Form 8-K WEC ENERGY GROUP, INC. For: Sep 07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

September 7, 2016

____________________

Commission | Registrant; State of Incorporation | IRS Employer | ||

File Number | Address; and Telephone Number | Identification No. | ||

001-09057 | WEC ENERGY GROUP, INC. | 39-1391525 | ||

(A Wisconsin Corporation) | ||||

231 West Michigan Street | ||||

P.O. Box 1331 | ||||

Milwaukee, WI 53201 | ||||

(414) 221-2345 | ||||

The name and address of the registrant have not changed since the last report.

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

1

ITEM 7.01 REGULATION FD DISCLOSURE.

Representatives of WEC Energy Group, Inc. will be meeting with investors to discuss the company’s corporate governance practices. Attached as Exhibit 99.1 are the presentation slides to be used at such meetings.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

99 Additional Exhibits

99.1 Presentation slides

2

SIGNATURES | |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | |

WEC ENERGY GROUP, INC. | |

(Registrant) | |

/s/ William J. Guc | |

Date: September 7, 2016 | William J. Guc – Vice President and Controller |

3

Corporate governance overview

• Company overview

• Leadership team

• Governance practices

• Executive compensation program

• Environmental and social performance

2WEC ENERGY GROUP | CORPORATE GOVERNANCE OVERVIEW

“ Our corporate strategy is to create long-term value by focusing

on the fundamentals: world-class reliability, operating efficiency

and financial discipline. In addition, we keep our customers at the

heart of the business, work every day to help grow and support the

communities we serve, and value and develop our employees who

are making a difference in a mission that matters.”

- Allen Leverett, WEC Energy Group President and CEO

• WEC Energy Group formed when Wisconsin Energy Corp.

acquired Integrys Energy Group in June 2015

• Leading electric and natural gas utility in the Midwest

• Eighth largest natural gas distribution company in the country

• One of the 15 largest investor-owned utility systems in the United States

• More than 99 percent of earnings from regulated operations

• Industry-leading total shareholder returns

Company overview

4WEC ENERGY GROUP | CORPORATE GOVERNANCE OVERVIEW

WEC Energy Group is formed

Wisconsin Energy Corp. acquired Integrys Energy Group on June 29, 2015. Completed transaction in 53 weeks.

Combined two companies with origins dating back to the 1800s. » More than a century of operating history.

ELECTRIC DISTRIBUTION ELECTRIC TRANSMISSION ELECTRIC GENERATIONNATURAL GAS DISTRIBUTION

Services: electricity,

natural gas and steam

Customers:

1.1 million electric

1.1 million natural gas

Service: natural gas

Customers: 828,000

Service: natural gas

Customers: 171,000

Services: natural gas

and appliance repair

Customers: 230,000

Service: natural gas

Customers: 159,000

Services: electricity

and natural gas

Customers:

450,000 electric

326,000 natural gas

60% ownership

5WEC ENERGY GROUP | CORPORATE GOVERNANCE OVERVIEW

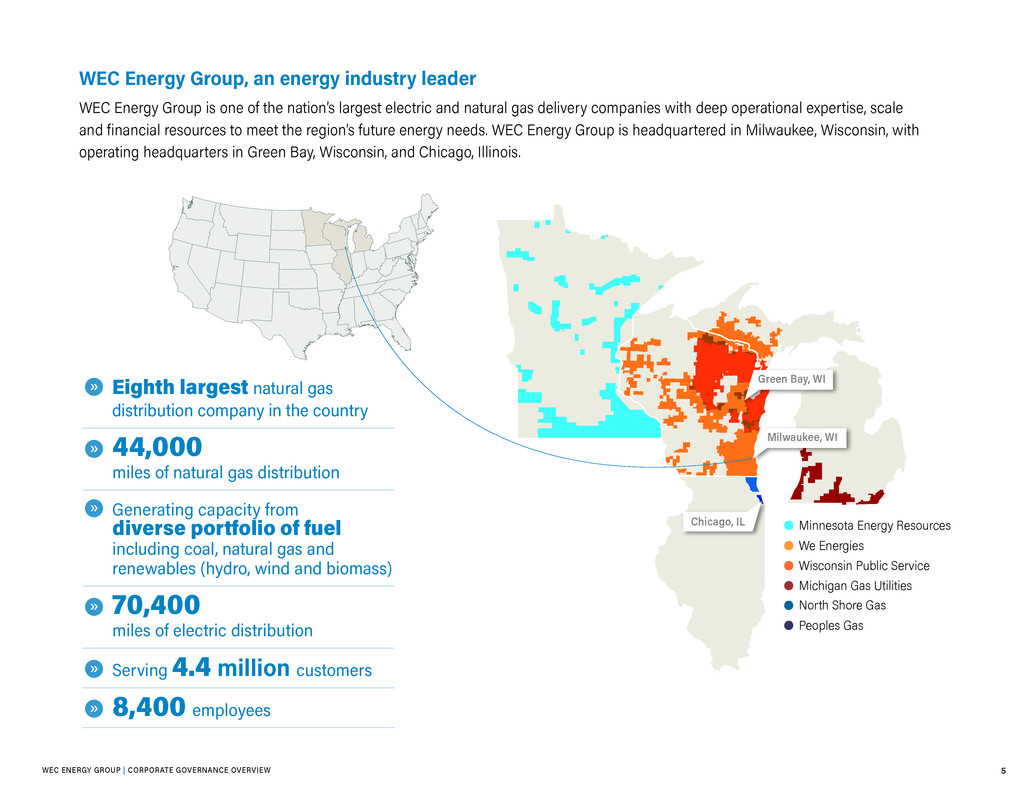

WEC Energy Group, an energy industry leader

WEC Energy Group is one of the nation’s largest electric and natural gas delivery companies with deep operational expertise, scale

and financial resources to meet the region’s future energy needs. WEC Energy Group is headquartered in Milwaukee, Wisconsin, with

operating headquarters in Green Bay, Wisconsin, and Chicago, Illinois.

• Minnesota Energy Resources

• We Energies

• Wisconsin Public Service

• Michigan Gas Utilities

• North Shore Gas

• Peoples Gas

» Eighth largest natural gas

distribution company in the country

» 44,000

miles of natural gas distribution

» Generating capacity from

diverse portfolio of fuel

including coal, natural gas and

renewables (hydro, wind and biomass)

» 70,400

miles of electric distribution

» Serving 4.4 million customers

» 8,400 employees

Milwaukee, WI

Green Bay, WI

Chicago, IL

6WEC ENERGY GROUP | CORPORATE GOVERNANCE OVERVIEW

Shareholder returns - track record of performance

Over the past decade, WEC Energy Group has consistently delivered among the best total returns in the industry.

One Year Three Year Five Year Ten Year

300%

250%

200%

150%

100%

50%

0%

254.8%— WEC Energy Group

— Dow Jones Utilities Average

— S&P Utilities Index

— Philadelphia Utility Index

— S&P Electric Index

Annualized returns for periods ending 12/31/15

Source: Bloomberg data assumes all dividends were reinvested and returns were compounded daily

» Company poised for growth

• Long-term earnings per share growth of

5-7 percent projected annually – driven by

multiyear infrastructure projects

• Targeting dividend growth in line with growth

in earnings per share

• Majority ownership of American Transmission Co.

brings additional transmission investment

opportunity

• Positioned to deliver among the best

risk-adjusted returns in the industry

INDUSTRY-LEADING TOTAL SHAREHOLDER RETURNS

• Board is led by non-executive chairman and independent presiding director

• New CEO appointed from within the company, effective May 1, 2016

• Non-executive chairman served as CEO for prior 13 years

• Experienced leadership team, many having worked together for more than 10 years

Leadership team

8WEC ENERGY GROUP | CORPORATE GOVERNANCE OVERVIEW

WEC Energy Group Board of Directors

The board of directors strategically acted to separate the offices of chief executive officer and chairman of the board as a component

of its management succession planning. The board is now led by a non-executive chairman and a lead independent presiding director.

The average years of service is nine years.

John F. Bergstrom,

director since 1987,

chairman and chief

executive officer,

Bergstrom Corp.

Patricia W. Chadwick,

director since 2006,

president, Ravengate

Partners LLC

Presiding director

Barbara L. Bowles,

director since 1998,

retired vice chair, Profit

Investment Management;

retired chairman, The

Kenwood Group Inc.

Curt S. Culver,

director since 2004,

non-executive chairman,

MGIC Investment Corp.

and Mortgage Guaranty

Insurance Corp.

Allen L. Leverett,

director since 2016,

president and chief

executive officer,

WEC Energy Group

William J. Brodsky,

director since 2015,

chairman, CBOE

Holdings Inc., and the

Chicago Board Options

Exchange

Thomas J. Fischer,

director since 2005,

principal, Fischer

Financial Consulting LLC

Ulice Payne Jr.,

director since 2003,

managing member,

Addison-Clifton LLC

Albert J. Budney Jr.,

director since 2015,

retired president,

Niagara Mohawk

Holdings Inc.

Paul W. Jones,

director since 2015,

retired executive

chairman and chief

executive officer,

A.O. Smith Corp.

Henry W. Knueppel,

director since 2013,

retired chairman and

chief executive officer,

Regal Beloit Corp.

Mary Ellen Stanek,

director since 2012,

managing director

and director of Asset

Management, Baird Financial

Group Inc.; chief investment

officer, Baird Advisors;

president, Baird Funds Inc.

Non-executive chairman

Gale E. Klappa,

director since 2003,

non-executive chairman,

WEC Energy Group

9WEC ENERGY GROUP | CORPORATE GOVERNANCE OVERVIEW

Allen L. Leverett named chief executive officer effective May 1, 2016

Allen Leverett was named president of WEC Energy Group in June 2015 and chief executive officer in May 2016.

He was appointed to the board of directors in January 2016.

Experience

Leverett had served as president of Wisconsin Energy Corp. since August 2013, as well as president – Wisconsin,

Michigan and Minnesota, with responsibility for business operations of the company’s utilities in those states.

Previously, Leverett served as president and chief executive officer of We Generation, the company’s power

generation group, since March 2011, with overall responsibility for the company’s electric generation portfolio, fuel

procurement, environmental compliance and renewable energy development strategy. He joined Wisconsin Energy

in 2003 as chief financial officer. In May 2004, he was named executive vice president and chief financial officer of

Wisconsin Energy and We Energies.

Prior to joining the company, Leverett served as chief financial officer and executive vice president of Georgia

Power in Atlanta, Georgia. Before that, he was vice president and treasurer of Southern Company Services,

with overall responsibility for financial planning and analysis, capital markets and leasing, treasury and investor

relations. Previously, he held a variety of positions in transmission planning, integrated resource planning, strategic

planning, wholesale marketing and finance.

Education

Leverett earned his bachelor’s degree, summa cum laude, in electrical engineering and mathematics from

Vanderbilt University, Nashville, Tennessee. He also earned a master’s degree in electrical engineering from

Stanford University, Palo Alto, California, and a Master of Business Administration degree with a finance

concentration from Auburn University, Auburn, Alabama.

Board participation

Leverett is a director of American Transmission Co. and non-executive chairman of Church Mutual Insurance Co.

He also is a member of the board of directors of the Electric Power Research Institute (EPRI) and the board of

trustees for Alverno College in Milwaukee.

President and

Chief Executive Officer

10WEC ENERGY GROUP | CORPORATE GOVERNANCE OVERVIEW

Leadership team

Leverett is supported by a seasoned leadership team. Seven of his 11 direct reports have been with the company more than 10 years.

Kevin Fletcher

President

WI Utilities

Joined company in 2011

Scott Lauber

EVP and Chief

Financial Officer

Joined company in 1990

Joan Shafer

EVP Human Resources

and Org. Effectiveness

Joined company in 1978

Tom Metcalfe

EVP

WI Utilities

Joined company in 2004

Heidi Humbert

VP and Chief

Audit Officer

Joined company in 2002

Charles Matthews

President

IL Utilities

Joined company in 2006

Susan Martin

EVP, General Counsel

and Corp. Secretary

Joined company in 2000

Robert Garvin

EVP

External Affairs

Joined company in 2011

Beth Straka

SVP Communications

and Investor Relations

Joined company in 2015

Jerold Franke

President

Wispark

Joined company in 1988

Pat Keyes

President, MN and MI Utilities

EVP Strategy

Joined company in 2011

• One of the earliest adopters of formal corporate governance guidelines

• Commonsense Principles of Corporate Governance benchmarking

• Regular assessment of board experience and qualifications

incorporated into active succession-planning processes

• Experientially skilled and diverse board of directors focused on

shareholder interests and concerns

Governance practices

12WEC ENERGY GROUP | CORPORATE GOVERNANCE OVERVIEW

COMMONSENSE PRINCIPLES WEC ENERGY GROUP PRACTICES

Board composition/internal governance ✔

• 11 of 13 independent directors

• Annual election of directors since 2005

• Board committee structure/service evaluated annually

• Stockholders can nominate directors

• Stock ownership requirements

• Balanced director tenure/retirement age at 72

Board responsibilities ✔ • Chairman active in stakeholder communications• Board participation in critical activities, including setting agenda

Shareholder rights ✔

• Proxy access bylaw (under development)

• Dual class voting is not practiced

• Written consent/special meeting provisions

Public reporting ✔

• Transparent quarterly financial results; reported using GAAP

• Quarterly reporting framed in broader context of strategy

• Disclosure of long-term goals is specific and measurable

• Take long-term strategic view and explain how material decisions are consistent with that view

Board leadership ✔ • Separate CEO/chair roles• Presiding independent director

Management succession planning ✔ • Board interaction with and evaluation of senior management• Public disclosure of succession planning process

Management compensation ✔

• Competitively tailored to business and industry, aligned with long-term performance

• Include current and long-term metrics, cash and equity components

• Public disclosure of benchmarks and performance measurements

• Clawback policies for cash and equity

Formal corporate governance guidelines

Since 1996, the board of directors has maintained strong corporate governance guidelines, which it has continued to modify as

governance practices and shareholder expectations have evolved. Our guidelines align with the “Commonsense Principles of Corporate

Governance,” a recommended governance framework that was published by a coalition of companies and investors in July 2016.

13WEC ENERGY GROUP | CORPORATE GOVERNANCE OVERVIEW

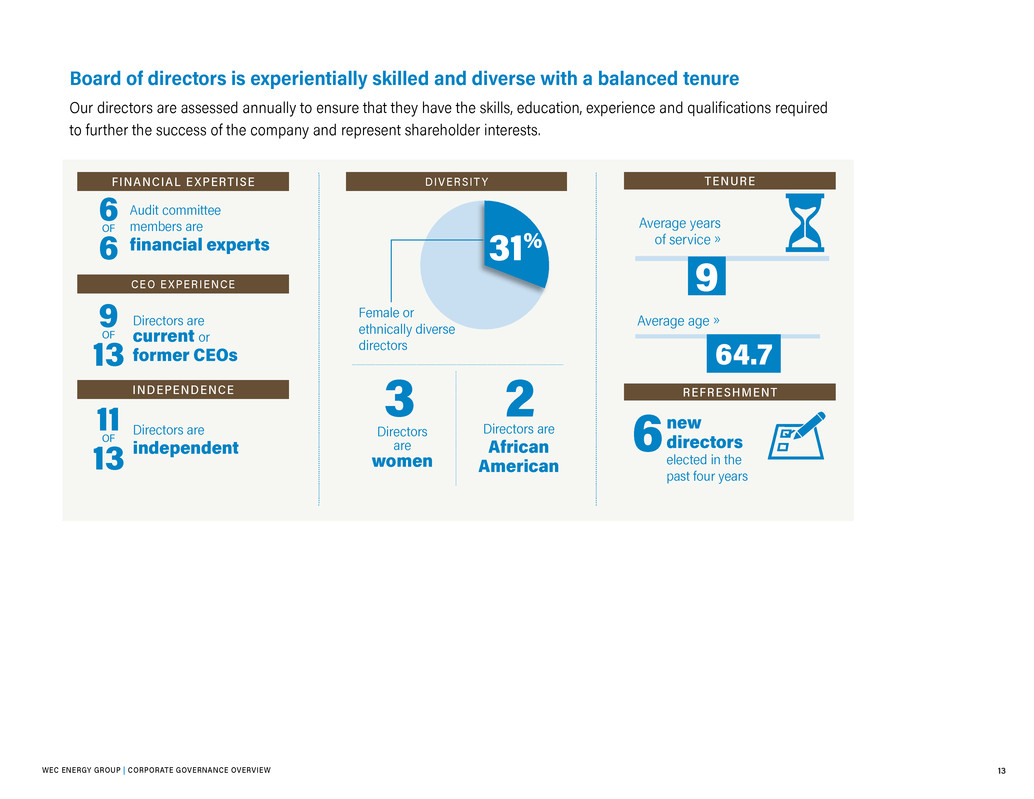

6

OF

6

9

OF

13

11

OF

13

Audit committee

members are

financial experts

new

directors

elected in the

past four years

Directors are

current or

former CEOs

3

6

2

Directors

are

women

Directors are

African

American

Directors are

independent

FINANCIAL E XPERTISE

CEO E XPERIENCE

INDEPENDENCE

DIVERSIT Y TENURE

REFRESHMENT

31%

Female or

ethnically diverse

directors 64.7

9

Average age »

Average years

of service »

Board of directors is experientially skilled and diverse with a balanced tenure

Our directors are assessed annually to ensure that they have the skills, education, experience and qualifications required

to further the success of the company and represent shareholder interests.

14WEC ENERGY GROUP | CORPORATE GOVERNANCE OVERVIEW

Governance practices evolve with shareholder input

At the May 2016 annual meeting, shareholders approved the board proceeding to adopt a proxy access bylaw.

• Ownership threshold

• Ownership duration

• Nominating group size limit

• Cap (max percent of board)

• Loaned shares count as owned

• Nominee prohibition on third-party

compensation arrangements

• Renomination restrictions on proxy

access nominations

• Nominee ineligibility for failure to

serve director or withdrawal from

election

• Board authority to interpret bylaw

KE Y BYL AW PROVISIONS FOR PROXY ACCESS:

• Includes short- and long-term components

• Program design links pay to performance measures

• Substantial portion of compensation is at risk

• Recent changes to program components as a result of shareholder input

Executive compensation program

16WEC ENERGY GROUP | CORPORATE GOVERNANCE OVERVIEW

Experienced, independent compensation committee administers the program

• Compensation committee chair has attained the National Association of Corporate Directors top designation of Board Leadership Fellow

• All members of compensation committee are independent

• Compensation committee utilizes the expertise of an independent compensation consultant

Link pay to performance

• Since 2004, annual incentive pay has been strategically linked to key performance measures

• Includes a short-term component and a long-term orientation

• Substantial portion of compensation is at risk and tied to company performance

• Stock is a considerable portion of executive compensation and meaningful stock ownership targets are set for senior executives

Responsive to shareholder interests

• Since 2011, the company has submitted an annual shareholder proposal on an advisory vote on executive compensation of the named

executive officers (“Say-on-Pay”); average approved percentage has been 88.6 percent

• Clawback policy was implemented in December 2014 which provides for the recoupment of incentive-based compensation

• Formal policy was adopted in December 2014 which prohibits any new arrangements that would provide executives with tax-gross ups

moving forward

• Effective in 2015 for annual incentive compensation, cash flow was added as a performance measure, in addition to earnings per share

from continuing operations

• Hedging and pledging of WEC Energy Group common stock is prohibited

• Repricing of stock options without shareholder approval is prohibited

• Equity award and other benefit plan obligations are satisfied through open-market purchases of WEC Energy Group common stock

so as not to dilute the interests of current shareholders

Compensation program design

The company has had a consistent approach to its compensation program, which includes being responsive to shareholder interests and

incorporates industry best practices.

17WEC ENERGY GROUP | CORPORATE GOVERNANCE OVERVIEW

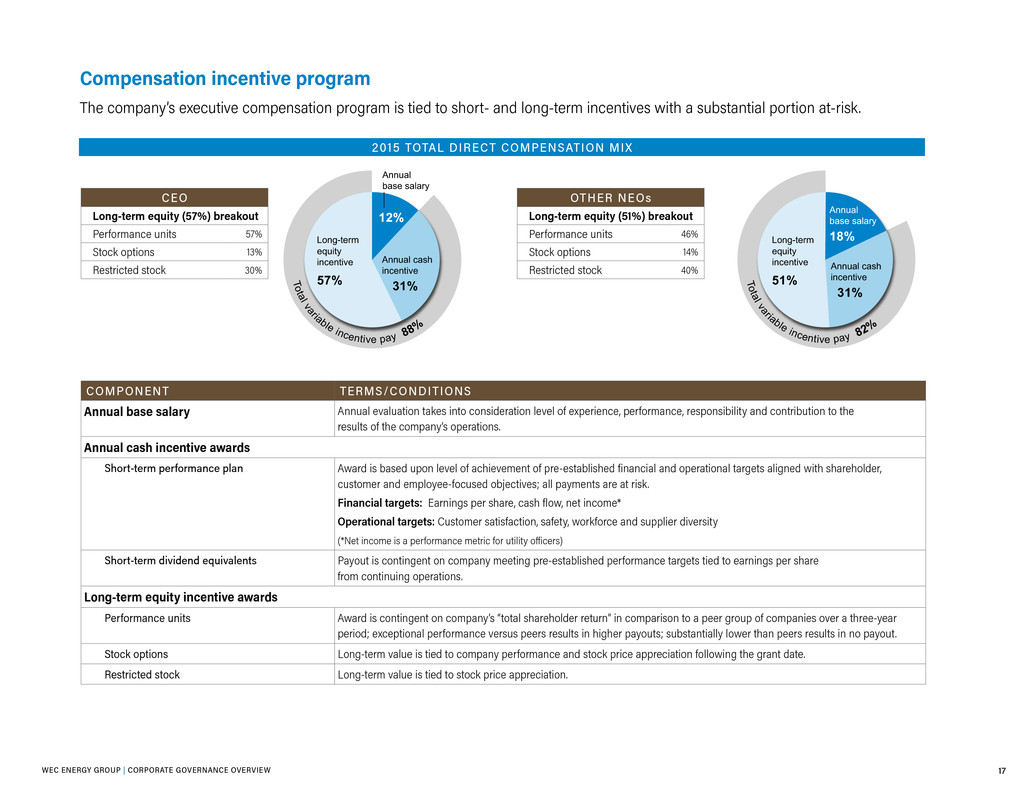

Compensation incentive program

The company’s executive compensation program is tied to short- and long-term incentives with a substantial portion at-risk.

12%

57%

18%

31%

Annual

base salary

Annual

base salary

Total variable incentive pay 8

8%

Total variable incentive pay 8

2%

Long-term

equity

incentive

51%

Long-term

equity

incentive

CEO 2015 total direct compensation mix Other NEOs 2015 total direct compensation mix

Annual cash

incentive

31%

Annual cash

incentive

12%

57%

18%

31%

Annual

base salary

Annual

base salary

Total variable incentive pay 8

8%

Total variable incentive pay 8

2%

Long-term

equity

incentive

51%

Long-term

equity

incentive

CEO 2015 total direct compensation mix Other NEOs 2015 total direct compensation mix

Annual cash

incentive

31%

Annual cash

incentive

2015 TOTAL DIRECT COMPENSATION MIX

CEO

Long-term equity (57%) breakout

Performance units 57%

Stock options 13%

Restricted stock 30%

OTHER NEOs

Long-term equity (51%) breakout

Performance units 46%

Stock options 14%

Restricted stock 40%

COMPONENT TERMS/CONDITIONS

Annual base salary Annual evaluation takes into consideration level of experience, performance, responsibility and contribution to the

results of the company’s operations.

Annual cash incentive awards

Short-term performance plan Award is based upon level of achievement of pre-established financial and operational targets aligned with shareholder,

customer and employee-focused objectives; all payments are at risk.

Financial targets: Earnings per share, cash flow, net income*

Operational targets: Customer satisfaction, safety, workforce and supplier diversity

(*Net income is a performance metric for utility officers)

Short-term dividend equivalents Payout is contingent on company meeting pre-established performance targets tied to earnings per share

from continuing operations.

Long-term equity incentive awards

Performance units Award is contingent on company’s “total shareholder return” in comparison to a peer group of companies over a three-year

period; exceptional performance versus peers results in higher payouts; substantially lower than peers results in no payout.

Stock options Long-term value is tied to company performance and stock price appreciation following the grant date.

Restricted stock Long-term value is tied to stock price appreciation.

• Balance the delivery of safe, reliable and affordable energy with a commitment to protecting

the environment

• Follow a multi-emission strategy to achieve greater environmental benefit for lower cost

• Goal of reducing CO2 emissions by approximately 40 percent below 2005 levels by 2030

• Strategically link incentive pay and operational goals to social performance targets since 2004

• Developed enhanced ESG disclosures for the newly combined company

• Invest in the communities we serve through charitable giving

Environmental and social performance

19WEC ENERGY GROUP | CORPORATE GOVERNANCE OVERVIEW

GUIDING PRINCIPLES OF OUR ENVIRONMENTAL COMMITMENT

Practice responsible

environmental

stewardship of all

properties and natural

resources entrusted to

our management.

Support research and implement new

technologies for emissions control,

energy efficiency, renewable energy

resources and other environmental and

health concerns associated with utility

operations.

Meet or surpass environmental

standards, invest in energy

efficiency measures and

support our recycling and

waste-reduction programs.

Participate with government

and other agencies in creating

responsible laws and regulations

to safeguard the environment,

community and workplace.

Board governance and risk management

A strong corporate governance structure supports the company’s strategic focus on environmental issues. Formal mechanisms are in place to provide

regular environmental updates, including on climate change, to the company’s board. The utility subsidiaries’ boards of directors and the board of

WEC Energy Group and its committees regularly receive briefings from internal specialists and external experts on emerging issues, and engage in

thoughtful discussion about the company’s strategy for establishing and achieving environmental performance objectives.

Transparency in reporting

• Wisconsin Energy issued first Corporate Responsibility Report in 2002

• WEC Energy Group 2015 Corporate Responsibility Report published in August 2016

Balancing reliability and customer costs with environmental stewardship

While providing safe, reliable and affordable energy to customers is a responsibility WEC Energy Group takes seriously, we also are focused

on our responsibility and commitment to protecting the environment.

20WEC ENERGY GROUP | CORPORATE GOVERNANCE OVERVIEW

Supporting a clean energy future

Over the past decade, WEC Energy Group has implemented a multi-emission strategy to achieve greater environmental

benefit for lower cost.

120%

100%

80%

60%

40%

20%

0%

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Nitrogen oxides

81% reduction

Sulfur dioxide

88% reduction

Mercury 84% reduction

PERCENTAGE OF REMAINING EMISSIONS

21WEC ENERGY GROUP | CORPORATE GOVERNANCE OVERVIEW

More than a decade of turning principles into action

• Retired 11 coal-fueled generating units on our system, totaling 652 megawatts (MW).

• Added two combined-cycle natural gas units totaling 1,090 MW that replaced

coal-fueled power generation.

• Converted Port Washington Generating Station from coal to natural gas,

making it the most thermally efficient generating power plant in Wisconsin.

• Converted Valley Power Plant from coal to natural gas, reducing CO2 emission

rate by more than 40 percent.

• Sold Milwaukee County Power Plant, which facilitated its conversion from coal to

natural gas.

• Invested more than $1.5 billion in air quality control systems on a number of existing

coal-fueled power generation units.

• Invested more than $1 billion in renewable energy – including the state's two largest

wind energy sites.

• Less than 30 percent of our revenues come from coal-based generation.

• In 2015, more than 50 percent of the electricity we delivered to our customers

was derived from low-or no-carbon sources such as natural gas, nuclear fuel,

wind farms and hydroelectric facilities.

Looking to the future

• We have piloted technical studies, completed research studies and engaged

with regulators. We will continue to be engaged on GHG emission reductions

on a scientific level.

• Working to develop alternative generation resources to serve the Upper Peninsula of

Michigan, so that we can retire the Presque Isle Power Plant (coal) by end of 2019.

• Continuing evaluation of possible future retirements of other coal-fueled units.

• Received research and test exemptions to evaluate co-firing of natural gas in some of our

coal-fueled units. Testing commenced June 15, 2016.

• As the regulation of GHG emissions takes shape, our plan is to work with our

industry partners, environmental groups, and the State of Wisconsin with a goal of

reducing CO2 emissions by approximately 40 percent below 2005 levels by 2030.

Greenhouse gas emissions

Addressing climate change is an integral component

of our strategic planning process. We will continue to

reshape our portfolio of electric generation facilities

with investments that will improve our environmental

performance, including reduced greenhouse gas (GHG)

intensity of our operating fleet.

2000 2003 2006 2009 2012 2015

120%

100%

80%

60%

40%

20%

0%

Carbon intensity

23% reduction

from 2000 levels

PERCENTAGE OF REDUCTION IN CARBON INTENSIT Y

CO2 rate - lbs/mwh

22WEC ENERGY GROUP | CORPORATE GOVERNANCE OVERVIEW

Since 2004, WEC Energy Group has strategically linked

management annual incentive compensation to operational

goals that include the following social performance measures:

2015 employee safety*

• Safest year in company history

• Injuries down 85 percent since 2003

2015 customer satisfaction survey results

• Top quartile in Midwest for customer satisfaction

and power quality*

• Top quartile nationally for customer service*

• Ranked number two in Midwest for overall customer

satisfaction^

2015 workplace diversity*

• Leadership diversity: leadership more diverse than service

area demographic for seventh consecutive year

• Supplier diversity: $159 million spent with certified

minority- and women-owned businesses, which is

17.36 percent of the company’s total procurement

spend on operations, maintenance and capital

*We Energies

^Wisconsin Public Service

Supporting communities served by our companies

Our companies provide financial support for nonprofit,

tax-exempt organizations in the communities we serve, while

company employees take an active role in their communities,

serving on nonprofit boards and volunteering their time.

• We Energies Foundation ranks ninth in grants paid and

third in number of grants distributed among the most active

foundations in the Milwaukee area.

Long-standing attention to social performance

Social performance is a way to measure how a company manages relationships with its employees, suppliers, customers and the

communities where it operates.

2015 CHARITABLE CONTRIBUTIONS AREAS OF FOCUS

Education

33%

Human

services

and health

34%

Arts and

culture

16%

13%

4%

Environmental

Community and

neighborhood

development

23WEC ENERGY GROUP | CORPORATE GOVERNANCE OVERVIEW

Much of the information contained in this presentation is forward-looking information based upon management’s current expectations and projections that

involve risks and uncertainties. Forward-looking information includes, among other things, information concerning earnings per share, rate case activity,

earnings per share growth, cash flow, dividend growth and dividend payout ratios, construction costs and capital expenditures, investment opportunities,

corporate initiatives, and rate base. Readers are cautioned not to place undue reliance on this forward-looking information. Forward-looking information is

not a guarantee of future performance and actual results may differ materially from those set forth in the forward-looking information.

In addition to the assumptions and other factors referred to in connection with the forward-looking information, factors that could cause WEC Energy Group’s

actual results to differ materially from those contemplated in any forward-looking information or otherwise affect our future results of operations and

financial condition include, among others, the following: general economic conditions, including business and competitive conditions in the company’s

service territories; timing, resolution and impact of future rate cases and other regulatory decisions; the company’s ability to successfully integrate the

operations of the Integrys companies with its own operations; availability of the company’s generating facilities and/or distribution systems; unanticipated

changes in fuel and purchased power costs; key personnel changes; varying weather conditions; continued industry consolidation; cyber-security

threats; the value of goodwill and its possible impairment; construction risks; equity and bond market fluctuations; the impact of any legislative and

regulatory changes; current and future litigation and regulatory investigations; changes in accounting standards; and other factors described under the

heading “Factors Affecting Results, Liquidity, and Capital Resources” in Management’s Discussion and Analysis of Financial Condition and Results of

Operations and under the headings “Cautionary Statement Regarding Forward-Looking Information” and “Risk Factors” contained in WEC Energy Group’s

Form 10-K for the year ended December 31, 2015 and in subsequent reports filed with the Securities and Exchange Commission. WEC Energy Group

expressly disclaims any obligation to publicly update or revise any forward-looking information.

Cautionary Statement Regarding Forward-Looking Information

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- WEC Energy Group (WEC) PT Raised to $96 at KeyBanc

- Nykredit Realkredit A/S upgrades full-year guidance, and Nykredit Bank raises deposit rates

- Irish Residential Properties Sub-Fund 1: Form 8.3 - Irish Residential Properties REIT PLC

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share