Form DEF 14A JAKKS PACIFIC INC For: Dec 16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant | x |

| Filed by a Party other than the Registrant | ¨ |

| Check the appropriate box: |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

JAKKS Pacific, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

JAKKS PACIFIC, INC.

2951 28TH STREET

SANTA MONICA, CA 90405

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 16, 2016

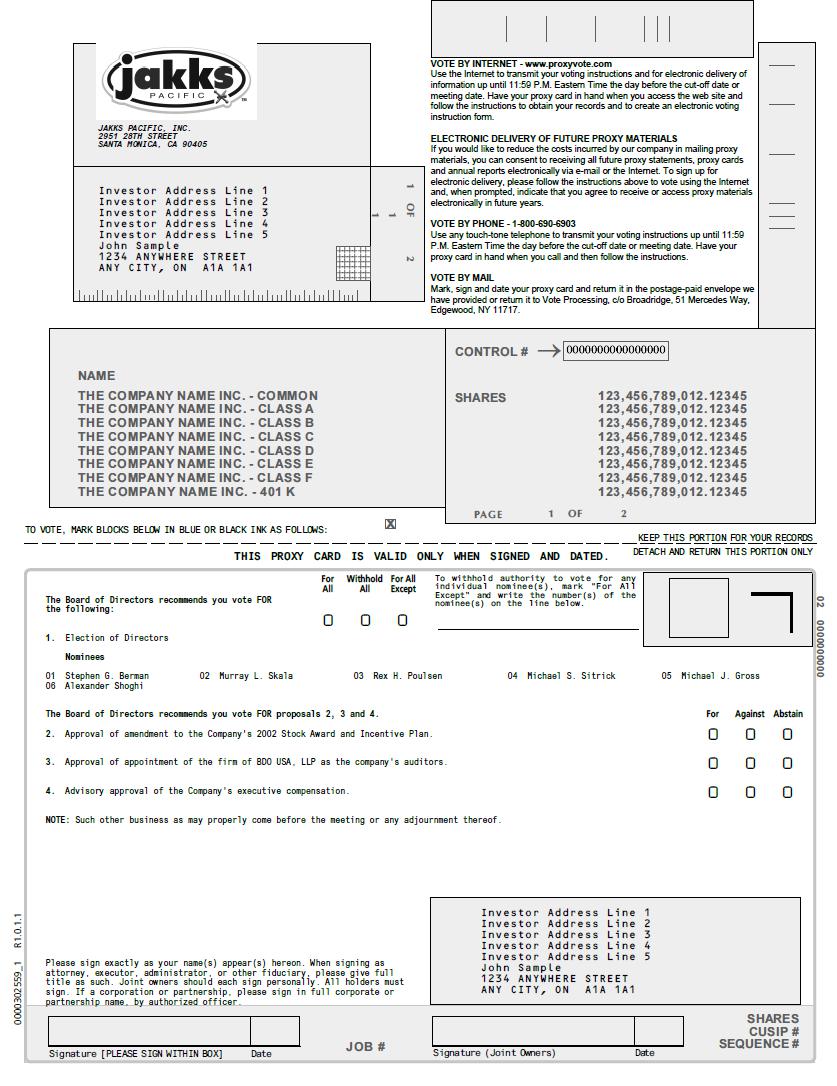

The Annual Meeting of Stockholders of JAKKS Pacific, Inc. (the “Company”) will be held at Sherwood Country Club, 320 West Stafford Road, Thousand Oaks, California 91361, on December 16, 2016 at 8:00 a.m. local time, to consider and act upon the following matters:

| (1) | To elect six (6) directors to serve for the ensuing year. |

| (2) | To approve an Amendment to the Company’s 2002 Stock Award and Incentive Plan. | |

| (3) | To ratify the selection by the Board of Directors of the firm of BDO USA, LLP, as the Company’s independent auditors for the current fiscal year. |

| (4) | To conduct an advisory vote on executive compensation. |

| (5) | To transact such other business as may properly come before the meeting or any adjournment thereof. |

Stockholders of record as of the close of business on October 21, 2016 will be entitled to notice of and to vote at the meeting or any adjournment thereof. The stock transfer books of the Company will remain open.

By Order of the Board of Directors,

Stephen G. Berman,

Secretary

Santa Monica, California

November 4, 2016

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE, DATE AND

SIGN THE ENCLOSED PROXY AND MAIL IT PROMPTLY IN THE ENCLOSED ENVELOPE

IN ORDER TO ENSURE REPRESENTATION OF YOUR SHARES. YOU MAY REVOKE THE

PROXY AT ANY TIME BEFORE THE AUTHORITY GRANTED THEREIN IS EXERCISED.

JAKKS PACIFIC, INC.

2951 28TH STREET

SANTA MONICA, CA 90405

PROXY STATEMENT FOR THE 2016 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 16, 2016

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of JAKKS Pacific, Inc. (the “Company”) for use at the 2016 Annual Meeting of Stockholders to be held on December 16, 2016, and at any adjournment of that meeting (the “Annual Meeting”). Throughout this Proxy Statement, “we,” “us” and “our” are used to refer to the Company.

The shares of our common stock represented by each proxy will be voted in accordance with the stockholder’s instructions as to each matter specified thereon, unless no instruction is given, in which case, the proxy will be voted in favor of such matter. A proxy may be revoked by the stockholder at any time before it is exercised by delivery of written revocation or a subsequently dated proxy to our corporate Secretary or by voting in person at the Annual Meeting.

We are mailing this Proxy Statement to our stockholders on or about November 4, 2016, accompanied by our Annual Report to Stockholders for our fiscal year ended December 31, 2015.

Voting Securities and Votes Required

At the close of business on October 21, 2016, the record date for the determination of stockholders entitled to vote at the Annual Meeting, there were outstanding and entitled to vote an aggregate of 20,011,876 shares of our common stock, par value $.001 per share. All holders of our common stock are entitled to one vote per share.

The affirmative vote of the holders of a majority of the shares of our common stock present or represented by proxy at the Annual Meeting is required for each of the agenda items, although with respect to the election of directors, directors receiving less than such votes may still be elected to the board as explained below and the voting on executive compensation is only advisory, all as hereinafter described.

With respect to approval of Proposal No. 4 (executive compensation), while our Board and its Compensation Committee will carefully consider the outcome of the vote expressed by our stockholders when making future executive compensation decisions, the vote will not be binding upon them.

A majority of the outstanding shares of our common stock represented in person or by proxy at the Annual Meeting will constitute a quorum at the meeting. All shares of our common stock represented in person or by proxy (including shares which abstain or do not vote for any reason with respect to one or more of the matters presented for stockholder approval) will be counted for purposes of determining whether a quorum is present at the Annual Meeting. Abstentions will be treated as shares that are present and entitled to vote for purposes of determining the number of shares present and entitled to vote with respect to any particular matter, but will not be counted as a vote in favor of such matter. Accordingly, an abstention from voting on a matter has the same legal effect as a vote against the matter. If a broker or nominee holding stock in “street name” indicates on the proxy that it does not have discretionary authority to vote as to a particular matter (“broker non-votes”), those shares will not be considered as present and entitled to vote with respect to such matter. Accordingly, a broker non-vote on a matter has no effect on the voting on such matter.

With respect to the election of directors, we have amended our By-Laws to implement a majority voting standard for uncontested director elections, but allowing the board to nonetheless retain a director who does not receive a majority vote in the event it believes that would serve the best interests of the Company and its shareholders. This is popularly referred to as the “Intel” procedure named after Intel Corporation who first adopted such a process in 2006, and which process has been adopted by numerous Fortune 500 companies since then. What this means in practice is that if a director is not elected with a majority of the votes cast at the annual meeting, the director shall offer to tender his or her resignation to the Board. The Nominating and Governance Committee will then consider the matter and make a recommendation to the Board on whether to accept or reject the resignation, or whether other action is to be taken. The Board will act on the Committee’s recommendation and publicly disclose its decision and the rationale behind it within 90 days from the date of the certification of the election results. The director who tenders his or her resignation will not participate in the Board’s decision. Inasmuch as this year there is an uncontested slate of director nominations, this process will be implicated.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information as of October 21, 2016 with respect to the beneficial ownership of our common stock by (1) each person known by us to own beneficially more than 5% of the outstanding shares of our common stock, (2) each of our directors and nominees for director, (3) each of our executive officers named in the Summary Compensation Table set forth under the caption “Executive Compensation”, below, and (4) all our directors and executive officers as a group.

|

Name and Address of Beneficial Owner(1)(2) |

Amount and Nature of Beneficial Ownership (3) |

Percent of Outstanding Shares(4) |

||||

| Dr. Patrick Soon-Shiong | 4,000,676 | (5) | 18.6 | |||

| AQR Capital Management, LLC | 1,866,373 | (6) | 9.2 | |||

| Dimensional Fund Advisors LP | 1,458,842 | (7) | 7.3 | |||

| Oasis Management Company Ltd. | 3,531,038 | (8) | 15.8 | |||

| Franklin Resources, Inc. | 2,284,540 | (9) | 11.4 | |||

| Wolverine Asset Management, LLC | 1,735,621 | (10) | 8.0 | |||

| Pine River Capital Management L.P. | 5,122,774 | (11) | 20.4 | |||

| Citadel Advisors LLC | 2,027,938 | (12) | 9.2 | |||

| Geode Capital Management, LLC | 1,428,230 | (13) | 7.1 | |||

| Whitebox Advisors, LLC | 1,315,693 | (14) | 6.2 | |||

| Steelhead Partners, LLC | 2,073,667 | (15) | 9.4 | |||

| Renaissance Technologies LLC | 1,820,725 | (16) | 9.4 | |||

| Stephen G. Berman | 615,283 | (17) | 3.1 | |||

| Rex H. Poulsen | 59,686 | (18) | * | |||

| Michael S. Sitrick | 62,313 | (19) | * | |||

| Murray L. Skala | 95,641 | (20) | * | |||

| Joel M. Bennett | 37,866 | * | ||||

| John J. McGrath | 166,858 | (21) | * | |||

| Alexander Shoghi | 12,542 | (22) | * | |||

| Michael J. Gross | 2,463 | (23) | * | |||

| All directors and executive officers as a group (7 persons) | 1,050,189 | 5.2 | % |

_________

| * | Less than 1% of our outstanding shares. |

| (1) | Unless otherwise indicated, such person’s address is c/o JAKKS Pacific, Inc., 2951 28th Street, Santa Monica, California 90405. |

| (2) | The number of shares of common stock beneficially owned by each person or entity is determined under the rules promulgated by the Securities and Exchange Commission. Under such rules, beneficial ownership includes any shares as to which the person or entity has sole or shared voting power or investment power. The percentage of our outstanding shares is calculated by including among the shares owned by such person any shares which such person or entity has the right to acquire within 60 days after November 4, 2016. The inclusion herein of any shares deemed beneficially owned does not constitute an admission of beneficial ownership of such shares. |

| (3) | Except as otherwise indicated, exercises sole voting power and sole investment power with respect to such shares. |

| (4) | Does not include any shares of common stock issuable upon the conversion of $100.0 million of our 4.25% convertible senior notes due 2018, initially convertible at the rate of 114.3674 shares of common stock per $1,000 principal amount at issuance of the notes (but subject to adjustment under certain circumstances as described in the notes) nor any shares of common stock issuable upon the conversion of $115.0 million of our 4.875% convertible senior notes due 2020, initially convertible at the rate of 103.7613 shares of common stock per $1,000 principal amount at issuance of the notes (but subject to adjustment under certain circumstances as described in the notes). Does include 3,112,840 shares of common stock repurchased by the Company under a prepaid forward purchase contract under which no shares have been returned to the Company. |

| (5) | The address of Dr. Patrick Soon-Shiong is 10182 Culver Blvd., Culver City, CA 90232. Includes 1,500,000 shares underlying a warrant owned by an affiliate (NantWorks LLC). Except for 239,622 shares, and the shares underlying the warrant, all of the shares are owned jointly with California Capital Z, LLC. All the information presented in this Item with respect to this beneficial owner was extracted solely from the Schedule 13D/A filed on July 26, 2016. |

| (6) | The address of AQR Capital Management, LLC is Two Greenwich Office Park, Greenwich, CT 06830. Possesses joint voting and dispositive power with respect to all of such shares and certain of the reported shares underlie presently convertible notes. All the information presented in this Item with respect to this beneficial owner, including the percentage ownership since the amount of derivative securities was not disclosed, was extracted solely from the Schedule 13G filed on February 16, 2016. The percentage ownership is likely higher as the Company has approximately 2 million less shares outstanding than when the schedule 13G was filed. |

| (7) | The address of Dimensional Fund Advisors LP (formerly known as Dimensional Fund Advisors, Inc.) is Building One, 6300 Bee Cove Road, Austin, TX 78746. Possesses sole voting power over 1,446,853 shares and sole dispositive power over 1458,842 shares. All the information presented in this Item with respect to this beneficial owner was extracted solely from the Schedule 13G/A filed on February 9, 2016. |

| (8) | The address of Oasis Management Company Ltd. is c/o Oasis Management (Hong Kong) LLC, 21/F Man Yee Building, 68Des Voeux Road, Central, Hong Kong. Possesses joint voting and dispositive power over with respect to all of such shares. 2,339,885 of such shares underlie presently convertible notes. All the information presented in this Item with respect to this beneficial owner was extracted solely from the Schedule 13G/A filed on October 27, 2015. |

| (9) | The address of Franklin Resources, Inc. is One Franklin Parkway, San Mateo, CA 94403. Sole voting and dispositive power is held by Franklin Templeton Investments Corp. (2,097,040 shares) and Templeton Investment Counsel, LLC (187,500 shares). All the information presented in this Item with respect to this beneficial owner was extracted solely from the Schedule 13G filed on December 10, 2015. |

| (10) | The address of Wolverine Asset Management, LLC is175 West Jackson Blvd., Suite 340, Chicago Illinois 60604. Possesses joint voting and dispositive power with respect to 1,704,621 of such shares (the balance is held jointly by other related parties) and all which shares underlie presently convertible notes. An additional 31,000 shares underlie options. All the information presented in this Item with respect to this beneficial owner was extracted solely from the Schedule 13G/A filed on February 16, 2016. |

| (11) | The address of Pine River Capital Management L.P. is 601 Carlson Pkwy, Suite 330, Minnetonka, MN 55305; Attn: Brian Taylor. Possesses joint voting and dispositive power with respect to all of such shares and all of such shares underlie presently convertible notes. All the information presented in this Item with respect to this beneficial owner was extracted solely from the Schedule 13D filed on July 6, 2016. |

| (12) | The address of Citadel Advisors, LLC is 131 S. Dearborn Street, 32nd Floor, Chicago, Illinois 60603. Possesses joint voting and dispositive power with respect to 1,970,538 of such shares (the balance is held jointly by other related parties), all of which shares underlie options and/or other convertible securities. All the information presented in this Item with respect to this beneficial owner was extracted solely from the Schedule 13G filed on February 16, 2016. |

| (13) | The address of Geode Capital Management, LLC is One Post Office Square, 20th Floor, Boston, MA 02109. All the information presented in this Item with respect to this beneficial owner was extracted solely from the Schedule 13G/A filed on February 11, 2016. |

| (14) | The address of Whitebox Advisors, LLC is 3033 Excelsior Boulevard, Suite 300, Minneapolis, MN 55416. Possesses joint voting and dispositive power with respect to all of such shares and all of the reported shares underlie presently convertible notes. All the information presented in this Item with respect to this beneficial owner was extracted solely from the Schedule 13G/A filed on August 12, 2015. |

|

(15)

|

The address of Steelhead Partners, LLC is 333 108th Avenue NE, Suite 2010, Bellevue, WA 98004. Possesses sole voting and dispositive power with respect to all of such shares and all of the reported shares underlie presently convertible notes. All the information presented in this Item with respect to this beneficial owner was extracted solely from the Schedule 13G filed on February 12, 2016. |

|

(16)

|

The address of Renaissance Technologies LLC is 800 Third Avenue, New York, NY. Possesses sole voting power with respect to 1,799,107 shares, sole dispositive power with respect to 1,819,939 shares and shared dispositive power for 786 shares. All the information presented in this Item with respect to this beneficial owner was extracted solely from the Schedule 13G filed on February 12, 2016. |

| (17) | Includes 439,698 shares of common stock issued on January 1, 2016 pursuant to the terms of Mr. Berman’s January 1, 2003 Employment Agreement (as amended to date), which shares are further subject to the terms of our January 1, 2016 Restricted Stock Award Agreement with Mr. Berman (the “Berman Agreement”). The Berman Agreement provides that Mr. Berman will forfeit his rights to some or all 439,698 shares unless certain conditions precedent are met prior to January 1, 2017, as described in the Berman Agreement, whereupon the forfeited shares will become authorized but unissued shares of our common stock. Also includes 18,238 shares granted on February 11, 2011 representing the stock component of his 2010 performance bonus which vest in seven tranches over six years, with each of the first six tranches equal to 14.5% of the total grant, and a seventh tranche equal to 13% of the total grant. The initial tranche vested on February 11, 2011 with each succeeding tranche vesting on January 1 of each year commencing with January 1, 2012 with the final tranche vesting on January 1, 2017. Certain of these shares may be restricted from transfer pursuant to the minimum stock ownership provisions adopted by the Company's Board of Directors. |

| (18) | Includes 49,686 shares of Common Stock issued pursuant to our 2002 Stock Award and Incentive Plan pursuant to which 12,542 of such shares may not be sold, mortgaged, transferred or otherwise encumbered prior to January 1, 2017. Certain of these shares may be restricted from transfer pursuant to the minimum stock ownership provisions adopted by the Company's Board of Directors. |

| (19) | Consists of 14,771 shares of Common Stock issued pursuant to our 2002 Stock Award and Incentive Plan, pursuant to which all of such shares may not be sold, mortgaged, transferred or otherwise encumbered prior to January 1, 2017. Certain of these shares may be restricted from transfer pursuant to the minimum stock ownership provisions adopted by the Company's Board of Directors. |

| (20) | Consists of 83,099 shares of Common Stock issued pursuant to our 2002 Stock Award and Incentive Plan, pursuant to which 12,542 of such shares may not be sold, mortgaged, transferred or otherwise encumbered prior to January 1, 2017. Certain of these shares may be restricted from transfer pursuant to the minimum stock ownership provisions adopted by the Company's Board of Directors. |

| (21) | Includes 9,422 shares of common stock issued on January 1, 2016 pursuant to the terms of Mr. McGrath’s March 4, 2010 Employment Agreement (as amended to date), which shares are further subject to the terms of our January 1, 2016 Restricted Stock Award Agreement with Mr. McGrath (the “McGrath Agreement”). The McGrath Agreement provides that Mr. McGrath will forfeit his rights to some or all 9,422 shares unless certain conditions precedent are met prior to January 1, 2017, as described in the McGrath Agreement, whereupon the forfeited shares will become authorized but unissued shares of our common stock. Also includes an additional 134,058 shares issued pursuant to Mr. McGrath’s Employment Agreement and which are subject to the terms of that certain March 25, 2016 Restricted Stock Award Agreement. These 134,058 shares will vest in three tranches, with each tranche equal to 1/3 of the total grant. The initial tranche will vest on the date in 2017 as of which the vesting condition is determined to be satisfied with the succeeding tranches vesting on the one- and two-year anniversaries of the first vesting date in 2018 and 2019. Certain of these shares may be restricted from transfer pursuant to the minimum stock ownership provisions adopted by the Company's Board of Directors. |

| (22) | Consists of 12,542 shares of common stock issued pursuant to our 2002 Stock Award and Incentive Plan, pursuant to which all of such shares may not be sold, mortgaged, transferred or otherwise encumbered prior to January 1, 2017. Certain of these shares may be restricted from transfer pursuant to the minimum stock ownership provisions adopted by the Company's Board of Directors. |

| (23) | Consists of 2,463 shares of common stock issued pursuant to our 2002 Stock Award and Incentive Plan, pursuant to which all of such shares may not be sold, mortgaged, transferred or otherwise encumbered prior to January 1, 2017. Certain of these shares may be restricted from transfer pursuant to the minimum stock ownership provisions adopted by the Company's Board of Directors. |

ELECTION OF DIRECTORS

(Proposal No. 1)

The persons named in the enclosed proxy will vote to elect as directors the six nominees named below, unless authority to vote for the election of any or all of the nominees is withheld by marking the proxy to that effect. All of the nominees have indicated their willingness to serve, if elected, but if any nominee should be unable to serve or for good cause will not serve, the proxies may be voted for a substitute nominee designated by management. Each director will be elected to hold office until the next annual meeting of stockholders or until his successor is elected and qualified. There are no family relationships between or among any of our executive officers or directors.

Nominees

Set forth below for each nominee as a director is his name, age, and position with us, the Committee of the Board upon which he currently sits, his principal occupation and business experience during at least the past five years and the date of the commencement of his term as a director.

| Name | Age | Position with the Company | Board Committee Membership | |||

| Stephen G. Berman | 52 | Chief Executive Officer, Chairman, President, Secretary and Director | - | |||

| Murray L. Skala | 69 | Director | - | |||

| Rex H. Poulsen | 65 | Director | Audit (Chairman), Nominating/Governance (Chairman), Compensation, Capital Allocation | |||

| Michael S. Sitrick | 69 | Director | Audit, Nominating/Governance, Compensation (Chairman), Capital Allocation (Chairman) | |||

| Alexander Shoghi | 35 | Director | Audit | |||

| Michael J. Gross | 41 | Director | - |

Stephen G. Berman has been our Chief Operating Officer (until August 23, 2011) and Secretary and one of our directors since co-founding JAKKS in January 1995. From February 17, 2009 through March 31, 2010 he was also our Co-Chief Executive Officer and has been our Chief Executive Officer since April 1, 2010. Since January 1, 1999, he has also served as our President, and since October 23, 2015 he has also served as our Chairman. From our inception until December 31, 1998, Mr. Berman was also our Executive Vice President. From October 1991 to August 1995, Mr. Berman was a Vice President and Managing Director of THQ International, Inc., a subsidiary of THQ. From 1988 to 1991, he was President and an owner of Balanced Approach, Inc., a distributor of personal fitness products and services.

Murray L. Skala has been one of our directors since October 1995. Since 1976, Mr. Skala has been a partner of the law firm Feder Kaszovitz LLP, our general counsel.

Rex H. Poulsen has been a director since December 26, 2012. Mr. Poulsen is currently a partner in the Glendale, California office of Hutchinson and Bloodgood LLP, a regional certified public accounting and consulting firm registered with the PCAOB. Mr. Poulsen has been continuously licensed as a Certified Public Accountant since 1974, and has spent most of his career with public accounting firms as an independent auditor of both private and publicly-held companies. Mr. Poulsen also has extensive experience in assisting companies in the areas of due diligence, valuation, and other services related to the purchase and sale of businesses, as well as providing services in connection with litigation matters including forensic accounting assignments and expert witness testimony. Mr. Poulsen received a Bachelor of Science degree in Accounting from Weber State University in 1973, and is a member of the American Institute of Certified Public Accountants.

Michael S. Sitrick has been a director since December 19, 2014. Since November 2009, Mr. Sitrick is the chairman and chief executive officer of Sitrick Brinko LLC, a subsidiary of Resources Connection, Inc (NASDAQ: RECN)., and the successor to Sitrick And Company which he founded in 1989 and was its founder, chairman and chief executive officer until he sold it to Resources Connection, Inc. in 2009, which is a public relations, strategic communications and crisis management company providing advice and counseling to some of the country’s largest corporations, non-profits and governmental agencies, in many areas including mergers and acquisitions, litigation support, corporate positioning and repositioning, developing and implementing strategies to deal with short sellers, executive transitions and government investigations. Prior thereto he was an executive and Senior Vice President – Communications for Wickes Companies, Inc. (from 1981to1989), head of Communications and Government Affairs for National Can Corporation (from1974 to 1981) and Group Supervisor at Selz, Seabolt and Associates before that. Prior thereto Mr. Sitrick was Assistant Director of Public Information in the Richard J. Daley administration in Chicago and worked as reporter. Mr. Sitrick is a published author, frequent lecturer, a former board member at two public companies (both of which were sold) and a current and former board member of several charitable organizations. He holds a B.S. degree in Business Administration and a major in Journalism from the University of Maryland, College Park.

Alexander Shoghi has been a director since December 18, 2015. Mr. Shoghi is a Portfolio Manager at Oasis Management, a private investment management firm headquartered in Hong Kong. Mr. Shoghi joined Oasis in 2005, first based in Hong Kong, and subsequently relocating to the US as the founder and manager of Oasis Capital in Austin, Texas in early 2012. From 2004 to 2005, Mr. Shoghi worked at Lehman Brothers in New York City. Mr. Shoghi received a Bachelor of Science of Business Administration in Finance and International Business from Georgetown University in 2004.

Michael J. Gross has been a director since October 19, 2016. Michael Gross has been the Vice Chairman of WeWork LLC since July 2015 and was its CFO from October 2013 to July 2015. Prior to joining WeWork LLC, Michael was appointed to the Board of Directors of Morgans Hotel Group from October 2009 to June 2013 and was its CEO from March 2011 to September 2013. From January 2008 until March 2011 Michael partnered with The Yucaipa Companies focusing on retail and consumer investment opportunities. From 1998 to 2007, Michael focused on consumer, retail and real estate companies with various investment and research roles at Prentice Capital Management, S.A.C. Capital Advisors, Lehman Brothers Inc., Salomon Smith Barney and Granite Partners. Michael graduated with a Bachelor of Science from Cornell University’s School of Hotel Administration.

Mr. Fergus McGovern was a director from December 19, 2014 until his unexpected and untimely death on February 27, 2016.

Qualifications for All Directors

In considering potential candidates for election to the Board, the Nominating and Corporate Governance Committee observes the following guidelines, among other considerations: (i) the Board must include a majority of independent directors; (ii) each candidate shall be selected without regard to age, sex, race, religion or national origin; (iii) each candidate should have the highest level of personal and professional ethics and integrity and have the ability to work well with others; (iv) each candidate should only be involved in activities or interests that do not conflict or interfere with the proper performance of the responsibilities of a director; (v) each candidate should possess substantial and significant experience that would be of particular importance to the Company in the performance of the duties of a director; and (vi) each candidate should have sufficient time available, and a willingness to devote the necessary time, to the affairs of the Company in order to carry out the responsibilities of a director, including, without limitation, consistent attendance at Board of Directors and committee meetings and advance review of Board of Directors and committee materials. The Chief Executive Officer will then interview such candidate. The Nominating and Governance Committee then determines whether to recommend to the Board of Directors that a candidate be nominated for approval by the shareholders. The manner in which the Nominating and Governance Committee evaluates a potential candidate does not differ based on whether the candidate is recommended by a shareholder of the Company.

With respect to nominating existing directors, the Nominating and Governance Committee reviews relevant information available to it, including the most recent individual director evaluations for such candidates, the number of meetings attended, his or her level of participation, biographical information, professional qualifications, and overall contributions to the Company.

The Board of Directors does not have a specific diversity policy, but considers diversity of race, ethnicity, gender, age, cultural background and professional experiences in evaluating candidates for Board membership.

The Board of Directors has identified the following qualifications, attributes, experience, and skills that are important to be represented on the Board as a whole: (i) management, leadership and strategic vision; (ii) financial expertise; (iii) marketing and consumer experience; and (iv) capital management.

A majority of our directors are “independent,” as defined under the rules of the Nasdaq Stock Market. Such independent directors are currently Messrs. Sitrick, Poulsen, Shoghi and Gross. Our directors hold office until the next annual meeting of stockholders and until their successors are elected and qualified. Our officers are elected annually by our Board of Directors and serve at its discretion. None of our current independent directors have served as such for more than the past five years. Our current independent directors were selected for their experience as businessmen (Sitrick and Gross) or financial expertise (Poulsen and Gross) or capital management expertise (Shoghi). We believe that our board is best served by benefiting from this blend of business and financial expertise and experience. Our remaining directors consist of our chief executive officer (Berman) who brings management’s perspective to the board’s deliberations and, our longest serving director (Skala), who, as an attorney with many years of experience advising businesses, is able to provide guidance to the board from a legal perspective.

The Board’s Role in Risk Oversight

The Board of Directors is responsible for oversight of the various risks facing the Company. Risks are considered in virtually every business decision and business strategy. While the Board recognizes that appropriate risk-taking is essential for the Company to remain competitive and achieve its long-term goals, it nonetheless strongly believes that risk taking must be closely monitored.

The Board has implemented the following risk oversight framework: (i) know the major risks inherent in the Company’s business and strategy and compensation policies; (ii) evaluate risk management processes; (iii) encourage open and regular communication about risks between management and the Board; and (iv) cultivate a culture of integrity and risk awareness.

While the Board oversees risk, management is responsible for managing risk. We have developed internal processes to identify and manage risk and communicate appropriately with the Board. Management communicates routinely with the Board, Board Committees and individual Directors on the significant risks identified and how they are being managed and Directors are encouraged to communicate directly with senior management.

The Board implements its risk oversight function both as a whole and through its designated and established Committees, which play significant roles in carrying out the risk oversight function. At the initial meeting of the Board of Directors following this annual meeting, the elected directors will review the composition of its various committees in light of the changes to the composition of the Board of Directors. All of our Committees meet regularly and report back to the full Board. The risk oversight functions are allocated among our Committees as follows:

| ● | The Audit Committee is responsible for overseeing risks associated with the Company’s financial statements, the financial reporting process, accounting and legal matters. The Audit Committee oversees the internal audit function and meets separately with representatives of the Company’s independent accounting firm. |

| ● | The Compensation Committee is responsible for overseeing risk associated with the Company’s compensation philosophy and programs. |

| ● | The Nominating and Governance Committee is responsible for overseeing risks related to evolving governance legislation and trends. |

| ● | The Capital Allocation Committee is responsible for overseeing risks associated with the allocation of the Company’s capital resources. |

Board Leadership Structure; Executive Sessions

Until the untimely passing of Jack Friedman in May 2010, our board structure featured (i) a combined Chairman of the Board and Chief Executive Officer, and (ii) non- management, active and effective directors of equal importance and with an equal vote. Since Mr. Friedman’s untimely passing in May 2010 we had not selected a Chairman to succeed him until October 1, 2015 when the board determined to elect Mr. Berman to the position of Chairman of the Board. The board intends to continue its current practice of having non-management Board members meet without management present at regularly scheduled executive sessions. Also, at least twice a year, such meetings include only the independent members of the Board.

Committees of the Board of Directors

In 2015 we had an Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee. The Capital Allocation Committee was established as a standing committee in February 2016.

Audit Committee

In addition to the risk oversight function described above, the primary functions of the Audit Committee are to select or to recommend to our Board the selection of outside auditors; to monitor our relationships with our outside auditors and their interaction with our management in order to ensure their independence and objectivity; to review, and to assess the scope and quality of, our outside auditor’s services, including the audit of our annual financial statements; to review our financial management and accounting procedures; to review our financial statements with our management and outside auditors; and to review the adequacy of our system of internal accounting controls. Messrs. Poulsen (Chairman), Shoghi and Sitrick are the current members of the Audit Committee, are each “independent” (as that term is defined in NASD Rule 4200(a)(14)), and are each able to read and understand fundamental financial statements. Mr. Poulsen, our audit committee financial expert, is the Chairman of the Audit Committee and possesses the financial expertise required under Rule 401(h) of Regulation SK of the Act and NASD Rule 4350(d)(2). He is further “independent”, as that term is defined under Item 7(d)(3)(iv) of Schedule 14A under the Exchange Act. We will, in the future, continue to have (i) an Audit Committee of at least three members comprised solely of independent directors, each of whom will be able to read and understand fundamental financial statements (or will become able to do so within a reasonable period of time after his or her appointment); and (ii) at least one member of the Audit Committee that will possess the financial expertise required under NASD Rule 4350(d)(2). Our Board has adopted a written charter for the Audit Committee and the Audit Committee reviews and reassesses the adequacy of that charter on an annual basis. The full text of the charter is available on our website at www.jakks.com.

Compensation Committee

In addition to the risk oversight function described above, the functions of the Compensation Committee are to make recommendations to the Board regarding compensation of management employees and to administer plans and programs relating to employee benefits, incentives, compensation and awards under our 2002 Stock Award and Incentive Plan (the “2002 Plan”). Messrs. Sitrick (Chairman) and Poulsen are the current members of the Compensation Committee. The Board has determined that each of them is “independent,” as defined under the applicable rules of the Nasdaq Stock Market. A copy of the Compensation Committee’s Charter is available on our website at www.jakks.com. Executive officers that are members of our Board make recommendations to the Compensation Committee with respect to the compensation of other executive officers that are not on the Board. Except as otherwise prohibited, the Committee may delegate its responsibilities to subcommittees or individuals. The Compensation Committee has the authority, in its sole discretion, to retain or obtain advice from a compensation consultant, legal counsel or other advisor and is directly responsible for the appointment, compensation and oversight of such persons. The Company provides the appropriate funding to such persons as determined by the Compensation Committee. The Compensation Committee conducts an independence assessment of its outside advisors using the six factors contained in Exchange Act Rule 10C-1. The Compensation Committee receives legal advice from our outside general counsel and for 2015 retained Lipis Consulting, Inc. (“LCI), a compensation consulting firm, which provides advice directly to the Compensation Committee. The Compensation Committee retained Willis Towers Watson (“WTW”), a compensation consulting firm, to advise it in 2016. WTW provides advice directly to the Compensation Committee.

The Compensation Committee also annually reviews the overall compensation of our executive officers for the purpose of determining whether discretionary bonuses should be granted. In 2015, LCI presented a report to the Compensation Committee comparing our performance, size and executive compensation levels to those of peer group companies. LCI also reviewed with the Compensation Committee the base salaries, annual bonuses, total cash compensation, long-term compensation and total compensation of our senior executive officers relative to those companies. The performance comparison presented to the Compensation Committee each year includes a comparison of our total shareholder return, earnings per share growth, sales, net income (and one-year growth of both measures) to the peer group companies. The Compensation Committee reviews this information along with details about the components of each executive officer’s compensation. LCI also provided guidance to the Compensation Committee with respect to the extension of Messrs. McGrath’s and Bennett’s employment agreements (see “Employment Agreements and Termination of Employment Arrangements”). The Compensation Committee consulted with Frederick W. Cook & Co., Inc. (“FWC), a compensation consulting firm, in 2012 with respect to determination of a portion of Mr. Berman’s bonus criteria for 2012, and in 2013 with respect to determination of a portion of his bonus criteria for 2013, and in 2014 with respect to the determination of a portion of his bonus criteria for 2014. The Compensation Committee also consulted with FWC in 2013 with respect to a portion of Mr. McGrath’s bonus criteria for 2013 and in 2014 with respect to a portion of his bonus criteria for 2014. The Compensation Committee consulted with LCI with respect to establishing the bonus criteria for Messrs. Berman and McGrath for 2015. The Compensation Committee consulted with WTW with respect to the amendments to the employment agreements for Messrs. Berman and McGrath in 2016.

Nominating and Corporate Governance Committee

In addition to the risk oversight function described above, the functions of the Nominating and Corporate Governance Committee are to develop our corporate governance system and to review proposed new members of our Board of Directors, including those recommended by our stockholders. Messrs. Poulsen (Chairman) and Sitrick are the current members of our Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee operates pursuant to a written charter adopted by the Board. The full text of the charter is available on our website at www.jakks.com. The Board has determined that each member of this Committee is “independent,” as defined under the applicable rules of the Nasdaq Stock Market. For instructions on how stockholders may submit recommendations for director nominees to our Nominating and Corporate Governance Committee, see “Stockholder Communications,” below.

The Nominating and Corporate Governance Committee will review, on an annual basis, the composition of our Board of Directors and the ability of its current members to continue effectively as directors for the upcoming fiscal year. The Nominating and Corporate Governance Committee reestablished the position of Chairman of the Board in 2015. In the ordinary course, absent special circumstances or a change in the criteria for Board membership, the Nominating and Corporate Governance Committee will renominate incumbent directors who continue to be qualified for Board service and are willing to continue as directors. If that Committee thinks it is in our best interests to nominate a new individual for director in connection with an annual meeting of stockholders, or if a vacancy on the Board occurs between annual stockholder meetings or an incumbent director chooses not to run, the nominating committee will seek out potential candidates for Board appointment who meet the criteria for selection as a nominee and have the specific qualities or skills being sought. Director candidates will be selected based on input from members of the Board, our senior management and, if the Committee deems appropriate, a third-party search firm. The Nominating and Corporate Governance Committee will evaluate each candidate’s qualifications and check relevant references and each candidate will be interviewed by at least one member of that Committee. Candidates meriting serious consideration will meet with all members of the Board. Based on this input, the Nominating and Corporate Governance Committee will evaluate whether a prospective candidate is qualified to serve as a director and whether the Committee should recommend to the Board that this candidate be appointed to fill a current vacancy on the Board, or presented for the approval of the stockholders, as appropriate.

Capital Allocation Committee

In addition to assisting the Board and management in reviewing the Company’s capital structure and material capital allocation decisions, the Board established the Capital Allocation Committee to assist the Board and management in reviewing strategic investments, and acquisitions and dispositions and other opportunities for maximizing shareholder value. In furtherance of such purposes, the Committee’s responsibilities include review of the Company’s financial strategies, including debt and equity issuances, repurchases of debt and bank credit facilities. The Committee is also responsible to consider and, if implemented, review the Corporation's dividend and share repurchase policies and programs and other strategies to return capital to stockholders. Messrs. Sitrick (Chairman) and Poulsen are the current members of the Capital Allocation Committee. The Board has determined that each of them is “independent” as defined under the applicable rules of the NASDAQ stock market. A copy of the Capital Allocation Committee’s charter is available on our website at www.jakks.com. The Committee does not have any authority or responsibility with respect to matters delegated by the Board to the Corporation's Audit, Compensation or Nominating and Governance Committees. The Committee has the authority, in its discretion, to retain independent consultants, counsel, and other advisors, and the Company pays for the expenses of retaining such persons as determined by the Capital Allocation Committee. The Capital Allocation Committee reviewed with management and the Board and financial advisors to the Board regarding the Company’s share and convertible debt repurchases.

Meetings of the Board of Directors and Board Member Attendance at Annual Stockholder Meeting

From January 1, 2015 through December 31, 2015, the Board of Directors, Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee each met or acted without a meeting pursuant to unanimous written consent fifteen times, five times, six times, and three times, respectively. All directors attended at least 75% of all board meetings and committee meetings of which they are members.

We do not have a formal written policy with respect to board members’ attendance at annual stockholder meetings, although we do encourage each of them to attend. All of the directors then serving and nominated for re-election attended our 2015 Annual Stockholder Meeting.

Stockholder Communications

Stockholders interested in communicating with our Board may do so by writing to any or all directors, care of our Chief Financial Officer, at our principal executive offices. Our Chief Financial Officer will log in all stockholder correspondence and forward to the director addressee(s) all communications that, in his judgment, are appropriate for consideration by the directors. Any director may review the correspondence log and request copies of any correspondence. Examples of communications that would be considered inappropriate for consideration by the directors include, but are not limited to, commercial solicitations, trivial, obscene, or profane items, administrative matters, ordinary business matters, or personal grievances. Correspondence that is not appropriate for Board review will be handled by our Chief Financial Officer. All appropriate matters pertaining to accounting or internal controls will be brought promptly to the attention of our Audit Committee Chair.

Stockholder recommendations for director nominees are welcome and should be sent to our Chief Financial Officer, who will forward such recommendations to our Nominating and Corporate Governance Committee, and should include the following information: (a) all information relating to each nominee that is required to be disclosed pursuant to Regulation 14A under the Securities Exchange Act of 1934 (including such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected); (b) the names and addresses of the stockholders making the nomination and the number of shares of our common stock which are owned beneficially and of record by such stockholders; and (c) appropriate biographical information and a statement as to the qualification of each nominee, and must be submitted in the time frame described under the caption, “Stockholder Proposals for 2017 Annual Meeting,” below. The Nominating and Corporate Governance Committee will evaluate candidates recommended by stockholders in the same manner as candidates recommended by other sources, using additional criteria, if any, approved by the Board from time to time. Our stockholder communication policy may be amended at any time with the consent of our Nominating and Corporate Governance Committee.

Code of Ethics

We have a Code of Ethics (which we call a code of conduct) that applies to all our employees, officers and directors. This code was filed as an exhibit to our Annual Report on Form 10-K for the fiscal year ended December 31, 2003. This code is posted on our website, www.jakks.com. We will disclose when there have been waivers of, or amendments to, such Code, as required by the rules and regulations promulgated by the Securities and Exchange Commission and/or Nasdaq.

Executive Officers

Our executive officers are elected by our Board of Directors and serve pursuant to the terms of their respective employment agreements. One of our executive officers, Stephen G. Berman, is also a director of the Company. See the section above entitled “Nominees” for biographical information about this officer. The other current executive officers are Joel M. Bennett, our Executive Vice President and Chief Financial Officer and John (Jack) McGrath, our Executive Vice President and Chief Operating Officer.

Joel M. Bennett, 54, joined us in September 1995 as Chief Financial Officer and was given the additional title of Executive Vice President in May 2000. From August 1993 to September 1995, he served in several financial management capacities at Time Warner Entertainment Company, L.P., including as Controller of Warner Brothers Consumer Products Worldwide Merchandising and Interactive Entertainment. From June 1991 to August 1993, Mr. Bennett was Vice President and Chief Financial Officer of TTI Technologies, Inc., a direct-mail computer hardware and software distribution company. From August 1986 to June 1991, Mr. Bennett held various financial management positions at The Walt Disney Company, including Senior Manager of Finance for its international television syndication and production division. Mr. Bennett began his career at Ernst & Young LLP as an auditor from August 1983 to August 1986. Mr. Bennett holds a Bachelor of Science degree in Accounting and a Master of Business Administration degree in Finance and is a Certified Public Accountant (inactive).

John J. (Jack) McGrath, 51, became our Chief Operating Officer on August 23, 2011. Prior thereto he was our Executive Vice President of Operations, which position he has held since December 2007. Mr. McGrath was our Vice President of Marketing from 1999 to August 2003 and became a Senior Vice President of Operations in August 2003 and Executive Vice President of Operations in December 2007. From January 1992 to December 1998, Mr. McGrath was Director of Marketing at Mattel Inc. and prior thereto he was a PFC in the U.S Army. Mr. McGrath holds a Bachelor of Science degree in Marketing.

Certain Relationships and Related Transactions

One of our directors, Murray L. Skala, is a partner in the law firm of Feder Kaszovitz LLP, which has performed, and is expected to continue to perform, legal services for us. In 2014 and 2015, we incurred approximately $2.4 million and $3.1 million, respectively, for legal fees and reimbursable expenses payable to that firm. As of December 31, 2014 and 2015, legal fees and reimbursable expenses of $0.6 million and $0.5 million, respectively, were payable to this law firm.

Pursuant to our Code of Conduct (a copy of which may be found on our website, www.jakks.com), all of our employees are required to disclose to our General Counsel, the Board of Directors or any committee established by the Board of Directors to receive such information, any material transaction or relationship that reasonably could be expected to give rise to actual or apparent conflicts of interest between any of them, personally, and us. In addition, our Code of Ethics also directs all employees to avoid any self-interested transactions without full disclosure. This policy, which applies to all of our employees, is reiterated in our Employee Handbook which states that a violation of this policy could be grounds for termination. In approving or rejecting a proposed transaction, our General Counsel, Board of Directors or designated committee will consider the facts and circumstances available and deemed relevant, including but not limited to, the risks, costs, and benefits to us, the terms of the transactions, the availability of other sources for comparable services or products, and, if applicable, the impact on director independence. Upon concluding their review, they will only approve those agreements that, in light of known circumstances, are in or are not inconsistent with, our best interests, as they determine in good faith.

Legal Proceedings

On July 25, 2013, a purported class action lawsuit was filed in the United States District Court for the Central District of California captioned Melot v. JAKKS Pacific, Inc. et al., Case No. CV13-05388 (JAK) against Stephen G. Berman, Joel M. Bennett (collectively the “Individual Defendants”), and the Company (collectively, “Defendants”). On July 30, 2013, a second purported class action lawsuit was filed containing similar allegations against Defendants captioned Dylewicz v. JAKKS Pacific, Inc. et al., Case No. CV13-5487 (OON). The two cases (collectively, the “Class Action”) were consolidated on December 2, 2013 under Case No. CV13-05388 JAK (SSx) and lead plaintiff and lead counsel appointed. On January 17, 2014, Plaintiff filed a consolidated class action complaint (the “First Amended Complaint”) against Defendants which alleged that the Company violated Section 10(b) of the Securities Exchange Act and Rule 10b-5 promulgated thereunder by making false and/or misleading statements concerning Company financial projections and performance as part of its public filings and earnings calls from July 17, 2012 through July 17, 2013. Specifically, the First Amended Complaint alleged that the Company’s forward looking statements, guidance and other public statements were false and misleading for allegedly failing to disclose (i) certain alleged internal forecasts, (ii) the Company's alleged quarterly practice of laying off and rehiring workers, (iii) the Company's alleged entry into license agreements with guaranteed minimums the Company allegedly knew it was unable to meet; and (iv) allegedly poor performance of the Monsuno and Winx lines of products after their launch. The First Amended Complaint also alleged violations of Section 20(a) of the Exchange Act by Messrs. Berman and Bennett. The First Amended Complaint sought compensatory and other damages in an undisclosed amount as well as attorneys’ fees and pre-judgment and post-judgment interest. The Company filed a motion to dismiss the First Amended Complaint on February 17, 2014, and the motion was granted, with leave to replead. A Second Amended Complaint (“SAC”) was filed on July 8, 2014 and it set forth similar allegations to those in the First Amended Complaint about discrepancies between internal projections and public forecasts and the other allegations except that the claim with respect to guaranteed minimums that the Company allegedly knew it was unable to meet was eliminated. The Company filed a motion to dismiss the SAC and that motion was granted with leave to replead. A Third Amended Complaint (“TAC”) was filed on March 23, 2015 with similar allegations. The Company filed a motion to dismiss the TAC and that motion was argued on July 22, 2015; after argument it was taken on submission and a decision has not been issued. The foregoing is a summary of the pleadings and is subject to the text of the pleadings which are on file with the Court. We believe that the claims in the Class Action are without merit, and we intend to defend vigorously against them. However, because the Class Action is in a preliminary stage, we cannot assure you as to its outcome, or that an adverse decision in such action would not have a material adverse effect on our business, financial condition or results of operations.

On February 25, 2014, a shareholder derivative action was filed in the Central District of California by Advanced Advisors, G.P. against the Company, nominally, and against Messrs. Berman, Bennett, Miller, Skala, Glick, Ellin, Almagor, Poulsen and Reilly and Ms. Brodsky (Advanced Partners, G.P., v. Berman, et al., CV14-1420 (DSF)). On March 6, 2014, a second shareholder derivative action alleging largely the same claims against the same defendants was filed in the Central District of California by Louisiana Municipal Police Employees Retirement System (Louisiana Municipal Police Employees Retirement System v. Berman et al., CV14-1670 (GHF). On April 17, 2014, the cases were consolidated under Case No. 2:14-01420-JAK (SSx) (the “Derivative Action”). On April 30, 2014, a consolidated amended complaint (“CAC”) was filed, which alleged (i) a claim for contribution under Sections 10(b) and 21(D) of the Securities Exchange Act related to allegations made in the Class Action; (ii) derivative and direct claims for alleged violations of Section 14 of the Exchange Act and Rule 14a-9 promulgated thereunder related to allegedly misleading statements about Mr. Berman’s compensation plan in the Company’s October 25, 2013 proxy statement; (iii) derivative claims for breaches of fiduciary duty related to the Company’s response to an unsolicited indication of interest from Oaktree Capital, stock repurchase, standstill agreement with the Clinton Group, and decisions related to the NantWorks joint venture; and (iv) claims against Messrs. Berman and Bennett for breach of fiduciary duty related to the Class Action. The CAC seeks compensatory damages, pre-judgment and post-judgment interest, and declaratory and equitable relief. The foregoing is a summary of the CAC and is subject to the text of the CAC, which is on file with the Court. A motion to dismiss the CAC or, in the alternative, to stay the CAC, was filed in May 2014. The Court granted the motion in part and denied the motion in part with leave for plaintiff to file an amended pleading. Plaintiff declined to do so. Accordingly, claims i, ii and iv have been dismissed and only the elements of claim iii not relating to the NantWorks joint venture remain. Thus, there are no surviving claims against Messrs. Poulsen, Reilly and Bennett and Ms. Brodsky and the Court approved the parties’ stipulation to strike their names as defendants in the CAC. Pleadings in response to the CAC were filed on October 30, 2014, which are on file with the Court. The matter was referred to mediation by the Court and the parties, at the mediation, reached an agreement in principle to resolve the action. Thereafter the parties entered into a memorandum of such agreement, subject to Court approval. A motion was filed seeking preliminary approval of the settlement and establishment of the procedure for final approval of the settlement; preliminary approval of the settlement was granted and a hearing regarding final approval of the proposed settlement and attorneys’ fees in connection therewith took place on November 2, 2015. At the hearing, the Judge indicated that he would approve the settlement with a formal order, and that he would take the attorneys’ fee issue under advisement. A formal order regarding the settlement has not been issued.

We are a party to, and certain of our property is the subject of, various pending claims and legal proceedings that routinely arise in the ordinary course of our business, but we do not believe that any of these claims or proceedings will have a material effect on our business, financial condition or results of operations.

Section 16(a) Beneficial Ownership Reporting Compliance

Based solely upon a review of Forms 3 and 4 and amendments thereto furnished to us during 2015 and Forms 5 and amendments thereto furnished to us with respect to 2015, except with respect to two directors who were each late one time, all other Forms 3, 4 and 5 required to be filed during 2015 by our directors and executive officers were done so on a timely basis.

COMPENSATION DISCUSSION AND ANALYSIS

Compensation Philosophy and Objectives

We believe that a strong management team comprised of highly talented individuals in key positions is critical to our ability to deliver sustained growth and profitability, and our executive compensation program is an important tool for attracting and retaining such individuals. We also believe that our most important resource is our people. While some companies may enjoy an exclusive or limited franchise or are able to exploit unique assets or proprietary technology, we depend fundamentally on the skills, energy and dedication of our employees to drive our business. It is only through their constant efforts that we are able to innovate through the creation of new products and the continual rejuvenation of our product lines, to maintain superior operating efficiencies, and to develop and exploit marketing channels. With this in mind, we have consistently sought to employ the most talented, accomplished and energetic people available in the industry. Therefore, we believe it is vital that our named executive officers receive an aggregate compensation package that is both highly competitive with the compensation received by similarly-situated executive officers at peer group companies, and also reflective of each individual named executive officer’s contributions to our success on both a long-term and short-term basis. As discussed in greater depth below, the objectives of our compensation program are designed to execute this philosophy by compensating our executives at the top quartile of their peers.

Our executive compensation program is designed with three main objectives:

| ● | to offer a competitive total compensation opportunity that will allow us to continue to retain and motivate highly talented individuals to fill key positions; |

| ● | to align a significant portion of each executive’s total compensation with our annual performance and the interests of our stockholders; and |

| ● | reflect the qualifications, skills, experience and responsibilities of our executives |

Administration and Process

Our executive compensation program is administered by the Compensation Committee. The Compensation Committee receives legal advice from our outside general counsel and has retained Lipis Consulting, Inc. (“LCI), a compensation consulting firm, which provides advice directly to the Compensation Committee. Historically, the base salary, bonus structure and the long-term equity compensation of our executive officers are governed by the terms of their individual employment agreements (see “Employment Agreements and Termination of Employment Arrangements”) and we expect that to continue in the future. With respect to our chief executive officer and president and our chief operating officer the Compensation Committee, with input from LCI, establishes target performance levels for incentive bonuses based on a number of factors that are designed to further our executive compensation objectives, including our performance, the compensation received by similarly-situated executive officers at peer group companies, the conditions of the markets in which we operate and the relative earnings performance of peer group companies.

Historically, a factor given considerable weight in establishing bonus performance criteria is Adjusted EPS which is the net income per share of our common stock calculated on a fully-diluted basis in accordance with GAAP, applied on a basis consistent with past periods, as adjusted in the sole discretion of the Compensation Committee to take account of extraordinary or special items.

As explained in greater detail below (see “Employment Agreements and Termination of Employment Arrangements”), pursuant to a September 2012 amendment to Mr. Berman’s employment agreement, commencing in 2013, his annual bonus was restructured so that part of it was capped at 300% of his base salary and the performance criteria and vesting are solely within the discretion of the Compensation Committee, which established all of the criteria during the first quarter of each fiscal year for that year’s bonus, based upon financial and non-financial factors selected by the Compensation Committee, and another part of his annual performance bonus is based upon the success of a joint venture entity we initiated in September 2012. The portion of the bonus equal to 200% of base salary is payable in cash and the balance in restricted stock vesting over three years. In addition, the annual grant of $500,000 of restricted stock was changed to $3,500,000 of restricted stock and the vesting criteria was also changed from being solely based upon established EPS targets to being based upon performance standards established by the Compensation Committee during the first quarter of each year. On June 7, 2016 we further amended the employment agreement to provide, among other things, for (i) extension of the term to December 31, 2020; (ii) modification of the performance and vesting standards for each $3.5 million Annual Restricted Stock Grant (“Berman Annual Stock Grant”) provided for under Section 3(b) of his Employment Agreement, effective as of January 1, 2017, so that 40% ($1.4 million) of each Berman Annual Stock Grant will be subject to time vesting in four equal annual installments over four years and 60% ($2.1 million) of each Berman Annual Stock Grant will be subject to three year “cliff vesting” (i.e. payment is based upon performance at the close of the three year performance period), with vesting of each Berman Annual Stock Grant determined by the following performance measures: (a) total shareholder return as compared to the Russell 2000 Index (weighted 50%), (b) net revenue growth as compared to our peer group (weighted 25%) and (c) EBITDA growth as compared to our peer group (weighted 25%); and (iii) modification of the performance measures for award of his Annual Performance Bonus equal to up to 300% of Base Salary (“Berman Annual Bonus”) provided for under Section 3(d) of his Employment Agreement, effective as of January 1, 2017, so that the performance measures will be based only upon net revenues and EBITDA, each performance measure weighted 50%, and with the specific performance criteria applicable to each Berman Annual Bonus determined by the Compensation Committee during the first quarter of each fiscal year; and (iv) increase Mr. Berman’s base salary to $1,450,000 effective June 1, 2016 subject to annual increases of at least $25,000 per year thereafter.

On August 23, 2011 we entered into an amended employment agreement with John J. (Jack) McGrath whereby he became Chief Operating Officer. As disclosed in greater detail below, Mr. McGrath’s employment agreement also provides for fixed and adjustable bonuses payable based upon adjusted EPS, which targets are set in the agreement, based upon input from our outside consulting firm, with the adjustable bonus capped at a maximum of 125% of base salary. On March 31, 2015, the Compensation Committee increased for 2015 the performance bonus that can be earned by Mr. McGrath from a maximum of up to 125% of his base salary to a maximum of up to 150% of his base salary, subject to achievement of certain performance based conditions established by the Committee, and also awarded Mr. McGrath the opportunity to earn an additional $925,000 of restricted stock subject to achievement of certain performance based vesting conditions. On September 29, 2016 we entered into a Fourth Amendment to the employment agreement with Mr. McGrath which provides, among other things, for (i) extension of the term December 31, 2020; (i) modification of the performance and vesting standards for each Annual Restricted Stock Grant (“McGrath Annual Stock Grant”) provided for under Section 3(d) of his Employment Agreement, effective as of January 1, 2017, as follows: each McGrath Annual Stock Grant will be equal to $1 million, and 40% ($0.4 million) of each McGrath Annual Stock Grant will be subject to time vesting in four equal annual installments over four years, and 60% ($0.6 million) of each McGrath Annual Stock Grant will be subject to three year “cliff vesting” (i.e. vesting is based upon satisfaction of the performance measures at the close of the three year performance period), determined by the following performance measures: (A) total shareholder return as compared to the Russell 2000 Index (weighted 50%), (B) net revenue growth as compared to our peer group (weighted 25%) and (C) growth in Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”) as compared to our peer group (weighted 25%); and (iii) modification of the Annual Performance Bonus (“McGrath Annual Bonus”) provided for under Section 3(e) of his Employment Agreement, effective as of January 1, 2017, as follows: the McGrath Annual Bonus will be equal to up to 125% of base salary, and the actual amount will be determined by performance measures based upon net revenues and EBITDA, each performance measure weighted 50%, and with the specific performance criteria applicable to each McGrath Annual Bonus determined by the Compensation Committee during the first quarter of each fiscal year, and payable in cash (up to 100% of base salary) and shares of our common stock (any excess over 100% of base salary) with the shares of stock vesting over three years in equal quarterly installments.

While the Compensation Committee does not establish target performance levels for our chief financial officer, it does consider similar factors when determining such officer’s bonus. The employment agreement for Mr. Bennett expired on December 31, 2009 and from January 1, 2010 through October 20, 2011 Mr. Bennett was an employee at will until his entry into a new employment agreement dated October 21, 2011. Prior to its expiration, the agreement authorized our Compensation Committee and Board of Directors to award an annual bonus to Mr. Bennett in an amount up to 50% of his salary as the Committee or Board determined in its discretion and also gave the Compensation Committee and the Board the discretionary authority to pay Mr. Bennett additional incentive compensation as it determined. Mr. Bennett’s new employment agreement does not contain a limitation on the percentage of salary that can be granted as a bonus. On February 18, 2014, we entered into a Continuation and Extension of Term of Employment Agreement with respect to Mr. Joel M. Bennett’s Employment Agreement dated October 21, 2011 such that it is deemed to have been renewed and continued from January 1, 2014 without interruption and it was extended through December 31, 2015. On June 11, 2015 Mr. Bennett’s employment agreement was extended through December 31, 2017.

The current employment agreements with our named executive officers also gives the Compensation Committee the authority to award additional compensation to each of them as it determines in its sole discretion based upon criteria it establishes.

The Compensation Committee also annually reviews the overall compensation of our named executive officers for the purpose of determining whether discretionary bonuses should be granted. In 2015, LCI presented a report to the Compensation Committee comparing our performance, size and executive compensation levels to those of peer group companies. LCI also reviewed with the Compensation Committee the base salaries, annual bonuses, total cash compensation, long-term compensation and total compensation of our senior executive officers relative to those companies. The performance comparison presented to the Compensation Committee each year includes a comparison of our total shareholder return, earnings per share growth, sales, net income (and one-year growth of both measures) to the peer group companies. The Compensation Committee reviews this information along with details about the components of each named executive officer’s compensation.

Peer Group

One of the factors considered by the Compensation Committee is the relative performance and the compensation of executives of peer group companies. The peer group for 2015 is comprised of a group of the companies selected in conjunction with FWC that we believe provides relevant comparative information, as these companies represent a cross-section of publicly-traded companies with product lines and businesses similar to our own throughout the comparison period. The composition of the peer group is reviewed annually and companies are added or removed from the group as circumstances warrant. For the last fiscal year, the peer group companies utilized for executive compensation analysis, which remained the same as in the previous year, were:

| ● | Activision Blizzard, Inc. | |

| ● | Electronic Arts, Inc. | |

| ● | Hasbro, Inc. | |

| ● | Leapfrog Enterprises, Inc. | |

| ● | Mattel, Inc. | |

| ● | Take-Two Interactive, Inc. |

Elements of Executive Compensation

The compensation packages for the Company’s senior executives have both performance-based and non-performance based elements. Based on its review of each named executive officer’s total compensation opportunities and performance, and our performance, the Compensation Committee determines each year’s compensation in the manner that it considers to be most likely to achieve the objectives of our executive compensation program. The specific elements, which include base salary, annual cash incentive compensation and long-term equity compensation, are described below.

The Compensation Committee has negative discretion to adjust performance results used to determine annual incentive and the vesting schedule of long-term incentive payouts to the named executive officers. The Compensation Committee also has discretion to grant bonuses even if the performance targets were not met.

Base Salary

Mr. Berman received compensation in 2015 pursuant to the terms of his employment agreement; Mr. McGrath became an executive officer on August 23, 2011 pursuant to the terms of an amendment to his employment agreement and Mr. Bennett entered into a new employment agreement on October 21, 2011 which was extended in 2015. As discussed in greater detail below, the employment agreement for Mr. Berman was to expire on December 31, 2010 and Mr. Bennett’s employment agreement expired on December 31, 2013. Effective November 11, 2010, Mr. Berman entered into an amended and restated employment agreement, which was further amended in 2012 and 2016. Pursuant to the terms of their employment agreements as in effect on December 31, 2013, Messrs. Berman, McGrath, and Bennett each receive a base salary which is increased automatically each year by at least $25,000 for Mr. Berman and $15,000 for each of Messrs. McGrath and Bennett pursuant to the terms of their respective employment agreements. Mr. Bennett’s extended employment agreement, which now expires in 2017, does not provide for automatic annual increases in base salary. Any further increase in base salary, as the case may be, is determined by the Compensation Committee based on a combination of two factors. The first factor is the Compensation Committee’s evaluation of the salaries paid in peer group companies to executives with similar responsibilities. The second factor is the Compensation Committee’s evaluation of the executive’s unique role, job performance and other circumstances. Evaluating both of these factors allows us to offer a competitive total compensation value to each individual named executive officer taking into account the unique attributes of, and circumstances relating to, each individual, as well as marketplace factors. This approach has allowed us to continue to meet our objective of offering a competitive total compensation value and attracting and retaining key personnel. Based on its review of these factors, the Compensation Committee determined not to increase the base salary of each of Messrs. Berman, McGrath and Bennett above the contractually required minimum increase in 2015 as unnecessary to maintain our competitive total compensation position in the marketplace. Pursuant to the 2016 amendment to his employment agreement, Mr. Berman’s base salary as of June 1, 2016 was increased to $1,450,000.

Annual Cash Incentive Compensation

The function of the annual cash bonus is to establish a direct correlation between the annual incentives awarded to the participants and our financial performance. This purpose is in keeping with our compensation program’s objective of aligning a significant portion of each executive’s total compensation with our annual performance and the interests of our shareholders.

The employment agreements as in effect on January 1, 2015 for Messrs. Berman and McGrath provided for an incentive cash bonus award based on a percentage of each participant’s base salary if the performance goals set by the Compensation Committee are met for that year. The employment agreements mandated that the specific criteria to be used is growth in earnings per share and the Compensation Committee sets the various target thresholds to be met to earn increasing amounts of the bonus up to a maximum of 200% of base salary for Mr. Berman and 125% for Mr. McGrath, although the Compensation Committee has the ability to increase the maximum in its discretion. Commencing in 2012, the Compensation Committee is required to meet to establish criteria for earning the annual performance bonus (and with respect to Mr. Berman, any additional annual performance bonus) during the first quarter of the year. As described elsewhere herein, Mr. Berman’s employment agreement was further amended in 2016.