Form DEF 14A Alliance HealthCare Serv For: Jun 06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

|

Filed by the Registrant x |

Filed by a Party other than the Registrant o |

|

Check the appropriate box:

|

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

x |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material under §240.14a-12 |

Alliance HealthCare Services, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

x |

No fee required. |

|

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

(1) |

Title of each class of securities to which transaction applies: |

|

|

(2) |

Aggregate number of securities to which transaction applies: |

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

(4) |

Proposed maximum aggregate value of transaction: |

|

|

(5) |

Total fee paid: |

|

o |

Fee paid previously with preliminary materials. |

|

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(2) |

Form, Schedule or Registration Statement No.: |

|

|

(3) |

Filing Party: |

|

|

(4) |

Date Filed: |

ALLIANCE HEALTHCARE SERVICES, INC.

100 Bayview Circle, Suite 400

Newport Beach, CA 92660

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held June 6, 2016

Dear Stockholders:

On June 6, 2016, Alliance HealthCare Services, Inc. will hold its Annual Meeting of Stockholders (the “Annual Meeting”) at its corporate headquarters located at 100 Bayview Circle, Suite 400, Newport Beach, California 92660. The meeting will begin at 9:00 a.m. Pacific time.

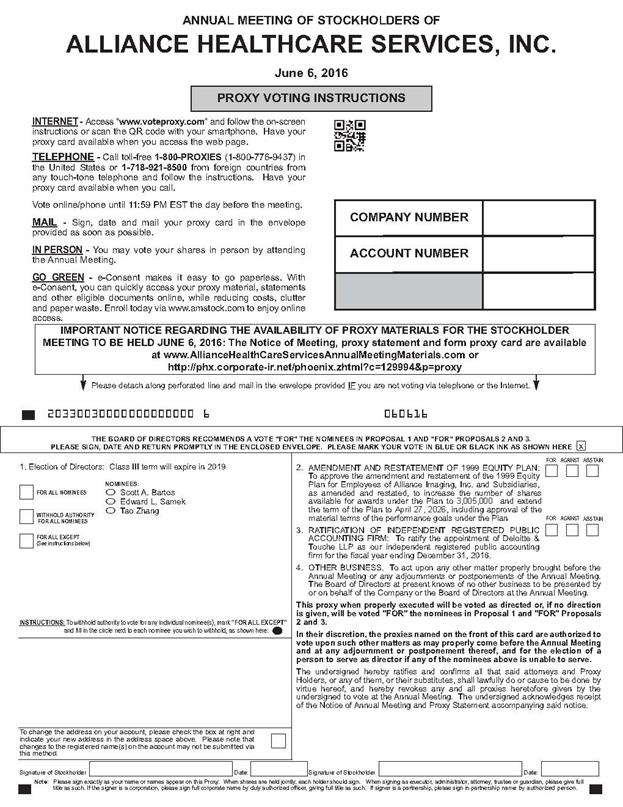

Only record holders of shares of our Common Stock at the close of business on April 15, 2016, are entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements of the Annual Meeting. The purposes of the meeting are:

|

|

1. |

To elect Scott A. Bartos, Edward L. Samek and Tao Zhang to serve as Class III directors to hold office for a three-year term expiring at the 2019 annual meeting of stockholders or until their respective successors are elected and qualified; |

|

|

2. |

To approve the amendment and restatement of the 1999 Equity Plan for Employees of Alliance Imaging, Inc. and Subsidiaries, as amended and restated (the “1999 Equity Plan”), to increase the number of shares of our common stock available to be awarded under the plan from 2,205,000 shares to 3,005,000 shares and extend the term of the 1999 Equity Plan to April 27, 2026, including approval of the material terms of the performance goals under the 1999 Equity Plan; |

|

|

3. |

To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016; and |

|

|

4. |

To act upon any other matter properly brought before the Annual Meeting or any adjournments or postponements of the Annual Meeting. |

YOUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE IN FAVOR OF THE PROPOSALS OUTLINED IN THIS PROXY STATEMENT.

|

Sincerely, |

|

|

|

Qisen Huang |

|

Chairman of the Board |

Important Notice Regarding the Availability of

Proxy Materials for the Annual Meeting of Stockholders to Be Held on June 6, 2016:

This proxy statement, our 2015 annual report to stockholders and a form of proxy card are

available at www.AllianceHealthCareServicesAnnualMeetingMaterials.com

and http://phx.corporate-ir.net/phoenix.zhtml?c=129994&p=proxy

Newport Beach, California

April 29, 2016

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

Annual Meeting of Stockholders

|

· Date and Time: |

June 6, 2016, 9:00 a.m. Pacific time |

|

|

|

|

· Place: |

Corporate Headquarters |

|

|

Alliance HealthCare Services, Inc. |

|

|

100 Bayview Circle, Suite 400 |

|

|

Newport Beach, California 92660 |

|

|

|

|

· Record Date: |

April 15, 2016 |

|

|

|

|

· Voting: |

Stockholders as of the record date are entitled to vote. Each share of Common Stock is entitled to one vote for each director nominee and one vote for each of the proposals to be presented. |

Meeting Agenda

|

|

· |

To elect Scott A. Bartos, Edward L. Samek and Tao Zhang to serve as Class III directors and to hold office for a three-year term expiring at the 2019 annual meeting of stockholders or until their respective successors are elected and qualified; |

|

|

· |

To approve the amendment and restatement of the 1999 Equity Plan for Employees of Alliance Imaging, Inc. and Subsidiaries, as amended and restated (the “1999 Equity Plan”), to increase the number of shares of our common stock available to be awarded under the plan from 2,205,000 shares to 3,005,000 shares and extend the term of the 1999 Equity Plan to April 27, 2026, including approval of the material terms of the performance goals under the 1999 Equity Plan; |

|

|

· |

To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016; and |

|

|

· |

To act upon any other matter properly brought before the Annual Meeting or any adjournments or postponements of the Annual Meeting. |

Director Nominees

The following table provides summary information about each of our three director nominees. Each director nominee is standing for election for a three-year term and must be approved by a plurality of votes cast.

|

Name |

|

Age |

|

Director Since |

|

Occupation |

|

Scott A. Bartos |

|

52 |

|

December 2012 |

|

Healthcare Director and Advisor |

|

|

|

|

|

|

|

|

|

Edward L. Samek |

|

79 |

|

October 2001 |

|

Independent Consultant and Investor |

|

|

|

|

|

|

|

|

|

Tao Zhang |

|

41 |

|

March 2016 |

|

Healthcare Entrepreneur |

|

Section |

Page |

|

1 |

|

|

6 |

|

|

6 |

|

|

9 |

|

|

9 |

|

|

10 |

|

|

10 |

|

|

12 |

|

|

13 |

|

|

14 |

|

|

15 |

|

|

16 |

|

|

18 |

|

|

18 |

|

|

18 |

|

|

19 |

|

|

20 |

|

|

21 |

|

|

29 |

|

|

31 |

|

|

31 |

|

|

Subsequent Events |

|

|

32 |

|

|

33 |

|

|

34 |

|

|

Description of Compensation Arrangements for Named Executive Officers |

35 |

|

39 |

|

|

40 |

|

|

40 |

|

|

44 |

|

|

45 |

|

|

45 |

|

|

45 |

|

|

45 |

|

|

47 |

|

|

49 |

|

|

55 |

|

|

55 |

|

|

56 |

|

|

56 |

|

|

57 |

|

ALLIANCE HEALTHCARE SERVICES, INC.

100 Bayview Circle, Suite 400

Newport Beach, CA 92660

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

To Be Held June 6, 2016

|

1. |

Q: |

Who is soliciting my vote? |

|

|

|

|

|

|

A: |

This proxy statement is solicited on behalf of the Board of Directors of Alliance HealthCare Services, Inc. (“Alliance,” “we” or “our”) for use at our Annual Meeting of Stockholders to be held June 6, 2016 (the “Annual Meeting”), at 9 A.M. local time, or at any continuation, postponement or adjournment thereof, for the purposes discussed in this proxy statement and in the accompanying Notice of Annual Meeting of Stockholders and any business properly brought before the Annual Meeting. |

|

|

|

|

|

2. |

Q: |

When and how was this proxy statement mailed to stockholders? |

|

|

|

|

|

|

A: |

This proxy statement is being first mailed to stockholders on or about May 7, 2016. |

|

|

|

|

|

3. |

Q: |

What may I vote on? |

|

|

|

|

|

|

A: |

You may vote on the following matters: |

|

|

|

|

|

|

|

(1) To elect Scott A. Bartos, Edward L. Samek and Tao Zhang to serve as Class III directors and to hold office for a three-year term expiring at the 2019 annual meeting of stockholders or until their respective successors are elected and qualified (“Proposal 1”); and |

|

|

|

|

|

|

|

(2) To approve the amendment and restatement of the 1999 Equity Plan for Employees of Alliance Imaging, Inc. and Subsidiaries, as amended and restated (the “1999 Equity Plan”), to increase the number of shares of our common stock available to be awarded under the plan from 2,205,000 shares to 3,005,000 shares and extend the term of the 1999 Equity Plan to April 27, 2026, including approval of the material terms of the performance goals under the 1999 Equity Plan (“Proposal 2”) and; (3) To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016 (“Proposal 3”). |

|

|

|

|

|

4. |

Q: |

How does the Board of Directors recommend I vote on the proposals? |

|

|

|

|

|

|

A: |

The Board of Directors recommends a vote FOR each of the director nominees listed in Proposal 1 and FOR Proposals 2 and 3. |

|

|

|

|

|

5. |

Q: |

Who is entitled to vote? |

|

|

|

|

|

|

A: |

Record holders of our common stock, par value $0.01 per share (the “Common Stock”), as of the close of business on April 15, 2016 (the “Record Date”), are entitled to vote at the Annual Meeting. As of the Record Date, 10,716,884 shares of Common Stock were outstanding. The shares of Common Stock in our treasury on that date, if any, will not be voted. Each holder of record of Common Stock on the Record Date will be entitled to one vote for each share on all matters to be voted on at the Annual Meeting. |

|

|

|

|

|

6. |

Q: |

What is the difference between a “beneficial stockholder” and a “stockholder of record”? |

|

|

|

|

|

|

A: |

Whether you are a beneficial stockholder or a stockholder of record depends on how you hold your shares: |

|

|

|

|

1

2

|

Q: |

How do I change or revoke my proxy or voting instructions? |

|

|

|

|

|

|

|

A: |

If you are a stockholder of record, you may revoke your proxy by sending a written notice of revocation to our Secretary, Richard W. Johns, at the address shown above. To change how your shares will be voted at the Annual Meeting, you can submit a duly executed written proxy bearing a date that is later than the date of your original proxy or you can submit a later dated proxy electronically via the Internet or by telephone. A previously submitted proxy will not be voted if the stockholder of record who executed it is present at the Annual Meeting and votes the shares represented by the proxy in person at the Annual Meeting. |

|

|

|

|

|

|

|

For shares you hold beneficially in street name, you may change your vote by submitting new voting instructions to your bank, broker, trustee or nominee, or, if you have obtained a legal proxy from your bank, broker, trustee or nominee giving you the right to vote your shares, by attending the Annual Meeting and voting in person. Please note that attendance at the Annual Meeting will not by itself constitute revocation of a proxy. Any change to your proxy or voting instructions that is provided by the Internet or by telephone must be submitted by 11:59 p.m. Pacific time on June 5, 2016. |

|

|

|

|

|

11. |

Q: |

How will my shares be voted if I do not provide specific voting instructions in the proxy or voting instruction form I submit? |

|

|

|

|

|

|

A: |

If you submit a proxy or voting instruction form but do not indicate your specific voting instructions on one or more of the proposals listed above in the notice of the meeting, your shares will be voted as recommended by the Board on those proposals (see Question 4) and as the proxyholders may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting. |

|

|

|

|

|

12. |

Q: |

Who will count the votes? |

|

|

|

|

|

|

A: |

Our Secretary will count the votes and act as the inspector of election. The inspector of election will separately tabulate affirmative and negative votes, abstentions and broker non-votes (described below). |

|

|

|

|

|

13. |

Q: |

How many votes are needed for a quorum and to approve each of the proposals? |

|

|

|

|

|

|

A: |

The holders of a majority of the shares of our Common Stock outstanding on the Record Date, represented in person or by proxy, constitute a quorum for the transaction of business. |

|

|

|

|

|

|

|

For purposes of Proposal 1 (election of directors), the election of each director nominee must be approved by a plurality of the votes cast by stockholders represented at the meeting in person or by proxy. A “plurality” means that the individuals who receive the largest number of votes are elected as directors up to the maximum number of directors to be elected at the Annual Meeting. |

|

|

|

|

|

|

|

For purposes of Proposal 2 (approval of an amendment and restatement of the 1999 Equity Plan), the affirmative approval of a majority of the shares represented at the meeting in person or by proxy and entitled to vote on the proposal at the Annual Meeting is required.

For purposes of Proposal 3 (ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm), the affirmative approval of a majority of the shares represented at the meeting in person or by proxy and entitled to vote on the proposal at the Annual Meeting is required. Please be aware that Proposal 3 is advisory only and is not binding on the company. Our Board of Directors will consider the outcome of the vote on this proposal in considering what action, if any, should be taken in response to the advisory vote by stockholders. |

3

|

|

|

|

|

14. |

Q: |

What effect will broker non-votes and abstentions have? |

|

|

|

|

|

|

A: |

A “broker non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner as to how to vote such shares. This year, Proposals 1 (election of directors) and 2 (amendment and restatement of our 1999 Equity Plan) are non-routine and your broker or other nominee does not have discretionary authority to vote on those proposals. As a result, shares that constitute broker non-votes will be counted as present at the Annual Meeting for the purpose of determining a quorum, but will not be considered votes cast for Proposal 1 or entitled to vote for Proposal 3 and will have no effect on the outcome of those proposals.

Proposal 3 (ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm) is considered routine and may be voted upon by your broker if you do not submit voting instructions. Consequently, if you hold your shares through a brokerage account and do not submit voting instructions to your broker, your broker may exercise its discretion to vote your shares on Proposal 3. If your broker exercises this discretion, your shares will be counted as present for determining the presence of a quorum at the Annual Meeting and will be voted on Proposal 3 in the manner directed by your broker. |

|

|

|

|

|

|

|

Abstentions also count toward establishing a quorum. However, for Proposal 1 (election of directors), abstentions, or shares for which authority is withheld to vote for director nominees, will have no effect on the outcome of that proposal. For Proposal 2 (amendment and restatement of 1999 Equity Plan) and Proposal 3 (ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm), we will treat abstentions as shares present or represented and entitled to vote on those proposals, so abstaining has the same effect as a vote “against” those proposals. |

|

|

|

|

|

15. |

Q: |

How will voting on any other business be conducted? |

|

|

|

|

|

|

A: |

We do not know of any business to be considered at the 2016 Annual Meeting other than the proposals described in this Proxy Statement. If any other business is properly presented at the Annual Meeting in accordance with our Amended and Restated Bylaws (which we refer to as our bylaws), your signed proxy card gives authority to Rhonda Longmore-Grund and Richard W. Johns to vote on such matters at their discretion. |

|

|

|

|

|

16. |

Q: |

Where can I find the voting results of the Annual Meeting? |

|

|

|

|

|

|

A: |

We intend to announce preliminary voting results at the Annual Meeting and disclose final results in a Current Report on Form 8-K filed with the SEC within the required timeframe. |

|

|

|

|

|

17. |

Q: |

Do stockholders have dissenters’ or appraisal rights? |

|

|

|

|

|

|

A: |

Our stockholders do not have dissenters’ or appraisal rights under Delaware law or under our certificate of incorporation or bylaws in connection with any proposal to be presented at the Annual Meeting. |

|

|

|

|

|

18. |

Q: |

Who is our largest principal stockholder? |

|

|

|

|

|

|

A: |

On March 29, 2016, THAIHOT Investment Company Limited, a wholly owned indirect subsidiary of Fujian Thai Hot Investment Co. Ltd (which we refer to collectively as Thai Hot) completed its purchase of 5,537,945 shares of common stock of the Company from funds managed by Oaktree Capital Management, L.P. (“Oaktree”) and MTS Health Investors, LLC (“MTS”), and Larry C. Buckelew (together with Oaktree and MTS, the “Selling Stockholders”) for approximately $102.5 million or $18.50 per share (the “Thai Hot Transaction”).

As of the record date for the meeting, Thai Hot, owned 5,537,945 shares of our Common Stock, representing approximately 51.7% of our outstanding shares. Thai Hot has advised us that it intends to vote these shares of Common Stock in favor of each of the Proposals described above. |

|

|

|

|

4

|

Q: |

Where can I find Alliance’s financial information? |

|

|

|

|

|

|

|

A: |

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2015, as amended, contains our consolidated financial statements and related information and is enclosed with this proxy statement. The Annual Report is not incorporated by reference into this proxy statement and is not deemed to be a part of this proxy statement. |

|

|

|

|

|

20. |

Q: |

When are stockholder proposals for the 2017 annual meeting due? |

|

|

|

|

|

|

A: |

In general, stockholders who, in accordance with Rule 14a-8 under the Securities Exchange Act of 1934, as amended, wish to present proposals for inclusion in the proxy materials to be distributed by us in connection with our 2017 Annual Meeting must submit their proposals to our Secretary on or before December 26, 2016. |

|

|

|

|

|

|

|

In accordance with our bylaws, to be properly brought before the 2017 Annual Meeting, a stockholder’s notice of the nominee or the matter the stockholder wishes to present must be delivered to our Secretary at the address provided below no earlier than February 7, 2017 and no later than March 9, 2017. All stockholders must also comply with the applicable requirements of the Securities Exchange Act of 1934, as amended. Your submission must contain the specific information required in our bylaws. If you would like a copy of our bylaws, please write to our Secretary at Alliance HealthCare Services, Inc., 100 Bayview Circle, Suite 400, Newport Beach, CA 92660. |

|

|

|

|

|

21. |

Q: |

How will we solicit proxies, and who will pay for the cost of the solicitation? |

|

|

|

|

|

|

A: |

Our Board of Directors is soliciting proxies for the Annual Meeting principally by mailing these proxy materials to our stockholders. We will bear the entire cost of soliciting proxies from our stockholders, including the expense of preparing and mailing the Notice and the proxy materials for the Annual Meeting. We will reimburse brokers and other custodians, nominees and fiduciaries for forwarding proxy and solicitation material to owners of our stock in accordance with applicable rules. Our officers, directors and employees may undertake solicitation activities without any compensation specifically for those duties. |

5

ELECTION OF DIRECTORS

Our Board of Directors, which we sometimes refer to as the Board, is divided into three classes, with each director serving a three-year term and one class of directors being elected at each year’s annual meeting of stockholders. At each annual meeting, nominees are elected as directors to a class with a term of office that expires at the annual meeting held three years after the year of the nominee’s election, or when their successors are elected and qualified. The term of office of the three incumbent Class III directors expires at the 2016 Annual Meeting. The Board has nominated incumbent directors Scott A. Bartos, Edward L. Samek and Tao Zhang for election to three-year terms of office that will expire at the Annual Meeting to be held in 2019 or when their respective successors are elected and qualified. Dr. Zhang, along with Messrs. Qisen Huang and Heping Feng, was appointed to the Board on March 29, 2016 pursuant to the terms of the Governance, Voting and Standstill Agreement that we entered into with Thai Hot, described in “Certain Relationships and Related Transactions” below, which provides Thai Hot with the right to designate up to the minimum number of directors that constitutes a majority of our Board (based on current ownership levels).

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR EACH OF THE THREE NOMINEES FOR DIRECTOR.

Below is information about the Class III nominees and our other current directors, including their principal occupations, business experience, directorships in other public companies and information about their specific experience, qualifications, attributes or skills that led to the conclusion that they should serve as directors in light of our structure and business. If for any reason any of the nominees should be unavailable to serve, proxies solicited by this proxy statement may be voted for a substitute as well as for the other nominees. The Board, however, expects each of the nominees to be available to serve if elected. There are no family relationships among any of our directors or executive officers.

Nominees and Other Members of the Board of Directors

|

Name |

|

Position |

|

Age |

|

|

Class |

|

Director Since |

|

Term Expires |

||

|

Qisen Huang |

|

Chairman of the Board |

|

|

51 |

|

|

II |

|

|

2016 |

|

2018 |

|

Larry C. Buckelew |

|

Vice Chairman of the Board |

|

|

62 |

|

|

II |

|

|

2009 |

|

2018 |

|

Scott A. Bartos |

|

Director |

|

|

52 |

|

|

III |

|

|

2012 |

|

2016 |

|

Tao Zhang |

|

Director |

|

|

41 |

|

|

III |

|

|

2016 |

|

2016 |

|

Neil F. Dimick |

|

Director |

|

|

66 |

|

|

I |

|

|

2002 |

|

2017 |

|

Heping Feng |

|

Director |

|

|

56 |

|

|

I |

|

|

2016 |

|

2017 |

|

Edward L. Samek |

|

Director |

|

|

79 |

|

|

III |

|

|

2001 |

|

2016 |

|

Percy C. Tomlinson |

|

Director and Chief Executive Officer |

|

|

54 |

|

|

II |

|

|

2013 |

|

2018 |

|

Paul S. Viviano |

|

Director |

|

|

63 |

|

|

I |

|

|

2003 |

|

2017 |

Incumbent Class III Directors serving for a term expiring in 2019

SCOTT A. BARTOS

During 2015, Mr. Bartos served as President, Chief Executive Officer and Chairman of the Board for Rural/Metro Corporation, the nation’s leading provider of ambulance, fire protection and safety services. Mr. Bartos is a director of Outset Medical, Inc. (formerly Home Dialysis Plus) and a director of Cardiovascular Systems Inc., a publicly traded company that develops and commercializes innovative solutions for treating peripheral and coronary vascular disease. Mr. Bartos previously served as president, chief executive officer, and director of LaVie Care Centers, a national long-term care company with revenues exceeding $1 billion annually, from July 2009 through the sale of the company in December 2011. Prior to joining LaVie, Mr. Bartos served as president and chief operation officer-east of Gambro Healthcare, Inc., and served in executive and management positions with companies such as Endoscopy Specialists, Inc., a company he founded and led through a merger and eventual public listing, U.S. Surgical Corporation, and PepsiCo, Inc. In determining that Mr. Bartos should continue to serve as a

6

director, the Board noted that Mr. Bartos’ background and experience is called upon in considering all significant aspects of our business and operations, particularly with respect to matters of business strategy, and that Mr. Bartos has substantial experience as a healthcare executive and director and is very knowledgeable regarding our industry, business and operations. Mr. Bartos currently serves as a member of our Audit Committee and Compensation Committee.

TAO ZHANG

Dr. Zhang has been a member of our Board of Directors since March 29, 2016. Dr. Zhang founded United Pacific Healthcare in August 2014, of which he is currently the Chairman and CEO. Previously, Dr. Zhang worked directly under Dr. Thomas Frist, Jr., the co-founder of Hospital Corporation of America (HCA), from 2008 through 2014. From 2008 to 2011 Dr. Zhang was in the U.S. on a part-time basis during which time he helped Dr. Frist and HCA to source and negotiate hospital acquisition deals in China. Dr. Zhang spent the remainder of the time with HCA in China as the full-time chairman and CEO of China Hospital Corporation. From 2001 through 2005, Dr. Zhang worked at CITIC Pacific in the healthcare division as project manager and then general manager. Dr. Zhang earned his MD degree in Qingdao University Medical School in 1998 and obtained further training in cardiac surgery for an additional three years in Beijing Fuwai Hospital. Dr. Zhang also holds both an MBA and a Master’s Degree in Health Sector Management from Duke University, obtained in 2007. Dr. Zhang currently serves on our Compensation Committee and Nominating and Corporate Governance Committee. Given Dr. Zhang’s substantial experience with the medical and healthcare delivery industry, the Board determined that Dr. Zhang should continue to serve as a director.

EDWARD L. SAMEK

Mr. Samek served as vice chairman of MedQuist, Inc. from 1998 to 2000 and as chairman and chief executive officer of The MRC Group and its predecessor companies from 1982 to 1998 when it was acquired by MedQuist. Previously he served as President of Hudson Pharmaceutical Corporation and Childcraft Education Corp. He has also held executive and management positions with Procter & Gamble, Johnson & Johnson and Avon Products, Inc. Currently an independent consultant and investor, Mr. Samek serves as an Honorary Trustee of the Jackson Laboratory and Chairman of the Board of Friends of Acadia (National Park). Mr. Samek has extensive background and experience in the healthcare services industry and broad experience on the boards of several healthcare companies. In addition, he is our longest serving director, having joined the Board in 2001. In determining that Mr. Samek should continue to serve as a director, the Board noted that Mr. Samek’s background and experience is called upon in considering all significant aspects of our business and operations, particularly with respect to matters of business strategy, and that Mr. Samek has substantial experience concerning our development and is very knowledgeable regarding our industry, business and operations. Mr. Samek currently serves as the Chairman of our Nominating and Corporate Governance Committee and as a member of our Audit Committee.

Incumbent Class I Directors serving for a term expiring in 2017

NEIL F. DIMICK

Mr. Dimick is a healthcare consultant and private investor. He served as executive vice president and chief financial officer of AmerisourceBergen Corporation from August 2001 through April 2002. From 1992 through August 2001 he served as senior executive vice president and chief financial officer of Bergen Brunswig Corporation. Mr. Dimick began his career as a corporate auditor with Deloitte & Touche where he held the position of partner for eight years. Mr. Dimick is also a director of WebMD Corporation, Resources Connection, Inc. and Mylan Laboratories, Inc. Mr. Dimick was a director of Thoratec Corporation from 2003 through October 2015 when the company was sold. Mr. Dimick has substantial experience in the healthcare services industry and is an “audit committee financial expert,” serving as a director and member of the audit committee of several publicly traded healthcare companies. This experience along with his chief financial officer and public accounting background is often called upon, particularly in connection with accounting and finance-related issues. Mr. Dimick has served as a member of our Board for more than nine years, providing him with significant background and experience concerning Alliance and its development. The Board concluded that Mr. Dimick should continue to serve as a director because he is very knowledgeable about our industry, business and operations due to his extensive work experience in the healthcare services industry and his long tenure as a member of the Board. Mr. Dimick currently serves as the Chairman of our Audit Committee and as a member of our Nominating and Corporate Governance Committee.

7

Mr. Feng, born in 1960, is a Chinese Certified Public Accountant. He is now a senior advisor of PricewaterhouseCoopers. Mr. Feng was the Vice Chairman of Morgan Stanley China from 2011 to Aug 2014. Before joining Morgan Stanley, he was the Office Managing Partner of PricewaterhouseCoopers Beijing. Mr. Feng made partner in PwC in 1995. Before joining PwC he was a Division head of the Ministry of Finance of PRC from 1985 to 1992. Mr. Feng has 20-years working experience in private and public services. He has worked extensively with major CIC and MOFCOM and market regulators and government agencies such as CSRC, CBRC, MoF. Mr. Feng currently serves on our Compensation Committee and Nominating and Corporate Governance Committee. Given Mr. Feng’s substantial experience with financial and accounting matters, the Board determined that Mr. Feng should continue to serve as a director.

PAUL S. VIVIANO

Mr. Viviano is a health care leader who has directed academic, nonprofit and for-profit healthcare organizations that deliver excellence in clinical care, research and diagnostics for three decades. Mr. Viviano joined Children’s Hospital Los Angeles as president and chief executive officer in 2015 and serves as a member of the institution’s Board of Trustees. Previous to serving as president and chief executive of CHLA, Mr. Viviano served as the CEO and Associate Vice Chancellor for the UC San Diego Health System, an institution noted for its leadership in medical research and patient care. He has also served as the president and chief executive officer of USC University Hospital and USC/Norris Cancer Hospital and held various chief executive roles within the St. Joseph Health System, ultimately serving as the president and chief operating officer for the system. He served as our chairman of the board and CEO for 10 years. Paul serves on the boards of several organizations, including Loyola Marymount University, where he serves as the Vice Chair of the Board of trustees. In addition, he was recently appointed to the Board of Directors of the Hospital Association of Southern California (HASC), and serves as the chair of HASC’s Los Angeles Central Area. Given the importance of hospital service business models to our operations and planning, and Mr. Viviano’s substantial experience with Alliance and the hospital industry, the Board determined that Mr. Viviano should continue to serve as a director. Mr. Viviano currently serves as the Chairman of our Compensation Committee and as a member of our Nominating and Corporate Governance Committee.

Incumbent Class II Directors serving for a term expiring in 2018

LARRY C. BUCKELEW

Mr. Buckelew was elected by the Board to serve as our Chairman of the Board of Directors, and Interim Chief Executive Officer in 2012 and currently serves as Vice Chairman of the Board of Directors as of 2016. On October 1, 2013, Mr. Buckelew resigned his temporary role as Interim Chief Executive Officer after 16 months of service. Prior to his election into these responsibilities, he served as a Corporate Director for Alliance since May 2009 and was a member of both the Audit and Compensation Committees. Prior to joining Alliance's Board in 2009, Mr. Buckelew served as President and Chief Executive Officer of Gambro Healthcare, Inc. from November 2000 through October 2005. Mr. Buckelew began his career with American Hospital Supply Corporation (AHSC) in 1975 and served as an executive with AHSC and later Baxter International, Inc. following their merger in November 1985. Mr. Buckelew joined Sunrise Medical Inc. as Division President in 1986, a role he held until being named as Corporate President in 1993. In 1994, Mr. Buckelew was elected as President/COO and Director for Sunrise, a position he held until 1996. In 1996, Mr. Buckelew was named as Group President for the Medical Group of companies for Teleflex Inc., and additionally as Chairman of Surgical Services Inc. (SSI) in 1998, positions he held until joining Gambro Healthcare Inc. in 2000. In addition to his board service for Alliance, Mr. Buckelew also served as Corporate Director for Welch Allyn Medical, a market leader in providing patient diagnostic instruments and medical devices, from 2007 through 2015 until the successful sale of the company to Hill Rom Medical, Inc. (HRC) in 2015. In January 2014, Mr. Buckelew was selected to serve as Lead Director for Rural/Metro Corporation, a leading national provider of ambulance, safety services, and fire protection. He served in this role until the successful sale of the company to Envision Healthcare (EVHC) in 2015. In determining that Mr. Buckelew should continue to serve as a director, the Board noted that Mr. Buckelew has substantial experience in the healthcare services and products industry, having served in executive positions with several large healthcare services providers and medical products companies throughout most of his career, that he has relevant board experience with other healthcare companies and that his background and experience provide him with a firm understanding of our industry, business and operations.

8

Mr. Qisen Huang, born in 1965, has a BA degree in engineering. Mr. Huang has been the legal representative and executive director of Fujian Thai Hot Investment Co., Ltd since 1996. Prior to that, Mr. Huang worked at China Construction Bank, Fujian Branch. Mr. Huang has been a representative of the National Committee of the Chinese People’s Political Consultative Conference since February 2013. Mr. Huang is the vice president of the Fujian Chamber of Commerce, and director of Fujian Haixia Bank. Mr. Huang has been the chairman and general manager of Thai Hot Group since March 2013. Thai Hot Group is a public company listed on Shenzhen Stock Exchange, and is a subsidiary of Fujian Thai Hot Investment Co., Ltd. Given Mr. Huang’s substantial business and executive management experience in several industries, the Board determined that Mr. Huang should continue to serve as a director.

PERCY C. TOMLINSON

Percy C. Tomlinson joined us as Chief Executive Officer in October 2013. Prior to joining Alliance, Mr. Tomlinson served as the Chief Executive Officer for Midwest Dental, a leading US provider of dental care services, since September 2012. Previously, he spent 10 years with the Center for Diagnostic Imaging (CDI), a national network of imaging providers offering a full range of diagnostic imaging, pain management and interventional radiology services. At CDI, Mr. Tomlinson served as Chief Executive Officer from May 2011 until September 2012, as President, and Chief Operating Officer from 2005 to 2011, and as Senior Vice President and Chief Financial Officer from 2002 to 2005. Prior to joining CDI, Mr. Tomlinson spent approximately 17 years in primarily finance-related roles, including as Executive Vice President and Chief Financial Officer of Department 56, a publicly traded wholesale and retail consumer products company and President of Harmon Solutions Group, an insurance claim outsourcing company. In addition to his executive management experience, Mr. Tomlinson served as a director of Vertical Health Solutions, Inc. from April 2011 through November 2013. He currently serves on the Board of Forefront Dermatology, a private healthcare company. Mr. Tomlinson holds an M.B.A. from Columbia University and a B.A. from the University of St. Thomas. Given Mr. Tomlinson’s 25 years of diverse executive management and leadership experience spanning the healthcare, consumer products, insurance, and airline industries, the Board determined that Mr. Tomlinson should continue to serve as a director.

Alliance’s business is managed under the direction of our Board, which selects our officers, delegates responsibilities for the conduct of our operations to those officers and monitors their performance. Our non-management directors meet regularly in executive session without the presence of our management. The position of presiding director of these executive sessions is selected by a majority of the non-management directors present.

The Board does not have a policy with respect to whether the role of the Chairman and the Chief Executive Officer should be separate. However, pursuant to the terms of a Governance, Voting and Standstill Agreement (the “Governance Agreement”) that we entered into with Thai Hot in connection with the Thai Hot Transaction the contractual right exists for Thai Hot to appoint the Chairman so long as Thai Hot beneficially owns an aggregate of at least 35% of our outstanding shares. Mr. Buckelew currently serves as the Vice Chairman of the Board and Mr. Tomlinson currently serves as Chief Executive Officer. The Board has determined that this is the appropriate leadership structure for the company at this time because it permits our Chief Executive Officer to focus on setting the strategic direction of the company and the day-to-day leadership and performance of the company, while permitting the Chairman and Vice Chairman to focus on providing independent guidance to the Chief Executive Officer and setting the agenda for Board meetings. Our Board acknowledges that no single leadership model is right for all companies at all times. As such, our Board periodically reviews its leadership structure and may, depending on the circumstances, choose a different leadership structure in the future, in light of our obligations under the Governance Agreement.

9

Our Board has reviewed the independence of the members of our Board, in accordance with the guidelines set out in our Corporate Governance Guidelines (available at http://investors.alliancehealthcareservices-us.com/phoenix.zhtml?c=129994&p=irol-govhighlights) and applicable rules of The NASDAQ Stock Market LLC, or NASDAQ. As a result of the review, the Board has determined that each of Messrs. Bartos, Dimick, Feng, Samek and Viviano, and Dr. Zhang, qualifies as an independent director in accordance with NASDAQ rules.

Our Board meets four times a year in regularly scheduled meetings. It may meet more often if necessary. The Board held 16 meetings in the fiscal year ended December 31, 2015, referred to as fiscal 2015. During fiscal 2015, all directors attended 75% or more of the total of (a) all meetings of the Board and (b) all meetings of committees of the Board on which such directors served. In addition to the formal meetings noted above, the Board and the committees of the Board are consulted frequently and sometimes act by written consent taken without a meeting. Our directors are invited to attend our 2016 Annual Meeting. Mr. Buckelew, who served as Alliance’s Chairman at the time, attended and presided over our 2015 Annual Meeting.

Executive management, in consultation with the Board, usually determines the agenda for the meetings. Board members receive the agenda and supporting information in advance of the meetings. Board members may raise other matters at the meetings. The chief executive officer, chief financial officer, general counsel and other selected members of senior management make presentations to the Board at the meetings, and a substantial portion of the meeting time is devoted to the Board’s discussion of these presentations. Significant matters that require Board approval are voted on at the meetings. Board members have complete access to senior management.

Our Board has a standing Nominating and Corporate Governance Committee, Compensation Committee and Audit Committee. A current copy of the charter for each committee is available at http://investors.alliancehealthcareservices-us.com.

During 2015, the Board also established a Special Committee composed of the Company’s independent directors not affiliated with any Selling Stockholders, to review the Thai Hot Transaction on behalf of the Company and to negotiate any matters related to the Thai Hot Transaction with Thai Hot and the Selling Stockholders on behalf of the Company. The members of the Special Committee consisted of Messrs. Dimick, Samek and Viviano. The Special Committee held two in-person meetings and twenty-eight telephonic meetings during the fiscal year ended December 31, 2015.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is responsible for the identification of qualified candidates to become Board and Board committee members; the selection of nominees for election as directors at annual stockholders meetings; the selection of candidates to fill Board vacancies; the development and recommendation to the Board of our Corporate Governance Guidelines; and oversight of the evaluation of the Board and management. The Nominating and Corporate Governance Committee’s current members are Messrs. Samek (Chairman), Dimick, Feng, and Viviano and Dr. Zhang. The Nominating and Corporate Governance Committee was formed in April 2007 and met once in fiscal 2015.

The Nominating and Corporate Governance Committee is responsible for reviewing with the Board, on an annual basis, the appropriate characteristics, skills and experience required for the Board as a whole and its individual members. The Nominating and Corporate Governance Committee, in recommending candidates (both new candidates and current Board members) for election or appointment, and the Board, in approving such candidates, take into account many factors, including the ability to make analytical inquiries, representation of significant stockholders, general understanding of marketing, finance, and other elements relevant to the success of a publicly traded company in today’s business environment, experience in our industry and with relevant social policy concerns, understanding of our business on a technical level, maintaining a diversity of viewpoints among Board members, other board service and educational and professional background. Each candidate nominee must also possess fundamental qualities of intelligence, honesty, good judgment, high ethics and standards of integrity,

10

fairness and responsibility. The Board evaluates each individual in the context of the Board as a whole, with the objective of assembling a group that can best perpetuate the success of the business and represent stockholder interests through the exercise of sound judgment using its diversity of experience in these various areas. The Nominating and Corporate Governance Committee specifically takes into account the importance of diversity of background and perspective among Board members. This is reflected in the diverse business and personal experience of Alliance’s directors as described in more detail above. The Nominating and Corporate Governance Committee assesses the effectiveness of its approach toward maintaining and encouraging diversity on the Board through the annual Board self-assessment as well as on-going feedback from Board members on an informal basis. We do not have a formal diversity policy pertaining to the selection of directors.

Stockholders may nominate candidates for election to our Board in accordance with our bylaws, a copy of which can be obtained by writing to our Secretary at Alliance HealthCare Services, Inc., 100 Bayview Circle, Suite 400, Newport Beach, CA 92660. In general, those nominations must be received in writing by our Secretary not less than 90 days nor more than 120 days before the first anniversary of the preceding year’s annual meeting, as set forth in our bylaws. The nomination must be accompanied by the name and address of the nominating stockholder and must state the number and class of shares held. It must include information regarding each nominee that would be required to be included in a proxy statement. The Nominating and Corporate Governance Committee will give appropriate consideration to candidates for Board membership recommended by stockholders, and will evaluate those candidates in the same manner as other candidates identified by the Nominating and Corporate Governance Committee.

Compensation Committee

The Compensation Committee is responsible for discharging the Board’s responsibilities relating to compensation of our executives, including by designing (in consultation with management or the Board), recommending to the Board for approval and evaluating our compensation plans, policies and programs. As part of these responsibilities, the Compensation Committee determines executive base compensation and incentive compensation and approves the terms of stock option and restricted stock grants pursuant to our equity plan. The Compensation Committee is also responsible for producing an annual report on executive compensation for inclusion in our proxy materials. Under its charter, the Compensation Committee is entitled to delegate any or all of its responsibilities to a subcommittee of the Compensation Committee, except that it is not permitted to delegate its responsibilities with respect to determination of the Chief Executive Officer’s compensation; evaluation of the Chief Executive Officer’s performance; review of compensation, employment and severance agreements for all other executive officers; review of incentive-compensation and equity-based plans; compensation matters intended to comply with Section 162(m) of the Internal Revenue Code of 1986, as amended, referred to as the Code; or compensation matters intended to be exempt from Section 16(b) under the Securities Exchange Act of 1934, as amended, pursuant to Rule 16b-3 under that Act. The Compensation Committee’s current members are Messrs. Viviano (Chairman), Bartos, and Feng and Dr. Zhang. Mr. Samek served on the Compensation Committee during 2015. During fiscal 2015, the Compensation Committee held six meetings.

As described in the Compensation Discussion and Analysis, the Compensation Committee has directly engaged Mercer, LLC, a nationally recognized consulting firm dedicated to assisting clients with compensation plan design for executives, key employees and boards of directors, to work with the Compensation Committee to assist it in the determination of the key elements of our compensation programs. Mercer, LLC does not provide any other services to us.

After review and consultation with Mercer, LLC, the Compensation Committee has determined that there are no conflicts of interest raised by the work of Mercer, LLC currently nor were any conflicts of interest raised by the work performed during the year ended December 31, 2015. In reaching these conclusions, the Compensation Committee considered the factors set forth in applicable SEC and NASDAQ rules.

11

The Audit Committee, which is solely responsible for appointing our independent registered public accounting firm, is also responsible for assisting our Board with its oversight responsibilities regarding: the integrity of our financial statements; our compliance with legal and regulatory requirements; our independent registered public accounting firm’s qualifications and independence; and the performance of our internal audit function and independent registered public accounting firm. The current members of the Audit Committee are Messrs. Dimick (Chairman), Bartos and Samek, each of whom served on the committee throughout 2015. Our Board has determined that each current member of the Audit Committee meets the NASDAQ composition requirements, including the requirements regarding financial literacy and financial sophistication, and the Board has determined that each member is independent under NASDAQ listing standards and the rules of the SEC regarding audit committee membership. Our Board has also determined that Mr. Dimick is an “audit committee financial expert” within the meaning of SEC rules.

Our Corporate Governance Guidelines provide that the members of the Audit Committee may not serve on the audit committee of more than two other public companies at the same time as they are serving on our Audit Committee unless our Board determines that such simultaneous service would not impair the ability of such member to effectively serve on our Audit Committee. Mr. Dimick currently serves on the audit committees of four public companies, in addition to our Audit Committee. In light of Mr. Dimick’s other commitments, our Board has concluded that his service on those four audit committees would not impair his ability to effectively serve on our Audit Committee. During fiscal 2015, the Audit Committee held eight meetings. For additional information concerning the Audit Committee, see “Report of the Audit Committee of the Board of Directors.”

Hotline for Accounting or Auditing Matters

As part of the Audit Committee’s role to establish procedures for the receipt of complaints regarding accounting, internal accounting controls or auditing matters, the Audit Committee established a hotline for the receipt of complaints regarding our accounting, internal accounting controls or auditing matters and the confidential, anonymous submission by our employees or stockholders of concerns regarding questionable accounting or auditing matters. Employees or stockholders may call (800) 799-4605 to make anonymous submission of their concerns.

Shareholder Engagement

Stockholders and other parties interested in communicating directly with our Audit Committee, our independent directors as a group, our non-management directors as a group or our presiding director of the executive sessions of the non-management directors may do so by writing to our Secretary at Alliance HealthCare Services, Inc. 100 Bayview Circle, Suite 400, Newport Beach, CA 92660. Our Secretary will review all such correspondence and forward to the Board a summary of that correspondence and copies of any correspondence that, in his opinion, deals with the functions of the Board or its committees or that he otherwise determines requires their attention. Directors may at any time review a log of all correspondence received by Alliance that is addressed to members of the Board and request copies of any such correspondence. Any concerns relating to accounting, internal controls or auditing matters will be brought to the attention of our Audit Committee and handled in accordance with the procedures established by our Audit Committee with respect to those matters.

The Compensation Committee and the Board as a whole perform an ongoing oversight of our compensation practices in light of the risks in our operations. The oversight includes, among other things, a review of management’s decision-making and policy-making structures and practices; the methodology used to define, update and measure short-term and long-term objectives; the effectiveness and nature of communications within Alliance and between management and our Board and other stakeholders; and our compliance policies, practices and programs. In general, based upon this review, each of the Compensation Committee and the Board believes that our compensation practices do not provide undue incentives for short-term planning or short-term financial awards, and do not reward unreasonable risk. You can find a more detailed description of the risk factors associated with our business in the “Risk Factors” section of our annual report on Form 10-K for the year ended December 31, 2015.

12

As described in more detail below, the Compensation Committee and the Board believe that our compensation policies and practices encourage actions that increase the value of Alliance and are well aligned with our strategic objectives. Based on management’s ongoing assessment of our compensation practices, and our review and discussion of the same with the Compensation Committee, we believe that our compensation policies and practices do not present risks that are reasonably likely to have a material adverse effect on Alliance. In evaluating our compensation policies and practices, a number of factors were identified which Alliance and the Compensation Committee believe discourage excessive risk-taking, including:

|

|

· |

The base salaries we pay to our employees are fixed in amount, and thus the Compensation Committee and the Board do not believe that these base salaries encourage excessive risk-taking. |

|

|

· |

The Radiology Division has established separate bonus and commission plans for its sales, marketing and operations teams. For the sales team, commissions are tied to signing service agreements with new customers and renewing service agreements with existing customers. The longer the term of the agreement and the higher the value of the agreement, the larger the commission. Also, if actual revenues generated by a particular deal are lower than what was projected in the original business model for the deal, we adjust the total commissions to reflect actual performance. Marketing staff receive bonuses based on achievement of same store volume growth. Operations team leaders receive bonuses based on achievement of budgeted revenue, adjusted EBITDA and return on invested capital. Some operations team members also receive a transactional bonus based on customer renewals. |

|

|

· |

The Oncology Division has established separate bonus and commission plans for its business development, marketing and operations teams. For the business development team, we pay bonuses when new deals are signed, based on the value of the particular deal. Also, if actual revenues generated by a particular deal are lower than what was projected in the original business model for the deal, we adjust the total commissions to reflect actual performance. Marketing staff are paid bonuses based on achievement of same store volume growth. We pay the operations team leaders bonuses based on achievement of budgeted revenue, adjusted EBITDA and return on invested capital. Physicists and dosimetrists working for the Oncology Division have up to 80% of their bonuses tied to quality components such as equipment safety and appropriate staffing levels. The Compensation Committee and Board believe that the Radiology Division and Oncology Division bonus and commission plans appropriately balance risk and the desire to focus our employees on specific short-term goals important to our success, and do not encourage unnecessary or excessive risk-taking. |

|

|

· |

Several of our employees are awarded long-term equity-based incentives that are important to help further align those employees’ interests with those of our stockholders. The Compensation Committee and Board do not believe that these equity-based incentives encourage unnecessary or excessive risk taking because their ultimate value is tied to our stock price. |

The Board’s Role in Risk Oversight

The Board oversees an enterprise-wide approach to risk management, designed to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance and to enhance stockholder value. A fundamental part of the Board’s risk management oversight is not only understanding the risks we face and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for us. The involvement of the full Board in setting our business strategy is a key part of its assessment of management’s appetite for risk and also a determination of what constitutes an appropriate level of risk for us.

While the Board has the ultimate oversight responsibility for the risk management process, various committees of the Board also have responsibility for risk management. The Board has delegated risk management responsibility with respect to legal and regulatory compliance, including compliance with the Sarbanes-Oxley Act of 2002, to the Audit Committee. The Audit Committee oversees the implementation of our Compliance Program, Records Retention Policy and Sarbanes-Oxley compliance as well as other compliance policies. The Audit Committee has a particular focus on financial risk, including internal controls, and receives an annual risk assessment report from our internal auditors. The Board has delegated responsibility for our directors and officers insurance programs to the Compensation Committee. The Audit Committee and Compensation Committee regularly

13

report to the Board concerning risk management issues. Our Audit Committee assists the Board in fulfilling its oversight responsibility with respect to regulatory, healthcare compliance and public policy issues that affect us and works closely with our legal and regulatory groups. In addition, in setting compensation, the Compensation Committee strives to create incentives that encourage a level of risk-taking behavior consistent with our business strategy.

Fiscal 2015 Directors’ Compensation

Under our compensation program for non-employee directors we paid our non-employee directors an annual fee of $40,000 for their services as directors, payable in quarterly installments of $10,000 each. In addition, each non-employee director who was unaffiliated with Oaktree and MTS (other than Mr. Buckelew) received a restricted stock unit award on December 31, 2015, with the number of units calculated as $140,000, divided by the average share price of our Common Stock over the 15-day period preceding the grant date, rounded down to the nearest whole unit. Mr. Buckelew received a restricted stock unit award on December 31, 2015, with the number of units calculated as $102,500, divided by the closing share price of our Common Stock as of the grant date. These restricted stock unit awards will vest on December 31, 2016 if the director continues his service with us through that date. On December 31, 2015, each of Messrs. Bendikson, Harmon and Lane (the “Oaktree/MTS Directors”) received additional cash compensation of $140,000 for his Board service during 2015.

Our directors also received the following retainers for their service on committees of the Board of Directors and for serving as a chair of a committee for 2015:

|

Committee Chair Retainers |

|

|

|

|

|

Audit |

|

$ |

30,000 |

|

|

Compensation |

|

|

5,000 |

|

|

Nominating and Corporate Governance |

|

|

5,000 |

|

|

Committee Member Retainers |

|

|

|

|

|

Audit |

|

$ |

15,000 |

|

|

Compensation |

|

|

5,000 |

|

|

Nominating and Corporate Governance |

|

|

5,000 |

|

Messrs. Dimick, Samek and Viviano also received fees for service on a Special Committee of the Board of Directors, to consider matters in connection with the sale of shares by the Selling Shareholders, as described in note 2 of the table included under “Directors Compensation Table for Fiscal 2015.”

We entered into an offer letter with Mr. Buckelew effective June 1, 2012, providing for his service as our Interim Chief Executive Officer, which concluded on October 1, 2013, and Chairman of our Board. Under the offer letter, Mr. Buckelew is entitled to receive additional retainers for his service as Chairman of the Board. The combined amount of these retainers was $335,000 per year through October 1, 2015, paid $197,500 in cash and $137,500 in restricted stock units, and is $265,000 per year thereafter, paid $162,500 in cash and $102,500 in restricted stock units. Effective upon the closing of the Thai Hot Transaction, Mr. Buckelew was appointed Vice Chairman of the Board. On the recommendation of the Special Committee of the Board, the Board approved that Mr. Buckelew’s compensation for his services on the Board would remain unchanged through the end of 2016.

As in prior years, non-employee directors received reimbursement of travel expenses related to their Board service. We do not provide Mr. Tomlinson, who serves as our Chief Executive Officer, additional compensation for serving on the Board.

We have established a directors’ deferred compensation plan for all non-employee directors. No directors elected to participate in the directors’ deferred compensation plan in 2015, and only Mr. Dimick had an account balance under the directors’ deferred compensation plan as of December 31, 2015. Upon the closing of the Thai Hot Transaction, in accordance with the terms of the deferred compensation plan, Mr. Dimick’s phantom units were converted and settled for cash.

14

Directors Compensation Table for Fiscal 2015

The following table summarizes the compensation earned during the fiscal year ended December 31, 2015 by each of our non-employee directors.

|

Name |

|

Fees Earned or Paid in Cash ($)(1)(2) |

|

|

Stock Awards ($)(3)(4) |

|

|

Total ($) |

|

|||

|

Scott A. Bartos |

|

|

60,000 |

|

|

|

140,000 |

|

|

|

200,000 |

|

|

Aaron A. Bendikson |

|

|

190,000 |

|

|

|

— |

|

|

|

190,000 |

|

|

Larry C. Buckelew |

|

|

188,750 |

|

|

|

128,750 |

|

|

|

317,500 |

|

|

Neil F. Dimick |

|

|

123,000 |

|

|

|

140,000 |

|

|

|

263,000 |

|

|

Michael P. Harmon |

|

|

180,000 |

|

|

|

— |

|

|

|

180,000 |

|

|

Curtis S. Lane |

|

|

190,000 |

|

|

|

— |

|

|

|

190,000 |

|

|

Edward L. Samek |

|

|

105,000 |

|

|

|

140,000 |

|

|

|

245,000 |

|

|

Paul S. Viviano |

|

|

80,000 |

|

|

|

140,000 |

|

|

|

220,000 |

|

|

(1) |

Amounts in this column represent cash retainer fees paid during 2015. The annual fee paid to each of the Oaktree/MTS Directors for his services during 2015 was $40,000, which was paid in equal quarterly installments to an investment fund, not to the Oaktree/MTS Directors individually, as specified by each Oaktree/MTS Director. In addition, on December 31, 2015, in lieu of an annual restricted stock award, the Oaktree/MTS Directors each received additional cash compensation of $140,000 in consideration of his Board service during the year, which was paid to an investment fund, not to the Oaktree/MTS Directors individually, as specified by each Oaktree/MTS Director. |

|

(2) |

Amounts in this column for Messrs. Dimick, Samek and Viviano include fees paid for service on a Special Committee to the Board. The Board authorized payment to the Special Committee Directors, Messrs. Dimick (Chairman), Samek, and Viviano, $12,000, $10,000, and $10,000 monthly fees, respectively, $2,500 for each in-person meeting attended, and $1,000 for each telephonic meeting attended. |

|

(3) |

The amounts in this column are the aggregate grant date fair values computed in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718 (revised January 15, 2010), “Stock Compensation.” Assumptions made in the valuation of awards in the “Stock Awards” column can be found in Note 4 of the Consolidated Financial Statements in the company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, as amended, but exclude the impact of estimated forfeitures related to service-based vesting conditions. No stock or option awards were forfeited by any of our non-employee directors during fiscal 2015. |

|

(4) |

On December 31, 2015, each non-employee director other than Mr. Buckelew and the Oaktree/MTS Directors was automatically granted an award of 15,812 restricted stock units under our 2015 director compensation program. The grant date fair value of each of these awards was $140,000. On December 31, 2015, Mr. Buckelew was automatically granted an award of 11,165 restricted stock units under our 2015 director compensation program pursuant to the terms of his offer letter described above. The grant date fair value of this award was $102,500. In addition, as of December 31, 2015, each director had the following number of unvested restricted stock units: Mr. Bartos (15,812), Mr. Bendikson (0), Mr. Buckelew (11,165), Mr. Dimick (15,812), Mr. Harmon (0), Mr. Lane (0), Mr. Samek (15,812) and Mr. Viviano (15,812). Mr. Dimick also had 1,112 outstanding phantom shares in his account under our directors’ deferred compensation plan. Mr. Buckelew had 100,000 outstanding option awards as of December 31, 2015. No other non-employee director in the table above had any outstanding option awards as of December 31, 2015. Mr. Tomlinson had outstanding option awards as of December 31, 2015, but he is a named executive officer for 2015 and information regarding his 2015 compensation and outstanding awards is provided below in the “Executive Compensation” section. |

15

OWNERSHIP OF ALLIANCE COMMON STOCK

The following table sets forth certain information regarding beneficial ownership of the Common Stock as of April 15, 2016 by: (a) each person who is known by us to own beneficially more than 5% of our Common Stock; (b) each of our named executive officers (as defined in “Compensation Discussion and Analysis”); (c) by each of our directors and nominees for director; and (d) by all of our current executive officers and directors as a group. Unless otherwise indicated, the address of the person or entities shown in the table below is c/o Alliance HealthCare Services, Inc., 100 Bayview Circle, Suite 400, Newport Beach, CA 92660.

|

Name |

|

Common Stock Owned Beneficially(1) |

|

|

Percentage of Shares Beneficially Owned(1) |

|

||

|

Greater than 5% Stockholders: |

|

|

|

|

|

|

|

|

|

THAIHOT Investment Company Limited(2) |

|

|

5,537,945 |

|

|

|

51.7 |

% |

|

Renaissance Technologies LLC(3) |

|

|

637,260 |

|

|

|

5.9 |

% |

|

BlackRock, Inc(4) |

|

|

559,085 |

|

|

|

5.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

Named Executive Officers: (5) |

|

|

|

|

|

|

|

|

|

Percy C. Tomlinson |

|

|

75,962 |

|

|

* |

|

|

|

Howard K. Aihara |

|

|

84,483 |

|

|

* |

|

|

|

Rhonda Longmore-Grund |

|

|

— |

|

|

|

— |

|

|

Richard W. Johns |

|

|

76,966 |

|

|

* |

|

|

|

Richard A. Jones |

|

|

91,700 |

|

|

* |

|

|

|

Gregory E. Spurlock |

|

|

22,773 |

|

|

* |

|

|

|

Directors: |

|

|

|

|

|

|

|

|

|

Qisen Huang(2) |

|

|

5,537,945 |

|

|

|

51.7 |

% |

|

Scott A. Bartos |

|

|

8,796 |

|

|

* |

|

|

|

Larry C. Buckelew |

|

|

43,037 |

|

|

* |

|

|

|

Neil F. Dimick |

|

|

40,088 |

|

|

* |

|

|

|

Heping Feng |

|

|

— |

|

|

|

— |

|

|

Tao Zhang |

|

|

— |

|

|

|

— |

|

|

Edward L. Samek |

|

|

52,088 |

|

|

* |

|

|

|

Paul S. Viviano |

|

|

61,825 |

|

|

* |

|

|

|

All Current Executive Officers and Directors (13 persons)(6) |

|

|

6,011,180 |

|

|

|

54.8 |

% |

|

* |

Less than 1% |

|

(1) |

Except as otherwise indicated, the persons named in the table have sole voting and investment power with respect to the shares of Common Stock shown as beneficially owned by them and have an address in care of our principal office. Beneficial ownership as reported in the above table has been determined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, as amended. The percentages are based upon 10,716,884 shares outstanding as of April 15, 2016, except for certain persons who hold options that are presently exercisable or exercisable within 60 days of that date. The percentages for those parties who hold options that are presently exercisable or exercisable within 60 days of April 15, 2016 are based upon the sum of 10,716,884 shares outstanding plus the number of shares subject to options that are presently exercisable or exercisable within 60 days of April 15, 2016 held by them, as indicated in the following notes. |

|

(2) |

The amounts shown and the following information was provided by THAIHOT Investment Company Limited, Fujian Thai Hot Investment Co., Ltd and Mr. Qisen Huang pursuant to a Schedule 13D filed with the SEC on March 29, 2016 indicating beneficial ownership as of March 29, 2016 of 5,537,945 shares of our Common Stock. Fujian Thai Hot Investment Co., Ltd. Is an investment holding company and an affiliate of THAIHOT Investment Company Limited. Mr. Qisen Huang is the 95% shareholder and director of Fujian Thai Hot Investment Co., Ltd. and the sole director of THAIHOT Investment Company Limited. The address of THAIHOT Investment Company Limited, Fujian Thai Hot Investment Co., Ltd and Mr. Qisen Huang is: c/o Fujian Thai Hot Investment Co., Ltd, No. 43 Hudong Road, Olympic Building, Fuzhou City, Fujian Province, China 350003. |

16

|

(4) |

The amounts shown and the following information was provided by BlackRock, Inc. pursuant to a Schedule 13G filed with the SEC on January 25, 2016 indicating beneficial ownership of December 31, 2015 of 559,085 shares of our Common Stock. BlackRock, Inc. reports that it has sole voting power over 554,450 of these shares and sole dispositive power over 559,085 shares. The address of the principal business office of BlackRock, Inc. is 55 East 52nd Street, New York, New York 10055. |

|

(5) |

Includes shares of our Common Stock that may be acquired as of or within 60 days of April 15, 2016 through the exercise of stock options as follows: Mr. Tomlinson (75,962), Mr. Aihara (32,703), Ms. Longmore-Grund (0), Mr. Johns (76,966), Mr. Jones (75,642) and Mr. Spurlock (16,961). Also includes shares of our Common Stock that may be acquired within 60 days of April 15, 2016 through the vesting of restricted stock unit awards as follows: Mr. Tomlinson (0), Mr. Aihara (0), Ms. Longmore-Grund (0), Mr. Johns (0), Mr. Jones (0) and Mr. Spurlock (0). |

|

(6) |

This amount includes 245,531 shares issuable upon exercise of stock options that are exercisable as of or within 60 days after April 15, 2016, and includes 0 shares that may be acquired within 60 days after April 15, 2016 through the vesting of restricted stock unit awards. |

17

Compensation Discussion and Analysis

This section discusses the principles underlying our compensation policies for our executive officers who are named in the “Summary Compensation Table” below. Our “named executive officers” for 2015, who we refer to as our “executives” or “executive officers” in this section are:

|

|

· |

Percy C. Tomlinson, President and Chief Executive Officer (CEO); |

|

|

· |

Howard K. Aihara, former Executive Vice President and Chief Financial Officer (CFO); |

|

|

· |

Richard W. Johns, Chief Operating Officer and Chief Legal Officer; |

|

|

· |

Richard A. Jones, President, Alliance Radiology Division; and |

|

|

· |

Gregory E. Spurlock, President, Alliance Oncology Division and International Business. |

Mr. Aihara ceased serving as the Company’s Executive Vice President and Chief Financial Officer effective as of March 10, 2016.