Form DEF 14A HAEMONETICS CORP For: Apr 02

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Information Required in Proxy Statement

Schedule 14A Information

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

þ | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material Pursuant to §240.14a-12 | |

HAEMONETICS CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

þ | No fee required. | |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

(1 | ) | Title of each class of securities to which transaction applies: |

(2 | ) | Aggregate number of securities to which transaction applies: |

(3 | ) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4 | ) | Proposed maximum aggregate value of transaction: |

(5 | ) | Total fee paid: |

o | Fee paid previously with preliminary materials. | |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

(1 | ) | Amount Previously Paid: |

(2 | ) | Form, Schedule or Registration Statement No.: |

(3 | ) | Filing Party: |

(4 | ) | Date Filed: |

HAEMONETICS CORPORATION

Notice of Annual Meeting of Shareholders

July 21, 2016

To the Shareholders:

Our Annual Meeting of Shareholders will be held on Thursday, July 21, 2016 at 10:00 AM at 400 Wood Road, Braintree, MA 02184 for the following purposes:

1. | To elect three (3) directors as more fully described in the accompanying Proxy Statement. |

2. | To consider and act upon an advisory vote regarding the compensation of our named executive officers. |

3. | To approve an Amendment to Haemonetics Corporation's 2007 Employee Stock Purchase Plan. |

4. | To approve the adoption of the Worldwide Executive Bonus Plan. |

5. | To ratify Ernst & Young LLP as our independent registered public accounting firm to audit the consolidated financial statements of the Company and its subsidiaries for the fiscal year ending April 1, 2017. |

6. | To consider and act upon any other business which may properly come before the Meeting. |

The Board of Directors has fixed the close of business on June 3, 2016 as the record date for the Meeting. All shareholders of record on that date are entitled to notice of and to vote at the Meeting.

Whether or not you plan to attend the Meeting, please complete and return the enclosed proxy in the envelope provided or vote by telephone or the Internet pursuant to instructions provided with the proxy.

By Order of the Board of Directors

Sandra Jesse

Secretary

Braintree, Massachusetts

June 10, 2016

HAEMONETICS CORPORATION

PROXY STATEMENT

TABLE OF CONTENTS

Page | |

Number | |

GENERAL INFORMATION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Haemonetics Corporation (the “Company”) for use at the Annual Meeting of Shareholders (the “Meeting”) to be held on Thursday, July 21, 2016 at the time and place set forth in the Notice of Meeting, and at any adjournment thereof.

MATERIALS

On approximately June 10, 2016, the Company began mailing to shareholders either this Proxy Statement or a Notice of Internet Availability of Proxy Materials containing instructions on how to access proxy materials via the Internet and how to vote online at www.investorvote.com/HAE.

The Company’s 2016 Annual Report, this Proxy Statement, and a form of proxy are available at www.investorvote.com/HAE.

Shareholders who have received a Notice of Internet Availability can request a paper copy of the proxy materials by contacting our transfer agent, Computershare Shareholder Services, P.O. Box 30710, College Station, Texas 77842-3170 by telephone at 1-866-641-4276 or by email at [email protected]. There is no charge to you for requesting a copy.

The Company’s principal executive offices are located at 400 Wood Road, Braintree, Massachusetts, USA 02184-9114, telephone number (781) 848-7100.

VOTING

If a proxy is properly delivered, it will be voted in the manner directed by the shareholder. This year, shareholders have the ability to choose from four means of voting: (1) mailing of a proxy card, (2) via telephone, by calling the toll-free number on the enclosed proxy card, (3) via Internet, by following the instructions on the enclosed proxy card, or (4) in person at the Meeting. If no instructions are specified with respect to any particular matter to be acted upon, the proxy will be voted in favor of the election of directors as set forth in this Proxy Statement and FOR Items 2 , 3, 4 and 5 listed in the Notice of the Meeting. For both Internet and telephone voting you will have the ability to confirm that your vote has been properly recorded.

Any person delivering a proxy has the power to revoke it by voting in person at the Meeting or by giving written notice of revocation to the Secretary of the Company at any time before the proxy is exercised. Alternatively, any person wishing to revoke a vote submitted by telephone or Internet may (a) simply re-vote in the same manner, and the last received vote cast will be recorded in the final tally or (b) vote in person at the Meeting.

Directions to the Meeting may be obtained by contacting Investor Relations. If calling from within the United States, please call (800) 225-5242 extension 569457. International callers, please use (781) 356-9457.

To contact us in writing:

Haemonetics Corporation

Attn: Investor Relations

400 Wood Road

Braintree, MA 02184

QUORUM

A majority of the votes entitled to be cast on the matter must be present in person or be represented by proxy at the Meeting in order to constitute a quorum for the election of any director or for the consideration of any question.

The election of the nominees for director, which is Item 1 in this Proxy Statement, will be decided by plurality vote. To approve all other Items listed in the Notice of Meeting, it is necessary that the votes cast favoring the action exceed the votes cast opposing the action.

Abstentions and “non-votes” are counted as present in determining whether the quorum requirement is satisfied. A “non-vote” occurs when a nominee holding shares for a beneficial owner is present or represented at the Meeting

2

Haemonetics 2016 Proxy Statement

but does not vote on a particular matter. Abstentions and broker non-votes will not be taken into account in determining the outcome of any Item.

BROKER VOTING AUTHORITY

If you are a beneficial owner whose shares are held of record by a broker, your broker has discretionary voting authority under New York Stock Exchange rules to vote your shares only on Item 5, the ratification of the appointment of Ernst & Young LLP as the Company's independent auditors. However, New York Stock Exchange rules do not permit brokers to vote on the election of directors or any matter which relates to executive compensation without instructions from you, in which case a broker non-vote will occur and your shares will not be voted on these matters. Accordingly, it is particularly important that beneficial owners instruct their brokers how they wish to vote their shares.

DIRECTOR ELECTION AUTHORITY

Under a policy adopted by the Board of Directors, in an uncontested election, any nominee for director who does not receive the favorable vote of at least a majority of the votes cast with respect to such director is required to tender his or her resignation to the Board of Directors. For purposes of the policy, a majority of votes cast means that the number of shares voted “for” a director’s election exceeds 50% of the number of votes cast with respect to that director’s election. Votes cast include votes to withhold authority and exclude abstentions with respect to that director’s election.

The Governance and Compliance Committee will make a recommendation to the Board as to whether to accept or reject the resignation, or whether other action should be taken. The Board will act on the Committee’s recommendation and publicly disclose its decision, and the rationale behind it, within 90 days from the date of the certification of the election results. The director who tenders his or her resignation will not participate in the Committee’s recommendation or in the Board’s decision.

If a majority of the members of the Governance and Compliance Committee fail to receive a “majority vote” in the same election, then the independent directors on the full Board of Directors shall appoint a committee from among themselves to consider the resignations and recommend to the Board whether to accept them.

If a director’s resignation is not accepted by the Board of Directors, the director shall continue to serve for the balance of the term for which he or she was elected and until his or her successor is duly elected, or his or her earlier resignation or removal.

If a director’s resignation is accepted by the Board of Directors, then the Board of Directors may, in accordance with the By-laws, fill any resulting vacancy or decrease the size of the Board of Directors.

SOLICITATION OF PROXIES

The Company has engaged MacKenzie Partners, Inc., to assist in the solicitation of proxies and provide related advice and informational support, for a services fee, plus customary disbursements, which are not expected to exceed $50,000 in total. The Company will bear these costs.

In addition, regular employees, none of whom will receive any extra compensation for their activities, or directors of the Company may also solicit proxies by telephone, e-mail or in person and arrange for brokerage houses and their custodians, nominees and fiduciaries to send proxies and proxy materials to their principals at the expense of the Company.

RECORD DATE AND VOTING

Only shareholders of record at the close of business on June 3, 2016 are entitled to attend and vote at the Meeting. On that date, the Company had outstanding and entitled to vote 51,042,696 shares of common stock with a par value of $.01 per share. Each outstanding share entitles the record holder to one vote on each of the director nominees and one vote on each other matter.

3

Haemonetics 2016 Proxy Statement

CORPORATE GOVERNANCE

STRUCTURE OF THE BOARD OF DIRECTORS

The Board of Directors oversees, directs and counsels executive management in conducting the business in the long-term interests of the Company and the shareholders. The Board’s responsibilities include:

• | Reviewing and approving the Company’s financial and strategic objectives, operating plans and significant actions, including acquisitions; |

• | Overseeing the conduct of the business and compliance with applicable laws and ethical standards; |

• | Overseeing the processes which maintain the integrity of our financial statements and public disclosures; |

• | Selecting, evaluating and determining the compensation of senior management, including the Chief Executive Officer; and |

• | Developing succession plans for position of Chief Executive Officer and the Board, and supervising senior management succession. |

The Board of Directors currently has seven members, all of whom are independent. The independent directors are organized into three standing committees: the Audit Committee, the Compensation Committee, and the Governance and Compliance Committee. This past year, leadership was provided by the Chairman of the Board, Richard J. Meelia.

We believe that having separate individuals serving in the roles of Chairman and Chief Executive Officer is appropriate for the Company at this time in recognition of the different responsibilities of each position and to foster independent leadership of our Board. This structure allows the Chief Executive Officer to focus on the day-to-day leadership of the Company and its operations and the Chairman to focus on leadership of the Board, while both individuals provide direction and guidance on strategic initiatives.

EXECUTIVE SESSIONS

Executive sessions of the non-management directors are generally held at the beginning and end of each board meeting. During fiscal 2016, the Chairman of the Board of Directors, Richard J. Meelia, presided over all such executive sessions.

COMMITTEES OF THE BOARD

Compensation

The Board of Directors has a Compensation Committee composed entirely of independent directors. Currently, the members of the Compensation Committee are Pedro Granadillo, Chairman, Susan Bartlett Foote, and Mark Kroll, PhD. During the last fiscal year, there were a total of nine meetings of the Compensation Committee which included four regular meetings and five telephonic meetings.

The Compensation Committee has three broad areas of responsibility:

• | determining the Company’s compensation philosophy and policy for the chief executive officer and other senior management, and directors, which includes: |

◦ | evaluation and approval of the compensation plans, policies and programs of the Company related to the chief executive officer and his direct reports |

◦ | annually reviewing and approving the relevant peer groups to be used for compensation comparison purposes and regularly reviews the competitive standing of all components of executive compensation; |

◦ | review and approval of senior management employment agreements, severance arrangements, and change in control agreements/provisions, in each case as, when and if appropriate, along with any executive benefits beyond those provided to other employees; |

4

Haemonetics 2016 Proxy Statement

◦ | obtaining and reviewing market data for all components of director compensation, and provides such market data and its recommendations as input to the Governance and Compliance Committee’s decision on director compensation; |

• | Determining the compensation of the chief executive officer and his direct reports, which includes: |

◦ | ensuring that the Board annually reviews and approves corporate goals and objectives relevant to the chief executive officer’s compensation; |

◦ | approving the grant of equity awards to officers, employees and directors under the Company’s incentive compensation plans and agreements—the Committee determines eligibility, the number and type of awards available for grant, and the terms and conditions of such grants; |

• | Communicating with shareholders on compensation matters, including: |

◦ | the review and approval of the Compensation Discussion and Analysis included in this proxy statement; |

◦ | Meeting with shareholders to obtain feedback on compensation and provide explanations of the Company's philosophy. |

Audit

The Board of Directors has an Audit Committee composed entirely of independent directors. Currently, the members of the Audit Committee are Charles Dockendorff, Chairman, Ronald Gelbman, Ronald Merriman and Richard Meelia. Mr. Gelbman did not serve on the Audit Committee during his appointment as Interim CEO. Ellen Zane also served on the Audit Committee prior to her resignation from the Board in April 2016.

The Board has determined that service by Ronald Merriman on the audit committees of three other public companies while he is serving on our Audit Committee does not impair Mr. Merriman’s ability to effectively serve on our Audit Committee.

During the last fiscal year, there were a total of ten meetings of the Audit Committee, which included 4 regular meetings and six telephonic meetings.

The Audit Committee:

• | provides general oversight of the Company’s financial reporting and disclosure practices, system of internal controls, and processes for monitoring compliance by the Company with Company policies; |

• | is directly responsible for the selection, termination, and compensation of the independent registered public accounting firm; |

• | reviews the scope of the audit for the year and the results of the audit when completed; |

• | reviews with the Company’s independent registered public accounting firm and internal finance function various matters relating to internal accounting controls; and |

• | reviews with the Company’s corporate control and analysis function, which has responsibility for internal audit, various matters relating to risk assessment and remediation. |

Governance and Compliance

The Board of Directors has a Governance and Compliance Committee composed entirely of independent directors. Currently, the members of the Governance and Compliance Committee are Ronald Gelbman, Chairman, Susan Bartlett Foote, Pedro Granadillo and Richard Meelia. Mr. Gelbman did not serve on the Committee during his appointment as Interim Chief Executive Officer. Ellen Zane served as Chair from October 2015 until her resignation from the Board in April 2016. Richard Meelia served as Chair from April 2016 until Mr. Gelbman's appointment as Interim Chief Executive Officer ended in May 2016. During the last fiscal year, there were a total of five meetings, which included four regular meetings and one telephonic meeting of the Governance and Compliance Committee.

5

Haemonetics 2016 Proxy Statement

The Governance and Compliance Committee:

• | recommends nominees for election as directors to the full Board of Directors; |

• | provides oversight of the Company's compliance programs, including those for non-financial regulatory matters, medical device promotion, anti-bribery, data security, environmental and safety; |

• | considers recommendations for nominees for directorships submitted by shareholders, directors and members of management; |

• | recommends to the Board a set of corporate governance principles applicable to the Company; |

• | reviews on a regular basis the Company’s corporate governance practices and recommends appropriate changes as applicable and in line with emerging best practices; and |

• | in collaboration with the Compensation Committee, recommends changes to board compensation based on outside market data, shareholder input and independent consultant recommendations. |

THE BOARD'S ROLE IN RISK MANAGEMENT

The Board is responsible for oversight of the Company’s risk management, while the Company's management is responsible for risk management on a day-to-day basis. The Board focuses on the quality and scope of the Company’s risk management strategies, considers the most significant areas of risk inherent in the Company’s business strategies and operations, and ensures that appropriate risk mitigation programs are implemented by management.

In addition to the full Board’s oversight of the Company’s risk management, Board committees consider discrete categories of risk relating to their respective areas of responsibility. All committees report to the full Board as appropriate, including when a matter rises to the level of a material or enterprise level risk.

The Board also requires executive management to be responsible for day-to-day risk management. The President and Chief Executive Officer has overall responsibility for the Company's risk management approach. This responsibility also includes identifying, evaluating, and addressing potential risks that may exist at the enterprise, strategic, financial, operational, compliance and reporting levels. The Company's internal audit function, which reports directly to the Audit Committee of the Board, serves as the primary monitoring and testing function for compliance with company-wide policies and procedures.

The Company believes that the division of risk management responsibilities described above constitutes an effective program for addressing the risks inherent in the operation of the Company and the achievement of its business objectives.

MEETINGS OF THE BOARD OF DIRECTORS

The Board of Directors typically meets four times per year in regular meetings to address the following areas in addition to routine or special business: a spring meeting, which focuses on the Company's Annual Operating Plan; a summer meeting, which focuses on the Company's governance, a fall meeting, which focuses on the Company's Strategic Plan; and a winter meeting, which focuses on the Company's succession planning. During the last fiscal year, there were a total of eight meetings of the full Board of Directors of the Company, four regular meetings and four telephonic meetings. All of the directors attended at least 75% of the aggregate of (i) the total number of meetings of the full Board of Directors held while he or she was a director, and (ii) the total number of meetings held by Committees of the Board of Directors on which they served. All directors are strongly encouraged to attend the Annual Meeting of Shareholders. All eight board members attended the Company's 2015 annual meeting of shareholders.

BOARD COMPOSITION AND THE DIRECTOR NOMINATION PROCESS

The Governance and Compliance Committee is responsible for reviewing and assessing the appropriate skills, experience, and background required for the Company’s Board of Directors. Because our business operates in regulated healthcare markets around the globe and encompasses research, manufacturing, and marketing

6

Haemonetics 2016 Proxy Statement

functions which are subject to technological and market changes, the skills, experience, and background which are needed are diverse.

While the priority and emphasis of each factor changes from time to time to take into account the current needs of the Company, the aim is to have a diverse portfolio of talents and backgrounds including diversity with respect to age, gender and ethnicity. The key factors in any assessment include independence, experience in key business disciplines, and industry background. The Committee and the Board review and assess the importance of these factors as part of the Board’s annual self-assessment process to ensure they continue to advance the Company’s goal of creating and sustaining a Board of Directors which can support and effectively oversee the Company’s business.

Although the Board has not adopted any absolute prerequisites for nomination of directors, the Governance and Compliance Committee considers the following minimum criteria when identifying director nominees:

• | the nominee’s skills and business, personal and professional accomplishments, government or other professional experience and acumen, bearing in mind the composition of the Board, the current state of the Company and the markets in which the Company is active at the time; |

• | the nominee’s reputation, integrity, independence of thought and judgment, financial sophistication and leadership; |

• | independence from management, as defined by the New York Stock Exchange and Securities and Exchange Commission; |

• | the number of other public companies for which the nominee serves as a director; |

• | the extent to which the nominee is prepared to participate fully in Board activities, including at least one Board committee, and attendance at, and active participation in, meetings of the Board and the committee(s) of which he or she is a member, and the absence of other commitments that would, in the judgment of the Committee, interfere with or limit his or her ability to do so; |

• | the extent to which the nominee helps the Board reflect the diversity and interests of the Company’s shareholders, employees, customers and communities; |

• | the willingness of the nominee to meet the Company’s stock ownership requirements for directors; |

• | the nominee’s knowledge of one or more segments of the Company’s business; and |

• | the nominee’s commitment to increasing shareholder value in the Company. |

In the case of current directors being considered for re-nomination, the Governance and Compliance Committee will also take into consideration the director’s history of attendance at Board and committee meetings, tenure as a member of the Board, and preparation for and participation in such meetings.

The Company’s nomination process for new Board members is as follows:

• | The Governance and Compliance Committee or other Board member identifies a need to add a new Board member who meets specific criteria or to fill a vacancy on the Board. |

• | The Governance and Compliance Committee initiates a search seeking input from Board members and senior management and hiring a search firm, if necessary. |

• | The Governance and Compliance Committee considers recommendations for nominees for directorships submitted by shareholders. |

• | An initial list of candidates that will satisfy specific criteria and otherwise qualify for membership on the Board is identified and presented to the Governance and Compliance Committee which evaluates the candidates. |

7

Haemonetics 2016 Proxy Statement

• | The Chairman of the Board, the Chairman of the Governance and Compliance Committee, the Chief Executive Officer, and at least one other member of the Governance and Compliance Committee interview top candidates. |

• | All other Board members are kept informed of progress. |

• | The Governance and Compliance Committee may offer other Board members the opportunity to interview the candidates and then meets to consider and approve the final candidates. |

• | The Governance and Compliance Committee seeks the entire Board's endorsement of the final candidates. |

• | The final candidates are nominated by the Board for shareholder election or appointed to fill a vacancy. |

The Governance and Compliance Committee reviews and evaluates all director nominations in the same manner and in accordance with the Company's By-laws. Shareholders who wish to submit candidates for consideration as nominees may submit an appropriate letter and resume to the Secretary of the Company at the Company’s executive offices in Braintree, Massachusetts.

COMMUNICATIONS WITH THE BOARD OF DIRECTORS

Interested parties and shareholders may communicate with the Board of Directors, or the non-management directors as a group, or any individual director by sending communications to the attention of the Secretary of the Company, Sandra Jesse, who will forward such communications to the Chairman. Communications may also be sent via the Investor Relations page on the Company’s website: www.Haemonetics.com

CODE OF CONDUCT, CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS

The Company's Code of Business Conduct requires that all of our directors, officers and employees avoid conflicts of interest, comply with all laws and other legal requirements, conduct business in an honest and ethical manner and otherwise act with integrity and in the best interest of the Company. The Company’s Code of Business Conduct, Governance Principles and the Charters of the Audit, the Compensation, and the Governance and Compliance committees may be viewed on the Investor Relations page on the Company’s website at www.Haemonetics.com and printed copies can be obtained by contacting the Secretary at the Company’s headquarters.

BOARD INDEPENDENCE

The Board has determined that each of the directors who has served during fiscal 2016, with the exception of Mr. Gelbman during his service as the Company's Interim Chief Executive Officer, has no material relationship with the Company and is independent within the meaning of the Securities and Exchange Commission and the New York Stock Exchange director independence standards in effect. In making this determination, the Board considered information provided by each director and by the Company with regard to each director’s business and personal activities as they may relate to the Company and its management.

8

Haemonetics 2016 Proxy Statement

ITEM 1— | ELECTION OF DIRECTORS |

Pursuant to the Articles of Organization of the Company, the Board of Directors is divided into three classes, with each class being as nearly equal in number as possible. One class of directors is elected each year for a term of three years and until their successors shall be duly elected and qualified or until their death, resignation or removal. The terms of Susan Bartlett Foote, Pedro P. Granadillo and Mark W. Kroll, PhD are expiring at this annual meeting.

The persons named in the accompanying proxy will vote, unless authority is withheld, for the election of the nominees named below. If any such nominees should become unavailable for election, which is not anticipated, the persons named in the accompanying proxy will vote for such substitutes as the Board of Directors may recommend. Should the Board of Directors not recommend a substitute for any nominee, the proxy will be voted for the election of the remaining nominees. The nominees are not related to each other or to any executive officer of the Company or its subsidiaries.

The Board of Directors believes election of Susan Bartlett Foote, Pedro P. Granadillo and Mark W. Kroll, PhD as Directors of the Company for the ensuing 3 years, is in the best interests of the Company and its shareholders and recommends a vote FOR such nominees.

NOMINEES FOR TERMS ENDING IN 2019

Susan Bartlett Foote

Director since 2004

Independent

Professor Emeritus, Division of Health Policy and Management, School of Public Health, University of Minnesota; Member Board of Directors, Banner Health System.

Professor Foote is a widely known and respected expert on health policy and brings to the Board extensive policy expertise in both healthcare and corporate responsibility, as well as experience with our hospital customers from her background in public service, academia and hospital board of director service.

Professor Foote, 69, joined the Board of Directors in 2004 and is a member of both the Compensation Committee and Governance and Compliance Committee. Professor Foote is currently a member of the Board of Directors of Banner Health System, a nationally recognized nonprofit healthcare system, and Professor Emeritus, Division of Health Policy and Management, School of Public Health, at the University of Minnesota. She is a member of the California State Bar Association.

From 1999 until 2009, Professor Foote held various leadership positions at the University of Minnesota, serving as Professor, Associate Professor and Division Head of the Division of Health Policy and Management, School of Public Health. In 1996, she founded and led Public Policy Partners, Inc., a health policy consulting firm and was a Partner at the law firm of Dorsey & Whitney LLP. Professor Foote also served as Senior Health Policy Analyst in the United States Senate from 1991 to 1994 and was Professor of Business & Public Policy at the University of California at Berkeley from 1982 until 1993.

Other Public Company Board Service: None

9

Haemonetics 2016 Proxy Statement

Pedro P. Granadillo

Director since 2004

Independent

Co-Founder of Umbria Pharmaceuticals; Retired Senior Vice President Global Manufacturing and Human Resources, Eli Lilly and Company.

Mr. Granadillo is a highly-respected pharmaceutical industry leader with extensive experience in corporate management. Having served as a global executive of one of the world’s largest pharmaceutical companies, Mr. Granadillo brings to the Board, many years of leadership experience in manufacturing operations, quality and human resources.

Mr. Granadillo, 69, joined the Board of Directors in 2004 and serves as Chairman of the Compensation Committee and is a member of the Governance and Compliance Committee. Until its acquisition by Shire plc in February, 2015, Mr. Granadillo was a member of the Board and served as Chairman of the Compensation Committee at NPS Pharmaceuticals, Inc., a public biotechnology company. Mr. Granadillo co-founded and is a director of Umbria Pharmaceuticals, a private pharmaceutical company.

Mr. Granadillo resigned as director of Nile Therapeutics, a public pharmaceutical company in December, 2013 and from Dendreon Corporation, a public biotechnology company in March 2014. He held various senior level positions during his tenure at Eli Lilly and Company including serving on the Executive Committee and as its Senior Vice President with world-wide responsibility for manufacturing, quality and human resources. Mr. Granadillo retired from Eli Lilly and Company in 2004 after 34 years of dedicated service including 13 years in Europe.

Other Public Company Board Service: None

Mark W. Kroll, PhD

Director since 2006

Independent

Member, Board of Directors of TASER International; Adjunct Full Professor of Biomedical Engineering, University of Minnesota

Dr. Kroll, a well-known pioneer in the field of electrical medical devices and distinguished technology expert throughout the global medical device industry, provides the Board with extensive expertise in the areas of medical innovation and technology. In 2010, Dr. Kroll was awarded the Career Achievement Award in Biomedical Engineering, among the highest international awards in biomedical engineering.

Dr. Kroll, 63, joined the Board of Directors in 2006 and serves on the Compensation Committee. He is currently a member of the Board of Directors of TASER International, Inc., a public safety technologies company, and is an Adjunct Full Professor of Biomedical Engineering at the University of Minnesota.

Dr. Kroll most recently served as Chairman of the Board of Directors at New Cardio, Inc., a public cardiac diagnostic and services company from 2008 until 2011. Dr. Kroll served as the Senior Vice President and Chief Technology Officer for the Cardiac Rhythm Management division of St. Jude Medical Inc. He also served as Vice President of the Tachycardia Business division and in various senior executive roles within St. Jude from 1995 through his retirement in 2005. Dr. Kroll also served as an Adjunct Full Professor of Biomedical Engineering at California Polytechnic University. He has more than 25 years’ experience with cardiovascular devices and instrumentation and is the named inventor of more than 350 U.S. patents as well as numerous international patents.

Other Public Company Board Service: TASER International, Inc.

10

Haemonetics 2016 Proxy Statement

CONTINUING BOARD MEMBERS

Ronald Gelbman

Director since 2000

Independent

Interim Chief Executive Officer Haemonetics Corporation; Retired Worldwide Chairman of the Health Systems and Diagnostics Group at Johnson & Johnson.

Having served as a member of the Executive Committee, World Chairman, Pharmaceuticals and Diagnostics, and Worldwide Chairman for Health Systems and Diagnostics for one of the world's largest global healthcare companies, Mr. Gelbman brings to the Board many years of international executive leadership and management experience in the global healthcare markets, strategic planning skills and marketing expertise.

Ronald G. Gelbman served as Interim Chief Executive Officer of Haemonetics from September 2015 to May 2016. He has been a member of the Haemonetics Board of Directors since 2000 and, except during his appointment as Interim CEO, serves as Chair of the Governance & Compliance Committee and a member of the Audit Committee.

Mr. Gelbman, 68, is a former member of the Executive Committee of Johnson & Johnson, and served as Worldwide Chairman of the Pharmaceuticals and Diagnostics Group. His responsibilities included the pharmaceutical companies (Ortho-McNeil Pharmaceutical, Janssen Pharmaceutica, Ortho Biotech and Janssen-Cilag), as well as the Janssen Research Foundation and Pharmaceutical Research Institute. In addition, he was responsible for Johnson & Johnson Health Care Systems, LifeScan, Ortho-Clinical Diagnostics and Therakos. A member of the Executive Committee since 1994, he retired from Johnson & Johnson in April, 2000. Mr. Gelbman began his career with Johnson & Johnson in 1972, serving in various senior level positions throughout the company.

In addition to serving as a Director of Haemonetics Corporation, Mr. Gelbman is also an Advisor to Cambryn Biologics and serves on the SunTrust Southwest Florida Board of Advisors. Among his community activities, Mr. Gelbman is a member of the Board of Trustees, Chair of Finance Committee, Treasurer, and former Chair of The Out-of-Door College Preparatory School. He was a member of the Board of Trustees and Executive Committee at Rollins College; a member of the Board of Directors of the Sarasota Hospital Foundation; Chair of the Sarasota YMCA and served on the Crummer School Board of Overseers, the Board of Trustees at the Ringling School of Art and Design, and the Board of Directors of the Healthcare Leadership Council in Washington, D.C.

Other Public Company Board Service: None

Charles J. Dockendorff

Director since 2014

Independent

Member Board of Directors of Keysight Technologies, Inc. and Boston Scientific Corporation.; Retired Executive Vice President and Chief Financial Officer (CFO) at Covidien plc.

Mr. Dockendorff is a highly-respected healthcare industry leader with extensive experience in finance and corporate management. As a retired global executive of one of the world’s largest healthcare products companies, Mr. Dockendorff brings to the Board many years of leadership experience in financial management and planning.

Mr. Dockendorff, 61, joined the Board of Directors in 2014 and is Chairman of the Audit Committee. He currently serves as a member of the Keysight Technologies Inc. Board of Directors where he is Chairman of the Audit and Finance Committee and a member of the Nominating and Corporate Governance Committee. Keysight Technologies is a New York Stock Exchange listed company focused on electronic measurement. In April 2015, Mr. Dockendorff joined the Board of Directors of Boston Scientific Corporation where he serves as as a member its Audit and Finance Committees. In May 2016, Mr. Dockendorff assumed the role of Chairman of Boston Scientific's Audit Committee.

11

Haemonetics 2016 Proxy Statement

In 2015, Mr. Dockendorff retired from Covidien plc, a leading $10 billion global healthcare products company, where he served as Executive Vice President and Chief Financial Officer since 2006. The business, formerly known as Tyco Healthcare, separated from parent company Tyco International on June 29, 2007. From 1995 until 2006, Mr. Dockendorff served as Vice President and Chief Financial Officer of Tyco Healthcare. Mr. Dockendorff joined the Kendall Healthcare Products Company, the foundation of the Tyco Healthcare business, in 1989 as Controller and was named Vice President and Controller five years later. He was appointed Chief Financial Officer of Tyco Healthcare in 1995, and helped the Company grow from $600 million in 1995 to $10 billion as Covidien in 2007.

Prior to joining Kendall/Tyco Healthcare, Mr. Dockendorff was the Chief Financial Officer, Vice President of Finance and Treasurer of Epsco, Inc. and Infrared Industries, Inc. In addition, Mr. Dockendorff worked as an accountant for Arthur Young & Company (now Ernst & Young) and the General Motors Corporation.

Other Public Company Board Service: Keysight Technologies, Inc.; Boston Scientific Corporation.

Richard J. Meelia

Chairman since 2011

Independent

Principal, Meelia Ventures, Inc.; Retired Chairman, President and Chief Executive Officer, Covidien plc.

Having served as President and CEO of one of the world’s largest global healthcare products companies and having a long and decorated career in the healthcare industry, Mr. Meelia provides the Board many years of leadership experience in the global healthcare industry, including expertise in strategic planning, market development and international operations.

Mr. Meelia, 67, joined the Board of Directors and assumed the role of Chairman in 2011. He is a member of the Audit Committee and Governance and Compliance Committee. Mr. Meelia served as Chair of the Governance and Compliance committee between Ms. Zane's resignation in April 2016 until Mr. Gelbman's appointment as Interim Chief Executive Officer ended in May 2016. He is currently a member of the Board of Directors of ConforMIS Inc., a medical technology company focused on custom joint replacements and Mallinckrodt LLC, a global specialty biopharmaceuticals company. Mr. Meelia is currently a principal of Meelia Ventures, LLC, a private equity firm focused on early stage healthcare companies. Mr. Meelia is also currently a member of several charitable Boards including Tufts Medical Center and St. Anselm College. He also currently serves as the Chairman of the Board of Apollo Endosurgery, Inc., a private company focused on the development of devices that advance therapeutic endoscopy.

From July 2007 until his retirement in July 2011, Mr. Meelia served as Chairman, President, and Chief Executive Officer of Covidien plc following its separation from Tyco International in June, 2007. From January 2006 through the separation, Mr. Meelia was the Chief Executive Officer of Tyco Healthcare and from 1995 through the separation, Mr. Meelia was also the President of Tyco Healthcare. Mr. Meelia joined Kendall Healthcare Products Company, the foundation of both the Tyco Healthcare Business and Covidien, as Group President in 1991. He became President of Tyco Healthcare in 1995. Mr. Meelia formerly served on the Haemonetics Board from 2005-2009. He resigned to focus on his CEO responsibilities at Covidien. Early in his career, Mr. Meelia was promoted through a series of sales and marketing positions at the Pharmaseal and McGaw divisions of American Hospital Supply, where he ultimately became Vice President of Sales and Marketing. Following his career at American Hospital Supply, and before joining Kendall Healthcare, Mr. Meelia was President of Infusaid, Inc. a $30 million division of Pfizer that marketed implantable infusion pumps and ports.

Other Public Company Board Service: ConforMIS Inc.

12

Haemonetics 2016 Proxy Statement

Ronald L. Merriman

Director since 2005

Independent

Retired Vice Chair and Partner of KPMG; Member Board of Directors, Aircastle Limited, Pentair plc., and Realty Income Corporation.

Having served as Vice Chair and Partner of KPMG, a global accounting and consulting firm, Mr. Merriman brings the Board extensive expertise in financial management, enterprise risk management and operational controls and effectiveness as well as extensive public company audit committee experience.

Mr. Merriman, 71, joined the Board of Directors in 2005 and is a member of the Audit Committee. He is currently a member of the Board of Directors, Chair of the Audit Committee and member of the Compensation Committee of Aircastle Limited, a public aircraft leasing company. He also serves as member of the Board of Directors and Chair of the Audit and Finance Committee of Pentair plc., a public global diversified industrial company, and is a member of the Board of Directors and Chairman of the Audit Committee and member of the Nominating and Corporate Governance Committee of Realty Income Corporation, a public real estate investment trust.

More recently, from 2003 to 2011, Mr. Merriman was the Managing Director of Merriman Partners, a management advisory firm he founded. From 1967 to 1997 Mr. Merriman served at KPMG where he was Vice Chair and a member of the Executive Management Committee. He also served as Chief Operating Officer of its Health Care and Life Sciences Business Segment. From 1997 to 1999, he served as Executive Vice President of Ambassador International, Inc., a publicly traded travel services business. He has also held leadership positions at various other firms including Managing Director of O'Melveny & Myers and Executive Vice President of Carlson Wagonlit Travel.

Other Public Company Board Service: Aircastle Limited, Pentair plc and Realty Income Corporation

13

Haemonetics 2016 Proxy Statement

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS, DIRECTORS, AND MANAGEMENT

The following table sets forth, as of May 20, 2016 certain information with respect to beneficial ownership of the Company’s common stock by: (i) each person known by the Company to own beneficially more than five percent of the Company’s common stock; (ii) each of the Company’s directors and nominees and each of the executive officers named in the Summary Compensation Table in this Proxy Statement; and (iii) all directors and executive officers as a group.

OWNERSHIP TABLE

Amount & Nature Beneficial | Percent | |||||||

Name of Beneficial Owner | Title of Class | Ownership | of Class | |||||

Ronald G. Gelbman (1) | Common Stock | 97,766 | 0.2 | % | ||||

Christopher Simon | Common Stock | — | — | % | ||||

Christopher Lindop (2) | Common Stock | 230,546 | 0.5 | % | ||||

Kent Davies (3) | Common Stock | 13,507 | — | % | ||||

David Fusco | Common Stock | — | — | % | ||||

Byron Selman (4) | Common Stock | 32,412 | 0.1 | % | ||||

Charles J. Dockendorff (5) | Common Stock | 14,996 | — | % | ||||

Susan Bartlett Foote (6) | Common Stock | 64,911 | 0.1 | % | ||||

Pedro P. Granadillo (7) | Common Stock | 69,873 | 0.1 | % | ||||

Mark W. Kroll (8) | Common Stock | 64,973 | 0.1 | % | ||||

Richard Meelia (9) | Common Stock | 61,751 | 0.1 | % | ||||

Ronald L. Merriman (10) | Common Stock | 50,425 | 0.1 | % | ||||

BlackRock, Inc. (11) | Common Stock | 4,676,637 | 9.4 | % | ||||

The Vanguard Group (12) | Common Stock | 3,836,928 | 7.6 | % | ||||

T. Rowe Price Associates, Inc. (13) | Common Stock | 2,673,780 | 5.2 | % | ||||

Black Creek Investment Management Inc. (14) | Common Stock | 2,586,691 | 5.1 | % | ||||

All executive officers and directors as a group ( 13 persons)(15) | Common Stock | 781,594 | 1.5 | % | ||||

(1) Includes 52,578 shares which Mr. Gelbman has the right to acquire upon the exercise of options currently exercisable or exercisable within 60 days of May 20, 2016. Mr. Gelbman served as Interim Chief Executive Officer from September 2015 to May 2016. | ||||||||

(2) Includes 206,917 shares which Mr. Lindop has the right to acquire upon the exercise of options currently exercisable or exercisable within 60 days of May 20, 2016. Mr. Lindop retired from the Company on June 3, 2016 | ||||||||

14

Haemonetics 2016 Proxy Statement

(3) Includes 12,358 shares which Mr. Davies has the right to acquire upon the exercise of options currently exercisable or exercisable within 60 days of May 20, 2016. | ||||||||

(4) Includes 27,989 shares which Mr. Selman has the right to acquire upon the exercise of options currently exercisable or exercisable within 60 days of May 20, 2016. | ||||||||

(5) Includes 12,180 shares which Mr. Dockendorff has the right to acquire upon the exercise of options currently exercisable or exercisable within 60 days of May 20, 2016. | ||||||||

(6) Includes 52,578 shares which Ms. Foote has the right to acquire upon the exercise of options currently exercisable or exercisable within 60 days of May 20, 2016. | ||||||||

(7) Includes 52,578 shares which Mr. Granadillo has the right to acquire upon the exercise of options currently exercisable or exercisable within 60 days of May 20, 2016. | ||||||||

(8) Includes 52,578 shares which Dr. Kroll has the right to acquire upon the exercise of options currently exercisable or exercisable within 60 days of May 20, 2016. | ||||||||

(9) Includes 49,208 shares which Mr. Meelia has the right to acquire upon the exercise of options currently exercisable or exercisable within 60 days of May 20, 2016. | ||||||||

(10) Includes 38,320 shares which Mr. Merriman has the right to acquire upon the exercise of options currently exercisable or exercisable within 60 days of May 20, 2016. | ||||||||

(11) This information has been derived from a Schedule 13G filed with the Securities and Exchange Commission on January 16, 2016 reporting sole ownership of and dispositive power over 4,790,386 shares and sole voting power over 4,676,637 shares. The reporting entity's address is 55 East 52nd Street, New York, NY 10022. | ||||||||

(12) This information has been derived from Schedule 13G filed with the Securities and Exchange Commission on February 11, 2016 reporting sole voting power over 88,328 shares, shared voting power over 3,300 shares, sole dispositive power over 3,748,200 shares and shared dispositive power over 88,728 shares. The reporting entity's address is 100 Vanguard Boulevard, Malvern, PA 19355. | ||||||||

(13) This information has been derived from Schedule 13G filed with the Securities and Exchange Commission on February 12, 2016 reporting sole voting power over 558,010 shares, shared voting and shared dispositive power over 0 shares and sole dispositive power over 2,673,780 The reporting entity's address is 100 E. Pratt Street, Baltimore, MD 21202. | ||||||||

(14) This information has been derived from a Schedule 13G filed with the Securities and Exchange Commission on February 16, 2016 reporting sole ownership of and voting power over 2,586,691shares. The reporting entity's address is 123 Front Street West, Suite 1200, Toronto, ON M5J 2M2, Canada. | ||||||||

(15) Includes 627,138 which executive officers and directors have the right to acquire upon the exercise of options currently exercisable or exercisable within 60 days of May 20, 2016. | ||||||||

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 (the “Act”) requires the Company’s directors, officers and persons who own more than 10% of the Company’s common stock to file with the Securities and Exchange Commission and the New York Stock Exchange reports concerning their ownership of the Company’s common stock and changes in such ownership. Copies of such reports are required to be furnished to the Company. To the Company’s knowledge, based solely on a review of copies of such reports furnished to the Company during or with respect to the Company’s most recent fiscal year, all Section 16(a) filings required by persons who were, during the most recent fiscal year, officers or directors of the Company or greater than 10% beneficial owners of its common stock were made on a timely basis.

15

Haemonetics 2016 Proxy Statement

TRANSACTIONS WITH RELATED PERSONS

The Board has adopted a policy and procedures for the disclosure, review, approval or ratification of any transaction in which the Company or one of its subsidiaries is a participant and in which any “related person” (director, executive officer or their immediate family members, or shareholders owning 5% or more of the Company’s outstanding stock) has a direct or indirect material interest. The policy requires that transactions involving a related person be reviewed and approved in advance. The Board of Directors reviews the transaction in light of the best interests of the Company and determines whether or not to approve the transaction. The policy requires that executive officers and directors of the Company report proposed related party transactions to the Company’s Chief Legal Officer, who will bring the proposed transaction to the attention of the Board of Directors. The Company is not aware of any transaction required to be reported under Item 404(a) of Regulation S-K promulgated by the Securities and Exchange Commission since the beginning of fiscal 2016, nor is the Company aware of any instances during the period in which the foregoing policies and procedures required review, approval or ratification of such transaction but for which such policies and procedures were not followed.

16

Haemonetics 2016 Proxy Statement

COMPENSATION RISK STATEMENT

As stated in the Company's compensation philosophy, risk is a key consideration of the Compensation Committee in the development and design of compensation programs and policies. In the fourth quarter of fiscal 2016, with the assistance of management, the Compensation Committee reviewed and assessed the potential for risk in the Company's compensation programs to eliminate any adverse effect on the Company. The assessment process was completed on the Company's compensation plans, including the following considerations:

• | Market Perspective: The competitiveness of compensation levels, target mix and provisions with market norms, as well as the quality of peer group selection; |

• | Performance Metrics: The type and combination of various financial and non-financial performance metrics used in incentive plans; |

• | Pay Mix: The mix of pay elements, including short-term vs. long-term, fixed vs. variable, and cash vs. equity; |

• | Leverage: The payout curve of incentive plans, including slope and caps |

• | Checks and Balances: Factors that balance compensation risk through oversight, design, and policies |

In the process of our compensation risk assessment, multiple factors were identified which mitigate potential unnecessary risk-taking, including:

• | Target compensation levels are set at approximately the median of the competitive market; |

• | The fiscal 2016 Peer Group is representative of the Company in key size parameters; |

• | Balanced metrics in our incentive plans promote both top line and bottom line growth; |

• | Annual non-sales bonus payouts are (i) based upon a plan design and performance targets for revenue and operating income which are pre-approved by the Compensation Committee of the Board of Directors at the beginning of every year, (ii) capped, and (iii) do not guarantee a minimum bonus payout; |

• | A recapture policy in our annual bonus plans would recoup any payouts made as a result of material non-compliance with any financial reporting requirement that requires a restatement or if an employee’s actions violate the Haemonetics Code of Business Conduct; |

• | A significant portion of compensation for our executives and other senior management is in the form of long-term incentives; |

• | Equity awards are granted to executives and senior management annually and vest over three or four years with overlapping vesting periods, which foster a continuous long-term perspective; |

• | Share ownership guidelines require meaningful levels of equity ownership for senior management; and |

• | Change-in-control agreements are competitive with market norms for severance amounts and are only payable in the case of both a change-in-control and the employee’s termination other than for cause. |

The Compensation Committee continues to monitor compensation risk, assess the potential risks of compensation programs and policies during the design and approval process. In addition, the Committee will conduct an annual compensation risk assessment to monitor ongoing compensation plans.

17

Haemonetics 2016 Proxy Statement

COMPENSATION DISCUSSION AND ANALYSIS

EXECUTIVE SUMMARY |

This Compensation Discussion and Analysis provides a detailed description of our executive compensation philosophy and programs, the compensation decisions the Compensation Committee has made under those programs and the factors considered in making those decisions. This Compensation Discussion and Analysis focuses on the compensation of six executives in fiscal 2016. These executives, in addition to Brian Concannon, who resigned from his position of President & Chief Executive Officer in September 2015, who are referred to as our Named Executive Officers (“NEOs”), are:

EXECUTIVE | TITLE |

Ronald Gelbman | Interim Chief Executive Officer |

Christopher Lindop | CFO & EVP, Business Development |

Kent Davies | Chief Operating Officer |

David Fusco | EVP Global Human Resources |

Byron Selman | President, Global Markets |

YEAR IN REVIEW

On September 29, 2015, Mr. Concannon resigned his positions as President, Chief Executive Officer and as a member of the Haemonetics Board. The Board of Directors appointed Mr. Gelbman, an experienced healthcare executive and long-standing Haemonetics Board member, as Interim Chief Executive Officer. To facilitate a seamless transition, Mr. Concannon remained with the Company until October 31, 2015. His eligible outstanding options and Restricted Stock Units vested at the end of October in accordance with the terms of their respective agreements. Mr. Concannon was issued no additional equity during the transitional period.

In October, we began a comprehensive review of our business and our strategy. This transition in leadership, strategic review and new direction influenced our compensation programs but did not alter our commitment to competitive, performance-based compensation.

Revenue grew 3%, in constant currency, and adjusted operating income declined by 27%. While we did not meet our long-term growth and profitability expectations in fiscal 2016, we did see two growth franchises - Plasma and Hemostasis management - continue multi-year trends of consistent double-digit percentage disposables revenue growth, with combined growth of 11%.

Our strategic review identified Plasma, Hemostasis Management and Cell Processing as the growth franchises within our portfolio. We also identified our Donor franchise as having both significant value and ongoing challenges including declining markets and intense competition. We will manage the Donor franchise to maximize operating income.

To achieve these goals, the Company has begun to implement an operating model that will streamline the management structure and align the franchises closely with the global sales organization. Additionally, the Company has begun to implement a rationalization of its cost structure, with an aim to bring about sustainable productivity improvement.

The Board of Directors completed its CEO search with the appointment of Christopher Simon as President and Chief Executive Officer effective May 16, 2016. Mr. Simon, who was with McKinsey & Company for over 20 years, brings considerable experience in the medical device and pharmaceutical industries and, importantly, was deeply involved in the development of the Company's recent strategic review and resulting strategic plan. Under his leadership, the Company is well-positioned to execute the strategic plan.

18

In June 2016, the Company's Chief Financial Officer, Christopher Lindop, retired. Mr. Lindop has led the Company's finance and business development activities since 2007. The Company has begun a search for his successor.

SHAREHOLDER OUTREACH

At our July 2015 Annual Meeting, we received a 98% shareholder advisor vote in support of our executive compensation, after receiving 69% in fiscal 2014. We believe this considerable improvement was due to our fiscal 2015 outreach efforts that included our Compensation Committee Chair, and the resulting changes to our equity compensation program, including the adoption of performance shares based upon relative Total Shareholder Return (rTSR) for our executives, which were made in response to feedback from shareholders.

Throughout fiscal 2016, our Chief Executive Officer, Chief Operating Officer, Chief Financial Officer and VP, Investor Relations continued to meet directly with shareholders on a regular basis to discuss our business fundamentals, performance and long-term outlook. In addition to these regular meetings, our Board Chair, Compensation Committee Chair and Board Member / Interim CEO met with six large shareholders of over eleven million shares, over 20% of our outstanding shares, collectively.

During these fiscal 2015 and 2016 shareholder meetings, our Board members received feedback on a variety of topics. While our shareholders generally support our compensation philosophy, programs and practices, they offered suggestions on how to further improve links between pay and performance.

Additionally, our Board Chair, Compensation Committee Chair and Board Member/Interim CEO participated in a discussion with representatives of Glass Lewis, a leading proxy advisory firm. Our Board members provided their perspectives on our recent company performance, our shareholder outreach efforts and governance practices. We welcomed the opportunity to answer their questions and provided transparency into our compensation practices.

We remain committed to an active and transparent dialogue with our investors and proxy advisory firms. We believe that we should seek and understand the views of our shareholders on governance related matters, and that our shareholders should fully understand our executive compensation programs, including how they align the interests of our executives with those of our shareholders and reward the achievement of our strategic objectives.

SHARE PRICE PERFORMANCE

The following graph compares the cumulative 5-year total return provided to shareholders on Haemonetics Corporation’s common stock relative to the cumulative total returns of the S&P 500 index and the S&P Health Care Equipment index. An investment of $100 (with reinvestment of all dividends) is assumed to have been made in our common stock and in each of the indexes on April 1, 2011 and its relative performance is tracked through April 2, 2016.

19

Haemonetics 2016 Proxy Statement

___________________________________

* | $100 invested on April 2, 2011 in stock or index, including reinvestment of dividends. Fiscal year ended April 2. | |

4/11 | 3/12 | 3/13 | 3/14 | 3/15 | 4/16 | |||||||||||||

Haemonetics Corporation | 100.00 | 104.69 | 125.18 | 96.48 | 132.84 | 106.04 | ||||||||||||

S&P 500 | 100.00 | 105.71 | 117.77 | 139.42 | 154.68 | 155.57 | ||||||||||||

S&P Health Care Equipment | 100.00 | 106.08 | 119.18 | 148.88 | 184.83 | 178.92 | ||||||||||||

Note: The stock price performance included in this graph is not necessarily indicative of future stock price performance. This graph shall not be deemed "filed" for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, regardless of any general incorporation language in such filing. | ||||||||||||||||||

IMPACT OF COMPANY PERFORMANCE ON COMPENSATION

Fiscal 2016 has been a year of uncertainty, transition, and an elevated level of turnover in leadership that has necessitated important decisions to retain key leaders, including NEOs. The Board approved targeted actions to improve executive retention with the introduction of Executive Severance Agreements for current and future direct reports of the Chief Executive Officer and offered a Restricted Stock Unit grant for key employees, including NEOs. As a result of fiscal 2016 business performance, bonus funding was 21.1% of plan.

20

Haemonetics 2016 Proxy Statement

In the three years prior to fiscal 2016, compensation of our NEOs has reflected our financial and share price performance. Annually, we provide our senior executives, including the NEOs, with three basic compensation elements: base salary, short and long-term incentive pay consisting of equity compensation in the form of stock options, Restricted Stock Units and performance stock units.

LOOKING AHEAD TO FISCAL 2017 COMPENSATION

The Compensation Committee strongly believes that executive compensation should be tied directly to performance and views Company performance in two primary ways: (a) the Company’s operating performance, including results against our long-term growth targets; and (b) total return to shareholders over time, relative to other companies, including the S&P Healthcare Equipment Index and our compensation peer group (see page 24).

In compensating the new CEO, the Board targeted all elements of executive compensation, including the choice of performance metrics, to ensure a vigorous alignment between pay and performance. As disclosed in detail in the Form 8-K filed on May 10, 2016 with the Securities and Exchange Commission, the new CEO's compensation is strongly performance-based. Such elements include performance based Restricted Stock Units and an annual performance-based cash incentive.

COMPENSATION PHILOSOPHY AND OBJECTIVES |

Haemonetics’ executive compensation programs are designed to align the interests of our executive officers with those of our shareholders. Our compensation philosophy is to provide market-competitive programs that enable Haemonetics to:

• | Attract, motivate and retain exceptional leaders - dedicated to the long-term success of the organization and to the creation of sustainable shareholder value. |

• | Pay for Performance - create direct alignment between the achievement of pre-determined financial, operational and strategic objectives over the short and long-term and the resulting executive compensation. |

• | Display a clear correlation between the cost of compensation and the value to the employee and to the Company - evaluate annually, balancing affordability and the value of our compensation elements. |

Our executive compensation plans are designed with specific emphasis on accountability for our financial results in the short-term and with shareholder value over the longer-term. We create this alignment of accountability through several interacting mechanisms, combining fixed pay with at-risk, performance-based pay elements, and establishing targeted positioning against the market.

When determining compensation levels, we target all elements of compensation at the market median. Through at-risk pay components, our pay program is designed to reward exceptional corporate and individual performance with actual pay above the market median; performance below expectations will result in actual pay levels below the market median.

The following is a summary of key executive compensation features aligned with competitive practice. These strategic components of executive pay include:

21

Haemonetics 2016 Proxy Statement

COMPONENT | KEY FEATURES | PURPOSE |

Pay Positioning | Targeted at the market 50th percentile for performance that meets financial and individual goals | Align pay with the market median |

Performance Targets | Ambitious yet achievable goals set for executives and the company | Align goals with our commitment to shareholders |

Base Salary | Fixed cash payment based on position, responsibilities, experience and individual performance | Offer a stable source of income that is balanced with at-risk pay |

Annual Incentive | Annual cash incentive tied to achievement of designated short-term Company, Business (as applicable) and Individual goals | Motivate and reward executives for achievement of short-term goals |

Long-Term Equity Incentives | Awards earned based on time and performance-based requirements | Create alignment with shareholders and promote achievement of Company long-term performance objectives; retains key executives |

Compensation Mix | Strategic weighting of fixed and variable compensation vehicles, to ensure focus on short and long-term goals | Balance focus on both short and long-term goals while allowing a baseline of income |

Benefits | Competitive health, life insurance, disability and retirement benefits on the same basis as our non-executive employees | To promote health and wellness in the workforce and to provide competitive retirement planning and saving opportunities |

DETERMINING EXECUTIVE COMPENSATION |

The Compensation Committee assesses multiple factors when establishing and maintaining the Company’s

executive compensation programs including: an annual review and analysis of our peer group, competitive industry compensation surveys, affordability, legal and regulatory considerations to inform the total compensation for the Chief Executive Officer (“CEO”) and his direct reports. The CEO is evaluated solely on Company performance including financial, strategic and operational goals. Executives, including NEOs, are evaluated on company performance, individual performance and potential.

22

Haemonetics 2016 Proxy Statement

ROLES AND RESPONSIBILITIES IN THE EXECUTIVE COMPENSATION PROCESS

ROLE | RELATIONSHIP TO COMPANY | KEY RESPONSIBILITIES | |

Compensation Committee of the Board of Directors | Independent Non-Employee Directors Appointed by the Board of Directors | l | Fulfill Committee Charter |

l | Evaluate and Approve Compensation Philosophy, Plans, Policies, Incentive Targets | ||

l | Set Competitive Short and Long-Term Cash Compensation Elements | ||

l | Determine the Extent to which Short and Long-Term Performance Goals have been Achieved | ||

l | Set Executive Benefits and Perquisites | ||

l | Determine CEO Compensation | ||

l | Review and Approve Recommendations of the CEO with regard to other NEO Compensation | ||

l | Engage shareholders and Solicit Feedback | ||

l | Approve Peer Group | ||

Management | Executive Employees of the Company | l | Provide Proposed Financial Targets and Results to the Committee |

l | Achievement of Corporate Objectives | ||

l | Conduct Executive Performance Reviews | ||

l | Perform Succession Planning and Determine Ratings | ||

l | Provide Leadership Competency Assessments | ||

l | Implement and Communicate Decisions | ||

l | Apprise Committee on Company Ability to Attract, Motivate, Retain Executives | ||

l | Provide Compensation Cost Analysis | ||

l | CEO - Recommend Changes to Direct Reports' (NEO) Compensation to Compensation Committee | ||

Compensation Consultant: Frederic W. Cook & Co., Inc., (F.W. Cook) | Independent Consultant Engaged by Compensation Committee1 | l | Executive Compensation Consulting Services |

l | Competitive Market Data Benchmarking and Analysis | ||

l | Regulatory Updates | ||

l | Market Trends Reporting | ||

l | Special Reports | ||

l | Committee Meeting Attendance | ||

l | Guidance to Compensation Committee | ||

l | Recommend Peer Group | ||

1 The Compensation Committee has evaluated the independence of the consultant and found they have met the requirements outlined under the Securities and Exchanges Commission rules.

ROLE OF PEER GROUP AND BENCHMARKING

The Committee conducts an annual executive compensation competitive assessment at the July Committee meeting. The market data provided by the Committee's compensation consultant provides important information on the competitiveness of our executive compensation in relation to similar companies in the Healthcare sector (GICS35) and the Electronics Equipment, Instruments & Components industry (GICS 452030).

23

Haemonetics 2016 Proxy Statement

F.W. Cook, the Committee's independent compensation consultants, filters the broader industry information based on comparable business content and model, peer group company size, statistical reliability and executive talent sources, among other criteria, to define and recommend the peer group. The two sources used to then benchmark executive compensation are:

• | The Peer Group - A group of similarly sized companies from the medical device, biotechnology and healthcare industries. The benchmarking information is extracted from the peer group proxies. |

• | Compensation Survey - When a job is not reported in the peer group proxies, the Compensation Committee considers aggregated data from a survey. The group of companies used in the analysis (based on a custom cut commissioned from Radford) consists of 18 companies selected in collaboration with Haemonetics management. |

Annually, the Committee reviews the peer group for continued appropriateness in advance of the annual executive compensation competitive assessment. When reviewing the peer group and suggesting potential replacement companies, the Committee considers the similarity of the company’s products and services, while screening for revenues of approximately one-half to two times ours and a market capitalization of approximately one-third to three times ours.

As a result of the assessment for fiscal 2016, the Committee approved the addition of Analogic Corporation to rebalance the peer group closer to the median revenue range.

FISCAL 2016 - PEER GROUP | ||

Allscripts Healthcare Solutions, Inc. | Hologic, Inc. | NuVasive Inc |

Analogic Corp. | IDEXX Laboratories, Inc. | PerkinElmer Inc. |

Bio-Rad Laboratories, Inc. | Integra LifeSciences Holdings | ResMed, Inc. |

Bruker Corp. | Masimo Corp. | Thoratec Corp. |

CONMED Corp. | MedAssets, Inc. | Waters Corp |

Greatbatch, Inc. | Myriad Genetics, Inc. | |

This peer group differs from the peer group used in the corporate performance graph contained in our annual report on Form 10-K. The Committee believes that the S&P 500 Index and the S&P Health Care Equipment Index contain many companies which are significantly different from our size and scope. The inclusion of these companies could have the effect of distorting the Committee’s understanding of the market for executive talent. As a result, the Committee has used a more targeted sampling of companies that are closer to our size and scope.

EVALUATING EXECUTIVE PERFORMANCE

Consistent with the annual performance cycle of the organization, executive performance is reviewed by the Compensation Committee in July. The CEO provides a performance rating to the Committee for each executive and a merit increase recommendation, where appropriate. The performance analysis includes an assessment of (i) achievement of individual and Company objectives; (ii) contribution to the Company’s short and long-term performance; and (iii) and how performance was achieved through the evaluation of leadership competencies, Company Values and Operating Principles.

For the CEO, the Board’s Chairman gathers input from all Board members and completes an assessment of the CEO’s performance and makes recommendations for the Committee’s consideration relative to the CEO’s compensation. The CEO is evaluated on all aspects of the Company's performance. In fiscal 2016, Mr. Concannon did not receive an increase to his salary.

24

Haemonetics 2016 Proxy Statement

ELEMENTS OF TOTAL COMPENSATION |

Our executive total compensation program is divided among four major elements: base salary, short-term incentives, long-term incentives and benefits. Total direct compensation is defined as fiscal 2016 base salary, annual incentive payment, and the grant date value of equity awards as disclosed in Summary Executive Compensation Table. A description of each element and their purpose at Haemonetics is described below:

COMPENSATION ELEMENT | PAY MIX | DESCRIPTION | PURPOSE |

Base Salary | 15% - 35% | Fixed cash compensation based on role, job scope, experience, qualification, and performance | To compensate for individual technical and leadership competencies required for a specific position and to provide economic security |

Short-Term Incentive | 15% - 20% | Annual cash incentive opportunity payable based on achievement of corporate, business unit, and individual objectives | To incentivize management to meet and exceed annual performance metrics and deliver on commitments to shareholders |

Long-Term Incentive | 45% - 70% | Annual equity award comprised of Stock Options, Restricted Stock Units and Performance Based Units | To incentivize management to increase shareholder value, reward long-term corporate performance, and promote employee commitment through stock ownership |

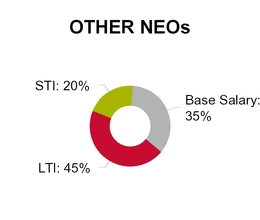

PAY MIX

The following chart illustrates the allocation of target total direct compensation for the CEO and for other NEOs among base salary, short term and long term incentive compensation, including the annualized value of the time and performance based Restricted Stock Units granted in fiscal 2016. All elements of compensation are considered to be at-risk with the exception of base salary.

TARGET ANNUAL PAY MIX

For our executives, the amount and mix attributed to base salary, short-term incentives and long-term incentives are determined in reference to market norms combined with our desire to align pay with the goals of our compensation strategy. While we evaluate our executive pay mix on an annual basis, we do not adhere to a rigid formula when determining the actual mix of compensation elements. Rather, our current policy is to balance the short and long-term focus of our compensation elements in order to reward short-term performance while emphasizing long-term value creation. These objectives are achieved by placing

25

Haemonetics 2016 Proxy Statement

considerable weight on long-term, equity based compensation while also offering enough cash and short-term compensation to attract and retain executive talent in an extremely competitive market.

BASE SALARY OVERVIEW

Base salary is provided to compensate for individual technical and leadership competencies required for a specific position and to provide economic security. The individual target base salary varies based on the field in which each executive operates, the scope of each position, the peer-group comparisons for similar executives, the experience and qualifications needed for the role, the executive's performance, and an assessment of internal equity amongst peers. Base salaries can increase through the merit process as discussed under the section titled "Evaluating Executive Performance." Base salaries can also increase due to a promotion or change in role.

When reviewing base salaries, the Compensation Committee relied on our Interim CEO’s evaluation of each NEO’s individual performance.

ANNUAL INCENTIVE PROGRAM