Form 8-K WESTFIELD FINANCIAL INC For: Apr 04

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 4, 2016

WESTFIELD FINANCIAL, INC.

(Exact name of registrant as specified in its charter)

| Massachusetts | 001-16767 | 73-1627673 |

| (State or other jurisdiction

of incorporation or organization) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

141 Elm Street

Westfield,

Massachusetts 01085

(Address of principal executive offices, zip code)

Registrant’s telephone number, including area code: (413) 568-1911

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☒ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| Item 7.01 | Regulation FD Disclosure |

As previously announced, Westfield Financial, Inc. (the “Company”) and Chicopee Bancorp., Inc. (“Chicopee”) entered into an Agreement and Plan of Merger, dated as of April 4, 2016, by and between the Company and Chicopee, pursuant to which the Company will acquire Chicopee and its wholly owned subsidiary, Chicopee Savings Bank, subject to the terms and conditions set forth therein. The Company has updated its joint investor presentation which provides supplemental information regarding the proposed transaction that the Company intends to make available to investors and post on the investor relations portion of its website, which is located at www.westfieldbank.com.

The updated presentation includes additional information with regard to calculating the dilution to tangible book value of Westfield common stock related to the merger, and the amount of time over which that dilution is expected to be earned back. The presentation is furnished as Exhibit 99.1 to this report, and supersedes in its entirety the joint investor presentation filed as Exhibit 99.2 to the Company’s Form 8-K filed with the SEC on April 4, 2016.

The information in the presentation shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing. All annualized, pro forma, projected, combined, estimated and similar numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results.

| Item 9.01 | Financial Statements and Exhibits. |

(a)

Not applicable.

(b)

Not applicable.

(c)

Not applicable.

(d)

Exhibits.

|

Exhibit No. |

Description | |

| 99.1 | Joint Investor Presentation dated April 6, 2016 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| WESTFIELD FINANCIAL, INC. | ||

| Date: April 6, 2016 | By: | /s/ James C. Hagan |

| James C. Hagan | ||

| President & Chief Executive Officer | ||

EXHIBIT INDEX

|

Exhibit No. |

Description | |

| 99.1 | Joint Investor Presentation dated April 6, 2016 | |

Westfield Financial, Inc. - 8K

Connecticut Massachusetts April 4, 2016 A Compelling Strategic Combination First In - Market Merger in Over 25 Years – Creating One of the Largest Community Banks in Hampden County and the Springfield MSA What better banking’s all about tm . NASDAQ: WFD Western New England Bancorp, Inc. (NASDAQ: WNEB)* *To take effect at close NASDAQ: CBNK

Disclaimer This presentation contains some statements that may constitute forward - looking statements . Forward - looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts . The forward - looking statements reflect Westfield and Chicopee's current views about future events and are subject to risks, uncertainties, assumptions and changes in circumstances that may cause Westfield or Chicopee's actual results to differ significantly from those expressed in any forward - looking statement . You should not rely uncritically on Forward - looking statements because they involve significant known and unknown risks, uncertainties and other factors that are, in some cases, beyond Westfield or Chicopee's control and which could materially affect actual results . The factors that could cause actual results to differ materially from current expectations include failure to complete the proposed merger, the imposition of adverse regulatory conditions in connection with regulatory approval of the proposed merger, disruption to the parties’ businesses as a result of the announcement and pendency of the merger, the inability to realize expected cost savings or to implement integration plans and other adverse consequences associated with the merger, changes in general economic conditions, changes in interest rates, changes in competitive product and pricing pressures among financial institutions within Westfield or Chicopee's markets, changes in the financial condition of Westfield or Chicopee's borrowers and other factors discussed in the reports that Westfield and Chicopee file with the Securities and Exchange Commission . The forward - looking statements contained herein represent Westfield and Chicopee's judgment as of the date of this release, and Westfield and Chicopee cautions readers not to place undue reliance on such statements . For further information, please refer to Westfield and Chicopee's reports filed with the Securities and Exchange Commission . 2

Safe Harbor and Legend This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval . In connection with the merger, Westfield will file with the Securities and Exchange Commission (“SEC”) a registration statement on Form S - 4 to register shares of Westfield common stock to be issued to Chicopee’s shareholders . The registration statement will include a proxy statement of Chicopee and a proxy statement and a prospectus of Westfield . A definitive proxy statement and prospectus will be mailed to Westfield and Chicopee stockholders seeking their approval of the merger . Westfield and Chicopee may also file other relevant documents with the SEC regarding the proposed transaction . INVESTORS AND SECURITY HOLDERS OF WESTFIELD AND CHICOPEE ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER . Such documents are not currently available . Investors and security holders will be able to obtain the documents (when available) free of charge at the SEC’s website, www . sec . gov . Copies of the documents filed with the SEC by Westfield and Chicopee will be available free of charge on Westfield’s website at www . westfieldbank . com under the tab “Investor Relations” and then under the heading “SEC Filings” or by contacting the Investor Relations Contact listed on the Investor Relations webpage or on Chicopee’s website at www . chicopeesavings . com under the tab “Investor Relations” and then under the heading “SEC Filings” or by contacting the Investor Relations Contact listed on the Investor Relations webpage . You may also read and copy any reports, statements and other information filed with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington DC . Information about the operation of the SEC Public Reference Room may be obtained by calling the SEC at 1 - 800 - SEC - 0330 . The information on Westfield and Chicopee’s websites is not, and shall not be deemed to be, a part of this release or incorporated into other filings Westfield or Chicopee make with the SEC . Westfield, Chicopee and their respective directors, executive officers and members of management may be deemed to be participants in the solicitation of proxies from the stockholders of Westfield and Chicopee in connection with the transaction . Information about the directors and executive officers of Westfield is set forth in the proxy statement for Westfield’s 2015 annual meeting of stockholders filed with the SEC on April 2 , 2015 . Information about the directors and executive officers of Chicopee is set forth in the proxy statement for Chicopee’s 2015 annual meeting of stockholders filed with the SEC on April 15 , 2015 . Additional information regarding the interests of these participants and other persons who may be deemed participants in the merger may be obtained by reading the joint proxy statement/prospectus regarding the merger when it becomes available . 3

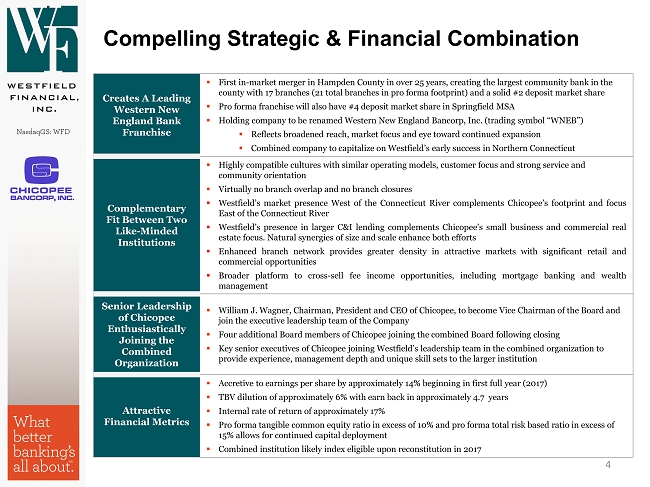

Compelling Strategic & Financial Combination 4 Creates A Leading Western New England Bank Franchise ▪ First in - market merger in Hampden County in over 25 years, creating the largest community bank in the county with 17 branches (21 total branches in pro forma footprint) and a solid #2 deposit market share ▪ Pro forma franchise will also have #4 deposit market share in Springfield MSA ▪ Holding company to be renamed Western New England Bancorp, Inc. (trading symbol “WNEB”) ▪ Reflects broadened reach, market focus and eye toward continued expansion ▪ Combined company to capitalize on Westfield’s early success in Northern Connecticut Complementary Fit Between Two Like - Minded Institutions ▪ Highly compatible cultures with similar operating models, customer focus and strong service and community orientation ▪ Virtually no branch overlap and no branch closures ▪ Westfield’s market presence West of the Connecticut River complements Chicopee’s footprint and focus East of the Connecticut River ▪ Westfield’s presence in larger C&I lending complements Chicopee’s small business and commercial real estate focus . Natural synergies of size and scale enhance both efforts ▪ Enhanced branch network provides greater density in attractive markets with significant retail and commercial opportunities ▪ Broader platform to cross - sell fee income opportunities, including mortgage banking and wealth management Senior Leadership of Chicopee Enthusiastically Joining the Combined Organization ▪ William J. Wagner, Chairman, President and CEO of Chicopee, to become Vice Chairman of the Board and join the executive leadership team of the Company ▪ Four additional Board members of Chicopee joining the combined Board following closing ▪ Key senior executives of Chicopee joining Westfield’s leadership team in the combined organization to provide experience, management depth and unique skill sets to the larger institution Attractive Financial Metrics ▪ Accretive to earnings per share by approximately 14% beginning in first full year (2017) ▪ TBV dilution of approximately 6% with earn back in approximately 4.7 years ▪ Internal rate of return of approximately 17% ▪ Pro forma tangible common equity ratio in excess of 10% and pro forma total risk based ratio in excess of 15% allows for continued capital deployment ▪ Combined institution likely index eligible upon reconstitution in 2017

Transaction Overview 5 Merger Consideration ▪ 100% stock – fixed exchange ratio of 2.425 shares ▪ Stock options converted to Westfield options ▪ Aggregate value of approximately $110 million, or $20.42 per share* Pro Forma Ownership ▪ Approximately 59% Westfield / 41% Chicopee of fully diluted shares outstanding Organizational Structure ▪ Holding Company will be renamed Western New England Bancorp, Inc. (NASDAQ: WNEB) ▪ Bank Subsidiary will operate under the Westfield Bank name ▪ Executive offices at current Westfield headquarters in Westfield, MA ▪ President and CEO: James C. Hagan (current Westfield CEO) ▪ Executive Management Team Role: William J. Wagner (current Chicopee CEO) Board Composition ▪ Chairman of the Board: Donald Williams (Westfield); Vice Chairman: Bill Wagner (Chicopee) ▪ 14 Directors – 9 Westfield / 5 Chicopee (as of closing) Required Approvals ▪ Customary regulatory approvals and shareholder approvals of both Westfield and Chicopee Targeted Closing ▪ Expected close in fourth quarter of 2016 Due Diligence ▪ Comprehensive reciprocal due diligence process including core systems, legal and credit due diligence ________ *Using WFD stock price at close on April 4 th , 2016

Creating Value for Both Sets of Shareholders 6 Double Digit Earnings Accretion Greater Franchise Value Better Positioned for Future Growth Potential for Stock Upside Improved Stock Liquidity Retain Strong Capital Base Double Digit Earnings Accretion Greater Franchise Value Better Positioned for Future Growth Potential for Stock Upside Improved Stock Liquidity

Westfield Financial, Inc. Companies with Similar Profiles… 7 ________ Source: SNL Financial as of 12/31/2015 Note: Market data as of April 4 , 2016 ▪ HQ: Westfield, MA ▪ Founded: 1853 ▪ Ticker: WFD ▪ Market Cap: $153.8 mm ▪ Assets: $1.3 bn ▪ Loans: $818 mm ▪ Deposits: $900 mm ▪ Branches: 13 ▪ MRQ ROAA: 0.42% ▪ MRQ ROATCE: 4.0% ▪ MRQ NIM: 2.58% ▪ MRQ Efficiency: 73.8% ▪ HQ: Chicopee, MA ▪ Founded: 1854 ▪ Ticker: CBNK ▪ Market Cap: $92.5 mm ▪ Assets: $679 mm ▪ Loans: $587 mm ▪ Deposits: $507 mm ▪ Branches: 8 ▪ MRQ ROAA: 0.57% ▪ MRQ ROATCE: 4.4% ▪ MRQ NIM: 3.46% ▪ MRQ Efficiency: 72.3% Chicopee Bancorp, Inc. 2016 Westfield Financial, Inc. (13 branches) Chicopee Bancorp, Inc. (8 branches)

14% 12% 12% 10% 8% 8% 7% 7% 7% 6% 4% 0% 2% 4% 6% 8% 10% 12% 14% 16% …Combining to Create one of the Largest Community Banks in Hampden County and Springfield MSA 8 Largest Community Bank in Hampden County, MA ________ Source: SNL Financial as of 6 /30/2015 Note: Two Westfield branches are located in Hartford County, CT outside of Springfield MSA Top 5 Deposit Market Share in Springfield MSA, MA 15% 14% 14% 14% 12% 11% 9% 5% 4% 4% 3% 0% 2% 4% 6% 8% 10% 12% 14% 16% 2015 Rank Institution (ST) Branches Deposits ($mm) Market Share (%) 1 Bank of America Corp. (NC) 18 1,835 13.9 2 Toronto-Dominion Bank 20 1,640 12.4 3 PeoplesBancorp MHC (MA) 19 1,636 12.4 Pro Forma Franchise 19 1,360 10.3 4 Berkshire Hills Bancorp Inc. (MA) 17 1,113 8.4 5 United Financial Bancorp (CT) 16 1,112 8.4 6 Florence Bancorp MHC (MA) 10 944 7.1 7 ESB Bancorp MHC (MA) 10 904 6.8 8 Westfield Financial Inc. (MA) 11 862 6.5 9 Country Bank for Savings (MA) 9 787 5.9 10 Chicopee Bancorp Inc. (MA) 8 498 3.8 Total For Institutions In Market 197 13,250 2015 Rank Institution (ST) Branches Deposits ($mm) Market Share (%) 1 Toronto-Dominion Bank 17 1,400 15.0 Pro Forma Franchise 17 1,329 14.3 2 Bank of America Corp. (NC) 14 1,304 14.0 3 PeoplesBancorp MHC (MA) 14 1,276 13.7 4 United Financial Bancorp (CT) 15 1,079 11.6 5 Berkshire Hills Bancorp Inc. (MA) 16 1,036 11.1 6 Westfield Financial Inc. (MA) 11 862 9.3 7 Chicopee Bancorp Inc. (MA) 6 467 5.0 8 Country Bank for Savings (MA) 5 356 3.8 9 Citizens Financial Group Inc. (RI) 15 346 3.7 10 KeyCorp (OH) 9 269 2.9 Total For Institutions In Market 143 9,311

Extends Footprint and Enhances Scale and Density in Springfield MSA and the “Knowledge Corridor” ________ Source: westernmassedc.com; masslive.com; reuters.com; SNL Financial Note: Two Westfield branches are located in Hartford County, CT outside of Springfield MSA Springfield MSA Hampden County Hampshire County Hartford County Population (2016) 630,835 469,440 161,395 898,233 Median HH Income $54,825 $50,986 $65,722 $67,237 # Businesses 60,873 17,250 6,594 39,051 Deposits (millions) $13,250.2 $9,310.8 $3,939.4 $35,718.8 Pro Forma: Deposits (millions) $1,359.6 $1,329.5 $30.1 $36.6 Branches 19 17 2 2 Market Share Rank: All Banks 4 2 14 21 Community Banks 2 1 8 3 Chicopee and Springfield, MA Economic “Mini - Revival” New England’s “Knowledge Corridor” □ The Greater Springfield - Hartford metropolitan area has been dubbed the “Knowledge Corridor” • Academic Powerhouse : Home to 29 universities and liberal arts colleges, and numerous highly regarded hospitals • Major Market : Second largest population in New England (1.7 million people) • Business Hub : Diverse and robust business sectors with over 50,000 businesses total □ Chicopee, with a population of 55,717 residents, is the second largest city in Western Massachusetts, and home to nearly 3,000 companies □ Approximately 4,700 businesses are based within the city of Springfield, employing more than 73,000 workers, making Springfield the economic hub of the region □ The regional impact from the Springfield economic development initiatives: • China Railway Rolling Stock Corporation new manufacturing plant will assemble ~285 new cars for Boston’s subway system in $566mm contract; CRRC also recently won $1.3bn bid to build rail cars for the Chicago Transit Authority • MGM Casino will be located in downtown Springfield with typical casino amenities and accommodations. The $950 million project is underway • Springfield Union Station, an $88 million project, will become a main transportation center in the region supporting Amtrak in addition to regional and state - supported trains • North Main Street Reconstruction to include sidewalks, traffic signals and street lights to the Chicopee city line Major Employers in the “Knowledge Corridor” Demographic Data 9

Diversified Loan and Deposit Mix 10 ________ Source: SNL Financial balances as of 12/31/2015 Westfield Chicopee Pro Forma Loans Deposits Total: $818.2 Yield: 4.02% Total: $586.9 Yield: 4.16% Total: $1,405.1 Yield: 4.08% Total: $900.3 Cost: 0.64% Loans/Deposits: 91% Total: $507.1 Cost: 0.56% Loans/Deposits: 116% Total: $1,407.5 Cost: 0.61% Loans/Deposits: 100% 1 - 4 Family 36.4% Home Equity 5.3% CRE 37.0% C&I 20.6% Other 0.7% 1 - 4 Family 21.8% Home Equity 6.7% CRE 49.1% Const 9.7% C&I 12.2% Other 0.6% 1 - 4 Family 30.3% Home Equity 5.9% CRE 42.1% Const 4.0% C&I 17.1% Other 0.6% Non - Interest Bearing 17.5% NOW 3.2% MMDA & Svgs 35.3% Time 44.0% Non - Interest Bearing 20.2% NOW 8.9% MMDA & Svgs 33.2% Time 37.6% Non - Interest Bearing 18.5% NOW 5.3% MMDA & Svgs 34.6% Time 41.7%

Strong Pro Forma Financial Metrics 11 ________ All balances and ratios as of December 31, 2015; market data as of April 4, 2016. Pro Forma combined performance ratios estimated full year 2017. Pro forma combined market data based on exchange ratio of 2.425; WFD stock price at April 4, 2016; estimated TBV at closing; and full year 2017 projected EPS Westfield Chicopee Pro Forma 12/31/2015 12/31/2015 Combined Assets ($millions) $1,340 $679 $2,019 Gross Loans ($millions) 818 587 1,405 Deposits ($millions) 900 507 1,407 Number of Branches 14 9 23 Deposits / Branch ($ millions) $64.3 $56.3 $61.2 CRE Loans / Loans 37% 49% 42% C&I Loans / Loans 21% 12% 17% Loans / Deposits 91% 116% 100% TCE / TA 10.41% 13.16% >10% Total Risk Based Capital Ratio 17.20% 16.50% >15% Efficiency Ratio 78% 74% ~65% ROAA 0.42% 0.45% >0.60% ROAE 4.10% 3.37% >5.75% Market Capitalization ($ millions) $153.8 $92.5 $254.1 P / TBV 110% 104% 114% P / EPS (x) 25.5 29.6 17.2 Balance Sheet Franchise Balance Sheet Ratios Performance Ratios Market Data

Key Merger Assumptions 12 Credit Mark ▪ Gross loan mark projected to be 1.75% of total loans Cost Savings ▪ Cost savings estimated at $7 million (15% of combined banks’ 2015 FY expense base) ▪ Phased in at 50% of the run - rate for the first six months post closing and 100% thereafter Revenue Synergies ▪ Several areas of opportunity, but no revenue synergies included in the modeling Restructuring Charges ▪ One - time merger costs of approximately $8.4 million, after - tax Core Deposit Intangible ▪ Core deposit intangible of 1.2%, amortized over 10 years SOYD Common Dividend ▪ Targeting 30% dividend payout ratio post - close

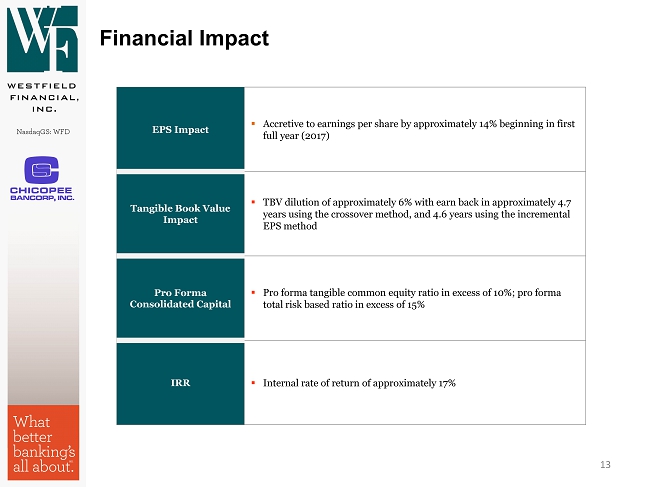

Financial Impact 13 EPS Impact ▪ Accretive to earnings per share by approximately 14% beginning in first full year (2017) Tangible Book Value Impact ▪ TBV dilution of approximately 6% with earn back in approximately 4.7 years using the crossover method, and 4.6 years using the incremental EPS method Pro Forma Consolidated Capital ▪ Pro forma tangible common equity ratio in excess of 10%; pro forma total risk based ratio in excess of 15% IRR ▪ Internal rate of return of approximately 17%

Investment Merits – A Compelling Strategic Combination 14 In - Market Combination Creating Largest Locally Owned Bank in Hampden County ▪ Not moving resources out of the market, but intensifying resources in our core market ▪ Strong brand dedicated to outstanding customer service and giving back to the community; holding company rebrand aimed toward continued market expansion Although Located in Same County, Extremely Complementary Franchises with Little Overlap ▪ Virtually no branch overlap and no branch closures ▪ Complementary areas of lending expertise ▪ Both banks benefit from larger lending limit and capabilities of broader institution Local Businesses Want to do Business with Local Banks ▪ The combined institution will have the capital of a larger regional bank with local decision making and the service of a local community bank ▪ While cost savings and attaining scale are important in any transaction, incremental revenue growth will be a key driver in this combination Attractive Financial Combination ▪ Significantly accretive to earnings per share ▪ Manageable TBV dilution with attractive earn back ▪ Internal rate of return of approximately 17% ▪ Combined institution has regulatory capital well in excess of regulatory minimums, allowing for continued capital deployment through organic growth, dividends, share repurchases and additional strategic opportunities ▪ Attractive valuation relative to similar - sized institutions in the Northeast

Reconciliation of Tangible Book Value Dilution and Earn Back 15 12/31/2015 9/30/2016 Actual Projected Westfield Stand Alone Tangible Book Value (in thousands) Shareholders' equity 139,466 142,453 Shares outstanding 18,268 18,268 Tangible book value $7.63 $7.80 Deal value (in thousands) including net value of options Calculated using Chicopee shares outstanding on 12/31/15 $110,196 Calculated using Chicopee shares outstanding on 12/31/15, net shares that are ultimately retired $104,394 Reconciliation of Chicopee Shares Chicopee shares outstanding, 12/31/15 5,211 Unvested ESOP shares used to retire ESOP loan ($3,926,014 ESOP loan / $20.42 deal value) (192) Shares of Chicopee currently owned by Westfield (92) Shares of Chicopee outstanding following closing 4,927 Exchange ratio 2.425 Newly issued and outstanding shares of Westfield 11,947 Reconciliation of Pro Forma Shares Actual Fully Diluted Westfield shares outstanding, 12/31/15 18,268 17,498 Newly issued shares of Westfield 11,947 11,947 Chicopee options converted to Westfield options (fully diluted equivalents) 450 Shares of Westfield owned by Chicopee (30) (30) Pro forma shares outstanding 30,185 29,865

16 Includes ALL one - time and restructuring costs related to the transaction, regardless of when incurred, and does NOT include any share repurchase activity (1) Other adjustments include tax benefit from ESOP unwind, gain on Chicopee shares owned by Westfield, and retirement of Wes tfi eld shares owned by Chicopee. Reconciliation of Tangible Book Value Dilution and Earn Back In thousands except per share data Shareholders' Tangible Shares Tangible Equity Intangibles Equity Outstanding Book Value Projected at closing, September 30, 2016 142,453 0 142,453 18,268 $7.80 Value of newly Issued equity (4,926,613 shares x $20.42 deal value) 100,601 A 11,947 Less shares of Westfield owned by Chicopee (253) (30) Value of newly issued WFD options ($20.42 deal value - $14.55 exercise price) x 646,098 options 3,793 B Total deal value for shares that remain outstanding (A+B) (104,394) Less: Chicopee projected book value at closing (9/30/16) 90,696 Implied premium to tangible book value (13,698) One time costs after tax: Borne by Westfield (3,568) Borne by Chicopee prior to closing (4,832) Credit mark, net of APLL, after tax (3,215) Other adjustments (1) (754) Net impact of purchase accounting adjustments, after tax 1,686 Total pro forma 242,272 (20,059) 222,214 30,185 $7.36 Accretion / dilution to tangible book value - 6%

17 ▪ I n our analysis described in the investor presentation, cost savings are phased in at 50% of run rate for the first six months p ost closing and 100% thereafter ▪ Our analysis of tangible book value dilution using the crossover method compares the projected stand alone performance, and resultant tangible book value, to the pro forma financial performance and resultant tangible book value, and assessed when th e pro forma tangible book value “crossed over” and became greater than it would have been on a stand alone basis; ▪ That method includes the impact of all restructuring charges, regardless of when they are incurred, and does not include any share repurchase activity, resulting in an earn back to tangible book value of 4.7 years; ▪ The more summary method above yields a similar conclusion (4.6 years) when comparing the initial dilution of tangible book value of $0.44 per share to the fully phased in annual improvement in earnings per share that result from the transaction of $0.09 per share. This method assumes a static impact on earnings per share every year, a fully phased in level of cost savin gs immediately, and a perpetual impact of the amortization of purchase accounting mark to market adjustments, which ultimately do become fully amortized, is therefore a more general approach but yields a similar conclusion. Reconciliation of Tangible Book Value Dilution and Earn Back Incremental EPS Earn Back Method ($0.44) A Net income FD shares EPS Incremental addition to EPS per year: Westfield stand alone EPS projection for 2017 $7,374 17,498 $0.42 Chicopee stand - alone projections for 2017 4,183 Fully phased in cost savings, after tax 4,550 Other deal adjustments (amort of purch acctg marks, etc.) (1,173) Add back: CDI amortization for 2017 (out of earnings but not TBV) 481 Pro forma cash earnings per share - 2017 (on fully phased in basis) * $15,415 29,865 $0.52 Annual pickup to EPS $0.09 B TBV earn back in years (A / B) 4.6

Connecticut Massachusetts What better banking’s all about tm . NASDAQ: WFD Western New England Bancorp, Inc. (NASDAQ: WNEB)* *To take effect at close NASDAQ: CBNK

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Blackstone Credit and Insurance appoints Dan Leiter as Head of International

- Highline Recognizes Eleven Townships in Michigan’s Menominee County for being Designated as Smart Rural Communities

- Nihon Global Growth Partners Submits Shareholder Proposals for Consideration at Toyo Suisan’s 2024 General Shareholders’ Meeting

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share