Form 8-K/A Jazz Pharmaceuticals For: May 27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

Amendment No. 1

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 27, 2016

JAZZ PHARMACEUTICALS PUBLIC LIMITED COMPANY

(Exact name of registrant as specified in its charter)

| Ireland | 001-33500 | 98-1032470 | ||

| (State or other jurisdiction of incorporation) |

(Commission File No.) |

(IRS Employer Identification No.) |

Fourth Floor, Connaught House, One Burlington Road, Dublin 4, Ireland

(Address of principal executive offices)

Registrant’s telephone number, including area code: 011-353-1-634-7800

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Explanatory Note

The information in this Current Report on Form 8-K/A amends material previously filed with the Securities and Exchange Commission (the “SEC”).

Item 7.01 Regulation FD Disclosure.

Jazz Pharmaceuticals plc (“Parent”) is furnishing, as Exhibit 99.2 to this Current Report on Form 8-K/A, a revised investor presentation, dated May 31, 2016 (the “Investor Presentation”), that was initially attached as Exhibit 99.2 to Parent’s Current Report on Form 8-K, dated May 31, 2016 (the “Original Filing”). The Investor Presentation attached as Exhibit 99.2 to the Original Filing contained certain errors on slide 24 of the Investor Presentation. The sole purpose of this Current Report on Form 8-K/A is to provide the revised Investor Presentation, which has been revised to provide the corrected slide 24. No other changes have been made to the Original Filing. The Investor Presentation related to the Agreement and Plan of Merger entered into on May 27, 2016 (the “Merger Agreement”), by and among Parent, Plex Merger Sub, Inc., a Delaware corporation and an indirect wholly-owned subsidiary of Parent (“Purchaser”), and Celator Pharmaceuticals, Inc., a Delaware corporation (the “Target”), pursuant to which Parent, through Purchaser, will commence a cash tender offer (the “Offer”) to acquire all of the outstanding shares of the Target’s common stock, par value $0.001 per share, for $30.25 per share net to the seller in cash, without interest, on the terms and subject to the conditions set forth in the Merger Agreement.

The information in this Item 7.01 and in Exhibit 99.2 to this Current Report on Form 8-K/A shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this Item 7.01 and in Exhibit 99.2 to this Current Report on Form 8-K/A shall not be incorporated by reference into any filing with the SEC made by Parent whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Additional Information

The Offer has not yet commenced, and this communication is neither an offer to purchase nor a solicitation of an offer to sell any shares of the common stock of the Target or any other securities. On the commencement date of the Offer, a tender offer statement on Schedule TO, including an offer to purchase, a letter of transmittal and related documents, will be filed with the SEC by the Purchaser and a Solicitation/Recommendation Statement on Schedule 14D-9 will be filed with the SEC by the Target. The offer to purchase shares of the Target’s common stock will only be made pursuant to the offer to purchase, the letter of transmittal and related documents filed as a part of the Schedule TO. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ BOTH THE TENDER OFFER STATEMENT AND THE SOLICITATION/RECOMMENDATION STATEMENT REGARDING THE OFFER, AS THEY MAY BE AMENDED FROM TIME TO TIME, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The tender offer statement will be filed with the SEC by Purchaser, and the solicitation/recommendation statement will be filed with the SEC by the Target. Investors and security holders may obtain a free copy of these statements (when available) and other documents filed with the SEC at the website maintained by the SEC at www.sec.gov or by directing such requests to the Information Agent for the Offer, which will be named in the tender offer statement.

Forward-Looking Statements

This communication contains forward-looking statements regarding Parent and the Target, including, but not limited to, statements related to the anticipated consummation of the tender offer for the Target common stock and the timing and benefits thereof, estimated future financial results and impacts, regulatory filings and the performance of VYXEOSTM, future commercial and pipeline opportunities, and other statements that are not historical facts. These forward-looking statements are based on each of the companies’ current expectations and inherently involve significant risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation, risks related to Parent’s ability to complete the tender offer on the proposed terms and schedule, including risks and uncertainties related to the satisfaction of closing conditions; the possibility that competing offers will be made; risks associated with business combination transactions, such as the risk that the acquired business will not be integrated successfully or that such integration may be more difficult, time-consuming or costly than expected; risks related to future opportunities and plans for the combined company, including uncertainty of the expected future regulatory filings, financial performance and results of the combined company following completion of the proposed transaction; disruption from the proposed acquisition, making it more difficult to conduct business as usual or maintain relationships with customers, employees or suppliers; the possibility that if Parent does not achieve the perceived benefits of the proposed acquisition as rapidly or to the extent anticipated by financial analysts or investors, the market price of Parent’s ordinary shares could decline; the difficulty and uncertainty of pharmaceutical product development; the inherent uncertainty associated with the regulatory approval process, including the risk that regulatory approval for VYXEOS in the U.S. may not be obtained in a timely manner or at all; the combined company’s ability to effectively commercialize its product candidates, including the need to establish pricing and reimbursement support; and those other risks detailed under the caption “Risk Factors” and elsewhere in Parent’s and the Target’s SEC filings and reports, including in Parent’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2016 and the Target’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2016, each of which is filed with the SEC, and future filings and reports by either company. Neither Parent nor the Target undertakes any duty or obligation to update any forward-looking statements contained in this presentation as a result of new information, future events or changes in its expectations.

Item 9.01. Financial Statements and Exhibits.

| Exhibit No. |

Description | |

| 99.2 | Investor Presentation, dated May 31, 2016. | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: May 31, 2016 | JAZZ PHARMACEUTICALS PUBLIC LIMITED COMPANY | |||||

| By: | /s/ Matthew P. Young | |||||

| Matthew P. Young | ||||||

| Executive Vice President, Chief Financial Officer | ||||||

EXHIBIT INDEX

| Exhibit No. |

Description | |

| 99.2 | Investor Presentation, dated May 31, 2016. | |

Acquisition of Celator Pharmaceuticals May 31, 2016 Exhibit 99.2

Forward-Looking Statements This presentation contains forward-looking statements regarding Jazz Pharmaceuticals and Celator Pharmaceuticals, including, but not limited to, statements related to the anticipated consummation of the tender offer for Celator common stock and the timing and benefits thereof, estimated future financial results and impacts, regulatory filings and the performance of VYXEOS, future commercial and pipeline opportunities, and other statements that are not historical facts. These forward-looking statements are based on each of the companies’ current expectations and inherently involve significant risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation, risks related to Jazz Pharmaceuticals' ability to complete the tender offer on the proposed terms and schedule, including risks and uncertainties related to the satisfaction of closing conditions; the possibility that competing offers will be made; risks associated with business combination transactions, such as the risk that the acquired business will not be integrated successfully or that such integration may be more difficult, time-consuming or costly than expected; risks related to future opportunities and plans for the combined company, including uncertainty of the expected future regulatory filings, financial performance and results of the combined company following completion of the proposed transaction; disruption from the proposed acquisition, making it more difficult to conduct business as usual or maintain relationships with customers, employees or suppliers; and the possibility that if Jazz Pharmaceuticals does not achieve the perceived benefits of the proposed acquisition as rapidly or to the extent anticipated by financial analysts or investors, the market price of Jazz Pharmaceuticals' ordinary shares could decline; the difficulty and uncertainty of pharmaceutical product development; the inherent uncertainty associated with the regulatory approval process, including the risk that regulatory approval for VYXEOS in the U.S. may not be obtained in a timely manner or at all; the combined company’s ability to effectively commercialize its product candidates, including the need to establish pricing and reimbursement support; and those other risks detailed under the caption "Risk Factors" and elsewhere in Jazz Pharmaceuticals’ and Celator Pharmaceuticals’ U.S. Securities and Exchange Commission (“SEC”) filings and reports, including in Jazz Pharmaceuticals’ Quarterly Report on Form 10-Q for the quarter ended March 31, 2016 and Celator Pharmaceuticals’ Quarterly Report on Form 10-Q for the quarter ended March 31, 2016, each of which is filed with the SEC, and future filings and reports by either company. Neither Jazz Pharmaceuticals nor Celator Pharmaceuticals undertakes any duty or obligation to update any forward-looking statements contained in this presentation as a result of new information, future events or changes in its expectations. "Safe Harbor" Statement Under the Private Securities Litigation Reform Act of 1995

Additional Information and Where to Find It The tender offer described in this communication (the “Offer”) has not yet commenced and this communication is neither an offer to purchase nor a solicitation of an offer to sell shares of Celator or other securities, nor is it a substitute for the tender offer materials that Jazz Pharmaceuticals and its acquisition subsidiary will file with the SEC upon commencement of the tender offer. At the time the Offer is commenced, Jazz Pharmaceuticals and its acquisition subsidiary will file tender offer materials on Schedule TO, and Celator will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the Offer. The tender offer materials (including an Offer to Purchase, a related Letter of Transmittal and certain other tender offer documents) and the Solicitation/Recommendation Statement, as they may be amended from time to time, will contain important information. Holders of Celator securities are urged to read these documents when they become available because they will contain important information that holders of Celator securities should consider before making any decision regarding tendering their securities. The Offer to Purchase, the related Letter of Transmittal and certain other tender offer documents, as well as the Solicitation/Recommendation Statement, will be made available to all holders of Celator securities at no expense to them. Investors and security holders may obtain free copies of these documents (when they are available) and other related documents filed with the SEC at the SEC’s web site at http://www.sec.gov or by (i) directing a request to Jazz Pharmaceuticals plc, c/o Jazz Pharmaceuticals, Inc., 3180 Porter Drive, Palo Alto, California 94304, U.S.A., Attention: Investor Relations, (ii) calling +353 1 634 7892 (Ireland) or + 1 650 496 2800 (U.S.) or (iii) sending an email to [email protected]. Investors and security holders may also obtain free copies of the documents filed with the SEC on Jazz Pharmaceuticals’ website at www.jazzpharmaceuticals.com under the heading "Investors" and then under the heading "SEC Filings." .

Background and Strategic Rationale

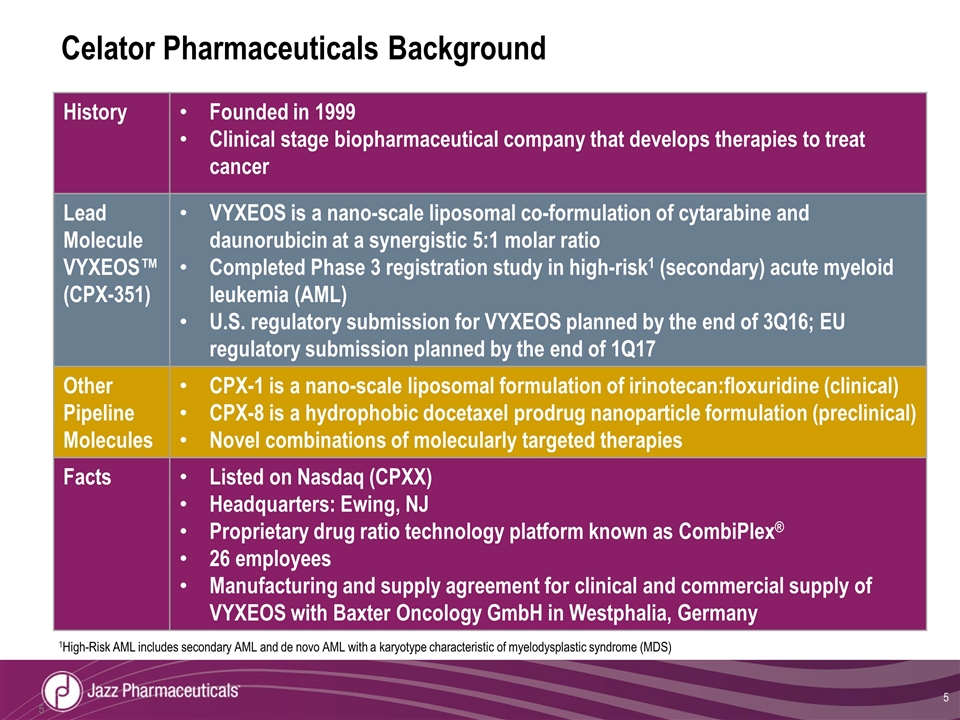

Celator Pharmaceuticals Background History Founded in 1999 Clinical stage biopharmaceutical company that develops therapies to treat cancer Lead Molecule VYXEOS™ (CPX-351) VYXEOS is a nano-scale liposomal co-formulation of cytarabine and daunorubicin at a synergistic 5:1 molar ratio Completed Phase 3 registration study in high-risk1 (secondary) acute myeloid leukemia (AML) U.S. regulatory submission for VYXEOS planned by the end of 3Q16; EU regulatory submission planned by the end of 1Q17 Other Pipeline Molecules CPX-1 is a nano-scale liposomal formulation of irinotecan:floxuridine (clinical) CPX-8 is a hydrophobic docetaxel prodrug nanoparticle formulation (preclinical) Novel combinations of molecularly targeted therapies Facts Listed on Nasdaq (CPXX) Headquarters: Ewing, NJ Proprietary drug ratio technology platform known as CombiPlex® 26 employees Manufacturing and supply agreement for clinical and commercial supply of VYXEOS with Baxter Oncology GmbH in Westphalia, Germany 1High-Risk AML includes secondary AML and de novo AML with a karyotype characteristic of myelodysplastic syndrome (MDS)

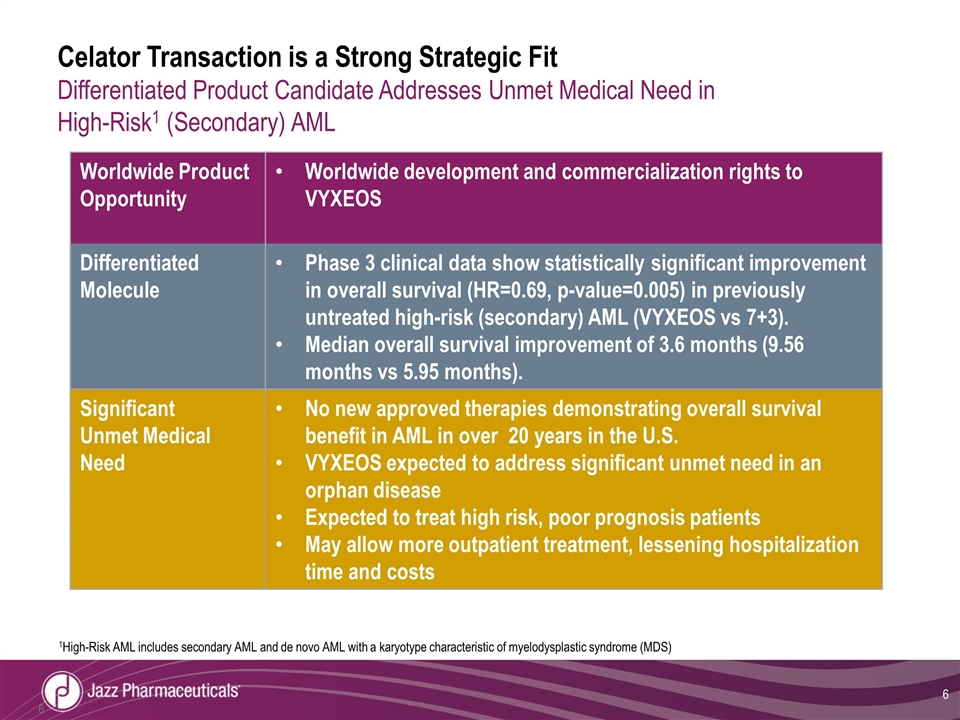

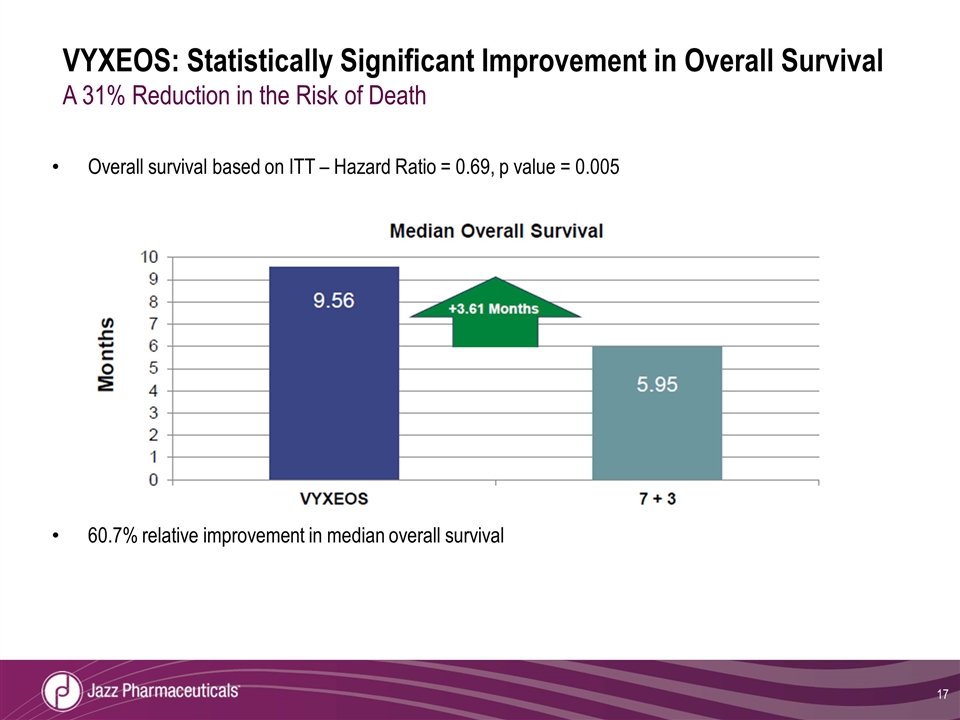

Celator Transaction is a Strong Strategic Fit Differentiated Product Candidate Addresses Unmet Medical Need in High-Risk1 (Secondary) AML Worldwide Product Opportunity Worldwide development and commercialization rights to VYXEOS Differentiated Molecule Phase 3 clinical data show statistically significant improvement in overall survival (HR=0.69, p-value=0.005) in previously untreated high-risk (secondary) AML (VYXEOS vs 7+3). Median overall survival improvement of 3.6 months (9.56 months vs 5.95 months). Significant Unmet Medical Need No new approved therapies demonstrating overall survival benefit in AML in over 20 years in the U.S. VYXEOS expected to address significant unmet need in an orphan disease Expected to treat high risk, poor prognosis patients May allow more outpatient treatment, lessening hospitalization time and costs 1High-Risk AML includes secondary AML and de novo AML with a karyotype characteristic of myelodysplastic syndrome (MDS)

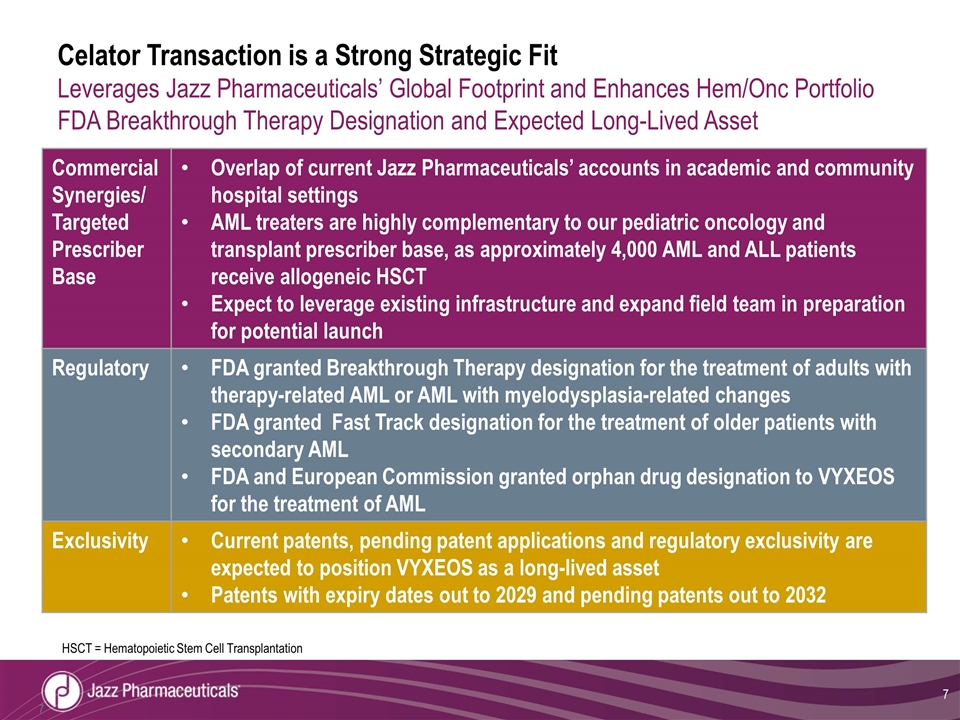

Celator Transaction is a Strong Strategic Fit Leverages Jazz Pharmaceuticals’ Global Footprint and Enhances Hem/Onc Portfolio FDA Breakthrough Therapy Designation and Expected Long-Lived Asset Commercial Synergies/ Targeted Prescriber Base Overlap of current Jazz Pharmaceuticals’ accounts in academic and community hospital settings AML treaters are highly complementary to our pediatric oncology and transplant prescriber base, as approximately 4,000 AML and ALL patients receive allogeneic HSCT Expect to leverage existing infrastructure and expand field team in preparation for potential launch Regulatory FDA granted Breakthrough Therapy designation for the treatment of adults with therapy-related AML or AML with myelodysplasia-related changes FDA granted Fast Track designation for the treatment of older patients with secondary AML FDA and European Commission granted orphan drug designation to VYXEOS for the treatment of AML Exclusivity Current patents, pending patent applications and regulatory exclusivity are expected to position VYXEOS as a long-lived asset Patents with expiry dates out to 2029 and pending patents out to 2032 HSCT = Hematopoietic Stem Cell Transplantation

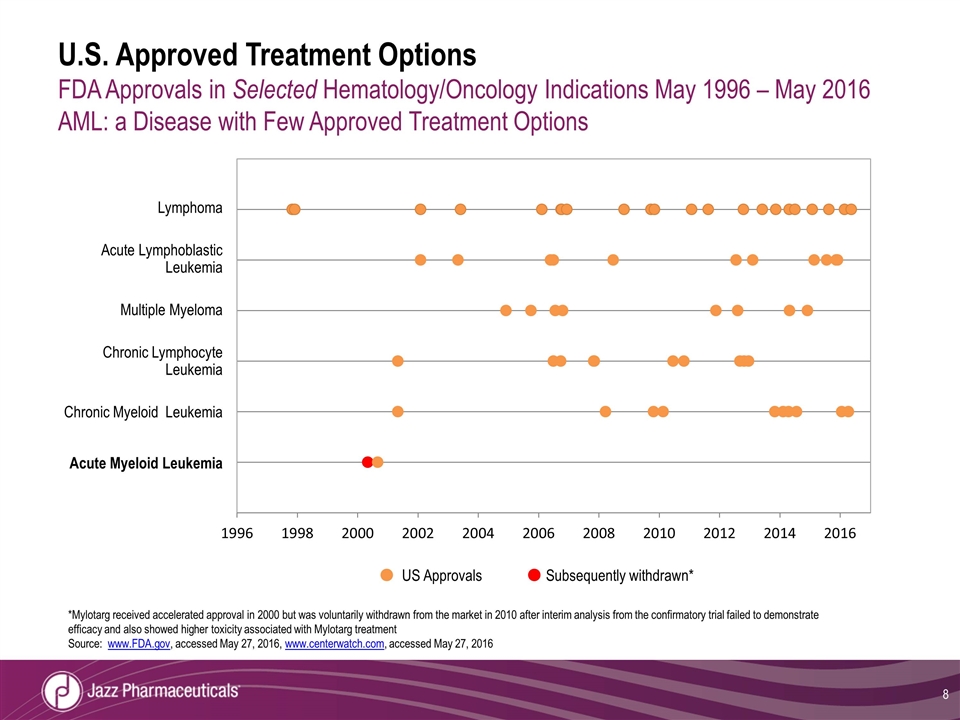

U.S. Approved Treatment Options FDA Approvals in Selected Hematology/Oncology Indications May 1996 – May 2016 AML: a Disease with Few Approved Treatment Options Lymphoma Acute Lymphoblastic Leukemia Multiple Myeloma Chronic Lymphocyte Leukemia Chronic Myeloid Leukemia Acute Myeloid Leukemia US Approvals Subsequently withdrawn* *Mylotarg received accelerated approval in 2000 but was voluntarily withdrawn from the market in 2010 after interim analysis from the confirmatory trial failed to demonstrate efficacy and also showed higher toxicity associated with Mylotarg treatment Source: www.FDA.gov, accessed May 27, 2016, www.centerwatch.com, accessed May 27, 2016

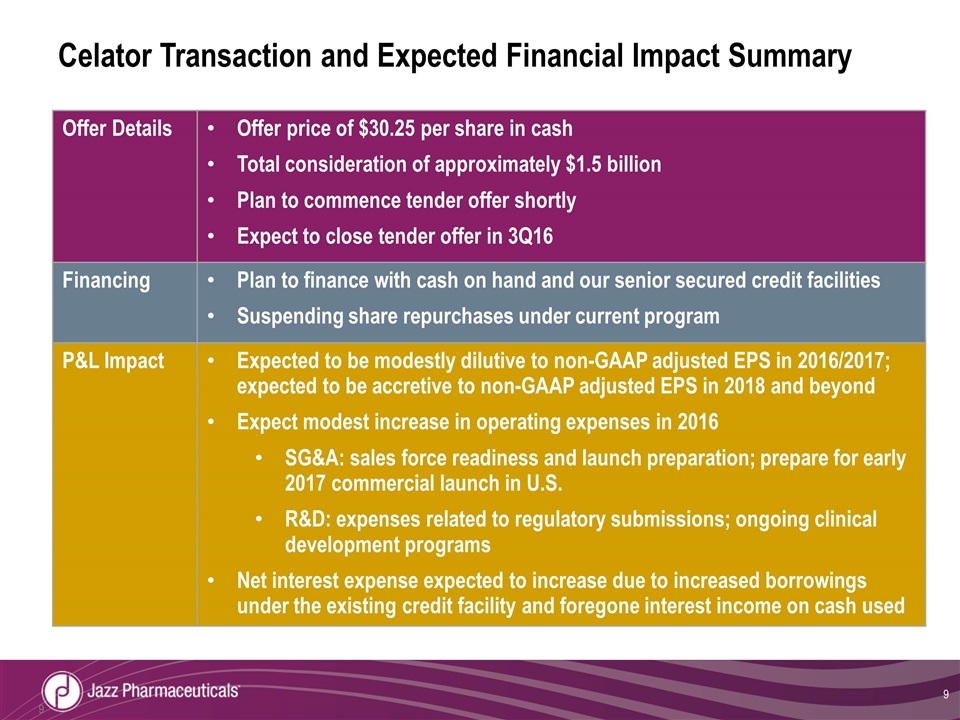

Celator Transaction and Expected Financial Impact Summary Offer Details Offer price of $30.25 per share in cash Total consideration of approximately $1.5 billion Plan to commence tender offer shortly Expect to close tender offer in 3Q16 Financing Plan to finance with cash on hand and our senior secured credit facilities Suspending share repurchases under current program P&L Impact Expected to be modestly dilutive to non-GAAP adjusted EPS in 2016/2017; expected to be accretive to non-GAAP adjusted EPS in 2018 and beyond Expect modest increase in operating expenses in 2016 SG&A: sales force readiness and launch preparation; prepare for early 2017 commercial launch in U.S. R&D: expenses related to regulatory submissions; ongoing clinical development programs Net interest expense expected to increase due to increased borrowings under the existing credit facility and foregone interest income on cash used

Clinical Overview

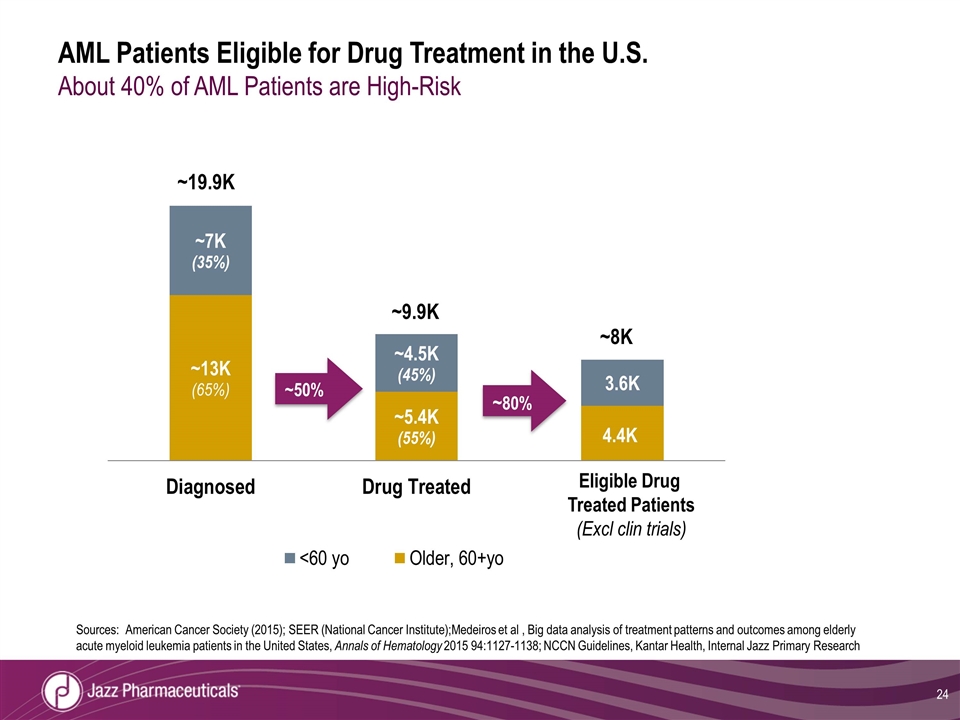

Significant Unmet Need AML is the Most Common Type of Acute Leukemia in Adults AML constitutes the most common form of all leukemias in adults1 AML is generally a disease of older adults Median age of diagnosis of ~67 years2 High risk AML represents approximately 40% of AML patients across age groups3 If left untreated, AML progresses rapidly to death1 Poor prognosis even with treatment1 1 Kadia TM, Ann Oncol. 2016 May 27 (5), 770-8, 2 http://seer.cancer.gov/statfacts/html/amyl.html, 3Internal Jazz primary research

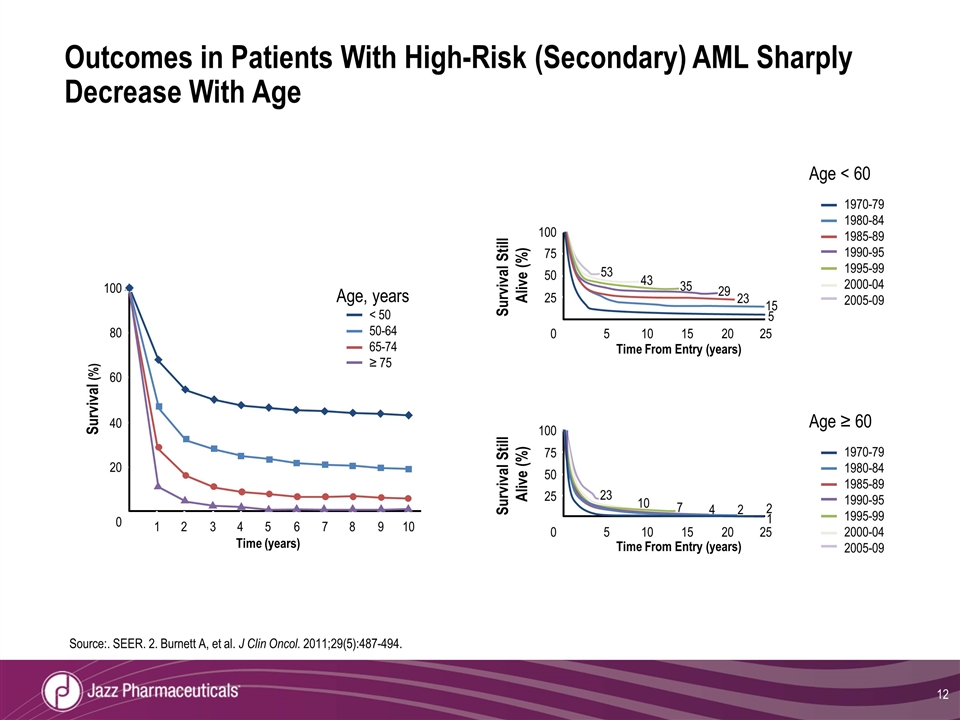

Source:. SEER. 2. Burnett A, et al. J Clin Oncol. 2011;29(5):487-494. 100 80 60 40 20 0 1 2 3 4 5 6 7 8 9 10 Time (years) Survival (%) Age, years < 50 50-64 65-74 ≥ 75 100 75 50 25 0 5 10 15 20 25 Survival Still Alive (%) Time From Entry (years) 53 43 35 29 23 15 5 Age ≥ 60 1970-79 1980-84 1985-89 1990-95 1995-99 2000-04 2005-09 0 100 75 50 25 Survival Still Alive (%) 5 10 15 20 25 Time From Entry (years) 23 10 7 4 2 2 1 Age < 60 1970-79 1980-84 1985-89 1990-95 1995-99 2000-04 2005-09 Outcomes in Patients With High-Risk (Secondary) AML Sharply Decrease With Age

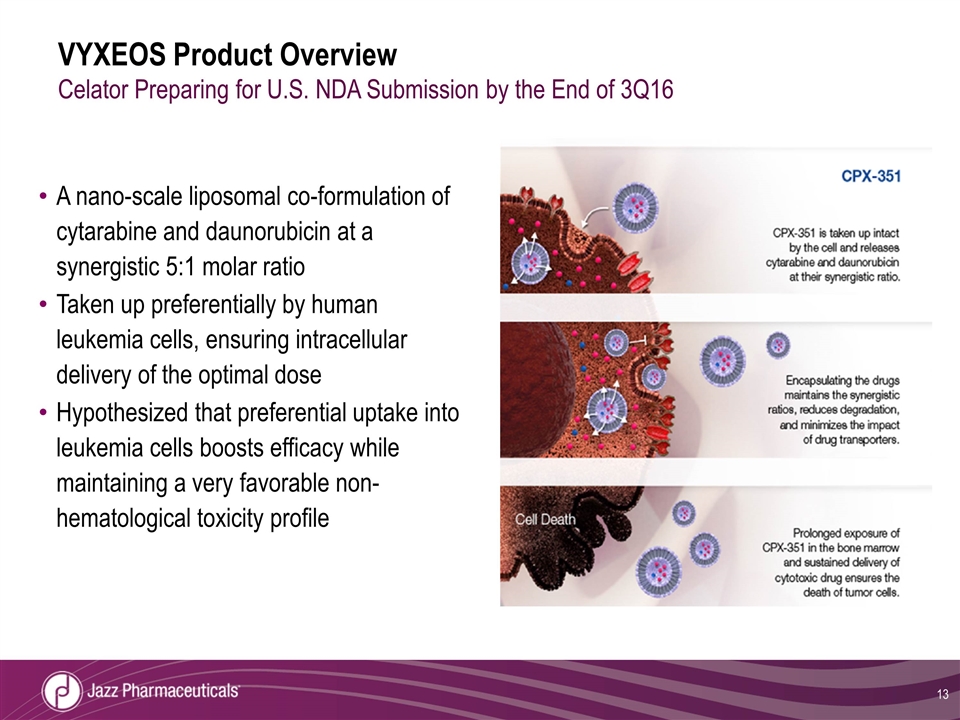

VYXEOS Product Overview Celator Preparing for U.S. NDA Submission by the End of 3Q16 A nano-scale liposomal co-formulation of cytarabine and daunorubicin at a synergistic 5:1 molar ratio Taken up preferentially by human leukemia cells, ensuring intracellular delivery of the optimal dose Hypothesized that preferential uptake into leukemia cells boosts efficacy while maintaining a very favorable non-hematological toxicity profile

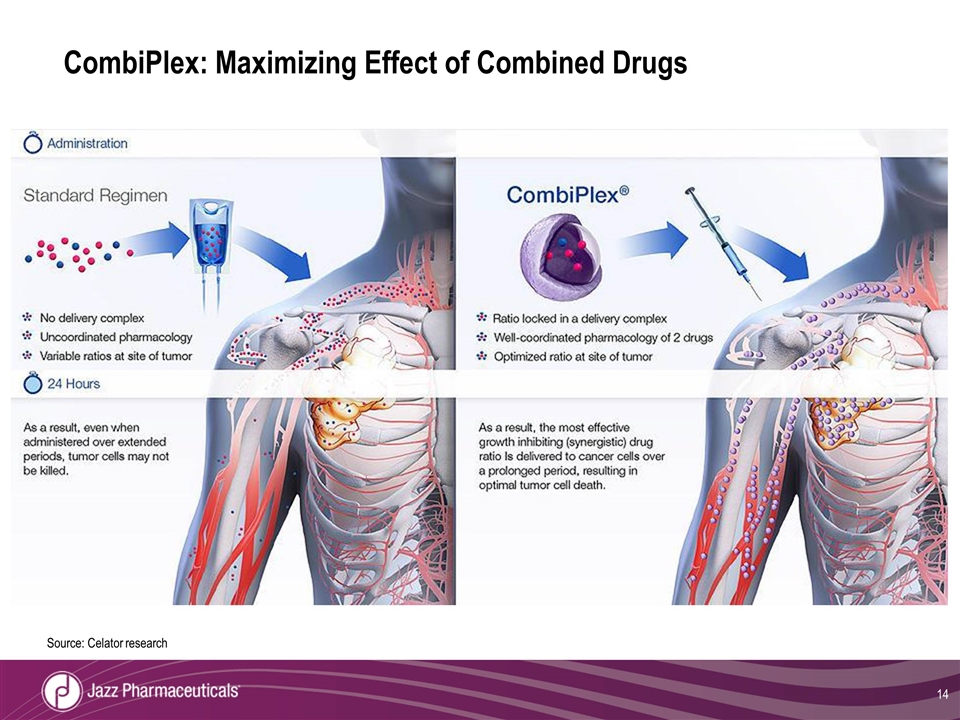

CombiPlex: Maximizing Effect of Combined Drugs Source: Celator research

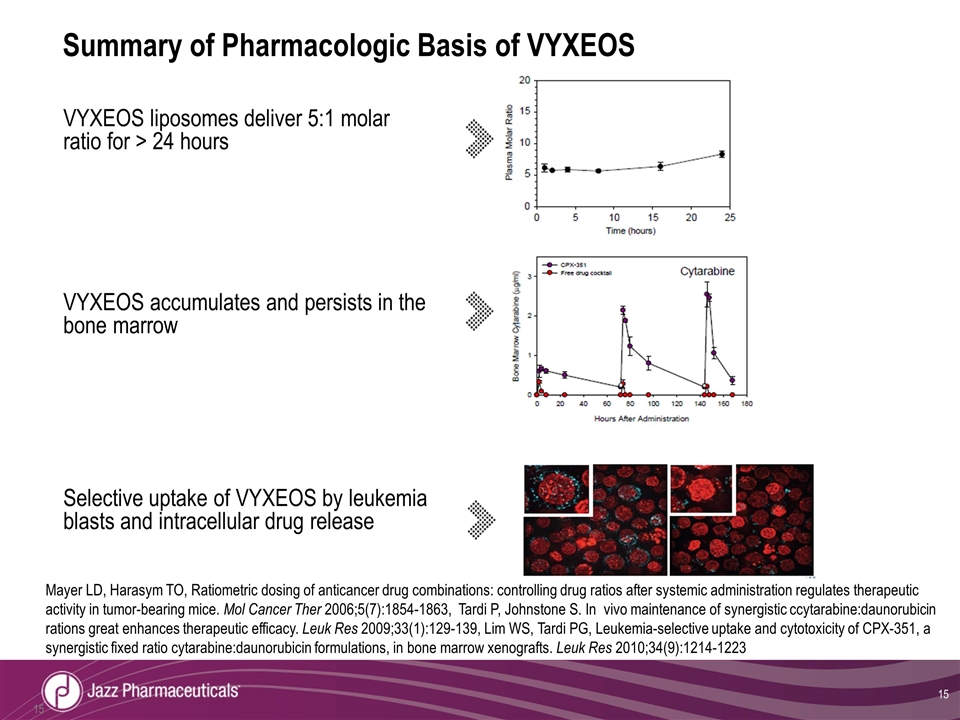

Summary of Pharmacologic Basis of VYXEOS VYXEOS liposomes deliver 5:1 molar ratio for > 24 hours VYXEOS accumulates and persists in the bone marrow Selective uptake of VYXEOS by leukemia blasts and intracellular drug release Mayer LD, Harasym TO, Ratiometric dosing of anticancer drug combinations: controlling drug ratios after systemic administration regulates therapeutic activity in tumor-bearing mice. Mol Cancer Ther 2006;5(7):1854-1863, Tardi P, Johnstone S. In vivo maintenance of synergistic ccytarabine:daunorubicin rations great enhances therapeutic efficacy. Leuk Res 2009;33(1):129-139, Lim WS, Tardi PG, Leukemia-selective uptake and cytotoxicity of CPX-351, a synergistic fixed ratio cytarabine:daunorubicin formulations, in bone marrow xenografts. Leuk Res 2010;34(9):1214-1223

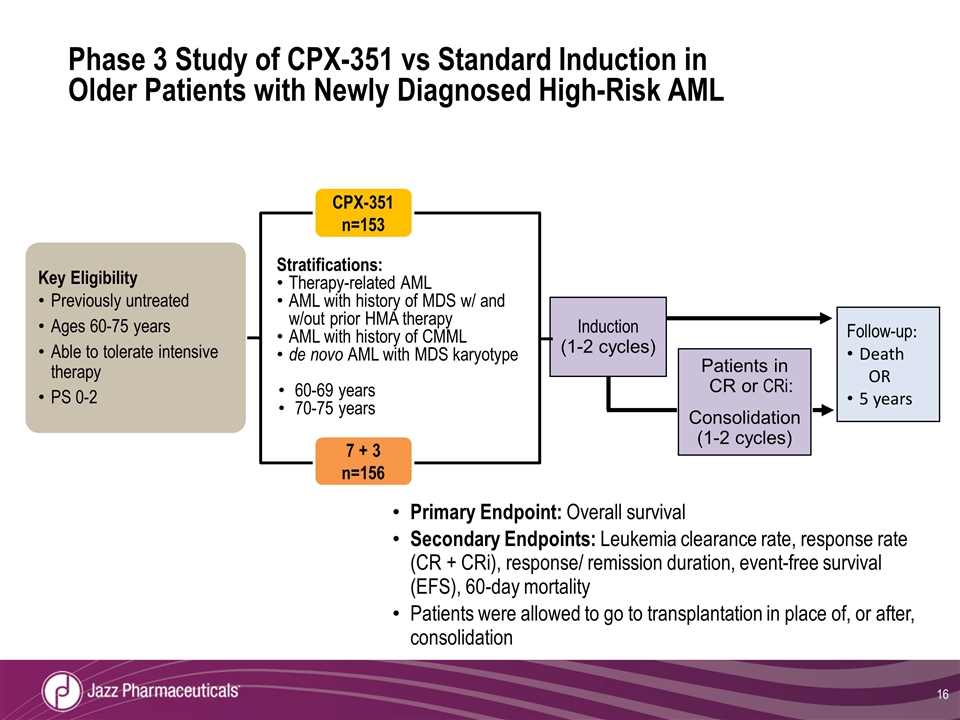

Phase 3 Study of CPX-351 vs Standard Induction in Older Patients with Newly Diagnosed High-Risk AML Primary Endpoint: Overall survival Secondary Endpoints: Leukemia clearance rate, response rate (CR + CRi), response/ remission duration, event-free survival (EFS), 60-day mortality Patients were allowed to go to transplantation in place of, or after, consolidation Key Eligibility Previously untreated Ages 60-75 years Able to tolerate intensive therapy PS 0-2 Stratifications: Therapy-related AML AML with history of MDS w/ and w/out prior HMA therapy AML with history of CMML de novo AML with MDS karyotype 60-69 years 70-75 years Follow-up: Death OR 5 years Induction (1-2 cycles) Patients in CR or CRi: Consolidation (1-2 cycles) CPX-351 n=153 7 + 3 n=156

Overall survival based on ITT – Hazard Ratio = 0.69, p value = 0.005 60.7% relative improvement in median overall survival VYXEOS: Statistically Significant Improvement in Overall Survival A 31% Reduction in the Risk of Death

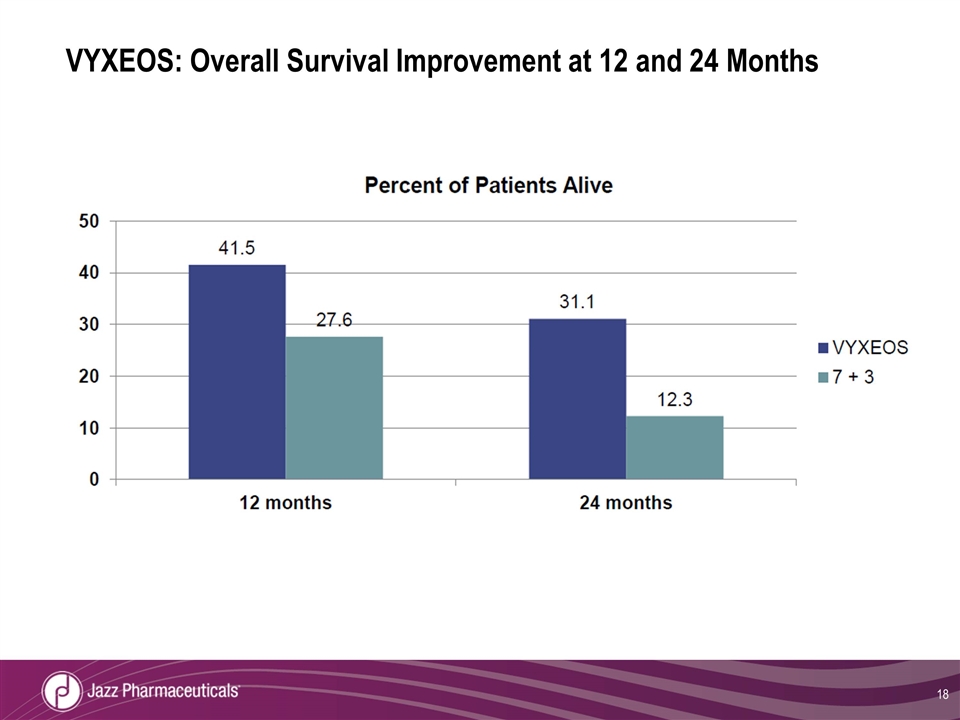

VYXEOS: Overall Survival Improvement at 12 and 24 Months

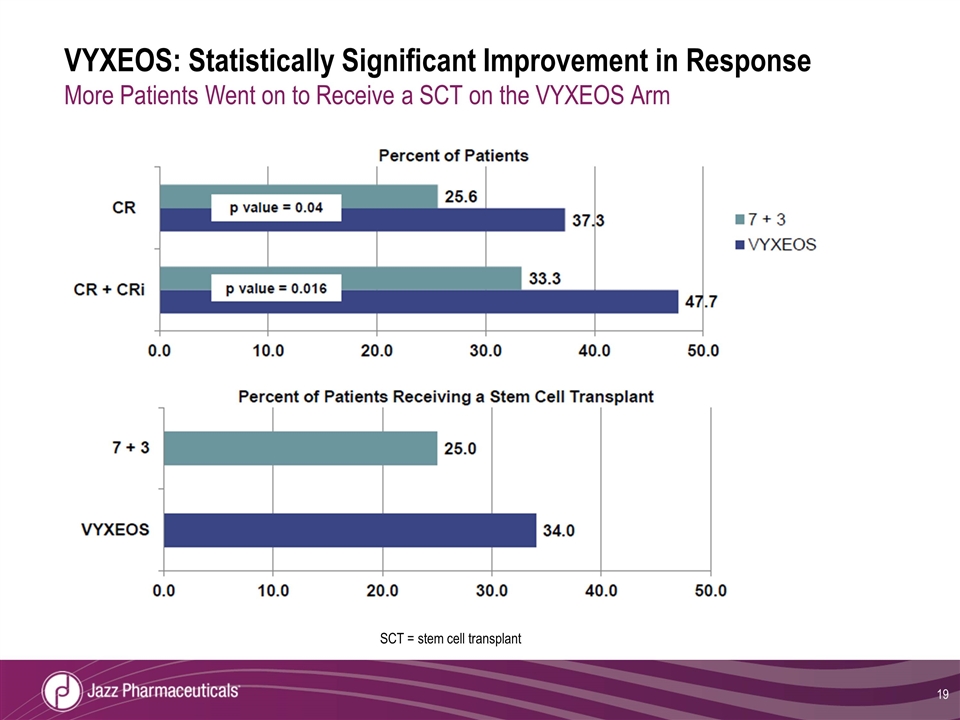

VYXEOS: Statistically Significant Improvement in Response More Patients Went on to Receive a SCT on the VYXEOS Arm SCT = stem cell transplant

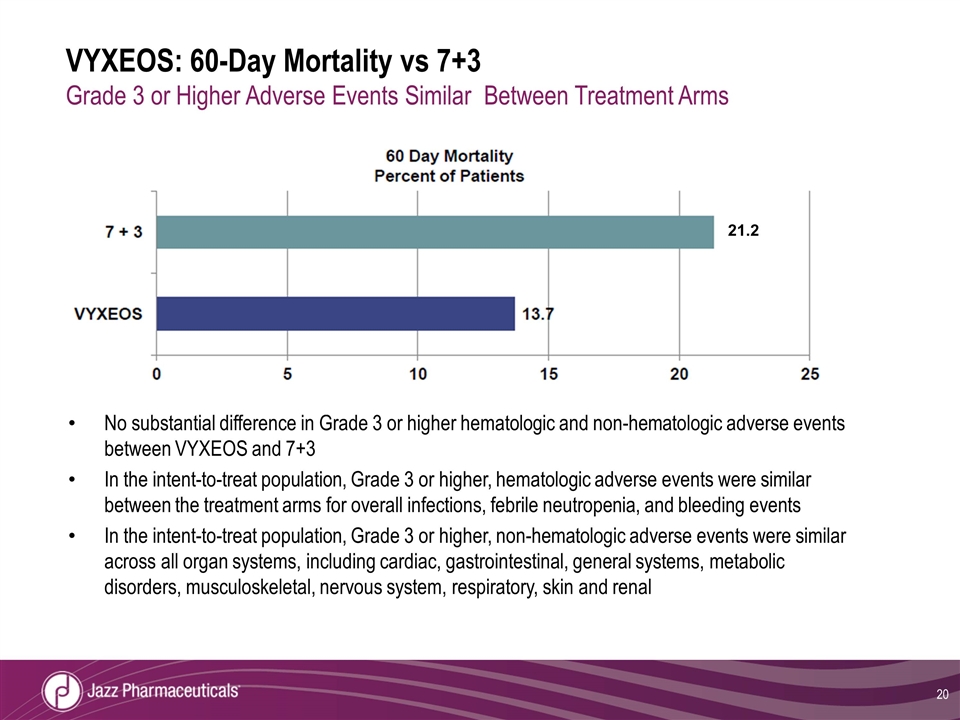

VYXEOS: 60-Day Mortality vs 7+3 Grade 3 or Higher Adverse Events Similar Between Treatment Arms No substantial difference in Grade 3 or higher hematologic and non-hematologic adverse events between VYXEOS and 7+3 In the intent-to-treat population, Grade 3 or higher, hematologic adverse events were similar between the treatment arms for overall infections, febrile neutropenia, and bleeding events In the intent-to-treat population, Grade 3 or higher, non-hematologic adverse events were similar across all organ systems, including cardiac, gastrointestinal, general systems, metabolic disorders, musculoskeletal, nervous system, respiratory, skin and renal 21.2

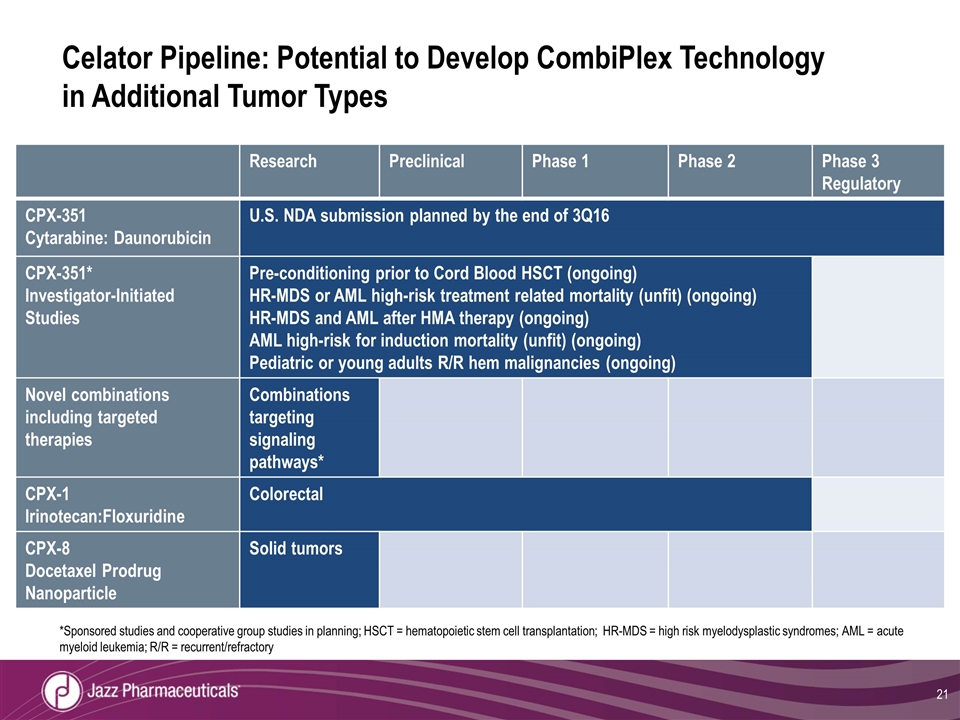

Celator Pipeline: Potential to Develop CombiPlex Technology in Additional Tumor Types Research Preclinical Phase 1 Phase 2 Phase 3 Regulatory CPX-351 Cytarabine: Daunorubicin U.S. NDA submission planned by the end of 3Q16 CPX-351* Investigator-Initiated Studies Pre-conditioning prior to Cord Blood HSCT (ongoing) HR-MDS or AML high-risk treatment related mortality (unfit) (ongoing) HR-MDS and AML after HMA therapy (ongoing) AML high-risk for induction mortality (unfit) (ongoing) Pediatric or young adults R/R hem malignancies (ongoing) Novel combinations including targeted therapies Combinations targeting signaling pathways* CPX-1 Irinotecan:Floxuridine Colorectal CPX-8 Docetaxel Prodrug Nanoparticle Solid tumors *Sponsored studies and cooperative group studies in planning; HSCT = hematopoietic stem cell transplantation; HR-MDS = high risk myelodysplastic syndromes; AML = acute myeloid leukemia; R/R = recurrent/refractory

Commercial Opportunity/Market Overview

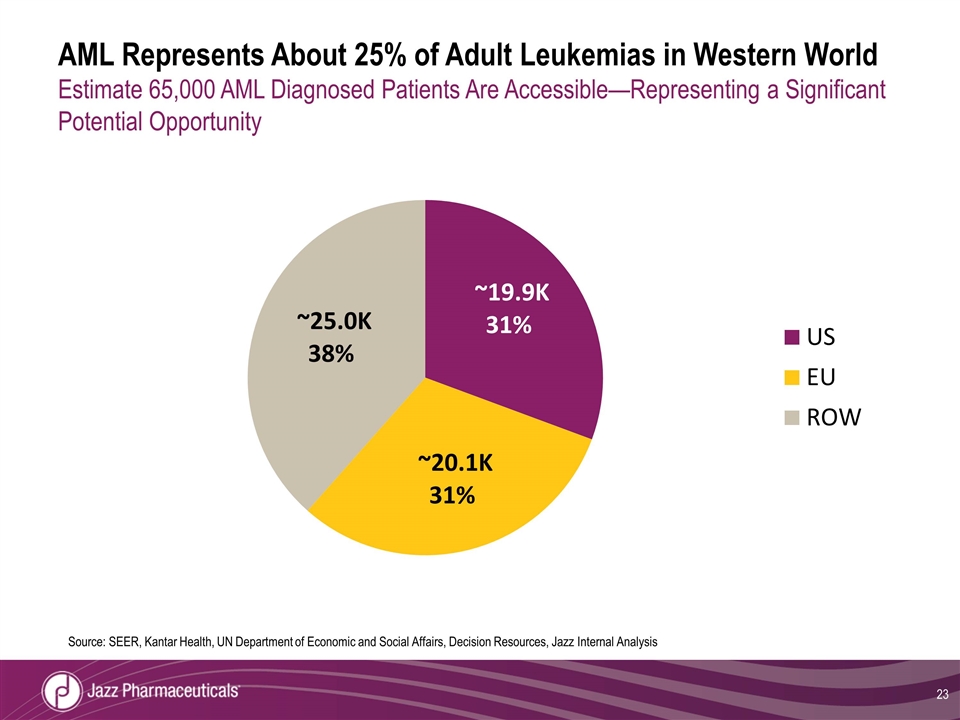

AML Represents About 25% of Adult Leukemias in Western World Estimate 65,000 AML Diagnosed Patients Are Accessible—Representing a Significant Potential Opportunity Source: SEER, Kantar Health, UN Department of Economic and Social Affairs, Decision Resources, Jazz Internal Analysis

AML Patients Eligible for Drug Treatment in the U.S. About 40% of AML Patients are High-Risk 24 ~50% ~80% ~19.9K ~9.9K ~8K Eligible Drug Treated Patients (Excl clin trials) Sources: American Cancer Society (2015); SEER (National Cancer Institute);Medeiros et al , Big data analysis of treatment patterns and outcomes among elderly acute myeloid leukemia patients in the United States, Annals of Hematology 2015 94:1127-1138; NCCN Guidelines, Kantar Health, Internal Jazz Primary Research

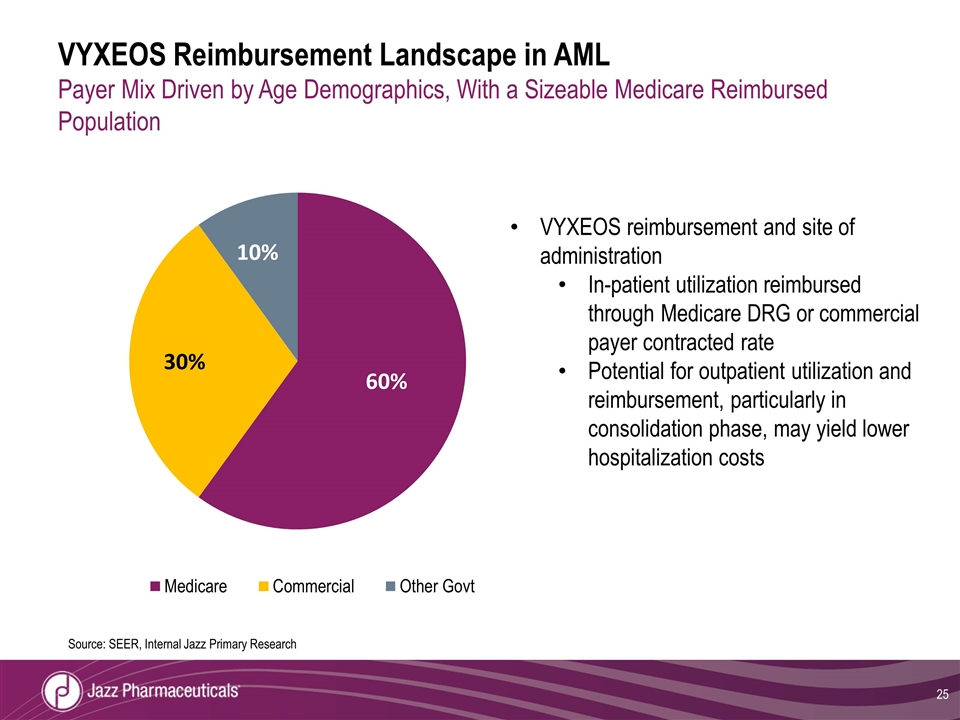

VYXEOS Reimbursement Landscape in AML Payer Mix Driven by Age Demographics, With a Sizeable Medicare Reimbursed Population Source: SEER, Internal Jazz Primary Research VYXEOS reimbursement and site of administration In-patient utilization reimbursed through Medicare DRG or commercial payer contracted rate Potential for outpatient utilization and reimbursement, particularly in consolidation phase, may yield lower hospitalization costs

Commercial Planning Potential launch preparation Immediately leverage knowledge from existing products AML treaters are in many of the same accounts as ALL and transplant targets Able to apply best practices from the recent Defitelio launch Implement launch team Kick off development of brand campaign, marketing materials, product positioning/messaging Increase commercial and medical infrastructure to support potential launch Sales force planning Currently expect to leverage existing infrastructure and anticipate some expansion of sales force and medical teams Reimbursement Gain appropriate pricing, access and reimbursement HEOR and AMCP dossier to be developed

Q&A

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Jazz Pharmaceuticals to Present Data Across Growing Oncology Pipeline and Portfolio at ASCO 2024

- Kudos Launches AI-Powered Recognition Assistant to Streamline Employee Recognition

- Knightscope to Present to Members of Congress at Hart Senate Office Building

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share