Form DEF 14A Pacira Pharmaceuticals, For: Jun 14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

ý |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material Pursuant to §240.14a-12 |

|

| PACIRA PHARMACEUTICALS, INC. | ||||

|

(Name of Registrant as Specified In Its Charter) |

||||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

Payment of Filing Fee (Check the appropriate box): |

||||

ý |

No fee required. |

|||

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

(1) |

Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

o |

Fee paid previously with preliminary materials. |

|||

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

PACIRA PHARMACEUTICALS, INC.

5 Sylvan Way, Suite 300

Parsippany, New Jersey 07054

NOTICE OF 2016 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 14, 2016

You are cordially invited to attend the 2016 Annual Meeting of Stockholders (the "Annual Meeting") of Pacira Pharmaceuticals, Inc., which will be held on Tuesday, June 14, 2016, at 2:00 p.m. Eastern Daylight Time, at the Trump SoHo New York, located at 246 Spring Street, New York, New York 10013.

Only stockholders who owned common stock at the close of business on April 18, 2016 can vote at the Annual Meeting or any adjournment that may take place. At the Annual Meeting, the stockholders will be asked to:

- 1.

- Elect

three Class II directors to our board of directors to serve until the 2019 Annual Meeting of Stockholders (Proposal 1);

- 2.

- Ratify

the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016

(Proposal 2);

- 3.

- Approve,

on an advisory basis, the compensation of our named executive officers (Proposal 3);

- 4.

- Approve

our Amended and Restated 2011 Stock Incentive Plan (Proposal 4); and

- 5.

- Transact any other business properly brought before the Annual Meeting.

You can find more information, including the nominees for directors and details regarding executive compensation and our independent registered public accounting firm, in the attached proxy statement.

The board of directors recommends that you vote in favor of each of the above proposals, each as outlined in the attached proxy statement.

We cordially invite all stockholders to attend the Annual Meeting in person. Stockholders of record at the close of business on April 18, 2016, the record date for the Annual Meeting, are entitled to notice of, and to vote at, the Annual Meeting or any adjournment thereof. Whether or not you expect to attend the Annual Meeting in person, please execute your vote promptly by following the instructions described under "How do I vote?" on page 2 of the proxy statement. If you execute your vote prior to the Annual Meeting and then decide to attend the Annual Meeting to vote your shares in person, you may still do so. Your proxy is revocable in accordance with the procedures set forth in the proxy statement.

| By order of the Board of Directors, | ||

/s/ KRISTEN WILLIAMS |

||

| Kristen Williams Chief Administrative Officer, General Counsel and Secretary |

Parsippany,

New Jersey

April 21, 2016

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE EXECUTE YOUR VOTE PROMPTLY BY FOLLOWING THE INSTRUCTIONS DESCRIBED UNDER "HOW DO I VOTE?" ON PAGE 2 OF THE PROXY STATEMENT. THIS WILL ENSURE THE PRESENCE OF A QUORUM AT THE MEETING. IF YOU ATTEND THE MEETING, YOU MAY VOTE IN PERSON IF YOU WISH TO DO SO EVEN IF YOU HAVE PREVIOUSLY VOTED.

2016 PROXY STATEMENT — SUMMARY

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information you should consider. You should read the entire Proxy Statement carefully before voting.

GENERAL INFORMATION

(see pages 1-4)

Meeting: 2016 Annual Meeting of Stockholders

Date: Tuesday, June 14, 2016

Time: 2:00 p.m. Eastern Daylight Time

Location: Trump SoHo New York

246 Spring Street

New York, New York 10013

Record Date: April 18, 2016

Record Date Shares Outstanding: 37,166,440 shares

Stock Symbol: PCRX

Exchange: NASDAQ

Registrar & Transfer Agent: Computershare Trust Company, N.A.

State of Incorporation: Delaware

Public Company Since: February 2011

Corporate Headquarters: 5 Sylvan Way, Suite 300

Parsippany, New Jersey 07054

Corporate Website: www.pacira.com

ANNUAL MEETING AGENDA (Board Recommendation)

(see page 1)

- •

- Election of Three Class II Directors ("FOR")

- •

- Ratification of Appointment of KPMG LLP as our Independent Registered Public Accounting Firm ("FOR")

- •

- Approval, on an Advisory Basis, of the Compensation of our Named Executive Officers ("FOR")

- •

- Approval of our Amended and Restated 2011 Stock Incentive Plan ("FOR")

- •

- Transact Other Business That May Properly Come Before the Meeting

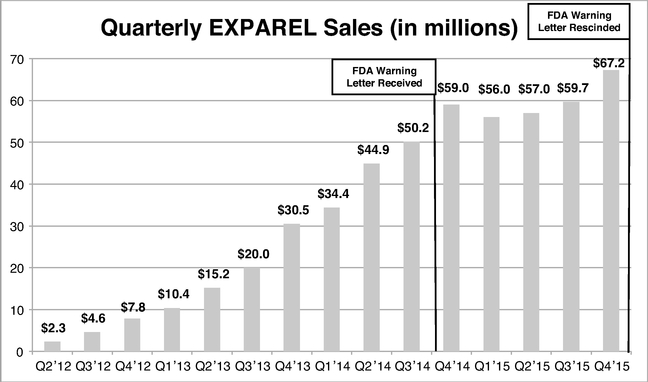

2015 BUSINESS HIGHLIGHTS

(see pages 26-27, 45)

- •

- Total revenue increase of $51.3 million, or 26% in 2015, as compared to 2014, driven by EXPAREL® sales of $239.9 million.

- •

- Favorable resolution of the U.S. Food and Drug Administration ("FDA") lawsuit.

- •

- Delivery of manufacturing process equipment to Patheon U.K. Limited to be used in the production of EXPAREL.

- •

- Initiation of studies for the use of EXPAREL in upper extremity and lower extremity nerve blocks.

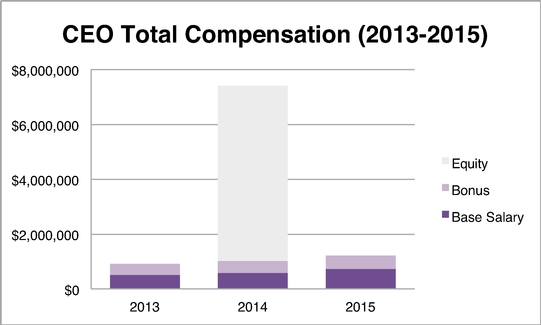

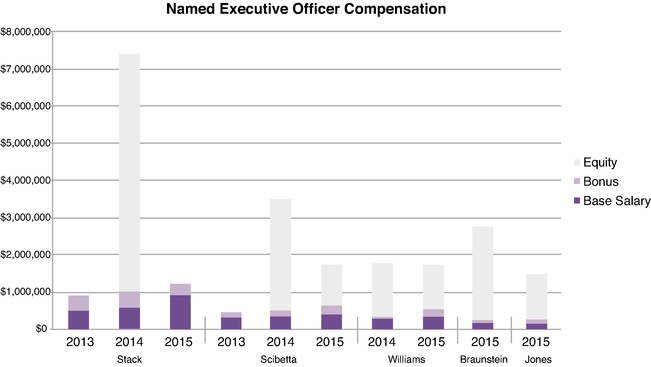

EXECUTIVE COMPENSATION HIGHLIGHTS

(see pages 26-45)

Say-on-Pay Vote: We hold an annual say-on-pay vote. Approximately 99% of the votes cast at the 2015 Annual Meeting of Stockholders approved, on an advisory basis, the compensation of our named executive officers.

2015 Compensation Highlights:

- •

- Limited equity grants to named executive officers in 2015, with no equity grants made to the CEO.

- •

- Total compensation down 83% compared to previous year for CEO, and approximately 37% lower for returning named executive officers.

- •

- Total 2015 CEO compensation was below the 25th percentile of our peer group and total average named executive officer compensation ranged between the 25th and 50th percentile.

STOCK INCENTIVE PLAN HIGHLIGHTS

(see pages 46-59)

Stock Incentive Plan Changes:

- •

- Increase the number of shares of common stock authorized for grant by 4,000,000 newly reserved shares.

- •

- Add a $1 million limit on the aggregate amount of all compensation granted during any calendar year to any member of our board of directors who is not an employee of our company.

Stock Incentive Plan Governance Highlights:

- •

- No recycling of shares or "liberal share counting" practices.

- •

- No single-trigger vesting of equity awards that are assumed in the event of a change in control.

- •

- No repricing of stock options without prior stockholder approval.

- •

- No stock options with exercise prices below fair market value.

- •

- Three-year average historical equity compensation utilization rate ("burn rate") of 3.52%.

PROXY STATEMENT

TABLE OF CONTENTS

PACIRA PHARMACEUTICALS, INC.

5 Sylvan Way, Suite 300

Parsippany, New Jersey 07054

(973) 254-3560

PROXY STATEMENT

FOR THE 2016 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 14, 2016

This proxy statement contains information about the 2016 Annual Meeting of Stockholders of Pacira Pharmaceuticals, Inc. (the "Annual Meeting") to be held on Tuesday, June 14, 2016, at 2:00 p.m. Eastern Daylight Time, at the Trump SoHo New York, located at 246 Spring Street, New York, New York 10013. This proxy statement will first be made available to stockholders on or about April 21, 2016. It is furnished to stockholders of Pacira Pharmaceuticals, Inc. in connection with the solicitation of proxies by our board of directors. In this proxy statement, unless expressly stated otherwise or the context otherwise requires, the use of "Pacira," the "Company," "our," "we" or "us" refers to Pacira Pharmaceuticals, Inc. and its subsidiaries.

This proxy statement and our 2015 annual report to stockholders are available at www.proxyvote.com.

All properly submitted proxies will be voted in accordance with the instructions contained in those proxies. If no instructions are specified, the proxies will be voted in accordance with the recommendation of our board of directors with respect to each of the matters set forth in the accompanying Notice of 2016 Annual Meeting of Stockholders.

PURPOSE OF THE ANNUAL MEETING

At the Annual Meeting, our stockholders will consider and vote on the following matters:

- 1.

- To

elect three Class II directors to our board of directors to serve until the 2019 Annual Meeting of Stockholders (Proposal 1);

- 2.

- To

ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016

(Proposal 2);

- 3.

- To

approve, on an advisory basis, the compensation of our named executive officers (Proposal 3);

- 4.

- To

approve our Amended and Restate 2011 Stock Incentive Plan (Proposal 4); and

- 5.

- To transact any other business properly brought before the Annual Meeting.

As of the date of this proxy statement, we are not aware of any business to come before the meeting other than Proposals 1 through 4, noted above.

WHO CAN ATTEND THE ANNUAL MEETING?

Only stockholders of record at the close of business on the record date of April 18, 2016 are entitled to receive notice of the Annual Meeting and to vote the shares of our common stock that they held on that

PACIRA PHARMACEUTICALS, INC. -- 2016 PROXY STATEMENT -- 1

date. As of the close of business on April 18, 2016, there were 37,166,440 shares of common stock outstanding and entitled to vote. Each share of common stock is entitled to one vote on each matter properly brought before the Annual Meeting.

WHAT IS THE DIFFERENCE BETWEEN BEING A "STOCKHOLDER OF RECORD" AND BEING A BENEFICIAL OWNER OF SHARES HELD IN "STREET NAME?"

Stockholder of Record. If your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A., then you are considered a "stockholder of record" of those shares. In this case, a set of proxy materials has been sent to you directly by us.

Beneficial Owners of Shares Held in Street Name. If your shares are held in a brokerage account or by a bank, trust or other nominee or custodian, then you are considered the beneficial owner of those shares, which are held in "street name." In this case, a set of proxy materials has been forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to instruct that organization as to how to vote the shares held in your account.

HOW DO I VOTE?

Stockholders of Record. If you are a stockholder of record, you can vote your shares over the Internet, by telephone as described on the proxy card, or by mail by marking, signing, dating and mailing your proxy card in the postage-paid envelope provided. Your designation of a proxy is revocable by following the procedures outlined in this proxy statement. The method by which you vote will not limit your right to vote in person at the Annual Meeting. If you receive hard copy materials and sign and return your proxy card without specifying choices, your shares will be voted as recommended by our board of directors.

Telephone and Internet voting for stockholders of record will be available up until 11:59 PM Eastern Daylight Time on June 13, 2016, and mailed proxy cards must be received prior to the start of the Annual Meeting in order to be counted at the Annual Meeting. If the Annual Meeting is adjourned or postponed, these deadlines may be extended.

Beneficial Owners of Shares Held in Street Name. If you hold your shares through a broker, bank, or other nominee in "street name," you need to submit voting instructions to your broker, bank or other nominee in order to cast your vote. You may mark, sign, date and mail the accompanying voting instruction form in the postage-paid envelope provided. Your vote is revocable by following the procedures outlined in this proxy statement. However, since you are not a stockholder of record you may not vote your shares in person at the Annual Meeting without obtaining a legal proxy from your broker, bank or other nominee.

The voting deadlines and availability of telephone and Internet voting for beneficial owners of shares held in "street name" will depend on the voting processes of the organization that holds your shares. Therefore, we urge you to carefully review and follow the voting instructions card and any other materials that you receive from that organization.

WHAT ARE "BROKER NON-VOTES" AND HOW DO THEY AFFECT THE PROPOSALS?

A broker non-vote occurs when a broker, bank, or other nominee holding shares for a beneficial owner in "street name" does not vote the shares on a proposal because the nominee does not have discretionary voting power for a particular item and has not received instructions from the beneficial owner regarding voting. Brokers who hold shares for the accounts of their clients have discretionary authority to vote shares if specific instructions are not given with respect to "routine" items.

PACIRA PHARMACEUTICALS, INC. -- 2016 PROXY STATEMENT -- 2

If your shares are held by a broker on your behalf and you do not instruct the broker as to how to vote your shares on Proposals 1, 3 or 4, the broker may not exercise discretion to vote for or against those proposals because each of these proposals are considered "non-routine" under applicable rules. With respect to Proposal 2, the ratification of the appointment of KPMG LLP as our independent registered public accounting firm, the broker may exercise its discretion to vote for or against that proposal in the absence of your instruction. Broker non-votes are not counted as votes in favor of or against any proposal.

WHAT CONSTITUTES A QUORUM AT THE ANNUAL MEETING?

A quorum of stockholders is necessary to hold a valid meeting. Our amended and restated bylaws (our "Bylaws") provide that a quorum will exist if stockholders holding a majority of the outstanding shares of common stock are present at the meeting in person or by proxy. Abstentions and broker non-votes count as present for establishing a quorum, provided that the broker has voted on at least the ratification of the appointment of our auditors, but will not be counted as votes cast. If a quorum is not present, the meeting may be adjourned until a quorum is obtained.

WHAT VOTES ARE REQUIRED TO ELECT DIRECTORS AND TO APPROVE THE OTHER PROPOSALS IN THIS PROXY STATEMENT?

Election of Directors. To be elected, director nominees must receive a plurality of the votes cast (the three nominees receiving the highest number of "FOR" votes cast will be elected). "WITHHOLD" votes and broker non-votes will have no effect on the outcome of Proposal 1. Cumulative voting is not permitted. See "Corporate Governance — Majority Vote Director Resignation Policy" (below) regarding director nominees who receive a greater number of votes "WITHHELD" than votes "FOR" their election.

Ratification of Appointment of Auditor, Say on Pay and Stock Incentive Plan. The affirmative vote of a majority of the shares of common stock present or represented by proxy and cast at the meeting ("FOR" or "AGAINST") is required to (a) ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016 (Proposal 2), (b) approve, on an advisory basis, the compensation of our named executive officers (Proposal 3), and (c) approve our Amended and Restated 2011 Stock Incentive Plan (Proposal 4). Abstentions and broker non-votes are not counted as votes cast and will have no effect on the outcome of these proposals.

WHAT ARE THE RECOMMENDATIONS OF THE BOARD OF DIRECTORS?

Our board of directors recommends that you vote:

- •

-

FOR the election of each of the three nominees to

serve as Class II directors on our board of directors, each for a three-year term;

- •

-

FOR the ratification of the appointment of

KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016;

- •

-

FOR the approval, on an advisory basis, of the

compensation of our named executive officers; and

- •

- FOR the approval of our Amended and Restated 2011 Stock Incentive Plan.

PACIRA PHARMACEUTICALS, INC. -- 2016 PROXY STATEMENT -- 3

WHAT CAN I DO IF I CHANGE MY MIND AFTER I VOTE?

Stockholder of Record. If you are a stockholder of record, you may revoke your proxy before the vote is taken at the Annual Meeting by:

- •

- submitting a new proxy with a later date before the applicable deadline either signed and returned by mail or transmitted using the

telephone or Internet voting procedures described in the "How do I vote?" section above;

- •

- by voting in person at the Annual Meeting; or

- •

- by filing a written revocation with our Secretary.

Beneficial Owners of Shares Held in Street Name. If your shares are held in "street name," you may submit new voting instructions by contacting your broker or other organization holding your account. You may also vote in person at the Annual Meeting, which will have the effect of revoking any previously submitted voting instructions, if you obtain a legal proxy from the organization that holds your shares as described in the "How do I vote?" section above.

Whether you are a stockholder of record or a beneficial owner of shares held in street name, your attendance at the Annual Meeting will not automatically revoke your proxy.

WHO PAYS FOR THE COST TO SOLICIT PROXIES FOR THE ANNUAL MEETING?

We will bear all expenses incurred in connection with the solicitation of proxies. We will reimburse brokers, fiduciaries and custodians for their costs in forwarding proxy materials to beneficial owners of common stock. Our directors, officers and employees also may solicit proxies by mail, telephone and personal contact. They will not receive any additional compensation for these activities. We may also elect to engage the services of a proxy solicitation firm to assist us in the solicitation of proxies, for which we would expect to pay customary fees and reimburse customary expenses.

HOW CAN I FIND THE RESULTS OF THE VOTING AFTER THE ANNUAL MEETING?

We will announce preliminary voting results at the Annual Meeting and will publish final results in a Current Report on Form 8-K to be filed with the SEC within four business days following the Annual Meeting.

PACIRA PHARMACEUTICALS, INC. -- 2016 PROXY STATEMENT -- 4

PROPOSAL NO. 1 — ELECTION OF CLASS II DIRECTORS

BOARD COMPOSITION

Our board of directors currently consists of nine members. Our directors hold office until their successors have been elected and qualified or until the earlier of their resignation or removal.

In accordance with the terms of our amended and restated certificate of incorporation (our "Certificate of Incorporation") and Bylaws, our board of directors is divided into three classes: Class I, Class II and Class III, with each class serving staggered three-year terms. Upon the expiration of the term of a class of directors, directors in that class will be eligible to be elected for a new three-year term at the annual meeting of stockholders in the year in which their term expires. The current members of the classes are divided as follows:

- •

- Class II: Paul Hastings, John Longenecker, and Andreas Wicki, and their term expires at the Annual Meeting.

- •

- Class III: Yvonne Greenstreet, Gary Pace, and David Stack, and their term expires at the annual meeting of stockholders to be

held in 2017.

- •

- Class I: Laura Brege, Mark Kronenfeld, and Dennis Winger, and their term expires at the annual meeting of stockholders to be held in 2018.

Our Certificate of Incorporation and Bylaws provide that the authorized number of directors may be changed only by resolution of the board of directors. Our Certificate of Incorporation and Bylaws also provide that our directors may be removed only for cause by the affirmative vote of the holders of at least 75% of the votes that all our stockholders would be entitled to cast in an annual election of directors, and that any vacancy on our board of directors, including a vacancy resulting from an enlargement of our board of directors, may be filled only by vote of a majority of our directors then in office.

NOMINEES FOR ELECTION AS CLASS II DIRECTORS FOR ELECTION TO A THREE-YEAR TERM EXPIRING AT THE 2019 ANNUAL MEETING OF STOCKHOLDERS

Biographical information for our directors who are up for re-election at the Annual Meeting is set forth below.

PACIRA PHARMACEUTICALS, INC. -- 2016 PROXY STATEMENT -- 5

Paul Hastings Age 56 Director Since June 2011 |

Mr. Hastings has served as a director since June 2011 and as our Lead Director since June 2013. Mr. Hastings has been the president and chief executive officer and a member of the board of directors of OncoMed Pharmaceuticals, Inc. (NASDAQ: OMED), a clinical development-stage biopharmaceutical company, since January 2006. In August 2013, he was elected chairman of the board. Prior to joining OncoMed, Mr. Hastings was president and chief executive officer of QLT, Inc., a biotechnology company focused on the development and commercialization of ocular products. Before this role, Mr. Hastings served as president and chief executive officer of Axys Pharmaceuticals, Inc., which was acquired by Celera Corporation in 2001. Prior to Axys, Mr. Hastings was president of Chiron Biopharmaceuticals and also held a variety of management positions of increasing responsibility at Genzyme Corporation, including president of Genzyme Therapeutics Europe and president of Worldwide Therapeutics. Mr. Hastings was Chairman of the Board of Proteolix (sold to Onyx) and was a member of the board of directors of ViaCell Inc. (sold to Perkin Elmer). Mr. Hastings currently serves on the board of directors of Relypsa Inc., a clinical-stage publicly-traded biopharmaceutical company, and the Bay Area Biosciences Association (Bay Bio), and he is on the board of directors and executive committee of the Biotechnology Industry Organization. He received a Bachelor of Science degree in pharmacy from the University of Rhode Island. We believe Mr. Hastings' qualifications to sit on our board of directors include his financial expertise and his extensive experience in the pharmaceutical and biotechnology industries. |

PACIRA PHARMACEUTICALS, INC. -- 2016 PROXY STATEMENT -- 6

John Longenecker, Ph.D. Age 56 Director since July 2007 |

Dr. Longenecker has served as a director since July 2007. Dr. Longenecker served as president and chief executive officer of HemaQuest Pharmaceuticals, Inc., a biopharmaceutical company focused on the development of therapeutics for blood diseases, from October 2010 until May 2014. From December 2009 to March 2010, Dr. Longenecker served as the president and chief executive officer of VitreoRetinal Technologies Inc., an ophthalmic biopharmaceutical company. From February 2002 to January 2009, Dr. Longenecker was the president and chief executive officer and a member of the board of directors of Favrille, Inc. In 1992, Dr. Longenecker joined DepoTech as senior vice president of research, development and operations and then served as president and chief operating officer from February 1998 to March 1999. Under Dr. Longenecker's leadership, DepoTech took its lead product, DepoCyt(e), from early pre-clinical research and development through to commercial launch. Following SkyePharma PLC's acquisition of DepoTech in 1999, Dr. Longenecker served as president for the U.S. operations of SkyePharma, Inc. and as a member of the executive committee for SkyePharma PLC. From 1982 to 1992, Dr. Longenecker was at Scios Inc. (Cal Bio), a biotechnology company where he served as vice-president and director of development. Dr. Longenecker was also a director of a number of Cal Bio subsidiaries during this period including Meta Bio and Karo Bio. Dr. Longenecker holds a B.S. in chemistry-education from Purdue University and a Ph.D. in biochemistry from The Australian National University. He was a post-doctoral fellow at Stanford University from 1980 to 1982. Dr. Longenecker's experience as the president of a public company demonstrates his leadership capability, extensive knowledge of complex financial and operational issues that public companies face, a thorough understanding of our business and industry, and business acumen to our board of directors. We believe Dr. Longenecker's extensive experience in the pharmaceutical and biotechnology industries, as well as his unique understanding of our DepoFoam® technology, provides valuable background and insight to our board of directors. |

|

Andreas Wicki, Ph.D. Age 57 Director since December 2006 |

Dr. Wicki has served as a director since our inception in December 2006. Dr. Wicki is a life sciences entrepreneur and investor with over 20 years of experience in the pharmaceutical and biotechnology industries. Dr. Wicki has been chief executive officer of HBM Healthcare Investments AG (formerly HBM BioVentures AG) since 2001. From 1998 to 2001, Dr. Wicki was the senior vice president of the European Analytical Operations at MDS Inc. From 1990 to 1998, he was co-owner and chief executive officer of ANAWA Laboratorien AG and Clinserve AG, two life sciences contract research companies. From 2007 to 2011, he served as a member of the board of directors of PharmaSwiss SA. Previously, Dr. Wicki held board positions on several privately-held companies and companies listed on international exchanges. Dr. Wicki holds an M.Sc. and Ph.D. in chemistry and biochemistry from the University of Bern, Switzerland. He currently serves on the board of directors of Buchler GmbH, HBM Healthcare Investments (Cayman) Ltd., and HBM BioCapital Ltd. We believe Dr. Wicki's qualifications to sit on our board of directors include his extensive experience with pharmaceutical companies, his financial expertise and his years of experience providing strategic and advisory services to pharmaceutical and biotechnology organizations. |

Proxies will be voted in favor of the nominees unless a contrary specification is made in the proxy. The nominees have consented to serve as directors of Pacira if elected. However, if any of the nominees are

PACIRA PHARMACEUTICALS, INC. -- 2016 PROXY STATEMENT -- 7

unable to serve or for good cause will not serve as a director, the persons named in the proxy intend to vote in their discretion for one or more substitutes who will be designated by our board of directors.

RECOMMENDATION OF THE BOARD OF DIRECTORS

THE BOARD OF DIRECTORS RECOMMENDS VOTING "FOR" THE ELECTION OF EACH DIRECTOR NOMINEE.

PACIRA PHARMACEUTICALS, INC. -- 2016 PROXY STATEMENT -- 8

DIRECTORS CONTINUING IN OFFICE

Biographical information for our directors continuing in office is set forth below.

Class III Directors (Term Expires at 2017 Annual Meeting)

Yvonne Greenstreet, MBChB Age 53 Director since March 2014 |

Dr. Greenstreet has served as a director since March 2014. Dr. Greenstreet most recently served as the Senior Vice President and Head of Medicines Development at Pfizer Inc. ("Pfizer"), a multinational pharmaceutical company based in New York, from December 2010 to November 2013. Prior to joining Pfizer, Dr. Greenstreet worked for 18 years at GlaxoSmithKline plc ("GSK"), a multinational pharmaceutical, biologics, vaccines and consumer healthcare company based in London, where she served in various positions, most recently as Senior Vice President and Chief of Strategy for Research and Development and as a member of GSK's corporate executive investment committee. Dr. Greenstreet currently serves on the Advisory Board of the Bill and Melinda Gates Foundation, and also currently serves on the board of directors of both Indivior PLC and Advanced Accelerator Applications S.A. Dr. Greenstreet previously served as a director of Molecular Insight Pharmaceuticals, Inc. from 2008 to 2010. She trained as a physician and earned her medical degree from Leeds University in the United Kingdom and her M.B.A. from INSEAD, France. We believe Dr. Greenstreet's qualifications to sit on our board of directors include her significant experience in senior management roles at large pharmaceutical companies and her extensive expertise in drug development and commercialization. |

|

Gary Pace, Ph.D. Age 68 Director since June 2008 |

Dr. Pace has served as a director since June 2008. Dr. Pace has been a director of ResMed (NYSE: RMD) since 1994, Transition Therapeutics Inc. (CDNX: TTH) since 2002 and Antisense Therapeutics Ltd (ASX: ANP) since 2015. He previously served as a member of the board of directors at QRxPharma Ltd (ASX: QRX) from 2001 to 2013, Celsion Corporation (NASDAQ: CLSN) from 2002 to 2010 and Peplin Inc. (ASX: PLI) from 2004 to 2009. He has more than 40 years of experience in the development and commercialization of advanced technologies, spanning biotechnology, pharmaceuticals, medical devices, and food industries. Dr. Pace was awarded a Centenary Medal by the Australian Government in 2003 "for service to Australian society in research and development" and was recognized as the 2011 Director of the Year (corporate governance) by the Corporate Directors Forum. Dr. Pace holds a B.Sc. with honors from the University of New South Wales and a Ph.D. from Massachusetts Institute of Technology. We believe Dr. Pace's qualifications to sit on our board of directors include his financial expertise and his years of experience providing strategic advisory services to complex organizations, including as a public company director. |

PACIRA PHARMACEUTICALS, INC. -- 2016 PROXY STATEMENT -- 9

David Stack Age 65 Director since November 2007 |

Mr. Stack has served as our chief executive officer and as a director since November 2007, and as president from November 2007 to October 2015. In June 2013, Mr. Stack was appointed as the chairman of our board of directors. Mr. Stack has been a managing director of MPM Capital, a private equity firm, since 2005 and a managing partner of Stack Pharmaceuticals, Inc., a commercialization, marketing, and strategy firm, since 1998. From 2001 to 2004, he was president and chief executive officer of The Medicines Company (NASDAQ: MDCO). Previously, Mr. Stack was president and general manager at Innovex, Inc. He was vice president, business development/marketing at Immunomedics from 1993 until 1995. Prior to that, he was with Roche Laboratories in positions of increasing responsibility from 1981 until 1993, including therapeutic world leader in infectious disease and director, business development and planning, infectious disease, oncology, and virology. He currently serves as a member of the board of directors of Medivo, Inc. and Amarin Corporation plc. He also currently serves as Chairman of Chiasma, Inc. and is on the board of directors of the Biotechnology Industry Organization's (BIO) Emerging Company and Health Sections. He was a member of the boards of directors of Molecular Insight Pharmaceuticals, Inc. (NASDAQ: MIPI) from 2006 to 2010 and BioClinica, Inc. (NASDAQ: BIOC) from 1999 to 2010. Mr. Stack holds a B.S. in pharmacy from Albany College of Pharmacy and a B.S. in Biology from Siena College. We believe Mr. Stack's qualifications to sit on our board of directors include his extensive experience with pharmaceutical companies, his financial expertise and his years of experience providing strategic and financial advisory services to pharmaceutical and biotechnology organizations, including evaluating business strategy and commercial planning. |

Class I Directors (Term Expires at 2018 Annual Meeting)

Laura Brege Age 58 Director since June 2011 |

Ms. Brege has served as a director since June 2011. Since September 2015. Ms. Brege has been Managing Director of Cervantes Life Science Partners, LLC., a health care advisory and consulting company. From September 2012 to July 2015, Ms. Brege served as president and the chief executive officer of Nodality, Inc., a privately held biotechnology company focused in oncology and immunology. Previously, Ms. Brege held the roles of chief operating officer, executive vice president, chief business officer and head of corporate affairs at Onyx Pharmaceuticals, Inc., a biopharmaceutical company that developed and marketed medicines for the treatment of cancer. Prior to joining Onyx in 2006, Ms. Brege was a general partner at Red Rock Capital Management, a venture capital firm, and senior vice president and chief financial officer at COR Therapeutics, Inc. Ms. Brege currently serves as a director of Acadia Pharmaceuticals Inc. (NASDAQ: ACAD), Aratana Therapeutics, Inc. (NASDAQ: PETX), Dynavax Technologies Corporation (NASDAQ: DVAX), and Portola Pharmaceuticals, Inc. (NASDAQ: PTLA). She previously served as a member of the board of directors of Angiotech Pharmaceuticals Inc. from 2007 to 2011 and Delcath Systems, Inc. from 2012 to 2014. Ms. Brege earned her undergraduate degree from Ohio University and has an M.B.A. from the University of Chicago. We believe Ms. Brege's qualifications to sit on our board of directors include her extensive experience in the pharmaceutical and biotechnology industries, including as a public company director. |

PACIRA PHARMACEUTICALS, INC. -- 2016 PROXY STATEMENT -- 10

Mark A. Kronenfeld, M.D. Age 61 Director since June 2013 |

Dr. Kronenfeld has served as a director since June 2013. Dr. Kronenfeld has been the Vice Chairman of Anesthesiology at Maimonides Medical Center, a large tertiary care academic medical center in New York City, since March 2009, and has served as Medical Director of Perioperative Services for Maimonides Medical Center since January 2011. Dr. Kronenfeld is a managing partner of Anesthesia Associates of Boro Park, a private medical practice, and a managing partner of Strategic Medical Management Partners. In 2001, Dr. Kronenfeld founded Ridgemark Capital Management ("Ridgemark"), a healthcare-focused hedge fund that invested in public and private healthcare and biomedical companies. He served as the Managing Partner and Portfolio Manager of Ridgemark from April 2001 to December 2008. Dr. Kronenfeld has founded and/or managed various consulting and investment companies focused on healthcare and medical technologies and has served on and chaired multiple leadership committees for various hospitals and medical centers. Previously, Dr. Kronenfeld taught and practiced adult and pediatric cardiac anesthesia at NYU and was Chief of Cardiac Anesthesiology at Hackensack University Medical Center and President of GMS Anesthesia Associates, a private medical practice. Dr. Kronenfeld received his M.D. degree and completed his residency in Anesthesiology at the University of California, San Diego School of Medicine, and completed a fellowship in Cardiothoracic Anesthesiology at New York University Medical Center. While an Assistant Professor and Attending Cardiac Anesthesiologist at NYU, Dr. Kronenfeld received and completed a Kellogg-sponsored Fellowship in Heath Care Management for Future Leaders in Health Care at NYU's Graduate School of Management. We believe Dr. Kronenfeld's significant leadership experience in the hospital setting and experience in conducting clinical trials provide valuable insight and perspective to our board of directors. |

|

Dennis L. Winger Age 68 Director since September 2013 |

Mr. Winger has served as a director since September 2013. Most recently, Mr. Winger was Senior Vice President and Chief Financial Officer of Applera Corporation, a life sciences company, from September 1997 until his retirement in December 2008. Previously, Mr. Winger served as Senior Vice President, Finance and Administration, and Chief Financial Officer of Chiron Corporation, a biotechnology company acquired by Novartis International in 2006. Mr. Winger currently serves as a director of Accuray Incorporated (NASDAQ: ARAY), a radiation oncology company, and Nektar Therapeutics (NASDAQ: NKTR), a clinical-stage biopharmaceutical company. He previously served on the boards of Vertex Pharmaceuticals Incorporated (NASDAQ: VRTX), from 2009 to 2012, Cephalon, Inc., from 2003 to 2011, and Cell Genesys, Inc., from 2004 to 2009. Mr. Winger also serves on the Board of Trustees of Siena College. Mr. Winger holds a B.A. in History from Siena College and an M.B.A. from Columbia University Graduate School of Business. We believe Mr. Winger's qualifications to sit on our board of directors include his extensive financial and leadership experience as chief financial officer for various life sciences companies and his experience as a director on several public company boards. |

PACIRA PHARMACEUTICALS, INC. -- 2016 PROXY STATEMENT -- 11

The following sets forth certain information with respect to the executive officers of the Company as of April 21, 2016.

Name

|

Age | Position(s) | |||

|---|---|---|---|---|---|

David Stack |

65 | Chief Executive Officer and Chairman | |||

James Scibetta |

51 | President and Chief Financial Officer | |||

Scott Braunstein, MD |

52 | Senior Vice President, Strategy and Corporate Development | |||

James B. Jones, MD |

51 | Senior Vice President and Chief Medical Officer | |||

Kristen Williams |

42 | Chief Administrative Officer, General Counsel and Secretary | |||

On April 19, 2015, we announced the appointment of Charles A. Reinhart, III as our chief financial officer effective May 3, 2016. Mr. Reinhart succeeds Jim Scibetta as our chief financial officer. Mr. Scibetta will continue to serve as president of the Company.

David Stack see "Directors Continuing in Office" above.

James Scibetta has served as our president since October 2015 and as our chief financial officer since August 2008. He has also served as our head of technical operations from January 2015 to October 2015, and as a senior vice president from 2014 to October 2015. Mr. Scibetta is currently responsible for overseeing the day-to-day operations and tactical execution of our Customer and Patient Solutions group, comprised of our customer-facing resources, and overseeing our Science Center Campus activities, which includes commercial manufacturing, tech transfer, and research and development. Prior to his employment at Pacira, Mr. Scibetta was chief financial officer of Bioenvision, Inc. (NASDAQ: BIVN) from 2006 until its acquisition by Genzyme, Inc. in 2007. From 2001 to 2006, Mr. Scibetta was executive vice president and chief financial officer of Merrimack Pharmaceuticals, Inc. Mr. Scibetta formerly served as a senior investment banker at Shattuck Hammond Partners, LLC and PaineWebber Inc., providing capital acquisition, merger and acquisition, and strategic advisory services to healthcare companies. He currently serves on the board and chairs the audit committee of Matinas BioPharma, and previously served on the boards of Merrimack Pharmaceuticals, LaboPharm and Nephros. Mr. Scibetta holds a B.S. in physics from Wake Forest University, and an M.B.A. in finance from the University of Michigan. He completed executive education studies in the Harvard Business School Leadership & Strategy in Pharmaceuticals and Biotechnology program. Mr. Scibetta was named 2013 CFO of the Year by NJbiz.com.

Scott Braunstein, MD has served as our senior vice president, strategy and corporate development since July 2015. Dr. Braunstein is responsible for evaluating, integrating and optimizing our strategic opportunities for the lead commercial product EXPAREL, our hospital-based sales franchise; the DepoFoam-based internal pipeline product candidates; and external in-licensing and acquisition product candidates. Prior to joining us, Dr. Braunstein was a Healthcare Analyst and Portfolio Manager at J.P. Morgan Asset Management from 2002 to 2014, where he invested in and conducted diligence on a wide variety of pharmaceutical products and product candidates, pharmaceutical company strategies, business models and management teams, providing stock recommendations for the entire J.P. Morgan Asset Equity Group. He also served in a similar role at Everpoint Asset Management from 2014 to 2015. Earlier in his career, Dr. Braunstein was an active lecturer and consultant for several global pharmaceutical companies and provided academic instruction as Assistant Clinical Professor for Columbia University and the Albert Einstein College of Medicine. He currently serves on the Board of Esperion Therapeutics, Inc., STAT Medical and the Cornell Alumni Association for the College of Agriculture and Life Sciences. Dr. Braunstein has been an operating partner of Aisling Capital, a private equity firm focusing on healthcare companies, since 2015. Dr. Braunstein earned his medical degree

PACIRA PHARMACEUTICALS, INC. -- 2016 PROXY STATEMENT -- 12

from the Albert Einstein College of Medicine, completed his internal medical residency at Cornell University-New York Hospital and conducted additional research in immunology and wound healing from 1993 to 1994 at Rockefeller University.

James B. Jones, MD has served as our senior vice president and chief medical officer since August 2015. He is primarily responsible for overseeing and guiding our clinical research and development efforts for the expanded uses of EXPAREL and our DepoFoam pipeline of products. Previously, he was chief medical officer at Cara Therapeutics from March 2011 to September 2013, where he oversaw the Phase 2 clinical development of the lead product candidate CR845, a peripherally-restricted kappa opioid agonist. Dr. Jones is a practicing Board Certified Emergency Medicine physician, having received his Doctorate of Medicine degree from the University of Pennsylvania and his Bachelor of Science and Doctorate of Pharmacy degrees from Purdue University.

Kristen Williams has served as our chief administrative officer, general counsel and secretary since October 2014. She previously served as our vice president, general counsel from March 2013 to October 2014, as corporate counsel from December 2011 to March 2013, and as a legal consultant to our company beginning in April 2011. Prior to joining Pacira, she was vice president, corporate compliance and assistant general counsel for Bioenvision, Inc., a biopharmaceutical company focused on the acquisition, development, and marketing of compounds and technologies for the treatment of cancer, from June 2004 until its merger with Genzyme Corporation in 2007. Prior to that, she practiced corporate law at Paul Hastings LLP in New York from September 1999 to June 2004, where her practice encompassed all aspects of public and private mergers and acquisitions, corporate finance, and securities law and compliance, with a core focus in the healthcare industry. Ms. Williams holds a B.S. in Business Administration from Bucknell University and a J.D. from the University of Denver, College of Law.

FAMILY RELATIONSHIPS

There are no family relationships among any of our directors or executive officers.

Our nominating and corporate governance committee is responsible for identifying individuals qualified to serve as directors, consistent with criteria approved by our board, and recommending the persons to be nominated for election as directors.

The process followed by our nominating and governance committee to identify and evaluate director candidates includes requests to board members and others for recommendations, meetings from time to time to evaluate biographical information and background material relating to potential candidates and interviews of selected candidates by members of the committee and our board.

The nominating and corporate governance committee evaluates potential candidates, taking into account several factors, including, without limitation, the individual's (a) reputation for integrity, honesty and adherence to a high ethical standard; (b) understanding of the Company's business and industry; (c) business acumen, experience, and ability to exercise sound judgments in matters that relate to the current and long-term objectives of the Company; and (d) willingness and ability to commit adequate time to board and committee matters and to contribute positively to the decision-making process of the Company. The committee does not have a formal policy regarding board diversity. In selecting director nominees, the committee focuses on identifying individuals who will further the interests of our

PACIRA PHARMACEUTICALS, INC. -- 2016 PROXY STATEMENT -- 13

stockholders through his or her established record of professional accomplishment and will contribute positively to the collaborative culture among board members.

Stockholders may recommend individuals to our nominating and corporate governance committee for consideration as potential director candidates by submitting their names, together with appropriate biographical information and background materials and, if the stockholder is not a stockholder of record, a statement as to whether the stockholder or group of stockholders making the recommendation has beneficially owned more than 5% of our common stock for at least a year as of the date such recommendation is made, to the nominating and corporate governance committee, c/o Secretary, Pacira Pharmaceuticals, Inc., 5 Sylvan Way, Suite 300, Parsippany, New Jersey 07054. Assuming that appropriate biographical and background material has been provided on a timely basis, the nominating and corporate governance committee will evaluate stockholder-recommended candidates by following substantially the same process, and applying substantially the same criteria, as it follows for candidates submitted by others. Stockholders also have the right under our Bylaws to nominate director candidates directly, without any action or recommendation on the part of the nominating and corporate governance committee or the board of directors, by following the procedures set forth below under the heading "Stockholder Proposals."

MAJORITY VOTE DIRECTOR RESIGNATION POLICY

Our board of directors has implemented a Majority Vote Director Resignation Policy in our Corporate Governance Guidelines. Under the policy, any director nominee who receives a greater number of "WITHHOLD" votes than "FOR" votes in an uncontested election must promptly tender his or her resignation to the board following certification of the stockholder vote. Within 90 days following the certification of the vote, the independent directors on the board would consider the offer of resignation and determine whether to accept or reject the tendered resignation. If the independent directors determine not to accept the tendered resignation, we will publicly disclose (via press release or SEC filing) such determination and the factors considered by the independent directors in making such determination.

Our board of directors has determined that each of our directors, with the exception of David Stack and Gary Pace, is an "independent director" as defined under the applicable NASDAQ rules. In making such independence determination, the board of directors considered the relationships that each such non-employee director has with us and all other facts and circumstances that the board of directors deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director.

We have entered into a consulting agreement with Dr. Pace, pursuant to which Dr. Pace provides consulting services to us in the manufacturing area as Technical Advisor to the Chief Executive Officer and the board of directors. Pursuant to the consulting agreement, through December 2015, Dr. Pace was compensated at the rate of $5,000 per month and has received options to purchase our common stock. In December 2015, the consulting agreement was amended to compensate Dr. Pace at an hourly rate with a maximum of $5,000 per month. See "Related Person Transactions — Consulting Agreement with Gary Pace" below for more information. As a result of Dr. Pace's compensation arrangements under the consulting agreement, the board of directors determined that he does not qualify as an "independent director" under applicable NASDAQ rules. In determining Mr. Kronenfeld's independence, the board of directors considered certain relationships between the Company and Maimonides Medical Center, where Dr. Kronenfeld is Vice Chairman of Anesthesiology.

PACIRA PHARMACEUTICALS, INC. -- 2016 PROXY STATEMENT -- 14

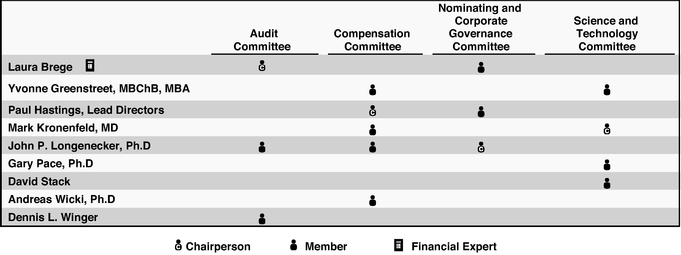

Our board of directors has established an audit committee, a compensation committee, a nominating and corporate governance committee and a science and technology committee. Each of these committees operate under a written charter that has been approved by our board of directors. Each committee charter is available by clicking on the "Investors & Media" section of our corporate website, located at http://www.pacira.com.

The following table is a summary of our committee structure and members on each of our committees:

Audit Committee

Our audit committee assists our board of directors in its oversight of our accounting and financial reporting process and the audits of our financial statements. The responsibilities of our audit committee include:

- •

- appointing, evaluating, retaining and, when necessary, terminating the engagement of our independent registered public

accounting firm;

- •

- overseeing the independence of our independent registered public accounting firm, including obtaining and reviewing reports from

the firm;

- •

- setting the compensation of our independent registered public accounting firm;

- •

- overseeing the work of our independent registered public accounting firm, including receiving and considering reports made by our

independent registered public accounting firm regarding accounting policies and procedures, financial reporting and disclosure controls;

- •

- reviewing and discussing with management and our independent registered public accounting firm our audited financial statements and

related disclosures;

- •

- preparing the annual audit committee report required by SEC rules;

- •

- coordinating the board's oversight of internal control over financial reporting, disclosure controls and procedures and code

of conduct;

- •

- reviewing our policies with respect to risk assessment and risk management;

- •

- establishing procedures related to the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters, and the confidential, anonymous submission by employees of concerns regarding accounting or auditing matters;

PACIRA PHARMACEUTICALS, INC. -- 2016 PROXY STATEMENT -- 15

- •

- reviewing our policies and procedures for reviewing and approving or ratifying related person transactions, including our related

person transaction policy; and

- •

- meeting independently with management and our independent registered public accounting firm.

All audit services to be provided to us and all non-audit services, other than de minimis non-audit services, to be provided to us by our independent registered public accounting firm must be approved in advance by our audit committee.

Our board of directors has determined that each of the directors serving on our audit committee are independent within the meaning of applicable NASDAQ rules and Rule 10A-3 under the Securities Exchange Act of 1934, as amended, or the Exchange Act. In addition, our board of directors has determined that Ms. Brege qualifies as an audit committee financial expert within the meaning of SEC regulations and applicable NASDAQ rules. In making this determination, our board has considered the formal education and nature and scope of her previous experience, coupled with past and present service on various audit committees. Our audit committee met ten (10) times during 2015.

Compensation Committee

Our compensation committee assists our board of directors in the discharge of its responsibilities relating to the compensation of our executive officers. The responsibilities of our compensation committee include:

- •

- approving our chief executive officer's compensation and approving the compensation of our other executive officers reporting directly

to our chief executive officer;

- •

- overseeing the evaluation of our senior executives;

- •

- overseeing, administering, reviewing and making recommendations to the board of directors with respect to our incentive compensation

and equity-based plans;

- •

- reviewing and making recommendations to the board of directors with respect to director compensation; and

- •

- reviewing and discussing with management the compensation discussion and analysis and preparing the annual compensation committee report, as required by SEC rules.

Our board of directors has determined that each of the directors serving on our compensation committee are independent within the meaning of applicable NASDAQ rules for purposes of membership on the compensation committee. Our compensation committee met nine (9) times during 2015.

As part of the 2015 compensation process, our compensation committee retained Radford ("Radford") as its independent compensation consultant, who has served in this capacity since 2011. Radford provided advisory services only with respect to executive and equity compensation and a competitive assessment of compensation for non-executives and sales personnel, in each case as directed by the compensation committee, and does no other business with the Company. Please see "Compensation Discussion and Analysis" for further description of the services provided by Radford. Radford provides additional services to management in the areas of non-executive compensation, with all activities being reviewed and approved by the chair of the compensation committee before any services are provided. Prior to engaging Radford, our compensation committee considered the independence of Radford in accordance with the terms of the compensation committee's charter and applicable regulations. Our compensation committee did not identify any conflicts of interest with respect to Radford.

PACIRA PHARMACEUTICALS, INC. -- 2016 PROXY STATEMENT -- 16

Nominating and Corporate Governance Committee

The responsibilities of our nominating and corporate governance committee include:

- •

- recommending to the board of directors the persons to be nominated for election as directors or to fill any vacancies on the board of

directors, and to be appointed to each of the board's committees;

- •

- developing and recommending to the board of directors corporate governance guidelines; and

- •

- overseeing an annual self-evaluation of the board of directors.

Our board of directors has determined that each of the directors serving on our nominating and corporate governance committee are independent within the meaning of applicable NASDAQ rules. Our nominating and corporate governance committee met three (3) times during 2015.

Science and Technology Committee

Our board of directors formed the science and technology committee in September 2015 to assist the board of directors in its oversight of our research and development activities and to advise the board of directors with respect to strategic and tactical scientific issues. The overall responsibilities of our science and technology committee are to consider and report to the board of directors on matters relating to our research and development initiatives and other appropriate strategic and tactical scientific issues. At its discretion, the science and technology committee may:

- •

- review our overall scientific and research and development strategy;

- •

- review our research and development programs;

- •

- review external scientific research, discoveries and commercial development as appropriate; and

- •

- review the attainment of key research and development milestones.

Our science and technology committee met one (1) time during 2015.

BOARD AND COMMITTEE MEETINGS ATTENDANCE

The full board of directors met eleven (11) times during 2015. During 2015, each member of the board of directors attended in person or participated in 75 percent or more of the aggregate of (i) the total number of meetings of the board of directors (held during the period for which such person has been a director) and (ii) the total number of meetings held by all committees of the board of directors on which such person served (during the periods that such person served). Our non-employee directors met in a special executive session without management at each regularly scheduled board meeting in 2015. Our board of directors expects to continue to conduct executive sessions limited to non-employee directors at least annually and our non-employee directors may schedule additional executive sessions at their discretion.

PACIRA PHARMACEUTICALS, INC. -- 2016 PROXY STATEMENT -- 17

DIRECTOR ATTENDANCE AT ANNUAL MEETING OF STOCKHOLDERS

We do not have a formal policy regarding attendance by members of our board of directors at our annual meetings of stockholders. Our practice, however, is to have a meeting of the board immediately following the annual meeting of stockholders. All members of our board attended the annual meeting of stockholders in 2015.

CODE OF BUSINESS CONDUCT AND ETHICS

We have adopted a written code of business conduct and ethics that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A current copy of the code is posted on the Corporate Governance section of our website, which is located at www.pacira.com. If we make any substantive amendments to, or grant certain waivers from, the code of business conduct and ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, we will disclose the nature of such amendment or waiver on our website or in a current report on Form 8-K.

BOARD LEADERSHIP STRUCTURE AND BOARD'S ROLE IN RISK OVERSIGHT

Our board of directors does not have a policy regarding separation of the roles of chief executive officer and chairman of the board. The board believes it is in our best interests to make that determination based on circumstances from time to time. Currently, our chief executive officer serves as the chairman of the board, and Paul Hastings, a non-employee independent director, serves as our lead director. Our board believes that this structure, combined with our corporate governance policies and processes, creates an appropriate balance between strong and consistent leadership and independent oversight of our business. The chairman chairs the meetings of our board and stockholders, with input from the lead director, and as such, our board believes that a person with a comprehensive knowledge of our company is in the best position to serve such role.

Our board believes that our current leadership structure and the composition of our board protect stockholder interests and provide adequate independent oversight, while also providing outstanding leadership and direction for our board and management. More than a majority of our current directors are "independent" under NASDAQ standards, as more fully described above. The independent directors meet in executive sessions, without management present, during each regularly scheduled board meeting and are very active in the oversight of our company. Each independent director has the ability to add items to the agenda for board meetings or raise subjects for discussion that are not on the agenda for that meeting. In addition, our board of directors and each committee of our board has complete and open access to any member of management and the authority to retain independent legal, financial and other advisors as they deem appropriate.

Our lead director plays a leading role with respect to corporate governance. His responsibilities include, without limitation, ensuring that our board works together as a cohesive team with open communication, ensuring that a process is in place by which the effectiveness of our board can be evaluated on a regular basis, monitors communications from stockholders and other interested parties and otherwise consults with management and the chairman on matters relating to corporate governance and board performance. To this end, our lead director works with the chairman on the board agenda and board materials, facilitates annual assessments of the performance of the board along with the nominating and corporate governance committee and acts as the primary internal spokesperson for our board, ensuring that management is aware of concerns of our board, the stockholders, other stakeholders, and the public and, in addition, ensuring that management strategies, plans and performance are appropriately represented to our board of directors. Our lead director's role also includes presiding at executive

PACIRA PHARMACEUTICALS, INC. -- 2016 PROXY STATEMENT -- 18

sessions of the non-employee directors. Our lead director also performs such other functions and responsibilities as requested by our board from time to time.

Our board of directors believes its administration of its risk oversight function has not affected its leadership structure. Risk is inherent with every business, and how well a business manages risk can ultimately determine its success. We face a number of risks, including those described under "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2015. Our board of directors is actively involved in oversight of risks that could affect us. This oversight is conducted primarily by our full board of directors, which has responsibility for general oversight of risks.

Our board of directors satisfies this responsibility through full reports by each committee chair regarding the committee's considerations and actions, as well as through regular reports directly from officers responsible for oversight of particular risks within our company. Our audit committee oversees risk management activities related to financial controls and legal and compliance risks. Our compensation committee oversees risk management activities relating to our compensation policies and practices, and our nominating and corporate governance committee oversees risk management activities relating to board composition and management succession planning. Our science and technology committee advises the board of directors on our research and development activities and any risks associated therewith. In addition, members of our senior management team attend our quarterly board meetings and are available to address any questions or concerns raised by the board on risk-management and any other matters. Our board of directors believes that full and open communication between management and the board of directors is essential for effective risk management and oversight.

We do not allow our management or directors to engage in hedging transactions in our stock or to pledge our stock to secure loans or other obligations.

Any interested party may contact the Chairman of our board of directors or the non-employee members of our board of directors, as a group, by submitting a written communication to the Chairman at the following address:

|

Chairman of the Board c/o Pacira Pharmaceuticals, Inc. 5 Sylvan Way, Suite 300 Parsippany, New Jersey 07054 United States |

You may submit your concern anonymously or confidentially by postal mail. You may also indicate whether you are a stockholder, customer, supplier, or other interested party.

A copy of any such written communication will also be forwarded to our General Counsel and retained for a reasonable period of time. Communications will be forwarded to all directors if they relate to important substantive matters and include suggestions or comments that our Chairman considers to be important for the directors to know.

The audit committee oversees the procedures for the receipt, retention, and treatment of complaints received by us regarding accounting, internal accounting controls or audit matters, and the confidential, anonymous submission by employees of concerns regarding questionable accounting, internal accounting controls or auditing matters. We have also established a toll-free telephone number for the reporting of such activity.

PACIRA PHARMACEUTICALS, INC. -- 2016 PROXY STATEMENT -- 19

NON-EMPLOYEE DIRECTOR COMPENSATION POLICY

Effective in June 2015, our board of directors, upon recommendation of our compensation consultant, amended our non-employee director compensation policy to bring our non-employee director compensation more in line with our peers. Our board of directors compensation policy provides for the following compensation to our non-employee directors:

Initial Stock Option Grant. Each non-employee director who joins our board of directors receives an option under our stock incentive plan to purchase an aggregate of 16,000 shares of common stock, upon his or her initial appointment to our board of directors. Subject to the non-employee director's continued service as a director, the option will vest in 36 equal successive monthly installments over the 36 month period following the date of grant. In the event of a change of control or our liquidation or dissolution, 100% of the then unvested options will immediately vest. The exercise price of the options will be equal to the closing price per share of our common stock as reported on the NASDAQ Global Select Market on the date of grant.

Annual Equity Grant. Each non-employee director receives (i) an option to purchase an aggregate of 4,000 shares of common stock and (ii) 2,000 restricted stock units, in each case on the date of our first board of directors meeting held after each annual meeting of stockholders. Unless otherwise provided at the time of grant, subject to the non-employee director's continued service as a director, both equity grants will vest 12 months from the date of grant. In the event of a change of control or our liquidation or dissolution, 100% of the then unvested options or restricted stock units will immediately vest. The exercise price of the options will be equal to the closing price per share of our common stock as reported on the NASDAQ Global Select Market on the date of grant.

Annual Fees. Effective in June 2015, each non-employee director receives an annual fee in cash as follows:

- •

-

Board Annual Fee — Each non-employee

member of our board of directors receives an annual fee of $50,000, and the lead director receives an additional annual fee of $25,000.

- •

-

Audit Committee Annual Fee — The

chair of the audit committee receives an annual fee of $30,000 and each other non-employee member of the audit committee receives an annual fee of $12,000.

- •

-

Compensation Committee Annual

Fee — The chair of the compensation committee receives an annual fee of $18,000 and each other non-employee

member of the compensation committee receives an annual fee of $9,000.

- •

-

Nominating and Corporate Governance Committee Annual

Fee — The chair of the nominating and corporate governance committee receives an annual fee of $12,000 and each

other non-employee member of the nominating and corporate governance committee receives an annual fee of $6,000.

- •

- Science and Technology Committee Annual Fee — The chair of the science and technology committee receives an annual fee of $12,000 and each other non-employee member of the science and technology committee receives an annual fee of $6,000.

Prior to June 2015, non-employee directors received the following annual cash fees: (i) board annual fee — $45,000, with the lead director receiving an additional annual fee of $20,000; (ii) audit committee chairperson — $20,000 and audit committee member — $10,000; (iii) compensation committee chairperson — $15,000 and compensation committee member — $7,500; and (iv) nominating and

PACIRA PHARMACEUTICALS, INC. -- 2016 PROXY STATEMENT -- 20

corporate governance committee chairperson — $10,000 and nominating and corporate governance committee member — $5,000. The science and technology committee was formed in September 2015.

The annual fees are payable in cash in advance in four equal quarterly installments on the first day of each calendar quarter, provided that the amount of such payment shall be prorated for any portion of such quarter that the director was not serving on our board of directors. Each non-employee director is also reimbursed for reasonable travel and other expenses in connection with attending meetings of the board and any committee on which he or she serves.

To date, Dr. Andreas Wicki, a non-employee director, has elected not to receive any compensation for his service on our board of directors. We do not compensate Mr. Stack, our chief executive officer and chairman, for his service on our board of directors.

The following table sets forth a summary of the compensation earned by our directors for the year ended December 31, 2015, with the exception of Mr. Stack, who does not receive compensation for service on our board of directors and whose compensation is included in the "Summary Compensation Table" below.

Name

|

Fees Earned in Cash ($) |

Stock Awards(1)(4) ($) |

Option Awards(1)(4) ($) |

All Other Compensation ($) |

Total ($) |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Laura Brege |

$ | 79,227 | $ | 158,860 | $ | 157,891 | $ | — | $ | 395,978 | ||||||

Yvonne Greenstreet |

58,009 | 158,860 | 157,891 | — | 374,760 | |||||||||||

Paul Hastings |

93,074 | 158,860 | 157,891 | — | 409,825 | |||||||||||

Mark Kronenfeld |

59,770 | 158,860 | 157,891 | — | 376,521 | |||||||||||

John Longenecker |

78,555 | 158,860 | 157,891 | — | 395,306 | |||||||||||

Gary Pace |

49,644 | 158,860 | 157,891 | 60,000 | (2) | 426,395 | ||||||||||

Andreas Wicki(3) |

— | — | — | — | — | |||||||||||

Dennis Winger |

59,037 | 158,860 | 157,891 | — | 375,788 | |||||||||||

- (1)

- Represents

the grant date fair value of option and restricted stock unit awards granted in 2015 computed in accordance with stock-based accounting rules

(FASB ASC Topic 718 Stock Compensation), excluding the effect of estimated forfeitures. For information regarding assumptions underlying the valuation of equity awards, see Note 11

to our financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2015. Our directors will only realize compensation to the extent the fair

value of our common stock is greater than the exercise price of such stock options.

- (2)

- Represents

fees earned by Dr. Pace in connection with his consulting agreement with us. See "Related Person Transactions" below.

- (3)

- To date, Dr. Wicki has elected not to receive any compensation for his service on our board of directors.

PACIRA PHARMACEUTICALS, INC. -- 2016 PROXY STATEMENT -- 21

- (4)

- The aggregate number of stock option and restricted stock unit awards outstanding for each of our non-employee directors as of December 31, 2015, is as follows:

Name

|

Number of Vested Stock Options |

Number of Unvested Stock Options |

Number of Unvested Restricted Stock Units |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

Laura Brege |

27,000 | 4,000 | 2,000 | |||||||

Yvonne Greenstreet |

21,125 | 5,875 | 2,000 | |||||||

Paul Hastings |

21,000 | 4,000 | 2,000 | |||||||

Mark Kronenfeld |

23,000 | 4,000 | 2,000 | |||||||

John Longenecker |

27,736 | 4,000 | 2,000 | |||||||

Gary Pace |

130,408 | 17,328 | 2,000 | |||||||

Andreas Wicki |

— | — | — | |||||||

Dennis Winger |

23,000 | 4,000 | 2,000 | |||||||

PACIRA PHARMACEUTICALS, INC. -- 2016 PROXY STATEMENT -- 22

PROPOSAL NO. 2 — RATIFICATION OF THE APPOINTMENT OF KPMG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2016

Our stockholders are being asked to ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016. Stockholder approval is not required to appoint KPMG LLP as our independent registered public accounting firm, however, the board of directors believes that submitting the appointment of KPMG LLP to the stockholders for ratification is good corporate governance. If the stockholders do not ratify this appointment, the audit committee and the board of directors will reconsider whether to retain KPMG LLP. If the appointment of KPMG LLP is ratified, the audit committee or the board of directors, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time it decides that such a change would be in the best interest of the Company and its stockholders. A representative of KPMG LLP is expected to be present at the Annual Meeting and will have an opportunity to make a statement if he or she desires to do so and to respond to appropriate questions.

On December 14, 2015, the board of directors, upon recommendation and approval by the audit committee, engaged KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016. KPMG LLP is replacing CohnReznick LLP ("CohnReznick"), who previously served as our independent registered public accounting firm since 2009, and who was dismissed upon completion of their audit services for the fiscal year ended December 31, 2015. CohnReznick completed the audit services for such fiscal year and the filing of the 2015 Annual Report was completed on February 25, 2016, and, therefore, the effective date of CohnReznick's dismissal was February 25, 2016.

The report of CohnReznick on our financial statements for the fiscal years ended December 31, 2014 and 2015 did not contain an adverse opinion or a disclaimer of opinion, and was not qualified or modified as to uncertainty, audit scope, or accounting principles.

During the two fiscal years ended December 31, 2015 and 2014, and the subsequent interim period through February 25, 2016, the effective date of CohnReznick's dismissal, there were no (1) disagreements with CohnReznick on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures, which disagreements if not resolved to their satisfaction would have caused CohnReznick to make reference in connection with their opinion to the subject matter of the disagreement, or (2) "reportable events" within the meaning of Item 304(a)(1)(v) of Regulation S-K.

During the two most recent years ended December 31, 2015 and 2014, and the subsequent interim period through February 25, 2016, the Company did not consult with KPMG regarding either (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company's financial statements, and no written or oral advice was provided to the Company by KPMG that KPMG concluded was an important factor considered by the Company in reaching a decision as to any accounting, auditing, or financial reporting issue; or (ii) any matter that was subject of a disagreement, as that term is defined in Item 304(a)(1)(iv) of Regulation S-K, or other reportable event of the types described in Item 304(a)(1)(v) of Regulation S-K.

PACIRA PHARMACEUTICALS, INC. -- 2016 PROXY STATEMENT -- 23

AUDITOR FEES

The following table summarizes the fees billed by our previous independent registered public accounting firm, CohnReznick, for professional services rendered to us during fiscal years 2015 and 2014:

| |