Form SC TO-C MEDIVATION, INC. Filed by: PFIZER INC

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Tender Offer Statement Pursuant to Section 14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

MEDIVATION, INC.

(Name of Subject Company)

MONTREAL, INC.

(Offeror)

PFIZER INC.

(Parent of Offeror)

(Names of Filing Persons)

Common stock, par value $0.01 per share

(Title of Class of Securities)

58501N101

(Cusip Number of Class of Securities)

Margaret M. Madden

Pfizer Inc.

235 East 42nd Street

New York, New York 10017

(212) 733-2323

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of Filing Persons)

With a copy to:

Christopher Comeau

Paul Kinsella

Ropes & Gray LLP

Prudential Tower

800 Boylston Street

Boston, MA 02199-3600

(617) 951-7000

CALCULATION OF FILING FEE

| Transaction Valuation* | Amount of Filing Fee** | |

| N/A* | N/A* | |

| * | A filing fee is not required in connection with this filing as it relates solely to preliminary communications made before the commencement of the tender offer. |

| ¨ | Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| Amount Previously Paid: n/a | Filing Party: n/a | |

| Form of Registration No.: n/a | Date Filed: n/a |

| x | Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to which the statement relates:

| x | Third-party tender offer subject to Rule 14d-1. |

| ¨ | Issuer tender offer subject to Rule 13e-4. |

| ¨ | Going-private transaction subject to Rule 13e-3. |

| ¨ | Amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment reporting the results of the tender offer. ¨

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

| ¨ | Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| ¨ | Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

This filing relates solely to preliminary communications made before the commencement of a tender offer by Montreal, Inc., a Delaware corporation (“Purchaser”) and a wholly-owned subsidiary of Pfizer Inc., a Delaware corporation (“Pfizer”), to acquire all of the outstanding shares of common stock of Medivation, Inc., a Delaware corporation (“Medivation”), at a price of $81.50 per share, net to the seller in cash, without interest, subject to any required withholding of taxes, pursuant to an Agreement and Plan of Merger, dated as of August 20, 2016, by and among Purchaser, Pfizer and Medivation.

Forward-Looking Statements

This document contains forward-looking information related to Pfizer, Medivation and the proposed acquisition of Medivation by Pfizer that involves substantial risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Forward-looking statements in this document include, among other things, statements about the potential benefits of the proposed acquisition, anticipated earnings accretion and growth rates, Pfizer’s and Medivation’s plans, objectives, expectations and intentions, the financial condition, results of operations and business of Pfizer and Medivation, XTANDI and Medivation’s other pipeline assets, IBRANCE (palbociclib), and the anticipated timing of closing of the acquisition. Risks and uncertainties include, among other things, risks related to the satisfaction of the conditions to closing the acquisition (including the failure to obtain necessary regulatory approvals) in the anticipated timeframe or at all, including uncertainties as to how many of Medivation’s stockholders will tender their shares in the tender offer and the possibility that the acquisition does not close; risks related to the ability to realize the anticipated benefits of the acquisition, including the possibility that the expected benefits from the proposed acquisition will not be realized or will not be realized within the expected time period; the risk that the businesses will not be integrated successfully; disruption from the transaction making it more difficult to maintain business and operational relationships; negative effects of this announcement or the consummation of the proposed acquisition on the market price of Pfizer’s common stock and on Pfizer’s operating results; significant transaction costs; unknown liabilities; the risk of litigation and/or regulatory actions related to the proposed acquisition; other business effects, including the effects of industry, market, economic, political or regulatory conditions; future exchange and interest rates; changes in tax and other laws, regulations, rates and policies; future business combinations or disposals; the uncertainties inherent in research and development, including the ability to sustain and increase the rate of growth in revenues for XTANDI despite increasing competitive, reimbursement and economic challenges; Medivation’s dependence on the efforts and funding by Astellas Pharma Inc. for the development, manufacturing and commercialization of XTANDI; the ability to meet anticipated trial commencement and completion dates and regulatory submission dates, as well as the possibility of unfavorable clinical trial results, including unfavorable new clinical data and additional analyses of existing clinical data; whether and when any drug applications may be filed in any jurisdictions for any additional indications for IBRANCE, XTANDI or for Medivation’s other pipeline assets; whether and when regulatory authorities may approve any such applications, which will depend on its assessment of the benefit-risk profile suggested by the totality of the efficacy and safety information submitted; decisions by regulatory authorities regarding labeling and other matters that could affect the availability or commercial potential of IBRANCE, XTANDI and Medivation’s other pipeline assets; and competitive developments.

A further description of risks and uncertainties relating to Pfizer and Medivation can be found in their respective Annual Reports on Form 10-K for the fiscal year ended December 31, 2015 and in their subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, all of which are filed with the U.S. Securities and Exchange Commission (the “SEC”) and available at www.sec.gov. Pfizer does not assume any obligation to update forward-looking statements contained in this document as the result of new information or future events or developments.

Additional Information and Where to Find It

The tender offer referenced in this document has not yet commenced. This announcement is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell securities, nor is it a substitute for the tender offer materials that Pfizer and Purchaser will file with the SEC. The solicitation and offer to buy Medivation stock will only be made pursuant to an Offer to Purchase and related tender offer materials. At the time the tender offer is commenced, Pfizer and its acquisition subsidiary will file a tender offer statement on Schedule TO and thereafter Medivation will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the tender offer. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 WILL CONTAIN IMPORTANT INFORMATION. MEDIVATION STOCKHOLDERS ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT HOLDERS OF MEDIVATION SECURITIES SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SECURITIES. The Offer to Purchase, the related Letter of Transmittal and certain other tender offer documents, as well as the Solicitation/Recommendation Statement, will be made available to all holders of Medivation stock at no expense to them. The tender offer materials and the Solicitation/Recommendation Statement will be made available for free at the SEC’s website at www.sec.gov. Additional copies may be obtained for free by contacting Pfizer or Medivation. Copies of the documents filed with the SEC by Medivation will be available free of charge on Medivation’s internet website at http://www.medivation.com or by contacting Medivation ’s Investor Relations Department at (650) 218-6900. Copies of the documents filed with the SEC by Pfizer will be available free of charge on Pfizer’s internet website at http://www.pfizer.com or by contacting Pfizer’s Investor Relations Department at (212) 733-2323.

In addition to the Offer to Purchase, the related Letter of Transmittal and certain other tender offer documents, as well as the Solicitation/Recommendation Statement, Pfizer and Medivation each file annual, quarterly and current reports and other information with the SEC. You may read and copy any reports or other information filed by Pfizer or Medivation at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. Pfizer’s and Medivation’s filings with the SEC are also available to the public from commercial document-retrieval reference room. Pfizer’s and Medivation’s filings with the SEC are also available to the public from commercial document-retrieval services and at the website maintained by the SEC at http://www.sec.gov.

EXHIBIT INDEX

| Exhibit No. |

Description | |

| 99.1 | Copy of Pfizer Presentation for Investor/Analyst Conference Call, dated August 22, 2016 | |

| 99.2 | Tweet from August 22, 2016 by Pfizer Inc. (@Pfizer) | |

| 99.3 | Tweet from August 22, 2016 by Pfizer Inc. (@Pfizer_news) | |

Acquisition of Medivation August 22, 2016 Exhibit 99.1

Forward-Looking Statements and Non-GAAP Financial Information Our discussions during this conference call will include forward-looking statements about, among other things, Pfizer, Medivation and Pfizer’s planned acquisition of Medivation, including its potential benefits, anticipated earnings accretion and growth rates, Pfizer’s and Medivation’s plans, objectives, expectations and intentions, the financial condition, results of operations and business of Pfizer and Medivation, Ibrance, Xtandi and Medivation’s other pipeline assets, and the anticipated timing of closing of the acquisition, that are subject to substantial risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Additional information regarding these factors can be found in the press release dated August 22, 2016 announcing the planned acquisition, Pfizer’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015 and in our subsequent reports on Form 10-Q, including in the sections thereof captioned “Risk Factors” and “Forward-Looking Information and Factors That May Affect Future Results”, as well as in our subsequent reports on Form 8-K, all of which are filed with the U.S. Securities and Exchange Commission (“the SEC”) and available at www.sec.gov and www.pfizer.com. The forward-looking statements in this presentation speak only as of the original date of this presentation and we undertake no obligation to update or revise any of these statements. Also, the discussions during this conference call may include certain financial measures that were not prepared in accordance with U.S. generally accepted accounting principles (GAAP). Any non-U.S. GAAP financial measures presented should not be viewed as substitutes for financial measures required by U.S. GAAP, have no standardized meaning prescribed by U.S. GAAP and may not be comparable to the calculation of similar measures of other companies Pfizer calculates projections regarding the expected accretive impact of the potential acquisition based on internal forecasts of its Adjusted Diluted Earnings Per Share (Adjusted Diluted EPS), which forecasts are non-GAAP financial measures derived by excluding certain amounts that would be included in GAAP calculations. These accretion projections should not be considered a substitute for GAAP measures. The determinations of the amounts that are excluded from the accretion calculations are a matter of management judgment and depend upon, among other factors, the nature of the underlying expense or income amounts. Pfizer is unable to present quantitative reconciliations because management cannot reasonably predict with sufficient reliability all of the necessary components of the comparable GAAP measure. Pfizer has excluded from the accretion calculations the impact of purchase accounting adjustments, acquisition-related costs, discontinued operations and certain significant items. Such items can have a substantial impact on GAAP measures of financial performance. For more information on the Adjusted Diluted EPS measure see Pfizer’s 2015 Financial Report, which was filed as exhibit 13 to Pfizer’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015 and Pfizer’s Quarterly Report on Form 10-Q for the quarterly period ended July 3, 2016.

Important Information About the Tender Offer The tender offer referenced in this communication has not yet commenced. This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell securities, nor is it a substitute for the tender offer materials that Pfizer and its acquisition subsidiary will file with the SEC. The solicitation and offer to buy Medivation stock will only be made pursuant to an Offer to Purchase and related tender offer materials. At the time the tender offer is commenced, Pfizer and its acquisition subsidiary will file a tender offer statement on Schedule TO and thereafter Medivation will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the tender offer. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 WILL CONTAIN IMPORTANT INFORMATION. MEDIVATION STOCKHOLDERS ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT HOLDERS OF MEDIVATION SECURITIES SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SECURITIES. The Offer to Purchase, the related Letter of Transmittal and certain other tender offer documents, as well as the Solicitation/Recommendation Statement, will be made available to all holders of Medivation stock at no expense to them. The tender offer materials and the Solicitation/Recommendation Statement will be made available for free at the SEC's website at www.sec.gov. Additional copies may be obtained for free by contacting Pfizer or Medivation. Copies of the documents filed with the SEC by Medivation will be available free of charge on Medivation’s internet website at http://www.Medivation.com or by contacting Medivation’s Investor Relations Department at (650) 218-6900. Copies of the documents filed with the SEC by Pfizer will be available free of charge on Pfizer’s internet website at http://www.pfizer.com or by contacting Pfizer’s Investor Relations Department at (212) 733-2323. In addition to the Offer to Purchase, the related Letter of Transmittal and certain other tender offer documents, as well as the Solicitation/Recommendation Statement, Pfizer and Medivation each file annual, quarterly and current reports and other information with the SEC. You may read and copy any reports or other information filed by Pfizer or Medivation at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. Pfizer’s and Medivation’s filings with the SEC are also available to the public from commercial document-retrieval services and at the website maintained by the SEC at http://www.sec.gov.

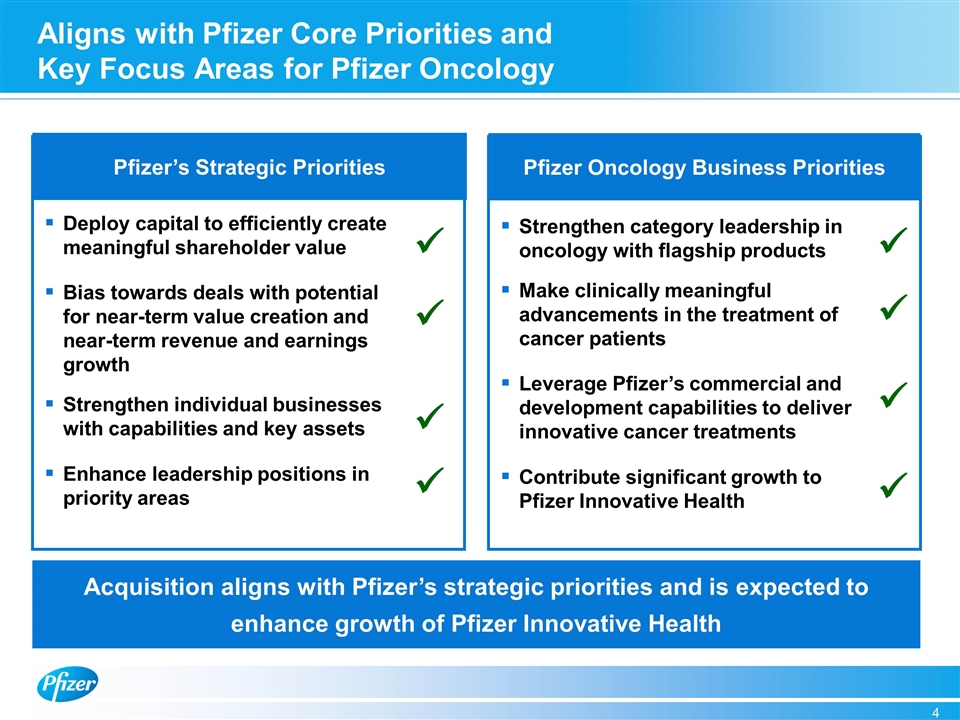

Aligns with Pfizer Core Priorities and Key Focus Areas for Pfizer Oncology Pfizer Oncology Business Priorities Pfizer’s Strategic Priorities Deploy capital to efficiently create meaningful shareholder value Bias towards deals with potential for near-term value creation and near-term revenue and earnings growth Strengthen individual businesses with capabilities and key assets Enhance leadership positions in priority areas ü ü ü ü Acquisition aligns with Pfizer’s strategic priorities and is expected to enhance growth of Pfizer Innovative Health Strengthen category leadership in oncology with flagship products Make clinically meaningful advancements in the treatment of cancer patients Leverage Pfizer’s commercial and development capabilities to deliver innovative cancer treatments Contribute significant growth to Pfizer Innovative Health ü ü ü ü

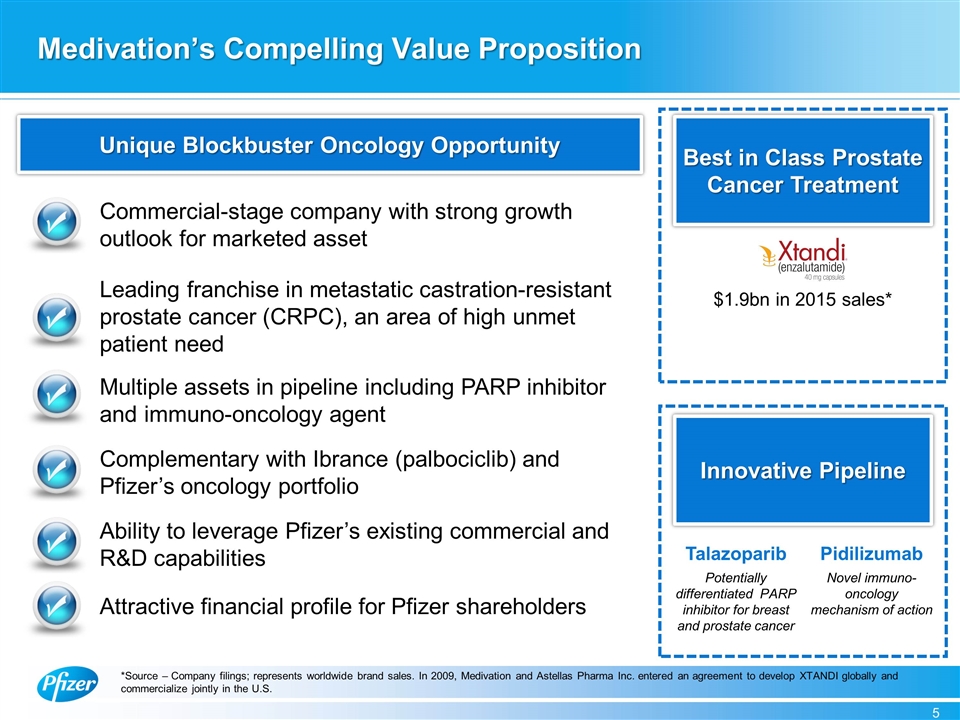

Best in Class Prostate Cancer Treatment Innovative Pipeline Medivation’s Compelling Value Proposition Commercial-stage company with strong growth outlook for marketed asset Multiple assets in pipeline including PARP inhibitor and immuno-oncology agent Complementary with Ibrance (palbociclib) and Pfizer’s oncology portfolio Ability to leverage Pfizer’s existing commercial and R&D capabilities $1.9bn in 2015 sales* Potentially differentiated PARP inhibitor for breast and prostate cancer Talazoparib *Source – Company filings; represents worldwide brand sales. In 2009, Medivation and Astellas Pharma Inc. entered an agreement to develop XTANDI globally and commercialize jointly in the U.S. Unique Blockbuster Oncology Opportunity Pidilizumab Novel immuno-oncology mechanism of action Leading franchise in metastatic castration-resistant prostate cancer (CRPC), an area of high unmet patient need Attractive financial profile for Pfizer shareholders

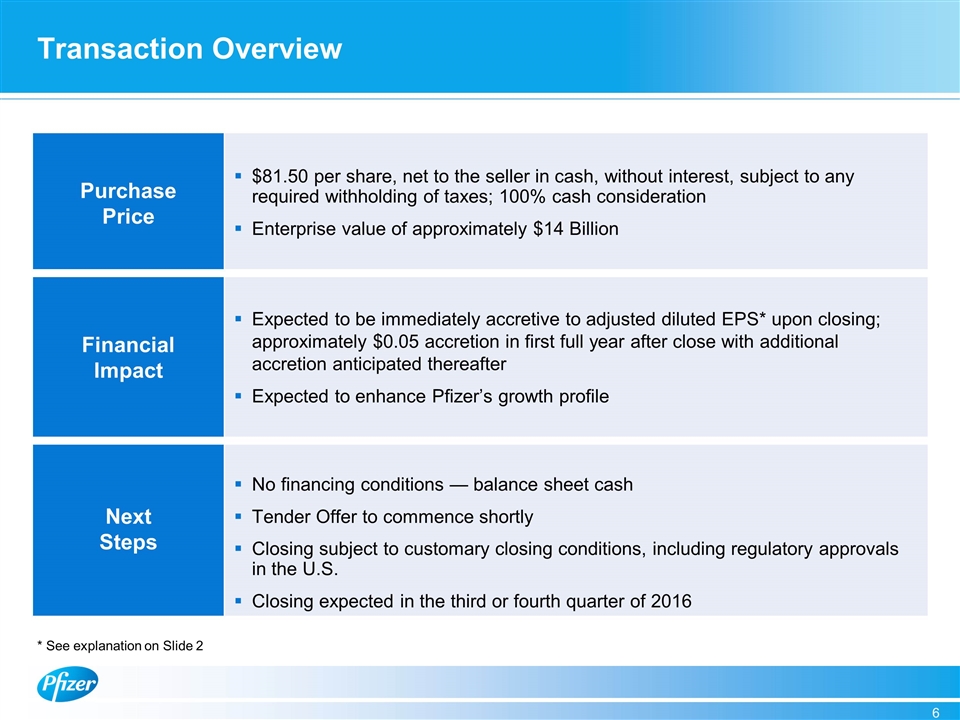

Transaction Overview Purchase Price $81.50 per share, net to the seller in cash, without interest, subject to any required withholding of taxes; 100% cash consideration Enterprise value of approximately $14 Billion Financial Impact Expected to be immediately accretive to adjusted diluted EPS* upon closing; approximately $0.05 accretion in first full year after close with additional accretion anticipated thereafter Expected to enhance Pfizer’s growth profile Next Steps No financing conditions — balance sheet cash Tender Offer to commence shortly Closing subject to customary closing conditions, including regulatory approvals in the U.S. Closing expected in the third or fourth quarter of 2016 * See explanation on Slide 2

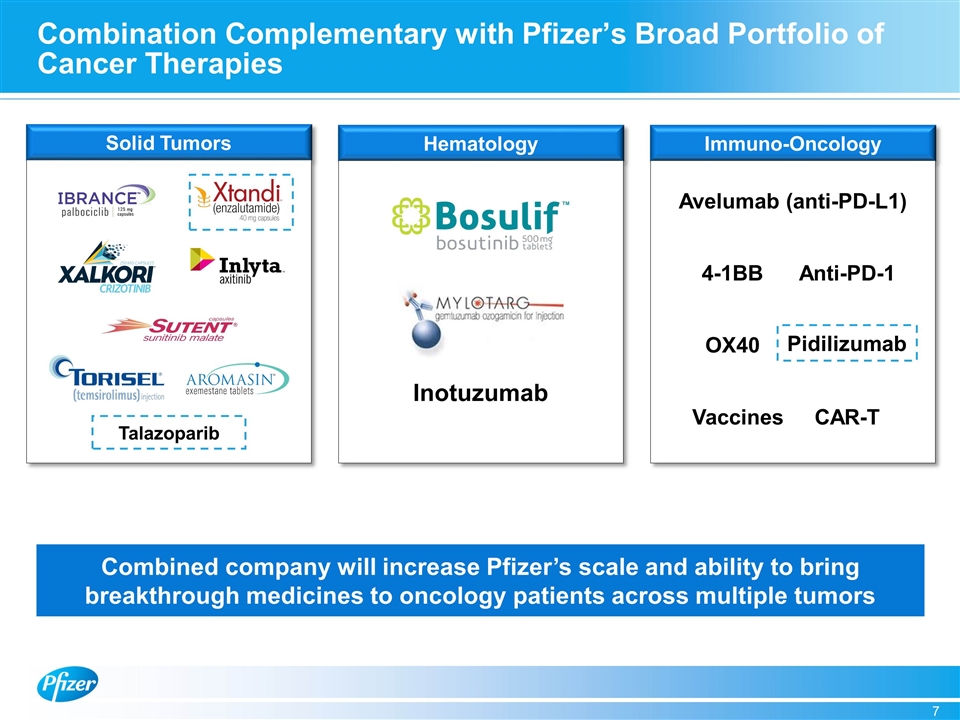

Combination Complementary with Pfizer’s Broad Portfolio of Cancer Therapies Hematology Immuno-Oncology Solid Tumors Combined company will increase Pfizer’s scale and ability to bring breakthrough medicines to oncology patients across multiple tumors Inotuzumab Talazoparib Pidilizumab Avelumab (anti-PD-L1) Anti-PD-1 4-1BB OX40 CAR-T Vaccines

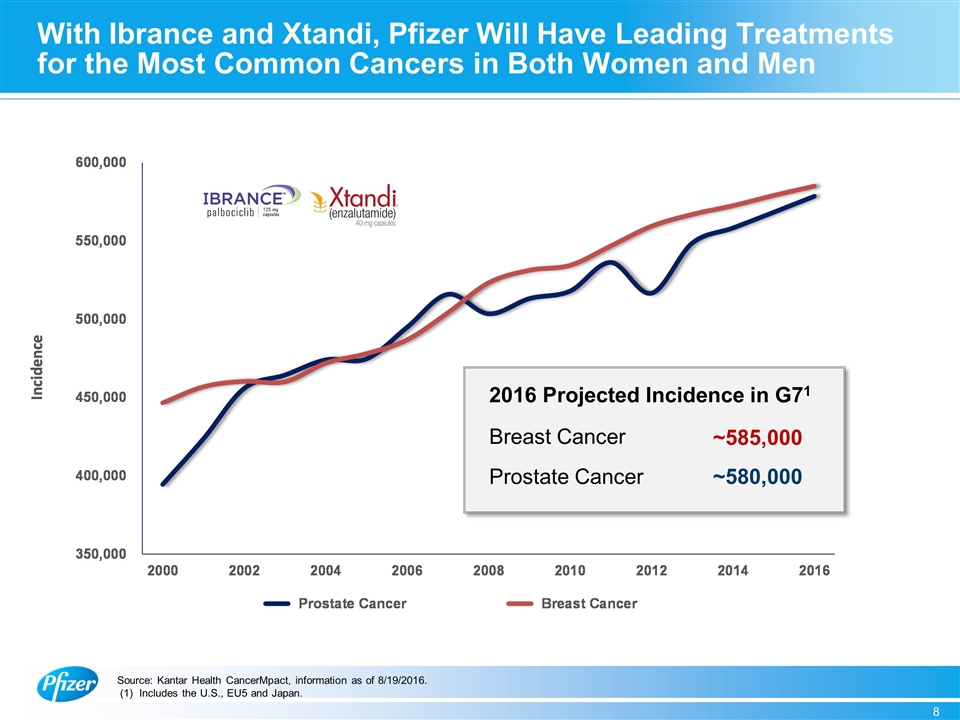

With Ibrance and Xtandi, Pfizer Will Have Leading Treatments for the Most Common Cancers in Both Women and Men 2016 Projected Incidence in G71 Breast Cancer Prostate Cancer ~580,000 ~585,000 Source: Kantar Health CancerMpact, information as of 8/19/2016. (1) Includes the U.S., EU5 and Japan.

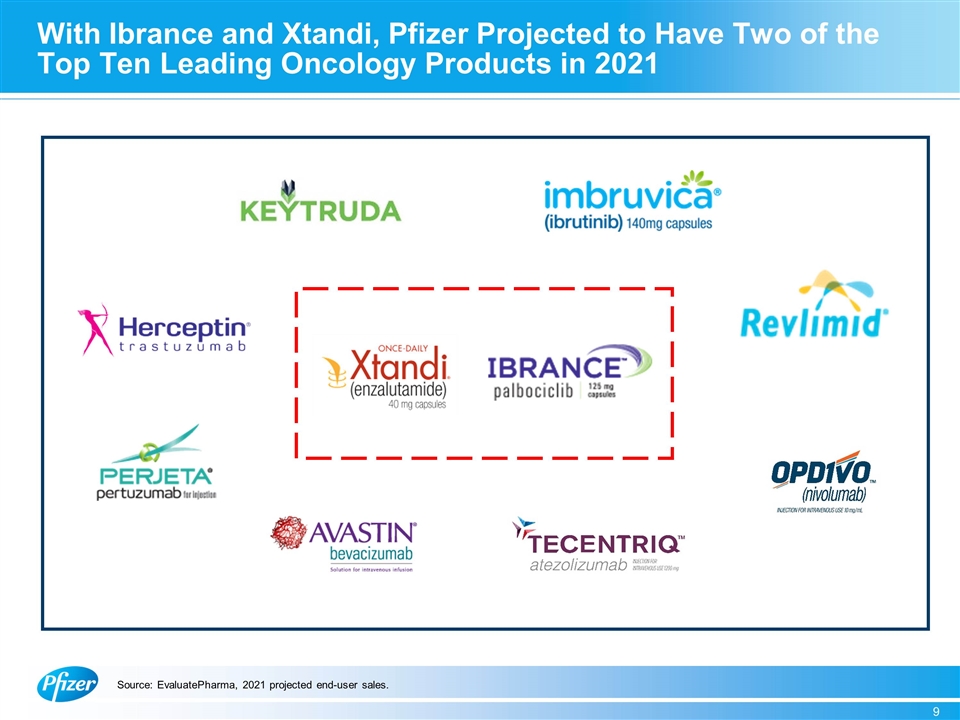

With Ibrance and Xtandi, Pfizer Projected to Have Two of the Top Ten Leading Oncology Products in 2021 Source: EvaluatePharma, 2021 projected end-user sales.

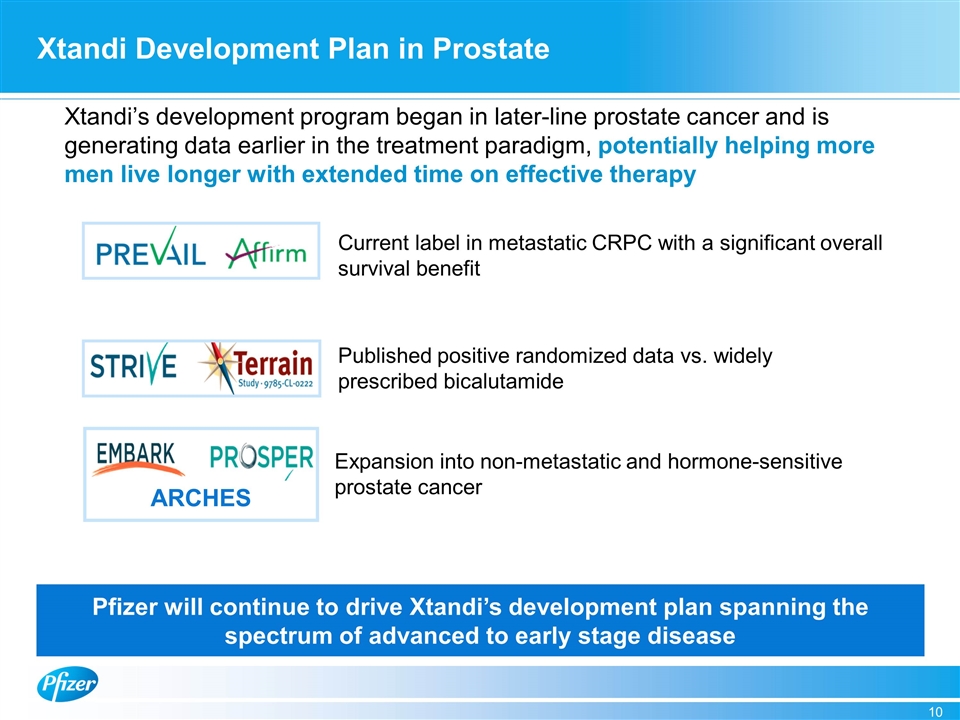

Xtandi Development Plan in Prostate ARCHES Xtandi’s development program began in later-line prostate cancer and is generating data earlier in the treatment paradigm, potentially helping more men live longer with extended time on effective therapy Current label in metastatic CRPC with a significant overall survival benefit Published positive randomized data vs. widely prescribed bicalutamide Expansion into non-metastatic and hormone-sensitive prostate cancer Pfizer will continue to drive Xtandi’s development plan spanning the spectrum of advanced to early stage disease

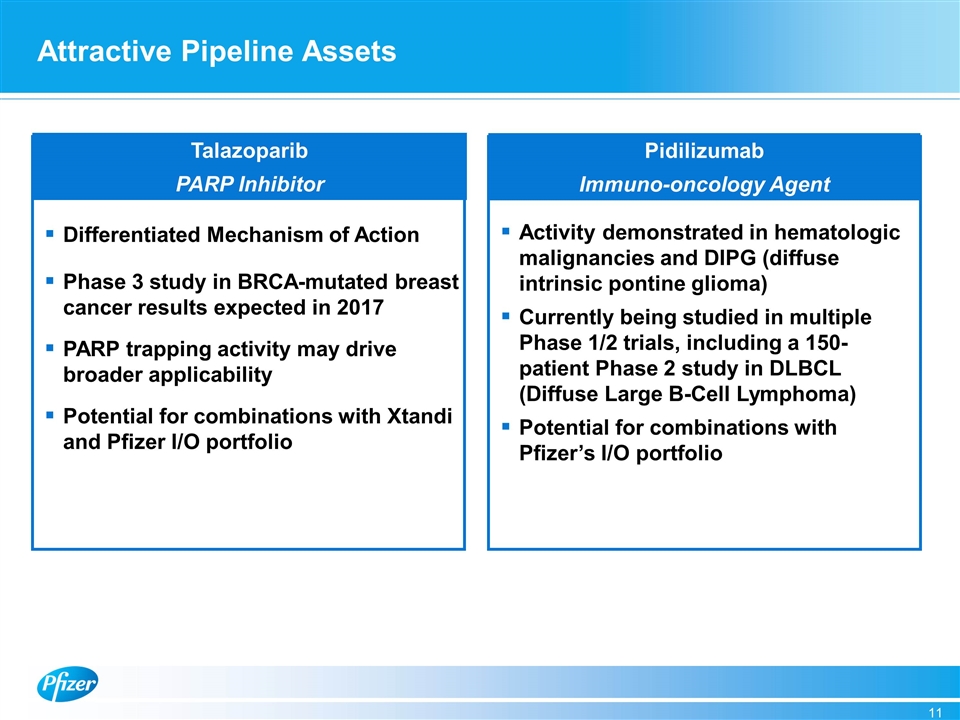

Attractive Pipeline Assets Pidilizumab Immuno-oncology Agent Talazoparib PARP Inhibitor Differentiated Mechanism of Action Phase 3 study in BRCA-mutated breast cancer results expected in 2017 PARP trapping activity may drive broader applicability Potential for combinations with Xtandi and Pfizer I/O portfolio Activity demonstrated in hematologic malignancies and DIPG (diffuse intrinsic pontine glioma) Currently being studied in multiple Phase 1/2 trials, including a 150-patient Phase 2 study in DLBCL (Diffuse Large B-Cell Lymphoma) Potential for combinations with Pfizer’s I/O portfolio

Key Takeaways Consistent with Pfizer strategy to add attractive assets with near-term revenue Xtandi is a blockbuster oncology asset in metastatic CRPC, an area of high unmet need Leading prostate franchise complements Ibrance and Pfizer’s immuno-oncology portfolio and adds commercial scale Talazoparib and pidilizumab have potential to drive further growth Expected to improve Pfizer’s overall revenue growth rate and accordingly have a greater impact on Pfizer’s Innovative business Expected to be immediately accretive and to create compelling shareholder value Creating shareholder value through disciplined capital deployment

Exhibit 99.2

Pfizer Tweets (@Pfizer), August 22, 2016

Pfizer To Acquire Medivation http://www.pfizer.com/news/press-release/press-release-detail/pfizer_to_acquire_medivation

Exhibit 99.3

Pfizer Tweets (@Pfizer_news), August 22, 2016

Pfizer To Acquire Medivation on.pfizer.com/2bIk7y4

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- PharmaEssentia Appoints Robert Geller, M.D. as Head of Medical and Shawn Gibbs, J.D. as Head of Legal

- NowVertical Group Announces Amendment to Acrotrend Obligations

- Maryland CareerQuest Connects Area Students with Training and Education Opportunities for Hands-On Careers

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share