Form DEF 14A PDC ENERGY, INC. For: Jun 09

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Under Rule 14a-12 |

PDC ENERGY, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||

| (1) | Amount previously paid:

| |||

| (2) | Form, Schedule or Registration Statement no.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Table of Contents

PDC ENERGY, INC.

1775 Sherman Street, Suite 3000

Denver, Colorado 80203

(303) 860-5800

April 20, 2016

Dear Stockholder of PDC Energy, Inc.:

You are cordially invited to attend the 2016 Annual Meeting of Stockholders of PDC Energy, Inc. to be held on June 9, 2016, at 1:00 p.m. Mountain Time at the Denver Financial Center at 1775 Sherman Street, Denver, Colorado 80203.

The accompanying Notice of Annual Meeting of Stockholders and Proxy Statement provide information concerning the matters to be considered at the meeting.

We hope you will join us at the Annual Meeting. Whether or not you plan to attend personally, it is important that your shares be represented at the Annual Meeting. We value your opinion and encourage you to participate in the Annual Meeting by voting your proxy. You may vote your shares by using the telephone or Internet voting options described in the attached Notice of Annual Meeting and proxy card. If you receive a proxy card by mail, you may cast your vote by completing, signing and returning it promptly. This will ensure that your shares are represented at the Annual Meeting even if you cannot attend in person.

| Sincerely, |

|

Barton R. Brookman |

| President and Chief Executive Officer |

Table of Contents

PDC ENERGY, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON

THURSDAY, JUNE 9, 2016

To the Stockholders of PDC Energy, Inc.:

The 2016 Annual Meeting of Stockholders of PDC Energy, Inc. (the “Company”) will be held on June 9, 2016, at 1:00 p.m. Mountain Time at the Denver Financial Center at 1775 Sherman Street, Denver, Colorado 80203, for the following purposes:

| • | To elect the two nominees named in the accompanying Proxy Statement as Class III Directors of the Company, each for a term of three years; |

| • | To ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016; |

| • | To approve, on an advisory basis, the compensation of the Company’s named executive officers; |

| • | To transact any other business that may properly come before the meeting and at any and all adjournments or postponements thereof. |

The Board of Directors has fixed the close of business on April 13, 2016, as the record date for determining the stockholders having the right to receive notice of, to attend and to vote at the Annual Meeting or any adjournment or postponement thereof. The presence in person or by proxy of the holders of a majority of the outstanding shares of the Company’s common stock entitled to vote is required to constitute a quorum.

Please vote by using the telephone or Internet voting options described in the accompanying Notice of Internet Availability of Proxy Materials or, if the attached Proxy Statement and a proxy card were mailed to you, please sign, date and return the proxy card in the enclosed envelope as soon as possible.

| By Order of the Board of Directors, |

|

|

| Daniel W. Amidon |

| Senior Vice President, General Counsel and Secretary |

April 20, 2016

Table of Contents

PDC ENERGY, INC.

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

To be held on June 9, 2016 at

The Denver Financial Center

1775 Sherman Street

Denver, Colorado 80203

The accompanying proxy is solicited by the Board of Directors (“Board”) of PDC Energy, Inc. (“PDC,” the “Company,” “we,” “us” or “our”) for use at the Annual Meeting of Stockholders of the Company (the “Annual Meeting”) to be held on June 9, 2016, at 1:00 p.m. Mountain Time and at any and all adjournments or postponements of the meeting, for the purposes set forth in this Proxy Statement and the accompanying Notice of Annual Meeting of Stockholders. On or about April 20, 2016, we began mailing notices containing instructions for accessing this Proxy Statement and our annual report online, and we began mailing proxy materials to stockholders who had previously requested delivery of the materials in paper form. For information on how to vote your shares, see the instructions included on the proxy card or instruction form described under “Information About Voting and the Meeting” herein.

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY

OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 9, 2016

The Notice of Annual Meeting of Stockholders, the Proxy Statement for the 2016 Annual Meeting of Stockholders, and the 2015 Annual Report to Stockholders, which includes the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, are available at www.envisionreports.com/PDCE.

Table of Contents

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 4 | ||||

| 4 | ||||

| Name, Principal Occupation for Past Five Years and Other Directorships |

5 | |||

| 9 | ||||

| PROPOSAL NO. 2 — RATIFY THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

10 | |||

| 12 | ||||

| ALL OTHER BUSINESS THAT MAY COME BEFORE THE 2016 ANNUAL MEETING |

13 | |||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

13 | |||

| 16 | ||||

| 18 | ||||

| 20 | ||||

| 22 | ||||

| 23 | ||||

| 24 | ||||

| 25 | ||||

| 25 | ||||

| 25 | ||||

| 26 | ||||

| 26 | ||||

| 27 | ||||

| 27 | ||||

| 45 | ||||

| 47 | ||||

| 48 | ||||

| 49 | ||||

| 50 | ||||

| 51 | ||||

| 60 | ||||

| 60 | ||||

| 61 |

Table of Contents

INFORMATION ABOUT VOTING AND THE MEETING

Stockholders of PDC, as recorded in the Company’s stock register on the record date of April 13, 2016, may vote at the Annual Meeting. The outstanding voting securities of the Company as of April 13, 2016 consisted of 46,296,867 shares of common stock. Each share of common stock is entitled to one vote on each matter considered at the meeting.

The Board is asking for your proxy. Giving the Board your proxy means that you authorize our representatives to vote your shares at the Annual Meeting in the manner you direct. We will vote your shares as you specify. You may vote for or withhold your vote from one or more Class III Director nominees. You may also vote for or against the other proposals, or abstain from voting. If your shares are held in your name with our transfer agent (which is sometimes referred to as being a “stockholder of record”), you can vote by completing, signing and dating your proxy card and returning it in the enclosed envelope. If you provide a signed proxy but do not specify how to vote, your shares will be voted (1) in favor of approval of both of the Class III Director nominees named in this Proxy Statement; (2) in favor of the ratification of the appointment of PricewaterhouseCoopers LLP (“PwC”) as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016; (3) to approve, on an advisory basis, the compensation of the Company’s Named Executive Officers (as defined herein). If any other business properly comes before the stockholders for a vote at the meeting, your shares will be voted in accordance with the discretion of the holders of the proxy.

If you hold shares through a broker, bank or other nominee, you will receive material from that firm asking how you want to vote and instructing you of the procedures to follow in order for you to vote your shares. If the nominee does not receive voting instructions from you, it may vote only on proposals that are considered “routine” matters under applicable rules. Without your instruction, the nominee may vote only on the ratification of the appointment of PwC as our independent registered public accounting firm for 2016. A nominee’s inability to vote because it lacks discretionary authority to do so is commonly referred to as a “broker non-vote.” The effect of broker non-votes may be different for the various proposals to be voted upon at the Annual Meeting. For a description of the effect of broker non-votes on each proposal, see “Votes Needed” below.

Voting 401(k) and Profit Sharing Plan Shares

If you are a participant in PDC’s 401(k) and Profit Sharing Plan and have shares of PDC common stock credited to your plan account as of the record date, you have the right to direct the plan trustee how to vote those shares. The trustee will vote the shares in your plan account in accordance with your instructions. Your vote may not be counted if your proxy card is not received by June 6, 2016. You cannot vote such shares at the Annual Meeting or change your vote.

If you are a stockholder of record, you may revoke your proxy before it is voted by:

| • | Submitting a new signed proxy with a later date; |

| • | Notifying PDC’s Corporate Secretary in writing before the meeting that you wish to revoke your proxy; or |

| • | Appearing at the meeting, notifying the inspector of the election that you wish to revoke your proxy, and voting in person at the meeting. Merely attending the meeting will not result in revocation of your proxy. |

1

Table of Contents

If you hold your shares through a broker, bank or other nominee, you must follow their instructions to revoke your voting instructions or otherwise vote at the meeting.

In order to carry on the business of the meeting, there must be a quorum. This means that at least a majority of the outstanding shares eligible to vote must be represented at the meeting, either by proxy or in person. Treasury shares, which are shares owned by PDC itself, are not voted and do not count for this purpose. Abstentions and broker non-votes will count for quorum purposes.

The following table presents the voting requirements for electing the two Class III Director nominees and approving the other proposals presented in this Proxy Statement. Under the “Uncontested Elections Policy” contained in Section 3(e) of our Corporate Governance Guidelines, which may be viewed on our website at www.pdce.com, any nominee who receives a greater number of “withhold” votes than “for” votes is required to submit to the Board a letter of resignation for consideration by the Nominating and Governance Committee. For more information about our Uncontested Elections Policy, see “Corporate Governance — Uncontested Elections Policy” below.

| PROPOSAL | VOTE REQUIRED TO ELECT OR APPROVE | |||

|

Proposal No. 1 Elect two Class III Directors. |

The two nominees who receive the greatest number of votes will be elected Directors for the three-year term ending in 2019. There is no cumulative voting for Directors. Abstentions and broker non-votes will have no effect on the election of Directors. | |||

|

Proposal No. 2 Ratify the appointment of PwC as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016. |

The affirmative vote of a majority of votes present or represented at the meeting is required for ratification. Abstentions will be counted as votes against Proposal No. 2. Brokers will have discretionary authority to vote on Proposal No. 2. | |||

|

Proposal No. 3 Approve, on an advisory basis, the compensation of the Company’s Named Executive Officers (as defined herein). |

The affirmative vote of a majority of votes present or represented at the meeting is required for approval. Abstentions will be counted as votes against Proposal No. 3. Broker non-votes will have no effect on the vote on Proposal No. 3. | |||

Only stockholders or their proxy holders and PDC guests may attend the Annual Meeting. For safety and security reasons, no cameras, audio or video recording equipment, large bags, briefcases, packages or other items deemed unnecessary in PDC’s discretion will be permitted in the meeting. In addition, each stockholder and PDC guest may be asked to present valid, government-issued picture identification, such as a driver’s license, before being admitted to the meeting.

If your shares are held in the name of your broker, bank, or other nominee, you must bring to the meeting an account statement or letter from the nominee indicating that you beneficially owned the shares on April 13, 2016, the record date for receiving notice of, attending and voting at the Annual Meeting.

2

Table of Contents

The Chairman has broad authority to conduct the Annual Meeting in an orderly and timely manner. This authority includes establishing rules for stockholders who wish to speak at the meeting. The Chairman may also exercise broad discretion in recognizing stockholders who wish to speak and in determining the extent of discussion on each item of business. In light of the need to conclude the meeting within a reasonable period of time, there can be no assurance that every stockholder who wishes to speak on an item of business will be able to do so. The Chairman may also rely on applicable law regarding disruptions or disorderly conduct to ensure that the meeting is conducted in a manner that is fair to all stockholders.

The Company will bear all costs related to the solicitation of proxies. The Company will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable and appropriate expenses incurred by them in sending the Notice of Internet Availability of Proxy Materials to the beneficial owners of the Company’s common stock. In addition to solicitations by mail, Directors, officers and employees of the Company may solicit proxies by telephone and, to the extent necessary, other electronic communication and personal interviews, without additional compensation. The Company has entered into an agreement with Morrow & Co., LLC, 470 West Avenue, 3rd Floor, Stamford, CT 06902, as its proxy solicitor and anticipates paying approximately $8,000 for such services.

No action is proposed at the Annual Meeting for which the laws of the State of Delaware or our Bylaws provide a right of our stockholders to dissent and obtain appraisal of or payment for such stockholders’ common stock.

If you have questions or need more information about the Annual Meeting, you may write to or call:

Corporate Secretary

PDC Energy, Inc.

1775 Sherman Street, Suite 3000

Denver, CO 80203

(303) 860-5800

For information about shares registered in your name, call PDC at (800) 624-3821. You are also invited to visit PDC’s website at www.pdce.com. The Company’s website materials are not incorporated by reference into this Proxy Statement.

3

Table of Contents

PROPOSALS REQUIRING STOCKHOLDER VOTE

PROPOSAL NO. 1 — ELECT TWO CLASS III DIRECTORS

(Proposal 1 on the Proxy Card)

As of the date of this Proxy Statement and as permitted by the Company’s Bylaws, the Board consists of eight members (“Directors”) divided into three classes. Directors are usually elected for three-year terms. The terms for members of each class end in successive years.

On April 14, 2016, the Board approved certain resolutions pursuant to which Mr. Brookman will be reappointed as a Class III member of the Board, to be effective immediately prior to the Annual Meeting. Moreover, upon conclusion of the Annual Meeting, the number of Directors shall be designated as seven. The sole purpose of the reclassification is to provide for a nearly equal apportionment of the Directors, as contemplated by the Company’s Certificate of Incorporation.

The Board has nominated two continuing Directors, Larry F. Mazza and Barton R. Brookman, to stand for re-election to the Board for a three-year term expiring in 2019. Mr. Mazza, a Class III Director, joined the Board in 2007 and currently serves as a member of the Audit Committee, the Compensation Committee, and the Nominating and Governance Committee, which he chairs. Mr. Brookman, who will be a Class III Director as of the Annual Meeting, joined the Board in 2015 and currently serves as the Company’s President and Chief Executive Officer.

The appointed proxies will vote your shares in accordance with your instructions and for the election of the two Class III Director nominees unless you withhold your authority to vote for one or both of them. The Board does not contemplate that any of the Director nominees will become unavailable for any reason; however, if any Director is unable to stand for election, the Board may reduce the size of the Board or select a substitute. Your proxy cannot otherwise be voted for a person who is not named in this Proxy Statement as a candidate for Director or for a greater number of persons than the number of Director nominees named.

Board of Directors

As of the Annual Meeting, the composition of the Board and the term of each Director was as follows:

| NOMINEES |

FIRST ELECTED DIRECTOR |

EXPIRATION OF CURRENT TERM | ||

| CLASS III: |

||||

| Larry F. Mazza |

2007 | 2016 | ||

| Barton R. Brookman |

2015 | 2016 | ||

| CLASS I: |

||||

| Joseph E. Casabona |

2007 | 2017 | ||

| David C. Parke |

2003 | 2017 | ||

| Jeffrey C. Swoveland |

1991 | 2017 | ||

| CLASS II: |

||||

| Anthony J. Crisafio |

2006 | 2018 | ||

| Kimberly Luff Wakim |

2003 | 2018 | ||

4

Table of Contents

Name, Principal Occupation for Past Five Years and Other Directorships

NOMINEES FOR TERM EXPIRING IN 2019 — CLASS III

|

Name: |

Larry F. Mazza, Director | |

| Age: |

55 | |

|

Committees: |

Audit Compensation Nominating and Governance (Chair) |

| • | Mr. Mazza, a CPA, was first elected to the Board in 2007. Mr. Mazza is President and Chief Executive Officer of MVB Financial Corp (“MVB”), a financial services company. He has more than 27 years of experience in both large banks and small community banks and is one of seven members of the West Virginia Board of Banking and Financial Institutions, which oversees the operation of financial institutions throughout West Virginia and advises the state Commissioner of Banking. Mr. Mazza is also an entrepreneur and is co-owner of nationally-recognized sports media business Football Talk, LLC, a pro football website and content provider for NBC SportsTalk. Prior to joining MVB in 2005, Mr. Mazza was Senior Vice President & Retail Banking Manager for BB&T Bank’s West Virginia North region. Mr. Mazza was employed by BB&T and its predecessors from 1986 to 2005. Prior thereto, Mr. Mazza was President of Empire National Bank, and later served as Regional President of One Valley Bank. Mr. Mazza also previously worked for KPMG (or its predecessors) as a CPA with a focus on auditing. |

| • | The Board has concluded that Mr. Mazza is qualified to serve as a Director because, among other things, he is a CPA, a CEO, and has extensive leadership and banking experience. Mr. Mazza also provides an important link to community and employee stakeholders, demonstrating a continuing commitment to our workforce located in Bridgeport, West Virginia. Mr. Mazza graduated from West Virginia University with a degree in Business Administration. |

|

Name: |

Barton R. Brookman, Director, President and Chief Executive Officer | |

| Age: |

53 | |

|

Committees: |

None |

| • | Mr. Brookman, the Company’s President and Chief Executive Officer (“CEO”), was appointed to the Board on January 1, 2015, simultaneous with his appointment as the Company’s CEO. Mr. Brookman originally joined the Company in July 2005 as Senior Vice President-Exploration and Production; he was appointed to the position of Executive Vice President and Chief Operating Officer in June 2013 and then served as President and Chief Operating Officer from June 2014 through December 2014. Prior to joining PDC, Mr. Brookman worked for Patina Oil and Gas and its predecessor Snyder Oil from 1988 until 2005 in a series of operational and technical positions of increasing responsibility, ending his service at Patina as Vice President of Operations. |

| • | The Board has concluded that in addition to his status of CEO of the Company, Mr. Brookman is qualified to serve as a Director due, among other things, to his many years of oil and gas industry executive management experience, his active involvement in industry groups and his knowledge of current developments and best practices in the industry. Mr. Brookman holds a B.S. in Petroleum Engineering from the Colorado School of Mines and a M.S. in Finance from the University of Colorado. |

5

Table of Contents

CONTINUING DIRECTORS WITH TERM EXPIRING IN 2017 — CLASS I

|

Name: |

Joseph E. Casabona, Director | |

| Age: |

72 | |

|

Committees: |

Audit (Chair) Nominating and Governance |

| • | Mr. Casabona, a CPA, was first elected to the Board in 2007. Mr. Casabona served as CEO of Paramax Resources Ltd., a junior public Canadian oil and gas company, from 2008 until the beginning of 2011. Mr. Casabona also served as Executive Vice President and as a member of the Board of Directors of Denver-based Energy Corporation of America (“ECA”), a domestic oil and gas company, from 1985 until his retirement in May 2007. Mr. Casabona’s major responsibilities with ECA included strategic and executive oversight of all matters affecting ECA. From 1968 until 1985, Mr. Casabona was employed at KPMG or its predecessors, with various titles including audit partner, where he primarily served public clients in the oil and gas industry. |

| • | The Board has concluded that Mr. Casabona is qualified to serve as a Director because, among other things, he is a CPA and brings to the Board extensive first-hand experience in all aspects of the oil and gas industry, including natural gas exploration, development, acquisitions, operations and strategic planning, as well as experience in the Company’s primary areas of operations. Mr. Casabona holds a BSBA from the University of Pittsburgh and a Master of Science-Mineral Economics from the Colorado School of Mines. |

|

Name: |

David C. Parke, Director | |

| Age: |

49 | |

|

Committees: |

Compensation Nominating & Governance |

| • | Mr. Parke, who was first elected to the Board in 2003, has served as a Managing Director of EVOLUTION Life Science Partners since October 2014. From June 2011 until October 2014, he was a Managing Director in the investment banking group of Burrill Securities LLC, an investment banking firm. From 2006 until June 2011, he was Managing Director in the investment banking group of Boenning & Scattergood, Inc., a regional investment bank. Prior to joining Boenning & Scattergood, from October 2003 to November 2006, he was a Director with the investment banking firm Mufson Howe Hunter & Company LLC. From 1992 through 2003, Mr. Parke was Director of Corporate Finance of Investec, Inc. and its predecessor, Pennsylvania Merchant Group Ltd., both investment banking companies. Prior to joining Pennsylvania Merchant Group, Mr. Parke served in the corporate finance departments of Wheat First Butcher & Singer, now part of Wells Fargo, and Legg Mason, Inc., now part of Stifel Nicolaus. |

| • | The Board has concluded that Mr. Parke is qualified to serve as a Director because, among other things, he has extensive investment banking experience, including experience in the oil and gas area, allowing him to contribute broad financial and investment banking expertise to the Board and to provide guidance on capital markets and acquisition matters. |

|

Name: |

Jeffrey C. Swoveland, Director (Non-Executive Chairman) | |

| Age: |

61 | |

|

Committees: |

Audit Compensation |

| • | Mr. Swoveland was first elected to the Board in 1991 and was elected Non-Executive Chairman of the Board in June 2011. From 2006 until January 2014, Mr. Swoveland was first Chief Operating Officer and later President and Chief Executive Officer of ReGear Life Sciences, Inc. (previously |

6

Table of Contents

| named Coventina Healthcare Enterprises), which develops and markets medical device products. From 2000 until 2007, Mr. Swoveland served as Chief Financial Officer of Body Media, Inc., a life-science company. Prior thereto, from 1994 to September 2000, Mr. Swoveland held various positions including Vice President of Finance, Treasurer and interim Chief Financial Officer with Equitable Resources, Inc., a diversified natural gas company. Mr. Swoveland also has worked as a geologist and exploratory geophysicist for both major and independent oil and gas companies. Mr. Swoveland serves as a member of the Board of Directors of Linn Energy, LLC (NASDAQ: LINE), a public independent oil and natural gas company. |

| • | The Board has concluded that Mr. Swoveland is qualified to serve as a Director because, among other things, he brings to the Board extensive corporate management, accounting and finance experience, and oil and gas industry expertise. Additionally, his service as a director of another public energy company provides leadership and knowledge of best practices that benefit the Company and his guidance and understanding of management processes of larger oil and gas companies benefits the Company as it continues to grow. |

CONTINUING DIRECTORS WITH TERM EXPIRING IN 2018 — CLASS II

|

Name: |

Anthony J. Crisafio, Director | |

| Age: |

63 | |

|

Committees: |

Audit Compensation |

| • | Mr. Crisafio, a Certified Public Accountant (“CPA”), was first elected to the Board in 2006. Mr. Crisafio has served as an independent business consultant for more than 20 years, providing financial and operational advice to businesses in a variety of industries. He previously served as the part-time contract Chief Financial Officer of Empire Energy USA, LLC, a domestic oil and gas company. Mr. Crisafio also previously served as the Interim Chief Financial Officer for the MDS Associated Companies, a domestic oil and gas company, from November 2013 to August 2014. Mr. Cristafio is currently the part-time Chief Financial Officer for TruFoodMfg, from November 2015 to present. Mr. Crisafio served as Chief Operating Officer, Treasurer and member of the Board of Directors of Cinema World, Inc. from 1989 until 1993. From 1975 until 1989, he was employed by Ernst & Young LLP, last serving as a partner from 1986 to 1989. He was responsible for several Securities and Exchange Commission (“SEC”) registered client engagements and gained significant experience with oil and gas industry clients and mergers and acquisitions. Mr. Crisafio also serves as an Advisory Board member for a number of privately held companies. |

| • | The Board has concluded that Mr. Crisafio is qualified to serve as a Director because, among other things, he is a CPA and brings to the Board more than 30 years of financial accounting and management expertise, with demonstrated business management and accounting experience. |

|

Name: |

Kimberly Luff Wakim, Director | |

| Age: |

58 | |

|

Committees: |

Audit Compensation (Chair) Nominating and Governance |

| • | Ms. Wakim, an attorney and Certified Public Accountant (“CPA”), was first elected to the Board in 2003. Ms. Wakim is a Partner with the law firm Clark Hill, PLC (formerly Thorp, Reed & Armstrong LLP), where she is the co-chair of the Corporate Restructuring and Bankruptcy Practice group. She has practiced law with the firm since 1990. Ms. Wakim was previously an |

7

Table of Contents

| auditor with Main Hurdman (now KPMG) and was Assistant Controller for PDC from 1982 to 1985. She has been a member of the American Institute of Certified Public Accountants and the West Virginia Society of Certified Public Accounts for more than 20 years. |

| • | The Board has concluded that Ms. Wakim is qualified to serve as a Director because, among other things, she is an attorney and CPA, and brings to the Board a combination of a strong legal background and expertise in accounting oversight. Ms. Wakim received a BSBA from West Virginia University and a J.D. from the West Virginia College of Law. |

The election of the Class III Directors will be effected by an affirmative vote of a plurality of the outstanding common shares. Abstentions and broker non-votes will have no effect on the election of Directors.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” EACH OF THE CLASS III NOMINEES TO THE BOARD OF DIRECTORS SET FORTH IN THIS PROPOSAL NO. 1. PROXIES SOLICITED BY THE BOARD WILL BE SO VOTED UNLESS STOCKHOLDERS SPECIFY A CONTRARY VOTE.

8

Table of Contents

The Audit Committee of the Board is comprised of five Directors and operates under a written charter adopted by the Board. Each member of the Audit Committee meets the independence requirements of Rule 5605(a)(2) of the NASDAQ listing standards and other applicable standards. The duties of the Audit Committee are summarized in this Proxy Statement under “Standing Committees of the Board” and are more fully described in its charter, which can be viewed on the Company’s website at www.pdce.com under “Corporate Governance.”

Management is responsible for the Company’s internal controls and preparation of the consolidated financial statements in accordance with generally accepted accounting principles. The Company’s independent registered public accounting firm is responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States) (“PCAOB”) and issuing a report thereon. The Audit Committee’s responsibilities include monitoring and overseeing these processes.

The Audit Committee met six times during 2015. In addition, the Audit Committee has authorized Audit Committee member Joseph E. Casabona to serve as a sub-committee of the Audit Committee to review and approve SEC periodic financial filings and other actions of the partnerships for which the Company serves as managing general partner (collectively, the “Partnerships”). The sub-committee met five times during 2015 to review such partnership filings.

The Audit Committee reviewed and discussed the Company’s audited consolidated financial statements for the year ended December 31, 2015 (the “Audited Financial Statements”) with the Company’s management and PwC, the Company’s independent registered public accounting firm. The Audit Committee also discussed with PwC the matters required to be discussed by Statement of Auditing Standards No. 61 (Codification of Statements of Auditing Standards AU § 380) as adopted by the PCAOB in Rule 3200T, as amended. The Audit Committee has received the written disclosures and the letter from PwC required by PCAOB Rule 3526 and has discussed with PwC its independence from the Company. The Audit Committee has discussed with management and PwC such other matters and received such assurances from them as the Audit Committee deemed appropriate.

Based on the foregoing review and discussions and relying thereon, the Audit Committee has recommended that the Board include the Audited Financial Statements in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015.

Joseph E. Casabona, Chair

Anthony J. Crisafio

Larry F. Mazza

Jeffrey C. Swoveland

Kimberly Luff Wakim

AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

9

Table of Contents

PROPOSAL NO. 2 — RATIFY THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

(Proposal 2 on the Proxy Card)

The Audit Committee has appointed PwC as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016 and the Company is submitting the appointment of PwC to the stockholders for ratification. If the appointment of PwC is not ratified, the Audit Committee will reconsider its selection. A representative of PwC is expected to attend the meeting and will have an opportunity to make a statement if he or she so desires, and will be available to respond to appropriate questions.

| PRINCIPAL ACCOUNTANT FEES AND SERVICES |

2015 | 2014 | ||||||

| Audit Fees(1) |

$ | 2,120,000 | $ | 1,667,500 | ||||

| Audit-Related Fees(2) |

110,247 | 101,628 | ||||||

| Tax Fees(3) |

42,883 | 93,448 | ||||||

| All Other Fees(4) |

154,585 | — | ||||||

|

|

|

|

|

|||||

| Total Fees |

$ | 2,427,715 | $ | 1,862,576 | ||||

|

|

|

|

|

|||||

| (1) | Audit Fees consist of the aggregate fees billed for professional services rendered for audit procedures performed with regard to the Company’s annual consolidated financial statements and the report on management’s assessment of internal controls over financial reporting and the effectiveness of the Company’s internal controls over financial reporting, including reviews of the consolidated financial statements included in our Quarterly Reports on Form 10-Q, and services that are normally provided by the independent registered public accounting firm in connection with statutory and regulatory filings or engagements, including fees related to comfort letters and consents issued in conjunction with our equity offerings. |

| (2) | Audit-Related Fees consist of the aggregate fees billed for assurance and related services that are reasonably related to the performance of the audit or review of the Company’s annual consolidated financial statements and are not reported under “Audit Fees.” Fees billed primarily include our proportionate share of amounts billed to the Company-sponsored partnerships for the audits of their annual financial statements. Total amounts billed to the Company-sponsored partnerships in 2015 and 2014 were $282,300 and $265,000, respectively. |

| (3) | Tax Fees consist of the aggregate fees billed for professional services rendered for tax compliance, tax advice and tax planning for the Company and its proportionately consolidated entities. |

| (4) | Other fees consist of aggregate fees billed for product and services other than services reported above. |

Audit Committee Pre-Approval Policies and Procedures

The Sarbanes-Oxley Act of 2002 requires that all services provided to the Company by its independent registered public accounting firm be subject to pre-approval by the Audit Committee or authorized Audit Committee members. The Audit Committee has adopted policies and procedures for pre-approval of all audit services and non-audit services to be provided by the Company’s independent registered public accounting firm. Services necessary to conduct the annual audit must be pre-approved by the Audit Committee annually. Permissible non-audit services to be performed by the independent accountant may also be approved on an annual basis by the Audit Committee if they are of a recurring nature. Permissible non-audit services which are not eligible for annual pre-approval to be conducted by the independent accountant must be pre-approved individually by the full Audit Committee or by an authorized Audit Committee member. Actual fees incurred for all services performed by the independent accountant will be reported to the Audit Committee after the services are fully performed. All of the services described in “Principal Accountant Fees and Services” were approved by

10

Table of Contents

the Audit Committee pursuant to its pre-approval policies in effect at the time. The duties of the Audit Committee are described in the Audit Committee Charter, which can be viewed on the Company’s website at www.pdce.com under “Corporate Governance.”

This proposal will be approved if it receives the affirmative vote of a majority of shares of common stock of the Company present or represented at the Annual Meeting and entitled to vote on this proposal. Abstentions will be counted as votes against this proposal. Brokers will have discretionary authority to vote on this proposal.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THIS PROPOSAL NO. 2. PROXIES SOLICITED BY THE BOARD WILL BE SO VOTED UNLESS STOCKHOLDERS SPECIFY A CONTRARY VOTE.

11

Table of Contents

PROPOSAL NO. 3 — APPROVE, ON AN ADVISORY BASIS, THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS

(Proposal 3 on the Proxy Card)

The stockholders of the Company are entitled to cast an advisory non-binding vote at the Annual Meeting on the compensation of the Company’s Named Executive Officers (as defined below). While this vote is non-binding, the Board and the Compensation Committee value the opinions of our stockholders and will take into consideration the outcome of the vote in connection with their ongoing evaluation of the Company’s compensation program. In 2011, based on the stockholder vote at the 2011 Annual Meeting of Stockholders and engagement with some of the Company’s largest stockholders, the Company determined to hold a “say-on-pay” vote annually, consistent with the majority of votes cast in favor of an annual advisory vote. The next non-binding advisory vote regarding such frequency will be held no later than the Company’s 2017 Annual Meeting of Stockholders, in accordance with SEC rules.

As described more fully under “Compensation Discussion and Analysis” below, the Company’s executive compensation program is designed to attract, motivate and retain individuals with the skills required to formulate and drive the Company’s strategic direction and achieve the annual and long-term performance necessary to create stockholder value. The program also seeks to align executive compensation with stockholder value on an annual and long-term basis through a combination of base pay, annual incentives and long-term incentives.

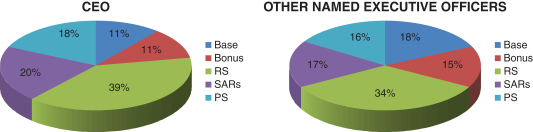

The Company’s practice of targeting the median in compensation and placing a significant portion of each Named Executive Officer’s compensation at risk demonstrates its pay-for-performance philosophy. Approximately 79% of the target 2015 compensation for our Named Executive Officers other than the CEO was in the form of variable compensation which was “at risk” (i.e., incentive cash compensation, performance-based equity, stock appreciation rights (“SARs”) and restricted stock). For the Company’s CEO, this figure was 83%.

Each of the Named Executive Officers has been granted significant equity to provide him a stake in the Company’s long-term success. The Company also has significant stock ownership guidelines applicable to its senior executives. The Company believes that this “tone at the top” guides the Company’s other officers and management personnel to obtain and maintain meaningful ownership stakes in the Company.

The Compensation Committee considers the results of the non-binding “say-on-pay” vote of our stockholders concerning the compensation of our Named Executive Officers. At our 2015 annual meeting of stockholders, an overwhelming majority (98%) of the votes cast approved the compensation of our Named Executive Officers. Accordingly, the Compensation Committee concluded that our executive compensation programs generally meet the expectations of our stockholders. We did not make any material changes to our executive compensation programs in 2015.

In light of the above, the Company believes that the compensation of its Named Executive Officers for 2015 was appropriate and reasonable, and that its compensation programs and practices are sound and in the best interests of the Company and its stockholders. Stockholders are being asked to vote on the following resolution:

RESOLVED, that the Company’s stockholders approve, on an advisory basis, the compensation of the Company’s Named Executive Officers, as disclosed pursuant to Item 402 of Regulation S-K, including the “Compensation Discussion and Analysis,” compensation tables and narrative disclosure in this Proxy Statement for the Company’s 2016 Annual Meeting of Stockholders.

This advisory vote will be approved if it receives the affirmative vote of a majority of shares of common stock of the Company present or represented at the Annual Meeting and entitled to vote on this proposal. Abstentions will be counted as votes against this proposal. Broker non-votes will not affect the outcome of this proposal.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE RESOLUTION SET FORTH IN THIS PROPOSAL NO. 3. PROXIES SOLICITED BY THE BOARD WILL BE SO VOTED UNLESS STOCKHOLDERS SPECIFY A CONTRARY VOTE.

12

Table of Contents

ALL OTHER BUSINESS THAT MAY COME BEFORE THE 2016 ANNUAL MEETING

As of the date of this Proxy Statement, the Board is not aware of any matters to be brought before the Annual Meeting other than the matters set forth in this Proxy Statement. However, if other matters properly come before the meeting in accordance with our Bylaws and SEC rules, it is the intention of the proxy holders named in the enclosed form of proxy to vote in accordance with their discretion on such matters pursuant to such proxy.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

AND RELATED STOCKHOLDER MATTERS

The following table sets forth certain information regarding beneficial ownership of the Company’s common stock as of March 31, 2016, by (1) each person known by the Company to own beneficially more than 5% of the outstanding shares of common stock; (2) each Director of the Company; (3) each Named Executive Officer; and (4) all Directors and executive officers as a group. Except as otherwise indicated, each person has sole voting and investment power with respect to all shares shown as beneficially owned, subject to community property laws where applicable. As of March 31, 2016, 46,205,100 shares of common stock of the Company were outstanding. Except as otherwise indicated, the address for each of the named security holders is c/o 1775 Sherman Street, Suite 3000, Denver, Colorado 80203.

| Name and Address of Beneficial Owner | Number of Shares Beneficially Owned |

Percentage of Shares Beneficially Owned |

||||||

| FMR LLC 245 Summer Street Boston, MA 02210 |

5,124,747 | (1) | 11.1 | % | ||||

| BlackRock, Inc. 55 East 52nd Street New York, NY 10022 |

3,836,895 | (2) | 8.4 | % | ||||

| Dimensional Fund Advisors LP 6300 Bee Cave Road, Building One Austin, TX 78746 |

3,236,419 | (3) | 7.1 | % | ||||

| The Vanguard Group 100 Vanguard Blvd. Malvern, PA 19355 |

3,074,146 | (4) | 6.7 | % | ||||

| Prudential Financial, Inc. 751 Broad St. Newark, NJ 07102 |

2,428,929 | (5) | 5.3 | % | ||||

| Barton R. Brookman, Jr. |

154,062 | (6) | * | |||||

| Gysle R. Shellum |

5,817 | (7) | * | |||||

| Lance A. Lauck |

108,222 | (8) | * | |||||

| Daniel W. Amidon |

94,164 | (9) | * | |||||

| Scott J. Reasoner |

46,803 | (10) | * | |||||

| James M. Trimble |

281,992 | (11) | * | |||||

| Jeffrey C. Swoveland |

22,127 | (12) | * | |||||

| Kimberly Luff Wakim |

15,567 | (13) | * | |||||

| David C. Parke |

16,068 | (14) | * | |||||

| Anthony J. Crisafio |

15,362 | (15) | * | |||||

| Joseph E. Casabona |

28,461 | (16) | * | |||||

| Larry F. Mazza |

20,334 | (17) | * | |||||

| All directors and executive officers as a group (12 persons) |

808,979 | (18) | 1.8 | % | ||||

13

Table of Contents

| * | Represents less than 1% of the outstanding shares of common stock. |

| (1) | As reported on a Schedule 13G/A filed with the SEC by FMR LLC on February 12, 2016, FMR LLC is a parent holding company in accordance with SEC Rule 13d-1(b)(1)(ii)(G) and holds sole voting power as to 689,909 shares and sole dispositive power as to 5,124,747 shares. |

| (2) | As reported on a Schedule 13G/A filed with the SEC by BlackRock, Inc. on January 27, 2016, BlackRock, Inc. holds sole voting power as to 3,740,893 shares and sole dispositive power as to 3,836,895 shares. |

| (3) | As reported on a Schedule 13G filed with the SEC by Dimensional Fund Advisors, LP on February 9, 2016, Dimensional Fund Advisors, LP is an investment advisor in accordance with SEC Rule 13d-1(b)(1)(ii)(E) and holds sole voting power as to 3,183,183 shares and sole dispositive power as to 3,236,419 shares. |

| (4) | As reported on a Schedule 13G/A filed with the SEC by The Vanguard Group on February 11, 2016, The Vanguard Group is an investment advisor in accordance with SEC Rule 13d-1(b)(1)(ii)(E) and holds sole voting power as to 50,807 shares, sole dispositive power as to 3,023,539 shares and shared dispositive power as to 50,607 shares. |

| (5) | As reported on a Schedule 13G/A filed with the SEC by Prudential Financial, Inc. on January 28, 2016. Prudential Financial, Inc. holds sole voting power as to 146,607 shares and sole dispositive power as to 146,607 shares. Prudential Financial holds shared voting power as to 2,282,322 shares and shared dispositive power as to 2,282,322 shares. |

| (6) | Excludes 55,954 restricted shares subject to vesting more than 60 days after March 31, 2016; includes 53,859 shares subject to SARs exercisable within 60 days of March 31, 2016. |

| (7) | Excludes 14,155 restricted shares subject to vesting more than 60 days after March 31, 2016; includes 4,070 shares subject to SARs exercisable within 60 days of March 31, 2016. |

| (8) | Excludes 25,174 restricted shares subject to vesting more than 60 days after March 31, 2016; includes 40,326 shares subject to SARs exercisable within 60 days of March 31, 2016. |

| (9) | Excludes 22,700 restricted shares subject to vesting more than 60 days after March 31, 2016; includes 39,889 shares subject to SARs exercisable within 60 days of March 31, 2016. |

| (10) | Excludes 18,287 restricted shares subject to vesting more than 60 days after March 31, 2016; includes 2,590 shares subject to SARs exercisable within 60 days of March 31, 2016. |

| (11) | Excludes 21,173 restricted shares subject to vesting more than 60 days after March 31, 2016; includes 102,369 shares subject to SARs exercisable within 60 days of March 31, 2016. |

| (12) | Excludes 5,952 restricted shares subject to vesting more than 60 days after March 31, 2016; includes 2,773 common shares purchased pursuant to the Deferred Compensation Plan. |

| (13) | Excludes 4,745 restricted shares subject to vesting more than 60 days after March 31, 2016; includes 5,296 common shares purchased pursuant to the Deferred Compensation Plan. |

| (14) | Excludes 4,745 restricted shares subject to vesting more than 60 days after March 31, 2016; includes 787 common shares deferred pursuant to the Deferred Compensation Plan. |

| (15) | Excludes 4,775 restricted shares and shares deferred pursuant to the Deferred Compensation Plan subject to vesting more than 60 days after March 31, 2016. |

| (16) | Excludes 4,745 restricted shares subject to vesting more than 60 days after March 31, 2016. |

| (17) | Excludes 4,745 restricted shares subject to vesting more than 60 days after March 31, 2016. |

| (18) | Excludes 187,150 restricted shares and shares deferred pursuant to the Deferred Compensation Plan subject to vesting more than 60 days after March 31, 2016; includes 8,856 common shares deferred pursuant to the Deferred Compensation Plan and 243,103 SARs exercisable within 60 days of March 31, 2016. |

14

Table of Contents

Each SAR referenced in the footnotes above entitles the executive officer to receive the difference between the fair market value of a share of our common stock on the date of exercise and its value on the date of initial grant, which ranged from $24.44 to $49.57, payable in shares only.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 (the “Exchange Act”) requires the Company’s officers and Directors, and persons who own more than 10% of a registered class of the Company’s equity securities, to file reports of ownership and changes in ownership with the SEC. Executive officers, Directors and holders of more than 10% of the common stock are required by SEC rules to furnish the Company with copies of all Section 16(a) reports they file. If requested, the Company assists its executive officers and Directors in complying with the reporting requirements of Section 16(a) of the Exchange Act.

Based solely on a review of the reports furnished to the Company or on written representations from reporting persons that all reportable transactions were reported, the Company believes that, during the fiscal year ended December 31, 2015, the Company’s executive officers and Directors and owners of more than 10% of the Company’s common stock timely filed all reports they were required to file under Section 16(a) of the Exchange Act.

15

Table of Contents

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines that govern the structure and function of the Board and establish the Board’s policies on a number of corporate governance issues. Among other matters, the Corporate Governance Guidelines address:

| • | Director selection qualification and responsibilities; |

| • | The holding and frequency of executive sessions of independent directors, Board self evaluation and senior executive performance reviews; |

| • | Board committee structure and function; |

| • | Succession planning; and |

| • | Governance matters, standard of business conduct and Board committee responsibilities. |

The Corporate Governance Guidelines were most recently amended on June 4, 2015.

Uncontested Elections Policy

The Corporate Governance Guidelines include an Uncontested Elections Policy (the “Policy”). Under the Policy, any nominee for Director in an uncontested election who receives a greater number of “withhold” votes than “for” votes will submit to the Board a letter of resignation for consideration by the Nominating and Governance Committee (“N&G Committee”). The N&G Committee will promptly consider the tendered resignation and will recommend to the Board whether or not to accept the tendered resignation or to take other action, such as rejecting the tendered resignation and addressing the apparent underlying causes of the “withhold” votes in a different way.

In making this recommendation, the N&G Committee will consider all factors deemed relevant by its members. These factors may include the underlying reasons for stockholders’ withholding of votes from such Director nominee (if ascertainable), the length of service and qualifications of the Director whose resignation has been tendered, the Director’s contributions to the Company, whether the Company will remain in compliance with applicable laws, rules, regulations and governing documents if it accepts the resignation and, generally, whether or not accepting the resignation is in the best interests of the Company and its stockholders. In considering the N&G Committee’s recommendation, the Board will take into account the factors considered by the N&G Committee and such additional information and factors as the Board believes to be relevant.

Other Corporate Governance Documents

The Company’s website includes the Corporate Governance Guidelines and the following additional governance documents:

Director Nomination Procedures

Director Stock Ownership Guidelines

Insider Trading Policy

Shareholder Communication Policy

Audit Committee Charter

Compensation Committee Charter

Nominating and Governance Committee Charter

Non-Executive Chairman Charter

Code of Business Conduct and Ethics

Waivers of Potential Conflicts of Interest

16

Table of Contents

Board of Directors

The Company’s Bylaws provide that the number of members of the Board shall be designated from time to time by a resolution of the Board; provided, that, pursuant to the Company’s Certificate of Incorporation (the “Charter”) the number of directors on the Board shall in no event be fewer than three or more than nine. As of the date of this filing, the designated number of Directors is eight. Under the Charter, the Board is divided into three separate classes of Directors which are required to be as nearly equal in number as practicable. At each annual meeting of stockholders, one class of Directors whose term has expired may be elected to a new term of three years. The classes are staggered so that the term of one class expires each year.

There is no family relationship between any Director or executive officer of the Company. There are no arrangements or understandings between any Director or officer and any other person pursuant to which the person was selected as an officer or Director of the Company.

Director Independence

In affirmatively determining whether a Director is “independent,” the Board analyzes and reviews the NASDAQ listing standards, which set forth certain circumstances under which a director is not considered independent. The current President and CEO of the Company, Mr. Brookman, is not independent under such standards, and the Company’s former President and CEO, Mr. Trimble, is also not independent under such standards. Audit Committee and Compensation Committee members are subject to additional, more stringent NASDAQ and Exchange Act independence requirements.

The Board has reviewed the business and charitable relationships between the Company and each non-employee Director (“Non-Employee Director”) to determine compliance with the NASDAQ listing standards and to evaluate whether there are any other facts or circumstances that might impair a Non-Employee Director’s independence. The Board has affirmatively determined that each of the Non-Employee Directors other than Mr. Trimble (i.e., Messrs. Casabona, Crisafio, Mazza, Parke and Swoveland, and Ms. Wakim) is independent under NASDAQ Listing Rule 5605, the Exchange Act and our Board committee charter requirements.

Board Meetings and Attendance

The Board has a standing Audit Committee, Compensation Committee and N&G Committee. Actions taken by these committees are reported to the Board at its next meeting. During 2015, each Director attended at least 75% of all meetings of the Board and committees of which he or she was a member. As specified in the Corporate Governance Guidelines, Directors are strongly encouraged, but not required, to attend the annual meeting of stockholders. All of the Directors attended the 2015 annual meeting of stockholders held on June 4, 2015.

17

Table of Contents

The following table identifies the members of each committee of the Board, the chair of each committee, and the number of meetings held in 2015.

| 2015 BOARD AND COMMITTEE MEMBERSHIPS | ||||||||||||||||

| Director | Board of Directors |

Audit Committee |

Compensation Committee |

Nominating and Governance Committee |

||||||||||||

| Barton R. Brookman |

x | |||||||||||||||

| Joseph E. Casabona |

x | x | (1) | x | ||||||||||||

| Anthony J. Crisafio |

x | x | x | |||||||||||||

| Larry F. Mazza |

x | x | x | x | (1) | |||||||||||

| David C. Parke |

x | x | x | |||||||||||||

| Jeffrey C. Swoveland(2) |

x | x | x | |||||||||||||

| James M. Trimble |

x | |||||||||||||||

| Kimberly Luff Wakim |

x | x | x | (1) | x | |||||||||||

| Number of Meetings in 2015 |

9 | 6 | (3) | 8 | 4 | |||||||||||

| 1. | Chair |

| 2. | Non-Executive Chairman. |

| 3. | A sub-committee of the Audit Committee held five additional meetings in 2015 related to SEC filings for partnerships for which the Company serves at the managing general partner and related matters. |

The Non-Employee Directors generally meet in “executive session” in connection with each regularly scheduled Board meeting without the employee Director (the CEO) present. Mr. Swoveland chairs these sessions; however, the other Non-Employee Directors may, in the event of his absence, select another Director to preside over the executive session. Beginning in 2015, due to the change in composition of our Board, the Board began convening meetings of independent Directors in executive session at least twice annually, without Mr. Brookman or Mr. Trimble present.

STANDING COMMITTEES OF THE BOARD

Audit Committee

The Audit Committee is composed entirely of persons whom the Board has determined to be independent under NASDAQ Listing Rule 5605(a)(2), Section 301 of the Sarbanes-Oxley Act of 2002, Section 10A(m)(3) of the Exchange Act and the relevant provisions of the Audit Committee Charter. The Board has adopted the Audit Committee Charter which was most recently amended on September 18, 2015, and which is posted on the Company’s website at www.pdce.com under Corporate Governance. The Board assesses the adequacy of the Audit Committee Charter on an annual basis and revises it as necessary. The Board has determined that all members of the Audit Committee qualify as “financial experts” as defined by SEC regulations. The Audit Committee’s primary purpose is to assist the Board in monitoring the integrity of the Company’s financial reporting process, systems of internal controls and financial statements, and compliance with legal and regulatory requirements. Additionally, the Audit Committee is directly responsible for the appointment, compensation and oversight of the independent auditors engaged by the Company for the purpose of preparing or issuing an audit report or related work. In performing its responsibilities, the Audit Committee:

| • | Monitors the integrity of the Company’s financial reporting process and systems of internal controls regarding finance, accounting and legal compliance; |

| • | Monitors the independence of the independent registered public accounting firm; and |

18

Table of Contents

| • | Provides an avenue for communications among the independent registered public accounting firm, management and the Board. |

Compensation Committee

The Board has determined that all members of the Compensation Committee are independent of the Company under Rules 5605(a)(2) and 5605(d)(2) of the NASDAQ listing standards. The Board has adopted a Compensation Committee Charter which is posted on the Company’s website at www.pdce.com under Corporate Governance. In performing its responsibilities, the Compensation Committee:

| • | Oversees the development of a compensation strategy for the Company’s Named Executive Officers; |

| • | Evaluates the performance of and establishes the compensation of the CEO; |

| • | Reviews and approves the elements of compensation for other senior executive officers of the Company; |

| • | Negotiates and approves the terms of employment and severance agreements with executive officers of the Company and approves all Company severance and change in control plans; |

| • | Reviews the Directors’ compensation for their Board and committee work and recommends to the Board any changes in such compensation; |

| • | Reviews and approves performance criteria and results for bonus and performance-based equity awards for senior executive officers and approves awards to those officers; |

| • | Recommends to the Board equity-based incentive plans necessary to implement the Company’s compensation strategy, approves all equity grants under the plans and administers all equity-based incentive programs of the Company, which may include specific delegation to management to grant awards to non-executive officers; and |

| • | Reviews and approves Company contributions to Company-sponsored retirement plans. |

Compensation Committee Interlocks and Insider Participation

There were no Compensation Committee interlocks during fiscal year 2015.

Nominating and Governance Committee

The Board has determined that all members of the N&G Committee are independent of the Company under Rule 5605(a)(2) of the NASDAQ listing standards. The Board has adopted a Nominating and Governance Committee Charter which was most recently amended and restated on June 4, 2015 and which can be viewed on the Company’s website. In performing its responsibilities, the N&G Committee:

| • | Assists the Board by identifying and recruiting individuals qualified to become Board members and recommending nominees for election at the next annual meeting of stockholders or to fill any vacancies; |

| • | Recommends to the Board and oversees development of corporate governance and ethics policies applicable to the Company; |

| • | Leads the Board in its annual self-assessment of the Board’s and its committees’ performance and the members’ contributions; and |

| • | Assists the Board in creating and maintaining an appropriate committee structure, and recommends to the Board the nominees for membership on, and Chair of, each committee, as well as the Non-Executive Chair position. |

19

Table of Contents

Board Leadership Structure

Although the Board has no specific policy with respect to the separation of the offices of Chairman and CEO, the Board believes that our current leadership structure, under which Mr. Brookman currently serves as President and CEO and Mr. Swoveland serves as Non-Executive Chairman of the Board, is the optimal structure for our Board at this time. Since June 2011, the roles of Chairman and CEO have been held by separate individuals. We believe that as directors continue to have increasing oversight responsibilities, it is beneficial to have an independent, separate Chairman who has the responsibility of leading the Board, allowing the CEO to focus on leading the Company. We believe our CEO and Chairman have an excellent working relationship which, given the separation of their positions, provides strong Board leadership while positioning our CEO as the leader of the Company in front of our employees and stockholders. The Board reconsiders this structure at least annually.

As Non-Executive Chairman, Mr. Swoveland generally chairs the meetings of executive sessions of our Non-Employee Directors. The Non-Executive Chairman, in consultation with the CEO, establishes the agenda for each Board meeting.

Non-Employee Directors’ compensation is reviewed annually by the Compensation Committee and is approved by the Board. We compensate Directors with a combination of cash and stock-based incentive compensation to attract and retain qualified candidates to serve on our Board and to align Directors with our stockholders. In determining how much to compensate our Directors, we consider the significant amount of time they spend fulfilling their duties, as well as the competitive market for skilled directors. No compensation is paid to our CEO for his service on the Board.

In 2015, the Compensation Committee directly engaged Willis Towers Watson PLC (f/k/a Towers Watson & Co.) (“Towers”) as its compensation consultant to review executive compensation and to conduct an annual review of the total compensation of our Non-Employee Directors (see “Role of the Compensation Consultant” in the Compensation Discussion and Analysis section of this Proxy Statement). Specifically, Towers evaluated retainer fees, potential meeting fees and stock-based long-term incentives using, as the competitive benchmark, total compensation paid to the directors of the energy companies which comprise the Company’s peer group used in determining 2015 executive compensation.

Below is a summary of the compensation paid to our Non-Employee Directors. No changes were made to our Directors’ compensation for 2015 with the exception of a reduction in the fee paid for service on the Sub-Committee of the Audit Committee, as described below. All Board and committee retainers are paid in quarterly installments.

Cash Compensation

Annual Board Retainer

For 2015, the annual cash retainer for service on the Board and for attendance at all Board meetings was $70,000. The Non-Executive Chairman received an additional cash retainer of $100,000.

20

Table of Contents

Annual Committee Retainers

Each Non-Employee Director receives an annual cash retainer for service on each committee on which he or she serves. The Chair of each Committee receives an additional annual retainer for his or her services as Chair. The following table shows the Committee and Chair retainers in effect for 2015:

COMMITTEE RETAINERS

| Committee |

Committee Retainer |

Additional Committee Chair Retainer |

||||||

| Audit |

$ | 15,000 | $ | 17,500 | ||||

| Compensation |

10,000 | 10,000 | ||||||

| Nominating and Governance |

6,000 | 7,500 | ||||||

In addition:

| • | A Special Committee consisting of Messrs. Crisafio, Mazza, Parke and Swoveland was created in 2008 to consider the potential repurchase of one or more of the partnerships for which the Company is the managing general partner). In 2015, Mr. Swoveland and Mr. Parke received Special Committee fees of $13,500 and $5,700, respectively. |

| • | A Sub-Committee of the Audit Committee, of which Mr. Casabona was the sole member during 2015, reviews and approves SEC financial filings for certain partnerships for which the Company is the managing general partner. Mr. Casabona received a cash retainer of $7,000 for serving in this capacity in 2015. |

Equity Compensation

In January 2015, the Non-Employee Directors were awarded restricted stock units for their service on the Board. The Non-Executive Chairman received the equivalent of $170,000 (4,255 units) and the remaining Non-Employee Directors each received the equivalent of $135,000 (3,379 units) of restricted stock units vest ratably over three years and were granted under the Company’s Amended and Restated 2010 Long-Term Equity Compensation Plan, which was most recently approved by stockholders in 2013, as the same has been amended from time to time, (the “2010 LTI Plan”).

Deferred Compensation

Each Non-Employee Director may choose to defer all or a portion of his or her annual cash compensation and all or a portion of his or her restricted stock units are awarded each year and/or vest in future years by participating in the Non-Employee Director Deferred Compensation Plan (the “Deferred Comp Plan”). All compensation deferred into this program is credited with hypothetical earnings and losses as if invested in common stock of the Company. As of December 31, 2015, four Directors had deferred cash and/or equity compensation in accordance with the Deferred Comp Plan.

Director Stock Ownership Requirements and Prohibition on Hedging

Each Non-Employee Director is expected to hold shares of Company stock in an amount equal to at least five times his or her annual Board retainer. Compliance with ownership requirements is reviewed annually. Qualifying stock holdings include directly-owned and unvested restricted Company stock as well as stock equivalents held in the Deferred Comp Plan. Directors are expected to comply with the ownership guidelines within five years of their election to the Board. As of December 31, 2015, all of the Directors met or exceeded the current expectations under the guidelines.

21

Table of Contents

The Company’s Insider Trading Policy expressly prohibits Non-Employee Directors from purchasing options, puts or calls or engaging in other transactions that are intended to hedge against the economic risk of owning Company stock.

Director Compensation

Compensation paid to the Non-Employee Directors for 2015 was as follows:

2015 DIRECTOR COMPENSATION

| Name |

Fees Earned or Paid in Cash(1) ($) |

Stock Awards(2) ($) |

Total ($) | |||||||||

| Joseph E. Casabona(3) |

115,500 | 133,910 | 249,410 | |||||||||

| Anthony J. Crisafio |

95,000 | 133,910 | 228,910 | |||||||||

| Larry F. Mazza |

108,500 | 133,910 | 242,410 | |||||||||

| David C. Parke(4) |

91,700 | 133,910 | 225,610 | |||||||||

| Jeffrey C. Swoveland(5) |

208,500 | 168,626 | 377,126 | |||||||||

| James M. Trimble |

70,000 | 133,910 | 203,910 | |||||||||

| Kimberly Luff Wakim |

111,000 | 133,910 | 244,910 | |||||||||

| (1) | Includes annual Board retainer, regular Committee and Committee Chair retainers, Audit sub-committee retainers, any cash compensation paid for participation on the Special Committee and retainers for the Non-Executive Chairman of the Board. No per-meeting fees are paid. |

| (2) | On January 13, 2015, the Company awarded 4,255 restricted stock units to the Non-Executive Chairman and 3,379 restricted stock units to each other Non-Employee Director equal to $170,000 and $135,000 of value, respectively, using the average of the 15-day closing prices ending ten days prior to the grant date ($39.96). The slightly lower amounts reported in the table reflect the grant date fair value as computed in accordance with FASB ASC Topic 718. |

| (3) | Mr. Casabona’s cash compensation includes $7,000 for his service on the Audit Sub-Committee. |

| (4) | Mr. Parke’s cash compensation includes $5,700 for his services on the Special Committee. |

| (5) | Mr. Swoveland’s cash compensation includes $100,000 for his service as Non-Executive Chairman of the Board and $13,500 for his services on the Special Committee. |

DIRECTOR QUALIFICATIONS AND SELECTION

The Board has adopted Director Nomination Procedures that prescribe the process the N&G Committee will use to recommend nominees for election to the Board. The Director Nomination Procedures can be viewed on the Company’s website. The N&G Committee evaluates each candidate based on his or her level and diversity of experience and knowledge (specifically within the industry and relevant industries in which the Company operates, as well as his or her overall experience and knowledge), skills, education, reputation, integrity, professional stature and other factors that may be relevant depending on the particular candidate.

Additional factors considered by the N&G Committee include the size and composition of the Board at the time, and the benefit to the Company of a broad mixture of skills, experience and perspectives on the Board. Accordingly, one or more of these factors may be given more weight in a particular case at a particular time, although no single factor is viewed as determinative. The N&G Committee has not specified any minimum qualifications that it believes must be met by any particular nominee.

22

Table of Contents

The N&G Committee identifies Director candidates primarily through recommendations made by the Non-Employee Directors. These recommendations are developed based on the Non-Employee Directors’ knowledge and experience in a variety of fields and on research conducted by the Company at the N&G Committee’s direction. The N&G Committee also considers recommendations made by Directors, employees, stockholders and others, including search firms. All recommendations, regardless of the source, are evaluated on the same basis against the criteria contained in the Director Nomination Procedures. The N&G Committee has the authority to engage consultants to help identify or evaluate potential Director nominees, but did not do so in 2015.

Diversity Consideration

In addition to qualities of intellect, integrity and judgment, the N&G Committee takes into consideration diversity of background, senior management experience, education and an understanding of some combination of oil and gas marketing, finance, technology, government regulation and public policy. The N&G Committee makes its determination in the context of an assessment of the perceived needs of the Board at that point in time. The N&G Committee evaluates all Director nominees, including any nominees recommended by stockholders, using these criteria. The Director nomination process specifically includes disclosure of the diversity provided by each candidate, and diversity is considered as part of the overall assessment of the Board’s functioning and needs.

STOCKHOLDER RECOMMENDATIONS AND NOMINATIONS

Stockholder Recommendations

The N&G Committee will consider Director candidates recommended by stockholders of the Company on the same basis as those recommended by other sources. Any stockholder who wishes to recommend a prospective Director nominee should notify the N&G Committee by writing to the N&G Committee at the Company’s headquarters or by email to [email protected]. All recommendations will be reviewed by the N&G Committee. A submission recommending a nominee should include:

| • | Sufficient biographical information to allow the N&G Committee to evaluate the potential nominee in light of the Director Nomination Procedures; |

| • | An indication as to whether the proposed nominee will meet the requirements for independence under NASDAQ and SEC guidelines; |

| • | Information concerning any relationships between the potential nominee and the stockholder recommending the potential nominee; and |

| • | An indication of the willingness of the proposed nominee to serve if nominated and elected. |

Stockholder Nominations

Stockholders may nominate candidates for election to the Board. The Company’s Bylaws require that stockholders who wish to submit nominations for election to the Board at meeting of stockholders follow certain procedures. The stockholder must give written notice to the Corporate Secretary at PDC Energy, Inc., 1775 Sherman Street, Suite 3000, Denver, Colorado 80203 or may email notice to [email protected]. In the case of an annual meeting, the notice must be provided not later than 80 days nor more than 90 days prior to the first anniversary of the preceding year’s annual meeting. If the date of the annual meeting is more than 30 days before or more than 60 days after that anniversary date, however, for notice by such stockholder to be timely, it must be received not earlier than 90 days and not later than 80 days before the annual meeting, or, if the first public announcement of the date of such annual meeting is less than 100 days prior to such annual meeting, within 10 days following the Company’s public announcement of the date of its annual meeting. The stockholder must

23

Table of Contents

be a stockholder of record at the time the notice is given and at the time of the annual meeting. The written notice must set forth, among other things, (1) as to each nominee, all information relating to that person that is required to be disclosed in solicitations of proxies for election of Directors in an election contest, or is otherwise required, in each case pursuant to Regulation 14A under the Exchange Act (including such person’s written consent to being named in the Proxy Statement as a nominee and to serving as a Director if elected); (2) as to the stockholder giving the notice and the beneficial owner, if any, on whose behalf the nomination is made (a) the name and address of the stockholder, as they appear on the Company’s books, and of such beneficial owner, and (b) the class and number of shares of the Company’s securities that are beneficially owned by such stockholder and the beneficial owner.

THE BOARD’S ROLE IN RISK MANAGEMENT

The Board seeks to understand and oversee the Company’s critical business risks. Risks are considered in every business decision, including by means of Board oversight of the Company’s internal risk management system. For instance, an assessment of potential risks (financial and otherwise) is included in every acquisition proposal presented to the Board. The Board realizes, however, that it is not possible or desirable to eliminate all risk and that appropriate risk-taking is essential in order to achieve the Company’s objectives.