Form SC TO-I GOLDMAN SACHS GROUP INC Filed by: GOLDMAN SACHS GROUP INC

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) OR 13(e)(1) OF

THE SECURITIES EXCHANGE ACT OF 1934

THE GOLDMAN SACHS GROUP, INC.

GOLDMAN SACHS CAPITAL II

GOLDMAN SACHS CAPITAL III

(Name of Subject Company (Issuer) )

THE GOLDMAN SACHS GROUP, INC.

(Name of Filing Persons (Offeror)

5.793% Fixed-to-Floating Rate Normal Automatic Preferred Enhanced Capital Securities

Floating Rate Normal Automatic Preferred Enhanced Capital Securities

(Title of Class of Securities)

381427AA1

38144QAA7

(CUSIP Number of Class of Securities)

Kenneth L. Josselyn

200 West Street

New York, New York 10282

Telephone: (212) 902-1000

(Name, address and telephone number of person authorized to receive notices and communications on behalf of filing person)

Copies to:

Alan J. Sinsheimer

Sullivan & Cromwell LLP

125 Broad Street

New York, New York 10004

(212) 558-4000

CALCULATION OF FILING FEE

| Transaction Valuation(1) | Amount of Filing Fee(2) | |

| $545,133,334 | $54,894.93 | |

|

| ||

| (1) | Calculated solely for purposes of determining the amount of the filing fee. |

| (2) | The amount of the filing fee, calculated in accordance with Rule 0-11 under the Securities Exchange Act of 1934, as amended, and Fee Rate Advisory No. 1 for fiscal year 2016 equals $100.70 per million dollars of the transaction. |

| ¨ | Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| Amount Previously Paid: Not applicable | Filing Party: Not applicable | |

| Form or Registration No: Not applicable | Date Filed: Not applicable |

| ¨ | Check the box if filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to which the statement relates:

| ¨ | third-party tender offer subject to Rule 14d-1. |

| x | issuer tender offer subject to Rule 13e-4. |

| ¨ | going-private transaction subject to Rule 13e-3. |

| ¨ | amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment reporting the results of the tender offer: ¨

This Tender Offer Statement on Schedule TO (this “Schedule TO”) is filed by The Goldman Sachs Group, Inc., a Delaware corporation (the “Company”), and relates to the offer by the Company to purchase, upon the terms and subject to the conditions set forth in the Offer to Purchase, dated July 20, 2016 (as it may be amended or supplemented from time to time, the “Offer to Purchase”) and in the related Letter of Transmittal (as it may be amended or supplemented from time to time, the “Letter of Transmittal,” and together with the Offer to Purchase, the “Offer”), up to $650,000,000 aggregate liquidation amount of Normal Automatic Preferred Enhanced Capital Securities (which is referred to in the singular and plural as “Apex”), $1,000 liquidation amount per security, comprising the 5.793% Fixed-to-Floating Rate Apex (CUSIP No. 381427AA1) of Goldman Sachs Capital II, a Delaware statutory trust (“GS Capital II”), and the Floating Rate Apex (CUSIP No. 38144QAA7) of Goldman Sachs Capital III, a Delaware statutory trust (“GS Capital III” and, together, with GS Capital II, the “Issuers”), at a price of $830 per Apex (the “Offer Price”). The Offer Price will be paid together with Accrued Distributions to, but excluding, the date on which the Company will pay for Apex accepted in the Offer (the “Settlement Date”). “Accrued Distributions” for any Apex means distributions that would be payable thereon if the current dividend period of the underlying preferred shares ended on the Settlement Date and the Company had paid the relevant dividend on the Settlement Date. If the Offer is not extended or earlier terminated, the Company expects the Settlement Date to be August 18, 2016.

The Company is the sponsor of GS Capital II and GS Capital III. The sole asset of GS Capital II consists of shares of perpetual Non-Cumulative Preferred Stock, Series E, of the Company (the “Series E Preferred Stock”) and the sole asset of GS Capital III consists of shares of perpetual Non-Cumulative Preferred Stock, Series F, of the Company (the “Series F Preferred Stock” and, together with the Series E Preferred Stock, the “Preferred Stock”). The Series E Preferred Stock and the Series F Preferred Stock rank equally as to payment of dividends and upon liquidation, have the same liquidation amount per share, have the same quarterly dividend payment dates and are subject to redemption at any time at an amount equal to their liquidation amount plus declared and unpaid dividends. Dividends accrue on the Series E Preferred Stock at a rate per annum equal to the greater of (i) three-month LIBOR plus 0.7675% and (ii) 4.000%, and dividends accrue on the Series F Preferred Stock at a rate per annum equal to the greater of (i) three-month LIBOR plus 0.77% and (ii) 4.000%. Holders of GS Capital II Apex and GS Capital III Apex are entitled to pro rata distributions of all dividends, redemption price or liquidation payments paid on or made with respect to the Preferred Stock held by the applicable Issuer, and the Company has irrevocably and unconditionally guaranteed the payment of such amounts to holders on a junior subordinated basis to the extent the applicable Issuer has funds on hand available therefor. The Company considers the GS Capital II Apex and GS Capital III Apex to consist of a single class of securities for purposes of Rule 13e-4 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Copies of the Offer to Purchase and Letter of Transmittal are filed with this Schedule TO as Exhibits (a)(1)(A) and (a)(1)(B), respectively. The Offer will expire at 11:59 p.m., New York City time, on August 16, 2016, unless the Offer is extended or earlier terminated by the Company. This Schedule TO is intended to satisfy the reporting requirements of Rule 13e-4(c)(2) promulgated under the Exchange Act. The information contained in the Offer to Purchase and the related Letter of Transmittal is hereby incorporated by reference in response to certain items of this Schedule TO.

| ITEM 1. | Summary Term Sheet. |

The information set forth in the Offer to Purchase under the heading “Summary Term Sheet” is incorporated herein by reference.

| ITEM 2. | Subject Company Information. |

(a) Name and Address. The name of the subject company, and the address and telephone number of its principal executive offices are as follows:

Goldman Sachs Capital II

c/o The Bank of New York Mellon

101 Barclay Street, Floor 4E

New York, New York 10286

Attn: Global Finance Unit

Telephone: (212) 815-2274

-1-

Goldman Sachs Capital III

c/o The Bank of New York Mellon

101 Barclay Street, Floor 4E

New York, New York 10286

Attn: Global Finance Unit

Telephone: (212) 815-2274

(b) Securities. This Schedule TO relates to the 5.793% Fixed-to-Floating Rate Normal Automatic Preferred Enhanced Capital Securities of Goldman Sachs Capital II and the Floating Rate Normal Automatic Preferred Enhanced Capital Securities of Goldman Sachs Capital III. As of July 19, 2016, the aggregate outstanding liquidation amount of GS Capital II Apex is $1,252,839,000 and the aggregate outstanding liquidation amount of GS Capital III Apex is $325,390,000. The information set forth on the cover page of the Offer to Purchase is incorporated herein by reference.

(c) Trading Market and Price. The information set forth in Section 7 of the Offer to Purchase, “Historical Price Range of the Apex,” is incorporated herein by reference.

| ITEM 3. | Identity and Background of Filing Person. |

(a) The information set forth in Section 9 of the Offer to Purchase, “Certain Information Concerning Goldman Sachs and the Issuers,” is incorporated herein by reference. The Company is the filing person of this Schedule TO. It is the sponsor of the Issuers and through ownership of all of the trust common securities issued by each Issuer, the Company has effective control over the Issuers. Pursuant to General Instruction C to Schedule TO, the following persons are the directors and/or executive officers of the Company:

| Name |

Position | |

| Lloyd C. Blankfein | Chairman, Chief Executive Officer and Director | |

| M. Michele Burns | Director | |

| Gary D. Cohn | President, Chief Operating Officer and Director | |

| Mark Flaherty | Director | |

| William W. George | Director | |

| James A. Johnson | Director | |

| Lakshmi N. Mittal | Director | |

| Adebayo O. Ogunlesi | Lead Director | |

| Peter Oppenheimer | Director | |

| Debora L. Spar | Director | |

| Mark E. Tucker | Director | |

| David A. Viniar | Director | |

| Mark O. Winkelman | Director | |

| Michael Sherwood | Vice Chairman | |

| Mark Schwartz | Vice Chairman and Chairman of Goldman Sachs Asia Pacific | |

| Harvey M. Schwartz | Executive Vice President and Chief Financial Officer | |

| Gregory K. Palm | Executive Vice President, General Counsel and Secretary of the Company | |

| Alan M. Cohen | Executive Vice President and Head of Global Compliance | |

| John F. W. Rogers | Executive Vice President, Chief of Staff and Secretary of the Board of Directors | |

| Edith W. Cooper | Executive Vice President and Global Head of Human Capital Management | |

The business address and telephone number for all of the above directors and executive officers is: c/o 200 West Street, New York, New York 10282, telephone: (212) 902-1000.

There is neither any person controlling the Company nor any executive officer or director of any corporation or other person ultimately in control of the Company.

| ITEM 4. | Terms of the Transaction. |

(a) Material Terms.

(a)(1)(i) The information set forth in the Offer to Purchase under the heading “Summary Term Sheet” and in Section 1, “Number of Apex; Expiration Time,” is incorporated herein by reference.

(a)(1)(ii) The information set forth in the Offer to Purchase under the heading “Summary Term Sheet,” in Section 1, “Number of Apex; Expiration Time,” and in Section 8, “Source and Amount of Funds,” is incorporated herein by reference.

(a)(1)(iii) The information set forth in the Offer to Purchase under the heading “Summary Term Sheet,” in Section 1, “Number of Apex; Expiration Time,” and in Section 15, “Extension of the Offer; Termination; Amendment,” is incorporated herein by reference.

(a)(1)(iv) Not applicable.

(a)(1)(v) The information set forth in the Offer to Purchase under the heading “Summary Term Sheet,” in Section 1, “Number of Apex; Expiration Time,” and in Section 15, “Extension of the Offer; Termination; Amendment,” is incorporated herein by reference.

(a)(1)(vi) The information set forth in the Offer to Purchase under the heading “Summary Term Sheet” and in Section 4, “Withdrawal Rights,” is incorporated herein by reference.

(a)(1)(vii) The information set forth in the Offer to Purchase under the heading “Summary Term Sheet,” in Section 3, “Procedures for Tendering the Apex,” and in Section 4, “Withdrawal Rights,” is incorporated herein by reference.

(a)(1)(viii) The information set forth in the Offer to Purchase under the heading “Summary Term Sheet,” in Section 3, “Procedures for Tendering the Apex,” and in Section 5, “Purchase of Apex and Payment of Offer Price,” is incorporated herein by reference.

(a)(1)(ix) The information set forth in the Offer to Purchase under the heading “Summary Term Sheet,” and in Section 1, “Number of Apex; Expiration Time,” is incorporated herein by reference.

(a)(1)(x) Not applicable.

(a)(1)(xi) The information set forth in the Offer to Purchase in Section 14, “Accounting Treatment,” is incorporated herein by reference.

(a)(1)(xii) The information set forth in the Offer to Purchase under the heading “Summary Term Sheet,” in Section 3, “Procedures for Tendering the Apex,” and Section 13, “Certain Material U.S. Federal Income Tax Consequences,” is incorporated herein by reference.

(a)(2)(i–vii) Not applicable.

(b) Purchases. The information set forth in the Offer to Purchase in Section 10, “Interests of Directors and Executive Officers; Transactions and Arrangements Concerning the Apex” is incorporated herein by reference. To the best of the Company’s knowledge, there are no arrangements to purchase the Issuers’ securities from any officer, director or affiliate of the Issuers.1

| 1 | NTD: GS to confirm. |

| ITEM 5. | Past Contacts, Transactions, Negotiations and Agreements. |

(e) Agreements Involving the Subject Company’s Securities. The information set forth in the Offer to Purchase in Section 10, “Interests of Directors and Executive Officers; Transactions and Arrangements Concerning the Apex,” is incorporated herein by reference.

| ITEM 6. | Purposes of the Transaction and Plans or Proposals. |

(a) Purposes. The information set forth in the Offer to Purchase under the heading “Summary Term Sheet,” and in Section 2, “Purpose of the Offer,” is incorporated herein by reference.

(b) Use of Securities Acquired. The information set forth in the Offer to Purchase under the heading “Summary Term Sheet,” in Section 2, “Purpose of the Offer,” and in Section 11, “Post-offer Exchange; Effects of the Offer on the Market for the Apex,” is incorporated herein by reference.

(c) Plans. The information set forth in the Offer to Purchase under the heading “Summary Term Sheet,” in Section 2, “Purpose of the Offer,” and Section 11, “Post-offer Exchange; Effects of the Offer on the Market for the Apex,” is incorporated herein by reference. Except for the Offer and the post-Offer exchange, the Company does not have, and to the best of its knowledge is not aware of any plans, proposals or negotiations that relate to or would result in any of the events listed in Regulation M-A Item 1006(c)(2) through (10).

| ITEM 7. | Source and Amount of Funds or Other Consideration. |

(a) Source of Funds. The information set forth in the Offer to Purchase under the heading “Summary Term Sheet,” and in Section 8, “Source and Amount of Funds,” is incorporated herein by reference. If the Offer is fully subscribed and the Settlement Date occurs on August 18, 2016, the Company will pay approximately $545 million, excluding fees and expenses, to purchase Apex.

(b) Conditions. The information set forth in Section 6 of the Offer to Purchase, “Conditions of the Offer,” is incorporated herein by reference. The Offer is subject to a financing condition. The successful sale of at least $650,000,000 in aggregate liquidation amount of non-cumulative preferred stock by the Company would satisfy the financing condition. If the primary financing plans fall through, the Company does not have any alternative financing arrangements or alternative financing plans.

(d) Borrowed Funds. None.

| ITEM 8. | Interest in Securities of the Subject Company. |

(a) Securities Ownership. The information set forth in Section 10 of the Offer to Purchase, “Interests of Directors and Executive Officers; Transactions and Arrangements Concerning the Apex,” is incorporated herein by reference. Except as described in Section 10 of the Offer to Purchase, “Interests of Directors and Executive Officers; Transactions and Arrangements Concerning the Apex,” and in the documents incorporated by reference in Section 9 of the Offer to Purchase, “Certain Information Concerning Goldman Sachs and the Issuers,” to the best of the Company’s knowledge, neither the Company’s directors or executive officers nor any associate or majority-owned subsidiary of such persons beneficially own any subject Apex.

(b) Securities Transactions. The information set forth in Section 10 of the Offer to Purchase, “Interests of Directors and Executive Officers; Transactions and Arrangements Concerning the Apex,” is incorporated herein by reference.

| ITEM 9. | Persons/Assets, Retained, Employed, Compensated or Used. |

(a) Solicitations or Recommendations. The information set forth in Section 16 of the Offer to Purchase, “Dealer Manager; Depositary; Information Agent,” is incorporated herein by reference.

| ITEM 10. | Financial Statements. |

Not applicable.

| ITEM 11. | Additional Information. |

(a) Agreements, Regulatory Requirements and Legal Proceedings. The information set forth in Section 12 of the Offer to Purchase, “Legal Matters; Regulatory Approvals,” is incorporated herein by reference.

(c) Other Material Information. None.

| ITEM 12. | Exhibits. |

See Exhibits Index.

| ITEM 13. | Information Required by Schedule 13E-3. |

Not applicable.

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| THE GOLDMAN SACHS GROUP, INC. | ||

| By: | /s/ Harvey M. Schwartz | |

| Name: | Harvey M. Schwartz | |

| Title: | Executive Vice President and Chief Financial Officer | |

Date: July 20, 2016

-6-

EXHIBIT INDEX

| (a)(1)(A) | Offer to Purchase, dated July 20, 2016. | |

| (a)(1)(B) | Letter of Transmittal. | |

| (a)(2) | None. | |

| (a)(3) | Not applicable. | |

| (a)(4) | Not applicable. | |

| (a)(5) | Press Release, dated July 20, 2016. | |

| (b) | None. | |

| (d)(1) | Registration Rights Instrument, dated as of December 10, 1999 (incorporated by reference to Exhibit G to Amendment No. 1 to the Company’s Initial Schedule 13D, filed December 17, 1999). | |

| (d)(2) | Form of Counterpart to Shareholders’ Agreement for former profit participating limited partners of The Goldman Sachs Group, L.P. (incorporated by reference to Exhibit I to Amendment No. 2 to the Company’s Initial Schedule 13D, filed June 21, 2000). | |

| (d)(3) | Form of Counterpart to Shareholders’ Agreement for non-U.S. corporations (incorporated by reference to Exhibit L to Amendment No. 3 to the Company’s Initial Schedule 13D, filed June 30, 2000). | |

| (d)(4) | Form of Counterpart to Shareholders’ Agreement for non-U.S. trusts (incorporated by reference to Exhibit M to Amendment No. 3 to the Company’s Initial Schedule 13D, filed June 30, 2000). | |

| (d)(5) | Supplemental Registration Rights Instrument, dated as of June 19, 2000 (incorporated by reference to Exhibit R to Amendment No. 5 to the Company’s Initial Schedule 13D, filed August 2, 2000). | |

| (d)(6) | Form of Written Consent Relating to Sale and Purchase of Common Stock (incorporated by reference to Exhibit FF to Amendment No. 35 to the Company’s Initial Schedule 13D, filed January 8, 2003). | |

| (d)(7) | Amended and Restated Shareholders’ Agreement, effective as of January 15, 2015 (incorporated by reference to Exhibit 10.6 to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014). | |

| (d)(8) | Indenture, dated as of May 19, 1999, between The Goldman Sachs Group, Inc. and The Bank of New York, as trustee (incorporated by reference to Exhibit 6 to the Company’s Registration Statement on Form 8-A, filed June 29, 1999). | |

| (d)(9) | Subordinated Debt Indenture, dated as of February 20, 2004, between The Goldman Sachs Group, Inc. and The Bank of New York, as trustee (incorporated by reference to Exhibit 4.2 to the Company’s Annual Report on Form 10-K for the fiscal year ended November 28, 2003). | |

| (d)(10) | Warrant Indenture, dated as of February 14, 2006, between The Goldman Sachs Group, Inc. and The Bank of New York, as trustee (incorporated by reference to Exhibit 4.34 to the Company’s Post-Effective Amendment No. 3 to Form S-3, filed on March 1, 2006). | |

| (d)(11) | Senior Debt Indenture, dated as of December 4, 2007, among GS Finance Corp., as issuer, The Goldman Sachs Group, Inc., as guarantor, and The Bank of New York, as trustee (incorporated by reference to Exhibit 4.69 to the Company’s Post-Effective Amendment No. 10 to Form S-3, filed on December 4, 2007). | |

| (d)(12) | Senior Debt Indenture, dated as of July 16, 2008, between The Goldman Sachs Group, Inc. and The Bank of New York Mellon, as trustee (incorporated by reference to Exhibit 4.82 to the Company’s Post-Effective Amendment No. 11 to Form S-3, filed July 17, 2008). | |

| (d)(13) | Senior Debt Indenture, dated as of October 10, 2008, among GS Finance Corp., as issuer, The Goldman Sachs Group, Inc., as guarantor, and The Bank of New York Mellon, as trustee (incorporated by reference to Exhibit 4.70 to the Company’s Registration Statement on Form S-3, filed October 10, 2008). | |

-7-

| (d)(14) | First Supplemental Indenture, dated as of February 20, 2015, among GS Finance Corp., as issuer, The Goldman Sachs Group, Inc., as guarantor, and The Bank of New York Mellon, as trustee, with respect to the Senior Debt Indenture, dated as of October 10, 2008 (incorporated by reference to Exhibit 4.7 to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014, filed on February 23, 2015). | |

| (d)(15) | Ninth Supplemental Subordinated Debt Indenture, dated as of May 20, 2015, between The Goldman Sachs Group, Inc. and The Bank of New York Mellon, as trustee, with respect to the Subordinated Debt Indenture, dated as of February 20, 2004 (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K, filed on May 22, 2015). | |

| (d)(16) | The Goldman Sachs Amended and Restated Stock Incentive Plan (2015) (incorporated by reference to Annex B to the Company’s Definitive Proxy Statement on Schedule 14A, filed on April 10, 2015). | |

| (d)(17) | The Goldman Sachs Amended and Restated Restricted Partner Compensation Plan (incorporated by reference to Exhibit 10.1 to the Company’s Quarterly Report on Form 10-Q for the period ended February 24, 2006). | |

| (d)(18) | Form of Employment Agreement for Participating Managing Directors (applicable to executive officers) (incorporated by reference to Exhibit 10.19 to the Company’s Registration Statement on Form S-1 (No. 333-75213)). | |

| (d)(19) | Letter, dated February 6, 2001, from The Goldman Sachs Group, Inc. to Mr. James A. Johnson (incorporated by reference to Exhibit 10.65 to the Company’s Annual Report on Form 10-K for the fiscal year ended November 24, 2000). | |

| (d)(20) | Letter, dated December 18, 2002, from The Goldman Sachs Group, Inc. to Mr. William W. George (incorporated by reference to Exhibit 10.39 to the Company’s Annual Report on Form 10-K for the fiscal year ended November 29, 2002). | |

| (d)(21) | Form of Year-End Option Award Agreement (incorporated by reference to Exhibit 10.36 to the Company’s Annual Report on Form 10-K for the fiscal year ended November 28, 2008). | |

| (d)(22) | Amendments to 2005 and 2006 Year-End RSU and Option Award Agreements (incorporated by reference to Exhibit 10.44 to the Company’s Annual Report on Form 10-K for the fiscal year ended November 30, 2007). | |

| (d)(23) | Form of Non-Employee Director Option Award Agreement (incorporated by reference to Exhibit 10.34 to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2009). | |

| (d)(24) | Form of Non-Employee Director RSU Award Agreement (pre-2015) (incorporated by reference to Exhibit 10.21 to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014). | |

| (d)(25) | General Guarantee Agreement, dated January 30, 2006, made by The Goldman Sachs Group, Inc. relating to certain obligations of Goldman, Sachs & Co. (incorporated by reference to Exhibit 10.45 to the Company’s Annual Report on Form 10-K for the fiscal year ended November 25, 2005). | |

| (d)(26) | Letter, dated June 28, 2008, from The Goldman Sachs Group, Inc. to Mr. Lakshmi N. Mittal (incorporated by reference to Exhibit 99.1 to the Company’s Current Report on Form 8-K, filed June 30, 2008). | |

| (d)(27) | General Guarantee Agreement, dated December 1, 2008, made by The Goldman Sachs Group, Inc. relating to certain obligations of Goldman Sachs Bank USA (incorporated by reference to Exhibit 4.80 to the Company’s Post-Effective Amendment No. 2 to Form S-3, filed March 19, 2009). | |

| (d)(28) | Guarantee Agreement, dated November 28, 2008 and amended effective as of January 1, 2010, between The Goldman Sachs Group, Inc. and Goldman Sachs Bank USA (incorporated by reference to Exhibit 10.51 to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2009). | |

-8-

| (d)(29) | Form of One-Time RSU Award Agreement (pre-2015) (incorporated by reference to Exhibit 10.32 to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014). | |

| (d)(30) | Amendments to Certain Non-Employee Director Equity Award Agreements (incorporated by reference to Exhibit 10.69 to the Company’s Annual Report on Form 10-K for the fiscal year ended November 28, 2008). | |

| (d)(31) | Form of Year-End RSU Award Agreement (not fully vested) (pre-2015) (incorporated by reference to Exhibit 10.36 to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014). | |

| (d)(32) | Form of Year-End RSU Award Agreement (fully vested) (pre-2015) (incorporated by reference to Exhibit 10.37 to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014). | |

| (d)(33) | Form of Year-End RSU Award Agreement (Base and/or Supplemental) (pre-2015) (incorporated by reference to Exhibit 10.38 to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014). | |

| (d)(34) | Form of Year-End Short-Term RSU Award Agreement (pre-2015) (incorporated by reference to Exhibit 10.39 to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014). | |

| (d)(35) | Form of Year-End Restricted Stock Award Agreement (fully vested) (pre-2015) (incorporated by reference to Exhibit 10.41 to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2013). | |

| (d)(36) | Form of Year-End Restricted Stock Award Agreement (Base and/or Supplemental) (pre-2015) (incorporated by reference to Exhibit 10.41 to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014). | |

| (d)(37) | Form of Year-End Short-Term Restricted Stock Award Agreement. (pre-2015) (incorporated by reference to Exhibit 10.42 to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014). | |

| (d)(38) | Form of Fixed Allowance RSU Award Agreement (pre-2015) (incorporated by reference to Exhibit 10.43 to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014). | |

| (d)(39) | General Guarantee Agreement, dated March 2, 2010, made by The Goldman Sachs Group, Inc. relating to the obligations of Goldman Sachs Execution & Clearing, L.P. (incorporated by reference to Exhibit 10.1 to the Company’s Quarterly Report on Form 10-Q for the period ended March 31, 2010). | |

| (d)(40) | The Goldman Sachs Long-Term Performance Incentive Plan, dated December 17, 2010 (pre-2015) (incorporated by reference to the Company’s Current Report on Form 8-K, filed December 23, 2010). | |

| (d)(41) | Form of Performance-Based Restricted Stock Unit Award Agreement (pre-2015) (incorporated by reference to the Company’s Current Report on Form 8-K, filed December 23, 2010). | |

| (d)(42) | Form of Performance-Based Option Award Agreement (incorporated by reference to the Company’s Current Report on Form 8-K, filed December 23, 2010). | |

| (d)(43) | Amended and Restated General Guarantee Agreement, dated November 21, 2011, made by The Goldman Sachs Group, Inc. relating to certain obligations of Goldman Sachs Bank USA (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K, filed November 21, 2011). | |

| (d)(44) | Form of Non-Employee Director RSU Award Agreement (incorporated by reference to the Company’s Annual Report on Form 10-K, filed February 19, 2016). | |

-9-

| (d)(45) | Form of One-Time RSU Award Agreement (incorporated by reference to the Company’s Annual Report on Form 10-K, filed February 19, 2016). | |

| (d)(46) | Form of Year-End RSU Award Agreement (not fully vested) (incorporated by reference to the Company’s Annual Report on Form 10-K, filed February 19, 2016). | |

| (d)(47) | Form of Year-End RSU Award Agreement (fully vested) (incorporated by reference to the Company’s Annual Report on Form 10-K, filed February 19, 2016). | |

| (d)(48) | Form of Year-End RSU Award Agreement (Base and/or Supplemental) (incorporated by reference to the Company’s Annual Report on Form 10-K, filed February 19, 2016). | |

| (d)(49) | Form of Year-End Short-Term RSU Award Agreement. (incorporated by reference to the Company’s Annual Report on Form 10-K, filed February 19, 2016). | |

| (d)(50) | Form of Year-End Restricted Stock Award Agreement (not fully vested) (incorporated by reference to the Company’s Annual Report on Form 10-K, filed February 19, 2016). | |

| (d)(51) | Form of Year-End Restricted Stock Award Agreement (fully vested) (incorporated by reference to the Company’s Annual Report on Form 10-K, filed February 19, 2016). | |

| (d)(52) | Form of Year-End Short-Term Restricted Stock Award Agreement (incorporated by reference to the Company’s Annual Report on Form 10-K, filed February 19, 2016). | |

| (d)(53) | Form of Fixed Allowance RSU Award Agreement (incorporated by reference to the Company’s Annual Report on Form 10-K, filed February 19, 2016). | |

| (d)(54) | Form of Fixed Allowance Deferred Cash Award Agreement (incorporated by reference to the Company’s Annual Report on Form 10-K, filed February 19, 2016). | |

| (d)(55) | Form of Performance-Based Restricted Stock Unit Award Agreement (incorporated by reference to the Company’s Annual Report on Form 10-K, filed February 19, 2016). | |

| (d)(56) | Replacement Capital Covenant by the Company, relating to the public offering of 1,750,000 5.793% Fixed-to-Floating Rate Normal Automatic Preferred Enhanced Capital Securities, liquidation amount of $1,000 per security, fully and unconditionally guaranteed, of Goldman Sachs Capital II (incorporated by reference to the Company’s Current Report on Form 8-K, filed May 18, 2007). | |

| (d)(57) | Replacement Capital Covenant by the Company, relating to the public offering of 500,000 Floating Rate Normal Automatic Preferred Enhanced Capital Securities, liquidation amount of $1,000 per security, fully and unconditionally guaranteed, of Goldman Sachs Capital III (incorporated by reference to the Company’s Current Report on Form 8-K, filed May 18, 2007). | |

| (d)(58) | Amendment, dated as of October 17, 2012, by the Company, to each Replacement Capital Covenant, dated as of May 15, 2007, entered into by the Company, in favor of and for the benefit of each Covered Debtholder (as defined in each Replacement Capital Covenant) (incorporated by reference to the Company’s Amendment No. 1 to the Tender Offer Statement on Schedule TO, filed February 23, 2016). | |

| (g) | None. | |

| (h) | None. | |

-10-

EXHIBIT (a)(1)(A)

|

OFFER TO PURCHASE

THE GOLDMAN SACHS GROUP, INC.

Offer to Purchase for Cash |

The Offer (as defined below) will expire at 11:59 p.m., New York City time, on August 16, 2016, unless extended or earlier terminated (such date and time, as the same may be extended, the “Expiration Time”). Tendered Apex (as defined below) may be withdrawn in accordance with the terms of the Offer at any time at or prior to the Expiration Time.

The Goldman Sachs Group, Inc., a corporation organized under the laws of the State of Delaware (“Goldman Sachs,” the “Company,” “we,” “our” and “us”), hereby offers to purchase for cash, upon the terms and subject to the conditions set forth in this Offer to Purchase (as it may be amended or supplemented from time to time, the “Offer to Purchase”) and in the accompanying Letter of Transmittal (as it may be amended or supplemented from time to time, the “Letter of Transmittal” and, together with the Offer to Purchase, the “Offer”), up to $650,000,000 aggregate liquidation amount of the Normal Automatic Preferred Enhanced Capital Securities listed below (which we refer to in the singular and plural as “Apex”), at a price of $830 per Apex (the “Offer Price”). The Offer Price will be paid together with Accrued Distributions to, but excluding, the Settlement Date (as defined below). “Accrued Distributions” for any Apex means distributions that would be payable thereon if the current dividend period of the underlying preferred shares ended on the Settlement Date and we had paid the relevant dividend on the Settlement Date. We will pay for Apex accepted in the Offer on a date (the “Settlement Date”) promptly after the Expiration Time. If the Offer is not extended or earlier terminated, we expect that the Settlement Date will be August 18, 2016 and the total consideration per Apex accepted in the Offer will be approximately $838.67.

| Series of Securities(1) |

Issuer |

CUSIP No. |

Aggregate Liquidation |

Offer Price | ||||

| 5.793% Fixed-to-Floating Rate Normal Automatic Preferred Enhanced Capital Securities, $1,000 liquidation amount per Apex | Goldman Sachs Capital II (“GS Capital II”) |

381427AA1 | $1,252,839,000 | $830 per Apex | ||||

| Floating Rate Normal Automatic Preferred Enhanced Capital Securities, $1,000 liquidation amount per Apex | Goldman Sachs Capital III (“GS Capital III” and, together with GS Capital II, the “Issuers”) |

38144QAA7 | $325,390,000 | $830 per Apex | ||||

| (1) | Because the two series of Apex are substantially similar, we are treating them as a single class for purposes of the Offer, including proration. |

If the aggregate liquidation amount of the Apex that are validly tendered and not properly withdrawn as of the Expiration Time exceeds $650,000,000 and the conditions of the Offer are met or waived, we will prorate the Apex we accept for purchase, as described in this Offer to Purchase. See Section 1.

THE OFFER IS NOT CONDITIONED ON ANY MINIMUM NUMBER OF APEX BEING TENDERED. THE OFFER IS, HOWEVER, SUBJECT TO CERTAIN CONDITIONS, INCLUDING A FINANCING CONDITION (AS DEFINED HEREIN). SEE SECTION 6 WHICH SETS FORTH IN FULL THE CONDITIONS TO THE OFFER.

NONE OF GOLDMAN SACHS, THE DEALER MANAGER, THE DEPOSITARY OR THE INFORMATION AGENT MAKES ANY RECOMMENDATION TO HOLDERS OF APEX AS TO WHETHER TO TENDER OR REFRAIN FROM TENDERING THEIR APEX. YOU SHOULD READ CAREFULLY THE INFORMATION IN THIS OFFER TO PURCHASE AND IN THE LETTER OF TRANSMITTAL BEFORE MAKING YOUR DECISION WHETHER TO TENDER YOUR APEX IN THE OFFER.

None of the Securities and Exchange Commission (the “SEC”), any state securities commission or any other regulatory authority has passed upon the accuracy or adequacy of this Offer to Purchase. Any representation to the contrary is unlawful. No person has been authorized to give any information or make any representations with respect to the Offer other than the information and representations contained or incorporated by reference herein and, if given or made, such information or representations must not be relied upon as having been authorized.

You may direct questions and requests for assistance to Goldman, Sachs & Co., the dealer manager (the “Dealer Manager”) for the Offer, or Global Bondholder Services Corporation, the information agent (the “Information Agent”) for the Offer, at the contact information set forth on the last page of this Offer to Purchase. You may direct requests for additional copies of this Offer to Purchase to the Information Agent.

The Dealer Manager for the Offer is:

Goldman, Sachs & Co.

July 20, 2016

IMPORTANT

The principal purpose of the Offer, in conjunction with the Financing Transaction (as defined in Section 6), is to enhance our capital structure. We expect to use the proceeds from the Financing Transaction and cash on hand to pay the consideration payable by us pursuant to the Offer and to pay the fees and expenses incurred by us in connection therewith. The Offer has certain conditions and no assurance can be given that these conditions will be satisfied. See Section 6.

All of the Apex are held in book-entry form through the facilities of The Depository Trust Company (“DTC”). If you desire to tender Apex, a DTC participant must electronically transmit your acceptance of the Offer through DTC’s Automated Tender Offer Program (“ATOP”), for which the transaction will be eligible. In accordance with ATOP procedures, DTC will then verify the acceptance of the Offer and send an agent’s message (as hereinafter defined) to Global Bondholder Services Corporation, the depositary for the Offer (the “Depositary”), for its acceptance. An “agent’s message” is a message transmitted by DTC, received by the Depositary and forming part of the book-entry confirmation, which states that DTC has received an express acknowledgment from you that you have received the Offer and agree to be bound by the terms of the Offer, and that we may enforce such agreement against you. Alternatively, you may also confirm your acceptance of the Offer by delivering to the Depositary a duly executed Letter of Transmittal. A tender will be deemed to have been received only when the Depositary receives (i) either a duly completed agent’s message through the facilities of DTC at the Depositary’s DTC account or a properly completed Letter of Transmittal, and (ii) confirmation of book-entry transfer of the Apex into the Depositary’s applicable DTC account. If your Apex are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, you should contact that person if you desire to tender your Apex. See Section 3.

There are no guaranteed delivery procedures available with respect to the Offer under the terms of this Offer to Purchase or any related materials. Holders must tender their Apex in accordance with the procedures set forth in this Offer to Purchase. See Section 3.

We have not authorized any person to make any recommendation on our behalf as to whether you should tender or refrain from tendering your Apex in the Offer. We have not authorized any person to give any information or to make any representation in connection with the Offer other than those contained in this Offer to Purchase. If given or made, you must not rely upon any such information or representation as having been authorized by Goldman Sachs, the Information Agent or the Dealer Manager. You must make your own decision whether to tender your Apex and, if so, how many Apex to tender.

We are not making the Offer to (nor will we accept any tender of Apex from or on behalf of) holders of Apex in any jurisdiction in which the making of the Offer or the acceptance of any tender of Apex would not be in compliance with the laws of such jurisdiction. However, we may, at our discretion, take such action as we may deem necessary for us to make the Offer in any such jurisdiction and extend the Offer to holders of Apex in such jurisdiction. In any jurisdiction the securities or blue sky laws of which require the Offer to be made by a licensed broker or dealer, the Offer shall be deemed to be made on our behalf by one or more registered brokers or dealers which are licensed under the laws of such jurisdiction.

THIS OFFER TO PURCHASE AND THE LETTER OF TRANSMITTAL CONTAIN IMPORTANT INFORMATION THAT HOLDERS ARE URGED TO READ BEFORE ANY DECISION IS MADE WITH RESPECT TO THE OFFER.

-i-

TABLE OF CONTENTS

| Page | ||||||

| Available Information |

iii | |||||

| Cautionary Note Regarding Forward-Looking Statements |

iii | |||||

| Summary Term Sheet |

4 | |||||

| Certain Significant Considerations |

9 | |||||

| The Offer |

11 | |||||

| Section 1 |

Number of Apex; Expiration Time | 11 | ||||

| Section 2 |

Purpose of the Offer | 12 | ||||

| Section 3 |

Procedures for Tendering the Apex | 12 | ||||

| Section 4 |

Withdrawal Rights | 15 | ||||

| Section 5 |

Purchase of Apex and Payment of Offer Price | 16 | ||||

| Section 6 |

Conditions of the Offer | 17 | ||||

| Section 7 |

Historical Price Range of the Apex | 19 | ||||

| Section 8 |

Source and Amount of Funds | 20 | ||||

| Section 9 |

Certain Information Concerning Goldman Sachs and the Issuers | 20 | ||||

| Section 10 |

Interests of Directors and Executive Officers; Transactions and Arrangements Concerning the Apex | 22 | ||||

| Section 11 |

Post-offer Exchange; Effects of the Offer on the Market for the Apex | 24 | ||||

| Section 12 |

Legal Matters; Regulatory Approvals | 24 | ||||

| Section 13 |

Certain Material U.S. Federal Income Tax Consequences | 25 | ||||

| Section 14 |

Accounting Treatment | 30 | ||||

| Section 15 |

Extension of the Offer; Termination; Amendment | 30 | ||||

| Section 16 |

Dealer Manager; Depositary; Information Agent | 31 | ||||

| Section 17 |

Rule 14e-4 “Net Long Position” Requirement | 32 | ||||

| Section 18 |

Miscellaneous | 32 | ||||

-ii-

AVAILABLE INFORMATION

Goldman Sachs is subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and files with the SEC proxy statements, Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as required of a U.S. publicly listed company. You may read and copy any document Goldman Sachs files at the SEC’s public reference room in Washington, D.C. at 100 F Street, NE, Room 1580, Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference rooms. Goldman Sachs’ SEC filings are also available to the public through:

| • | the SEC’s website at www.sec.gov; and |

| • | the New York Stock Exchange, 20 Broad Street, New York, New York 10005. |

Goldman Sachs’ common stock is listed on the New York Stock Exchange and trades under the symbol “GS.”

Copies of the materials referred to in the preceding paragraph, as well as copies of any current amendment or supplement to this Offer to Purchase, may also be obtained from the Information Agent at its address set forth on the back cover of this Offer to Purchase.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Statements in this Offer to Purchase, including information incorporated by reference, that are based on information other than historical data may constitute “forward-looking statements.” Forward-looking statements provide current expectations or forecasts of future events and include, among others:

| • | statements with respect to the beliefs, plans, objectives, goals, guidelines, expectations, anticipations and future financial condition, results of operations and performance of the Company and its subsidiaries; and |

| • | statements preceded by, followed by or that include the words “may,” “could,” “should,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “intend,” “plan,” “projects,” or similar expressions. |

These forward-looking statements are not guarantees of future performance, nor should they be relied upon as representing management’s views as of any subsequent date. Forward-looking statements involve significant risks and uncertainties, and actual results may differ materially from those presented, either expressed or implied, in this Offer to Purchase, including the information incorporated by reference. You should carefully consider those risks and uncertainties in reading this Offer to Purchase. For a discussion of some of the risks and important factors that could affect our future results and financial condition, see “Risk Factors” in Part I, Item 1A of our Annual Report on Form 10-K for the Year Ended December 31, 2015 (the “2015 Form 10-K”).

-iii-

SUMMARY TERM SHEET

We are providing this summary term sheet for your convenience. It highlights material information in this Offer to Purchase, but you should realize that it does not describe all the details of the Offer to the same extent described elsewhere in this Offer to Purchase. We recommend that you read the entire Offer to Purchase and the Letter of Transmittal because they contain the full details of the Offer. We have included references to the sections of this Offer to Purchase where you will find a more complete discussion.

| The Offeror | The Offer is being made by Goldman Sachs, a corporation organized under the laws of the State of Delaware. Our principal executive offices are located at 200 West Street, New York, New York 10282, and our telephone number is (212) 902-1000. | |

| The Issuers | The Issuers of the Apex are Delaware statutory trusts sponsored by Goldman Sachs. The property trustee for the Issuers is The Bank of New York Mellon.

The sole asset of GS Capital II is our perpetual Non-Cumulative Preferred Stock, Series E (the “Series E Preferred Stock”) and the primary purpose of GS Capital II is to distribute dividends received on or the proceeds of any redemption of the Series E Preferred Stock to the holders of the GS Capital II Apex. The sole asset of GS Capital III is our perpetual Non-Cumulative Preferred Stock, Series F (the “Series F Preferred Stock”) and the primary purpose of GS Capital III is to distribute dividends received on or the proceeds of any redemption of our Series F Preferred Stock to the holders of the GS Capital III Apex. | |

| Terms of the Offer | We are offering to purchase for cash, upon the terms and subject to the conditions set forth in the Offer to Purchase and Letter of Transmittal, up to $650,000,000 aggregate liquidation amount of Apex. If the aggregate liquidation amount of Apex that are validly tendered and not properly withdrawn as of the Expiration Time exceeds $650,000,000 and the conditions of the Offer are met or waived, we will prorate the Apex we accept for purchase, as described in this Offer to Purchase. See Section 1.

At the time you tender your Apex, you will not know the extent of participation by other holders of Apex in the Offer or whether more than $650,000,000 in aggregate liquidation amount of Apex will be validly tendered and not properly withdrawn as of the Expiration Time. As a result, you will not know whether we will be able to accept for purchase all of your validly tendered and not properly withdrawn Apex at the time you tender those Apex.

The consideration for each $1,000 liquidation amount of Apex tendered and accepted for purchase pursuant to the Offer will be $830, plus Accrued Distributions. | |

-4-

| Proration | If proration of the Apex is required, we or the Depositary will determine the final proration factor as soon as practicable after the Expiration Time, and we will announce the results of proration by press release. Fractional Apex will be rounded down to the nearest $1,000 liquidation amount. | |

| Source and Amount of Funds | We expect to use the proceeds from the Financing Transaction and cash on hand to pay the consideration payable by us pursuant to the Offer and to pay the fees and expenses incurred by us in connection therewith. If the Offer is fully subscribed and the Settlement Date occurs on August 18, 2016, we will pay an aggregate of approximately $545 million to purchase the Apex, excluding fees and expenses. | |

| Time to Tender | You may tender Apex until the Offer expires.

The Offer will expire on August 16, 2016 at 11:59 p.m., New York City time, unless we extend it (such time and date, as the same may be extended, the Expiration Time). See Section 1.

We may choose to extend the Offer for any reason, subject to applicable laws. We cannot assure you that we will extend the Offer or, if we do, of the length of any extension. See Section 15.

If a broker, dealer, commercial bank, trust company or other nominee holds your Apex, it is likely that it has an earlier deadline for you to act to instruct it to accept the Offer on your behalf. We recommend that you contact the broker, dealer, commercial bank, trust company or other nominee to determine its deadline. | |

| Extension, Amendment, and Termination of the Offer | We reserve the right to extend or amend the Offer. If we extend the Offer, we will delay the acceptance of any Apex that have been tendered. We reserve the right to terminate the Offer under certain circumstances. See Section 6 and Section 15.

We will issue a press release by 9:00 a.m., New York City time, on the business day after the scheduled Expiration Time if we decide to extend the Offer. We will announce any amendment to the Offer by making a public announcement of the amendment. See Section 15. | |

| Purpose of the Offer | The purpose of the Offer, in conjunction with the Financing Transaction, is to enhance our capital structure. See Section 2. | |

| Conditions of the Offer | The Offer is not conditioned upon any minimum number of Apex being tendered. However, the Offer is subject to other conditions, including, among others, a Financing Condition (as defined herein), and the absence of court and governmental action prohibiting, challenging or restricting the Offer. See Section 6. | |

-5-

| Procedures for Tendering Apex | The Offer will expire at the Expiration Time, which is 11:59 p.m., New York City time, on August 16, 2016, unless we extend or earlier terminate the Offer. To tender your Apex prior to the expiration of the Offer, you must electronically transmit your acceptance of the Offer through ATOP, which is maintained by DTC, and by which you will agree to be bound by the terms and conditions set forth in the Offer, or deliver to the Depositary a duly executed Letter of Transmittal.

A tender will be deemed to be received after you have expressly agreed to be bound by the terms of the Offer, which is accomplished by the transmittal of an agent’s message to the Depositary by the DTC in accordance with ATOP procedures, or by delivery to the Depositary of a duly executed Letter of Transmittal. You should contact the Information Agent for assistance at the contact information listed on the last page of this Offer to Purchase. Please note that we will not purchase your Apex in the Offer unless the Depositary receives the required confirmation prior to the Expiration Time. If a broker, dealer, commercial bank, trust company or other nominee holds your Apex, it is likely that it has an earlier deadline for you to act to instruct it to accept the Offer on your behalf. We recommend that you contact your broker, dealer, commercial bank, trust company or other nominee to determine its applicable deadline. See Section 3.

We will not accept any alternative, conditional or contingent tenders. Apex may be tendered and accepted for payment only in liquidation amounts of $1,000 and integral multiples thereof.

There are no guaranteed delivery procedures available with respect to the Offer under the terms of this Offer to Purchase or any related materials. Holders must tender their Apex in accordance with the procedures set forth in this Offer to Purchase. See Section 3. | |

| Withdrawal Rights | You may withdraw any Apex you have tendered at any time before the Expiration Time, unless we extend the Offer. We cannot assure you that we will extend the Offer or, if we do, of the length of any extension we may provide. See Section 4. | |

| Withdrawal Procedure | You must deliver, on a timely basis prior to the Expiration Time, which is at 11:59 p.m., New York City time, on August 16, 2016, a written notice of your withdrawal to the Depositary at the address appearing on the last page of this Offer to Purchase. Your notice of withdrawal must (i) specify the name of the participant for whose account such Apex were tendered and such participant’s account number at DTC to be credited with the withdrawn Apex, (ii) contain the title and number of Apex to be withdrawn and (iii) be signed by such participant in the same manner as the participant’s name is listed on the applicable “agent’s message” or Letter of Transmittal. Some additional requirements apply for Apex that have been tendered under the procedure for book-entry transfer set forth in Section 3. See Section 4. | |

-6-

| No Recommendation as to Whether to Tender | None of Goldman Sachs, the Dealer Manager, the Depositary or the Information Agent makes any recommendation to holders of Apex as to whether to tender or refrain from tendering their Apex. You should read carefully the information in this Offer to Purchase before making your decision whether to tender your Apex. See Section 18. | |

| Untendered or Unpurchased Apex | Any tendered Apex that we do not accept for purchase will be returned without expense to their tendering holder. Apex not tendered or otherwise not purchased pursuant to the Offer will remain outstanding. If the Offer is consummated, then the aggregate liquidation amount of each series of Apex that remains outstanding will be reduced. This may adversely affect the liquidity of and/or increase the volatility in the market for the Apex that remain outstanding after consummation of the Offer. See Section 11. | |

| Market Prices of the Apex | The GS Capital II Apex are traded on the New York Stock Exchange Arca (the “NYSE Arca”) under the symbol “GS/43PE” and the GS Capital III Apex are traded on the NYSE Arca under the symbol “GS/43PF”. On July 19, 2016, the last trading day prior to the date of this Offer to Purchase, the last reported price for the GS Capital II Apex on the NYSE Arca was $799.89 and the last reported price for the GS Capital III Apex on the NYSE Arca was $781.10. These prices do not include Accrued Distributions. | |

| Appraisal Rights | You will have no appraisal rights in connection with the Offer. | |

| Time of Payment | We will pay the Offer Price to you in cash for any Apex we accept for purchase promptly after the Expiration Time. We refer to the date on which such payment is made as the “Settlement Date.” If the Offer is not extended or earlier terminated, we expect that the Settlement Date will be August 18, 2016. See Section 5. | |

| Payment of Brokerage Commissions | If you are a registered holder of Apex and you tender your Apex directly to the Depositary, you will not incur any brokerage commissions. If you hold Apex through a broker, dealer, commercial bank, trust company or other nominee, we recommend that you consult your broker, dealer, commercial bank, trust company or other nominee to determine whether transaction costs are applicable. See Section 3. | |

| U.S. Federal Income Tax Consequences | The cash received in exchange for tendered Apex generally will be treated for U.S. federal income tax purposes either as (i) consideration received with respect to a sale or exchange of the tendered Apex, or (ii) a distribution from Goldman Sachs in respect of its stock, depending on the particular circumstances of each holder of Apex. See Section 13 for a more detailed discussion.

We recommend that holders of the Apex consult their own tax advisors to determine the particular tax consequences to them of participating in the Offer, including the applicability and effect of any state, local or non-U.S. tax laws. | |

-7-

| Payment of Stock Transfer Tax | If you are the registered holder and you instruct the Depositary to make the payment for the Apex directly to you, then generally you will not incur any stock transfer tax. See Section 5. | |

| Exchanges after Conclusion of Offer | Following the completion of the Offer, we expect to exchange the Apex of GS Capital II that we hold (including the Apex we acquire in the Offer) for a like amount of our Series E Preferred Stock held by GS Capital II and the Apex of GS Capital III that we hold (including the Apex we acquire in the Offer) for a like amount of our Series F Preferred Stock held by GS Capital III, and then retire such Series E Preferred Stock and Series F Preferred Stock. See Section 2. | |

| Further Information | You may call the Dealer Manager with questions regarding the terms of the Offer or the Information Agent with questions regarding how to tender and/or request additional copies of the Offer to Purchase, the Letter of Transmittal or other documents related to the Offer.

Goldman, Sachs & Co. is acting as the Dealer Manager and Global Bondholder Services Corporation is acting as the Depositary and Information Agent for the Offer. See the last page of this Offer to Purchase for additional information about the Dealer Manager, Depositary and Information Agent. | |

-8-

CERTAIN SIGNIFICANT CONSIDERATIONS

We have not obtained a third-party determination that the Offer is fair to holders of the Apex.

None of Goldman Sachs, the Dealer Manager, the Depositary or the Information Agent makes any recommendation as to whether you should tender your Apex in the Offer. We have not retained, and do not intend to retain, any unaffiliated representative to act on behalf of the holders of the Apex for purposes of negotiating the Offer or preparing a report concerning the fairness of the Offer. You must make your own independent decision regarding your participation in the Offer.

We may not accept all of the Apex tendered in the Offer.

Depending on the number of Apex tendered in the Offer, we may not accept all of the Apex tendered in the Offer and may have to prorate the Apex that we do accept. Any Apex not accepted will be returned to tendering holders promptly after expiration. See Section 1 and Section 5.

If the Offer is successful, there may be a more limited trading market for the Apex and their market prices may be depressed.

Depending on the number of Apex of either Issuer that are accepted in the Offer, the trading market for those Apex that remain outstanding after the Offer may be more limited. A reduced trading volume may decrease the prices and increase the volatility of the trading prices of the Apex that remain outstanding following the completion of the Offer.

Holders of Apex that participate in the Offer are giving up their right to future distributions on the Apex.

If you tender your Apex, and they are accepted for purchase, you will be giving up your right to any future distributions that are paid on the Apex.

We may acquire additional Apex following the Offer at prices that are more or less than the Offer Price.

From time to time in the future, to the extent permitted by applicable law, we may acquire Apex that remain outstanding, whether or not the Offer is consummated, through tender offers, exchange offers, on the open market, in negotiated transactions or otherwise, upon such terms and at such prices as we may determine, which may be more or less than the price to be paid pursuant to the Offer, including for cash or other consideration. There can be no assurance as to which, if any, of these alternatives (or combinations thereof) we may pursue.

The cash you receive pursuant to the Offer may be treated as a taxable dividend for U.S. federal income tax purposes.

The cash received in exchange for tendered Apex generally will be treated for U.S. federal income tax purposes either as (i) consideration received with respect to a sale or exchange of the tendered Apex, or (ii) a distribution from Goldman Sachs in respect of its stock, depending on the particular circumstances of each holder of Apex. If cash received by you is treated as a distribution, then it will be treated as a dividend to the extent that it reflects share of Goldman Sachs’ current and accumulated earnings and profits, as determined under U.S. federal income tax principles. In addition, if you are a

-9-

non-U.S. holder of Apex and a broker or other paying agent is unable to determine whether sale or exchange treatment should apply to you, such paying agent may be required to report the transaction as resulting in a distribution for U.S. federal income tax purposes that is made out of Goldman Sachs’ current or accumulated earnings and profits and withhold tax at a 30% rate on the full amount you receive (in which case, you may be eligible to obtain a refund of all or a portion of any tax). See Section 13 for a more detailed discussion.

-10-

THE OFFER

Section 1 Number of Apex; Expiration Time.

General. We are offering to purchase for cash, upon the terms and subject to the conditions set forth in the Offer to Purchase and Letter of Transmittal, up to $650,000,000 aggregate liquidation amount of Apex (a total of 650,000 Apex). If more than $650,000,000 aggregate liquidation amount of Apex are validly tendered and not properly withdrawn as of the Expiration Time and the conditions to the Offer are satisfied or waived, we will prorate the Apex we accept for purchase in order to accept for purchase only $650,000,000 aggregate liquidation amount of Apex, as described in this Section 1.

If you elect to participate in the Offer, you may tender a portion of or all of the Apex you hold, although we may not be able to accept for purchase all of the Apex you tender. At the time you tender your Apex, you will not know the extent of participation by other holders of Apex in the Offer. As a result, you will not know whether we will be able to accept for purchase all of your validly tendered and not properly withdrawn Apex.

For each $1,000 liquidation amount of Apex tendered and accepted for purchase pursuant to the Offer, we will pay $830 in cash (the “Offer Price”), plus Accrued Distributions.

In addition, to the extent permitted by applicable law, we and our affiliates may from time to time acquire Apex that remain outstanding after the Expiration Time through one or more tender or exchange offers, on the open market, in negotiated transactions or otherwise, at prices that may be less than, equal to or greater than the prices paid for the Apex in the Offer. Until the expiration of at least ten business days after the Expiration Time or the date we otherwise terminate the Offer, neither we nor any of our affiliates will make any purchases of the Apex other than pursuant to the Offer.

Proration. If more than $650,000,000 aggregate liquidation amount of Apex are validly tendered and not properly withdrawn as of the Expiration Time and the conditions to the Offer are satisfied or waived, we will accept Apex on a pro rata basis (based on the number of Apex validly tendered and not properly withdrawn), with appropriate adjustments to avoid purchases of fractional Apex, with the result that we will accept Apex with an aggregate liquidation amount of $650,000,000. Fractions resulting from the proration will be rounded down to the nearest $1,000 liquidation amount. In that case, we or the Depositary will determine the final proration factor (which will be the same for all of the Apex) as soon as practicable after the Expiration Time, and we will announce the results of proration by press release.

Expiration Time. The term “Expiration Time” means 11:59 p.m., New York City time, on August 16, 2016, unless and until we shall have extended the period of time during which the Offer will remain open, in which event the term Expiration Time shall refer to the latest time and date at which the Offer, as so extended by us, shall expire. We will pay for all properly tendered and not properly withdrawn Apex that are accepted for purchase promptly after the Expiration Time. If we materially change the Offer or information concerning the Offer, we will extend the Offer to the extent and in the manner required by Rules 13e-4(d)(2), 13e-4(e)(3), 13e-4(f)(1) and 14e-1(b) under the Exchange Act.

For the purposes of the Offer, a “business day” means any day other than a Saturday, Sunday or U.S. federal holiday and consists of the time period from 12:01 a.m. through 12:00 midnight, New York City time.

-11-

If we (i) increase or decrease the price to be paid for the Apex or (ii) decrease the aggregate liquidation amount that we may purchase in the Offer, then the Offer must remain open for at least ten business days following the date that notice of the increase or decrease is first published, sent or given in the manner specified in Section 15.

THE OFFER IS NOT CONDITIONED ON ANY MINIMUM NUMBER OF APEX BEING TENDERED. THE OFFER IS, HOWEVER, SUBJECT TO CERTAIN CONDITIONS, INCLUDING A FINANCING CONDITION (AS DEFINED HEREIN). SEE SECTION 6.

This Offer to Purchase and the related Letter of Transmittal will be mailed to record holders of Apex and will be furnished to brokers, dealers, commercial banks, trust companies or other nominee holders and similar persons whose names, or the names of whose nominees, appear on the securities register of each Issuer or, if applicable, who are listed as participants in DTC’s security position listing for subsequent transmittal to beneficial owners of the Apex.

Section 2 Purpose of the Offer.

The Offer. The principal purpose of the Offer, in conjunction with the Financing Transaction, is to enhance our capital structure.

Following the completion of the Offer, we expect to exchange the Apex of GS Capital II that we hold (including the Apex we acquire in the Offer) for a like amount of our Series E Preferred Stock held by GS Capital II and the Apex of GS Capital III that we hold (including the Apex we acquire in the Offer) for a like amount of our Series F Preferred Stock held by GS Capital III (the “Exchange”), and then retire such Series E Preferred Stock and Series F Preferred Stock.

General. None of Goldman Sachs, the Dealer Manager, the Depositary or the Information Agent makes any recommendation to holders of Apex as to whether to tender or refrain from tendering their Apex. Holders of Apex should carefully evaluate all information in the Offer, should consult their own investment and tax advisors, and should make their own decisions about whether to tender their Apex, and, if so, how many Apex to tender.

Section 3 Procedures for Tendering the Apex

All of the Apex are held in book-entry form through the facilities of DTC. Only registered holders of Apex are authorized to tender the Apex. Therefore, to tender Apex that are held through a broker, dealer, commercial bank, trust company or other nominee, a beneficial owner thereof must instruct such nominee to tender the Apex on such beneficial owner’s behalf according to the procedures described below.

If you desire to tender Apex, a DTC participant must electronically transmit your acceptance of the Offer through DTC’s ATOP, for which the transaction will be eligible. In accordance with ATOP procedures, DTC will then verify the acceptance of the Offer and send an agent’s message (as hereinafter defined) to the Depositary, for its acceptance. An “agent’s message” is a message transmitted by DTC, received by the Depositary and forming part of the book-entry confirmation, which states that DTC has received an express acknowledgment from you that you have received the Offer and agree to be bound by the terms of the Offer, and that we may enforce such agreement against you. Alternatively, you may also confirm your acceptance of the Offer by delivering to the Depositary a duly executed Letter of Transmittal. A tender will be deemed to have been received only when the Depositary receives (i) either

-12-

a duly completed agent’s message through the facilities of DTC at the Depositary’s DTC account or a properly completed Letter of Transmittal and (ii) confirmation of book-entry transfer of the Apex into the Depositary’s applicable DTC account.

If a broker, dealer, commercial bank, trust company or other nominee holds your Apex, it is likely that it has an earlier deadline for you to act to instruct it to accept the Offer on your behalf. We recommend that you contact your broker, dealer, commercial bank, trust company or other nominee to determine its applicable deadline.

We recommend that investors who hold Apex through brokers, dealers, commercial banks, trust companies or other nominees consult the brokers, dealers, commercial banks, trust companies or other nominees to determine whether transaction costs are applicable if they tender Apex through the brokers, dealers, commercial banks, trust companies or other nominees and not directly to the Depositary.

We will not accept any alternative, conditional or contingent tenders. Apex may be tendered and accepted for payment only in liquidation amounts of $1,000 and integral multiples thereof. A defective tender of Apex (which defect is not waived by us or cured by the holder) will not constitute a valid tender of Apex and will not entitle the holder thereof to the Offer Price. A defective tender of Apex that is waived by us or cured by the holder will constitute a valid tender of Apex and will entitle the holder thereof to the Offer Price.

Signature Guarantees. Except as otherwise provided below, all signatures on a Letter of Transmittal must be guaranteed by a financial institution (including most banks, savings and loans associations and brokerage houses) which is a participant in the Securities Transfer Agents Medallion Program. Signatures on a Letter of Transmittal need not be guaranteed if:

| • | the Letter of Transmittal is signed by the registered holder (which term, for purposes of this Section 3, shall include any participant in DTC whose name appears on a security position listing as the owner of the Apex) of the Apex tendered therewith and the holder has not completed either of the boxes under “Special Payment and Delivery Instructions” within the Letter of Transmittal; or |

| • | the Apex are tendered for the account of a bank, broker, dealer, credit union, savings association or other entity which is a member in good standing of the Securities Transfer Agents Medallion Program or a bank, broker, dealer, credit union, savings association or other entity which is an “eligible guarantor institution,” as such term is defined in Rule 17Ad-15 under the Exchange Act. See Instruction 1 of the Letter of Transmittal. |

There are no guaranteed delivery procedures available with respect to the Offer under the terms of this Offer to Purchase or any related materials. Holders must tender their Apex in accordance with the procedures set forth in this Section 3.

We will make payment for Apex tendered and accepted for purchase in the Offer only after the Depositary receives a timely confirmation of the book-entry transfer of the Apex into the Depositary’s account at DTC and a properly completed and a duly executed Letter of Transmittal or an agent’s message, and any other documents required by the Letter of Transmittal.

-13-

Book-Entry Delivery. The Depositary will establish an account with respect to the Apex for purposes of the Offer at DTC within two business days after the date of this Offer to Purchase, and any financial institution that is a DTC participant may make book-entry delivery of Apex by causing DTC to transfer the Apex into the Depositary’s account in accordance with DTC’s procedures for transfer. Although DTC participants may effect delivery of Apex into the Depositary’s account at DTC, such deposit must be accompanied by either:

| • | a message that has been transmitted to the Depositary through the facilities of DTC, or “agent’s message,” or |

| • | a properly completed and duly executed Letter of Transmittal, including any other required documents, that has been transmitted to and received by the Depositary at its address set forth on the back page of this Offer to Purchase before the Expiration Time. |

Any “agent’s message” must state (i) the title and number of Apex that have been tendered by such participant pursuant to the Offer, (ii) that such participant has received the Offer to Purchase and agrees to be bound by the terms of the Offer and (iii) that we may enforce such agreement against such participant. Notwithstanding any other provision of the Offer, payment of the Offer Price in exchange for the Apex tendered and accepted for purchase pursuant to the Offer will occur only after timely receipt by the Depositary of either an agent’s message or Letter of Transmittal.

Method of Delivery. The method of delivery of the Letter of Transmittal and any other required documents is at the election and risk of the tendering holder of Apex. If you choose to deliver required documents by mail, we recommend that you use registered mail with return receipt requested, properly insured. Delivery of the Letter of Transmittal and any other required documents to DTC does not constitute delivery to the Depositary.

Appraisal Rights. You will have no appraisal rights in connection with the Offer.

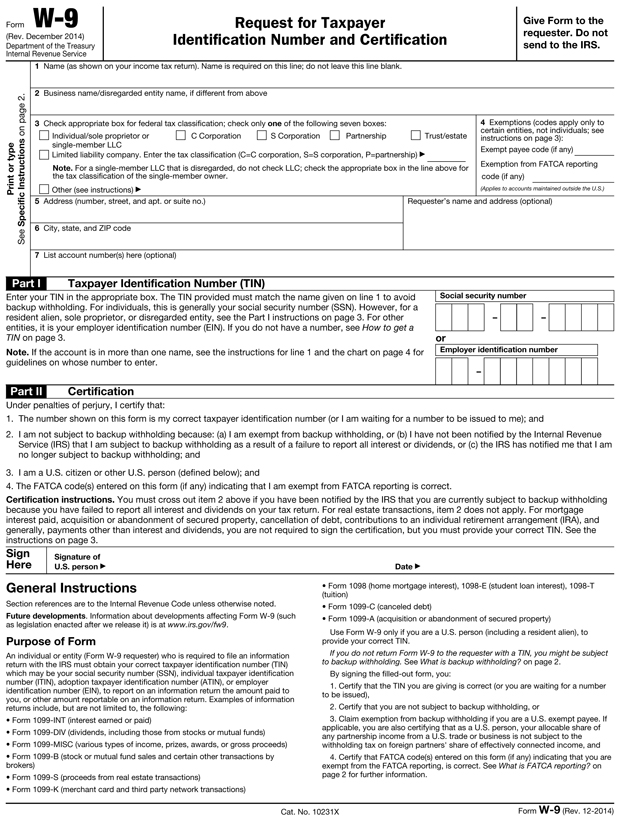

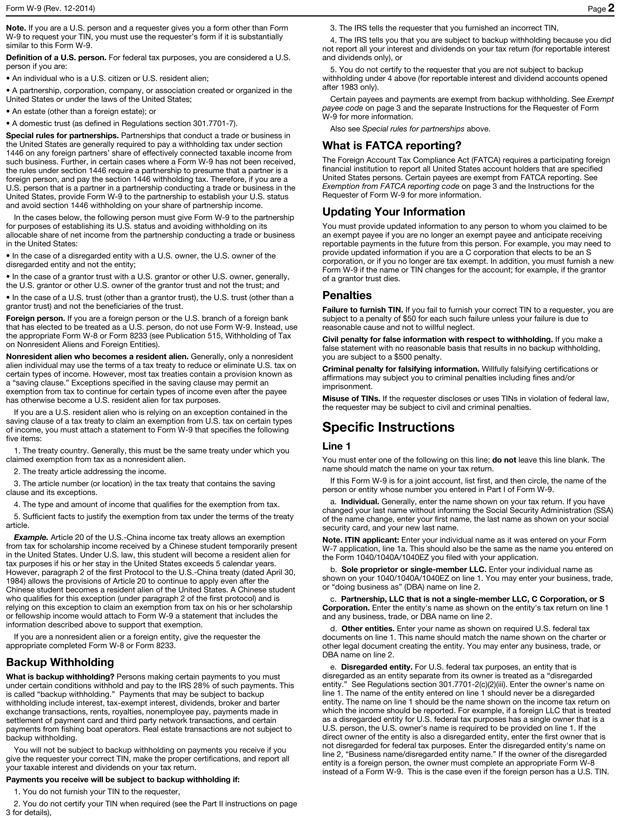

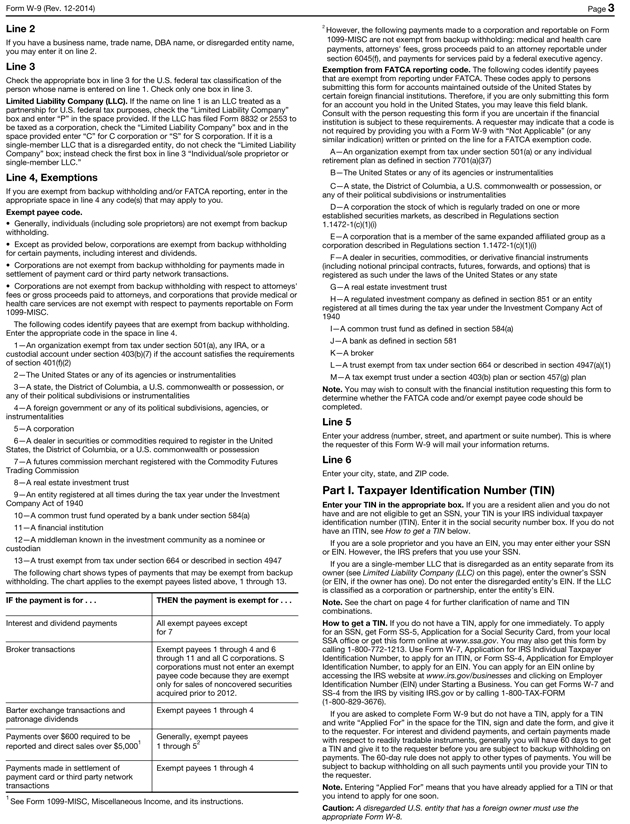

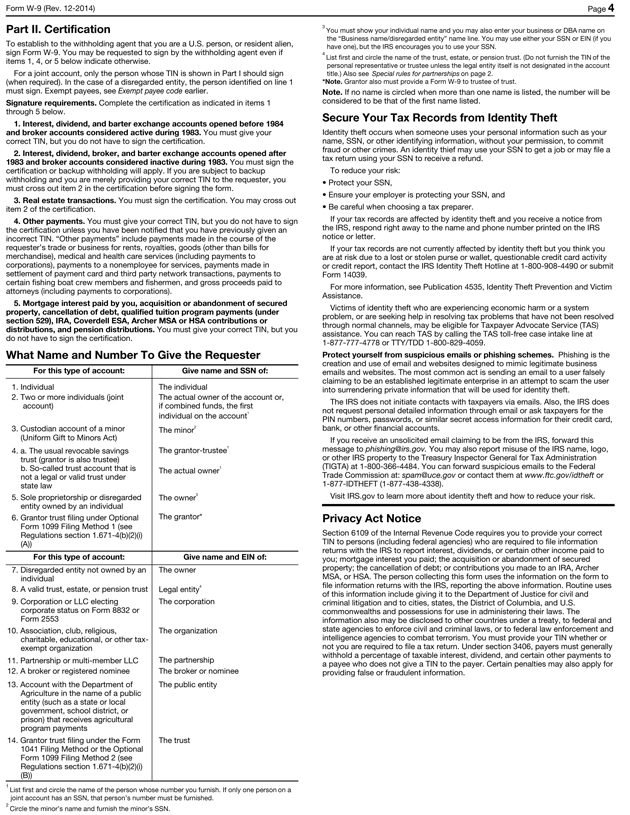

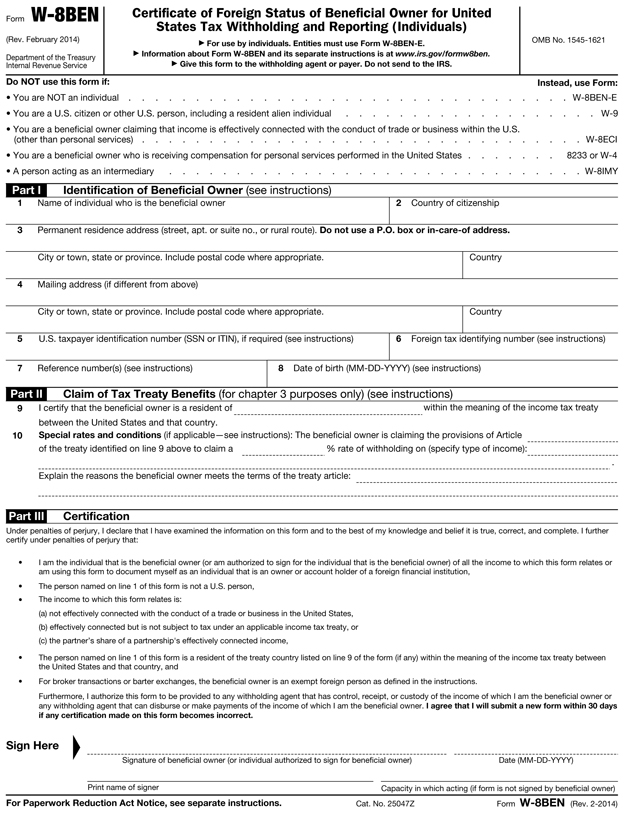

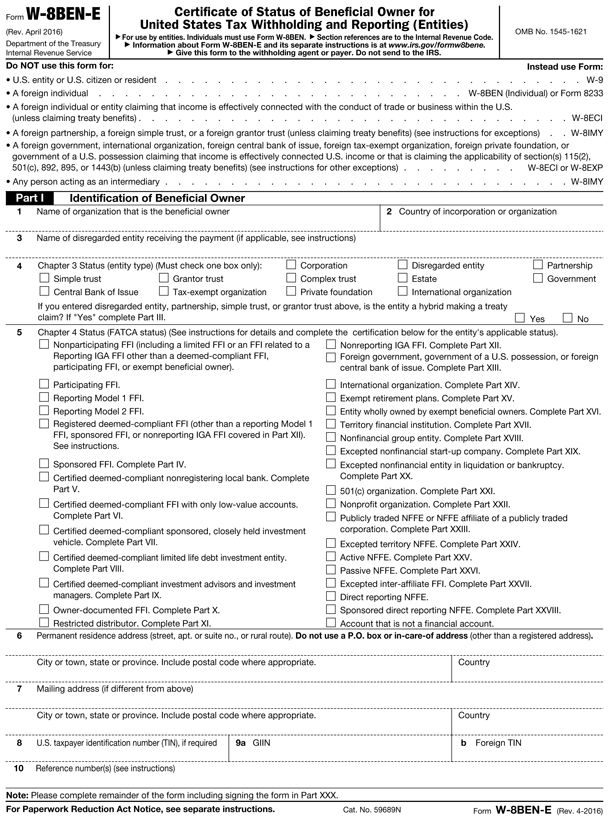

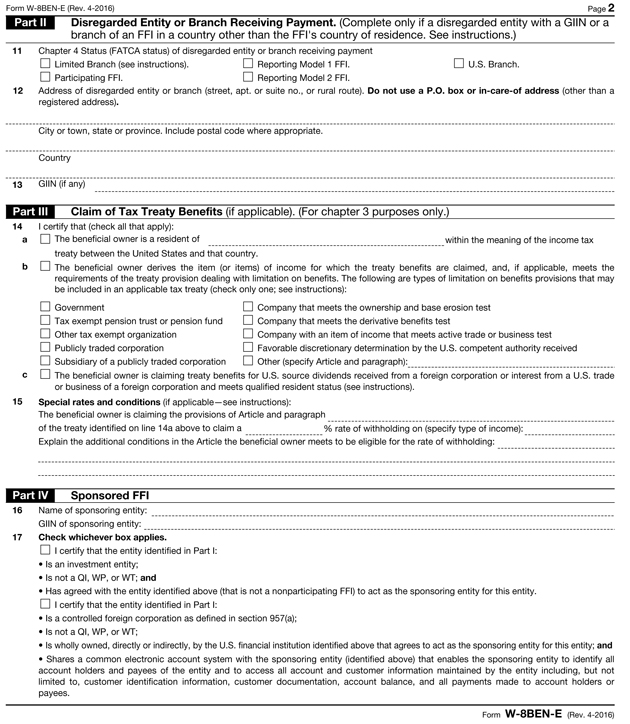

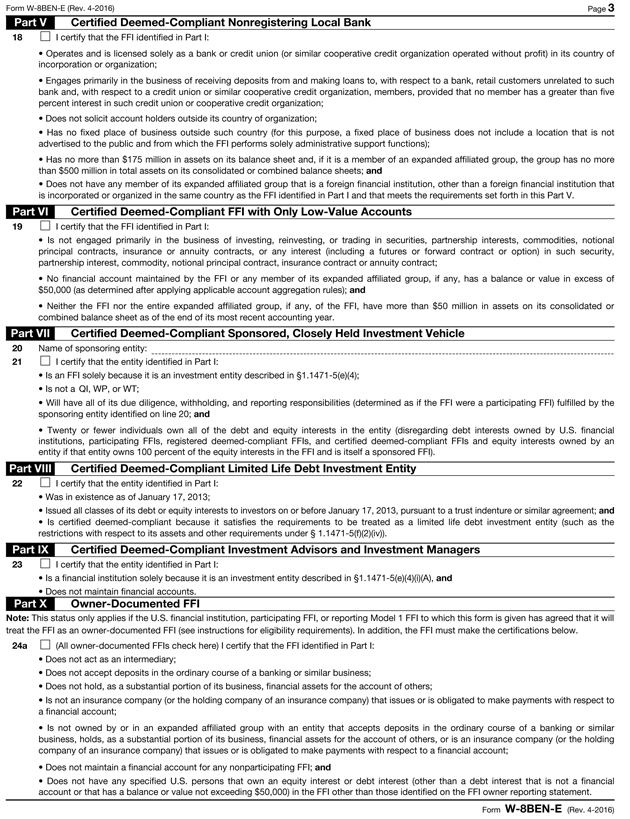

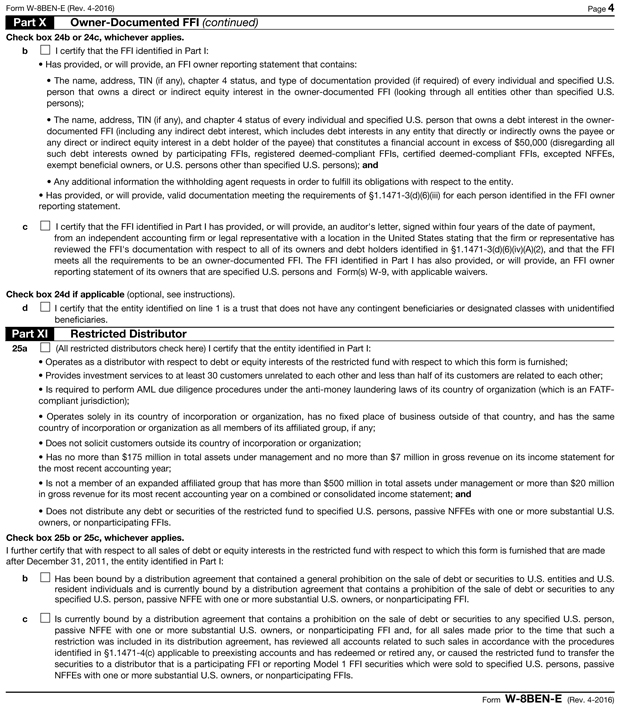

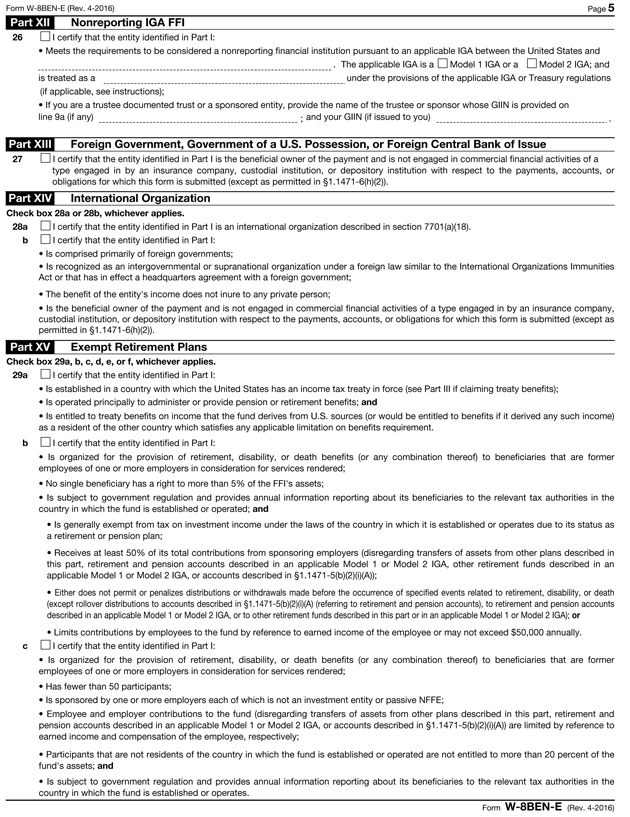

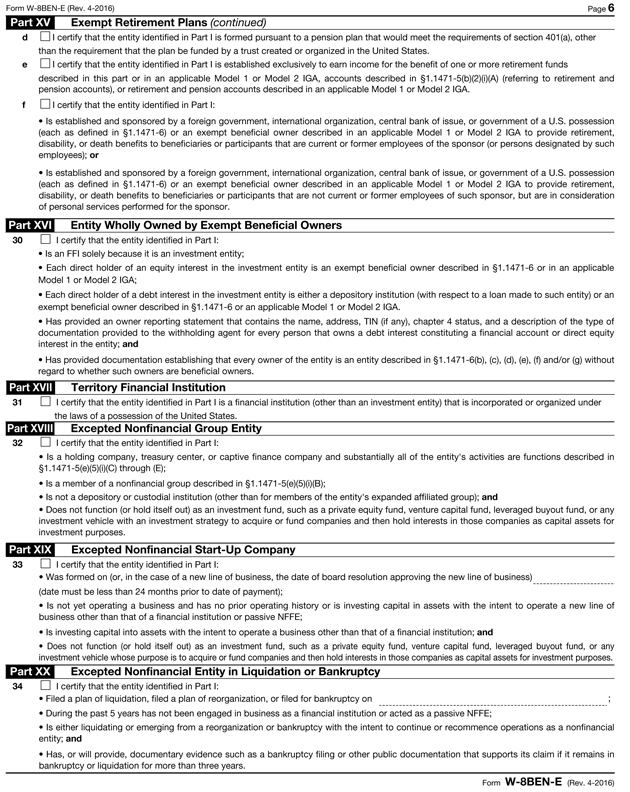

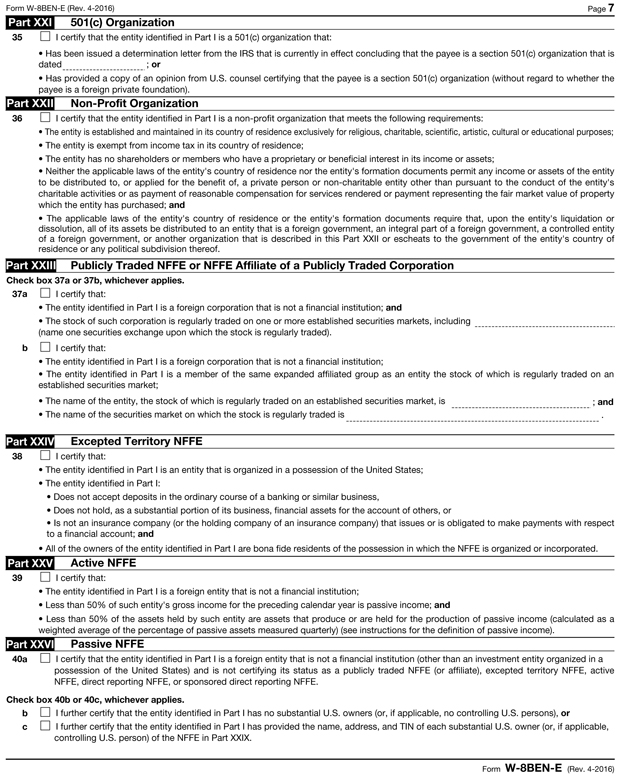

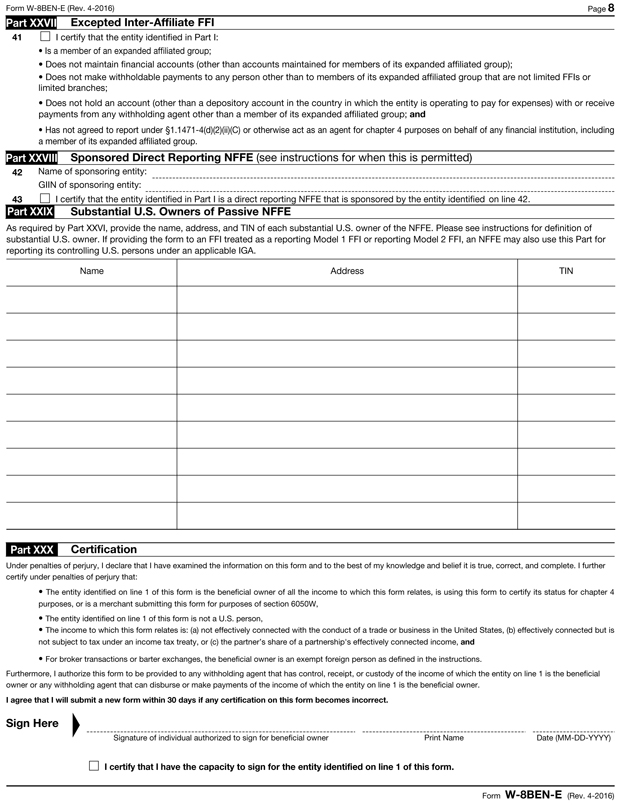

U.S. Federal Backup Withholding Tax. Under the U.S. federal income tax backup withholding rules, 28% of the gross proceeds payable to a holder of Apex or other payee pursuant to the Offer will be withheld and remitted to the U.S. Treasury, unless the holder of the Apex or other payee provides his or her taxpayer identification number (i.e., employer identification number or Social Security number) to the Depositary and certifies under penalties of perjury that such number is correct and that such holder of the Apex or other payee is exempt from backup withholding, or such holder of the Apex or other payee otherwise establishes an exemption from backup withholding. If the Depositary is not provided with the correct taxpayer identification number, the holder of the Apex or other payee may also be subject to certain penalties imposed by the Internal Revenue Service (the “IRS”). Therefore, each tendering U.S. Holder (as defined below in Section 13) should complete and sign the IRS Form W-9 included as part of the Letter of Transmittal so as to provide the information and certification necessary to avoid backup withholding unless the U.S. Holder otherwise establishes to the satisfaction of the Depositary that such tendering U.S. Holder is not subject to backup withholding. Certain holders of the Apex (including, among others, C corporations) are not subject to these backup withholding and reporting requirements. In order for a Non-U.S. Holder (as defined below in Section 13) to qualify as an exempt recipient, such holder of the Apex generally must submit an IRS Form W-8BEN, IRS Form W-8BEN-E (each included as part of the Letter of Transmittal) or other applicable IRS Form W-8, signed under penalties of perjury, attesting to that holder’s non-U.S. status. Tendering holders of the Apex can obtain other applicable forms from the Depositary or from www.irs.gov. See Instruction 8 of the Letter of Transmittal.

-14-

Backup withholding is not an additional tax, and any amounts withheld under the backup withholding rules will be allowed as a refund or a credit against a holder’s U.S. federal income tax liability provided the required information is timely furnished to the IRS.

TO PREVENT U.S. FEDERAL BACKUP WITHHOLDING TAX ON THE GROSS PAYMENTS MADE TO YOU PURSUANT TO THE OFFER, YOU MUST PROVIDE THE DEPOSITARY WITH A COMPLETED IRS FORM W-9 OR IRS FORM W-8, AS APPROPRIATE, OR OTHERWISE ESTABLISH AN EXEMPTION FROM SUCH WITHHOLDING.

Where Apex are tendered on behalf of the holder of the Apex by a broker or other DTC participant, the foregoing IRS Forms and certifications generally must be provided by the holder of the Apex to the DTC participant, instead of the Depositary, in accordance with the DTC participant’s applicable procedures.

For a discussion of certain material U.S. federal income tax consequences for tendering holders of the Apex, see Section 13.

Return of Withdrawn Apex. In the event of proper withdrawal of tendered Apex, the Depositary will credit the Apex to the appropriate account maintained by the tendering holder of Apex at DTC without expense to the holder of the Apex.

Determination of Validity; Rejection of Apex; Waiver of Defects; No Obligation to Give Notice of Defects. We will determine, in our sole discretion, all questions as to the validity, form, eligibility (including time of receipt) and acceptance for purchase of any tender of Apex, and our determination will be final and binding on all parties. We reserve the absolute right to reject any or all tenders of any Apex that we determine are not in proper form or the acceptance for purchase of or payment for which we determine may be unlawful. We also reserve the absolute right to waive any defect or irregularity in any tender with respect to any particular Apex or any particular holder of Apex, and our interpretation of the terms of the Offer will be final and binding on all parties. No tender of Apex will be deemed to have been properly made until the holder of the Apex cures, or we waive, all defects or irregularities. None of Goldman Sachs, the Dealer Manager, the Depositary, the Information Agent or any other person will be under any duty to give notification of any defects or irregularities in any tender or incur any liability for failure to give this notification.

Tendering Holder’s Representation and Warranty; Goldman Sachs’ Acceptance Constitutes an Agreement. A tender of Apex under the procedures described above will constitute the tendering holder’s acceptance of the terms and conditions of the Offer, as well as the tendering holder’s representation and warranty to us that (i) such holder of Apex has the full power and authority to tender, sell, assign and transfer the tendered Apex and (ii) when we accept the tendered Apex for purchase, we will acquire good and unencumbered title thereto, free and clear of all liens, restrictions, changes and encumbrances and not subject to any adverse claims.

Our acceptance for purchase of Apex tendered under the Offer will constitute a binding agreement between the tendering holder of Apex and us upon the terms and conditions of the Offer.

Section 4 Withdrawal Rights.