Form 425 CalAtlantic Group, Inc. Filed by: LENNAR CORP /NEW/

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

October 29, 2017

Date of Report (Date of earliest event reported)

LENNAR CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 1-11749 | 95-4337490 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

700 Northwest 107th Avenue, Miami, Florida 33172

(Address of principal executive offices) (Zip Code)

(305) 559-4000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☒ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

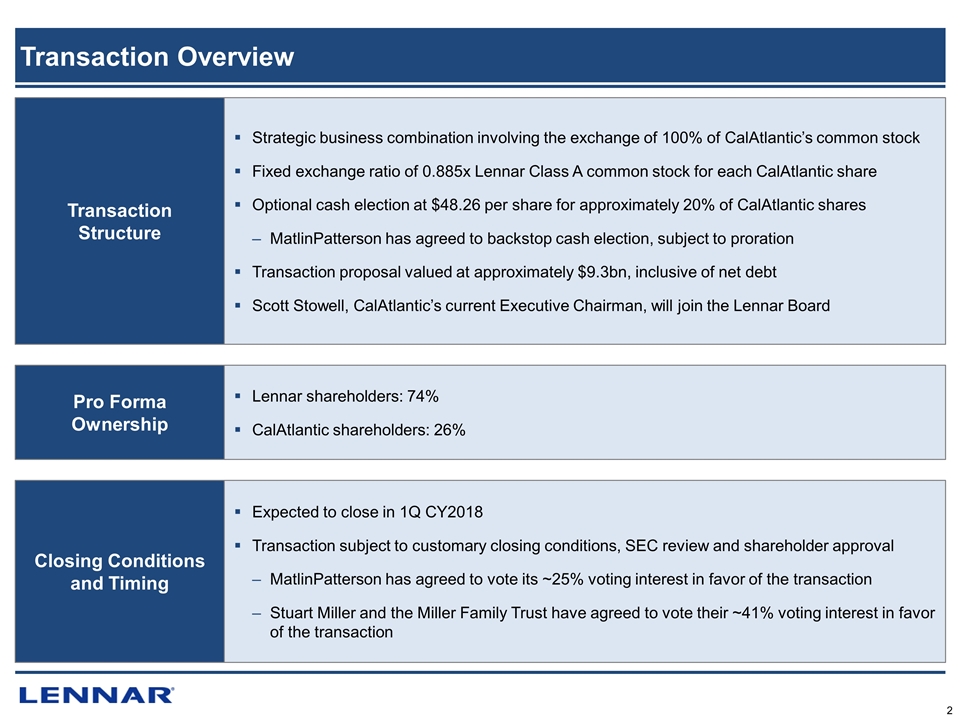

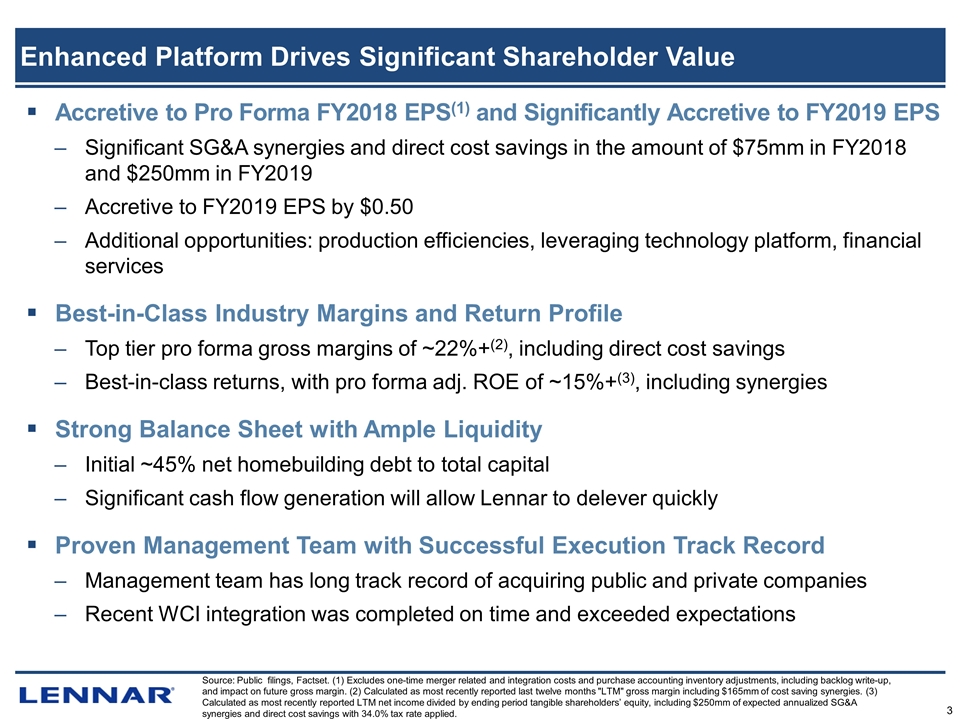

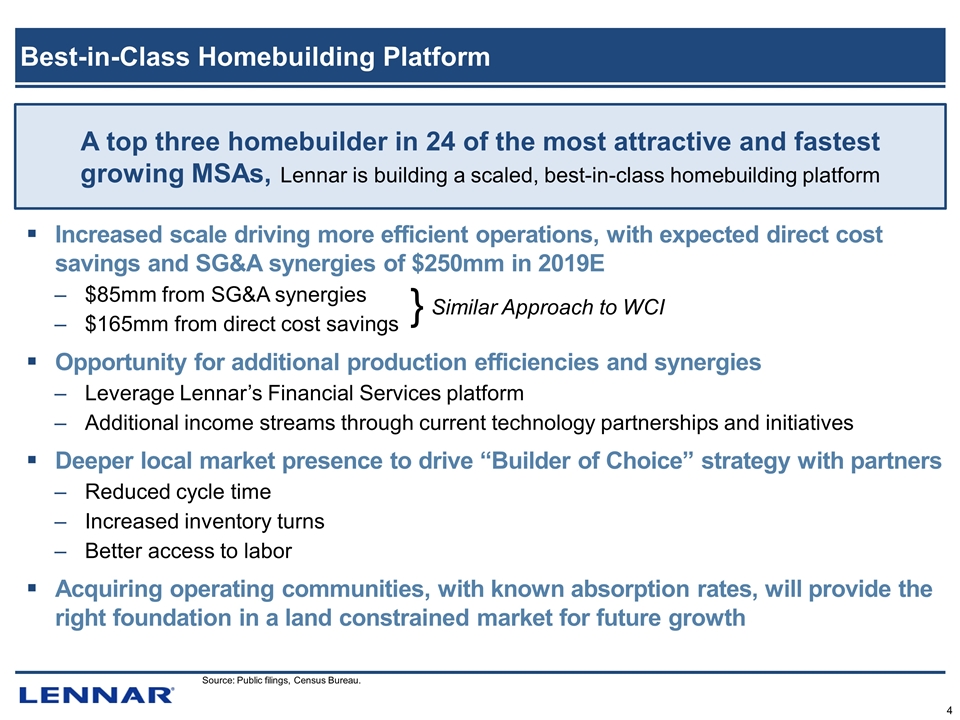

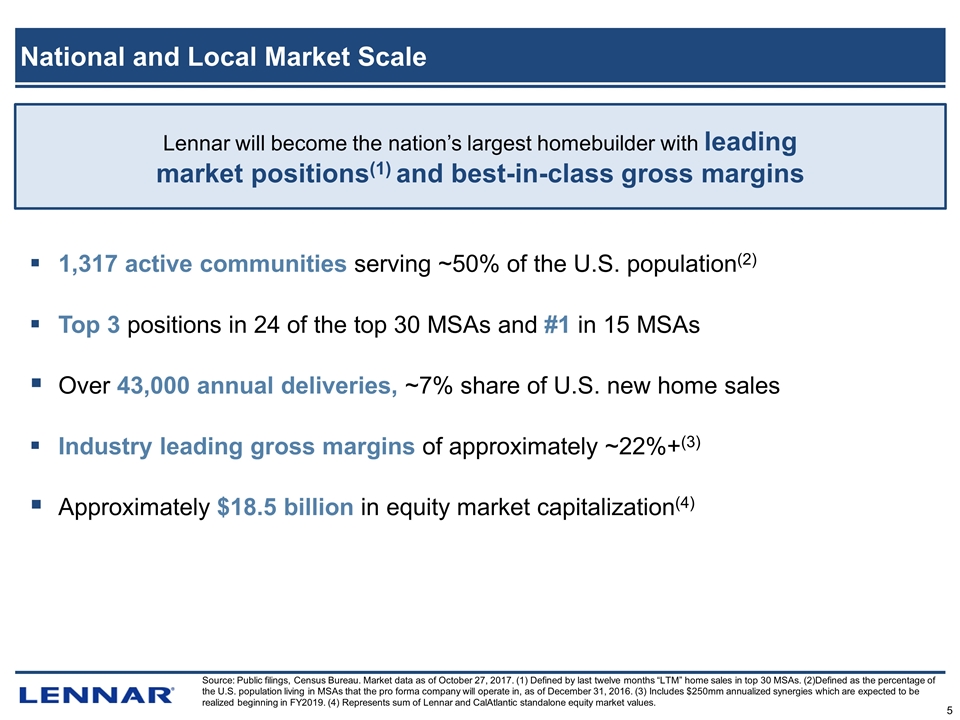

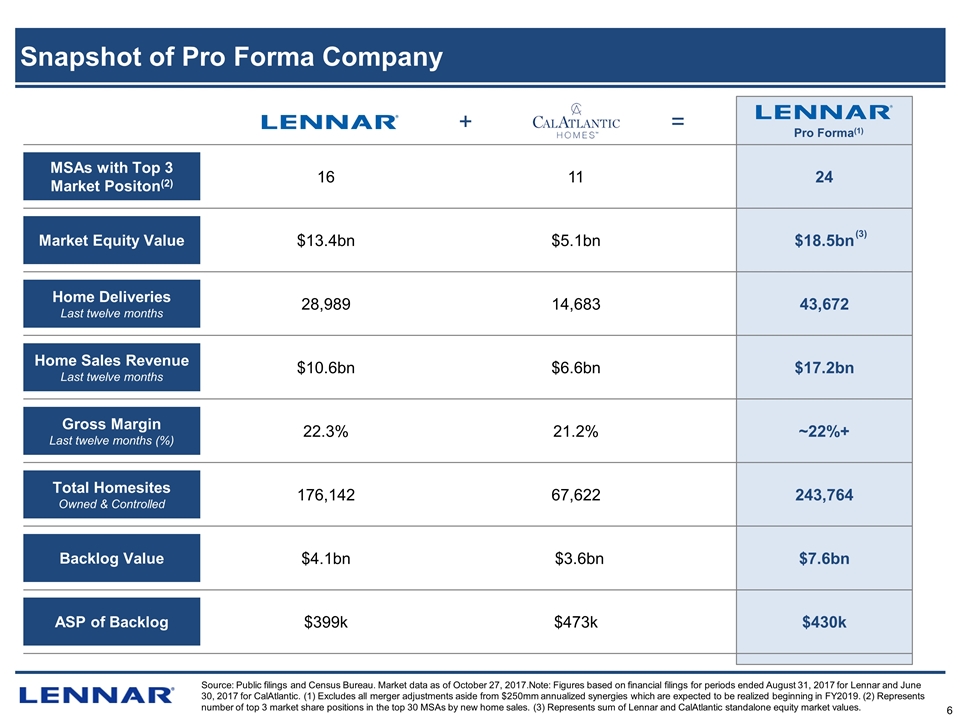

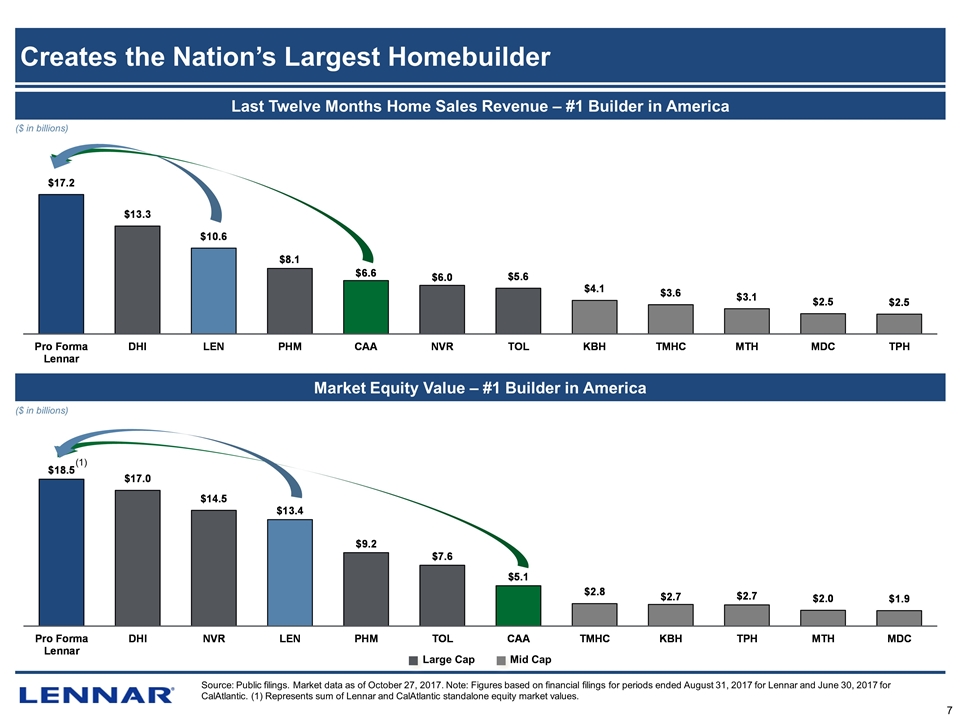

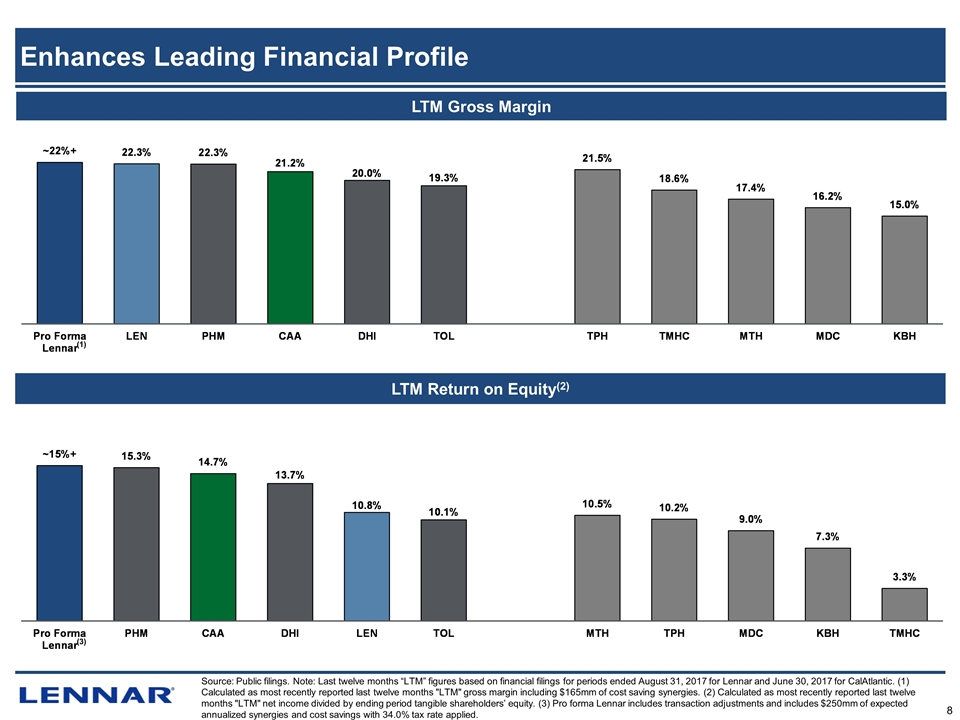

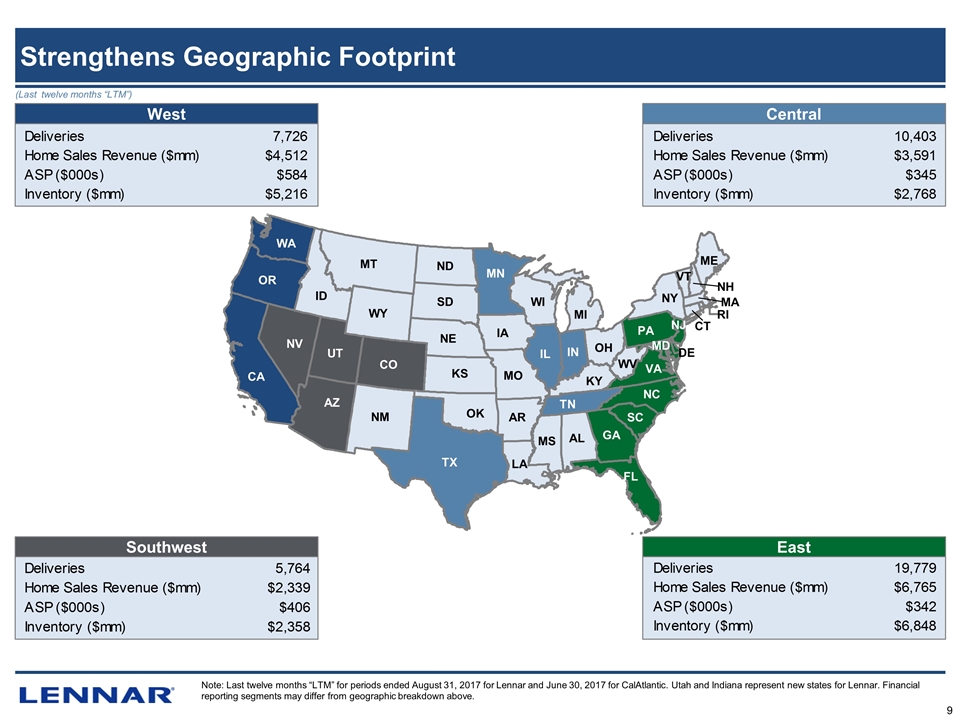

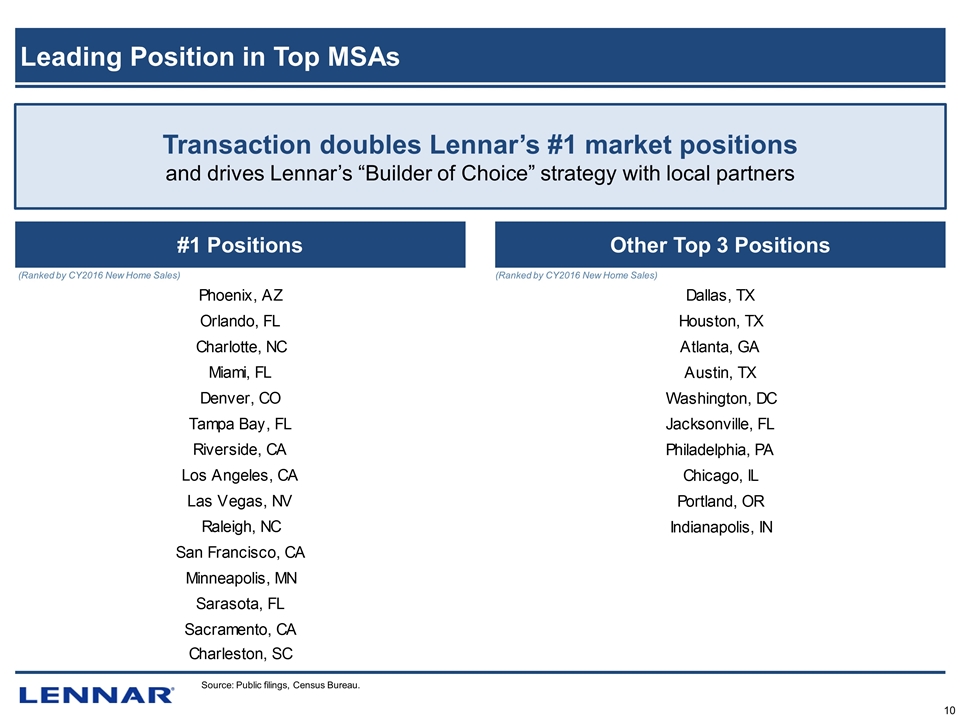

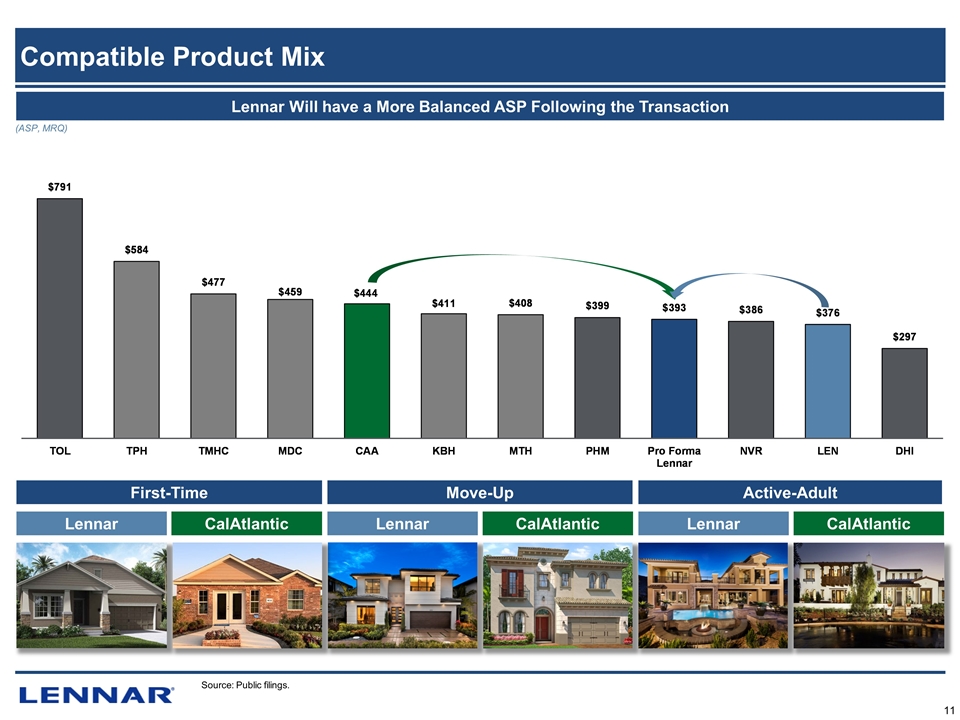

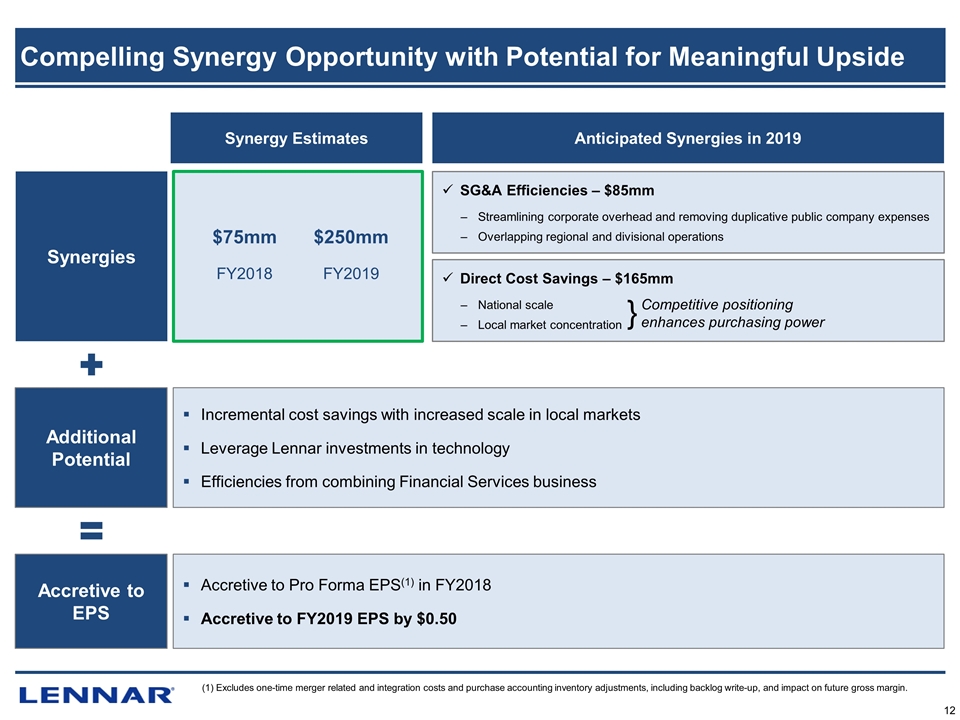

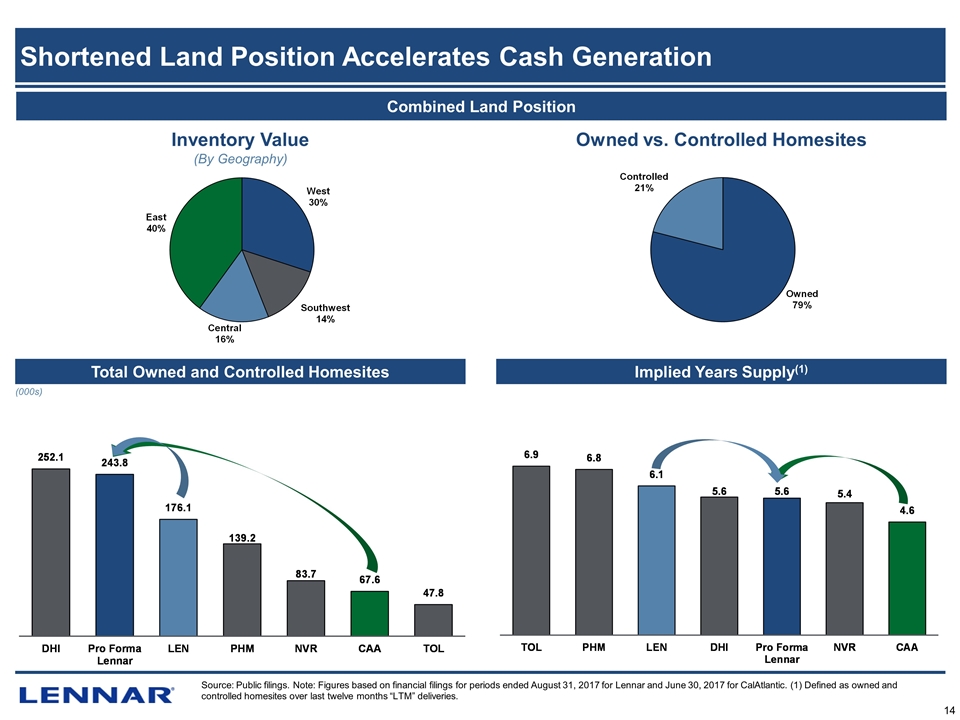

On October 29, 2017, Lennar Corporation, a Delaware corporation (the “Company”), entered into a definitive Agreement and Plan of Merger (the “Merger Agreement”) with CalAtlantic Group, Inc., a Delaware corporation (“CalAtlantic”). Subject to the terms and conditions of the Merger Agreement, CalAtlantic will be merged with and into a wholly-owned subsidiary of the Company, with the wholly-owned subsidiary of the Company continuing as the surviving corporation (the “Merger”).

Under the terms of the Merger Agreement, CalAtlantic’s stockholders will receive 0.885 shares of the Company’s Class A common stock for each share of CalAtlantic’s common stock. CalAtlantic’s stockholders will also have the option to exchange all or a portion of their shares of common stock for cash in an amount of $48.26 per share (the “Cash Election Option”) in lieu of receiving the Company’s Class A common stock, subject to a maximum cash amount of $1,162,250,000. The Cash Election Option will be subject to proration to the extent they exceed the maximum cash amount. No fractional shares of the Company’s Class A common stock will be issued in the Merger. Any holder of CalAtlantic’s common stock who would be entitled to receive a fraction of a share of the Company’s Class A common stock will instead receive cash equal to the market value of a share of such Class A common stock (based on the last sale price reported on the New York Stock Exchange (the “NYSE”) on the last trading day before the closing date).

The Merger Agreement provides that the Company may issue shares of its Class B common stock as a dividend to holders of its Class A and Class B common stock within 30 days of the Merger Agreement. If the Company issues that dividend, the merger consideration will include in addition to the Company’s Class A common stock the shares of Class B common stock that would have been issued as a dividend on the Class A common stock issued in the Merger.

The executive officers of the Company will continue to serve as executive officers of the Company upon the consummation of the Merger. Immediately following the effective time of the Merger, a member of the current CalAtlantic board will be elected to the Company’s board of directors.

The completion of the Merger is subject to the satisfaction or waiver of certain conditions, including (a) the adoption of the Merger Agreement and Merger by the affirmative vote of the holders of a majority of all outstanding shares of CalAtlantic common stock; (b) the approval by the affirmative vote of the holders of a majority of all outstanding shares of the Company’s Class A common stock as well as a majority of all outstanding shares of the Company’s Class A common stock and Class B common stock, voting together without regard to class, to amend the Company’s certificate of incorporation to increase the number of authorized shares of the Company’s Class A common stock; (c) the approval by the affirmative vote of the holders of a majority of the outstanding shares of the Company’s Class A common stock and Class B common stock, voting together without regard to class, to issue the Company’s Class A common stock (and if required, the Company’s Class B common stock) in the Merger; (d) the absence of a material adverse effect on the Company or CalAtlantic; (e) the absence of any law or order prohibiting the Merger; and (f) the delivery of opinion from counsel to CalAtlantic that the Merger will constitute a tax-free reorganization under Section 368(a) of the Internal Revenue Code of 1986, as amended.

The Merger Agreement contains customary representations and warranties by the Company and CalAtlantic, which will terminate when the Merger becomes effective. It also contains covenants by the parties, including a covenant by the parties that until the Merger takes place (or the Merger Agreement is terminated), the parties and each of their subsidiaries will, with certain exceptions, operate their businesses in the ordinary course consistent with past practice. CalAtlantic has also agreed that, subject to certain exceptions, it will terminate all ongoing discussions regarding any proposal to enter into an acquisition transaction and will not authorize or approve and will use its reasonable best efforts to prevent any of its officers, directors, employees, agents or representatives to initiate, solicit, knowingly encourage or otherwise knowingly facilitate any inquiry or the making of any proposal with respect to an acquisition transaction; provided, however, that if CalAtlantic receives an acquisition proposal that its board determines in good faith, after consultation with its independent financial advisor, constitutes or would be reasonably expected to result in a transaction which would be more favorable to CalAtlantic’s stockholders than the Merger, CalAtlantic may furnish non-public information to the potential acquirer making the acquisition proposal and enter into discussions and negotiations with that potential acquirer. CalAtlantic is obligated to inform the Company about any acquisition proposal, including the identity of the potential acquirer, within two business days after CalAtlantic receives any such acquisition proposal.

The Merger Agreement may be terminated under certain circumstances, including by either party if (1) the Merger has not been consummated by May 31, 2018; provided that if the closing does not occur by the third business day before May 31, 2018 because the conditions to closing have not been satisfied or waived, either party may extend the outside closing date to no later than August 31, 2018; (2) the consummation of the Merger has been enjoined or prohibited; (3) the Company and/or CalAtlantic stockholder approvals are not obtained; (4) the other party breaches its representations and covenants and such breach would result in the closing conditions not being satisfied; or (5) the board of directors of the other party makes an adverse change in its recommendation to its stockholders. In addition, the Merger Agreement may be terminated by CalAtlantic if before its stockholders’ meeting to vote on the Merger, (i) CalAtlantic receives an acquisition proposal that its board determines in good faith would be a superior proposal (i.e., would be more favorable to CalAtlantic’s stockholders than the Merger), (ii) CalAtlantic gives the Company notice of the superior proposal, (iii) the Company does not agree to increase the merger consideration or, the Company agrees to increase the merger consideration but CalAtlantic’s board in good faith determines after consultation with its financial advisor that the superior proposal continues to be a superior proposal and (iv) CalAtlantic pays the Company a termination fee of $178,700,000. If the Merger Agreement is terminated under other circumstances specified in the Merger Agreement, the Company may be required to pay to CalAtlantic a termination fee of $178,700,000 or CalAtlantic may be required to pay the Company a termination fee of $178,700,000. In addition, if the Merger Agreement is terminated by either party because the Company or the CalAtlantic stockholder approvals are not obtained, then the party that was unable to obtain stockholder approval must reimburse the other party for its reasonable out-of-pocket expenses up to an amount equal to $30,000,000.

In connection with the Merger Agreement, the Company entered into a Voting and Cash Election Agreement (the “Voting Agreement”) with MP CA Homes LLC, a Delaware limited liability company (“MP CA Homes”), a stockholder currently holding 25.4% shares of CalAtlantic’s common stock. Pursuant to the Voting Agreement, among other things and subject to the terms and conditions therein, MP CA Homes has agreed to vote all of its shares of CalAtlantic’s common stock in favor of the Merger. In addition, to the extent that CalAtlantic’s stockholders do not elect to exchange their shares of CalAtlantic’s common stock equal to or greater than the maximum cash amount, MP CA Homes has agreed to exchange that number of shares of CalAtlantic’s common stock held by it that would cause the number of shares as to which the Cash Election Option is exercised to be equal to or greater than the maximum cash amount.

Stuart Miller, the Chief Executive Officer of Company, has agreed to vote 41.4% of the voting interests he and his family directly and indirectly holds in the Company in favor of the matters to be voted upon in the Company’s stockholders’ meeting in connection with the Merger.

It is expected that the Merger will qualify as a tax-free reorganization for U.S. federal income tax purposes.

The foregoing descriptions of the Merger Agreement and the Voting Agreement are only summaries and do not purport to be complete. They are qualified in their entirety by the actual terms of the Merger Agreement and the Voting Agreement, copies of which are filed as Exhibit 2.1 and Exhibit 10.1 to this Form 8-K, respectively, and are incorporated herein by reference.

The description of the Merger Agreement above, and the Merger Agreement itself, are included in, or as an exhibit to, this Current Report on Form 8-K to provide investors and others with information about the Merger. They are not intended to provide factual information about any of the parties to the Merger Agreement to anyone other than the parties. Some of the representations and warranties in the Merger Agreement may have been intended to allocate risks among parties rather than to assure the correctness of information. Also, many of the representations and warranties are qualified by information in documents that are not filed with this Current Report on Form 8-K. In addition, many of the representations and warranties exclude facts or conditions that would not have a material adverse effect on one or more parties or are otherwise limited to material items. Accordingly, nobody reading this Current Report on Form 8-K should rely on statements made in representations and warranties in the Merger Agreement as being complete, or necessarily correct, descriptions of the matters to which they relate.

Item 7.01. Regulation FD Disclosure.

On October 30, 2017, the Company and CalAtlantic issued a joint press release announcing the execution of the Merger Agreement. A copy of the press release is attached hereto as Exhibit 99.1.

2

The Company is hosting a conference call and webcast on October 30, 2017 during which it will make a presentation on the Merger. A copy of the presentation is attached hereto as Exhibit 99.2.

Additional Information about the Proposed Merger and Where to Find It

This Current Report on Form 8-K may be deemed to be solicitation material in respect of the proposed Merger. In connection with the proposed Merger, the Company expects to file with the SEC a registration statement on Form S-4 that will include a joint proxy statement of the Company and CalAtlantic that also constitutes a prospectus of the Company, which joint proxy statement/prospectus will be mailed or otherwise disseminated to the Company and CalAtlantic stockholders when it becomes available. The Company and CalAtlantic also plan to file other relevant documents with the SEC regarding the Merger. INVESTORS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE MERGER. You may obtain a free copy of the joint proxy statement/prospectus (if and when it becomes available) and other relevant documents filed by the Company with the SEC at the SEC’s website at www.sec.gov. Copies of the documents filed by the Company with the SEC will be available free of charge on the Company’s website at www.lennar.com or by contacting Allison Bober, Investor Relations at (305) 485-2038.

Certain Information Regarding Participants

The Company and its directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed Merger. You can find information about the Company’s executive officers and directors in the Company’s definitive proxy statement filed with the SEC on March 7, 2017 in connection with its 2017 annual meeting of stockholders and in Form 4s of the Company’s directors and executive officers filed with the SEC. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the joint proxy statement/prospectus and other relevant documents filed with the SEC if and when they become available. You may obtain free copies of these documents from the SEC at the SEC’s website or from the Company using the sources indicated above.

Forward Looking Statements

Some of the statements in this Form 8-K are “forward-looking statements,” as that term is defined in the Private Securities Litigation Reform Act of 1995, including statements regarding the expected time of the completion of the transaction. These forward-looking statements, which are based on current expectations, estimates and projections about the industry and markets in which the Company and CalAtlantic operate and beliefs of and assumptions made by the Company’s and CalAtlantic’s management, involve uncertainties that could significantly affect the financial results of the Company or CalAtlantic or the combined company. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” and variations of such words and similar expressions are intended to identify such forward-looking statements, which generally are not historical in nature. Such forward-looking statements include, but are not limited to, statements about the anticipated benefits of the proposed Merger between the Company and CalAtlantic, including future financial and operating results, the attractiveness of the value to be received by CalAtlantic stockholders, and the combined company’s plans, objectives, expectations and intentions. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future—including statements relating to expected synergies, improved market positioning and ongoing business strategies—are forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Although we believe the expectations reflected in the forward-looking statements are based on reasonable assumptions, we can give no assurance that our expectations will be attained and therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. Some of the factors that may affect outcomes and results include, but are not limited to: (i) the Company’s and CalAtlantic’s ability to obtain requisite approval from their respective stockholders; (ii) the Company’s and CalAtlantic’s ability to satisfy the conditions to closing of the Merger; (iii) the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement; (iv) availability of financing and capital; (v) failure to realize the benefits expected from the proposed acquisition; (vi) the risk that the cost savings and any other synergies from the acquisition may not be fully realized

3

or may take longer to realize than expected; (vii) failure to promptly and effectively integrate the acquisition; (viii) other risks related to the completion of the Merger and actions related thereto; and (ix) the risks detailed in the Company’s and CalAtlantic’s filings with the Securities and Exchange Commission (the “SEC”), including the “Risk Factors” sections of the Company’s Annual Report on Form 10-K for the fiscal year ended November 30, 2016, CalAtlantic’s Annual Report on Form 10-K for the year ended December 31, 2016 and their respective most recent Quarterly Reports on Form 10-Q. There can be no assurance that the Merger will be completed, or if it is completed, that it will close within the anticipated time period or that the expected benefits of the Merger will be realized. It is not possible for the management of either company to predict all the possible risks that could affect it or to assess the impact of all possible risks on the two companies’ businesses. Forward-looking statements speak only as of the date they are made, and management undertakes no obligation to update publicly any of them in light of new information or future events.

Item 9.01. Financial Statements and Exhibits.

| (d) | Exhibits. |

| * | Schedules and exhibits omitted pursuant to Item 601(b)(2) of Regulation S-K. Lennar Corporation hereby agrees to furnish supplementally to the SEC, upon its request, any or all omitted schedules and exhibits. |

4

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: October 30, 2017 | Lennar Corporation | |||||

| By: | /s/ Bruce Gross | |||||

| Name: | Bruce Gross | |||||

| Title: | Vice President and Chief Financial Officer | |||||

5

Exhibit 2.1

EXECUTION VERSION

AGREEMENT AND PLAN OF MERGER

among

CALATLANTIC GROUP, INC.,

LENNAR CORPORATION

and

CHEETAH CUB GROUP CORP.

Dated October 29, 2017

| Page | ||||||||||

| ARTICLE 1 THE MERGER | 5 | |||||||||

| 1.1 | The Merger | 5 | ||||||||

| 1.2 | Certificate of Incorporation | 5 | ||||||||

| 1.3 | By-Laws | 5 | ||||||||

| 1.4 | Directors | 5 | ||||||||

| 1.5 | Officers | 5 | ||||||||

| 1.6 | Stock of the Company | 5 | ||||||||

| 1.7 | Shares of Merger Sub | 6 | ||||||||

| 1.8 | Preferred Share Purchase Rights | 6 | ||||||||

| 1.9 | Company Convertible Debt | 6 | ||||||||

| 1.10 | Warrants | 6 | ||||||||

| 1.11 | Options | 6 | ||||||||

| 1.12 | Restricted Stock Units and Performance Share Units | 7 | ||||||||

| 1.13 | Stock Appreciation Rights | 7 | ||||||||

| 1.14 | Adjustments | 8 | ||||||||

| 1.15 | Cash Election | 8 | ||||||||

| 1.16 | Delivery of Merger Consideration | 10 | ||||||||

| 1.17 | Governance Matters | 12 | ||||||||

| ARTICLE 2 CLOSING DATE AND EFFECTIVE TIME OF MERGER | 12 | |||||||||

| 2.1 | Closing | 12 | ||||||||

| 2.2 | Execution of Certificate of Merger | 12 | ||||||||

| 2.3 | Effective Time of the Merger | 12 | ||||||||

| ARTICLE 3 REPRESENTATIONS AND WARRANTIES |

13 | |||||||||

| 3.1 | Representations and Warranties of the Company | 13 | ||||||||

| 3.2 | Representations and Warranties of Parent and Merger Sub | 21 | ||||||||

| 3.3 | No other representations and warranties | 29 | ||||||||

| 3.4 | Termination of Representations and Warranties | 29 | ||||||||

| ARTICLE 4 ACTIONS PRIOR TO THE MERGER |

29 | |||||||||

| 4.1 | Company Activities Until Effective Time | 29 | ||||||||

| 4.2 | Parent Activities Until Effective Time | 31 | ||||||||

| 4.3 | Company Stockholders Meeting | 32 | ||||||||

| 4.4 | Parent Stockholders Meeting | 33 | ||||||||

| 4.5 | Registration Statement/Proxy Statement | 33 | ||||||||

| 4.6 | HSR Act Filings | 35 | ||||||||

| 4.7 | No Solicitation of Offers; Notice of Proposals from Others | 35 | ||||||||

| 4.8 | Company Board Recommendation. | 35 | ||||||||

| 4.9 | Parent Board Recommendation. | 37 | ||||||||

| 4.10 | Company’s Cooperation with Regard to Financing | 37 | ||||||||

| 4.11 | Return of Materials Subject to Confidentiality Agreements | 37 | ||||||||

| 4.12 | Communications to Company Employees | 37 | ||||||||

| 4.13 | Defense Against Litigation | 37 | ||||||||

| 4.14 | Efforts of Parent and Merger Sub to Fulfill Conditions | 38 | ||||||||

| 4.15 | Company’s Efforts to Fulfill Conditions | 38 | ||||||||

| ARTICLE 5 CONDITIONS PRECEDENT TO MERGER | 38 | |||||||||

| 5.1 | Conditions to the Company’s Obligations | 38 | ||||||||

| 5.2 | Conditions to Obligations of Parent and Merger Sub | 39 | ||||||||

| Page | ||||||||||

| ARTICLE 6 TERMINATION | 40 | |||||||||

| 6.1 | Right to Terminate | 40 | ||||||||

| 6.2 | Manner of Terminating Agreement | 42 | ||||||||

| 6.3 | Effect of Termination | 42 | ||||||||

| 6.4 | Fees | 43 | ||||||||

| ARTICLE 7 ABSENCE OF BROKERS | 44 | |||||||||

| 7.1 | Company Representations and Warranties Regarding Brokers and Others | 44 | ||||||||

| 7.2 | Parent Representations and Warranties Regarding Brokers and Others | 45 | ||||||||

| ARTICLE 8 OTHER AGREEMENTS | 45 | |||||||||

| 8.1 | Indemnification for Prior Acts | 45 | ||||||||

| 8.2 | Company Employee Matters | 46 | ||||||||

| ARTICLE 9 GENERAL | 47 | |||||||||

| 9.1 | Expenses | 47 | ||||||||

| 9.2 | Access to Properties, Books and Records | 47 | ||||||||

| 9.3 | Publicity and Notification | 48 | ||||||||

| 9.4 | Entire Agreement | 48 | ||||||||

| 9.5 | Benefit of Agreement | 48 | ||||||||

| 9.6 | Effect of Disclosures | 49 | ||||||||

| 9.7 | Captions and Interpretation | 49 | ||||||||

| 9.8 | Definitions | 49 | ||||||||

| 9.9 | Assignments | 51 | ||||||||

| 9.10 | Notices and Other Communications | 51 | ||||||||

| 9.11 | Governing Law | 52 | ||||||||

| 9.12 | Exclusive Jurisdiction; Consent to Jurisdiction | 52 | ||||||||

| 9.13 | Remedies; Specific Performance | 52 | ||||||||

| 9.14 | Attorney Conflicts and Attorney Client Privilege | 53 | ||||||||

| 9.15 | Waiver of Jury Trial | 53 | ||||||||

| 9.16 | Amendments | 53 | ||||||||

| 9.17 | Counterparts | 53 | ||||||||

| 9.18 | Tax Matters | 53 | ||||||||

| 9.19 | Nonsurvival of Representations and Warranties | 54 | ||||||||

| 9.20 | Severability | 54 | ||||||||

| 9.21 | Parent Guarantee | 54 | ||||||||

| 9.22 | Extension of Time; Waiver | 54 | ||||||||

| * | The exhibits and schedules to this Agreement have been omitted pursuant to Item 601(b)(2) of Regulation S-K. Lennar Corporation hereby undertakes to furnish copies of any of the exhibits upon request by the U.S. Securities and Exchange Commission. |

3

AGREEMENT AND PLAN OF MERGER

This is an Agreement and Plan of Merger (this “Agreement”) dated as of October 29, 2017, among CalAtlantic Group, Inc. (the “Company”), a Delaware corporation, Lennar Corporation (“Parent”), a Delaware corporation, and Cheetah Cub Group Corp. (“Merger Sub”), a Delaware corporation.

RECITALS

WHEREAS, the parties intend to effect the merger of the Company with and into Merger Sub (the “Merger”), with Merger Sub being the entity that survives the Merger;

WHEREAS, the Board of Directors of each of the Company, Parent and Merger Sub has approved this Agreement and the Merger in accordance with Section 251 of the Delaware General Corporation Law (the “DGCL”), and determined that the Merger is advisable;

WHEREAS, the Board of Directors of Parent has determined that it is advisable for the stockholders of Parent to (i) authorize and approve an amendment to Parent’s certificate of incorporation increasing the number of shares of Parent Class A Stock that Parent is authorized to issue under Parent’s certificate of incorporation to a number at least sufficient to enable Parent to issue all the shares of Parent Class A Stock that will constitute Merger Consideration or are otherwise required hereunder, including in Sections 1.11, 1.12 and 1.13 (the “Parent Certificate Amendment”), and (ii) authorize the issuance of Parent Class A Stock (and, if required Parent’s Class B common stock) in the Merger as contemplated by this Agreement (collectively, the “Parent Stockholder Matters”);

WHEREAS, as an inducement to the Company to enter into this Agreement, Stuart Miller and the Miller family trusts have entered into an agreement, pursuant to which Stuart Miller and the Miller family trusts have agreed, on the terms and conditions in that agreement, to vote the shares of Parent Stock held by it to approve the Parent Stockholder Matters;

WHEREAS, as an inducement to Parent and Merger Sub to enter into this Agreement, MP CA Homes LLC has entered into an agreement, pursuant to which MP CA Homes LLC has agreed, on the terms and conditions in that agreement, to vote the shares of Company Common Stock held by it to adopt this Agreement and approve the Merger;

WHEREAS, each of the parties intends that for Federal income tax purposes, (i) the Merger will qualify as a reorganization under Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”), and (ii) this Agreement constitutes a “plan of reorganization” within the meaning of Treasury Regulation Section 1.368-2(g); and

WHEREAS, the Company, Parent and Merger Sub desire to make certain representations, warranties, covenants and agreements in connection with this Agreement and also to prescribe certain conditions to the Merger.

4

NOW, THEREFORE, in consideration of the foregoing and their respective representations, warranties, covenants and agreements set forth in this Agreement, and intending to be legally bound hereby, the parties hereto agree as follows:

AGREEMENT

THE MERGER

1.1 The Merger. At the Effective Time described in Section 2.3, the Company will be merged with and into Merger Sub, the separate existence of the Company will terminate, and Merger Sub will continue as the corporation that survives the Merger (the “Surviving Corporation”). The Merger will have the effects set forth in this Agreement and the applicable provisions of Delaware law. Without limiting the generality of the foregoing, when the Merger becomes effective, (i) the real and personal property, other assets, rights, privileges, immunities, powers, purposes and franchises of Merger Sub will continue unaffected and unimpaired by the Merger and will be the property, other assets, rights, privileges, immunities, powers, purposes and franchises of the Surviving Corporation, (ii) the separate existence of the Company will terminate, and the Company’s real and personal property, other assets, rights, privileges, immunities, powers, purposes and franchises will be merged into the Surviving Corporation, and (iii) the Merger will have the other effects specified in Section 259 of the DGCL.

1.2 Certificate of Incorporation. From the Effective Time until it is subsequently amended, the Certificate of Incorporation of the Surviving Corporation will be the same as the Certificate of Incorporation of Merger Sub immediately before the Effective Time, except that it will provide that the name of the Surviving Corporation will be “CalAtlantic Group, Inc.” That Certificate of Incorporation, separate and apart from this Agreement, may be certified as the Certificate of Incorporation of the Surviving Corporation.

1.3 By-Laws. From the Effective Time until they are subsequently amended or repealed, the bylaws of Merger Sub immediately before the Effective Time will be the bylaws of the Surviving Corporation.

1.4 Directors. The directors of Merger Sub immediately before the Effective Time will be the directors of the Surviving Corporation after the Effective Time and will hold office in accordance with the bylaws of the Surviving Corporation.

1.5 Officers. The officers of Merger Sub immediately before the Effective Time will be the officers of the Surviving Corporation after the Effective Time and will hold office until they resign or are removed or replaced by the Board of Directors of the Surviving Corporation.

(a) Subject to Sections 1.6(c), 1.14 and 1.15, at the Effective Time, by virtue of the Merger and without any action on the part of any holder of any capital stock of the Company, Parent or Merger Sub, each share of common stock of the Company (“Company Common Stock”), par value $0.01 per share, which is outstanding immediately before the Effective Time will be converted into and become the right to receive either (i) 0.885 duly authorized and issued and fully paid and non-assessable shares (the “Merger Consideration”) of Class A common stock of Parent (“Parent Class A Stock”), par value $0.10 per share (the number of shares of Parent Class A Stock to be issued with regard to a share of Company Common Stock being the “Exchange Ratio”) or (ii) the Cash Payment Amount pursuant to Section 1.15.

(b) Each share of Company Common Stock held in the treasury of the Company or held by any direct or indirect wholly-owned subsidiary of the Company, and each share of Company Common Stock held by

5

Parent or Merger Sub, immediately before the Effective Time (collectively, “Excluded Shares”) will, at the Effective Time, be cancelled and cease to exist and no Merger Consideration will be issued with respect to any of those shares.

(c) No fractional shares of Parent Class A Stock will be issued as a result of the Merger. Any holder of Company Common Stock who, but for this Section 1.6(c), would be entitled to receive a fraction of a share of Parent Class A Stock will receive, instead of that fraction of a share, cash equal to the Closing Date Market Value of a share of Parent Class A Stock times that fraction (which fraction shall be rounded to the nearest thousandth when expressed in decimal form). The “Closing Date Market Value” of a share of Parent Class A stock will be the last sale price reported on the New York Stock Exchange (“NYSE”) on the last NYSE trading day before the Closing Date.

1.7 Shares of Merger Sub. At the Effective Time, all the common stock, par value $0.10 per share, of Merger Sub (“Merger Sub Stock”) which is outstanding immediately before the Effective Time will be converted into one share of common stock, par value $0.01 per share, of the Surviving Corporation (“Surviving Corporation Stock”). At the Effective Time, any certificate or other document which evidenced shares of Merger Sub Stock will automatically become and be a certificate or other document evidencing the same number of shares of Surviving Corporation Stock.

1.8 Preferred Share Purchase Rights. At the Effective Time, all the Preferred Share Purchase Rights (“Preferred Share Rights”) that have been issued under the Amended and Restated Rights Agreement, dated as of December 20, 2011, between the Company and Mellon Investor Services LLC, as Rights Agent, as amended (including to substitute Computershare Inc., as successor Rights Agent) (the “Rights Agreement”), will be cancelled and will cease to exist, and no additional Merger Consideration or any other consideration will be issued or paid with regard to the Preferred Share Rights.

1.9 Company Convertible Debt. At the Effective Time, all outstanding debt of the Company which, by its terms, is convertible into Company Common Stock will remain outstanding and unaffected by the Merger, except that the holder of such debt will receive, on conversion of the convertible debt held by it, the number of shares of Parent Class A Stock equal to (a) the number of shares of Company Common Stock the holder would have received if the Merger had not taken place multiplied by (b) the Exchange Ratio; unless the indenture relating to a particular issue of convertible debt provides otherwise, in which case the holder of convertible debt of that issue will receive what is provided in the indenture.

1.10 Warrants. At the Effective Time, each warrant issued by the Company which is outstanding at that time, will remain outstanding, and will be exercisable and will expire in accordance with its terms, except that when it is exercised with respect to a specified number of shares of Company Common Stock, the holder will receive, instead of that number of shares of Company Common Stock, the Merger Consideration for that number of shares of Company Common Stock and the exercise price per share thereof will be correspondingly adjusted.

1.11 Options. At the Effective Time, each option (each, a “Company Option”) to purchase shares of Company Common Stock that is outstanding immediately prior to the Effective Time shall cease to represent a right to acquire shares of Company Common Stock and shall be automatically converted into an option to acquire shares of Parent Class A Stock (a “Parent Merger Option”), on the same terms and conditions (including any vesting or forfeiture provisions or repurchase rights, but taking into account any acceleration thereof pursuant to the existing terms of the relevant equity plans of the Company or applicable award agreement by reason of the transactions contemplated hereby) as were applicable under such Company Option as of immediately prior to the Effective Time, subject to adjustment as provided in this Section 1.11. The number of shares of Parent Class A Stock subject to the Parent Merger Option into which a Company Option is converted shall be equal to (i) the number of shares of Company Common Stock subject to the Company Option immediately prior to the Effective Time multiplied by (ii) the Exchange Ratio, rounded down, if necessary, to the nearest whole share of Parent Class A Stock, and such Parent Merger Option shall have an exercise price per full share of Parent Class A Stock

6

equal to (A) the exercise price of the Company Option per share of Company Common Stock divided by (B) the Exchange Ratio, rounded up, if necessary, to the nearest whole cent; provided, that (1) in the case of any Company Option to which Section 421 of the Code applies as of the Effective Time by reason of its qualification under Section 422 of the Code, the exercise price, the number of shares of Parent Class A Stock subject to such option and the terms and conditions of exercise of such option shall be determined in a manner consistent with the requirements of Section 424(a) of the Code; and (2) the exercise price, the number of shares of Parent Class A Stock subject to, and the terms and conditions of exercise of each Parent Merger Option shall also be determined in a manner consistent with the requirements of Section 409A of the Code. At or prior to the Effective Time, Parent shall take all corporate action necessary to reserve for issuance sufficient shares of Parent Class A Stock for delivery upon exercise of Parent Merger Options. As soon as practicable after the Effective Time, Parent shall file a registration statement on Form S-8 (or any successor or other appropriate forms), with respect to the shares of Parent Class A Stock subject to such options and shall use its commercially reasonable efforts to maintain the effectiveness of such registration statement (and maintain the current status of the prospectus or prospectuses contained therein) for so long as such options remain outstanding.

1.12 Restricted Stock Units and Performance Share Units. At the Effective Time, each time-based or performance-based restricted stock unit award granted under the equity plans of the Company (each, a “Company RSU”) representing the right to receive shares of Company Common Stock that is outstanding immediately prior to the Effective Time shall cease to represent a right to acquire shares of Company Common Stock and shall be converted into a right to receive shares of Parent Class A Stock (a “Parent Merger RSU”), on the same terms and conditions (including any vesting or forfeiture provisions or repurchase rights, but taking into account any acceleration or other deemed satisfaction thereof pursuant to the existing terms of the relevant equity plans of the Company or applicable award agreement by reason of the transactions contemplated hereby) as were applicable under such Company RSU as of immediately prior to the Effective Time. The number of shares of Parent Class A Stock subject to the Parent Merger RSU into which a Company RSU is converted shall be equal to (i) the number of shares of Company Common Stock subject to the Company RSU immediately prior to the Effective Time multiplied by (ii) the Exchange Ratio, rounded down, if necessary, to the nearest whole share of Parent Class A Stock. At the Effective Time all performance-based vesting criteria to which any outstanding Company RSUs are subject for which the performance period has not yet been completed as of the Effective Time shall be deemed achieved at the target performance level. At or prior to the Effective Time, Parent shall take all corporate action necessary to reserve for issuance sufficient shares of Parent Class A Stock for delivery upon the vesting and settlement of Parent Merger RSUs. As soon as practicable after the Effective Time, Parent shall file a registration statement on Form S-8 (or any successor or other appropriate forms), with respect to the shares of Parent Class A Stock subject to such restricted stock units and shall use its commercially reasonable efforts to maintain the effectiveness of such registration statement (and maintain the current status of the prospectus or prospectuses contained therein) for so long as such restricted stock units remain outstanding.

1.13 Stock Appreciation Rights. At the Effective Time, each stock appreciation right of the Company (each, a “Company SAR”) based on shares of Company Common Stock that is outstanding immediately prior to the Effective Time shall, at the Effective Time, cease to represent a right based on the shares of Company Common Stock and shall be automatically converted into a right based on the shares of Parent Class A Stock (a “Parent Merger SAR”), on the same terms and conditions (including any vesting or forfeiture provisions or repurchase rights, but taking into account any acceleration thereof pursuant to the existing terms of the relevant equity plans of the Company or applicable award agreement by reason of the transactions contemplated hereby) as were applicable under such Company SAR as of immediately prior to the Effective Time, subject to adjustment as provided in this Section 1.13. The number of shares of Parent Class A Stock to which the Parent Merger SAR into which a Company SAR is converted relates shall be equal to (i) the number of shares of Company Common Stock to which the Company SAR related immediately prior to the Effective Time multiplied by (ii) the Exchange Ratio, rounded down, if necessary, to the nearest whole share of Parent Class A Stock, and such Parent Merger SAR shall have an exercise price per full share of Parent Class A Stock equal to (A) the exercise price per share of Company Common Stock of the Company SAR divided by (B) the Exchange Ratio, rounded up, if necessary, to the nearest whole cent; provided, that the exercise price, the number of shares of Parent Class A

7

Stock to which the Parent Merger SAR relates, and the terms and conditions of exercise of the Parent Merger SAR shall also be determined in a manner consistent with the requirements of Section 409A of the Code. If the holders of Parent Merger SARs are entitled to receive shares of Parent Class A Stock on exercise of the Parent Merger SARs, at or prior to the Effective Time, Parent shall take all corporate action necessary to reserve for issuance sufficient shares of Parent Class A Stock for delivery upon exercise of Parent Merger SARs, and as soon as practicable after the Effective Time, Parent shall file a registration statement on Form S-8 (or any successor or other appropriate forms), with respect to the shares of Parent Class A Stock that may be issuable on exercise of Parent Merger SARs and shall use its commercially reasonable efforts to maintain the effectiveness of such registration statements (and maintain the current status of the prospectus or prospectuses contained therein) for so long as such stock appreciation rights remain outstanding.

(a) If between the date of this Agreement and the Effective Time, the outstanding shares of Company Common Stock or any or all classes of Parent Stock are changed into a different number of shares or a different type of securities by reason of a reclassification, recapitalization, split, combination, exchange of shares, conversion or similar event, or any dividend payable in stock or other securities is declared with regard to the Company Common Stock or the Parent Stock with a record date between the date of this Agreement and the Effective Time, the Exchange Ratio will be adjusted so that the Merger will have the same economic effect on the holders of Company Common Stock as that contemplated by this Agreement if there had been no such reclassification, recapitalization, split, combination, exchange, conversion, similar event or dividend, and as so adjusted will, from and after the date of such event, be the Exchange Ratio, subject to further adjustment in accordance with this Section 1.14(a). For the avoidance of doubt, the Parent Class B Dividend completed in accordance with Section 1.14(b) shall be governed by such section and shall not result in an adjustment to the Exchange Ratio pursuant to this Section 1.14(a).

(b) Without limiting the generality of what is said in Section 1.14(a), if Parent issues shares of its Class B common stock (“Parent Class B Stock” and, together with the Parent Class A Stock, the “Parent Stock”), par value $0.10 per share, as a dividend with regard to the Parent Stock, that is payable to holders of record thereof on a date between the date of this Agreement and the Effective Time (the “Parent Class B Dividend”), (i) the Merger Consideration will include, in addition to the Parent Class A Stock described in Section 1.6, the number of shares of Parent Class B Stock that would have been issued as a dividend on the Parent Class A Stock included in the Merger Consideration if that Parent Class A Stock had been outstanding on the record date for the dividend, (ii) each reference in this Article 1 to Parent Class A Stock will be deemed to include the shares of Parent Class B Stock that are issuable as part of the Merger Consideration with regard to that Parent Class A Stock, and (iii) each reference in this Article 1 to the Exchange Ratio will be deemed to include the shares of Parent Class B Stock that are issuable as part of the Merger Consideration with regard to that Parent Class A Stock (except where such deemed substitution would not be practical, such as in adjustments to the exercise price of Company Options, and in such case, with equitable and proportionate adjustments in such exercise price or other adjustment, taking into account the Parent Class B Dividend).

(a) Each person who is a record holder of Company Common Stock (other than Excluded Shares) during the period beginning on the day the Registration Statement becomes effective, and ending on the fifth business day, before the day on which the Company Stockholder Meeting is scheduled to be held (the “Election Period”) (provided, that if the Company Stockholder Meeting is postponed or adjourned such that there is a new record date for the postponed or adjourned Company Stockholder Meeting, the Election Period shall end on the fifth business day before the day on which such postponed or adjourned Company Stockholder Meeting is scheduled to be held), will have the option to elect (a “Cash Election”) to receive with regard to any or all of the shares of Company Common Stock held of record by that person, in lieu of the Merger Consideration described in Section 1.6(a), $48.26 in cash, without interest, per share of

8

Company Common Stock (the “Cash Payment Amount”), subject to possible proration as provided in Section 1.15(c). The option to make a Cash Election will expire at 11:59 p.m. Eastern Time on the fifth business day before the day on which the Company Stockholder Meeting is scheduled to be held (the “Election Deadline”), whether or not the Company Stockholder Meeting is actually held on that day.

(b) At least 20 business days before the Election Deadline, Parent will cause the Distribution Agent to transmit to each holder of record of Company Common Stock at the close of business on the day for determining the holders of record of Company Common Stock who are entitled to vote at the Company Stockholders Meeting (or to each holder of record of Company Common Stock at the close of business on another day that is not more than 60 days before the day on which the Company Stockholders Meeting is scheduled to be held) a notice of the Cash Election (which may be the Registration Statement) and a form of election with respect to the Cash Election (the “Cash Election Form”), in each case which is reasonably acceptable to the Company, which will enable a record holder to specify the number of shares of Company Common Stock, if any, as to which the record holder elects to exercise the Cash Election. Parent will use commercially reasonable efforts to cause the Distribution Agent to make the notice of the Cash Election and the Cash Election Form available to all persons who become record holders of shares of Company Common Stock during the period between the record date for the Company Stockholders Meeting and the Election Deadline. In order to properly exercise the Cash Election, a record holder of Company Common Stock must return to the Distribution Agent, and the Distribution Agent must have received by the Election Deadline, a completed and signed Cash Election Form, together with the Certificate evidencing the shares of Company Common Stock as to which the Cash Election is being exercised or an Agent’s Notice stating that such shares of Company Common Stock have been transferred by book entry transfer to an account established by the Distribution Agent for the purpose of receiving Company Common Stock. A holder of shares of Company Common Stock who submits a Cash Election Form will have the right to change or withdraw such holder’s Cash Election at any time before the Election Deadline, but not after the Election Deadline, in accordance with procedures set forth in the Cash Election Form. After a Cash Election is validly made and not withdrawn with respect to any shares of Company Common Stock, the holder thereof may not revoke such Cash Election after the Cash Election Deadline. Notwithstanding anything in this Agreement to the contrary, all Cash Elections shall automatically be deemed revoked upon termination of this Agreement in accordance with Article 6. Holders of shares of Company Common Stock will receive the Merger Consideration described in Section 1.6(a) with regard to all the shares of Company Common Stock as to which such holders do not validly make, or withdraw, a Cash Election, or to the extent provided in Section 1.15(c).The Distribution Agent shall have reasonable discretion to determine if any Cash Election is not properly made or withdrawn with respect to any share of Company Common Stock (none of the Company, Parent, Merger Sub or the Distribution Agent being under any duty to notify any holder of shares of Company Common Stock of any such defect). In the event the Distribution Agent makes such a determination, such Cash Election shall be deemed to be not in effect, and the shares of Company Common Stock covered by such Cash Election shall be entitled to receive the Merger Consideration, unless a valid Cash Election Form is thereafter timely delivered and received with respect to such shares of Company Common Stock.

(c) The aggregate amount the Surviving Corporation will pay as a result of Cash Elections will be limited to $1,162,250,000 (the “Maximum Cash Amount”). If the total amount the Surviving Corporation would be required to pay if it paid the Cash Payment Amount with regard to all the shares of Company Common Stock as to which valid Cash Elections are made and not withdrawn would exceed the Maximum Cash Amount, each holder of Company Common Stock who makes a valid Cash Election that is not withdrawn will receive (i) the Cash Payment Amount with regard to the number of shares of Company Common Stock equal to the number of shares as to which the Cash Election was made by such holder, multiplied by a fraction, of which (x) the numerator is the Maximum Cash Amount, and (y) the denominator is (A) the Cash Payment Amount, multiplied by (B) the total number of shares of Company Common Stock as to which valid Cash Elections are made and not withdrawn, and (ii) the Merger Consideration with regard to the remaining shares of Company Common Stock as to which such holder of Company Common Stock made a Cash Election. Parent and the Company, in their reasonable discretion, shall have the joint right to

9

make all determinations, not inconsistent with this Agreement and the DGCL, with respect to the manner and extent to which Cash Elections are to be taken into account in making the determinations pursuant to this Section 1.15(c).

(d) Not more than two business days after the day on which the Effective Time occurs, Parent will deliver to the Distribution Agent cash in the amount equal to the Maximum Cash Amount (or such lesser amount as is necessary to enable the Distribution Agent to distribute the Cash Payment Amount with regard to all the shares of Company Common Stock as to which the Cash Election is validly exercised and not withdrawn). Promptly after the Distribution Agent receives cash as provided in this Section 1.15(d), the Distribution Agent will distribute the cash to the holders of shares Company Common Stock who are entitled to receive it hereunder.

(e) The provisions of the first sentence of Section 1.16(b) and Sections 1.16(d) through (h) will apply to cash and Merger Consideration to which holders of Company Common Stock become entitled under this Section 1.15.

1.16 Delivery of Merger Consideration.

(a) Prior to the Effective Time, Merger Sub will designate a bank or trust company, with the Company’s prior approval (not to be unreasonably withheld, conditioned or delayed), to act as Distribution Agent in connection with the Merger (the “Distribution Agent”). At, or immediately before, the Effective Time, Parent will (i) provide to the Distribution Agent, or instruct the transfer agent for the Parent Class A Stock to deliver to the Distribution Agent upon request, the number of shares of Parent Class A Stock required to be distributed to the holders of Company Common Stock, and (ii) cash in an amount reasonably estimated to be sufficient to enable the Distribution Agent to make all required payments of cash in lieu of fractional shares (and additional cash at later dates to the extent it is required for payments in lieu of fractional shares), in each case in trust for the benefit of the holders of Company Common Stock. Until the Distribution Agent uses funds provided to it to pay cash in lieu of fractional shares, the funds will be invested by the Distribution Agent, as directed by the Surviving Corporation, in short-term obligations of or guaranteed by the United States of America or obligations of an agency of the United States of America which are backed by the full faith and credit of the United States of America, in commercial paper obligations rated A-1 or P-1 or better by Moody’s Investors Services Inc. or Standard & Poor’s Corporation, respectively, or in certificates of deposit or banker’s acceptances issued by commercial banks, each of which has capital, surplus and undivided profits aggregating more than $500 million (based on the most recent financial statements of the banks which are then publicly available). No such investment (or losses thereon) shall affect the amount of the cash in lieu of fractional shares of Parent Class A Stock, or cash pursuant to Section 1.15, payable by Parent to the holders of Company Common Stock pursuant to this Agreement. If, after Parent has delivered shares of Parent Class A Stock to the Distribution Agent, it is reasonably determined that holders of Company Common Stock will be entitled to fewer shares of Parent Class A Stock, less cash in lieu of fractional shares or less cash pursuant to Section 1.15, than the number of shares or amount of cash the Distribution Agent is holding, the Distribution Agent will promptly return the excess shares or cash to Parent. In the event that the number of shares of Parent Class A stock delivered to the Distribution Agent will not be sufficient to pay the Merger Consideration and any dividends and distributions payable under Section 1.16(b), or that the amount of cash distributed to the Distribution Agent and held by the Distribution Agent will not be sufficient to pay for fractional shares of Parent Class A Stock or will not be sufficient to pay for all validly made and not withdrawn Cash Elections (in any case whether because of losses on the funds invested by the Distribution Agent pursuant to this Section 1.16(a) or otherwise), Parent shall deliver (or cause to be delivered) additional shares of Parent Class A Stock and/or additional funds to the Distribution Agent in an amount equal to the deficiency.

(b) The Distribution Agent will be deemed to be the agent for the holders of the Company Common Stock for the purpose of receiving the Merger Consideration, and delivery of shares of Parent Class A Stock to the Distribution Agent will be deemed to be delivery to the holders of the Company Common Stock (except that delivery to the Distribution Agent before the Effective Time will be deemed to be delivery to

10

the holders of the Company Common Stock at the Effective Time). Until they are distributed, the shares of Parent Class A Stock held by the Distribution Agent will be deemed to be outstanding from and after the Effective Time (except that excess shares returned to Parent as provided in Section 1.16(a) will be deemed never to have been outstanding), but the Distribution Agent will not vote those shares or exercise any rights of a stockholder with regard to them. If any dividends or distributions are paid with regard to shares of Parent Class A Stock while they are held by the Distribution Agent, the Distribution Agent will hold the dividends or distributions, uninvested, until shares of Parent Class A Stock are distributed to particular former holders of Company Common Stock, at which time the Distribution Agent will distribute the dividends or distributions that have been paid with regard to those shares of Parent Class A Stock to the former holders of Company Common Stock who are entitled to receive the shares.

(c) Promptly after the Effective Time (but in no event later than two business days after the date on which the Effective Time occurs), the Surviving Corporation will cause the Distribution Agent to mail to each person who was a record holder of Company Common Stock at the Effective Time, a form of letter of transmittal for use in effecting the surrender of stock certificates representing Company Common Stock (“Certificates”) in order to receive the Merger Consideration, such letter of transmittal to be in customary form and to have such other provisions as Parent and the Company may reasonably agree. When the Distribution Agent receives either (i) a Certificate, together with a properly completed and executed letter of transmittal and any other documents required thereunder, or (ii) an Agent’s Notice from The Depositary Trust Company (an “Agent’s Notice”) stating that shares of Company Common Stock have been transferred by book entry transfer into an account established by the Distribution Agent for the purpose of receiving Company Common Stock, the Distribution Agent will promptly arrange for the delivery of the applicable Merger Consideration (or a cash payment if required under Section 1.15) to the holder of the shares formerly represented by the Certificate or transferred by book entry to the Distribution Agent’s account or as otherwise directed in the letter of transmittal or the Agent’s Notice.

(d) No interest will be paid or accrued on the Merger Consideration issuable upon the surrender of Certificates or book entry transfer of shares. If Merger Consideration is to be distributed to a person other than the person in whose name a surrendered Certificate is registered, the surrendered Certificate must be properly endorsed or otherwise be in proper form for transfer, and the person who surrenders the Certificate must provide funds for payment of any transfer or other taxes required by reason of the issuance of Merger Consideration to a person other than the registered holder of the surrendered Certificate or establish to the satisfaction of the Surviving Corporation that the tax has been paid. After the Effective Time, a Certificate which has not been surrendered will no longer represent, and uncertificated shares reflected on the records of the Company’s transfer agent will no longer constitute, stock of the Company, and instead will represent or constitute only the right to receive the Merger Consideration with regard to what had been shares of Company Common Stock (and any dividends paid to holders of record after the Effective Time with regard to the Parent Class A Stock that constitutes the Merger Consideration).

(e) If the Distribution Agent believes, or Parent notifies the Distribution Agent that it believes, that the Distribution Agent is required to withhold any portion of the Merger Consideration (or any cash amount) payable to any person under the Code, or any provision of any state, local or foreign tax law, the Distribution Agent will withhold Merger Consideration with a Closing Date Market Value equal to the sum the Distribution Agent is required (or that the Distribution Agent or Parent believes the Distribution Agent is required) to withhold and Parent will provide the Distribution Agent, in exchange for the withheld Merger Consideration, cash with which to pay the required withholding taxes to the applicable Taxing authorities. Any Merger Consideration that constitutes a compensatory payment to the recipient may, at the direction of the Distribution Agent, be processed through the Surviving Corporation’s payroll system. Any Merger Consideration that is withheld as permitted by this Section 1.16(e) will be deemed to have been distributed to the person from whom it is withheld.

(f) If a Certificate has been lost, stolen or destroyed, the Surviving Corporation will accept, and will instruct the Distribution Agent to accept, an affidavit and indemnification reasonably satisfactory to it instead of the Certificate.

11

(g) At any time which is more than six months after the Effective Time, Parent may require the Distribution Agent to return to Parent any funds and any shares of Parent Class A Stock which have been provided to the Distribution Agent but have not been disbursed to former holders of Company Common Stock (including, without limitation, dividends received by the Distribution Agent in respect of those shares of Parent Class A Stock), and after the funds and shares have been returned to Parent, former stockholders of the Company must look to Parent for issuance of the Merger Consideration upon surrender of the Certificates that formerly represented, or book entry transfer of, shares of Company Common Stock.

(h) Neither the Surviving Corporation nor the Distribution Agent will be liable to any former stockholder of the Company for any Merger Consideration or cash payment amount which is delivered to a public official pursuant to any abandoned property, escheat or similar law.

(i) After the Effective Time, the Surviving Corporation will not record any transfers of shares of Company Common Stock on the stock transfer books of the Company or the Surviving Corporation, and the stock ledger of the Company will be closed. If, after the Effective Time, Certificates or uncertificated shares are presented for transfer, they will be cancelled and treated as having been surrendered for the Merger Consideration (which will be paid upon receipt of a properly completed letter of transmittal or an Agent’s Notice and any other documents required thereby).

1.17 Governance Matters. Unless otherwise agreed by the Company and Parent prior to the Effective Time, Scott D. Stowell will be elected to the Parent Board as of immediately following the Effective Time; provided, however, that if Scott D. Stowell is unable or unwilling to serve as a director on the Parent Board immediately following the Effective Time, the Company Board may select another individual to serve on the Parent’s Board as of immediately following the Effective Time, such person to be reasonably acceptable to the Nominating and Corporate Governance Committee of Parent’s Board.

CLOSING DATE AND EFFECTIVE TIME OF MERGER

2.1 Closing. The closing of the Merger (the “Closing”) will take place at 9:00 a.m., Eastern time, on the day (the “Closing Date”) that is the first business day after the later of (a) the day on which the later of the stockholder approvals described in Sections 5.1 and 5.2 is obtained, or (b) the earliest day on which all the conditions in Sections 5.1 and 5.2, other than conditions which are expected to be fulfilled on the Closing Date, have been fulfilled or waived (to the extent permitted by law, and subject to such fulfillment or waiver at the Closing). The Closing will take place by an electronic exchange of documents (unless either the Company or Parent requests a physical Closing, in which case the Closing will take place at the offices of Goodwin Procter, LLP, 620 Eighth Avenue, New York, NY or another place agreed to by the Company and Parent). The Closing Date and the time and place of the Closing (if there is a physical Closing) may be changed with the written consent of the Company and Parent.

2.2 Execution of Certificate of Merger. Not later than 3:00 p.m. Eastern time on the day before the expected Closing Date, Merger Sub and the Company will each execute a certificate of merger (the “Certificate of Merger”) substantially in the form of Exhibit 2.2 and deliver it to Goodwin Procter LLP for filing with the Secretary of State of Delaware. If all the conditions in Article 5 are fulfilled or waived (to the extent permitted by law) and all the documents required to be delivered at the Closing are delivered as contemplated by this Agreement, on the Closing Date Merger Sub will cause the Certificate of Merger to be filed with the Secretary of State of Delaware.

2.3 Effective Time of the Merger. The Merger will become effective at 11:59 p.m. Eastern time on the day on which the Certificate of Merger is filed with the Secretary of State of Delaware or at such other time as the Company and Parent shall agree in writing and shall specify in the Certificate of Merger (that being the “Effective Time”).

12

REPRESENTATIONS AND WARRANTIES

3.1 Representations and Warranties of the Company. Except as disclosed or reflected in (a) documents filed by the Company with the Securities and Exchange Commission (the “SEC”) at least two business days before the date of this Agreement (other than disclosures regarding future risks made under the caption “Risk Factors” or disclosures constituting forward looking statements that were the subject of disclaimers) or (b) a section of the disclosure letter delivered by the Company to Parent in connection with the execution of this Agreement (the “Company Disclosure Letter”) (it being understood that the disclosure of any information in a particular section or subsection of the Company Disclosure Letter shall be deemed disclosure with respect to any other section or subsection of this Agreement to the extent the relevance of such item is reasonably apparent on the face of such disclosure), the Company represents and warrants to Parent and Merger Sub as follows:

(a) The Company is a corporation duly organized, validly existing and in good standing under the laws of the State of Delaware.

(b) The Company has all corporate power and authority necessary to enable it to enter into this Agreement and carry out the transactions contemplated by this Agreement, subject to obtaining the Company Stockholder Approval. All corporate actions necessary to authorize the Company to enter into this Agreement and carry out the transactions contemplated by it, other than obtaining the Company Stockholder Approval and the filing of appropriate Merger documentation as required by the DGCL, have been taken. This Agreement has been duly executed by the Company and is a valid and binding agreement of the Company, enforceable against the Company in accordance with its terms, except as enforcement may be limited by the Enforceability Exceptions.

(c) Without limiting what is said in Section 3.1(b), the Board of Directors of the Company (the “Company Board”) has unanimously (i) determined that this Agreement and the transactions contemplated by it are fair to and in the best interests of the Company and its stockholders, (ii) adopted this Agreement and approved the transactions contemplated by it, including the Merger, and declared that this Agreement and the Merger are advisable, and (iii) resolved to recommend that the Company’s stockholders vote all the shares of Company Common Stock they own, or as to which they for any other reason have voting power, in favor of adopting this Agreement and approving the Merger; provided, that such recommendation was made subject to the understanding that the Company Board may effect a Company Adverse Recommendation Change if one is permitted by Section 4.8 hereof. The determinations and recommendations of the Company Board described in the first sentence of this Section 3.1(c) were made after the Company Board received and considered an opinion of J.P. Morgan Securities LLC (“J.P. Morgan”), as financial adviser to the Company, to the effect that, as of the date of this Agreement and subject to the limitations, qualifications and assumptions set forth therein, the Exchange Ratio is fair from a financial point of view to the Company’s stockholders.

(d) Assuming that the Company Stockholder Approval is obtained, if the consents described in Section 3.1(e) and in Section 3.1-D of the Company Disclosure Letter are obtained, neither the execution and delivery of this Agreement by the Company or of any document to be delivered by the Company in accordance with this Agreement nor the consummation of the transactions contemplated by this Agreement or by any document to be delivered in accordance with this Agreement will violate, result in a breach of, or constitute a default (or an event which, with notice or lapse of time or both, would constitute a default) under, the Certificate of Incorporation or By-Laws of the Company, any agreement or instrument to which the Company or any subsidiary of the Company is a party or by which any of them is bound, any law, or any order, rule or regulation of any court or other governmental agency or any other regulatory or quasi-regulatory organization having jurisdiction over the Company or any of its subsidiaries, except violations, breaches or defaults that, individually or in the aggregate, have not had and would not reasonably be expected to have, a Material Adverse Effect upon the Company. As used in this Agreement, the term “Material Adverse Effect” upon a company means a material adverse effect upon (i) the consolidated financial position, results of operations, assets, business or operations of the applicable company and its

13

subsidiaries, taken as a whole or (ii) the ability of the applicable company to consummate the Merger and the other transactions contemplated by this Agreement without material delay or impairment; provided, however, that the following shall not constitute, either alone or in combination, a “Material Adverse Effect” or be taken into account when determining whether a “Material Adverse Effect” has occurred or would reasonably be expected to occur: (A) changes in the economy or financial, credit or capital markets of the United States of America (the “United States”) in general, including changes in interest rates and availability and cost of borrowings or other costs of financing, (B) changes generally affecting the industry or industries in which that company or its subsidiaries conduct their businesses, (C) changes in applicable law, (D) changes in generally accepted accounting principles or interpretations of them, (E) changes in global or national political conditions (including the outbreak or escalation of war or acts of terrorism) or any natural disaster, (F) changes attributable to the execution, public disclosure or performance of this Agreement or the announcement, pendency or consummation of the transactions contemplated by it, including the institution of litigation relating to or arising from the transactions that are the subject of this Agreement, and the impact of the execution, disclosure or performance of this Agreement on relationships, contractual or otherwise, with suppliers, customers, employees, Governmental Authorities, business partners or similar relationships, (G) the performance by the applicable company or any of its subsidiaries of its obligations under this Agreement, (H) any action taken with the written consent of the other party or that is required by the terms of this Agreement, (I) any failure to meet any internal or third party estimates, projections or forecasts of revenue, earnings or other financial performance (but not the facts or circumstances underlying or giving rise to such failure), (J) with respect to the Company, (x) any items set forth in the Company Disclosure Letter, or (y) any change, in and of itself, in the trading price or trading volume of Company Common Stock on the NYSE, or (K) with respect to Parent, (x) any items set forth in the Parent Disclosure Letter or (y) any change, in and of itself, in the trading price of either class of Parent Stock on the NYSE; except to the extent that the effect of a change described in one or more of clauses (A) through (E) materially disproportionately adversely affects the applicable company and its subsidiaries, taken as a whole, as compared to other companies engaged in similar businesses, and then only to the extent of such disproportionality.

(e) Except as set forth in Section 3.1-E of the Company Disclosure Letter, no governmental filings, authorizations, approvals, or consents, or other governmental action, other than (i) the termination or expiration of waiting periods under the Hart Scott Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”), if any, (ii) the filing of the Certificate of Merger with the Secretary of State of the State of Delaware, (iii) the filing with the SEC of the Joint Proxy Statement and any reports relating to the Merger required to be filed under the Exchange Act and the rules under it or and any other applicable state or federal securities, takeover and “blue sky” laws, and (iv) such other filings, authorizations, approvals consents or other action, the failure of which to be obtained or made, individually or in the aggregate, have not had and would not reasonably be expected to have, a Material Adverse Effect upon the Company, are required to permit the Company to fulfill all its obligations under this Agreement.

(f) The Company and each of its subsidiaries is qualified to do business as a foreign corporation in each state in which it is required to be qualified, except states in which the failure to qualify, individually or in the aggregate, have not had and would not reasonably be expected to have, a Material Adverse Effect on the Company.

(g) The only authorized stock of the Company is 600,000,000 shares of Company Common Stock and 10,000,000 shares of preferred stock, par value $0.01 per share. At the close of business on October 23, 2017 (the “Measurement Time”), the only outstanding stock of the Company was not more than 111,500,000 shares of Company Common Stock. All those shares have been duly authorized and issued and are fully paid and non-assessable. Except as shown on Section 3.1-G of the Company Disclosure Letter, at the date of this Agreement, the Company has not issued any options, warrants or convertible or exchangeable securities, or any stock units, which are outstanding, and is not a party to any other agreements, which require, or upon the passage of time, the payment of money or the occurrence of any other event may require, the Company to issue or sell any of its stock.

14

(h) Except as shown in Section 3.1-H of the Company Disclosure Letter, neither the Company nor any of its subsidiaries is a party to any agreement regarding the voting of shares of Company Common Stock or committing the Company to register shares of Company Common Stock under the Securities Act of 1933, as amended (the “Securities Act”). No holder of Company Common Stock or other securities of the Company is entitled under the Company’s certificate of incorporation or By-Laws, or under any agreement to which the Company or any of its subsidiaries is a party, to preemptive rights with regard to Company Common Stock or any other securities issued by the Company.

(i) The Company and the Company Board have done all things necessary so that (i) neither the execution of this Agreement nor the Merger or any other transaction that is the subject of this Agreement will give any holder of Preferred Share Rights any right to exercise those Preferred Stock Rights or any other rights with regard to the Preferred Share Rights, and (ii) neither Parent nor Merger Sub will be a “15% Stockholder” for purposes of the Rights Agreement or the Preferred Share Rights.

(j) Exhibit 21.1 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2016 (the “Company 10-K”) which was filed with the Securities and Exchange Commission (“SEC”), and Section 3.1-J of the Company Disclosure Letter, together contain a complete list of all the corporations and other entities of which, at the date of this Agreement, the Company owns directly or indirectly more than 50% of the equity measured by value or power to vote in the election of directors or persons performing similar functions (each corporation or other entity of which a company owns directly or indirectly more than 50% of the equity being a “subsidiary” of that company), other than subsidiaries that, taken together, do not constitute a significant subsidiary as that term is defined in Rule 1-02(w) of SEC Regulation S-X (a “Significant Subsidiary”). Except as to subsidiaries that taken together do not constitute a Significant Subsidiary and are not otherwise material to the Company and its subsidiaries taken together, each subsidiary of the Company has been duly organized and is validly existing and, to the extent the concept is applicable, in good standing under the laws of the jurisdiction in which it was formed, all the shares of stock or other equity interests in each of those subsidiaries that are directly or indirectly owned by the Company have been duly authorized and validly issued and, with regard to stock of corporations or other equity interests in limited liability entities, are fully paid and non-assessable, none of those shares or other equity interests is subject to any preemptive rights, and neither the Company nor any of its subsidiaries has issued any options, warrants or convertible or exchangeable securities, or is a party to any other agreements, which require, or upon the passage of time, the payment of money or the occurrence of any other event may require, the Company or any subsidiary to issue or transfer any shares of or other equity interests in any subsidiary of the Company, and there are no registration covenants or transfer or voting restrictions with respect to any shares of or other equity interests in any of the Company’s subsidiaries.

(k) Except (i) as shown in Section 3.1-K of the Company Disclosure Letter, (ii) as described in the Company 10-Q, (iii) as required pursuant to any joint venture arrangements entered into after June 30, 2017, or (iv) as part of the normal conduct of business of the Company, at the date of this Agreement, neither the Company nor any subsidiary has any actual or contingent obligation to make, after the date of this Agreement, an equity investment in any entity (other than the Company’s wholly owned subsidiaries), whether by purchasing equity securities of the entity, making contributions to the capital of the entity, paying sums owed by the entity (as a guarantor of the entity’s obligations or otherwise) or in any other manner.

(l) Since January 1, 2014, the Company has filed with the SEC all forms, statements, reports and documents it has been required to file under the Securities Act, the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or the rules under either of them.