Buy Any Seasonal Market Weakness Ahead of Year End Rally - Oppenheimer (SPY)

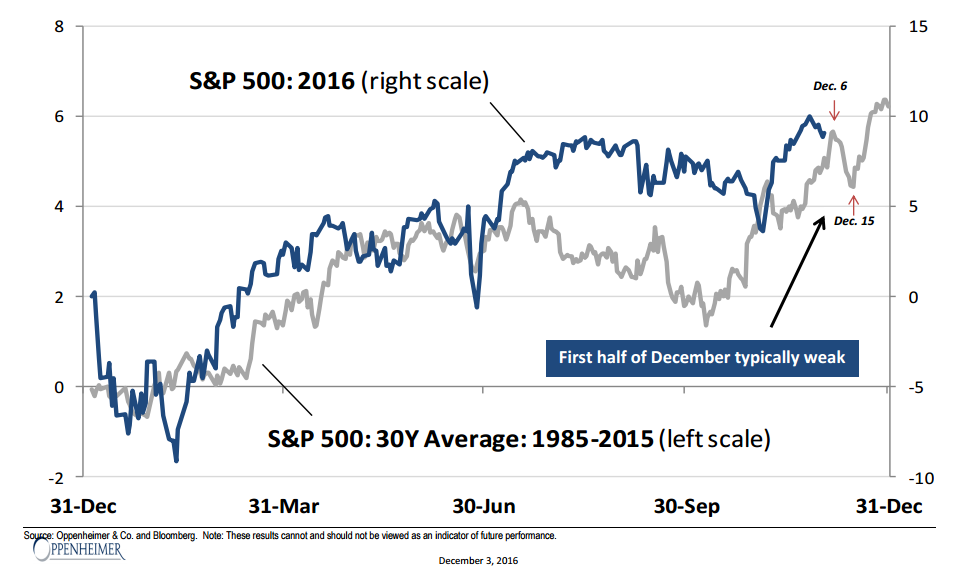

Technical analyst Ari Wald at Oppenheimer would use any weakness in the S&P 500 over the coming weeks to add to positions. Wald notes from a trading basis, seasonal weakness in the first half of December is usually met with buying demand ahead of a year-end rally.

"Since 1985, average S&P 500 performance has declined between Dec. 6th and Dec. 15th before reversing higher and reaching new highs into year-end," Wald commented. "In addition, it’s important to highlight the differences in our indicators between now vs. one-year ago ahead of the Q1’16 correction: 1) internal breadth is broader now; 2) leadership is cyclical now; 3) credit spreads are narrowing now; 4) commodity prices have stabilized now; 5) interest rates are moving in the right direction now; and 6) the overall trend is stronger now too. In accordance with the typical seasonal trajectory, we therefore recommend buying early-December weakness rather than selling late-December strength."

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Global S&P Futures mixed in premarket

- Futures falter as Meta Platforms weighs on megacaps

- Durable Goods (Mar P) 2.6% vs 2.5% Expected, Ex-Trans 0.2% vs 0.2%

Create E-mail Alert Related Categories

Analyst Comments, TechnicalsRelated Entities

Standard & Poor'sSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share