Form DEF 14A LINKEDIN CORP For: Jun 09

Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

ý |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material under §240.14a-12 |

|

| LinkedIn Corporation | ||||

|

(Name of Registrant as Specified In Its Charter) |

||||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

Payment of Filing Fee (Check the appropriate box): |

||||

ý |

No fee required. |

|||

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

o |

Fee paid previously with preliminary materials. |

|||

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

![]()

LinkedIn Corporation

2029 Stierlin Court

Mountain View, CA 94043

www.linkedin.com

To the Stockholders of LinkedIn Corporation:

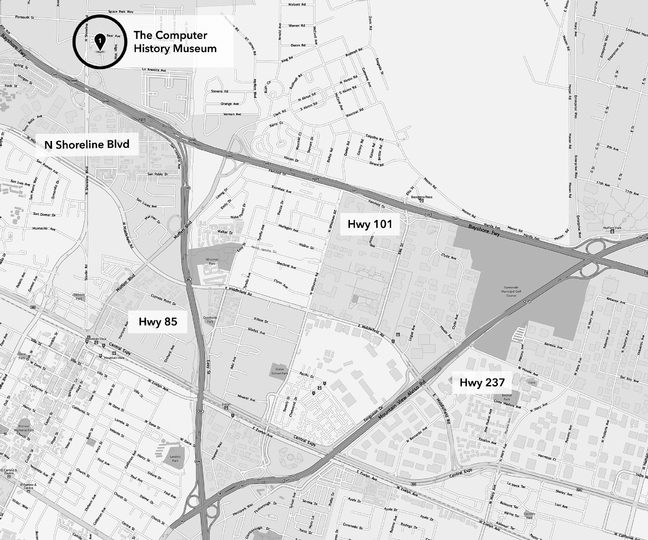

You are cordially invited to attend the 2016 Annual Meeting of Stockholders (the "Annual Meeting") of LinkedIn Corporation ("LinkedIn" or the "Company") to be held on June 9, 2016, at 10:00 a.m. Pacific Time, at the Computer History Museum, 1401 N. Shoreline Blvd., Mountain View, California 94043. At the Annual Meeting, we will ask you to consider the following proposals:

- •

- to elect two Class II directors;

- •

- to ratify the appointment of Deloitte & Touche LLP as our independent registered public accountants for the fiscal year

ending December 31, 2016; and

- •

- to consider a stockholder proposal regarding a report to stockholders on plans to increase racial and gender diversity on our Board, if properly presented at the meeting.

Stockholders of record as of April 12, 2016 may vote at the Annual Meeting.

Your vote is important. Whether or not you plan to attend the meeting in person, we would like for your shares to be represented. Please vote as soon as possible.

Sincerely,

|

|

|||

| Reid Hoffman Chair of the Board of Directors |

A. George "Skip" Battle Lead Independent Director |

Jeffrey Weiner Chief Executive Officer |

![]()

LinkedIn Corporation

2029 Stierlin Court

Mountain View, CA 94043

www.linkedin.com

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 9, 2016

On June 9, 2016, LinkedIn Corporation will hold its 2016 Annual Meeting of Stockholders at 10:00 a.m. Pacific Time. The meeting will be held at the Computer History Museum, 1401 N. Shoreline Blvd., Mountain View, California 94043 for the following purposes:

- •

- to elect A. George "Skip" Battle and Michael J. Moritz as Class II directors;

- •

- to ratify the appointment of Deloitte & Touche LLP as our independent registered public accountants for the fiscal year

ending December 31, 2016;

- •

- to consider a stockholder proposal regarding a report to stockholders on plans to increase racial and gender diversity on our Board,

if properly presented at the meeting; and

- •

- to transact such other business that may properly come before the Annual Meeting or at any adjournment or postponement thereof.

More information about these business items is described in the proxy statement accompanying this notice. Any of the above matters may be considered at the Annual Meeting at the date and time specified above or at any adjournment or postponement of the Annual Meeting.

Your vote is important. Whether or not you plan to attend the meeting in person, we would like for your shares to be represented. To ensure that your vote is counted at the meeting, please vote as soon as possible.

|

By order of the Board of Directors, | |

|

Michael J. Callahan Senior Vice President, General Counsel & Secretary |

Mountain

View, California

April 22, 2016

YOUR VOTE IS IMPORTANT.

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE COMPLETE, SIGN, DATE AND RETURN THE PROXY CARD OR VOTING INSTRUCTION CARD AS INSTRUCTED OR VOTE BY TELEPHONE OR USING THE INTERNET AS INSTRUCTED ON THE PROXY CARD, VOTING INSTRUCTION CARD OR THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS.

i

LINKEDIN CORPORATION

PROXY STATEMENT FOR 2016 ANNUAL MEETING OF STOCKHOLDERS

LinkedIn's Board of Directors (the "Board") is providing these proxy materials to you for use in connection with the 2016 Annual Meeting of Stockholders (the "Annual Meeting") to be held on June 9, 2016 at 10:00 a.m. Pacific Time, and at any postponement or adjournment of the meeting. The Annual Meeting will be held at the Computer History Museum, 1401 N. Shoreline Blvd., Mountain View, California 94043. Stockholders of record as of April 12, 2016 (the "Record Date") are invited to attend the Annual Meeting and are asked to vote on the proposals described in this proxy statement.

A Notice of Internet Availability (the "Notice") was first mailed on or about April 26, 2016 to stockholders of record as of the Record Date, and these proxy solicitation materials combined with our Annual Report on Form 10-K for the fiscal year ended December 31, 2015, including financial statements, were first made available on the Internet on or about April 26, 2016. Our principal executive offices are located at 2029 Stierlin Court, Mountain View, California 94043, and our telephone number is (650) 687-3600. We maintain a website at www.linkedin.com. The information on our website is not incorporated by reference into this proxy statement.

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS

AND OUR ANNUAL MEETING

Q: What is the purpose of the Annual Meeting?

A: For stockholders to vote on the following proposals:

- •

- to elect A. George "Skip" Battle and Michael J. Moritz as Class II directors;

- •

- to ratify the appointment of Deloitte & Touche LLP as our independent registered public accountants for the

fiscal year ending December 31, 2016;

- •

- to consider a stockholder proposal, brought by the Comptroller of the State of New York that asks the Board to report to

stockholders on plans to increase gender and racial diversity on our Board (the "Stockholder Proposal"); and

- •

- to transact such other business that may properly come before the Annual Meeting or at any adjournment or postponement thereof.

Q: How does the Board of Directors recommend I vote on these proposals?

A: The Board recommends that you vote:

- •

- FOR the election of A. George "Skip" Battle and Michael J. Moritz as Class II directors;

- •

- FOR the ratification of the appointment of Deloitte & Touche LLP as our independent registered public

accountants for the fiscal year ending December 31, 2016; and

- •

- The Board makes no recommendation regarding the Stockholder Proposal.

Q: What can you tell me about the Stockholder Proposal?

A: A stockholder proposal, brought by the Comptroller of the State of New York as the trustee of the New York State Common Retirement Fund (the "Fund"), asks the Board to report to stockholders on plans to increase gender and racial diversity on the Board. It is the same stockholder proposal that was brought before our 2015 Annual Meeting of Stockholders by the Fund. It was not approved at that meeting.

1

The Board has included a statement regarding board diversity immediately following the Stockholder Proposal on page 24 of this proxy statement.

Q: Why did I receive a one-page notice in the mail about the Internet availability of proxy materials instead of a full set of printed proxy materials?

A: Under Securities and Exchange Commission (the "SEC") rules, we make our proxy materials available via the Internet. Instead of mailing printed copies of the proxy materials to all of our stockholders, the SEC rules allow us to send you, our stockholders as of the Record Date, a Notice containing instructions on how to access the proxy materials via the Internet and how to request a printed copy by mail if you prefer. Sending you the Notice and using the Internet instead of mailing printed proxy materials also saves costs and natural resources.

Q: Who is making this solicitation?

A: LinkedIn's Board is asking you for your proxy to vote at the Annual Meeting.

Q: Who is entitled to vote at the meeting?

A: Stockholders Entitled to Vote. Stockholders who our records show owned shares of either class of our common stock as of the close of business on the Record Date may vote at the Annual Meeting. On the Record Date, we had a total of 117,986,490 shares of LinkedIn Class A common stock ("Class A Common Stock") issued and outstanding, which were held of record by approximately 333 stockholders, and a total of 15,559,383 shares of LinkedIn Class B common stock ("Class B Common Stock") issued and outstanding, which were held of record by approximately 14 stockholders. The stock transfer books will not be closed between the Record Date and the date of the Annual Meeting. Each share of Class A Common Stock is entitled to one vote on each proposal and each share of Class B Common Stock is entitled to ten votes on each proposal. The Class A Common Stock and Class B Common Stock will vote as a single class on all matters described in this proxy statement for which your vote is being solicited. The Class A Common Stock and Class B Common Stock, together, are referred to in this proxy statement as the "Common Stock."

Registered Stockholders. If your shares are registered directly in your name with LinkedIn's transfer agent, you are considered the stockholder of record with respect to those shares, and the Notice was provided to you directly by LinkedIn. As the stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card or to vote in person at the Annual Meeting.

Street Name Stockholders. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name and the Notice was forwarded to you by your broker or nominee, who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker or nominee how to vote your shares. If you request a printed copy of the proxy materials by mail, your broker or nominee will provide a voting instruction card for you to use. Beneficial owners are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you follow your broker's procedures for obtaining a legal proxy.

Q: Can I attend the meeting in person?

A: Yes. You are invited to attend the Annual Meeting if you are a registered stockholder or a street name stockholder as of the Record Date. In order to enter the Annual Meeting, you must present a form of photo identification acceptable to us, such as a valid driver's license or passport, as well as proof of share ownership, such as a broker statement or legal proxy. Please note that

2

since a street name stockholder is not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you follow your broker's procedures for obtaining a legal proxy.

Q: How can I get electronic access to the proxy materials?

A: The Notice provides you with instructions about how to:

- •

- view our proxy materials for the Annual Meeting via the Internet; and

- •

- request that we send our future proxy materials to you by mail or by email.

By accessing the proxy materials via the Internet or choosing to receive your future proxy materials by email, you will save us the cost of printing and mailing documents to you and will reduce the impact of our annual stockholders' meetings on the environment. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. If you choose to receive future proxy materials by mail, you will receive a paper copy of those materials, including a form of proxy. Your election to receive proxy materials by mail or email will remain in effect until you notify us that you are terminating your request.

Q: How can I vote my shares?

A: Registered Stockholders: Registered stockholders may vote in person at the Annual Meeting or by one of the following methods:

- •

- By Mail. If you requested printed copies of the proxy materials to be mailed to you, you can complete, sign and date the

proxy card and return it in the prepaid envelope provided;

- •

- By Telephone. Call the toll-free telephone number in the Notice and follow the recorded instructions; or

- •

- By Internet. Access LinkedIn's secure website registration page via the Internet, as identified in the Notice, and follow the instructions.

Please note that the Internet and telephone voting facilities for registered stockholders will close at 11:59 p.m. Eastern Time on June 8, 2016.

Street Name Stockholders: If your shares are held by a broker, bank or other nominee, you should have received instructions on how to vote or instruct the broker to vote your shares from your broker, bank or other nominee. Please follow their instructions carefully. Also, please note that if the holder of record of your shares is a broker, bank or other nominee and you wish to vote in person at the Annual Meeting, you must request a legal proxy from the bank, broker or other nominee that holds your shares and present that proxy and proof of identification at the Annual Meeting to vote your shares.

Street name stockholders may generally vote by one of the following methods:

- •

- By Mail. If you requested printed copies of the proxy

materials to be mailed to you, you may vote by signing, dating and returning your voting instruction card to your broker in pre-addressed envelope provided;

- •

- By Methods Listed on Your Voting Instruction Card. Please refer to your voting instruction card or other information provided by your bank, broker, nominee or other holder of record to determine whether you may vote by telephone or electronically on the Internet, and follow the instructions on the voting instruction card or other information provided by your bank, broker, nominee or other holder of record; or

3

- •

- In Person With a Proxy from the Record Holder. A street name stockholder who wishes to vote at the Annual Meeting will need to obtain a legal proxy from his or her bank, brokerage firm or other nominee. Please consult the voting instruction card provided to you by your bank, broker or other nominee to determine how to obtain a legal proxy in order to vote in person at the Annual Meeting.

Q: If I submit a proxy, how will it be voted?

A: When your proxy is properly completed, dated, executed and returned, the shares represented by your proxy will be voted at the Annual Meeting in accordance with your instructions. If no specific instructions are given, however, the shares will be voted in accordance with the recommendations of our Board as described above. If any matters not described in the proxy statement are properly presented at the Annual Meeting, including any proposal for adjournment, the proxy holders will use their own judgment to determine how to vote your shares. If the Annual Meeting is adjourned, the proxy holders can vote your shares on the new meeting date as well, unless you have revoked your proxy instructions, as described below under "Can I change my vote?"

Q: Can I change my vote?

A: You may change your vote at any time prior to the vote at the Annual Meeting. To revoke your proxy instructions and change your vote if you are a holder of record, you must (i) attend the Annual Meeting and vote your shares in person (please be aware that attendance at the Annual Meeting will not, by itself, revoke a proxy), (ii) advise our Corporate Secretary at our principal executive office (2029 Stierlin Court, Mountain View, California 94043) of your revocation in writing before the proxy holders vote your shares, (iii) deliver later dated and signed proxy instructions (which must be received prior to the Annual Meeting) or (iv) vote again on a later date on the Internet or by telephone prior to the Annual Meeting (only your latest Internet or telephone proxy submitted prior to the Annual Meeting will be counted).

Q: What happens if I decide to attend the Annual Meeting, but I have already voted or submitted a proxy covering my shares?

A: You may attend the meeting and vote in person even if you have already voted or submitted a proxy. Please be aware that attendance at the Annual Meeting will not, by itself, revoke a proxy. If a bank, broker or other nominee holds your shares and you wish to attend the Annual Meeting and vote in person, you must obtain a legal proxy from the holder of record of the shares giving you the right to vote those shares.

Q: What quorum is required for the Annual Meeting?

A: At the Annual Meeting, the presence in person or by proxy of a majority of the aggregate voting power of the stock issued and outstanding and entitled to vote at the Annual Meeting is required for the Annual Meeting to proceed. If you have returned valid proxy instructions or attend the Annual Meeting in person, your shares of Common Stock will be counted for the purpose of determining whether there is a quorum, even if you wish to abstain from voting on some or all matters at the meeting. Shares represented by broker non-votes will be considered present and entitled to vote for quorum purposes.

Q: How are votes counted?

A: Each holder of shares of Class A Common Stock is entitled to one vote for each share of Class A Common Stock held as of the Record Date, and each holder of shares of Class B Common

4

Stock is entitled to 10 votes for each share of Class B Common Stock held as of the Record Date. The Class A Common Stock and Class B Common Stock are voting as a single class on all matters described in this proxy statement for which your vote is being solicited.

Each director is elected by a plurality of the votes of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors at the Annual Meeting. "Plurality" means that the two individuals who receive the largest number of votes cast "for" are elected as directors. Abstentions and broker non-votes will have no effect on the outcome of the vote.

The ratification of independent registered public accountants and approval of the Stockholder Proposal each require the affirmative vote of a majority of shares present in person or represented by proxy and entitled to vote on such proposal at the Annual Meeting. Abstentions are treated as shares present and entitled to vote for purposes of each such proposal and have the same effect as a vote "against" the proposal. Broker non-votes, if any, will have no effect on the outcome of the vote.

Q: What are broker non-votes?

A: Broker non-votes are shares held by brokers that do not have discretionary authority to vote on non-routine matters and have not received voting instructions from their clients. If your broker holds your shares in its name and you do not instruct your broker how to vote, your broker will nevertheless have discretion to vote your shares on our sole "routine" matter—the ratification of the appointment of Deloitte & Touche as our independent registered public accounting firm. Your broker will not have discretion to vote on the election of directors or the approval ofthe Stockholder Proposal, absent direction from you.

Q: Who will tabulate the votes?

A: LinkedIn has designated a representative of Broadridge Financial Solutions, Inc., as the Inspector of Election who will tabulate the votes.

Q: Who pays for the proxy solicitation process?

A: LinkedIn will pay the cost of preparing, assembling, printing, mailing and distributing these proxy materials and soliciting votes. We may, on request, reimburse brokerage firms and other nominees for their expenses in forwarding proxy materials to beneficial owners. In addition to soliciting proxies by mail, we expect that our directors, officers and employees may solicit proxies in person or by telephone or facsimile. None of these individuals will receive any additional or special compensation for doing this, although we will reimburse these individuals for their reasonable out-of-pocket expenses.

Q: May I propose actions for consideration at next year's annual meeting of stockholders or nominate individuals to serve as directors?

A: You may present proposals for action at a future meeting or submit nominations for election of directors only if you comply with the requirements of the proxy rules established by the SEC and our bylaws, as applicable. In order for a stockholder proposal to be included in our proxy statement and form of proxy for our 2017 Annual Meeting of Stockholders under rules set forth in the Securities Exchange Act of 1934, as amended (the "Exchange Act"), the proposal must be received by us no later than December 27, 2016. If a stockholder intends to submit a proposal that is not intended to be included in our proxy statement, or a nomination for director for our 2017 Annual Meeting of Stockholders, the stockholder must give us notice in accordance with the requirements set forth in our bylaws no later than the 45th day and no earlier than the 75th day prior to the one

5

year anniversary of the mailing of the proxy statement for the 2016 Annual Meeting. If the date of the 2017 Annual Meeting is more than 30 days before or more than 60 days after such anniversary date, notice by the stockholder must be received no earlier than 120 days prior to the 2017 Annual Meeting and no later than the later of (i) the 90th day prior to the date of the 2017 Annual Meeting or (ii) the 10th day following the date on which public announcement of the date of the 2017 Annual Meeting is first made by LinkedIn. Our bylaws require that certain information and acknowledgments with respect to the proposal or the nominee and the stockholder making the proposal or nomination be set forth in the notice. Our bylaws have been publicly filed with the SEC and can also be found in the Corporate Governance section of our Investor Relations webpage by visiting investors.linkedin.com and clicking Corporate Governance (https://investors.linkedin.com/results-and-financials/corporate-governance/default.aspx).

Q: What should I do if I get more than one proxy or voting instruction card?

A: Stockholders may receive more than one set of voting materials, including multiple copies of the Notice, these proxy materials, proxy cards or voting instruction cards. For example, stockholders who hold shares in more than one brokerage account may receive separate copies of the Notice for each brokerage account in which shares are held. Stockholders of record whose shares are registered in more than one name will receive more than one Notice. You should vote in accordance with all of the Notices you receive relating to our Annual Meeting to ensure that all of your shares are counted.

Q: How do I obtain a separate set of proxy materials or request a single set for my household?

A: We have adopted a procedure approved by the SEC called "householding." Under this procedure, stockholders who have the same address and last name and do not participate in electronic delivery of proxy materials will receive only one copy of the Notice and our annual report and proxy statement unless one or more of these stockholders notifies us that they wish to continue receiving individual copies. This procedure reduces printing costs, postage fees and the use of natural resources. Each stockholder who participates in householding will continue to be able to access or receive a separate proxy card.

If you wish to receive a separate Notice, proxy statement or annual report at this time, contact Broadridge Financial Solutions, Inc. by telephone at 866-540-7095 (inside or outside of the U.S.). If you wish to receive a separate annual report and a separate proxy statement in the future, you may contact Investor Relations, LinkedIn Corporation, 2029 Stierlin Court, Mountain View, CA 94043. You may also send a message to our Investor Relations department by email at [email protected] or on our website at investors.linkedin.com under "Contact Us" (https: //investors.linkedin.com/contact-us/default.aspx).

If you are a stockholder who has multiple accounts in your name or you share an address with other stockholders and would like to receive only one copy of future notices and proxy materials for your household, you may notify your broker, if your shares are held in a brokerage account, or if you hold registered shares, by notifying either LinkedIn Investor Relations or Broadridge using the contact methods above.

Q: What if I have questions about lost stock certificates or need to change my mailing address?

A: You may contact our transfer agent, Computershare Trust Company, N.A., by telephone at 1-877-373-6374 (U.S.) or +1-781-575-3120 (outside the U.S.), or by email at [email protected], if you have lost your stock certificate or need to change your mailing address.

6

BOARD OF DIRECTORS MEETINGS AND COMMITTEES

The Board is composed of seven members: A. George "Skip" Battle, Reid Hoffman, Leslie Kilgore, Stanley J. Meresman, Michael J. Moritz, David Sze and Jeffrey Weiner. Mr. Hoffman serves as Chair of our Board and Mr. Battle is our Lead Independent Director.

Our Board has determined that Messrs. Battle, Meresman, Moritz and Sze and Ms. Kilgore, representing five of our seven directors, are "independent" as that term is defined under the applicable rules and regulations of the SEC and the listing requirements and rules of the New York Stock Exchange ("NYSE"). There are no family relationships between any director and an executive officer.

The Board held seven meetings during fiscal year 2015. The Board also acted seven times by unanimous written consent. Each director attended at least 80% of the aggregate number of meetings of our Board and the committees on which such director served during fiscal year 2015. Our Board members are strongly encouraged, per our Corporate Governance Guidelines, to attend each annual meeting of stockholders, and all of our directors attended the 2015 Annual Meeting, either in person or telephonically.

Information about the Directors and Nominees

In accordance with our certificate of incorporation, our Board is divided into three classes with staggered three-year terms. At each annual general meeting of stockholders, the applicable class of directors is elected to serve until the third annual meeting following election or until their successors are duly elected and qualified. Set forth below is information regarding our directors and the nominees as of April 22, 2016:

Name

|

Age | Position | Director Since |

||||||

|---|---|---|---|---|---|---|---|---|---|

Directors with terms expiring at the 2016 Annual Meeting (Class II) |

|||||||||

A. George "Skip" Battle |

72 | Lead Independent Director | 2010 | ||||||

Michael J. Moritz |

61 | Director | 2011 | ||||||

Directors whose terms will expire at the 2017 Annual Meeting (Class III) |

|

||||||||

Reid Hoffman |

48 | Chair | 2003 | ||||||

Stanley J. Meresman |

69 | Director | 2010 | ||||||

David Sze |

50 | Director | 2004 | ||||||

Directors whoses terms will expire at the 2018 Annual Meeting (Class I) |

|

||||||||

Leslie Kilgore |

50 | Director | 2010 | ||||||

Jeffrey Weiner |

46 | Chief Executive Officer and Director | 2009 | ||||||

Business Experience and Qualifications of Directors

Nominees/Class II Directors (current term will expire at the 2016 Annual Meeting)

A. George "Skip" Battle has served on our Board of Directors since February 2010 and was appointed as our Lead Independent Director in December 2010. Since his retirement, Mr. Battle has been serving on the boards of directors of various public and private companies. Mr. Battle is currently the chairman of the board of directors for Fair Isaac Corporation, an analytic products company, and is also a member of the board of directors for Netflix, Inc., an Internet television network, Expedia, Inc., an online travel reservations provider, and Workday, Inc., a company that

7

provides enterprise cloud applications for human resources and finance. From December 2006 to July 2014, he served as a member of the board of directors of OpenTable, Inc., an online network connecting reservation-taking restaurants and people who dine at those restaurants, from June 1997 to December 2012 he served as a trustee of the Masters Select family of mutual funds, and from June 2005 until May 2011 he served as a member of the board of directors of Advent Software, Inc., a software and consulting company. From January 2004 to July 2005, Mr. Battle served as Executive Chairman of Ask Jeeves, Inc., an Internet search engine company, and from December 2000 to January 2004 he served as Chief Executive Officer of Ask Jeeves. From 1968 until his retirement in 1995, Mr. Battle served in management roles at Arthur Andersen LLP and then Andersen Consulting LLP (now Accenture), where he became worldwide managing partner of market development and a member of the firm's executive committee. He holds an M.B.A. from the Stanford Graduate School of Business, awarded in 1968 and a B.A. in Economics from Dartmouth College, awarded in 1966. Mr. Battle was selected to serve on our Board of Directors and was nominated to continue serving as a director on our Board due, in part, to his extensive background in public accounting and auditing, as well as his experience in the Internet industry. Mr. Battle qualifies as an "audit committee financial expert" under Securities and Exchange Commission, or the SEC guidelines. In addition, his current service on other public company boards of directors provides us with important perspectives on corporate governance matters.

Michael J. Moritz has served on our Board of Directors since January 2011. Mr. Moritz has been a Managing Member of Sequoia Capital, a venture capital firm, since 1986, and has served as Chair of Sequoia Capital Operations, LLC since 2012. He currently serves as a director for Green Dot Corporation, a provider of general purpose reloadable pre-paid debit cards and as a director of several private companies. Mr. Moritz previously served as a director of a variety of companies, including Flextronics Ltd., Google Inc., PayPal, Inc., Yahoo! Inc., Zappos.com, Inc. and Kayak Software Corporation. Mr. Moritz holds an M.A. in Modern History from Christ Church, Oxford, awarded in 1976. Mr. Moritz was selected to serve on our Board and was nominated for re-election to our Board due, in part, to his extensive background in and experience with the venture capital industry, providing guidance and counsel to a wide variety of Internet and technology companies and service on the boards of directors of a range of public and private companies.

Class III Directors (current term will expire at the 2017 Annual Meeting)

Reid Hoffman is one of our co-founders and has served on our Board of Directors since March 2003. He was appointed Chair of our Board in December 2010. He has been a Partner at Greylock Partners, a venture capital firm, since November 2009. Mr. Hoffman serves on the board of directors for several private companies and non-profit organizations, including Edmodo, Kiva.org, and Mozilla Corporation. Previously, he served as our Chief Executive Officer from March 2003 to February 2007 and from December 2008 to June 2009. Mr. Hoffman also served as our President, Products from February 2007 to December 2008, and as our Executive Chair from June 2009 to November 2009. Mr. Hoffman served as a member of the board of directors of Zynga Inc., a public social gaming company, from January 2008 to June 2014. Prior to LinkedIn, Mr. Hoffman was Executive Vice President of PayPal Inc., an online payment company, from January 2000 to October 2002. Mr. Hoffman holds a Master's degree in Philosophy from Oxford University, awarded in 1993, and a B.S. in Symbolic Systems from Stanford University, awarded in 1990. Mr. Hoffman was selected to serve on our Board due to the perspective and experience he brings as one of our founders and as one of our largest stockholders, as well as his extensive experience with technology companies.

Stanley J. Meresman has served on our Board of Directors since October 2010. During the last five years, Mr. Meresman has served on the boards of directors of various public and private companies, including service as Chair of the audit committee for various companies. Mr. Meresman currently serves as a director of, and Chair of the Audit Committee for, Palo Alto Networks, Inc., a

8

leader in enterprise security, and as a director of several private companies. He served as a member of the board of directors of Zynga Inc. from June 2011 to June 2015, Meru Networks, Inc. from September 2010 to May 2013, and Riverbed Technologies, Inc. from March 2005 to May 2012. Mr. Meresman was a Venture Partner with Technology Crossover Ventures, a private equity firm, from January 2004 through December 2004 and was General Partner and Chief Operating Officer of Technology Crossover Ventures from November 2001 to December 2003. During the four years prior to joining Technology Crossover Ventures, Mr. Meresman was a private investor and board member and advisor to several technology companies. From May 1989 to May 1997, Mr. Meresman was the Senior Vice President and Chief Financial Officer of Silicon Graphics, Inc., a manufacturer of high-performance computing solutions. Prior to Silicon Graphics, he was Vice President of Finance and Administration and Chief Financial Officer of Cypress Semiconductor, a semiconductor company. Mr. Meresman holds an M.B.A. from the Stanford Graduate School of Business, awarded in 1972, and a B.S. in Industrial Engineering and Operations Research from the University of California, Berkeley, awarded in 1968. Mr. Meresman was selected to serve on our Board due, in part, to his background as Chair of the audit committee of other public companies and his financial and accounting expertise from his prior extensive experience as Chief Financial Officer of two publicly traded corporations. Mr. Meresman qualifies as an "audit committee financial expert" under SEC guidelines. In addition, his current and past service on other public company boards of directors provides us with important perspectives on corporate governance matters.

David Sze has served on our Board of Directors since September 2004. Mr. Sze is Senior Managing Partner at Greylock Partners, which he joined in 2000. He currently serves as a trustee of the Rockefeller University and on the boards of directors of several private companies. From April 2009 to June 2015, Mr. Sze served on the board of directors of Pandora Media, Inc., an Internet radio provider. Prior to Greylock Partners, Mr. Sze was Senior Vice President of Product Strategy at Excite and then Excite@Home. As an early employee at Excite, Mr. Sze also held roles as General Manager of Excite.com and Vice President of Content and Programming for the Excite Network. Prior to Excite, he was in product marketing and development at Electronic Arts, Inc. and Crystal Dynamics, respectively. He started his career in management consulting for Marakon Associates and The Boston Consulting Group. Mr. Sze holds an M.B.A. from the Stanford Graduate School of Business, awarded in 1993, and a B.A. from Yale University, awarded in 1988. Mr. Sze was selected to serve on our Board due, in part, to his extensive background with Internet and technology companies.

Class I Directors (current term will expire at the 2018 Annual Meeting)

Leslie Kilgore has served on our Board of Directors since March 2010. Ms. Kilgore served as the Chief Marketing Officer (formerly Vice President of Marketing) of Netflix, Inc., an Internet television network, from March 2000 to February 2012, and has served as a member of the board of directors of Netflix since January 2012. From February 1999 to March 2000, Ms. Kilgore served as Director of Marketing for Amazon.com, Inc., an Internet retailer. Ms. Kilgore served as a Brand Manager for The Procter & Gamble Company, a manufacturer and marketer of consumer products, from August 1992 to February 1999. Ms. Kilgore currently serves on the boards of two private companies. Ms. Kilgore holds an M.B.A. from the Stanford Graduate School of Business, awarded in 1992, and a B.S. from The Wharton School at the University of Pennsylvania, awarded in 1987. Ms. Kilgore was selected to serve on our Board due, in part, to her extensive experience in marketing and the consumer products industry. Ms. Kilgore qualifies as an "audit committee financial expert" under SEC guidelines.

Jeffrey Weiner has served as our Chief Executive Officer since June 2009 and as a member of our Board of Directors since July 2009. In addition to LinkedIn, Mr. Weiner serves on the board of directors of Intuit Inc., a provider of business and financial management solutions, and

9

DonorsChoose.org. Mr. Weiner served as our interim President from December 2008 to June 2009. Prior to LinkedIn, Mr. Weiner was an Executive in Residence at Greylock Partners and Accel Partners, both venture capital firms, from September 2008 to June 2009, where he focused on advising the leadership teams of the firms' consumer technology portfolio companies and worked closely with the partners to evaluate new investment opportunities. Previously, Mr. Weiner held several key leadership roles at Yahoo! Inc., a digital media and Internet experience company, from May 2001 to June 2008, including most recently as an Executive Vice President where he was responsible for many of the company's consumer-facing products. He is also a member of the advisory board at Venture For America and the advisory council at The Boys & Girls Clubs of the Peninsula. He holds a B.S. in Economics from The Wharton School at the University of Pennsylvania. Mr. Weiner was selected to serve on our Board due, in part, to the perspective and experience he brings as our Chief Executive Officer and his extensive background in the Internet industry.

Committees of the Board of Directors

The Board of Directors has established the following standing committees: an Audit Committee, a Compensation Committee and a Governance and Nominating Committee.

The following chart details the membership of each standing committee, which is current as of April 22, 2016, and the number of meetings for each committee in fiscal year 2015.

Name of Director

|

Audit | Compensation | Governance and Nominating |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

A. George "Skip" Battle |

M | M | C | |||||||

Leslie Kilgore |

M | C | M | |||||||

Stanley J. Meresman |

C | M | M | |||||||

Number of Meetings in fiscal year 2015 |

8 | * | 5 | ** | 4 | *** | ||||

M = Member C = Chair

- *

- In

addition to its eight meetings, the Audit Committee also acted one time by unanimous written consent.

- **

- In

addition to its five meetings, the Compensation Committee also acted six times by unanimous written consent.

- ***

- In addition to its four meetings, the Governance and Nominating Committee also acted one time by unanimous written consent.

Audit Committee

Our Audit Committee provides oversight of our accounting and financial reporting process, the audit of our financial statements, and our internal control function. Among other matters, our Audit Committee assists the Board in oversight of the integrity of our financial statements, our internal accounting and financial controls, our compliance with legal and regulatory requirements, the organization and performance of our internal audit function, and the independent auditors' qualifications, independence and performance. The Audit Committee reviews the scope of the annual audit; reviews and discusses with management and the independent auditors the results of the annual audit and the review of our quarterly consolidated financial statements including the disclosures in our annual and quarterly reports filed with the SEC; reviews our risk assessment and risk management processes; is responsible for the engagement, retention and compensation of the independent auditors; oversees our internal audit function; oversees compliance with SEC and other legal and regulatory requirements; establishes procedures for receiving, retaining and investigating complaints received by us regarding accounting, internal accounting controls or audit matters;

10

approves audit and permissible non-audit services provided by our independent auditor; and reviews and approves related party transactions under Item 404 of Regulation S-K.

The current members of our Audit Committee are Mr. Meresman, who is the Chair of the committee, Mr. Battle and Ms. Kilgore. All members of our Audit Committee meet the requirements for financial literacy under the applicable rules and regulations of the SEC and the NYSE. Our Board has determined that all of the members of the Audit Committee are audit committee financial experts as defined under the applicable rules of the SEC and have the requisite financial sophistication as defined under the rules and regulations of the NYSE. All of the members of our Audit Committee are independent directors as defined under the applicable rules and regulations of the SEC and the NYSE including the enhanced independence requirements for Audit Committee members.

The Audit Committee Report is included elsewhere in this proxy statement. A copy of the Audit Committee's written charter is available on our website in the Corporate Governance section of our Investor Relations webpage by visiting investors.linkedin.com and clicking Corporate Governance (https://investors.linkedin.com/results-and-financials/corporate-governance/default.aspx).

Compensation Committee

Our Compensation Committee adopts, amends, and administers the compensation policies, plans and benefit programs for our executive officers and all other members of our executive team. In addition, among other things, our Compensation Committee provides oversight of and administers our equity compensation and equity incentive compensation plans and programs; annually evaluates, in consultation with the Board, the performance of our CEO, reviews and approves corporate goals and objectives relevant to the compensation of our CEO and other executives, including compensation plans, policies, programs and arrangements not available to employees, and evaluates the performance of these executives in light of those goals and objectives. Our Compensation Committee is also responsible for making recommendations regarding director compensation to the full Board, taking into account their independence status.

The current members of our Compensation Committee are Ms. Kilgore, who is the Chair of the committee, Mr. Battle and Mr. Meresman. All of the members of our Compensation Committee are independent under the applicable rules and regulations of the SEC and the NYSE, including the enhanced independence requirements for compensation committee members. In addition all members are non-employee directors under Section 16 of the Exchange Act and outside directors under Section 162(m) of the Internal Revenue Code, or the Code.

The Compensation Committee Report is included elsewhere in this proxy statement. A copy of the Compensation Committee's written charter is available on our website in the Corporate Governance section of our Investor Relations webpage by visiting investors.linkedin.com and clicking Corporate Governance (https://investors.linkedin.com/results-and-financials/corporate-governance/default.aspx).

Governance and Nominating Committee

Our Governance and Nominating Committee is responsible for, among other things, reviewing and making recommendations to the full Board regarding corporate governance, the composition of our Board, identification, evaluation and nomination of director candidates, the structure and composition of committees of our Board and stockholder Board nominations and proposals. In addition, our Governance and Nominating Committee oversees our corporate governance guidelines, reviews and makes recommendations regarding our committee charters, oversees compliance with our code of business conduct and ethics, develops and periodically reviews succession planning for executives, reviews actual and potential conflicts of interest of our directors and officers other than

11

related party transactions reviewed by the Audit Committee and oversees the board self-evaluation process.

The current members of our Governance and Nominating Committee are Mr. Battle, who is the Chair of the committee, Ms. Kilgore and Mr. Meresman. All of the members of our Governance and Nominating Committee are independent under the rules and regulations of the NYSE.

A copy of the Governance and Nominating Committee's written charter is available on our website in the Corporate Governance section of our Investor Relations webpage by visiting investors.linkedin.com and clicking Corporate Governance (https://investors.linkedin.com/results-and-financials/corporate-governance/default.aspx).

Stockholder Recommendations

Stockholders can nominate directors for our Board to the Governance and Nominating Committee by submitting a proposal to our Corporate Secretary at 2029 Stierlin Court, Mountain View, California 94043. Written submissions which include the following requirements will be forwarded to the Governance and Nominating Committee for review and consideration:

- •

- the nominee's name, age, business address and residence address;

- •

- the principal occupation or employment of the nominee;

- •

- the class and number of shares of the Company that are held of record or are beneficially owned by the nominee and any derivative

positions held or beneficially held by the nominee;

- •

- whether and the extent to which any hedging or other transaction or series of transactions has been entered into by or on behalf of

the nominee with respect to any securities of the Company, and a description of any other agreement, arrangement or understanding (including any short position or any borrowing or lending of shares),

the effect or intent of which is to mitigate loss to, or to manage the risk or benefit of share price changes for, or to increase or decrease the voting power of the nominee;

- •

- a description of all arrangements or understandings between the stockholder and each nominee and any other person or persons (naming

such person or persons) pursuant to which the nominations are to be made by the stockholder;

- •

- a written statement executed by the nominee acknowledging that as a director of the Company, the nominee will owe a fiduciary duty

under Delaware law with respect to the Company and its stockholders; and

- •

- any other information relating to the nominee that would be required to be disclosed about such nominee if proxies were being solicited for the election of the nominee as a director, or that is otherwise required, in each case pursuant to Regulation 14A under the Exchange Act (including without limitation the nominee's written consent to being named in the proxy statement, if any, as a nominee and to serving as a director if elected.

In addition to these requirements, stockholder nominations must meet the other requirements set forth in our bylaws. For a description of the process for nominating directors in accordance with our bylaws, please see "May I propose actions for consideration at next year's annual meeting of stockholders or nominate individuals to serve as directors?" in the section "Questions and Answers about the Proxy Materials and Our Annual Meeting" at the beginning of this proxy statement.

12

Director Qualifications

The Governance and Nominating Committee works with the Board to determine periodically, as appropriate, the desired Board qualifications, expertise and characteristics, including such factors as business experience and diversity; and with respect to diversity, the Governance and Nominating Committee may consider such factors as differences in professional background, education, skill, and other individual qualities and attributes that contribute to the total mix of viewpoints and experience represented on the Board.

The Governance and Nominating Committee and the Board evaluate each individual in the context of the membership of the Board as a group, with the objective of having a group that can best perpetuate the success of the business and represent stockholder interests through the exercise of sound judgment using its diversity of background and experience in the various areas. Each director should be an individual of high character and integrity. In determining whether to recommend a director for re-election, the Governance and Nominating Committee also considers the director's past attendance at meetings, participation in and contributions to the activities of the Board and the Company and other qualifications and characteristics set forth in the Governance and Nominating Committee Charter.

Each director must ensure that other existing and anticipated future commitments do not materially interfere with the members' service as a director. Any employee director must submit his or her offer of resignation from the Board in writing upon termination of employment with the Company. Upon change of his or her principal employer, any non-employee director must submit his or her offer of resignation from the Board in writing to the Chair of the Governance and Nominating Committee. The Board, through the Governance and Nominating Committee, will determine whether to accept or reject such resignation and will make a recommend to the Board as to whether to accept or reject the offer of resignation, or whether other action should be taken.

Identification and Evaluation of Nominees for Directors

Our Governance and Nominating Committee uses a variety of methods for identifying and evaluating nominees for directors. Our Governance and Nominating Committee regularly assesses the appropriate size and composition of our Board, the needs of the Board and the respective committees of the Board, and the qualifications of candidates in light of these needs. Candidates may come to the attention of the Governance and Nominating Committee through stockholders, management, current members of the Board, or search firms. The evaluation of these candidates may be based solely upon information provided to the committee or may also include discussions with persons familiar with the candidate, an interview of the candidate or other actions the committee deems appropriate, including the use of third parties to review candidates. All candidates, including those recommended by stockholders, are evaluated in light of the criteria above.

Board Self-Evaluation

Our Board performs an annual self-assessment, led by the Chair of our Governance and Nominating Committee, to, among other things, evaluate the effectiveness of the Board and its committees in fulfilling their respective obligations.

Compensation Committee Interlocks and Insider Participation

During fiscal year 2015, Ms. Kilgore and Messrs. Battle and Meresman served on our Compensation Committee. None of the members of our Compensation Committee is or has at any time been one of our officers or was during fiscal year 2015 an employee of the Company. None of our executive officers currently serves or in the past year has served as a member of the Board or

13

Compensation Committee of any entity that has one or more executive officers serving on our Board or Compensation Committee.

Communications with the Board of Directors

Stockholders and other interested parties may communicate with our Board of Directors at the following address:

The

Board of Directors

c/o Corporate Secretary

LinkedIn Corporation

2029 Stierlin Court

Mountain View, CA 94043

Communications are distributed to our Board or to any individual director, as appropriate, depending on the facts and circumstances outlined in the communication. Material that is unduly hostile, threatening, illegal or similarly unsuitable will be excluded, with the provision that any communication that is filtered out must be made available to any non-management director upon request.

Corporate Governance Guidelines and Code of Ethics

We have adopted a Code of Business Conduct and Ethics that applies to all of our employees, including our executive officers and directors, and those employees responsible for financial reporting. We have also adopted Corporate Governance Guidelines, which, in conjunction with our certificate of incorporation, bylaws, charters of the committees of our Board, form the framework for our corporate governance. Both our Code of Business Conduct and Ethics and our Corporate Governance Guidelines are available on our website by visiting investors.linkedin.com and clicking Corporate Governance (https://investors.linkedin.com/results-andfinancials/corporate-governance/default.aspx). To the extent mandated by legal requirements, we intend to disclose on our website any amendments to our Code of Business Conduct and Ethics, or any waivers of its requirements.

Board Leadership and Role in Risk Oversight

We believe that our Board and committee structure provides strong overall management of the Company. While our Board Chair and Chief Executive roles are separate, our current Board Chair, Reid Hoffman, is not independent under NYSE rules given his holdings in and voting control over the Company. The Board determined that it would be beneficial to have a Lead Independent Director to, among other things, preside over executive sessions of the independent directors. The complementary roles of the Board Chair and the Lead Independent Director help to lead the Board effectively.

The Board believes that Mr. Hoffman's service as Board Chair is appropriate and is in the best interests of the Board, the Company and its stockholders. He is a co-founder of the Company and, until 2009, he was an employee. He brings valuable insight given his tenure with us, as well as his knowledge of our industry. Our Lead Independent Director, Skip Battle, is independent under the NYSE rules and has deep technology and financial experience. Mr. Battle also has significant experience on the boards of directors of other public and private companies, specifically technology companies, at various stages of their development. Jeff Weiner, our CEO is also a director, which brings an internal perspective to our Board, and we have two directors that are affiliated with early investors in the Company who are very familiar with our business, culture and values. Our Lead Independent Director and two other independent directors, who all serve on our standing committees, provide perspectives from their own experience and expertise, which ensures that we

14

have a broad range of backgrounds and viewpoints informing our Board and committees' decision-making and strategic thinking.

Our Board as a whole has responsibility for risk oversight, with reviews of certain areas being conducted by the relevant Board committees. These committees then provide reports to the full Board. The oversight responsibility of the Board and its committees is enabled by management reporting processes that are designed to provide visibility to the Board about the identification, assessment, and management of critical risks and management's risk mitigation strategies. These areas of focus include strategic, operational, financial and reporting, succession and compensation, compliance, and other risks. Our Board, including its committees, oversees risks associated with their respective areas of responsibility, as summarized below. Each committee meets in executive session with key management personnel and representatives of outside advisors as necessary.

Board/Committee

|

Primary Areas of Risk Oversight | |

|---|---|---|

Full Board |

Strategic, financial and execution risks and exposures associated with our business strategy, product innovation and sales road map, policy matters, significant litigation and regulatory exposures, and other current matters that may present material risk to our financial performance, operations, infrastructure, plans, prospects or reputation, acquisitions and divestitures. | |

Audit Committee |

Risks and exposures associated with financial matters, particularly financial reporting, tax, accounting, disclosure, internal control over financial reporting, investment guidelines and credit and liquidity matters, our programs and policies relating to legal compliance and strategy, and our operational infrastructure, particularly reliability, business continuity and capacity. |

|

Governance and Nominating Committee |

Risks and exposures associated with director and management succession planning, corporate governance and overall Board effectiveness. |

|

Compensation Committee |

Risks and exposures associated with leadership assessment, executive compensation programs and arrangements, including overall incentive and equity plans. |

Neither Mr. Weiner nor Mr. Hoffman receives compensation for his service on the Board of Directors. In addition, given the value of the investments made by the funds with which Messrs. Moritz and Sze are affiliated as well as the internal policies of certain of those funds, to date, we have not provided them with compensation for their service on the Board. Messrs. Battle and Meresman, and Ms. Kilgore serve on each of the committees of our Board. On May 21, 2015, in connection with their service, our Board approved the grant of equity awards to each of them with a targeted value of $395,000 with 70% of the value in Restricted Stock Units ("RSUs") for shares of our Class A Common Stock, and 30% of the value in stock options for shares of our Class A Common Stock. Our Compensation Committee's valuation methodology provided that the number of RSUs was calculated using an average stock price for the month preceding the 2015 Annual Meeting, and the stock options were valued at a 2:1 ratio of options to RSUs. The grants of RSUs were made on June 3, 2015, the date of our 2015 Annual Meeting of Stockholders. The grants of

15

stock options were made, and the exercise price of such stock options was equal to the closing price of the Company's Class A Common Stock, on August 3, 2015, the first trading day of an open trading window following our 2015 Annual Meeting. Given the value of this equity compensation, none of Messrs. Battle or Meresman or Ms. Kilgore receives cash compensation for their service on the Board of Directors. We reimburse our non-employee directors for reasonable expenses in connection with attendance at Board of Director and committee meetings.

Director Equity Awards

The following table sets forth information regarding the equity compensation granted to our non-employee directors during the fiscal year 2015.

Name

|

RSU Awards ($)(1) |

Option Awards ($)(1) |

Total Director Compensation ($) |

RSU Awards (#)(2) |

Option Awards (#)(3) |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

A. George "Skip" Battle(4) |

297,697 | 88,513 | 386,210 | 1,396 | 1,197 | |||||||||||

Reid Hoffman(4) |

— | — | — | — | — | |||||||||||

Leslie Kilgore(4) |

297,697 | 88,513 | 386,210 | 1,396 | 1,197 | |||||||||||

Stanley Meresman(4) |

297,697 | 88,513 | 386,210 | 1,396 | 1,197 | |||||||||||

Michael Moritz(4) |

— | — | — | — | — | |||||||||||

David Sze(4) |

— | — | — | — | — | |||||||||||

- (1)

- The

amounts included in the "RSU Awards" and "Option Awards" columns represent the aggregate grant date fair value of RSU awards and Option awards

calculated in accordance with authoritative accounting guidance on stock-based compensation. The valuation assumptions used in determining such amounts are described in the Notes to our Consolidated

Financial Statements included in our Annual Report on Form 10-K filed on February 12, 2016. Pursuant to our Compensation Committee's valuation methodology, at the time the grants were

approved, the targeted value of the grants was $395,000.

- (2)

- RSU

awards shown in the table above vest at a rate of 25% per quarter on August 15, 2015, November 15, 2015, February 15, 2016 and

May 15, 2016.

- (3)

- The

stock option awards in the table above vest at a rate of 8.33% each month beginning on June 3, 2015 through the earlier of, June 2, 2016,

or the 2016 Annual Meeting of Stockholders.

- (4)

- At the end of fiscal year 2015, Mr. Battle held a total of 698 outstanding RSUs and a total of 4,075 outstanding options; Ms. Kilgore held a total of 698 outstanding RSUs and a total of 5,190 outstanding options; and Mr. Meresman held a total of 698 outstanding RSUs and a total of 5,190 outstanding options. Mr. Hoffman held no RSUs or options for his own account at the end of fiscal year 2015, but is Trustee of the Weiner 2012 Irrevocable Trust, which does have an interest in one of Mr. Weiner's options for Class B Common Stock—see footnote 1 to the table "Security Ownership of Certain Beneficial Owners and Management" below. Messrs. Moritz and Sze held no outstanding RSUs or options at the end of fiscal year 2015.

16

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of our Common Stock as of March 31, 2016 as to (i) each person who is known by us to beneficially own more than 5% of our outstanding Common Stock, (ii) each of the named executive officers and other persons named in the Summary Compensation Table, (iii) each director and nominee for director, and (iv) all directors and executive officers as a group. Unless otherwise indicated, the address of each listed stockholder is c/o LinkedIn Corporation, 2029 Stierlin Court, Mountain View, California 94043.

Applicable percentage ownership is based on 117,984,448 shares of Class A Common Stock and 15,560,088 shares of Class B Common Stock outstanding at March 31, 2016. In computing the number of shares of stock beneficially owned by a person and the percentage ownership of that person, we deemed outstanding shares subject to options held by that person that are currently exercisable or exercisable within 60 days of March 31, 2016, and shares issuable upon the vesting of restricted stock units within 60 days of March 31, 2016. However, we did not deem these shares to be outstanding for the purpose of computing the percentage ownership of any other person.

| |

Class A Common Stock |

Class B Common Stock† |

|

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

% of Total Voting Power# |

|||||||||||||||

Name of Beneficial Owner

|

Shares | % | Shares | % | ||||||||||||

5% Stockholders: |

||||||||||||||||

Reid Hoffman and Michelle Yee, Trustees of the Reid Hoffman and Michelle Yee Living Trust dated October 27, 2009(1) |

— | — | 14,678,356 | 93.2 | 53.3 | |||||||||||

T. Rowe Price Associates, Inc.(2) |

9,410,966 | 8.0 | — | — | 3.4 | |||||||||||

Prudential Financial, Inc.(3) |

6,847,019 | 5.8 | — | — | 2.5 | |||||||||||

Sands Capital Management Inc.(4) |

6,604,158 | 5.6 | — | — | 2.4 | |||||||||||

Jennison Associates LLC(5) |

6,561,011 | 5.6 | — | — | 2.4 | |||||||||||

Capital World Investors(6) |

4,513,883 | 3.8 | — | — | 1.7 | |||||||||||

Named Executive Officers and Directors: |

||||||||||||||||

Jeffrey Weiner(7) |

408,199 | * | 668,577 | 4.1 | 2.5 | |||||||||||

Steven Sordello(8) |

96,204 | * | 129,095 | * | * | |||||||||||

Michael Callahan(9) |

24,218 | * | — | * | * | |||||||||||

Michael Gamson(10) |

34,610 | * | 109,663 | * | * | |||||||||||

J. Kevin Scott(11) |

38,428 | * | — | * | * | |||||||||||

A. George "Skip" Battle(12) |

16,932 | * | 5,554 | * | * | |||||||||||

Reid Hoffman(13) |

— | — | 14,678,356 | 93.2 | 53.3 | |||||||||||

Leslie Kilgore(14) |

9,116 | * | 37,500 | * | * | |||||||||||

Stanley Meresman(15) |

6,912 | * | 3,032 | * | * | |||||||||||

Michael Moritz(16) |

671,620 | * | — | * | * | |||||||||||

David Sze(17) |

30,908 | * | — | * | * | |||||||||||

All executive officers and directors as a group (12 persons)(18) |

1,350,407 | 1.1 | 15,631,777 | 95.2 | 55.9 | |||||||||||

- †

- Options to purchase Class B Common Stock included in this table may be early exercisable, and to the

extent such shares of Class B Common Stock are unvested as of a given date, such Class B Common Stock will remain subject to a right of repurchase held by us. The Class B Common

Stock is convertible at any time by the holder into shares of Class A Common Stock on a share-for-share basis, such that each holder of Class B Common Stock beneficially owns an

equivalent number of Class A Common Stock.

- #

- Percentage total voting power represents voting power with respect to all shares of our Class A and

Class B Common Stock, as a single class. Each holder of Class B Common Stock shall be entitled to ten votes per share of Class B Common Stock and each holder of Class A

Common Stock shall be entitled to one vote per share of Class A Common Stock on all matters submitted to our stockholders for a vote. The Class A Common Stock and Class B Common

Stock vote together as a single class on all matters submitted to a vote of our stockholders, except as may otherwise be required by law.

- *

- Represents beneficial ownership of less than 1%.

17

- (1)

- Mr. Hoffman's ownership consists of 14,489,899 shares of Class B Common Stock owned by the Reid Hoffman

and Michelle Yee Living Trust dated October 27, 2009 ("Hoffman Trust"). Reid Hoffman retains sole voting and dispositive power over these shares. His ownership also includes 188,457 shares of

Class B Common Stock issuable pursuant to fully-vested stock options exercisable within 60 days of March 31, 2016 that are held by the Weiner 2012 Irrevocable Trust, of which

Mr. Hoffman is the Trustee. In August 2014, options exercisable for shares of Class B Common Stock were transferred from the beneficial ownership of Jeffrey Weiner, our CEO, to the

Weiner 2012 Irrevocable Trust. Mr. Weiner has no pecuniary, dispositive or voting control of the options or underlying shares. Mr. Hoffman has sole voting and dispositive power over the

shares held in the Weiner 2012 Irrevocable Trust, but he has no pecuniary interest therein and disclaims beneficial ownership of these shares. The address for Mr. Hoffman is 2029 Stierlin

Court, Mountain View, CA 94043.

- (2)

- According to a Schedule 13(G)/A filed February 11, 2016, the 9,410,966 Class A Common Stock

shares reported by T. Rowe Price Associates, Inc. ("TRP") are owned, or may be deemed to be beneficially owned, by TRP, an investment adviser, which holds sole voting power of 3,355,904

Class A Common Stock shares and sole dispositive power of 9,410,966 Class A Common Stock shares. The address for TRP is 100 E. Pratt Street, Baltimore, MD 21202.

- (3)

- According to a Schedule 13(G)/A filed January 28, 2016, the 6,847,019 Class A Common Stock shares

reported by Prudential Financial, Inc. ("Prudential") are owned, or may be deemed to be beneficially owned, by Prudential, the parent holding company, which holds sole voting and dispositive

power of 538,613 Class A Common Stock shares, share voting power of 3,638,040 Class A Common Stock shares, and shared dispositive power of 6,308,406 Class A Common Stock shares.

The 6,847,019 Class A Common Stock shares reported are owned, directly or indirectly, by Prudential or its investment advisors, The Prudential Insurance Company of America, Prudential

Retirement Insurance and Annuity Company, Jennison Associates LLC, PGIM, Inc., or Quantitative Management Associates LLC. The address for these entities is 751 Broad Street,

Newark, NJ 07102-3777.

- (4)

- According to a Schedule 13(G) filed February 16, 2016, the 6,604,158 Class A Common Stock shares

reported by Sands Capital Management, LLC ("Sands") are owned, or may be deemed to be beneficially owned, by Sands, an investment adviser, which holds sole voting power of 4,736,497

Class A Common Stock shares and sole dispositive power of 6,604,158 Class A Common Stock shares. The address for Sands is 1101 Wilson Blvd., Suite 2300, Arlington, VA 22209.

- (5)

- According to a Schedule 13(G)/A filed February 4, 2016, the 6,561,011 Class A Common Stock shares

reported by Jennison Associates LLC ("Jennison"), are held as a result of Jennison's role as an investment adviser of several managed portfolios. Jennison may be deemed to be the beneficial

owner of the Class A Common Stock. Jennison has sole voting power of 3,890,645 Class A Common Stock shares and shared dispositive power of 6,561,011 Class A Common Stock shares.

The address for Jennison is 466 Lexington Avenue, New York, NY 10017

- (6)

- According to a Schedule 13(G) filed February 12, 2016, the 4,513,883 Class A Common Stock shares

reported by Capital World Investors ("Capital") are owned, or may be deemed to be beneficially owned, by Capital, an investment adviser, which holds sole voting power and dispositive power of

4,513,883 Class A Common Stock shares. The address for Capital is 333 South Hope Street, Los Angeles, CA 90071.

- (7)

- Mr. Weiner's ownership consists of (i) 105,924 shares of Class A Common Stock held of record by

the Weiner/Derouaux Revocable Trust, dated November 20, 2012 for which Mr. Weiner serves as the trustee ("Weiner/Derouaux Trust"); (ii) 13,029 shares of Class A Common

Stock issuable pursuant to restricted stock units that will vest within 60 days of March 31, 2016; (iii) 289,246 shares of Class A Common Stock issuable pursuant to stock

options exercisable within 60 days of March 31, 2016; and (iv) 668,577 shares of Class B Common Stock issuable pursuant to stock options exercisable within 60 days

of March 31, 2016. His ownership does not include 188,487, shares of Class B Common Stock issuable pursuant to fully-vested stock options exercisable within 60 days of

March 31, 2016 that are held by the Weiner 2012 Irrevocable Trust, of which Reid Hoffman, our Board Chair, is the trustee. In August 2014, options exercisable for shares of Class B

Common Stock were transferred from the beneficial ownership of Mr. Weiner to the Weiner 2012 Irrevocable Trust. Mr. Weiner has no pecuniary, dispositive or voting control of the options

or underlying shares. Mr. Hoffman has sole voting and dispositive power over the shares held in the Weiner 2012 Irrevocable Trust, but he has no pecuniary interest therein.

- (8)

- Mr. Sordello's ownership consists of (i) 40,710 shares of Class A Common Stock held of record by

Steven Sordello & Susan Sordello Trust dated September 19, 2003 for which Mr. Sordello serves as the trustee ("Sordello Trust"); (ii) 6,081 shares of Class A Common

Stock issuable pursuant to restricted stock units that will vest within 60 days March 31, 2016; (iii) 49,413 shares of Class A Common Stock issuable pursuant to stock

options exercisable within 60 days of March 31, 2016; and (iv) 129,095 shares of Class B Common Stock, held of record by the Sordello Trust.

- (9)

- Mr.Callahan's ownership consists of (i) 5,563 shares of Class A Common Stock; and (ii) 4,333

shares of Class A Common Stock issuable pursuant to restricted stock units that will vest within 60 days of March 31, 2016; and (iii) 14,322 shares of Class A Common

Stock issuable pursuant to stock options exercisable within 60 days of March 31, 2016.

- (10)

- Mr. Gamson's ownership consists of (i) 5,501 shares of Class A Common Stock; (ii) 5,553

shares of Class A Common Stock issuable pursuant to restricted stock units that will vest within 60 days of March 31, 2016; (iii) 23,556 shares of Class A Common

Stock issuable pursuant to stock options exercisable within 60 days of March 31, 2016; (iv) 106,668 shares of Class B Common Stock; and (v) 2,995 shares of

Class B Common Stock issuable pursuant to stock options exercisable within 60 days of March 31, 2016.

- (11)

- As required under applicable SEC disclosure rules, Mr. Scott is included in this table as a Named Executive Officer for 2015 on the basis of his 2015 compensation, but was not an executive officer through the end of 2015. While Mr. Scott is no longer considered an executive officer as of December 3, 2015, he remains employed by LinkedIn and is still a member of our executive team. Mr. Scott's ownership consists of (i) 4,709 shares of Class A Common Stock; and (ii) 9,329 shares of Class A Common Stock issuable pursuant to restricted stock units that will vest within 60 days of March 31, 2016; and (iii) 24,390 shares of Class A Common Stock issuable pursuant to stock options exercisable within 60 days of March 31, 2016.

18

- (12)

- Mr. Battle's ownership consists of (i) 12,608 shares of Class A Common Stock; (ii) 349

shares of Class A Common Stock issuable pursuant to restricted stock units that will vest within 60 days of March 31, 2016; (iii) 3,975 shares of Class A Common

Stock issuable pursuant to stock options exercisable within 60 days of March 31, 2016; and (v) 5,554 shares of Class B Common Stock.

- (13)

- Mr. Hoffman's ownership is through the Hoffman Trust, described above.

- (14)

- Ms. Kilgore's ownerships consists of (i) 3,677 shares of Class A Common Stock; (ii) 349

shares of Class A Common Stock issuable pursuant to restricted stock units that will vest within 60 days of March 31, 2016; (iii) 5,090 shares of Class A Common

Stock issuable pursuant to stock options exercisable within 60 days of March 31, 2016; and (iv) 37,500 shares of Class B Common Stock.

- (15)

- Mr. Meresman's ownership consists of (i) 1,473 shares of Class A Common Stock held of record by

Stanley J. Meresman and Sharon A. Meresman, Trustees of the Meresman Family Trust UDT dated September 13, 1989 ("Meresman Trust"); (ii) 349 shares of Class A Common Stock issuable

pursuant to restricted stock units that will vest within 60 days of March 31, 2016; (iii) 5,090 shares of Class A Common Stock issuable pursuant to stock options

exercisable within 60 days of March 31, 2016; and (iv) 3,032 shares of Class B Common Stock held of record by the Meresman Trust.

- (16)

- Mr. Moritz' ownership consists of 671,620 shares of Class A Common Stock held of record by The Maximus

Trust dated March 19, 1996 for which Mr. Moritz serves as a trustee.

- (17)

- Mr. Sze's ownership consists of 30,908 shares of Class A Common Stock.

- (18)

- Consists of (i) 882,693 shares of Class A Common Stock beneficially owned by the current directors and executive officers; (ii) 423,296 shares of Class A Common Stock issuable pursuant to stock options exercisable within 60 days of March 31, 2016; (iii) 44,418 shares of Class A Common Stock issuable pursuant to restricted stock units that will vest within 60 days of March 31, 2016; (iv) 14,771,748 shares of Class B Common Stock; and (v) 860,029 shares of Class B Common Stock issuable pursuant to stock options exercisable within 60 days of March 31, 2016.

19

PROPOSAL ONE: ELECTION OF DIRECTORS

Our Board of Directors consists of seven members. In accordance with our certificate of incorporation, our Board is divided into three classes with staggered three-year terms. At the 2016 Annual Meeting, two Class II directors will each be elected for three-year terms.