Form DEF 14A MEDICINES CO /DE For: Dec 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Pursuant to §240.14a-12

THE MEDICINES COMPANY

(Name of Registrant as Specified In its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x | No fee required. | |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

(1) Title of each class of securities to which transaction applies: | ||

(2) Aggregate number of securities to which transaction applies: | ||

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

(4) Proposed maximum aggregate value of transaction: | ||

(5) Total fee paid: | ||

o | Fee paid previously with preliminary materials. | |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

(1) Amount Previously Paid: | ||

(2) Form, Schedule or Registration Statement No.: | ||

(3) Filing Party: | ||

(4) Date Filed: | ||

April 26, 2016

To our stockholders:

We are pleased to invite you to our 2016 annual meeting of stockholders. The meeting will take place on Thursday, May 26, 2016 at 10:00 a.m., local time, at our principal executive offices, located at 8 Sylvan Way, Parsippany, New Jersey 07054. Annual meetings play an important role in maintaining communication and understanding among our management, board of directors and stockholders, and we hope you will join us.

Enclosed with this letter you will find the notice of our 2016 annual meeting of stockholders, which lists the matters to be considered at the meeting, and the proxy statement related to our 2016 annual meeting of stockholders, which describes the matters listed in the notice and provides other information you may find useful in deciding how to vote. We have also enclosed our annual report to stockholders, which contains our annual report on Form 10-K for the year ended December 31, 2015 as filed with the Securities and Exchange Commission, including our audited consolidated financial statements for 2015, and other information that may be of interest to our stockholders.

The ability to have your vote counted at the meeting is an important stockholder right. Regardless of the number of shares you hold, and whether or not you plan to attend the meeting, we hope that you will cast your vote. If you are a stockholder of record, you may vote in person or by proxy over the Internet, by telephone or by returning your proxy card by mail in the envelope provided. You will find voting instructions in the proxy statement and on the enclosed proxy card. If your shares are held in "street name"—that is, held for your account by a bank, broker or other holder of record—you will receive instructions from your bank, broker or the other holder of record of your shares that you must follow for your shares to be voted.

Thank you for your ongoing support and continued interest in The Medicines Company.

Sincerely,

Clive A. Meanwell, MD, PhD

Chief Executive Officer

THE MEDICINES COMPANY

8 Sylvan Way

Parsippany, New Jersey 07054

8 Sylvan Way

Parsippany, New Jersey 07054

NOTICE OF 2016 ANNUAL MEETING OF STOCKHOLDERS

Time and Date | 10:00 a.m., local time, on Thursday, May 26, 2016 | ||||

Place | 8 Sylvan Way, Parsippany, New Jersey 07054 | ||||

Items of Business | At the meeting, we will ask you and our other stockholders to: | ||||

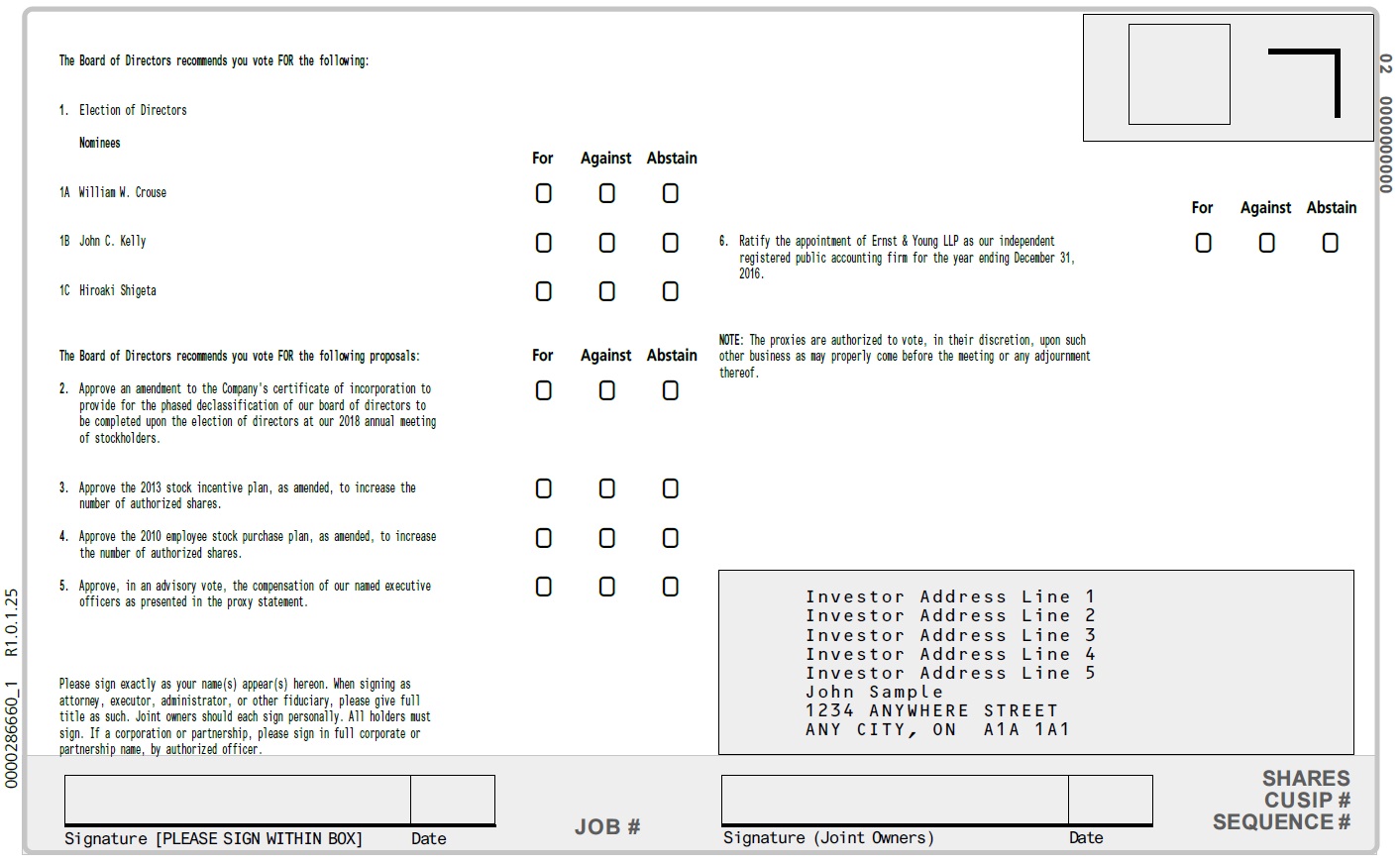

(1 | ) | elect three class I directors for terms to expire at our 2017 annual meeting of stockholders contingent upon the approval of proposal 2, provided that if proposal 2 is not approved, then to elect the three class I directors for terms to expire at our 2019 annual meeting of stockholders; | |||

(2 | ) | approve an amendment to our third amended and restated certificate of incorporation, as amended, to provide for the phased declassification of our board of directors, which declassification will be completed upon the election of directors at our 2018 annual meeting of stockholders; | |||

(3 | ) | approve our 2013 stock incentive plan, as amended, in order to increase the number of shares of common stock authorized for issuance under the plan by 2,300,000 shares; | |||

(4 | ) | approve our 2010 employee stock purchase plan, as amended, in order to increase the number of shares of common stock authorized for issuance under the plan by 1,000,000 shares; | |||

(5 | ) | approve, in an advisory vote, the compensation of our named executive officers as presented in our proxy statement; | |||

(6 | ) | ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2016; and | |||

(7 | ) | transact any other business as may properly come before the meeting or any postponement or adjournment of the meeting. | |||

Our board of directors has no knowledge of any other business to be transacted at our 2016 annual meeting. | |||||

Record Date | You may vote if you were a stockholder of record at the close of business on April 15, 2016. | ||||

Proxy Voting | It is important that your shares be represented and voted at the meeting. Whether or not you plan to attend the meeting, please vote your shares by proxy over the Internet, by telephone or by returning your proxy card by mail in the enclosed postage paid envelope. You may revoke your proxy at any time before its exercise at the meeting if you follow specified procedures. | ||||

By order of the Board of Directors,

Stephen M. Rodin

Secretary

Secretary

April 26, 2016

Parsippany, New Jersey

Parsippany, New Jersey

TABLE OF CONTENTS

i

ii

THE MEDICINES COMPANY

8 Sylvan Way

Parsippany, New Jersey 07054

8 Sylvan Way

Parsippany, New Jersey 07054

PROXY STATEMENT

For our Annual Meeting of Stockholders to be held on May 26, 2016

The Medicines Company, a Delaware corporation (often referred to as "the company", "we" or "us" in this document), is sending you this proxy statement and the enclosed proxy card because our board of directors is soliciting your proxy to vote at our 2016 annual meeting of stockholders (the "annual meeting"). The annual meeting will be held on Thursday, May 26, 2016, at 10:00 a.m., local time, at our principal executive offices at 8 Sylvan Way, Parsippany, New Jersey 07054. You may obtain directions to the location of the annual meeting by contacting Investor Relations, 8 Sylvan Way, Parsippany, New Jersey 07054, email: [email protected]. If the annual meeting is adjourned for any reason, then the proxies submitted may be used at any reconvened annual meeting.

This proxy statement summarizes information about the proposals to be considered at the meeting and other information you may find useful in determining how to vote. The proxy card is the means by which you actually authorize another person to vote your shares in accordance with your instructions.

We are mailing this proxy statement and the enclosed proxy card to stockholders on or about April 26, 2016. In this mailing, we are also including a copy of our annual report to stockholders for the year ended December 31, 2015.

Important Notice Regarding the Availability of Proxy Materials for

the Stockholder Meeting to be Held on May 26, 2016

the Stockholder Meeting to be Held on May 26, 2016

This Proxy Statement and the Annual Report for the year ended December 31, 2015 are available at www.proxyvote.com.

Our annual report on Form 10-K for the year ended December 31, 2015, as filed with the Securities and Exchange Commission, or the SEC, and including our audited financial statements, is included in our annual report to stockholders in this mailing and is also available free of charge at our website at www.themedicinescompany.com or through the SEC's electronic data system at www.sec.gov. To request a printed copy of our Form 10-K (including exhibits), which we will provide to you free of charge, either: write to Investor Relations, The Medicines Company, 8 Sylvan Way, Parsippany, New Jersey 07054, email Investor Relations at [email protected], or call (800) 388-1183.

You may request a copy of the materials relating to our 2016 annual meeting of stockholders, including the proxy statement and form of proxy for our 2016 annual meeting and the annual report to stockholders for the year ended December 31, 2015, at the website listed above, by sending an email to us at [email protected], or by calling (800) 388-1183.

1

INFORMATION ABOUT THE ANNUAL MEETING

Who may vote?

Holders of record of our common stock at the close of business on April 15, 2016, the record date for the annual meeting, are entitled to one vote per share of common stock that they hold on each matter properly brought before the meeting. As of the close of business on April 15, 2016, 70,011,782 shares of our common stock were outstanding.

A list of stockholders entitled to vote will be available at the meeting. In addition, you may contact our Secretary, Stephen M. Rodin, at the address of our principal executive office set forth above to make arrangements to review a copy of the stockholder list at our principal executive offices, for any purpose germane to the meeting, between the hours of 8:30 A.M. and 5:00 P.M., local time, on any business day from May 16, 2016 up to the time of the meeting.

How may I vote my shares if I am a stockholder of record?

If you are a stockholder of record (meaning that you hold shares in your name in the records of our transfer agent, American Stock Transfer & Trust Company), you may vote your shares at the meeting in person or by proxy as follows:

• | You may vote in person. If you attend the annual meeting, you may vote by delivering your completed proxy card in person or you may vote by completing a ballot at the meeting. Ballots will be available at the meeting. |

• | You may vote by mail. To vote by mail, you need to complete, date and sign the proxy card that accompanies this proxy statement and promptly mail it in the enclosed postage-paid envelope. If you vote by mail, you do not need to vote over the Internet or by telephone. |

• | You may vote over the Internet. To vote over the Internet through services provided by Broadridge Investor Communications Solutions, Inc., please go to the following website: www.proxyvote.com, and follow the instructions at that site for submitting your proxy electronically. If you vote over the Internet, you do not need to complete and mail your proxy card or vote your proxy by telephone. |

• | You may vote by telephone. To vote by telephone through services provided by Broadridge Investor Communications Solutions, Inc., call (800) 690-6903, and follow the instructions provided on the proxy card. If you vote by telephone, you do not need to complete and mail your proxy card or vote your proxy over the Internet. |

Your proxy will only be valid if you complete and return the proxy card, vote over the Internet or vote by telephone at or before the annual meeting (and prior to the times specified on the proxy card with respect to Internet and telephone voting). The persons named in the proxy card will vote the shares you own in accordance with your instructions provided on your proxy card, in your vote over the Internet or in your vote by telephone. If you return the proxy card, vote over the Internet or vote by telephone, but do not give any instructions on a particular matter described in this proxy statement, the persons named in the proxy card will vote the shares you own in accordance with the recommendations of our board of directors, which are set forth below in this proxy statement.

The proxy card enclosed with this proxy statement states the number of shares you are entitled to vote if you are a stockholder of record. If you believe that there is an error in the number of shares listed as being owned by you of record, please contact our Investor Relations department by sending an email to us at [email protected] or by calling (800) 388-1183.

How may I vote my shares if I hold them in "street name?"

If the shares you own are held on your behalf by an intermediary, such as a bank or brokerage firm or someone else who holds shares of record on your behalf, then your shares are held in what we refer to as "street name." If your shares are held in "street name" then you are deemed to be the beneficial owner of your shares and the bank or brokerage firm that actually holds the shares for you is the record holder of your shares and is required to vote the shares it holds on your behalf according to your instructions. The proxy materials, including voting and revocation instructions, should have been forwarded to you by the bank or brokerage firm that holds your shares. In order to vote your shares, you will need to follow the instructions that your bank or brokerage firm provides you. Many banks or brokerage firms may solicit voting instructions over the Internet or by telephone.

If you do not give instructions to your bank or brokerage firm, such firm will still be able to vote your shares with respect to certain "discretionary" items. The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm (proposal 6) is considered a discretionary item. Accordingly, your bank or brokerage firm may vote your shares in its discretion with respect to this matter even if you do not give instructions.

However, under stock exchange rules that regulate voting by registered brokerage firms, the election of our nominees to serve as class I directors (proposal 1), the approval of an amendment to our third amended and restated certificate of incorporation, as amended, to provide for the phased declassification of our board of directors (proposal 2), the approval of our 2013 stock incentive plan, as amended (proposal 3), the approval of our 2010 employee stock purchase plan, as amended (proposal 4), and the advisory vote to approve the compensation of our named

2

executive officers (proposal 5) are not considered to be discretionary items. Accordingly, your bank or brokerage firm may not vote your shares with respect to such matters if you do not give them voting instructions on the proposals.

If you provide your bank or brokerage firm with instructions with respect to one or more but not all proposals or you do not provide your bank or brokerage firm with instructions but your bank or broker exercises its discretionary authority to vote on your behalf with respect to proposal 6, your shares which are not voted on a particular matter will be treated as "broker non-votes" on that particular matter. "Broker non-votes" occur when your bank or brokerage firm submits a proxy for your shares but does not indicate a vote for a particular proposal because the bank or brokerage firm either does not have authority to vote on that proposal and has not received voting instructions from you or has discretionary authority but chooses not to exercise it. "Broker non-votes" are not counted as votes for or against the proposal in question or as abstentions, nor are they counted to determine the number of votes present for the particular proposal. We do, however, count "broker non-votes" for the purpose of determining a quorum for the meeting. If your shares are held in "street name" by your bank or broker, please check the instruction card provided by your bank or brokerage firm or contact your bank or brokerage firm to determine whether you will be able to vote by telephone or over the Internet.

Regardless of whether your shares are held in street name, you are welcome to attend the meeting. You may not vote shares held in street name in person at the meeting, however, unless you obtain a proxy, executed in your favor, from the holder of record (i.e., your bank or brokerage firm).

How may I change or revoke my vote?

If you are a stockholder of record, even if you have submitted your proxy to vote your shares, you may change or revoke your vote at any time before the taking of the vote by taking one of the following actions:

• | send written notice of revocation to our Secretary, Stephen M. Rodin, at the address of our principal executive office set forth above; |

• | vote your shares by proxy over the Internet, by telephone or by returning a new proxy card subsequent to the initial submission of your proxy up until 11:59 p.m., Eastern time, the day before the meeting; or |

• | attend the meeting and vote in person. |

If you own shares in street name, your bank or brokerage firm should provide you with instructions for changing or revoking your vote.

What constitutes a quorum?

In order for business to be conducted at the annual meeting, a quorum must be present. The holders of a majority of the shares of the capital stock of the company issued and outstanding and entitled to vote at the meeting, present in person or represented by proxy, constitute a quorum for the transaction of business. As of the record date, April 15, 2016, 70,011,782 shares of our common stock were outstanding. As a result, a quorum for the annual meeting consists of at least 35,005,892 shares of common stock, representing a majority of the shares of capital stock issued, outstanding and entitled to vote at the meeting.

Shares of common stock present in person or represented by proxy (including broker non-votes and shares that abstain or with respect to which voting instructions are provided for one or more, but not all, of the matters to be voted upon) will be counted as present for the purpose of determining whether a quorum exists for the annual meeting. However, if a broker non-vote occurs with respect to any shares of the company's common stock on any matter, then those shares will be treated as not present and not entitled to vote with respect to that matter (even though those shares are considered entitled to vote for purposes of determining whether a quorum exists because they are entitled to vote on other matters) and will not be voted.

If a quorum is not present, the meeting will be adjourned until a quorum is obtained.

What vote is required to approve each matter?

Proposal One—Election of Class I Directors

In order for a nominee for director to be elected to office, the number of votes cast “FOR” that nominee must exceed the number of votes cast “AGAINST” that nominee, provided that if the number of nominees exceeds the number of directors to be elected (a situation we do not anticipate), the directors shall be elected by a plurality of the votes cast by the stockholders entitled to vote on the election of directors at such meeting, meaning that the three nominees for director who receive the most votes will be elected as directors.

3

Proposal Two—Approval of an Amendment to our Third Amended and Restated Certificate of Incorporation, as Amended, to Provide for the Phased Declassification of our Board of Directors

The affirmative vote of the holders of at least 75% of the votes which all the stockholders would be entitled to cast in any annual election of directors or class of directors (which is equivalent to at least 75% of the shares of common stock that is issued and outstanding) is needed to approve the amendment to our third amended and restated certificate of incorporation, as amended.

Proposal Three—Approval of our 2013 Stock Incentive Plan, as amended

The affirmative vote of the holders of a majority of the shares of common stock present or represented by proxy and voting on the matter is needed to approve our 2013 stock incentive plan, as amended.

Proposal Four—Approval of our 2010 Employee Stock Purchase Plan, as amended

The affirmative vote of the holders of a majority of the shares of common stock present or represented by proxy and voting on the matter is needed to approve our 2010 employee stock purchase plan, as amended.

Proposal Five—Advisory Vote to Approve the Compensation of our Named Executive Officers

The affirmative vote of the holders of a majority of the shares of common stock present or represented by proxy and voting on the matter is needed to approve, on an advisory basis, the compensation of our named executive officers as presented in this proxy statement.

Proposal Six—Ratification of Appointment of Independent Registered Public Accounting Firm

The affirmative vote of the holders of a majority of the shares of common stock present or represented by proxy and voting on the matter is needed to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2016.

How will votes be counted?

Each share of common stock is entitled to one vote. Shares will not be voted in favor of a matter and will not be counted as voting on a matter (1) if the holder of the shares abstains from voting on a particular matter or (2) if the shares are broker non-votes. As a result of the voting standards applicable to the proposals before the annual meeting, abstentions and broker non-votes will have no effect on the outcome of voting on proposal 1, proposal 3, proposal 4, proposal 5 and proposal 6; however, abstentions and broker non-votes will have the same effect as a vote against proposal 2.

How does the board of directors recommend that I vote?

Our board of directors recommends that you vote:

• | FOR proposal one—to elect our three nominees to our board of directors; |

• | FOR proposal two—to approve an amendment to our third amended and restated certificate of incorporation, as amended, to provide for the phased declassification of our board of directors, which declassification will be completed upon the election of directors at our 2018 annual meeting of stockholders; |

• | FOR proposal three—to approve our 2013 stock incentive plan, as amended; |

• | FOR proposal four—to approve our 2010 employee stock purchase plan, as amended; |

• | FOR proposal five—to approve, in an advisory vote, the compensation of our named executive officers as presented in this proxy statement; and |

• | FOR proposal six—to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2016. |

Will any other business be conducted at the annual meeting?

Our board of directors does not know of any other business to be conducted or matters to be voted upon at the meeting. Under our bylaws, the deadline for stockholders to notify us of any proposals or nominations for director to be presented for action at the annual meeting has passed.

4

If any other matter properly comes before the meeting, the persons named in the proxy card that accompanies this proxy statement will exercise their judgment in deciding how to vote, or otherwise act, at the meeting with respect to that matter.

Who is soliciting proxies and how, and who is paying for it?

We will bear the costs of soliciting proxies. In addition to solicitations by mail, our directors, officers and regular employees, without additional remuneration, may solicit proxies by telephone, facsimile, email, personal interviews and other means. We may retain a proxy solicitation firm to assist in the solicitation of proxies in connection with the annual meeting of stockholders. In that event, we expect to pay such firm customary fees and expenses. We have requested brokerage houses, custodians, nominees and fiduciaries to forward copies of the proxy materials to the persons for whom they hold shares and request instructions for voting the shares. We will reimburse the brokerage houses and other persons for their reasonable out-of-pocket expenses in connection with this distribution.

How and when may I submit a proposal for the 2017 annual meeting?

If you are interested in submitting a proposal for inclusion in the proxy statement and proxy card for our 2017 annual meeting, you need to follow the procedures outlined in Rule 14a-8 of the Securities Exchange Act of 1934, as amended, or the Exchange Act. We must receive your proposal intended for inclusion in the proxy statement at our principal executive offices, 8 Sylvan Way, Parsippany, New Jersey 07054 Attention: Secretary, no later than December 27, 2016.

If you wish to propose a nominee for election to our board or present a proposal at our 2017 annual meeting, but do not wish to have the proposal considered for inclusion in the proxy statement and proxy card, you must give written notice to us at the address of our principal executive offices set forth above. Our bylaws specify the information that must be included in any such notice, including but not limited to certain information about the nominee or a brief description of the business to be brought before an annual meeting, as applicable, and the name and number of shares of our common stock beneficially owned by the stockholder nominating such person or proposing such business. See "Information About Corporate Governance—Stockholder Nominees" below. We must receive this notice no earlier than January 26, 2017 and no later than February 25, 2017. However, if the date of our 2017 annual meeting is prior to April 26, 2017 or after July 25, 2017, we must receive your notice no earlier than the 120th day prior to our 2017 annual meeting and no later than the close of business on the later of (1) the 90th day prior to our 2017 annual meeting and (2) the 10th day following the date on which notice of the date of the meeting was mailed or public disclosure of the date of the meeting was made, whichever occurs first. If you fail to provide timely notice of a proposal to be presented at our 2017 annual meeting, the chairman of the meeting may exclude the proposal from being brought before the meeting.

How may I request to receive future proxy statements electronically?

If you would like to assist in reducing the costs that we incur in mailing proxy materials, you can consent to receiving or accessing future proxy statements, form of proxy, annual report or notices of Internet availability electronically via e-mail or the Internet. To sign up for electronic delivery, please contact Investor Relations, 8 Sylvan Way, Parsippany, New Jersey 07054, telephone: (800) 388-1183, email: [email protected].

HOUSEHOLDING OF ANNUAL MEETING MATERIALS

Some banks, brokers and other record holders may be participating in the practice of "householding" proxy statements and annual reports. This means that only one copy of our proxy statement and annual report or notice of Internet availability of proxy materials may have been sent to multiple stockholders in your household. We will promptly deliver a separate copy of these documents to you if you call or write us at the following address, phone number or email: The Medicines Company, 8 Sylvan Way, Parsippany, New Jersey 07054, Attention: Investor Relations, (800) 388-1183, email: [email protected]. In addition, this proxy statement and our annual report are available at www.proxyvote.com. If you would like to receive separate copies of the annual report and proxy statement or notice of Internet availability of proxy materials in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker, or other nominee record holder, or you may contact us at the above address and phone number.

5

DISCUSSION OF PROPOSALS

Proposal One: Election of Class I Directors

Our board of directors is currently divided into three classes and consists of three class I directors (William W. Crouse, John C. Kelly and Hiroaki Shigeta), four class II directors (Fredric N. Eshelman, Robert J. Hugin, Clive A. Meanwell and Elizabeth H.S. Wyatt) and four class III directors (Alexander J. Denner, Armin M. Kessler, Robert G. Savage and Melvin K. Spigelman). The terms of the three classes are staggered so that only one class is elected each year. The class I, class II and class III directors were elected to serve until the annual meeting of stockholders to be held in 2016, 2017 and 2018, respectively, and until their respective successors are elected and qualified.

If proposal 2 is approved by the requisite percentage of stockholders, the company will begin its phased transition to a declassified board structure, such declassification to be completed upon the election of directors at our 2018 annual meeting of stockholders. As part of the transition, the nominees elected pursuant to this proposal 1 will be elected to serve as class I directors for terms ending at our 2017 annual meeting of stockholders. Upon the effective date of the amendment to our certificate of incorporation, which is expected to be promptly following our 2016 annual meeting of stockholders, our board of directors will be divided into two classes, and consist of seven class I directors (William W. Crouse, John C. Kelly, Hiroaki Shigeta, Fredric N. Eshelman, Robert J. Hugin, Clive A. Meanwell and Elizabeth H.S. Wyatt) and four class II directors (Alexander J. Denner, Armin M. Kessler, Robert G. Savage and Melvin K. Spigelman). The terms of the two classes will be staggered so that only one class is elected each year. The class I directors were, or, in the case of the directors nominated pursuant to this proposal 1, will be, elected to serve until our 2017 annual meeting of stockholders and the class II directors were elected to serve until our 2018 annual meeting of stockholders, and, in each case, until their respective successors are elected and qualified.

If proposal 2 is not approved by the requisite percentage of stockholders, no change will be made to our classified board structure, with our board of directors remaining divided into three classes, and the directors nominated pursuant to this proposal 1 will be elected to serve as class I directors for terms ending at our 2019 annual meeting of stockholders.

Our board of directors, on the recommendation of our nominating and corporate governance committee, has nominated William W. Crouse, John C. Kelly, and Hiroaki Shigeta for election as class I directors at the annual meeting.

The persons named in the enclosed proxy card will vote to elect each of these nominees as a class I director for terms to expire at our 2017 annual meeting of stockholders contingent upon the approval of proposal 2, provided that if proposal 2 is not approved, then the persons named in the enclosed proxy card will vote to elect the class I directors for terms to expire at our 2019 annual meeting of stockholders, and, in each case, until his successor is elected and qualified. Each of the nominees is a presently a director, and each has indicated a willingness to continue to serve as director, if elected. If a nominee becomes unable or unwilling to serve, however, the proxies may be voted for a substitute nominee selected by our board of directors.

No director or executive officer of ours, or person chosen by us to become a director or executive officer of ours, is related by blood, marriage or adoption to any other director or executive officer of ours, or person chosen by us to become a director or executive officer of ours. No director or executive officer of ours, or any associate of any such director or officer, is a party adverse to us or any of our subsidiaries, or has a material interest adverse to us or any of our subsidiaries, in any legal proceeding.

Our board of directors recommends a vote "FOR" the election of each of the nominees.

Director Nominees

Set forth below are the names of each nominee for class I director, the year in which each first became a director, their ages as of April 1, 2016, their positions and offices with us, if any, their principal occupations and business experience for at least the past five years, their education and the names of other public companies for which they serve as a director or have served as a director during the past five years. We have also included information about each nominee's specific experience, qualifications, attributes or skills that led our board to conclude that he or she should serve as one of our directors at the time we file our proxy statement, in light of our business and structure. In addition to the information presented below regarding each nominee's specific experience, qualifications, attributes and skills, we believe that all of our director nominees have a reputation for integrity, honesty and adherence to high ethical standards. They each have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to us and our board. Finally, we value their experience on other public company boards of directors and board committees. See "Information about Corporate Governance—Director Candidates and Nomination Process" for additional discussion of our director nomination requirements and process.

WILLIAM W. CROUSE

Age: 73

Age: 73

William W. Crouse has been a director since April 2003. From January 1994 to December 2011, Mr. Crouse was a general partner at HealthCare Ventures, a venture capital firm with a focus on biotechnology companies. From 1987 to 1993, Mr. Crouse served as worldwide president of Ortho Diagnostic Systems, a subsidiary of Johnson & Johnson that manufactures diagnostic tests for hospitals, and a vice president

6

of Johnson & Johnson International. Before joining Johnson & Johnson, Mr. Crouse was a division director of DuPont Pharmaceuticals Company, where he was responsible for international operations and worldwide commercial development activities. Before joining Dupont, he served as president of Revlon Health Care Group's companies in Latin America, Canada, and Asia/Pacific. He also held numerous management positions at E.R. Squibb & Sons, a pharmaceutical company. Mr. Crouse is currently a Trustee Emeritus of the New York Blood Center. In the past five years, he has also served as a director of Uluru, Inc., a specialty wound care company. Mr. Crouse received a B.S. in finance and economics from Lehigh University and an M.B.A. from Pace University.

We believe Mr. Crouse's extensive global experience as a senior executive in the pharmaceutical and diagnostics industry is valuable to our board and the company. In addition, Mr. Crouse's private equity investing experience provides a unique perspective to our board.

JOHN C. KELLY

Age: 73

Age: 73

John C. Kelly has been a director since April 2011, and served as our lead director from May 2015 to August 2015. From October 2009 to February 2010, Mr. Kelly served as senior vice president, finance of Pfizer Inc., or Pfizer. From March 2008 to October 2009, Mr. Kelly served as vice president and controller at Wyeth and from June 2002 to March 2008, he served as vice president, financial operations of Wyeth. Prior to joining Wyeth in 2002, he spent more than 35 years in public accounting at Arthur Andersen in various leadership capacities, including as the partner in charge of audit and business consulting practices in the New York metropolitan area. Mr. Kelly is currently a director of C.R. Bard, Inc., a medical device company, and a subsidiary of Horizon Blue Cross Blue Shield of New Jersey. He is a certified public accountant and was an elected member of the Council of the American Institute of Certified Public Accountants. Mr. Kelly received a B.S. in business administration and an M.B.A. in international finance from Seton Hall University.

We believe Mr. Kelly's extensive experience in the pharmaceutical industry is valuable to our board and the company. In addition, Mr. Kelly's background in accounting and finance is of considerable importance in his role as chair of our audit committee.

HIROAKI SHIGETA

Age: 73

Age: 73

Hiroaki Shigeta has been a director since April 2007 and served as our lead director from May 2010 to September 2012. Mr. Shigeta served as a consultant to us from July 2006 to December 2007. From January 2005 until June 2006, he served as a consultant to various Japanese pharmaceutical companies. From October 1993 to December 2004, Mr. Shigeta served in a variety of senior management positions with Hoffman-La Roche, Inc. and its affiliates. From January 2003 to December 2004, Mr. Shigeta was the U.S. head, Far East relations of Hoffman-La Roche and from June 2002 to April 2003, he was a member of the board of Chugai Seiyaku KK, Tokyo, a majority-owned affiliate of Roche Holding of Switzerland. From January 2001 to May 2002, Mr. Shigeta served as chairman and representative director of Nippon Roche KK, a pharmaceutical company and a Japanese affiliate of Roche Holding of Switzerland. From October 1993 to December 2000, Mr. Shigeta was the president and chief executive officer of Nippon Roche KK. Mr. Shigeta has also served as a director of MediciNova, Inc., a biopharmaceutical company. Mr. Shigeta received a B.A. in economics from Momoyama Gakuin University in Osaka, Japan and a B.Sc from Haas Business School, University of California at Berkeley.

We believe Mr. Shigeta's extensive global experience in the pharmaceutical industry is valuable to our board and the company, especially as we continue to expand our operations outside of the United States, including in Japan.

Other Current Directors

Set forth below are the names of each of our other current directors, the year in which each first became a director, their ages as of April 1, 2016, their positions and offices with us, if any, their principal occupations and business experience for at least the past five years, their education, and the names of other public companies for which they serve as a director or have served as a director during the past five years. As with the director nominees, we have also included information about each director's specific experience, qualifications, attributes, or skills that led our board to conclude that he or she should serve as one of our directors at the time we file our proxy statement, in light of our business and structure. In addition to the information presented below regarding each director's specific experience, qualifications, attributes and skills, we also believe that all of our directors have a reputation for integrity, honesty and adherence to high ethical standards. They each have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to the company and our board. Finally, as applicable, we value their experience on other public company boards of directors and board committees.

Directors Whose Terms Expire in 2017 (Class II Directors)

FREDRIC N. ESHELMAN

Age: 67

Fredric N. Eshelman has been a director and non-executive chairman since August 2015. Dr. Eshelman has more than 35 years of strategic development, executive, operational and financial leadership experience in the pharmaceutical and healthcare industries. Dr. Eshelman was the founder of Pharmaceutical Product Development, Inc. (PPD) and founding chairman of Furiex Pharmaceuticals, Inc. In 2014, Dr. Eshelman founded Eshelman Ventures, LLC, an investment company focused on healthcare companies. From 2009 to 2014, Dr. Eshelman served as chairman of the Board of Furiex. From 2009 to 2011, he served as executive chairman of PPD. He also served as chief executive officer of PPD

7

from 1990 to 2009 and as vice chairman of its Board of Directors from 1993 to 2009. Dr. Eshelman currently serves on the board of directors of AeroMD Inc., Cellective Biotherapy, Inc., Dignify Therapeutic, Inc., Eyenovia, Inc., G1 Therapeutics, Inc., Innocrin Pharmaceuticals, Inc., Medikidz USA, Inc., Meryx, Inc., Neoantigenics LLC and Valeant Pharmaceuticals International, Inc., and the advisory board of Auven Therapeutics. Dr. Eshelman received a bachelors degree in pharmacy from UNC Chapel Hill and a doctorate in pharmacy from the University of Cincinnati, and he completed an OPM program at Harvard University.

We believe Dr. Eshelman's experience in drug discovery and development of pharmaceutical products and in the operation of biopharmaceutical businesses is valuable to our board and the company. In addition, Dr. Eshelman’s experience in strategic planning at a variety of biopharmaceutical companies is of considerable importance and enables him to serve a valuable role as our non-executive chairman.

ROBERT J. HUGIN

Age: 61

Age: 61

Robert J. Hugin has been a director since April 2003. Mr. Hugin is executive chairman of Celgene Corporation, a biopharmaceutical company focused on cancer and immunology diseases. Mr. Hugin served as chief executive officer of Celgene from June 2010 through February 2016. From May 2006 to June 2010, Mr. Hugin served as the president and chief operating officer of Celgene, and from June 1999 to May 2006, Mr. Hugin served as the senior vice president and chief financial officer of Celgene. From 1985 to 1999, Mr. Hugin held multiple positions with J.P. Morgan & Co. Inc., a global investment banking firm. Mr. Hugin is a director of Celgene Corporation and Atlantic Health System, Inc. He also served as a past-chairman of The Pharmaceutical Research and Manufacturers of America and is a member of the Board of Trustees of Princeton University, The Darden Foundation, University of Virginia and of Family Promise, a national non-profit network assisting homeless families. Mr. Hugin received an A.B. degree from Princeton University in 1976 and an M.B.A. from the University of Virginia in 1985 and served as a United States Marine Corps infantry officer during the intervening period.

We believe Mr. Hugin's extensive experience in the biopharmaceutical industry is valuable to our board and the company. In addition, Mr. Hugin's background in the financial industry is of considerable importance and enables him to serve a valuable role on our board.

CLIVE A. MEANWELL

Age: 58

Age: 58

Clive Meanwell is a founder and has been a director since 1996. He has served as our chief executive officer since February 2012, our chief executive officer and president from October 2009 to February 2012, our chief executive officer from August 2004 to October 2009, as our president from August 2004 to December 2004, our executive chairman from September 2001 to August 2004 and our chief executive officer and president from 1996 to September 2001. Dr. Meanwell was also chairman of our board from September 2001 to August 2015. From 1995 to 1996, Dr. Meanwell was a partner and managing director at MPM Capital, L.P., a venture capital firm. From 1986 to 1995, Dr. Meanwell held various positions at Hoffmann-La Roche, Inc., a pharmaceutical company, including senior vice president from 1992 to 1995, vice president from 1991 to 1992 and director of product development from 1986 to 1991. Dr. Meanwell received an M.D. and a Ph.D. from the University of Birmingham, United Kingdom.

We believe Dr. Meanwell's extensive experience in the biopharmaceutical industry and his in-depth knowledge of our business is valuable to our board and the company. In addition, Dr. Meanwell's global operational roles, deal-making, private equity and medical experience are also of considerable importance.

ELIZABETH H.S. WYATT

Age: 68

Age: 68

Elizabeth H.S. Wyatt has been a director since March 2005 and has served as our lead director from September 2012 to May 2015. Prior to her retirement in 2000, Ms. Wyatt held several senior positions at Merck & Co., Inc., a pharmaceutical company, over the course of 20 years, including most recently, vice president, corporate licensing. Previously she had been a consultant and academic administrator, responsible for the Harvard Business School's first formal marketing of its executive education programs. She also serves as the vice chair of the Board of Sweet Briar College and chaired the Search Committee for a former president of Sweet Briar College. Ms. Wyatt received a B.A. from Sweet Briar College, a M.Ed. from Boston University and an M.B.A. from Harvard Business School.

We believe Ms. Wyatt's extensive global experience as a senior executive in the pharmaceutical industry is valuable to our board and the company. In addition, Ms. Wyatt's specific deal-making experience provides a unique perspective to our board.

Directors Whose Terms Expire in 2018 (Class III Directors)

ALEXANDER J. DENNER

Age: 46

Alexander J. Denner, Ph.D. is a founding partner and chief investment officer of Sarissa Capital Management LP, a registered investment advisor formed in 2012. From 2006 to 2011, Dr. Denner served as a Senior Managing Director of Icahn Capital, an entity through which Carl C. Icahn conducts his investment activities. Prior to that, he served as a portfolio manager at Viking Global Investors, a private investment fund, and Morgan Stanley Investment Management, a global asset management firm. Dr. Denner has served as a director of Biogen Inc. since June

8

2009 and as a director of ARIAD since February 2014 (chairman since January 2016). Previously, Dr. Denner had also served as a director of the following healthcare companies: Amylin Pharmaceuticals, Inc., Enzon Pharmaceuticals, VIVUS, Inc. and ImClone Systems Incorporated, where he also served as chairman of the executive committee. Dr. Denner received his B.S. degree from the Massachusetts Institute of Technology and his M.S., M.Phil. and Ph.D. degrees from Yale University.

We believe Dr. Denner’s significant experience overseeing the operations of healthcare companies and evaluating corporate governance matters is valuable to our board and the company. In addition, Dr. Denner has extensive experience as an investor, particularly with respect to healthcare companies, and possesses broad healthcare industry knowledge, which is also valuable to our board and the company.

ARMIN M. KESSLER

Age: 78

Age: 78

Armin M. Kessler has been a director since October 1998. Mr. Kessler joined us after a 35-year career in the pharmaceutical industry, which included senior management positions at Sandoz Pharma Ltd. (now Novartis Pharma AG) in Switzerland, the United States and Japan and, most recently, at Hoffmann-La Roche, in Basel, Switzerland, where he was chief operating officer and head of the pharmaceutical division until he retired in 1995. Mr. Kessler currently also serves as a director of Actelion Pharmaceuticals Ltd., a Swiss publicly traded company. In the past five years, Mr. Kessler has also served as a director of Gen-Probe Incorporated, which was acquired by Hologic, Inc. Mr. Kessler received degrees in physics and chemistry from the University of Pretoria, a degree in chemical engineering from the University of Cape Town, a law degree from Seton Hall University School of Law and an honorary doctorate in business administration from the University of Pretoria. Mr. Kessler is a registered patent attorney with the United States Patent and Trademark Office.

We believe Mr. Kessler's extensive global experience as a senior executive in the pharmaceutical, diagnostics, vitamins and fragrance/flavors industries is valuable to our board and the company. In addition, Mr. Kessler's background in law and patent prosecution is of particular value to our board.

ROBERT G. SAVAGE

Age: 62

Age: 62

Robert G. Savage has been a director since April 2003 and served as our lead director from October 2006 until May 2010. Since May 2003, Mr. Savage has served as president of Strategic Imagery LLC, a consulting company he owns. From February 2002 to May 2003, Mr. Savage was group vice president and president for the General Therapeutics and Inflammation Business of Pharmacia Corporation, a research-based pharmaceutical firm acquired by Pfizer in May 2003. From September 1996 to January 2002, Mr. Savage held several senior positions with Johnson & Johnson, including worldwide chairman for the Pharmaceuticals Group during 2001, company group chairman responsible for the North America pharmaceuticals business from 2000 to 2001, president, Ortho-McNeil Pharmaceuticals from 1998 to 2000 and vice president sales & marketing from 1996 to 1998. In the past five years, Mr. Savage has also served as a director for EpiCept Corporation, MergeWorth Rx Corporation and Savient Pharmaceuticals, Inc. Mr. Savage received a B.S. in biology from Upsala College and an M.B.A. from Rutgers University.

We believe Mr. Savage's extensive global experience as a senior executive in the pharmaceutical industry is valuable to our board and the company. In addition, Mr. Savage's background in human talent development is of particular value to our board and the company.

MELVIN K. SPIGELMAN

Age: 67

Melvin K. Spigelman has been a director since September 2005. Since January 2009, Dr. Spigelman has served as president and chief executive officer of the Global Alliance for TB Drug Development, a non-profit organization which seeks to accelerate the discovery and development of faster-acting and affordable drugs to fight tuberculosis. From June 2003 to January 2009, Dr. Spigelman served as director of research and development of the Global Alliance for TB Drug Development. Before joining the Global Alliance for TB Drug Development, Dr. Spigelman was the president of Hudson-Douglas Ltd, a consulting company, from June 2001 to June 2003. From 2000 to 2001, Dr. Spigelman served as a vice president, global clinical centers at Knoll Pharmaceuticals, a pharmaceutical unit of BASF Pharma, and from 1992 to 2000, Dr. Spigelman was the vice president of research and development at Knoll. Dr. Spigelman serves as a director of Synergy Pharmaceuticals Inc., where he is a member of the audit and compensation committees and chair of the external communications oversight committee. Dr. Spigelman received a B.A. in engineering from Brown University and an M.D. from The Mount Sinai School of Medicine.

We believe Dr. Spigelman's extensive experience as a senior executive in the pharmaceutical industry is valuable to our board and the company. In addition, Dr. Spigelman's specific experience in medical products development and medicine provide unique perspectives to our board.

9

Proposal Two: Approval of an Amendment to our Third Amended and Restated Certificate of Incorporation, as Amended, to Provide for the Phased Declassification of our Board of Directors, which declassification will be completed upon the election of directors at our 2018 annual meeting of stockholders

The company’s third amended and restated certificate of incorporation, as amended (“certificate”), currently provides for our board of directors to be divided into three classes, as nearly equal in number as possible, with one class to be elected by the stockholders each year. As part of our commitment to effective governance practices, management and our board undertook a review of current corporate governance trends and considered the view held by many institutional stockholders that transitioning to a declassified board is preferable to maintaining a classified board. After careful consideration, in April 2016, our board determined that it is appropriate to propose for stockholder consideration an amendment to our certificate that, if approved, would provide for the phased declassification of our board over a two-year period, which declassification would be completed upon the election of directors at our 2018 annual meeting of stockholders.

If this proposal 2 is approved by the requisite percentage of stockholders, the company will begin its phased transition to a declassified board structure. In accordance with the proposed amendment to our certificate, the transition will be phased in as follows:

• | The nominees elected pursuant to proposal 1 will be elected to serve as class I directors for terms ending at our 2017 annual meeting of stockholders. Upon the effective date of this proposed amendment to our certificate, which is expected to be promptly following our 2016 annual meeting of stockholders, our board of directors will be divided into two classes, and consist of seven class I directors (those directors currently in class I and class II or their successors) and four class II directors (those directors currently in class III or their successors). The terms of the two classes will be staggered so that only one class is elected each year. The class I directors were, or, in the case of the directors nominated pursuant to proposal 1, will be, elected to serve until our 2017 annual meeting of stockholders and the class II directors were elected to serve until our 2018 annual meeting of stockholders, and, in each case, until their respective successors are elected and qualified. |

• | The nominees elected at our 2017 annual meeting of stockholders will be elected to serve as class I directors for terms ending at our 2018 annual meeting of stockholders. Immediately following the election of directors at our 2017 annual meeting of stockholders, our board of directors will be divided into a single class, and consist of eleven class I directors (those directors who, immediately prior to the election of directors at our 2017 annual meeting of stockholders, were in class I and class II or their successors). The terms of the class will be such that it is elected each year. The class I directors were, or, in the case of the directors nominated at our 2017 annual meeting of stockholders, will be, elected to serve until our 2018 annual meeting of stockholders, and until their respective successors are elected and qualified. |

• | Commencing immediately following the election of directors at our 2018 annual meeting of stockholders, our board would cease to be classified, and the directors elected at our 2018 annual meeting of stockholders (and each annual meeting of stockholders thereafter) will be elected for a term expiring at our next annual meeting, and until their respective successors are elected and qualified. |

Pursuant to the proposed amendment, until the election of directors at our 2018 annual meeting of stockholders, in the event of any increase or decrease in the authorized number of directors, existing directors will remain in their class and, unless otherwise provided by resolution of our board of directors, the newly created or eliminated directorships will be (i) from the election of directors at our 2016 annual meeting of stockholders until the election of directors at our 2017 annual meeting of stockholders, added to class II or subtracted from class I; provided that to the extent such adjustment would make class II larger than class I, directors will be added or subtracted such that no one class will have more than one director more than any other class, and (ii) from the election of directors at our 2017 annual meeting of stockholders until the election of directors at our 2018 annual meeting of stockholders, added to or subtracted from class I.

If this proposal 2 is not approved by the requisite percentage of stockholders, no change will be made to our classified board structure, with our board of directors remaining divided into three classes. Further, the directors nominated pursuant to proposal 1 will be elected to serve as class I directors for terms ending at our 2019 annual meeting of stockholders.

Under Delaware law, directors serving on a non-classified board generally may be removed by stockholders with or without cause, while directors serving on a classified board may be removed by stockholders only for cause, unless otherwise provided in a company’s certificate of incorporation. If this proposal 2 is approved, commencing immediately following the election of directors at our 2018 annual meeting of stockholders, our board would cease to be classified and, at such time, our directors would be able to be removed with or without cause. Our certificate (both currently and as proposed to be amended) provides that directors may be removed only by the affirmative vote of the holders of at least 75% of the votes which all the stockholders would be entitled to cast in any annual election of directors or class of directors.

If the requisite percentage of stockholders approve the proposed amendment, we anticipate filing the amendment to our certificate with the Delaware Secretary of State promptly following the annual meeting. Further, the board of directors has approved that, subject to the approval of this proposal 2, our second amended and restated bylaws will be amended to conform to the changes made to our certificate.

The above is a summary of the proposed amendment to our certificate, the full text of which is set forth in Appendix I to this proxy statement. A copy of our certificate is attached as Exhibit 3.1 to our quarterly report on Form 10-Q for the period ending June 30, 2015. This summary is subject to the text of the amendment and our certificate in all respects.

10

Our board of directors recommends a vote "FOR" this proposal to amend our certificate to provide for the phased declassification of our board of directors.

Proposal Three: Approval of our 2013 Stock Incentive Plan, as amended

In April 2016, upon the recommendation of our compensation committee, our board of directors adopted, subject to stockholder approval, an amendment to our 2013 Stock Incentive Plan ("2013 plan") to increase the number of shares of common stock authorized for issuance under our 2013 plan by 2,300,000. We are submitting this amendment for your consideration and approval.

In addition, in April 2016, upon the recommendation of our compensation committee, our board of directors adopted amendments to our 2013 plan to add a one-year minimum vesting period for full-value awards, including restricted stock awards and RSUs, to limit the treatment of certain performance awards in the event of a change in control of the company and to modify the performance conditions under the plan to remove the ability to adjust performance metrics due to extraordinary items.

We believe that our future success depends, in large part, upon our ability to maintain a competitive position in attracting, retaining and motivating key personnel. Stock-based equity incentives are an important component of our compensation philosophy, intended to provide equity ownership opportunities and performance-based incentives to better align award recipient’s interests with those of our stockholders. As of April 1, 2016, under our 2013 plan, options to purchase 6,174,716 shares of common stock and 442,287 shares of restricted stock were outstanding, and 2,103,408 shares were available for future grant plus the number of shares subject to outstanding awards granted under our Amended and Restated 2004 Stock Incentive Plan ("2004 plan") that may become available for new grants under our 2013 plan if the award expires, terminates or is surrendered, canceled, forfeited or repurchased by us. Currently, we only grant equity incentive awards under our 2013 plan.

To further align award recipient’s interests with those of our stockholders we have adopted both a share retention requirement for our named executive officers and executive stock ownership guidelines, in addition to our existing non-employee director stock ownership guidelines.

• | Our share retention policy requires that our named executive officers retain 50% of net after tax shares obtained via the vesting of any full-value stock award until the named executive officer meets our prescribed ownership guidelines. |

• | Our executive stock ownership guidelines require our chief executive officer to own shares of our common stock with a value equal to 6x his base salary and each other named executive officer to own shares of our common stock with a value equal to 1x his respective base salary, as calculated under our policy. |

• | Our non-employee director stock ownership guidelines require each of our directors to own shares of our common stock with a value equal to 3x the non-employee director annual retainer. |

In light of our compensation philosophy and business strategy, we believe that the number of shares currently available for grants under our 2013 plan will be insufficient to satisfy our future equity compensation needs. In determining the proposed share increase, our compensation committee and our board of directors considered among other things, our stock price and volatility, our historical share usage (or burn rate), our current overhang under our equity incentive plans and how it compares with our industry peers, the existing terms of our outstanding awards, assumptions regarding stock option exercise activity and forfeiture rate, and our proposed fungible ratio. Although our share usage will depend upon and be influenced by a number of factors, such as the number of plan participants, the price per share of our common stock and the methodology used to establish the equity award mix, if this proposal is approved by stockholders, we expect to have sufficient shares for grants to be made over the next year and to return to stockholders to request approval of additional shares at our 2017 annual meeting of stockholders.

Our board of directors recommends a vote "FOR" this proposal to approve our 2013 plan, as amended.

11

Highlights of our 2013 Plan

No Liberal Share Recycling | Plan prohibits the reuse of shares withheld or delivered to satisfy the exercise price of an award or to satisfy tax withholding requirements. |

Double Trigger Equity Acceleration | Awards do not vest automatically upon a change in control. In connection with a change in control, vesting occurs if a participant has a qualifying termination within the one year following the change in control. |

Performance Award Vesting in Connection with a Change in Control | Upon a change in control of the company, performance awards granted under the plan may not vest in an amount in excess of the greater of target performance achievement on a prorated basis or actual performance achievement. |

Multi-Year Vesting Practice | Equity awards granted to our CEO, other executives and employees generally vest over a 4-year period. |

Minimum Vesting Requirement | Full-value awards, including restricted stock awards and RSUs, granted under the plan are subject to a one-year minimum vesting period from the award’s grant date, subject to an exception for up to 5% of the authorized share pool and the plan administrator’s acceleration discretion. |

Burn Rate | The 3-year average burn rate of the plan is 4.64% (see the table below for further details). |

Overhang | Our “overhang” at December 31, 2015 was 14.8%. If the 2,300,000 additional shares proposed to be authorized for grant under the plan were included, our overhang on that date would have been 17.1%. “Overhang” is the sum of the total number of shares (1) underlying all equity awards outstanding and (2) available for future award grants, divided by: the sum of the total number of shares (a) underlying all equity awards outstanding, (b) available for future award grants and (c) outstanding at the time of calculation. |

Fungible Share Ratio | All restricted stock, restricted stock units or other awards with a share or unit purchase price less than the fair market value of the underlying common stock on the date of grant is counted against the share limits of the plan as 1.92 shares of common stock. |

No Repricing of Stock Options or Stock Appreciation Rights | Plan prohibits the direct or indirect repricing of stock options or stock appreciation rights without stockholder approval. |

No Discounted Stock Options or Stock Appreciation Rights | All stock options and stock appreciation rights must have an exercise price or measurement price equal to or greater than the fair market value of the underlying common stock on the date of grant. |

No Reloading of Stock Options | Plan does not permit the automatic grant of an additional stock option upon the exercise of an outstanding stock option. |

No Automatic Annual Increase | Plan does not include “evergreen” features with respect to which additional shares are automatically authorized for issuance each year without stockholder approval. |

Stockholder Approval Requirements | Stockholder approval is required prior to an amendment that would (1) materially increase the number of shares available, (2) expand the types of available awards or (3) materially expand the class of participants eligible to participate in the plan. |

Administered by an Independent Committee | Certain aspects of the plan, including the granting of options to executive officers, are administered by our Compensation Committee, which is made up entirely of independent directors. |

Set forth below is a table that reflects our burn rate for 2015, 2014 and 2013 as well as the average over those years.

Fiscal Year | Options Granted | Restricted Stock Granted | Restricted Stock Multiplier (1) | Total Equity Awards Granted | Weighted Average # of Shares Outstanding (2) | Burn Rate (3) | |||||||

2015 | 2,106,929 | 206,237 | 2.0 | 2,519,403 | 66,809,090 | 3.77% | |||||||

2014 | 2,825,541 | 306,161 | 2.0 | 3,437,863 | 64,473,412 | 5.33% | |||||||

2013 | 2,263,649 | 266,388 | 2.0 | 2,796,425 | 58,096,008 | 4.81% | |||||||

3-Year Average | 4.64% | ||||||||||||

(1) | Restricted stock awards are subject to a volatility-based multiplier of 2.0X based on the company’s current three-year historical volatility of 39.5%, which multiplier is consistent with the multiplier used by shareholder advisory firms. |

(2) | Weighted average number of common shares outstanding used to calculated basic earnings per share in the year. |

12

(3) | “Burn Rate” is the number of equity awards granted in the year divided by the total number of shares of common stock outstanding. |

If our stockholders do not approve this amendment, we will continue to grant awards under the plan until the number of shares authorized and available for issuance under our 2013 plan has been exhausted. In the event that we reach the current maximum number of shares authorized under our 2013 plan, regardless of whether stockholders approve this amendment to our 2013 plan, our board of directors will consider whether to adopt alternative arrangements based on its assessment of the needs of the company.

Description of our 2013 plan

The following is a brief summary of our 2013 plan as proposed to be amended. The full text of this proposed amendment is set forth in Appendix II to this proxy statement. A copy of the plan is attached as Appendix I to our proxy statement for our 2013 annual meeting of stockholders and the previous amendments thereto are attached as Appendix I to our proxy statement for our 2014 annual meeting of stockholders and Appendix II to our proxy statement for our 2015 annual meeting of stockholders. This summary is subject to the text of the amendment and the plan in all respects. Our stockholders adopted our 2013 plan on May 30, 2013 at our 2013 annual meeting of stockholders, and approved plan amendments on May 29, 2014 and May 28, 2015 at our 2014 and 2015 annual meeting of stockholders, respectively.

Number of Shares Available for Award. Under our 2013 plan we are currently authorized to issue awards with respect to a total number of shares not to exceed 18,842,134 shares of our common stock (subject to adjustment in the event of stock splits and other similar changes in capitalization or events), which includes the number of shares of our common stock subject to awards granted under our 2004 plan that were outstanding at the time of approval of our 2013 plan and subject to expiration, termination or surrender, cancellation, forfeiture or repurchase by us. If this amendment is approved by stockholders, we will be authorized to issue awards with respect to a total number of shares not to exceed 21,142,134 shares of our common stock. On a pro forma basis as of April 1, 2016, if this amendment is approved, we would have 4,403,408 shares available for new grants under our 2013 plan plus the number of shares of our common stock subject to awards granted under our 2004 plan which may expire, terminate or be surrendered, canceled, forfeited or repurchased by us.

Our 2013 plan uses a “fungible share” concept under which the awards of options and stock appreciation rights, or SARs, cause one share per share subject to such award to be removed from the available share pool, while the award of restricted stock, restricted stock units, or other stock-based awards where the purchase price for the award is less than 100% of the fair market value of our common stock on the date of grant is currently counted against the pool as 1.92 shares for each share subject to such award. Shares subject to awards under the 2013 and 2004 plans that are forfeited, cancelled or otherwise expire without having been exercised or settled, or that are settled by cash or other non-share consideration, will become available for issuance pursuant to a new award under our 2013 plan and will be credited back to the pool at the same rates at which they left the plan. Shares are subtracted for exercises of SARs using the proportion of the total SAR that is exercised, rather than the number of shares actually issued. Shares (including shares subject to an award) used to satisfy an option exercise price or tax withholding applicable to an award will not be added back to the number of shares available for issuance under our 2013 plan.

Eligibility to Receive Awards; Individual Award Limits. Employees, officers, directors, consultants and advisors of the company and its subsidiaries and of other business ventures in which the company has a controlling interest are eligible to be granted awards under our 2013 plan. Under present law, however, incentive stock options may only be granted to employees of the company and its corporate subsidiaries. The maximum number of shares with respect to which awards may be granted to any participant under our 2013 plan may not exceed 500,000 shares per calendar year. For purposes of this limit, the combination of an option in tandem with a SAR is treated as a single award. Performance awards in the form of cash-based awards may provide for cash payments of up to $4.0 million per calendar year per individual.

Types of Awards. Our 2013 plan provides for the grant of incentive stock options intended to qualify under Section 422 of the Internal Revenue Code of 1986, as amended, or the Code, nonstatutory stock options, stock appreciation rights, restricted stock, restricted stock units and other stock-based and cash-based awards as described below.

Incentive Stock Options and Nonstatutory Stock Options. Optionees receive the right to purchase a specified number of shares of common stock at a specified exercise price and subject to such other terms and conditions as are specified in connection with the option grant. Options must be granted at an exercise price equal to or greater than the fair market value of the common stock on the date of grant. Under our 2013 plan, options may not be granted for a term in excess of ten years. Options may not provide for the automatic grant of additional options in connection with the exercise of an original option. Our 2013 plan permits the following forms of payment of the exercise price of options: (i) payment by cash, check or in connection with a “cashless exercise” through a broker, (ii) subject to certain conditions, surrender to the company of shares of common stock, (iii) to the extent provided for in a nonstatutory stock option agreement or as approved by our board in its sole discretion, “net exercise” in which a portion of the shares to be issued on exercise are withheld to pay the exercise price, (iv) subject to certain conditions, any other lawful means, or (v) any combination of these forms of payment.

Stock Appreciation Rights (SAR). A SAR, is an award entitling the holder, upon exercise, to receive an amount in common stock or cash or a combination thereof determined by reference to appreciation, from and after the date of grant, in the fair market value of a share of common stock over the SAR's measurement price. The measurement price must be equal to or greater than the fair market value of our common stock on the date the SAR is granted. SARs may be granted independently or in tandem with an option. SARs may not be granted for a term in excess of ten years.

Restricted Stock Awards. Restricted stock awards entitle recipients to acquire shares of our common stock, subject to the right of the company to repurchase (or to require forfeiture if issued at no cost) some or all of those shares from the recipient in the event that the conditions specified in the applicable award are not satisfied prior to the end of the applicable restriction period established for that award. The right to receive any dividends with respect to restricted stock is conditioned on the vesting of the award unless otherwise provided in an award agreement.

13

Restricted Stock Unit Awards (RSUs). RSUs, entitle the recipient to receive shares of our common stock (or, if provided in the applicable award, cash equal to the fair market value of such shares) to be delivered at the time such shares vest pursuant to the terms and conditions established by our board of directors. An RSU award may provide the participant with the right to receive an amount equal to any dividends or other distributions declared and paid on an equal number of outstanding shares of our common stock, which we refer to as the right to receive dividend equivalents. The right to receive dividend equivalents (which may be paid in cash and/or shares or our common stock) will be conditioned on the vesting of the RSU award with respect to which they were awarded.

Minimum Vesting Condition. Subject to the plan administrator’s discretion to accelerate vesting under the plan, full-value awards, including restricted stock awards and RSUs, must have a minimum vesting period of one year from the date of grant. The foregoing notwithstanding, up to 5% of the total number of shares available for issuance under the plan and authorized in or after April 2016 may be granted without regard to this minimum vesting period.

Other Stock-Based and Cash-Based Awards. Under our 2013 plan, our board of directors has the right to grant other awards based upon our common stock having such terms and conditions as determined by our board, including the grant of shares of our common stock and the grant of awards that are valued in whole or in part by reference to, or otherwise based on, shares of our common stock. These awards may be paid in shares of our common stock or in cash and are available to our board of directors as a form of payment in settlement of other awards granted under our 2013 plan or as payment in lieu of compensation to which a participant is otherwise entitled. Our board may also grant awards denominated in cash rather than shares of our common stock. Dividend equivalents with respect to such awards may be paid in cash and/or shares of our common stock and will be conditioned on the vesting of the award with respect to which they were awarded.