Form DEF 14A CORCEPT THERAPEUTICS For: May 19

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |

Corcept Therapeutics Incorporated

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| 1) | Title of each class of securities to which transaction applies:

| |||

| 2) | Aggregate number of securities to which transaction applies:

| |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| 4) | Proposed maximum aggregate value of transaction:

| |||

| 5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1) | Amount Previously paid:

| |||

| 2) | Form, Schedule or Registration Statement No.:

| |||

| 3) | Filing Party:

| |||

| 4) | Date Filed:

| |||

Table of Contents

Corcept Therapeutics Incorporated

149 Commonwealth Drive

Menlo Park, California 94025

Notice of Annual Meeting of Stockholders

To Be Held on May 19, 2016

Dear Stockholder:

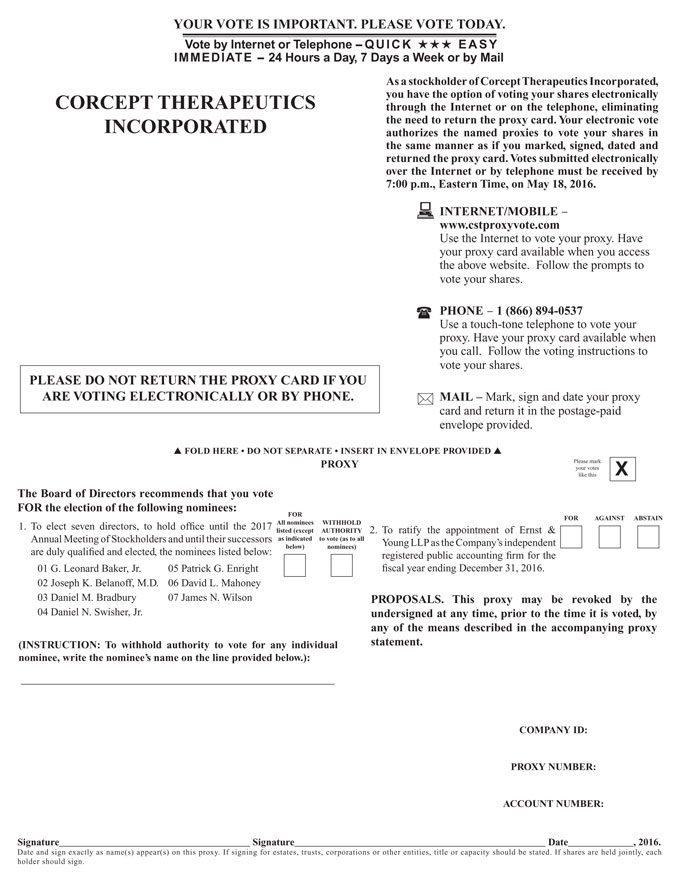

The Annual Meeting of Stockholders of Corcept Therapeutics Incorporated, or the Company, will be held on Thursday, May 19, 2016 at 8:00 a.m. local time at the Company’s headquarters located at 149 Commonwealth Drive, Menlo Park, CA 94025 for the following purposes, as more fully described in the accompanying Proxy Statement:

| 1. | To elect seven directors to hold office until the 2017 Annual Meeting of Stockholders and until their successors are duly elected and qualified. |

| 2. | To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016. |

| 3. | To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

Only stockholders of record at the close of business on April 8, 2016 will be entitled to notice of, and to vote at, such meeting or any adjournments or postponements thereof.

By Order of the Board of Directors,

/s/ G. Charles Robb

G. Charles Robb

Chief Financial Officer and Secretary

Menlo Park, California

April 22, 2016

Important Notice Regarding the Availability of Proxy Materials for the

Stockholder Meeting to be Held on May 19, 2016

Our 2016 Proxy Materials are available at www.corcept.com/proxymaterials/2016

YOUR VOTE IS IMPORTANT!

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE VOTE YOUR SHARES BY INTERNET, BY TELEPHONE OR BY COMPLETING, SIGNING, DATING AND MAILING PROMPTLY THE ACCOMPANYING PROXY CARD IN THE ENCLOSED RETURN ENVELOPE, WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES. THIS WILL ENSURE THE PRESENCE OF A QUORUM AT THE MEETING. IF YOU ATTEND THE MEETING, YOU MAY VOTE IN PERSON EVEN IF YOU HAVE PREVIOUSLY SENT IN YOUR PROXY CARD. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE MEETING, YOU MUST OBTAIN FROM THE RECORD HOLDER A PROXY ISSUED IN YOUR NAME.

i

Table of Contents

| 1 | ||||

| 3 | ||||

| 5 | ||||

| 6 | ||||

| 8 | ||||

| 9 | ||||

| 10 | ||||

| 10 | ||||

| 10 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

11 | |||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 25 | ||||

| 25 | ||||

| 27 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 33 |

ii

Table of Contents

Corcept Therapeutics Incorporated

149 Commonwealth Drive

Menlo Park, California 94025

650-327-3270

2016 ANNUAL MEETING OF STOCKHOLDERS

General

We are furnishing this Proxy Statement and the enclosed proxy in connection with the solicitation of proxies by our Board of Directors (the “Board”) for use at the Annual Meeting of Stockholders of Corcept Therapeutics Incorporated (the “Company”) to be held on May 19, 2016 at 8:00 a.m. local time, at our headquarters located at 149 Commonwealth Drive, Menlo Park, California 94025 and at any adjournments thereof (the “Annual Meeting”). This Proxy Statement and accompanying proxy card are being first mailed to stockholders on or about April 22, 2016.

Who Can Vote

Only holders of our common stock as of the close of business on April 8, 2016 (the “Record Date”) are entitled to vote at the Annual Meeting. Stockholders who hold shares of our common stock in “street name” may vote at the Annual Meeting only if they hold a valid proxy from their broker.

Shares Outstanding and Quorum

As of the Record Date, there were 109,710,939 shares of common stock outstanding. A majority of the outstanding shares of common stock entitled to vote at the Annual Meeting must be present in person or by proxy in order for there to be a quorum at the meeting. Stockholders of record who are present at the meeting in person or by proxy and who abstain from voting, including brokers holding customers’ shares of record who cause abstentions to be recorded at the meeting, will be included in the number of shares present at the meeting for purposes of determining whether a quorum is present.

Voting Rights

Each stockholder of record is entitled to one vote at the Annual Meeting for each share of common stock held by such stockholder on the Record Date. Stockholders do not have cumulative voting rights. Stockholders may vote their shares by using the proxy card enclosed with this Proxy Statement. All proxies we receive which are properly voted, whether by signed proxy card or by telephonic or internet voting, that have not been revoked will be voted in accordance with the instructions contained in the proxy. If a proxy is received which does not specify a vote or an abstention, the shares represented by that proxy will be voted (a) for the nominees to the Board listed on the proxy card and in this Proxy Statement and (b) for the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016. We are not aware, as of the date hereof, of any matters to be voted upon at the Annual Meeting other than those stated in this Proxy Statement and the accompanying Notice of Annual Meeting of Stockholders. If any other matters are properly brought before the Annual Meeting, the enclosed proxy card gives discretionary authority to the persons named as proxies to vote the shares represented by the proxy card in their discretion.

Votes Required to Approve Each Proposal

Under Delaware law and our Amended and Restated Bylaws, if a quorum exists at the Annual Meeting, (a) the seven nominees for director who receive the greatest number of votes cast will be elected to the Board and (b) the proposal to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016 will be approved if the proposals receive the affirmative vote of the majority of the votes cast affirmatively or negatively. The holders of a majority of all outstanding shares of common stock entitled to vote at the meeting, present in person or by proxy, shall constitute a quorum for the Annual Meeting.

Table of Contents

Abstentions and broker non-votes will have no impact on the election of directors because they have not been cast in favor of or against any nominee. Abstentions and broker non-votes will likewise not have any effect on the proposal to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016 because approval of these proposals is based solely on the number of votes cast affirmatively or negatively. Abstentions and broker non-votes will be counted for purpose of determining whether a quorum exists.

Revocability of Proxies

A stockholder of record may revoke a proxy at any time before it is voted at the Annual Meeting by (a) delivering a proxy revocation or another duly executed proxy bearing a later date to the Secretary of our company at 149 Commonwealth Drive, Menlo Park, California 94025, or (b) attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not revoke a proxy unless the stockholder actually votes in person at the meeting.

Solicitation of Proxies

The proxy card accompanying this Proxy Statement is solicited by our Board. We will pay all of the costs of soliciting proxies. In addition to solicitation by mail, our officers, directors and employees may solicit proxies personally, or by telephone, without receiving additional compensation. We, if requested, will pay brokers, banks and other fiduciaries that hold shares of common stock for beneficial owners for their reasonable out-of-pocket expenses of forwarding these materials to stockholders.

Householding of Proxy Materials

“Householding” is a procedure approved by the Securities and Exchange Commission (the “SEC”) under which stockholders who have the same address and last name and do not participate in electronic delivery of proxy materials will receive only one copy of our Proxy Statement from a company, single bank, broker or other intermediary, unless one or more of these stockholders notifies us, the bank, broker or other intermediary that they wish to continue to receive individual copies. At the present time, we do not “household” for any of our stockholders of record. However, as explained below, your bank, broker or other intermediary may be householding your account if you hold your shares in street name.

If you hold shares in street name, your bank, broker or other intermediary may be delivering only one copy of our Proxy Statement to multiple stockholders of the same household who share the same address, and may continue to do so, unless your bank, broker or other intermediary has received contrary instructions from one or more of the affected stockholders in the household. If you are such a beneficial holder, contact your bank, broker or other intermediary directly in order to receive a separate set of our proxy materials.

Table of Contents

NOMINEES TO BOARD OF DIRECTORS

At the Annual Meeting, the stockholders will vote on the election of seven directors, each to serve until the annual meeting of stockholders in 2017 and until their successors are duly elected and qualified.

The name, age as of April 22, 2016 and principal occupation of each person nominated for election to the Board, all of whom currently serve as our directors, are set forth below:

| Name |

Age |

Occupation | ||

| James N. Wilson (3) |

72 | Chairman of the Board of the Company | ||

| Joseph K. Belanoff, M.D. |

58 | Chief Executive Officer and President of the Company | ||

| G. Leonard Baker, Jr. (2) |

73 | Venture Capitalist | ||

| Daniel M. Bradbury (2) |

55 | Independent Director | ||

| Patrick G. Enright (1) |

54 | Venture Capitalist | ||

| David L. Mahoney (1)(2) |

61 | Private Equity Investor | ||

| Daniel N. Swisher, Jr. (1) |

53 | Independent Director |

| (1) | Member of Audit Committee |

| (2) | Member of Compensation Committee |

| (3) | Member of Corporate Governance and Nominating Committee |

In addition to the information presented below regarding each director’s specific experience, qualifications, attributes and skills that led our Board to the conclusion that each individual should serve as a director, we also believe that all of our director nominees have a reputation for integrity, honesty and adherence to high ethical standards. They each have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to us and our Board. Our Board believes that the backgrounds and qualifications of the directors, considered as a group, provide a significant mix of experience, knowledge and abilities that allows the Board to fulfill its responsibilities.

James N. Wilson has served as a director and as Chairman of our Board since 1999. In addition, since 2005, Mr. Wilson has been the Chairman of the Board of NuGEN Technologies, Inc. (NuGEN), a provider of systems for genomic analysis. From 2002 to 2009, he served as the lead independent director of Amylin Pharmaceuticals, Inc. (Amylin), a publicly-traded biopharmaceutical company, and from 1996 to 2001 Mr. Wilson was Chairman of the Board of Amira Medical, Inc., which was acquired by Hoffmann-La Roche A.G. From 1991 to 1994, he was Chief Operating Officer of Syntex Corporation (Syntex), which was acquired by Roche Holding, Ltd. From 1989 to 1990, Mr. Wilson was Chairman and Chief Executive Officer of Neurex Corporation (Neurex), which was acquired by Elan Corporation plc, and from 1982 to 1988, Mr. Wilson was Chief Executive Officer of LifeScan, Inc., which was acquired by Johnson & Johnson Company. Mr. Wilson received his B.A. and M.B.A. from the University of Arizona. Our Board selected Mr. Wilson to serve as a director because he brings to our Board extensive experience in the biotechnology industry, evidenced by 30 years of representing biotechnology companies as a director or officer.

Joseph K. Belanoff, M.D. is a co-founder of our company, has served as a member of our Board and as our Chief Executive Officer since 1999, and has served as our President since January 1, 2014. Dr. Belanoff is currently a clinical faculty member and has held various positions in the Department of Psychiatry and Behavioral Sciences at Stanford University since 1992. Dr. Belanoff received his B.A. from Amherst College and his M.D. from Columbia University’s College of Physicians & Surgeons. Our Board selected Dr. Belanoff to serve as a director because, as our Chief Executive Officer, he brings expertise and knowledge regarding our finances, commercial, business operations, and pre-clinical and clinical development programs to our Board. Dr. Belanoff also has expertise in drug discovery, clinical medicine and psychopharmacology.

G. Leonard Baker, Jr. has served as a member of our Board since 1999. Since 1973, Mr. Baker has been a Managing Director of the General Partner of Sutter Hill Ventures, a venture capital firm in Palo Alto, California. Mr. Baker currently serves on the boards of a number of private companies. Mr. Baker received his B.A. from Yale University and his M.B.A. from Stanford University. Mr. Baker’s contributions as a director include his broad experience and expertise in advising companies in capital raising, strategic transactions and operations.

Table of Contents

Daniel M. Bradbury has served as a member of our Board since October 2012. Mr. Bradbury is the founder and Managing Member of BioBrit, LLC, a life sciences consulting firm and investment fund. Mr. Bradbury served as President and Chief Executive Officer of Amylin Pharmaceuticals, Inc. (Amylin) from March 2007 until its acquisition by Bristol-Myers Squibb Company in August 2012. From June 2006 until August 2012 he was a member of Amylin’s board of directors and served on its Finance and Risk Management Committee. Mr. Bradbury served as Amylin’s President (2006 to 2007), Chief Operating Officer (2003 to 2006) and Executive Vice President (2000 to 2003) and held a variety of sales and marketing positions (1994 to 2003). Before joining Amylin, Mr. Bradbury worked in marketing and sales roles for ten years at SmithKline Beecham Pharmaceuticals. He currently serves on the boards of directors and is a member of board committees of the following publicly-traded companies: Illumina, Inc. (Audit and Compensation Committees), Geron Corporation (Audit Committee), Biocon Limited (Audit, Compensation, Risk Review and Social Responsibility Committees) and Syngene International Limited (Nomination and Remuneration Committees). Mr. Bradbury also serves on the board of trustees of the Keck Graduate Institute, the Investor Growth Capital Advisory Board, and the BioMed Ventures Advisory Committee. Mr. Bradbury currently serves on the University of California San Diego’s Rady School of Management’s Advisory Council and the University of Miami’s Innovation Corporate Advisory Council. He received a Bachelor of Pharmacy from Nottingham University and a Diploma in Management Studies from Harrow and Ealing Colleges of Higher Education in the United Kingdom. Our Board selected Mr. Bradbury to serve as a director because he brings to our Board extensive experience in operations and management in the pharmaceutical industry.

Patrick G. Enright has served as a member of our Board since 2008. He is a founder of Longitude Capital, a venture capital firm focused on investments in pharmaceutical and medical technology companies, and has served as its Managing Director since 2006. From 2002 through 2006, Mr. Enright was a Managing Director of Pequot Ventures, a venture capital investment firm, where he co-led the life sciences investment practice. Mr. Enright also has significant life sciences operations experience, beginning his career more than 25 years ago at Sandoz (now Novartis), a pharmaceutical company. He currently serves on the boards of directors of several publically held companies, including Esperion Therapeutics, Inc., where he serves as the Chair of the Audit Committee, Jazz Pharmaceuticals plc, where he serves as a member of the Compensation Committees, and Aimmune Therapeutics, Inc., a biopharmaceutical company, where he serves as the Chair of the Compensation Committee and a member of the Nominating and Corporate Governance Committee. Mr. Enright received a B.S. from Stanford University and an M.B.A. from the Wharton School at the University of Pennsylvania. As a venture capital investor focused on life science companies and someone who has worked in the pharmaceutical industry, Mr. Enright brings to our Board both operating experience and financial expertise in the life sciences industry.

David L. Mahoney is a private equity investor who has served as a member of our Board since July 2004. From 1999 to 2001, Mr. Mahoney served as co- Chief Executive Officer of McKesson HBOC, Inc., a healthcare supply management and information technology company, and as Chief Executive Officer of iMcKesson LLC, a healthcare management and connectivity company. He joined McKesson Corporation in 1990 as Vice President for Strategic Planning. Prior to joining McKesson, Mr. Mahoney was a principal with McKinsey & Company, a management consulting firm, where he worked from 1981 to 1990. Mr. Mahoney serves on the board of Symantec Corporation (Symantec), a publicly-traded software technology company, including as a member of its Compensation Committee and Nominating and Governance Committees; and Adamas Pharmaceuticals, Inc. (Adamas), a publicly traded bio-pharmaceutical company where he is the Lead Independent Director and serves on the Audit Committee. Mr. Mahoney also served as a member of the Audit Committee of Symantec from 2003 to 2011. He also serves on the board of directors of San Francisco Museum of Modern Art and Mercy Corps and is a Trustee of the Schwab/Laudis Family of Funds. Mr. Mahoney previously served on the Board of Directors of KQED, Inc., a public non-profit television and radio operator. Mr. Mahoney received his B.A. from Princeton University and his M.B.A. from Harvard University. Our Board selected Mr. Mahoney to serve as a director because he brings to our Board extensive experience in pharmaceutical distribution, fiscal management and in operating and advising technology companies.

Daniel N. Swisher, Jr. became a member of our Board in June 2015. He has been the Chief Executive Officer and a member of the Board of Sunesis Pharmaceuticals, Inc., a clinical-stage biopharmaceutical company, since 2003, and Sunesis’ President since 2005. He joined Sunesis in 2001 and had previously served as the

Table of Contents

company’s chief business officer and chief financial officer. Prior to that, Mr. Swisher had held a broad range of senior management roles, including Senior Vice president of Sales and Marketing, at ALZA Corporation, a pharmaceutical and medical systems company, from 1992 to 2001. Mr. Swisher is also Chairman of the Board of Cerus Corporation, a biopharmaceutical company, a position he has held since 2013. Mr. Swisher holds a B.A. from Yale University and an M.B.A. from the Stanford Graduate School of Business. Our Board selected Mr. Swisher to serve as a director because he brings to our Board sales experience, operating experience and financial expertise in the life sciences industry.

There are no family relationships among any of our directors or executive officers.

DIRECTORS NOT STANDING FOR RE-ELECTION

The following current directors have decided to retire from our Board as of the date of this Annual Meeting and are, therefore, not standing for re-election.

Joseph C. Cook, Jr. joined our Board in 2002. Mr. Cook is a founder and director of Ironwood Pharmaceuticals, Inc. (Ironwood), a publicly traded biotechnology company, and served as Chairman of its board of directors from 1998 to 2010. Mr. Cook is a principal, director and co-founder of Mountain Group Capital, LLC, a private investment company, and a principal, director and founder of The Limestone Fund, a recipient of the State of Tennessee TNInvestco award. He serves as Executive Chairman and President of Nusirt Biopharma Inc., a company developing medicines for people with diabetes. Mr. Cook served as Chairman of Amylin Pharmaceuticals, Inc. (Amylin) from 1998 to 2009 and was Chief Executive Officer from 1998 to 2003. He spent 28 years at Eli Lilly and Company (Lilly), retiring in 1993 as a Group Vice-President. In 2009, Mr. Cook received the Pinnacle Award for Life Science Leadership from the Rady School of Management at the University of California at San Diego. In 1999, Mr. Cook also received The Nathan W. Dougherty Award for Distinguished Service in the Engineering Profession from the University of Tennessee. Mr. Cook received his B.S. in Engineering from the University of Tennessee in 1965. Our Board selected Mr. Cook to serve as a director because he brought to our Board extensive experience in the pharmaceutical industry.

Joseph L. Turner joined our Board in 2010. Mr. Turner was Senior Vice President of Finance and Administration and Chief Financial Officer at Myogen, Inc., a therapeutics company focused on cardiovascular disease, from 1999 until its acquisition by Gilead Sciences, Inc. in November 2006. Prior to Myogen, Inc., he served as Vice President, Finance and Chief Financial Officer at Centaur Pharmaceuticals, Inc., a privately-held biopharmaceutical company, from 1997 to 1999 and as Vice President, Finance and Chief Financial Officer of Cortech, Inc. from 1992 to 1997. From 1979 to 1991, Mr. Turner worked at Lilly, where he held a variety of financial management positions both within the United States and abroad. Mr. Turner is currently a member of the boards of directors of Alexza Pharmaceuticals, Inc. (Alexza) and Sophiris Bio Inc. (Sophiris), publicly traded biotechnology companies. Mr. Turner serves as the Chair of the Audit and Ethics Committee of Alexza and of the Audit Committee of Sophiris. He also serves on the board of directors of BioClin Therapeutics, Inc., a privately held pharmaceutical company. Mr. Turner also currently serves on the board of managers of Swarthmore College and of the Linda Crnic Institute for Down Syndrome Research at the University of Colorado Medical School. Mr. Turner previously served on the boards of directors and committees of several publicly-held biotechnology companies: member of the board and Chair of the Audit Committee of Kythera Biopharmaceuticals, Inc. (acquired by Allergan); member of the board and Chair of the Audit Committee of Allos Therapeutics, Inc. (acquired by Spectrum Pharmaceuticals); and member of the boards and Audit Committees of QLT, Inc. and SGX Pharmaceuticals, Inc., (acquired by Lilly). Mr. Turner also served previously on board of directors and committees of privately-held biotechnology companies: director and Chairman of the Audit Committee of NovaCardia, Inc. (acquired by Merck & Co., Inc.); and director of Sequel Pharmaceuticals, Inc. and ApopLogic Pharmaceuticals, Inc. Mr. Turner received his M.B.A. from the University of North Carolina at Chapel Hill, an M.A. in Molecular Biology from the University of Colorado at Boulder and a B.A. in Chemistry from Swarthmore College. Our Board selected Mr. Turner to serve as a director because he brought to our Board more than 30 years of experience in financial management and fiscal oversight of biotechnology companies.

Table of Contents

The information below describes the criteria and process that the Corporate Governance and Nominating Committee uses to evaluate candidates to the Board.

Corporate Governance and Nominating Committee. Our Corporate Governance and Nominating Committee currently consists of Joseph C. Cook, Jr. (Chairman), Joseph L. Turner and James N. Wilson. Following the 2016 Annual Meeting of Stockholders, assuming the election of each director nominee herein, the Corporate Governance and Nominating Committee will consist of David L. Mahoney (Chairman), Patrick G. Enright and James N. Wilson. The Corporate Governance and Nominating Committee met four times during 2015. The Corporate Governance and Nominating Committee is responsible for identifying individuals qualified to serve as members of the Board, recommending to the independent members of the Board nominees for election as our directors and providing oversight with respect to corporate governance and ethical conduct. Although Mr. Wilson was during 2015 our employee and therefore was not an “independent director” for NASDAQ purposes, our director nomination process meets applicable NASDAQ requirements because our director nominees are selected by the independent members of the Board in votes in which only independent directors participate. The Corporate Governance and Nominating Committee has a written charter, a copy of which is available on our website at www.corcept.com.

The information below describes the criteria and process that the Corporate Governance and Nominating Committee uses to evaluate candidates to the Board.

Board Membership Criteria. The Corporate Governance and Nominating Committee is responsible for assessing the appropriate balance of experience, skills and characteristics required of the Board. Nominees for director are selected on the basis of depth and breadth of experience, knowledge, integrity, ability to make independent analytical inquiries, understanding of our business environment, the willingness to devote adequate time to Board duties, the interplay of the candidate’s experience and skills with those of other Board members, and the extent to which the candidate would be a desirable addition to the Board and any Committees of the Board. Although there is no specific policy regarding diversity in identifying director nominees, both the Corporate Governance and Nominating Committee and the Board seek the talents and backgrounds that would be most helpful to us when selecting director nominees. In particular, the Corporate Governance and Nominating Committee, when recommending director candidates to the full Board for nomination, may consider whether a director candidate, if elected, assists in achieving a mix of Board members that represents a diversity of background and experience. In addition, the Corporate Governance and Nominating Committee seeks to ensure that at least a majority of the directors are independent under the rules of the NASDAQ Stock Market, that the Audit Committee and Compensation Committee are each composed entirely of independent directors, and that members of the Audit Committee possess such accounting and financial expertise as the NASDAQ Stock Market and SEC rules require.

Stockholders Proposals for Nominees. The Corporate Governance and Nominating Committee will consider written proposals from stockholders for nominees for director. Any such nominations should be submitted to the Corporate Governance and Nominating Committee c/o the Secretary of our Company and should include (at a minimum) the following information: (a) all information relating to such nominee that is required to be disclosed pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended, or Exchange Act, including such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected; (b) the name(s) and address(es) of the stockholder(s) making the nomination and the number of shares of our common stock which are owned beneficially and of record by such stockholder(s); and (c) appropriate biographical information and a statement as to the qualifications of the nominee, and should be submitted in the time frame described in our Amended and Restated Bylaws and under the caption, “Stockholder Proposals for the 2017 Annual Meeting” below.

Process for Identifying and Evaluating Nominees. The Corporate Governance and Nominating Committee initiates the process for identifying and evaluating nominees to the Board by identifying a slate of candidates who meet the criteria for selection as nominees and have the specific qualities or skills being sought based on input from members of the Board, management and, if the Corporate Governance and Nominating Committee deems appropriate, a third-party search firm. In addition, pursuant to the Securities Purchase Agreement, dated as of March 14, 2008, we agreed to take all necessary steps to have one designee of Longitude Venture Partners, L.P., one of our significant stockholders, nominated for election to our Board, subject to compliance with relevant NASDAQ Stock

Table of Contents

Market rules and regulations and approval of the nominee by the Corporate Governance and Nominating Committee for so long as Longitude Venture Partners, L.P. beneficially owns at least 5% of our issued and outstanding common stock. Candidates, including candidates proposed by Longitude Venture Partners, L.P., are evaluated by the Corporate Governance and Nominating Committee on the basis of the factors described above under “Board Membership Criteria.”

With respect to candidates for initial election to the Board, the Corporate Governance and Nominating Committee also reviews biographical information and qualifications and checks the candidate’s references. Qualified candidates are interviewed by at least one member of the Corporate Governance and Nominating Committee. Serious candidates meet, either in person or by telephone, with all members of the Corporate Governance and Nominating Committee and as many other members of the Board as practicable.

Using the input from interviews and other information obtained, the Corporate Governance and Nominating Committee evaluates which of the prospective candidates is qualified to serve as a director and whether the committee should recommend to the independent members of the Board that the Board nominate, or elect to fill a vacancy with, a prospective candidate. Candidates recommended by the Corporate Governance and Nominating Committee are presented to the independent members of the Board for selection as nominees to be presented for the approval of the stockholders or for election to fill a vacancy. The Corporate Governance and Nominating Committee expects that a similar process will be used to evaluate nominees recommended by stockholders.

Nominees to the Board of Directors for the Annual Meeting. The nominees for the Annual Meeting were recommended for selection by the Corporate Governance and Nominating Committee and were selected by the independent members of the Board.

Table of Contents

The Board met four times during 2015. In addition to the Corporate Governance and Nominating Committee, which is described above, the Board has standing Audit and Compensation Committees. The Audit Committee met five times and the Compensation Committee met two times during 2015. The Corporate Governance and Nominating Committee met three times during 2015. Each member of the Board attended 75% or more of the total number of Board meetings and meetings of Board committees on which such Board member served.

We have a policy of encouraging our directors to attend the annual stockholder meetings. Three of our directors attended the 2015 annual stockholder meeting.

Audit Committee. In 2015, the Audit Committee consisted of Joseph L. Turner (Chairman), Patrick G. Enright, David L. Mahoney and Daniel N. Swisher, Jr. Mr. Swisher became Chairman of the Committee on January 27, 2016. Following the 2016 Annual Meeting of Stockholders, assuming the election of each director nominee herein, the Audit Committee shall consist of Daniel N. Swisher, Jr. (Chairman), Patrick G. Enright and David L. Mahoney. The Board has determined that all members of the Audit Committee are independent directors under the rules of the NASDAQ Stock Market and each of them is able to read and understand fundamental financial statements. In addition, the Board has determined that each member of the Audit Committee also satisfies the independence requirements of Rule 10A-3(b)(1) of the Exchange Act. The Board has determined that Mr. Enright is independent even though he falls outside the “safe harbor” definition set forth in Rule 10A-3(e)(1)(ii) under the Exchange Act because Longitude Venture Partners, LP and its affiliates own in excess of 10% of our common stock. Among other things, the Board considered Mr. Enright’s history of service and the percentage of common stock held by others, and it determined that he is not an “affiliated person” of our company who would be ineligible to serve on the Audit Committee. The Board has determined that each of Messrs. Turner, Enright, Mahoney and Swisher qualifies as an “Audit Committee financial expert” as defined by Item 407(d)(5) of Regulation S-K of the Securities Act and the Exchange Act. The purpose of the Audit Committee is to oversee the accounting and financial reporting processes and financial statements audits. The responsibilities of the Audit Committee include appointing and providing for the compensation of the independent registered public accounting firm to conduct the annual audit of our accounts, reviewing the scope and results of the independent audits, reviewing and evaluating internal accounting policies, and approving all professional services to be provided to us by our independent registered public accounting firm. The Audit Committee has a written charter, a copy of which is available on our website at www.corcept.com.

Compensation Committee. In 2015, the Compensation Committee consisted of G. Leonard Baker, Jr. (Chairman), Daniel M. Bradbury, Joseph C. Cook, Jr. and David L. Mahoney. Following the 2016 Annual Meeting of Stockholders, assuming the election of each director nominee herein, the Compensation Committee shall consist of G. Leonard Baker Jr. (Chairman), Daniel M. Bradbury and Daniel N. Swisher, Jr. The Board has determined that all members of the Compensation Committee are independent directors under the rules of the NASDAQ Stock Market. The Compensation Committee administers our benefit plans, reviews and administers all compensation arrangements for executive officers, and establishes and reviews general policies relating to the compensation and benefits of our officers and employees. The Compensation Committee has a written charter, pursuant to which it may delegate its authority and responsibilities as it deems appropriate to members of the Compensation Committee or to a subcommittee. A copy of the charter is available on our website at www.corcept.com.

Table of Contents

BOARD LEADERSHIP STRUCTURE AND ROLE IN RISK OVERSIGHT

Board Leadership Structure. In accordance with our Amended and Restated Bylaws, our Board appoints our officers, including our Chief Executive Officer. Our Board does not have a policy on whether the role of the Chairman of the Board and Chief Executive Officer should be separate and, if it is to be separate, whether the Chairman of the Board should be selected from the non-employee directors or be an employee and if it is to be combined, whether a lead independent director should be selected. Our Board is committed to corporate governance practices and values independent board oversight as an essential component of strong corporate performance. For example, seven of our nine current directors qualify as independent under the rules of the NASDAQ Stock Market. In February 2016, our Board undertook a review of the independence of each director and considered whether any director has a material relationship with us that could compromise his ability to exercise independent judgment in carrying out his responsibilities. As a result of this review, our Board determined that the following directors are “independent” under the rules of the NASDAQ Stock Market:

G. Leonard Baker, Jr.

Daniel M. Bradbury

Joseph C. Cook, Jr.

Patrick G. Enright

David L. Mahoney

Daniel N. Swisher, Jr.

Joseph L. Turner

Currently, we separate the roles of Chief Executive Officer and Chairman of the Board in recognition of the differences between the two roles. The Chief Executive Officer is responsible for setting the strategic direction for our company and the day-to-day leadership and performance of our company, while the Chairman of the Board provides guidance to the Chief Executive Officer and management and sets the agenda for Board meetings and presides over meetings of the full Board. Dr. Belanoff, our Chief Executive Officer, is an employee of our company and is therefore not “independent” under the rules of NASDAQ Stock Market. During 2015, Mr. Wilson, our Chairman of the Board, was also an employee of our company and was therefore not “independent” under the rules of NASDAQ Stock Market. Our Board believes that the current board leadership structure is appropriate for our company and our stockholders at this time.

Risk Oversight. The Board oversees our company’s risk exposures and risk management of various parts of the business, including appropriate guidelines and policies to minimize business risks and major financial risks and the steps management has undertaken to control them. In its risk oversight role, the Board reviews our strategic plan at least annually, which includes an assessment of potential risks facing our company. While the Board has the ultimate oversight responsibility for the risk management process, various committees of the Board also have responsibility for risk management. Our Audit Committee is responsible for overseeing management of our risks relating to accounting matters, financial reporting and SEC compliance. Our Compensation Committee is responsible for overseeing the management of risks relating to our executive compensation plans and arrangements. In addition, in setting compensation, the Compensation Committee strives to create incentives that do not encourage risk-taking behavior that is inconsistent with our company’s business strategy. Our Corporate Governance and Nominating Committee is responsible for overseeing management of our risks associated with the independence of our Board and potential conflicts of interest. Each committee regularly reports to the full Board.

Table of Contents

Stockholders or other interested parties may communicate with any director or committee of our Board by writing to them c/o Secretary, Corcept Therapeutics Incorporated, 149 Commonwealth Drive, Menlo Park, California 94025. Comments or questions regarding our accounting, internal controls or auditing matters will be referred to members of the Audit Committee. Comments or questions regarding the nomination of directors and other corporate governance matters will be referred to members of the Corporate Governance and Nominating Committee.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The current members of our Compensation Committee are G. Leonard Baker, Jr. (Chairman), Daniel M. Bradbury, Joseph C. Cook, Jr. and David L. Mahoney. None of the members of our Compensation Committee is currently, or has been, an officer or employee of our company. None of our executive officers currently serves or in the past year has served as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our Board or Compensation Committee.

INFORMATION CONCERNING EXECUTIVE OFFICERS

The names of our executive officers, their ages as of April 22, 2016 and certain other information about them are set forth below:

| Name |

Age |

Position | ||

| Joseph K. Belanoff, M.D. |

58 | Chief Executive Officer, President and Director | ||

| Robert S. Fishman |

54 | Chief Medical Officer | ||

| G. Charles Robb |

53 | Chief Financial Officer |

Joseph K. Belanoff, M.D. Biographical information regarding Dr. Belanoff is set forth under “Nominees to Board of Directors.”

Robert S. Fishman, M.D. has served as our Chief Medical Officer since September 2015. From May 2012 to March 2015, Dr. Fishman served as the Senior Vice President of Clinical Development at InterMune, Inc., a biopharmaceutical company. Prior to his tenure at InterMune, Dr. Fishman served as Vice President of Clinical Development at Alexza Pharmaceuticals, a biopharmaceutical company, from September 2007 to May 2012. Before that, he held positions of increasing responsibility at Heatport, Aerogen and Anthera Pharmaceuticals. Dr. Fishman trained in internal medicine at Deaconess Hospital, Boston, completed a fellowship in pulmonary and critical care medicine at Massachusetts General Hospital and began his career as a member of the Stanford pulmonary medicine faculty. He earned an A.B. in Biology from Harvard and an M.D. from Stanford University School of Medicine.

G. Charles Robb has served as our Chief Financial Officer since September 2011 and as our Secretary since January 2014. From April 2005 through August 2011, Mr. Robb served as the Senior Vice President of Operations, Administration and Finance of Fitness Anywhere, Inc. (FAI), a private fitness equipment and training company with operations in the United States, Europe and Asia. From 2003 to 2005, Mr. Robb was engaged in the private practice of law. From 2000 to 2002, he was Senior Vice President of Citadon, Inc. He also held positions in business development for Nomura Asset Capital Corporation from 1998 to 1999 and in sales and marketing for Legal Research Network, Inc. from 1996 to 1998. From 1992 to 1996, Mr. Robb practiced law at Howard, Rice, Nemerovski, Canady, Falk & Rabkin. Mr. Robb earned a B.A. in English and Political Philosophy from Yale and a J.D. from Harvard Law School.

Table of Contents

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding ownership of our common stock as of March 31, 2016 (or earlier date with respect to information regarding former employees or that is based on filings with the SEC) by (a) each person known to us to own more than 5% of the outstanding shares of our common stock, (b) our directors, (c) our Chief Executive Officer and each other executive officer named in the compensation tables appearing later in this Proxy Statement and (d) all directors and executive officers as a group. The information in this table is based solely on statements in filings with the SEC or other information we believe to be reliable. Percentage of ownership is based on 109,670,939 shares of common stock outstanding as of March 31, 2016. Beneficial ownership is determined in accordance with the rules of the SEC, and includes voting and investment power with respect to the shares. Shares of common stock subject to outstanding options and warrants exercisable within 60 days of March 31, 2016 are deemed outstanding for computing the percentage of ownership of the person holding such options or warrants, but are not deemed outstanding for computing the percentage of any other person.

| Name of Beneficial Owner (1) |

Number of Shares Beneficially Owned (2) |

Percentage of Shares Beneficially Owned |

||||||

| 5% Stockholders |

||||||||

| Longitude Venture Partners, LP and affiliated entities and individuals (3) |

14,991,890 | 13.7 | % | |||||

| Federated Investors, Inc. and affiliated entities (4) |

14,189,245 | 12.9 | % | |||||

| Ingalls & Snyder, LLC and affiliated entities(5) |

8,933,637 | 8.1 | % | |||||

| Directors and Named Executive Officers |

||||||||

| Patrick G. Enright (3) |

14,991,890 | 13.7 | % | |||||

| Joseph K. Belanoff (6) |

6,405,861 | 5.8 | % | |||||

| G. Leonard Baker, Jr. (7) |

4,515,527 | 4.1 | % | |||||

| James N. Wilson (8) |

3,524,400 | 3.2 | % | |||||

| Joseph C. Cook, Jr. (9) |

2,998,564 | 2.7 | % | |||||

| David L. Mahoney (10) |

1,534,320 | 1.4 | % | |||||

| G. Charles Robb (11) |

886,674 | * | ||||||

| Steven Lo (12) |

585,416 | * | ||||||

| Anne M. LeDoux (13) |

430,416 | * | ||||||

| Joseph L. Turner (14) |

340,000 | * | ||||||

| Daniel M. Bradbury (15) |

330,633 | * | ||||||

| Robert S. Fishman |

— | * | ||||||

| Daniel N. Swisher, Jr. |

— | * | ||||||

|

|

|

|||||||

| All directors and executive officers as a group (13 persons) (16) |

36,543,701 | 33.3 | % | |||||

|

|

|

|||||||

| * | Less than 1% of our outstanding common stock. |

| (1) | Unless otherwise indicated, the address of each of the named individuals is c/o Corcept Therapeutics, 149 Commonwealth Drive, Menlo Park, California 94025. |

| (2) | Beneficial ownership of shares is determined in accordance with the rules of the SEC and generally includes any shares over which a person exercises sole or shared voting or investment power, or of which a person has the right to acquire ownership within 60 days after March 31, 2016. Except as otherwise noted, each person or entity has sole voting and investment power with respect to the shares shown. |

| (3) | Consists of (a) 14,516,932 shares held by Longitude Venture Partners, LP, (b) 194,958 shares held by Longitude Capital Associates, L.P. and (c) 280,000 shares that may be acquired by Patrick Enright within 60 days of March 31, 2016 pursuant to options. Juliet Tammenoms Bakker and Mr. Enright may be deemed to have shared voting and investment power over |

Table of Contents

| the shares held by Longitude Venture Partners, LP, and Longitude Capital Associates, L.P. Each of these individuals disclaims beneficial ownership of all such shares, except to the extent of his or her pecuniary interest therein. The address for Longitude Capital is 800 El Camino Real, Suite 220, Menlo Park, California 94025. Mr. Enright is a member of our Board and a managing member of Longitude Capital Partners, LLC, the general partner of each of Longitude Venture Partners, LP, and Longitude Capital Associates, L.P. |

| (4) | Consists of 14,189,245 shares beneficially held by registered investment companies and separate accounts advised by subsidiaries of Federated Investors, Inc., or Federated, that have been delegated the power to direct investments and power to vote the securities by the registered investment companies’ board of trustees or directors and by the separate accounts’ principals. The foregoing beneficial ownership information is based on information obtained from the Amendment No. 7 to Form 13G filed by Federated Investors, Inc. with respect to its holdings as of December 31, 2015. Federated is the parent holding company of Federated Equity Management Company of Pennsylvania and Federated Global Investment Management Corp., collectively referred to herein as the Investment Advisers, which act as investment advisers to registered investment companies and separate accounts that own shares of our common stock. The Investment Advisers are wholly owned subsidiaries of FII Holdings, Inc., which is wholly owned subsidiary of Federated. All of Federated’s outstanding voting stock is held in the Voting Shares Irrevocable Trust, or the Trust, for which John F. Donahue, Rhodora J. Donahue and J. Christopher Donahue act as trustees, collectively referred to herein as the Trustees. The Trustees exercise collective voting control over Federated. Each of Federated, the Trust and the Trustees disclaims beneficial ownership of all holdings reflected herein, except to the extent of his individual pecuniary interest therein. Federated’s address is Federated Investors Tower, Pittsburgh, Pennsylvania 15222-3779. |

| (5) | Consists of 8,933,637 shares held by Ingalls & Snyder LLC, or Ingalls, for the benefit of Ingalls & Snyder Value Partners, L.P., or ISVP, or other investment advisory clients. Information regarding the holdings of Ingalls and ISVP is based on information obtained from the Amendment No. 7 to Form 13G filed by Ingalls with respect to its holdings as of December 31, 20154. ISVP is an investment partnership managed under an investment advisory contract by Ingalls, a registered broker dealer and a registered investment advisor. Ingalls holds investment authority but not voting authority over shares held by its investment advisory clients. Mr. Thomas O. Boucher, Jr., a Managing Director of Ingalls, and Mr. Robert L. Gipson and Adam Janovic, Senior Directors of Ingalls, are the general partners of ISVP and share investment and voting power over the shares held by ISVP. Each of these individuals disclaims beneficial ownership of all such shares, except to the extent of his individual pecuniary interest therein.. The address for Ingalls is 1325 Avenue of the Americas, New York, NY 10019. |

| (6) | Includes (a) 3,641,666 shares that may be acquired by Dr. Belanoff within 60 days of March 31, 2016 pursuant to options, (b) 300,000 shares held as custodian for Edward G. Belanoff and (c) 300,000 shares held as custodian for Julia E. Belanoff under the California Uniform Transfers to Minors Act over which Dr. Belanoff has voting control. |

| (7) | Includes (a) 207 shares held in Mr. Baker’s name, (b) 955,055 shares held in The Baker Revocable Trust of which Mr. Baker is a trustee, (c) 676,631 shares held by a Roth IRA for the benefit of Mr. Baker and 2,613,634 shares held by Saunders Holdings, L.P. of which Mr. Baker is a trustee of a trust which is the general partner and (d) 270,000 shares that may be acquired by Mr. Baker within 60 days of March 31, 2016 |

| (8) | Includes (a) 1,111,937 shares that may be acquired by Mr. Wilson within 60 days of March 31, 2016 pursuant to options, (b) 1,511,396 shares held by the James N. Wilson and Pamela D. Wilson Trust, (c) 901,067 shares held by James and Pamela Wilson Family Partners. Mr. Wilson has voting power over the shares held by the James N. Wilson and Pamela D. Wilson Trust and James and Pamela Wilson Family Partners pursuant to voting agreements. Mr. Wilson disclaims beneficial ownership of all of such shares, except to the extent of his pecuniary interest therein. |

| (9) | Consists of (a) 1,755,669 shares held jointly by Joseph C. Cook, Jr. and Judith Cook, (b) 488,054 shares held by the Joseph C. Cook, Jr., IRA Rollover, (c) 175,273 shares held by Farview Management, Co. L.P., a Tennessee limited partnership, (d) 339,568 shares held by the Judith E. and Joseph C. Cook, Jr. Foundation, Inc., and (e) 240,000 shares that may be acquired by Mr. Cook within 60 days of March 31, 2016 pursuant to options. Mr. Cook and Judith E. Cook may be deemed to have shared voting and investment power over the shares held by the Cook Foundation. Each of these individuals disclaims beneficial ownership of all such shares, except to the extent of his or her pecuniary interest therein. Mr. Cook and Judith E. Cook may be deemed to have shared voting and investment power over the shares held in joint name. Mr. Cook is a member of our Board. |

| (10) | Includes (a) 1,169,320 shares held by the David L. Mahoney and Winnifred C. Ellis 1998 Family Trust, (b) 55,000 shares held by the Black Dog Private Foundation, of which Mr. Mahoney is the president, and (c) 310,000 shares that may be acquired by Mr. Mahoney within 60 days of December 31, 2015 pursuant to options. Mr. Mahoney is a member of our Board. |

| (11) | Includes 885,416 shares that may be acquired by Mr. Robb within 60 days of March 31, 2016 pursuant to options. |

Table of Contents

| (12) | Includes 585,416 shares that Mr. Lo had the right to acquire upon his departure from the Company on September 4, 2015 pursuant to options. |

| (13) | Includes 380,416 shares that may be acquired by Ms. LeDoux within 60 days of March 31, 2016 pursuant to options. |

| (14) | Includes 330,000 shares that may be acquired by Mr. Turner within 60 days of March 31, 2016 pursuant to options. |

| (15) | Consists of (a) 177,925 shares held in the name of BioBrit, LLC, over which Mr. Bradbury has voting and investment power, and (b) 152,708 shares that may be acquired by Mr. Bradbury within 60 days of March 31, 2016 pursuant to options. |

| (16) | Total number of shares includes common stock held by directors, executive officers and entities affiliated with directors and executive officers. See footnotes 1 through 3 and 6 through 14 above. |

Table of Contents

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

As a matter of policy, all related-party transactions between us and any of our officers, directors, or principal stockholders, are reviewed and approved by our Audit Committee, as set forth in our Audit Committee charter, or a majority of the independent and disinterested members of our Board, are on terms no less favorable to us than could be obtained from unaffiliated third parties and are in connection with bona fide business purposes. In 2015, there were no related-party transactions that required review by the Audit Committee.

Severance and Change in Control Agreements. We have entered into severance and change in control agreements with our executive officers. The agreements provide that, if employment is terminated without cause or for good reason regardless of whether it is in connection with a change in control, the executive will be eligible for 12 months of his or her then current base salary and continued health insurance coverage for this same period. In addition, the agreements provide for the full vesting of all outstanding equity awards in the event the executive’s employment is terminated without cause or for good reason within 18 months following a change in control.

Director Indemnification Agreements. We have entered into indemnification agreements with our directors and executive officers. Such agreements require us, among other things, to indemnify our officers and directors, other than for liabilities arising from willful misconduct of a culpable nature, and to advance their expenses incurred as a result of any proceedings against them as to which they could be indemnified.

See “Director Compensation” for a discussion of our director compensation policy.

We have adopted a Code of Ethics that applies to all of our directors, officers and employees, including our principal executive officer, our principal financial officer and our principal accounting officer, a copy of which is available on our website at www.corcept.com. We intend to disclose on our website at www.corcept.com any amendment to, or waiver of, any provision of our Code of Ethics applicable to our directors and executive officers required to be disclosed under the rules of the SEC and the NASDAQ Stock Market.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under Section 16(a) of the Exchange Act and SEC rules, our directors, executive officers and beneficial owners of more than 10% of any class of our equity securities are required to file periodic reports of their ownership, and changes in that ownership, with the SEC. Based solely on our review of copies of these reports and representations of such reporting persons, we believe that, during the year ended December 31, 2015, such reporting persons met all applicable Section 16(a) filing requirements, with the exception of Joseph C. Cook, who filed a late report on March 25, 2015 with respect to the exercise of warrants to purchase shares of the Company’s common stock.

Table of Contents

Compensation Discussion and Analysis

The Compensation Committee of our Board is delegated the primary responsibility for our executive compensation program, which is intended to provide compensation packages for our named executive officers that are appropriately competitive within our industry, provide rewards for significant corporate performance and are appropriate for our stage of development. Compensation packages are designed to encourage a balanced focus on both short- and long-term goals. Direct compensation consists of a base salary, periodic cash bonuses for the achievement of significant corporate milestones and long-term equity incentive awards.

This section discusses the principles underlying our policies and decisions with respect to the compensation of our executive officers who are named in the “2015 Summary Compensation Table” and the material factors relevant to an analysis of these policies and decisions. Our named executive officers for 2015 were as follows: Joseph K. Belanoff, M.D., Chief Executive Officer and President, G. Charles Robb, Chief Financial Officer, Robert S. Fishman, Chief Medical Officer, Steven Lo, former Senior Vice President, Oncology, and Anne M. LeDoux, former Vice President, Controller and Chief Accounting Officer.

Dr. Fishman was hired as our Chief Medical Officer effective September 28, 2015. Mr. Lo resigned effective September 4, 2015, and Ms. LeDoux retired effective July 1, 2015. She continues to provide consulting services to us on an as-needed basis.

Executive Summary

During 2015, we had significant development, operational and commercial accomplishments. A summary of our principal activities and accomplishments for the year follows:

| • | Increased revenue from the sale of Korlym® for the treatment of patients with Cushing’s syndrome from $26.6 million in 2014 to $50.3 million in 2015, an increase of 89 percent. |

| • | Generated GAAP net income of $1.0 million in the fourth quarter of 2015. |

| • | Generated preliminary efficacy results in our Phase 1/2 trial of Korlym® in combination with eribulin to treat triple-negative breast cancer. |

| • | Completed a Phase 1 study of the safety and tolerability of our next-generation selective cortisol modulator, CORT125134. |

| • | Advanced the pre-clinical development of other compounds from our proprietary series of selective cortisol modulators. |

Executive Compensation 2015 Program Overview

Based on our compensation philosophy, pay program structure and company and individual performance, our Compensation Committee took the following actions with respect to the compensation for our named executive officers for 2015:

Base Salary. To recognize the increased complexity of the business, the Compensation Committee increased the annual base salaries of each of our named executive officers by three to four percent as compared to 2014, other than Dr. Fishman’s base salary, which was established in arms-length negotiations in connection with his commencement of employment in September 2015.

Bonuses. In accordance with our practice of awarding bonuses to named executive officers only for the achievement of significant corporate goals, we did not pay cash bonuses to our named executive officers in 2015 or for 2015 performance, with the exception of Ms. LeDoux, who received a bonus payment in February 2015 of $65,000 to recognize her contributions to the Company in light of her impending retirement and to compensate her in lieu of an annual equity grant. In March 2016, our Board approved a bonus program pursuant to which cash bonuses were payable to each of Drs. Belanoff and Fishman and Mr. Robb upon the achievement of the first of certain clinical milestones. The size of these bonuses was based primarily on each such named executive officer’s contributions to the achievement of the milestones. Such bonuses were paid in April 2016.

Table of Contents

Equity Awards. In February 2015, the Board granted options to Dr. Belanoff and Messrs. Robb and Lo. These options vest over a four-year period at a rate of 2.08334 percent on each monthly anniversary of their grant dates. The awards were given as an incentive toward continued service to the company. The size of these stock awards was based on the compensation that the Chief Executive Officer and members of our Compensation Committee and Board believed was appropriate.

Strong Stockholder Support for our Compensation Decisions

At our annual stockholder meeting in 2014, our stockholders approved the 2013 compensation of our named executive officers, with a 99% approval rating. In light of this support, the Compensation Committee did not change the design of our compensation programs during 2014 or 2015 as a result of the non-binding stockholder vote on executive compensation. The Compensation Committee will continue to work to ensure that management’s interests are aligned with our stockholders’ interests to support long-term value creation. Taking into account the stockholder vote in favor of having a non-binding stockholder vote on executive compensation once every three years, we expect that our next advisory vote to approve our named executive officers’ compensation will be at our 2017 annual stockholder meeting.

Compensation Principles and Objectives

Compensation for our named executive officers is intended to be performance-based, with the exception of the named executive officer’s base salaries. The Compensation Committee believes that compensation paid to our named executive officers should be closely aligned with our performance on both a short-term and long-term basis, should be linked to specific, measurable results that create value for stockholders, and should help us attract and retain key executives critical to our long-term success.

In establishing compensation for executive officers, these are the Compensation Committee’s objectives:

| • | Align officer and stockholder interests by providing a portion of total compensation opportunities for senior management in the form of equity awards and bonuses tied to company and individual performance. |

| • | Ensure executive officer compensation is competitive within the marketplace in which we compete for executive talent by relying on the Compensation Committee’s judgment, expertise and personal experience with other similar companies, recognizing that because of the company’s business model and stage of development, there may be few directly comparable companies; and |

| • | Recognize that best compensation practices for a young company with relatively few employees may be substantially different than for a larger, more mature company and that we should make full use of our greater latitude and breadth of compensation opportunities. |

Our overall compensation program is structured to attract, motivate and retain highly qualified executive officers by paying them competitively, consistent with our success and their contribution to that success. Given the long product development cycles in our business, we believe compensation should be structured to ensure that a portion of compensation opportunity is related to factors that directly and indirectly promote long-term stockholder value. Accordingly, we set goals designed to link each named executive officer’s compensation to our corporate performance, such as the attainment of commercial, development and operational goals and meeting agreed upon financial targets.

Consistent with our performance-based philosophy, we reserve the largest potential compensation awards for performance- and incentive-based programs for our named executive officers, commensurate with their greater responsibilities. Such programs include stock options grants designed to provide compensation opportunities if milestones are attained that increase our market value. Incentive-based programs provide compensation in the form

Table of Contents

of both cash and equity, to reward for both short-term and long-term performance. The Compensation Committee allocates total compensation between cash and equity compensation based on the Compensation Committee members’ knowledge of compensation practices in the biotechnology and specialty pharmaceutical industries. The balance between equity and cash compensation for our named executive officers is evaluated annually to align the interests of management with stockholders through both short- and long-term incentives.

The Chairman of the Board and the members of the Compensation Committee are seasoned executives of, consultants to, or venture capitalists with investments in the biotechnology and specialty pharmaceutical industry. Collectively they have served as board and compensation committee members of many public and privately held companies including Amylin, Ironwood, NuGen, Neurex, Syntex, Sunesis Pharmaceuticals and Cerus Corporation. As a result of this extensive involvement in the compensation of executives in these and other companies, we believe that the Chairman of the Board and the members of the Compensation Committee collectively have developed a clear understanding and knowledge of the compensation structures that are necessary to attract, motivate and retain management talent.

Determination of Compensation

The Compensation Committee is charged with the primary authority to determine and recommend the compensation awards available to our executive officers for approval by the Board. Based on the Compensation Committee members’ collective understanding of compensation practices in similar companies in the biotechnology and specialty pharmaceutical industry, our executive compensation package consists of the following elements, in addition to the employee benefit plans in which all employees may participate:

| • | Base salary: compensation for ongoing service throughout the year. |

| • | Periodic performance-based cash compensation: awards to recognize and reward achievement of performance goals. |

| • | Long-term performance-based equity incentive program: equity compensation to provide an incentive to our named executive officers to manage us from the perspective of an owner with an equity stake in the business. |

| • | Severance and change in control benefits: remuneration paid to executives in the event of a change in control or involuntary employment termination. |

To aid the Compensation Committee in making its determination, our Chief Executive Officer provides recommendations annually to the Compensation Committee regarding the compensation of all other executive officers (other than himself) based on the overall corporate achievements during the period being assessed and his knowledge of the individual contributions to our success by each of the named executive officers. The performance of our named executive officers as a team is reviewed annually by the Compensation Committee.

We set base salary structures and grants of stock options based on the Compensation Committee members’ collective understanding of compensation practices in the biotechnology and specialty pharmaceutical industry and such members’ experiences as seasoned executives, consultants, board and compensation committee members, or investors in similar biotechnology and specialty pharmaceutical industry companies.

Tax Considerations

In making its compensation determinations, our Compensation Committee considers the impact of Section 162(m) of the Internal Revenue Code of 1986, as amended, which limits the tax deductibility by us of annual compensation in excess of $1,000,000 paid to our Chief Executive Officer and any of our three other most highly compensated executive officers, other than our Chief Financial Officer.

While the tax impact of any compensation arrangement is one factor to be considered, such impact is evaluated in light of the Compensation Committee’s overall compensation philosophy and objectives. The

Table of Contents

Compensation Committee will consider ways to maximize the deductibility of executive compensation, while retaining the discretion it deems necessary to compensate officers in a manner commensurate with performance and the competitive environment for executive talent. From time to time, the Compensation Committee may award compensation to our executive officers that may not be fully deductible if it determines that such award is consistent with its philosophy and is in our and our stockholders’ best interests.

Elements of Executive Compensation

Base Compensation

We pay base salaries to provide fixed compensation based on the Compensation Committee’s assessment of competitive market practices. Due to the Compensation Committee’s collective experience with similar companies in the biotechnology and specialty pharmaceutical industry, the Compensation Committee has intimate knowledge and understanding of what the industry demands in order to motivate and retain our executive officers. We provide each named executive officer with a base salary that was established by negotiations with each named executive officer when such individual first joined us as an employee or was promoted to the position of executive officer. To recognize the increased complexity of the business, the Compensation Committee increased the annual base salary for Dr. Belanoff by 4.4%, for Mr. Robb by 3.5%, for Mr. Lo by 3.5% and for Ms. LeDoux by 3.4%, in each case, effective March 1, 2015. Dr. Fishman’s annual base salary of $400,000 was established in arms-length negotiations in connection with his commencement of employment with us in September 2015. While base salaries are not considered by the Internal Revenue Service to constitute performance-based compensation, each year the Compensation Committee reviews the Chief Executive Officer’s base salary to determine if a change is appropriate based on Company performance, such as providing Korlym to treat patients with Cushing’s syndrome, our progress on research and development programs and the development of the administrative infrastructure needed to support a growing business. Similarly, the Chief Executive Officer reviews the base salary of the other named executive officers and may propose changes in base salary based on performance to the Compensation Committee. Other than the annual merit increases that the Compensation Committee has approved, no formulaic base salary increases are provided to the named executive officers.

Performance-Based Compensation

Performance Goals and Periodic Performance-Based Cash Compensation. We structure our compensation programs to reward executive officers based on our performance. To date, we have not instituted an annual performance-based cash compensation or annual performance-based equity compensation program. The Compensation Committee believes that the objective to ensure that executive officers’ compensation is aligned with our corporate strategies, business objectives and the long-term interests of our stockholders is achieved when significant milestones are met, such as the approval of a new product, increase in revenue, meeting the predetermined endpoints in our clinical trials, demonstrating progress in our research and development programs and completing financing transactions. The achievement of these types of milestones does not necessarily correspond with annual performance periods.

Performance-based cash compensation has been awarded in recent years primarily to recognize the accomplishment of certain value enhancing milestones such as successful financing transactions, initiation of clinical trials and positive results in clinical trials. The Compensation Committee believes that performance-based compensation should be based on achievement of these types of milestone successes. The Chief Executive Officer reviews the performance of the other named executive officers and may propose bonus and equity compensation for these individuals to the Compensation Committee.

As discussed above, in accordance with our practice of making bonus awards only on the achievement of significant milestones, we did not pay cash bonuses to our named executive officers in 2015 or for 2015 performance, with the exception of Ms. LeDoux, who received a bonus payment in February 2015 of $65,000 to recognize her contributions to the Company in light of her impending retirement and to compensate her in lieu of an annual equity grant.

In March 2016, our Board approved a bonus program pursuant to which cash bonuses were payable to each of Drs. Belanoff and Fishman and Mr. Robb upon the achievement of the first of three milestones relating to the

Table of Contents

advancement of our Cushing’s syndrome and oncology development programs, including the opening of an investigational new drug application for the company’s planned Phase 2 trial of its selective cortisol modulator CORT125134 to treat patients with Cushing’s syndrome, as well as patient enrollment and screening milestones in our two Phase 1/2 oncology trials. The size of these bonuses was based primarily on each such named executive officer’s contributions to the achievement of these milestones. In April 2016, the patient screening milestone was attained and bonuses were paid in the following amounts: Dr. Belanoff: $400,000; Mr. Robb: $146,000; and Dr. Fishman: $40,000. Mr. Lo and Ms. LeDoux were not eligible to receive a bonus in April 2016 because they were not employed by us at that time.

Long-Term Performance-Based Equity Incentive Program. Our executive officers, along with all of our employees, are eligible receive grants of stock options under our 2012 Incentive Award Plan. We believe, with our performance-based approach to compensation, that equity ownership in our company is important to link an executive officer’s compensation to the performance of our stock and stockholder gains while creating an incentive for sustained growth. We have, thus far, used stock options as the only long-term performance-based equity incentive vehicle because the Compensation Committee believes that stock options maximize an executive officer’s incentive to increase our stock price and maximize stockholder value, since there is no financial gain to an executive officer unless our stock price appreciates.

Equity compensation in the form of incentive or non-qualified stock options is awarded by the Compensation Committee from time to time. The size and the timing of each grant is based on a number of factors, including the executive officer’s salary, such executive officer’s contributions to the achievement of our financial and strategic objectives, the value of the stock option at the time of grant, the possible value of the option if we achieve our objectives and industry practices and norms from the collective knowledge of the Compensation Committee as seasoned executives of, consultants to, board and compensation members of, and venture capitalists with investments in similar companies in the industry. The relative weight given to each of these factors varies among individuals at the Compensation Committee’s discretion. There is no set formula for the granting of stock options to individual executives and employees. Grants also may be made following a significant change in job responsibility or in recognition of a significant achievement.

Stock options granted to our named executive officers generally have a multi-year vesting schedule in order to provide an incentive for continued employment. These vesting schedules are generally either four or five years depending on the date of the initial option grant. From time to time, we have also granted stock options that vest based on the attainment of performance goals. Stock option awards generally expire ten years from the date of the grant. This provides a reasonable time frame in which to provide the executive officer with the possibility of price appreciation of our shares. The exercise price of such stock options is 100% of the fair market value of the underlying stock on the date of grant.

In February 2015, the Board approved grants of options to our named executive officers in the following amounts: 450,000 shares to Dr. Belanoff; 150,000 shares to Mr. Robb; and 100,000 shares to Mr. Lo. These option awards vest over a four-year period at the rate of 2.08334% on each monthly anniversary of the grant date, subject to the named executive officer’s continued employment through each applicable vesting date. These awards were given to our named executive officers as an incentive toward continued service to the company. The size of the stock award was based on the level of compensation that the Chief Executive Officer and members of our Compensation Committee and Board believed was appropriate given the named executive officer’s degree of responsibility for the Company’s success. Ms. LeDoux did not receive an annual stock option grant in light of her impending retirement. Dr. Fishman was not employed by us in February 2015.