Form 8-K/A Manitex International, For: Jan 15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of the earliest event reported) January 15, 2015

MANITEX INTERNATIONAL, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Michigan | 001-32401 | 42-1628978 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 9725 Industrial Drive, Bridgeview, Illinois | 60455 | |||

| (Address of Principal Executive Offices) | (Zip Code) | |||

(708) 430-7500

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Explanatory Note

This Amendment No. 1 on Form 8-K/A amends and supplements the Current Report on Form 8-K of Manitex International, Inc. a Michigan corporation (the “Registrant”), filed with the Securities and Exchange Commission (the “Commission”) on January 21, 2015 (the “Initial Form 8-K”) to include financial statements and pro forma financial information permitted pursuant to Item 9.01 of Form 8-K to be excluded from the Initial Form 8-K and filed by amendment to the Initial Form 8-K no later than 71 days after the date on which the Initial Form 8-K was required to be filed. As previously reported in the Initial Form 8-K, effective as of January 15, 2015 the Registrant completed the purchase of PM Group on January 15, 2015.

| Item 9.01 | Financial Statement Exhibits |

| (a) | Financial Statement of Business Acquired |

Audited financial statements of the PM Group for the year ended December 31, 2013 that include audited statements of financial position as of December 31, 2013 and 2012, and consolidated statements of income, consolidated statements of comprehensive income, statements of changes in equity and statements of cash flows for each of the years ended December 31, 2013, 2012 and 2011 and the related Independent Auditors Report thereon are included as Exhibit 99.1 to this Current Report on Form 8-K/A and are incorporated herein by reference.

Unaudited interim financial statements of PM Group for the nine month period ended September 30, 2014 that include unaudited condensed consolidated statements of financial position as of September 30, 2014 and December 31, 2013 and condensed consolidated unaudited statements of income, unaudited condensed consolidated statements of comprehensive income, unaudited condensed consolidated statements of changes in equity and unaudited statements of cash flows for the nine month periods ended September 30, 2014 and 2013 are included as Exhibit 99.2 to this Current Report on Form 8-K/A and are incorporated herein by reference.

| (b) | Pro Forma Financial Information |

The Unaudited Pro Forma Condensed Consolidated Statement of Income for the year ended December 31, 2013, the Unaudited Pro Forma Condensed Consolidated Balance Sheet as of September 30, 2014, the Unaudited Pro Forma Condensed Consolidated Statement of Income for the nine month period ended September 30, 2014, and the notes to the Unaudited Pro Forma Condensed Consolidated Financial Information of Manitex are included as Exhibit 99.3 to this Current Report on Form 8-K/A and are incorporated herein by reference.

| (c) | Exhibit Index |

| 23.1 | Consent of Deloitte & Touche S.p.A. | |

| 99.1 | Audited financial statements of PM Group for the year ended December 31, 2013 | |

| 99.2 | Unaudited interim financial statements of PM Group for the nine month period ended September 30, 2014 | |

| 99.3 | Unaudited Pro Forma Condensed Consolidated Statement of Income for the year ended December 31, 2013, Unaudited Pro Forma Condensed Consolidated Balance Sheet as of September 30, 2014, Unaudited Pro Forma Condensed Consolidated Statement of Income for the nine month period ended September 30, 2014, and the notes to the Unaudited Pro Forma Condensed Consolidated Financial Information of Manitex International, Inc. | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: March 26, 2015

| MANITEX INTERNATIONAL, INC. | ||

| By: | /s/ DAVID H. GRANSEE | |

| Name: | David H. Gransee | |

| Title: | Vice President & Chief Financial Officer | |

EXHIBIT INDEX

| Exhibit Number |

Description | |

| 23.1 | Consent of Deloitte & Touche S.p.A. | |

| 99.1 | Audited financial statements of PM Group for the year ended December 31, 2013 | |

| 99.2 | Unaudited interim financial statements of PM Group for the nine month period ended September 30, 2014 | |

| 99.3 | Unaudited Pro Forma Condensed Consolidated Statement of Income for the year ended December 31, 2013, Unaudited Pro Forma Condensed Consolidated Balance Sheet as of September 30, 2014, Unaudited Pro Forma Condensed Consolidated Statement of Income for the nine month period ended September 30, 2014, and the notes to the Unaudited Pro Forma Condensed Consolidated Financial Information of Manitex International, Inc. | |

Exhibit 23.1

CONSENT OF INDEPENDENT AUDITORS

We consent to the incorporation by reference in Registration Statement Nos. 333-191881 and 333-202103 on Form S-3 and No. 333-126978 on Form S-8 of our report dated December 1, 2014, relating to the financial statements of PM Group S.p.A. included in this Current Report on Form 8-K/A.

/s/ Deloitte & Touche S.p.A.

Milan, Italy

March 26, 2015

Exhibit 99.1

ANNUAL REPORT AT DECEMBER 31, 2013

GROUP CONSOLIDATED FINANCIAL STATEMENTS

PM GROUP

1

|

Deloitte & Touche S.p.A. Piazza Malpighi 4/2 40123 Bologna Italia Tel +39 051 65811 Fax +39 051 230874 www.deloitte.it |

INDEPENDENT AUDITORS’ REPORT

To the Board of Directors of

PM Group S.p.A.

We have audited the accompanying consolidated financial statements of PM Group S.p.A. and its subsidiaries (the “Group”) which comprise the consolidated statement of financial position as of December 31, 2013 and 2012, and the consolidated statements of income, comprehensive income, changes in equity and cash flows for each of the three years in the period ended December 31, 2013, and the related notes to the consolidated financial statements.

Management’s Responsibility for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

Auditors’ Responsibility

Our responsibility is to express an opinion on these consolidated financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the Group’s preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Group’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of PM Group S.p.A. and its subsidiaries as of December 31, 2013 and 2012, and the results of their operations and their cash flows for each of the three years in the period ended December 31, 2013, in accordance with the International Financial Reporting Standards as issued by the International Accounting Standards Board.

/s/ Deloitte & Touche S.p.A.

Bologna, Italy

December 1, 2014

2

Consolidated Statement of Financial Position

| (in Euro) |

31/12/2013 | 31/12/2012 | ||||||||

| NON-CURRENT ASSETS |

||||||||||

| Tangible assets |

(1) | 19,256,205 | 24,730,071 | |||||||

| Goodwill |

(2) | 33,192,959 | 68,142,670 | |||||||

| Other intangible assets |

(3) | 3,715,926 | 6,740,592 | |||||||

| Investments in other entities |

1,560 | 3,952 | ||||||||

| Deferred tax assets |

(4) | 5,703,493 | 8,055,179 | |||||||

| Other non-current assets |

(5) | 161,832 | 298,531 | |||||||

|

|

|

|

|

|||||||

| Total non-current assets |

62,031,975 | 107,970,995 | ||||||||

|

|

|

|

|

|||||||

| CURRENT ASSETS |

||||||||||

| Inventory |

(6) | 13,851,167 | 30,999,477 | |||||||

| Trade receivables |

(7) | 28,521,700 | 31,900,571 | |||||||

| Current tax receivables |

(8) | 2,066,842 | 2,469,100 | |||||||

| Dividends receivable |

300,000 | 0 | ||||||||

| Cash and cash equivalents |

(9) | 2,220,199 | 2,217,357 | |||||||

| Other current assets |

(10) | 1,570,414 | 1,282,425 | |||||||

|

|

|

|

|

|||||||

| Total current assets |

48,530,322 | 68,868,930 | ||||||||

|

|

|

|

|

|||||||

| Assets held for sale |

(32) | 44,640,884 | 0 | |||||||

|

|

|

|

|

|||||||

| TOTAL ASSETS |

155,203,181 | 176,839,925 | ||||||||

|

|

|

|

|

|||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

||||||||||

| Share capital |

23,311,420 | 23,311,420 | ||||||||

| Reserves |

-34,324 | -185,602 | ||||||||

| Accumulated deficit |

-49,299,634 | -12,360,095 | ||||||||

| Shareholders’ equity - Group |

-26,022,538 | 10,765,723 | ||||||||

| Capital and reserves of non-controlling interests |

905,756 | 957,823 | ||||||||

| Net profit (loss) attributable to non-controlling interests |

29,961 | -31,573 | ||||||||

| Shareholders’ equity attributable to non-controlling interests |

935,717 | 926,250 | ||||||||

|

|

|

|

|

|||||||

| TOTAL SHAREHOLDERS’ EQUITY |

(11) | -25,086,821 | 11,691,973 | |||||||

|

|

|

|

|

|||||||

| NON-CURRENT LIABILITIES |

||||||||||

| Non-current financial payables |

(12) | 1,137,551 | 19,041,611 | |||||||

| Employee benefits |

(13) | 1,413,558 | 2,640,541 | |||||||

| Provisions for risks and charges |

(14) | 1,437,325 | 1,091,403 | |||||||

| Deferred tax liabilities |

(15) | 3,038,312 | 2,883,045 | |||||||

|

|

|

|

|

|||||||

| Total non-current liabilities |

7,026,746 | 25,656,600 | ||||||||

|

|

|

|

|

|||||||

| CURRENT LIABILITIES |

||||||||||

| Current financial payables |

(16) | 100,162,961 | 102,583,464 | |||||||

| Liabilities for financial instruments and derivatives |

(17) | 2,141,069 | 3,140,057 | |||||||

| Current tax payables |

(18) | 1,624,037 | 2,102,781 | |||||||

| Current trade payables |

(19) | 22,131,036 | 25,238,003 | |||||||

| Other current liabilities |

(20) | 4,498,986 | 6,427,047 | |||||||

|

|

|

|

|

|||||||

| Total current liabilities |

130,558,089 | 139,491,352 | ||||||||

|

|

|

|

|

|||||||

| Liabilities held for sale |

(32) | 42,705,167 | 0 | |||||||

|

|

|

|

|

|||||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

155,203,181 | 176,839,925 | ||||||||

|

|

|

|

|

|||||||

PM GROUP

4

Consolidated Statement of income

| (in Euro) |

31/12/2013 | 31/12/2012 | 31/12/2011 | |||||||||||

| Revenue from operating activities |

(21) | 78,599,391 | 89,499,575 | 77,456,904 | ||||||||||

| Other revenue and income |

(22) | 1,813,681 | 2,089,834 | 1,672,182 | ||||||||||

| Change in inventories or finished goods and work in progress |

-3,729,115 | -939,667 | 678,906 | |||||||||||

| Increase in non-current assets due to capitalisation of internal costs |

(23) | 2,028,908 | 2,288,470 | 2,123,202 | ||||||||||

| Cost of raw material |

(24) | -39,324,976 | -46,406,557 | -38,953,219 | ||||||||||

| Services |

(25) | -12,862,803 | -18,570,751 | -18,812,548 | ||||||||||

| Personnel |

(26) | -17,921,205 | -16,497,431 | -16,061,409 | ||||||||||

| Other operating expenses |

(27) | -2,532,914 | -2,799,310 | -2,718,078 | ||||||||||

| Depreciation and amortisation |

(28) | -3,048,540 | -3,505,865 | -3,429,054 | ||||||||||

| Impairment of goodwill and development costs |

(28) | -18,057,240 | 0 | 0 | ||||||||||

| Provisions |

(29) | -1,567,575 | -1,120,276 | -1,626,687 | ||||||||||

|

|

|

|

|

|

|

|||||||||

| Operating profit /(loss) |

-16,602,388 | 4,038,022 | 330,199 | |||||||||||

|

|

|

|

|

|

|

|||||||||

| Financial income and exchange gains |

(30) | 1,724,164 | 1,171,385 | 741,674 | ||||||||||

| Financial expenses and exchange losses |

(30) | -6,634,041 | -8,203,773 | -7,290,800 | ||||||||||

|

|

|

|

|

|

|

|||||||||

| Loss before taxation |

-21,512,265 | -2,994,366 | -6,218,927 | |||||||||||

|

|

|

|

|

|

|

|||||||||

| Taxes on income |

(31) | -980,858 | -526,165 | 319,986 | ||||||||||

|

|

|

|

|

|

|

|||||||||

| Net Loss from contiunuing operations |

-22,493,123 | -3,520,531 | -5,898,941 | |||||||||||

|

|

|

|

|

|

|

|||||||||

| Profit (Loss) from discontinued operations |

(32) | -14,467,773 | 931,037 | 312,388 | ||||||||||

|

|

|

|

|

|

|

|||||||||

| Net Loss for the period |

-36,960,896 | -2,589,494 | -5,586,553 | |||||||||||

|

|

|

|

|

|

|

|||||||||

| Profit (Loss) attributable to non-controlling interests |

29,961 | -31,573 | -18,925 | |||||||||||

|

|

|

|

|

|

|

|||||||||

| Net Loss attributable to the Group |

-36,990,857 | -2,557,921 | -5,567,628 | |||||||||||

|

|

|

|

|

|

|

|||||||||

PM GROUP

5

Consolidated statement of comprehensive income

| (in Euro) |

31/12/2013 | 31/12/2012 | 31/12/2011 | |||||||||

| Net Loss for the period (A) |

(36,960,896 | ) | (2,589,494 | ) | (5,586,553 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Gains/(losses) from translation into Euro of financial statements of foreign entities |

168,800 | (116,578 | ) | (70,398 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Total other items of comprehensive income that will be recycled through the income statement, net of tax effect (b1) |

168,800 | (116,578 | ) | (70,398 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Actuarial gains/(losses) from defined benefit plans |

(17,435 | ) | 0 | 0 | ||||||||

|

|

|

|

|

|

|

|||||||

| Total other items of comprehensive income that will not subsequently be recycled through the income statement, net of tax effect (b2) |

(17,435 | ) | 0 | 0 | ||||||||

|

|

|

|

|

|

|

|||||||

| Total other items of comprehensive income, net of tax effect (b1) + (b2) = (B) |

151,365 | (116,578 | ) | (70,398 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Total comprehensive (loss) for the period (A)+(B) |

(36,809,531 | ) | (2,706,072 | ) | (5,656,951 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total comprehensive income (loss) attributable to non-controlling interests |

29,961 | (35,884 | ) | (21,675 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| TOTAL COMPREHENSIVE (LOSS) ATTRIBUTABLE TO THE GROUP |

(36,839,492 | ) | (2,670,188 | ) | (5,635,276 | ) | ||||||

|

|

|

|

|

|

|

|||||||

PM GROUP

6

Consolidated Statement of changes in equity

| (in Euro) |

Share capital |

Reserve for additional paid-in capital |

Translation reserve |

Reserve under IAS 19 |

Total reserves |

Accumulated Deficit |

Shareholders’ equity - Group |

Capital and reserves of non- controlling interests |

Profit/ (Loss) attributable to non- controlling interests |

Shareholders’ equity of non- controlling interests |

TOTAL SHAREHOLDERS’ EQUITY |

|||||||||||||||||||||||||||||||||

| Shareholders’ equity at 1/1/2011 |

17,811,420 | 3,281,863 | (5,774 | ) | 3,276,089 | (4,234,459 | ) | 16,853,050 | 990,265 | (6,456 | ) | 983,809 | 17,836,859 | |||||||||||||||||||||||||||||||

| Share capital increase |

5,500,000 | (3,281,863 | ) | (3,281,863 | ) | 2,218,137 | 2,218,137 | |||||||||||||||||||||||||||||||||||||

| Movement on translation reserve |

(67,648 | ) | (67,648 | ) | (67,648 | ) | (2,750 | ) | (2,750 | ) | (70,398 | ) | ||||||||||||||||||||||||||||||||

| Loss for year ended December 31, 2011 |

0 | (5,567,628 | ) | (5,567,628 | ) | (18,925 | ) | (18,925 | ) | (5,586,553 | ) | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Shareholders’ equity at 31/12/2011 |

23,311,420 | 0 | (73,422 | ) | 0 | (73,422 | ) | (9,802,087 | ) | 13,435,911 | 987,515 | (25,381 | ) | 962,134 | 14,398,045 | |||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Movement on translation reserve |

(112,267 | ) | (112,267 | ) | (112,267 | ) | (4,311 | ) | (4,311 | ) | (116,578 | ) | ||||||||||||||||||||||||||||||||

| Loss for year ended December 31, 2012 |

0 | (2,557,921 | ) | (2,557,921 | ) | (31,573 | ) | (31,573 | ) | (2,589,494 | ) | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Shareholders’ equity at 31/12/2012 |

23,311,420 | 0 | (185,689 | ) | 0 | (185,689 | ) | (12,360,008 | ) | 10,765,723 | 983,204 | (56,954 | ) | 926,250 | 11,691,973 | |||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Movement on translation reserve |

168,800 | 168,800 | 168,800 | 0 | 168,800 | |||||||||||||||||||||||||||||||||||||||

| Movement on IAS 19 reserve |

(17,435 | ) | (17,435 | ) | (17,435 | ) | 0 | (17,435 | ) | |||||||||||||||||||||||||||||||||||

| Effect of Acquisition of 41% of Air Service |

0 | 0 | (13,494 | ) | (13,494 | ) | (13,494 | ) | ||||||||||||||||||||||||||||||||||||

| Effect of share capital increase PM Argentina |

0 | 7,000 | 7,000 | (7,000 | ) | (7,000 | ) | 0 | ||||||||||||||||||||||||||||||||||||

| Other movements |

0 | 44,231 | 44,231 | 0 | 44,231 | |||||||||||||||||||||||||||||||||||||||

| Profit (Loss) for year ended December 31, 2013 |

0 | (36,990,857 | ) | (36,990,857 | ) | 29,961 | 29,961 | (36,960,896 | ) | |||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Shareholders’ equity at 31/12/2013 |

23,311,420 | 0 | (16,889 | ) | (17,435 | ) | (34,324 | ) | (49,299,634 | ) | (26,022,538 | ) | 962,710 | (26,993 | ) | 935,717 | (25,086,821 | ) | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

PM GROUP

7

Consolidated Statement of cash flows

| (in Euro) |

2013 | 2012 | 2011 | |||||||||

| Cash flows generated by operating activities |

||||||||||||

| Net Loss for the period |

(36,960,896 | ) | (2,589,494 | ) | (5,586,553 | ) | ||||||

| Adjustments made in order to reconciile net loss with the cash flows generated by operating activities |

||||||||||||

| - Depreciation and amortization |

4,260,362 | 4,736,000 | 4,609,807 | |||||||||

| - Impairment |

31,161,078 | 0 | 0 | |||||||||

| - Deferred tax/Deferred tax income |

1,358,668 | (517,350 | ) | (505,299 | ) | |||||||

| - Income and expenses on derivatives |

(891,250 | ) | 699,108 | 856,722 | ||||||||

| - Financial income recognized in Statement of Income |

(832,914 | ) | (1,171,385 | ) | (741,674 | ) | ||||||

| - Finance costs recognised in Statement of Income |

6,634,041 | 7,504,665 | 6,434,078 | |||||||||

| - Change in Employee Severance Indemnity Provision and other employee benefits |

(147,157 | ) | 156,835 | (196,349 | ) | |||||||

| Operating profit before changes in working capital |

4,581,932 | 8,818,379 | 4,870,732 | |||||||||

| Effect of changes in assets and liabilities in net working capital |

||||||||||||

| - Trade receivables |

(13,403,851 | ) | 1,544,207 | (1,759,298 | ) | |||||||

| - Inventory |

4,540,514 | 8,734,411 | (8,883,337 | ) | ||||||||

| - Other current assets |

(197,938 | ) | 472,449 | (669,455 | ) | |||||||

| - Trade payables |

7,271,301 | (8,480,233 | ) | 7,449,004 | ||||||||

| - Other current liabilities |

775,744 | (6,530,114 | ) | 5,474,122 | ||||||||

| - Tax receivables |

(624,357 | ) | (251,491 | ) | (252,590 | ) | ||||||

| - Tax payables |

213,148 | 1,532,111 | 217,617 | |||||||||

| - Taxes paid during the period |

(430,618 | ) | (561,151 | ) | (247,717 | ) | ||||||

| - Other non current assets |

16,488 | (27,751 | ) | 4,406 | ||||||||

| - Provisions for risks and charges |

1,743,204 | 82,669 | (143,290 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| Cash generated by operating activities (A) |

4,485,567 | 5,333,486 | 6,060,194 | |||||||||

|

|

|

|

|

|

|

|||||||

| Cash flows generated (absorbed) by investing activities |

||||||||||||

| - Payments for property, plant and equipment |

(1,046,042 | ) | (1,625,351 | ) | (1,355,838 | ) | ||||||

| - Proceeds from disposal of property, plant and equipment |

184,603 | 205,710 | 193,468 | |||||||||

| - Payments for intangible assets |

(2,716,892 | ) | (2,758,025 | ) | (2,403,850 | ) | ||||||

| - Interest received |

3,948 | 11,059 | 54,083 | |||||||||

| - Proceeds on sale of financial assets |

413 | 0 | 0 | |||||||||

|

|

|

|

|

|

|

|||||||

| Change in cash absorbed by investing activities (B) |

(3,573,971 | ) | (4,166,607 | ) | (3,512,137 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Cash flows generated by operating activities after cash flows absorbed by investing activities (A-B) |

911,596 | 1,166,879 | 2,548,057 | |||||||||

|

|

|

|

|

|

|

|||||||

| Cash flows (absorbed) generated by financing activities |

||||||||||||

| Short term financial payables and derivatives arranged (repaid) |

2,778,715 | 3,761,876 | 1,673,646 | |||||||||

| Medium/long term financial payables and derivatives arranged (repaid) |

1,419,965 | (3,160,896 | ) | (1,621,996 | ) | |||||||

| Interest paid |

(5,237,304 | ) | (5,870,815 | ) | (4,391,006 | ) | ||||||

| Share capital increase and reserves paid in cash |

30,737 | 0 | 2,218,137 | |||||||||

|

|

|

|

|

|

|

|||||||

| Change in cash absorbed by financing activities |

(1,007,887 | ) | (5,269,835 | ) | (2,121,219 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Movement on translation reserve |

168,800 | (116,578 | ) | (70,398 | ) | |||||||

| Reclassification of assets held for sale |

(69,668 | ) | 0 | 0 | ||||||||

| Increase (decrease) in cash and cash equivalents |

2,842 | (4,219,534 | ) | 356,440 | ||||||||

|

|

|

|

|

|

|

|||||||

| Cash and cash equivalents at start of period |

2,217,357 | 6,436,891 | 6,080,451 | |||||||||

|

|

|

|

|

|

|

|||||||

| Cash and cash equivalents at end of period |

2,220,199 | 2,217,357 | 6,436,891 | |||||||||

|

|

|

|

|

|

|

|||||||

PM GROUP

8

EXPLANATORY NOTES

General information

PM Group S.p.A. (the “Parent Company” or “Company” or “PM”) is a company which is subject to the laws of the Italian Republic. PM Group S.p.A. and its subsidiaries (“PM Group” or “Group”) operate primarily in Italy, France, Spain, Chile, Romania, Argentina and the United States of America. The Group manufactures: (i) truck mounted hydraulic knuckle boom cranes (“Business Unit PM”), (ii) truck mounted aerial platforms (“Business Unit Oil & Steel”) and (iii) production, sale and rental of building structure, like scaffolding, formworks for walls and slabs (“Business Unit Pilosio”).

Structure and content of the consolidated financial statements

The group consolidated financial statements to which these explanatory notes relate (hereinafter: the “Group Consolidated Financial Statements”) include: (i) the statements of income, comprehensive income, changes in equity and cash flows for the years ended December 31, 2011, 2012 and 2013 and (ii) the statements of financial position as of December 31, 2012 and 2013. The Group Consolidated Financial Statements have been drawn up in accordance with the International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). The designation “IFRS” also includes all valid International Accounting Standards (“IAS”), as well as all interpretations of the IFRS Interpretation Committee, previously known as the International Financial Reporting Interpretations Committee (“IFRIC”), and before that the Standing Interpretations Committee (“SIC”). The financial statements were authorized and approved on December 1, 2014, by Board of Directors. This basis of preparation was considered best to represent the balance sheet, income statement and financial situation of the Company and the Group:

| • | Statement of financial position prepared with current assets/liabilities classified separately from non-current assets/liabilities; |

| • | Statement of income costs classified based on their nature; |

| • | Statement of cash flows prepared under the indirect method. |

PM GROUP

9

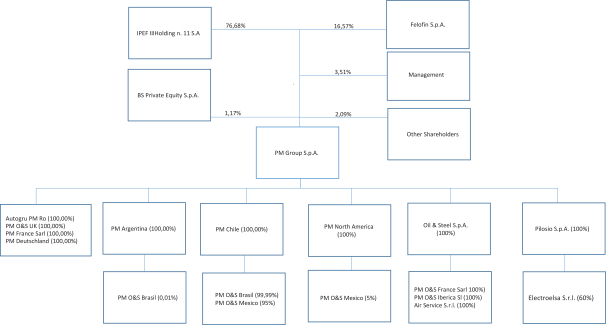

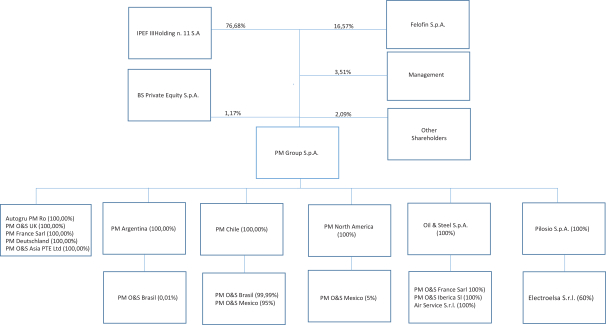

Group organizational structure

The chart below shows the Group’s organizational structure as at December 31, 2013:

Significant Accounting Policies

Basis of preparation

These consolidated financial statements have been prepared in Euro which is the main currency in the countries where the PM Group companies conduct their business.

The amounts reported in the consolidated financial statements are stated in Euro.

The consolidated financial statements have been prepared on the historical cost basis except for certain properties and financial instruments that are measured at revalued amounts or fair values at the end of each reporting period, as explained in the accounting policies below.

Historical cost is generally based on the fair value of the consideration given in exchange for goods and services.

PM GROUP

10

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date, regardless of whether that price is directly observable or estimated using another valuation technique. In estimating the fair value of an asset or a liability, the Group takes into account the characteristics of the asset or liability if market participants would take those characteristics into account when pricing the asset or liability at the measurement date. Fair value for measurement and/or disclosure purposes in these consolidated financial statements is determined on such a basis, except for share-based payment transactions that are within the scope of IFRS 2, leasing transactions that are within the scope of IAS 17, and measurements that have some similarities to fair value but are not fair value, such as net realisable value in IAS 2 or value in use in IAS 36.

Basis of consolidation

The consolidated financial statements incorporate the financial statements of the Group and entities (including structured entities) controlled by the Company and its subsidiaries. Control is achieved when the Company:

| • | has power over the investee; |

| • | is exposed, or has rights, to variable returns from its involvement with the investee; and |

| • | has the ability to use its power to affect its returns. |

The Company reassesses whether or not it controls an investee if facts and circumstances indicate that there are changes to one or more of the three elements of control listed above.

Consolidation of a subsidiary begins when the Company obtains control over the subsidiary and ceases when the Company loses control of the subsidiary. Specifically, income and expenses of a subsidiary acquired or disposed of during the year are included in the consolidated statement of profit or loss and other comprehensive income from the date the Company gains control until the date when the Company ceases to control the subsidiary.

Profit or loss and each component of other comprehensive income are attributed to the owners of the Company and to the non-controlling interests. Total comprehensive income of subsidiaries is attributed to the owners of the Company and to the non-controlling interests even if this results in the non-controlling interests having a deficit balance.

When necessary, adjustments are made to the financial statements of subsidiaries to bring their accounting policies into line with the Group’s accounting policies.

All intragroup assets and liabilities, equity, income, expenses and cash flows relating to transactions between members of the Group are eliminated in full on consolidation.

Companies which PM Group controls directly or indirectly are consolidated on a line-by-line basis. This involves including all assets and liabilities in their entirety from the date when control was acquired until the date when it ends. Control may be exercised through a direct or indirect holding of a majority of shares with voting rights or through a dominant influence expressed by the power to determine, also indirectly under contractual or legal agreements, the financial and operational decisions of the entity, while obtaining the related benefits, even without any share ownership relationship. The presence of potential voting rights exercisable at the reporting date is considered for the purposes of determining control.

PM GROUP

11

The main consolidation principles adopted when applying the line-by-line consolidation method are as follows:

| - | subsidiaries are consolidated from the date on which control is effectively transferred to the Group and cease to be consolidated from the date on which control is transferred out of the Group; |

| - | if necessary, adjustments are made to the financial statements of subsidiaries in order to bring the accounting principles used into line with those adopted by the Group; |

| - | the assets and liabilities, income and expenses of companies consolidated under the line-by-line method are included in full in the consolidated financial statements. The carrying amount of the investments is eliminated against the corresponding portion of equity of the consolidated companies while attributing to each asset and liability item its fair value at the date of acquisition of control (acquisition method as defined by IFRS 3 “Business combinations”). Any residual positive difference is recorded under “Goodwill” while any residual negative difference is recorded in the income statement. |

| - | Receivable and payable, revenue and cost balances between consolidated companies and the effects of all significant transactions between them are eliminated; |

| - | The portions of shareholders’ equity and the net profit/loss for the period attributable to non-controlling interests are disclosed separately under shareholders’ equity and in the consolidated income statement; |

| - | Subsidiaries consolidated on a line-by-line basis but held for sale are classified in accordance with IFRS 5. Therefore, once consolidated on a line-by-line basis, the related assets are classified under a single caption “Assets held for sale”, the liabilities are classified under a single caption “Liabilities held for sale” and the result for the period is classified in the income statement under a single caption “Profit or loss from discontinued operations” |

Foreign currencies

In preparing the financial statements of each individual group entity, transactions in currencies other than the entity’s functional currency (foreign currencies) are recognised at the rates of exchange prevailing at the dates of the transactions. At the end of each reporting period, monetary items denominated in foreign currencies are retranslated at the rates prevailing at that date. Non-monetary items carried at fair value that are denominated in foreign currencies are retranslated at the rates prevailing at the date when the fair value was determined. Non-monetary items that are measured in terms of historical cost in a foreign currency are not retranslated.

Exchange differences on monetary items are recognised in profit or loss in the period in which they arise.

For the purposes of presenting these consolidated financial statements, the assets and liabilities of the Group’s foreign operations are translated into Euros using exchange rates prevailing at the end of each reporting period. Income and expense items are translated at the average exchange rates for the period, unless exchange rates fluctuate significantly during that period, in which case the exchange rates at the dates of the transactions are used. Exchange differences arising, if any, are recognised in other comprehensive income and accumulated in equity (and attributed to non-controlling interests as appropriate).

On the disposal of a foreign operation (i.e. a disposal of the Group’s entire interest in a foreign operation, or a disposal involving loss of control over a subsidiary that includes a foreign operation, or a partial disposal of an interest in a joint arrangement or an associate that includes a foreign operation of which the retained interest becomes a financial asset), all of the exchange differences accumulated in equity in respect of that operation attributable to the owners of the Company are reclassified to profit or loss.

In addition, in relation to a partial disposal of a subsidiary that includes a foreign operation that does not result in the Group losing control over the subsidiary, the proportionate share of accumulated exchange

PM GROUP

12

differences are re-attributed to non-controlling interests and are not recognised in profit or loss. For all other partial disposals (i.e. partial disposals of associates or joint arrangements that do not result in the Group losing significant influence or joint control), the proportionate share of the accumulated exchange differences is reclassified to profit or loss.

Goodwill and fair value adjustments to identifiable assets acquired and liabilities assumed through acquisition of a foreign operation are treated as assets and liabilities of the foreign operation and translated at the rate of exchange prevailing at the end of each reporting period. Exchange differences arising are recognised in other comprehensive income.

Financial statements expressed in currencies other than the Euro are translated into Euro applying the rules indicated above. The exchange rates applied for 2013 are shown below:

| 2011 |

||||||||

| Currency |

Closing | Average | ||||||

| US Dollar |

1.29 | 1.39 | ||||||

| Romanian Lei |

4.32 | 4.24 | ||||||

| GB Pound |

0.84 | 0.87 | ||||||

| Chilean Peso |

672.00 | 672.47 | ||||||

| Argentinean Peso |

5.57 | 5.74 | ||||||

| 2012 |

||||||||

| Currency |

Closing | Average | ||||||

| US Dollar |

1.32 | 1.29 | ||||||

| Romanian Lei |

4.44 | 4.46 | ||||||

| GB Pound |

0.82 | 0.81 | ||||||

| Chilean Peso |

631.73 | 625.07 | ||||||

| Argentinean Peso |

6.49 | 5.85 | ||||||

| 2013 |

||||||||

| Currency |

Closing | Average | ||||||

| US Dollar |

1.38 | 1.33 | ||||||

| Romanian Lei |

4.47 | 4.42 | ||||||

| GB Pound |

0.83 | 0.85 | ||||||

| Chilean Peso |

724.77 | 658.27 | ||||||

| Argentinean Peso |

8.99 | 7.28 | ||||||

| Brazilian Real |

3.26 | 2.87 | ||||||

| Mexican Peso |

18.07 | 16.96 | ||||||

The separate financial statements which have been consolidated have a December 31 reporting date i.e. the same as the consolidated financial statements and are those specifically prepared and approved by the Boards of Directors of the individual companies, as adjusted, where necessary, to bring them into line with the accounting principles of the holding company.

A full list of the investments included in the scope of consolidation at December 31, 2013 with details of shareholders’ equity and profit/loss for the period calculated in accordance with the applicable accounting standards (some subsidiaries prepared their separate financial statements at December 31, 2013 in accordance with Italian or foreign statutory reporting principles but prepared consolidated reporting packages for the PM consolidation process in accordance with IFRS) is shown in the following table:

PM GROUP

13

Consolidated companies:

| Name |

Location |

Country |

Share Capital (local currency/000) |

Shareholders’ equity (Euro/000) |

Including profit (loss) for 2013 (Euro/000) |

% interest held |

||||||||||||

| 1 |

PM Group | San Cesario sul Panaro | Italy | EUR | 23,311 | (26,478) | (40,371) | |||||||||||

| 2 |

Autogru PM RO | Arad | Romania | RON | 8,482 | 2,163 | 1 | 100.00 | % | |||||||||

| 3 |

PM North America | Rolling Meadows, Ill | USA | USD | 25 | 104 | 1 | 100.00 | % | |||||||||

| 4 |

PM France | Chassieu | France | EUR | 150 | (368) | (6) | 100.00 | % | |||||||||

| 5 |

PM Argentina | Buenos Aires | Argentina | ARS | 60 | 252 | (1,072) | 100.00 | % | |||||||||

| 6 |

PM Deutschland | Ulm | Germany | EUR | 25 | 32 | 2 | 100.00 | % | |||||||||

| 7 |

PM Chile | Santiago | Chile | CLP | 19,742 | (149) | (385) | 100.00 | % | |||||||||

| 8 |

Oil & Steel | San Cesario sul Panaro | Italy | EUR | 362 | (5,611) | (8,112) | 100.00 | % | |||||||||

| 9 |

PM Oil & Steel UK | London | UK | GBP | 300 | (10) | 0 | 100.00 | % | |||||||||

| 10 |

PM Oil & Steel France | Chassieu | France | EUR | 35 | (137) | (126) | 100.00 | % | |||||||||

| 11 |

PM Oil & Steel Iberica | Valencia | Spain | EUR | 200 | 103 | (102) | 100.00 | % | |||||||||

| 12 |

Air Service | Modena | Italy | EUR | 115 | 77 | (38) | 100.00 | % | |||||||||

| 13 |

Pilosio | Feletto Umberto | Italy | EUR | 5,000 | 1,186 | (8,485) | 100.00 | % | |||||||||

| 14 |

Electroelsa | Poggibonsi | Italy | EUR | 400 | 2,216 | 61 | 60.00 | % | |||||||||

| 15 |

PM Oil & Steel do Brasil | Sao Paulo | Brazil | BRL | 600 | 177 | (7) | 100.00 | % | |||||||||

| 16 |

PM Oil & Steel Mexico | Mexico City | Mexico | MXN | 350 | 14 | (5) | 100.00 | % | |||||||||

All Group companies are consolidated on a line-by-line basis.

At December 31, 2013, changes to the scope of consolidation or to the percentage interests held in subsidiaries compared to December 31, 2012 were as follows.

| - | PM Argentina: following a share issue (Euro 1,000 thousand) wholly subscribed by PM Group, the percentage interest held by PM Group increased from 95% to 100 % |

| - | PM Oil & Steel was incorporated on January 31, 2013 and is owned by PM Chile (99.99%) and PM Argentina (0.01%) |

| - | PM Oil & Steel Mexico was incorporated on November 13, 2013 and is owned by PM Chile (95%) and PM North America (5%) |

These changes did not have any significant effect on the 2013 consolidated financial statements.

Going Concern

In the year ended December 31, 2013, the Group incurred losses totaling Euro 36,991 thousand which reduced its shareholders’ equity to Euro (26,023) thousand. The losses were primarily due to impairment charges recognized on goodwill and development cost assets as described in more detail in note 2. At December 31, 2013, financial payables amounted to Euro 101,300 thousand compared to Euro 95,826 at December 31, 2012, excluding the financial payables of the Pilosio S.p.A (“Pilosio BU”). As a consequence of the financial results, the Group was not in compliance with covenants set out in the loan agreements as of December 31, 2013. The Group failed to make principal repayments due on certain loans payable outstanding at December 31, 2013, and starting in July 2013 failed to make payments on interest accruing on the senior loan payable. This resulted in the Group defaulting on its loans payable to the creditor banks totaling Euro 78,921 thousand at December 31, 2013. Consequently, the balance in default has been reclassified to current financial payables in the consolidated financial statements.

In 2014, management finalized an operation (“the Operation”) intended to restructure the financial indebtedness of the Group and restore the equity level. The Operation was to be implemented in accordance with Article 182 bis of the Bankruptcy Act. When the new business plan was being finalized, two entities - Manitex International Inc. (“Manitex” or “the Investor”) and Columna Holdings Limited (the company wholly controlling the parent company of PM Group - “Columna”) submitted to the Company and the creditor banks certain proposals to invest in the Company and its subsidiary Pilosio S.p.A. Following the negotiations between Manitex, Columna and the creditor banks, the Operation was finalized on July 2014.

PM GROUP

14

The main terms of the Operation are as follows:

| • | Increase the net equity of the PM Group by Euro 44.5 million through a capital contribution of Euro 12 million cash and the acquisition of Euro 32.5 million of outstanding principal loans payable balance from the credit banks by Manitex. Subsequent to the capital contribution, Manitex will own 100% of the shares of PM Group; |

| • | Modification of the repayment terms of the remaining outstanding principal balance of approximately Euro 32.5 million through an extension of the maturity date, and covenants on terms more favorable to Group.; |

| • | Restructuring the financial position of Oil & Steel S.p.A (“Oil & Steel) through PM Group’s purchase of Oil & Steel’s loans payable balance from the creditor banks totaling approximately Euro 6,077 thousand at a purchase price corresponding to 15% of the outstanding balance. This amount foregone by the creditor banks would lead to a further reduction of the Group’s outstanding loans payable by approximately Euro 5.1 million; |

| • | A further purchase of Euro 5,000 thousand of the outstanding loan payable through a put and call option agreement between Manitex and the creditor bank. The agreement will be settled based on a purchase price to be determined from the consolidated financial statements of the PM Group at December 31, 2017; |

| • | Additional loan of Euro 1,500 thousand granted by existing creditor banks to Oil & Steel S.p.A.; |

| • | Repayment of a portion of the loans payable balance totaling Euro 5,250 thousand by PM Group when the Debt Restructuring Agreement becomes effective; |

| • | The sale of Pilosio for a price of Euro 1,000 to a company owned by Columna, and therefore associated company of the current majority shareholder of PM group, and therefore, a related party. |

The above terms have been included in Commitment Letters signed by Columna and Manitex respectively on July 16, 2014 and July 17, 2014 as well as in the PM Group and Oil & Steel Debt Restructuring Agreement signed by the creditor banks in July 2014. Both the Commitment Letters and the PM Group and Oil & Steel Debt Restructuring Agreement (collectively the “Agreement”) are subject to certain conditions, the most significant of which is the definitive approval by the competent Courts of the Agreement with respect to Article 182 bis of the Bankruptcy Act, signed by PM Group, Oil & Steel and the creditor banks. On November 18, 2014, the Courts in Modena have approved the Agreement.

In view of the expected impact of the Operation and taking into account the difficult conditions in some of its main markets, the Group has prepared a new Business Plan for the period 2014 – 2017 which was approved by the holding company Board of Directors on June 10, 2014. Both the new business plan and the Operation provide that, before Manitex is offered the option to subscribe to the share capital increase, the current shareholders must be offered the chance to subscribe a share capital increase also for Euro 44,500 thousand.

Regardless of whether the share capital increase is subscribed to by the current shareholders or by Manitex, the new Business Plan forecasts sufficient cash flows to meet the Group’s remaining obligations following the completion of the Operation.

The situation outlined above - specifically: i) the Group’s current negative shareholders’ equity and precarious financial situation; ii) issues and uncertainty regarding the economic environment; iii) the resulting uncertainty which inevitably affects the forecasts reflected in the Business Plan in relation to the Group’s future operating performance (in terms of both revenue and profitability); iv) the fact that the Operation has not yet been completed – confirms the existence of uncertainty that could cast doubts over the Group’s ability to continue to operate as a going concern. Nonetheless, after evaluating the uncertainties described above, given the state of progress of the Operation and the fact that the Courts in Modena have approved the Agreement in terms of Article 182 bis of the Bankruptcy Act signed by PM Group, Oil & Steel and the

PM GROUP

15

creditor banks, management considers it probable that the Operation will have a positive outcome in the near future and, consequently, that the Group’s economics and financial situation will be improved. For these reasons, management reasonably believes that the Group has sufficient resources to continue to operate in the near future and have, therefore, prepared these consolidated financial statements on a going concern basis.

Note that failure to complete the Operation would undermine the going concern assumption and require the Group to follow the procedures provided for by law when dealing with business failure. This would result in changes to the valuation criteria applied to a number of assets and liabilities, in particular to tangible and intangible assets and deferred tax assets, which ultimately could result in significant writedowns.

Changes in the Group’s ownership interests in existing subsidiaries

Changes in the Group’s ownership interests in subsidiaries that do not result in the Group losing control over the subsidiaries are accounted for as equity transactions. The carrying amounts of the Group’s interests and the non-controlling interests are adjusted to reflect the changes in their relative interests in the subsidiaries. Any difference between the amount by which the non-controlling interests are adjusted and the fair value of the consideration paid or received is recognised directly in equity and attributed to owners of the Company.

When the Group loses control of a subsidiary, a gain or loss is recognised in profit or loss and is calculated as the difference between (i) the aggregate of the fair value of the consideration received and the fair value of any retained interest and (ii) the previous carrying amount of the assets (including goodwill), and liabilities of the subsidiary and any non-controlling interests. All amounts previously recognised in other comprehensive income in relation to that subsidiary are accounted for as if the Group had directly disposed of the related assets or liabilities of the subsidiary (i.e. reclassified to profit or loss or transferred to another category of equity as specified/permitted by applicable IFRSs). The fair value of any investment retained in the former subsidiary at the date when control is lost is regarded as the fair value on initial recognition for subsequent accounting under IAS 39, when applicable, the cost on initial recognition of an investment in an associate or a joint venture.

Business combinations

Acquisitions of businesses are accounted for using the acquisition method. The consideration transferred in a business combination is measured at fair value, which is calculated as the sum of the acquisition-date fair values of the assets transferred by the Group, liabilities incurred by the Group to the former owners of the acquiree and the equity interests issued by the Group in exchange for control of the acquiree. Acquisition-related costs are generally recognised in profit or loss as incurred.

At the acquisition date, the identifiable assets acquired and the liabilities assumed are recognised at their fair value, except that:

| • | deferred tax assets or liabilities, and assets or liabilities related to employee benefit arrangements are recognised and measured in accordance with IAS 12 Income Taxes and IAS 19 respectively; |

| • | assets (or disposal groups) that are classified as held for sale in accordance with IFRS 5 Non-current Assets Held for Sale and Discontinued Operations are measured in accordance with that Standard. |

Goodwill is measured as the excess of the sum of the consideration transferred, the amount of any non-controlling interests in the acquiree, and the fair value of the acquirer’s previously held equity interest in the acquiree (if any) over the net of the acquisition-date amounts of the identifiable assets acquired and the liabilities assumed. If, after reassessment, the net of the acquisition-date amounts of the identifiable assets acquired and liabilities assumed exceeds the sum of the consideration transferred, the amount of any non-controlling interests in the acquiree and the fair value of the acquirer’s previously held interest in the acquiree (if any), the excess is recognised immediately in profit or loss as a bargain purchase gain.

PM GROUP

16

Non-controlling interests that are present ownership interests and entitle their holders to a proportionate share of the entity’s net assets in the event of liquidation may be initially measured either at fair value or at the non-controlling interests’ proportionate share of the recognised amounts of the acquiree’s identifiable net assets. The choice of measurement basis is made on a transaction-by-transaction basis. Other types of non-controlling interests are measured at fair value or, when applicable, on the basis specified in another IFRS.

When the consideration transferred by the Group in a business combination includes assets or liabilities resulting from a contingent consideration arrangement, the contingent consideration is measured at its acquisition-date fair value and included as part of the consideration transferred in a business combination. Changes in the fair value of the contingent consideration that qualify as measurement period adjustments are adjusted retrospectively, with corresponding adjustments against goodwill. Measurement period adjustments are adjustments that arise from additional information obtained during the ‘measurement period’ (which cannot exceed one year from the acquisition date) about facts and circumstances that existed at the acquisition date.

The subsequent accounting for changes in the fair value of the contingent consideration that do not qualify as measurement period adjustments depends on how the contingent consideration is classified. Contingent consideration that is classified as equity is not remeasured at subsequent reporting dates and its subsequent settlement is accounted for within equity. Contingent consideration that is classified as an asset or a liability is remeasured at subsequent reporting dates in accordance with IAS 39, or IAS 37 Provisions, Contingent Liabilities and Contingent Assets, as appropriate, with the corresponding gain or loss being recognised in profit or loss.

When a business combination is achieved in stages, the Group’s previously held equity interest in the acquiree is remeasured to its acquisition-date fair value and the resulting gain or loss, if any, is recognised in profit or loss. Amounts arising from interests in the acquiree prior to the acquisition date that have previously been recognised in other comprehensive income are reclassified to profit or loss where such treatment would be appropriate if that interest were disposed of.

If the initial accounting for a business combination is incomplete by the end of the reporting period in which the combination occurs, the Group reports provisional amounts for the items for which the accounting is incomplete. Those provisional amounts are adjusted during the measurement period (see above), or additional assets or liabilities are recognised, to reflect new information obtained about facts and circumstances that existed at the acquisition date that, if known, would have affected the amounts recognised at that date.

Goodwill

Goodwill arising on an acquisition of a business is carried at cost as established at the date of acquisition of the business (see note above) less accumulated impairment losses, if any.

For the purposes of impairment testing, goodwill is allocated to each of the Group’s cash-generating units (or groups of cash-generating units) that is expected to benefit from the synergies of the combination.

A cash-generating unit to which goodwill has been allocated is tested for impairment annually, or more frequently when there is an indication that the unit may be impaired. If the recoverable amount of the cash-generating unit is less than its carrying amount, the impairment loss is allocated first to reduce the carrying amount of any goodwill allocated to the unit and then to the other assets of the unit pro rata based on the carrying amount of each asset in the unit. Any impairment loss for goodwill is recognised directly in profit or loss. An impairment loss recognised for goodwill is not reversed in subsequent periods.

PM GROUP

17

On disposal of the relevant cash-generating unit, the attributable amount of goodwill is included in the determination of the profit or loss on disposal.

Non-current assets held for sale

Non-current assets and disposal groups are classified as held for sale if their carrying amount will be recovered principally through a sale transaction rather than through continuing use. This condition is regarded as met only when the asset (or disposal group) is available for immediate sale in its present condition subject only to terms that are usual and customary for sales of such asset (or disposal group) and its sale is highly probable. Management must be committed to the sale, which should be expected to qualify for recognition as a completed sale within one year from the date of classification.

When the Group is committed to a sale plan involving loss of control of a subsidiary, all of the assets and liabilities of that subsidiary are classified as held for sale when the criteria described above are met, regardless of whether the Group will retain a non-controlling interest in its former subsidiary after the sale.

Non-current assets (and disposal groups) classified as held for sale are measured at the lower of their previous carrying amount and fair value less costs to sell.

Revenue recognition

Revenue is measured at the fair value of the consideration received or receivable. Revenue is reduced for estimated customer returns, rebates and other similar allowances.

Sale of goods

Revenue from the sale of goods is recognised when the goods are delivered and title has passed, at which time all the following conditions are satisfied:

| • | the Group has transferred to the buyer the significant risks and rewards of ownership of the goods; |

| • | the Group retains neither continuing managerial involvement to the degree usually associated with ownership nor effective control over the goods sold; |

| • | the amount of revenue can be measured reliably; |

| • | it is probable that the economic benefits associated with the transaction will flow to the Group; and |

| • | the costs incurred or to be incurred in respect of the transaction can be measured reliably. |

Rendering of services

Revenue from a contract to provide services is recognised by reference to the stage of completion of the contract. The stage of completion of the contract is determined as follows:

| • | installation fees are recognised by reference to the stage of completion of the installation, determined as the proportion of the total time expected to install that has elapsed at the end of the reporting period; |

PM GROUP

18

| • | servicing fees included in the price of products sold are recognised by reference to the proportion of the total cost of providing the servicing for the product sold; and |

| • | revenue from time and material contracts is recognised at the contractual rates as labour hours and direct expenses are incurred. |

Dividend and interest income

Dividend income from investments is recognised when the shareholder’s right to receive payment has been established (provided that it is probable that the economic benefits will flow to the Group and the amount of income can be measured reliably).

Interest income from a financial asset is recognised when it is probable that the economic benefits will flow to the Group and the amount of income can be measured reliably. Interest income is accrued on a time basis, by reference to the principal outstanding and at the effective interest rate applicable, which is the rate that exactly discounts estimated future cash receipts through the expected life of the financial asset to that asset’s net carrying amount on initial recognition.

Leasing

Leases are classified as finance leases whenever the terms of the lease transfer substantially all the risks and rewards of ownership to the lessee. All other leases are classified as operating leases.

Assets held under finance leases are initially recognised as assets of the Group at their fair value at the inception of the lease or, if lower, at the present value of the minimum lease payments. The corresponding liability to the lessor is included in the consolidated statement of financial position as a finance lease obligation.

Lease payments are apportioned between finance expenses and reduction of the lease obligation so as to achieve a constant rate of interest on the remaining balance of the liability. Finance expenses are recognised immediately in profit or loss, unless they are directly attributable to qualifying assets, in which case they are capitalised in accordance with the Group’s general policy on borrowing costs. Contingent rentals are recognised as expenses in the periods in which they are incurred.

Operating lease payments are recognised as an expense on a straight-line basis over the lease term, except where another systematic basis is more representative of the time pattern in which economic benefits from the leased asset are consumed. Contingent rentals arising under operating leases are recognised as an expense in the period in which they are incurred.

In the event that lease incentives are received to enter into operating leases, such incentives are recognised as a liability. The aggregate benefit of incentives is recognised as a reduction of rental expense on a straight-line basis, except where another systematic basis is more representative of the time pattern in which economic benefits from the leased asset are consumed.

Borrowing costs

Borrowing costs directly attributable to the acquisition, construction or production of qualifying assets, which are assets that necessarily take a substantial period of time to get ready for their intended use or sale, are added to the cost of those assets, until such time as the assets are substantially ready for their intended use or sale.

PM GROUP

19

Investment income earned on the temporary investment of specific borrowings pending their expenditure on qualifying assets is deducted from the borrowing costs eligible for capitalisation.

All other borrowing costs are recognised in profit or loss in the period in which they are incurred.

Retirement benefit costs and termination benefits

Payments to defined contribution retirement benefit plans are recognised as an expense when employees have rendered service entitling them to the contributions.

For defined benefit retirement benefit plans, the cost of providing benefits is determined using the projected unit credit method, with actuarial valuations being carried out at the end of each annual reporting period. Remeasurement, comprising actuarial gains and losses, the effect of the changes to the asset ceiling (if applicable) and the return on plan assets (excluding interest), is reflected immediately in the statement of financial position with a charge or credit recognised in other comprehensive income in the period in which they occur. Remeasurement recognised in other comprehensive income is reflected immediately in retained earnings and will not be reclassified to profit or loss. Past service cost is recognised in profit or loss in the period of a plan amendment. Net interest is calculated by applying the discount rate at the beginning of the period to the net defined benefit liability or asset. Defined benefit costs are categorised as follows:

| • | service cost (including current service cost, past service cost, as well as gains and losses on curtailments and settlements); |

| • | net interest expense or income; and |

| • | remeasurement. |

The Group presents the first two components of defined benefit costs in profit or loss in the line item personel. Curtailment gains and losses are accounted for as past service costs.

The retirement benefit obligation recognised in the consolidated statement of financial position represents the actual deficit or surplus in the Group’s defined benefit plans. Any surplus resulting from this calculation is limited to the present value of any economic benefits available in the form of refunds from the plans or reductions in future contributions to the plans.

A liability for a termination benefit is recognised at the earlier of when the entity can no longer withdraw the offer of the termination benefit and when the entity recognises any related restructuring costs.

Taxation

Income tax expense represents the sum of the tax currently payable and deferred tax.

Current tax

The tax currently payable is based on taxable profit for the year. Taxable profit differs from ‘profit before tax’ as reported in the consolidated statement of income because of items of income or expense that are taxable or deductible in other years and items that are never taxable or deductible. The Group’s current tax is calculated using tax rates that have been enacted or substantively enacted by the end of the reporting period.

PM GROUP

20

Deferred tax

Deferred tax is recognised on temporary differences between the carrying amounts of assets and liabilities in the consolidated financial statements and the corresponding tax bases used in the computation of taxable profit. Deferred tax liabilities are generally recognised for all taxable temporary differences. Deferred tax assets are generally recognised for all deductible temporary differences to the extent that it is probable that taxable profits will be available against which those deductible temporary differences can be utilised. Such deferred tax assets and liabilities are not recognised if the temporary difference arises from the initial recognition (other than in a business combination) of assets and liabilities in a transaction that affects neither the taxable profit nor the accounting profit. In addition, deferred tax liabilities are not recognised if the temporary difference arises from the initial recognition of goodwill.

The carrying amount of deferred tax assets is reviewed at the end of each reporting period and reduced to the extent that it is no longer probable that sufficient taxable profits will be available to allow all or part of the asset to be recovered.

Deferred tax liabilities and assets are measured at the tax rates that are expected to apply in the period in which the liability is settled or the asset realised, based on tax rates (and tax laws) that have been enacted or substantively enacted by the end of the reporting period.

The measurement of deferred tax liabilities and assets reflects the tax consequences that would follow from the manner in which the Group expects, at the end of the reporting period, to recover or settle the carrying amount of its assets and liabilities.

Current and deferred tax for the year

Current and deferred tax are recognised in profit or loss, except when they relate to items that are recognised in other comprehensive income or directly in equity, in which case, the current and deferred tax are also recognised in other comprehensive income or directly in equity respectively. Where current tax or deferred tax arises from the initial accounting for a business combination, the tax effect is included in the accounting for the business combination.

Property, plant and equipment

Tangible assets are stated in the consolidated statement of financial position at acquisition or production cost, less any subsequent accumulated depreciation and subsequent accumulated impairment losses.

Assets under construction are carried at cost, less any recognised impairment loss. Cost includes professional fees and, for qualifying assets, borrowing costs capitalised in accordance with the Group’s accounting policy. Such properties are classified to the appropriate categories of property, plant and equipment when completed and ready for intended use. Depreciation of these assets, on the same basis as other property assets, commences when the assets are ready for their intended use.

Freehold land is not depreciated.

Depreciation is recognised so as to write off the cost or valuation of assets (other than freehold land and properties under construction) less their residual values over their useful lives, using the straight-line method as follows:

| Depreciation rate | ||

| Buildings |

3% | |

| Plant and machinery |

10 – 15.5% | |

| Industrial and commercial equipment |

25% | |

| Other tangible assets |

10 – 25% |

PM GROUP

21

The estimated useful lives, residual values and depreciation method are reviewed at the end of each reporting period, with the effect of any changes in estimate accounted for on a prospective basis.

Assets held under finance leases are depreciated over their expected useful lives on the same basis as owned assets. However, when there is no reasonable certainty that ownership will be obtained by the end of the lease term, assets are depreciated over the shorter of the lease term and their useful lives.

An item of property, plant and equipment is derecognised upon disposal or when no future economic benefits are expected to arise from the continued use of the asset. Any gain or loss arising on the disposal or retirement of an item of property, plant and equipment is determined as the difference between the sales proceeds and the carrying amount of the asset and is recognised in profit or loss.

Intangible assets

Intangible assets acquired separately

Intangible assets with finite useful lives that are acquired separately are carried at cost less accumulated amortisation and accumulated impairment losses. Amortisation is recognised on a straight-line basis over their estimated useful lives, as follows:

| Depreciation rate | ||||

| Development costs |

20 | % | ||

| Patents and intellectual property rights |

20 | % | ||

| Concessions, licenses, trademarks |

20 | % | ||

The estimated useful life and amortisation method are reviewed at the end of each reporting period, with the effect of any changes in estimate being accounted for on a prospective basis. Intangible assets with indefinite useful lives that are acquired separately are carried at cost less accumulated impairment losses.

Internally-generated intangible assets - research and development expenditure

Expenditure on research activities is recognised as an expense in the period in which it is incurred.

An internally-generated intangible asset arising from development (or from the development phase of an internal project) is recognised if, and only if, all of the following have been demonstrated:

| • | the technical feasibility of completing the intangible asset so that it will be available for use or sale; |

| • | the intention to complete the intangible asset and use or sell it; |

| • | the ability to use or sell the intangible asset; |

| • | how the intangible asset will generate probable future economic benefits; |

PM GROUP

22

| • | the availability of adequate technical, financial and other resources to complete the development and to use or sell the intangible asset; and |

| • | the ability to measure reliably the expenditure attributable to the intangible asset during its development. |

The amount initially recognised for internally-generated intangible assets is the sum of the expenditure incurred from the date when the intangible asset first meets the recognition criteria listed above. Where no internally-generated intangible asset can be recognised, development expenditure is recognised in profit or loss in the period in which it is incurred.

Subsequent to initial recognition, internally-generated intangible assets are reported at cost less accumulated amortisation and accumulated impairment losses, on the same basis as intangible assets that are acquired separately.

Derecognition of intangible assets

An intangible asset is derecognised on disposal, or when no future economic benefits are expected from use or disposal. Gains or losses arising from derecognition of an intangible asset, measured as the difference between the net disposal proceeds and the carrying amount of the asset, are recognised in profit or loss when the asset is derecognised.

Impairment of tangible and intangible assets other than goodwill

At the end of each reporting period, the Group reviews the carrying amounts of its tangible and intangible assets to determine whether there is any indication that those assets have suffered an impairment loss. If any such indication exists, the recoverable amount of the asset is estimated in order to determine the extent of the impairment loss (if any). When it is not possible to estimate the recoverable amount of an individual asset, the Group estimates the recoverable amount of the cash-generating unit to which the asset belongs. When a reasonable and consistent basis of allocation can be identified, corporate assets are also allocated to individual cash-generating units, or otherwise they are allocated to the smallest group of cash-generating units for which a reasonable and consistent allocation basis can be identified.

Intangible assets with indefinite useful lives and intangible assets not yet available for use are tested for impairment at least annually, and whenever there is an indication that the asset may be impaired.

Recoverable amount is the higher of fair value less costs to sell and value in use. In assessing value in use, the estimated future cash flows are discounted to their present value using a pre-tax discount rate that reflects current market assessments of the time value of money and the risks specific to the asset for which the estimates of future cash flows have not been adjusted.

If the recoverable amount of an asset (or cash-generating unit) is estimated to be less than its carrying amount, the carrying amount of the asset (or cash-generating unit) is reduced to its recoverable amount. An impairment loss is recognised immediately in profit or loss.

Inventories

Inventories are stated at the lower of cost and net realisable value. Costs of inventories are determined on a first-in-first-out basis. Net realisable value represents the estimated selling price for inventories less all estimated costs of completion and costs necessary to make the sale.

PM GROUP

23

Provisions

Provisions are recognised when the Group has a present obligation (legal or constructive) as a result of a past event, it is probable that the Group will be required to settle the obligation, and a reliable estimate can be made of the amount of the obligation.

The amount recognised as a provision is the best estimate of the consideration required to settle the present obligation at the end of the reporting period, taking into account the risks and uncertainties surrounding the obligation. When a provision is measured using the cash flows estimated to settle the present obligation, its carrying amount is the present value of those cash flows (when the effect of the time value of money is material).

When some or all of the economic benefits required to settle a provision are expected to be recovered from a third party, a receivable is recognised as an asset if it is virtually certain that reimbursement will be received and the amount of the receivable can be measured reliably.

Restructurings

A restructuring provision is recognised when the Group has developed a detailed formal plan for the restructuring and has raised a valid expectation in those affected that it will carry out the restructuring by starting to implement the plan or announcing its main features to those affected by it. The measurement of a restructuring provision includes only the direct expenditures arising from the restructuring, which are those amounts that are both necessarily entailed by the restructuring and not associated with the ongoing activities of the entity.

Warranties