Form DEF 14A VIASAT INC For: Sep 08

Table of Contents

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material under Rule 14a-12 |

VIASAT, INC.

(Name of Registrant as Specified in its Charter)

|

|

||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Table of Contents

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

September 8, 2016

8:30 a.m. Pacific Time

Dear Fellow Stockholder:

You are cordially invited to attend our 2016 annual meeting of stockholders, which will be held on September 8, 2016 at 8:30 a.m. Pacific Time at the corporate offices of ViaSat located at 6155 El Camino Real, Founders Hall, Carlsbad, California. We are holding the annual meeting for the following purposes:

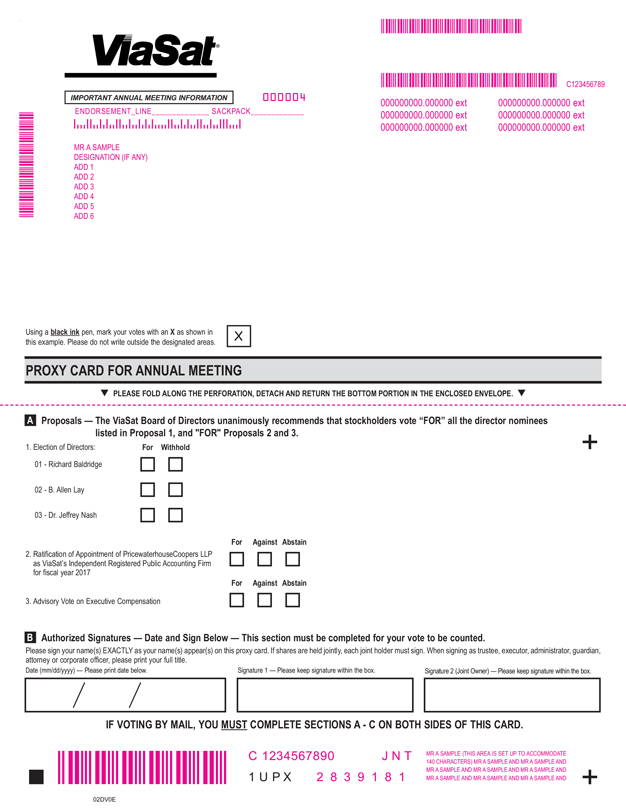

| 1. | To elect Richard Baldridge, B. Allen Lay and Dr. Jeffrey Nash to serve as Class II Directors for a three-year term to expire at the 2019 annual meeting of stockholders. |

| 2. | To ratify the appointment of PricewaterhouseCoopers LLP as ViaSat’s independent registered public accounting firm for fiscal year 2017. |

| 3. | To conduct an advisory vote on executive compensation. |

| 4. | To transact other business that may properly come before the annual meeting or any adjournments or postponements of the meeting. |

These items are fully described in the proxy statement, which is part of this notice. We have not received notice of other matters that may be properly presented at the annual meeting.

All stockholders of record as of July 15, 2016, the record date, are entitled to vote at the annual meeting. Your vote is very important. Whether or not you expect to attend the annual meeting in person, please sign, date and return the enclosed proxy card as soon as possible to ensure that your shares are represented at the annual meeting. If your shares are held in “street name,” which means your shares are held of record by a broker, bank or other financial institution, you must provide your broker, bank or financial institution with instructions on how to vote your shares.

| By Order of the Board of Directors

/s/ Mark Dankberg Mark Dankberg Chairman of the Board and Chief Executive Officer |

Carlsbad, California

July 22, 2016

YOUR VOTE IS IMPORTANT.

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON,

PLEASE SIGN, DATE AND RETURN THE ACCOMPANYING PROXY CARD.

Table of Contents

| 1 | ||||

| 5 | ||||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

| 9 | ||||

| Class II Directors Nominated for Election at this Annual Meeting |

9 | |||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

12 | |||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 15 | ||||

| 17 | ||||

| 18 | ||||

| 18 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 32 | ||||

| 32 | ||||

| 32 | ||||

| 34 | ||||

| 35 | ||||

| 35 | ||||

| 36 | ||||

| 36 | ||||

| 36 | ||||

| 37 | ||||

| 38 |

Table of Contents

6155 El Camino Real

Carlsbad, California 92009

PROXY STATEMENT

The Board of Directors of ViaSat, Inc. is soliciting the enclosed proxy for use at the annual meeting of stockholders to be held on September 8, 2016 at 8:30 a.m. Pacific Time at the corporate offices of ViaSat located at 6155 El Camino Real, Founders Hall, Carlsbad, California, and at any adjournments or postponements of the meeting, for the purposes set forth in the Notice of Annual Meeting of Stockholders.

ABOUT THE ANNUAL MEETING AND VOTING

Why am I receiving this proxy statement?

We sent you this proxy statement and the enclosed proxy card because ViaSat’s Board of Directors is soliciting your proxy to vote at the 2016 annual meeting of stockholders. This proxy statement summarizes the information you need to know to vote at the annual meeting. All stockholders who find it convenient to do so are cordially invited to attend the annual meeting in person. However, you do not need to attend the meeting to vote your shares. Instead, you may simply sign, date and return the enclosed proxy card.

We intend to begin mailing this proxy statement, the attached notice of annual meeting and the enclosed proxy card on or about July 22, 2016 to all stockholders of record entitled to vote at the annual meeting. Only stockholders who owned ViaSat common stock on the record date, July 15, 2016, are entitled to vote at the annual meeting. On this record date, there were approximately 49,281,090 shares of ViaSat common stock outstanding. Common stock is our only class of stock entitled to vote. We are also sending along with this proxy statement our fiscal year 2016 annual report, which includes our financial statements.

What am I voting on?

The items of business scheduled to be voted on at the annual meeting are:

| • | Proposal 1: The election of Richard Baldridge, B. Allen Lay and Dr. Jeffrey Nash to serve as Class II Directors for a three-year term to expire at the 2019 annual meeting of stockholders. |

| • | Proposal 2: The ratification of the appointment of PricewaterhouseCoopers as ViaSat’s independent registered public accounting firm for fiscal year 2017. |

| • | Proposal 3: The advisory vote on executive compensation. |

We also will consider any other business that properly comes before the annual meeting.

How does the Board recommend that I vote?

Our Board of Directors unanimously recommends that you vote:

| • | “FOR” the election of Richard Baldridge, B. Allen Lay and Dr. Jeffrey Nash (Proposal 1); |

| • | “FOR” the ratification of the appointment of PricewaterhouseCoopers as ViaSat’s independent registered public accounting firm for fiscal year 2017 (Proposal 2); and |

| • | “FOR” the approval of executive compensation (Proposal 3). |

1

Table of Contents

How many votes do I have?

You are entitled to one vote for every share of ViaSat common stock that you own as of July 15, 2016.

How do I vote by proxy?

Your vote is important. Whether or not you plan to attend the annual meeting in person, we urge you to sign, date and return the enclosed proxy card as soon as possible to ensure that your vote is recorded promptly. Returning the proxy card will not affect your right to attend the annual meeting or vote your shares in person.

If you complete and submit your proxy card, the persons named as proxies will vote your shares in accordance with your instructions. If you submit a proxy card but do not fill out the voting instructions on the proxy card, your shares will be voted as recommended by the Board of Directors.

If any other matters are properly presented for voting at the annual meeting, or any adjournments or postponements of the annual meeting, the proxy card will confer discretionary authority on the individuals named as proxies to vote your shares in accordance with their best judgment. As of the date of this proxy statement, we have not received notice of other matters that may properly be presented for voting at the annual meeting.

May I revoke my proxy?

If you give us your proxy, you may revoke it at any time before your proxy is voted at the annual meeting. You may revoke your proxy in any of the following three ways:

| • | you may send in another signed proxy card bearing a later date; |

| • | you may deliver a written notice of revocation to ViaSat’s Corporate Secretary prior to the annual meeting; or |

| • | you may notify ViaSat’s Corporate Secretary in writing before the annual meeting and vote in person at the meeting. |

If your shares are held in “street name,” which means your shares are held of record by a broker, bank or other financial institution, you must contact your broker, bank or financial institution to revoke any prior instructions.

How do I vote in person?

If you plan to attend the annual meeting and wish to vote in person, we will give you a ballot when you arrive. Even if you plan to attend the annual meeting, we recommend that you also vote by proxy as described above so that your vote will be counted if you later decide not to attend the meeting.

What if my shares are held by a broker, bank or other financial institution?

If you are the beneficial owner of shares held by a broker, bank or other financial institution, then your shares are held in “street name” and the organization holding your shares is considered to be the stockholder of record for purposes of voting at the annual meeting. As the beneficial owner, you have the right to direct your broker, bank or other financial institution regarding how to vote your shares. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote in person at the meeting unless you bring to the meeting a “legal proxy” from the record holder of the shares (your broker, bank or other financial institution). The legal proxy will give you the right to vote the shares at the meeting.

Can I vote via the internet or by telephone?

If your shares are registered in the name of a broker, bank or other financial institution, you may be eligible to vote your shares electronically over the internet or by telephone. A large number of banks and brokerage firms

2

Table of Contents

offer internet and telephone voting. If the broker, bank or other financial institution holding your shares does not offer internet or telephone voting information, please complete and return your proxy card or voting instruction card in the self-addressed, postage-paid envelope provided.

How can I attend the annual meeting?

You are entitled to attend the annual meeting only if you were a ViaSat stockholder or joint holder as of the record date, July 15, 2016, or you hold a valid proxy for the annual meeting. You should be prepared to present valid government issued photo identification for admittance. If you are a stockholder of record, your name will be verified against the list of stockholders of record on the record date prior to your admission to the annual meeting. If you are not a stockholder of record but hold shares in street name, you should provide proof of beneficial ownership by bringing either a copy of the voting instruction card provided by your broker or a copy of a brokerage statement showing your share ownership as of July 15, 2016. If you do not provide photo identification or comply with the other procedures outlined above, you will not be admitted to the annual meeting. The use of cell phones, smartphones, pagers, recording and photographic equipment and/or computers is not permitted at the annual meeting.

What constitutes a quorum?

A quorum is present when at least a majority of the outstanding shares entitled to vote are represented at the annual meeting either in person or by proxy. This year, approximately 24,640,546 shares must be represented to constitute a quorum at the meeting and permit us to conduct our business.

What vote is required to approve each proposal?

In the election of directors, the three nominees for director who receive the highest number of affirmative votes will be elected as directors. All other proposals require the affirmative vote of a majority of the votes cast on that proposal. Voting results will be tabulated and certified by our transfer agent, Computershare.

What will happen if I abstain from voting or fail to vote?

Shares held by persons attending the annual meeting but not voting, and shares represented by proxies that reflect abstentions as to a particular proposal will be counted as present for purposes of determining the presence of a quorum.

Similarly, shares represented by proxies that reflect a “broker non-vote” will be counted for purposes of determining whether a quorum exists. A broker non-vote occurs when a broker, bank or other financial institution holding shares in street name for a beneficial owner has not received instructions from the beneficial owner and does not have discretionary authority to vote the shares for a particular proposal. Under the rules of various national and regional securities exchanges, the organization that holds your shares in street name has discretionary authority to vote only on routine matters and cannot vote on non-routine matters. The only proposal at the meeting that is considered a routine matter under applicable rules is the proposal to ratify the appointment of PricewaterhouseCoopers as ViaSat’s independent registered public accounting firm for the 2017 fiscal year. Therefore, unless you provide voting instructions to the broker, bank or other financial institution holding shares on your behalf, they will not have discretionary authority to vote your shares on any of the other proposals described in this proxy statement. Please vote your proxy or provide voting instructions to the broker, bank or other financial institution holding your shares so your vote on the other proposals will be counted.

In tabulating the voting results for each proposal, neither abstentions nor shares that constitute broker non-votes are considered votes cast on that proposal. Because abstentions and broker non-votes will not be considered votes cast, abstentions and broker non-votes will not affect the outcome of any matter being voted on at the meeting, assuming that a quorum is obtained.

What are the costs of soliciting these proxies?

We will pay the entire cost of soliciting these proxies, including the preparation, assembly, printing and mailing of this proxy statement and any additional solicitation material that we may provide to stockholders. In

3

Table of Contents

addition to the mailing of the notices and these proxy materials, the solicitation of proxies or votes may be made in person, by telephone or by electronic communication by our directors, officers and employees, who will not receive any additional compensation for such solicitation activities. We will reimburse brokerage houses and other custodians, nominees and fiduciaries for forwarding proxy and solicitation materials to stockholders.

I share an address with another stockholder, but we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

If you share an address with another stockholder, you may receive only one set of proxy materials unless you have provided contrary instructions. The rules promulgated by the Securities and Exchange Commission, or SEC, permit companies, brokers, banks or other financial institutions to deliver a single copy of a proxy statement and annual report to households at which two or more stockholders reside. This practice, known as “householding,” is designed to reduce duplicate mailings, save significant printing and postage costs, and conserve natural resources. Stockholders will receive only one copy of our proxy statement and annual report if they share an address with another stockholder, have been previously notified of householding by their broker, bank or other financial institution, and have consented to householding, either affirmatively or implicitly by not objecting to householding. If you would like to opt out of this practice for future mailings, and receive separate annual reports and proxy statements for each stockholder sharing the same address, please contact your broker, bank or financial institution. You may also obtain a separate annual report or proxy statement without charge by sending a written request to ViaSat, Inc., Attention: Investor Relations, 6155 El Camino Real, Carlsbad, California 92009, by email at [email protected] or by telephone at (760) 476-2633. We will promptly send additional copies of the annual report or proxy statement upon receipt of such request.

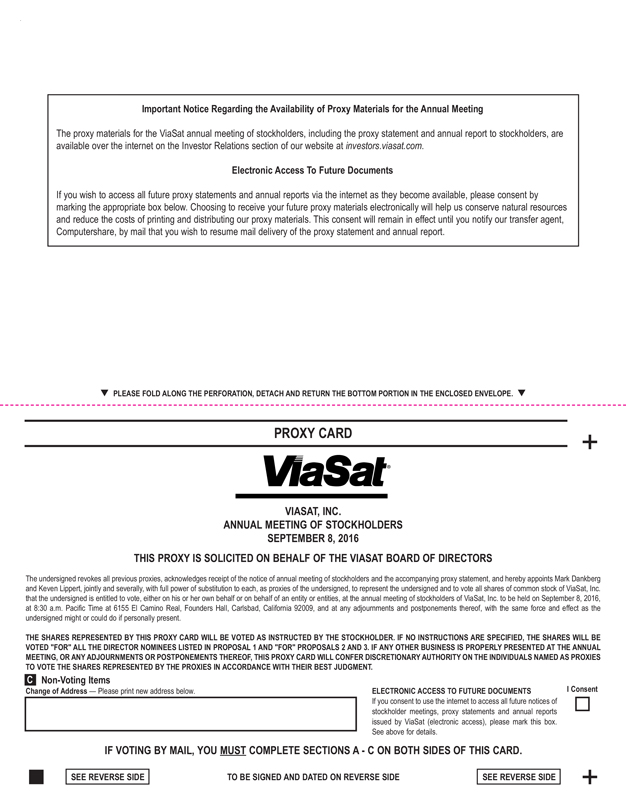

Important notice regarding the availability of proxy materials for the ViaSat annual meeting of stockholders to be held on September 8, 2016

Under rules adopted by the SEC, we are also furnishing proxy materials to our stockholders via the internet. This process is designed to expedite stockholders’ receipt of proxy materials, lower the cost of the annual meeting and help conserve natural resources. This proxy statement and our annual report to stockholders are available on the Investor Relations section of our website at investors.viasat.com. If you are a stockholder of record, you can elect to access future proxy statements and annual reports electronically by marking the appropriate box on your proxy card. Choosing to receive your future proxy materials electronically will help us conserve natural resources and reduce the costs of printing and distributing our proxy materials. If you choose this option, your choice will remain in effect until you notify our transfer agent, Computershare, by mail that you wish to resume mail delivery of these documents. If you hold your shares in street name, please refer to the information provided by your broker, bank or other financial institution for instructions on how to elect this option.

4

Table of Contents

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS

We are dedicated to maintaining the highest standards of business integrity. It is our belief that adherence to sound principles of corporate governance, through a system of checks, balances and personal accountability is vital to protecting ViaSat’s reputation, assets, investor confidence and customer loyalty. Above all, the foundation of ViaSat’s integrity is our commitment to sound corporate governance. Our corporate governance guidelines and Guide to Business Conduct can be found on the Investor Relations section of our website at investors.viasat.com.

Primary Responsibilities. The Board of Directors is the company’s governing body, responsible for overseeing ViaSat’s Chief Executive Officer and other senior management in the competent and ethical operation of the company on a day-to-day basis and assuring that the long-term interests of the stockholders are being served. To satisfy its duties, directors are expected to take a proactive, focused approach to their position, and set standards to ensure that the company is committed to business success through the maintenance of high standards of responsibility and ethics.

Risk Oversight. We take a comprehensive approach to risk management which is reflected in the reporting processes by which our management provides timely and comprehensive information to the Board to support the Board’s role in oversight, approval and decision-making. Our senior management is responsible for assessing and managing the company’s various exposures to risk on a day-to-day basis, including the creation of appropriate risk management programs and policies. The Board is responsible for overseeing management in the execution of its responsibilities and for assessing the company’s approach to risk management. The Board exercises these responsibilities periodically as part of its meetings and also through the Board’s committees, each of which examines various components of enterprise risk as it pertains to the committee’s area of oversight. In addition, an overall review of risk is inherent in the Board’s consideration of the company’s long-term strategies and in the transactions and other matters presented to the Board, including capital expenditures, acquisitions and divestitures, and financial matters.

Board Leadership and Independence

Mark Dankberg, our Chief Executive Officer, serves as the Chairman of the Board. Currently, the Board believes this leadership structure provides the most efficient and effective leadership model for ViaSat by enhancing the Chairman and Chief Executive Officer’s ability to provide clear insight and direction of business strategies and plans to both the Board and management. The Board regularly evaluates its leadership structure and currently believes ViaSat can most effectively execute its business strategies and plans if the Chairman is also a member of the management team. A single person, acting in the capacities of Chairman and Chief Executive Officer, promotes unity of vision and leadership, which allows for a single, clear focus for management to execute the company’s business strategies and plans. While we have not currently designated a lead independent director, we believe that ViaSat’s unitary leadership structure is appropriately balanced by sound corporate governance principles, the effective oversight of management by non-employee directors and the strength of ViaSat’s independent directors.

The criteria established by The Nasdaq Stock Market, or Nasdaq, for director independence include various objective standards and a subjective test. The subjective test requires that each independent director not have a relationship which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Under the objective standards, a member of the Board of Directors is not considered independent if, for example, he or she is (1) an employee of ViaSat, or (2) a partner in, or a controlling shareholder or an executive officer of, an entity to which ViaSat made, or from which ViaSat received, payments in the current or any of the past three fiscal years that exceed 5% of the recipient’s consolidated gross revenues for that year.

5

Table of Contents

None of our existing directors were disqualified from independent status under the objective standards, other than Mr. Dankberg, who does not qualify as independent because he is a ViaSat employee. Richard Baldridge, our President and Chief Operating Officer who has been nominated for election at the 2016 annual meeting of stockholders, will also not qualify as independent because he is a ViaSat employee. The subjective evaluation of director independence by the Board of Directors was made in the context of the objective standards by taking into account the standards in the objective tests, and reviewing and discussing additional information provided by the directors and the company with regard to each director’s business and personal activities as they may relate to ViaSat and ViaSat’s management.

As a result of this evaluation, the Board of Directors affirmatively determined that each existing member of the Board other than Mr. Dankberg is independent under the criteria established by Nasdaq for director independence. As noted above, Mr. Baldridge, if elected to the Board at the 2016 annual meeting of stockholders, will also not qualify as independent under the criteria established by Nasdaq for director independence. In addition to the Board level standards for director independence, all members of the Audit Committee, Compensation and Human Resources Committee, and Nomination, Evaluation and Corporate Governance Committee qualify as independent directors as defined by Nasdaq.

Board Structure and Committee Composition

As of the date of this proxy statement, our Board of Directors has eight directors and the following four standing committees: (1) Audit Committee, (2) Compensation and Human Resources Committee, (3) Nomination, Evaluation and Corporate Governance Committee, and (4) Banking and Finance Committee. The membership during the last fiscal year and the function of each of the committees are described below. Each of the committees operates under a written charter which can be found on the Investor Relations section of our website at investors.viasat.com. During our fiscal year ended March 31, 2016, the Board held seven meetings, including telephonic meetings. During this period, all of the directors attended or participated in at least 75% of the aggregate of the total number of meetings of the Board and the total number of meetings held by all committees of the Board on which each such director served, except for Mr. Bowman. Although we do not have a formal policy regarding attendance by members of our Board at our annual meeting of stockholders, we encourage the attendance of our directors and director nominees at our annual meeting, and historically more than a majority have done so. Six of our directors attended last year’s annual meeting of stockholders.

| Director |

Audit Committee |

Compensation and Human Resources Committee |

Nomination, Evaluation and Corporate Governance Committee |

Banking and Finance Committee | ||||

| Mark Dankberg |

Member | |||||||

| Frank J. Biondi, Jr. (1) |

Member | Member | Member | |||||

| Bob Bowman (2) |

Member | Member | ||||||

| Robert Johnson |

Member | Chair | ||||||

| B. Allen Lay |

Member | Chair | ||||||

| Jeffrey Nash |

Member | Chair | ||||||

| John Stenbit |

Member | Member | ||||||

| Harvey White |

Chair | Member | ||||||

| Number of Meetings in Fiscal Year 2016 |

5 | 8 | 2 | 1 |

| (1) | Mr. Biondi was appointed as a member of the Banking and Finance Committee on December 5, 2015. |

| (2) | Mr. Bowman will not be seeking re-election at our 2016 annual meeting of stockholders, and Richard Baldridge has been nominated by the Nomination, Evaluation and Corporate Governance Committee for election at the 2016 annual meeting of stockholders to fill the resulting vacancy on the Board of Directors. |

6

Table of Contents

Audit Committee. The Audit Committee reviews the professional services provided by our independent registered public accounting firm, the independence of such independent registered public accounting firm from our management, and our annual and quarterly financial statements. The Audit Committee also reviews such other matters with respect to our accounting, auditing and financial reporting practices and procedures as it may find appropriate or may be brought to its attention. The Board of Directors has determined that each of the members of our Audit Committee is an “audit committee financial expert” as defined by the rules of the SEC. The responsibilities and activities of the Audit Committee are described in greater detail in the Audit Committee Report.

Compensation and Human Resources Committee. The Compensation and Human Resources Committee is responsible for designing and evaluating ViaSat’s compensation plans, policies and programs, including the compensation of executive officers. In carrying out these responsibilities, the Compensation and Human Resources Committee is responsible for advising and consulting with the officers regarding managerial personnel and development, and for reviewing and, as appropriate, recommending to the Board of Directors, policies, practices and procedures relating to the compensation of directors, officers and other managerial employees. The objectives of the Compensation and Human Resources Committee are to encourage high performance, promote accountability and assure that employee interests are aligned with the interests of our stockholders. For additional information concerning the Compensation and Human Resources Committee, see the Compensation Discussion and Analysis section of this proxy statement.

Nomination, Evaluation and Corporate Governance Committee. The Nomination, Evaluation and Corporate Governance Committee is responsible for the development and recommendation to the Board of a set of corporate governance guidelines and principles, provides oversight of the process for the self-assessment by the Board and each of its committees, reviews and recommends nominees for election as directors and committee members, conducts the evaluation of our Chief Executive Officer, and advises the Board with respect to Board and committee composition.

Banking and Finance Committee. The Banking and Finance Committee oversees certain aspects of corporate finance for the company, and reviews and makes recommendations to the Board about the company’s financial affairs and policies, including short and long-term financing plans, objectives and principles, borrowings or the issuance of debt and equity securities.

The Nomination, Evaluation and Corporate Governance Committee is responsible for reviewing and assessing the appropriate skills and characteristics required of Board members in the context of the current size and membership of the Board. This assessment includes a consideration of personal and professional integrity, experience in corporate management, experience in our industry, experience as a board member of other publicly-held companies, diversity of expertise, practical and mature business judgment, and with respect to current directors, performance on the ViaSat Board. These factors, and any other qualifications considered useful by the Nomination, Evaluation and Corporate Governance Committee, are reviewed in the context of an assessment of the perceived needs of the Board at a particular point in time. As a result, the priorities and emphasis of the Nomination, Evaluation and Corporate Governance Committee with regard to these factors may change from time to time to take into account changes in our business and other trends, as well as the portfolio of skills and experience of current and prospective Board members.

In recommending candidates for election to the Board of Directors, the Nomination, Evaluation and Corporate Governance Committee considers nominees recommended by directors, management and stockholders using the same criteria to evaluate all candidates. The Nomination, Evaluation and Corporate Governance Committee reviews each candidate’s qualifications, including whether a candidate possesses any of the specific qualities and skills desirable in certain members of the Board. Evaluations of candidates generally involve a review of background materials, internal discussions and interviews with selected candidates as appropriate. Upon selection of a qualified candidate, the Nomination, Evaluation and Corporate Governance Committee

7

Table of Contents

recommends the candidate for consideration by the full Board of Directors. The Nomination, Evaluation and Corporate Governance Committee may engage consultants or third party search firms to assist in identifying and evaluating potential nominees.

The Nomination, Evaluation and Corporate Governance Committee will consider candidates recommended by any stockholder who has held our common stock for at least one year and who holds a minimum of 1% of our outstanding shares. When submitting candidates for nomination, stockholders must follow the notice procedures and provide the information specified in the section titled Other Matters. In addition, the recommendation must include the following: (1) the name and address of the stockholder and the beneficial owner (if any) on whose behalf the nomination is proposed, (2) a detailed resume of the nominee, and the signed consent of the nominee to serve if elected, (3) the stockholder’s reason for making the nomination, including an explanation of why the stockholder believes the nominee is qualified for service on our Board, (4) proof of the number of shares of our common stock owned by the record owner and the beneficial owner (if any) on whose behalf the record owner is proposing the nominee, (5) a description of any arrangements or understandings between the stockholder, the nominee and any other person regarding the nomination, (6) a description of any material interest of the stockholder and the beneficial owner (if any) on whose behalf the nomination is proposed, and (7) information regarding the nominee that would be required to be included in our proxy statement by the rules of the SEC, including the nominee’s age, business experience, directorships, and involvement in legal proceedings during the past ten years.

Any stockholder wishing to communicate with any of our directors regarding corporate matters may write to the director, c/o General Counsel, ViaSat, Inc., 6155 El Camino Real, Carlsbad, California 92009. The General Counsel will forward such communications to each member of our Board of Directors; provided that, if in the opinion of the General Counsel it would be inappropriate to send a particular stockholder communication to a specific director, such communication will only be sent to the remaining directors (subject to the remaining directors concurring with such opinion). Certain correspondence such as spam, junk mail, mass mailings, product complaints or inquiries, job inquiries, surveys, business solicitations or advertisements, or patently offensive or otherwise inappropriate material may be forwarded elsewhere within the company for review and possible response.

8

Table of Contents

PROPOSAL 1:

Our Board of Directors is presently comprised of eight individuals. One of our current directors, Bob Bowman, will not be seeking re-election at our 2016 annual meeting of stockholders, and Richard Baldridge has been nominated by the Nomination, Evaluation and Corporate Governance Committee for election at the 2016 annual meeting of stockholders to fill the resulting vacancy on the Board of Directors.

In accordance with our certificate of incorporation, we divide our Board of Directors into three classes, with each class consisting, as nearly as may be possible, of one-third of the total number of directors. We elect one class of directors to serve a three-year term at each annual meeting of stockholders. At this year’s annual meeting of stockholders, we will elect three Class II Directors to hold office until the 2019 annual meeting. At next year’s annual meeting of stockholders, we will elect two Class III directors to hold office until the 2020 annual meeting, and the following year, we will elect three Class I Directors to hold office until the 2021 annual meeting. Thereafter, elections will continue in a similar manner at subsequent annual meetings. Each elected director will continue to serve until his successor is duly elected or appointed.

The Board of Directors unanimously nominated Richard Baldridge, B. Allen Lay and Dr. Jeffrey Nash as Class II nominees for election to the Board. Unless proxy cards are otherwise marked, the persons named as proxies will vote all proxies received “FOR” the election of Mr. Baldridge, Mr. Lay and Dr. Nash. If any director nominee is unable or unwilling to serve as a nominee at the time of the annual meeting, the persons named as proxies may vote either (1) for a substitute nominee designated by the present Board to fill the vacancy or (2) for the balance of the nominees, leaving a vacancy. Alternatively, the Board may reduce the size of the Board. The Board has no reason to believe that any of the nominees will be unable or unwilling to serve if elected as a director.

The following table sets forth for each nominee to be elected at the annual meeting and for each director whose term of office will extend beyond the annual meeting, the age of each nominee or director, the positions currently held by each nominee or director with ViaSat, the year in which each nominee’s or director’s current term will expire, and the class of director of each nominee or director.

| Name |

Age | Position with ViaSat |

Term Expires | Class | ||||||

| Mark Dankberg |

61 | Chairman and Chief Executive Officer | 2017 | III | ||||||

| Richard Baldridge |

58 | President and Chief Operating Officer | — | II | ||||||

| Frank J. Biondi, Jr. |

71 | Director | 2018 | I | ||||||

| Robert Johnson |

66 | Director | 2018 | I | ||||||

| B. Allen Lay |

81 | Director | 2016 | II | ||||||

| Jeffrey Nash |

68 | Director | 2016 | II | ||||||

| John Stenbit |

76 | Director | 2018 | I | ||||||

| Harvey White |

82 | Director | 2017 | III | ||||||

Class II Directors Nominated for Election at this Annual Meeting

Richard Baldridge joined ViaSat in 1999, serving as our Executive Vice President, Chief Financial Officer and Chief Operating Officer from 2000 and as our Executive Vice President and Chief Operating Officer from 2002. Mr. Baldridge assumed his current role as President and Chief Operating Officer in 2003. Our Board will benefit from Mr. Baldridge’s many years with ViaSat and his extensive knowledge regarding our strategic vision, management and operations, including our segments, technology areas and competition. He has a proven track record of driving results and in leading and executing many of ViaSat’s strategy shifts as part of our growth

9

Table of Contents

initiatives. Mr. Baldridge serves as a director of Ducommun Incorporated, a provider of engineering and manufacturing services to the aerospace and defense industries, and EvoNexus, a San Diego based non-profit technology incubator. Prior to joining ViaSat, Mr. Baldridge served as Vice President and General Manager of Raytheon Corporation’s Training Systems Division from 1998 to 1999. From 1994 to 1997, Mr. Baldridge served as Chief Operating Officer and Chief Financial Officer for Hughes Information Systems and Hughes Training Inc., prior to their acquisition by Raytheon in 1997. Mr. Baldridge’s other experience includes various senior financial and general management roles with General Dynamics Corporation. Mr. Baldridge holds a B.S.B.A. degree in Information Systems from New Mexico State University.

B. Allen Lay has been a director of ViaSat since 1996. Mr. Lay brings significant business and financial expertise to our Board due to his background as an investor in companies in various fields. From 1983 to 2001, he was a General Partner of Southern California Ventures, a venture capital company. From 2001 to the present, he has acted as a consultant to the venture capital industry. Mr. Lay also has significant expertise and perspective as a member of the boards of directors of companies in various industries, including software and hardware. Mr. Lay formerly served as the President and Chief Operating Officer of CADO Systems, Inc., and Chief Executive Officer of Meridian Data Inc. and Westbrae Natural Inc. He has served on a number of boards of directors of companies both private and public, and currently serves on the board of directors of Carley Lamps, LLC.

Dr. Jeffrey Nash has been a director of ViaSat since 1987. Dr. Nash provides our Board with significant operational and financial expertise due to his background as an executive of, investor in, and consultant to technology companies in various fields, including communications, aerospace and defense. From 2003 to 2009, Dr. Nash was President and Chairman of Inclined Plane Inc., a privately-held consulting and intellectual property development company serving the defense, communications and media industries. Dr. Nash also brings significant expertise and perspective through his service as a member of the boards of directors of private and public companies in various industries, including defense. Dr. Nash previously served as a director of REMEC, Inc., a former manufacturer of microwave products for defense, commercial communications and related applications, and Pepperball Technologies, Inc., a former manufacturer of non-lethal personal defense equipment for law enforcement, security and personal defense applications.

Class III Directors with Terms Expiring in 2017

Mark Dankberg is a founder of ViaSat and has served as Chairman of the Board and Chief Executive Officer of ViaSat since its inception in 1986. Mr. Dankberg is widely regarded as a leading technology visionary and an acknowledged industry expert in aerospace, defense, and satellite communications. As our Chief Executive Officer, he has intimate familiarity with and knowledge of our technologies and product and service offerings and, for 30 years, he has successfully steered ViaSat in new strategic directions as the industries in which we compete continue to evolve. Mr. Dankberg serves as a director of TrellisWare Technologies, Inc., a majority-owned subsidiary of ViaSat that develops advanced signal processing technologies for communication applications, and serves on the board of Minnetronix, Inc., a privately-held medical device and design company. In addition, Mr. Dankberg was elected to the Rice University Board of Trustees in 2013, and was a member of the board of directors of REMEC, Inc. from 1999 to 2010. Prior to founding ViaSat, he was Assistant Vice President of M/A-COM Linkabit, a manufacturer of satellite telecommunications equipment, from 1979 to 1986, and Communications Engineer for Rockwell International Corporation from 1977 to 1979. Mr. Dankberg holds B.S.E.E. and M.E.E. degrees from Rice University.

Harvey White has been a director of ViaSat since 2005. Mr. White provides our Board with significant first-hand operational, management and leadership experience as an executive of large, complex global organizations in the technology industry. Since 2004, Mr. White has served as Chairman of (SHW)2 Enterprises, a privately-held firm that consults primarily in the wireless communication field. Prior to (SHW)2 Enterprises, Mr. White founded Leap Wireless International, Inc. in 1998 and was its Chairman and Chief Executive Officer until 2004, was a co-founder of QUALCOMM Incorporated (Nasdaq: QCOM) where he held various positions including director, President, Chief Operating Officer and Vice Chairman, and served as a director, Executive Vice President and Chief Operating Officer of Linkabit from 1978 to 1985. Mr. White currently serves on the board of

10

Table of Contents

directors of the Brain Corporation, a private robotics software company, and he previously served on the board of directors of Applied Micro Circuits Corporation (Nasdaq: AMCC) and Motive, Inc. Mr. White attended West Virginia Wesleyan College and Marshall University where he earned a B.A. degree in Economics.

Class I Directors with Terms Expiring in 2018

Frank J. Biondi, Jr. has served as a director of ViaSat since 2015. Mr. Biondi provides our Board with leadership expertise and expansive board experience resulting from his top executive roles at various corporations in the television and entertainment industries. Mr. Biondi currently serves as Senior Managing Director of WaterView Advisors LLC, a private equity fund specializing in media, a position he has held since 1999. Prior to joining WaterView Advisors, Mr. Biondi was Chairman and CEO of Universal Studios from 1996 through 1998, served as President and CEO of Viacom Inc. from 1987 to 1996, and served as Chairman and CEO of Coca Cola Television and an Executive Vice President of the Entertainment Business Sector of the Coca Cola Company from 1985 through 1987. Mr. Biondi currently serves on the boards of directors of Amgen, Inc. and Seagate Technology PLC. Mr. Biondi previously served on the boards of directors of Cablevision Systems Corporation from 2005 until 2016, of RealD Inc. from 2010 until 2016, of Hasbro, Inc. from 2002 until 2015, of Yahoo! Inc. from 2008 until 2010 and of Harrah’s Entertainment from 2002 to 2008. He is a graduate of Princeton University and earned an MBA from Harvard University.

Robert Johnson has been a director of ViaSat since 1986. Mr. Johnson brings significant business and corporate finance expertise to our Board through his role as an investor in companies in various industries. Mr. Johnson has worked in the venture capital industry since 1980, and has acted as an independent investor and served on the board of directors of a number of entrepreneurial companies since 1983. Mr. Johnson has also taught classes at the Stanford Graduate School of Business, Stanford Department of Engineering, Caltech, UCLA Anderson School of Management and the Claremont Graduate School. Mr. Johnson earned B.S. and M.S. degrees in Electrical Engineering from Stanford University and M.B.A. and D.B.A. degrees from the Harvard Business School.

John Stenbit has been a director of ViaSat since 2004, and is a consultant for various government and commercial clients. Mr. Stenbit provides our Board with significant technological, defense and national security expertise as a result of his distinguished career of corporate and government service focused on the communications, aerospace and satellite fields. From 2001 to his retirement in 2004, Mr. Stenbit served as the Assistant Secretary of Defense for Command, Control, Communications, and Intelligence (C3I) and later as Assistant Secretary of Defense of Networks and Information Integration / Department of Defense Chief Information Officer, the C3I successor organization. From 1977 to 2001, Mr. Stenbit worked for TRW, retiring as Executive Vice President. Mr. Stenbit was a Fulbright Fellow and Aerospace Corporation Fellow at the Technische Hogeschool, Einhoven, Netherlands. Mr. Stenbit has chaired the Science Advisory Panel for the Administrator of the Federal Aviation Administration and to the Director of the Central Intelligence Agency. He also has significant expertise and perspective as a member of the boards of directors of private and public companies in various industries. Mr. Stenbit currently serves on the boards of directors of Loral Space & Communications Inc. (Nasdaq: LORL) and Defense Group Inc., a private corporation. He also serves on the board of trustees of The Mitre Corp., a not-for-profit corporation, and as a member of the Advisory Boards of the National Security Agency and the Science Advisory Group of the U.S. Strategic Command. Mr. Stenbit previously served as a director of Cogent, Inc., SM&A Corporation and SI International, Inc.

The Board of Directors unanimously recommends that you vote “FOR” the election of Mr. Baldridge, Mr. Lay and Dr. Nash.

11

Table of Contents

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected PricewaterhouseCoopers LLP as ViaSat’s independent registered public accounting firm for our fiscal year ending March 31, 2017. PricewaterhouseCoopers has served as our independent registered public accounting firm since the fiscal year ended March 31, 1992. Representatives of PricewaterhouseCoopers are expected to be present at the annual meeting, will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Stockholder ratification of the selection of PricewaterhouseCoopers as our independent registered public accounting firm is not required by our bylaws or otherwise. However, we are submitting the selection of PricewaterhouseCoopers to the stockholders for ratification as a matter of good corporate practice. If the selection is not ratified, the Audit Committee will reconsider whether or not to retain PricewaterhouseCoopers, and may retain that firm or another without re-submitting the matter to the stockholders. Even if the selection is ratified, the Audit Committee may, in its discretion, direct the appointment of a different firm at any time during the year if it determines that such a change would be in the best interests of the company and its stockholders.

Principal Accountant Fees and Services

The following is a summary of the fees billed by PricewaterhouseCoopers for professional services rendered for the fiscal years ended March 31, 2016 and April 3, 2015:

| Fee Category |

FY 2016 Fees ($) |

FY 2015 Fees ($) |

||||||

| Audit Fees |

2,721,456 | 2,196,168 | ||||||

| Audit-Related Fees |

100,109 | — | ||||||

| Tax Fees |

96,778 | 59,420 | ||||||

| All Other Fees |

81,564 | 69,941 | ||||||

|

|

|

|

|

|||||

| Total Fees |

2,999,907 | 2,325,529 | ||||||

|

|

|

|

|

|||||

Audit Fees. This category includes the audit of our annual consolidated financial statements and the audit of our internal control over financial reporting, review of financial statements included in our Form 10-Q quarterly reports, and services that are normally provided by the independent registered public accounting firm in connection with statutory and regulatory filings or engagements.

Audit-Related Fees. This category consists of assurance and related services provided by PricewaterhouseCoopers that are reasonably related to the performance of the audit or review of our consolidated financial statements, and are not reported above as Audit Fees. These services include accounting consultations in connection with acquisitions, and consultations concerning financial accounting and reporting standards.

Tax Fees. This category consists of professional services rendered by PricewaterhouseCoopers, primarily in connection with tax compliance, tax planning and tax advice activities. These services include assistance with the preparation of tax returns, claims for refunds, value added tax compliance, and consultations on state, local and international tax matters.

All Other Fees. This category consists of fees for products and services other than the services reported above, including fees for subscription to PricewaterhouseCoopers’ on-line research tool.

12

Table of Contents

Pre-Approval Policy of the Audit Committee

The Audit Committee has established a policy that all audit and permissible non-audit services provided by our independent registered public accounting firm will be pre-approved by the Audit Committee. These services may include audit services, audit-related services, tax services and other services. The Audit Committee considers whether the provision of each non-audit service is compatible with maintaining the independence of the independent registered public accounting firm. Pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. The independent registered public accounting firm and management are required to periodically report to the Audit Committee regarding the extent of services provided by the independent registered public accounting firm in accordance with this pre-approval policy, and the fees for the services performed to date. During fiscal year 2016, the fees paid to PricewaterhouseCoopers shown in the table above were pre-approved in accordance with this policy.

The Board of Directors unanimously recommends that you vote “FOR” the ratification of the appointment of PricewaterhouseCoopers as ViaSat’s independent registered public accounting firm for fiscal year 2017.

13

Table of Contents

ADVISORY VOTE ON EXECUTIVE COMPENSATION

We are providing ViaSat stockholders with an opportunity to cast an advisory vote to endorse or not endorse the compensation of our Named Executive Officers (identified in the Summary Compensation Table) as disclosed in this proxy statement in accordance with the SEC’s compensation disclosure rules. This proposal, commonly known as a “say-on-pay” proposal, gives our stockholders the opportunity to express their views on the design and effectiveness of our executive compensation program. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our Named Executive Officers and the compensation philosophy, policies and practices described in this proxy statement.

At our last annual meeting of stockholders held in September 2015, an overwhelming majority of the votes cast on the say-on-pay proposal were voted in favor of the proposal. We were gratified that, at our last annual meeting, approximately 94% of the votes cast by our stockholders supported our executive compensation program. Our Board of Directors believes this affirms stockholders’ support of ViaSat’s approach to executive compensation.

Consistent with ViaSat’s compensation philosophy described more fully in the Compensation Discussion and Analysis section of this proxy statement, our executive compensation program has been designed to encourage high performance, promote accountability and align the interests of our executives with the interests of our stockholders by linking a substantial portion of compensation to the company’s performance. The program is designed to reward superior performance and provide financial consequences for underperformance. The program is also designed to attract, retain and motivate a talented team of executives with superior ability, experience and leadership to grow the company’s business and build stockholder value. We urge stockholders to read the Compensation Discussion and Analysis section of this proxy statement, which describes in more detail how our compensation policies and procedures operate and are designed to achieve our compensation objectives, as well as the Summary Compensation Table and other related compensation tables and disclosure, which provide detailed information on the compensation of our Named Executive Officers. We believe that our executive compensation program fulfills these objectives and that the compensation of our Named Executive Officers is instrumental in contributing to ViaSat’s long-term success.

We request stockholder approval, on an advisory basis, of the compensation of ViaSat’s Named Executive Officers, as disclosed in ViaSat’s proxy statement for the 2016 annual meeting of stockholders pursuant to the compensation disclosure rules of the SEC, including the Compensation Discussion and Analysis, the Summary Compensation Table and the other related compensation tables and disclosure.

While this advisory vote is non-binding, our Board of Directors values the opinions that our stockholders express in their votes and will, as a matter of good corporate practice, take into account the outcome of the vote when considering future compensation decisions.

Consistent with the preference of our stockholders as reflected in our prior non-binding advisory vote on the frequency of future say-on-pay votes, this say-on-pay advisory vote will be presented on an annual basis unless otherwise disclosed. Following this year’s advisory vote, the next scheduled say-on-pay advisory vote will take place at our 2017 annual meeting of stockholders.

The Board of Directors unanimously recommends that you vote “FOR” the approval of the compensation of the Named Executive Officers as disclosed in this proxy statement.

14

Table of Contents

The following table sets forth information known to us regarding the ownership of ViaSat common stock as of July 1, 2016 by (1) each director, (2) each of the Named Executive Officers identified in the Summary Compensation Table, (3) all directors and executive officers of ViaSat as a group, and (4) all other stockholders known by us to be beneficial owners of more than 5% of ViaSat common stock.

| Name of Beneficial Owner (1) |

Amount and Nature of Beneficial Ownership (2) |

Percent Beneficial Ownership (%) (3) |

||||||

| Directors and Officers: |

||||||||

| Mark Dankberg |

1,971,977 | (4) | 4.0 | |||||

| Robert Johnson |

692,096 | (5) | 1.4 | |||||

| B. Allen Lay |

363,813 | (6) | * | |||||

| Richard Baldridge |

349,207 | (7) | * | |||||

| Jeffrey Nash |

341,365 | (8) | * | |||||

| Harvey White |

73,500 | (9) | * | |||||

| John Stenbit |

34,500 | (10) | * | |||||

| Shawn Duffy |

28,302 | (11) | * | |||||

| Bob Bowman |

25,200 | (12) | * | |||||

| Keven Lippert |

17,343 | (13) | * | |||||

| Ken Peterman |

16,581 | (14) | * | |||||

| Frank J. Biondi, Jr. |

4,000 | (15) | * | |||||

| All directors and executive officers as a group (17 persons) |

4,867,032 | 9.7 | ||||||

| Other 5% Stockholders: |

||||||||

| The Baupost Group, L.L.C. |

11,533,137 | (16) | 23.4 | |||||

| FPR Partners, LLC |

5,917,893 | (17) | 12.0 | |||||

| Southeastern Asset Management, Inc. |

4,606,627 | (18) | 9.3 | |||||

| BlackRock, Inc. |

4,172,455 | (19) | 8.5 | |||||

| The Vanguard Group |

3,340,647 | (20) | 6.8 | |||||

| * | Less than 1%. |

| (1) | This table shows beneficial ownership of our common stock as calculated under SEC rules, which specify that a person is the beneficial owner of securities if that person has sole or shared voting or investment power. Except as indicated in the footnotes to this table and pursuant to applicable community property laws, to our knowledge, the persons named in the table have sole voting and investment power with respect to all shares of common stock beneficially owned. Unless otherwise indicated, the address of each person or entity named below is c/o ViaSat, Inc., 6155 El Camino Real, Carlsbad, California 92009. |

| (2) | In computing the number of shares beneficially owned by a person named in the table and the percentage ownership of that person, shares of common stock that such person had the right to acquire within 60 days after July 1, 2016 are deemed outstanding, including without limitation, upon the exercise of options or the vesting of restricted stock units. These shares are not, however, deemed outstanding for the purpose of computing the percentage ownership of any other person. References to options in the footnotes of the table include only options to purchase shares that were exercisable within 60 days after July 1, 2016 and references to restricted stock units in the footnotes of the table include only restricted stock units that are scheduled to vest within 60 days after July 1, 2016. |

| (3) | For each person included in the table, percentage ownership is calculated by dividing the number of shares beneficially owned by such person by the sum of (a) 49,280,147 shares of common stock outstanding on July 1, 2016 plus (b) the number of shares of common stock that such person had the right to acquire within 60 days after July 1, 2016. |

15

Table of Contents

| (4) | Includes (a) 385,750 shares subject to options exercisable by Mr. Dankberg within 60 days after July 1, 2016, (b) 62,261 shares held by the Dankberg Family Foundation, (c) 1,522,378 shares held by the Dankberg Family Trust, and (d) 661,967 shares pledged as collateral in a brokerage margin account. With respect to the shares pledged by Mr. Dankberg, it should be noted that (i) Mr. Dankberg’s pledged shares are not designed to shift or hedge any economic risk associated with his ownership of ViaSat common stock, (ii) the total number of shares of ViaSat common stock pledged under this margin account arrangement constituted only 1.34% of the total outstanding shares of ViaSat common stock as of July 1, 2016, (iii) the maximum aggregate principal amount of advances secured by Mr. Dankberg’s pledged shares is $9.5 million, which, based on the closing price of ViaSat common stock on July 1, 2016, would be equivalent to only approximately 134,029 shares of ViaSat common stock, and (iv) Mr. Dankberg has advised us that he has the financial capacity to meet a margin call or repay any advance under his margin agreement without resort to the pledged shares. |

| (5) | Includes (a) 25,000 shares subject to options exercisable by Mr. Johnson within 60 days after July 1, 2016, and (b) 667,096 shares held by the Robert W. Johnson Revocable Trust dated 8/13/1992. |

| (6) | Includes (a) 20,000 shares subject to options exercisable by Mr. Lay within 60 days after July 1, 2016, and (b) 186,026 shares, 127,387 shares and 30,400 shares held by Lay Ventures, L.P., the Lay Living Trust and the Lay Charitable Remainder Trust, respectively. |

| (7) | Includes (a) 204,025 shares subject to options exercisable by Mr. Baldridge within 60 days after July 1, 2016, and (b) 143,113 shares held by the Richard and Donna Baldridge Family Trust. |

| (8) | Includes (a) 20,000 shares subject to options exercisable by Dr. Nash within 60 days after July 1, 2016, and (b) 321,365 shares held by the Nash Family Trust n/d/t 3/18/1980. |

| (9) | Includes (a) 20,000 shares subject to options exercisable by Mr. White within 60 days after July 1, 2016, (b) 51,900 shares held by the Harvey P. and Sheryl L. White Trust, and (c) 1,600 shares held by The Sheryl & Harvey White Foundation. |

| (10) | Includes (a) 21,500 shares subject to options exercisable by Mr. Stenbit within 60 days after July 1, 2016, and (b) 6,600 shares held by THE PIETJE 2012 GIFT TRUST. |

| (11) | Includes 14,375 shares subject to options exercisable by Ms. Duffy within 60 days after July 1, 2016. |

| (12) | Includes 19,000 shares subject to options exercisable by Mr. Bowman within 60 days after July 1, 2016. |

| (13) | Includes 16,250 shares subject to options exercisable by Mr. Lippert within 60 days after July 1, 2016. |

| (14) | Includes 9,376 shares subject to options exercisable by Mr. Peterman within 60 days after July 1, 2016. |

| (15) | Includes 3,000 shares subject to options exercisable by Mr. Biondi within 60 days after July 1, 2016. |

| (16) | Based solely on information contained in a Schedule 13G jointly filed with the SEC on February 13, 2015 by The Baupost Group, L.L.C. (Baupost), SAK Corporation and Seth A. Klarman. Such Schedule states that Baupost, SAK Corporation and Mr. Klarman have shared voting and dispositive power over 11,533,137 shares. Baupost is a registered investment adviser and acts as an investment adviser and general partner to certain private investment limited partnerships. SAK Corporation is the manager of Baupost. Mr. Klarman is the sole director and sole officer of SAK Corporation and a controlling person of Baupost. The address of Baupost, SAK Corporation and Mr. Klarman is 10 St. James Avenue, Suite 1700, Boston, Massachusetts 02116. |

| (17) | Based solely on information contained in a Schedule 13G jointly filed with the SEC on February 16, 2016 by FPR Partners, LLC (FPR), Andrew Raab and Bob Peck. Such Schedule states that FPR, Mr. Raab and Mr. Peck have shared voting and dispositive power over 5,917,893 shares. FPR is a registered investment adviser and acts as an investment manager to certain limited partnerships. Mr. Raab and Mr. Peck are the senior managing members of FPR. The address of FPR, Mr. Raab and Mr. Peck is 199 Fremont Street, Suite 2500, San Francisco, California 94105. |

| (18) | Based solely on information contained in a Schedule 13G jointly filed with the SEC on February 12, 2016 by Southeastern Asset Management, Inc. (Southeastern), Longleaf Partners Small-Cap Fund (Longleaf) and O. Mason Hawkins. Such Schedule states that Southeastern and Longleaf have shared voting and dispositive power over 3,436,313 shares, that Southeastern has sole voting power over 1,125,390 shares, no voting power over 44,924 shares and sole dispositive power over 1,170,314 shares, and that Mr. Hawkins does not have shared voting power or shared dispositive power with respect to any shares. Southeastern is a registered investment adviser and acts as an investment adviser to Longleaf, an investment company. All of the securities reported are owned legally by Southeastern’s investment advisory clients. Mr. Hawkins is the |

16

Table of Contents

| chairman of the board and chief executive officer of Southeastern. The address of Southeastern, Longleaf and Mr. Hawkins is 6410 Poplar Avenue, Suite 900, Memphis, Tennessee 38119. |

| (19) | Based solely on information contained in a Schedule 13G filed with the SEC on January 27, 2016 by BlackRock, Inc. The address of BlackRock, Inc. is 55 East 52nd Street, New York, New York 10055. |

| (20) | Based solely on information contained in a Schedule 13G filed with the SEC on February 11, 2016 by The Vanguard Group (Vanguard). Such Schedule states that Vanguard has sole voting power over 88,948 shares, shared voting power over 2,700 shares, sole dispositive power over 3,251,799 shares and shared dispositive power over 88,948 shares. The address of Vanguard is 100 Vanguard Boulevard, Malvern, Pennsylvania 19355. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our directors, executive officers and holders of more than 10% of ViaSat common stock to file reports of ownership and changes in ownership with the SEC. These persons are required to furnish us with copies of all forms that they file. Based solely on our review of copies of these forms in our possession, or in reliance upon written representations from our directors and executive officers, we believe that all of our directors, executive officers and 10% stockholders complied with the Section 16(a) filing requirements during the fiscal year ended March 31, 2016.

17

Table of Contents

Compensation Discussion and Analysis

The following Compensation Discussion and Analysis provides information regarding the compensation program in place for our executive officers, including the Named Executive Officers identified in the Summary Compensation Table, during our 2016 fiscal year. In particular, this Compensation Discussion and Analysis provides information related to each of the following aspects of our executive compensation program:

| • | overview and objectives of our executive compensation program, |

| • | explanation of our executive compensation processes and criteria, |

| • | description of the components of our compensation program, and |

| • | discussion of how each component fits into our overall compensation objectives. |

Overview and Objectives of Executive Compensation Program

The principal components of our executive compensation program include:

| • | base salary, |

| • | short-term or annual awards in the form of cash bonuses, |

| • | long-term equity awards, and |

| • | other benefits generally available to all of our employees. |

Our executive compensation program incorporates these components because our Compensation and Human Resources Committee considers a blend of these components to be necessary and effective in order to provide a competitive total compensation package to our executive officers while meeting the principal objectives of our executive compensation program. In addition, the Compensation and Human Resources Committee believes that our use of base salary, annual cash bonuses and long-term equity awards as the primary components of our executive compensation program is consistent with the executive compensation programs employed by technology companies of similar size and stage of growth.

Our overall compensation objectives are premised on the following three fundamental principles, each of which is discussed below: (1) a significant portion of executive compensation should be performance-based, linking the achievement of company financial objectives and individual objectives; (2) the financial interests of our executive management and our stockholders should be aligned; and (3) the executive compensation program should be structured so that we can compete in the marketplace in hiring and retaining top level executives with compensation that is competitive and fair. Because our compensation program is designed to reward prudent business judgment and promote disciplined progress towards longer-term company goals, we believe that our balanced compensation policies and practices do not encourage unnecessary and excessive risk-taking by employees that could reasonably be expected to have a material adverse effect on us.

Performance-Based Compensation. We strongly believe that a significant amount of executive compensation should be performance-based. In other words, our compensation program is designed to reward superior performance, and we believe that our executive officers should feel accountable for the overall performance of our business as well as their individual performance. In order to achieve this objective, we have structured our compensation program so that executive compensation is tied, in large part, directly to both company-wide and individual performance. For example, and as discussed specifically below, annual cash bonuses are based on, among other things, pre-determined corporate financial performance metrics and operational targets, and individual performance.

Alignment with Stockholder Interests. We believe that executive compensation and stockholder interests should be linked, and our compensation program is designed so that the financial interests of our executive officers are aligned with the interests of our stockholders. We accomplish this objective in multiple ways. First,

18

Table of Contents

as noted above, payments of annual cash bonuses are based on, among other things, pre-determined corporate financial performance metrics and operational targets that, if achieved, we believe enhance the value of our common stock.

Second, a significant portion of the total compensation paid to our executive officers is paid in the form of equity to further align the interests of executives with stockholders and to provide each executive with an incentive to manage ViaSat from the perspective of an owner with an equity stake in the business. Because vesting is based on continued service to ViaSat, our equity-based incentives also facilitate the retention of executives through the term of the awards. We use a combination of restricted stock units and stock option awards as the primary incentive vehicles for long-term compensation to create a meaningful opportunity for reward predicated on the creation of long-term stockholder value. We believe that restricted stock units are an effective tool for meeting our compensation goal of increasing long-term stockholder value by tying the value of the restricted stock units to our future performance. In addition, because employees are able to profit from stock options only if our stock price increases in value over the stock option’s exercise price, we believe the options provide effective incentives to executives to achieve increases in the value of our stock.

Structure Allows Competitive and Fair Compensation Packages. We provide innovative broadband, advanced wireless communications and secure networking products, systems and services for residential, commercial, military and civil government customers. The markets in which we compete are highly competitive and characterized by rapid change, converging technologies and a migration to solutions that offer higher capacity and speed and other superior advantages. We believe our success depends to a significant degree on our ability to attract and retain highly skilled personnel. Stockholders are accordingly best served when we can attract and retain talented executives with compensation packages that are competitive and fair. Therefore, we strive to create compensation packages for executive officers that deliver compensation that is comparable to the total compensation delivered by the companies with which we compete for executive talent.

Compensation Processes and Criteria

The Compensation and Human Resources Committee is responsible for determining our overall executive compensation philosophy, and for evaluating and recommending all components of executive officer compensation to our Board of Directors for approval. The Compensation and Human Resources Committee acts under a written charter adopted and approved by our Board and may, in its discretion, obtain the assistance of outside advisors, including compensation consultants, legal counsel and accounting and other advisors. Each member of our Compensation and Human Resources Committee qualifies as an “outside director” within the meaning of Section 162(m) of the Internal Revenue Code, a “non-employee director” within the meaning of Rule 16b-3 of the Securities Exchange Act of 1934, and as independent within the meaning of the corporate governance standards of Nasdaq. A copy of the Compensation and Human Resources Committee charter can be found on the Investor Relations section of our website at investors.viasat.com.

Because our executive compensation program relies on the use of three relatively straightforward components (base salary, annual cash bonuses and long-term equity awards), the process for determining each component of executive compensation remains fairly consistent across each component. The Compensation and Human Resources Committee determines compensation in a manner consistent with our primary objectives for executive compensation discussed above. In determining each component of executive compensation, the Compensation and Human Resources Committee generally considers each of the following factors:

| • | industry compensation data, |

| • | individual performance and contributions, |

| • | company financial and operational performance, |

| • | company strategic positioning, |

| • | total executive compensation, |

| • | affordability of cash compensation based on ViaSat’s financial results, |

19

Table of Contents

| • | results of the most recent say-on-pay vote, and |

| • | availability and affordability of shares for equity awards. |

Industry Compensation Data. The Compensation and Human Resources Committee reviews the executive compensation data of comparable technology companies and other companies which are otherwise relevant as part of the process of determining executive compensation. In fiscal year 2016, the Compensation and Human Resources Committee again engaged Compensia, independent compensation consultant to the Compensation and Human Resources Committee, to provide insight and advice on matters relating to executive officer compensation and benefits practices. After conducting an evaluation using the factors established by the SEC and Nasdaq, the Compensation and Human Resources Committee determined that Compensia is independent and that there is no conflict of interest resulting from the engagement of Compensia during fiscal year 2016.

With the assistance of Compensia, the Compensation and Human Resources Committee identified a group of companies to reference as a peer group for compensation comparison purposes. For fiscal year 2016 compensation decisions, this peer group consisted of the following companies, which peer group was unchanged from the 2015 peer group: Akamai Technologies, Arris Group, Aruba Networks, Inc., Avid Technology, Inc., Ciena Corporation, Equinix, Inc., Finisar Corp., FLIR Systems, Inc., Harris Corporation, Internap Network Svs., Polycom, Inc., Riverbed, Rockwell Collins Inc. and Teledyne Technologies. The peer group was selected based on factors such as industry, revenue, business model and market capitalization. Additionally, the Compensation and Human Resources Committee believes that this group of companies provides an appropriate peer group because it is comprised of similar organizations against whom we compete to obtain and retain top quality talent. In addition to peer group data, the Compensation and Human Resources Committee also reviewed information from the Radford Global Technology Survey, a nationally recognized compensation survey containing market information of companies in the high technology industry. This survey was not compiled specifically for ViaSat but rather represents a database containing comparative compensation data and information for a broad range of other high technology companies, thereby permitting the Compensation and Human Resources Committee to review pooled compensation data for positions similar to those held by each executive officer. The survey data provided to the Compensation and Human Resources Committee does not include the particular names of those companies whose pay practices are surveyed with respect to any particular position being reviewed. Unlike peer group compensation data, which is limited to publicly available information and does not provide precise comparisons for certain positions, the more comprehensive survey data can be used to provide pooled compensation data for positions closely akin to those held by each executive officer. In addition, the pool of senior executive talent from which we draw, and against which we compare ourselves, extends beyond the limited community of ViaSat’s immediate peer group. Rather, this pool includes a wide range of other organizations in the technology sector outside of ViaSat’s traditional competitors. As a result, the Compensation and Human Resources Committee relies on a combination of industry survey data published by Radford and peer group compensation data in evaluating our executive compensation.