Form 8-K WEST PHARMACEUTICAL SERV For: Sep 26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported) – September 26, 2016

WEST PHARMACEUTICAL SERVICES, INC. |

(Exact name of registrant as specified in its charter)

Pennsylvania | 1-8036 | 23-1210010 | ||

(State or other jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||

530 Herman O. West Drive, Exton, PA | 19341-0645 | |||

(Address of principal executive offices) | (Zip Code) | |||

Registrant’s telephone number, including area code: 610-594-2900

Not Applicable |

(Former name or address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Appointment of New Senior Vice President, Global Operations and Supply Chain

On September 26, 2016, West Pharmaceutical Services, Inc. (the "Company") announced that it had appointed David A. Montecalvo to serve as Senior Vice President, Global Operations and Supply Chain, effective September 26, 2016 (the "Commencement Date"). Mr. Montecalvo will serve on the Company's senior leadership team and will oversee the Company’s Global Operations function.

Mr. Montecalvo, 51, joins the Company from Medtronic plc, where he served in a number of senior leadership roles, including Vice President, Contract Manufacturing Operations, for the company’s Restorative Therapies Group, a $7 billion group of businesses; and Vice President, Business Operations Integration, where he was responsible for directing and leading the global operations integration of Covidien plc into Medtronic. Prior to working at Medtronic, Mr. Montecalvo held senior operations and product development roles at Urologix, Inc. and LecTec Corporation.

Mr. Montecalvo earned a Bachelor of Science degree in biomedical engineering from Case Western Reserve University. He also earned a Master of Business Administration degree in venture management from the University of St. Thomas.

A copy of the press release issued by the Company announcing the appointment of Mr. Montecalvo is filed as Exhibit 99.1 hereto and is incorporated by reference.

Employment Agreement

The Company entered into an employment agreement with Mr. Montecalvo appointing him as Senior Vice President, Global Operations and Supply Chain effective September 26, 2016 (the "Employment Agreement"). Pursuant to the Employment Agreement, Mr. Montecalvo will receive an annual base salary of $370,000. He will also be eligible for an annual incentive plan bonus in 2016, with a target amount of 60% of base salary, prorated based on Mr. Montecalvo's period of employment in 2016.

Effective on the Commencement Date, Mr. Montecalvo received a long-term incentive plan ("LTIP") award with a grant date fair value of $300,000, 50% of which consisted of stock options and 50% of which consisted of performance share units ("PSUs"). He will also receive a LTIP award with an expected value of $400,000, 50% of which will consist of stock options and 50% of which will consist of PSUs, at the Board of Directors' annual grant meeting in February 2017. The LTIP award made on the Commencement Date is substantially similar to the awards made to other executives during 2016. Mr. Montecalvo also received a restricted stock unit ("RSU") award with a grant date fair value of $100,000. If Mr. Montecalvo remains employed, the RSU will vest 100% on the fifth anniversary of the Commencement Date. The RSU will also vest 100% in the event Mr. Montecalvo terminates employment for Good Reason or is terminated by the Company without Cause, as defined in the award agreement. All other terms and conditions of the RSU are consistent with awards made in 2015. The forms of the awards will be filed as exhibits to the Employment Agreement.

In addition, Mr. Montecalvo will receive a sign-on cash bonus of $150,000. The Company will pay Mr. Montecalvo the entire cash bonus on the first normal payroll date following the Commencement Date. The sign-on bonus is subject to a two-year repayment obligation, pursuant to which if Mr. Montecalvo terminates his employment with the Company for any reason other than Good Reason (and in the absence of Death or any Disability), or if the Company terminates Mr. Montecalvo's employment with Cause, all as defined in the Employment Agreement, on or prior to the second anniversary of the Commencement Date, then Mr. Montecalvo agrees to fully repay the Company the amount of the sign-on bonus paid by the Company.

If, however, on or prior to the second anniversary of the Commencement Date, the Company terminates Mr. Montecalvo’s employment other than for Cause, or if Mr. Montecalvo terminates his employment with the Company for Good Reason, Mr. Montecalvo shall receive a lump-sum cash severance amount of $450,000, conditioned upon Mr. Montecalvo's execution of a release of claims in favor of the Company and non-disparagement, cooperation and confidentiality obligations.

Mr. Montecalvo will be subject to the Company's standard change-in-control agreement for executive officers.

The foregoing description of the Employment Agreement is qualified in its entirety by reference to the full text of the Employment Agreement, which will be filed as an exhibit to the Company's Quarterly Report on Form 10-Q for the quarter ending September 30, 2016.

2

Item 7.01 Regulation FD Disclosure.

Attached hereto as Exhibit 99.2 is a copy of the presentation to be used by management of the Company at the management conference call hosted by Janney Montgomery Scott on September 29, 2016 at 1:00pm Eastern time (call-in numbers: Domestic 800-954-0686, International +1-212-231-2920, ID 21818704).

A copy of the presentation materials will be available through the Investors link on http://www.westpharma.com.

The information in this report (including Exhibit 99.2) is being furnished pursuant to Item 7.01 and shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended ("Exchange Act"), or otherwise subject to the liabilities of that section, nor will it be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific referencing in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) | Exhibits | |

Exhibit 99.1 | West Pharmaceutical Services, Inc. Press Release, dated September 26, 2016. | |

Exhibit 99.2 | West Pharmaceutical Services, Inc. Investor Presentation. | |

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

WEST PHARMACEUTICAL SERVICES, INC. | ||

/s/ William J. Federici | ||

William J. Federici | ||

Senior Vice President and Chief Financial Officer | ||

September 26, 2016 | ||

4

EXHIBIT INDEX

Exhibit No. | Description | |

99.1 | West Pharmaceutical Services, Inc. Press Release, dated September 26, 2016. | |

99.2 | West Pharmaceutical Services, Inc. Investor Presentation. | |

5

Exhibit 99.1

Media Contact: | |

Emily Denney, Global Communications +1-610-594-3035 [email protected] | |

West Appoints David A. Montecalvo Senior Vice President, Global Operations and Supply Chain

Exton, PA -- September 26, 2016 -- West Pharmaceutical Services, Inc. (NYSE: WST), a global leader in innovative solutions for injectable drug administration, today announced it has appointed David A. Montecalvo to serve as Senior Vice President, Global Operations and Supply Chain, effective September 26, 2016. Mr. Montecalvo will serve on the senior leadership team and will oversee the Company’s Global Operations function.

Mr. Montecalvo joins West from Medtronic plc, where he served in a number of senior leadership roles, including Vice President, Contract Manufacturing Operations, for the company’s Restorative Therapies Group, a $7 billion group of businesses; and Vice President, Business Operations Integration, where he was responsible for directing and leading the global operations integration of Covidien plc into Medtronic. With 30 years of experience in the medical device and life science industry, Mr. Montecalvo has also held senior operations and product development roles at Urologix, Inc. and Lectec Corporation.

“David Montecalvo brings a wealth of expertise in global operations, business integration and product development,” said Eric M. Green, West’s President and Chief Executive Officer. “As we continue to make significant progress in achieving the operational excellence objectives outlined in our long-term business strategy, including our margin expansion targets, we intend to leverage David’s experience to continue this progress. He shares West’s priorities of safety, quality and operational excellence and will be a valuable addition to West’s leadership team, as we work to execute our strategy to be the world leader in the integrated containment and delivery of injectable medicines.”

“I am honored to join West, and to be a part of the Company’s continued success as a critical partner in the delivery of healthcare,” said Mr. Montecalvo. “There are so many exciting advancements ahead for us in the pharmaceutical, biotech and medical device industry, and I am particularly pleased to join West - a company that is at the core of helping bring innovative therapies to patients.”

Mr. Montecalvo earned a Bachelor of Science degree in biomedical engineering from Case Western University. He also earned a Master of Business Administration degree from the University of St. Thomas.

About West

West Pharmaceutical Services, Inc., is a leading manufacturer of packaging components and delivery systems for injectable drugs and healthcare products. Working by the side of its customers from concept to patient, West creates products that promote the efficiency, reliability and safety of the world's pharmaceutical drug supply. West is headquartered in Exton, Pennsylvania, and supports its customers from locations in North and South America, Europe, Asia and Australia. West's 2015 sales of $1.4 billion

reflect the daily use of approximately 110 million of its components and devices, which are designed to improve the delivery of healthcare to patients around the world.

West Pharmaceutical Services, Inc.

September 2016

Cautionary Statement Under the Private Securities Litigation Reform Act of 1995

This slide presentation and any accompanying management commentary contain “forward-looking statements” as that term is defined in the Private Securities

Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about product development and operational performance.

Each of these statements is based on preliminary information, and actual results could differ from any preliminary estimates. We caution investors that the risk

factors listed under “Cautionary Statement” in our press releases, as well as those set forth under the caption "Risk Factors" in our most recent Annual Report

on Form 10-K as filed with the Securities and Exchange Commission and as revised or supplemented by our quarterly reports on Form 10-Q, could cause our

actual results to differ materially from those estimated or predicted in the forward-looking statements. You should evaluate any statement in light of these

important factors. Except as required by law or regulation, we undertake no obligation to publicly update any forward-looking statements, whether as a result

of new information, future events, or otherwise.

Non-U.S. GAAP Financial Measures

Certain financial measures included in these presentation materials, or which may be referred to in management’s discussion of the Company’s results and

outlook, have not been calculated in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”), and therefore are referred to as non-

GAAP financial measures. Non-GAAP financial measures should not be considered in isolation or as an alternative to such measures determined in

accordance with GAAP. Please refer to “Reconciliation of Non-GAAP Measures” at the end of these materials for more information.

Trademarks

Registered trademarks used in this report are the property of West Pharmaceutical Services, Inc. or its subsidiaries, in the United States and other

jurisdictions, unless noted otherwise. Daikyo Crystal Zenith® and Flurotec® are trademarks or registered trademarks, and are licensed from of Daikyo Seiko,

Ltd. Repatha® is a registered trademark of Amgen, Inc.

Safe harbor statement

2

By your side…

Pharmaceutical, biotechnology, generic and

medical device companies trust West and our

ability to deliver consistent high quality and

technologically advanced containment and

delivery solutions.

We share their commitment to improving health

for patients worldwide.

Our mission

3

Become the

world leader

in integrated

containment

and delivery

of injectable

medicines

4

Injectable market

$284 Billion

of Annual

Drug Sales

$7- 8 Billion

Containment &

Delivery Product Sales

Source: IMS and Company estimates

An integral part of the

healthcare industry

Top 35

Injectable biologics

rely on West and

Daikyo components

~ 40 Billion

Components

manufactured

annually

Top 75

Supplier to the top 75

pharmaceutical & biotech

injectable companies

5

2015 Sales

$1.4 billion

2015 Sales

$1.4 billion

2015 Net Sales

by Geography

West business – at a glance

7%

39%

33%

21%

Americas

Europe, Middle East, Africa

Asia Pacific

2015 Net Sales

by Category

53% 40%

7%

High-Value Components

Standard Packaging

Delivery Devices

Contract Manufacturing

P

RO

P

RI

E

T

A

R

Y

P

RO

D

U

C

T

S

6

Proprietary Products

Stoppers

Seals

Caps

Syringe Components

Daikyo CZ Vials & Syringes

Reconstitution Systems

Self-Injection Devices

West’s role in delivering

medicines to patients

Contract-Manufactured

Products

Program Management

Injection Molding

High-volume Integrated

Assemblies

Quality Systems

$0.3B

$1.1B

~8,000

product

SKU’s

7

%

%

%

%

%

%

%

%

%

2011 2012 2013 2014 2015

Net Sales

Sustained, consistent growth

8

2011 2012 2013 2014 2015

Adjusted Diluted EPS*

(reported, $ millions)

CAGR

4.8%

$1,192.3

$1,399.8

CAGR

11.8%

$1.17

$1.83

(Non-GAAP)

Constant Currency

CAGR 6.7%

Comparison of Cumulative

Five-Year Total Return

0

50

100

150

200

250

300

350

400

2010 2011 2012 2013 2014 2015

S&P MidCap

400 Index

West Pharmaceutical

Services, Inc.

Source: Company estimates; *Please refer to “Reconciliation of Non-GAAP Measures” at the end of these materials for more information.

Long-term strategy

9

Market Led

and Customer

Experience

Operational

Excellence

Product

and Service

Differentiation

Drive

Shareholder

Value

Become the

world leader

in integrated

containment

and delivery

of injectable

medicines

Addressing unique needs

10

Quality – A High Bar Set By Our Customers

GENERICS

Speed to

market

Efficient

manufacturing

BIOLOGICS

Packaging

solutions for

sensitive

molecules

Self-injection

technologies

PHARMA

Total cost of

ownership

Life cycle

management

Quality

manufacturing

Design for

manufacturing

CONTRACT-

MANUFACTURED

PRODUCTS

Patient Focus

West solutions:

Integrated containment & delivery

11

Increasing levels of

customer intimacy

Increasing

value to West

STERILIZED

WASHED

COATED

ADMINISTERED

CAMERA

INSPECTED

QUALITY

BY DESIGN

CONTAINMENT

SELF

INJECTION

CONTRACT MANUFACTURING

INJECTION MOLDING

CONTRACT MANUFACTURING

MULTI-COMPONENT ASSEMBLY

Circles reflect relative size of 2015 net sales

Standard

Packaging

High-Value

Components

0%

5%

10%

15%

20%

0% 30% 60%

2015 Category Gross Margin %

Proprietary

Devices

Contract

Manufacturing

2015 GM 32.6%

5-Yr Sales CAGR 6.7%

Product net sales & margin growth

2011-2015 compound annual net sales growth rates

(excludes currency)

> High-Value

components have

driven growth

> Proprietary devices

present significant

growth opportunity

> Steady Contract

Manufacturing

and standard

packaging businesses

5

-Y

ear

C

AG

R

12

0%

Net sales of $388 million, organic sales growth* of 8.2%

Proprietary Products organic sales growth of 8.9%

Contract-Manufactured Products organic sales growth of

5.1%

Increased operating profit margin

Reported diluted EPS of $0.60. Adjusted diluted EPS of $0.59,

an increase of 26% from prior year

Global Operations – increased throughput, operational

efficiencies and quality

Innovation and Technology – new product launches and

approvals

Q2 2016 highlights

13

* Excluding the impact from changes in foreign exchange

14

Proprietary Products, 80% of total sales

GENERICS

Double-digit organic

sales growth

BIOLOGICS

High-single digit

organic sales growth

PHARMA

High-single digit

organic sales growth

Mid-single digit

organic sales growth

CONTRACT-

MANUFACTURED

PRODUCTS

Q2 2016 highlights

20% of total

High-Value Product Offerings +17% organic sales growth

Global Operations

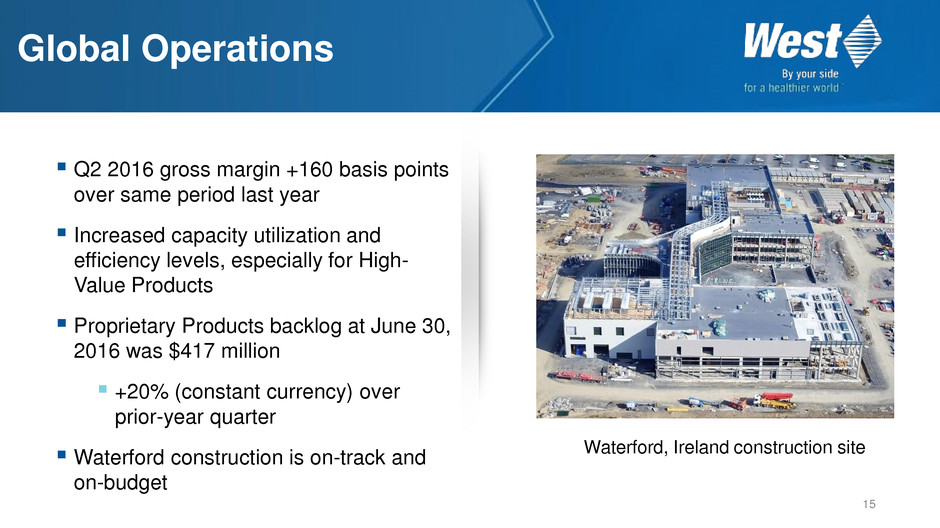

Q2 2016 gross margin +160 basis points

over same period last year

Increased capacity utilization and

efficiency levels, especially for High-

Value Products

Proprietary Products backlog at June 30,

2016 was $417 million

+20% (constant currency) over

prior-year quarter

Waterford construction is on-track and

on-budget

15

Waterford, Ireland construction site

SmartDose® technology

developments

First commercial approval

Selected by Amgen for

Repatha® monthly single dosing

FDA approval in July

Multiple active programs in

place with additional customers

Next-generation technology in

development

16

17

Engineered for

Multiple Injection

Modalities

Designed for

Biologics

Developed for

Quality Risk

Management

Launched

1-3mL NovaPure® Plunger

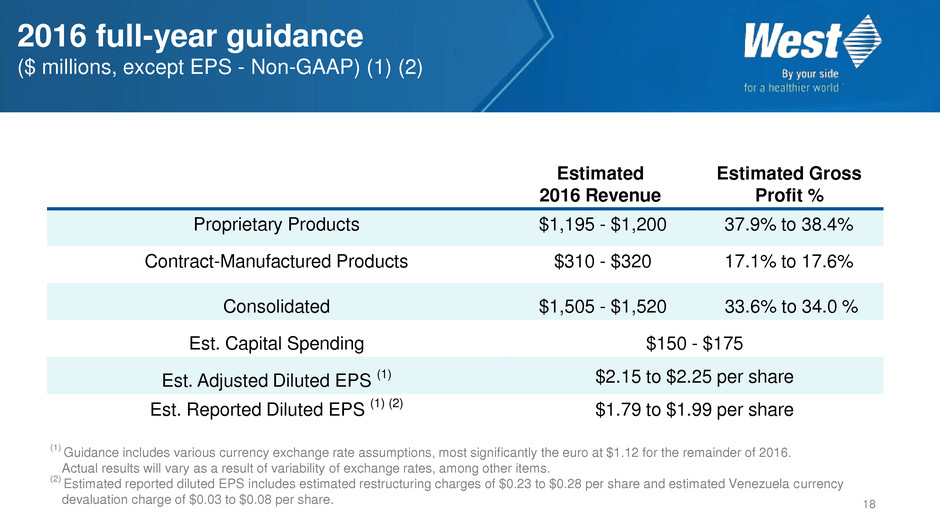

2016 full-year guidance

($ millions, except EPS - Non-GAAP) (1) (2)

18

Estimated

2016 Revenue

Estimated Gross

Profit %

Proprietary Products $1,195 - $1,200 37.9% to 38.4%

Contract-Manufactured Products $310 - $320 17.1% to 17.6%

Consolidated $1,505 - $1,520 33.6% to 34.0 %

Est. Capital Spending $150 - $175

Est. Adjusted Diluted EPS (1) $2.15 to $2.25 per share

Est. Reported Diluted EPS (1) (2) $1.79 to $1.99 per share

(1)

Guidance includes various currency exchange rate assumptions, most significantly the euro at $1.12 for the remainder of 2016.

Actual results will vary as a result of variability of exchange rates, among other items.

(2)

Estimated reported diluted EPS includes estimated restructuring charges of $0.23 to $0.28 per share and estimated Venezuela currency

devaluation charge of $0.03 to $0.08 per share.

Building for the future

Market-led

strategy

addressing the

specific needs of

pharmaceutical,

biotechnology,

generic and

medical device

customers

Strong

competitive

position

Quality culture

Designed into

regulated products

Scientific and

technical expertise

Global

Operations

expanding

capacity to meet

growing customer

demand

Proprietary

products and

contract

manufacturing

expected to drive

net sales growth

and margin

expansion

Financial

strength to

invest

Strong balance

sheet and

increasing

operating

cash flow

19

Innovations in

integrated

containment and

delivery driving

new products

and services for

long-term growth

Create Value for Customers, Patients, Employees and Shareholders

Create Value for Customers, Patients, Employees and Shareholders

Appendix:

Reconciliation of non-GAAP

measures

20

2015 2014 2013 2012 2011

Diluted EPS Reported (GAAP) $1.30 $1.75 $1.57 $1.15 $1.08

Pension settlement charge 0.43 - - - -

Executive retirement and related costs 0.09 - - - -

License costs - 0.01 - - -

Discrete tax items 0.01 0.02 0.06 0.03 0.02

Restructuring, impairment and related

charges

- - - 0.05 0.05

Acquisition-related contingencies - - - 0.01 (0.01)

Extinguishment of debt - - - 0.14 -

Special separation benefits - - - - 0.03

Diluted EPS Adjusted (Non-GAAP) $1.83 $1.78 $1.63 $1.38 $1.17

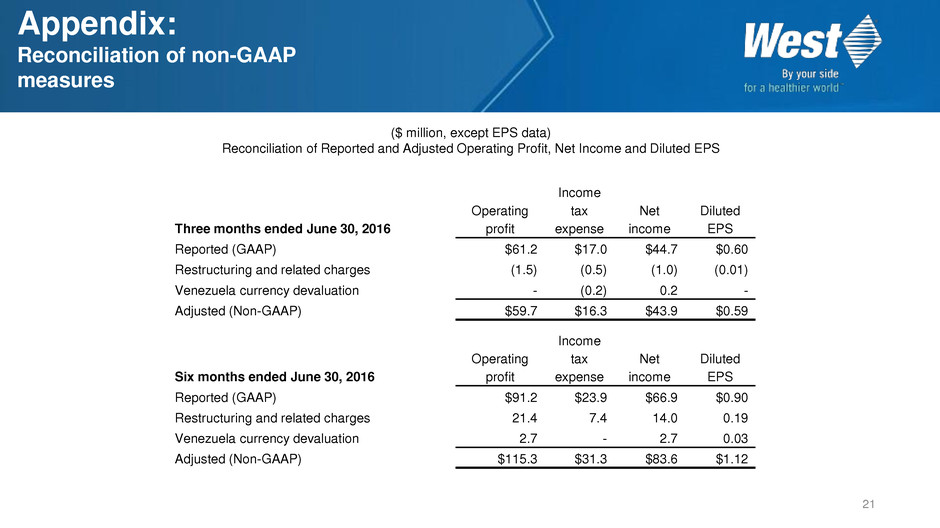

($ million, except EPS data)

Reconciliation of Reported and Adjusted Operating Profit, Net Income and Diluted EPS

21

Three months ended June 30, 2016

Operating

profit

Income

tax

expense

Net

income

Diluted

EPS

Reported (GAAP) $61.2 $17.0 $44.7 $0.60

Restructuring and related charges (1.5) (0.5) (1.0) (0.01)

Venezuela currency devaluation - (0.2) 0.2 -

Adjusted (Non-GAAP) $59.7 $16.3 $43.9 $0.59

Six months ended June 30, 2016

Operating

profit

Income

tax

expense

Net

income

Diluted

EPS

Reported (GAAP) $91.2 $23.9 $66.9 $0.90

Restructuring and related charges 21.4 7.4 14.0 0.19

Venezuela currency devaluation 2.7 - 2.7 0.03

Adjusted (Non-GAAP) $115.3 $31.3 $83.6 $1.12

Appendix:

Reconciliation of non-GAAP

measures

($ million, except EPS data)

Reconciliation of Net Sales to Net Sales at Constant Currency(1)

(1) Net sales at constant currency translates the current-period reported sales of subsidiaries whose functional currency is other

than the U.S. dollar at the applicable foreign exchange rates in effect during the comparable prior-year period.

22

Three months ended June 30, 2016 Proprietary CM Eliminations Total

Reported net sales (GAAP) $311.0 $77.2 $(0.2) $388.0

Effect of changes in currency translation rates 1.5 (0.3) - 1.2

Net sales at constant currency (Non-GAAP)(1) $312.5 $76.9 $(0.2) $389.2

Six months ended June 30, 2016 Proprietary CM Eliminations Total

Reported net sales (GAAP) $601.8 $148.8 $(0.5) $750.1

Effect of changes in currency translation rates 10.4 (0.2) - 10.2

Net sales at constant currency (Non-GAAP)(1) $612.2 $148.6 $(0.5) $760.3

Appendix:

Reconciliation of non-GAAP

measures

(1) Guidance includes various currency exchange rate assumptions, most significantly the euro at

$1.12 for the remainder of 2016. Actual results will vary as a result of exchange rate variability.

Reconciliation of adjusted diluted EPS guidance to reported diluted EPS guidance

23

Full Year 2016 Guidance(1)

Adjusted diluted EPS guidance $2.15 to $2.25

Estimated restructuring charges

Estimated currency devaluation (Venezuela)

(0.23 to 0.28)

(0.03 to 0.08)

Reported diluted EPS guidance $1.79 to $1.99

Appendix:

Reconciliation of non-GAAP

measures

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- West Pharma (WST) Declares $0.20 Quarterly Dividend; 0.2% Yield

- Teck Announces Dividend

- Stockholder Alert: Robbins LLP Informs Investors of the Class Action Filed Against Lincoln National Corporation (LNC)

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share