Form DFAN14A TICC Capital Corp. Filed by: TPG Specialty Lending, Inc.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ¨ Filed by a Party other than the Registrant x

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement | |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ¨ |

Definitive Proxy Statement | |

| x |

Definitive Additional Materials | |

| ¨ |

Soliciting Material Pursuant to §240.14a-12 | |

TICC CAPITAL CORP.

(Name of Registrant as Specified In Its Charter)

TPG Specialty Lending, Inc.

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | Fee not required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

On July 25, 2016, TPG Specialty Lending, Inc. issued the following press release:

TPG Specialty Lending, Inc. Questions TICC Capital Corp.’s Troubling Corporate Governance Practices

Describes TICC’s Long Track Record that Appears to Prioritize the Personal Interests of Management at the Expense of its Stockholders

Questions TICC’s Reasons for the Unprecedented Change in its Traditional Annual Meeting Scheduling Amid Significant Share Purchases by TICC Directors

Reminds TICC Stockholders That They Have the Right to Terminate the External Adviser’s Contract AT NO COST To Stockholders

Urges TICC Stockholders to Vote the GOLD Proxy Card to Terminate TICC’s External Adviser’s Contract and Elect T. Kelley Millet to the TICC Board

NEW YORK—(BUSINESS WIRE)—TPG Specialty Lending, Inc. (“TSLX”; NYSE:TSLX), a specialty finance company focused on lending to middle-market companies, today issued a letter to TICC Capital Corp. (“TICC”) stockholders highlighting TICC’s long track record of troubling corporate governance practices that appear to prioritize the personal interests of management at the expense of stockholders. Please click here to view the full letter: http://www.changeticcnow.com/content/uploads/2016/07/TSLX-Questions-TICC-Governance-Practices.pdf.

TSLX presents a timeline outlining how TICC insiders accumulated shares of TICC between May 5 and June 27, 2016, amid an unprecedented departure from TICC’s traditional annual meeting schedule.

TSLX further explains that TICC has failed to take sufficient remedial action to implement meaningful reforms despite clear requests for change from stockholders, respected proxy advisors and independent analysts.

The letter also urges stockholders to protect their investment in TICC by signing and returning the GOLD proxy card voting FOR the termination of the investment advisory agreement between TICC and its external adviser and the election of TSLX’s highly-qualified and independent nominee, T. Kelley Millet, to TICC’s Board of Directors at TICC’s 2016 Annual Meeting, scheduled for September 2, 2016.

TSLX’s proxy materials are also available through the SEC’s website and at www.changeTICCnow.com.

About TPG Specialty Lending

TPG Specialty Lending, Inc. (“TSLX” or the “Company”) is a specialty finance company focused on lending to middle-market companies. The Company seeks to generate current income primarily in U.S.-domiciled middle-market companies through direct originations of senior secured loans and, to a lesser extent, originations of mezzanine loans and investments in corporate bonds and equity securities. The Company has elected to be regulated as a business development company, or BDC, under the Investment Company Act of 1940 and the rules and regulations promulgated thereunder. TSLX is externally managed by TSL Advisers, LLC, a Securities and Exchange Commission registered investment adviser. TSLX leverages the deep investment, sector, and operating resources of TPG Special Situations Partners, the dedicated special situations and credit platform of TPG, with approximately $16 billion of assets under management as of March 31, 2016, and the broader TPG platform, a global private investment firm with approximately $74 billion of assets under management as of March 31, 2016. For more information, visit the Company’s website at www.tpgspecialtylending.com.

Forward-Looking Statements

Information set forth herein may contain forward-looking statements, including, but not limited to, statements with regard to the expected future financial position, results of operations, cash flows, dividends, portfolio, financing plans, business strategy, budgets, capital expenditures, competitive positions, growth opportunities, plans and objectives of management of TICC Capital Corp. (“TICC”), statements with regard to the expected future financial position, results of operations, cash flows, dividends, portfolio, financing plans, business strategy, budgets, capital expenditures, competitive positions, growth opportunities, plans and objectives of management of TPG Specialty Lending, Inc. (“TSLX”), and statements with regard to TSLX’s proposed business combination transaction with TICC (including any financing required in connection with a possible transaction and the benefits, results, effects and timing of a possible transaction). Statements set forth herein concerning the business outlook or future economic performance, anticipated profitability, revenues, expenses, dividends or other financial items, and product or services line growth of TSLX, TICC and/or the combined businesses of TSLX and TICC, including, but not limited to, statements containing words such as “anticipate,” “approximate,” “believe,” “plan,” “estimate,” “expect,” “project,” “could,” “would,” “should,” “will,” “intend,” “may,” “potential,” “upside” and other similar expressions, together with other statements that are not historical facts, are forward-looking statements that are estimates reflecting the best judgment of TSLX based upon currently available information.

Such forward-looking statements are inherently uncertain, and stockholders and other potential investors must recognize that actual results may differ materially from TSLX’s expectations as a result of a variety of factors including, without limitation, those discussed below. Such forward-looking statements are based upon TSLX’s current expectations and include known and unknown risks, uncertainties and other factors, many of which TSLX is unable to predict or control, that may cause TSLX’s plans with respect to TICC or the actual results or performance of TICC, TSLX or TICC and TSLX on a combined basis to differ materially from any plans, future results or performance expressed or implied by such forward-looking statements. These statements involve risks, uncertainties and other factors discussed below and detailed from time to time in TSLX’s filings with the Securities and Exchange Commission (“SEC”).

Risks and uncertainties related to a possible transaction include, among others, uncertainty as to whether TSLX will further pursue, enter into or consummate a transaction on the terms set forth in its proposal or on other terms, uncertainty as to whether TICC’s board of directors will engage in good faith, substantive discussions or negotiations with TSLX concerning its proposal or any other possible transaction, potential adverse reactions or changes to business relationships resulting from the announcement or completion of a transaction, uncertainties as to the timing of a transaction, adverse effects on TSLX’s stock price resulting from the announcement or consummation of a transaction or any failure to complete a transaction, competitive responses to the announcement or consummation of a transaction, the risk that regulatory or other approvals and any financing required in connection with the consummation of a transaction are not obtained or are obtained subject to terms and conditions that are not anticipated, costs and difficulties related to a potential integration of TICC’s businesses and operations with TSLX’s businesses and operations, the inability to obtain, or delays in obtaining, cost savings and synergies from a transaction, unexpected costs, liabilities, charges or expenses resulting from a transaction, litigation relating to a transaction, the inability to retain key personnel, and any changes in general economic and/or industry specific conditions.

In addition to these factors, other factors that may affect TSLX’s plans, results or stock price are set forth in TSLX’s Annual Report on Form 10-K and in its reports on Forms 10-Q and 8-K.

Many of these factors are beyond TSLX’s control. TSLX cautions investors that any forward-looking statements made by TSLX are not guarantees of future performance. TSLX disclaims any obligation to update any such factors or to announce publicly the results of any revisions to any of the forward-looking statements to reflect future events or developments.

Third Party-Sourced Statements and Information

Certain statements and information included herein have been sourced from third parties. TSLX does not make any representations regarding the accuracy, completeness or timeliness of such third party statements or information. Except as expressly set forth herein, permission to cite such statements or information has neither been sought nor obtained from such third parties. Any such statements or information should not be viewed as an indication of support from such third parties for the views expressed herein. All information in this communication regarding

TICC, including its businesses, operations and financial results, was obtained from public sources. While TSLX has no knowledge that any such information is inaccurate or incomplete, TSLX has not verified any of that information. TSLX reserves the right to change any of its opinions expressed herein at any time as it deems appropriate. TSLX disclaims any obligation to update the data, information or opinions contained herein.

Proxy Solicitation Information

In connection with TSLX’s solicitation of proxies for the 2016 annual meeting of TICC stockholders in favor of (a) the election of TSLX’s nominee to serve as a director of TICC and (b) TSLX’s proposal to terminate the Investment Advisory Agreement, dated as of July 1, 2011, by and between TICC and TICC Management, LLC, as contemplated by Section 15(a) of the Investment Company Act of 1940, as amended, TSLX filed an amended definitive proxy statement in connection therewith on Schedule 14A with the SEC on July 14, 2016 (the “TSLX Proxy Statement”). TSLX has mailed the TSLX Proxy Statement and accompanying GOLD proxy card to stockholders of TICC. This communication is not a substitute for the TSLX Proxy Statement.

TSLX STRONGLY ADVISES ALL STOCKHOLDERS OF TICC TO READ THE TSLX PROXY STATEMENT AND THE OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY CONTAIN IMPORTANT INFORMATION. SUCH TSLX PROXY MATERIALS ARE AND WILL BECOME AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV AND ON TSLX’S WEBSITE AT HTTP://WWW.TPGSPECIALTYLENDING.COM. IN ADDITION, TSLX WILL PROVIDE COPIES OF THE TSLX PROXY STATEMENT WITHOUT CHARGE UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO TSLX’S PROXY SOLICITOR AT [email protected].

The participants in the solicitation are TSLX and T. Kelley Millet, and certain of TSLX’s directors and executive officers may also be deemed to be participants in the solicitation. As of the date hereof, TSLX beneficially owned 1,633,719 shares of common stock of TICC. As of the date hereof, Mr. Millet did not directly or indirectly beneficially own any shares of common stock of TICC.

Security holders may obtain information regarding the names, affiliations and interests of TSLX’s directors and executive officers in TSLX’s Annual Report on Form 10-K for the year ended December 31, 2015, which was filed with the SEC on February 24, 2016, its proxy statement for the 2016 annual meeting of TSLX stockholders, which was filed with the SEC on April 8, 2016, and certain of its Current Reports on Form 8-K. These documents can be obtained free of charge from the sources indicated above. Additional information regarding the interests of these participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is available in the TSLX Proxy Statement and other relevant materials to be filed with the SEC (if and when available).

This document shall not constitute an offer to sell, buy or exchange or the solicitation of an offer to sell, buy or exchange any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No

offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Contacts

TPG Specialty Lending, Inc.

Investors

Lucy Lu

212-601-4753

or

Charlie Koons

MacKenzie Partners, Inc.

800-322-2885

or

Media

Luke Barrett

212-601-4752

or

Tom Johnson or Pat Tucker

Abernathy MacGregor

212-371-5999

[email protected] /[email protected]

July 25, 2016

Fellow TICC Stockholders:

TICC Capital Corp. (“TICC” or the “Company”) has a long track record of troubling

corporate governance prac ces that appear to priori ze protec ng the personal

interests of

management at the expense of you, the stockholders.

The m e is now to tell TICC that enough is enough.

It is your right as a stockholder to enact change at TICC. VOTE THE

ENCLOSED GOLD CARD NOW to

protect your investment and end more

than a decade of failure at TICC.

On

behalf of TPG Specialty Lending, Inc. (“TSLX”), we urge you to vote today to

terminate the investment advisory agreement between TICC and its external

adviser

and to elect our highly qualified and independent nominee, T. Kelley Millet, to TICC’s

Board of Directors.

Stockholders have the right, under the Investment Company Act of 1940, as

amended, to terminate the external adviser’s contract at no cost to stockholders.

Sincerely,

TPG Specialty Lending, Inc.

Joshua Easterly Michael Fishman

Chairman and

Co--?Chief Execuv e O?cerCo--?Chief Execuv e O?cer

PROTECT YOUR INVESTMENT. VOTE

THE GOLD CARD TODAY TO END A DECADE OF

FAILURE AT TICC. YOUR VOTE COUNTS. VOTING INFORMATION CAN BE FOUND AT

WWW.CHANGETICCNOW.COM

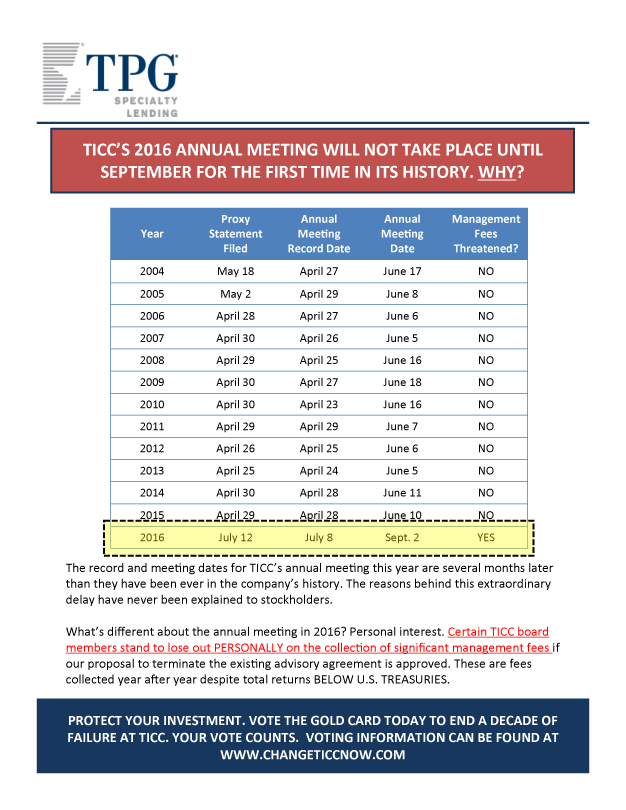

TICC’S 2016 ANNUAL MEETING WILL NOT TAKE PLACE UNTIL

SEPTEMBER FOR THE FIRST TIME IN ITS HISTORY. WHY?

Proxy Annual Annual Management

Year Statement Mee ng Mee ng Fees

Filed Record Date Date Threatened?

2004 May 18 April 27 June 17 NO

2005 May 2 April 29 June 8 NO

2006 April 28 April 27 June 6 NO

2007 April 30 April

26 June 5 NO

2008 April 29 April 25 June 16 NO

2009 April 30 April 27 June 18 NO

2010 April

30 April 23 June 16 NO

2011 April 29 April 29 June 7 NO

2012 April 26 April 25 June 6 NO

2013 April 25 April 24 June 5

NO

2014 April 30 April 28 June 11 NO

2015 April

29 April 28 June 10 NO

The record and meeng dates for TICC’s annual mee ng this year are several months later

than they have been ever in the company’s history. The reasons behind this extraordinary

delay have never been explained to stockholders.

What’s different about

the annual mee ng in 2016? Personal interest. Certain TICC board

members stand to lose out PERSONALLY on the collec on of signi?cant management fees if

our proposal to terminate the exisng advisory agreement is approved. These are fees

collected

year aer year despite total returns BELOW U.S. TREASURIES.

PROTECT YOUR INVESTMENT. VOTE THE GOLD CARD TODAY TO END A DECADE OF

FAILURE AT TICC. YOUR VOTE COUNTS. VOTING INFORMATION CAN BE FOUND AT

WWW.CHANGETICCNOW.COM

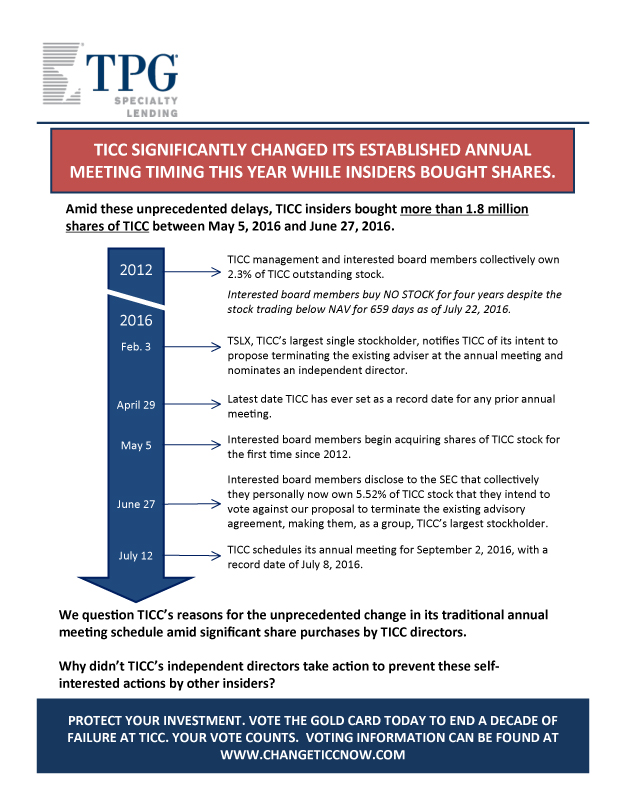

TICC SIGNIFICANTLY CHANGED ITS ESTABLISHED ANNUAL

MEETING TIMING THIS YEAR WHILE INSIDERS BOUGHT SHARES.

Amid these

unprecedented delays, TICC insiders bought more than 1.8 million

shares of TICC between May 5, 2016 and June 27, 2016.

TICC management and interested board members collec vely own

2012 2.3% of TICC outstanding

stock.

Interested board members buy NO STOCK for four years despite the

stock

trading below NAV for 659 days as of July 22, 2016.

2016

Feb. 3 TSLX,

TICC’s largest single stockholder, no fies TICC of its intent to

propose termina ng the exis ng adviser at the annual mee ng and

nominates an independent director.

April 29 Latest date TICC has ever set as a record date for

any prior annual

meen g.

May 5 Interested board members begin acquiring

shares of TICC stock for

the ?rst me since 2012.

Interested board members

disclose to the SEC that collec vely

they personally now own 5.52% of TICC stock that they intend to

June 27 vote against our proposal to terminate the exis ng advisory

agreement, making them, as

a group, TICC’s largest stockholder.

July 12 TICC schedules its annual mee ng for September 2, 2016, with a

record date of July 8, 2016.

We ques on TICC’s reasons for the unprecedented change in

its tradi onal annual

mee ng schedule amid signi?cant share purchases by TICC directors.

Why didn’t TICC’s independent directors take ac on to prevent these self--?

interested ac ons by other insiders?

PROTECT YOUR INVESTMENT. VOTE THE GOLD CARD TODAY TO END

A DECADE OF

FAILURE AT TICC. YOUR VOTE COUNTS. VOTING INFORMATION CAN BE FOUND AT

WWW.CHANGETICCNOW.COM

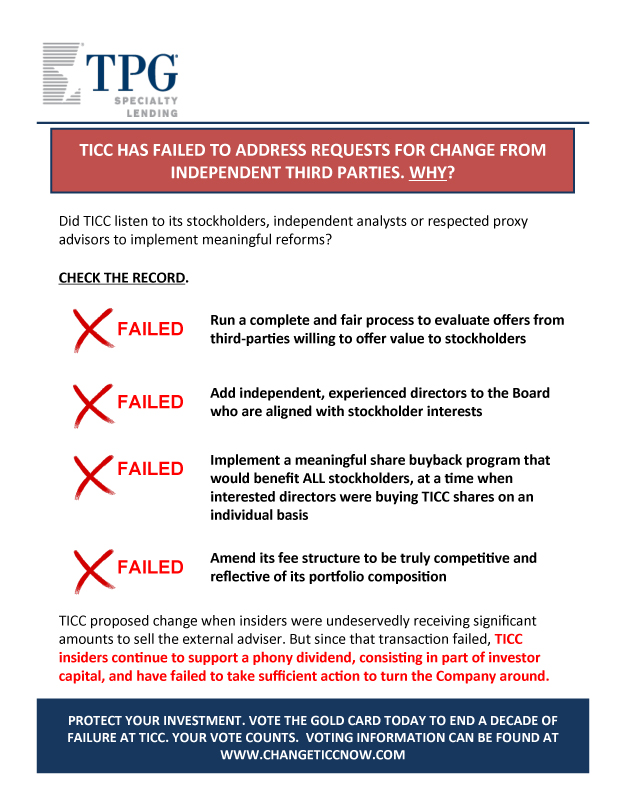

TICC HAS FAILED TO ADDRESS REQUESTS FOR CHANGE FROM

INDEPENDENT THIRD PARTIES. WHY?

Did TICC listen to its stockholders,

independent analysts or respected proxy

advisors to implement meaningful reforms?

CHECK THE RECORD.

Run a complete and fair process to evaluate o?ers from

FAILEDthird--?par es willing to o?er value to stockholders

Add independent, experienced directors to the Board

FAILED who are aligned with stockholder

interests

Implement a meaningful share buyback program that

FAILED would

bene?t ALL stockholders, at a me when

interested directors were buying TICC shares on an

individual basis

Amend its fee structure to be truly compe ve and

FAILED re?ec ve of its por olio composi on

TICC proposed change when insiders were

undeservedly receiving signi?cant

amounts to sell the external adviser. But since that transac on failed, TICC

insiders con nue to support a phony dividend, consis ng in part of investor

capital, and have

failed to take su?cient ac on to turn the Company around.

PROTECT YOUR INVESTMENT. VOTE THE GOLD CARD TODAY TO END A DECADE OF

FAILURE AT TICC. YOUR VOTE COUNTS. VOTING INFORMATION CAN BE FOUND AT

WWW.CHANGETICCNOW.COM

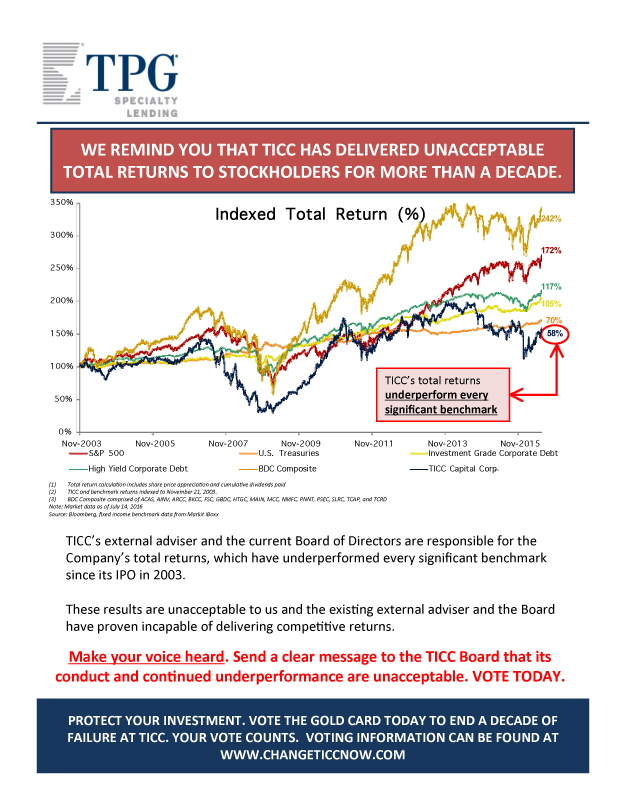

WE REMIND YOU THAT TICC HAS DELIVERED UNACCEPTABLE

TOTAL RETURNS TO STOCKHOLDERS FOR MORE THAN A DECADE.

350%

Indexed Total Return (%) 242%

300%

172%

250%

117%

200% 105%

70%

150% 58%

100%

TICC’s total returns

50% underperform every

signi?cant benchmark

0%

Nov-2003 Nov-2005 Nov-2007 Nov-2009 Nov-2011 Nov-2013 Nov-2015

S&P 500 U.S. Treasuries Investment Grade Corporate Debt

High Yield Corporate Debt BDC

Composite TICC Capital Corp

| (1) | Total return calcula on includes share price apprecia on and cumula ve dividends paid |

| (2) | TICC and benchmark returns indexed to November 21, 2003. |

(3) BDC Composite comprised of ACAS, AINV, ARCC, BKCC, FSC, GBDC, HTGC, MAIN, MCC, NMFC, PNNT, PSEC, SLRC, TCAP, and TCRD

Note: Market data as of July 14, 2016

Source: Bloomberg, ?xed income benchmark data from

Markit iBoxx

TICC’s external adviser and the current Board of Directors are responsible for the

Company’s total returns, which have underperformed every significant benchmark

since its

IPO in 2003.

These results are unacceptable to us and the exisng external adviser and the Board

have proven incapable of delivering compev e returns.

Make your voice heard. Send a clear

message to the TICC Board that its

conduct and con nued underperformance are unacceptable. VOTE TODAY.

PROTECT YOUR INVESTMENT. VOTE THE GOLD CARD TODAY TO END A DECADE OF

FAILURE AT TICC. YOUR

VOTE COUNTS. VOTING INFORMATION CAN BE FOUND AT

WWW.CHANGETICCNOW.COM

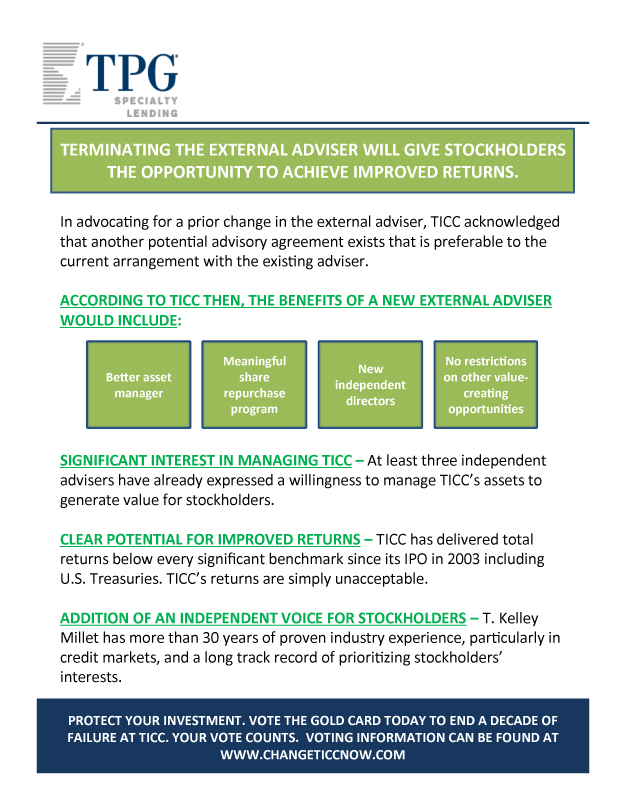

TERMINATING THE EXTERNAL ADVISER WILL GIVE STOCKHOLDERS

THE OPPORTUNITY TO ACHIEVE IMPROVED RETURNS.

In advoca ng for a prior change in the external

adviser, TICC acknowledged

that another poten al advisory agreement exists that is preferable to the

current arrangement with the exisng adviser.

ACCORDING TO TICC THEN, THE BENEFITS OF A NEW

EXTERNAL ADVISER

WOULD INCLUDE:

Meaningful No restric ons

New

Be er asset shareon other value--?

independent

manager repurchase crea ng

directors

program opportuni es

SIGNIFICANT INTEREST IN MANAGING TICC – At least three independent

advisers have already

expressed a willingness to manage TICC’s assets to

generate value for stockholders.

CLEAR POTENTIAL FOR IMPROVED RETURNS – TICC has delivered total

returns below every

signi?cant benchmark since its IPO in 2003 including

U.S. Treasuries. TICC’s returns are simply unacceptable.

ADDITION OF AN INDEPENDENT VOICE FOR STOCKHOLDERS – T. Kelley

Millet has more than 30

years of proven industry experience, par cularly in

credit markets, and a long track record of priorizi ng stockholders’

interests.

PROTECT YOUR INVESTMENT. VOTE THE GOLD CARD TODAY TO END A DECADE OF

FAILURE AT TICC. YOUR VOTE COUNTS. VOTING INFORMATION CAN BE FOUND AT

WWW.CHANGETICCNOW.COM

If you have any ques ons concerning this le er OR HOW

TO VOTE, please call MacKenzie Partners, Inc. at one of

the phone numbers listed below.

105 Madison Avenue

New York, NY 10016

(212) 929--?5500 (call collect)

or

TOLL--?FREE (800) 322--?2885

[email protected]

About TPG Specialty Lending

TPG Specialty Lending, Inc. (“TSLX” or the “Company”) is a specialty finance company focused on lending to

middle--?

market companies. The Company seeks to generate current income primarily in

U.S.--?domiciled middle--?market

companies through direct origina ons of senior

secured loans and, to a lesser extent, origina ons of mezzanine loans

and investments in corporate bonds and equity securi es. The Company has elected to be

regulated as a business

development company, or BDC, under the Investment Company Act of 1940 and the rules and regula ons promulgated

thereunder. TSLX is externally managed by TSL Advisers, LLC, a Securi es and Exchange Commission registered

investment adviser. TSLX leverages the deep investment, sector, and opera ng resources of TPG Special Situa ons

Partners, the dedicated special situao ns and credit plao rm of TPG, with approximately $16 billion of assets under

management as of March 31, 2016, and the broader TPG pla orm, a global private investment ?rm with approximately

$74 billion of assets under management as of March 31, 2016. For more informaon, visit the Company’s website at

www.tpgspecialtylending.com.

Forward--?Looking

Statements

Informa on set forth herein may contain forward--?looking statements, including, but not limited to, statements

with

regard to the expected future ?nancial posi on, results of opera ons, cash ?ows, dividends, por olio, ?nancing plans,

business strategy, budgets, capital expenditures, compe ve posi ons, growth opportuni es, plans and objec ves of

management of TICC Capital Corp. (“TICC”), statements with regard to the expected future financial posi on, results of

opera ons, cash ?ows, dividends, por olio, ?nancing plans, business strategy, budgets, capital expenditures,

compe ve posi ons, growth opportuni es, plans and objec ves of management of TPG Specialty Lending, Inc.

(“TSLX”), and statements with regard to TSLX’s proposed business combina on transac on with TICC (including any

PROTECT YOUR INVESTMENT. VOTE THE GOLD CARD TODAY TO END A DECADE OF

FAILURE AT TICC. YOUR

VOTE COUNTS. VOTING INFORMATION CAN BE FOUND AT

WWW.CHANGETICCNOW.COM

?nancing required in connecon with a possible transacon and the bene?ts, results, e?ects and m ing of a possible

transacTICC’S on). Statements set forth EXTERNAL ADVISER AND herein concerning the business outlook MANAGEMENT or future economic HAS performance, anCOLLECTEDcipated

pro?tability, revenues, expenses, dividends or other ?nancial items, and product or services line growth of TSLX, TICC

and/or the combined businesses of TSLX and TICC, MILLIONS including, but IN not FEESlimited to, statements containing words such as

an cipate,” “approximate,” “believe,” “plan,” “es mate,” “expect,” “project,” “could,”

“would,” “should,” “will,”

“intend,” “may,” “poten al,” “upside” and other similar

expressions, together with other statements that are not

historical facts, are forward--?looking statements that are es

mates re?ec ng the best judgment of TSLX based upon

currently available informa on.

Such forward--?looking statements are inherently uncertain, and stockholders and other poten al investors must

recognize that actual results may differ materially from TSLX’s expecta ons as a result of a variety of factors including,

without limita on, those discussed below. Such forward--?looking statements are based upon TSLX’s current expecta ons

and include known and unknown risks, uncertain es and other factors, many of which TSLX is unable to predict or

control, that may cause TSLX’s plans with respect to TICC or the actual results or performance of TICC, TSLX or TICC and

TSLX on a combined basis to di?er materially from any plans, future results or performance expressed or implied by

such forward--?looking statements. These statements involve risks, uncertain es and other factors discussed below and

detailed from me to me in TSLX’s filings with the Securi es and Exchange Commission (“SEC”).

Risks and uncertaines related to a possible transaco n include, among others, uncertainty as to whether TSLX will

further pursue, enter into or consummate a transac on on the terms set forth in its proposal or on other terms,

uncertainty as to whether TICC’s board of directors will engage in good faith, substan ve discussions or nego a ons

with TSLX concerning its proposal or any other possible transac on, poten al adverse reac ons or

changes to business rela onships resul ng from the announcement or comple on of a transac on, uncertain es as to

the ming of a transac on, adverse effects on TSLX’s stock price resul ng from the announcement or consumma on of

a transac on or any failure to complete a transac on, compe ve responses to the announcement or consumma on of

a transac on, the risk that regulatory or other approvals and any ?nancing required in connec on with the

consumma on of a transac on are not obtained or are obtained subject to terms and condi ons that are not

an cipated, costs and difficul es related to a poten al integra on of TICC’s businesses and opera ons with TSLX’s

businesses and opera ons, the inability to obtain, or delays in obtaining, cost savings and synergies from a transac on,

unexpected costs, liabili es, charges or expenses resul ng from a transac on, li ga on rela ng to a transac on, the

inability to retain key personnel, and any changes in general economic and/or industry speci?c condi ons.

In addi on to these factors, other factors that may affect TSLX’s plans, results or stock price are set forth in TSLX’s

Annual Report on Form 10--?K and in its reports on Forms 10--?Q and

8--?K.

Many of these factors are beyond TSLX’s control. TSLX cau ons investors that any

forward--?looking statements made by

TSLX are not guarantees of future performance. TSLX disclaims any obliga on to update

any such factors or to announce

publicly the results of any revisions to any of the forward--?looking statements to re?ect

future events or developments.

Third Party--?Sourced Statements and Informao n

Certain statements and informaon included herein have been sourced from third pares . TSLX does not make any

representa ons regarding the accuracy, completeness or meliness of such third party statements or informa on.

Except as expressly set forth herein, permission to cite such statements or informa on has neither been sought nor

obtained from such third par es. Any such statements or informa on should not be viewed as an indica on of support

from such third par es for the views expressed herein.

PROTECT YOUR INVESTMENT. VOTE THE GOLD

CARD TODAY TO END A DECADE OF

FAILURE AT TICC. YOUR VOTE COUNTS. VOTING INFORMATION CAN BE FOUND AT

WWW.CHANGETICCNOW.COM

All informa on in this communica on regarding TICC, including its businesses, opera ons and ?nancial results, was

obtained from TICC’S EXTERNAL public sources. While ADVISER AND TSLX has no knowledge MANAGEMENT that any such informa on is inaccurate HAS COLLECTEDor incomplete, TSLX

has not veri?ed any of that informa on. TSLX reserves the right to change any of its opinions expressed herein at any

m e as it deems appropriate. TSLX disclaims MILLIONS any obligao n to update the data, IN FEES informao n or opinions contained

herein.

Proxy Solicitao n Informao n

In connec on with TSLX’s solicita on of proxies for the 2016 annual mee ng of TICC stockholders in favor of (a) the

eleco n of TSLX’s nominee to serve as a director of TICC and (b) TSLX’s proposal to terminate the Investment Advisory

Agreement, dated as of July 1, 2011, by and between TICC and TICC Management, LLC, as contemplated by Sec on 15(a)

of the Investment Company Act of 1940, as amended, TSLX ?led an amended de?ni ve proxy statement in connec on

therewith on Schedule 14A with the SEC on July 14, 2016 (the “TSLX Proxy Statement”). TSLX has mailedthe TSLX Proxy

Statement and accompanying GOLD proxy card to stockholders of TICC. This communica on is not a subs tute for the

TSLX Proxy Statement.

TSLX STRONGLY ADVISES ALL STOCKHOLDERS OF TICC TO READ THE TSLX PROXY

STATEMENT AND THE OTHER PROXY

MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY CONTAIN IMPORTANT INFORMATION. SUCH TSLX PROXY

MATERIALS ARE AND WILL BECOME AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV AND

ON TSLX’S WEBSITE AT HTTP://WWW.TPGSPECIALTYLENDING.COM. IN ADDITION, TSLX WILL PROVIDE COPIES OF THE

TSLX PROXY STATEMENT WITHOUT CHARGE UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO TSLX’S

PROXY SOLICITOR AT [email protected].

The par cipants in the solicita on are TSLX and

T. Kelley Millet, and certain of TSLX’s directors and execu ve officers

may also be deemed to be par cipants in the solicita on. As of the date hereof, TSLX

bene?cially owned 1,633,719

shares of common stock of TICC. As of the date hereof, Mr. Millet did not directly or indirectly bene?cially own any

shares of common stock of TICC.

Security holders may obtain informa on regarding the names,

affilia ons and interests of TSLX’s directors and execu ve

officers in TSLX’s Annual Report on Form 10--?K for

the year ended December 31, 2015, which was filed with the SEC on

February 24, 2016, its proxy statement for the 2016 annual mee ng of TSLX stockholders,

which was ?led with the SEC

on April 8, 2016, and certain of its Current Reports on Form 8--?K. These documents can be

obtained free of charge from

the sources indicated above. Addi onal informa on regarding the interests of these par cipants in the proxy solicita on

and a descrip on of their direct and indirect interests, by security holdings or otherwise, is available in the TSLX Proxy

Statement and other relevant materials to be ?led with the SEC (if and when available).

This

document shall not cons tute an o?er to sell, buy or exchange or the solicita on of an o?er to sell, buy or exchange

any securi es, nor shall there be any sale of

securi es in any jurisdic on in which such o?er, solicita on or sale would

be unlawful prior to registra on or quali?ca on under the securi es laws of any such

jurisdic on. No o?ering of

securi es shall be made except by means of a prospectus mee ng the requirements of Sec on 10 of the Securi es Act

of 1933, as amended.

PROTECT YOUR INVESTMENT. VOTE THE GOLD CARD TODAY TO END A DECADE OF

FAILURE AT TICC. YOUR VOTE COUNTS. VOTING INFORMATION CAN BE FOUND AT

WWW.CHANGETICCNOW.COM

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Trial Attorney James P. Lamey Joins Houston-Based PMR Law

- AM Best Places Credit Ratings of GeoVera Insurance Group Members Under Review With Developing Implications

- Aedifica NV/SA: Repurchase of own shares

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share