier trials. Clinical results are frequently susceptible to varying interpretations that may delay, limit or prevent regulatory approvals. Negative or inconclusive results or adverse medical events during a clinical trial could cause a clinical trial to be delayed, repeated or terminated. In addition, failure to construct appropriate clinical trial protocols could result in the test or control group experiencing a disproportionate number of adverse events and could cause a clinical trial to be repeated or terminated.

Moreover, principal investigators for our clinical trials may serve as scientific advisors or consultants to us from time to time and receive compensation in connection with such services. Under certain circumstances, the Company may be required to report some of these relationships to the FDA. The FDA may conclude that a financial relationship between the company and a principal investigator has created a conflict of interest or otherwise affected interpretation of the study. The FDA may therefore question the integrity of the data generated at the applicable clinical trial site and the utility of the clinical trial itself may be jeopardized. This could result in a delay in approval, or rejection, of our marketing applications by the FDA and may ultimately lead to the denial of regulatory approval of one or more of our product candidates.

We have a history of significant losses and a significant accumulated deficit.

We may incur losses in the future and our losses may increase. We have incurred net losses in each fiscal year since inception. For the six months ended June 30, 2017, we had a net loss of US$13,186,295 and at June 30, 2017, we had an accumulated deficit of US$214,969,901. We have increased our research and development expenses in recent periods and we plan further increases in the future as cash flows allow. The planned increases in research and development expenses may result in larger losses in future periods. As a result, we will need to generate significantly greater revenues than we have to date to achieve and maintain profitability. There can be no assurance that revenues will increase. Our business strategies may not be successful and we may not be profitable in any future period. Our operating results have varied in the past and they may continue to fluctuate in the future. In addition, our operating results may not follow any past trends.

You will experience immediate dilution.

Since the price per share of our Unit Shares being offered is higher than the net tangible book value per share of our Common Shares, you will suffer substantial dilution in the net tangible book value of the Common Shares you purchase in this Offering. Based on the combined public offering price of $1.46 per Unit, and after deducting the underwriting discount and estimated offering expenses payable by us, if you purchase Units in this offering, you will suffer immediate and substantial dilution.

The Warrants and Notes may result in significant dilution to our shareholders.

As part of this Offering we will issue the purchasers five-year Series A Warrants representing the right to acquire a Series A Warrant Share at an exercise price of $1.61 per share, two-year Series B Warrants representing the right to acquire a Series B Warrant Share at an exercise price of $1.61 per share, and two-year Series F Warrants representing the right to acquire a Series F Warrant Share at an exercise price of $1.61 per share. We will also issue the Notes and Series E Warrants pursuant to the Concurrent Private Placement. Each of the Series A Warrants, Series B Warrants, Series E Warrants, Series F Warrants and the Notes contain so-called full-ratchet anti-dilution provisions as well as other anti-dilution provisions that may be triggered upon any future issuance by us of Common Shares or Common Share equivalents at a price per share below the then-exercise price of the Warrants or conversion price of the Notes, subject to some exceptions, which could result in significant additional dilution to our shareholders. In addition, each of the Series A Warrants, Series B Warrants, Series E Warrants, Series F Warrants and the Notes contain future-priced conversion or exercise provisions and certain other provisions that could reset the conversion or exercise price of the securities based on the market price of the Common Shares at a future date. These provisions could result in the issuance of a large number of Common Shares if the market price for our Common Shares declines below the initial

S-16

conversion and exercise prices, thereby putting pressure on the market price of our Common Shares and increasing the risk of further dilution upon subsequent conversions or exercises of the securities. To the extent that purchasers of Units or Notes sell Common Shares issued upon the exercise of the Series A, Series B, Series C, Series D, Series E or Series F Warrants or the conversion of the Notes, or holders of the Class C Warrants exercise such securities, the market price of our Common Shares may decrease due to the additional selling pressure in the market. The risk of dilution from issuances of Common Shares underlying the Series A, Series B, Series D, Series E and Series F Warrants or pursuant to the conversion of the Notes may cause shareholders to sell their Common Shares, which could further contribute to any decline in the Common Share price.

Our Common Shares may be delisted from the Nasdaq or the TSX, which could affect their market price and liquidity. If our Common Shares were to be delisted, investors may have difficulty in disposing of their shares.