Form SC 13D/A CASELLA WASTE SYSTEMS Filed by: JCP Investment Management, LLC

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

§ 240.13d-2(a)

(Amendment No. 2)1

Casella Waste Systems, Inc.

(Name of Issuer)

Class A Common Stock, $0.01 par value per share

(Title of Class of Securities)

147448104

(CUSIP Number)

JAMES C. PAPPAS

JCP INVESTMENT MANAGEMENT, LLC

1177 West Loop South, Suite 1650

Houston, TX 77027

(713) 333-5540

OLSHAN FROME WOLOSKY LLP

Park Avenue Tower

65 East 55th Street

New York, New York 10022

(212) 451-2300

Authorized to Receive Notices and Communications)

September 10, 2015

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ¨.

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See § 240.13d-7 for other parties to whom copies are to be sent.

_______________

1 The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP NO. 147448104

|

1

|

NAME OF REPORTING PERSON

JCP Investment Partnership, LP

|

||

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) x

(b) o

|

|

|

3

|

SEC USE ONLY

|

||

|

4

|

SOURCE OF FUNDS

WC

|

||

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

¨

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

TEXAS

|

||

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

1,571,819

|

|

|

8

|

SHARED VOTING POWER

- 0 -

|

||

|

9

|

SOLE DISPOSITIVE POWER

1,571,819

|

||

|

10

|

SHARED DISPOSITIVE POWER

- 0 -

|

||

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,571,819*

|

||

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

o

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

3.9%

|

||

|

14

|

TYPE OF REPORTING PERSON

PN

|

||

* Includes 12,500 Shares underlying call options exercisable within sixty (60) days hereof.

2

CUSIP NO. 147448104

|

1

|

NAME OF REPORTING PERSON

JCP Single-Asset Partnership, LP

|

||

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) x

(b) o

|

|

|

3

|

SEC USE ONLY

|

||

|

4

|

SOURCE OF FUNDS

WC

|

||

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

¨

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

TEXAS

|

||

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

714,851

|

|

|

8

|

SHARED VOTING POWER

- 0 -

|

||

|

9

|

SOLE DISPOSITIVE POWER

714,851

|

||

|

10

|

SHARED DISPOSITIVE POWER

- 0 -

|

||

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

714,851*

|

||

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

o

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.8%

|

||

|

14

|

TYPE OF REPORTING PERSON

PN

|

||

* Includes 12,500 Shares underlying call options exercisable within sixty (60) days hereof.

3

CUSIP NO. 147448104

|

1

|

NAME OF REPORTING PERSON

JCP Investment Partners, LP

|

||

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) x

(b) o

|

|

|

3

|

SEC USE ONLY

|

||

|

4

|

SOURCE OF FUNDS

AF

|

||

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

¨

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

TEXAS

|

||

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

2,286,670

|

|

|

8

|

SHARED VOTING POWER

- 0 -

|

||

|

9

|

SOLE DISPOSITIVE POWER

2,286,670

|

||

|

10

|

SHARED DISPOSITIVE POWER

- 0 -

|

||

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,286,670*

|

||

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

o

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.7%

|

||

|

14

|

TYPE OF REPORTING PERSON

PN

|

||

* Includes 25,000 Shares underlying call options exercisable within sixty (60) days hereof.

4

CUSIP NO. 147448104

|

1

|

NAME OF REPORTING PERSON

JCP Investment Holdings, LLC

|

||

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) x

(b) o

|

|

|

3

|

SEC USE ONLY

|

||

|

4

|

SOURCE OF FUNDS

AF

|

||

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

¨

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

TEXAS

|

||

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

2,286,670

|

|

|

8

|

SHARED VOTING POWER

- 0 -

|

||

|

9

|

SOLE DISPOSITIVE POWER

2,286,670

|

||

|

10

|

SHARED DISPOSITIVE POWER

- 0 -

|

||

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,286,670*

|

||

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

o

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.7%

|

||

|

14

|

TYPE OF REPORTING PERSON

OO

|

||

* Includes 25,000 Shares underlying call options exercisable within sixty (60) days hereof.

5

CUSIP NO. 147448104

|

1

|

NAME OF REPORTING PERSON

JCP Investment Management, LLC

|

||

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) x

(b) o

|

|

|

3

|

SEC USE ONLY

|

||

|

4

|

SOURCE OF FUNDS

AF

|

||

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

¨

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

TEXAS

|

||

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

2,286,670

|

|

|

8

|

SHARED VOTING POWER

- 0 -

|

||

|

9

|

SOLE DISPOSITIVE POWER

2,286,670

|

||

|

10

|

SHARED DISPOSITIVE POWER

- 0 -

|

||

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,286,670*

|

||

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

o

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.7%

|

||

|

14

|

TYPE OF REPORTING PERSON

OO

|

||

* Includes 25,000 Shares underlying call options exercisable within sixty (60) days hereof.

6

CUSIP NO. 147448104

|

1

|

NAME OF REPORTING PERSON

James C. Pappas

|

||

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) x

(b) o

|

|

|

3

|

SEC USE ONLY

|

||

|

4

|

SOURCE OF FUNDS

AF

|

||

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

¨

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

USA

|

||

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

2,286,670

|

|

|

8

|

SHARED VOTING POWER

- 0 -

|

||

|

9

|

SOLE DISPOSITIVE POWER

2,286,670

|

||

|

10

|

SHARED DISPOSITIVE POWER

- 0 -

|

||

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,286,670*

|

||

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

o

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.7%

|

||

|

14

|

TYPE OF REPORTING PERSON

IN

|

||

* Includes 25,000 Shares underlying call options exercisable within sixty (60) days hereof.

7

CUSIP NO. 147448104

|

1

|

NAME OF REPORTING PERSON

Brett W. Frazier

|

||

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) x

(b) o

|

|

|

3

|

SEC USE ONLY

|

||

|

4

|

SOURCE OF FUNDS

PF

|

||

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

¨

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

USA

|

||

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

40,000

|

|

|

8

|

SHARED VOTING POWER

- 0 -

|

||

|

9

|

SOLE DISPOSITIVE POWER

40,000

|

||

|

10

|

SHARED DISPOSITIVE POWER

- 0 -

|

||

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

40,000

|

||

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

o

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

Less than 1%

|

||

|

14

|

TYPE OF REPORTING PERSON

IN

|

||

8

CUSIP NO. 147448104

The following constitutes Amendment No. 2 to the Schedule 13D filed by the undersigned (“Amendment No. 2”). This Amendment No. 2 amends the Schedule 13D filed on April 28, 2015, as amended by Amendment No. 1 (the “Schedule No. 1 Amendment”) thereto filed on May 29, 2015, as specifically set forth herein.

|

Item 3.

|

Source and Amount of Funds or Other Consideration.

|

Item 3 is hereby amended and restated to read as follows:

The Shares purchased by JCP Partnership and JCP Single-Asset were purchased with working capital (which may, at any given time, include margin loans made by brokerage firms in the ordinary course of business) in open market purchases, except as otherwise noted. The aggregate purchase price of the 1,559,319 Shares owned directly by JCP Partnership is approximately $7,848,960, excluding brokerage commissions. The aggregate purchase price of certain call options exercisable into 12,500 Shares beneficially owned by JCP Partnership, as further described in Item 6 below, is approximately $12,500, excluding brokerage commissions. The aggregate purchase price of the 702,351 Shares owned directly by JCP Single-Asset is approximately $3,953,620, excluding brokerage commissions. The aggregate purchase price of certain call options exercisable into 12,500 Shares beneficially owned by JCP Single-Asset, as further described in Item 6 below, is approximately $12,500, excluding brokerage commissions.

The Shares purchased by Mr. Frazier were purchased in the open market with personal funds. The aggregate purchase price of the 40,000 Shares owned directly by Mr. Frazier is approximately $230,000, excluding brokerage commissions.

|

Item 4.

|

Purpose of Transaction.

|

Item 4 is hereby amended to add the following:

On September 10, 2015, JCP Management (together with its affiliates, “JCP”) issued an open letter to the Issuer’s Board of Directors (the “Board”), a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference. In the letter, JCP stated that it was a long-term shareholder of Casella Waste Systems, Inc. (the “Issuer”) and that for the last five (5) months, JCP had attempted to communicate constructively with the Board regarding the Issuer’s poor operational and financial performance, archaic corporate governance, and capital structure that undermine the rights of public shareholders, while giving disproportionate voting power to the Issuer’s Chairman and CEO, John Casella, and his brother, the Issuer’s Vice Chairman, Doug Casella. In the letter, JCP also expressed its profound disappointment with the outcome of its engagement with the Issuer and the Board’s apparent failure to protect and enhance shareholder value. JCP also expressed its belief that the problematic status quo and troubling underperformance at the Issuer are largely results of a failure of the Board and that new leadership is not only warranted, but long overdue.

To that end, JCP expects to file preliminary proxy materials on, or near, September 10, 2015, with the Securities and Exchange Commission in connection with JCP’s efforts to solicit support to the election of its highly-qualified nominees, James C. Pappas and Brett W. Frazier, at the Issuer’s 2015 Annual Meeting of Stockholders. JCP further stated in its letter that despite the Issuer’s dismal operating performance and leadership, concerning related-party transactions and lack of accountability of both the Board and CEO, JCP remains confident that under the right leadership, realignment of interests and proper structuring of corporate governance, the Issuer can deliver substantial value for all of its stakeholders.

Also on September 10, 2015, JCP issued a detailed presentation entitled Casella: Long Term Performance Review (the “Presentation”), which outlines how the considerable intrinsic value existing within the Issuer has been, and continues to be, depressed by the substantial underperformance and poor decision making of the Board and CEO. A copy of the Presentation is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

9

CUSIP NO. 147448104

|

Item 5.

|

Interest in Securities of the Issuer.

|

Items 5(a) – (c) are hereby amended and restated to read as follows:

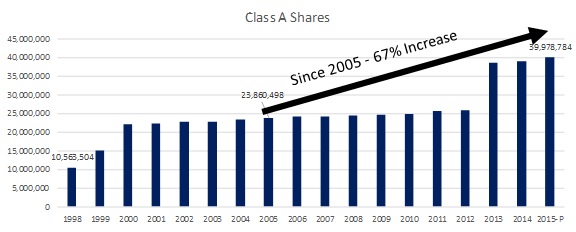

The aggregate percentage of Shares reported owned by each person named herein is based upon 39,978,784 Shares outstanding as of September 1, 2015, which is the total number of Shares outstanding as reported in the Issuer’s Preliminary Proxy Statement on Schedule 14A, filed with the Securities and Exchange Commission on September 4, 2015.

|

A.

|

JCP Partnership

|

|

|

(a)

|

As of the close of business on September 9, 2015, JCP Partnership beneficially owned 1,571,819 Shares, including 12,500 Shares underlying certain call options.

|

Percentage: Approximately 3.9%

|

|

(b)

|

1. Sole power to vote or direct vote: 1,571,819

|

|

|

2. Shared power to vote or direct vote: 0

|

|

|

3. Sole power to dispose or direct the disposition: 1,571,819

|

|

|

4. Shared power to dispose or direct the disposition: 0

|

|

|

(c)

|

JCP Partnership has not entered into any transactions in the Shares since the filing of the Schedule 13D.

|

|

B.

|

JCP Single-Asset

|

|

|

(a)

|

As of the close of business on September 9, 2015, JCP Single-Asset beneficially owned 714,851 Shares, including 12,500 Shares underlying certain call options.

|

Percentage: Approximately 1.8%

|

|

(b)

|

1. Sole power to vote or direct vote: 714,851

|

|

|

2. Shared power to vote or direct vote: 0

|

|

|

3. Sole power to dispose or direct the disposition: 714,851

|

|

|

4. Shared power to dispose or direct the disposition: 0

|

|

|

(c)

|

The transactions in the Shares by JCP Single-Asset since the filing of the Schedule 13D are set forth in Schedule A and are incorporated herein by reference.

|

|

C.

|

JCP Partners

|

|

|

(a)

|

JCP Partners, as the general partner of each of JCP Partnership and JCP Single-Asset, may be deemed the beneficial owner of the (i) 1,571,819 Shares owned by JCP Partnership and (ii) 714,851 Shares owned by JCP Single-Asset.

|

Percentage: Approximately 5.7%

|

|

(b)

|

1. Sole power to vote or direct vote: 2,286,670

|

|

|

2. Shared power to vote or direct vote: 0

|

|

|

3. Sole power to dispose or direct the disposition: 2,286,670

|

|

|

4. Shared power to dispose or direct the disposition: 0

|

|

|

(c)

|

JCP Partners has not entered into any transactions in the Shares since the filing of the Schedule 13D. The transactions in the Shares on behalf of JCP Single-Asset since the filing of the Schedule 13D are set forth in Schedule A and are incorporated herein by reference.

|

10

CUSIP NO. 147448104

|

D.

|

JCP Holdings

|

|

|

(a)

|

JCP Holdings, as the general partner of JCP Partners, may be deemed the beneficial owner of the (i) 1,571,819 Shares owned by JCP Partnership and (ii) 714,851 Shares owned by JCP Single-Asset.

|

Percentage: Approximately 5.7%

|

|

(b)

|

1. Sole power to vote or direct vote: 2,286,670

|

|

|

2. Shared power to vote or direct vote: 0

|

|

|

3. Sole power to dispose or direct the disposition: 2,286,670

|

|

|

4. Shared power to dispose or direct the disposition: 0

|

|

|

(c)

|

JCP Holdings has not entered into any transactions in the Shares since the filing of the Schedule 13D. The transactions in the Shares on behalf of JCP Single-Asset since the filing of the Schedule 13D are set forth in Schedule A and are incorporated herein by reference.

|

|

E.

|

JCP Management

|

|

|

(a)

|

JCP Management, as the investment manager of each of JCP Partnership and JCP Single-Asset, may be deemed the beneficial owner of the (i) 1,571,819 Shares owned by JCP Partnership and (ii) 714,851 Shares owned by JCP Single-Asset.

|

Percentage: Approximately 5.7%

|

|

(b)

|

1. Sole power to vote or direct vote: 2,286,670

|

|

|

2. Shared power to vote or direct vote: 0

|

|

|

3. Sole power to dispose or direct the disposition: 2,286,670

|

|

|

4. Shared power to dispose or direct the disposition: 0

|

|

|

(c)

|

JCP Management has not entered into any transactions in the Shares since the filing of the Schedule 13D. The transactions in the Shares on behalf of JCP Single-Asset since the filing of the Schedule 13D are set forth in Schedule A and are incorporated herein by reference.

|

|

F.

|

Mr. Pappas

|

|

|

(a)

|

Mr. Pappas, as the managing member of JCP Management and sole member of JCP Holdings, may be deemed the beneficial owner of the (i) 1,571,819 Shares owned by JCP Partnership and (ii) 714,851 Shares owned by JCP Single-Asset.

|

Percentage: Approximately 5.7%

|

|

(b)

|

1. Sole power to vote or direct vote: 2,286,670

|

|

|

2. Shared power to vote or direct vote: 0

|

|

|

3. Sole power to dispose or direct the disposition: 2,286,670

|

|

|

4. Shared power to dispose or direct the disposition: 0

|

11

CUSIP NO. 147448104

|

|

(c)

|

Mr. Pappas has not entered into any transactions in the Shares since the filing of the Schedule 13D. The transactions in the Shares on behalf of JCP Single-Asset since the filing of the Schedule 13D are set forth in Schedule A and are incorporated herein by reference.

|

|

G.

|

Mr. Frazier:

|

|

|

(a)

|

As of the close of business on September 9, 2015, Mr. Frazier directly owned 40,000 Shares.

|

Percentage: Less than 1%

|

|

(b)

|

1. Sole power to vote or direct vote: 40,000

|

|

|

2. Shared power to vote or direct vote: 0

|

|

|

3. Sole power to dispose or direct the disposition: 40,000

|

|

|

4. Shared power to dispose or direct the disposition: 0

|

|

|

(c)

|

Mr. Frazier has not entered into any transactions in the Shares since the filing of the Schedule No. 1 Amendment.

|

The Reporting Persons, as members of a “group” for the purposes of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended, may be deemed the beneficial owner of the Shares directly owned by the other Reporting Persons. Each Reporting Person disclaims beneficial ownership of such Shares except to the extent of his or its pecuniary interest therein.

|

Item 6.

|

Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer.

Item 6 is hereby amended to add the following:

|

JCP Partnership purchased in the over the counter market American-style call options referencing an aggregate of 12,500 Shares, which have an exercise price of $5.00 per Share and expire on December 18, 2015. JCP Single-Asset purchased in the over the counter market American-style call options referencing an aggregate of 12,500 Shares, which have an exercise price of $5.00 per Share and expire on December 18, 2015.

12

CUSIP NO. 147448104

Depending on market conditions and other factors, the JCP may alter the mix of its collective beneficial ownership position in the Issuer, which is currently composed of 2,261,580 Shares and 25,000 Shares underlying the American-style call options described in this Item 6, by, among other things, exercising certain of the American-style call options, purchasing or selling Shares, and/or purchasing or selling options.

Other than as described herein, there have been no contracts, arrangements, understandings or relationships among the Reporting Persons, or between the Reporting Persons and any other person, with respect to the securities of the Issuer entered into since the filing of the Schedule No.1 Amendment.

|

Item 7.

|

Material to be Filed as Exhibits.

|

Item 7 is hereby amended to add the following exhibit:

|

|

99.1

|

Open Letter to the Board, dated September 10, 2015.

|

|

|

99.2

|

Investor Presentation on the Issuer, dated September 10, 2015.

|

13

CUSIP NO. 147448104

SIGNATURES

After reasonable inquiry and to the best of his knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete and correct.

Dated: September 10, 2015

|

JCP Investment Partnership, LP

|

|||

|

By:

|

JCP Investment Management, LLC

Investment Manager

|

||

|

By:

|

/s/ James C. Pappas

|

||

|

Name:

|

James C. Pappas

|

||

|

Title:

|

Managing Member

|

||

|

JCP Single-Asset Partnership, LP

|

|||

|

By:

|

JCP Investment Management, LLC

Investment Manager

|

||

|

By:

|

/s/ James C. Pappas

|

||

|

Name:

|

James C. Pappas

|

||

|

Title:

|

Managing Member

|

||

|

JCP Investment Partners, LP

|

|||

|

By:

|

JCP Investment Holdings, LLC

|

||

|

General Partner

|

|||

|

By:

|

/s/ James C. Pappas

|

||

|

Name:

|

James C. Pappas

|

||

|

Title:

|

Sole Member

|

||

|

JCP Investment Holdings, LLC

|

|||

|

By:

|

/s/ James C. Pappas

|

||

|

Name:

|

James C. Pappas

|

||

|

Title:

|

Sole Member

|

||

|

JCP Investment Management, LLC

|

|||

|

By:

|

/s/ James C. Pappas

|

||

|

Name:

|

James C. Pappas

|

||

|

Title:

|

Managing Member

|

||

|

/s/ James C. Pappas

|

|

|

James C. Pappas

Individually and as attorney-in-fact for Brett W. Frazier

|

13

CUSIP NO. 147448104

SCHEDULE A

Transactions in the Shares Since the Filing of Amendment No. 1 to the Schedule 13D

|

Shares of Class A Common

Stock Purchased/(Sold)

|

Price Per

Share($)

|

Date of

Purchase/Sale

|

JCP INVESTMENT PARTNERSHIP, LP

|

12,500*

|

1.0000

|

07/10/2015

|

|

350

|

5.6000

|

07/10/2015

|

|

8,129

|

5.7500

|

07/13/2015

|

|

150

|

5.7133

|

07/15/2015

|

|

25,450

|

5.7500

|

07/15/2015

|

|

10,000

|

5.8900

|

07/16/2015

|

|

21,755

|

5.9129

|

07/20/2015

|

|

10,000

|

5.8049

|

07/21/2015

|

|

50

|

5.7000

|

07/22/2015

|

*Represents shares underlying American-style call options purchased in the over the counter market. These call options expire on December 18, 2015.

JCP SINGLE-ASSET PARTNERSHIP, LP

|

12,500*

|

1.0000

|

07/10/2015

|

|

349

|

5.6000

|

07/10/2015

|

|

8,130

|

5.7500

|

07/13/2015

|

|

150

|

5.7133

|

07/15/2015

|

|

25,450

|

5.7500

|

07/15/2015

|

|

10,000

|

5.8900

|

07/16/2015

|

|

21,754

|

5.9129

|

07/20/2015

|

|

10,000

|

5.8049

|

07/21/2015

|

|

50

|

5.7000

|

07/22/2015

|

*Represents shares underlying American-style call options purchased in the over the counter market. These call options expire on December 18, 2015.

Exhibit 99.1

JCP Investment Management, LLC

1177 West Loop South, Suite 1650

Houston, Texas 77027

713.333.5540

September 10, 2015

Dear Members of the Board:

JCP Investment Management, LLC (“JCP”) currently owns 2,286,670 Class A shares or 5.72% of the issued and outstanding Class A common stock of Casella Waste Systems, Inc. (“Casella” or, the “Company”), making us one of the Company’s largest public shareholders. We are long-term shareholders and have been investing in Casella since 20101.

JCP is an investment firm focused on investing across the capital structure primarily in North America. We have a track record of significant value enhancement at companies in which we have become involved, and at which we have gained representation on the Board.

For the last 5 months, we have attempted to communicate constructively with the Board of Directors of Casella (the ”Board”) regarding the Company’s poor operational and financial performance, archaic corporate governance, and capital structure that undermine the rights of public shareholders while giving disproportionate voting power to Chairman and CEO, John Casella, and his brother Vice Chairman, Doug Casella.

Our hope was that we could have worked constructively with the Board to add Class A shareholder representation in the boardroom and improve the Board with the experience and perspective that will lead to decisions that tackle the fundamental problems, while protecting the rights of public shareholders and enhancing the value of the public shareholders’ investments.

Unfortunately, our attempts to date have been flatly rejected by the Board, which never even made a counterproposal for an amicable resolution. Instead, the Board’s apparent strategy has been to implement tangential changes, which were clearly reactive to our involvement but short of addressing the core problems.

Casella has underperformed for over a decade under the leadership of John Casella, a veteran of 18 years, as Chairman and CEO. It is astonishing that a public company CEO who has overseen the Company’s stock plummet from $18 a share at its IPO in 1997 to $6.60 today could keep his post after 18 years of underperformance. It is clear to us that the only plausible explanation is that from his position as a Chairman and, together with his brother, a holder of all the supervoting Class B stock that entitles him and his brother to more than 22% of the combined voting power, John Casella has ensured his position with the Company and jeopardized the Board’s primary responsibility of holding management accountable, which has lead to over a decade of underperformance. Chairman and CEO Casella’s rule over the Company has been at the expense of the public shareholders who have suffered and continue to suffer significant losses during his tenure.

Despite their Class B shares supervoting rights, since Casella’s has diluted the Class A shares from approximately 10.5 million shares to nearly 40 million shares – the Class A shares NOW have a chance to make a change difference. The 10:1 voting power of the Class B shares is not enough to insulate the management team from poor performance

Casella has a strong position in the Northeast market. By replacing Chairman and CEO John Casella with a proven leader, we believe Casella can create meaningful value for its shareholders.

In the following pages, we describe in greater detail:

|

|

1.

|

A troubling history of underperformance and mismanagement under Chairman and CEO John Casella, making immediate Board and CEO change necessary;

|

|

|

2.

|

Our concerns around related party transactions and a capital structure that entrenches Chairman and CEO John Casella while undermining the rights of the public shareholders; and

|

|

|

3.

|

Why JCP’s track record of significant value creation is highly relevant to helping Casella overcome its current challenges.

|

____________________________________

1 Note: the shares owned by JCP include options to purchase 25,000 shares of the Company’s Class A common stock.

|

1.

|

A Troubling History of Underperformance and Mismanagement Under Chairman and CEO John Casella

|

Under the leadership of Chairman and CEO John Casella, Casella has produced a negative return for shareholders over 10 years and since the IPO. Simply stated, we have lost all faith in Chairman and CEO John Casella’s ability to lead this large, increasingly complex company.

Shareholder Returns Have Suffered Dramatically Under Chairman and CEO John Casella

Casella’s stock has produced negative 48% returns over 10 years and dramatically underperformed the Company’s peers and the S&P 500 index over the last 5- and 10- Years periods.

Capital Allocation Has Been Atrocious Under Chairman and CEO John Casella

Profitability has not followed with incremental cash outlays. It is surprising to us that the Board has complacently allowed Chairman and CEO John Casella to spend more than $770 million over the last 10 years in capital expenditures with no resulting increase of earnings power.

Excessive Leverage and Class A Stock Dilution Have Been Rampant Under Chairman and CEO John Casella

Chairman and CEO John Casella’s use of excessive leverage over the last several years has not produced incremental earning power. Along with continuously increasing leverage, Chairman and CEO John Casella also continues to take actions that dilute public shareholders year after year.

Broken Promises and Consistently Missed Guidance Under Chairman and CEO John Casella

We are struck by the dramatic magnitude by which Chairman and CEO John Casella has consistently missed his own announced long-term targets. The following table shows that Chairman and CEO John Casella has been putting out the same targets since 1999.

As shown in the previous chart, Chairman and CEO John Casella has clearly struggled to hit long-term targets. We are concerned with the newest “guidance” that the Company has issued. In 1999, the Company issued its first guidance of Revenue, EBITDA and EPS. Since then, Chairman and CEO John Casella has chronically missed projections and has yet to meet any of his targets. Companies that chronically miss targets and fail to produce growth, while their peers do both, typically change management. Yet, this Board has failed to hold management accountable for its mistakes and shows no sign it plans to do so.

Immediate Board and CEO Change are Necessary in Order to Halt the Value Destruction

We believe that the Company’s earnings potential is not being achieved due to poor leadership. Casella possesses recurring cash flows, talented employees and strong assets with the ability to grow. We firmly believe that in order to improve Casella’s performance, the Board must be reconstituted to include direct representatives of the public shareholders who have the commitment and discipline to hold management accountable.

|

2.

|

Our Concerns Around Related Party Transactions and a Capital Structure that Entrenches Chairman and CEO John Casella while Undermining the rights of the Public Shareholders

|

During the past 10 years, the Company has paid more than $80 million to Casella Construction, Inc. (“Casella Construction”), a company of which John Casella is both a director and executive officer and his brother Doug Casella is President. We see a clear conflict with the Casella brothers controlling the entities on both ends of these expensive transactions for Casella shareholders. We wonder how the best interests of the public interests are adequately protected when the Casella brothers siphon this large amount to their affiliated entity? For context, the +$80 million paid to Casella Construction over the course of a decade represents a third of the current market cap of the Company. Those exorbitant amounts on both absolute and relative basis have continued to be paid to Casella Construction, even as the Company’s shareholders have suffered significant losses over the same period in which John Casella has run the Company.

Worse, for many years, the Company led by Chairman and CEO John Casella paid Vice Chairman Doug Casella a salary of more than $100,000, and in some years $200,000, from a subsidiary of the Company. The Casella-led Board also authorized a loan from the Company to the former COO of the Company in the amount of nearly $1 million. That loan was made at the prime rate, while the Company was borrowing more expensively at significantly higher rates. It is concerning both that Chairman and CEO John Casella would allow the Company to borrow at a higher rate than he is lending and without a maturity and that the rest of the Board would complacently go along with these self-serving activities. This persistent pattern of costly related party transactions raises serious questions as to whether John Casella’s actions appropriately place the best interests of public shareholders above his personal interests and those of other insiders.

Chairman and CEO John Casella’s grip on the Board and the Company has been aided by the Company’s dual class stock structure that creates a gap between the economic investment of shareholders and their voting power. The Class B shares, which have 10 votes per share, are 100% held by Chairman and CEO John Casella and, his brother and Vice Chairman of the Company, Doug Casella. The Class B shares entitle the Casella brothers to more than 20% of the voting power of the Class A and Class B combined. This unbalanced capitalization structure effectively allows insider control with a lesser economic stake in the Company and significantly impairs the rights of public shareholders. Together the supervoting rights, and the combined Chairman and CEO roles give John Casella undue influence over the Company, ensure his longevity despite chronic failures, and drive deep misalignment between his interests on the one hand and those of the public shareholders on the other.

|

3.

|

JCP’s Capabilities and Record of Value Creation Are Highly Relevant to Casella’s Current Challenges

|

Casella now finds itself in a predicament – lack of leadership who can create value, a poorly-aligned board and a 10 year track record of value destruction. Shareholders can no longer afford to watch in silence as the Company languishes due to CEO John Casella’s poor performance and the Board’s failure to hold the CEO and management accountable. JCP has the experience and alignment of interest required to fix Casella’s problems.

JCP is Seeking Real Change on the Board of Casella with the Addition of Candidates Who Have the Commitment and Discipline to Fight for the Right of Public Shareholders

JCP has nominated and intends to seek the election of James Pappas and Brett Frazier to the Board at the upcoming Annual Meeting of shareholders of Casella. Messrs. Pappas and Frazier have the skill sets and commitment to protect shareholder rights and shareholder value. Our recent communications with the Board have persuaded us that the pervasive and blatant disregard for shareholder input and subservient attitude to John Casella plague the current Board and render it incapable of fixing the core issues facing the Company.

JCP is Prepared to Identify Potential Replacement CEO Candidates

JCP has replaced sitting Chairman and/or CEOs in the past at The Pantry and Morgan’s, respectively, and is prepared to do the same at Casella. Our diligent and long term work at The Pantry and Morgan’s produced a significant amount of value for shareholders. Both of these situations took significant time and effort. We are prepared to work just as hard this time.

* * *

The dismal operating performance under Chairman and CEO John Casella’s leadership, the deeply concerning related party transactions and the lack of accountability of both the Board and CEO all solidify our view that material change in executive leadership and corporate governance are immediately required at Casella.

Casella has significant value creating opportunities and talented employees. With the right leadership, alignment of interests, and governance structures in place, we are confident that the Company can deliver substantial value for all stakeholders.

Sincerely,

James C. Pappas

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

13DSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share