Form 8-K XEROX CORP For: Jan 29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________________________________________________________________________

FORM 8-K

_____________________________________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): January 28, 2016

_____________________________________________________________________________________________________

XEROX CORPORATION

(Exact name of registrant as specified in its charter)

______________________________________________________________________________________________________

New York | 001-04471 | 16-0468020 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||

P. O. Box 4505

45 Glover Avenue

Norwalk, Connecticut

06856-4505

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (203) 968-3000

Not Applicable

(Former name or former address, if changed since last report)

______________________________________________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

______________________________________________________________________________________________________

____________________________________________________________________________________________________

Item 1.01. Entry into a Material Definitive Agreement

In connection with the planned separation of Registrant’s Business Process Outsourcing “(BPO”) business from its Document Technology and Document Outsourcing business (the “Separation”), disclosed under Item 8.01 Other Events of this Report, on January 28, 2016, Xerox Corporation (the “Company”) entered into an Agreement (the “Agreement”) with Icahn Partners Master Fund LP, Icahn Partners LP, Icahn Onshore LP, Icahn Offshore LP, Icahn Capital LP, IPH GP LLC, Icahn Enterprises Holdings LP, Icahn Enterprises G.P. Inc., Beckton Corp., High River Limited Partnership, Hopper Investments LLC, Barberry Corp., Jonathan Christodoro and Carl C. Icahn (collectively, the “Icahn Group”), pursuant to which the Company and the Icahn Group have agreed to certain matters relating to BPO following the Separation. A copy of the Agreement is attached as Exhibit 10(s) to this Report and is incorporated herein by reference. Also attached to this Report as Exhibit 99.1 is the joint press release issued on January 29, 2016 by Registrant and Carl C. Icahn regarding the Agreement, which is incorporated herein by reference.

____________________________________________________________________________________________________

Item 2.02. Results of Operations and Financial Condition.

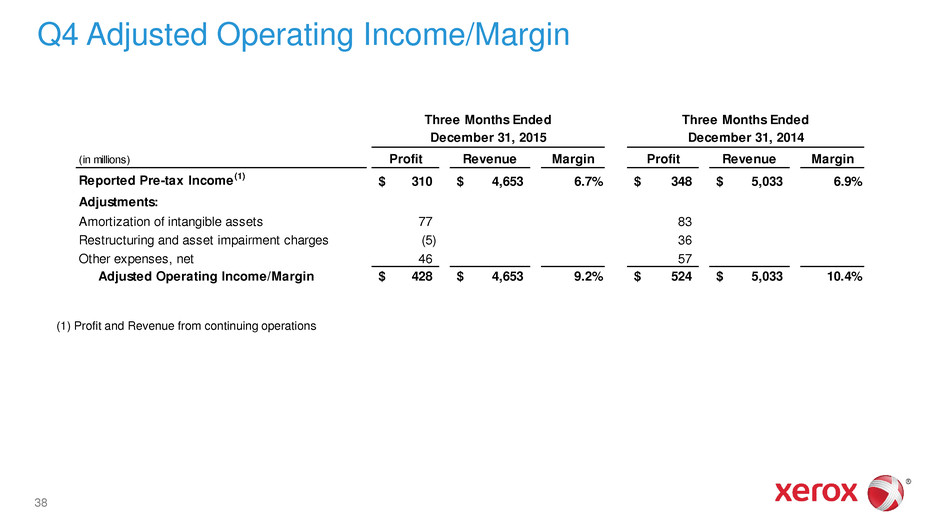

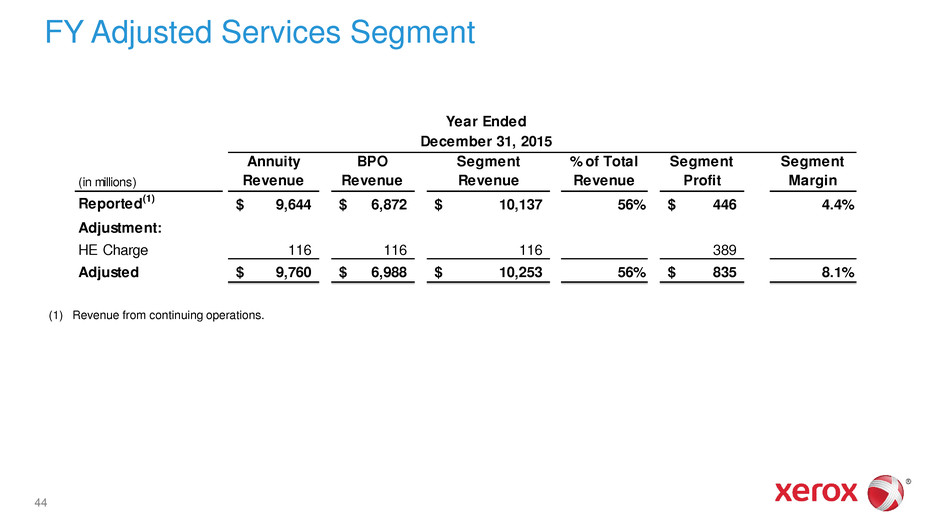

On January 29, 2016, Registrant released its fourth quarter 2015 earnings and is furnishing to the Securities and Exchange Commission a copy of: (a) the earnings press release; and (b) and an earnings presentation, as Exhibits 99.2 and 99.3, respectively, to this Report under Item 2.02 of Form 8-K.

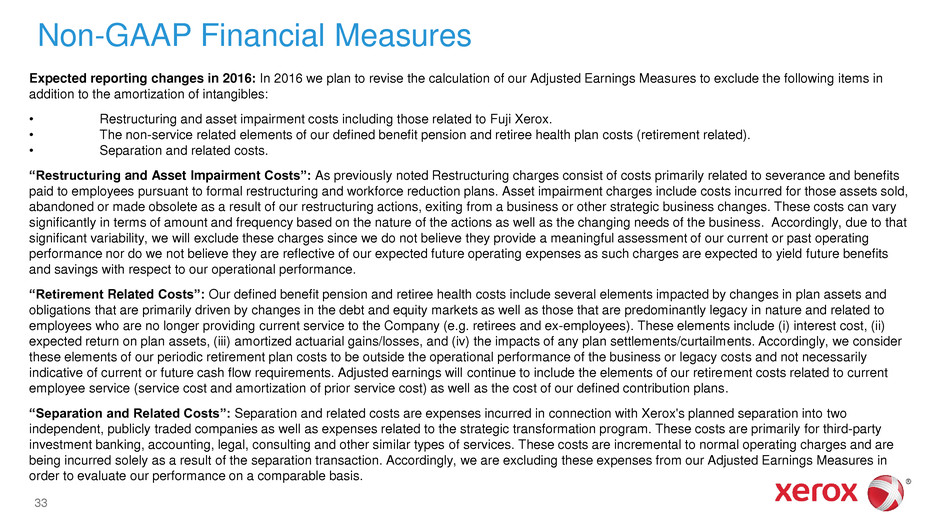

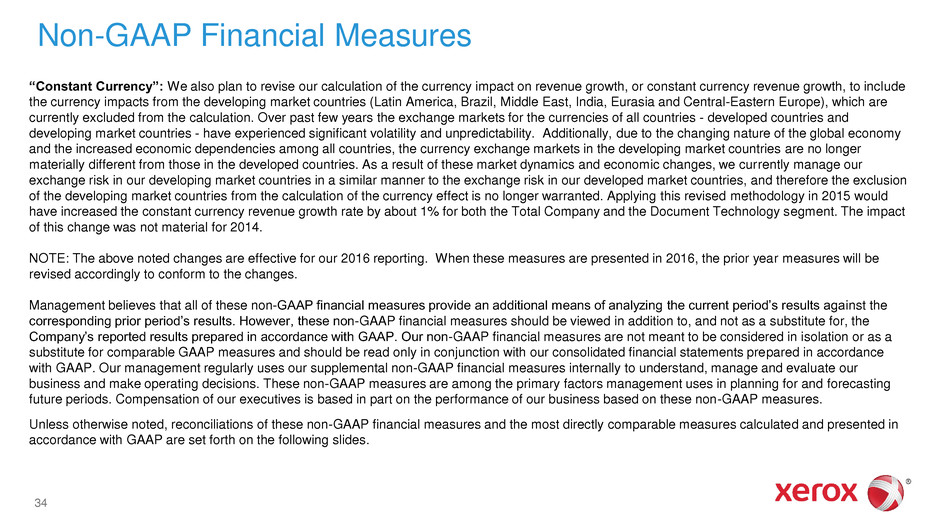

Exhibits 99.2 and 99.3 to this Report contain certain financial measures that are considered “non-GAAP financial measures” as defined in the SEC rules. Exhibits 99.2 and 99.3 to this Report also contains the reconciliation of these non-GAAP financial measures to their most directly comparable financial measures calculated and presented in accordance with generally accepted accounting principles, as well as the reasons why Registrant’s management believes that presentation of the non-GAAP financial measures provides useful information to investors regarding Registrant’s results of operations and, to the extent material, a statement disclosing any other additional purposes for which Registrant’s management uses the non-GAAP financial measures.

The information contained in Item 2.02 of this Report and in Exhibits 99.2 and 99.3 to this Report shall not be deemed “filed” with the Commission for purposes of Section 18 of the Exchange Act of 1934, as amended, or otherwise subject to the liability of that section.

Item 8.01. Other Events

On January 29, 2016, Registrant announced the results of its review of the Company’s portfolio and capital allocation options announced in October 2015. Registrant’s Board has unanimously approved a plan to separate Registrant’s BPO business from its Document Technology and Document Outsourcing business (the “Separation”). Each of the businesses will operate as a separate, publicly-traded company. A copy of Registrant’s press release describing the Separation is filed as Exhibit 99.4 to this Report and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Exhibit No. | Description | |

10(s) | Agreement dated January 28, 2016 between the Icahn Group and Registrant | |

99.1 | Joint press release of Registrant and Carl C. Icahn dated January 29, 2016 re Icahn agreement | |

99.2 | Registrant’s fourth quarter 2015 earnings press release dated January 29, 2016 | |

99.3 | Registrant’s fourth quarter 2015 earnings presentation | |

99.4 | Registrant’s press release dated January 29, 2016 regarding Separation | |

Forward Looking Statements

This report contains “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “will,” “should” and similar expressions, as they relate to us, are intended to identify forward-looking statements. These statements reflect management’s current beliefs, assumptions and expectations, including with respect to the proposed separation of the Business Process Outsourcing (“BPO”) business from the Document Technology and Document Outsourcing business, the expected timetable for completing the separation, the future financial and operating performance of each business, the strategic and competitive advantages of each business, future opportunities for each business and the expected amount of cost reductions that may be realized in the cost transformation program, and are subject to a number of factors that may cause actual results to differ materially. Such factors include but are not limited to: changes in economic conditions, political conditions, trade protection measures, licensing requirements and tax matters in the United States and in the foreign countries in which we do business; changes in foreign currency exchange rates; our ability to successfully develop new products, technologies and service offerings and to protect our intellectual property rights; the risk that multi-year contracts with governmental entities could be terminated prior to the end of the contract term and that civil or criminal penalties and administrative sanctions could be imposed on us if we fail to comply with the terms of such contracts and applicable law; the risk that our bids do not accurately estimate the resources and costs required to implement and service very complex, multi-year governmental and commercial contracts, often in advance of the final determination of the full scope and design of such contracts or as a result of the scope of such contracts being changed during the life of such contracts; the risk that subcontractors, software vendors and utility and network providers will not perform in a timely, quality manner; service interruptions; actions of competitors and our ability to promptly and effectively react to changing technologies and customer expectations; our ability to obtain adequate pricing for our products and services and to maintain and improve cost efficiency of operations, including savings from restructuring actions and the relocation of our service delivery centers; the risk that individually identifiable information of customers, clients and employees could be inadvertently disclosed or disclosed as a result of a breach of our security systems; the risk in the hiring and retention of qualified personnel; the risk that unexpected costs will be incurred; our ability to recover capital investments; the risk that our Services business could be adversely affected if we are unsuccessful in managing the start-up of new contracts; the collectability of our receivables for unbilled services associated with very large, multi-year contracts; reliance on third parties, including subcontractors, for manufacturing of products and provision of services; our ability to expand equipment placements; interest rates, cost of borrowing and access to credit markets; the risk that our products may not comply with applicable worldwide regulatory requirements, particularly environmental regulations and directives; the outcome of litigation and regulatory proceedings to which we may be a party; the possibility that the proposed separation of the BPO business from the Document Technology and Document Outsourcing business will not be consummated within the anticipated time period or at all, including as the result of regulatory, market or other factors; the potential for disruption to our business in connection with the proposed separation; the potential that BPO and Document Technology and Document Outsourcing do not realize all of the expected benefits of the separation; and other factors that are set forth in the “Risk Factors” section, the “Legal Proceedings” section, the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section and other sections of our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2015, June 30, 2015 and September 30, 2015 and our 2014 Annual Report on Form 10-K filed with the Securities and Exchange Commission. Xerox assumes no obligation to update any forward-looking statements as a result of new information or future events or developments, except as required by law.

______________________________________________________________________________________________________

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Registrant has duly authorized this Report to be signed on its behalf by the undersigned duly authorized.

Date: January 29, 2016

XEROX CORPORATION | ||

By: | /s/ Joseph H. Mancini, Jr. | |

Joseph H. Mancini, Jr. | ||

Vice President and Chief Accounting Officer | ||

______________________________________________________________________________________________________

EXHIBIT INDEX

Exhibit No. | Description | |

10(s) | Agreement dated January 28, 2016 between the Icahn Group and Registrant | |

99.1 | Joint press release of Registrant and Carl C. Icahn dated January 29, 2016 re Icahn agreement | |

99.2 | Registrant’s fourth quarter 2015 earnings press release dated January 29, 2016 | |

99.3 | Registrant’s fourth quarter 2015 earnings presentation | |

99.4 | Registrant’s press release dated January 29, 2016 regarding Separation | |

Exhibit 10 (s)

EXECUTION COPY

AGREEMENT

This Agreement, dated 5:00 p.m, New York City time, on January 28, 2016 (this “Agreement”), is by and among the persons and entities listed on Schedule A hereto (collectively, the “Icahn Group”, and individually a “member” of the Icahn Group) and Xerox Corporation (the “Company”).

In consideration of and reliance upon the mutual covenants and agreements contained herein, and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereto agree as follows:

1. | SpinCo Matters. |

(a) | Substantially concurrently with the announcement of this Agreement, the Company shall announce its intention to consummate a transaction (the “Separation”, and the effective time of the Separation, the “Separation Effective Time”) pursuant to which the Company’s business processing outsourcing business (“SpinCo”) shall be separated from the Company’s document technology business into its own publicly traded company. |

(b) | Unless the Separation Effective Time shall have occurred by December 31, 2016, the Company shall call its 2017 annual meeting of the Company’s shareholders to be held no later than March 31, 2017, at which meeting any shareholder of the Company that has delivered written notice to the Company on or prior to January 31, 2017 (which notice shall contain the information required by the second paragraph of Article I, Section 6 of the Company’s bylaws, as in effect as of the date hereof) shall be permitted to nominate directors of the Company and/or propose other business; it being understood and agreed that such meeting shall not be required to be held by such date if the Separation Effective Time shall have occurred at or prior to 11:59 p.m. New York City time on March 30, 2017. |

(c) | The initial board of directors of SpinCo (the “SpinCo Board”) shall be comprised of nine (9) members, who shall be selected as follows: (i) two (2) members selected by the current board of directors of the Company (the “Current Board”), who may, but shall not be required to be, members of the Current Board; (ii) three (3) members selected by the Icahn Group (the “Icahn Designees”), who may, but shall not be required to be, employees or affiliates of the Icahn Group, that are approved by the Current Board (such approval not to be unreasonably withheld, conditioned or delayed), provided that, if either such member is employed by Icahn Enterprises L.P. or Icahn Capital LP and listed on Schedule B hereto, the selection of such member shall not be subject to approval by the Current Board; and (iii) four (4) members |

[[NYCORP:3578672v12:4754W: 01/28/2016--02:10 PM]]

selected by the Current Board, one (1) of whom is approved by the Icahn Group (such approval not to be unreasonably withheld, conditioned or delayed) and one (1) other of whom shall be the new Chief Executive Officer of SpinCo; it being understood and agreed that the SpinCo Board shall have no more than (x) two (2) members who are current or former directors, officers or employees of the Company or any affiliate of the Company and (y) three (3) members that are employees or affiliates of the Icahn Group. Should any of the Icahn Designees resign from the SpinCo Board or be rendered unable to, or refuse to be appointed to, or for any other reason fail to serve on or is not serving on, the SpinCo Board (other than due to the termination of the obligations to nominate and/or appoint under this Agreement), the Icahn Group shall be entitled to designate, and the Company or SpinCo, as applicable, shall cause to be appointed as a member of the SpinCo Board, a replacement (a “Replacement Designee”) that is approved by the Company or SpinCo, as applicable, such approval not to be unreasonably withheld, conditioned or delayed (an “Acceptable Replacement Designee”) (and if such proposed Replacement Designee is not an Acceptable Replacement Designee, the Icahn Group shall be entitled to continue designating a Replacement Designee until such proposed Replacement Designee is an Acceptable Replacement Designee). Any such Replacement Designee who becomes a SpinCo Board member in replacement of an Icahn Designee shall be deemed to be an Icahn Designee for all purposes under this Agreement.

(d) | The Company shall engage a nationally recognized search firm to find a new Chief Executive Officer for SpinCo, who shall: (i) be hired at or prior to the Separation Effective Time; (ii) not be a current or former director, officer or employee of the Company or any affiliate of the Company; and (iii) be selected by the Current Board. In connection therewith, the Current Board will form a new committee of the Board (the “CEO Search Committee”), which will be responsible for running the process for the selection of the new Chief Executive Officer of SpinCo. |

Subject to the Icahn Group’s compliance with the Confidentiality Agreement (as defined below), for so long as the Icahn Group has Beneficial Ownership of at least 4.9% of the outstanding Voting Securities (as defined below) of the Company, a person selected by the Icahn Group (the “Observer”), which such person shall be Jonathan Christodoro, shall receive copies of all documents distributed to the CEO Search Committee, including notice of all meetings of the CEO Search Committee, all written consents executed by the CEO Search Committee and all materials prepared for consideration at any meeting of the CEO Search Committee, and shall be permitted to attend, but not vote, at all meetings (whether such meetings are held in person or telephonically or otherwise) of the CEO Search Committee; provided

2

[[NYCORP:3578672v12:4754W: 01/28/2016--02:10 PM]]

that if Jonathan Christodoro resigns or withdraws as the Observer or is rendered unable to, or refuses to, serve as the Observer (other than due to the termination of the obligations of the Company under this Agreement), the Icahn Group shall be entitled to designate, a replacement observer (a “Replacement Observer”) that is approved by the Company, such approval not to be unreasonably withheld, conditioned or delayed (an “Acceptable Replacement Observer”) (and if such proposed designee is not an Acceptable Replacement Observer, the Icahn Group shall be entitled to continue designating a Replacement Observer until such proposed designee is an Acceptable Replacement Observer). Any such Replacement Observer who becomes an Acceptable Replacement Observer shall be deemed to be the Observer for all purposes under this Agreement.

The Company acknowledges that the Observer desires to have conversations with members of the CEO Search Committee regarding the selection of the new Chief Executive Officer of SpinCo. The Company and the Current Board shall not take any actions to limit such dialogue or restrict members of the CEO Search Committee from speaking to the Observer (or suggest that members of the CEO Search Committee not do so). In the event the process for the selection of the new Chief Executive Officer of SpinCo is conducted by the Current Board or any committee thereof instead of the CEO Search Committee, the Observer shall be entitled to the same observer rights on the Current Board or such committee thereof, solely with respect to matters pertaining to the selection of the new Chief Executive Officer of SpinCo, as the Observer is entitled to under this Section 1(h) with respect to the CEO Search Committee.

(e) | If, immediately prior to the Separation Effective Time, the Icahn Group has Beneficial Ownership of at least 4.9% of the outstanding Voting Securities (as defined below) of the Company and the Icahn Group has not materially breached this Agreement and failed to cure such material breach within five business days of written notice from the Company specifying any such material breach, the Company will take such action (if it has not previously so acted), and after the Separation Effective Time, SpinCo will take such action (if it has not previously so acted), in each case as necessary to provide that, from and after the Separation Effective Time until otherwise approved by a majority vote of the stockholders of SpinCo or in the case of clauses (iv) through (x) until the Icahn Group no longer has Beneficial Ownership of at least 4.9% of the outstanding Voting Securities of SpinCo: |

3

[[NYCORP:3578672v12:4754W: 01/28/2016--02:10 PM]]

(i) | the SpinCo Board shall be annually elected (i.e., not a “staggered” board); |

(ii) | SpinCo will not have a Rights Plan (as defined below) at or immediately following the Separation Effective Time; |

(iii) | any Rights Plan adopted by the SpinCo Board after the Separation Effective Time not ratified by stockholders within one hundred thirty-five (135) days of its taking effect, shall automatically expire; |

(iv) | the provisions of SpinCo’s certificate of incorporation (the “SpinCo Charter”) and/or the bylaws of SpinCo (the “SpinCo Bylaws”) (but if only in the SpinCo Bylaws, then the provision granting stockholders such right to call special meetings may not be amended without a stockholder vote or restricted in the SpinCo Charter) shall require the SpinCo Board to call a special meeting of stockholders at the request of stockholders who own not less than 20% of the outstanding shares of common stock of SpinCo (the “SpinCo Shares”) and meet reasonable requirements specified therein (including advance notice, required disclosures, permitted matters and other terms, but excluding any length of ownership or similar holding period requirements); provided that (X) until such time after the Separation Effective Time that a single person or entity (or “group” of persons or entities who have filed as a “group” as defined under Section 13(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) with respect to their ownership in SpinCo) owns at least a majority of the outstanding stock of SpinCo, business at stockholder-requested special meetings shall not be authorized to include the removal of directors or the election of directors, which matters shall only be taken by the stockholders at an annual meeting or at a special meeting called by the SpinCo Board and (Y) following such time after the Separation Effective Time that a single person or entity (or “group” of persons or entities who have filed as a “group” as defined under Section 13(d) of the Exchange Act with respect to their ownership in SpinCo) owns at least a majority of the outstanding stock of SpinCo, stockholders of SpinCo shall have the power to remove (without cause) and replace directors at a special meeting and such removal (without cause) and replacement of directors shall not require a vote of more than a majority of shares present and voted at such meeting; |

(v) | neither the SpinCo Charter nor the SpinCo Bylaws shall impose minimum voting requirements for which matters subject to a stockholder vote are |

4

[[NYCORP:3578672v12:4754W: 01/28/2016--02:10 PM]]

deemed approved greater than requiring approval from a majority of the outstanding SpinCo Shares, except as required by law;

(vi) | SpinCo will schedule its first annual meeting of stockholders following the Separation Effective Time no later than the twelve-month anniversary of the Separation Effective Time; |

(vii) | SpinCo shall have elected not to be governed by Section 912 of the New York Business Corporation Law; |

(viii) | SpinCo shall not adopt or approve change-of-control provisions in plans benefiting or agreements with directors, officers or employees (including equity plans and change-of-control severance agreements) with ownership triggers below 50%; |

(ix) | if SpinCo receives a bona fide, binding premium offer from a third party (the “Initial Party”) to acquire all of the outstanding SpinCo Shares and rejects that offer in favor of an offer from another party (the “Other Party”) that the SpinCo Board deems superior, and if SpinCo engages in substantive negotiations with such Other Party and provides material non-public information to it and the Initial Party then makes a “topping” bona fide, binding premium bid that is superior to the Other Party’s offer and requests non-public information from SpinCo, SpinCo will, subject to fiduciary duties and compliance with contractual arrangements, enter into a confidentiality agreement (on terms no less favorable to the Company than entered into with the Other Party) with the Initial Party that would enable non-competitively sensitive non-public information to be shared with such party; and |

(x) | SpinCo shall be a corporation incorporated under the laws of the State of New York. |

The term “Rights Plan” shall mean any plan or arrangement of the sort commonly referred to as a “rights plan” or “stockholder rights plan” or “shareholder rights plan” or “poison pill” that is designed to increase the cost to a potential acquirer of exceeding the applicable ownership thresholds through the issuance of new rights, common stock or preferred shares (or any other security or device that may be issued to stockholders of SpinCo other than ratably to all stockholders of SpinCo) that carry severe redemption provisions, favorable purchase provisions or otherwise, and any related rights agreement that effectuates the Rights Plan.

5

[[NYCORP:3578672v12:4754W: 01/28/2016--02:10 PM]]

(f) | So long as an Icahn Designee is a member of the SpinCo Board: (1) the SpinCo Board will not (or if prior to the Separation Effective Time, the Company shall not permit the SpinCo Board to) form an executive committee of the SpinCo Board or any other committee of the SpinCo Board with functions similar to those customarily granted to an executive committee unless, in each case, one of the Icahn Designees is a member (if the committee has more than 4 members then no less than two (2) Icahn Designees shall be appointed members thereof); and (2) all SpinCo Board consideration of, and voting with respect to, any tender offer or exchange offer, merger, acquisition, business combination, reorganization, restructuring, recapitalization, sale or acquisition of material assets, liquidation or dissolution, in each case involving SpinCo or any of its Subsidiaries or its or their securities or a material amount of the assets or businesses of SpinCo or any of its Subsidiaries, and any material financing transactions and appointment and employment of executive officers, will take place only at the full SpinCo Board level or in committees of which one of the Icahn Designees is a member (if the applicable committee has more than 4 members then no less than two (2) Icahn Designees shall be appointed members thereof). |

(g) | From and after the Separation Effective Time, so long as an Icahn Designee is on the SpinCo Board, SpinCo shall notify the Icahn Group in writing no less than 45 calendar days before the advance notice deadline set forth in the SpinCo Bylaws which Icahn Designees, if any, are to be nominated by SpinCo for election as a director at such meeting. If the Icahn Group is notified by SpinCo that any of the Icahn Designees are to be nominated, SpinCo shall use its reasonable best efforts to cause the election of such Icahn Designees to the SpinCo Board at such meeting (including listing such Icahn Designees in the proxy statement and proxy card prepared, filed and delivered in connection with such meeting and recommending that SpinCo’s stockholders vote in favor of the election of each of such Icahn Designees (along with all other SpinCo nominees) and otherwise supporting him or her for election in a manner no less rigorous and favorable than the manner in which SpinCo supports its other nominees in the aggregate). The Icahn Group agrees to provide, or cause to be provided, to the Company or SpinCo, as applicable, such information as is required to be disclosed in proxy statements under applicable law or is otherwise necessary for appointment of the Icahn Designees to the SpinCo Board or inclusion of any Icahn Designees on a slate of directors, as applicable. |

(h) | Prior to the Separation Effective Time, the Company shall cause SpinCo to execute and deliver to the Icahn Group a joinder agreement in the form attached hereto as Exhibit A. Effective upon SpinCo’s execution and delivery of such joinder agreement, SpinCo shall have no liability with respect to the covenants and |

6

[[NYCORP:3578672v12:4754W: 01/28/2016--02:10 PM]]

agreements (or liabilities) of the Company contained herein and the Company shall have no liability with respect to the covenants and agreements (or liabilities) of SpinCo contained herein.

2. | SpinCo Standstill. No member of the Icahn Group shall, directly or indirectly, from the Separation Effective Time to the date that no Icahn Designee serves on the SpinCo Board (such period, the “SpinCo Standstill Period”), with respect to SpinCo and its controlled Affiliates which are not publicly traded entities (which shall not include, for the avoidance of doubt, the Company), so long as SpinCo has not materially breached this Agreement and failed to cure such breach within five business days of written notice from the Icahn Group specifying any such breach: |

(a) | solicit proxies or written consents of stockholders or conduct any other type of referendum (binding or non-binding) with respect to, or from the holders of, the Voting Securities of SpinCo, or become a “participant” (as such term is defined in Instruction 3 to Item 4 of Schedule 14A promulgated under the Exchange Act) in or assist any third party in any “solicitation” of any proxy, consent or other authority (as such terms are defined under the Exchange Act) to vote or withhold from voting any Voting Securities of SpinCo (other than such encouragement, advice or influence that is consistent with SpinCo management’s recommendation in connection with such matter); |

(b) | encourage, advise or influence any other person or assist any third party in so encouraging, assisting or influencing any person with respect to the giving or withholding of any proxy, consent or other authority to vote or in conducting any type of referendum (other than such encouragement, advice or influence that is consistent with SpinCo management’s recommendation in connection with such matter); |

(c) | form or join in a partnership, limited partnership, syndicate or a “group” as defined under Section 13(d) of the Exchange Act, with respect to the Voting Securities of SpinCo, or otherwise support or participate in any effort by a third party with respect to the matters set forth in this Section 2; |

(d) | present (or request to present) at any annual meeting or any special meeting of SpinCo’s stockholders, any proposal for consideration for action by stockholders or propose (or request to propose) any nominee for election to the SpinCo Board or seek representation on the SpinCo Board (in each case except pursuant to Section 1(c)) or the removal of any member of the SpinCo Board; |

7

[[NYCORP:3578672v12:4754W: 01/28/2016--02:10 PM]]

(e) | grant any proxy, consent or other authority to vote with respect to any matters (other than to the named proxies included in SpinCo’s proxy card for any annual meeting or special meeting of stockholders) or deposit any Voting Securities of SpinCo in a voting trust or subject them to a voting agreement or other arrangement of similar effect (excluding customary brokerage accounts, margin accounts, prime brokerage accounts and the like), in each case, except as provided in Section 2 below; |

(f) | call or seek to call any special meeting of SpinCo or make any request under Section 220 of the Delaware General Corporation Law (the “DGCL”) or other applicable legal provisions (including equivalent statutes in any other State in which SpinCo is incorporated) regarding inspection of books and records or other materials (including stocklist materials) of SpinCo or any of its subsidiaries; |

(g) | institute, solicit, assist or join, as a party, any litigation, arbitration or other proceeding against or involving SpinCo or any of its current or former directors or officers (including derivative actions) other than to enforce the provisions of this Agreement; |

(h) | seek, propose, participate in, facilitate or assist any third party to seek or propose any merger, consolidation, business combination, tender or exchange offer, sale or purchase of assets, sale or purchase of securities, dissolution, liquidation, restructuring, recapitalization, extraordinary dividend, significant share repurchase or similar transaction involving SpinCo or any of its non-publicly traded controlled Affiliates (other than the Company after the Separation Effective Time) (collectively, a “SpinCo Extraordinary Transaction”); provided that the members of the Icahn Group shall be permitted to sell or tender their Voting Securities of SpinCo, and otherwise receive consideration, pursuant to any SpinCo Extraordinary Transaction and provided, further that (without limiting the following clause (i)) SpinCo may waive the restrictions in this clause (h) with the approval of the SpinCo Board and provided, further, that from the commencement by a third party (not a party to this Agreement or an Affiliate of a party) of any bona fide tender or exchange offer that is not recommended by the SpinCo Board in its Recommendation Statement on Schedule 14D-9 which, if consummated, would constitute a SpinCo Extraordinary Transaction, then the Icahn Group shall similarly be permitted to commence a tender or exchange offer for all of the Voting Securities of SpinCo at the same or higher consideration per share; |

(i) | request, directly or indirectly, any amendment or waiver of the foregoing in a manner that would reasonably likely require public disclosure by the Icahn Group or SpinCo. |

8

[[NYCORP:3578672v12:4754W: 01/28/2016--02:10 PM]]

Notwithstanding the foregoing, nothing in this Section 2 shall prevent an Icahn Designee acting in his or her capacity as a director of the Company from raising any such matters at the SpinCo Board.

From the date of this Agreement until the end of the SpinCo Standstill Period, (1) the Icahn Group shall not directly or indirectly make, or cause to be made, by press release or similar public statement to the press or media (including social media), or in an SEC or other public filing, any statement or announcement that disparages (as distinct from objective statements reflecting business criticism of SpinCo but not of its individual directors or officers (provided that the Icahn Group shall provide advance notice of, and a copy of, any written statement before it is made)) SpinCo or any of its officers or directors with respect to matters relating to their service at SpinCo (including any former officers or directors); and (2) neither SpinCo nor any of its officers or directors shall directly or indirectly make, or cause to be made, by press release or similar public statement to the press or media (including social media), or in an SEC or other public filing, any statement or announcement that disparages (as distinct from objective statements reflecting business criticism (provided that SpinCo shall provide advance notice of, and a copy of, any written statement before it is made)) any member of the Icahn Group or any of its current or former officers or directors with respect to matters relating to the Company or SpinCo. For the avoidance of doubt, the foregoing restrictions shall not be deemed to apply to advisors of the Icahn Group or SpinCo who are not acting at the behest of such party.

From the date of this Agreement until the end of the SpinCo Standstill Period, (1) the Icahn Group shall not permit any Icahn Affiliate to do any of the items in this Section 2 that the Icahn Group is restricted from doing and shall not publicly encourage or support any other person to take any of the actions described in this Section 2 that the Icahn Group is restricted from doing and (2) SpinCo shall not permit any of its controlled Affiliates to do any of the items in this Section 2 that SpinCo is restricted from doing and shall not publicly encourage or support any other person to take any of the actions described in this Section 2 that SpinCo is restricted from doing.

3. | Voting Commitment. Unless the Company has materially breached this Agreement and failed to cure within five business days following receipt of written notice from the Icahn Group specifying such breach, at the 2016 annual meeting of the Company’s shareholders (the “2016 Annual Meeting”), the Icahn Group shall (i) not, directly or indirectly, nominate directors or propose any other business for consideration by shareholders at the 2016 Annual Meeting, (ii) (A) cause, in the case of all Voting Securities of the Company owned of record, and (B) instruct the record owner, in the case of all shares of Voting Securities of the Company Beneficially Owned but not owned of record, directly or indirectly, by it, or by any controlled Affiliates of the members of the Icahn Group (such controlled Affiliates, collectively and |

9

[[NYCORP:3578672v12:4754W: 01/28/2016--02:10 PM]]

individually, the “Icahn Affiliates”), in each case as of the record date for the 2016 Annual Meeting, in each case that are entitled to vote at the 2016 Annual Meeting, to be present for quorum purposes and to be voted, at the 2016 Annual Meeting or at any adjournments or postponements thereof (x) for all directors nominated by the Current Board for election at the 2016 Annual Meeting and (y) against any directors proposed that are not nominated by the Current Board for election at the 2016 Annual Meeting, (iii) not, directly or indirectly, solicit proxies or written consents of stockholders or conduct any other type of referendum (binding or non-binding) with respect to, or from the holders of, the Voting Securities of the Company, or become a “participant” (as such term is defined in Instruction 3 to Item 4 of Schedule 14A promulgated under the Exchange Act) in or assist any third party in any “solicitation” of any proxy, consent or other authority (as such terms are defined under the Exchange Act) to vote or withhold from voting any Voting Securities of the Company (other than such encouragement, advice or influence that is consistent with the Company management’s recommendation in connection with such matter) and (iv) not, directly or indirectly, encourage, advise or influence any other person or assist any third party in so encouraging, assisting or influencing any person with respect to the giving or withholding of any proxy, consent or other authority to vote or in conducting any type of referendum (other than such encouragement, advice or influence that is consistent with the Company management’s recommendation in connection with such matter). Except as provided in the foregoing sentence, the Icahn Group shall not be restricted from voting “For”, “Against” or “Abstaining” from any other proposals at the 2016 Annual Meeting.

4. | Public Announcement. No earlier than 6:45 a.m., New York City time, on January 29, 2016, the Company and the Icahn Group shall announce this Agreement and the material terms hereof by means of a press release in the form attached hereto as Exhibit B (the “Press Release”). Neither the Company nor the Icahn Group shall make any public announcement or statement that contradicts or disagrees with the statements made in the Press Release, except as required by law or the rules of any stock exchange or with the prior written consent of the other party. |

5. | Representations and Warranties of All Parties; Representations and Warranties of the Icahn Group. |

(a) | Each of the parties represents and warrants to the other party that: (a) such party has all requisite company power and authority to execute and deliver this Agreement and to perform its obligations hereunder; (b) this Agreement has been duly and validly authorized, executed and delivered by it and is a valid and binding obligation of such party, enforceable against such party in accordance with its terms; (c) this Agreement will not result in a violation of any terms or conditions of any agreements to which such person is a party or by which such party may otherwise be bound or of any law, |

10

[[NYCORP:3578672v12:4754W: 01/28/2016--02:10 PM]]

rule, license, regulation, judgment, order or decree governing or affecting such party; and (d) there is currently no pending or outstanding litigation between the Icahn Group and the Company or Affiliates thereof.

(b) | Each member of the Icahn Group jointly represents and warrants that, as of the date of this Agreement, (i) the Icahn Group collectively Beneficially Own, an aggregate of 92,377,043 shares of Common Stock, par value $1.00, of the Company (“Common Stock”); and (ii) except for such ownership, no member of the Icahn Group, individually or in the aggregate with all other members of the Icahn Group and Icahn Affiliates, has any other Beneficial Ownership of, and/or economic exposure to, any Voting Securities of the Company, including through any derivative transaction described in the definition of “Beneficial Ownership” above. As used in this Agreement, the term “Voting Securities” means common stock or such other equity securities of the Company or SpinCo, as applicable, having the power to vote in the election of members of the board of directors of the Company or SpinCo, as applicable, and shall include securities convertible into, or exercisable or exchangeable for such common stock or such other equity securities, whether or not subject to the passage of time or other contingencies, “Beneficial Ownership” of “Voting Securities” means ownership of: (i) Voting Securities, (ii) rights or options to own or acquire any Voting Securities (whether such right or option is exercisable immediately or only after the passage of time or upon the satisfaction of one or more conditions (whether or not within the control of such person), compliance with regulatory requirements or otherwise) and (iii) any other economic exposure to Voting Securities, including through any derivative transaction that gives any such person or any of such person’s controlled Affiliates the economic equivalent of ownership of an amount of Voting Securities due to the fact that the value of the derivative is explicitly determined by reference to the price or value of Voting Securities, or which provides such person or any of such person’s controlled Affiliates an opportunity, directly or indirectly, to profit, or to share in any profit, derived from any increase in the value of Voting Securities, in any case without regard to whether (x) such derivative conveys any voting rights in Voting Securities to such person or any of such person’s Affiliates, (y) the derivative is required to be, or capable of being, settled through delivery of Voting Securities, or (z) such person or any of such person’s Affiliates may have entered into other transactions that hedge the economic effect of such Beneficial Ownership of Voting Securities and “Affiliate” shall have the meaning set forth in Rule 12b-2 promulgated by the SEC under the Exchange Act. “SEC” shall mean the U.S. Securities and Exchange Commission. |

6. | Confidentiality Agreement. The Icahn Group, the Observer and the Company shall enter into a customary confidentiality agreement (the “Confidentiality Agreement”) covering any |

11

[[NYCORP:3578672v12:4754W: 01/28/2016--02:10 PM]]

confidential information relating to the selection of directors pursuant to Section 1(c) and the selection of the Chief Executive Officer of SpinCo pursuant to Section 1(d).

7. | Remedies; Forum and Governing Law. The parties hereto recognize and agree that if for any reason any of the provisions of this Agreement are not performed in accordance with their specific terms or are otherwise breached, immediate and irreparable harm or injury would be caused for which money damages would not be an adequate remedy. Accordingly, each party agrees that in addition to other remedies the other party shall be entitled to at law or equity, the other party shall be entitled to an injunction or injunctions to prevent breaches of this Agreement and to enforce specifically the terms and provisions of this Agreement exclusively in the Court of Chancery or other federal or state courts of the State of Delaware. In the event that any action shall be brought in equity to enforce the provisions of this Agreement, no party shall allege, and each party hereby waives the defense, that there is an adequate remedy at law. Furthermore, each of the parties hereto (a) consents to submit itself to the personal jurisdiction of the Court of Chancery or other federal or state courts of the State of Delaware in the event any dispute arises out of this Agreement or the transactions contemplated by this Agreement, (b) agrees that it shall not attempt to deny or defeat such personal jurisdiction by motion or other request for leave from any such court, (c) agrees that it shall not bring any action relating to this Agreement or the transactions contemplated by this Agreement in any court other than the Court of Chancery or other federal or state courts of the State of Delaware, and each of the parties irrevocably waives the right to trial by jury, (d) agrees to waive any bonding requirement under any applicable law, in the case any other party seeks to enforce the terms by way of equitable relief and (e) irrevocably consents to service of process by a reputable overnight mail delivery service, signature requested, to the address of such party’s principal place of business or as otherwise provided by applicable law. THIS AGREEMENT SHALL BE GOVERNED IN ALL RESPECTS, INCLUDING VALIDITY, INTERPRETATION AND EFFECT, BY THE LAWS OF THE STATE OF DELAWARE APPLICABLE TO CONTRACTS EXECUTED AND TO BE PERFORMED WHOLLY WITHIN SUCH STATE WITHOUT GIVING EFFECT TO THE CHOICE OF LAW PRINCIPLES OF SUCH STATE. |

8. | No Waiver. Any waiver by any party of a breach of any provision of this Agreement shall not operate as or be construed to be a waiver of any other breach of such provision or of any breach of any other provision of this Agreement. The failure of a party to insist upon strict adherence to any term of this Agreement on one or more occasions shall not be considered a waiver or deprive that party of the right thereafter to insist upon strict adherence to that term or any other term of this Agreement. |

12

[[NYCORP:3578672v12:4754W: 01/28/2016--02:10 PM]]

9. | Entire Agreement. This Agreement contains the entire understanding of the parties with respect to the subject matter hereof and may be amended only by an agreement in writing executed by the parties hereto. |

10. | Notices. All notices, consents, requests, instructions, approvals and other communications provided for herein and all legal process in regard hereto shall be in writing and shall be deemed validly given, made or served, if (a) given by telecopy and email, when such telecopy and email is transmitted to the telecopy number set forth below and sent to the email address set forth below and the appropriate confirmation is received or (b) if given by any other means, when actually received during normal business hours at the address specified in this subsection: |

If to the Company:

Xerox Corporation

P.O. Box 4505, 45 Glover Avenue

Norwalk, CT 06850

Attention: General Counsel

Facsimile: (203) 849-5152

Email: [email protected]

With a copy to (which shall not constitute notice):

Cravath, Swaine & Moore LLP

825 Eighth Avenue

New York, New York 10019

Attention: Scott A. Barshay O. Keith Hallam, III

Facsimile: (212) 474-3700 (212) 474-3700

If to the Icahn Group:

Icahn Associates Corp.

767 Fifth Avenue, 47th Floor

New York, New York 10153

Attention: Carl C. Icahn Keith Cozza

Facsimile: (212) 750-5807 (212) 702-4323

With a copy to (which shall not constitute notice):

Icahn Associates Corp.

767 Fifth Avenue, 47th Floor

New York, New York 10153

Attention: Jesse Lynn Louie Pastor

13

[[NYCORP:3578672v12:4754W: 01/28/2016--02:10 PM]]

Facsimile: (917) 591-3310 (212) 688-1158

11. | Severability. If at any time subsequent to the date hereof, any provision of this Agreement shall be held by any court of competent jurisdiction to be illegal, void or unenforceable, such provision shall be of no force and effect, but the illegality or unenforceability of such provision shall have no effect upon the legality or enforceability of any other provision of this Agreement. |

12. | Counterparts. This Agreement may be executed in two or more counterparts (including by facsimile or PDF) which together shall constitute a single agreement. |

13. | Successors and Assigns. This Agreement and the rights hereunder shall not be assignable or assigned, directly or indirectly, by operation of law or otherwise, by any of the parties to this Agreement. |

14. | No Third Party Beneficiaries. This Agreement is solely for the benefit of the parties hereto and is not enforceable by any other persons; provided that from and after the Separation Effective Time, SpinCo shall be a beneficiary of this Agreement, both SpinCo and the Company shall be bound to this Agreement as applicable (and for the avoidance of doubt the Icahn Group shall remain bound), and for purposes of enforcement of this Agreement prior to the Separation Effective Time only, references herein to the “Company” shall also be deemed to refer to SpinCo. |

15. | Fees and Expenses. Neither the Company (nor SpinCo), on the one hand, nor the Icahn Group, on the other hand, will be responsible for any fees or expenses of the other in connection with this Agreement. |

16. | Interpretation and Construction. Each of the parties hereto acknowledges that it has been represented by counsel of its choice throughout all negotiations that have preceded the execution of this Agreement, and that it has executed the same with the advice of said independent counsel. Each party and its counsel cooperated and participated in the drafting and preparation of this Agreement and the documents referred to herein, and any and all drafts relating thereto exchanged among the parties shall be deemed the work product of all of the parties and may not be construed against any party by reason of its drafting or preparation. Accordingly, any rule of law or any legal decision that would require interpretation of any ambiguities in this Agreement against any party that drafted or prepared it is of no application and is hereby expressly waived by each of the parties hereto, and any controversy over interpretations of this Agreement shall be decided without regards to events of drafting or preparation. The section headings contained in this Agreement are for reference |

14

[[NYCORP:3578672v12:4754W: 01/28/2016--02:10 PM]]

purposes only and shall not affect in any way the meaning or interpretation of this Agreement. The term “including” shall be deemed to mean “including without limitation” in all instances.

[Signature Pages Follow]

15

[[NYCORP:3578672v12:4754W: 01/28/2016--02:10 PM]]

IN WITNESS WHEREOF, each of the parties hereto has executed this Agreement, or caused the same to be executed by its duly authorized representative as of the date first above written.

Very truly yours, |

XEROX CORPORATION |

By: /s/ Ursula M. Burns |

Name: Ursula M. Burns |

Title: Chairman and Chief Executive Officer |

[Signature Page to Agreement between the Icahn Group and Xerox]

[[NYCORP:3578672v12:4754W: 01/28/2016--02:10 PM]]

Accepted and agreed as of the date first written above:

MR. CARL C. ICAHN |

By: /s/ Carl. C. Icahn |

Carl C. Icahn |

HIGH RIVER LIMITED PARTNERSHIP |

By: /s/ Keith Cozza |

Name: Keith Cozza |

Title: Authorized Signatory |

HOPPER INVESTMENTS LLC |

By: /s/ Keith Cozza |

Name: Keith Cozza |

Title: Authorized Signatory |

BARBERRY CORP. |

By: /s/ Keith Cozza |

Name: Keith Cozza |

Title: Authorized Signatory |

[Signature Page to Agreement between the Icahn Group and Xerox]

[[NYCORP:3578672v12:4754W: 01/28/2016--02:10 PM]]

ICAHN PARTNERS LP |

By: /s/ Keith Cozza |

Name: Keith Cozza |

Title: Authorized Signatory |

ICAHN PARTNERS MASTER FUND LP |

By: /s/ Keith Cozza |

Name: Keith Cozza |

Title: Authorized Signatory |

ICAHN ENTERPRISES G.P. INC. |

By: /s/ Keith Cozza |

Name: Keith Cozza |

Title: Authorized Signatory |

[Signature Page to Agreement between the Icahn Group and Xerox]

[[NYCORP:3578672v12:4754W: 01/28/2016--02:10 PM]]

ICAHN ENTERPRISES HOLDINGS L.P. |

By: /s/ Keith Cozza |

Name: Keith Cozza |

Title: Authorized Signatory |

IPH GP LLC |

By: /s/ Keith Cozza |

Name: Keith Cozza |

Title: Authorized Signatory |

ICAHN CAPITAL LP |

By: /s/ Keith Cozza |

Name: Keith Cozza |

Title: Authorized Signatory |

ICAHN ONSHORE LP |

By: /s/ Keith Cozza |

Name: Keith Cozza |

Title: Authorized Signatory |

ICAHN OFFSHORE LP |

By: /s/ Keith Cozza |

Name: Keith Cozza |

Title: Authorized Signatory |

[Signature Page to Agreement between the Icahn Group and Xerox]

[[NYCORP:3578672v12:4754W: 01/28/2016--02:10 PM]]

BECKTON CORP |

By: /s/ Keith Cozza |

Name: Keith Cozza |

Title: Authorized Signatory |

MR. JONATHAN CHRISTODORO |

/s/ Jonathan Christodoro |

Jonathan Christodoro |

[Signature Page to Agreement between the Icahn Group and Xerox]

[[NYCORP:3578672v12:4754W: 01/28/2016--02:10 PM]]

[Signature Page to Agreement between the Icahn Group and Xerox]

[[NYCORP:3578672v12:4754W: 01/28/2016--02:10 PM]]

SCHEDULE A

------------------------------

MR. CARL C. ICAHN

HIGH RIVER LIMITED PARTNERSHIP

HOPPER INVESTMENTS LLC

BARBERRY CORP.

ICAHN PARTNERS LP

ICAHN PARTNERS MASTER FUND LP

ICAHN ENTERPRISES G.P. INC.

ICAHN ENTERPRISES HOLDINGS L.P.

IPH GP LLC

ICAHN CAPITAL LP

ICAHN ONSHORE LP

ICAHN OFFSHORE LP

BECKTON CORP.

MR. JONATHAN CHRISTODORO

Schedule B

[[NYCORP:3578672v12:4754W: 01/28/2016--02:10 PM]]

SCHEDULE B

------------------------------

SungHwan Cho

Jonathan Christodoro

Keith Cozza

Hunter C. Gary

Vincent J. Intrieri

Andrew Langham

Jesse A. Lynn

Courtney Mather

Samuel Merksamer

Louis J. Pastor

Schedule B

[[NYCORP:3578672v12:4754W: 01/28/2016--02:10 PM]]

EXHIBIT A

WHEREAS, Xerox Corporation (the “Company”) has entered into that certain Agreement by and among the parties listed on Schedule A thereto (the “Icahn Group”) and the Company (the “Agreement”), dated January 24, 2016, a copy of which is attached hereto; and

WHEREAS, the Company is pursuing a Separation (as defined in the Agreement); and

WHEREAS, the Agreement requires that SpinCo execute and deliver to the Icahn Group this Joinder Agreement.

NOW, THEREFORE, the undersigned hereby joins in the Agreement and agrees that, immediately upon the Separation Effective Time (as defined in the Agreement), it shall be deemed to be “SpinCo” within the meaning of the Agreement and shall be bound by all of the terms and conditions of the Agreement applicable to SpinCo thereunder.

[Signature page follows]

A-1

[[NYCORP:3578672v12:4754W: 01/28/2016--02:10 PM]]

IN WITNESS WHEREOF, the undersigned has executed this Joinder Agreement as of ___________, 2016.

SPINCO: [___________________], a [●] corporation |

By: Name: Title: |

ACCEPTED:

MR. CARL C. ICAHN

Carl C. Icahn

HIGH RIVER LIMITED PARTNERSHIP

By:

Name: Keith Cozza

Title: Authorized Signatory

HOPPER INVESTMENTS LLC

By:

Name: Keith Cozza

Title: Authorized Signatory

A-2

[[NYCORP:3578672v12:4754W: 01/28/2016--02:10 PM]]

BARBERRY CORP.

By:

Name: Keith Cozza

Title: Authorized Signatory

ICAHN PARTNERS LP

By:

Name: Keith Cozza

Title: Authorized Signatory

[Signature Page to Joinder to Xerox/Icahn Agreement]

ICAHN PARTNERS MASTER FUND LP

By:

Name: Keith Cozza

Title: Authorized Signatory

ICAHN ENTERPRISES G.P. INC.

By:

Name: Keith Cozza

Title: Authorized Signatory

ICAHN ENTERPRISES HOLDINGS L.P.

By:

Name: Keith Cozza

Title: Authorized Signatory

IPH GP LLC

By:

Name: Keith Cozza

Title: Authorized Signatory

ICAHN CAPITAL LP

A-3

[[NYCORP:3578672v12:4754W: 01/28/2016--02:10 PM]]

By:

Name: Keith Cozza

Title: Authorized Signatory

ICAHN ONSHORE LP

By:

Name: Keith Cozza

Title: Authorized Signatory

ICAHN OFFSHORE LP

By:

Name: Keith Cozza

Title: Authorized Signatory

[Signature Page to Joinder to Xerox/Icahn Agreement]

BECKTON CORP

By:

Name: Keith Cozza

Title: Authorized Signatory

[Signature Page to Joinder to Xerox/Icahn Agreement]

A-4

[[NYCORP:3578672v12:4754W: 01/28/2016--02:10 PM]]

EXHIBIT B

Xerox and Carl Icahn Announce Agreement

NORWALK, Conn., Jan. 29, 2016 – Xerox (NYSE: XRX) and Carl C. Icahn announced today that they have entered into an agreement related to the governance of the Business Process Outsourcing (“BPO”) company that will be created as a result of the planned separation of Xerox into two independent, publicly-traded companies, which was announced earlier today.

Under the agreement, when the separation is complete, the BPO company will have certain best-in-class corporate governance provisions and a Board of Directors composed of nine members: six directors selected by Xerox (two of whom may come from the current Xerox Board of Directors) and three directors selected by Icahn. In addition, in connection with the planned separation, Xerox agreed that a committee of its Board of Directors will begin searching for an external candidate to be Chief Executive Officer of the BPO company and to allow a person selected by Icahn to observe and advise the committee in that search process. Additional details regarding the agreement will be included in a Form 8-K to be filed by Xerox later today.

"We are pleased to have reached an agreement with Mr. Icahn that ensures that we will have strong leadership and best-in-class governance for the new Business Process Outsourcing company that will be created by our separation plan,” said Ursula Burns, chairman and chief executive officer of Xerox.

Mr. Icahn said: “We applaud Ursula Burns and Xerox’s Board of Directors for recognizing the importance of separating Xerox into two publicly-traded companies. We strongly believe that an independent BPO company with fresh, focused leadership and best-in-class corporate governance will greatly enhance shareholder value, and we are proud to be a part of that process.”

About Xerox

Xerox is helping change the way the world works. By applying our expertise in imaging, business process, analytics, automation and user-centric insights, we engineer the flow of work to provide greater productivity, efficiency and personalization. We conduct business in 180 countries, and our more than 140,000 employees create meaningful innovations and provide business process services, printing equipment, software and solutions that make a real difference for our clients - and their customers. Learn more at www.xerox.com.

Forward-looking Statements

This release contains “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “will,” “should” and similar expressions, as they relate to us, are intended to identify forward-looking statements. These statements reflect management’s current beliefs, assumptions and expectations, including with respect to the proposed separation of the Business Process Outsourcing ("BPO")

B-1

[[NYCORP:3578672v12:4754W: 01/28/2016--02:10 PM]]

business from the Document Technology and Document Outsourcing business, the expected timetable for completing the separation, the future financial and operating performance of each business, the strategic and competitive advantages of each business, future opportunities for each business and the expected amount of cost reductions that may be realized in the cost transformation program, and are subject to a number of factors that may cause actual results to differ materially. Such factors include but are not limited to: changes in economic conditions, political conditions, trade protection measures, licensing requirements and tax matters in the United States and in the foreign countries in which we do business; changes in foreign currency exchange rates; our ability to successfully develop new products, technologies and service offerings and to protect our intellectual property rights; the risk that multi-year contracts with governmental entities could be terminated prior to the end of the contract term and that civil or criminal penalties and administrative sanctions could be imposed on us if we fail to comply with the terms of such contracts and applicable law; the risk that our bids do not accurately estimate the resources and costs required to implement and service very complex, multi-year governmental and commercial contracts, often in advance of the final determination of the full scope and design of such contracts or as a result of the scope of such contracts being changed during the life of such contracts; the risk that subcontractors, software vendors and utility and network providers will not perform in a timely, quality manner; service interruptions; actions of competitors and our ability to promptly and effectively react to changing technologies and customer expectations; our ability to obtain adequate pricing for our products and services and to maintain and improve cost efficiency of operations, including savings from restructuring actions and the relocation of our service delivery centers; the risk that individually identifiable information of customers, clients and employees could be inadvertently disclosed or disclosed as a result of a breach of our security systems; the risk in the hiring and retention of qualified personnel; the risk that unexpected costs will be incurred; our ability to recover capital investments; the risk that our Services business could be adversely affected if we are unsuccessful in managing the start-up of new contracts; the collectability of our receivables for unbilled services associated with very large, multi-year contracts; reliance on third parties, including subcontractors, for manufacturing of products and provision of services; our ability to expand equipment placements; interest rates, cost of borrowing and access to credit markets; the risk that our products may not comply with applicable worldwide regulatory requirements, particularly environmental regulations and directives; the outcome of litigation and regulatory proceedings to which we may be a party; the possibility that the proposed separation of the BPO business from the Document Technology and Document Outsourcing business will not be consummated within the anticipated time period or at all, including as the result of regulatory, market or other factors; the potential for disruption to our business in connection with the proposed separation; the potential that BPO and Document Technology and Document Outsourcing do not realize all of the expected benefits of the separation; and other factors that are set forth in the “Risk Factors” section, the “Legal Proceedings” section, the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section and other sections of our Quarterly Reports on Form 10-Q for the quarters ended, March 31, 2015, June 30, 2015 and September 30, 2015 and our 2014 Annual Report on Form 10-K filed with the Securities and Exchange Commission. Xerox assumes no obligation to update any forward-looking statements as a result of new information or future events or developments, except as required by law.

-XXX-

Media Contacts:

B-2

[[NYCORP:3578672v12:4754W: 01/28/2016--02:10 PM]]

Sean Collins, Xerox, +1-310-497-9205, [email protected]

Carl Langsenkamp, Xerox, +1-585-423-5782, [email protected]

Investor Contacts:

Jennifer Horsley, Xerox, +1-203-849-2656, [email protected]

Sean Cornett, Xerox, +1-203-849-2672, [email protected]

Note: To receive RSS news feeds, visit http://news.xerox.com. For open commentary, industry perspectives and views visit http://twitter.com/xerox, http://www.linkedin.com/company/xerox, http://simplifywork.blogs.xerox.com, http://www.facebook.com/XeroxCorp or http://www.youtube.com/XeroxCorp.

Xerox® and Xerox and Design® are trademarks of Xerox in the United States and/or other countries.

B-3

[[NYCORP:3578672v12:4754W: 01/28/2016--02:10 PM]]

Exhibit 99.1

News from Xerox

For Immediate Release

Xerox Corporation

45 Glover Avenue

P.O. Box 4505

Norwalk, CT 06856-4505

tel +1-203-968-3000

Xerox and Carl Icahn Announce Agreement

NORWALK, Conn., Jan. 29, 2016 - Xerox (NYSE: XRX) and Carl C. Icahn announced today that they have entered into an agreement related to the governance of the Business Process Outsourcing (“BPO”) company that will be created as a result of the planned separation of Xerox into two independent, publicly-traded companies, which was announced earlier today.

Under the agreement, when the separation is complete, the BPO company will have certain best-in-class corporate governance provisions and a Board of Directors composed of nine members: six directors selected by Xerox (two of whom may come from the current Xerox Board of Directors) and three directors selected by Icahn. In addition, in connection with the planned separation, Xerox agreed that a committee of its Board of Directors will begin searching for an external candidate to be Chief Executive Officer of the BPO company and to allow a person selected by Icahn to observe and advise the committee in that search process. Additional details regarding the agreement will be included in a Form 8-K to be filed by Xerox later today.

“We are pleased to have reached an agreement with Mr. Icahn that ensures that we will have strong leadership and best-in-class governance for the new Business Process Outsourcing company that will be created by our separation plan,” said Ursula Burns, chairman and chief executive officer of Xerox.

Mr. Icahn said: “We applaud Ursula Burns and Xerox’s Board of Directors for recognizing the importance of separating Xerox into two publicly-traded companies. We strongly believe that an independent BPO company with fresh, focused leadership and best-in-class corporate governance will greatly enhance shareholder value, and we are proud to be a part of that process.”

About Xerox

Xerox is helping change the way the world works. By applying our expertise in imaging, business process, analytics, automation and user-centric insights, we engineer the flow of work to provide greater productivity, efficiency and personalization. We conduct business in 180 countries, and our more than 140,000 employees create meaningful innovations and provide business process services, printing equipment, software and solutions that make a real difference for our clients - and their customers. Learn more at www.xerox.com.

Forward-Looking Statements

This release contains “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “will,” “should” and similar expressions, as they relate to us, are intended to identify forward-looking statements. These statements reflect management’s current beliefs, assumptions and expectations, including with respect to the proposed separation of the Business Process Outsourcing ("BPO") business from the Document Technology and Document Outsourcing business, the expected timetable for completing the separation, the future financial and operating performance of each business, the strategic and competitive advantages of each business, future opportunities for each business and the expected amount of cost reductions that may be realized in the cost transformation program, and are subject to a number of factors that may cause actual results to differ materially. Such factors include but are not limited to: changes in economic conditions, political conditions, trade protection measures, licensing requirements and tax matters in the United States and in the foreign countries in which we do business; changes in foreign currency exchange rates; our ability to successfully develop new products, technologies and service offerings and to protect our intellectual property rights; the risk that multi-year contracts with governmental entities could be terminated prior to the end of the contract term and that civil or criminal penalties and administrative sanctions could be imposed on us if we fail to comply with the terms of such contracts and applicable law; the risk that our bids do not accurately estimate the resources and costs required to implement and service very complex, multi-year governmental and commercial contracts, often in advance of the final determination of the full scope and design of such contracts or as a result of the scope of such contracts being changed during the life of such contracts; the risk that subcontractors, software vendors and utility and network providers will not perform in a timely, quality manner; service interruptions; actions of competitors and our ability to promptly and effectively react to changing technologies and customer expectations; our ability to obtain adequate pricing for our products and services and to maintain and improve cost efficiency of operations, including savings from restructuring actions and the relocation of our service delivery centers; the risk that individually identifiable information of customers, clients and employees could be inadvertently disclosed or disclosed as a result of a breach of our security systems; the risk in the hiring and retention of qualified personnel; the risk that unexpected costs will be incurred; our ability to recover capital investments; the risk that our Services business could be adversely affected if we are unsuccessful in managing the start-up of new contracts; the collectability of our receivables for unbilled services associated with very large, multi-year contracts; reliance on third parties, including subcontractors, for manufacturing of products and provision of services; our ability to expand equipment placements; interest rates, cost of borrowing and access to credit markets; the risk that our products may not comply with applicable worldwide regulatory requirements, particularly environmental regulations and directives; the outcome of litigation and regulatory proceedings to which we may be a party; the possibility that the proposed separation of the BPO business from the Document Technology and Document Outsourcing business will not be consummated within the anticipated time period or at all, including as the result of regulatory, market or other factors; the potential for disruption to our business in connection with the proposed separation; the potential that BPO and Document Technology and Document Outsourcing do not realize all of the expected benefits of the separation; and other factors that are set forth in the “Risk Factors” section, the “Legal Proceedings” section, the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section and other sections of our Quarterly Reports on Form 10-Q for the quarters ended, March 31, 2015, June 30, 2015 and September 30, 2015 and our 2014 Annual Report on Form 10-K filed with the Securities and Exchange Commission. Xerox assumes no obligation to update any forward-looking statements as a result of new information or future events or developments, except as required by law.

-XXX-

Media Contacts:

Sean Collins, Xerox, +1-310-497-9205, [email protected]

Carl Langsenkamp, Xerox, +1-585-423-5782, [email protected]

Investor Contacts:

Jennifer Horsley, Xerox, +1-203-849-2656, [email protected]

Sean Cornett, Xerox, +1 203-849-2672, [email protected]

Note: To receive RSS news feeds, visit http://news.xerox.com/. For open commentary, industry perspectives and views visit http://twitter.com/xerox, http://www.linkedin.com/company/xerox, http://simplifywork.blogs.xerox.com, http://www.facebook.com/XeroxCorp or http://www.youtube.com/XeroxCorp.

Xerox® and Xerox and Design® are trademarks of Xerox in the United States and/or other countries.

Exhibit 99.2

News from Xerox

For Immediate Release

Xerox Corporation

45 Glover Avenue

P.O. Box 4505

Norwalk, CT 06856-4505

tel +1-203-968-3000

Xerox Reports Fourth-Quarter 2015 Earnings

• | Delivers GAAP EPS of 27 cents, adjusted EPS of 32 cents and sequential increase in operating margin to 9.2% |

• | Generates strong cash flow of $878 million in the quarter, $1.6 billion full-year |

• | Services segment delivers revenue of $2.6 billion and double-digit growth in signings in the quarter |

• | Document Technology continues to deliver strong operating margin and remains the industry equipment share revenue leader |

• | Announces annual cash dividend increase of 11% to 31 cents per share |

• | Announces full-year 2016 guidance of $0.66 to $0.76 in GAAP EPS and $1.10 to $1.20 in adjusted EPS |

NORWALK, Conn., Jan. 29, 2016 - Xerox (NYSE: XRX) today announced its fourth-quarter financial results, delivering strong earnings and cash flow as a result of a continuous focus on productivity and business model optimization.

The company recorded fourth-quarter 2015 adjusted earnings per share of 32 cents, or GAAP EPS from continuing operations of 27 cents including the amortization of intangibles.

“We delivered solid performance in the fourth quarter, with earnings that were above our expectations, as a result of the progress we are making across both segments in optimizing our operating models,” said Ursula Burns, Xerox chairman and chief executive officer.

“In the face of a challenging environment, our Services segment drove sequential improvement in margin and double-digit year-over-year signings growth. Similarly, Document Technology was the industry equipment sales revenue market share leader for the 24th consecutive quarter and, through our continued focus on performance and productivity, maintained its strong margins.”

“Looking forward, we will continue to take actions that deliver value for shareholders and clients. This is reflected in the plan we announced today to separate into two market leading companies and implement a $2.4 billion strategic transformation program. We will do what is right to position our company for success through a focus on transforming our operations and optimizing our structure," Burns added.

Fourth Quarter 2015 Results

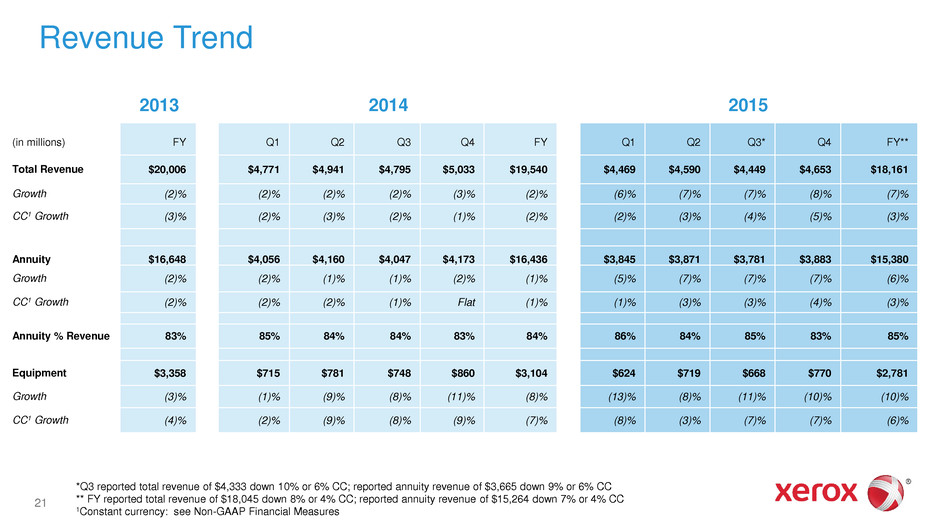

Revenues were $4.7 billion in the quarter, down 8 percent or 5 percent in constant currency year-over-year. Annuity revenue was 83 percent of total revenue.

Fourth-quarter operating margin of 9.2 percent was down 1.2 percentage points from the same quarter a year ago.

Gross margin was 31.3 percent, and selling, administrative and general expenses were 19.0 percent of revenue.

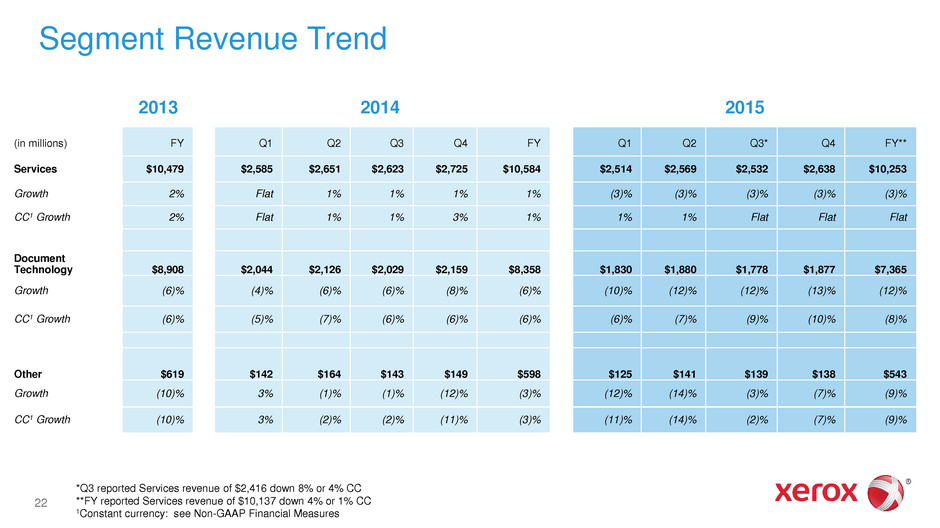

Revenue from the company’s Services segment, which represented 57 percent of total revenue, was $2.6 billion, down 3 percent or flat in constant currency. Document Technology revenue was $1.9 billion, down 13 percent or 10 percent in constant currency. Services margin was 9.4 percent. Document Technology margin was 11.8 percent.

1

Xerox generated $878 million in cash flow from operations during the fourth quarter and ended 2015 with a cash balance of $1.4 billion.

Full Year 2015 Results:

• | GAAP EPS from continuing operations of 49 cents, adjusted EPS of 98 cents |

• | Total revenue of $18.2 billion*, $10.3 billion from Services*, $7.4 billion from Document Technology |

• | Operating margin of 8.4 percent |

• | Operating cash flow of $1.6 billion |

• | Net income from continuing operations of $552 million, adjusted net income of $1.1 billion |

• | Share repurchase of $1.3 billion, dividend payments of $326 million |

* Reported Total and Services revenue was $18.0 billion and $10.1 billion, respectively. All full-year 2015 results exclude the impact from the third quarter Health Enterprise settlement charge.

Full Year 2016 Guidance

For full-year 2016, Xerox expects GAAP earnings of $0.66 to $0.76 per share.

In 2016 the company plans to revise its calculation of adjusted EPS to exclude restructuring, certain retirement related costs as well as separation and related costs in addition to the amortization of intangibles. Based on this revised calculation, full-year 2016 adjusted EPS guidance is expected to be $1.10 to $1.20 per share. On a comparable basis, full-year 2015 adjusted EPS would have been $1.07 per share.

Xerox expects to generate operating cash flow of $1.3 to $1.5 billion and free cash flow of $1.0 to $1.2 billion in 2016.

For the first quarter of 2016, Xerox expects GAAP earnings of 5 to 8 cents per share and adjusted EPS of 21 to 24 cents per share.

Dividend Declaration and Planned Increase

Today, the company announced that its board of directors has declared an 11 percent increase in the company’s quarterly cash dividend to 7.75 cents per share on Xerox common stock. The dividend is payable on April 29, 2016 to shareholders of record on March 31, 2016.

The board also declared a quarterly cash dividend of $20 per share on Xerox Series A Convertible Perpetual Preferred Stock. The dividend is payable on April 1, 2016 to shareholders of record on March 15, 2016.

In 2016, Xerox will continue its practice of returning value to shareholders. It expects to use more than 50 percent of its free cash flow for share repurchases and dividends.

About Xerox

Xerox is helping change the way the world works. By applying our expertise in imaging, business process, analytics, automation and user-centric insights, we engineer the flow of work to provide greater productivity, efficiency and personalization. We conduct business in 180 countries, and our more than 140,000 employees create meaningful innovations and provide business process services, printing equipment, software and solutions that make a real difference for our clients - and their customers. Learn more at www.xerox.com.

Non-GAAP Measures: