Form DEF 14A KROGER CO For: Jun 23

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant [X] | ||

| Filed by a Party other than the Registrant [ ] | ||

| Check the appropriate box: | ||

| [ ] | Preliminary Proxy Statement | |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| [X] | Definitive Proxy Statement | |

| [ ] | Definitive Additional Materials | |

| [ ] | Soliciting Material Pursuant to §240.14a-12 | |

| THE KROGER CO. | ||

| (Name of Registrant as Specified In Its Charter) | ||

|

(Name

of Person(s) Filing Proxy Statement, if other than the

Registrant) |

| Payment of Filing Fee (Check the appropriate box): | ||||

| [X] | No fee required. | |||

|

[

] |

Fee computed on

table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1) | Title of each class of securities to which transaction applies: | |||

| 2) | Aggregate number of securities to which transaction applies: | |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) | Proposed maximum aggregate value of transaction: | |||

| 5) | Total fee paid: | |||

|

[

] |

Fee paid previously

with preliminary materials. | |||

|

[

] |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for

which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or

Schedule and the date of its filing. | |||

| 1) | Amount Previously Paid: | |||

| 2) | Form, Schedule or Registration Statement No.: | |||

| 3) | Filing Party: | |||

| 4) | Date Filed: | |||

Notice of 2016 Annual Meeting of Shareholders

Fellow Kroger Shareholders:

It is our pleasure to invite you to join our Board of Directors, senior leadership, and other Kroger associates at The Kroger Co. Annual Meeting of Shareholders.

| When: | Thursday, June 23, 2016, at 11:00 a.m. eastern time. | ||

| Where: | School for Creative and Performing Arts | ||

| Corbett Theater | |||

| 108 W. Central Parkway | |||

| Cincinnati, OH 45202 | |||

| Items of Business: | 1. | To elect eleven director nominees. | |

| 2. | To approve our executive compensation, on an advisory basis. | ||

| 3. | To ratify the selection of our independent auditor for fiscal year 2016. | ||

| 4. | To vote on four shareholder proposals, if properly presented at the meeting. | ||

| 5. | To transact other business as may properly come before the meeting. | ||

| Who can Vote: | Holders of Kroger common shares at the close of business on the record date April 27, 2016 are entitled to notice of and to vote at the meeting. | ||

| How to Vote: | Your vote is important! Please vote your proxy in one of the following ways: | ||

| 1. | Via the internet, by visiting www.proxyvote.com. | ||

| 2. | By telephone, by calling the number on your proxy card, voting instruction form or notice. | ||

| 3. | By mail, by marking, signing, dating and mailing your proxy card if you requested printed materials, or your voting instruction form. No postage is required if mailed in the United States. | ||

| 4. | In person, by attending the meeting in Cincinnati. | ||

| Attending the Meeting: | Shareholders holding shares at the close of business on the record date, or their duly appointed proxies, may attend the meeting. If you plan to attend the meeting, you must bring either: (1) the notice of meeting that was separately mailed to you or (2) the top portion of your proxy card, either of which will be your admission ticket. | ||

| Webcast of the Meeting: | If you are unable to attend the meeting, you may listen to a live webcast of the meeting by visiting ir.kroger.com at 11:00 a.m. eastern time on June 23, 2016. | ||

We appreciate your continued confidence in Kroger, and we look forward to seeing you at the meeting.

| By Order of the Board of Directors, | |

| Christine S. Wheatley, Secretary | |

| May 12, 2016 | |

| Cincinnati, Ohio |

Proxy Statement

May 12, 2016

We are providing this notice, proxy statement and annual report to the shareholders of The Kroger Co. (“Kroger”) in connection with the solicitation of proxies by the Board of Directors for use at the Annual Meeting of Shareholders to be held on June 23, 2016, at 11:00 a.m. eastern time, at the School for Creative and Performing Arts, Corbett Theater, 108 W. Central Parkway, Cincinnati, Ohio 45202, and at any adjournments thereof.

Our principal executive offices are located at 1014 Vine Street, Cincinnati, Ohio 45202-1100. Our telephone number is 513-762-4000. This notice, proxy statement and annual report, and the accompanying proxy card were first furnished to shareholders on May 12, 2016.

Who can vote?

You can vote if as of the close of business on April 27, 2016, you were a shareholder of record of Kroger common shares.

Who is asking for my vote, and who pays for this proxy solicitation?

Your proxy is being solicited by Kroger’s Board of Directors. Kroger is paying the cost of solicitation. We have hired D.F. King & Co., Inc., 48 Wall Street, New York, New York, a proxy solicitation firm to assist us in soliciting proxies and we will pay them a fee estimated not to exceed $15,000.

We also will reimburse banks, brokers, nominees, and other fiduciaries for postage and reasonable expenses incurred by them in forwarding the proxy material to beneficial owners of our common shares.

Proxies may be solicited personally, by telephone, electronically via the Internet, or by mail.

Who are the members of the Proxy Committee?

Robert D. Beyer, W. Rodney McMullen, and Ronald L. Sargent, all Kroger Directors, are the members of the Proxy Committee for our 2016 Annual Meeting.

How do I vote my proxy?

You can vote your proxy in one of the following ways:

| 1. | Via the internet, by visiting www.proxyvote.com. | |

| 2. | By telephone, by calling the number on your proxy card, voting instruction form, or notice. | |

| 3. | By mail, by marking, signing, dating and mailing your proxy card if you requested printed materials, or your voting instruction form. No postage is required if mailed in the United States. | |

| 4. | In person, by attending the meeting in Cincinnati. | |

What do I need to attend the meeting in person in Cincinnati?

If you plan to attend the meeting, you must bring either: (1) the notice of meeting that was separately mailed to you or (2) the top portion of your proxy card, either of which will be your admission ticket.

You must also bring valid photo identification, such as a driver’s license or passport.

Can I change or revoke my proxy?

The common shares represented by each proxy will be voted in the manner you specified unless your proxy is revoked before it is exercised. You may change or revoke your proxy by providing written notice to Kroger’s Secretary at 1014 Vine Street, Cincinnati, Ohio 45202-1100, in person at the meeting or by executing and sending us a subsequent proxy.

How many shares are outstanding?

As of the close of business on April 27, 2016, the record date, our outstanding voting securities consisted of 953,786,557 common shares.

1

How many votes per share?

Each common share outstanding on the record date will be entitled to one vote on each of the 11 director nominees and one vote on each other proposal. Shareholders may not cumulate votes in the election of directors.

What voting instructions can I provide?

You may instruct the proxies to vote “For” or “Against” each proposal. Or you may instruct the proxies to “Abstain” from voting.

What happens if proxy cards or voting instruction forms are returned without instructions?

If you are a registered shareholder and you return your proxy card without instructions, the Proxy Committee will vote in accordance with the recommendations of the Board of Directors.

If you hold shares in street name and do not provide your broker with specific voting instructions on proposals 1, 2, 4, 5, 6 or 7, which are considered non-routine matters, your broker does not have the authority to vote on those proposals. This is generally referred to as a “broker non-vote.” Proposal 3, ratification of auditors, is considered a routine matter and, therefore, your broker may vote your shares according to your broker’s discretion.

The vote required, including the effect of broker non-votes and abstentions for each of the matters presented for shareholder vote, is set forth below.

What are the voting requirements for each of the proposals?

Proposal No. 1, Election of Directors – An affirmative vote of the majority of the total number of votes cast “For” or “Against” a director nominee is required for the election of a director in an uncontested election. A majority of votes cast means that the number of shares voted “For” a director nominee must exceed the number of votes “Against” such director. Broker non-votes and abstentions will have no effect on this proposal.

Proposal No. 2, Advisory Vote to Approve Executive Compensation – Advisory approval by shareholders of executive compensation requires the affirmative vote of the majority of shares participating in the voting. Broker non-votes and abstentions will have no effect on this proposal.

Proposal No. 3, Ratification of Independent Auditors – Ratification by shareholders of the selection of independent public accountants requires the affirmative vote of the majority of shares participating in the voting. Abstentions will have no effect on this proposal.

Proposal Nos. 4, 5, 6 and 7, Shareholder Proposals – The affirmative vote of the majority of shares participating in the voting on a shareholder proposal is required for such proposal to pass. Accordingly, broker non-votes and abstentions will have no effect on these proposals. Proxies will be voted against these proposals unless the Proxy Committee is otherwise instructed on a proxy properly executed and returned.

How does the Board of Directors recommend that I vote?

| Proposal | Board Recommendation | |

| Item No. 1, Election of Directors | FOR | |

| See pages 4-7 | ||

| Item No. 2, Advisory Vote to Approve Executive Compensation | FOR | |

| See page 49 | ||

| Item No. 3, Ratification of Independent Auditors | FOR | |

| See pages 54-55 | ||

| Item Nos. 4, 5, 6 and 7, Shareholder Proposals | AGAINST | |

| See pages 57-63 |

Meeting to be Held on June 23, 2016

2

Kroger’s Corporate Governance Practices

Kroger is committed to strong corporate governance. We believe that strong governance builds trust and promotes the long-term interests of our shareholders. Highlights of our corporate governance practices include the following:

| ✓ | All director nominees are

independent, except for the CEO. | ||

| ✓ | All five Board Committees are fully

independent. | ||

| ✓ | Annual election of all

directors. | ||

| ✓ | All directors are elected with a

simple majority standard for all uncontested director elections, with

cumulative voting available in contested director

elections. | ||

| ✓ | Commitment to Board refreshment and

diversity. | ||

| ✓ | Regular engagement with shareholders

to understand their perspectives and concerns. | ||

| ✓ | Regular executive sessions of the

independent directors, at board and committee

level. | ||

| ✓ | Strong independent lead director with

clearly defined roles and responsibilities. | ||

| ✓ | Annual Board and Committee

self-assessments. | ||

| ✓ | Annual evaluation of the Chairman and

CEO by the independent directors. | ||

| ✓ | High degree of Board interaction with

management to ensure successful oversight and succession

planning. | ||

| ✓ | Stock ownership guidelines align

executive and director interests with those of

shareholders. | ||

| ✓ | Prohibition on all hedging, short

sales and pledging. | ||

| ✓ | No poison pill (shareholder rights

plan). | ||

| ✓ | Shareholders have the right to call a

special meeting. | ||

| ✓ | Robust code of

ethics. | ||

| ✓ | Strong Board oversight of enterprise risk. |

3

Proposals to Shareholders

Item 1. Election of Directors

You are being asked to elect 11 director nominees for a one-year term. The Board of Directors recommends that you vote FOR the election of all director nominees.

As of the date of this proxy statement, the Kroger Board of Directors consists of twelve members. David B. Lewis will be retiring from the Board of Directors immediately prior to the 2016 annual meeting, in accordance with Kroger’s director retirement policy, and will not be standing for re-election. The number of directors will be reduced to eleven by the Board. All nominees, if elected at the 2016 annual meeting, will serve until the annual meeting in 2017, or until their successors have been elected by the shareholders or by the Board pursuant to Kroger’s Regulations, and qualified.

Kroger’s Articles of Incorporation provide that the vote required for election of a director nominee by the shareholders, except in a contested election or when cumulative voting is in effect, is the affirmative vote of a majority of the votes cast for or against the election of a nominee.

The experience, qualifications, attributes, and skills that led the Corporate Governance Committee and the Board to conclude that the following individuals should serve as directors are set forth opposite each individual’s name. The committee memberships stated below are those in effect as of the date of this proxy statement. Except as noted, each nominee has been employed by his or her present employer (or a subsidiary thereof) in an executive capacity for at least five years.

Nominees for Directors for Terms of Office Continuing until 2017

|

Nora A. Aufreiter Age 56 Director Since 2014 Committees: |

Ms. Aufreiter is a Director Emeritus of McKinsey & Company, a global management consulting firm. She retired in June 2014 after more than 27 years with McKinsey, most recently as a director and senior partner. During that time, she worked extensively in the U.S., Canada, and internationally with major retailers, financial institutions and other consumer-facing companies. Before joining McKinsey, Ms. Aufreiter spent three years in financial services working in corporate finance and investment banking. She is a member of the Board of Directors of The Bank of Nova Scotia, The Neiman Marcus Group, and Cadillac Fairview, one of North America’s largest owners, operators and developers of commercial real estate. Ms. Aufreiter also serves on the boards of St. Michael’s Hospital and the Canadian Opera Company, and is a member of the Dean’s Advisory Board for the Ivey Business School in Ontario, Canada. Ms. Aufreiter has over 30 years of broad business experience in a variety of retail sectors. Her vast experience in leading McKinsey’s North American Retail Practice, North American Branding service line and the Consumer Digital and Omnichannel service line is of particular value to the Board. She also brings to the Board valuable insight on commercial real estate. |

4

|

Robert D. Beyer, Age 56 Director Since 1999 Committees: |

Mr. Beyer is Chairman of Chaparal Investments LLC, a private investment firm and holding company that he founded in 2009. From 2005 to 2009, Mr. Beyer served as Chief Executive Officer of The TCW Group, Inc., a global investment management firm. From 2000 to 2005, he served as President and Chief Investment Officer of Trust Company of the West, the principal operating subsidiary of TCW. Mr. Beyer is a member of the Board of Directors of The Allstate Corporation and Leucadia National Corporation. Mr. Beyer has decided not to seek re-election to Allstate’s board of directors at its annual meeting in May 2016, after ten years of service on its board. Mr. Beyer brings to Kroger his experience as CEO of TCW, a global investment management firm serving many of the largest institutional investors in the U.S. He has exceptional insight into Kroger’s financial strategy, and his experience qualifies him to serve as a member of the Board. While at TCW, he also conceived and developed the firm’s risk management infrastructure, an experience that is useful to Kroger’s Board in performing its risk management oversight functions. His abilities and service as a director were recognized by his peers, who selected Mr. Beyer as an Outstanding Director in 2008 as part of the Outstanding Directors Program of the Financial Times. His strong insights into corporate governance form the foundation of his leadership role as Lead Director on the Board. | |

Anne Gates Age 56 Director Since 2015 Committees: |

Ms. Gates is President of MGA Entertainment, Inc., a privately-held developer, manufacturer and marketer of toy and entertainment products for children, a position she has held since 2014. Ms. Gates held roles of increasing responsibility with The Walt Disney Company from 1992-2012. Her roles included executive vice president, managing director and chief financial officer for Disney Consumer Products and senior vice president of operations, planning and analysis. Prior to joining Disney, Ms. Gates worked for PepsiCo and Bear Stearns. Ms. Gates has over 15 years of experience in the retail and consumer products industry. She brings to Kroger financial expertise gained while serving as President of MGA and CFO of a division of the Walt Disney Company. Ms. Gates has a broad business background in marketing, strategy and business development, including international business. Her expertise in toy and entertainment products is of particular value to the Board. Ms. Gates has been designated an Audit Committee financial expert. | |

|

Susan J. Kropf Age 67 Director Since 2007 Committees: |

Ms. Kropf was President and Chief Operating Officer of Avon Products Inc., a manufacturer and marketer of beauty care products, from 2001 until her retirement in January 2007. She joined Avon in 1970 and, during her tenure at Avon, Ms. Kropf also served as Executive Vice President and Chief Operating Officer, Avon North America and Global Business Operations from 1998 to 2000 and President, Avon U.S. from 1997 to 1998. Ms. Kropf was a member of Avon’s Board of Directors from 1998 to 2006. She currently is a director of Avon Products Inc., Coach, Inc., and Sherwin Williams Company. In the past five years she also served as a director of MeadWestvaco Corporation. Ms. Kropf has unique and valuable consumer insight, having led a major, publicly-traded retailer of beauty and related consumer products. She has extensive experience in manufacturing, marketing, supply chain operations, customer service, and product development, all of which assist her in her role as a member of Kroger’s Board. Ms. Kropf has a strong financial background, and has significant boardroom experience through her service on the boards of various public companies, including experience serving on compensation, audit, and corporate governance committees. She was inducted into the YWCA Academy of Women Achievers. |

5

|

W. Rodney McMullen, Age 55 Director Since 2003 |

Mr. McMullen was elected Chairman of the Board in January 2015 and Chief Executive Officer of Kroger in January 2014. Mr. McMullen served as Kroger’s President and Chief Operating Officer from August 2009 to December 2013. Prior to that role, Mr. McMullen was elected to various roles at Kroger including Vice Chairman in 2003, Executive Vice President in 1999 and Senior Vice President in 1997. Mr. McMullen is a director of Cincinnati Financial Corporation and VF Corporation. Mr. McMullen has broad experience in the supermarket business, having spent his career spanning over 37 years with Kroger. He has a strong financial background, having served as our CFO, and played a major role as architect of Kroger’s strategic plan. His service on the compensation, executive, and investment committees of Cincinnati Financial Corporation and the audit and nominating and governance committees of VF Corporation add depth to his extensive retail experience. | |

|

Jorge P. Montoya Age 69 Director Since 2007 Committees: |

Mr. Montoya was President of The Procter & Gamble Company’s Global Snacks & Beverage division, and President of Procter & Gamble Latin America, from 1999 until his retirement in 2004. Prior to that, he was an Executive Vice President of Procter & Gamble, a provider of branded consumer packaged goods, from 1995 to 1999. Mr. Montoya is a director of The Gap, Inc. Mr. Montoya brings to Kroger’s Board over 30 years of leadership experience at a premier consumer products company. He has a deep knowledge of the Hispanic market, as well as consumer products and retail operations. Mr. Montoya has vast experience in marketing and general management, including international business. He was named among the 50 most important Hispanics in Business & Technology, in Hispanic Engineer & Information Technology Magazine. | |

|

Clyde R. Moore Age 62 Director Since 1997 Committees: |

Mr. Moore was the Chairman of First Service Networks, a national provider of facility and maintenance repair services, until his retirement in 2015. Prior to that he was Chairman and Chief Executive Officer of First Service Networks from 2000 to 2014. Mr. Moore has over 30 years of general management experience in public and private companies. He has sound experience as a corporate leader overseeing all aspects of a facilities management firm and numerous manufacturing companies. Mr. Moore’s expertise broadens the scope of the Board’s experience to provide oversight to Kroger’s facilities, digital and manufacturing businesses. | |

|

Susan M. Phillips Age 71 Director Since 2003 Committees: |

Dr. Phillips is Professor Emeritus of Finance at The George Washington University School of Business. She joined The George Washington University School of Business as a Professor and Dean in 1998. Dr. Phillips retired from her position as Dean in 2010, and retired from her position as Professor the following year. She was a member of the Board of Governors of the Federal Reserve System from December 1991 through June 1998. Before her Federal Reserve appointment, Dr. Phillips served as Vice President for Finance and University Services and Professor of Finance in The College of Business Administration at the University of Iowa from 1987 through 1991. She is a director of CBOE Holdings, Inc., State Farm Mutual Automobile Insurance Company, State Farm Companies Foundation, the Chicago Board Options Exchange, and Agnes Scott College. Dr. Phillips also was a director of the National Futures Association and State Farm Life Insurance Company until early 2016. Dr. Phillips brings to the Board strong financial acumen, along with a deep understanding of, and involvement with, the relationship between corporations and the government. Her experience in academia brings a unique and diverse viewpoint to the Board’s deliberations. Dr. Phillips has been designated an Audit Committee financial expert. |

6

|

James A. Runde Age 69 Director Since 2006 Committees: |

Mr. Runde is a special advisor and a former Vice Chairman of Morgan Stanley, a financial services provider, where he was employed from 1974 until his retirement in 2015. He was a member of the Board of Directors of Burlington Resources Inc. prior to its acquisition by ConocoPhillips in 2006. Mr. Runde serves as a Trustee Emeritus of Marquette University and the Pierpont Morgan Library. Mr. Runde brings to Kroger’s Board a strong financial background, having led a major financial services provider. He has served on the compensation committee of a major corporation. | |

|

Ronald L. Sargent Age 60 Director Since 2006 Committees: |

Mr. Sargent is Chairman and Chief Executive Officer of Staples, Inc., a business products retailer, where he has been employed since 1989. Prior to joining Staples, Mr. Sargent spent 10 years with Kroger in various positions. In addition to serving as a director of Staples, Mr. Sargent is a director of Five Below, Inc. During the past five years, he was a director of Mattel, Inc. and The Home Depot, Inc. Mr. Sargent has over 35 years of retail experience, first with Kroger and then with increasing levels of responsibility and leadership at Staples, Inc. His efforts helped carve out a new market niche for the international retailer that he leads. His understanding of retail operations and consumer insights are of particular value to the Board. Mr. Sargent has been designated an Audit Committee financial expert. | |

|

Bobby S. Shackouls Age 65 Director Since 1999 Committees: |

Mr. Shackouls was Chairman of the Board of Burlington Resources Inc., a natural resources business, from July 1997 until its merger with ConocoPhillips in 2006 and its President and Chief Executive Officer from December 1995 until 2006. Mr. Shackouls was also the President and Chief Executive Officer of Burlington Resources Oil and Gas Company (formerly known as Meridian Oil Inc.), a wholly-owned subsidiary of Burlington Resources, from 1994 to 1995. Mr. Shackouls is a director of Plains GP Holdings, L.P. and Oasis Petroleum Inc. During the past five years, Mr. Shackouls was a director of ConocoPhillips and PNGS GP LLC, the general partner of PAA Natural Gas Storage, L.P. Mr. Shackouls previously served as Kroger’s Lead Director. Mr. Shackouls brings to the Board the critical thinking that comes with a chemical engineering background, as well as his experience leading a major natural resources company, coupled with his corporate governance expertise. |

The Board of Directors Recommends a Vote For Each Director Nominee.

7

Information Concerning the Board of Directors

Board Leadership Structure and Lead Independent Director

The Board is currently composed of eleven independent non-employee directors and one management director, Mr. McMullen, the Chairman and CEO. Kroger has a balanced governance structure in which independent directors exercise meaningful and vigorous oversight.

In addition, as provided in the Guidelines on Issues of Corporate Governance (the “Guidelines”), the Board has designated one of the independent directors as Lead Director. The Lead Director works with the Chairman to share governance responsibilities, facilitate the development of Kroger’s strategy and grow shareholder value. The Lead Director serves a variety of roles, consistent with current best practices, including:

| ● | reviewing and approving Board meeting

agendas, materials and schedules to confirm the appropriate topics are reviewed and sufficient time is allocated to

each; |

| ● | serving as the principal liaison between

the Chairman, management and the non-management directors; |

| ● | presiding at the executive sessions of

independent directors and at all other meetings of the Board at which the Chairman is not present;

|

| ● | calling meetings of independent

directors at any time; and |

| ● |

serving as the Board’s representative for any consultation and direct communication, following a request, with major shareholders. The Lead Director carries out these

responsibilities in numerous ways, including: |

| ● | facilitating communication and

collegiality among the Board; |

| ● | soliciting direct feedback from

non-executive directors; |

| ● | overseeing the succession process,

including site visits and meeting with a wide range of corporate

and division management associates;

|

| ● | meeting with the CEO frequently to

discuss strategy; |

| ● | serving as a sounding board

and advisor to the CEO; and |

| ● | discussing Company matters with other directors between meetings. |

Unless otherwise determined by the Board, the chair of the Corporate Governance Committee is designated as the Lead Director. Robert Beyer, an independent director and the chair of the Corporate Governance Committee, is currently the Lead Director. Mr. Beyer is an effective Lead Director for Kroger due to, among other things, his independence, his deep strategic and operational understanding of Kroger obtained while serving as a Kroger director, his insight into corporate governance, his experience on the boards of other large publicly traded companies, and his commitment and engagement to carrying out the roles and responsibilities of the Lead Director.

With respect to the roles of Chairman and CEO, the Guidelines provide that the Board will determine when it is in the best interests of Kroger and our shareholders for the roles to be separated or combined, and the Board exercises its discretion as it deems appropriate in light of prevailing circumstances. Upon retirement of our former Chairman, David B. Dillon, on December 31, 2014, the Board determined that it is in the best interests of Kroger and our shareholders for one person to serve as the Chairman and CEO, as was the case from 2004 through 2013. The Board believes that this leadership structure improves the Board’s ability to focus on key policy and operational issues and helps the Company operate in the long-term interests of shareholders. Additionally, this structure provides an effective balance between strong Company leadership and appropriate safeguards and oversight by independent directors. The Board believes that the combination or separation of these positions should continue to be considered as part of the succession planning process, as was the case in 2003 and 2014 when the roles were separated.

8

The Board and each of its committees conduct an annual self-evaluation to determine whether the Board is functioning effectively at each level. As part of this annual self-evaluation, the Board assesses whether the current leadership structure continues to be appropriate for Kroger and its shareholders. The Guidelines provide the flexibility for the Board to modify our leadership structure in the future as appropriate. We believe that Kroger, like many U.S. companies, has been well-served by this flexible leadership structure.

Committees of the Board of Directors

To assist the Board in undertaking its responsibilities, and to allow deeper engagement in certain areas of company oversight, the Board has established five standing committees: Audit, Compensation, Corporate Governance, Financial Policy and Public Responsibilities. All committees are composed exclusively of independent directors, as determined under the NYSE listing standards. The current charter of each Board committee is available on our website at ir.kroger.com under Corporate Governance – Committee Composition.

| Name of Committee, Number

of Meetings, and Current Members |

Committee Functions | |

|

Audit Committee Meetings in 2015: 5 Members: |

●Oversees the

Company’s financial reporting and accounting matters, including review of

the Company’s financial statements and the audit thereof, the Company’s

financial reporting and accounting process, and the Company’s systems of

internal control over financial reporting

●Selects, evaluates

and oversees the compensation and work of the independent registered

public accounting firm and reviews its performance, qualifications, and

independence

●Oversees and

evaluates the Company’s internal audit function, including review of its

audit plan, policies and procedures and significant

findings

●Oversees risk

assessment and risk management, including review of legal or regulatory

matters that could have a significant effect on the

Company

●Reviews and monitors

the Company’s compliance programs, including the whistleblower

program | |

|

Compensation Committee Meetings in 2015: 5 Members: |

●Recommends for

approval by the independent directors the compensation of the CEO, and

determines the compensation of other senior management and

directors

●Administers the

Company’s executive compensation policies and programs, including

determining grants of equity awards under the

plans

●Has sole authority

to retain and direct the committee’s compensation

consultant

●Assists the full

Board with senior management succession

planning |

9

| Name of

Committee, Number of Meetings, and Current Members |

Committee Functions |

|

Corporate Governance

Committee |

●Oversees the

Company’s corporate governance policies and

procedures

●Develops criteria

for selecting and retaining directors and identifies and recommends

qualified candidates to be director nominees

●Designates

membership and chairs of Board committees

●Reviews the Board’s

performance and director independence

●Reviews, along with

the other independent directors, the performance of the

CEO |

|

Financial Policy

Committee |

●Reviews and

recommends financial policies and practices

●Oversees management

of the Company’s financial resources

●Reviews the

Company’s annual financial plan, significant capital investments, plans

for major acquisitions or sales, issuance of new common or preferred

stock, dividend policy, creation of additional debt and other capital

structure considerations including additional leverage or dilution in

ownership

●Monitors the

investment management of assets held in pension and profit sharing plans

administered by the Company |

|

Public Responsibilities

Committee |

●Reviews the

Company’s policies and practices affecting its social and public

responsibility as a corporate citizen, including: community relations,

charitable giving, supplier diversity, sustainability, government

relations, political action, consumer and media relations, food and

pharmacy safety and the safety of customers and

employees

●Reviews and examines

the Company’s evaluation of and response to changing public expectations

and public issues affecting the

business |

Director Nominee Selection Process

The Corporate Governance Committee is responsible for recommending to the Board a slate of nominees for election at each annual meeting of shareholders. The Corporate Governance Committee recruits candidates for Board membership through its own efforts and through recommendations from other directors and shareholders. In addition, the Corporate Governance Committee has retained an independent search firm to assist in identifying and recruiting director candidates who meet the criteria established by the Corporate Governance Committee.

These criteria are:

| ● | Demonstrated ability in fields considered

to be of value in the deliberation and long-term planning of the Board, including business management, public

service, education, technology, law and government; |

| ● | Highest standards of personal character and

conduct; |

| ● | Willingness to fulfill the obligations of

directors and to make the contribution of which he or she is capable, including regular attendance and participation

at Board and committee meetings, and preparation for all meetings, including review of all meeting

materials provided in advance of the meeting; and |

| ● | Ability to understand the perspectives of Kroger’s customers, taking into consideration the diversity of our customers, including regional and geographic differences. |

10

The Corporate Governance Committee considers racial, ethnic and gender diversity to be important elements in promoting full, open and balanced deliberations of issues presented to the Board. The Corporate Governance Committee considers director candidates that help the Board reflect the diversity of our shareholders, associates, customers and the communities in which we operate. Some consideration also is given to the geographic location of director candidates in order to provide a reasonable distribution of members from Kroger’s operating areas.

At least annually, the Corporate Governance Committee actively engages in Board succession planning. The Corporate Governance Committee takes into account the Board and committee evaluations regarding the specific backgrounds, skills, and experiences that would contribute to overall Board and committee effectiveness as well as the future needs of the Board and its committees in light of Kroger’s current and future business strategies and the skills and qualifications of directors who are expected to retire in the future.

Candidates Nominated by Shareholders

The Corporate Governance Committee will consider shareholder recommendations for nominees for membership on the Board of Directors. If shareholders wish to nominate a person or persons for election to the Board at our 2017 annual meeting, written notice must be submitted to Kroger’s Secretary, and received at our executive offices, in accordance with Kroger’s Regulations, not later than March 28, 2017. Such notice should include the name, age, business address and residence address of such person, the principal occupation or employment of such person, the number of Kroger common shares owned of record or beneficially by such person and any other information relating to the person that would be required to be included in a proxy statement relating to the election of directors. The Secretary will forward the information to the Corporate Governance Committee for its consideration. The Corporate Governance Committee will use the same criteria in evaluating candidates submitted by shareholders as it uses in evaluating candidates identified by the Corporate Governance Committee, as described above.

Corporate Governance Guidelines

The Board has adopted the Guidelines. The Guidelines, which include copies of the current charters for each of the five standing committees of the Board, are available on our website at ir.kroger.com under Corporate Governance – Highlights. Shareholders may obtain a copy of the Guidelines by making a written request to Kroger’s Secretary at our executive offices.

Independence

The Board has determined that all of the non-employee directors have no material relationships with Kroger and, therefore, are independent for purposes of the New York Stock Exchange listing standards. The Board made its determination based on information furnished by all members regarding their relationships with Kroger and its management, and other relevant information. After reviewing the information, the Board determined that all of the non-employee directors were independent because:

| ● | they all satisfied the criteria for

independence set forth in Rule 303A.02 of the NYSE Listed Company Manual, |

| ● | the value of any business transactions

between Kroger and entities with which the directors are affiliated falls below the thresholds identified by the

NYSE listing standards, and |

| ● | none had any material relationships with Kroger except for those arising directly from their performance of services as a director for Kroger. |

In determining that Mr. Sargent is independent, the Board considered transactions during fiscal 2015 between Kroger and Staples, Inc. (where Mr. Sargent is Chairman and CEO) and determined that the amount of business fell below the thresholds set by the NYSE listing standards. The transactions involved the purchase of goods by Kroger in the ordinary course of business totaling approximately $12 million and represented less than 0.06% of Staples’ annual consolidated gross revenue. Kroger periodically employs a bidding process or negotiations following a benchmarking of costs of products from various vendors for the items purchased from Staples and awards the business based on the results of that process.

11

Audit Committee Expertise

The Board has determined that Anne Gates, Susan M. Phillips and Ronald L. Sargent, independent directors who are members of the Audit Committee, are “audit committee financial experts” as defined by applicable SEC regulations and that all members of the Audit Committee are “financially literate” as that term is used in the NYSE listing standards and are independent in accordance with Rule 10A-3 of the Securities Exchange Act of 1934.

Code of Ethics

The Board has adopted The Kroger Co. Policy on Business Ethics, applicable to all officers, employees and directors, including Kroger’s principal executive, financial and accounting officers. The Policy is available on our website at ir.kroger.com under Corporate Governance – Highlights. Shareholders may also obtain a copy of the Policy by making a written request to Kroger’s Secretary at our executive offices.

Communications with the Board

The Board has established two separate mechanisms for shareholders and interested parties to communicate with the Board. Any shareholder or interested party who has concerns regarding accounting, improper use of Kroger assets or ethical improprieties may report these concerns via the toll-free hotline (800-689-4609) or email address ([email protected]) established by the Board’s Audit Committee. The concerns are investigated by Kroger’s Vice President of Auditing and reported to the Audit Committee as deemed appropriate by the Vice President of Auditing.

Shareholders or interested parties also may communicate with the Board in writing directed to Kroger’s Secretary at our executive offices. Communications relating to personnel issues or our ordinary business operations, or seeking to do business with us, will be forwarded to the business unit of Kroger that the Secretary deems appropriate. All other communications will be forwarded to the chair of the Corporate Governance Committee for further consideration. The chair of the Corporate Governance Committee will take such action as he or she deems appropriate, which may include referral to the full Corporate Governance Committee or the entire Board.

Attendance

The Board held five meetings in fiscal year 2015. During fiscal year 2015, all incumbent directors attended at least 75% of the aggregate number of meetings of the Board and committees on which that director served. Members of the Board are expected to use their best efforts to attend all annual meetings of shareholders. All eleven members then serving on the Board attended last year’s annual meeting.

Independent Compensation Consultants

The Compensation Committee directly engages a compensation consultant from Mercer Human Resource Consulting to advise the Compensation Committee in the design of Kroger’s executive compensation. In 2015, Kroger paid that consultant $390,767 for work performed for the Compensation Committee. Kroger, on management’s recommendation, retained the parent and affiliated companies of Mercer Human Resource Consulting to provide other services for Kroger in 2015, for which Kroger paid $2,339,577. These other services primarily related to insurance claims (for which Kroger was reimbursed by insurance carriers as claims were adjusted), insurance brokerage and bonding commissions provided by Marsh USA Inc., and pension plan compliance and actuary services provided by Mercer Inc. Kroger also made payments to affiliated companies for insurance premiums that were collected by the affiliated companies on behalf of insurance carriers, but these amounts are not included in the totals referenced above, as the amounts were paid over to insurance carriers for services provided by those carriers.

12

Although neither the Compensation Committee nor the Board expressly approved the other services, after taking into consideration the NYSE’s independence standards and the SEC rules, the Compensation Committee determined that the consultant is independent and his work has not raised any conflict of interest because:

| ● | the consultant was first engaged by the

Compensation Committee before he became associated with Mercer; |

| ● | the consultant works exclusively for the

Compensation Committee and not for our management; |

| ● | the consultant does not benefit from the

other work that Mercer’s parent and affiliated companies perform for Kroger; and

|

| ● | neither the consultant nor the consultant’s team perform any other services for Kroger. |

The Compensation Committee may engage an additional compensation consultant from time to time as it deems advisable.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee was an officer or employee of Kroger during fiscal 2015, and no member of the Compensation Committee is a former officer of Kroger or was a party to any disclosable related person transaction involving Kroger. During fiscal 2015, none of our executive officers served on the board of directors or on the compensation committee of any other entity that has or had executive officers serving as a member of Kroger’s Board of Directors or Compensation Committee of the Board.

Board Oversight of Enterprise Risk

While risk management is primarily the responsibility of Kroger’s management team, the Board is responsible for strategic planning and overall supervision of our risk management activities. The Board’s oversight of the material risks faced by Kroger occurs at both the full Board level and at the committee level.

The Board receives presentations throughout the year from various department and business unit leaders that include discussion of significant risks as necessary. At each Board meeting, the Chairman and CEO addresses matters of particular importance or concern, including any significant areas of risk that require Board attention. Additionally, through dedicated sessions focusing entirely on corporate strategy, the full Board reviews in detail Kroger’s short- and long-term strategies, including consideration of significant risks facing Kroger and their potential impact. The independent directors, in executive sessions led by the Lead Director, address matters of particular concern, including significant areas of risk, that warrant further discussion or consideration outside the presence of Kroger employees. At the committee level, reports are given by management subject matter experts to each committee on risks within the scope of their charters.

The Audit Committee has oversight responsibility not only for financial reporting of Kroger’s major financial exposures and the steps management has taken to monitor and control those exposures, but also for the effectiveness of management’s processes that monitor and manage key business risks facing Kroger, as well as the major areas of risk exposure and management’s efforts to monitor and control that exposure. The Audit Committee also discusses with management its policies with respect to risk assessment and risk management.

Management, including our Chief Ethics and Compliance Officer, provides regular updates throughout the year to the respective Board committees regarding management of the risks they oversee, and each of these committees reports on risk to the full Board at each regular meeting of the Board.

We believe that our approach to risk oversight, as described above, optimizes our ability to assess inter-relationships among the various risks, make informed cost-benefit decisions, and approach emerging risks in a proactive manner for Kroger. We also believe that our risk structure complements our current Board leadership structure, as it allows our independent directors, through the five fully independent Board committees, and in executive sessions of independent directors led by the Lead Director, to exercise effective oversight of the actions of management, led by Mr. McMullen as Chairman of the Board and CEO, in identifying risks and implementing effective risk management policies and controls.

13

Compensation Discussion and Analysis

Executive Summary

Named Executive Officers

This Compensation Discussion and Analysis provides a discussion and analysis of our compensation program for our named executive officers (“NEOs”). For the 2015 fiscal year ended January 30, 2016, the NEOs were:

| Name | Title | |

| W. Rodney McMullen | Chairman and Chief Executive Officer | |

| J. Michael Schlotman | Executive Vice President and Chief Financial Officer | |

| Michael J. Donnelly | Executive Vice President of Merchandising | |

| Christopher T. Hjelm | Executive Vice President and Chief Information Officer | |

| Frederick J. Morganthall II | Executive Vice President of Retail Operations |

Messrs. Schlotman, Donnelly, Hjelm and Morganthall were each promoted to the position of Executive Vice President effective September 1, 2015.

Executive Compensation in Context: Our Growth Plan, Financial Strategy and Fiscal Year 2015 Results

Kroger’s growth plan includes four key performance indicators: positive identical supermarket sales without fuel (“ID Sales”) growth, slightly expanding non-fuel first in, first out (“FIFO”) operating margin, growing return on invested capital (“ROIC”), and annual market share growth. In 2015, we met or exceeded our goals for each of these performance indicators:

| ● | ID Sales. ID Sales increased 5.0% from 2014. Through 2015, we have achieved

49 consecutive quarters of positive

ID Sales growth. |

| ● | ROIC. Our ROIC for 2015 was 13.93%, compared to 13.76% for 2014,

excluding Roundy’s (acquired in

December 2015). |

| ● | Non-Fuel FIFO Operating

Margin. We exceeded our commitment to slightly expand

FIFO operating margin, excluding

fuel and Roundy’s on a rolling four quarters basis. |

| ● | Market

Share. Our market share grew for an eleventh consecutive

year. |

| Other highlights

of the year include: | |

| ● | Net earnings per

diluted share were $2.06. |

| ● | We exceeded our

long-term, net earnings per diluted share growth rate of 8-11% in

2015. |

| ● | We reduced

operating costs excluding fuel as a percentage of sales for the eleventh

consecutive year. |

| Also during

2015, we met all of our objectives with regard to our financial

strategy: | |

| ● | Maintain our

current investment grade debt rating. Our net total debt

to adjusted EBITDA ratio decreased,

even while investing approximately $870 million in our merger with

Roundy’s late in the

year. |

| ● | Repurchase

shares. In 2015, we repurchased $703 million in Kroger

common shares. |

| ● | Fund the

dividend. We returned $385 million to shareholders

through our dividend in 2015, and we increased our dividend for the ninth consecutive year since we

reinstated our dividend in 2006. |

| ● | Increase capital investments. Our 2015 cash flow generation was strong, allowing us to make $3.3 billion in capital investments during the year, excluding mergers, acquisitions and purchases of leased facilities. |

The compensation of our NEOs in 2015 reflects Kroger’s short-term and long-term goals and outcomes. Total compensation for the year is an indicator of how well Kroger performed compared to our business plan, reflecting how our compensation program responds to business challenges and the marketplace.

14

Summary of Key Compensation Practices

| What we do: | What we do not do: |

|

✓Align pay and

performance

✓Significant share ownership guidelines of 5x

salary for our CEO

✓Multiple performance metrics under our short- and

long-term performance-based plans discourage excessive risk

taking

✓Balance between short-term and long-term compensation

discourages short-term risk taking at the expense of long-term

results

✓Engagement of an independent compensation

consultant

✓Robust clawback policy

✓Ban on hedging and pledging of Kroger

securities

✓Limited perquisites |

×No employment contracts with executives

×No special severance or change of control programs applicable only

to executive officers

×No gross-up payments were made to executives under Kroger

plans

×No re-pricing or backdating of options

×No guaranteed salary increases or bonuses

×No payment of dividends or dividend equivalents until performance

units are earned

×No single-trigger cash severance benefits

upon a change in control |

Summary of Fixed and At-Risk Pay Elements

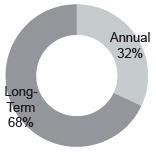

The fixed and at-risk pay elements of NEO compensation are reflected in the following table and charts. The amounts used in the charts are based on the amounts reported in the Summary Compensation Table for 2015, excluding the Change in Pension Value and Nonqualified Deferred Compensation Earnings column.

| Fixed | At-Risk | ||||

| ‹—————————— Annual ————— | ———————› | ‹—————— Long-Term ——————› | |||

| Pay | Base Salary | All Other | Annual Cash | Long-Term | Restricted Stock |

| Element | Compensation | Bonus | Cash Bonus and | and Stock Options | |

| Performance Units | (time-based | ||||

| (the “Long-Term | equity awards) | ||||

| Incentive Plan”) | |||||

|

Description |

●Fixed cash compensation

●Reviewed annually

●No automatic or guaranteed increases |

●Insurance premiums paid by the Company

●Dividends paid on unvested restricted stock

●Matching and automatic contributions to defined contribution

benefit plans |

●Variable cash compensation

●Payout depends on actual performance against annually established

goals |

●Variable compensation payable as long-term cash bonus and

performance units

●3-year performance period

●Payout depends on

actual performance against established goals |

●Stock options vest over 5

years

●Exercise price of stock

options is closing price on day of grant

●Restricted stock

vests over 3 or 5 years |

15

| Fixed | At-Risk | ||||

| ‹———————————— Annual ———— | ———————› | ‹—————— Long-Term ——————› | |||

|

Purpose |

●Provide a base level of cash compensation

●Recognize individual performance, scope of responsibility and

experience |

●Provide benefits competitive with peers |

●Metrics and targets align with annual business goals

●Rewards and incentivizes approximately 13,000 Kroger employees,

including NEOs, for annual performance on key financial and operational

measures |

●Metrics and targets align with long-term business

strategy

●Rewards and incentivizes approximately 160 key employees, including

the NEOs, for long-term performance on key financial and operational

measures

●Drives sustainable

performance that ties to long-term value creation for

shareholders |

●Retain executive

talent

●Align the interests of

executives with long-term shareholder value

●Provide direct

alignment to stock price

appreciation |

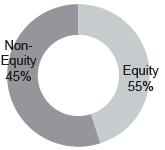

|

CEO

87% of CEO pay is At

Risk |

Average of Other NEOs  82% of Other NEO pay is At Risk | |

|

CEO

68% of CEO pay is Long-Term |

Average of Other NEOs  68% of Other NEO pay is Long-Term |

16

|

CEO

60% of CEO pay is Equity |

Average of Other NEOs

55% of Other NEO pay is Equity |

The following discussion and analysis addresses the compensation of the NEOs and the factors considered by the Compensation Committee in setting compensation for the NEOs and, in the case of the CEO’s compensation, making recommendations to the independent directors. Additional detail is provided in the compensation tables and the accompanying narrative disclosures that follow this discussion and analysis.

Our Compensation Philosophy and Objectives

As one of the largest retailers in the world, our executive compensation philosophy is to attract and retain the best management talent and to motivate these employees to achieve our business and financial goals. Kroger’s incentive plans are designed to reward the actions that lead to long-term value creation. The Compensation Committee believes that there is a strong link between our business strategy, the performance metrics in our short-term and long-term incentive programs, and the business results that drive shareholder value.

We believe our strategy creates value for shareholders in a manner consistent with our focus on our core values: honesty, integrity, respect, inclusion, diversity and safety.

To achieve our objectives, the Compensation Committee seeks to ensure that compensation is competitive and that there is a direct link between pay and performance. To do so, it is guided by the following principles:

| ● |

A significant portion of pay should

be performance-based, with the percentage of total pay tied to performance

increasing proportionally with an executive’s level of

responsibility. |

| ● |

Compensation should include

incentive-based pay to drive performance, providing superior pay for

superior performance, including both a short- and long-term

focus. |

| ● |

Compensation policies should include

an opportunity for, and a requirement of, equity ownership to align the

interests of executives and shareholders. |

| ● |

Components of compensation should be tied to an evaluation of business and individual performance measured against metrics that directly drive our business strategy. The

Compensation Committee has three related objectives regarding

compensation: |

| ● |

First, the Compensation Committee

believes that compensation must be designed to attract and retain those

best suited to fulfill the challenging roles that officers play at Kroger.

|

| ● |

Second, a majority of compensation

should help align the interests of our officers with the interests of our

shareholders. |

| ● |

Third, compensation should create strong incentives for the officers to achieve the annual business plan targets established by the Board, and to achieve Kroger’s long-term strategic objectives. |

17

Components of Executive Compensation at Kroger

Compensation for our NEOs is comprised of the following:

| ●

Annual Compensation: | |

| ➢ | Salary |

| ➢ | Performance-Based Annual Cash

Bonus |

| ●

Long-Term Compensation: | |

| ➢ | Performance-Based Long-Term

Incentive Plan (consisting of a long-term cash bonus and performance units) |

| ➢ | Non-qualified stock

options |

| ➢ | Restricted

stock |

|

● Retirement and other benefits ● Limited perquisites | |

The annual and long-term performance-based compensation awards described herein were made pursuant to our 2011 Long-Term Incentive and Cash Bonus Plan and our 2014 Long-Term Incentive and Cash Bonus Plan, each of which was approved by our shareholders in 2011 and 2014, respectively.

Annual Compensation – Salary

Our philosophy with respect to salary is to provide a sufficient and stable source of fixed cash compensation. All of our compensation cannot be at-risk or long-term. It is important to provide a meaningful annual salary to attract and retain a high caliber leadership team, and to have an appropriate level of cash compensation that is not variable.

Salaries for the NEOs (with the exception of the CEO) are established each year by the Compensation Committee, in consultation with the CEO. The CEO’s salary is established by the independent directors. Salaries for the NEOs are reviewed annually in June.

The amount of each NEO’s salary is influenced by numerous factors including:

| ● | An assessment of individual

contribution in the judgment of the CEO and the Compensation Committee (or, in the case of the CEO, of the

Compensation Committee and the rest of the independent directors); |

| ● | Benchmarking with comparable

positions at peer group companies; |

| ● | Tenure in role;

and |

| ● | Relationship to other Kroger executives’ salaries. |

The assessment of individual contribution is a qualitative determination, based on the following factors:

| ● | Leadership;

|

| ● | Contribution to the officer

group; |

| ● | Achievement of established

objectives, to the extent applicable; |

| ● | Decision-making

abilities; |

| ● | Performance of

the areas or groups directly reporting to the

officer; |

| ● | Increased

responsibilities; |

| ● | Strategic

thinking; and |

| ● | Furtherance of Kroger’s core values. |

18

The amounts shown below reflect the salaries of the NEOs effective at the end of each fiscal year.

| Salary | ||||||||

| 2013 | 2014 | 2015 | ||||||

| W. Rodney McMullen(1) | $ | 1,100,000 | $ | 1,200,000 | $ | 1,240,000 | ||

| J. Michael Schlotman(2) | $ | 735,000 | $ | 760,000 | $ | 840,000 | ||

| Michael J. Donnelly(2) | $ | 643,560 | $ | 662,900 | $ | 750,000 | ||

| Christopher T. Hjelm(2)(3) | $ | 700,000 | ||||||

| Frederick J. Morganthall II(2)(3) | $ | 670,000 | ||||||

| (1) | Mr. McMullen was named CEO of Kroger as of January 1, 2014 and Chairman of the Board as of January 1, 2015. | |

| (2) | Messrs. Schlotman, Donnelly, Hjelm and Morganthall were each promoted to the position of Executive Vice President effective September 1, 2015. | |

| (3) | Messrs. Hjelm and Morganthall became NEOs in 2015. | |

Annual Compensation – Performance-Based Annual Cash Bonus

The NEOs, along with approximately 13,000 of their fellow Kroger associates, participate in a performance-based annual cash bonus plan. Approximately 7,000 of those associates are eligible for the same plan as the NEOs. The remaining associates are eligible for an annual cash bonus plan of which 40% is based on the Kroger corporate plan and 60% is based on the metrics and targets for their respective supermarket division or operating unit of the Company.

Over time, the Compensation Committee and our independent directors have placed an increased emphasis on our strategic plan by making the targets more difficult to achieve. The annual cash bonus plan is structured to encourage high levels of performance. A threshold level of performance must be achieved before any payouts are earned, while a payout of up to 200% of target can be achieved for superior performance.

The amount of annual cash bonus that the NEOs earn each year is based upon Kroger’s performance compared to targets established by the Compensation Committee and the independent directors based on the business plan adopted by the Board of Directors.

The annual cash bonus plan is designed to encourage decisions and behavior that drive the annual operating results and the long-term success of the Company. Kroger’s success is based on a combination of factors, and accordingly the Compensation Committee believes that it is important to encourage behavior that supports multiple elements of our business strategy.

Establishing Annual Cash Bonus Potentials

The Compensation Committee establishes annual cash bonus potentials for each NEO, other than the CEO, whose annual cash bonus potential is established by the independent directors. Actual payouts, which can exceed 100% of the potential amounts but may not exceed 200% of the potential amounts, represent the extent to which performance meets or exceeds the goals established by the Compensation Committee. Actual payouts may be as low as zero if performance does not meet the goals established by the Compensation Committee.

The Compensation Committee considers multiple factors in making its determination or recommendation as to annual cash bonus potentials:

| ● | The individual’s level within

the organization, as the Compensation Committee believes that more

senior executives should have a more substantial

part of their compensation dependent upon Kroger’s performance; |

| ● | The individual’s salary, as the Compensation Committee believes that a significant portion of a NEO’s total cash compensation should be dependent upon Kroger’s performance; |

19

| ● | The officer’s level in the

organization and the internal relationship of annual cash bonus

potentials within

Kroger; |

| ● | Individual

performance; |

| ● | The recommendation of the CEO

for all NEOs other than the CEO; and |

| ● | The compensation consultant’s benchmarking report regarding annual cash bonus potential and total compensation awarded by our peer group. |

The annual cash bonus potential in effect at the end of the fiscal year for each NEO is shown below. Actual annual cash bonus payouts are prorated to reflect changes, if any, to bonus potentials during the year.

| Annual Cash Bonus Potential | ||||||||

| 2013 | 2014 | 2015 | ||||||

| W. Rodney McMullen(1) | $ | 1,500,000 | $ | 1,600,000 | $ | 1,650,000 | ||

| J. Michael Schlotman(2) | $ | 550,000 | $ | 550,000 | $ | 600,000 | ||

| Michael J. Donnelly(2) | $ | 425,000 | $ | 550,000 | $ | 600,000 | ||

| Christopher T. Hjelm(2)(3) | $ | 600,000 | ||||||

| Frederick J. Morganthall II(2)(3) | $ | 600,000 | ||||||

| (1) | Mr. McMullen was named CEO of Kroger as of January 1, 2014 and Chairman of the Board as of January 1, 2015. | |

| (2) | Messrs. Schlotman, Donnelly, Hjelm and Morganthall were each promoted to the position of Executive Vice President effective September 1, 2015. | |

| (3) | Messrs. Hjelm and Morganthall became NEOs in 2015. | |

Annual Cash Bonus Plan Metrics and Connection to our Business Plan

The annual cash bonus plan has the following measurable performance metrics, all of which are interconnected, and individually necessary to sustain our business model and achieve our growth strategy:

| Metric | Weight | Rationale for Use |

|

ID Sales |

30% |

●ID Sales represent sales,

without fuel, at our supermarkets that have

been open without expansion or relocation for five full quarters.

●We believe this is

the best measure of the real growth of our

sales across the enterprise. A key driver of our model is strong ID Sales; it is the engine that fuels our

growth. |

|

EBITDA without Fuel(1) |

30% |

●EBITDA is an important way

for us to evaluate our earnings from

operating the business; we cannot achieve solid EBITDA without a strong operating model. This is one of the

closest measures we have for how much cash our

business generates after operating

expenses.

●Unlike earnings per

share, which can be affected by management

decisions on share buybacks, this measure of earnings is relevant for all of our approximately 13,000

associates who are eligible for the annual cash

bonus plan. |

20

| Metric | Weight | Rationale for Use |

|

Customer 1st Strategy |

30% |

●Kroger’s Customer 1st

Strategy is the focus, in all of

Kroger’s decision-making, on the customer.

The “Four Keys” of Kroger’s Customer

1st Strategy are People,

Products, Shopping Experience and

Price.

●This proprietary

metric measures the improvement in how Kroger is

perceived by customers in each of the Four

Keys.

●Annual cash bonus

payout is based on certain elements of the

Customer 1st Plan, to highlight

annual objectives that are intended to

receive the most focused attention in that

year. |

|

Total Operating Costs as a Percentage of Sales, without Fuel(2) |

10% |

●An essential part of

Kroger’s model is to increase productivity and

efficiency, and to take costs out of the business in a sustainable way.

●We strive to be

disciplined, so that as the Company grows, expenses are properly managed. |

|

Total of 4 Metrics |

100% |

|

|

Fuel Bonus |

5% “Kicker” |

●An additional 5% is earned

if Kroger achieves three goals with respect to its

supermarket fuel operations: targeted fuel EBITDA, an increase in total gallons sold, and additional

fuel centers placed in

service.

●The fuel bonus was

added to the annual cash bonus plan as an

incentive to encourage the addition of fuel centers at a faster rate, while maintaining fuel EBITDA and

fuel gallon

growth.

●The fuel bonus of 5%

is only available if all three measures are met.

If any of the three fuel goals are not met, no portion of the fuel bonus is

earned. |

| (1) | EBITDA is calculated as operating profit plus depreciation and amortization, excluding fuel and consolidated variable interest entities. | |

| (2) | Total Operating Costs is calculated as the sum of (i) operating, general and administrative expenses, depreciation and amortization, and rent expense, without fuel, and (ii) warehouse and transportation costs, shrink, and advertising expenses, for our supermarket operations, without fuel. | |

The use of these four primary metrics creates checks and balances on the various behaviors and decisions that impact the long-term success of the Company. The ID Sales, EBITDA without fuel and Customer 1st Strategy metrics are weighted equally to highlight the need to simultaneously achieve all three metrics in order to maintain our growth.

We aligned the weighting of ID Sales and EBITDA without fuel metrics to emphasize sales growth balanced with the focus on profit. Kroger’s business is not sustainable if we merely increase our ID Sales, but do not have a corresponding increase in earnings. Furthermore, payouts in the ID Sales and EBITDA without fuel segments are interrelated. Achieving the goal for both the ID Sales and EBITDA without fuel results in a higher percentage payout on both elements. Achieving the target on one, but not the other will limit the payout percentage on both.

By supporting the Customer 1st Strategy and the Four Keys, we will better connect with our customers. Our unique competitive advantage is our ability to deliver on the Four Keys, which are the items that matter most to our customers, and it is that multi-faceted achievement that we believe drives our ID Sales growth.

As we strive to achieve our aggressive growth targets, we also continuously aim to reduce our operating costs as a percentage of sales, without fuel. Productivity improvements and other reductions in operating costs allow us to reduce costs in areas that do not matter to our customers so that we can

21

invest money in the areas that matter the most to our customers, like the Four Keys. We carefully manage operating cost reductions to ensure a consistent delivery of the customer experience. This again shows the need to have multiple metrics, to create checks and balances on the various behavior and decisions that are influenced by the design of the bonus plan.

Results of 2015 Annual Cash Bonus Plan

The 2015 goals established by the Compensation Committee, the actual 2015 results and the bonus percentage earned for each of the performance metrics of the annual cash bonus plan were as follows:

| Actual | ||||||||||||

| Performance | ||||||||||||

| Goals | Compared to | Amount | ||||||||||

| Target | Actual | Target | Weight | Earned | ||||||||

| Performance Metrics | Minimum | (100%) | Performance(1) | (A) | (B) | (A) x (B) | ||||||

| ID Sales | 2.1% | 4.1% | 5.0% | 134.3% | 30% | 40.3% | ||||||

| EBITDA without Fuel | $4.4384 | $5.2217 | $5.2351 | |||||||||

| Billion | Billion | Billion | 126.3%(2) | 30% | 37.9% | |||||||

| Customer 1st Strategy(3) | * | * | * | * | 30% | 39.0% | ||||||

| Over | Over | Over | 45.0% | 10% | 4.5% | |||||||

| Total Operating Costs as | budget by | budget by | budget by | |||||||||

| Percentage of Sales, | 25 basis | 5 basis | 16 basis | |||||||||

| without Fuel(4) | points | points | points | |||||||||

| 0% | 5.0% | |||||||||||

| Fuel Bonus(5) | [As described in the footnote below] | or 5% | ||||||||||

| Total Earned | 126.7% | |||||||||||

| (1) | Actual performance results exclude Roundy’s because the merger occurred after the performance goals were established. | |

| (2) | Under the terms of the plan, if ID Sales results exceed the target and EBITDA results exceed the target, then the payout percentage for reaching the EBITDA target is 125% rather than 100%. | |

| (3) | The Customer 1st Strategy component also was established by the Compensation Committee at the beginning of the year, but is not disclosed as it is competitively sensitive. | |

| (4) | Total Operating Costs without fuel were budgeted at 26.07% as a percentage of sales for fiscal year 2015. | |

| (5) | An additional 5% is earned if Kroger achieves three goals with respect to its supermarket fuel operations: achievement of the targeted fuel EBITDA of $242 million, an increase in total gallons sold of 3%,and achievement of 50 additional fuel centers placed in service. Actual results were: fuel EBITDA of $450 million; an increase in total gallons sold of 8.53%; and 57 additional fuel centers placed in service. | |

Following the close of the year, the Compensation Committee reviewed Kroger’s performance against each of the metrics outlined above and determined the extent to which Kroger achieved those objectives. The Compensation Committee believes our management produced outstanding results in 2015, measured against increasingly aggressive business plan objectives. Due to our performance when compared to the goals established by the Compensation Committee, and based on the business plan adopted by the Board, the NEOs and all other participants in the corporate annual cash bonus plan earned 126.7% of their bonus potentials.

In 2015, as in all years, the Compensation Committee retained discretion to reduce the annual cash bonus payout for all executive officers, including the NEOs, if the Compensation Committee determined for any reason that the bonus payouts were not appropriate given their assessment of Company performance. The independent directors retained that discretion for the CEO’s bonus. The Compensation Committee and the independent directors also retained discretion to adjust the goals for each metric

22

under the plan should unanticipated developments arise during the year. No adjustments were made to the goals in 2015. The Compensation Committee, and the independent directors in the case of the CEO, determined that the annual cash bonus payouts earned appropriately reflected the Company’s strong performance in 2015 and therefore should not be adjusted.

The actual annual cash bonus percentage payout for 2015 represented excellent performance that exceeded our business plan objectives, with the exception of operating costs as a percentage of sales, without fuel. The strong link between pay and performance is illustrated by a comparison of earned amounts under our annual cash bonus plan in previous years, such as 2009, 2010 and 2012, when payouts were less than 100%. In those years, we did not achieve all of our business plan objectives. A comparison of actual annual cash bonus percentage payouts in prior years demonstrates the variability of annual cash bonus incentive compensation and its strong link to our performance:

| Annual Cash Bonus | |||

| Fiscal Year | Payout Percentage | ||

| 2015 | 126.7 | % | |

| 2014 | 121.5 | % | |

| 2013 | 104.9 | % | |

| 2012 | 85.9 | % | |

| 2011 | 138.7 | % | |

| 2010 | 53.9 | % | |

| 2009 | 38.5 | % | |

| 2008 | 104.9 | % | |

| 2007 | 128.1 | % | |

| 2006 | 141.1 | % | |

As described above, the annual cash bonus payout percentage is applied to each NEO’s bonus potential, which is determined by the Compensation Committee, and the independent directors in the case of the CEO. The actual amounts of performance-based annual cash bonuses paid to the NEOs for 2015 are reported in the Summary Compensation Table in the “Non-Equity Incentive Plan Compensation” column and footnote 4 to that table.

Long-Term Compensation

The Compensation Committee believes in the importance of providing an incentive to the NEOs to achieve the long-term goals established by the Board. As such, a majority of compensation is conditioned on the achievement of the Company’s long-term goals and is delivered via four long-term compensation vehicles: long-term cash bonus, performance units, stock options and restricted stock. Long-term compensation promotes long-term value creation and discourages the over-emphasis of attaining short-term goals at the expense of long-term growth.

The Compensation Committee considers several factors in determining the target value of long-term compensation awarded to the NEOs or, in the case of the CEO, recommending to the independent directors the amount awarded. These factors include:

| ● | The compensation consultant’s

benchmarking report regarding long-term compensation awarded by our peer

group; |

| ● |

The officer’s level in the

organization and the internal relationship of long-term compensation

awards within Kroger; |

| ● | Individual performance;

and |

| ● | The recommendation of the CEO, for all NEOs other than the CEO. |

23