Form DEF 14A DOCUMENT SECURITY SYSTEM For: Apr 29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for the use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to §240.14a-12 |

| DOCUMENT SECURITY SYSTEMS, INC. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| [ ] | Fee paid previously with preliminary materials. | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-1l (a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

| 1 |

DOCUMENT SECURITY SYSTEMS, INC.

200 CANAL VIEW BOULEVARD, SUITE 300

ROCHESTER, NEW YORK 14623

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

The Annual Meeting of Stockholders (the “Annual Meeting”) of Document Security Systems, Inc. (the “Company”, “we”, “us” or “our”) will be held on Tuesday, June 28, 2016, at 11:00 a.m. (Eastern Standard Time) at 200 Canal View Boulevard, Suite 300, Rochester, New York 14623 for the purposes of:

| 1. | Considering and voting upon a proposal to elect six directors to the Company’s Board of Directors to hold office until the next Annual Meeting; | |

| 2. | Considering and voting upon a proposal to ratify Freed Maxick CPAs, P.C. as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016; | |

| 3. | Conducting an advisory vote on executive compensation; | |

| 4. | Approving an amendment to the Company’s Certificate of Incorporation to effect a 1-for-4 reverse stock split; and | |

| 5. | To transact such other business as may properly come before the meeting or any adjournment thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this notice.

The Board of Directors has fixed the close of business on Friday, April 29, 2016 as the record date (the “Record Date”) for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting and at any adjournment or postponement thereof.

This year, we are again implementing the “Notice and Access” method approved by the Securities and Exchange Commission that allows companies to provide proxy materials to stockholders via the Internet. The Internet will be used as our primary means of furnishing proxy materials to our stockholders. Consequently, stockholders will not receive paper copies of our proxy materials. We will instead send stockholders a notice with instructions for accessing the proxy materials and voting via the Internet. The notice also provides information on how stockholders may obtain paper copies of our proxy materials if they so choose. This makes the proxy distribution process more efficient and less costly.

A Notice of Internet Availability of Proxy Materials, which contains specific instructions on how to access those materials via the Internet and vote online, as well as instructions on how to request paper copies, will be mailed to our stockholders on or about May 16, 2016. The Company’s Annual Report and the Proxy Statement, along with any amendments to the foregoing materials that are required to be furnished to stockholders, will be available at https://materials.proxyvote.com/25614T.

| By order of the Board of Directors | |

| |

| Robert Fagenson | |

| Chairman of the Board |

| 2 |

WHETHER

OR NOT YOU PLAN ON ATTENDING THE ANNUAL MEETING IN PERSON, PLEASE VOTE AS PROMPTLY

AS POSSIBLE TO ENSURE THAT YOUR VOTE IS COUNTED.

| 3 |

DOCUMENT SECURITY SYSTEMS, INC.

200 CANAL VIEW BOULEVARD, SUITE 300

ROCHESTER, NEW YORK 14623

PROXY STATEMENT FOR THE COMPANY’S

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 28, 2016

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS

Why am I receiving these proxy materials?

The proxy materials describe the proposals on which our Board of Directors would like you, as a stockholder, to vote on at the Annual Meeting. The materials provide you with information on these proposals so that you can make an informed decision. We intend to mail a Notice of Internet Availability of Proxy Materials (the “Notice”) to all stockholders of record entitled to vote at the Annual Meeting.

Who can vote at the Annual Meeting of Stockholders?

Stockholders who owned shares of common stock of the Company, par value $0.02 per share (the “Common Stock”), as of April 29, 2016, the Record Date, may attend and vote at the Annual Meeting. Each share is entitled to one vote. There were 51,881,948 shares of Common Stock outstanding as of the Record Date. All shares of Common Stock shall vote together as a single class.

What is the proxy card?

The proxy card enables you to appoint the persons named therein as your representative to vote your shares at the Annual Meeting, and to provide specific instructions as to how you wish your shares to be voted. By completing and returning the proxy card, you are authorizing these persons to vote your shares at the Annual Meeting in accordance with your instructions on the proxy card. By providing specific voting instructions for each proposal identified on the proxy card, your shares will be voted in accordance with your wishes whether or not you attend the Annual Meeting. Even if you plan to attend the Annual Meeting, we suggest that you complete and return your proxy card before the Annual Meeting date just in case your plans change. If a routine proposal comes up for vote at the Annual Meeting that is not on the proxy card, your appointed representative will vote your shares, under your proxy, according to their best judgment.

What am I voting on?

You are being asked to vote on the election of the Company’s Board of Directors, on the ratification of the Company’s independent registered public accountants for the fiscal year ending December 31, 2016, for approval of executive compensation as disclosed in this Proxy Statement of the Company’s executive officers who are named in this Proxy Statement’s Summary Compensation Table, and for approval of an amendment to the Company’s certificate of incorporation to effect a 1-for-4 reverse stock split. We may also transact any other business that properly comes before the Annual Meeting.

How does the Board of Directors recommend that I vote?

Our Board of Directors unanimously recommends that the stockholders vote “For” the nominees for director, “For” the ratification of the Company’s independent registered public accountants for the fiscal year ending December 31, 2016, “For” approval of the executive compensation disclosed in this Proxy Statement of the Company’s executive officers who are named in this Proxy Statement’s Summary Compensation Table, and “For” approval of an amendment to the Company’s certificate of incorporation to effect a 1-for-4 reverse stock split.

What is the difference between holding shares as a stockholder of record and holding shares as a beneficial owner?

Most of our stockholders hold their shares in an account at a brokerage firm, bank, broker dealer or other nominee holder, rather than holding share certificates in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

| 4 |

Registered Stockholders (Stockholders of Record)

If on the Record Date, your shares were registered directly in your name with our transfer agent, American Stock Transfer and Trust Company, LLC, you are a stockholder of record who may vote at the Annual Meeting. As the stockholder of record, you have the right to direct the voting of your shares via the internet or telephone or, if you request, by returning a proxy card to us. You may also vote in person at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, please vote via the internet or telephone, or if you request, complete, date and sign a proxy card and provide specific voting instructions to ensure that your shares will be voted at the Annual Meeting.

Beneficial Owner

If on the Record Date, your shares were held in an account at a brokerage firm, bank, broker-dealer or other similar organization, you are considered the beneficial owner of shares held “in street name”, and the Notice is being forwarded to you by that organization. The organization holding your account is considered the shareholder of record for purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to instruct your nominee holder on how to vote your shares and to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you receive a valid proxy from your brokerage firm, bank, broker dealer or other nominee holder. To obtain a valid proxy, you must make a special request of your brokerage firm, bank, broker dealer or other nominee holder. If you do not make this request, you can still vote by following the voting instructions contained in the Notice; however, you will not be able to vote in person at the Annual Meeting.

How do I Vote?

Stockholders of record (also called registered stockholders) may vote by any of the following methods:

A. By mail: if you request or receive proxy materials by mail, you may vote by completing the proxy card with your voting instructions and returning it in the postage-paid envelope provided.

If we receive your proxy card prior to the Annual Meeting date and you have marked your voting instructions on the proxy card, your shares will be voted:

| ● | as you instruct, and | |

| ● | as your proxy representative may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting. |

B. By Internet: read the proxy materials and follow the instructions provided in the Notice.

C. By toll-free telephone: read the proxy materials and call the toll free number provided for in the proxy voting instructions.

D. In person at the Annual Meeting.

If your shares are held in the name of a broker, bank, broker dealer or other nominee holder of record, you may vote by any of the following methods:

A. By Mail: If you request or receive printed copies of the proxy materials by mail, you may vote by completing the proxy card with your voting instructions and returning it to your broker, bank, broker dealer or other nominee holder of record prior to the Annual Meeting.

B. By Internet: You may vote via the Internet by following the instructions provided in the Notice mailed to you by your nominee holder.

C. By toll-free telephone: You may vote by calling the toll free telephone number found in the proxy voting instructions.

D. In Person: If you are a beneficial owner of shares held in street name and you wish to vote in person at the Annual Meeting, you must obtain a valid proxy from the nominee organization that holds your shares.

Why did I receive a Notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

Pursuant to rules adopted by the Securities and Exchange Commission, the Company has elected to provide access to its proxy materials over the Internet. Accordingly, the Company is sending such Notice to the Company’s stockholders of record and beneficial owners. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. The Company encourages you to take advantage of the availability of the proxy materials on the Internet.

| 5 |

What does it mean if I receive more than one proxy card?

You may have multiple accounts at the transfer agent and/or with brokerage firms. Please sign and return all proxy cards, and provide your voting instructions, to ensure that all of your shares are voted for each of the proposals.

What if I change my mind after I return my proxy?

You may revoke your proxy and change your vote at any time before the polls close at the Annual Meeting. You may do this by:

| ● | sending a written notice to the Secretary of the Company stating that you would like to revoke your proxy of a particular date; | |

| ● | signing another proxy card with a later date and returning it before the polls close at the Annual Meeting; | |

| ● | submitting a vote at a later time via Internet or telephone before the closure of those voting facilities at 11:59 p.m. (Eastern Time) on June 27, 2016; or | |

| ● | attending the Annual Meeting and voting in person. |

Please note, however, that if your shares are held of record by a brokerage firm, bank, broker dealer or other nominee, you must instruct your broker, bank, broker dealer or other nominee that you wish to change your vote by following the procedures on the voting form provided to you by the broker, bank, broker dealer or other nominee. If your shares are held in street name, and you wish to attend the Annual Meeting and vote at the Annual Meeting, you must bring to the Annual Meeting a legal proxy from the broker, bank, broker dealer or other nominee holding your shares, confirming your beneficial ownership of the shares and giving you the right to vote your shares.

How are votes counted?

Consistent with state law and our bylaws, the presence, in person or by proxy, of at least a majority of the shares entitled to vote at the meeting will constitute a quorum for purposes of voting on a particular matter at the meeting. Once a share is represented for any purpose at the meeting, it is deemed present for quorum purposes for the remainder of the meeting and any adjournment thereof unless a new record date is set for the adjournment. Shares held of record by stockholders or their nominees who do not vote by proxy or attend the meeting in person will not be considered present or represented and will not be counted in determining the presence of a quorum. Signed proxies that withhold authority or reflect abstentions and “broker non-votes” will be counted for purposes of determining whether a quorum is present. “Broker non-votes” are proxies received from brokerage firms or other nominees holding shares on behalf of their clients who have not been given specific voting instructions from their clients with respect to matters being voted on. Broker non-votes will be counted for purposes of establishing a quorum to conduct business at the meeting, but not for determining the number of shares voted FOR, AGAINST, ABSTAINING or WITHHELD FROM with respect to any matters.

Assuming the presence of a quorum at the meeting:

| ● | The election of directors will be determined by an affirmative vote of a majority of the votes cast for each director at the meeting. Withheld votes and broker non-votes, if any, are not treated as votes cast, and therefore will have no effect on the proposal to elect directors. | |

| ● | The advisory vote on executive compensation will be decided by the affirmative vote of a majority of the votes cast on this proposal at the meeting. Withheld votes and broker non-votes, if any, are not treated as votes cast, and therefore will have no effect on this proposal. However, the stockholder vote on this matter will not be binding on our Company or the Board of Directors, and will not be construed as overruling or determining any decision by the Board on executive compensation. | |

| ● | The affirmative vote of the holders of a majority of the total outstanding shares of our common stock as of the Record Date is necessary to approve the 1-for-4 reverse stock split. Withheld votes and broker non-votes, if any, are not treated as votes cast, and therefore will effectively be a vote against this proposal. | |

| ● | The ratification of the appointment of our independent registered public accounting firm requires the affirmative vote of a majority of the votes cast at the meeting for this proposal. Withheld votes and broker non-votes, if any, are not treated as votes cast, and therefore will have no effect on this proposal. |

We strongly encourage you to provide instructions to your bank, brokerage firm, or other nominee by voting your proxy. This action ensures that your shares will be voted in accordance with your wishes at the meeting.

| 6 |

Is my vote kept confidential?

Proxies, ballots and voting tabulations identifying stockholders are kept confidential and will not be disclosed except as may be necessary to meet legal requirements.

Where do I find the voting results of the Annual Meeting?

We plan to announce preliminary voting results at the Annual Meeting. We will also file a Current Report on Form 8-K with the Securities and Exchange Commission within four business days of the Annual Meeting disclosing the final voting results.

Who can help answer my questions?

You can contact our corporate headquarters, at (585) 325-3610, or send a letter to: Investor Relations, Document Security Systems, Inc., 200 Canal View Boulevard, Suite 300, Rochester, New York 14623, with any questions about proposals described in this Proxy Statement or how to execute your vote.

| 7 |

DOCUMENT SECURITY SYSTEMS, INC.

200 CANAL VIEW BOULEVARD, SUITE 300

ROCHESTER, NEW YORK 14623

PROXY STATEMENT

SOLICITATION OF PROXIES

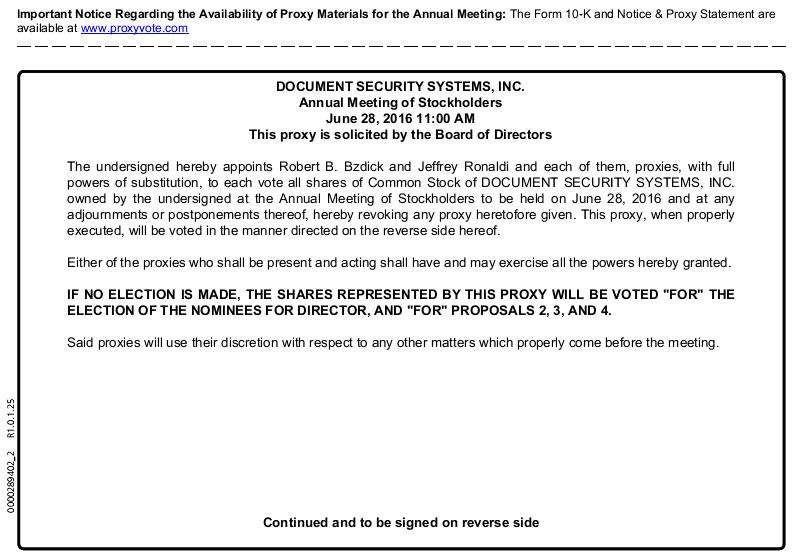

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Document Security Systems, Inc. (the “Company”), for use at the Annual Meeting of Stockholders of the Company (the “Annual Meeting”) to be held at 200 Canal View Boulevard, Suite 300, Rochester, New York 14623 on Tuesday, June 28, 2016, at 11:00 a.m. (Eastern Standard Time) and at any adjournments or postponements thereof. Solicitation of proxies may be made by directors, officers, a solicitor or other employees of the Company. Compensation may be paid to a proxy solicitor should the Company determine that such services are required. This solicitation of proxies is being made by the Company which will bear all costs associated with the mailing of the proxy materials and the solicitation of proxies. Whether or not you expect to attend the Annual Meeting in person, and if you request and receive proxy materials by mail, please return your executed proxy card in the enclosed envelope and the shares represented thereby will be voted in accordance with your instructions. The Notice of Internet Availability of Proxy Materials (the “Notice”) will be mailed to all stockholders on or about May 16, 2016. The proxy voting instructions accompanying the Notice describe the process for voting your shares via the Internet or by telephone. For stockholders who request mailings of the proxy materials, we will begin mailing the proxy materials to stockholders on or about May 19, 2016.

REVOCABILITY OF PROXY

Any stockholder executing a proxy that is solicited has the power to revoke it prior to the voting of the proxy. Revocation may be made by attending the Annual Meeting and voting the shares of stock in person, or by delivering to the Secretary of the Company at the principal office of the Company prior to the Annual Meeting a written notice of revocation or a later-dated, properly executed proxy.

RECORD DATE

Stockholders of record at the close of business on April 29, 2016 (the “Record Date”) will be entitled to vote at the Annual Meeting.

ACTION TO BE TAKEN UNDER PROXY

In the case of the Company receiving a signed proxy (“Proxy”) from a registered stockholder containing voting instructions “FOR” the election of each of the nominated directors, and “FOR” Proposals 2, 3 and 4, the persons named in the Proxy (Robert Bzdick, Secretary of the Company, and Jeffrey Ronaldi, Chief Executive Officer of the Company), or either one of them who acts (the “Proxy Representative”), will vote:

| (1) | FOR the election of the persons named herein as nominees for directors of the Company; | |

| (2) | FOR ratification of Freed Maxick CPAs, P.C. as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016; | |

| (3) | FOR approval of executive compensation disclosed in this Proxy Statement of the Company’s executive officers who are named in this Proxy Statement’s Summary Compensation Table;

| |

| (4) | FOR approval of an amendment to the certificate of incorporation to effect a 1-for-4 reverse stock split; and | |

| (5) | According to their judgment on the transaction of such matters or other business as may properly come up for vote at the Annual Meeting or any adjournments or postponements thereof. |

If the giver of the Proxy provides voting instructions to cast a vote “AGAINST” any or all of the nominated directors or any of the proposals, the Proxy Representative will vote such shares accordingly. If the giver of the Proxy provides voting instructions to “ABSTAIN” from voting on any or all of the above proposals, the Proxy Representative will abstain from voting the shares accordingly. For registered stockholders, if no specific voting instructions are given to the Proxy Representative, then the Proxy Representative will vote “FOR” Proposals 1, 2, 3 and 4 and according to their judgment on any other matters properly submitted for a vote at the Annual Meeting.

| 8 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth beneficial ownership of Common Stock as of March 31, 2016 by each person known by the Company to beneficially own more than 5% of the Common Stock, each director and nominee for election as a director, each of the executive officers named in the Summary Compensation Table (see “Executive Compensation” below), and by all of the Company’s directors and executive officers as a group. Each person has sole voting and dispositive power over the shares listed opposite his name except as indicated in the footnotes to the table and each person’s address is c/o Document Security Systems, Inc., 200 Canal View Boulevard, Suite 300, Rochester, New York 14623.

For purposes of this table, beneficial ownership is determined in accordance with the Securities and Exchange Commission rules, and includes investment power with respect to shares owned and shares issuable pursuant to warrants or options exercisable within 60 days of March 31, 2016.

The percentages of shares beneficially owned are based on 51,881,948 shares of our Common Stock issued and outstanding as of March 31, 2016, and is calculated by dividing the number of shares that person beneficially owns by the sum of (a) the total number of shares outstanding on March 31, 2016, plus (b) the number of shares such person has the right to acquire within 60 days of March 31, 2016.

| Name | Number of Shares Beneficially Owned | Percentage

of Outstanding Shares Beneficially Owned | ||||||

| Robert Fagenson | 1,412,096 | (1) | 2.72 | % | ||||

| Jeffrey Ronaldi | 516,690 | (2) | * | |||||

| Robert B. Bzdick | 1,388,325 | (3) | 2.66 | % | ||||

| Ira A. Greenstein | 145,632 | (4) | * | |||||

| Warren Hurwitz | 45,000 | (5) | * | |||||

| Joseph Sanders | 927,673 | (6) | 1.79 | % | ||||

| Philip Jones | 96,620 | (7) | * | |||||

| All officers and directors as a group (7 persons) | 4,532,036 | 8.59 | % | |||||

| 5% Shareholders | ||||||||

| None | ||||||||

* Less than1%.

(1) Includes 1,135,321 shares of the Company’s Common Stock, 76,775 shares of the Company’s Common Stock issuable upon the exercise of currently exercisable stock options, 100,000 shares of the Company’s Common Stock held by Mr. Fagenson’s wife, and an aggregate of 100,000 shares of the Company’s Common Stock held in trusts for Mr. Fagenson’s two adult children, of which Mr. Fagenson is trustee. Mr. Fagenson disclaims beneficial ownership of the 100,000 shares of the Company’s Common Stock held by his wife and the 100,000 shares of the Company’s Common Stock held in trusts for Mr. Fagenson’s two adult children.

(2) Includes 296,187 shares of the Company’s Common Stock, 207,101 shares of the Company’s Common Stock issuable upon exercise of stock options within 60 days of March 31, 2016, and 13,402 shares of the Company’s Common Stock issuable upon exercise of warrants with an exercise price of $4.80.

(3) Includes 1,019,982 shares of the Company’s Common Stock and 368,343 shares of the Company’s Common Stock issuable upon the exercise of stock options within 60 days of March 31, 2016.

(4) Includes 28,857 shares of the Company’s Common Stock and 116,775 shares of the Company’s Common Stock issuable upon the exercise of stock options within 60 days of March 31, 2016.

(5) Includes 15,000 shares of the Company’s Common Stock and 30,000 shares of the Company’s Common Stock issuable upon exercise of stock options within 60 days of March 31, 2016.

(6) Consists of 927,673 shares of the Company’s Common Stock.

(7) Includes 18,750 shares of the Company’s Common Stock, and 77,870 shares of the Company’s Common Stock issuable upon the exercise of options within 60 days of March 31, 2016.

| 9 |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

AND RELATED PERSON TRANSACTIONS

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our executive officers and directors, and persons who beneficially own more than 10% of our equity securities (“Reporting Persons”) to file reports of ownership and changes in ownership with the Securities and Exchange Commission. Based solely on our review of copies of such reports and representations from the Reporting Persons, we believe that during the fiscal year ended December 31, 2015, all Reporting Persons were in compliance with the applicable requirements of Section 16(a) of the Exchange Act.

Transactions with Related Persons

During 2015, the Company paid consulting fees of approximately $35,000 to Patrick White, its former CEO, under a consulting agreement. The agreement expired in March 2015, and all payments thereunder ceased at that time.

Review, Approval or Ratification of Transactions with Related Persons

The Board conducts an appropriate review of and oversees all related party transactions on a continuing basis and reviews potential conflict of interest situations. The Board has adopted formal standards to apply when it reviews, approves or ratifies any related party transaction. In addition, the Board applies the following standards to such reviews: (i) all related party transactions must be fair and reasonable and on terms comparable to those reasonably expected to be agreed to with independent third parties for the same goods and/or services at the time they are authorized by the Board and (ii) all related party transactions should be authorized, approved or ratified by the affirmative vote of a majority of the directors who have no interest, either directly or indirectly, in any such related party transaction.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

INFORMATION ABOUT THE NOMINEES

The Company’s By-laws, as amended, specify that the number of directors shall be at least three and no more than nine persons, unless otherwise determined by a vote of the majority of the Board of Directors. All of the nominees named below have been nominated by the Company to stand for election as incumbents. Each director of the Company serves for a one-year term (or until the next annual meeting of stockholders) or until such director’s successor is duly elected and qualified or until such director’s earlier resignation or removal.

Biographical and certain other information concerning the Company’s nominees for election to the Board is set forth below. There are no familial relationships among any of our directors or nominees. Except as indicated below, none of our directors is a director in any other reporting companies. None of our directors has been affiliated with any company that has filed for bankruptcy within the last ten years. We are not aware of any proceedings to which any of our directors, or any associate of any such director is a party adverse to us or any of our subsidiaries or has a material interest adverse to us or any of our subsidiaries.

BOARD NOMINEES

| Name | Age | |

| Robert B. Fagenson | 67 | |

| Jeffrey Ronaldi | 50 | |

| Joseph Sanders | 55 | |

| Robert B. Bzdick | 61 | |

| Warren Hurwitz | 51 | |

| Ira A. Greenstein | 56 |

The principal occupation and business experience for each director nominee, for at least the past five years, is as follows:

Robert B. Fagenson spent the majority of his career at the New York Stock Exchange, where he was Managing Partner of one of the largest specialist firms operating on the exchange trading floor. Having sold his firm and subsequently retired from that business in 2007, he has since been the Chief Executive Officer of Fagenson & Co., Inc., a 50 year old broker dealer that is engaged in institutional brokerage as well as investment banking and money management. On March 1, 2012, Fagenson & Co., Inc. transferred its brokerage operations, accounts and personnel to National Securities Corporation and now operates as a branch office of that firm. On April 4, 2012, Mr. Fagenson was elected Chairman of the Board of National Holdings Corporation which is the parent of National Securities Corporation, a full line broker dealer with offices around the United States. On January 1, 2015, Mr. Fagenson was named Chief Executive Officer of National Holdings Corporation.

| 10 |

During his career as a member of the New York Stock Exchange beginning in 1973, Mr. Fagenson has served as a Governor on the trading floor and was elected to the NYSE Board of Directors in 1993, where he served for six years, eventually becoming Vice Chairman of the Board in 1998 and 1999. He returned to the NYSE Board in 2003 and served as a director until the Board was reconstituted with only non-industry directors in 2004.

Mr. Fagenson has previously served on the boards of a number of public companies and is presently the Non-Executive Chairman of the Board of Directors of Document Security Systems, Inc. He has served as a director of the Company since 2004 and as the Board’s Non-Executive Chairman since 2008. He is also a director of the National Organization of Investment Professionals (NOIP).

In addition to his business related activities, Mr. Fagenson serves as Vice President and a director of New York Services for the Handicapped, Treasurer and director of the Centurion Foundation, Director of the Federal Law Enforcement Officers Association Foundation, Treasurer and director of the New York City Police Museum and as a member of the Board of the Sports and Arts in Schools Foundation. He is a member of the alumni boards of both the Whitman School of Business and the Athletic Department at Syracuse University. He also serves in a voluntary capacity on the boards and committees of many civic, social and community organizations. Mr. Fagenson received his B.S. degree in Transportation Sciences & Finance from Syracuse University in 1970. Mr. Fagenson’s extensive experience as a board member for many public companies and as a corporate executive qualifies him to serve on our board of directors.

Jeffrey Ronaldi has served as the Company’s Chief Executive Officer and director since July 1, 2013. Mr. Ronaldi had previously served as Lexington Technology Group, Inc.’s Chief Executive Officer since November 9, 2012. He also has served since July 2011 as Managing Director at HPR Capital, LLC; since January 2008 he has also served as Managing Partner of CTD Group, LLC and since June 2005, he has served as Managing Director of SSL Services, LLC. From November 2008 to November 2010, he served as Chief Executive Officer at Turtle Bay Technologies, an intellectual property management firm that provides strategic capital, asset management services and guidance for intellectual property owners. Since August 2008, Mr. Ronaldi has provided consulting services to Juridica Investments Ltd., a closed-end investment fund listed on the Alternative Investment Market (AIM) of the London Stock Exchange. Mr. Ronaldi’s experience with Turtle Bay Technologies and management of intellectual property qualifies him to serve on our board of directors.

Robert B. Bzdick joined the Company on February 17, 2010 as Chief Operating Officer after the Company’s acquisition of its wholly-owned subsidiary, Premier Packaging Corporation, for which Mr. Bzdick was the Chief Executive Officer. Mr. Bzdick became a director of the Company in March 2010 and Chief Executive Officer in December 2012. Mr. Bzdick resigned as Chief Executive Officer of the Company and was appointed President of the Company on July 1, 2013. Prior to founding Premier Packaging Corporation in 1989, Mr. Bzdick held positions of Controller, Sales Manager, and General Sales Manager at the Rochester, New York division of Boise Cascade, LLC (later Georgia Pacific Corporation). Mr. Bzdick has over 29 years of experience in manufacturing and operations management in the printing and packaging industry. Mr. Bzdick brings his considerable packaging and printing industry experience to the Company, which qualifies him to serve on our board of directors.

Ira A. Greenstein is President of Genie Energy Ltd., an energy services company. Prior to joining Genie Energy Ltd. in December 2011, Mr. Greenstein served as President of IDT Corporation (NYSE: IDT), a provider of wholesale and retail telecommunications services and continues to serve as counsel to the Chairman. Prior to joining IDT in January 2000, Mr. Greenstein was a partner in the law firm of Morrison & Foerster LLP from February 1997 to November 1999, where he served as the chairman of the firm’s New York Business Department. Concurrent to his tenure at Morrison & Foerster, Mr. Greenstein served as General Counsel and Secretary of Net2Phone, Inc. from January 1999 to November 1999. Prior to 1997, Mr. Greenstein was an associate in the New York and Toronto offices of Skadden, Arps, Meagher & Flom LLP. Mr. Greenstein also served on the Securities Advisory Committee to the Ontario Securities Commission from 1992 through 1996. From 1991 to 1992, Mr. Greenstein served as second counsel to the Ontario Securities Commission. Mr. Greenstein serves on the boards of Ohr Pharmaceutical, Inc., NanoVibronix Inc. and Regal Bank of New Jersey. Mr. Greenstein is a member of the Dean’s Council of the Columbia Law School Center on Corporate Governance. Mr. Greenstein received a B.S. from Cornell University and a J.D. from Columbia University Law School. Mr. Greenstein was appointed to our Board of Directors in September 2004.

Mr. Greenstein provides the Company with significant public company management experience, particularly in regards to legal and corporate governance matters, mergers and acquisitions, and strategic planning. In addition, Mr. Greenstein’s extensive legal experience has provided the Company insights and guidance throughout the Company’s patent litigation initiatives. All of this experience qualifies him to serve on our board of directors.

| 11 |

Warren Hurwitz has served as a director of the Company since July 1, 2013. Mr. Hurwitz has served since March 2005 as a partner of Altitude Capital Partners, a private investment fund that he co-founded that is focused on investing in, enforcing and protecting the rights of intellectual property assets. Prior to Altitude Capital Partners, Mr. Hurwitz was a Senior Vice President at HSBC Capital (USA), the U.S. private equity arm of HSBC Group, from May 2001 through June 2004 and has held various positions within HSBC Markets (USA) Inc. from June 1994 through May 2001. Mr. Hurwitz received his B.A. degree in Economics from the State University of New York at Albany and his MBA from Fordham University. Mr. Hurwitz’s experience with Altitude Capital Partners and the investment, enforcement and protection of intellectual property rights qualify him to serve on our board of directors.

Joseph Sanders has served as a director of the Company since October 1, 2015. Mr. Sanders graduated with a BS in Business Administration and Finance from the University of Southern California and went on to receive an MBA in Finance from Loyola Marymount University. He received his license as a financial advisor in 1981, and then worked as a financial analyst at Hughes Aircraft for two years. Thereafter, between 1983 and 2001, Mr. Sanders served as a financial advisor at Dean Witter, EF Hutton, Shearson Lehman, Bateman Eichler, AG Edwards, Sutro and Morgan Stanley. Since 2001, Mr. Sanders has served as a Registered Investment Advisor with a firm now known as Newport Coast Securities. All of this experience qualifies him to serve on our board of directors.

There are no legal proceedings that have occurred within the past ten years concerning our directors which involved a criminal conviction, a criminal proceeding, an administrative or civil proceeding limiting one’s participation in the securities or banking industries, or a finding of securities or commodities law violations.

RECOMMENDATION OF THE BOARD FOR PROPOSAL NO. 1:

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF ALL THE NOMINEES DESCRIBED ABOVE.

INFORMATION CONCERNING BOARD OF DIRECTORS

Compensation of Directors

Each independent director (as defined under Section 803 of the NYSE MKT LLC Company Guide) is entitled to receive base cash compensation of $12,000 annually, provided such director attends at least 75% of all Board of Director meetings, and all scheduled committee meetings. Each independent director is entitled to receive an additional $1,000 for each Board of Director meeting he attends, and an additional $500 for each committee meeting he attends, provided such committee meeting falls on a date other than the date of a full Board of Directors meeting. Each of the independent directors is also eligible to receive discretionary grants of options or restricted stock under the Company’s 2013 Employee, Director and Consultants Equity Incentive Plan. Non-independent members of the Board of Directors do not receive cash compensation in their capacity as directors, except for reimbursement of travel expenses.

Director Compensation

The following table sets forth cash compensation and the value of stock options awards granted to the Company’s non-employee independent directors for their service in 2015:

| Name | Fees

Earned or Paid in Cash | Stock Awards | Option Awards (1) (2) | Total | ||||||||||||

| ($) | ($) | ($) | ($) | |||||||||||||

| Robert B. Fagenson | 12,000 | - | 3,213 | 15,213 | ||||||||||||

| Ira A. Greenstein | 10,500 | - | 3,213 | 13,713 | ||||||||||||

| Joseph Sanders | 1,000 | - | - | 1,000 | ||||||||||||

| Warren Hurwitz | 11,500 | 3,200 | - | 14,700 | ||||||||||||

| Jonathan Perrelli (3) | 1,500 | 3,200 | - | 4,700 | ||||||||||||

| (1) | Represents the total grant date fair value of option awards computed in accordance with FASB ASC 718. Our policy and assumptions made in the valuation of share-based payments are contained in Note 8 to our financial statements for the year ended December 31, 2015. | |

| (2) | At December 31, 2015, the following directors held options to purchase common shares in the following amounts: Mr. Fagenson, 76,775 shares; Mr. Greenstein, 116,775 shares; Mr. Sanders, no shares; and Mr. Hurwitz, 30,000 shares. | |

| (3) | Mr. Perrelli’s service as a director ended on August 26, 2015. |

| 12 |

Board of Directors and Committees

The Company has determined that each of the following directors, Messrs. Hurwitz, Fagenson, Sanders and Greenstein, qualify as independent directors (as defined under Section 803 of the NYSE MKT LLC Company Guide).

In fiscal 2015, each of the Company’s directors attended or participated in 75% or more of the aggregate of (i) the total number of meetings of the Board of Directors held during the period in which each such director served as a director and (ii) the total number of meetings held by all committees of the Board of Directors during the period in which each such director served on such committee. During the fiscal year ended December 31, 2015, the Board held four meetings and acted by written consent on twelve occasions. The Board’s independent directors met in executive session on one occasion outside the presence of the non-independent directors and management.

Audit Committee

The Company has separately designated an Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee held four meetings in 2015. The Audit Committee is responsible for, among other things, the appointment, compensation, removal and oversight of the work of the Company’s independent registered public accounting firm, overseeing the accounting and financial reporting process of the Company, and reviewing related person transactions. The Audit Committee is currently comprised of Robert Fagenson and Warren Hurwitz. It is anticipated that each of Mr. Fagenson and Mr. Hurwitz will be re-appointed to serve as members of the Audit Committee at the Company’s Annual Meeting of Directors. Robert Fagenson is qualified as a “financial expert” as defined in Item 407 under Regulation S-K of the Securities Act of 1933, as amended. Each of the members of the Audit Committee is an independent director (as defined under Section 803 of the NYSE MKT LLC Company Guide). The Audit Committee operates under a written charter adopted by the Board of Directors, which can be found in the Investors/Corporate Governance section of our web site, www.dsssecure.com.

Compensation and Management Resources Committee

The purpose of the Compensation and Management Resources Committee is to assist the Board in discharging its responsibilities relating to executive compensation, succession planning for the Company’s executive team, and to review and make recommendations to the Board regarding employee benefit policies and programs, incentive compensation plans and equity-based plans. The Compensation and Management Resources Committee held two meetings in 2015.

The Compensation and Management Resources Committee is responsible for, among other things, (a) reviewing all compensation arrangements for the executive officers of the Company and (b) administering the Company’s stock option plans. The Compensation and Management Resources Committee currently consists of Ira Greenstein and Robert Fagenson. Each of the members of the Compensation and Management Resources Committee is an independent director (as defined under Section 803 of the NYSE MKT LLC Company Guide). It is anticipated that Mr. Fagenson and Mr. Greenstein will be re-appointed to serve as members of the Compensation and Management Resources Committee at the Company’s Annual Meeting of Directors. The Compensation and Management Resource Committee operates under a written charter adopted by the Board of Directors, which can be found in the Investors/Corporate Governance section of our web site, www.dsssecure.com.

The duties and responsibilities of the Compensation and Management Resources Committee in accordance with its charter are to review and discuss with management and the Board the objectives, philosophy, structure, cost and administration of the Company’s executive compensation and employee benefit policies and programs; no less than annually, review and approve, with respect to the Chief Executive Officer and the other executive officers (a) all elements of compensation, (b) incentive targets, (c) any employment agreements, severance agreements and change in control agreements or provisions, in each case as, when and if appropriate, and (d) any special or supplemental benefits; make recommendations to the Board with respect to the Company’s major long-term incentive plans, applicable to directors, executives and/or non-executive employees of the Company and approve (a) individual annual or periodic equity-based awards for the Chief Executive Officer and other executive officers and (b) an annual pool of awards for other employees with guidelines for the administration and allocation of such awards; recommend to the Board for its approval a succession plan for the Chief Executive Officer, addressing the policies and principles for selecting a successor to the Chief Executive Officer, both in an emergency situation and in the ordinary course of business; review programs created and maintained by management for the development and succession of other executive officers and any other individuals identified by management or the Compensation and Management Resources Committee; review the establishment, amendment and termination of employee benefits plans, review employee benefit plan operations and administration; and any other duties or responsibilities expressly delegated to the Compensation and Management Resources Committee by the Board from time to time relating to the Committee’s purpose.

The Compensation and Management Resources Committee may request any officer or employee of the Company or the Company’s outside counsel to attend a meeting of the Compensation and Management Resources Committee or to meet with any members of, or consultants to, the Compensation and Management Resources Committee. The Company’s Chief Executive Officer does not attend any portion of a meeting where the Chief Executive Officer’s performance or compensation is discussed, unless specifically invited by the Compensation and Management Resources Committee.

| 13 |

The Compensation and Management Resources Committee has the sole authority to retain and terminate any compensation consultant to be used to assist in the evaluation of director, Chief Executive Officer or other executive officer compensation or employee benefit plans, and shall have sole authority to approve the consultant’s fees and other retention terms. The Compensation and Management Resources Committee also has the authority to obtain advice and assistance from internal or external legal, accounting or other experts, advisors and consultants to assist in carrying out its duties and responsibilities, and has the authority to retain and approve the fees and other retention terms for any external experts, advisors or consultants.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is responsible for overseeing the appropriate and effective governance of the Company, including, among other things, (a) nominations to the Board of Directors and making recommendations regarding the size and composition of the Board of Directors and (b) the development and recommendation of appropriate corporate governance principles. The Nominating and Corporate Governance Committee currently consists of Ira Greenstein and Robert Fagenson, each of whom is an independent director (as defined under Section 803 of the NYSE MKT LLC Company Guide). It is anticipated that Mr. Greenstein and Mr. Fagenson will be re-appointed at the Company’s Annual Meeting of Directors to serve as members of the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee held one meeting in 2015. The Nominating and Corporate Governance Committee operates under a written charter adopted by the Board of Directors, which can be found in the Investors/Corporate Governance section of our web site, www.dsssecure.com. The Nominating and Corporate Governance Committee adheres to the Company’s By-Laws provisions and Securities and Exchange Commission rules relating to proposals by shareholders when considering director candidates that might be recommended by stockholders, along with the requirements set forth in the committee’s Policy with Regard to Consideration of Candidates Recommended for Election to the Board of Directors, also available on our website. The Nominating and Corporate Governance Committee of the Board of Directors is responsible for identifying and selecting qualified candidates for election to the Board of Directors prior to each annual meeting of the Company’s stockholders. In identifying and evaluating nominees for director, the Committee considers each candidate’s qualities, experience, background and skills, as well as other factors, such as the individual’s ethics, integrity and values which the candidate may bring to the Board of Directors.

Code of Ethics

The Company has adopted a code of Ethics that establishes the standards of ethical conduct applicable to all directors, officers and employees of the Company. A copy of the Code of Ethics covering all of our employees, directors and officers, is available on the Investors/Corporate Governance section of our web site at www.dsssecure.com.

Leadership Structure and Risk Oversight

Currently, the positions of Chief Executive Officer and Chairman of the Board are held by two different individuals. Robert Fagenson currently serves as Chairman of the Board and Jeffrey Ronaldi currently serves as Chief Executive Officer of the Company and as a member of the Board. Although no formal policy currently exists, the Board determined that the separation of these positions would allow our Chief Executive Officer to devote his time to the daily execution of the Company’s business strategies and the Board Chairman to devote his time to the long-term strategic direction of the Company. Our senior management manages the risks facing the Company under the oversight and supervision of the Board. While the full Board is ultimately responsible for risk oversight at our Company, two of our Board committees assist the Board in fulfilling its oversight function in certain areas of risk. The Audit Committee assists the Board in fulfilling its oversight responsibilities with respect to risk in the areas of financial reporting and internal controls. The Nominating and Corporate Governance Committee assists the Board in fulfilling its oversight responsibilities with respect to risk in the area of corporate governance. Other general business risks such as economic and regulatory risks are monitored by the full Board. While the Board oversees the Company’s risk management, management is responsible for day-to-day oversight of risk management processes.

Compensation Risk Assessment

Our Board considered whether our compensation program encouraged excessive risk taking by employees at the expense of long-term Company value. Based upon its assessment, the Board does not believe that our compensation program encourages excessive or inappropriate risk-taking. The Board believes that the design of our compensation program does not motivate imprudent risk-taking.

| 14 |

DIRECTOR NOMINATIONS

The Nominating and Corporate Governance Committee of the Board of Directors is responsible for identifying and selecting qualified candidates for election to the Board of Directors prior to each annual meeting of the Company’s stockholders. A copy of the Nominating and Corporate Governance Committee Charter is available on the Investors/Corporate Governance/Charters section of our web site, www.dsssecure.com. In addition, stockholders who wish to recommend a candidate for election to the Board of Directors must submit a written notice of such recommendation to the Company and strictly comply with all the requirements set forth in the Nominating and Corporate Governance Committee Policy With Regard to Consideration of Candidates Recommended for Election to the Board of Directors, a copy of which is also available on the Investors/Charters section of our web site. The standards for considering nominees to the Board are included in the Corporate Governance Committee Charter. In identifying and evaluating nominees for director, the Committee considers each candidate’s qualities, experience, background and skills, as well as other factors, such as the individual’s ethics, integrity and values which the candidate may bring to the Board of Directors. Any stockholder who desires the Committee to consider one or more candidates for nomination as a director should either by personal delivery or by United States mail, postage prepaid, deliver a written notice of recommendation addressed to: Document Security Systems, Inc., Nominating and Corporate Governance Committee, 200 Canal View Boulevard, Suite 300, Rochester, New York 14623. Each written notice must set forth: (a) the name and address of the stockholder making the recommendation and of the person or persons recommended, (b) a representation that the stockholder is a holder of record of the stock of the Company entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice, (c) a description of all arrangements or understandings between the stockholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the stockholder, (d) such other information regarding each nominee proposed by such stockholder as would be required to be included in a proxy statement filed pursuant to the proxy rules of the SEC, (e) the consent of such person(s) to serve as a director(s) of the Company if nominated and elected, and (f) a description of how the person(s) satisfy the criteria for consideration as a candidate referred to above.

COMMUNICATION WITH DIRECTORS

The Company has established procedures for stockholders or other interested parties to communicate directly with the Board of Directors. Such parties can contact the Board of Directors by mail at: Document Security Systems, Inc., Board of Directors, Attention: Robert Fagenson, Chairman of the Board, 200 Canal View Boulevard, Suite 300, Rochester, New York 14623. All communications made by this means will be received by the Chairman of the Board.

AUDIT COMMITTEE REPORT

The following Audit Committee Report shall not be deemed to be “soliciting material,” “filed” with the SEC, or subject to the liabilities of Section 18 of the Exchange Act. Notwithstanding anything to the contrary set forth in any of the Company’s previous filings under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, that might incorporate by reference future filings, including this Proxy Statement, in whole or in part, the following Audit Committee Report shall not be incorporated by reference into any such filings.

The Audit Committee is comprised of two independent directors (as defined under Section 803 of the NYSE MKT LLC Company Guide). The Audit Committee operates under a written charter adopted by the Board of Directors, which can be found in the Investors/Corporate Governance section of our web site, www.dsssecure.com.

We have reviewed and discussed with management the Company’s audited consolidated financial statements as of and for the fiscal year ended December 31, 2015.

We have reviewed and discussed with management and the independent registered public accounting firm the quality and the acceptability of the Company’s financial reporting and internal controls.

We have discussed with the independent registered public accounting firm the overall scope and plans for their audit as well as the results of their examinations, their evaluations of the Company’s internal controls, and the overall quality of the Company’s financial reporting.

We have discussed with management and the independent registered public accounting firm such other matters as required to be discussed with the Audit Committee under Professional Standards, the corporate governance standards of the NYSE MKT LLC Exchange and the Audit Committee’s Charter.

We have received and reviewed the written disclosures and the letter from the independent registered public accounting firm required by the Statement on Auditing Standards as adopted by the Public Company Accounting Oversight Board, and have discussed with the independent registered public accounting firm their independence from management and the Company, including the impact of permitted non-audit related services approved by the Committee to be performed by the independent registered public accounting firm.

Based on the reviews and discussions referred to above, we recommended to the Board of Directors that the financial statements referred to above be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, filed with the SEC on March 30, 2016.

Robert Fagenson, Audit Committee Member

Warren Hurwitz, Audit Committee Member

| 15 |

EXECUTIVE OFFICERS

The persons who are serving as Named Executive Officers of the Company as of March 31, 2016 are Jeffrey Ronaldi, Chief Executive Officer, Robert Bzdick, President, and Philip Jones, Chief Financial Officer. The biographies for each of Jeffrey Ronaldi and Robert Bzdick are contained herein in the information disclosures relating to the Company’s nominees for director.

Philip Jones, 47, joined the Company in 2005 as Controller and Principal Accounting Officer and has been the Company’s Chief Financial Officer since May 2009. Mr. Jones also serves as the Company’s Treasurer. Prior to joining the Company, Mr. Jones held financial management positions at Zapata Corporation, a public holding company, and American Fiber Systems, a private telecom company. In addition, Mr. Jones was a CPA at PriceWaterhouseCoopers and Arthur Andersen. Mr. Jones holds a Bachelor’s Degree in Economics from SUNY Geneseo and an MBA from the Rochester Institute of Technology. Mr. Jones is on the board of directors of U-Vend, Inc.

There are no familial relationships among any of our officers or directors. None of our executive officers has been affiliated with any company that has filed for bankruptcy within the last ten years. We are not aware of any proceedings to which any of our executive officers or any associate of any such officer, is a party adverse to us or any of our subsidiaries or has a material interest adverse to us or any of our subsidiaries.

Each executive officer serves at the pleasure of the board of directors.

There are no legal proceedings that have occurred within the past ten years concerning our executive officers which involved a criminal conviction, a criminal proceeding, an administrative or civil proceeding limiting one’s participation in the securities or banking industries, or a finding of securities or commodities law violations.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth the compensation earned by persons serving as the Company’s Chief Executive Officer and Chief Financial Officer during 2015, and its other two most highly compensated executive officer who served the Company in 2015, referred to herein collectively as the “Named Executive Officers”, or NEOs, for services rendered to us for the years ended December 31, 2015 and 2014:

| Name and Principal Position | Year | Salary | Bonus | Stock Awards | Option Awards (1) | All Other Compensation (2) | Total | |||||||||||||||||||||

| ($) | ($) | ($) | ($) | ($) | ($) | |||||||||||||||||||||||

| Jeffrey Ronaldi | 2015 | 282,692 | - | 23,750 | - | - | 306,442 | |||||||||||||||||||||

| Chief Executive Officer | 2014 | 350,000 | 70,000 | 60,000 | 151,184 | 1,186 | 632,370 | |||||||||||||||||||||

| Robert B. Bzdick | 2015 | 220,000 | 110,251 | - | - | 37,377 | 367,628 | |||||||||||||||||||||

| President | 2014 | 220,000 | 77,321 | - | 86,390 | 24,285 | 407,996 | |||||||||||||||||||||

| Peter Hardigan(3) | 2015 | 137,980 | - | 11,875 | - | 4,496 | 154,351 | |||||||||||||||||||||

| Chief Operating Officer | 2014 | 250,000 | 50,000 | 30,000 | 107,988 | 1,186 | 439,174 | |||||||||||||||||||||

| Philip Jones | 2015 | 135,000 | - | 3,562 | - | 4,157 | 142,719 | |||||||||||||||||||||

| Chief Financial Officer | 2014 | 150,000 | - | 9,000 | 39,040 | 1,186 | 199,226 | |||||||||||||||||||||

| (1) | Represents the total grant date fair value of option awards computed in accordance with FASB ASC 718. Our policy and assumptions made in the valuation of share-based payments are contained in Note 8 to our financial statements for the year ended December 31, 2015. | |

| (2) | Includes health insurance premiums and automobile expenses paid by the Company. | |

| (3) | Mr. Hardigan’s employment as Chief Operating Officer of the Company terminated on July 31, 2015. | |

| 16 |

Employment and Severance Agreements

Mr. Bzdick serves as the Company’s President pursuant to an employment agreement that runs until February 10, 2020 (the “Bzdick Employment Agreement”). The Bzdick Employment Agreement was originally executed on February 10, 2010, and was later amended effective October 1, 2012. Mr. Bzdick’s annual base salary under the Bzdick Employment Agreement is $200,000. The Bzdick Employment Agreement also provides for non-competition covenants by Mr. Bzdick in favor of the Company for the longer of (i) one year after termination of employment, or (ii) any period during which Mr. Bzdick receives severance payments.

On October 1, 2012, the Company entered into a letter agreement with Philip Jones (the “Jones Letter Agreement”) which became effective on July 1, 2013. Under the Jones Letter Agreement, if Mr. Jones’ employment is terminated, the Company will pay Mr. Jones severance in the amount of $150,000 in bi-weekly installments in accordance with the Company’s regular payroll practices, for a period of 12 months. Mr. Jones is an “at will” employee.

On November 9, 2015, the Company entered into an employment agreement with Jeffrey Ronaldi to serve as the Company’s Chief Executive Officer (the “Ronaldi Employment Agreement”), which expires on December 31, 2016. Under the Ronaldi Employment Agreement, Mr. Ronaldi’s annual base salary is $150,000. The agreement also contains performance incentive provisions, and six-month post-employment non-competition covenants. If the Company terminates his employment prior to his employment expiration date, then the Company would be obligated to pay his base salary through December 31, 2016.

Peter Hardigan’s employment as Chief Operating Officer of the Company terminated on July 31, 2015. The Company did not owe Mr. Hardigan any severance payment upon his separation from the Company. Mr. Hardigan is subject to certain non-competition covenants for a period of twelve months following his termination.

Outstanding Equity Awards at Fiscal Year-End

The following table summarizes the equity awards we have made to our Named Executive Officers, which were outstanding as of December 31, 2015:

| Name | Number of Securities Underlying Unexercised Options | Number of Securities Underlying Unexercised Options | Number of Shares of Stock That Have Not Vested | Market Value of Shares of Stock That Have Not Vested | Option Exercise Price | Option Expiration Date | ||||||||||||||||

| (#) | (#) | (#) | ($) | ($) | ||||||||||||||||||

| Exercisable | Un-exercisable | |||||||||||||||||||||

| Philip Jones | 100,000 | 3.00 | 11/19/17 | |||||||||||||||||||

| 29,586 | 14,793 | (2) | 2.00 | 3/5/2019 | ||||||||||||||||||

| 33,500 | 0.60 | 12/18/2019 | ||||||||||||||||||||

| Robert B. Bzdick | 100,000 | - | - | 3.00 | 11/19/2017 | |||||||||||||||||

| 150,000 | - | 3.00 | 11/19/2017 | |||||||||||||||||||

| 78,895 | 39,448 | (2) | 2.00 | 3/5/2019 | ||||||||||||||||||

| Jeffrey Ronaldi | 833,333 | 166,667 | (1) | 3.00 | 11/20/2022 | |||||||||||||||||

| 138,067 | 69,034 | (2) | 2.00 | 3/5/2019 | ||||||||||||||||||

(1) One half of these options shall vest in 12 equal quarterly tranches, with the first tranches having vested as of February 15, 2013, and May 15, 2013 and the remaining tranches vesting on each of August 15, November 15, February 15 and May 15 thereafter through August 15, 2015. Following the completion of the Merger on July 1, 2013, the remaining one half of these options shall vest in 12 equal tranches, with a tranche to vest on the last day of each calendar quarter commencing on September 30, 2013.

(2) One-third of these options vested on the date of grant, one-third on 3/5/2015, and one-third on 3/5/2016.

| 17 |

Equity Compensation Plan Information

As of December 31, 2015, securities issued and securities available for future issuance under our 2013 Employee, Director and Consultant Equity Incentive Plan (the “2013 Plan”) is as follows:

| Weighted | Number of securities | |||||||||||||||

| average exercise | remaining available for | |||||||||||||||

| Number of securities | price of | future issuance (under | ||||||||||||||

| Restricted | to be issued upon | outstanding | equity compensation | |||||||||||||

| stock to be | exercise of | options, | Plans (excluding | |||||||||||||

| issued upon | outstanding options, | warrants and | securities reflected in | |||||||||||||

| vesting | warrants and rights | rights | column (a & b)) | |||||||||||||

| Plan Category | (a) | (b) | (c) | (d) | ||||||||||||

| Equity compensation plans approved by security holders | ||||||||||||||||

| 2013 Employee, Director and Consultant Equity Incentive Plan | - | 4,424,559 | $ | 2.89 | 1,281,103 | |||||||||||

| Equity compensation plans not approved by security holders | ||||||||||||||||

| Contractual warrant grants for services | - | 358,064 | 4.46 | - | ||||||||||||

| Total | - | 4,782,623 | $ | 3.01 | 1,281,103 | |||||||||||

The warrants listed in the table above were issued to third party service providers in partial or full payment for services rendered.

PROPOSAL NO. 2

RATIFICATION OF THE APPOINTMENT OF FREED MAXICK CPAs, P.C.

AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

FOR THE FISCAL YEAR ENDING DECEMBER 31, 2016

The Company’s stockholders are being asked to ratify the Board of Directors’ appointment of Freed Maxick CPAs, P.C. as the Company’s independent registered public accounting firm for fiscal 2016.

In the event that the ratification of this selection is not approved by an affirmative majority of the votes cast on the proposal at the Annual Meeting, management will review its future selection of the Company’s independent registered public accounting firm.

A representative of Freed Maxick CPAs, P.C. is expected to be present at the Annual Meeting and will have an opportunity to make a statement if he or she desires to do so. It is also expected that such representative will be available to respond to appropriate questions.

Audit Fees

Audit fees consist of fees for professional services rendered for the audit of the Company’s consolidated financial statements included in the Company’s Annual Report on Form 10-K, including the review of financial statements included in the Company’s Quarterly Reports on Form 10-Q, and for services that are normally provided by the auditor in connection with statutory and regulatory filings or engagements. The aggregate fees billed for professional services rendered by our principal accountant, Freed Maxick CPAs, P.C., for audit and review services for the fiscal years ended December 31, 2015 and 2014 were approximately $123,500 and $143,600, respectively.

Audit Related Fees

The aggregate fees billed for other related services by our principal accountant, Freed Maxick CPAs, P.C., pertaining to registration statements and consultation on financial accounting or reporting standards for the years ended December 31, 2015 and 2014 were approximately $8,500 and $70,900, respectively.

Tax Fees

The aggregate fees billed for professional services rendered by our principal accountant, Freed Maxick CPAs, P.C., for tax compliance, tax advice and tax planning during the years ended December 31, 2015 and 2014 were approximately $30,200 and $33,400, respectively.

| 18 |

All Other Fees

There were no fees billed for professional services rendered by our principal accountant, Freed Maxick CPAs, P.C., for other related services during the years ended December 31, 2015 and 2014.

Administration of the Engagement; Pre-Approval of Audit and Permissible Non-Audit Services

The Company’s Audit Committee Charter requires that the Audit Committee establish policies and procedures for pre-approval of all audit or permissible non-audit services provided by the Company’s registered public independent auditing firm. Our Audit Committee, approved, in advance, all work performed by our principal accountant, Freed Maxick CPAs, P.C. These services may include audit services, audit-related services, tax services and other services. The Audit Committee may establish, either on an ongoing or case-by-case basis, pre-approval policies and procedures providing for delegated authority to approve the engagement of the independent registered public accounting firm, provided that the policies and procedures are detailed as to the particular services to be provided, the Audit Committee is informed about each service, and the policies and procedures do not result in the delegation of the Audit Committee’s authority to management. In accordance with these procedures, the Audit Committee pre-approved all services performed by Freed Maxick CPAs, P.C. The percentage of hours expended on Freed Maxick CPAs, P.C.’s engagement to audit our financial statements for the most recent fiscal year that were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees was 0%.

RECOMMENDATION OF THE BOARD FOR PROPOSAL NO. 2:

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF FREED MAXICK CPAs, P.C. AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2016.

PROPOSAL NO. 3

ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) requires the Company’s stockholders to have the opportunity to cast a non-binding advisory vote regarding the approval of the compensation disclosed in this Proxy Statement of the Company’s Named Executive Officers included in the Summary Compensation Table. The Company has disclosed the compensation of the Named Executive Officers pursuant to rules adopted by the SEC.

We believe that our compensation policies for the Named Executive Officers are designed to attract, motivate and retain talented executive officers and are aligned with the long-term interests of the Company’s stockholders. This advisory stockholder vote, commonly referred to as a “say-on-pay vote,” gives you as a stockholder the opportunity to approve or not approve the compensation of the Named Executive Officers that is disclosed in this Proxy Statement by voting for or against the following resolution (or by abstaining with respect to the resolution):

RESOLVED, that the stockholders of Document Security Systems, Inc. approve all of the compensation of the Company’s executive officers who are named in the Summary Compensation Table of the Company’s 2016 Proxy Statement, as such compensation is disclosed in the Company’s 2016 Proxy Statement pursuant to Item 402 of Regulation S-K, which disclosure includes the Proxy Statement’s Summary Compensation Table and other executive compensation tables and related narrative disclosures.

Because your vote is advisory, it will not be binding on either the Board of Directors or the Company. However, the Company’s Compensation and Management Resources Committee will take into account the outcome of the stockholder vote on this proposal at the Annual Meeting when considering future executive compensation arrangements. In addition, your non-binding advisory votes described in this Proposal 3 will not be construed: (1) as overruling any decision by the Board of Directors, any Board committee or the Company relating to the compensation of the Named Executive Officers, or (2) as creating or changing any fiduciary duties or other duties on the part of the Board of Directors, any Board committee or the Company.

RECOMMENDATION OF THE BOARD FOR PROPOSAL NO. 3:

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” APPROVAL OF THE COMPENSATION OF THE COMPANY’S EXECUTIVE OFFICERS DISCLOSED IN THE SUMMARY COMPENSATION TABLE OF THIS PROXY STATEMENT.

| 19 |

PROPOSAL NO. 4

APPROVAL OF AMENDMENT TO CERTIFICATE OF INCORPORATION TO EFFECT A 1-FOR-4 REVERSE STOCK SPLIT

General

Our Board of Directors has approved an amendment to our Certificate of Incorporation that would effect a 1-for-4 reverse stock split of our Common Stock, subject to stockholder approval. Under the proposed amendment, every 4 outstanding shares of our Common Stock would be combined and converted into one share of Common Stock. If we receive stockholder approval of the amendment, the reverse stock split will become effective as of 5:00 p.m. Eastern Daylight Time on the effective date of the certificate of amendment to our Certificate of Incorporation with the office of the Secretary of State of the State of New York, which we would expect to be the date of filing. The reverse stock split should not have any economic effect on our stockholders, warrant holders or holders of options, except to the extent that a stockholder owns less than 4 shares of Common Stock at the effective time of the reverse stock split, in which case such stockholder will receive cash in an amount equal to the product obtained by multiplying: (x) the closing sales price of our Common Stock on the effective date of the reverse stock split as reported on the NYSE MKT, by (y) the amount of the fractional share. The reverse stock split will not result in fractional shares, as discussed further below. The text of the proposed amendment to our Certificate of Incorporation is attached to this proxy statement as Appendix A.

Reasons for the Reverse Stock Split

On March 15, 2016, we were notified by the NYSE MKT LLC (the “NYSE MKT”) that we were not in compliance with the continued listing standards set forth in Section 1003(f)(v) of the NYSE MKT LLC Company Guide (the “Company Guide”), which addresses Low Selling Price Issues. The NYSE MKT stated that the Company’s most recent thirty-day average selling price per share fell below the acceptable minimum required average share price for continued listing under Section 1003(f)(v) of the Company Guide, and that the Company’s stock had been closing at or below $0.20 per share since December 11, 2015. The NYSE MKT does not provide a specific minimum average price per share in its rules for purposes of compliance with Section 1003(f)(v) of the Company Guide, but instead makes those determinations in its discretion, on a case by case basis. A primary purpose of the reverse stock split would be to reduce the outstanding shares of Common Stock so that after giving effect to the reverse stock split our Common Stock trades at a higher price per share than before the split. We believe that the reverse stock split will increase our stock price and allow us to avoid a delisting.

Certain Risks Associated with the Reverse Stock Split

Our total market capitalization immediately after the proposed reverse stock split may be lower than immediately before the proposed reverse stock split

There are numerous factors and contingencies that could affect our stock price following the proposed reverse stock split, including the status of the market for our stock at the time, our reported results of operations in future periods, and general economic, market and industry conditions. Accordingly, the market price of our Common Stock may not be sustainable at the direct arithmetic result of the reverse stock split. If the market price of our Common Stock declines after the reverse stock split, our total market capitalization (the aggregate value of all of our outstanding Common Stock at the then existing market price) after the split will be lower than before the split.

The reverse stock split may result in some stockholders owning “odd lots” that may be more difficult to sell or require greater transaction costs per share to sell.

The reverse stock split may result in some stockholders owning “odd lots” of less than 100 shares of our Common Stock on a post-split basis. Odd lots may be more difficult to sell, or require greater transaction costs per share to sell, than shares in “round lots” of even multiples of 100 shares.

Effects on Existing Shares of Common Stock