Form 8-K WYNN RESORTS LTD For: Sep 09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 9, 2015

WYNN RESORTS, LIMITED

(Exact name of registrant as specified in its charter)

NEVADA | 000-50028 | 46-0484987 | ||

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) | ||

3131 Las Vegas Boulevard South - Las Vegas, Nevada 89109

(Address of principal executive offices) (Zip Code)

(702) 770-7555

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01. | Regulation FD Disclosure. |

On September 9, 2015, Wynn Macau, Limited (“WML”), an indirect subsidiary of Wynn Resorts, Limited (the “Registrant”) with ordinary shares of its common stock listed on The Stock Exchange of Hong Kong Limited (the “HKSE”), filed its interim report in respect of the six months ended June 30, 2015 (the “Interim Report”) with the HKSE, as required by the HKSE listing rules. The Registrant owns approximately 72% of WML’s ordinary shares of common stock. The Interim Report is furnished herewith as Exhibit 99.1. The information in this Form 8-K and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. | Financial Statements and Exhibits |

(d) | Exhibits. |

Exhibit No. | Description | |

99.1 | Interim Report of Wynn Macau, Limited in respect of the six months ended June 30, 2015. | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

WYNN RESORTS, LIMITED | ||||

Dated: September 9, 2015 | By: | /s/ Stephen Cootey | ||

Stephen Cootey | ||||

Chief Financial Officer and Treasurer | ||||

(Principal Financial and Accounting Officer) | ||||

EXHIBIT INDEX

Exhibit No. | Description | |

99.1 | Interim Report of Wynn Macau, Limited, in respect of the six months ended June 30, 2015. | |

201 5 Interim Repor t 中期報告 2015 Interim Report 中期報告 Wynn Macau, Limited Rua Cidade de Sintra, NAPE, Macau (853) 2888-9966 www.wynnmacau.com

2 Corporate Information 4 Highlights 5 Management Discussion and Analysis 28 Directors and Senior Management 40 Other Information 52 Report on Review of Interim Financial Information 54 Interim Financial Information 79 Definitions 85 Glossary Contents

2 Wynn Macau, Limited Corporate Information BOARD OF DIRECTORS Executive Directors Mr. Stephen A. Wynn (Chairman of the Board) Mr. Gamal Aziz Ms. Linda Chen Mr. Ian Michael Coughlan Non-Executive Director Mr. Matthew O. Maddox Independent Non-Executive Directors Dr. Allan Zeman, GBM, GBS, JP (Vice-chairman of the Board) Mr. Jeffrey Kin-fung Lam, GBS, JP Mr. Bruce Rockowitz Mr. Nicholas Sallnow-Smith AUDIT AND RISK COMMITTEE Mr. Nicholas Sallnow-Smith (Chairman) Mr. Bruce Rockowitz Dr. Allan Zeman, GBM, GBS, JP REMUNERATION COMMITTEE Mr. Nicholas Sallnow-Smith (Chairman) Mr. Jeffrey Kin-fung Lam, GBS, JP Mr. Matthew O. Maddox Mr. Bruce Rockowitz NOMINATION AND CORPORATE GOVERNANCE COMMITTEE Mr. Jeffrey Kin-fung Lam, GBS, JP (Chairman) Mr. Nicholas Sallnow-Smith Dr. Allan Zeman, GBM, GBS, JP COMPANY SECRETARY Ms. Ho Wing Tsz Wendy, FCIS, FCS AUTHORIZED REPRESENTATIVES Dr. Allan Zeman, GBM, GBS, JP Ms. Ho Wing Tsz Wendy, FCIS, FCS (Mrs. Seng Sze Ka Mee, Natalia as alternate) AUDITORS Ernst & Young Certified Public Accountants LEGAL ADVISORS As to Hong Kong and U.S. laws: Skadden, Arps, Slate, Meagher & Flom As to Hong Kong law: Mayer Brown JSM As to Macau law: Alexandre Correia da Silva As to Cayman Islands law: Maples and Calder

3Interim Report 2015 Corporate Information REGISTERED OFFICE P.O. Box 309 Ugland House Grand Cayman KY1-1104 Cayman Islands HEADQUARTERS IN MACAU Rua Cidade de Sintra NAPE, Macau SAR PRINCIPAL PLACE OF BUSINESS IN HONG KONG Level 54, Hopewell Centre 183 Queen’s Road East Hong Kong PRINCIPAL SHARE REGISTRAR AND TRANSFER OFFICE Appleby Trust (Cayman) Limited HONG KONG SHARE REGISTRAR Computershare Hong Kong Investor Services Limited STOCK CODE 1128 COMPANY WEBSITE www.wynnmacaulimited.com

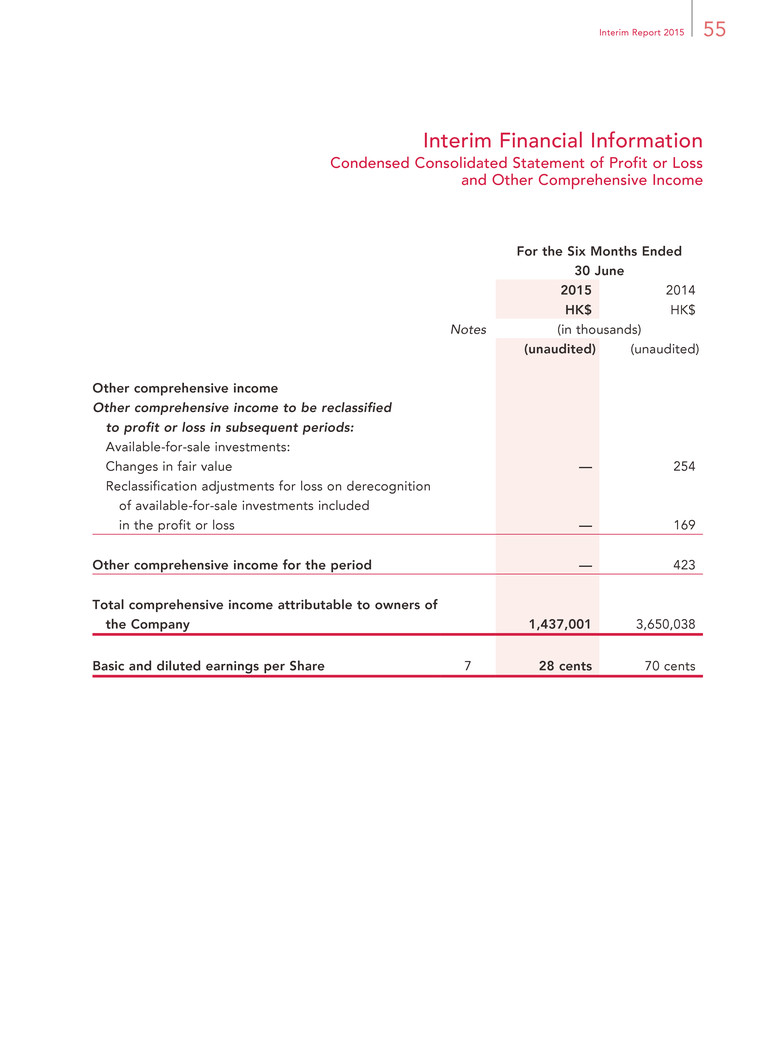

4 Wynn Macau, Limited Highlights FINANCIAL HIGHLIGHTS For the Six Months Ended 30 June 2015 2014 HK$ HK$ (in thousands, except per share amounts or otherwise stated) Casino revenues 9,623,267 15,358,669 Other revenues 631,024 879,691 Adjusted EBITDA 2,548,692 4,623,914 Profit attributable to owners 1,437,001 3,649,615 Earnings per Share — basic and diluted (HK$) 28 cents 70 cents

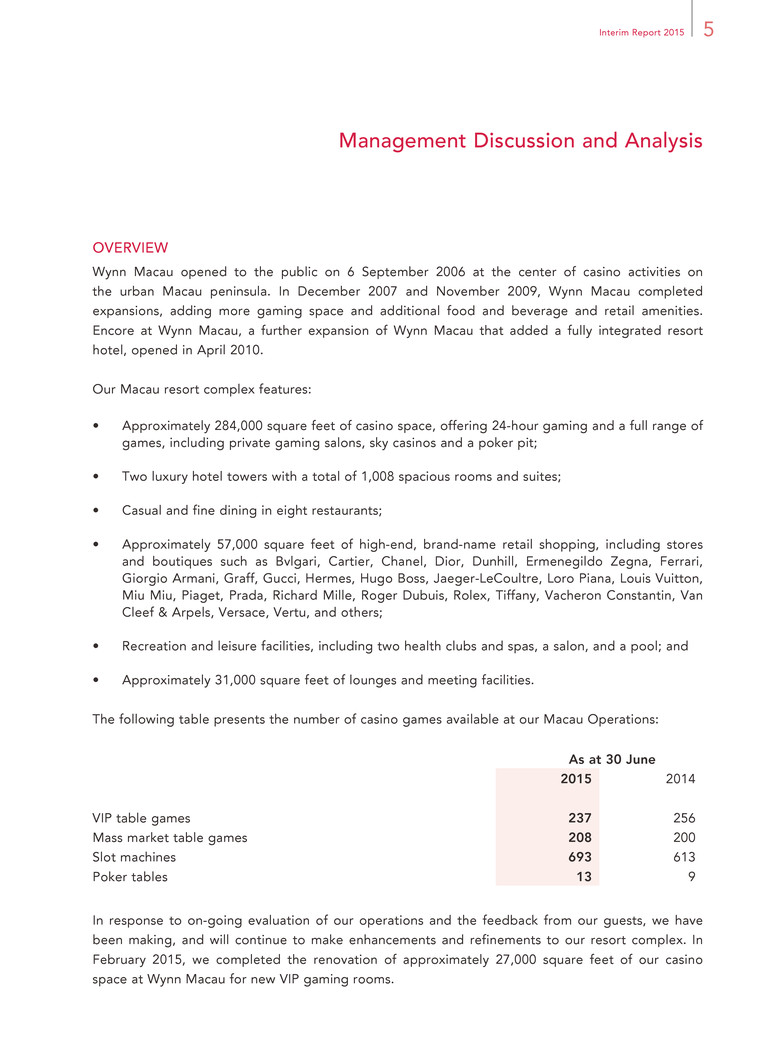

5Interim Report 2015 Management Discussion and Analysis OVERVIEW Wynn Macau opened to the public on 6 September 2006 at the center of casino activities on the urban Macau peninsula. In December 2007 and November 2009, Wynn Macau completed expansions, adding more gaming space and additional food and beverage and retail amenities. Encore at Wynn Macau, a further expansion of Wynn Macau that added a fully integrated resort hotel, opened in April 2010. Our Macau resort complex features: • Approximately 284,000 square feet of casino space, offering 24-hour gaming and a full range of games, including private gaming salons, sky casinos and a poker pit; • Two luxury hotel towers with a total of 1,008 spacious rooms and suites; • Casual and fine dining in eight restaurants; • Approximately 57,000 square feet of high-end, brand-name retail shopping, including stores and boutiques such as Bvlgari, Cartier, Chanel, Dior, Dunhill, Ermenegildo Zegna, Ferrari, Giorgio Armani, Graff, Gucci, Hermes, Hugo Boss, Jaeger-LeCoultre, Loro Piana, Louis Vuitton, Miu Miu, Piaget, Prada, Richard Mille, Roger Dubuis, Rolex, Tiffany, Vacheron Constantin, Van Cleef & Arpels, Versace, Vertu, and others; • Recreation and leisure facilities, including two health clubs and spas, a salon, and a pool; and • Approximately 31,000 square feet of lounges and meeting facilities. The following table presents the number of casino games available at our Macau Operations: As at 30 June 2015 2014 VIP table games 237 256 Mass market table games 208 200 Slot machines 693 613 Poker tables 13 9 In response to on-going evaluation of our operations and the feedback from our guests, we have been making, and will continue to make enhancements and refinements to our resort complex. In February 2015, we completed the renovation of approximately 27,000 square feet of our casino space at Wynn Macau for new VIP gaming rooms.

6 Wynn Macau, Limited Management Discussion and Analysis Cotai Development — Wynn Palace The Group is currently constructing Wynn Palace, an integrated resort containing an approximately 1,700-room hotel, a performance lake, meeting space, a casino, a spa, retail offerings and food and beverage outlets in the Cotai area of Macau. The total project budget is approximately HK$31 billion including construction costs, capitalized interest, pre-opening expenses, land costs and financing fees. As at 30 June 2015, we have invested approximately HK$20.6 billion in the project. The Company expects to open Wynn Palace in the first half of 2016. On 29 July 2013, WRM and Palo finalized and executed a guaranteed maximum price construction (“GMP”) contract with Leighton Contractors (Asia) Limited, acting as the general contractor. Under the GMP contract, the general contractor is responsible for both the construction and design of the Wynn Palace project. The general contractor is obligated to substantially complete the project in the first half of 2016 for a guaranteed maximum price of HK$20 billion. Our general contractor has notified us that it will not achieve the early completion milestone on 25 January 2016. However, the general contractor stated it remains on schedule to complete the project on or before the substantial completion date. We continue to expect to open Wynn Palace in the first half of 2016. Both the contract time and guaranteed maximum price are subject to further adjustment under certain specified conditions. The performance of the general contractor is backed by a full completion guarantee given by Leighton Holdings Limited, the parent company of the general contractor, as well as a performance bond for equal to 5% of the guaranteed maximum price. Macau Macau, which was a territory under Portuguese administration for approximately 450 years, was transferred from Portuguese to Chinese political control in December 1999. Macau is governed as a special administrative region of China and is located approximately 37 miles southwest of, and approximately one hour away via ferry from, Hong Kong. Macau, which has been a casino destination for more than 50 years, consists principally of a peninsula on mainland China, and two neighboring islands, Taipa and Coloane between which the Cotai area is located. We believe that Macau is located in one of the world’s largest concentrations of potential gaming customers, despite a recent decline in gaming revenues. According to Macau statistical information, casinos in Macau, the largest gaming market in the world, generated approximately HK$118.1 billion in gaming revenue during the six months ended 30 June 2015, a decrease of approximately 37.0% compared to the approximate HK$187.5 billion generated in the six months ended 30 June 2014.

7Interim Report 2015 Management Discussion and Analysis FACTORS AFFECTING OUR RESULTS OF OPERATIONS AND FINANCIAL CONDITION Tourism The levels of tourism and overall gaming activities in Macau are key drivers of our business. Both the Macau gaming market and visitation to Macau grew significantly leading up to 2014. However, beginning in 2014, the Macau gaming market experienced its first year-over-year decline in annual gaming revenues since its liberalization in 2002, despite the increase in tourist arrivals to Macau, by 7.5% in 2014 as compared to 2013. Commencing from the fourth quarter of 2014, tourist arrivals to Macau have experienced a downward trend. Statistics show a decrease of 3.5% from 15.3 million in the six months ended 30 June 2014 to 14.8 million in the six months ended 30 June 2015. The decrease in tourist arrivals to Macau and a change in their spending habits and gaming activities have contributed to the further reduction in gaming revenues in Macau for the six months ended 30 June 2015. The Macau market has experienced tremendous growth in capacity since the opening of Wynn Macau. As at 31 May 2015, there were 29,900 hotel rooms and as at 30 June 2015, there were 5,814 table games and 14,192 slots in Macau, compared to 12,978 hotel rooms and 2,762 table games and 6,546 slots as at 31 December 2006. Gaming customers traveling to Macau typically come from nearby destinations in Asia including mainland China, Hong Kong, Taiwan, South Korea and Japan. According to the Macau Statistics and Census Service Monthly Bulletin of Statistics, approximately 90.8% of visitors to Macau for the six months ended 30 June 2015 were from mainland China, Hong Kong, and Taiwan. Tourism levels in Macau are affected by a number of factors, all of which are beyond our control. Key factors affecting tourism levels in Macau may include, among others: • Prevailing economic conditions in mainland China and Asia; • Restrictions, conditions or other factors which affect visitation by citizens of mainland China to Macau; • Various countries’ policies on currency exchange controls and currency export restrictions, for example on the Renminbi, the currency of the PRC, and the issuance of travel visas that may be in place from time to time; • Competition from other destinations which offer gaming and leisure activities; • Occurrence of natural disasters and disruption of travel; and • Possible outbreaks of infectious disease.

8 Wynn Macau, Limited Management Discussion and Analysis Economic and Operating Environment A significant number of our gaming customers at Wynn Macau come from mainland China. Any economic disruption or contraction in China could disrupt the number of patrons visiting our property or the amount they may be willing to spend. In addition, policies adopted from time to time by the Chinese government, including any travel restrictions imposed by China on its citizens such as restrictions imposed on exit visas granted to residents of mainland China for travel to Macau, could disrupt the number of visitors from mainland China to our property. Furthermore, the Chinese government’s ongoing anti-corruption campaign has influenced the behavior of Chinese consumers and their spending patterns both domestically and abroad. The campaign has specifically led to tighter currency transfer regulations, including real time monitoring of certain financial channels, which has disrupted the number of visitors and the amount of money they can bring from mainland China to Macau. The overall effect of the campaign and monetary transfer restrictions has resulted in decreased visitation and negatively affect our revenues and results of operations. Competition Since the liberalization of Macau’s gaming industry in 2002, there has been a significant increase in the number of casino properties in Macau. There are six gaming operators in Macau, including WRM. The three concessionaires are WRM, SJM, and Galaxy. The three subconcessionaires are Melco Crown, MGM Macau, and Venetian Macau. As at 30 June 2015, there were approximately 35 casinos in Macau, including 20 operated by SJM. Each of the six gaming operators has operating casinos and expansion plans underway. Wynn Macau also faces competition from casinos located in other areas of Asia, such as Resorts World Sentosa and Marina Bay Sands in Singapore and Resorts World Genting, located outside of Kuala Lumpur, Malaysia. Wynn Macau also faces competition from casinos in the Philippines such as Solaire Resort and Casino and City of Dreams Manila. Several other major casino resorts are scheduled to open over the next few years. Wynn Macau also encounters competition from other major gaming centers located around the world, including Australia and Las Vegas, cruise ships in Asia that offer gaming, and other casinos throughout Asia. Further, if current efforts to legalize gaming in other Asian countries are successful, Wynn Macau will face additional regional competition.

9Interim Report 2015 Management Discussion and Analysis Gaming Promoters A significant amount of our casino play is brought to us by gaming promoters. Gaming promoters have historically played a critical role in the Macau gaming market and are important to our casino business. Gaming promoters introduce premium VIP players to Wynn Macau and often assist those players with their travel and entertainment arrangements. In addition, gaming promoters often grant credit to their players. In exchange for their services, Wynn Macau generally pays the gaming promoters a commission which is a percentage of the gross gaming win generated by each gaming promoter. Approximately 80% of these commissions are netted against casino revenues, because such commissions approximate the amount of the commission returned to the VIP players by the gaming promoters, and approximately 20% of these commissions are included in other operating expenses, which approximate the amount of the commission ultimately retained by the gaming promoters as compensation. The total amount of commissions paid to gaming promoters and netted against casino revenues was HK$2.0 billion and HK$4.0 billion for the six months ended 30 June 2015 and 2014, respectively. Commissions decreased 50.5% for the six months ended 30 June 2015 compared to the six months ended 30 June 2014 as VIP gross table games win decreased due to decreased business volumes. We typically advance commissions to gaming promoters at the beginning of each month to facilitate their working capital requirements. These advances are provided to a gaming promoter and are offset by the commissions earned by such gaming promoter during the applicable month. The aggregate amounts of exposure to our gaming promoters, which is the difference between commissions advanced to each individual gaming promoter, and the commissions payable to each such gaming promoter, were HK$509.6 million and HK$683.5 million as at 30 June 2015 and 2014, respectively. At the end of each month any commissions outstanding are cleared no later than the fifth business day of the succeeding month and prior to the advancement of any further funds to a gaming promoter. We believe we have developed strong relationships with our gaming promoters. Our commission percentages have remained stable throughout our operating history. In addition to commissions, gaming promoters each receive a monthly complimentary allowance based on a percentage of the turnover its clients generate. The allowance is available for room, food and beverage and other products and services for discretionary use with the gaming promoter’s clients.

10 Wynn Macau, Limited Management Discussion and Analysis Given present market conditions in Macau and certain economic and other factors occurring in the region, gaming promoters have encountered difficulties in attracting patrons to come to Macau. Further, gaming promoters have experienced decreased liquidity, limiting their ability to grant credit to their patrons, resulting in decreased gaming volumes in Macau and at Wynn Macau. Credit already extended by our gaming promoters to their patrons may become difficult for them to collect. The inability to attract sufficient patrons, grant credit and collect amounts due in a timely manner can negatively affect our gaming promoters’ operations, cause gaming promoters to wind up or liquidate their operations or result in our gaming promoters leaving Macau, and as a result, our results of operations could be adversely impacted. Premium Credit Play We selectively extend credit to our VIP players contingent upon our marketing team’s knowledge of the players, their financial background and payment history. We follow a series of credit procedures and require various signed documents from each credit recipient that are intended to ensure, among other things, that if permitted by applicable law, the debt can be legally enforced in the jurisdiction where the player resides. In the event the player does not reside in a jurisdiction where gaming debts are legally enforceable, we can attempt to assert jurisdiction over assets the player maintains in jurisdictions where gaming debts are recognized. In addition, we typically require a check in the amount of the applicable credit line from credit players, collateralizing the credit we grant. Number and Mix of Table Games and Slot Machines The mix of VIP table games, mass table games and slot machines in operation at our resort changes from time to time as a result of marketing and operating strategies in response to changing market demand and industry competition. The shift in the mix of our games will affect casino profitability.

11Interim Report 2015 Management Discussion and Analysis ADJUSTED EBITDA Adjusted EBITDA is earnings before finance costs, finance revenues, net foreign currency differences, changes in fair value of interest rate swaps, taxes, depreciation and amortization, pre- opening costs, property charges and other, share-based payments, Wynn Macau, Limited corporate expenses, and other non-operating income and expenses. Adjusted EBITDA is presented exclusively as a supplemental disclosure because our Directors believe that it is widely used to measure the performance, and as a basis for valuation, of gaming companies. Our Adjusted EBITDA presented herein also differs from the Adjusted Property EBITDA presented by Wynn Resorts, Limited for its Macau segment in its filings with the SEC, primarily due to the inclusion of license fees, adjustments for IFRS differences with U.S. GAAP, corporate support and other support services in arriving at operating profit. The following table sets forth a quantitative reconciliation of Adjusted EBITDA to its most directly comparable IFRS measurement, operating profit, for the six months ended 30 June 2015 and 2014. For the Six Months Ended 30 June 2015 2014 HK$ HK$ (in thousands) Operating profit 1,754,628 3,914,996 Add Depreciation and amortization 526,888 485,939 Pre-opening costs 158,632 62,117 Property charges and other 285 80,954 Share-based payments 68,459 26,295 Wynn Macau, Limited corporate expenses 39,800 53,613 Adjusted EBITDA 2,548,692 4,623,914

12 Wynn Macau, Limited Management Discussion and Analysis REVIEW OF HISTORICAL OPERATING RESULTS Summary Breakdown Table The following table presents certain selected statement of profit or loss and other comprehensive income line items and certain other data. For the Six Months Ended 30 June 2015 2014 HK$ HK$ (in thousands, except for averages, daily win figures and number of tables and slot machines) Total casino revenues(1) 9,623,267 15,358,669 Rooms(2) 62,282 65,647 Food and beverage(2) 110,075 101,973 Retail and other(2) 458,667 712,071 Total operating revenues 10,254,291 16,238,360 VIP table games turnover 253,295,988 483,737,001 VIP gross table games win(1) 7,239,754 13,764,628 Mass market table drop 19,194,956 21,716,415 Mass market gross table games win(1) 3,770,430 4,745,327 Slot machine handle 16,029,350 22,157,034 Slot machine win(1) 759,762 1,050,412 Average number of gaming tables(3) 468 473 Average daily gross win per gaming table(4) 129,929 216,094 Average number of slots(3) 678 732 Average daily win per slot(4) 6,190 7,928

13Interim Report 2015 Management Discussion and Analysis Notes: (1) Total casino revenues do not equal the sum of “VIP gross table games win”, “mass market gross table games win” and “slot machine win” because casino revenues are reported net of the relevant commissions. The following table presents a reconciliation of the sum of “VIP gross table games win”, “mass market gross table games win” and “slot machine win” to total casino revenues. For the Six Months Ended 30 June 2015 2014 HK$ HK$ (in thousands) VIP gross table games win 7,239,754 13,764,628 Mass market gross table games win 3,770,430 4,745,327 Slot machine win 759,762 1,050,412 Poker revenues 81,915 82,731 Commissions (2,228,594) (4,284,429) Total casino revenues 9,623,267 15,358,669 (2) Promotional allowances are excluded from revenues in the accompanying condensed consolidated statement of profit or loss and other comprehensive income prepared in accordance with IFRS. Management also evaluates non-casino revenues on an adjusted basis.

14 Wynn Macau, Limited Management Discussion and Analysis The following table presents a reconciliation of net non-casino revenues as reported in our condensed consolidated statement of profit or loss and other comprehensive income to gross non-casino revenues calculated on the adjusted basis. The adjusted non-casino revenues as presented below are used for management reporting purposes and are not representative of revenues as determined under IAS 18. For the Six Months Ended 30 June 2015 2014 HK$ HK$ (in thousands) Room revenues 62,282 65,647 Promotional allowances 430,068 452,851 Adjusted room revenues 492,350 518,498 Food and beverage revenues 110,075 101,973 Promotional allowances 204,185 301,442 Adjusted food and beverage revenues 314,260 403,415 Retail and other revenues 458,667 712,071 Promotional allowances 26,123 22,775 Adjusted retail and other revenues 484,790 734,846 (3) For purposes of this table, we calculate average number of gaming tables and average number of slots as the average numbers of gaming tables and slot machines in service on each day in the period. (4) Daily gross win per gaming table and daily win per slot are presented in this table on the basis of the average number of gaming tables and average number of slots, respectively, over the number of days Wynn Macau and Encore were open in the applicable period. In addition, the total table games win figures used herein do not correspond to casino revenues figures in our financial information because figures in our financial information are calculated net of commissions and the total table games win herein is calculated before commissions.

15Interim Report 2015 Management Discussion and Analysis Discussion of Results of Operations Financial results for the six months ended 30 June 2015 compared to financial results for the six months ended 30 June 2014 Operating Revenues Total operating revenues decreased 36.9% from HK$16.2 billion in the six months ended 30 June 2014 to HK$10.3 billion in the six months ended 30 June 2015. This decrease was primarily due to lower gaming volume in our VIP casino in the six months ended 30 June 2015 compared to the six months ended 30 June 2014. Casino Revenues Casino revenues decreased 37.3% from HK$15.4 billion (94.6% of total operating revenues) in the six months ended 30 June 2014 to HK$9.6 billion (93.8% of total operating revenues) in the six months ended 30 June 2015. The components and reasons are as follows: VIP casino gaming operations. VIP gross table games win decreased from HK$13.8 billion in the six months ended 30 June 2014 to HK$7.2 billion in the six months ended 30 June 2015. VIP table games turnover decreased by 47.6%, from HK$483.7 billion in the six months ended 30 June 2014 to HK$253.3 billion in the six months ended 30 June 2015. VIP gross table games win as a percentage of turnover (calculated before commissions) was 2.85% in the six months ended 30 June 2014 compared to 2.86% in the six months ended 30 June 2015, which was within our expected range of 2.7% to 3.0%. Mass market casino gaming operations. Mass market gross table games win decreased by 20.5%, from HK$4.7 billion in the six months ended 30 June 2014 to HK$3.8 billion in the six months ended 30 June 2015. Mass market table drop decreased 11.6% from HK$21.7 billion in the six months ended 30 June 2014 to HK$19.2 billion in the six months ended 30 June 2015. The mass market gross table games win percentage was 21.9% in the six months ended 30 June 2014 compared to 19.6% in the six months ended 30 June 2015. Slot machine gaming operations. Slot machine win decreased by 27.7% from HK$1.1 billion in the six months ended 30 June 2014 to HK$759.8 million in the six months ended 30 June 2015. Slot machine handle decreased by 27.7%, from HK$22.2 billion in the six months ended 30 June 2014 to HK$16.0 billion in the six months ended 30 June 2015. Slot machine win per unit per day decreased by 21.9% from HK$7,928 in the six months ended 30 June 2014 to HK$6,190 in the six months ended 30 June 2015. Slot machine win, slot machine handle and slot machine win per unit per day decreased primarily due to decreased business volumes.

16 Wynn Macau, Limited Management Discussion and Analysis Non-casino Revenues Net non-casino revenues, which include rooms, food and beverage and retail and other revenues, decreased by 28.3% from HK$879.7 million (5.4% of total operating revenues) in the six months ended 30 June 2014 to HK$631.0 million (6.2% of total operating revenues) in the six months ended 30 June 2015. The decrease in revenues was largely due to lower retail sales in the six months ended 30 June 2015. Room. Our room revenues, which exclude promotional allowances in our condensed consolidated statement of profit or loss and other comprehensive income, decreased by 5.1% from HK$65.6 million in the six months ended 30 June 2014 to HK$62.3 million in the six months ended 30 June 2015. Management also evaluates room revenues on an adjusted basis which include promotional allowances. Adjusted room revenues including promotional allowances decreased by 5.0% from HK$518.5 million in the six months ended 30 June 2014 to HK$492.4 million in the six months ended 30 June 2015. The following table presents additional information about our adjusted room revenues (which include promotional allowances): Adjusted room revenues information For the Six Months Ended 30 June 2015 2014 Adjusted Average Daily Rate (includes promotional allowances of HK$2,217 in the six months ended 30 June 2015 and HK$2,284 in the six months ended 30 June 2014) HK$2,529 HK$2,605 Occupancy 96.9% 98.3% Adjusted REVPAR (includes promotional allowances of HK$2,149 in the six months ended 30 June 2015 and HK$2,245 in the six months ended 30 June 2014) HK$2,451 HK$2,559

17Interim Report 2015 Management Discussion and Analysis Food and beverage. Food and beverage revenues, which exclude promotional allowances in our condensed consolidated statement of profit or loss and other comprehensive income increased by 7.9% from HK$102.0 million in the six months ended 30 June 2014 to HK$110.1 million in the six months ended 30 June 2015. Management also evaluates food and beverage revenues on an adjusted basis including promotional allowances. Food and beverage revenues adjusted to include these promotional allowances decreased by 22.1% from HK$403.4 million in the six months ended 30 June 2014 to HK$314.3 million in the six months ended 30 June 2015. The decrease was due primarily to decreased business volumes in VIP casino gaming operations. Retail and other. Our retail and other revenues, which exclude promotional allowances in our condensed consolidated statement of profit or loss and other comprehensive income, decreased by 35.6%, from HK$712.1 million in the six months ended 30 June 2014 to HK$458.7 million in the six months ended 30 June 2015. The decrease was due primarily to lower retail sales. Management also evaluates retail and other revenues on an adjusted basis which includes promotional allowances. Adjusted retail and other revenues including promotional allowances decreased by 34.0% from HK$734.8 million in the six months ended 30 June 2014 to HK$484.8 million in the six months ended 30 June 2015, reflecting lower retail sales. Operating Costs and Expenses Gaming taxes and premiums. Gaming taxes and premiums decreased by 39.3% from HK$7.8 billion in the six months ended 30 June 2014 to HK$4.7 billion in the six months ended 30 June 2015. This decrease was due primarily to decreased gross gaming win. WRM is subject to a 35% gaming tax on gross gaming win. In addition, WRM is required to pay 4% of its gross gaming win as contributions for public development and social facilities. Staff costs. Staff costs increased by 4.0%, from HK$1.5 billion in the six months ended 30 June 2014 to HK$1.6 billion in the six months ended 30 June 2015. This increase in staff costs was primarily due to general salary increment and additional staff benefits in the form of non-vested Shares of the Company. Additionally, the Company is carrying excess headcount above the needs for its current operations as the Company prepares for the opening of Wynn Palace.

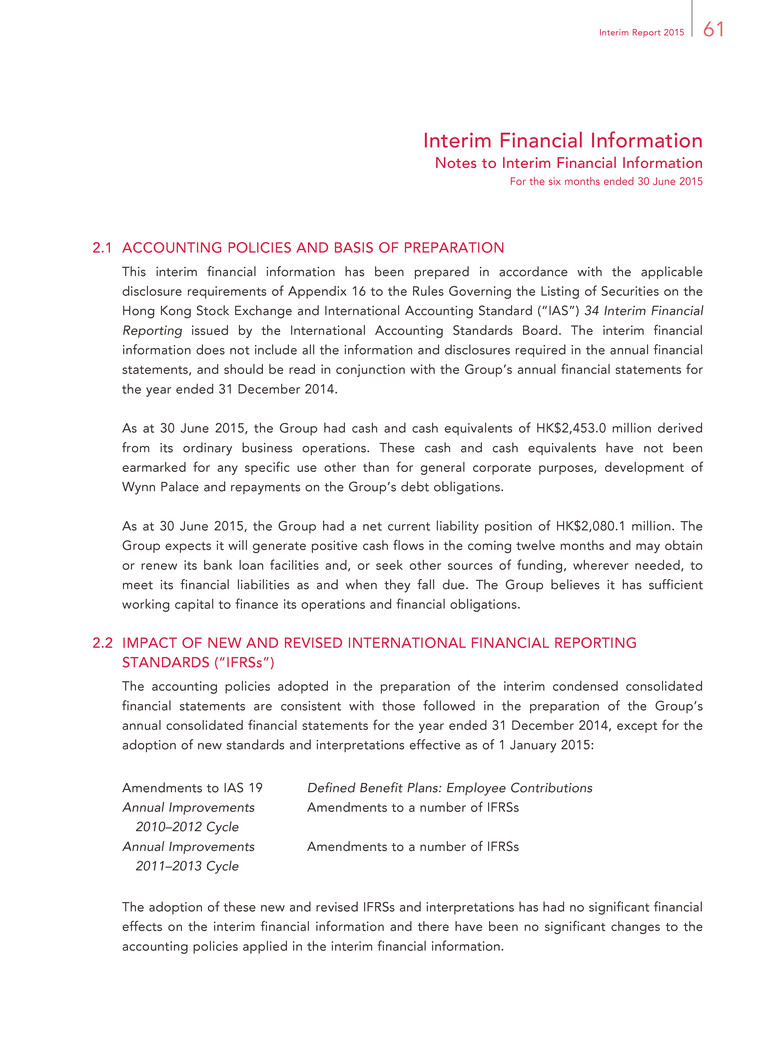

18 Wynn Macau, Limited Management Discussion and Analysis Other operating expenses. Other operating expenses decreased by 31.8% from HK$2.5 billion in the six months ended 30 June 2014 to HK$1.7 billion in the six months ended 30 June 2015. Provision for doubtful accounts increased from a benefit during the six months ended 30 June 2014 to a provision for the six months ended 30 June 2015. The increase was primarily a result of additional reserves based on specific review of customer accounts during the six months ended 30 June 2015 and a benefit from adjustments made to provision for doubtful accounts based on the results of historical collection patterns and current collection trends in the same period of 2014. For the six months ended 30 June 2015, the increase in provision for doubtful accounts, repairs and maintenance and operating rental expense, other support services, auditors’ remuneration and other operating expenses were offset by reductions in business volume related expense such as gaming promoters’ commissions, license fees and cost of sales. Depreciation and amortization. Depreciation and amortization in the six months ended 30 June 2014 increased 8.4% from HK$485.9 million to HK$526.9 million in the six months ended 30 June 2015. The increase was primarily due to additional depreciation associated with building improvements of our casino space at Wynn Macau for new VIP gaming rooms. Property charges and other. Property charges and other decreased from HK$81.0 million in the six months ended 30 June 2014 to HK$0.3 million in the six months ended 30 June 2015. Amounts in each period represent the gain/loss on the sale of equipment and other asset as well as costs related to assets retired or abandoned as a result of renovating certain assets of Wynn Macau in response to customer preferences and changes in market demand. As a result of the foregoing, total operating costs and expenses decreased by 31.0%, from HK$12.3 billion in the six months ended 30 June 2014 to HK$8.5 billion in the six months ended 30 June 2015. Finance Revenues Finance revenues decreased from HK$73.9 million in the six months ended 30 June 2014 to HK$18.9 million in the six months ended 30 June 2015. The decrease was primarily due to holding lower average cash balances for the six months ended 30 June 2015 compared to the six months ended 30 June 2014. During 2015 and 2014, our short-term investment strategy has been to preserve capital while retaining sufficient liquidity. The majority of our short-term investments were primarily in time deposits and fixed deposits with a maturity of three months or less.

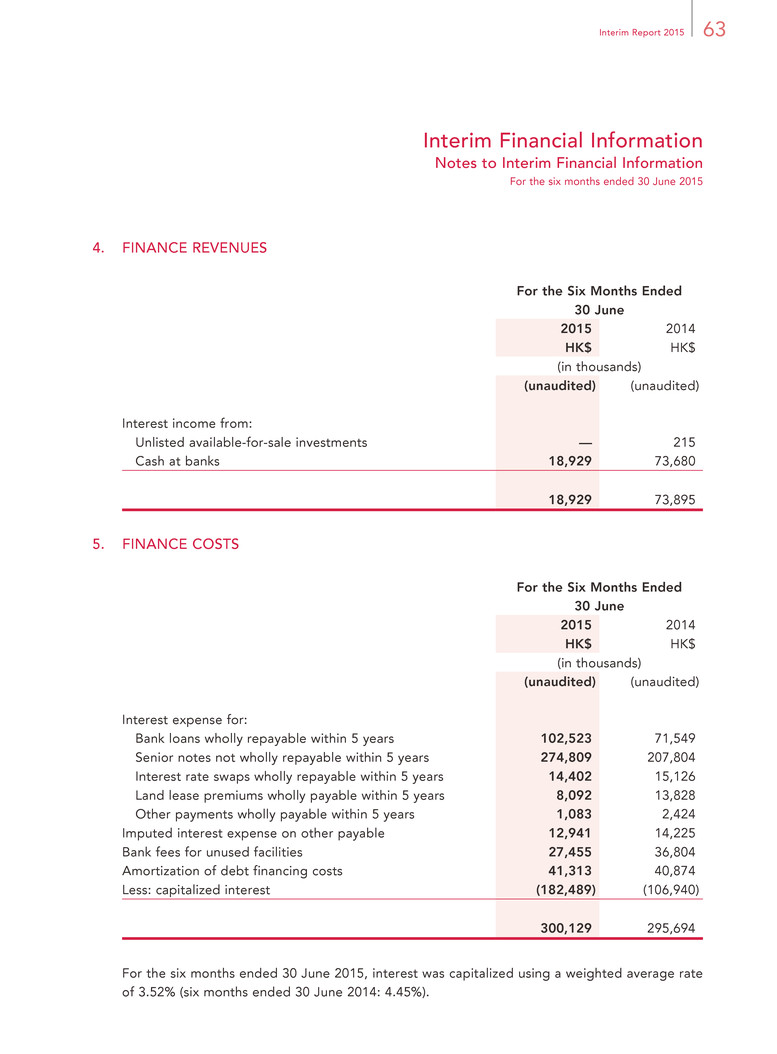

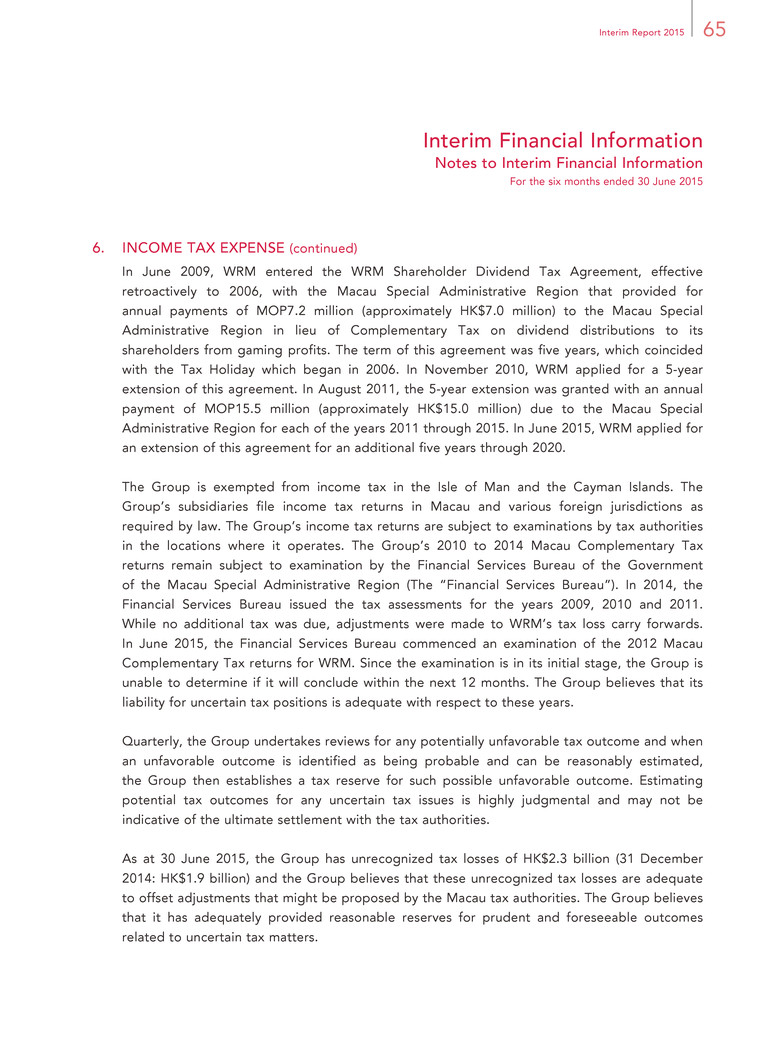

19Interim Report 2015 Management Discussion and Analysis Finance Costs Finance costs increased by 1.5%, from HK$295.7 million in the six months ended 30 June 2014 to HK$300.1 million in the six months ended 30 June 2015. Finance costs increased in the six months ended 30 June 2015 primarily due to the issuance of the WML 2021 Notes with the aggregate principal amount of US$750 million (approximately HK$5.9 billion) in March 2014 and the drawing of a total of approximately HK$4.2 billion under the senior secured revolving credit facility during the period from December 2014 through June 2015, partially offset by the increase in capitalized interest related to the construction of Wynn Palace. Interest Rate Swaps As required under the terms of the Wynn Macau Credit Facilities, we entered into agreements to swap the interest on our loans from floating to fixed rates. These transactions did not qualify for hedge accounting. Changes in the fair value of our interest rate swaps are recorded as an increase or decrease in swap fair value during each period. During the six months ended 30 June 2015 and 30 June 2014, we recorded a loss of HK$44.4 million and a loss of HK$29.6 million, respectively, resulting from the movement in the fair value of our interest rate swaps. Income Tax Expense In the six months ended 30 June 2015, our income tax expense was HK$3.2 million compared to an income tax expense of HK$12.5 million in the six months ended 30 June 2014. Our tax expense for the six months ended 30 June 2015 primarily relates to the current tax expense recorded by our subsidiaries owning WRM’s shares under the WRM Shareholder Dividend Tax Agreement and a deferred tax benefit resulting from a decrease in the deferred tax liability for property and equipment. In the six months ended 30 June 2014, our income tax expense relates to the current tax expense of our subsidiaries owning WRM’s shares under the WRM Shareholder Dividend Tax Agreement and a deferred tax expense resulting from an increase in the deferred tax liability for property and equipment. Net Profit Attributable to Owners of the Company As a result of the foregoing, compared to HK$3.6 billion for the six months ended 30 June 2014, net profit attributable to owners of the Company was HK$1.4 billion for the six months ended 30 June 2015.

20 Wynn Macau, Limited Management Discussion and Analysis LIQUIDITY AND CAPITAL RESOURCES Capital Resources Since Wynn Macau opened in 2006, we have generally funded our working capital and recurring expenses as well as capital expenditures from cash flow from operations and cash on hand. Our cash balances as at 30 June 2015 were approximately HK$2.5 billion. Such cash is available for operations, new development activities, the development of Wynn Palace and enhancements to Wynn Macau and Encore. Our Wynn Macau Credit Facilities consist of approximately HK$19.5 billion in a combination of Hong Kong dollar and U.S. dollar facilities, including an approximately HK$7.4 billion fully funded senior term loan facility and an approximately HK$12.1 billion senior revolving credit facility. As at 30 June 2015, the Group had approximately HK$7.8 billion of available borrowing capacity under the Wynn Macau Credit Facilities. The Company has issued 5.25% fixed rate, unsecured senior notes due 2021 with an aggregate principal amount of US$1.35 billion (approximately HK$10.5 billion) for working capital requirement and general corporate purposes.

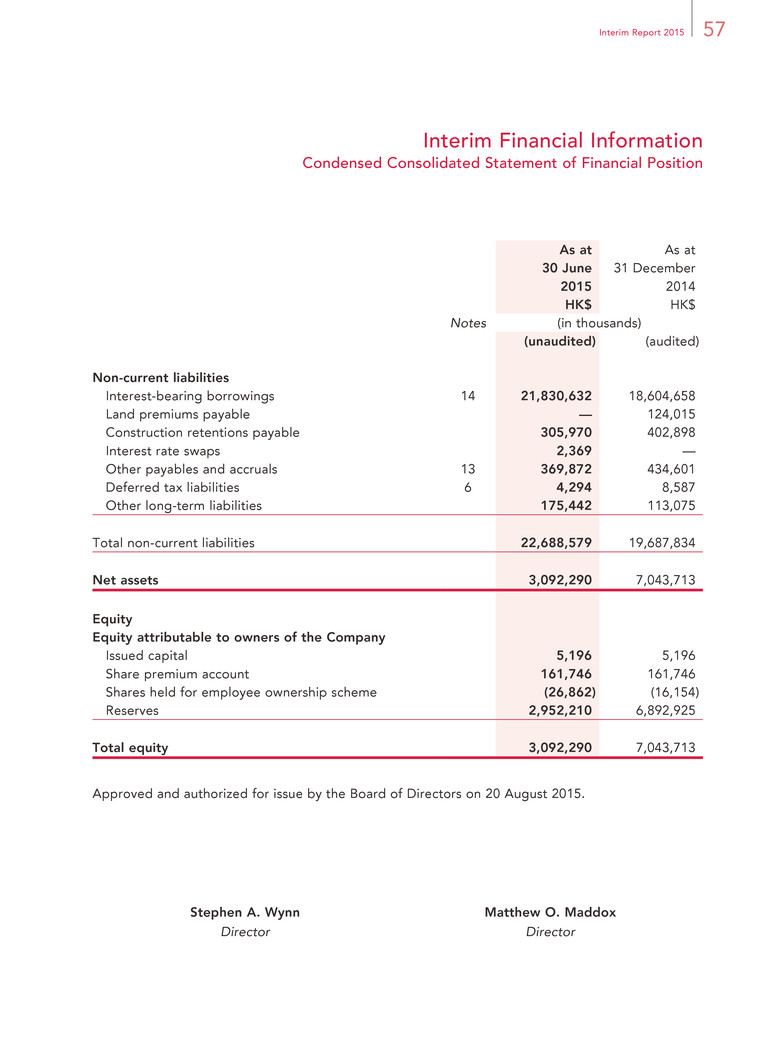

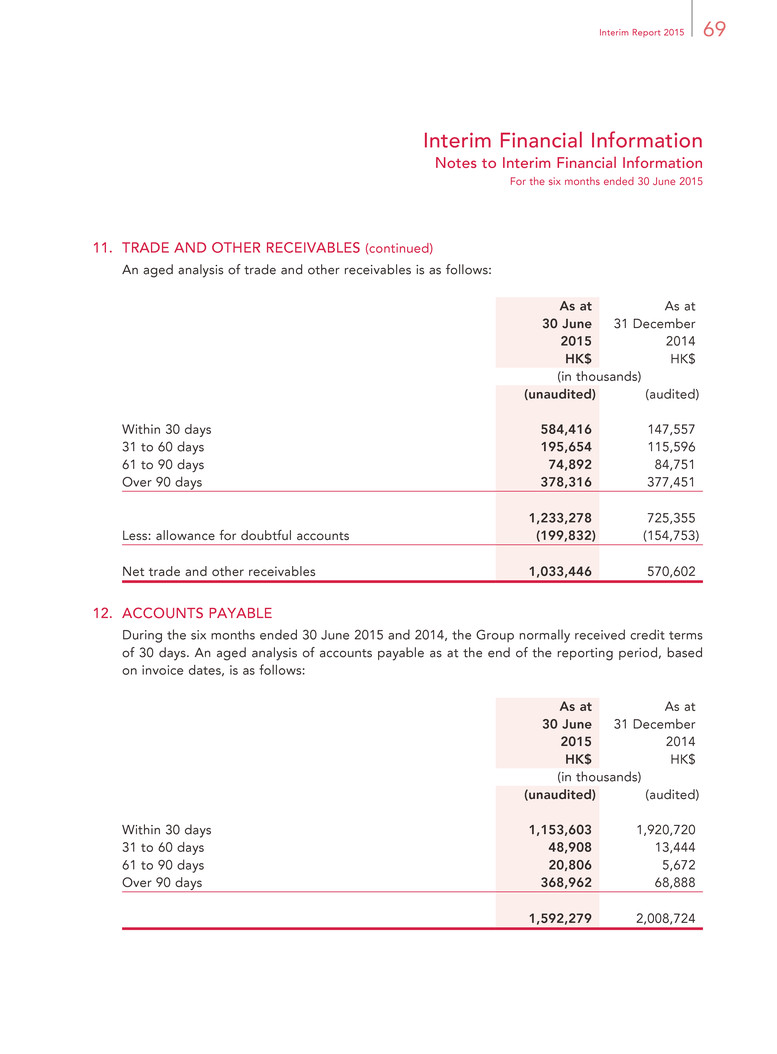

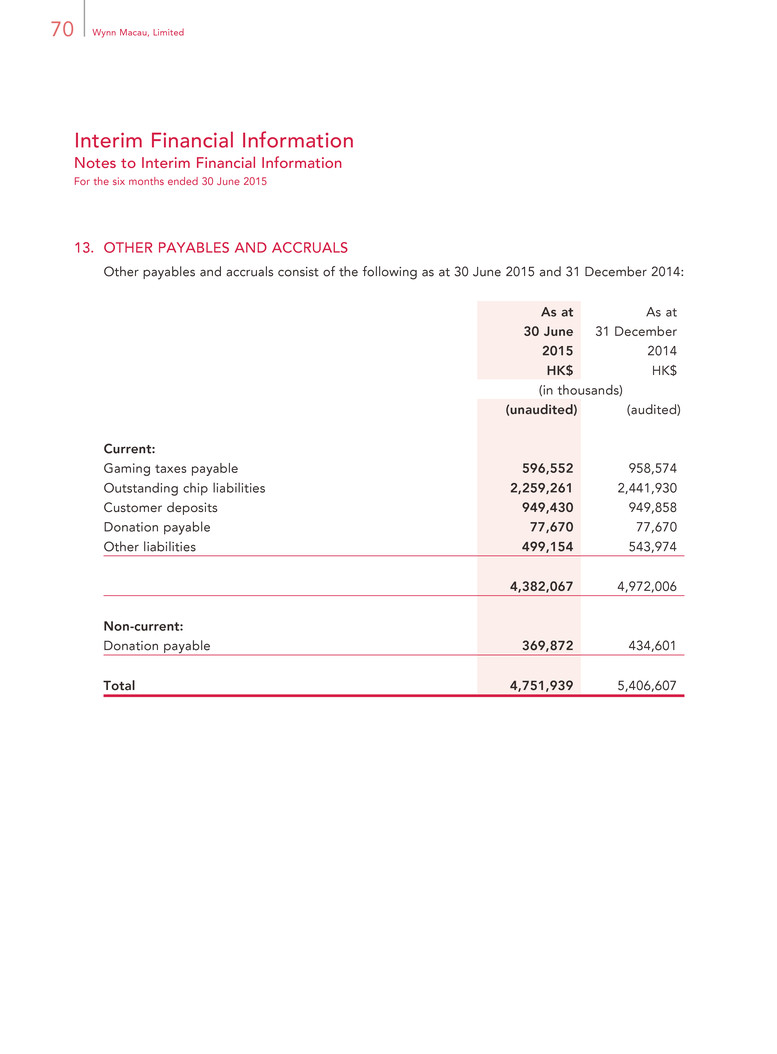

21Interim Report 2015 Management Discussion and Analysis Gearing Ratio The gearing ratio is a key indicator of our Group’s capital structure. The gearing ratio is net debt divided by total capital plus net debt. The table below presents the calculation of our gearing ratio as at 30 June 2015 and 31 December 2014. As at 30 June 2015 31 December 2014 HK$ HK$ (in thousands except for percentages) Interest-bearing borrowings 21,830,632 18,604,658 Accounts payable 1,592,279 2,008,724 Land premiums payable 245,005 363,044 Other payables and accruals 4,751,939 5,406,607 Construction retentions payable 305,970 402,898 Amounts due to related companies 162,472 159,198 Other liabilities 202,590 137,321 Less: cash and cash equivalents (2,452,995) (10,789,890) restricted cash and cash equivalents (14,130) (7,580) Net debt 26,623,762 16,284,980 Equity 3,092,290 7,043,713 Total capital 3,092,290 7,043,713 Capital and net debt 29,716,052 23,328,693 Gearing ratio 89.6% 69.8%

22 Wynn Macau, Limited Management Discussion and Analysis Cash Flows The following table presents a summary of the Group’s cash flows for the six months ended 30 June 2015 and 2014. For the Six Months Ended 30 June 2015 2014 HK$ HK$ (in millions) Net cash generated from operating activities 438.0 2,897.4 Net cash used in investing activities (6,140.1) (1,314.5) Net cash (used in) generated from financing activities (2,637.7) 447.7 Net (decrease) increase in cash and cash equivalents (8,339.8) 2,030.6 Cash and cash equivalents at beginning of period 10,789.9 14,130.4 Effect of foreign exchange rate changes, net 2.9 (13.7) Cash and cash equivalents at end of period 2,453.0 16,147.3 Net cash generated from operating activities Our net cash generated from operating activities is primarily affected by operating profit generated by our Macau Operations and changes in our working capital. Net cash from operating activities was HK$0.4 billion for the six months ended 30 June 2015, compared to HK$2.9 billion for the six months ended 30 June 2014. Operating profit was HK$1.8 billion for the six months ended 30 June 2015, compared to HK$3.9 billion for the six months ended 30 June 2014. The decline in net cash from operating activities was primarily attributable to the decrease in operating profit, as well as unfavorable changes in working capital. Net cash used in investing activities Net cash used in investing activities was HK$6.1 billion for the six months ended 30 June 2015, compared to net cash used in investing activities of HK$1.3 billion for the six months ended 30 June 2014.

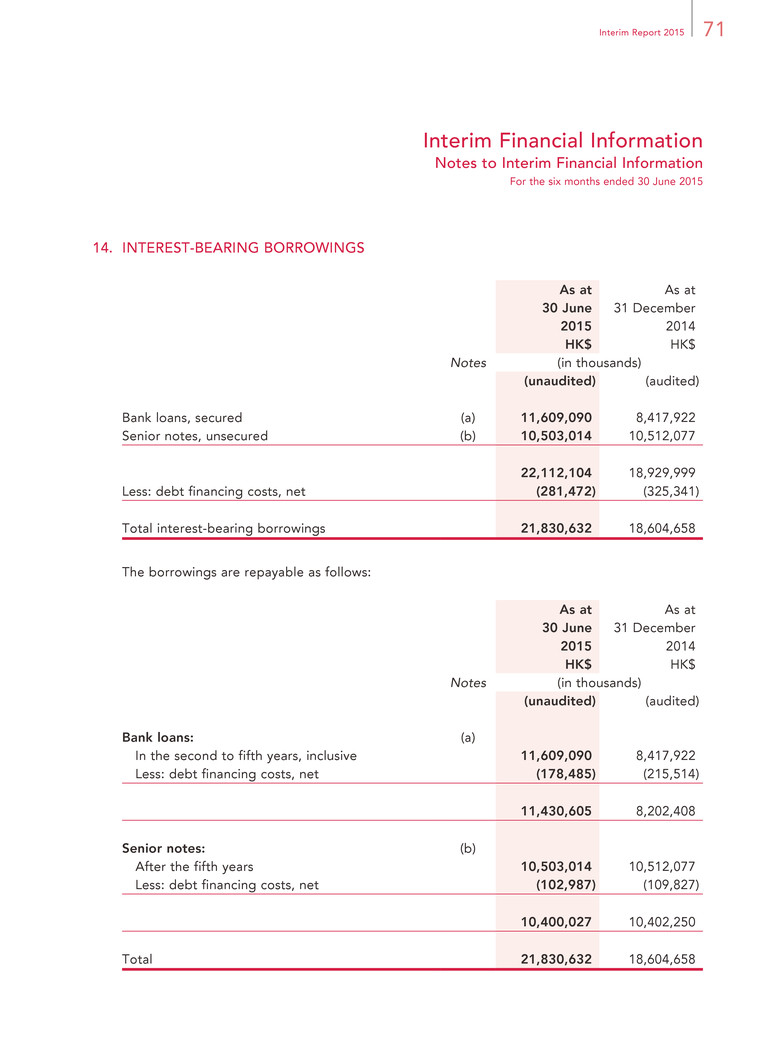

23Interim Report 2015 Management Discussion and Analysis Major expenditures in the six months ended 30 June 2015 included capital expenditures of HK$6.2 billion for both Wynn Palace construction costs and renovations to enhance and refine the Macau Operations. Major expenditures in the six months ended 30 June 2014 included capital expenditures of HK$3.0 billion for both Wynn Palace construction costs and renovations to enhance and refine the Macau Operations, partially offset by a HK$1.6 billion reduction in restricted cash. Net cash (used in) generated from financing activities Net cash used in financing activities was HK$2.6 billion during the six months ended 30 June 2015, compared to HK$447.7 million net cash from financing activities during the six months ended 30 June 2014. During the six months ended 30 June 2015, the net cash used in financing activities was primarily due to a HK$5.4 billion special dividend payment made in March 2015, HK$248.7 million for interest payments and a HK$118.0 million payment for land premiums, partially offset by receipts of HK$3.2 billion in proceeds from the senior revolving credit facility. During the six months ended 30 June 2014, the net cash from financing activities was primarily due to the Company’s receipt of HK$5.9 billion in proceeds from the WML 2021 Notes, partially offset by a HK$5.1 billion dividend payment made in June 2014. Indebtedness The following table presents a summary of our indebtedness as at 30 June 2015 and 31 December 2014. Indebtedness information As at 30 June 2015 31 December 2014 HK$ HK$ (in thousands) Bank loans 11,609,090 8,417,922 Senior notes 10,503,014 10,512,077 Less: debt financing costs, net (281,472) (325,341) Total interest-bearing borrowings 21,830,632 18,604,658 The Group had approximately HK$7.8 billion available to draw under the Wynn Macau Credit Facilities as at 30 June 2015.

24 Wynn Macau, Limited Management Discussion and Analysis Wynn Macau Credit Facilities Overview As at 30 June 2015, the Wynn Macau Credit Facilities consisted of approximately HK$19.5 billion in a combination of Hong Kong dollar and U.S. dollar facilities, including an approximately HK$7.4 billion fully funded senior term loan facility and an approximately HK$12.1 billion senior revolving credit facility. The facilities may be used for a variety of purposes, including investment in our Wynn Palace project, further enhancements at our resort and general corporate purposes. The HK$7.4 billion equivalent term loan facility matures in July 2018 with the principal amount of the term loan to be repaid in two installments in July 2017 and July 2018. The final maturity for the revolving credit facility is July 2017, by which date any outstanding revolving loans must be repaid. The senior secured facilities bear interest at a rate of LIBOR or HIBOR plus a margin of between 1.75% and 2.50% depending on WRM’s leverage ratio. Security and Guarantees Borrowings under the Wynn Macau Credit Facilities are guaranteed by Palo and by certain subsidiaries of the Company that own equity interests in WRM, and are secured by substantially all of the assets of WRM, the equity interests in WRM and substantially all of the assets of Palo. With respect to the Concession Agreement and WRM’s land concession agreement, the WRM lenders have certain cure rights and consultation rights with the Macau government in the event of an enforcement action by the lenders. Second Ranking Lender WRM is also party to a bank guarantee reimbursement agreement with Banco National Ultramarino S.A. to secure a guarantee in favor of the Macau government as required under the Concession Agreement. The amount of this guarantee is MOP300 million (approximately HK$291.3 million) and it lasts until 180 days after the end of the term of the Concession Agreement. The guarantee assures WRM’s performance under the Concession Agreement, including the payment of certain premiums, fines and indemnities for breach. The guarantee is secured by a second priority security interest in the same collateral package securing the Wynn Macau Credit Facilities.

25Interim Report 2015 Management Discussion and Analysis Other Terms The Wynn Macau Credit Facilities contain representations, warranties, covenants and events of default customary for casino development financings in Macau. The Directors confirm that there is no non-compliance with the financial covenants or general covenants contained in the Wynn Macau Credit Facilities. The Company is not a party to the credit facilities agreement and related agreements and has no rights or obligations thereunder. WML 2021 Notes The Company has issued 5.25% fixed rate, unsecured senior notes due on 15 October 2021 with an aggregate principal amount of US$1.35 billion (approximately HK$10.5 billion). The Company may use the net proceeds from the offering of the WML 2021 Notes for working capital requirements and general corporate purposes. The WML 2021 Notes are listed on the Hong Kong Stock Exchange. QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISK Market risk is the risk of loss arising from adverse changes in market rates and conditions, such as interest rates, and foreign currency exchange rates. Foreign Currency Exchange Risks The financial statements of foreign operations are translated into Hong Kong dollars, the Company’s functional and presentation currency, for incorporation into the condensed consolidated financial information. The majority of our assets and liabilities are denominated in U.S. dollars, Hong Kong dollars and Macau patacas, and there are no significant assets and liabilities denominated in other currencies. Assets and liabilities are translated at the prevailing foreign exchange rates in effect at the end of the reporting period. Income, expenditures and cash flow items are measured at the actual foreign exchange rates or average foreign exchange rates for the period. The Hong Kong dollar is linked to the U.S. dollar and the exchange rate between these two currencies has remained relatively stable over the past several years. The Macau pataca is pegged to the Hong Kong dollar, and in many cases the two currencies are used interchangeably in Macau. However, the exchange linkages of the Hong Kong dollar and the Macau pataca, and the Hong Kong dollar to the U.S. dollar, are subject to potential changes due to, among other things, changes in governmental policies and international economic and political developments.

26 Wynn Macau, Limited Management Discussion and Analysis Interest Rate Risks One of our primary exposures to market risk is interest rate risk associated with our credit facilities, which bear interest based on floating rates. We attempt to manage interest rate risk by managing the mix of long-term fixed rate borrowings and variable rate borrowings supplemented by hedging activities as considered necessary. We cannot assure you that these risk management strategies will have the desired effect, and interest rate fluctuations could have a negative impact on our results of operations. As at 30 June 2015, the Group had three interest rate swap agreements intended to manage the underlying interest rate risk on borrowings under the Wynn Macau Credit Facilities. Under two swap agreements, the Group pays a fixed interest rate of 0.73% on borrowings of approximately HK$3.95 billion incurred under the Wynn Macau Credit Facilities in exchange for receipts on the same amount at a variable interest rate based on the applicable HIBOR at the time of payment. These interest rate swaps fix the all-in interest rate on approximately HK$3.95 billion of borrowings under the Wynn Macau Credit Facilities at 2.48% to 3.23% and expire in July 2017. Under the third swap agreement, the Group pays a fixed rate of 0.6763% on borrowings of US$243.8 million (approximately HK$1.8 billion) incurred under the Wynn Macau Credit Facilities in exchange for receipts on the same amount at a variable interest rate based on the applicable LIBOR at the time of payment. This interest rate swap fixes the all-in interest rate on the US$243.8 million (approximately HK$1.8 billion) of borrowings under the Wynn Macau Credit Facilities at 2.43% to 3.18% and expires in July 2017. The carrying values of these interest rate swaps on the condensed consolidated statement of financial position approximates their fair values. The fair value approximates the amount the Group would pay if these contracts were settled at the respective valuation dates. Fair value is estimated based upon current, and predictions of future interest rate levels along a yield curve, the remaining duration of the instruments and other market conditions and, therefore, is subject to significant estimation and a high degree of variability of fluctuation between periods. We adjust this amount by applying a non-performance valuation, considering our creditworthiness or the creditworthiness of our counterparties at each settlement date, as applicable. These transactions do not qualify for hedge accounting. Accordingly, changes in the fair values during the six months ended 30 June 2015 and 2014, were charged to the condensed consolidated statement of profit or loss and other comprehensive income. To the extent there are liabilities of Wynn Macau under the swap agreement, such liabilities are secured by the same collateral package securing the Wynn Macau Credit Facilities.

27Interim Report 2015 Management Discussion and Analysis OFF BALANCE SHEET ARRANGEMENTS We have not entered into any transactions with special purpose entities nor do we engage in any transactions involving derivatives except for interest rate swaps. We do not have any retained or contingent interest in assets transferred to an unconsolidated entity. OTHER LIQUIDITY MATTERS We expect to fund our operations and capital expenditure requirements from operating cash flows, cash on hand and availability under the Wynn Macau Credit Facilities. However, we cannot be sure that operating cash flows will be sufficient for those purposes. We may refinance all or a portion of our indebtedness on or before maturity. We cannot be sure that we will be able to refinance any of the indebtedness on acceptable terms or at all. New business developments (including our development of Wynn Palace) or other unforeseen events may occur, resulting in the need to raise additional funds. There can be no assurances regarding the business prospects with respect to any other opportunity. Any other development would require us to obtain additional financing. In the ordinary course of business, in response to market demands and client preferences, and in order to increase revenues, we have made and will continue to make enhancements and refinements to our resort. We have incurred and will continue to incur capital expenditures related to these enhancements and refinements. Taking into consideration our financial resources, including our cash and cash equivalents, internally generated funds and availability under the Wynn Macau Credit Facilities, we believe that we have sufficient liquid assets to meet our current and anticipated working capital and operating requirements. RELATED PARTY TRANSACTIONS For details of the related party transactions, see note 17 to the Interim Financial Information. Our Directors confirm that all related party transactions are conducted on normal commercial terms, and that their terms are fair and reasonable.

28 Wynn Macau, Limited Directors and Senior Management OUR DIRECTORS The following table presents certain information in respect of the members of our Board. Members of our Board Name Age Position Date of Appointment as a Director Stephen A. Wynn 73 Chairman of the Board, Executive Director and Chief Executive Officer 16 September 2009 Gamal Mohammed Abdelaziz 58 Executive Director and President 29 March 2014 Linda Chen 48 Executive Director and Chief Operating Officer 16 September 2009 Ian Michael Coughlan 56 Executive Director 16 September 2009 Matthew O. Maddox 39 Non-executive Director 28 March 2013 Allan Zeman, GBM, GBS, JP 67 Vice-chairman of the Board and Independent Non-executive Director 16 September 2009 Jeffrey Kin-fung Lam, GBS, JP 63 Independent Non-executive Director 16 September 2009 Bruce Rockowitz 56 Independent Non-executive Director 16 September 2009 Nicholas Sallnow-Smith 65 Independent Non-executive Director 16 September 2009 The biography of each Director is set out below: Executive Directors Mr. Stephen A. Wynn, aged 73, has been a Director of the Company since its inception and an executive Director, the Chairman of the Board of Directors and Chief Executive Officer of the Company since 16 September 2009. Mr. Wynn was also the President of the Company from September 2009 to January 2014. Mr. Wynn has served as Director, Chairman and Chief Executive Officer of WRM since October 2001. Mr. Wynn has also served as Chairman and Chief Executive Officer of Wynn Resorts, Limited since June 2002. Mr. Wynn has over 40 years of experience in the gaming casino industry. From April 2000 to September 2002, Mr. Wynn was the managing member

29Interim Report 2015 Directors and Senior Management of Valvino Lamore, LLC, the predecessor and a current wholly-owned subsidiary of Wynn Resorts, Limited. Mr. Wynn also serves as an officer and/or director of several subsidiaries of Wynn Resorts, Limited. Mr. Wynn served as Chairman, President and Chief Executive Officer of Mirage Resorts, Inc. and its predecessor, Golden Nugget Inc., between 1973 and 2000. Mr. Wynn developed and opened The Mirage, Treasure Island and Bellagio in 1989, 1993 and 1998, respectively. In 2011, Barron’s ranked Mr. Wynn as one of the world’s 30 best CEOs. Mr. Gamal Mohammed Abdelaziz, aged 58, is the President of the Company and has been an executive Director of the Company since 29 March 2014. Mr. Aziz also serves as President and Chief Operating Officer of Wynn Resorts Development LLC, a subsidiary of Wynn Resorts, Limited. Prior to joining Wynn Resorts Development LLC, Mr. Aziz served as President and Chief Executive Officer of MGM Hospitality, LLC, a division of MGM Resorts International, where he was responsible for developing and operating luxury hotels throughout the world under the Bellagio, MGM Grand and Skylofts brands. Prior to that, Mr. Aziz served as President and Chief Operating Officer of MGM Grand Hotel & Casino in Las Vegas; and as Senior Vice President of the Bellagio Hotel and Resort in Las Vegas. In addition, Mr. Aziz has held senior management roles at various hotels and gaming properties in the United States, including Caesars Palace in Las Vegas, The Plaza Hotel in New York City, the Westin Hotel in Washington, D.C., and the St. Francis in San Francisco. Mr. Aziz is more widely known as “Gamal Aziz” and is typically referred to as such in the Company’s communications. Ms. Linda Chen, aged 48, has been an executive Director and the Chief Operating Officer of the Company since 16 September 2009, Chief Operating Officer of WRM since June 2002. Ms. Chen is responsible for the marketing and strategic development of WRM. Ms. Chen served as a director of Wynn Resorts, Limited from October 2007 to December 2012 and is the President of WIML. In these positions, she is responsible for the set-up of international marketing operations of Wynn Resorts, Limited. Prior to joining the Group, Ms. Chen was Executive Vice President — International Marketing at MGM Mirage, a role she held from June 2000 until May 2002, and was responsible for the international marketing operations for MGM Grand, Bellagio and The Mirage. Prior to this position, Ms. Chen served as the Executive Vice President of International Marketing for Bellagio and was involved with its opening in 1998. She was also involved in the opening of the MGM Grand in 1993 and The Mirage in 1989. Ms. Chen is also a member of the Nanjing Committee of the Chinese People’s Political Consultative Conference (Macau). Ms. Chen holds a Bachelor of Science Degree in Hotel Administration from Cornell University in 1989 and completed the Stanford Graduate School of Business Executive Development Program in 1997.

30 Wynn Macau, Limited Directors and Senior Management Mr. Ian Michael Coughlan, aged 56, has been an executive Director of the Company since 16 September 2009. Mr. Coughlan is also the President of WRM, a position he has held since July 2007. In this role, he is responsible for the entire operation and development of Wynn Macau. Prior to this role, Mr. Coughlan was Director of Hotel Operations — Worldwide for Wynn Resorts, Limited. Mr. Coughlan has over 30 years of hospitality experience with leading hotels across Asia, Europe and the United States. Before joining Wynn Resorts, Limited, he spent ten years with The Peninsula Group, including posts as General Manager of The Peninsula Hong Kong from September 2004 to January 2007, and General Manager of The Peninsula Bangkok from September 1999 to August 2004. His previous assignments include senior management positions at The Oriental Singapore, and a number of Ritz-Carlton properties in the United States. Mr. Coughlan holds a Diploma from Shannon College of Hotel Management, Ireland. Non-executive Director Mr. Matthew O. Maddox, aged 39, was appointed as a non-executive Director of the Company and a member of the Remuneration Committee on 28 March 2013. Since November 2013, he has served as the President of Wynn Resorts, Limited. From March 2008 to May 2014, Mr. Maddox was the Chief Financial Officer of Wynn Resorts, Limited. Since joining Wynn Resorts in 2002, Mr. Maddox has served as Wynn Resorts’ Senior Vice President of Business Development and Treasurer, as the Senior Vice President of Business Development for Wynn Las Vegas, LLC, as the Chief Financial Officer of WRM, and as Wynn Resorts’ Treasurer and Vice President-Investor Relations. Mr. Maddox also serves as an officer of several subsidiaries of Wynn Resorts, Limited. Prior to joining Wynn Resorts, Limited in 2002, Mr. Maddox worked in Corporate Finance for Caesars Entertainment, Inc. (formerly Park Place Entertainment, Inc.). Before joining Park Place Entertainment, Mr. Maddox worked as an investment banker for Bank of America Securities in the Mergers and Acquisitions Department.

31Interim Report 2015 Directors and Senior Management Independent non-executive Directors Dr. Allan Zeman, GBM, GBS, JP, aged 67, has been a Director of the Company since its inception and a non-executive Director of the Company since 16 September 2009 and is the Vice Chairman of the Company. Effective from 29 March 2014, Dr. Zeman became an independent non-executive Director of the Company. He was also a non-executive director of Wynn Resorts, Limited, from October 2002 to December 2012. Dr. Zeman founded The Colby International Group in 1975 to source and export fashion apparel to North America. In late 2000, The Colby International Group merged with Li & Fung Limited. Dr. Zeman is the Chairman of Lan Kwai Fong Holdings Limited. He is also the owner of Paradise Properties Group, a property developer in Thailand. Dr. Zeman was also Chairman of Ocean Park, a major theme park in Hong Kong, from July 2003 to June 2014. Dr. Zeman is Vice Patron of Hong Kong Community Chest, and serves as a director of the “Star” Ferry Company, Limited. Dr. Zeman also serves as an independent non-executive director of Pacific Century Premium Developments Limited, Sino Land Company Limited, Tsim Sha Tsui Properties Limited, Television Broadcasts Limited (TVB) and Global Brands Group Holding Limited, all of which are listed on the Hong Kong Stock Exchange. Having lived in Hong Kong for over 40 years, Dr. Zeman has been very involved in government services as well as community activities. Besides having been the Chairman of Hong Kong Ocean Park from July 2003 to June 2014, he is also a member of the General Committee of the Hong Kong General Chamber of Commerce and Hong Kong China’s representative to the Asia-Pacific Economic Cooperation (APEC) Business Advisory Council (“ABAC HK Members”). Dr. Zeman also serves as a Member of the Board of West Kowloon Cultural District Authority, and the chairman of its Performing Arts Committee. He is also the member of the Economic Development Commission Working Group on Convention and Exhibition Industries and Tourism of the Government of Hong Kong. In June 2015, Dr. Zeman was appointed as a Board Member of the Airport Authority of Hong Kong. In September 2014, Dr. Zeman was invited by former HKSAR Chief Executive Mr. CH Tung, as a Special Advisor to his Our Hong Kong Foundation, which dedicated to promoting the long-term and overall interests of HK. In 2001, Dr. Zeman was appointed a Justice of the Peace in Hong Kong. He was awarded the Gold Bauhinia Star in 2004 and the Grand Bauhinia Medal in 2011. In 2012, he was awarded Honorary Doctorate Degrees of Business Administration from City University of Hong Kong and University of Science and Technology of Hong Kong.

32 Wynn Macau, Limited Directors and Senior Management Mr. Jeffrey Kin-fung Lam, GBS, JP, aged 63, has been an independent non-executive Director of the Company since 16 September 2009. Mr. Lam was appointed as a non-official member of the Hong Kong Executive Council in October 2012. Mr. Lam is also a member of the National Committee of the Chinese People’s Political Consultative Conference, a member of the Hong Kong Legislative Council, the Chairman of the Assessment Committee of Mega Events Funds, a member of the board of Hong Kong Airport Authority, a member of the Fight Crime Committee in Hong Kong, a member of Independent Commission Against Corruption (ICAC) Complaints Committee and the Chairman of Aviation Security Company Limited. Mr. Lam is also a General Committee Member of the Hong Kong General Chamber of Commerce and the Vice-Chairman of The Hong Kong Shippers’ Council. In addition, Mr. Lam is an independent non-executive director of CC Land Holdings Limited, China Overseas Grand Oceans Group Limited, Bracell Limited (formerly known as Sateri Holdings Limited), Chow Tai Fook Jewellery Group Limited and HNA International Investment Holdings Limited (formerly Shougang Concord Technology Holdings Ltd.), all of which are listed on the Hong Kong Stock Exchange. Mr. Lam was also an independent non-executive director of Hsin Chong Construction Group Ltd. from August 2002 to May 2014. In 1996, Mr. Lam was appointed Justice of the Peace in Hong Kong and became a member of the Most Excellent Order of the British Empire. He was awarded the honor of the Gold Bauhinia Star in July 2011 and the Silver Bauhinia Star in 2004. Mr. Lam was conferred University Fellow of Tufts University in the United States and Hong Kong Polytechnic University in 1997 and in 2000, respectively. Mr. Bruce Rockowitz, aged 56, has been an independent non-executive Director of the Company since 16 September 2009. Mr. Rockowitz has been appointed as the Chief Executive Officer, Vice Chairman and Executive Director of Global Brands Group Holding Limited, a company spun off from Li & Fung Limited and listed on the Hong Kong Stock Exchange in July 2014. Mr. Rockowitz joined Li & Fung Limited as Executive Director in 2001 until June 2014. He was the President of the Li & Fung Group from 2004 to 2011, and Group President and Chief Executive Officer from 2011 to June 2014. He was also the co-founder and Chief Executive Officer of Colby International Limited, a large Hong Kong buying agent, prior to its acquisition by Li & Fung in 2000. In addition to his positions at Li & Fung and Global Brands Group, Mr. Rockowitz is the non-executive director of The Pure Group, a lifestyle, fitness and yoga group operating in Hong Kong, Singapore, Taiwan and mainland China. He is a member of the Advisory Board for the Wharton School’s Jay H Baker Retailing Center, an industry research center for retail at the University of Pennsylvania. He is also a board member of the Education Foundation for Fashion Industries, the private fund-raising arm of the Fashion Institute of Technology, New York. In March 2012, he became a member of the Global Advisory Council of the Women’s Tennis Association (WTA). In 2008, Mr. Rockowitz was ranked first by Institutional Investor for Asia’s Best CEOs in the consumer category. In the years 2010 and 2011, he was also

33Interim Report 2015 Directors and Senior Management ranked as one of the world’s 30 best CEOs by Barron’s. In 2011, he was presented with the Alumni Achievement Award by the University of Vermont. In 2012, Mr. Rockowitz was named Asia’s Best CEO at Corporate Governance Asia’s Excellence Recognition Awards, and he was also presented with an Asian Corporate Director Recognition Award by the same organization in 2012 and 2013. Mr. Nicholas Sallnow-Smith, aged 65, has been an independent non-executive Director of the Company since 16 September 2009. Mr. Sallnow-Smith has also served as the Chairman and an independent non-executive director of Link Asset Management Limited (formerly The Link Management Limited) since April 2007 and is also Chairman of Link Asset Management Limited’s Finance and Investment, and Nominations Committees. Link Asset Management Limited is the manager to Link Real Estate Investment Trust (formerly The Link Real Estate Investment Trust), which is listed on the Hong Kong Stock Exchange. Mr. Sallnow-Smith is also a non-executive director of Unitech Corporate Parks Plc., a company listed on the London Stock Exchange in the Alternative Investment Market (“AIM”) and a non-executive director of Aviva Life Insurance Company Limited in Hong Kong. Prior to joining Link Asset Management Limited, Mr. Sallnow-Smith was Chief Executive of Hongkong Land Holdings Limited from February 2000 to March 2007. He has a wide ranging finance background in Asia and the United Kingdom for over 30 years, including his roles as Finance Director of Hongkong Land Holdings Limited from 1998 to 2000 and as Group Treasurer of Jardine Matheson Limited from 1993 to 1998. Mr. Sallnow-Smith’s early career was spent in the British Civil Service, where he worked for Her Majesty’s Treasury in Whitehall, London from 1975 to 1985. During that time, he was seconded for two years to Manufacturers Hanover London, working in export finance and in their merchant banking division, Manufacturers Hanover Limited. He left the Civil Service in 1985, following a period working in the International Finance section of H. M. Treasury on Paris Club and other international debt policy matters, and spent two years with Lloyds Merchant Bank before moving into the corporate sector in 1987. Mr. Sallnow-Smith served as the Convenor of the Hong Kong Association of Corporate Treasurers from 1996 to 2000, as Chairman of the Matilda Child Development Centre in 1994 and 1995 and as Chairman of the Matilda International Hospital from 2003 to 2005. He is the Chairman of the Hong Kong Youth Arts Foundation, a member of the Council of the Treasury Markets Association (Hong Kong Association of Corporate Treasurers Representative), and the Chairman of Manpower Committee of the Hong Kong General Chamber of Commerce. He was the Chairman of the General Committee of The British Chamber of Commerce in Hong Kong from 2012 to 2014. He is also a director of The Photographic Heritage Foundation Hong Kong, of The East Asian History of Science Foundation, and a Councillor of the Foundation for the Arts and Music in Asia Limited. He has been a member of the Financial Reporting Council of Hong Kong since December 2012. Mr. Sallnow-Smith was educated at Gonville & Caius College, Cambridge, and the University of Leicester and is a Fellow of the Association of Corporate Treasurers. He holds M.A. (Cantab) and M.A. (Soc. of Ed.) Degrees.

34 Wynn Macau, Limited Directors and Senior Management OUR SENIOR MANAGEMENT The following table presents certain information concerning the senior management personnel of the Group (other than our Executive Directors). Senior management Wynn Resorts (Macau) S.A. Name Age Position Frank Xiao 47 President — Marketing Jay M. Schall 42 Senior Vice President and General Counsel#, Senior Vice President — Legal Wynn Macau Name Age Position Charlie Ward 66 Executive Vice President — Casino Operations Frank Anthony Cassella 38 Senior Vice President — Chief Financial Officer Mo Yin Mok 54 Senior Vice President — Human Resources Craig Arthur Raymond Mitchell 54 Assistant Vice President — Slot Operations Rory McGregor Forbes 45 Executive Director — Security Operations Wynn Palace Name Age Position Frederic Jean-Luc Luvisutto 43 Chief Operating Officer Robert Alexander Gansmo 45 Senior Vice President — Chief Financial Officer Peter James Barnes 56 Senior Vice President — Security & Corporate Investigation# Dianne Fiona Dennehy 59 Senior Vice President — Main Floor Gaming Mao Ling Yeung 43 Senior Vice President — Human Resources Dennis Hudson 55 Vice President — Wynn Club Gaming

35Interim Report 2015 Directors and Senior Management Wynn Design and Development Name Age Position Michael Derrington Harvey 65 President — Wynn Design and Development, Asia Notes: # Position held in the Company. The biography of each member of the senior management team (other than our executive Directors) is set out below: Mr. Frank Xiao, aged 47, is the President — Marketing of WRM, a position he has held since October 2012. Prior to this position, Mr. Xiao was the Senior Executive Vice President — Premier Marketing between August 2006 and October 2012. Mr. Xiao is responsible for providing leadership and guidance to the marketing team and staff, developing business for and promoting Wynn Macau. Prior to this position, Mr. Xiao was the Senior Executive Vice President — China Marketing for WIML and Worldwide Wynn between 2005 until 2006. Prior to joining the Group, Mr. Xiao was the Senior Vice President of Far East Marketing at MGM Grand Hotel. During his 12 years at the MGM Grand Hotel, he was promoted several times from his first position as Far East Marketing Executive in 1993. Mr. Xiao holds a Bachelor of Science Degree in Hotel Administration and a Master’s Degree in Hotel Administration from the University of Nevada, Las Vegas. Mr. Jay M. Schall, aged 42, is the Senior Vice President and General Counsel of the Company and Senior Vice President — Legal of WRM. He has held senior legal positions with WRM since May 2006. Mr. Schall has over fifteen years of experience in the legal field, including over ten years in Macau and Hong Kong. Prior to joining the Group, Mr. Schall practiced United States law at a major law firm in the United States and in Hong Kong. Mr. Schall is a member of the State Bar of Texas. Mr. Schall holds a Bachelor of Arts Degree from Colorado College, an MBA from Tulane University, Freeman School of Business and a Juris Doctor (magna cum laude, Order of the Coif) from Tulane University School of Law.

36 Wynn Macau, Limited Directors and Senior Management Mr. Charlie Ward, aged 66, is Wynn Macau Executive Vice President — Casino Operations, a position he has held since 1 March 2012. Mr. Ward is responsible for providing leadership and operational direction for Wynn Macau gaming operations. Mr. Ward has more than 40 years of experience in the gaming industry, having served at gaming companies including MGM and Wynn. Over his career Mr. Ward has gained experience in a wide range of assignments including customer/ VIP relations, game protection and casino set up, opening and operations. Prior to this position, Mr. Ward held the position of Vice President of Table Games at Wynn | Encore Las Vegas between 2008 and 2012. Prior to this position, Mr. Ward was at MGM Grand Hotel and Casino for 14 years and in 2007 was promoted to the pre-opening team of MGM Grand Macau as Vice President of VIP Gaming. Mr. Frank Anthony Cassella, aged 38, is the Wynn Macau Senior Vice President — Chief Financial Officer, a position he has held since January 2014. Mr. Cassella is responsible for the management and administration of Wynn Macau finance division. Prior to this position, Mr. Cassella worked at Wynn Resorts, Limited since 2006, most recently as the Executive-Director of Financial Reporting. Prior to joining Wynn Resorts, Limited, Mr. Cassella practiced as a certified public accountant with firms in Las Vegas and New York, including PricewaterhouseCoopers and KPMG. Mr. Cassella graduated from the Pennsylvania State University, where he obtained a Bachelor of Science Degree in Accounting. Ms. Mo Yin Mok, aged 54, is the Wynn Macau Senior Vice President — Human Resources, a position she has held since June 2014. Ms. Mok has an extensive 20-year background in hospitality and human resources, primarily in the luxury hotel sector at The Regent Four Seasons Hong Kong and The Peninsula Hong Kong. Prior to joining the Group, she led The Peninsula Group’s worldwide human resources team and, in her position, supported eight Peninsula hotels with more than 5,000 staff, and orchestrated human resources activities for the opening of The Peninsula Tokyo. Ms. Mok also served at the front lines of the hospitality industry as the Director of Rooms Division at The Peninsula Hong Kong with responsibility for front office, housekeeping, security and spa departments. Ms. Mok currently serves on the Future Students and Placement Advisory Committee of the University of Macau and is a panel member of the Hong Kong Council for Accreditation of Academic and Vocational Qualifications. Ms. Mok holds a Bachelor of Science Degree in Hospitality Management from Florida International University in the United States, where she received a Rotary International Ambassadorial Scholarship. She also obtained an MBA from the Chinese University of Hong Kong.

37Interim Report 2015 Directors and Senior Management Mr. Craig Arthur Raymond Mitchell, aged 54, is the Wynn Macau Assistant Vice President — Slot Operations, a position he has held since June 2011. Mr. Mitchell is responsible for providing leadership and guidance to the slot department management team and staff. This includes establishing the operational structure, instituting departmental policies and procedures, developing slot merchandising strategies, and projecting and evaluating the revenues and expenses of the department. Prior to this position, Mr. Mitchell was the Director — Slot Operations between June 2008 and May 2011 and a Shift Manager of Slots between June 2006 and May 2008. Mr. Mitchell held management roles in various hospitality-related businesses prior to joining the Group including Gaming Manager at a Rugby Super League Club in Sydney which had 300 slot machines. From 1989, he was Operations Manager and Duty Manager at Balmain Leagues Club (Tigers), Australia. Mr. Mitchell has attended the Gaming Executive Development Program at the University of Nevada, United States. Mr. Rory McGregor Forbes, aged 45, is the Wynn Macau Executive Director — Security Operations, a position he has held since 10 July 2014. Mr. Forbes is responsible for all aspects of WRM’s security. Prior to joining the Group, Mr. Forbes served in the Royal Hong Kong Police Force, where he enjoyed a decorated 13-year career, rising to the rank of Senior Inspector. He then spent four and a half years with The HALO Trust which specializes in mine clearance and destruction of explosive ordnance in conflict zones. Immediately prior to joining Wynn Macau, Mr. Forbes was Associate Director of Security at Venetian Macau. Mr. Forbes speaks five languages and has professional experience in executive and VIP security, crowd management and public order control. Mr. Forbes holds a Bachelor Degree in Modern Chinese and Business Studies and a Master of Science Degree in Public Policy and Management. Mr. Forbes also completed the Chinese Public Security Bureau University course in Beijing, China and the Senior Police Administration Course in Ottawa, Canada. Mr. Frederic Jean-Luc Luvisutto, aged 43, is the Wynn Palace Chief Operating Officer, a position he has held since January 2014. Prior to this position, Mr. Luvisutto was the Managing Director of the Star Resort and Casino in Sydney, Australia. Before this he was the Managing Director of Jupiters Resort and Casino, Gold Coast, Australia. Mr. Luvisutto’s hospitality and gaming career spans 18 years and also includes appointments as Vice President of The Signature at MGM Grand in Las Vegas and Vice President — Hotel Operations at Monte Carlo Resort and Casino in Las Vegas. Mr. Luvisutto graduated from the Lausanne Hotel Management School, Switzerland. Mr. Robert Alexander Gansmo, aged 45, is the Wynn Palace Senior Vice President — Chief Financial Officer, a position he has held since January 2014. Prior to this position, Mr. Gansmo was the Senior Vice President — Chief Financial Officer of Wynn Macau from April 2009 to January 2014, and the Director — Finance of Wynn Macau, a position he assumed in January 2007. Mr. Gansmo is responsible for the management and administration of Wynn Palace’s finance division. Before joining