Form DEF 14A EPLUS INC For: Sep 15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to Rule 14a-12 |

ePlus inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

EPLUS INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be held on Thursday, September 15, 2016

To the Shareholders of ePlus inc.:

NOTICE IS HEREBY GIVEN THAT the Annual Meeting of Shareholders of ePlus inc., a Delaware corporation, will be held on Thursday, September 15, 2016, at The Westin Washington Dulles Airport, 2520 Wasser Terrace, Herndon, Virginia 20171 at 8:00 a.m. local time for the purposes stated below:

| 1. | To elect as directors the nominees named in the attached proxy statement, each to serve an annual term, and until their successors have been duly elected and qualified; |

| 2. | To hold an advisory vote on the compensation of our named executive officers as disclosed in the proxy statement; |

| 3. | To ratify the selection of Deloitte & Touche LLP as our independent registered accounting firm for our fiscal year ending March 31, 2017; and |

| 4. | To transact such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof. |

This year we are again electronically disseminating Annual Meeting materials to some of our shareholders, as permitted under the Notice and Access rules approved by the Securities and Exchange Commission. For shareholders whom Notice and Access applies, proxy materials were made available to you over the Internet beginning on or about August 3, 2016. Holders of our common stock at the close of business on July 21, 2016, are entitled to vote at the Annual Meeting of Shareholders.

You are cordially invited to attend the Annual Meeting in person. To ensure that your vote is counted at the Annual Meeting, however, please vote as promptly as possible.

|

By Order of the Board of Directors

|

|

|

/s/ Erica S. Stoecker

|

|

|

August 3, 2016

|

Erica S. Stoecker

|

|

Corporate Secretary &

|

|

|

General Counsel

|

YOUR VOTE IS IMPORTANT

BROKERS ARE NOT PERMITTED TO VOTE ON THE ELECTION OF DIRECTORS OR ON CERTAIN OTHER PROPOSALS WITHOUT INSTRUCTIONS FROM THE BENEFICIAL OWNER. THEREFORE, IF YOUR SHARES ARE HELD IN THE NAME OF YOUR BROKER OR BANK, IT IS IMPORTANT THAT YOU VOTE. WE ENCOURAGE YOU TO VOTE PROMPTLY, EVEN IF YOU PLAN TO ATTEND THE ANNUAL MEETING.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON SEPTEMBER 15, 2016:

THE COMPANY’S PROXY STATEMENT FOR THE 2016 ANNUAL MEETING OF SHAREHOLDERS AND THE ANNUAL REPORT FOR THE FISCAL YEAR ENDED MARCH 31, 2016, ARE AVAILABLE AT WWW.EDOCUMENTVIEW.COM/PLUS.

|

1

|

|

|

4

|

|

|

8

|

|

|

8

|

|

|

8

|

|

|

9

|

|

|

9

|

|

|

9

|

|

|

10

|

|

|

10

|

|

|

10

|

|

|

11

|

|

|

13

|

|

|

13

|

|

|

13

|

|

|

14

|

|

|

16

|

|

|

33

|

|

|

33

|

|

|

34

|

|

|

37

|

|

|

38

|

|

|

38

|

|

|

38

|

|

|

38

|

|

|

39

|

|

|

39

|

|

|

39

|

|

|

39

|

|

|

40

|

|

|

40

|

|

ePlus inc.

|

www.eplus.com

|

PROXY STATEMENT

FOR THE 2016 ANNUAL MEETING OF SHAREHOLDERS

This Proxy Statement is furnished to the shareholders of ePlus inc. ("we," "us," "our," or "the Company"), a Delaware corporation, in connection with the solicitation of proxies by our Board of Directors (also referred to herein as the Board) to be voted at the Annual Meeting of Shareholders or any adjournments or postponements of that meeting. The Annual Meeting of Shareholders will be held on September 15, 2016, at 8:00 a.m. at The Westin Washington Dulles Airport, 2520 Wasser Terrace, Herndon, Virginia 20171.

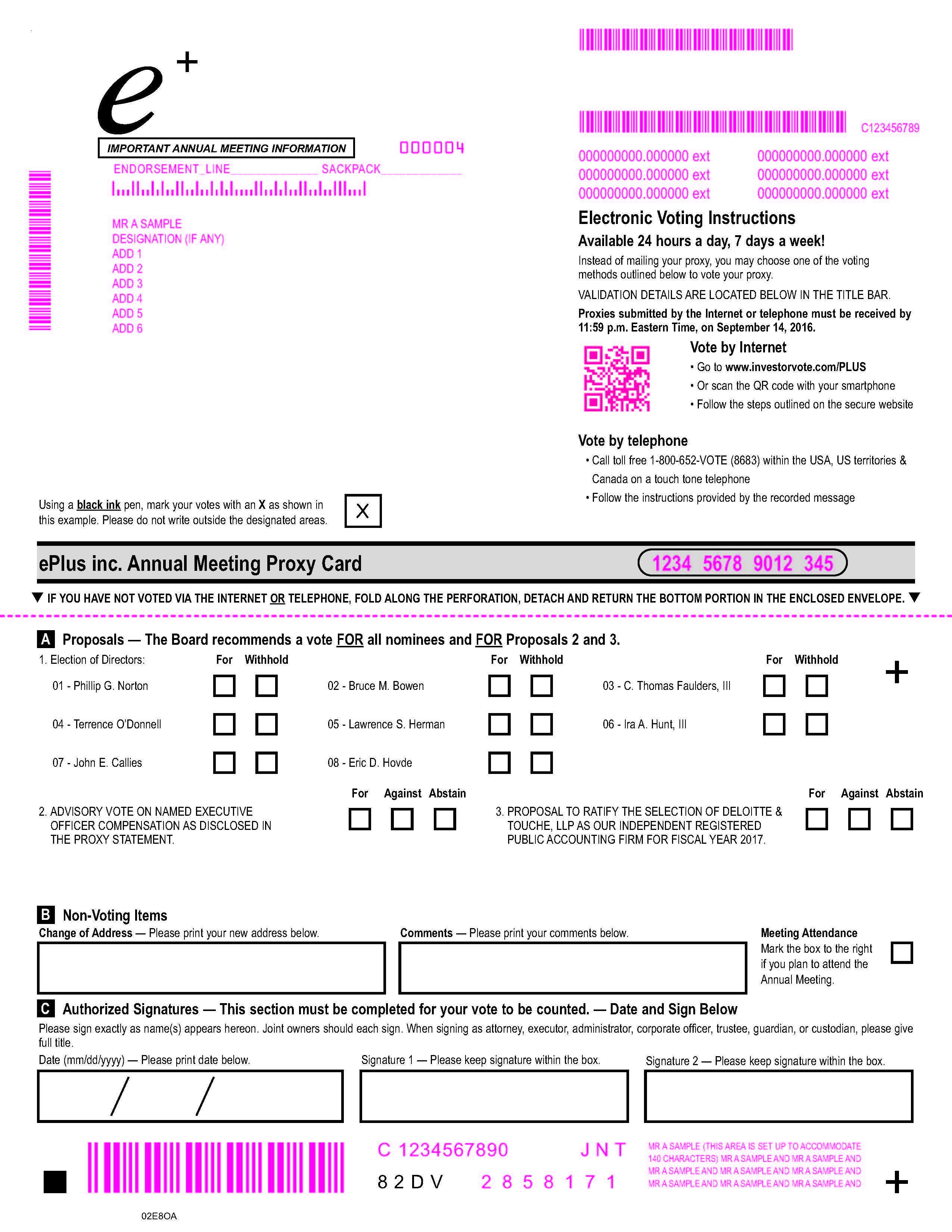

We are using the "Notice and Access" method of furnishing proxy materials to you over the Internet. "Notice and Access" rules adopted by the Securities and Exchange Commission (the "SEC") permit us to furnish proxy materials, including this Proxy Statement and our Annual Report on Form 10-K for fiscal year 2016, to our shareholders by providing access to such documents on the Internet instead of mailing printed copies. We believe that this process will provide you with a convenient and quick way to access your proxy materials and vote your shares, while allowing us to reduce the environmental impact of our Annual Meeting and the costs of printing and distributing the proxy materials. On or about August 3, 2016, we mailed to our shareholders a Notice of Internet Availability of Proxy Materials (the "Notice") containing instructions on how to access our Proxy Statement and Annual Report on Form 10-K and how to vote electronically over the Internet or request a printed set of the proxy materials. The Notice provides instructions on how to vote and identifies the items to be voted on at the Annual Meeting. You may vote: (i) by Internet; (ii) by telephone; (iii) by requesting and returning a paper proxy card or voting instruction card; or (iv) by submitting a ballot in person at the Annual Meeting. You cannot vote by marking the Notice and returning it. The Notice also contains instructions on how to receive a paper copy of the proxy materials. Most shareholders will not receive printed copies of the proxy materials unless they request them. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials in the Notice. Any request to receive proxy materials by mail will remain in effect until you revoke it.

Only holders of record of our common stock at the close of business on July 21, 2016 (the "Record Date"), will be entitled to vote at the Annual Meeting of Shareholders and any postponements or adjournments of that meeting. On the Record Date, we had 7,132,979 outstanding shares of Common Stock. Each share of common stock is entitled to one vote, and there is no cumulative voting.

You are voting on:

| · | Election of the eight director nominees named in this proxy statement to serve for an annual term (Proposal No. 1); |

| · | An advisory vote on our executive compensation as disclosed in this proxy statement (Proposal No. 2); |

| · | Ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending March 31, 2017 (Proposal No. 3). |

Our Board recommends that you vote your shares as follows:

|

·

|

“FOR” each of the nominees to the Board (Proposal No. 1);

|

| · | “FOR” the proposal regarding an advisory vote on executive compensation (Proposal No. 2); |

| · | “FOR” ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year ending March 31, 2017 (Proposal No. 3). |

How to Vote

Shareholders of Record. If on the record date your shares were registered directly in your name with our transfer agent, Computershare, then you are a shareholder of record and you may vote using any of the following methods:

|

ePlus inc.

|

www.eplus.com

|

| · | Internet. You may vote by going to the web address www.envisionreports.com/PLUS 24 hours a day, seven days a week, until 11:59 p.m. Eastern Time on September 14, 2016, and following the instructions for Internet voting shown on the Notice. |

| · | Telephone. You may vote by dialing 1-800-652-VOTE (8683) 24 hours a day, seven days a week, until 11:59 p.m. Eastern Time on September 14, 2016, and following the instructions for telephone voting shown on the Notice. |

| · | Mail. If you requested printed proxy materials or you receive a paper copy of the proxy card, then you may vote by completing, signing, dating and mailing the proxy card in the envelope provided. The card must be received by close of business on the business day before the Annual Meeting. If you vote by Internet or telephone, please do not mail your proxy card. |

| · | In person at the Annual Meeting. Shareholders of record may attend the Annual Meeting and vote in person. |

Whichever method you use (other than voting in person), the named proxies will vote the shares of which you are the shareholder of record in accordance with your instructions. By submitting your proxy, you authorize the proxies to use their judgment to determine how to vote on any other matter brought before the Annual Meeting, or any adjournments or postponements thereof. We do not know of any other business to be considered at the Annual Meeting.

Beneficial Owners of Shares Held in Street Name. If on the record date your shares were held in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name.” The organization holding your account is considered the shareholder of record for purposes of voting at the Annual Meeting. You will receive instructions from your bank, broker or other nominee describing how to vote your shares. You may vote by proxy via the Internet by visiting www.envisionreports.com/PLUS and entering the control number found in the Notice forwarded to you by your bank, broker or other nominee. The availability of Internet voting may depend on the voting process of the organization that holds your shares. If you request printed copies of the proxy materials by mail, you may vote by proxy by calling the toll free number found on the voting instruction form provided by your bank, broker or other nominee. The availability of telephone voting may depend on the voting process of the organization that holds your shares. If you request printed copies of the proxy materials by mail, you will receive a voting instruction form and you may vote by filling out the voting instruction form and returning it in the envelope provided. You are also invited to attend the Annual Meeting. However, since you are not the shareholder of record you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid proxy from your broker or other agent.

Making Changes to Your Proxy. You can revoke your proxy at any time before the final vote at the Annual Meeting. If you are a shareholder of record, you may revoke your proxy in any one of three ways:

| · | You may submit another properly completed proxy card with a later date (if you have opted for a printed set of materials), or vote again on a later date via the Internet or by telephone (only your latest Internet or telephone proxy submitted prior to the Annual Meeting will be counted). |

| · | You may send a written notice that you are revoking your proxy to the Corporate Secretary, ePlus inc., 13595 Dulles Technology Drive, Herndon, Virginia, 20171. |

| · | You may attend the Annual Meeting and vote in person. Attending the Annual Meeting will not, by itself, revoke your proxy. |

Please note that to be effective, your new proxy card or written notice of revocation must be received by the Corporate Secretary prior to the Annual Meeting.

If you are a beneficial owner of shares, you may submit new voting instructions by contacting your broker or other agent. You may also vote in person at the Annual Meeting if you obtain a legally valid proxy from your broker or other agent as described above.

|

ePlus inc.

|

www.eplus.com

|

How Proxies are Voted

All shares represented by valid proxies received prior to the Annual Meeting will be voted and, where a shareholder specifies by means of the proxy a choice with respect to any matter to be acted upon, the shares will be voted in accordance with the shareholder’s instructions.

Shareholders of Record. If you are a shareholder of record and indicate when voting on the Internet or by telephone that you wish to vote as recommended by the Board, or (if you have opted for a printed set of materials, you sign and return a proxy card without giving specific voting instructions) your shares will be voted as recommended by the Board by the persons named as proxies and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting.

Beneficial Owner of Shares Held in Street Name. If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, under the rules of various national and regional securities exchanges, the organization that holds your shares may generally vote on “routine” matters but cannot vote on “non-routine” matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization that holds your shares will inform the inspector of elections that it does not have the authority to vote on this matter with respect to your shares. This is generally referred to as a “broker non-vote.”

The ratification of the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending March 31, 2017, (Proposal No. 3) is a matter considered routine under applicable rules. A broker or other nominee may generally vote on routine matters, and therefore no broker non-votes are expected to exist in connection with Proposal No. 3.

The election of directors (Proposal No. 1) and the advisory vote on executive compensation (Proposal No. 2), are matters considered non-routine under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters, and therefore there may be broker non-votes on Proposals No. 1 and No. 2.

For Proposal No. 1, directors are elected by a plurality of the shares present in person or by proxy at the Annual Meeting and entitled to vote on the election of directors subject to the Company’s director resignation policy should any director not receive a majority of the votes cast. A plurality means that the nominees with the greatest number of votes are elected as directors up to the maximum number of directors to be chosen at the Annual Meeting. In the election of directors, Proposal 1, you may vote FOR each of the nominees or your vote may be WITHHELD with respect to one or more of the nominees. Broker non-votes will have no effect. Please note, however, that the Company’s Corporate Governance Guidelines provide that, in an uncontested election (that is, an election where the number of director nominees does not exceed the number of directors to be elected), if any nominee for director does not receive a majority of the votes cast, he is expected to tender his resignation in writing to the Chairman of the Nominating and Corporate Governance Committee, which resignation will be conditioned upon acceptance by the Board. The Nominating and Corporate Governance Committee shall evaluate the resignation tendered and shall make a recommendation to the Board whether to accept or reject the resignation, or whether other actions should be taken. The Board shall act on each such resignation, taking into account the recommendation of the Nominating and Corporate Governance Committee, within 90 days following the certification of the election results. If a director’s resignation is not accepted by the Board, then the director who tendered that resignation will continue to serve on the Board until the 2017 Annual Meeting of Shareholders and until his successor is elected and qualified, or until his earlier death, unconditional resignation or removal. For more information, please see our Corporate Governance Guidelines at www.eplus.com/Investors/Pages/Corporate-Governance-Guidelines.aspx.

For Proposal No. 2, the favorable vote of holders of a majority of the shares entitled to vote and present in person or by proxy at the meeting will be required for approval, on an advisory basis. As advisory votes, this proposal is not binding upon the Company. However, the Compensation Committee, which is responsible for designing and administering the Company’s executive compensation program, values the opinions expressed by shareholders and will consider the outcome of the vote when making future compensation decisions. Broker non-votes will have no effect.

|

ePlus inc.

|

www.eplus.com

|

Approval of Proposal No. 3 requires the affirmative vote of holders of a majority of shares entitled to vote and present in person or by proxy at the meeting.

Effect of Broker Non-Votes and Abstentions

A broker non-vote is considered present for purposes of determining whether a quorum exists, but is not considered a “vote cast” or “entitled to vote” with respect to such matter. A share voted “abstain” with respect to any proposal is considered as present and entitled to vote with respect to that proposal, but is not considered a vote cast with respect to that proposal. Therefore, an abstention will not have any effect on the election of directors. Because each of the other proposals requires the affirmative vote of the holders of a majority of the shares present and entitled to vote on each such proposal in order to pass, an abstention will have the effect of a vote against each of the other proposals.

Quorum Requirements

A quorum of shareholders is necessary to hold a valid Annual Meeting. A quorum will be present if at least a majority of the outstanding shares entitled to vote at the Annual Meeting are represented by proxy or by shareholders present in person at the Annual Meeting. On the Record Date, there were 7,132,979 shares outstanding and entitled to vote. Thus, at least 3,566,490 shares must be represented by proxy and by shareholders present and entitled to vote at the Annual Meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker or bank), vote via Internet or by telephone, or if you vote in person at the Annual Meeting. We will count abstentions and broker non-votes for purposes of determining a quorum. If there is no quorum, the chairman of the Annual Meeting or holders of a majority of the votes present at the Annual Meeting may adjourn the Annual Meeting to another time or date.

Cost of Proxy Solicitation

The Company will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding the proxy materials to beneficial owners.

(Proposal # 1)

The Board presently has eight members. The Board has nominated the directors, Messrs. Norton, Bowen, O’Donnell, Faulders, Herman, Hovde, Callies and Hunt to be elected to serve until the next Annual Meeting of Shareholders and until their successors are duly elected and qualified. Each of the nominees for election is currently a director of the Company and was selected by the Board as a nominee in accordance with the recommendation of the Nominating and Corporate Governance Committee. Biographical information as of July 21, 2016, for each nominee is provided herein.

Unless otherwise instructed or unless authority to vote is withheld, all signed proxies will be voted for the election of the Board’s nominees. Each of the nominees has agreed to be named in this proxy statement and to serve if elected, and we know of no reason why any of the nominees would not be able to serve. However, if any nominee is unable or declines to serve as a director, or if a vacancy occurs before the election (which events are not currently anticipated), the proxy holders will vote for the election of such other person or persons as are nominated by the Board.

|

ePlus inc.

|

www.eplus.com

|

Vote Required

The eight nominees receiving the highest number of affirmative votes of the outstanding shares of the Company’s common stock present or represented by proxy and voting at the meeting, will be elected as directors to serve until the next Annual Meeting of Shareholders and until their successors are duly elected and qualified, subject to the Company’s director resignation policy should any director not receive a majority of the votes cast.

Recommendation of the Board

The Board unanimously recommends that you vote in favor of the election of Messrs. Norton, Bowen, O’Donnell, Faulders, Herman, Hovde, Callies and Hunt.

Phillip G. Norton, age 72, joined the Company in March 1993 and served from that time through July 31, 2016 as our Chairman of the Board and Chief Executive Officer. Effective August 1, 2016, Mr. Norton became our Executive Chairman. Mr. Norton had extensive leasing experience prior to joining ePlus and was the founder, Chairman of the Board of Directors, President and Chief Executive Officer of Systems Leasing Corporation, an equipment leasing and equipment Brokerage Company which he founded in 1978 and sold to PacifiCorp, Inc., a large Northwest utility, in 1986. From 1986 to 1990, Mr. Norton served as President and CEO of PacifiCorp Capital, Inc., the leasing entity of PacifiCorp, Inc., which had over $650 million of leased assets. From 1990 until 1993, Mr. Norton coached high school basketball and invested in real estate. From 1970-1975, he worked in various sales and management roles for Memorex Corporation, a manufacturer of storage and communication equipment and from 1975-1978, he was Vice President of Federal Leasing Corporation, a provider of financing and logistics to federal, state, and local governments. In June 2011, Mr. Norton began serving on the Board of Directors of The Northern Virginia Technology Council, the largest membership and trade association for the technology in the United States.

Mr. Norton is a 1966 graduate of the U.S. Naval Academy, with a Bachelor of Science in engineering, and served in the U.S. Navy from 1966-1970 as a Lieutenant in the Supply Corps.

With over thirty years of senior management experience in the equipment leasing and equipment sales markets, Mr. Norton brings leadership, vision, and extensive business, operating, and financing experience to the Company and the Board. He has tremendous knowledge of our markets, and since joining the Company in 1993, he has guided the expansion of our business lines and revenues. Today, we are a provider of advanced technology solutions, leasing, and software with over $1 billion in annual revenues, as compared to our initial businesses of equipment leasing and brokerage with annual revenues of $40 million when the Company went public in 1996. During his tenure as Chief Executive Officer, Mr. Norton led several successful capital raising initiatives, including our IPO and secondary offerings and two private equity rounds; multiple accretive acquisitions; the hiring and retention of numerous highly qualified personnel; and the development of strong industry relationships with key technology partners. As Executive Chairman, Mr. Norton will help facilitate a smooth transition to Mr. Marron’s leadership, consult on strategy, acquisitions, and the financing segment, and engage with customers. He will also continue to serve on our Board.

Bruce M. Bowen, age 64, founded our company in 1990 and served as our President until September 1996. Beginning in September 1996, Mr. Bowen has served as our Executive Vice President and from September 1996 to June 1997 also served as our Chief Financial Officer. In March 2014, Mr. Bowen stepped down as Executive Vice President, however, he continues to serve as an employee, focusing on business development and special projects. Mr. Bowen has served on the Board since our founding. Mr. Bowen is a 1973 graduate of the University of Maryland with a Bachelor of Science in Finance and in 1978 received a Master of Business Administration in Finance from the University of Maryland.

Mr. Bowen has been in the equipment leasing business since 1975. Prior to founding the Company he served as Senior Vice President of PacifiCorp Capital, Inc. In the past, he has served as Chairman of the Association for Government Leasing and Finance as well as various committees of the Equipment Leasing and Finance Association, which gave him a broad understanding of issues affecting our industry. During his leasing career, Mr. Bowen has participated in equipment lease financing in excess of $3 billion, involving many major vendors as well as government contractors. Throughout his leasing career, he has been responsible for finance and funding, and sales and operations activities, providing the Board with a vast array of knowledge in a multitude of industry-specific areas.

|

ePlus inc.

|

www.eplus.com

|

Terrence O’Donnell, age 72, joined our Board in November 1996 upon the completion of our IPO. Mr. O’Donnell is Of Counsel with the law firm of Williams & Connelly LLP in Washington D.C. He served as Executive Vice President, General Counsel and Chief Compliance Officer of Textron, Inc. from March 2000 and Corporate Secretary from 2009, until he retired from Textron Inc. on January 31, 2012. Mr. O’Donnell has practiced law since 1977, and from 1989 to 1992 served as General Counsel to the U.S. Department of Defense. Mr. O’Donnell served on the Board of Directors and the Compensation, Nominating and Audit Committees of IGI Laboratories, Inc., an NYSE-Amex Equities company from 1993 to 2009. Mr. O’Donnell is a 1966 graduate of the U.S. Air Force Academy and received a Juris Doctor from Georgetown University Law Center in 1971.

Mr. O’Donnell brings to the Board experience in a variety of capacities relevant to the business of the Company. His role at Textron Inc., a multi-industry company with global operations including a commercial finance subsidiary, as Executive Vice President, General Counsel, Corporate Secretary and Chief Compliance Officer, provided valuable experience in business, finance, mergers and acquisitions, compliance, leasing, government procurement, environmental, health and safety, corporate and securities law, board and corporate governance, and internal controls, all of which complement directly his service on the Board of ePlus. His public service as a White House staff member for 5 years, 1972-1977, and as General Counsel of the Department of Defense, 1989-1992, have provided a deep understanding of the federal government and the governmental regulatory environment. His service on the board and committees of another public company, IGI, Inc. for some 16 years, including his chairmanship of the IGI Audit Committee for over 12 years, provides insight and experience relevant to his service on the Board of ePlus and his role as Chairman of the Audit Committee. His private practice experience at Williams & Connolly has also provided significant experience in regulatory matters, litigation, and securities and corporate law.

C. Thomas Faulders, III, age 66, joined our Board in July 1998. Mr. Faulders has been the President and Chief Executive Officer of the University of Virginia Alumni Association since 2006. Prior to that, Mr. Faulders served as the Chairman and Chief Executive Officer of LCC International, Inc. from 1999 to 2005 and as Chairman of Telesciences, Inc., an information services company, from 1998 to 1999. From 1995 to 1998, Mr. Faulders was Executive Vice President, Treasurer, and Chief Financial Officer of BDM International, Inc., a prominent systems integration company. Mr. Faulders also served as the Vice President and Chief Financial Officer of COMSAT Corporation, an international satellite communication company, from 1992 to 1995. Prior to this, Mr. Faulders served in a variety of executive roles at MCI, including Treasurer and Senior Vice President of Marketing. He has served on numerous boards in the past and has held roles as chairs of compensation, audit and governance committees. He is a 1971 graduate of the University of Virginia and in 1981 received a Master of Business Administration from the Wharton School of the University of Pennsylvania.

Mr. Faulders’ extensive executive and financial experience in the telecommunications and high tech sectors enables him to assist ePlus directly in the oversight of financial and SEC reporting matters, and the knowledge and experience to provide insight and guidance in the formulation of strategic planning. He qualifies as an audit committee financial expert within the meaning of SEC regulations.

Lawrence S. Herman, age 72, joined our Board in March 2001. Until his retirement in July 2007, Mr. Herman was one of KPMG’s and BearingPoint’s most senior Managing Directors with responsibility for managing the strategy and emerging markets in the company’s state and local government practice. During his 40 year career with BearingPoint and KPMG, Mr. Herman specialized in developing, evaluating, and implementing financial and management systems and strategies for state and local governments around the nation, as well as mid-market companies and organizations. He is considered to be one of the nation’s foremost state budget, financial accounting and fiscal planning experts. Mr. Herman received his Bachelor of Science degree in Mathematics and Economics from Tufts University in 1965 and his Master of Business Administration in 1967 from Harvard Business School.

Mr. Herman’s senior executive role as Managing Director at both KPMG and BearingPoint provided him with significant expertise in private sector and public sector government systems and technology issues. These roles provide the Board and the Company with significant expertise and experience in market segments core to the Company's business.

|

ePlus inc.

|

www.eplus.com

|

Eric D. Hovde, age 52, joined our Board in November 2006. Mr. Hovde is an active entrepreneur who has started and managed numerous business enterprises. Mr. Hovde is the Chief Executive Officer of H Bancorp, a $1.7 billion private bank holding company with banking operations on both the east and the west coast. He is also the Chief Executive Officer of Hovde Capital Advisors, LLC, an asset management firm that focuses on investing in the financial services and real estate sectors of the public equity markets. Additionally, Mr. Hovde is the co-owner of Hovde Properties, LLC, a real estate development and management company where he oversees management of the company and all large development projects. Throughout his career he has also served as a director on numerous bank boards and currently serves as the President of Sunwest Bank in Orange County, California.

Mr. Hovde’s career has provided him with an expertise in the financial services industry and the investment management areas and, as such, he has been featured on television and in national print media publications—including CNBC, Bloomberg TV, and The Wall Street Journal. His familiarity and understanding of the interplay between the economy and the financial and real estate markets brings a knowledgeable perspective of acting in multiple capacities – that of an executive, an industry commentator, and a financial industry expert – to the Board.

Mr. Hovde received his degrees in Economics and International Relations at the University of Wisconsin-Madison.

John E. Callies, age 62, joined our board on July 23, 2010. Mr. Callies was employed by IBM in various capacities for thirty-four years. Most recently, he served as General Manager of IBM Global Financing from 2004 until his retirement in June 2010. With operations in 55 countries supporting 125,000 clients, he led the world's largest information technology financing and asset management organization and Mr. Callies was responsible for business direction and management of a portfolio of nearly $35 billion in total assets. Previously, as Vice President, Marketing, On Demand Business for IBM, Mr. Callies had company-wide responsibility for all marketing efforts in support of On Demand Business, along with leading the marketing management discipline for IBM. In 2003, Mr. Callies was appointed Vice President, Marketing and Strategy, of IBM Systems Group. Prior to that, beginning in 1996 when he was named General Manager, Small and Medium Business, IBM Asia Pacific Corporation, based in Tokyo, Japan, Mr. Callies has filled roles in marketing and marketing management. In 1991 he was named General Manager of IBM Credit Corporation’s end-user financing division, now called IBM Global Financing. His career at IBM Credit Corporation began in 1985, when he progressed through various executive positions in sales and operations. He is a Senior Advisor to McKinsey and Company and also serves on the Advisory Board of the Leeds School of Business at the University of Colorado. Mr. Callies is a 1976 graduate of Lehigh University.

Mr. Callies brings over thirty years of experience in the technology marketplace to the ePlus Board. In particular, his broad understanding of the computer reseller channel, financing and international markets will help the Company strengthen its position in the marketplace.

Ira A. Hunt, III, age 60, joined the Board in September 2014. Beginning in June 2016, Mr. Hunt is Managing Director and Cyber Lead for Accenture Federal Services in Arlington Virginia. In the role he is responsible for building Accenture's new cyber security practice focused on novel and differentiated approaches to address the cyber security needs of Accenture Federal Services' diverse client portfolio. Previously he was Chief Architect for Bridgewater Associates, a hedge fund located in Westport, Connecticut and President and Chief Executive Officer of Hunt Technology, LLC, a private consulting practice focused on strategic IT planning, cyber and data-centric security, big data analytics, and cloud computing.

In October 2013, after a 28 year career, Mr. Hunt retired from the Central Intelligence Agency (the “CIA”) as their Chief Technology Officer (“CTO”). As CTO, Mr. Hunt set the information technology strategic direction and future technology investment plan for the CIA.

Prior to that, Mr. Hunt served as Director, Application Services, of one of the largest business units in the CIA. Mr. Hunt was responsible for building the mission software that the CIA’s core business activities—All-Source Analysis and Clandestine Collection and Operations—used to conduct their day-to-day work.

Mr. Hunt began his CIA career in 1985 as an analyst in the CIA’s Directorate of Intelligence and subsequently served in positions of increasing responsibility across the organization to include: the Directorate of Intelligence, DCI’s Non-Proliferation Center, Crime Narcotics Center, and Open Source Program Office, and CIO. Mr. Hunt began his career in 1979 working as an aerospace engineer for Rockwell International and General Research Corporation. He holds a Bachelor of Engineering and Master of Engineering in Civil/Structural Engineering from Vanderbilt University in Nashville, Tennessee.

|

ePlus inc.

|

www.eplus.com

|

Mr. Hunt currently serves on the Board of Directors for Mission Link, a non-profit organization focused on providing guidance and connections between innovative start-ups and small to medium companies with the Intelligence and Defense communities. He has served on the Armed Forces Communications and Electronic Association.

Mr. Hunt’s experiences as a long-time Senior Executive at the CIA combined with the extensive network of relationships and connections he has built throughout the Venture Capital, Private Equity, and start-up communities bring an additional set of skills and opportunities to the Board. Recognized throughout his CIA career as strategic thinker and successful implementer, Mr. Hunt brings valuable insights into the direction that information technology is heading and the potential value proposition of these new capabilities to government and private sector organizations.

Our Board plays an active role in overseeing management and representing the interests of shareholders. Directors are expected to attend Board meetings and the meetings of committees on which they serve. Directors are also frequently in communication with management between formal meetings. During the fiscal year ended March 31, 2016, the Board met a total of eight times. All directors attended at least 75% of the total Board and committee meetings to which they were assigned during the fiscal year ended March 31, 2016. The Company does not have a policy about directors’ attendance at the Annual Meeting of Shareholders. All eight members of our Board attended the 2015 Annual Meeting of Shareholders. Our Board has determined that six of our eight Board members are “independent directors” as defined in NASDAQ Rule 5605(a)(2). Of our two non-independent directors, Mr. Norton, who is Chairman of our Board, and who was our Chief Executive Officer during the fiscal year ended March 31, 2016, transitioned effective August 1, 2016 to an Executive Chairman role. Mr. Bowen, who formerly was our Executive Vice President, moved to a business development and special projects role in March 2014.

The Company’s historical practice was to combine the Chief Executive Officer and Chairman roles, coupled with a strong, independent, and clearly defined lead director position, which we believe further strengthens the governance structure. Beginning August 1, 2016, when Mr. Mark Marron was promoted to CEO, Mr. Norton stepped down as CEO and retained his Chairman position. However, Mr. Norton’s Executive Chairman position is a management position, and Mr. C. Thomas Faulders, III currently serves as our Lead Independent Director. The Board believes this will to provide an efficient and effective leadership model for the Company. Board oversight is further enhanced by the fact that all of the Board’s key committees – Audit, Compensation, and Nominating and Corporate Governance, are comprised entirely of independent directors. The Board, as part of its regular review of the effectiveness of the Company’s governance structure, reviews at least annually whether or not combining the roles of CEO and Chairman will serve the best interests of the Company and its shareholders.

The Nominating and Corporate Governance Committee annually reviews and assesses the continuing effectiveness of the role of Lead Independent Director. As provided in our Corporate Governance Guidelines and Policies, the Lead Independent Director’s responsibilities include:

| ● | Serve as a liaison between the CEO and independent directors; |

| ● | Preside at regular executive sessions of independent directors, or at Board meetings when the Chairman is ill, absent, or otherwise unable to carry out the duties of Chairman; |

| ● | Convene additional executive sessions of independent directors as needed, either at his own initiative or at the request of other independent directors; |

| ● | In conjunction with the CEO, or committee chair as appropriate, determine Board and committee agendas and the types of information that should be provided to the directors; |

|

ePlus inc.

|

www.eplus.com

|

| ● | Discuss with the CEO the amount of time to be allotted for meeting agenda items, and have final approval of meeting agendas for the Board and types of information sent to the Board; |

| ● | Meet with ePlus shareholders, as appropriate; and |

| ● | Review, in conjunction with the Chairman of the Board and the Chair of the Nominating and Corporate Governance Committee, factors that may affect a director’s independence. |

The Lead Independent Director also occasionally approves non-material changes to corporate policies, when proposed changes arise outside the Board’s scheduled review process.

The Board oversees the Company’s enterprise risk management process. Management reviews the process with the full Board on a periodic basis, including identification of key risks and steps taken to monitor or mitigate them. Although the full Board is responsible for this oversight function, the Audit, Compensation and Nominating and Corporate Governance Committees assist the Board in discharging its oversight duties. Accordingly, while each of the three committees contributes to the risk management oversight function by assisting the Board in the manner outlined below, the Board itself remains responsible for the oversight of the Company’s risk management program.

The Audit Committee discusses with management and the independent auditor, as appropriate, (i) risks related to its duties and responsibilities as described in its charter, (ii) management’s policies and processes for risk assessment and risk management and (iii) in the period between the Board’s risk oversight reviews, management’s evaluation of the Company’s major risks and the steps management has taken or proposes to take to monitor and mitigate such risks. The Company’s Compensation Committee reviews risks related to the subject matters enumerated in its charter, including the Company’s compensation programs and plans and incentive compensation and equity plans. The Nominating and Corporate Governance Committee considers risks related to the subject matters for which it is responsible, primarily corporate governance matters and related person transactions.

We are committed to ethical behavior in all that we do. Our Code of Conduct applies to all of our directors, officers and employees. It sets forth our policies and expectations on a number of topics, including our commitment to promoting a fair workplace, avoiding conflicts of interest, compliance with laws (including insider trading laws), appropriate relations with government officials and employees, and compliance with accounting principles.

We also maintain a toll-free hotline through which concerns may be raised regarding accounting or financial reporting matters, or other matters of concern. The hotline is available in the United States and the United Kingdom, to all employees, 7 days a week, 24 hours a day, in English and in Spanish. Employees using the hotline may choose to remain anonymous. All hotline inquiries are forwarded to a member of our Audit Committee, as well as to our General Counsel and Vice President of Human Resources.

Our Code of Conduct is posted on our website at http://www.eplus.com/ethics. Printed copies of the Code of Conduct may be obtained by shareholders, without charge, by contacting Corporate Secretary, ePlus inc., 13595 Dulles Technology Drive, Herndon, Virginia 20171-3413. We intend to make any required disclosures regarding any amendments to our Code of Conduct or waivers granted to any of our directors or executive officers on our website at www.eplus.com.

Each year, the Nominating and Corporate Governance Committee recommends to the Board the slate of directors to serve as nominees for election by the shareholders at the Annual Meeting. Incumbent directors standing for reelection are evaluated by the Nominating and Corporate Governance Committee in accordance with the Committee’s charter, which includes reviewing the incumbent’s capabilities, availability to serve, independence and other relevant factors. The process for identifying and evaluating candidates to be nominated to the Board starts with an evaluation of a candidate by the Chairman of the Committee, followed by the Committee in its entirety. Director candidates may also be identified by shareholders. In evaluating such nominations, the Nominating and Corporate Governance Committee seeks to achieve a balance of knowledge, experience, and capabilities on the Board, including factors such as technical experience, IT business expertise, financial experience, and ability to contribute toward business development. Furthermore, any member of the Board shall meet the following criteria:

|

ePlus inc.

|

www.eplus.com

|

| ● | Unquestioned personal ethics and integrity; |

| ● | Possess specific skills and experience aligned with ePlus’ strategic direction and operating challenges; |

| ● | Bring to the Board diversity in skills and experience that complement the overall composition of the Board; |

| ● | Have a history of core business competencies of high achievement; |

| ● | Possess a demonstrated record of success, financial literacy and history of making good business decisions and exposure to best practices; |

| ● | Demonstrate interpersonal skills that maximize group dynamics; |

| ● | Be enthusiastic about ePlus; and |

| ● | Have sufficient time to become fully engaged. |

Additionally, the Nominating and Corporate Governance Committee annually reviews the Board’s size, structure, composition and functioning, to ensure an appropriate blend and balance of diverse skills and experience. Diversity may encompass a candidate’s gender, race, national origin, educational and professional experiences, expertise and specialized or unique technical backgrounds and/or other tangible or intangible aspects of the candidate’s qualifications in relation to the qualifications of the then current board members and other potential candidates. The Nominating and Corporate Governance Committee does not have a formal policy specifying how diversity should be applied in identifying or evaluating director candidates, and diversity is but one of many factors the Nominating and Corporate Governance Committee may consider.

Shareholder proposals for nominations to the Board should be submitted to the Corporate Secretary of the Company as specified in the Company’s Bylaws. The information requirements for any shareholder proposal or nomination can be found in Section 2.8 of our Bylaws, available at http://www.eplus.com/bylaws. Proposed shareholder nominees are communicated to the Nominating and Corporate Governance Committee and are considered in the selection process for nominees to be included among the director candidates to be recommended to the Board.

Persons interested in communicating with the directors regarding concerns or issues may address correspondence to a particular director, to the Board, or to the independent directors generally, in care of ePlus inc. at 13595 Dulles Technology Drive, Herndon, Virginia 20171-3413. If no particular director is named, letters will be forwarded, as appropriate and depending on the subject matter, by the General Counsel to the Chair of the Audit Committee, the Chair of the Compensation Committee, or the Chair of the Nominating and Corporate Governance Committee. The General Counsel reviews such communications for spam (such as junk mail or solicitations) or misdirected communications.

Our Board has reviewed the relationships concerning independence of each director on the basis of the definition of “independent” contained in the Nasdaq Marketplace Rules and our Corporate Governance Guidelines and Policies, a copy of which is available on our website at http://www.eplus.com/corporate-governance-guidelines. Guideline No. 13 and Exhibit A to our Corporate Governance Guidelines and Policies provides that the Board has determined that the following relationships will not be considered material relationships that would impair a director's independence:

Business Relationships

| ● | The Company does business with a director’s business affiliate or the business affiliate of an immediate family member of a director for goods or services, or other contractual arrangements, in the ordinary course of business and on substantially the same terms as those prevailing at the time for comparable transactions with non-affiliated persons and the annual revenues or purchases from such business affiliate are less than the greater of $200,000 and 1% of such person’s consolidated gross revenues; |

|

ePlus inc.

|

www.eplus.com

|

| ● | A company (of which a director or an immediate family member is an officer) does business with the Company and the annual sales to, or purchases from, the Company during such other company’s preceding fiscal year are less than the greater of $200,000 and 1% of the gross annual revenues of such other company; |

| ● | A law firm of which a director or an immediate family member is a partner or of counsel performs legal services for the Company, the director or the immediate family member does not personally perform any legal services for the Company, and the annual payments to such law firm are less than the greater of $200,000 and 1% of such law firm’s consolidated gross revenues; |

| ● | An investment bank or consulting firm of which a director or an immediate family member is a partner or of counsel performs investment banking or consulting services for the Company, the director or the immediate family member does not personally perform any investment banking or consulting services for the Company and the annual payments to such investment bank or consulting firm are less than the greater of $200,000 and 1% of such investment bank’s or consulting firm’s consolidated gross revenues; and |

| ● | The director serves on a regularly constituted advisory board of the Company, for which such director receives standard fees of no more than $50,000 per annum. |

Relationships with Not-for-Profit Entities

| ● | A foundation, university or other not-for-profit organization of which a director or immediate family member is an officer, director or trustee receives from the Company contributions in an amount which does not exceed the greater of $100,000 and 1% of the not-for-profit organization’s aggregate revenues during the entity’s preceding fiscal year. (The Company’s automatic matching of employee charitable contributions, if any, are not included in the Company’s contributions for this purpose.) |

In accordance with that review, our Board has made a subjective determination as to each independent director that no relationships exist that, in our Board’s opinion, would interfere with his exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, the Board reviewed and discussed information provided by the directors and by management with regard to each director’s business and personal activities as they may relate to our business and our management.

The Board has determined that the following current directors, Messrs. O’Donnell, Hunt, Herman, Faulders, Hovde and Callies are independent under the Nasdaq Marketplace Rules and in accordance with the Corporate Governance Guidelines and Policies. The Board has also determined that the members of each committee of the Board are independent under the listing standards of the Nasdaq Marketplace Rules for the respective committees on which they serve. In determining the independence of the directors, the Board additionally considered the relationships described under “Related Person Transactions,” which it determined were immaterial to the individuals’ independence.

The Board has established standing Audit, Compensation, and Nominating and Corporate Governance committees. Membership in each of these committees, as of March 31, 2016, is shown in the following table:

|

Name

|

Audit

|

Compensation

|

Nominating and

Corporate Governance

|

|||

|

John E. Callies

|

Member

|

Chair

|

||||

|

Ira A. Hunt, III

|

|

|

|

Member

|

|

Member

|

|

C. Thomas Faulders III

|

Member

|

Member

|

||||

|

Lawrence S. Herman

|

|

Member

|

|

|

|

Chair

|

|

Eric D. Hovde

|

Member

|

Member

|

||||

|

Terrence O'Donnell

|

|

Chair

|

|

|

|

Member

|

All directors, including committee chairs, served on the respective committees listed above for the entire fiscal year ended March 31, 2016.

|

ePlus inc.

|

www.eplus.com

|

The table below identifies the number of meetings held by each committee in the fiscal year ended March 31, 2016, provides a brief description of the duties and responsibilities of each committee, and provides general information regarding the location of each committee’s charter.

|

Audit Committee (9 meetings)

|

||

|

Duties and Responsibilities

|

General Information

|

|

|

•

|

Appoint, compensate, retain and oversee the work of the independent auditor engaged for the purpose of preparing or issuing audit reports and performing other audit, review or attest services for the Company;

|

|

•

|

Discuss the annual audited financial statements with management and the Company’s independent auditor, including the Company’s disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and recommend to the Board of Directors whether the audited financial statements should be included in the Company’s Annual Report on Form 10-K;

|

|

•

|

Discuss the Company’s unaudited financial statements and related footnotes and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” portion of the Company’s Form 10-Q for each interim quarter with management and independent auditor, as appropriate;

|

|

•

|

Provide oversight of the Company’s internal audit function; and

|

|

•

|

Discuss the earnings press releases, as well as financial information and earnings guidance, if any, provided to analysts and ratings agencies with management and the independent auditor, as appropriate.

|

|

•

|

Established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

|

|

•

|

Amended its charter in December 2015.

|

|

•

|

Copy of the Audit Committee charter can be viewed in the Shareholder Information section of our website at http://www.eplus.com/Investors/Pages/Committee-Charters.aspx.

|

|

•

|

Audit Committee Report begins on page 34.

|

|

•

|

The Board has determined that each member of the Audit Committee is independent within the meaning of the listing standards of the NASDAQ Marketplace Rules and applicable SEC regulations.

|

|

•

|

The Board has determined that Mr. Faulders is an Audit Committee financial expert within the meaning of SEC regulations.

|

|

Compensation Committee (7 meetings)

|

||

|

Duties and Responsibilities

|

General Information

|

|

|

•

|

Review the effectiveness of the Company’s executive compensation programs;

|

|

•

|

Review and approve goals and objectives for the Company’s executive officers. The Committee evaluates and sets the compensation of our Chief Executive Officer, and reviews CEO recommendations regarding the compensation of our other executive officers;

|

|

•

|

Administer the Company’s equity benefit plans. The Committee may not delegate the authority to grant equity awards to the Company’s management;

|

|

•

|

Review and approve the Company’s general compensation strategy and the competitiveness of our executive officers;

|

|

•

|

Direct responsibility for the appointment, compensation and oversight of any work of any Compensation consultant, legal counsel or other advisor retained by the Committee; and

|

|

•

|

Review and approve, or review and recommend to the Board, employment agreements, severance and change in control agreements for the Company’s executive officers.

|

|

•

|

Amended its charter in December 2015.

|

|

•

|

Copy of the Compensation Committee charter can be viewed in the Shareholder Information section of our website at http://www.eplus.com/Investors/Pages/Committee-Charters.aspx.

|

|

•

|

See also the Compensation Committee Interlocks and Insider Participation on page 13.

|

|

•

|

See also the Compensation Committee Report on page 15.

|

|

Nominating and Corporate Governance Committee (5 meetings)

|

||

|

Duties and Responsibilities

|

General Information

|

|

|

•

|

Select and recommend to the Board nominees for director;

|

|

•

|

Make recommendation to the Board concerning the composition of committees;

|

|

•

|

Oversee the evaluation of the Board and each of its committees;

|

|

•

|

Review and recommend to the Board compensation of non-employee directors;

|

|

•

|

Review our related party transaction policy, and any related party transactions;

|

|

•

|

Oversee management development and succession planning; and

|

|

•

|

Review and assess the adequacy of our corporate governance framework, including our Certificate of Incorporation, Bylaws, and Corporate Governance Guidelines, and making recommendations to the Board as appropriate.

|

|

•

|

Reviewed its charter in December 2015 and determined that no changes were necessary.

|

|

•

|

Copy of the Nominating and Corporate Governance Committee charter can be viewed in the Shareholder Information section of our website at http://www.eplus.com/Investors/Pages/Committee-Charters.aspx.

|

|

•

|

A copy of our Corporate Governance Guidelines can be found on our website at http://www.eplus.com/Investors/Pages/Corporate-Governance-Guidelines.aspx.

|

Compensation Committee Interlocks and Insider Participation

The Compensation Committee is comprised entirely of the four independent directors listed above. No member of the Compensation Committee is a current, or during fiscal year 2016 was a former, officer or employee of the Company or any of its subsidiaries. During fiscal year 2016, no member of the Compensation Committee had a relationship that must be described under the SEC rules relating to disclosure of related person transactions. In fiscal year 2016, none of our executive officers served on the board of directors or compensation committee of any entity that had one or more of its executive officers serving on the Board or the Compensation Committee of the Company.

The following table sets forth the compensation for the members of the Board of ePlus for the fiscal year ended March 31, 2016. Mr. Norton, the Company’s Executive Chairman of the Board, and who served as President and Chief Executive Officer during the fiscal year, and Mr. Bowen, the Company’s founder, who currently performs a business development and special projects role as an employee with the Company, do not receive any additional compensation for their service as a director. Mr. Norton’s compensation is reported under “Executive Compensation” herein and accordingly is not included in the following table. As Mr. Bowen is not an executive officer, his compensation is included in the table below.

The general policy of the Board is that compensation for non-employee directors should be a mix of cash and equity-based compensation. For the fiscal year ended March 31, 2016, each non-employee director received an annual cash retainer of $75,000, paid in quarterly installments, or, alternatively, at the director’s election, a director may receive his cash compensation in non-forfeitable restricted stock. In addition, each non-employee director will receive an annual grant of restricted stock having a fair market value on the date of grant (determined without regard to the restrictions applicable thereto) equal to the aggregate dollar amount of cash compensation earned by a non-employee director during the Company’s fiscal year ended immediately prior to the annual grant date. All awards of restricted stock vest ratably over two years. Upon joining the Board, a new non-employee director will receive a pro-rata share of restricted stock awarded to the other non-employee directors, based on the number of days the new non-employee director will serve before the next regularly scheduled annual grant date (i.e., September 25th). These pro-rata awards will also vest ratably over two years. The restricted stock grants described in this paragraph are rounded down, to avoid a fractional share award.

Directors are also reimbursed for their out-of-pocket expenses incurred to attend Board and committee meetings.

|

Name

|

Fees Earned or

Paid in Cash

($)(1)

|

Stock

Awards

($)(2)(3)

|

Option

Awards

($)

|

All Other

Compensation

($)

|

Total

($)

|

|||||||||||||||

|

John E. Callies

|

75,000

|

74,943

|

-

|

-

|

149,943

|

|||||||||||||||

|

Ira A. Hunt, III

|

75,000

|

74,943

|

-

|

-

|

149,943

|

|||||||||||||||

|

C. Thomas Faulders, III

|

75,000

|

74,943

|

-

|

-

|

149,943

|

|||||||||||||||

|

Lawrence S. Herman

|

75,000

|

74,943

|

-

|

-

|

149,943

|

|||||||||||||||

|

Eric D. Hovde

|

75,000

|

74,943

|

-

|

-

|

149,943

|

|||||||||||||||

|

Terrence O'Donnell

|

75,000

|

74,943

|

-

|

-

|

149,943

|

|||||||||||||||

|

Bruce Bowen (4)

|

300,000

|

-

|

-

|

3,300

|

303,300

|

|||||||||||||||

| (1) | The above table reflects fees earned during the fiscal year 2016. Pursuant to our 2008 Non-Employee Director Long-Term Incentive Plan, directors may make a stock fee election, through which they receive shares of restricted stock in lieu of cash compensation. The stock fee elections are made on a calendar year basis, and the stock grant is made on the first business day after the end of each quarter of board service. The number of shares received is determined by using the Fair Market Value of a share of common stock, as defined in the 2008 Director LTIP, rounded down to avoid a fractional share. |

|

ePlus inc.

|

www.eplus.com

|

For the fiscal year ended March 31, 2016, one director, Terrence O’Donnell, received restricted stock instead of cash, as set forth below:

|

Board Service Time

|

Number of

Shares Granted

|

|||

|

April 1, 2015 - June 30, 2015

|

245

|

|||

|

July 1, 2015 - September 30, 2015

|

232

|

|||

|

October 1, 2015 - December 31, 2015

|

205

|

|||

|

January 1, 2016 - March 31, 2016

|

230

|

|||

| (2) | The values in this column represent the aggregate grant date fair values of the fiscal year 2016 restricted stock awards, computed in accordance with Financial Accounting Standards Codification Topic 718, Compensation – Stock Compensation (“FASB Topic 718”). |

| (3) | As of March 31, 2016, the aggregate number of nonvested restricted stock shares outstanding for each director (except Mr. Norton) was as follows: |

|

Name

|

Number of

Restricted

Stock Shares

|

|||

|

John E. Callies

|

1,619

|

|||

|

Ira A. Hunt, III

|

1,646

|

|||

|

C. Thomas Faulders, III

|

1,619

|

|||

|

Lawrence S. Herman

|

1,619

|

|||

|

Eric D. Hovde

|

2,084

|

|||

|

Terrence O'Donnell

|

3,102

|

|||

|

Bruce Bowen

|

1,442

|

|||

| (4) | Mr. Bowen is a non-executive officer employee. The above table reflects compensation paid to him as an employee, not as a director. Mr. Bowen’s compensation also includes a $3,300 company match to his 401(k) plan. |

The following table sets forth the name, age and position of each person who was an executive officer of ePlus on June 30, 2016. There are no family relationships between any director or executive officer and any other director or executive officer of ePlus. Additional information relating to Mr. Norton, who is the Chairman of our Board and an executive officer of the Company, may be found in the section entitled “Proposal 1 – Election of Directors.”

|

Name

|

Age

|

Position

|

||

|

Phillip G. Norton (1)

|

72

|

Chief Executive Officer

|

||

|

Elaine D. Marion

|

48

|

Chief Financial Officer

|

||

|

Mark P. Marron (2)

|

55

|

Chief Operating Officer

|

| (1) | On July 21, 2016, Mr. Norton advised that he would be stepping down from his role as President and Chief Executive Officer, and, effective August 1, 2016, continued employment with the Company as Executive Chairman. |

| (2) | On July 21, 2016, the Board appointed Mr. Marron as President and Chief Executive Officer of the Company, effective August 1, 2016. |

The business experience of each non-director executive officer of ePlus is described below.

|

ePlus inc.

|

www.eplus.com

|

Elaine D. Marion joined us in 1998. Ms. Marion became our Chief Financial Officer on September 1, 2008. Since 2004, Ms. Marion served as our Vice President of Accounting. Prior to that, she was the Controller of ePlus Technology, inc., a subsidiary of ePlus, from 1998 to 2004. Ms. Marion serves on the Advisory Board of the School of Business at the University of Mary Washington. Ms. Marion is a graduate of George Mason University, where she earned a Bachelor of Science degree with a concentration in Accounting.

Mark P. Marron was appointed as our President and Chief Executive Officer, effective August 1, 2016. Mr. Marron first joined our subsidiary ePlus Technology, inc. in 2005 as Senior Vice President of Sales. On April 22, 2010, he was appointed as Chief Operating Officer of ePlus inc. and President of ePlus Technology, inc. Prior to joining us, from 2001 – 2005 Mr. Marron served as Senior Vice President of Worldwide Sales of NetIQ. Prior to joining NetIQ, Mr. Marron served as Senior Vice President and General Manager of Worldwide Channel Sales for Computer Associates International Inc. Mr. Marron has a Bachelor of Science degree in Computer Science from Montclair State University.

Each of our executive officers is chosen by the Board and holds his or her office until his or her successor shall have been duly chosen and qualified or until his or her death or until he or she resigns or is removed by the Board.

Report of the Compensation Committee

The information contained in this report is not soliciting material, is not deemed filed with the SEC and is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and irrespective any general incorporation of this proxy statement by reference.

The Compensation Committee has reviewed the Compensation Discussion and Analysis and discussed that Analysis with management. Based on its review and discussions with management, the committee recommended to our Board of Directors that the Compensation Discussion and Analysis, as it appears below, be included in this proxy statement and incorporated by reference into the Company’s 2016 Annual Report on Form 10-K.

Submitted by the Compensation Committee

John E. Callies (Chairman)

C. Thomas Faulders, III

Eric D. Hovde

Ira A. Hunt, III

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

The primary focus of the Compensation Discussion and Analysis is to provide information regarding our executive compensation guiding principles, the elements of our executive compensation program and the factors that were considered in making compensation decisions for our named executive officers. Our named executive officers for the fiscal year ended March 31, 2016 were as follows:

|

Phillip G. Norton (1)

|

Chairman, President and Chief Executive Officer

|

|

Elaine D. Marion

|

Chief Financial Officer

|

|

Mark P. Marron (2)

|

Chief Operating Officer

|

|

Steven J. Mencarini

|

Senior Vice President

|

|

(1)

|

On July 21, 2016, Mr. Norton advised that he would be stepping down from his role as President and Chief Executive Officer, and, effective August 1, 2016, continued employment with the Company as Executive Chairman.

|

|

(2)

|

On July 21, 2016, the Board appointed Mr. Marron as President and Chief Executive Officer of the Company, effective August 1, 2016.

|

Executive Summary

The Compensation Committee oversees the executive compensation program and determines the compensation for the Company’s executive officers. The Company believes the compensation program for the named executive officers contributed to the Company’s financial performance in fiscal year 2016. During the 2016 fiscal year net sales increased 5.3% to $1.2 billion, from $1.17 billion in fiscal year 2015, and operating income rose 7.1% to $75.8 million, up from $70.7 million in fiscal year 2015.

The Company’s goal for its executive compensation program is to attract, motivate and retain a talented, entrepreneurial, ethical and creative team of executives who will provide leadership for the Company’s success in dynamic and competitive markets. The Company seeks to accomplish this goal in a way that rewards performance and is aligned with its shareholders’ long-term interests. Our executive compensation program evolves and is adjusted over time to support ePlus’ business goals and promote both short- and long-term profitable growth of the Company. Cash compensation consists primarily of base salary and payments under our annual executive incentive plan that, for the fiscal year ended on March 31, 2016, are based on three Company financial performance metrics. These performance metrics provide an objective, quantifiable measurement, which promotes accountability and directly ties compensation to performance. Additionally, using only financial performance metrics enables the Company to utilize the IRS Code Section 162(m) exclusion, thus reducing the Company’s tax liability. Equity-based compensation, which vests over several years, is used to align compensation with the long-term interests of ePlus’ shareholders by focusing our executive officers on increasing shareholder value.

The compensation for our named executive officers for the fiscal year ended March 31, 2016, consisted of three elements— base salaries, annual performance-based cash bonuses, and long-term equity awards in the form of restricted stock—that are designed to reward performance in a straightforward manner. The annual bonus program provides incentives for executives to help achieve the Company’s annual financial goals and to focus on certain business goals. Restricted stock awards provide incentives for executives to remain employed by the Company and to create and maintain long-term value for shareholders, since the shares vest over a multi-year period. These components of the program are directly linked to the principle that executive compensation should be based on performance. Additionally, on July 21, 2016, the Compensation Committee approved the Company’s entering into an employment agreement with Mr. Norton, effective August 1, 2016, through which he will receive three retention payments in the amounts of $250,000, $250,000 and $500,000, on January 31, 2017, July 31, 2017, and January 31, 2018, respectively.

The Company’s executive compensation program is also intended to promote and maintain stability within the executive team by issuing restricted stock with multi-year vesting terms. Most restricted stock awards made to the named executive officers have vested over a three-year vesting period. In June 2015 Ms. Marion and Mr. Marron each received a grant of restricted stock which will vest over a five-year period, and in July 2016, in connection with Mr. Norton’s transition to Executive Chairman, stock that had been granted in June 2016 with a three-year vest schedule was modified to be a two-year vest schedule. Each named executive officer has been an employee of the Company for at least 10 years. The Company expects each named executive officer to contribute to the Company’s overall success as a member of the executive team rather than focus solely on specific objectives within the officer’s area of responsibility.

|

ePlus inc.

|

www.eplus.com

|

The Company believes its executive compensation program is simple in design and serves the Company and its shareholders well.

Objectives of Our Compensation Program

The Compensation Committee and ePlus’ management believe that compensation is an important tool that should help recruit, retain and motivate the employees that the Company will depend on for current and future success. The primary objectives of the Compensation Committee are to design and administer a compensation program for our named executive officers to:

| ● | attract, retain, and reward highly qualified and experienced executives; |

| ● | align compensation with our business objectives and performance; |

| ● | align our practices with the market |

| ● | provide incentives for the creation of long-term shareholder value; and |

| ● | reward achievement of performance goals. |

2015 Say on Pay Vote

The Company holds and annual advisory vote on executive compensation (colloquially referred to as “Say on Pay”) at its Annual Meeting of shareholders. At our Annual Meeting of shareholders in September 2015, we included a Say on Pay proposal for our shareholders to provide an advisory vote. Shareholders voted strongly in support of our executive compensation program in 2015 with approximately 97% of the votes cast in support of the program. The Compensation Committee evaluated the results of the 2015 advisory vote, together with the other factors and data discussed in this Compensation Discussion and Analysis in determining executive compensation policies and decisions. The Compensation Committee considered the vote results and did not make any significant changes to our executive compensation policies and decisions for fiscal year 2016 directly as a result of the 2015 advisory vote.

Executive Compensation Decision-Making Process

Role of Compensation Committee

The Compensation Committee, which is composed entirely of independent directors, generally establishes the components of our compensation program and may evaluate the components from time to time. The Compensation Committee is responsible for evaluating and setting the compensation for our Chief Executive Officer. The Committee reviews the executive compensation program on an annual basis, with awards and adjustments generally being made in June. Compensation decisions may be made at other times of the year in the case of promotions, new hires, or changes in responsibilities. In making these determinations, the Committee may consider the company’s performance, the individual performance of a named executive officer, information from our compensation consultant, and recommendations from management.

|