Form 8-K Western Gas Partners LP For: Oct 28

�

�

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

�

�

FORM�8-K

�

�

CURRENT REPORT

PURSUANT TO SECTION�13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October�28, 2014

�

�

WESTERN GAS PARTNERS, LP

(Exact name of registrant as specified in its charter)

�

�

�

| Delaware | � | 001-34046 | � | 26-1075808 |

| (State or other jurisdiction of incorporation or organization) |

� | (Commission File Number) |

� | (IRS Employer Identification No.) |

1201 Lake Robbins Drive

The Woodlands, Texas 77380-1046

(Address of principal executive office) (Zip Code)

(832) 636-6000

(Registrants� telephone number, including area code)

�

�

Check the appropriate box below if the Form�8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

�

| � | Written communications pursuant to Rule�425 under the Securities Act (17 CFR 230.425) |

�

| � | Soliciting material pursuant to Rule�14a-12 under the Exchange Act (17 CFR 240.14a-12) |

�

| � | Pre-commencement communications pursuant to Rule�14d-2(b)�under the Exchange Act (17 CFR 240.14d-2(b)) |

�

| � | Pre-commencement communications pursuant to Rule�13e-4(c)�under the Exchange Act (17 CFR 240.13e-4(c)) |

�

�

�

Item�1.01 Entry into a Material Definitive Agreement.

Nuevo Merger Agreement

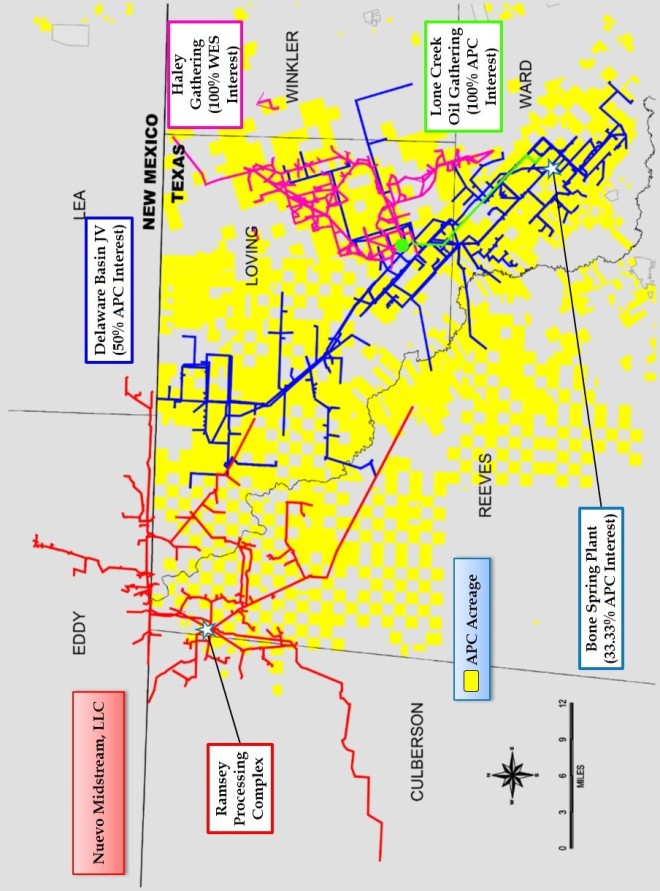

On October�28, 2014, the Partnership announced its entry into an Agreement and Plan of Merger (�Merger Agreement�) by and among the Partnership, Maguire Midstream LLC, an indirect wholly owned subsidiary of the Partnership, Nuevo Midstream, LLC (�Nuevo�) and the other parties thereto, pursuant to which the Partnership will acquire Nuevo for $1.5 billion in cash, subject to adjustment. Nuevo�s assets currently include a cryogenic processing complex, gas gathering system and related facilities and equipment that serve production from Reeves, Loving and Culberson Counties, Texas and Eddy and Lea Counties, New Mexico. The Partnership expects to fund this acquisition with (i)�cash on hand, (ii)�borrowings under its revolving credit facility and (iii)�as discussed in more detail below, the issuance of $750.0 million of Class C units to a subsidiary of Anadarko Petroleum Corporation (�Anadarko�).

The closing of the Acquisition is subject to the satisfaction of certain customary conditions, including the expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976. The Partnership expects the Acquisition to close in the fourth quarter of 2014. Pursuant to the Merger Agreement, Nuevo has agreed to indemnify the Partnership against certain losses resulting from any breach of Nuevo�s representations, warranties, covenants or agreements, and for certain other matters. The Partnership has agreed to indemnify Nuevo against certain losses resulting from any breach of the Partnership�s representations, warranties, covenants or agreements.

The above summary of the Merger Agreement is qualified in its entirety by reference to the Merger Agreement, a copy of which is attached as Exhibit 2.1 to this Current Report on Form 8-K and incorporated in this Item�1.01 by reference.

The Partnership�s acquisition of Nuevo is subject to a business opportunity provision contained in a joint venture agreement between Anadarko and a third party. That provision provides that the third party may purchase 50% of Nuevo at a cost equal to the proportionate consideration to be paid by the Partnership. The third party is required to respond to the Partnership�s offer within thirty days of receiving notice, and will have an additional thirty days to fund its share of the purchase price if it accepts the offer. The Partnership is prepared to purchase 100% of Nuevo if the third party does not elect to purchase its 50% interest. The Partnership will issue the Class C units to Anadarko regardless of whether the third party elects to purchase an interest in Nuevo.

Class C Unit Purchase Agreement

In connection with the execution of the Merger Agreement, the Partnership entered into a Unit Purchase Agreement (�UPA�) with Anadarko and APC Midstream Holdings LLC (�AMH�), an indirect wholly-owned subsidiary of Anadarko. Pursuant to the terms of the UPA, the Partnership will issue $750 million of Class C units to AMH at a price linked to the trading price of the Partnership�s common units on the NYSE. The Class C units will be issued upon the closing of the transactions under the Merger Agreement.

The Class C units will receive distributions in the form of additional Class C units until the end of 2017 (unless earlier converted), and will be disregarded with respect to calculating the Partnership�s cash distributions until they are converted to common units. The Class�C units will convert into common units on a one-for-one basis on December�31, 2017, unless the Partnership elects to convert such units earlier or Anadarko extends the conversion date.

The above summary of the UPA is qualified in its entirety by reference to the UPA, a copy of which is attached as Exhibit 10.1 to this Current Report on Form 8-K and incorporated in this Item�1.01 by reference.

Item�2.02 Results of Operations and Financial Condition.

On October�28, 2014, Western Gas Partners, LP and Western Gas Equity Partners, LP issued a joint press release announcing third quarter 2014 results. The press release is included in this report as Exhibit 99.1.

Item�3.03 Unregistered Sales of Equity Securities.

The description of the UPA and the Class C units provided above under Item�1.01 is incorporated in this Item�3.03 by reference. The issuance of the Class C units will be taken in reliance upon the exemption from registration requirements of the Securities Act of 1933, as amended, provided by Section�4(2) thereof.

Item�9.01 Financial Statements and Exhibits.

(d) Exhibits

�

| ��2.1# | �� | Agreement and Plan of Merger, dated October�28, 2014, by and among Western Gas Partners, LP, Maguire Midstream LLC and Nuevo Midstream, LLC. |

| 10.1 | �� | Unit Purchase Agreement, dated October 28, 2014, by and among Western Gas Partners, LP, APC Midstream Holdings LLC and Anadarko Petroleum Corporation. |

| 99.1 | �� | Press Release dated October�28, 2014. |

�

| # | Pursuant to Item�601(b)(2) of Regulation S-K, the registrant agrees to furnish supplementally a copy of any omitted schedule to the SEC upon request. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

�

| � | � | � | WESTERN GAS PARTNERS, LP | |||||

| � | � | � | By: | � | Western Gas Holdings, LLC, its general partner | |||

| Dated: | � | October 28, 2014 | � | � | By: | � | /s/ Benjamin M. Fink | |

| � | � | � | � | Benjamin M. Fink Senior Vice President, Chief Financial Officer | ||||

EXHIBIT INDEX

�

| Exhibit Number |

�� | Exhibit Title |

| ��2.1# | �� | Agreement and Plan of Merger, dated October 28, 2014, by and among Western Gas Partners, LP, Maguire Midstream LLC and Nuevo Midstream, LLC. |

| 10.1 | �� | Unit Purchase Agreement, dated October 28, 2014, by and among Western Gas Partners, LP, APC Midstream Holdings LLC and Anadarko Petroleum Corporation. |

| 99.1 | �� | Press Release dated October 28, 2014. |

�

| # | Pursuant to Item�601(b)(2) of Regulation S-K, the registrant agrees to furnish supplementally a copy of any omitted schedule to the SEC upon request. |

Exhibit 2.1

Execution Version

AGREEMENT AND PLAN OF MERGER

by and among

NUEVO MIDSTREAM, LLC

WESTERN GAS PARTNERS, LP

MAGUIRE MIDSTREAM LLC

Dated as of October�28, 2014

TABLE OF CONTENTS

�

| � | �� | Page | � | |||

| ARTICLE�I |

�� | |||||

| � | DEFINED TERMS; RULES OF CONSTRUCTION |

�� | � | 1 | �� | |

| 1.1 | � | Definitions |

�� | � | 1 | �� |

| 1.2 | � | Rules of Construction |

�� | � | 15 | �� |

| ARTICLE�II |

�� | |||||

| � | THE MERGER |

�� | � | 16 | �� | |

| 2.1 | � | Merger |

�� | � | 16 | �� |

| 2.2 | � | Effective Time |

�� | � | 17 | �� |

| 2.3 | � | Effect of the Merger |

�� | � | 17 | �� |

| 2.4 | � | Certificate of Formation and Limited Liability Company Agreement |

�� | � | 17 | �� |

| 2.5 | � | Directors, Managers and Officers |

�� | � | 17 | �� |

| 2.6 | � | Conversion of Merger Subsidiary Member Interests and Outstanding Company Member Interests |

�� | � | 17 | �� |

| 2.7 | � | Closing of Transfer Books |

�� | � | 18 | �� |

| 2.8 | � | Payments |

�� | � | 18 | �� |

| 2.9 | � | Closing Adjustment Amount |

�� | � | 19 | �� |

| 2.10 | � | Final Adjustment Amount |

�� | � | 19 | �� |

| 2.11 | � | Purchase Price Allocation |

�� | � | 21 | �� |

| ARTICLE�III |

�� | |||||

| � | REPRESENTATIONS AND WARRANTIES |

�� | � | 22 | �� | |

| 3.1 | � | Representations and Warranties of the Company |

�� | � | 22 | �� |

| 3.2 | � | Representations and Warranties of Parent and Merger Subsidiary |

�� | � | 35 | �� |

| ARTICLE IV |

�� | |||||

| � | COVENANTS OF THE COMPANY |

�� | � | 38 | �� | |

| 4.1 | � | Conduct of Business |

�� | � | 38 | �� |

| 4.2 | � | Access and Information |

�� | � | 41 | �� |

| 4.3 | � | Supplemental Disclosure Letter |

�� | � | 42 | �� |

| 4.4 | � | Company Transaction Costs |

�� | � | 43 | �� |

| 4.5 | � | Pay-Off Letters; Company Transaction Costs |

�� | � | 43 | �� |

| 4.6 | � | Assignment of Excluded Assets |

�� | � | 43 | �� |

| 4.7 | � | Insurance |

�� | � | 43 | �� |

| 4.8 | � | Non-Compete/Non-Solicitation; Release |

�� | � | 43 | �� |

| 4.9 | � | No Negotiation |

�� | � | 43 | �� |

| 4.10 | � | Notice of Equity Issuances |

�� | � | 44 | �� |

�

i

| ARTICLE V |

�� | |||||

| � | COVENANTS OF PARENT AND MERGER SUBSIDIARY |

�� | � | 44 | �� | |

| 5.1 | � | Access to Information |

�� | � | 44 | �� |

| 5.2 | � | Indemnification of Officers, Directors, Company Employees and Agents |

�� | � | 45 | �� |

| 5.3 | � | WARN Act |

�� | � | 46 | �� |

| 5.4 | � | Company Employee Matters |

�� | � | 46 | �� |

| 5.5 | � | Use of Company Names and Marks |

�� | � | 47 | �� |

| 5.6 | � | Contacts with Company Customers |

�� | � | 48 | �� |

| ARTICLE VI |

�� | |||||

| � | MUTUAL COVENANTS |

�� | � | 48 | �� | |

| 6.1 | � | Governmental Consents |

�� | � | 48 | �� |

| 6.2 | � | Reasonable Efforts; Further Assurances |

�� | � | 49 | �� |

| 6.3 | � | Notification of Certain Matters |

�� | � | 49 | �� |

| 6.4 | � | Investigation and Agreement by Parent and Merger Subsidiary; No Other Representations or Warranties |

�� | � | 50 | �� |

| 6.5 | � | Waiver |

�� | � | 52 | �� |

| 6.6 | � | Tax Matters |

�� | � | 52 | �� |

| ARTICLE VII |

�� | |||||

| � | CONDITIONS PRECEDENT |

�� | � | 53 | �� | |

| 7.1 | � | Conditions to Each Party�s Obligation |

�� | � | 53 | �� |

| 7.2 | � | Conditions to Obligations of Parent and Merger Subsidiary |

�� | � | 54 | �� |

| 7.3 | � | Conditions to Obligations of the Company |

�� | � | 55 | �� |

| ARTICLE VIII |

�� | |||||

| � | CLOSING |

�� | � | 55 | �� | |

| 8.1 | � | Closing |

�� | � | 55 | �� |

| 8.2 | � | Actions to Occur at Closing |

�� | � | 56 | �� |

| 8.3 | � | Allocation of Merger Consideration Among Company Member Interest Holders |

�� | � | 57 | �� |

| ARTICLE IX |

�� | |||||

| � | TERMINATION, AMENDMENT AND WAIVER |

�� | � | 57 | �� | |

| 9.1 | � | Termination |

�� | � | 57 | �� |

| 9.2 | � | Effect of Termination |

�� | � | 57 | �� |

| 9.3 | � | Return of Confidential Information |

�� | � | 58 | �� |

| ARTICLE X |

�� | |||||

| � | SURVIVAL; INDEMNITY |

�� | � | 58 | �� | |

| 10.1 | � | Survival |

�� | � | 58 | �� |

| 10.2 | � | Indemnification |

�� | � | 59 | �� |

�

ii

| 10.3 | � | Third-Party Claim Procedures |

�� | � | 60 | �� |

| 10.4 | � | Direct Claim Procedures |

�� | � | 61 | �� |

| 10.5 | � | Calculation of Damages |

�� | � | 61 | �� |

| 10.6 | � | Exclusive Remedy; Non-Recourse |

�� | � | 62 | �� |

| 10.7 | � | Limitations on Liability |

�� | � | 63 | �� |

| ARTICLE XI |

�� | |||||

| � | GENERAL PROVISIONS |

�� | � | 63 | �� | |

| 11.1 | � | Amendment and Modification |

�� | � | 63 | �� |

| 11.2 | � | Severability |

�� | � | 63 | �� |

| 11.3 | � | Expenses |

�� | � | 63 | �� |

| 11.4 | � | Parties in Interest |

�� | � | 63 | �� |

| 11.5 | � | Notices |

�� | � | 64 | �� |

| 11.6 | � | Counterparts |

�� | � | 65 | �� |

| 11.7 | � | Time |

�� | � | 65 | �� |

| 11.8 | � | Entire Agreement |

�� | � | 65 | �� |

| 11.9 | � | Public Announcements |

�� | � | 65 | �� |

| 11.10 | � | Assignment |

�� | � | 66 | �� |

| 11.11 | � | Transfer Taxes |

�� | � | 66 | �� |

| 11.12 | � | Governing Law |

�� | � | 66 | �� |

| 11.13 | � | WAIVER OF JURY TRIAL |

�� | � | 66 | �� |

| 11.14 | � | Consent to Jurisdiction; Venue |

�� | � | 66 | �� |

| 11.15 | � | Remedies |

�� | � | 67 | �� |

| ARTICLE XII |

�� | |||||

| � | THE REPRESENTATIVES |

�� | � | 67 | �� | |

| 12.1 | � | Authorization of the Representatives |

�� | � | 67 | �� |

| 12.2 | � | Exculpation |

�� | � | 68 | �� |

�

iii

EXHIBITS

�

| Exhibit�A | �� | Example Working Capital Schedule/Agreed Accounting Principles |

| Exhibit�B | �� | Form of Escrow Agreement |

| Exhibit�C | �� | Form of Third Amended and Restated Limited Liability Company Agreement |

| Exhibit�D | �� | Form of Non-Compete and Non-Solicitation Agreement |

| Exhibit�E | �� | Form of Resignation and Mutual Release |

| Exhibit�F-1 | �� | Form of Officer Certificate |

| Exhibit�F-2 | �� | Form of Officer Certificate |

COMPANY DISCLOSURE SCHEDULES

�

| 1.1(a) | �� | Company Transaction Cost Payees |

| 1.1(b) | �� | Debt (Exclusions) |

| 1.1(c) | �� | Excluded Assets |

| 1.1(d) | �� | Loan Agreements |

| 1.1(e) | �� | Low Pressure System Area |

| 1.1(f) | �� | Permitted Liens |

| 3.1(b) | �� | Ownership; Capitalization |

| 3.1(c) | �� | Subsidiaries; Ownership of Other Entities |

| 3.1(e) | �� | No Conflicts; Filings and Consents |

| 3.1(f)(i) | �� | Financial Statements |

| 3.1(f)(ii) | �� | Undisclosed Liabilities |

| 3.1(g)(i) | �� | Ordinary Course of Business Exceptions |

| 3.1(g)(ii) | �� | Ordinary Course of Business Exceptions |

| 3.1(h) | �� | Compliance with Laws; Permits |

| 3.1(i) | �� | Litigation |

| 3.1(j) | �� | Insurance |

| 3.1(k) | �� | Owned Real Property |

| 3.1(l) | �� | Leased Real Property |

| 3.1(m) | �� | Easements |

| 3.1(n) | �� | Environmental Matters |

| 3.1(o) | �� | Tax Matters |

| 3.1(p)(i) | �� | Material Contracts |

| 3.1(p)(iii) | �� | Geographical Limitations; Preferential Purchase Rights |

| 3.1(q) | �� | ERISA Compliance |

| 3.1(s)(i) | �� | Labor Matters |

| 3.1(s)(ii) | �� | Employees |

| 3.1(t) | �� | Intellectual Property |

| 3.1(u) | �� | Brokerage Commissions |

| 3.1(v) | �� | Business Guaranties |

| 3.1(w) | �� | Regulatory Status |

| 4.1(a) | �� | Conduct of Business Exceptions |

| 4.1(d) | �� | Capital Expenditures |

| 7.2(d) | �� | Closing Condition � Material Third-Party Consents |

�

iv

AGREEMENT AND PLAN OF MERGER

THIS AGREEMENT AND PLAN OF MERGER (this �Agreement�), dated as of October�28, 2014, is made by and among NUEVO MIDSTREAM, LLC, a Delaware limited liability company (the �Company�), each of the Representatives (solely in such capacity and solely for the purposes of Section�6.6 and Article XII hereof), Western Gas Partners, LP, a Delaware limited partnership (�Parent�), and Maguire Midstream LLC, a Delaware limited liability company and wholly owned subsidiary of Parent (�Merger Subsidiary�).

PRELIMINARY STATEMENTS

WHEREAS, upon the terms and subject to the conditions of this Agreement and in accordance with the Delaware Limited Liability Company Act, 6 Del. C. � 18-101 et seq. (the �DLLCA�), Parent, Merger Subsidiary and the Company will enter into a business combination pursuant to which Merger Subsidiary, an entity organized for the sole purpose of entering into the transaction contemplated hereby, will merge with and into the Company with the Company being the surviving company (the �Merger�);

WHEREAS, the respective boards of managers or similar governing authorities of Parent, Merger Subsidiary and the Company have approved this Agreement, the Merger and the related transactions contemplated hereby, and have determined that the Merger is advisable to, and in the best interests of, the respective companies and their respective members or equityholders, as applicable; and

WHEREAS, Parent and the sole member of Merger Subsidiary have approved this Agreement, the Merger and the related transactions contemplated hereby in accordance with the DLLCA and Merger Subsidiary�s Governing Documents.

AGREEMENTS

NOW, THEREFORE, in consideration of the representations, warranties, covenants and agreements set forth herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and upon the terms and subject to the conditions hereinafter set forth, the parties hereto, intending to be legally bound hereby, agree as follows:

ARTICLE I

DEFINED TERMS; RULES OF CONSTRUCTION

1.1 Definitions. The following terms shall have the following meanings in this Agreement:

�Affiliate� or �Affiliates� means, with respect to any Person, any other Person controlling, controlled by or under common control with such Person. For purposes of this definition, the term �control� (and correlative terms) means the power, whether by contract, equity ownership or otherwise, to direct the policies or management of a Person.

�Aggregate Member Consideration� has the meaning set forth in Section 2.6(b).

�Aggregated Group� has the meaning set forth in Section�3.1(q)(i).

�Agreed Accounting Principles� means the same accounting methods, practices, principles, policies and procedures that were used in the preparation of the balance sheet included in the Example Working Capital Schedule attached as Exhibit A, which such methods, practices, principles, policies and procedures shall be in accordance with GAAP except as otherwise expressly specified on Exhibit�A.

�Agreement� has the meaning set forth in the Preamble.

�Allocation� has the meaning set forth in Section�2.10(c).

�Ancillary Documents� means the Escrow Agreement, the Non-Compete and Non-Solicitation Agreements referenced in Section�4.8, the Resignation and Release referenced in Section�8.2(b)(ii), and the FIRPTA Certificates.

�Antitrust Laws� means, collectively, (a)�the HSR Act; (b)�the Sherman Antitrust Act of 1890, as amended; (c)�the Clayton Act of 1914, as amended; (d)�the Federal Trade Commission Act of 1914, as amended; and (e)�any other Applicable Law designed to prohibit, restrict or regulate actions for the purpose or effect of monopolization or restraint of trade.

�Applicable Laws� means (excluding Environmental Laws), statutes, rules, regulations, ordinances, judgments, orders, decrees, injunctions and writs of any Governmental Authority applicable to the business or operations of the Company and the Company Subsidiaries, as in effect on the date of this Agreement.

�Balance Sheet� has the meaning set forth in Section�3.1(f)(i).

�Balance Sheet Date� means June�30, 2014.

�Base Merger Consideration� means $1,500,000,000.

�Board of Managers� means the board of managers of the Company established pursuant to the Company LLC Agreement.

�Business Day� means any day other than (a)�a Saturday, Sunday or federal holiday or (b)�a day on which commercial banks in Houston, Texas, are authorized or required to be closed.

�Cash� means all cash and cash equivalents of the Company and the Company Subsidiaries as determined in accordance with GAAP.

�Certificate of Merger� has the meaning set forth in Section�2.2.

�Claim� has the meaning set forth in Section�5.2(a).

�Class A Units� means the Company�s Class�A member interests issued pursuant to the Company LLC Agreement.

�

2

�Class B Units� means the Company�s Class B member interests issued pursuant to Company LLC Agreement.

�Closing� has the meaning set forth in Section�8.1.

�Closing Adjustment Amount� means an amount equal to (a)�Estimated Cash, minus (b)�Estimated Debt, plus (c)�any Estimated Working Capital Surplus, minus (d)�any Estimated Working Capital Deficiency, plus (e)�Estimated Growth Capital Expenditures, minus (f)�$3,000, which represents one half of the Escrow Agent�s up front fees and expenses payable by the Company under the Escrow Agreement.

�Closing Balance Sheet� has the meaning set forth in Section�2.9.

�Closing Cash� has the meaning set forth in Section�2.10(a).

�Closing Date� means the date on which the Closing occurs.

�Closing Debt� has the meaning set forth in Section�2.10(a).

�Closing Growth Capital Expenditures� has the meaning set forth in Section�2.10(a).

�Closing Merger Consideration� means an amount (not less than zero) equal to (a)�the Base Merger Consideration plus (b)�the Closing Adjustment Amount (which amount will be subtracted if a negative number) minus (c)�the Company Transaction Costs.

�Closing Working Capital Deficiency� has the meaning set forth in Section�2.10(a).

�Closing Working Capital Surplus� has the meaning set forth in Section�2.10(a).

�Code� means the United States Internal Revenue Code of 1986, as amended. All references to the Code, U.S. Treasury regulations or other governmental pronouncements shall be deemed to include references to any applicable successor regulations or amending pronouncement.

�Company� has the meaning set forth in the Preamble.

�Company Disclosure Schedule� means that certain disclosure letter of even date with this Agreement from the Company to Parent delivered concurrently with the execution and delivery of this Agreement, as amended or supplemented in accordance with the terms of this Agreement.

�Company Employees� has the meaning set forth in Section�3.1(s)(ii).

�Company Guarantees and Sureties� shall mean the credit support, corporate guarantees, letters of credit and other guarantee obligations and bonds and sureties made or posted with respect to or in support of the business of the Company and its subsidiaries as described on Company Disclosure Schedule 3.1(v).

�

3

�Company Indemnified Parties� has the meaning set forth in Section 10.2(b).

�Company LLC Agreement� means the Second Amended and Restated Limited Liability Company Agreement of the Company, dated as of April�8, 2013.

�Company Lease� has the meaning set forth in Section�3.1(l).

�Company Member Interest Holder� shall mean each Person which holds Company Member Interests in the Company.

�Company Member Interests� shall mean the Class�A Units, Class B Units and Profit Units.

�Company Names and Marks� means the name �Nuevo� and any trade name, trademark, service mark, logo or internet domain comprising the foregoing, and all derivatives and formulations thereof as used by the Company and the Company Subsidiaries in connection with the conduct of their businesses.

�Company Permits� has the meaning set forth in Section�3.1(h), but shall not include �Easements�.

�Company Subsidiaries� means Nuevo Crude Services, LLC, a Delaware limited liability company, and Nuevo Pipeline, LLC, a Delaware limited liability company.

�Company Transaction Costs� means all fees, costs and expenses of any financial advisors, consultants, or attorneys engaged by the Company or the Representatives and payable by the Company (all of which Persons, to the Company�s Knowledge, are identified in Company Disclosure Schedule 1.1(a)) in connection with the structuring, negotiation or consummation of the transactions contemplated by this Agreement and the other Transaction Documents which are unpaid as of the Closing.

�Confidentiality Agreement� means the Confidentiality Agreement, dated as of May�12, 2014, by and between the Company and Western Gas Partners, LP, as supplemented on August�7, 2014.

�Consents� means all authorizations, consents, orders or approvals of, or registrations, declarations or filings with, or expiration of waiting periods imposed by, any Governmental Authority or any other person, in each case that are necessary in order to consummate the transactions contemplated by this Agreement and the other Transaction Documents.

�Contracts� means any note, bond, mortgage, indenture, deed of trust, license, lease, agreement, contract or other legally binding instrument or contractual obligation whether written or oral; provided, however, that the term �Contract� shall not include Easements.

�Cure Period� has the meaning set forth in Section�9.1(b)(i).

�

4

�Current Assets� means trade accounts receivable, natural gas liquids pipeline linefill (to the extent owned by the Company or the Company Subsidiaries), down payments, installment payments, inventory (including prepaid pipe and condensate inventories), work in process, other current assets (including prepaid expenses, deposits and other miscellaneous current assets), all determined on a consolidated basis in accordance with the Agreed Accounting Principles; provided that Current Assets shall not include, in whole or in part, (a)�Cash (to the extent such amounts are taken into consideration in calculating the Closing Adjustment Amount), (b)�the Excluded Assets, (c)�any intercompany accounts, or (d)�deferred Tax assets.

�Current Liabilities� means accounts payable, accrued payroll and related liabilities, accrued liabilities, the current portion of any nominal interest bearing obligations related to the prepayment of the Company�s insurance premiums to the extent not treated as Debt, and other current liabilities all determined on a consolidated basis, in accordance with the Agreed Accounting Principles; provided that Current Liabilities shall not include, in whole or in part (a)�Debt (including the current portion of Debt), (b)�the Excluded Assets, (c)�intercompany accounts, (d)�Company Transaction Costs, or (e)�deferred Tax liabilities.

�D&O Indemnified Liabilities� has the meaning set forth in Section�5.2(a).

�D&O Indemnified Persons� has the meaning set forth in Section�5.2(a).

�Damages� has the meaning set forth in Section�10.2(a).

�Debt� means, except for accounts and obligations owed by the Company to any Company Subsidiary or owed by a Company Subsidiary to the Company and/or another Company Subsidiary, (a)�all indebtedness of the Company or any of the Company Subsidiaries for the repayment of borrowed money, whether or not represented by debentures, notes or similar instruments, all accrued and unpaid interest thereon, and, solely with respect to the Loan Agreements, all premiums, penalties, fees and other amounts included in the Debt Pay-Off Amount; (b)�all obligations of the Company or any of the Company Subsidiaries under leases required to be capitalized in accordance with GAAP; (c)�all obligations of the Company or any of the Company Subsidiaries issued or assumed as the deferred purchase price of property, all conditional sale obligations of such Person and all obligations of such Person under any title retention agreement (but excluding trade accounts payable and other accrued current liabilities arising in the Ordinary Course of Business); (d)�all obligations of the Company or any of the Company Subsidiaries for the reimbursement of any obligor on any letter of credit, banker�s acceptance or similar credit transaction; (e)�all obligations of the Company or any of the Company Subsidiaries under interest rate or currency swap transactions; (f)�all obligations of the type referred to in clauses�(a) through (e)�of other Persons for the payment of which the Company or any Company Subsidiary is responsible or liable, directly or indirectly, as obligor, guarantor, surety or otherwise, including guarantees of such obligations; (g)�all obligations of the type referred to in clauses (a)�through (f)�of other Persons secured by (or for which the holder of such obligations has an existing right, contingent or otherwise, to be secured by) any Lien on any property or asset of the Company or any Company Subsidiary (whether or not such obligation is assumed by such Person); provided, that Debt shall not include (i)�the transactions and obligations described on Company Disclosure Schedule 1.1(b), or (ii)�any indebtedness to the extent reflected in the calculation of Working Capital as reflected on the Closing Balance Sheet or the Final Balance Sheet, as applicable.

�

5

�Debt Pay-Off Amount� has the meaning set forth in Section 2.8(a)(i).

�Disclosure Schedules� means, collectively, the Company Disclosure Schedule and the Parent Disclosure Schedule.

�DLLCA� has the meaning set forth in the Recitals.

�DOJ� means the United States Department of Justice.

�Easement� means the easements, rights-of-way agreements, land-related licenses and surface use agreements, land use agreements and similar type land-related agreements of the Company and any of the Company Subsidiaries relating to pipelines of the Company that are used in the business conducted by the Company and any of the Company Subsidiaries; provided that Easements shall not include fee interests in Real Property or Leased Real Property.

�Effective Time� has the meaning set forth in Section 2.2.

�Electronic Data Room� has the meaning set forth in Section 1.2(c).

�Employee Benefit Plan� or �Employee Benefit Plans� means any �employee benefit plan� within the meaning of Section�3(3) of ERISA and any bonus, deferred compensation, incentive compensation, equity ownership, equity purchase, equity option, phantom shares, vacation, employment, retention, change in control, transaction, severance, disability, death benefit, hospitalization or insurance plan, agreement or arrangement providing benefits to any present or former employee of the Company, any Company Subsidiary or any member of the Aggregated Group maintained by any such entity.

�Environmental Laws� means all constitutions, treaties, laws, statutes, rules, regulations, ordinances, judgments, orders, decrees, injunctions, rules of common law, other legally enforceable requirements and writs of any Governmental Authority applicable to the business or operations of the Company and the Company Subsidiaries (a)�pertaining to the prevention of pollution, remediation of contamination, protection of natural resources, restoration of environmental quality, and worker health and safety to the extent such worker health and safety relates to exposure to Hazardous Materials, and (b)�relating to the presence of, exposure to, or the manufacture, use, handling, storage, treatment, generation, discharge, transportation, distribution, processing, disposal, discharge or release, of any Hazardous Materials.

�Equity Interests� means (a)�with respect to any corporation, all shares, interests, participations or other equivalents of capital stock of such corporation, however designated, and (b)�with respect to any partnership or limited liability company, all partnership or limited liability company interests, units, participations or equivalents of partnership or limited liability company interests of such partnership or limited liability company, however designated.

�

6

�ERISA� means the Employee Retirement Income Security Act of 1974, as amended.

�Escrow Agent� means Citibank National Association.

�Escrow Agreement� means the Escrow Agreement to be entered into at the Closing between the Parent, the Representatives (on behalf of the Company Member Interest Holders) and the Escrow Agent, substantially in the form attached hereto as Exhibit�B.

�Escrow Amount� means one hundred twenty-five million dollars ($125,000,000).

�Escrow Fund� means the monies, from time to time, held in escrow by the Escrow Agent under the terms of the Escrow Agreement.

�Estimated Cash� has the meaning set forth in Section�2.9.

�Estimated Debt� has the meaning set forth in Section 2.9.

�Estimated Growth Capital Expenditures� has the meaning set forth in Section�2.9.

�Estimated Working Capital Deficiency� has the meaning set forth in Section�2.9.

�Estimated Working Capital Surplus� has the meaning set forth in Section�2.9.

�Example Working Capital Schedule� has the meaning set forth in the definition of �Current Assets.�

�Excluded Assets� means:

(a) An aggregate amount equal to refunds of Taxes paid by the Company or the Company Subsidiaries prior to the Effective Time or with respect to a tax period ending on or prior to the Effective Time, net of any Damages suffered or incurred by the Company or the Company Subsidiaries (for the avoidance of doubt, other than Damages which were addressed in the calculation of Working Capital or Damages for which the Parent has received a payment in response to an indemnification claim relating to Taxes from the Escrow Account) after the Effective Time in connection with, relating to or arising from any liabilities or obligations relating to Taxes that relate to the period prior to the Effective Time;

(b) All computer or communications software or intellectual property (including tapes and program documentation and all tangible manifestations and technical information relating thereto) owned, licensed or used by the Company or the Company Subsidiaries, and specifically listed on Company Disclosure Schedule 1.1(c);

�

7

(c) All offices and related office and computer equipment owned, leased, licensed or used by the Company or the Company Subsidiaries, and described on Company Disclosure Schedule 1.1(c);

(d) The name �Nuevo� and all other Company Names and Marks;

(e) All other assets listed on Company Disclosure Schedule 1.1(c); and

(f) All communications by and among the Company and its Affiliates and their respective Affiliates and any advisor to the Company or its Affiliates related to the potential sale of the Company or any of its properties and any communications by and among the Company and its Affiliates and their advisors and other bidders for the Company in its bid auction process.

�Final Adjustment Amount� means an amount equal to (a)�Final Cash, minus (b)�Final Debt, plus (c)�any Final Working Capital Surplus, minus (d)�any Final Working Capital Deficiency, plus (e)�any Final Growth Capital Expenditures, minus (f)�50% of any amount to be paid to the Referee pursuant to Section�2.10(b), if applicable.

�Final Adjustment Deficiency� has the meaning set forth in Section�2.10(c).

�Final Adjustment Surplus� has the meaning set forth in Section�2.10(c).

�Final Balance Sheet� has the meaning set forth in Section�2.10(a).

�Final Cash� has the meaning set forth in Section�2.10(b).

�Final Closing Statement� has the meaning set forth in Section�2.10(a).

�Final Debt� has the meaning set forth in Section�2.10(b).

�Final Growth Capital Expenditures� has the meaning set forth in Section�2.10(b).

�Final Working Capital Deficiency� has the meaning set forth in Section�2.10(b).

�Final Working Capital Surplus� has the meaning set forth in Section�2.10(b).

�Financial Statements� has the meaning set forth in Section�3.1(f).

�FIRPTA Certificate� has the meaning set forth in Section�2.8(b)(i).

�Fraud� of a Person means an intentional and knowing breach of this Agreement by such Person but shall not include negligent or reckless misrepresentation.

�FTC� means the United States Federal Trade Commission.

�

8

�GAAP� means generally accepted accounting principles in the United States, consistently applied.

�General Survival Period� has the meaning set forth in Section 10.1.

�Governing Documents� means, when used with respect to an entity, the documents governing the formation, operation and governance of such entity, including (a)�in the instance of a corporation, the articles or certificate of incorporation and bylaws of such corporation, (b)�in the instance of a partnership, the partnership agreement, (c)�in the instance of a limited partnership, the certificate of formation and the limited partnership agreement, and (d)�in the instance of a limited liability company, the articles of organization or certificate of formation and operating agreement or limited liability company agreement.

�Governmental Authority� means any governmental department, commission, board, bureau, agency, court or other instrumentality, whether foreign or domestic, of any country, nation, republic, federation or similar entity or any state, county, parish or municipality, jurisdiction or other political subdivision thereof.

�Growth Capital Expenditures� means the aggregate amount of capital expenditures for growth projects (but excluding maintenance capital expenditures expended or incurred in the Ordinary Course of Business) expended or incurred by the Company or a Company Subsidiary with respect to the business of the Company or the Company Subsidiaries on or after October�1, 2014.

�Hazardous Materials� means any substance, pollutant, contaminant, material, or waste, or combination thereof, whether solid, liquid, or gaseous in nature and including any petroleum or petroleum-derived products, radon, radioactive materials or friable asbestos, urea formaldehyde foam insulation, and polychlorinated biphenyls that, in each instance, is subject to regulation, under any Environmental Laws, including the Comprehensive Environmental Response, Compensation and Liability Act, and the Solid Waste Disposal Act, and the Resource Conservation and Recovery Act.

�HSR Act� means the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended.

�Indemnified Party� has the meaning set forth in Section�10.3(a).

�Indemnifying Party� has the meaning set forth in Section�10.3(a).

�Insperity� has the meaning set forth in Section�3.1(s)(ii).

�Insperity Agreement� has the meaning set forth in Section�3.1(s)(ii).

�Insurance Policies� has the meaning set forth in Section�3.1(j).

�Intellectual Property� means the following intellectual property rights, including both statutory and common law rights, as applicable: (a)�copyrights; (b)�trademarks, service marks, trade names, slogans, domain names, logos, and trade dress, and registrations and

�

9

applications for registrations thereof; (c)�patents and patent applications (including all reissues, divisions, continuations, continuations-in-part, renewals and extensions of the foregoing); (d)�trade secrets, including but not limited to, ideas, designs, concepts, compilations of information, methods, techniques, procedures, processes and other know-how, whether or not patentable; and (e)�registrations for any of the foregoing.

�Knowledge� means (a)�with respect to the Company, the actual knowledge of any of the following individuals: John J. Lendrum, III, Randy Ziebarth, Chris Work, Dwight Serrett, and Ralph Carthrae, and (b)�with respect to Parent, the actual knowledge of any of the following individuals: Donald R. Sinclair, Benjamin M. Fink, Philip H. Peacock, Jacqueline A. Dimpel and Craig Collins.

�Leased Real Property� means all of the real property leased by the Company or any of the Company Subsidiaries; provided that Easements are not included within the definition of �Leased Real Property�.

�Liens� means liens, pledges, charges, deeds of trust, security interests, mortgages, options, rights of first refusal, and other encumbrances of any kind.

�Loan Agreements� means, collectively, the Debt documents set forth on Company Disclosure Schedule 1.1(d).

�Low Pressure System� means approximately 130 miles of pipelines ranging in diameter from two to six inches, consisting primarily of polyurethane pipe that gathers natural gas from approximately 95 locations in Culberson, Reeves, and Loving�Counties in�Texas, and Eddy County in New Mexico, and generally covering the area described in Company Disclosure Schedule�1.1(e), which system includes the pipelines which were contributed to the Company pursuant to the contribution agreement dated as of July�19, 2011, among Ramsey Gas System Operations, LLC, the Company and others.

�Material Adverse Effect� means any change, circumstance, effect, event, fact or development that, individually or in the aggregate with all other changes, circumstances, effects, events, facts or developments, has a material and adverse effect on the business, financial condition, assets, liabilities or results of operations of the Company and the Company Subsidiaries, taken as a whole; provided that no change, circumstance, effect, event, fact or development shall be deemed (individually or in the aggregate) to constitute, nor shall any of the foregoing be taken into account in determining whether there has been, a Material Adverse Effect, to the extent that such change, circumstance, effect, event, fact or development results from, arises out of, or relates to (a)�a general deterioration in the economy or in the economic conditions prevalent in the industry in which the Company and the Company Subsidiaries operate; (b)�the outbreak or escalation of hostilities involving the United States, the declaration by the United States of a national emergency or war or the occurrence of any other calamity or crisis, including acts of terrorism; (c)�the disclosure of the fact that Parent is the prospective acquirer of the Company; (d)�the execution of this Agreement, or the announcement, disclosure or pendency of the transactions contemplated by this Agreement or any other Transaction Document (provided, however, that any breach, violation or default, event of default or event of acceleration (or any event or circumstance that with notice, lapse of time or both would be or

�

10

constitute a breach, violation, default, event of default or event of acceleration), or right of first refusal, right of first offer or preferential purchase right, that occurs, becomes exercisable or is otherwise triggered upon or as a result of the execution of this Agreement or the announcement, disclosure or pendency of the transactions contemplated by this Agreement or any other Transaction Document may be taken into account in determining whether there has been a Material Adverse Effect); (e)�the announcement or disclosure of the Company�s intention to review the possibility of selling itself; (f)�any change in GAAP, Applicable Laws or Environmental Laws or the interpretation thereof; (g)�actions taken by Parent or any of its Affiliates; (h)�any failure by the Company to meet any internal or published projections, forecasts, estimates or predictions in respect of revenues, earnings or other financial or operating metrics for any period (provided, however, that any change, circumstance, effect, event, fact or development underlying such failure that is not otherwise excluded from the definition of Material Adverse Effect may be taken into account in determining whether there has been a Material Adverse Effect); or (i)�compliance with the terms of, or the taking of any action required by, this Agreement or any other Transaction Document, except to the extent that any of the changes, circumstances, effects, events, facts or developments referred to in clauses (a), (b)�or (f)�above materially and disproportionately impact the Company and the Company Subsidiaries, taken as a whole, as compared to other companies in the industry in which the Company and the Company Subsidiaries operate (in which event the extent of such material and disproportionate impact may be taken into account in determining whether a Material Adverse Effect has occurred).

�Material Contracts� has the meaning specified in Section�3.1(p)(ii).

�Merger� has the meaning set forth in the Recitals.

�Merger Subsidiary� has the meaning set forth in the Preamble.

�Objection Notice� has the meaning set forth in Section�2.10(b).

�Ordinary Course of Business� means the ordinary and usual course of normal day-to-day operations of the Company and the Company Subsidiaries consistent with past practices.

�Ordinary Course Producer Obligations� means the obligations of the Company (to be performed in the ordinary course) to acquire rights-of-way and/or construct, install, operate or maintain pipeline assets pursuant to the terms and provisions of various Contracts of the Company or the Company Subsidiaries.

�Outstanding Company Member Interest� or �Outstanding Company Member Interests� has the meaning set forth in Section�2.6(b).

�Owned Real Property� means all of the real property owned in fee by the Company or any of the Company Subsidiaries; provided that Easements are not included within the definition of �Owned Real Property.�

�Parent� has the meaning set forth in the Preamble.

�

11

�Parent Disclosure Schedule� means the disclosure letter of even date with this Agreement from Parent to the Company delivered concurrently with the execution and delivery with this Agreement.

�Parent Indemnified Parties� has the meaning set forth in Section�10.2(a).

�Parent Warranty Breach� has the meaning set forth in Section�10.2(b).

�Pay-Off Letter� or �Pay-Off Letters� means the letters, and any updates thereto, to be sent by each of the Company�s lenders or debt holders under the Loan Agreements to Parent prior to Closing, which letters shall be in form and substance reasonably satisfactory to Parent and shall specify the aggregate amount of Debt that will be outstanding as of the Effective Time under each Loan Agreement and wire transfer information for each such lender or debt holder to be paid at Closing.

�Permitted Liens� means (a)�statutory Liens for Taxes not yet due and payable or being contested in good faith by appropriate proceedings and as to which adequate reserves (determined in accordance with GAAP) have been recorded in the Financial Statements; (b)�mechanics�, carriers�, workers�, repairers� and other similar Liens imposed by Applicable Law or Environmental Laws arising or incurred in the Ordinary Course of Business for obligations that are not overdue or that are being contested in good faith by appropriate proceedings; (c)�in the case of leases of vehicles, rolling stock and other personal property, encumbrances that do not impair the operation of the business at the facility at which such leased equipment or other personal property is located; (d)�Liens on leases of real property arising from the provisions of such leases (but expressly excluding Liens arising out of or relating to the breach or default by the Company or any Company Subsidiary under any such applicable lease), including, in relation to Leased Real Property, any agreements and/or conditions imposed on the issuance of land use permits, zoning, business licenses, use permits or other entitlements of various types issued by any Governmental Authority, necessary or beneficial to the continued use and occupancy of such Leased Real Property or the continuation of the business conducted by the Company or any of the Company Subsidiaries; (e)�pledges or deposits made in the Ordinary Course of Business in connection with workers� compensation, unemployment insurance and other social security legislation; (f)�deposits to secure the performance of bids, contracts (other than for borrowed money), leases, statutory obligations, surety and appeal bonds, performance bonds and other obligations of a like nature incurred in the Ordinary Course of Business; (g)�zoning and building regulations and restrictive covenants and easements of record that do not detract in any material respect from the value of the Real Property and do not materially and adversely impair the use of any property affected thereby; (h)�public utility easements of record to serve the Real Property; (i)�Liens not otherwise included as Permitted Liens that are disclosed in real estate title commitments made available by the Company prior to the date hereof or in any real estate title reports made available by the Company prior to the date hereof; (j)�all matters disclosed by instruments recorded in the public real property records made available to Parent by the Company; (k)�imperfections or defects in title and Liens, the existence of which would not reasonably be expected to impair the operations of the Company or the Company Subsidiaries in any material respect; and (l)�Liens listed on Company Disclosure Schedule 1.1(f).

�

12

�Person� means an individual, corporation, partnership, limited liability company, association, trust, unincorporated organization or other entity.

�Pipelines and Facilities� means (a)�the natural gas and natural gas liquids gathering and transmission pipelines owned by the Company and located in Reeves, Culberson, and Loving counties in Texas and Eddy and Lea counties in New Mexico, and (b)�all material above ground facilities owned by the Company or the Company Subsidiaries and used in their businesses, including material processing plants, treating plants and compressor stations, but in each case excluding the Low Pressure System.

�Pre-Closing Casualty Loss� means any material casualty loss or material damage to any material assets of the Company or any Company Subsidiary that occurs prior to the Effective Time other than with respect to assets which have been fully repaired or replaced as of the Closing Date.

�Pre-Closing Period� means any Tax period ending on or before the Closing Date.

�Pre-Closing Tax Returns� has the meaning set forth in Section�6.4(a).

�Profit Units� means profits interests or units issued pursuant to the terms of the Company LLC Agreement.

�Real Property� means the Leased Real Property and the Owned Real Property.

�Reasonable Efforts� means a Party�s reasonable commercial efforts without incurring unreasonable expenses.

�Referee� has the meaning set forth in Section�2.10(b).

�Representatives� means Dennis Jaggi, William Waldrip, William Lemmons, Jr., Zachary Kayem, John J. Lendrum, III, Randy Ziebarth, and Chris Work, and any successor representatives appointed in accordance with the procedures set forth in Section�12.1.

�Straddle Period� means any Tax period beginning on or before and ending after the Closing Date.

�Straddle Tax Returns� has the meaning set forth in Section�6.4(b).

�Subsidiary� or �Subsidiaries� means, with respect to any Person, another Person in which such first Person owns or controls, directly or indirectly, an amount of the voting securities, other voting ownership or voting partnership interests which is sufficient to elect at least a majority of its board of directors or other governing body, or, in the case of a limited partnership, the board of directors or other governing body of its general partner (or, if there are no such voting interests, 50% or more of the equity interests of such Person).

�Subsidiary Interests� means the issued and outstanding member interests in the Company Subsidiaries.

�

13

�Supplemental Disclosure Item� has the meaning set forth in Section�4.3.

�Supplemental Disclosure Letter� has the meaning set forth in Section�4.3.

�Surviving Company� has the meaning set forth in Section�2.1.

�Tax� or �Taxes� means (a)�all federal, state, local or foreign taxes, charges, fees, imposts, levies or other assessments, including all net income, gross receipts, capital, sales, use, ad valorem, value added, transfer, franchise, profits, inventory, capital stock, fuel tax, license, withholding, payroll, employment, social security, unemployment, excise, severance, stamp, occupation, property and estimated taxes, customs duties, fees, assessments and charges of any kind whatsoever, and (b)�all interest, penalties, fines, additions to tax or additional amounts imposed by any Taxing Authority in connection with any item described in clause (a).

�Tax Proceeding� has the meaning set forth in Section�6.6(c).

�Tax Return� means any return, report or statement required to be filed with respect to any Tax (including any attachments thereto, and any amendment thereof), including any information return, claim for refund, amended return or declaration of estimated Tax, and including, where permitted or required, combined, consolidated or unitary returns for any group of entities that includes the Company and/or the Company Subsidiaries.

�Taxing Authority� means any Governmental Authority responsible for the administration of any Tax.

�Termination Date� has the meaning set forth in Section�9.1(b)(ii).

�Third-Party Claim� has the meaning set forth in Section�10.3(a).

�Transaction Documents� means, collectively, this Agreement and each other agreement, document and instrument required to be executed in accordance herewith.

�Transfer Tax� means any real property transfer or excise, sales, use, value added, stamp, documentary, recording, registration, conveyance, stock transfer, intangible property transfer, personal property transfer, gross receipts, registration, duty, securities transactions or similar fees or Taxes or governmental charges (together with any interest or penalty, addition to Tax or additional amount imposed), including, without limitation, any payments made in lieu of any such Taxes or governmental charges, but excluding, for avoidance of doubt, any gross income, modified gross income, net income or franchise taxes.

�Withholding Documents� has the meaning set forth in Section�2.8(b).

�Working Capital� means Current Assets minus Current Liabilities.

�Working Capital Deficiency� means the amount by which the Working Capital Target exceeds the Working Capital.

�

14

�Working Capital Surplus� means the amount by which Working Capital exceeds the Working Capital Target.

�Working Capital Target� means zero.

1.2 Rules of Construction.

(a) Each of the parties acknowledges that it has been represented by independent counsel of its choice throughout all negotiations that have preceded the execution of this Agreement. Each party and its counsel cooperated in the drafting and preparation of this Agreement and the documents referred to herein, and any and all drafts relating thereto shall be deemed the work product of the parties and may not be construed against any party by reason of their preparation. Accordingly, any rule of law or any legal decision that would require interpretation of any ambiguities in this Agreement against any party that drafted it is of no application and is hereby expressly waived.

(b) The inclusion of any information in the Disclosure Schedules shall not be deemed an admission or acknowledgment, in and of itself and solely by virtue of the inclusion of such information in the Disclosure Schedules, that such information is required to be listed in the Disclosure Schedules or that such items are material to the Company or Parent, as the case may be. The headings, if any, of the individual Sections of each of the Disclosure Schedules are inserted for convenience only and shall not be deemed to constitute a part thereof or a part of this Agreement. The Disclosure Schedules are arranged in Sections corresponding to those contained in Section�3.1 and Section�3.2 merely for convenience, and the disclosure of an item in one Section�of the Disclosure Schedules as an exception to a particular representation or warranty shall be deemed adequately disclosed as an exception with respect to all other representations or warranties to the extent that the relevance of such item to such representations or warranties is reasonably apparent on the face of such disclosure, notwithstanding the presence or absence of an appropriate Section of the Disclosure Schedules with respect to such other representations or warranties or an appropriate cross reference thereto.

(c) The specification of any dollar amount in the representations and warranties or otherwise in this Agreement or in the Disclosure Schedules is not intended and shall not be deemed to be an admission or acknowledgment of the materiality of such amounts or items.

(d) All references in this Agreement to Exhibits, Schedules, Articles, Sections, subsections and other subdivisions refer to the corresponding Exhibits, Schedules, Articles, Sections, subsections and other subdivisions of this Agreement unless expressly provided otherwise. Titles appearing at the beginning of any Articles, Sections, subsections or other subdivisions of this Agreement are for convenience only, do not constitute any part of such Articles, Sections, subsections or other subdivisions, and shall be disregarded in construing the language contained therein. The words �this Agreement,� �herein,� �hereby,� �hereunder� and �hereof� and words of similar import, refer to this Agreement as a whole and not to any particular subdivision unless expressly so limited. The words �this section,� �this subsection� and words of similar import, refer only to the Sections or subsections hereof in which such words occur. The word �including� (in its various forms) means �including, without limitation.�

�

15

Pronouns in masculine, feminine or neuter genders shall be construed to state and include any other gender and words, terms and titles (including terms defined herein) in the singular form shall be construed to include the plural and vice versa, unless the context otherwise expressly requires. Unless the context otherwise requires, all defined terms contained herein shall include the singular and plural and the conjunctive and disjunctive forms of such defined terms. Unless the context otherwise requires, all references to a specific time shall refer to Houston, Texas time. All references to currency herein shall be to, and all payments required hereunder shall be paid in, lawful currency of the United States of America. Unless specifically provided for herein, the term �or� shall not be deemed to be exclusive. The words �will� and �will not� are expressions of command and not merely expressions of future intent or expectation. When used in this Agreement, the word �either� shall be deemed to mean �one or the other�, not �both�. Any item referred to herein as delivered, provided, furnished or made available to Parent or its representatives prior to the date hereof refers to the version of such item available as of October�26, 2014 in the �Project Nuevo Midstream� electronic data room hosted by Intralinks (the �Electronic Data Room�), except with respect to (i)�individual Employee compensation information which was delivered by separate disclosure to Parent, (ii)�Company board minutes and consents which were reviewed by representatives of the Parent in the Company�s offices, and (iii)�real estate and Easements records (which were included in electronic discs physically delivered to Parent for review, or were made available through CLSLink� and CLSLink GIS� Viewer databases made available to Parent for review, or were reviewed by representatives of the Parent in the Company�s offices).

(e) Notwithstanding anything contained in this Agreement to the contrary, except as otherwise expressly provided in this Agreement, the parties hereto agree that no amount shall be (or is intended to be) included, in whole or in part (either as an increase or a reduction), more than once in the calculation of the Merger consideration or any component thereof or calculation relating thereto, in each case, if the effect of such additional inclusion (either as an increase or a reduction) would be to cause such amount to be (i)�paid twice for the benefit of the same Person or (ii)�deducted twice to the detriment of the same Person, in each case, for purposes of the transactions contemplated by this Agreement.

(f) The parties hereto further covenant and agree that if any provision of this Agreement requires an amount or calculation to be �determined in accordance with this Agreement and GAAP� (or words of similar import), then to the extent that the terms of this Agreement conflict with, or are inconsistent with, GAAP in connection with such determination, the terms of this Agreement shall control.

ARTICLE II

THE MERGER

2.1 Merger. Upon the terms and subject to the conditions set forth in this Agreement, at the Effective Time, Merger Subsidiary shall be merged with and into the Company in accordance with the terms of, and subject to the conditions set forth in, this Agreement and the DLLCA. Following the Merger, the Company shall continue as the surviving company in the Merger (sometimes hereinafter referred to as the �Surviving Company�) and the separate corporate existence of Merger Subsidiary shall cease.

�

16

2.2 Effective Time. Upon the terms and subject to the conditions set forth in this Agreement, the Company, Parent and Merger Subsidiary shall cause a Certificate of Merger meeting the requirements of the DLLCA (the �Certificate of Merger�) to be properly executed and filed with the Secretary of State of the State of Delaware on the Closing Date. The Merger shall become effective at the time of filing of the Certificate of Merger with the Secretary of State of the State of Delaware, in accordance with the terms and conditions of the DLLCA, or at such other time as Merger Subsidiary and the Company shall agree and specify in the Certificate of Merger, which filing shall be made as soon as practicable on the Closing Date (the �Effective Time�).

2.3 Effect of the Merger. At and after the Effective Time, the Merger shall have the effects provided herein and set forth in the DLLCA. Without limiting the generality of the foregoing and subject thereto, at the Effective Time, the separate existence of the Company and Merger Subsidiary will cease and, without other transfer, all the property, rights, privileges, immunities, powers and franchises of the Company and Merger Subsidiary shall vest in the Surviving Company, and all debts, liabilities, obligations and duties of the Company and Merger Subsidiary shall become the debts, liabilities, obligations and duties of the Surviving Company as if the Surviving Company had itself incurred them.

2.4 Certificate of Formation and Limited Liability Company Agreement. The certificate of formation of the Company and the Company LLC Agreement in effect immediately prior to the Effective Time shall be the certificate of formation and limited liability company agreement of the Surviving Company as of the Effective Time, until duly amended in accordance with the provisions thereof and Applicable Laws. As a result of the Merger and effective immediately following the Effective Time, the Company LLC Agreement shall be amended and replaced by the Third Amended and Restated Limited Liability Company Agreement in the form of Exhibit�C attached hereto. Upon the effective time of the Merger, the name of the Company (as the surviving company) will be changed to a name selected by Parent which does not include any Company Names and Marks.

2.5 Directors, Managers and Officers. The directors (or managers, as the case may be) and officers of Merger Subsidiary immediately prior to the Effective Time shall be the directors (or managers, as the case may be) and officers of the Surviving Company as of the Effective Time.

2.6 Conversion of Merger Subsidiary Member Interests and Outstanding Company Member Interests. At the Effective Time, by virtue of the Merger and without any action on the part of any party:

(a) All member interests of Merger Subsidiary issued and outstanding immediately prior to the Effective Time shall remain outstanding and shall represent 100% of the member interests of the Surviving Company, so that, after the Effective Time, Parent shall be the holder of all of the issued and outstanding member interests of the Surviving Company.

(b) Each Company Member Interest outstanding immediately prior to the Effective Time (each, an �Outstanding Company Member Interest� and collectively, the �Outstanding Company Member Interests�) (i)�shall be converted into the right to receive its

�

17

respective portion of the Closing Merger Consideration plus the Final Adjustment Surplus or minus the Final Adjustment Deficiency in accordance with the provisions of the Company LLC Agreement (such resulting amount, the �Aggregate Member Consideration�), and (ii)�shall otherwise cease to be outstanding, shall be canceled and retired and cease to exist.

2.7 Closing of Transfer Books. From and after the Effective Time, the member interest transfer books of the Company shall be closed and no transfer of Company Member Interests shall thereafter be made. From and after the Effective Time, Company Member Interests outstanding immediately prior to the Effective Time shall cease to have any rights with respect to such Outstanding Company Member Interests, except as otherwise expressly provided for in this Agreement or by Applicable Law.

2.8 Payments.

(a) At the Closing, Parent shall pay or cause to be paid the following amounts by wire transfers of immediately available funds:

(i) Parent shall pay or cause to be paid to each lender or debt holder under the Loan Agreements, to an account designated by such lender or debt holder in writing, the amount of Debt specified in such lender�s or debt holder�s Pay-Off Letter (collectively, the sum of such Debt amounts for all such payees being hereinafter referred to as the �Debt Pay-Off Amount�);

(ii) Parent shall pay or cause to be paid all Company Transaction Costs that remain outstanding as of the Closing Date to such account or accounts as are designated by the Company in accordance with Section�4.4;

(iii) Parent shall pay or cause to be paid to the Escrow Agent the Escrow Amount; and

(iv) Parent shall, in accordance with written instructions from the Representatives, pay to the Company Member Interest Holders, the Closing Merger Consideration (less the Escrow Amount), by wire transfer of immediately available funds to the respective accounts designated in writing by the Representatives.

For U.S. federal income tax purposes, Parent, the Company and the Representatives agree that the Parent shall be treated as the owner of the Escrow Amount during the term of the Escrow Agreement. The Parties shall not take any action that would be inconsistent with the foregoing.

(b) Withholding.

(i) Each Company Member Interest Holder will be required to deliver to Parent (x)�a duly executed certificate of non-foreign status (or, if any such holder is disregarded as separate from another Person for U.S. federal income tax purposes, such certificate will be from such other Person) in the form and manner that complies with Section�1445 of the Code and the Treasury Regulations thereunder (each certificate contemplated by this clause (x)�of this Section�2.8(b)(i), a �FIRPTA Certificate�), (y)�a completed Internal Revenue Service Form W-9 and (z)�any other form or document that may be required or

�

18

reasonably requested by Parent to allow Parent to pay any merger consideration required to be paid by Parent under this Agreement without withholding or deduction on account of any Tax (the documents contemplated by this Section�2.8(b)(i), the �Withholding Documents�). The Withholding Documents shall be delivered to Parent for review not less than three (3)�Business Days prior to the Closing Date and each Withholding Document shall be accurately completed by the applicable Person in a manner reasonably acceptable to Parent.

(ii) If any Company Member Interest Holder fails to provide the documentation required in Section�2.8(b)(i) above, each of the Surviving Company and Parent shall be entitled to deduct and withhold from the consideration otherwise payable to any Company Member Interest Holders pursuant to this Article II any amounts that the Surviving Company or Parent, as the case may be, is required to deduct and withhold with respect to payment under any provision of federal, state or local income Tax law. If the Surviving Company or Parent, as the case may be, so withholds amounts, such amounts shall be treated for all purposes of this Agreement as having been paid to the Company Member Interest Holders in respect of which the Surviving Company or the Parent, as the case may be, made such deduction or withholding.

2.9 Closing Adjustment Amount. No later than three (3)�Business Days before the Closing Date, the Company shall have delivered to Parent an estimated consolidated balance sheet of the Company and the Company Subsidiaries prepared as of 11:59 p.m. on the date immediately prior to the Closing Date (except as otherwise contemplated by this Agreement) (the �Closing Balance Sheet�), and a statement which sets forth a good faith estimate of the following amounts (as of the Effective Time): (a)�the amount of Cash (�Estimated Cash�), (b)�the amount of unpaid Debt (�Estimated Debt�), (c)�the major components of Working Capital to enable Parent to calculate Working Capital and the amount of Working Capital Surplus or Working Capital Deficiency (�Estimated Working Capital Surplus� or �Estimated Working Capital Deficiency�), and (d)�the amount of Growth Capital Expenditures expended or accrued through the Effective Time (the �Estimated Growth Capital Expenditures�), provided that Growth Capital Expenditures shall only be considered to be accrued through the Effective Time to the extent such amounts are included in Current Liabilities in the calculation of Working Capital. The Closing Balance Sheet shall be prepared by the Company in accordance with the Agreed Accounting Principles applied in a manner consistent with the preparation of the Example Working Capital Schedule.

2.10 Final Adjustment Amount.

(a) As promptly as practicable after the Closing Date (but in no event later than one hundred twenty (120)�days after the Closing Date), Parent shall cause the Company to prepare and deliver to the Representatives a consolidated balance sheet of the Company and the Company Subsidiaries prepared as of 11:59 p.m. on the date immediately prior to the Closing Date (except as otherwise contemplated by this Agreement) (the �Final Balance Sheet�), and a statement (the �Final Closing Statement�) which shall set forth the following amounts (as of the Effective Time): (i)�the amount of Cash (�Closing Cash�), (ii)�the amount of unpaid Debt (�Closing Debt�), (iii)�the major components of Working Capital to enable the Representatives (on behalf of the Company Member Interest Holders) to calculate Working Capital and the amount of Working Capital Surplus or Working Capital Deficiency as of such time and date

�

19

(�Closing Working Capital Surplus� or �Closing Working Capital Deficiency�), and (iv)�the final amount of Growth Capital Expenditures expended through the Effective Time (the �Closing Growth Capital Expenditures�). The Final Balance Sheet shall be prepared in accordance with the Agreed Accounting Principles. Following the delivery of the Final Balance Sheet and Final Closing Statement to the Representatives, Parent and the Surviving Company shall afford the Representatives and their representatives the opportunity to examine the Final Balance Sheet, the Final Closing Statement and such supporting schedules, analyses, workpapers, including any audit workpapers, and other underlying records or documentation, as are requested and reasonably necessary and appropriate. Parent and the Surviving Company shall cooperate fully and promptly with the Representatives and their representatives in such examination, including providing answers to reasonable questions asked by the Representatives and their representatives and access to records, and, if applicable, to outside consultants. Notwithstanding the foregoing provisions of this Section�2.10(a), Parent and the Surviving Company shall not be required to grant access or furnish information to the Representatives or their representatives to the extent that such information is subject to an attorney/client or attorney work product privilege.

(b) If within forty-five (45)�days following delivery of the Final Balance Sheet and Final Closing Statement to the Representatives, the Representatives have not delivered to Parent written notice (the �Objection Notice�) of their objections to the Final Balance Sheet and/or Final Closing Statement, then Closing Cash, Closing Debt, Closing Working Capital Surplus or Closing Working Capital Deficiency, and Closing Growth Capital Expenditures, as applicable, as set forth in or derived from such Final Balance Sheet and Final Closing Statement shall be deemed final and conclusive and shall be �Final Cash�, �Final Debt�, �Final Working Capital Surplus� or �Final Working Capital Deficiency� and �Final Growth Capital Expenditures�, respectively. If the Representatives deliver the Objection Notice within such 45-day period, then Parent and the Representatives shall endeavor in good faith to resolve the objections, for a period not to exceed fifteen (15)�days from the date of delivery of the Objection Notice. If at the end of the 15-day period there are any items that remain in dispute, then the remaining items in dispute shall be submitted for resolution to a �big four� accounting firm to be selected jointly by the Representatives and Parent within the following five (5)�days or, if the Representatives and Parent are unable to mutually agree within such five-day period, such accounting firm shall be Grant Thornton LLP (such jointly selected accounting firm or Grant Thornton LLP, the �Referee�). The Referee shall determine any unresolved items within thirty (30)�days after the items that remain in dispute are submitted to it. If any items are submitted to the Referee for resolution, (i)�each party shall furnish to the Referee such relevant workpapers and other relevant documents and information relating to such items as the Referee may request and are available to that party or its Subsidiaries (or its independent public accountants) and will be afforded the opportunity to present to the Referee any material relating to the determination of the matters in dispute and to discuss such determination with the Referee; (ii)�to the extent that a value has been assigned to any item that remains in dispute, the Referee shall not assign a value to such item that is greater than the greatest value for such item claimed by either party or less than the smallest value for such item claimed by either party; (iii)�the determination by the Referee of Final Cash, Final Debt, Final Working Capital Surplus, Final Working Capital Deficiency, and Final Growth Capital Expenditures, as set forth in a written notice delivered to both parties by the Referee, shall be made in accordance with this Agreement and shall be binding and conclusive on the parties and shall constitute an arbitral award that is final, binding

�

20

and unappealable and upon which a judgment may be entered by a court having jurisdiction thereof; and (iv)�the fees and expenses of the Referee shall be paid by the Parent, provided that Parent will be entitled to a credit for 50% of such fees and expenses on the Final Closing Statement as reflected in the definition of �Final Adjustment Amount.�

(c) To the extent that the Final Adjustment Amount exceeds the Closing Adjustment Amount, such excess (the �Final Adjustment Surplus�) shall be paid by Parent to the Company Member Interest Holders, in accordance with written instructions from the Representatives, within five (5)�Business Days of the determination of the Final Adjustment Amount. To the extent that the Final Adjustment Amount is less than the Closing Adjustment Amount, such deficiency (the �Final Adjustment Deficiency�) shall be paid to the Parent by a directed payment out of the Escrow Funds to Parent, pursuant to the terms of the Escrow Agreement. Parent acknowledges and agrees that any items included in the determination of the Final Adjustment Surplus or Final Adjustment Deficiency (to the extent of the value of such items so included) may not form the basis for any claims for indemnification by any Parent Indemnified Party hereunder, as and to the extent contemplated by Article�X.