Form SC 13D UTSTARCOM HOLDINGS CORP. Filed by: Shanghai Phicomm Communication Co., Ltd.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

UTStarcom Holdings Corp.

(Name of Issuer)

Ordinary Shares, Par Value US$0.00375 per share

(Title of Class of Securities)

918076100

(CUSIP Number)

Gu Guoping Shanghai Phicomm Communication Co. Ltd. 3666

Sixian Road 011-86-21- 31183118 |

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

December 4, 2015

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ¨.

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

*The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| CUSIP No. 918076100 | |||||

| 1. | Names of Reporting Persons. | ||||

GU GUOPING |

|||||

| 2. | Check the Appropriate Box if a Member of a Group (See Instructions) | (a) | o | ||

| (b) | x | ||||

| 3. | SEC Use Only | ||||

| 4. | Source of Funds (See Instructions) | ||||

AF |

|||||

| 5. | Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) | o | |||

| 6. | Citizenship or Place of Organization | ||||

People’s Republic of China |

|||||

| Number of Shares Beneficially Owned by Each Reporting Person With |

7. | Sole Voting Power | |||

| -0- | |||||

| 8. | Shared Voting Power | ||||

11,739,932 |

|||||

| 9. | Sole Dispositive Power | ||||

| -0- | |||||

| 10. | Shared Dispositive Power | ||||

11,739,932 |

|||||

| 11. | Aggregate Amount Beneficially Owned by Each Reporting Person | ||||

11,739,932 |

|||||

| 12. | Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares | o | |||

| 13. | Percent of Class Represented by Amount in Row (11) | ||||

31.7% |

|||||

| 14. | Type of Reporting Person | ||||

| IN | |||||

| 2 |

| CUSIP No. 918076100 | |||||

| 1. | Names of Reporting Persons. | ||||

Shanghai Phicomm Communication Co., Ltd. |

|||||

| 2. | Check the Appropriate Box if a Member of a Group (See Instructions) | (a) | o | ||

| (b) | x | ||||

| 3. | SEC Use Only | ||||

| 4. | Source of Funds (See Instructions) | ||||

| WC | |||||

| 5. | Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) | o | |||

| 6. | Citizenship or Place of Organization | ||||

People’s Republic of China |

|||||

| Number of Shares Beneficially Owned by Each Reporting Person With |

7. | Sole Voting Power | |||

| -0- | |||||

| 8. | Shared Voting Power | ||||

11,739,932 |

|||||

| 9. | Sole Dispositive Power | ||||

| -0- | |||||

| 10. | Shared Dispositive Power | ||||

11,739,932 |

|||||

| 11. | Aggregate Amount Beneficially Owned by Each Reporting Person | ||||

11,739,932 |

|||||

| 12. | Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares | o | |||

| 13. | Percent of Class Represented by Amount in Row (11) | ||||

31.7% |

|||||

| 14. | Type of Reporting Person | ||||

| CO | |||||

| 3 |

| CUSIP No. 918076100 | |||||

| 1. | Names of Reporting Persons. | ||||

Phicomm Technology (Hong Kong) Co., Limited |

|||||

| 2. | Check the Appropriate Box if a Member of a Group (See Instructions) | (a) | o | ||

| (b) | x | ||||

| 3. | SEC Use Only | ||||

| 4. | Source of Funds (See Instructions) | ||||

AF |

|||||

| 5. | Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) | o | |||

| 6. | Citizenship or Place of Organization | ||||

Hong Kong |

|||||

| Number of Shares Beneficially Owned by Each Reporting Person With |

7. | Sole Voting Power | |||

| -0- | |||||

| 8. | Shared Voting Power | ||||

11,739,932 |

|||||

| 9. | Sole Dispositive Power | ||||

| -0- | |||||

| 10. | Shared Dispositive Power | ||||

11,739,932 |

|||||

| 11. | Aggregate Amount Beneficially Owned by Each Reporting Person | ||||

11,739,932 |

|||||

| 12. | Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares | o | |||

| 13. | Percent of Class Represented by Amount in Row (11) | ||||

31.7% |

|||||

| 14. | Type of Reporting Person | ||||

| CO | |||||

| 4 |

| CUSIP No. 918076100 | |||||

| 1. | Names of Reporting Persons. | ||||

The Smart Soho International Limited |

|||||

| 2. | Check the Appropriate Box if a Member of a Group (See Instructions) | (a) | o | ||

| (b) | x | ||||

| 3. | SEC Use Only | ||||

| 4. | Source of Funds (See Instructions) | ||||

AF |

|||||

| 5. | Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) | o | |||

| 6. | Citizenship or Place of Organization | ||||

Cayman Islands |

|||||

| Number of Shares Beneficially Owned by Each Reporting Person With |

7. | Sole Voting Power | |||

| -0- | |||||

| 8. | Shared Voting Power | ||||

11,739,932 |

|||||

| 9. | Sole Dispositive Power | ||||

| -0- | |||||

| 10. | Shared Dispositive Power | ||||

11,739,932 |

|||||

| 11. | Aggregate Amount Beneficially Owned by Each Reporting Person | ||||

11,739,932 |

|||||

| 12. | Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares | o | |||

| 13. | Percent of Class Represented by Amount in Row (11) | ||||

31.7% |

|||||

| 14. | Type of Reporting Person | ||||

| CO | |||||

| 5 |

| CUSIP No. 918076100 | |||||

| 1. | Names of Reporting Persons. | ||||

Chongqing

Liangjian New Area Strategic Emerging Industries Equity Investment Fund |

|||||

| 2. | Check the Appropriate Box if a Member of a Group (See Instructions) | (a) | o | ||

| (b) | x | ||||

| 3. | SEC Use Only | ||||

| 4. | Source of Funds (See Instructions) | ||||

| WC | |||||

| 5. | Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) | o | |||

| 6. | Citizenship or Place of Organization | ||||

Peoples Republic of China |

|||||

| Number of Shares Beneficially Owned by Each Reporting Person With |

7. | Sole Voting Power | |||

| -0- | |||||

| 8. | Shared Voting Power | ||||

| -0- | |||||

| 9. | Sole Dispositive Power | ||||

| -0- | |||||

| 10. | Shared Dispositive Power | ||||

11,739,932 |

|||||

| 11. | Aggregate Amount Beneficially Owned by Each Reporting Person | ||||

11,739,932 |

|||||

| 12. | Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares | o | |||

| 13. | Percent of Class Represented by Amount in Row (11) | ||||

31.7% |

|||||

| 14. | Type of Reporting Person | ||||

PN |

|||||

| 6 |

| Item 1. | Security and Issuer |

This Schedule 13D relates to the Ordinary Shares, par value US$0.00375 per share (the “Ordinary Shares”) of UTStarcom Holdings Corp., a Cayman Islands corporation (the “Issuer”). The principal executive office of the Issuer is located at Level 6, 28 Hennessy Road, Admiralty, Hong Kong.

| Item 2. | Identity and Background |

This Schedule 13D is filed by Gu Guoping, Shanghai Phicomm Communication Co., Ltd. (“Phicomm”), Phicomm Technology (Hong Kong) Co., Limited (“Phicomm HK”), The Smart Soho International Limited (“Smart Soho”) and Chongqing Liangjian New Area Strategic Emerging Industries Equity Investment Fund Partnership (Limited Liability Partnership) (“the Fund”). Mr. Gu, Phicomm, Phicomm HK and Smart Soho are sometimes hereinafter referred to collectively as the “Phicomm Group,” and the Phicomm Group and the Fund are sometimes referred to collectively as the “Filing Persons” and each, individually, as a “Filing Person.” In addition, Smart Soho is sometimes hereinafter referred to as the “Acquirer”

The following sets forth certain information regarding the Filing Persons:

GU GUOPING. Mr. Gu is an individual and a citizen of the People’s Republic of China. His principal occupation is as Chairman of Phicomm. In connection with the acquisition of the Issuer’s Ordinary Shares reported herein, subject to satisfaction of certain conditions (see Item 4), he wass elected a director and Chairman of the Board of the Issuer. Mr. Gu, directly and through entities he owns and/or controls, is the beneficial owner of 39.86% of the share capital of Phicomm. Mr. Gu may also be deemed the beneficial owner of 11.55% of the share capital held by certain other shareholders of Phicomm who have agreed to act in concert with Mr. Gu Accordingly, Mr. Gu may be deemed the beneficial owner of 51.41% of the share capital of Phicomm and to control Phicomm.

PHICOMM. Phicomm is a corporation organized under the laws of the People’s Republic of China (“PRC”). Its principal business office is located at 3666 Sixian Road Songjiang District Shanghai, People’s Republic of China. Phicomm is a leading technology company involved in research, development and manufacture of networking and communication equipment. Its primary businesses cover the areas of mobile, IP Networking and communication products for personal, small office/home office (SOHO) users and enterprise users, cloud service business and ICT smart city.

PHICOMM HK. Phicomm HK is a corporation organized under the laws of Hong Kong. Phicomm HK is principally engaged in the business of trading in smart phones, smart phone parts and accessories and other communication products and parts and in acting as an investment holding company, and its registered office is located at Suite 1205-6, ICBC Tower, Citibank Plaza, 3 Garden Road, Central, Hong Kong. Phicomm HK is a wholly-owned subsidiary of Phicomm and was organized to hold Phicomm’s shares of Smart Soho in connection with Smart Soho’s acquisition the Issuer’s Ordinary Shares in the transactions described in this Schedule 13D.

ACQUIRER. Smart Soho is a Cayman Islands corporation. The principal business of the Acquirer is acting as an investment holding company, and its registered office is located PO Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands. The Acquirer is an indirect, majority-owned subsidiary of Phicomm and was organized to acquire the Issuer’s ordinary shares in the transactions described in this Schedule 13D. Phicomm HK directly owns 60% of the Acquirer’s outstanding shares.

THE FUND. The Fund is an investment limited partnership organized under the laws of the People’s Republic of China. The Fund’s registered office is located at No. 19, Yinglong Road, Longxing Township, Yubei, Chongqing, People’s Republic of China.

| 7 |

The following table sets forth the names, addresses, present principal occupation or employment (including their positions with or other relationships to Phicomm), the name and address of their principal employers, and the principal businesses of such employers of the directors, executive officers and controlling persons of Phicomm, Phicomm HK, the Acquirer and the Fund. Each of the persons listed in the table below is a citizen of the People’s Republic of China.

Name |

Residence

or Business Address |

Principal

Occupation or Employment |

Employer’s

Address and Principal Business |

Phicomm

| |||

| Gu Guoping | 3666 Sixian Road Songjiang District Shanghai People’s Republic of China |

Director and Chairman of Phicomm | 3666 Sixian Road Songjiang District Shanghai People’s Republic of China |

| Wang Zhonghua | 3666 Sixian Road Songjiang District Shanghai People’s Republic of China |

Director and Vice Chairman of Phicomm | 3666 Sixian Road Songjiang District Shanghai People’s Republic of China |

| Zheng Min | 3666 Sixian Road Songjiang District Shanghai People’s Republic of China |

Director and CEO of Phicomm | 3666 Sixian Road Songjiang District Shanghai People’s Republic of China |

| Lin Tao | 10 floor, No. 555, Rongmei Road, Songjiang District, Shanghai, People’s Republic of China | Director of Phicomm | 3666 Sixian Road Songjiang District Shanghai People’s Republic of China |

| Jin Biao | No. 789, Minnan Road, Shanghai, People’s Republic of China | Director of Phicomm | 3666 Sixian Road Songjiang District Shanghai People’s Republic of China |

| Qu Hong | No. 3 Guohua Investment Building, Dong Zhi Men South Street, Dong Cheng District, Beijing, People’s Republic of China | Director of Phicomm | 3666 Sixian Road Songjiang District Shanghai People’s Republic of China |

| Xu Jinxian | 7 floor, 90 Building, Daye Area of Guang Fu Lin Road, Song Jiang District, Shanghai, People’s Republic of China | Independent Non-executive Director of Phicomm | 3666 Sixian Road Songjiang District Shanghai People’s Republic of China |

| Wei Jian | Room 2602, No. 100, Yu Tong Road, Zhabei District, Shanghai, People’s Republic of China | Independent Non-executive Director of Phicomm | 3666 Sixian Road Songjiang District Shanghai People’s Republic of China |

| Sun Lijiang | Room 525, Wenli Building, No. 1350, Ganlan Road, Lingang New Town, Pudong New District, Shanghai, People’s Republic of China | Independent Non-executive Director of Phicomm | 3666 Sixian Road Songjiang District Shanghai People’s Republic of China |

| 8 |

| Phicomm HK | |||

| Gu Guoping (sole director) | c/o Shanghai Phicomm Communication Co., Ltd. | Chairman of Phicomm | See “Phicomm,” above

|

Smart Soho

| |||

| Gu Guoping (sole director) | c/o Shanghai Phicomm Communication Co., Ltd. | Chairman of Phicomm | See “Phicomm,” above. |

| The Fund | |||

| Zhang Jun | c/o Chongqing Liangjian New Area Strategic Emerging Industries Equity Investment Fund Partnership (Limited Liability Partnership) | Executive Partner Representative | See “The Fund,” above

|

During the last five years neither (i) any member of the Phicomm Group or, to their knowledge, any of the respective directors or officers of any member of the Phicomm Group nor (ii) the Fund or, to its knowledge, any the directors or officers of the Fund, has been convicted in a criminal proceeding (excluding, in each case, traffic violations or similar misdemeanors), nor was any of them a party to a civil proceeding of a United States judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

To the extent that the Phicomm Group and the Fund may be deemed to share dispositive power over the Issuer’s Ordinary Shares owned by the Acquirer, as more fully described in Items 5 and 6 below, the Phicomm Group and the Fund may be deemed to constitute a group within the meaning of Rule 13d-5 under the Act. The Filing Persons are filing a single Schedule 13D pursuant to Rule 13d-1(k)(2) under the Act. As provided in Rule 13d-1(k)(1)(ii) under the Act, the Phicomm Group is responsible for completeness and accuracy of the information set forth herein with respect to the members of the Phicomm Group but not the information with respect to the Fund, and the Fund is responsible for completeness and accuracy of the information set forth herein with respect to the Fund but not the information with respect to the Phicomm Group.

| 9 |

| Item 3. | Source and Amount of Funds or Other Consideration |

On the date of this Schedule 13D, the Filing Persons are the beneficial owners of a total of 11,739,932 Ordinary Shares of the Issuer (see Item 5). The aggregate purchase price for the Ordinary Shares purchased and to be purchased by the Acquirer is US$70,439,592. 60% of the funds to acquire such Ordinary Shares have been or will be obtained from the working capital of Phicomm which will contribute such funds to Phicomm HK which, in turn, will use such funds to purchase 60% of the outstanding ordinary shares of the Acquirer. The remaining 40% of such funds was obtained from the Fund, in exchange for 40% of the outstanding shares of the Acquirer. The Fund acquired such funds from its working capital. All such funds have been or will be used to purchase the Issuer’s Ordinary Shares.

Phicomm HK and the Fund acquired their shares of the Acquirer pursuant to a Capital Increase and Share Subscription Agreement dated December 2, 2015, between the Fund and Phicomm, Phicomm HK and the Acquirer (the “Subscription Agreement”). For certain information regarding the Subscription Agreement, please see Item 6.

| Item 4. | Purpose of Transaction |

The Phicomm Group acquired the Ordinary Shares beneficially owned by them on the date of this Schedule 13D with a view to acquiring control of the Issuer. Depending upon market conditions and other relevant business and legal considerations, the Phicomm Group may, from time to time, acquire additional Ordinary Shares (in the public markets and/or in privately negotiated transactions) and/or dispose of some or all of their Ordinary Shares or cause affiliates to acquire, hold or dispose of Ordinary Shares. (Acquirer’s right to transfer or otherwise dispose of the Issuer’s Ordinary Shares is, however, restricted by the Subscription Agreement. See Item 6, below.)

In furtherance of the Phicomm Group’s intention to acquire control of the Issuer, under the Purchase Agreement (as defined in Item 6, below) pursuant to which the Acquirer purchased the Ordinary Shares, the conditions to Acquirer’s obligation to complete the purchase of the Ordinary Shares included the requirements that (i) each seller of Ordinary Shares under such agreement (or each affiliate of such sellers) that is a director of the Issuer (consisting of Mr. Himanshu H. Shah and Mr. Hong Liang Lu) shall have submitted his resignation from the board of directors of the Issuer, (ii) Mr. William Wong, the Issuer’s Chief Executive Officer, shall have submitted his resignation as a director and Chief Executive Officer of the Issuer, (iii) the Issuer’s board of directors shall have adopted resolutions increasing the total number of directors of the Issuer from six (6) persons to (8) persons, (iv) designees of the Acquirer shall have been appointed to the Issuer’s board of directors to fill the five vacancies caused by such resignations and the increase in the total number of directors, and (v) a designee of the Acquirer shall have been elected or appointed as the Chief Executive Officer of the Issuer. Pursuant to these provisions, Messrs. Shah, Lu and Wong have resigned from the Issuer’s board and Mr. Wong has resigned as the Issuer’s Chief Executive Officer. In addition, the number of directors of the Issuer was increased to eight (8), five designees of the Acquirer -- Messrs. Gu Guoping, Wang Zhonghua and Zheng Min, each of whom is an executive director of Phicomm, Ms. Sun Lijiang, an independent (non-executive) director of Phicomm, and Mr. Tenling Ti, who does not have any position with Phicomm -- have been elected to the Issuer’s board to fill the vacancies so created, and Mr. Tenling Ti will also become the Chief Executive Officer of the Issuer. All of the foregoing matters -- the action taken by the Issuer’s board of directors, the resignations of Messrs. Shah, Lu and Wong, the election of the Acquirer’s designees to the Issuer’s board and the appointment of Mr. Ti as the Issuer’s CEO -- will become effective upon the sellers’ receipt of aggregate payments of US$64,569,626 out of the total purchase price of US$70,439,592 for the Ordinary Shares. Acquirer has paid US$30,000,000 of such amount and, under the Purchase Agreement, payment of US$34,569,626 is due by December 16, 2015. See Item 6. Upon the effectiveness of such actions, the Issuer’s board will consist of eight persons, four of whom Phicomm believes are independent directors under the governance rules of the Nasdaq Stock Market and four of whom are affiliated with either Phicomm or (in the case of Mr. Ti), the Issuer. The eighth director will be Mr. Ti, Phicomm’s designee as Chief Executive Officer of the Issuer. In addition, effective upon the payment of such US$64,569,626, Mr. Gu Guoping, the Chairman of Phicomm, will become Chairman of the Board of the Issuer.

| 10 |

The Phicomm Group intends to examine and explore possible approaches to increasing the Issuer’s business volume and coverage around the world, which may involve an examination of possible synergies between the Issuer’s business and Phicomm’s business. As part of this examination, through Phicomm’s Chairman Mr. Gu and their other designees on the Issuer’s Board, the Phicomm Group expects to engage in discussions with the Issuer’s Board of Directors, the Issuer’s management, other significant shareholders of the Issuer and other relevant parties concerning the Issuer and the Phicomm Group’s investment in the Issuer’s securities. The Phicomm Group anticipates that such discussions could include, but would not be limited to, the business, operations, financial condition, governance, management, strategy and future plans of the Issuer as well as any other matters which the Phicomm Group believes could be relevant to preserving and increasing the value of their investment in the Issuer’s Ordinary Shares and efforts to increase shareholder value generally. In this regard, the Subscription Agreement obligates the Acquirer to actively adopt such feasible plans and measures as may be necessary to promote the improvement and appreciation of the Issuer.

The Phicomm Group has not developed specific topics for such discussions or prepared or developed any specific plans or proposals relating to the Issuer, but they believe that possible matters for examination or exploration could include, among other possibilities, acquisitions or business combinations by the Issuer, dispositions of non-performing or non-core business, significant expansion of the Issuer’s sales and marketing efforts in attractive markets where the Issuer does not currently have extensive operations or sales. However, the Phicomm Group cannot predict whether any of the foregoing activities will ultimately result in plans or proposals that would be presented to the Issuer or its board or shareholders, and they have not entered into any contracts or made any commitments with respect to any of the foregoing matters.

Whether the Phicomm Group pursues one or more of the foregoing courses of action or develop any plans or proposals for any of the foregoing matters to the Issuer will depend on their evaluation of numerous factors, including their examination of Issuer’s the business, operations, financial condition, governance, management, strategy and future plans as described above, the market price of the Ordinary Shares, other investment opportunities available to the Phicomm Group, conditions in the securities markets, and economic and industry conditions in China and elsewhere. Except as described herein, the Phicomm Group does not have any plans or proposals which relate to, or could result in, any of the matters referred to in paragraphs (a) through (j), inclusive, of the instructions to Item 4 of Schedule 13D. The Phicomm Group reserves the right, at any time and from time to time, to review or reconsider their position and/or change their purpose and/or formulate plans or proposals with respect to the Issuer and its securities and to take such actions with respect to their investment in the Issuer as they deem appropriate, including, but not limited to, changing their current intentions with respect to any or all of the matters referred to above.

| 11 |

As described in Item 6, certain provisions of Acquirer’s corporate documents and the Subscription Agreement may be deemed to provide the Fund with shared dispositive power over the Issuer’s Ordinary Shares. To the extent that the Fund may be deemed a beneficial owner of the Issuer’s shares, the Fund acquired such beneficial ownership for investment, principally to realize a favorable return on its investment in the Acquirer’s ordinary shares, which it believes may be available to it upon exercise of its rights to require Phicomm to repurchase the Acquirer’s shares pursuant to the Subscription Agreement. the Fund does not any presently have any plans or proposals which relate to, or could result in, any of the matters referred to in paragraphs (a) through (j), inclusive, of the instructions to Item 4 of Schedule 13D. The Fund reserves the right, at any time and from time to time, to review or reconsider its position and/or formulate such plans or proposals in the event the Fund realizes on Phicomm HK’s pledge of the Acquirer’s shares to the Fund. See Item 6 for a description of Phicomm’s repurchase obligations with respect to the Acquirer’s shares held by the Fund and Phicomm HK’s pledge of Acquirer’s shares to the Fund.

| Item 5. | Interest in Securities of the Issuer |

On the date of this Schedule 13D, the Phicomm Group is the beneficial owners of 11,739,932 Ordinary Shares, constituting approximately 31.7% of the Issuer’s Ordinary Shares. Such percentage beneficial ownership has been calculated based upon 37,025,578 outstanding Ordinary Shares (38,148,076 outstanding Ordinary Shares at December 31, 2014, as set forth on the cover page of the Issuer’s Annual Report on Form 20-F for the year ended December 31, 2014 and giving effect to share repurchases by the Issuer and vesting of restricted stock units). All of such 11,739,932 Ordinary Shares are issued and outstanding. 5,000,0,00 such shares are owned directly by the Acquirer, and 6,739,932 shares are subject to Acquirer’s contractual purchase rights under the Purchase Agreement described in Item 6.

As the indirect owner (through Phicomm HK) of 60% of the voting ordinary shares of the Acquirer, Phicomm may be deemed to possess indirect voting and dispositive power over the Ordinary Shares owned by the Acquirer and therefore may be deemed to be a beneficial owner of all such shares. As the Chairman and controlling shareholder of Phicomm, Mr. Gu may also be deemed to possess indirect voting and dispositive power over the Ordinary Shares owned by the Acquirer, and thus also be a beneficial owner of all such shares.

Under the Acquirer’s Memorandum and Articles of Association (the “M&A”), any merger or consolidation of the Acquirer must be approved by a special resolution (i.e., a two-thirds vote of shareholders, so that the Fund’s approval of such actions is required), and any transfer or other disposition of the outstanding shares of the Acquirer by any shareholder must be approved by all of the members of the Acquirer. Under the Subscription Agreement, any transfer of Phicomm HK’s shares of the Acquirer requires the prior consent of the Fund. The Fund’s rights under (i) the Acquirer’s M&A to consent to a merger or consolidation of the Acquirer and transfers of shares in the Acquirer and (ii) under the Subscription Agreement to consent to transfers of the shares of Acquirer, may be deemed to provide the Fund with the indirect power to consent to transfers of the Ordinary Shares owned by the Acquirer. In addition, under the Subscription Agreement, any transfer of the Issuer’s Ordinary Shares by Acquirer also requires the Fund’s consent. The Fund’s possession of such indirect and direct consent rights with respect to transfers of the Issuer’s Ordinary Shares held by Acquirer may be deemed to provide the Fund with beneficial ownership of such Ordinary Shares in the form of shared dispositive power over such Ordinary Shares.

Except for the Phicomm Group’s purchase of 11,739,932 Ordinary Shares, as reported in this Schedule 13D and Phicomm HK’s obligation to complete its pledge of the Acquirer’s shares to the Fund, none of the Filing Persons and, none of their respective officers or directors beneficially owns and Ordinary Shares or has effected any transactions in the Issuer’s securities during the 60 days preceding the filing of this Schedule 13D.

| 12 |

| Item 6. | Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer |

Purchase Agreement

On November 4, 2015, the Acquirer entered into a Purchase and Sale Agreement (the “Purchase Agreement”) with Shah Capital Management, Inc. (“Shah Management”), Shah Capital Opportunity Fund LP (“Shah Opportunity” and, together with Shah Management, the “Shah Sellers”), Himanshu H. Shah (“Mr. Shah”), Hong Liang Lu (“Mr. Lu”), Lu Charitable Remainder Trust (“Lu Charitable Trust”), Lu Family Trust (“Lu Family Trust”) and The Lu Family Limited Partnership (“Lu Family Partnership,” together with Mr. Lu, Lu Charitable Trust and Lu Family Partnership, the “Lu Sellers” and the Lu Sellers, the Shah Sellers and Mr. Shah being, collectively, the “Sellers”). The Purchase Agreement sets out the terms for the purchase of 11,739,932 Ordinary Shares held by the Sellers by Acquirer at a price of US$6.00 per share, for a total consideration of US$70,439,592, subject to certain closing conditions. The aggregate purchase price excludes US$1,000,000 previously deposited in an escrow account and paid to the Sellers in consideration of certain amendments made to the Purchase Agreement. Under the Purchase Agreement, as amended, the aggregate purchase price, is payable in two tranches of US$64,569,626 and US$5,869,966. Acquirer paid a total of US$30,000,000 of the first tranche on December 4, 2015 and acquired 5,000,000 Ordinary Shares from the Shah Sellers. Payment of the remaining US$34,569,626 of the first tranche is due December 16, 2015. Payment of the second tranche of US$5,869,966, shall take place as soon as practicable after payment of the first tranche, but in no event later than January 8, 2016. Under the Purchase Agreement, Acquirer will acquire full and complete ownership of all 11,739,932 Ordinary Shares upon payment of the entire first tranche of the Purchase Price, and its obligation to pay the second tranche is not subject to the performance of any obligation or fulfillment of any condition by any Seller. Phicomm Technology (Hong Kong) Co., Limited, a subsidiary of Phicomm and owner of 60% of the share capital of Acquirer, has guaranteed payment of the second tranche of the purchase price to the Sellers.

The Purchase Agreement contains, among other provisions, certain representations and warranties by the parties (including, in the case of the Seller, certain representations and warranties relating to the Issuer), and conditions to the parties’ respective obligations customarily included in agreements of this type. Such conditions include satisfaction of the requirements set forth in the Purchase Agreement for the election of five designees of the Acquirer to the Issuer’s board of directors of the Issuer. Such conditions will be satisfied upon the Acquirer’s payment of the entire first tranche of the purchase of the Ordinary Shares. See Item 4.

Subscription Agreement

Phicomm, Phicomm HK and Acquirer have entered into the Subscription Agreement with the Fund pursuant to which the Fund agreed to purchase shares of Acquirer in the aggregate amount of US$28,175,836.80 (40% of the purchase price for the Issuer’s Ordinary Shares under the Purchase Agreement), and Phicomm HK agreed to purchase additional shares in the amount of US$42,263,755.20 (60% of the purchase price under the Purchase Agreement), in exchange for 40% and 60%, respectively, of the shares of Acquirer. The Subscription Agreement requires that the consideration paid for the shares of Acquirer be used solely for the acquisition of the Issuer’s Ordinary Shares and that Acquirer engage in no business activities other than ownership of the Issuer’s share (which may include purchases of additional Ordinary Shares).

| 13 |

The Subscription Agreement contains various provisions that may directly or indirectly restrict or otherwise affect the Filing Parties’ beneficial ownership of, and their ability to effect transactions in, the Issuer’s Ordinary Shares. During the two-year period commencing three years after the closing of the share purchases under the Subscription Agreement (the “two-year exit period”), the Fund has the right to require that Phicomm repurchase the Fund’s shares in Acquirer, in whole or in part at a purchase price equal to the higher of the “Annualized Return Purchase Price” and (ii) the “Market Value Purchase Price,” each as defined in the Subscription Agreement. The Fund may also require Phicomm to repurchase its shares of Acquirer at any time upon the occurrence of certain events specified in the Investment Agreement, including a breach by any of Phicomm, Phicomm HK or Acquirer of their representations, undertakings and warranties in the Investment Agreement, a Material Adverse Change (as defined in the Subscription Agreement) in the business, operations, assets, financial condition or prospects of Phicomm, Phicomm HK and Acquirer, certain bankruptcy or similar events occurring in Phicomm, Phicomm HK, Acquirer or the Issuer, and a delisting of the Issuer from Nasdaq. Phicomm’s repurchase obligations have been jointly and severally guaranteed by Phicomm HK and the Acquirer, and Phicomm HK will pledge its shares in the Acquirer to secure its guarantee. Any realization by the Fund on Phicomm HK’s pledge of its shares would result in the Fund becoming the sole shareholder of Acquirer and, therefore, the sole beneficial owner of all of the Issuer’s Ordinary Shares held by Acquirer.

From the date of the Subscription Agreement until expiration of the two-year exit period, Acquirer may not, among other restrictions on its activities, carry out any investment, financing and trading or other activities or transactions, sell, pledge or otherwise dispose of its 11,739,932 Ordinary Shares of the Issuer or make any contract or commitment other than for its daily operations. Phicomm HK must obtain the Fund’s consent to any transfer of its shares in Acquirer (other than certain transfers to affiliates) and, upon receiving notice of any such proposed transfer, the Fund has a right of first refusal to purchase the shares to be transferred on the same terms and conditions or to require the proposed transferee to purchase the Fund’s shares (in whole or in part) on terms no less favorable than those offered to Phicomm HK. Phicomm has the right to repurchase any Acquirer shares that the Fund owns at the end of the two-year exit period at a purchase price to be negotiated by the parties, but not less than the Annualized Return Purchase Price. Upon a liquidation of Acquirer, the Fund is entitled to receive a liquidating distribution in an amount not less than the greater of the Annualized Return Purchase Price and the Market Value Repurchase Price of the shares it then holds. Phicomm and Phicomm HK have agreed to indemnify the Fund for any losses, damages, or depreciation in the value of the Fund’s shares in Acquirer resulting from Acquirer’s acquisition of the Ordinary Shares of the Issuer or its actions as a shareholder of the Issuer.

The foregoing descriptions of certain material terms of the Purchase Agreement and the Subscription Agreement in this Item 6 are not complete and are qualified in their entirety by reference to the full text of such agreements, each of which is an exhibit to this Schedule 13D and is hereby incorporated by reference into this Item 6. See Item 7.

To the best knowledge of the Phicomm Group, except as provided herein, there are no other contracts, arrangements, understandings or relationships (legal or otherwise) among the Filing Persons and between any member of the Phicomm Group and any other person with respect to any securities of the Issuer. To the best knowledge of the Fund, except as provided herein, there are no other contracts, arrangements, understandings or relationships (legal or otherwise) among the Filing Persons and between the Fund and any other person with respect to any securities of the Issuer.

| 14 |

| Item 7. | Materials to be Filed as Exhibits |

The following documents are filed as exhibits to this Schedule 13D:

| Exhibit No. | Document

|

| 99.1 | Purchase and Sale Agreement dated as of November 4, 2015 between The Smart Soho International Limited (the “Acquirer”) and, Himanshu Shah, Shah Capital Management, Inc., Shah Capital Opportunity Fund LP, Hong Liang Lu, Lu Charitable Remainder Trust, The Lu Family Limited Partnership and Lu Family Trust (collectively, the ’Sellers”) (incorporated by reference to Exhibit 99.2 to Amendment No. 15 to the Schedule 13D filed by the Sellers on November 5, 2015). |

| 99.2 | Letter Agreement amending the Purchase Agreement dated December 4, 2015 between Acquirer and the Sellers (incorporated by reference to Exhibit 99.3 to Amendment No. 16 to the Schedule 13D filed by the Sellers on December 11, 2015) |

| 99.3 | Joint Filing Agreement (filed herewith). |

| 99.4 | Letter of Guarantee dated December 4, 2015 issued by Phicomm Technology (Hong Kong) Co., Limited to the Sellers (filed herewith). |

| 99.5 | English translation of Capital Increase and Share Subscription Agreement dated December 2, 2015, among Chongqing Liangjian New Area Strategic Emerging Industries Equity Investment Fund Partnership (Limited Liability Partnership), Shanghai Phicomm Communication Co., Ltd., Phicomm Technology (Hong Kong), Limited and The Smart Soho International Limited (filed herewith). |

| 15 |

Signatures

After reasonable inquiry and to the best of each of the undersigned’s knowledge and belief, each of the undersigned certify that the information set forth in this statement is true, complete and correct.

Dated: December 14, 2015

| SHANGHAI PHICOMM COMMUNICATION CO., LTD. | |||

| By: | /s/ | Gu Guoping | |

| Name: | Gu Guoping | ||

| Title: | Chairman | ||

| PHICOMM TECHNOLOGY (HONG KONG) CO., LIMITED. | |||

| By: | /s/ | Gu Guoping | |

| Name: | Gu Guoping | ||

| Title: | Sole Director | ||

| THE SMART SOHO INTERNATIONAL LIMITED | |||

| By: | /s/ | Gu Guoping | |

| Name: | Gu Guoping | ||

| Title: | Sole Director | ||

| GU GUOPING, individually | |||

| /s/ | Gu Guoping | ||

| Name: | Gu Guoping | ||

| Chongqing

Liangjian New AREA Strategic Emerging Industries Equity Investment Fund Partnership (Limited LIABILITY Partnership) | |||

| By: | /s/ | Zhang Jun | |

| Name: | Zhang Jun | ||

| Title: | Executive Partner Representative | ||

Exhibit 99.3

JOINT FILING AGREEMENT

In accordance with Rule 13d-1(k) under the Securities Exchange Act of 1934, as amended, the undersigned agree to the joint filing on behalf of each of them of a statement on Schedule 13D (including amendments thereto) with respect to the Ordinary Shares of UTStarcom Holdings Corp. and further agree that this Joint Filing Agreement shall be included as an exhibit to such joint filings.

The undersigned further agree that each party hereto is responsible for the timely filing of such Schedule 13D and any amendments thereto, and for the completeness and accuracy of the information concerning such party contained therein; provided, however, that no party is responsible for the completeness or accuracy of the information concerning any other party making the filing, unless such party knows or has reason to believe that such information is inaccurate.

This Joint Filing Agreement may be executed in any number of counterparts, each of which shall be deemed an original.

IN WITNESS WHEREOF, the parties have executed this Joint Filing Agreement on December 14, 2015.

| SHANGHAI PHICOMM COMMUNICATION CO., LTD. | Chongqing

Liangjian New AREA Strategic Emerging Industries Equity Investment Fund Partnership (Limited LIABILITY Partnership) | ||||||||

| By: | /s/ | Gu Guoping | |||||||

| Name: | Gu Guoping | ||||||||

| Title: | Chairman | ||||||||

| By: | /s/ | Zhang Jun | |||||||

| PHICOMM TECHNOLOGY (HONG KONG) CO., LIMITED. | Name: | Zhang Jun | |||||||

| Title: | Executive Partner Representative | ||||||||

| By: | /s/ | Gu Guoping | |||||||

| Name: | Gu Guoping | ||||||||

| Title: | Sole Director | ||||||||

| THE SMART SOHO INTERNATIONAL LIMITED | |||||||||

| By: | /s/ | Gu Guoping | |||||||

| Name: | Gu Guoping | ||||||||

| Title: | Sole Director | ||||||||

| GU GUOPING, individually | |||||||||

| /s/ | Gu Guoping | ||||||||

| Name: | Gu Guoping | ||||||||

Exhibit 99.4

LETTER OF GUARANTEE

WHEREAS, The Smart Soho International Limited (“Smart Soho”) entered into a Purchase and Sale Agreement (the “Agreement”) with Shah Capital Management, Inc., Shah Capital Opportunity Fund LP, Hong Liang Lu, Lu Charitable Remainder Trust, Lu Family Trust and The Lu Family Limited Partnership (collectively, the “Sellers”) on November 4, 2015, setting out certain terms of a transaction for the sale of 11,739,932 Ordinary Shares held by the Sellers to Smart Soho.

WHEREAS, it is a condition to the obligations of the Sellers to complete the sale and purchase of such 11,739,932 Ordinary Shares that Smart Soho shall have delivered a letter of guarantee from the undersigned Guarantor (as below defined) pursuant to which the undersigned Guarantor shall guarantee the payment obligations of Smart Soho in respect of the “Second Tranche Payments” under the Agreement;

NOW THEREFORE, Phicomm Technology (Hong Kong) Co., Limited (“Guarantor”) hereby guarantees to the Sellers the payment obligations of Smart Soho in respect of the Second Tranche Payments under the Agreement (the “Guaranteed Obligations”), and shall be liable in respect of the Guaranteed Obligations until the full satisfaction by the Guarantor and Smart Soho of such payment obligations.

Guarantor shall remain obligated under this Letter of Guarantee, notwithstanding that, without any notice to or further assent by Guarantor, the Guaranteed Obligations may, from time to time, be renewed, extended, amended, modified, compromised, waived, surrendered, or released by Sellers with the agreement or consent of Smart Soho. Guarantor’s guarantee of the Guaranteed Obligations shall continue to be effective, or be reinstated, as the case may be, if at any time payment, or any part thereof, of any of the Guaranteed Obligations is rescinded or must otherwise be restored or returned by Sellers upon the insolvency, bankruptcy, dissolution, liquidation, or reorganization of Smart Soho, or upon or as a result of the appointment of a receiver, conservator, or trustee or similar officer for Smart Soho or any substantial part of its property, all as though such payments had not been made. Guarantor waives notice of any claim or default or demand for payment made by Sellers to or against Smart Soho and Guarantor agrees that its guarantee of the Guaranteed Obligations shall be continuing and absolute despite any legal or equitable discharge of the Guaranteed Obligations in bankruptcy. Guarantor’s guarantee of the Guaranteed Obligations shall remain in full force and effect and be binding upon Guarantor and the successors and assigns thereof, and shall inure to Sellers and their respective successors and assigns until all the Guaranteed Obligations have been indefeasibly paid in full. Guarantor further agrees that its liability under this Letter of Guarantee shall be continuing, absolute, primary, and direct, and that the Sellers shall not be required to pursue any right or remedy they may have against Smart Soho under the Agreement, or any modifications or amendments thereto, or any other document(s) or instrument(s) executed by Smart Soho, or otherwise. Guarantor affirms that the Sellers shall not be required to first commence any action or obtain any judgment against Smart Soho before enforcing this Letter of Guarantee against Guarantor, and that Guarantor will, upon demand, pay the Sellers any amount, the payment of which is guaranteed hereunder and the payment of which by Smart Soho is in default under the Agreement.

Guarantor warrants and represents to the Sellers that the execution and delivery of this Letter of Guarantee is not in contravention of Guarantor’s Articles of Association, other constitutional documents or applicable law; that the execution and delivery of this Letter of Guarantee, and the performance thereof, has been duly authorized by the Guarantor’s Board of Directors; and that the execution, delivery, and performance of this Letter of Guarantee will not result in a breach of, or constitute a default under, any loan agreement, indenture, or contract to which Guarantor is a party or by or under which it is bound.

This Letter of Guarantee and the rights and obligations provided hereunder shall be governed by the laws of New York, without regard to the conflicts of law principles thereof. Any dispute arising out of or in connection with this Letter of Guarantee, including any question regarding its existence, validity or termination and the rights and obligations provided hereunder shall be referred to and finally resolved by arbitration in accordance with Clause 4.06 of the Agreement which shall be incorporated into and apply to this Letter of Guarantee mutatis mutandis.

Capitalized terms and expressions hereunder shall have the same meaning as those stipulated in the Agreement.

For and on behalf of

Phicomm Technology (Hong Kong) Co., Limited

| /s/ Gu Guoping | |

| Date: December 4, 2015 |

Exhibit 99.5

Capital Increase and Share Subscription Agreement

by and among

Chongqing Liangjiang New Area Strategic Emerging Industries Equity Investment Fund Partnership (Limited Liability Partnership)

Shanghai Phicomm Communication Co., Ltd

Phicomm Technology (Hong Kong) Co., Limited

and

The Smart Soho International Limited

Date: December 2, 2015

Place: Chongqing, China

| 1/20 |

Table of Contents

| 1. | DEFINITIONS AND INTERPRETATION | 5 |

| 2. | CLOSING OF THE SHARES OF PARTY D | 8 |

| 3. | GUARANTEES | 10 |

| 4. | OBLIGATIONS OF THE INVESTED PARTY | 11 |

| 5. | REPURCHASE | 12 |

| 6. | EARLY EXIT AND COMPENSATION | 14 |

| 7. | RIGHTS OF PARTY A AS THE INVESTOR | 17 |

| 8. | CONFIDENTIALITY | 17 |

| 9. | GENERAL PROVISIONS | 17 |

| 10. | VIOLATION OF LAWS | 18 |

| 11. | NOTICE | 18 |

| 12. | TERMINATION | 19 |

| 13. | REMEDIES AND WAIVER | 19 |

| 14. | FORCE MAJEURE | 19 |

| 15. | ARBITRATION | 19 |

| 16. | APPLICABLE LAWS | 19 |

| 17. | EFFECTIVENESS | 19 |

| 18. | MISCELLANEOUS | 19 |

| APPENDIX A AMENDMENT TO THE MEMORANDUM AND ARTICLES OF ASSOCIATION | 22 | |

| APPENDIX B REPRESENTATIONS, WARRANTIES AND UNDERTAKINGS | 25 | |

| 2/20 |

Capital Increase and Share Subscription Agreement

This Capital Increase and Share Subscription Agreement is made and entered into as of December 2, 2015 in Chongqing, China, by and among:

| (1) | Chongqing Liangjiang New Area Strategic Emerging Industries Equity Investment Fund Partnership (Limited Liability Partnership) (hereinafter referred to as “Party A”), a partnership incorporated and existing under the laws of the People’s Republic of China with its registered address at No. 19, Yinglong Road, Longxing Township, Yubei, Chongqing; |

| (2) | Shanghai Phicomm Communication Co., Ltd. (hereinafter referred to as “Party B”), a liability limited company incorporated and existing under the laws of the People’s Republic of China with its registered address at No. 3666, Sixian Road, Songjiang District, Shanghai; |

| (3) | Phicomm Technology (Hong Kong) Co., Limited (hereinafter referred to as “Party C”), a liability limited company incorporated and existing under the laws of the Hong Kong Special Administrative Region of the People’s Republic of China with its registered address at Suite 1205-6, ICBC Tower, Citibank Plaza, 3 Garden Road, Central, Hong Kong; |

| (4) | The Smart Soho International Limited (hereinafter referred to as “Party D”), a liability limited company incorporated and existing under the laws of Cayman Islands with its registered address at PO Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands. |

| 3/20 |

Whereas

| (A) | Party B has established a wholly-owned subsidiary, Party C, in Hong Kong, Party C has established a wholly-owned subsidiary, Party D, in Cayman Islands, and Party D intends to acquire the shares of UTStarcom Holdings Corp., a company listed on NASDAQ, (hereinafter referred to “UTStarcom”); |

| (B) | On August 6, 2015, Party D concluded a binding term sheet (hereinafter referred to the “Term Sheet”) and a third-party escrow agreement (hereinafter referred to the “Escrow Agreement”) with Shah Capital Management and Hong Liang Lu, shareholders of UTStarcom, and their respective affiliates (hereinafter referred to as the “Sellers”) with respect to the proposed acquisition of 11,739,932 shares of UTStarcom by Party D from the Sellers; and Party C has deposited US$1,000,000 into the designated account for the benefit of Party D in accordance with the Escrow Agreement; |

| (C) | On November 4, 2015, Party D concluded the Purchase and Sale Agreement with the Sellers, pursuant to which Party D, among certain other terms and conditions agreed by the parties, acquired 11,739,932 ordinary shares of UTStarcom from the Sellers at a price of US$6 per share (hereinafter referred to as the “Acquisition of UT Shares”); |

| (D) | Party D has established a special purpose entity for and only for the purpose of implementing the Acquisition of UT Shares, and the special purpose entity has a total share capital of US$50,000 divided into 50,000 shares with a par value of US$1 per share; and the issued share capital of Party D is US$1 as of the date of this Agreement, which is wholly owned by Party C; |

| (E) | The parties unanimously agree that Party C increases the capital of Party D by US$42,263,755.2 (including US$1,000,000 deposited into the designated account in accordance with the Escrow Agreement) and Party A increases the capital of Party D by US$28,175,836.8 (hereinafter referred to as the “Capital Increased by Party A”); Party A is admitted as a new shareholder of Party D and obtains 40% shares of Party D (hereinafter referred to as the “Subject Shares”); and Party C holds 60% shares of Party D. |

| (F) | Party B undertakes that Party A has the right to require Party B repurchasing the 40% shares of Party D from Party A at any time within two years after three years of the Closing Date (hereinafter referred to as the “Shares Repurchase”), and Party A has the right to require Party B determining the repurchase price based on the higher of the Annualized Return Repurchase Price or the Market Value Repurchase Price. |

| 4/20 |

NOW THEREFORE, the parties reach this Agreement as follows regarding the increase of the capital of Party D by Party C and Party A for share capital expansion through friendly negotiations.

1. Definitions and Interpretation

| 1.1 | Unless otherwise stipulated, for the purpose of this Agreement and the appendices hereto: |

| “Amendment to the Articles” shall refer to the amendment to the articles of association jointly concluded by Party A and Party C in the form and substance specified in Appendix A hereto; |

| “Business Day” shall refer to any day on which the banks are open for business in the PRC, Hong Kong and Cayman Islands (other than Saturdays, Sundays and statutory public holidays); |

| “Closing” shall refer to the completion of additional issue and share subscription in accordance with Clause 2 hereof; |

| “Closing Date” shall refer to the date on which the increased capital payable by Party A to Party D is paid to the account designated by Party D at the time stipulated in Clause 2.4; |

| “Contribution Date” shall refer to the date on which Party A instructs the remitting bank to remit the Capital Increased by Party A to the account of Party D; |

| “Lock-up Period” shall refer to the three years applicable to Party A from the Closing Date; |

| “Number of the Subject Shares” shall refer to the aggregate number of the additional shares issued by Party D to Party A with a par value of US$0.1 per share (US$28,175,836.8 in total), which is 28,175,836 shares in total, accounting for 40% of the total shares of Party D upon the additional issue by Party D to Party A and Party C; |

| “Encumbrances” shall refer to any and all the mortgage, assignment of receivable accounts, bonds, liens, guarantees, pledge, reserved ownership, rights of acquisition, security interest, options, rights of pre-emption or other similar rights, rights of first refusal and other burdens or conditions; |

| 5/20 |

| “Approval Authority” shall refer to the governmental authority of the PRC competent to conduct examination and approval; |

| “IPR” shall refer to any trademark, ongoing trademark application, patent, ongoing patent application, proprietary technology, registered and unregistered design, copyright, trade secret and license related to the foregoing or other similar industrial or commercial right; |

| “Material Adverse Change” has the meaning set forth in Clause 6.1(u); |

| “PRC” shall refer to the People’s Republic of China (for the purpose of this Agreement, excluding Hong Kong, Macau and Taiwan); |

| “Registration Authority” shall refer to the governmental authority of the PRC competent to issue business licenses; |

| “RMB” shall refer to the statutory currency of the PRC; |

| “Tax” or “Taxation” shall refer to any and all the taxes imposed in the PRC or any other region in any form, including all the state taxes or local taxes; |

| “Transaction” shall refer to the issue of shares by Party D to Party A and Party C hereunder; |

| “US$”shall refer to the statutory currency of the United States of America; |

| “Warranties” shall refer to the representations, warranties and undertakings made by the parties as stipulated in Appendix B hereto; |

| “Capital Increased by Party A” shall refer to the amount paid by Party A to Party D for capital increase, that is, US$28,175,836.8; |

| “Capital Increased by Party C” shall refer to the amount paid by Party C to Party D for capital increase, that is, US$42,263,755.2 (including the US$1,000,000 deposited into the designated account in accordance with the Escrow Agreement); |

| “Annualized Return Purchase Price” shall refer to the total value of the principal and the interest from the Closing Date to the date of the repurchase notice from Party A to Party B, among which the principal is the proportion of the number of the shares to be repurchased each time as required by Party A in the Number of the Subject Shares multiplied by the Capital Increased by Party A and the interest is calculated at the annualized interest rate of 8%; |

| 6/20 |

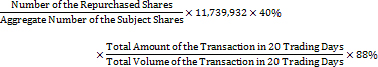

“Market Value Purchase Price” shall refer to

For the purpose of this definition, 20 trading days shall refer to the 20 trading days before Party A notifies Party B of exit in writing;

| 1.2 | Any reference to laws and regulations in this Agreement or the appendices and schedules hereto shall include the laws and regulations and the laws and regulations amended or re-enacted according to the laws and regulations from time to time, whether before or after the date of this Agreement, as long as such amendments or re-enacts apply to or may be apply to any Transaction entered into prior to the Closing, and (as long as the liabilities under the Transaction will exist or take place) also include the previous laws or regulations directly or indirectly replaced by the laws or regulations (including the amendments or re-enacts thereto). |

| 1.3 | The headings of this Agreement are for convenience of reference only and will not affect the interpretation of this Agreement. |

| Any reference to “this Agreement” herein shall include any and all the amendments, supplements and changes agreed by the parties. |

Unless otherwise stipulated, words importing the singular shall include the plural and vice versa; and words importing a gender shall include any other gender. “Person” (regardless of any of the following words used together with “Person” sometimes) shall include individuals, corporations, enterprises, partnerships, firms, trustees, trusts, executors, administrators or other legal personal representatives, unincorporated associations, joint ventures, enterprise groups or other commercial enterprises, governmental, administrative or regulatory authorities or agencies and successors, legal representatives and assigns thereof (as the case may be). Pronouns shall include the similar extended meanings.

Any reference to “writing” and “in the written form” shall include the tangible copies in any form.

Any reference to “whereas”, “clause”, “appendix” and “schedule” means the whereas, clause, appendix and schedule of this Agreement (unless otherwise stipulated). Any reference to “sub-clause” means a paragraph of a clause. Appendices and schedules shall constitute an integral part hereof and have the same legal force and effect as this Agreement as if the same were explicitly specified in the body of this Agreement.

| 7/20 |

| 1.4 | If the date on which a certain matter or obligation shall be completed is not a Business Day, any matter or obligation to be completed on the date shall be completed on the immediately following Business Day. |

2. Closing of the Shares of Party D

| 2.1 | In accordance with the relevant provisions hereof, Party D, as the owner of the Subject Shares, agrees to issue additional shares to be subscribed for by Party A and Party C. In reliance on various Warranties, Party A agrees to purchase from Party D the Subject Shares, free from Encumbrances, and all the interests related thereto. |

| 2.2 | Before Party A makes contribution to Party D, the following conditions shall be satisfied: |

| 2.2.1 | The Purchase and Sale Agreement between Party D and the shareholders of UTSTARCOM remains legitimate and valid, and Party D has fully disclosed to Party A any and all the legal documents concluded by and between Party D and the Sellers in relation to the Purchase and Sale Agreement; |

| 2.2.2 | Party C undertakes to pay the increased capital of US$42,263,755.2 (including the US$1,000,000 deposited into the designated account in accordance with the Escrow Agreement) to the account designated by Party D within the time limit and in the manner agreed herein. |

| 2.2.3 | The authorized representatives or authorized authorities of Party C and Party D have passed or made necessary resolutions or expressions, approving Party D to issue additional shares as agreed herein to Party A and Party C, respectively, so that Party A and Party C will become the shareholders of Party D, holding the corresponding number of shares upon the capital increase of Party D. |

| 2.2.4 | The contribution by Party A to Party D has been approved by the internal competent authority of Party A through resolutions and approved by any and all the Approval Authorities related to the contribution. |

| 2.2.5 | In consideration that Party A will become the registered shareholder of Party D, Party C and Party D have delivered to Party A for review any and all the application documents to be signed by Party A and submitted to the local commercial registration authority in the place where Party D is located and have obtained the consent of Party A. | |

| 2.2.6 | The representations, warranties and undertakings of Party B, Party C and Party D under this Agreement and the appendices hereto have been legally and duly satisfied and remain legitimate and valid upon capital contribution. |

| 8/20 |

| 2.3 | Party A agrees to contribute US$28,175,836.8 to Party D only for the Acquisition of UT |

Shares specified in item (C) of the whereas clause hereof, and obtains 40% shares of Party D.

| 2.4 | Subject to the satisfaction of all the conditions under Clause 2.2, Party A shall pay the agreed amount in US$ directly to the account designated by Party D, and shall ensure that the Capital Increased by Party A will be fully paid to the designated account before 16:00 on December 3, 2015 (Beijing Time) (except that Party A will not be deemed as breaching this Agreement if the amount may not be received in the account by the reasons not attributable to Party A). The cost incurred by Party A due to foreign currency purchase shall be solely borne by Party A. If the participation of Party A in this capital increase will be subject to foreign investment filing/examination and approval procedures in accordance with the laws and regulations of the PRC, Party A shall reasonably complete such foreign investment filing/examination and approval procedures in good faith as early as possible before the payment date agreed herein, during which Party C and Party D shall render all the necessary assistance or cooperation. The information of the account designated by Party D is as follows: |

| Account Name: THE SMART SOHO INTERNATIONAL LIMITED |

| Account Number: NRA10010020000000608 |

| Opening Bank: SPD Silicon Valley Bank |

| 2.5 | Party D will go through the relevant procedures of capital verification and share registration and other administrative examination and approval, registration, filing and similar formalities stipulated by local laws and regulations or required by competent administrative authorities with respect to this capital increase in Cayman Islands by itself and at its own cost. |

| 2.6 | If Party A fails to make contribution before the time agreed in Clause 2.4 due to the non-satisfaction of the conditions under Clause 2.2, Party D shall raise funds by itself (including but not limited to borrowing funds from third parties) so that the Purchase and Sale Agreement with the relevant shareholders UTSTARCOM may be performed in due time, and any and all the liabilities of breach, damage and losses, costs and fees to any third party so incurred shall be solely borne by Party D and Party A is not required to assume any payment obligation or indemnity liability for the same. |

| 9/20 |

| 2.7 | If Party A fails to make contribution before the time agreed in Clause 2.4 due to the non-satisfaction of the conditions under Clause 2.2 and Party C or Party D notifies Party A of terminating or rescinding this Agreement or not making contribution to Party D before Party A makes contribution, Party D shall indemnify Party A for the cost, fees and other expenses incurred by Party A for the application of the project, which is RMB[ ] in total. Subject to the satisfaction of the conditions under Clause 2.2, if Party A fails to make contribution before the time agreed in Clause 2.4, Party A shall indemnify the damage to or losses of Party A, Party B and Party D so incurred, including but not limited to the termination fee, business travel cost, consultation fee and attorney fee under the Purchase and Sale Agreement with the relevant shareholders UTSTARCOM. |

| 2.8 | Upon the issuance of the Subject Shares, Party A will hold 40% shares of Party D and Party C will hold 60% shares of Party D. Party C shall procure Party D to complete the relevant registration formalities within 15 working days upon the contribution made by Party A so that Party A will become the legitimate shareholder of Party D, holding 40% shares of Party D with the number of such shares meeting the requirements regarding the Number of the Subject Shares, and, during the same period, all the supporting documents regarding the shares held by Party A and the supporting documents proving Party C’s complete performance of the capital increase obligations hereunder shall be delivered to Party A, and the legitimate supporting documents regarding the shares held by Party C, proving that Party C has been registered as holding 60% shares of Party D, shall also be provided. |

| 2.9 | Once any party becomes aware that any covenant hereunder has been or may not be satisfied, the party shall immediately notify the other parties. |

| 3.1 | After Party A makes contribution to Party D, in order to ensure that Party B may perform the obligations of repurchasing shares from Party A: |

| 3.1.1 | Party C will pledge all the shares of Party D held by it upon its contribution of the Capital Increased by Party C to Party A as a guarantee on the repurchase of shares by Party B from Party A. | |

| 3.1.2 | Party C shall complete the procedures related to the above share pledge within 15 working days from the Closing Date and assume any and all the relevant fees so incurred so that Party A may become the legitimate pledgee of the shares without hindrance with a view to ensuring that Party B will repurchase the shares and Party A will successfully take back all the repurchase price and the relevant fees incurred during the exercise of the creditor’s rights. | |

| 3.1.3 | Before Party B repurchases the shares and Party A successfully takes back all the repurchase price and the relevant fees incurred during the exercise of the creditor’s rights, Party A has the right not to release the share pledge. | |

| 3.1.4 | If Party B fails to repurchase the shares as agreed, Party A is entitled to the priority in taking back all the repurchase price and the relevant fees incurred during the exercise of the creditor’s rights from the amounts obtained from auction or other sale of the relevant pledged shares. |

| 10/20 |

| 3.2 | For the purpose of ensuring the performance of this Agreement, each of Party B, Party C and Party D irrevocably assumes several and joint liabilities for the possible liabilities of breach, indemnity liabilities or payment obligations of the other parties hereunder for two years from the due date of the said payment obligations. |

4. Obligations of the Invested Party

| 4.1 | Party B, Party C and Party D shall ensure that the Capital Increased by Party A and the Capital Increased by Party C received by Party D and the amounts paid to the Sellers of the shares of UTSTARCOM by Party C for and on behalf of Party D will be used only for the acquisition of the shares of UTSTARCOM. Party D shall be engaged in no other business activities (including but not limited to continuing to purchase other shares of UTSTARCOM) and the shareholding structure of Party D shall not be changed without the written consent of Party A. |

| 4.2 | Party B shall actively adopt such feasible plans and measures as may be necessary to promote the improvement and appreciation of UTSTARCOM. |

| 4.3 | Party D shall submit the registration documents to and obtain the share registration certificates from the competent approval authority of Cayman Islands regarding the matter that Party A and Party C increase the capital of Party D and hold 40% and 60% shares of Party D respectively within 15 working days after the Closing Date; otherwise, Party A has the right to immediately exercise its right of repurchase in accordance with Clause 5 hereof. |

| 4.4 | While Party A exercises its right of repurchase, Party B, Party C and Party D shall render reasonable cooperation so that the relevant examination or registration procedures will be completed within the reasonable period. |

| 4.5 | After Party A pays the increased capital, Party B, Party C and Party D shall make reasonable efforts in good faith to ensure that Party A will obtain the investment returns on the Capital Increased by Party A in an amount no lower than the repurchase price agreed herein under the conditions agreed herein through either requiring Party B repurchasing the Subject Shares held by Party A or liquidating the Subject Shares held by Party A in legitimate ways. |

| 11/20 |

| 5.1 | The parties agree that Party A has the right to require Party B repurchasing the shares of Party D held by Party A in whole or in part by a written notice at any time within two years from the expiry of the Lock-up Period (i.e. thirty-six months upon the Closing). Once Party A raises the repurchase requirement, Party B must perform the obligation of repurchase. Each time when Party A exercises the right of repurchase, Party A shall send a written notice to Party B, specifying the number of the shares of Party D to be repurchased and the repurchase price. Party A has the right to require Party B accepting the shares of Party D held by Party A in the number so notified at the price calculated in accordance with the following Clause 5.2 by notice once or several times subject to the satisfaction of the repurchase conditions agreed herein. |

| 5.2 | Party B shall pay the repurchase price in US$. Party B shall make notifications to and go through relevant registration, filing and examination and approval formalities with the competent foreign exchange administration authorities and banks in advance. The repurchase price payable by Party B shall be the higher of the Annualized Return Repurchase Price and the Market Value Repurchase Price. |

| 5.3 | In addition to paying the repurchase price to Party A, Party B shall also assume any and all the fees incurred due to the Share Repurchase (including but not limited to the fees incurred due to the employment of any intermediary, third party or staff and the administrative fees, taxes and charges paid to the competent governmental administrative authorities or agencies, but excluding the taxes and charges incurred and paid to the competent Taxation authorities of the PRC by Party A). |

| 5.4 | If the shares to be repurchased must be evaluated according to the mandatory rules under the laws of the PRC, the parties agree to appoint an evaluation institution recognized by the state-owned assets supervision and administration authority of Chongqing and designated by Party A to evaluate the shares (subject to the reference date and methods of evaluation determined by Party A). If the evaluated price is higher than the repurchase price agreed herein, the parties shall separately determine the repurchase price and methods through negotiations. |

| 12/20 |

| 5.5 | Party B and Party D shall conclude all of such documents as may be necessary for the completion of the Share Repurchase (including but not limited to procuring the authorized authorities of the parties to pass resolutions approving the Share Repurchase; executing share transfer agreements; and executing the amended articles of association) within 15 working days from the date of the written repurchase notice issued by Party A, and complete all the examination and registration formalities within 12 months from the date of the written repurchase notice issued by Party A (the “Transition Period”), and, during the Transition Period, Party B shall pay all the payable repurchase price and the occupation cost incurred by Party B with respect to the repurchase price during the Transition Period to Party A. The calculation method of the occupation cost is as follows: the interest accrued on the payable repurchase price at the annualized interest rate of 10% from the next day after Party A issues the written notice to the date when Party B actually makes the payment before the expiry of the Transition Period. In case of any outstanding amount upon the expiry of the Transition Period, Party B shall also pay the liquidated damages at 0.1% of the outstanding amount per day. |

| 5.6 | For the avoidance of doubts, notwithstanding the foregoing, Party A may also select to retain its shares in Party D without requiring Party B repurchasing the same within two years from the expiry of the Lock-up Period. |

| 5.7 | Party C and Party D are severally and jointly liable to guarantee the payment of all the amounts payable by Party B when Party A requires Party B repurchasing the shares. |

| 5.8 | In case of any event stipulated in Clause 6.1 hereof, Party A has the right to require Party B early repurchasing the shares held by Party C and paying all the payable amounts regardless of the rules hereof on the Lock-up Period of 36 months. |

| 5.9 | Notwithstanding anything to the contrary, Party B shall redeem all the shares of Party D held by Party A and pay all the payable amounts to Party A before the expiry of the exit period (two years from the expiration of the Lock-up Period), and the agreements in Clause 5.5 shall not violate the agreements in this clause, except for the circumstances stipulated in the above Clause 5.6. |

| 5.10 | If Party A still holds the shares of Party D upon two years from the expiry of the Lock-up Period, Party B may repurchase all the shares of Party D then held by Party A by a written notice to Party A. The repurchase price shall be separately determined by the parties through negotiations. |

| 13/20 |

6. Early Exit and Compensation

| 6.1 | In case of any of the following events, Party A has, at any time, the right to: either require Party B repurchasing the shares of Party D held by Party A in whole or in part in accordance with Clause 5 regardless of the period agreed in Clause 5.1; or rescind this Agreement by a written notice and, if Party A has made contribution, require the party accepting the contribution returning all the contribution and indemnifying any and all the damage to or losses of Party A so caused (including but not limited to litigation fee, arbitration fee, public notarization fee, attorney fee, evaluation fee, certification fee, mailing fee, business travel cost and photocopying fee): |

| (a) | Party B fails to provide the guarantees to Party A as agreed herein or Party C fails to complete the change registration formalities regarding the share pledge as agreed herein within 15 working days after the Closing Date; |

| (b) | Party B or its affiliate fails to pledge the shares of Party D held by it to Party A and complete the share pledge registration formalities within 15 working days from the date when Party B or its affiliate accepts the shares of Party D transferred by Party C as agreed in Clause 7.1 hereof; |

| (c) | Party D fails to complete the relevant registration formalities regarding the change to its shareholding structure or otherwise prevents Party A from becoming its legitimate shareholder within 15 working days after the Closing Date; |

| (d) | Party D fails to provide Party A with the payment voucher regarding the payment of the Capital Increased by Party C paid by Party C and the registration document issued by the competent approval authority of Cayman Islands regarding Party C’s holding of 60% shares of Party D within 15 working days after the Closing Date; |

| (e) | any or several of Party B, Party C and Party D breach the representations, undertakings and warranties under this Agreement and the appendices hereto (as specified in Appendix B); |

| (f) | any or several of Party B, Party C and Party D breach the confidentiality obligations hereunder; |

| (g) | the shareholding structure of Party D is changed without the written consent of Party A within the Lock-up Period; |

| 14/20 |

| (h) | any or several of Party B, Party C and Party D are subject to material lawsuits or arbitrations without timely notifying Party A in writing during the Lock-up Period, or the main bank accounts or significant properties of any or several of Party B, Party C and Party D are attached or frozen by judicial authorities, or the financial conditions of any or several of Party B, Party C and Party D have been or may be subject to the Material Adverse Change, or the significant properties of any or several of Party B, Party C and Party D are frozen, attached or detained by judicial or administrative authorities, or any or several of Party B, Party C and Party D are subject to significant adverse reports published by public media, so that Party A has reasonable grounds to believe that its exercise of the right of repurchase may be incurred or affected; |

| (i) | the operation of any or several of Party B, Party C and Party D is in disorder or suspended for any reason; |

| (j) | any or several of Party B, Party C and Party D or the major shareholders, actual controllers or legal representatives of any or several of Party B, Party C and Party D are suspected to be involved in material irregularity or criminal offenses; |

| (k) | Party A has reasonable grounds to believe that Party B has no sufficient ability or sincerity to fully repurchase the shares as agreed herein as Party B is subject to material operating losses or material derogation in its goodwill or transfers its major assets or major profitable business; |

| (l) | any or several of Party B, Party C and Party D breach any obligation in this Agreement or the Guarantee Documents (the guarantee terms, guarantee contracts, pledge contracts and mortgage contracts hereunder being referred to collectively as the “Guarantee Documents”), or any or several of Party B, Party C and Party D indicate explicitly or through acts that the party/parties will not perform the contractual obligations; |

| (m) | any or several of Party B, Party C and Party D close business or decrease registered capital passively or voluntarily; |

| (n) | any or several of Party B, Party C and Party D cancel the plan of Share Repurchase hereunder or cause the same impossible to be implemented; |

| (o) | any or several of Party B, Party C and Party D make material mistakes in operation so that financial losses are caused. |