Form 8-K VALLEY NATIONAL BANCORP For: Aug 09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported) August 9, 2016

VALLEY NATIONAL BANCORP

(Exact Name of Registrant as Specified in Charter)

New Jersey | 1-11277 | 22-2477875 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification Number) |

1455 Valley Road, Wayne, New Jersey | 07470 |

(Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code (973) 305-8800 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

INFORMATION TO BE INCLUDED IN THE REPORT

Item 7.01 | Regulation FD Disclosure. |

Valley National Bancorp (the “Company”) is furnishing presentation materials included as Exhibit 99.1 to this report pursuant to Item 7.01 of Form 8-K. The Company is not undertaking to update this presentation. The information in this report (including Exhibit 99.1) is being furnished pursuant to Item 7.01 and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. This report will not be deemed an admission as to the materiality of any information herein (including Exhibit 99.1).

Item 9.01 | Financial Statements and Exhibits. |

(d) | Exhibits |

99.1 | Valley National Bancorp presentation materials used for investor meetings during the third quarter of 2016. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: August 9, 2016 | VALLEY NATIONAL BANCORP | ||

By: | /s/ Ira D. Robbins | ||

Ira D. Robbins | |||

Executive Vice President & Treasurer | |||

EXHIBIT INDEX

Exhibit No. | Description |

99.1 | Valley National Bancorp presentation materials used for investor meetings during the third quarter of 2016. |

© 2010 Valley National Bank. Member FDIC. Equal Opportunity Lender. © 2016 Valley National Bank®. Member FDIC. Equal Opportunity Lender. All Rights Reserved.

Investor Presentation

EXHIBIT 99.1

© 2010 Valley National Bank. Member FDIC. Equal Opportunity Lender. 2

Forward Looking Statements

The foregoing contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are not historical

facts and include expressions about management’s confidence and strategies and management’s expectations about new and existing programs and products,

acquisitions, relationships, opportunities, taxation, technology, market conditions and economic expectations. These statements may be identified by such forward

looking terminology as “should,” “expect,” “believe,” “view,” “opportunity,” “allow,” “continues,” “reflects,” “typically,” “usually,” “anticipate,” or similar statements

or variations of such terms. Such forward-looking statements involve certain risks and uncertainties. Actual results may differ materially from such forward-looking

statements. Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements include, but are not limited to:

weakness or a decline in the U.S. economy, in particular in New Jersey, New York Metropolitan area (including Long Island) and Florida; unexpected changes in

market interest rates for interest earning assets and/or interest bearing liabilities; less than expected cost savings from the maturity, modification or prepayment of

long-term borrowings that mature through 2022; further prepayment penalties related to the early extinguishment of high cost borrowings; less than expected cost

savings in 2016 and 2017 from Valley's branch efficiency and cost reduction plans; lower than expected cash flows from purchased credit-impaired loans; claims and

litigation pertaining to fiduciary responsibility, contractual issues, environmental laws and other matters; cyber attacks, computer viruses or other malware that may

breach the security of our websites or other systems to obtain unauthorized access to confidential information, destroy data, disable or degrade service, or sabotage

our systems; Results of examinations by the OCC, the FRB, the CFPB and other regulatory authorities, including the possibility that any such regulatory authority may,

among other things, require us to increase our allowance for credit losses, write-down assets, require us to reimburse customers, change the way we do business, or

limit or eliminate certain other banking activities; government intervention in the U.S. financial system and the effects of and changes in trade and monetary and

fiscal policies and laws, including the interest rate policies of the Federal Reserve; our inability to pay dividends at current levels, or at all, because of inadequate

future earnings, regulatory restrictions or limitations, and changes in the composition of qualifying regulatory capital and minimum capital requirements (including

those resulting from the U.S. implementation of Basel III requirements); higher than expected loan losses within one or more segments of our loan portfolio;

unexpected significant declines in the loan portfolio due to the lack of economic expansion, increased competition, large prepayments, changes in regulatory lending

guidance or other factors; unanticipated credit deterioration in our loan portfolio; unanticipated loan delinquencies, loss of collateral, decreased service revenues,

and other potential negative effects on our business caused by severe weather or other external events; an unexpected decline in real estate values within our

market areas; changes in accounting policies or accounting standards, including the potential issuance of new authoritative accounting guidance which may increase

the required level of our allowance for credit losses; higher than expected income tax expense or tax rates, including increases resulting from changes in tax laws,

regulations and case law; higher than expected FDIC insurance assessments; the failure of other financial institutions with whom we have trading, clearing,

counterparty and other financial relationships; lack of liquidity to fund our various cash obligations; unanticipated reduction in our deposit base; potential

acquisitions that may disrupt our business; declines in value in our investment portfolio, including additional other-than-temporary impairment charges on our

investment securities; future goodwill impairment due to changes in our business, changes in market conditions, or other factors; legislative and regulatory actions

(including the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act and related regulations) subject us to additional regulatory oversight which

may result in higher compliance costs and/or require us to change our business model; our inability to promptly adapt to technological changes; our internal controls

and procedures may not be adequate to prevent losses; the inability to realize expected revenue synergies from the CNL merger in the amounts or in the timeframe

anticipated; inability to retain customers and employees, including those of CNL; and other unexpected material adverse changes in our operations or earnings. A

detailed discussion of factors that could affect our results is included in our SEC filings, including the “Risk Factors” section of our Annual Report on Form 10-K for the

year ended December 31, 2015. We undertake no duty to update any forward-looking statement to conform the statement to actual results or changes in our

expectations. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of

activity, performance or achievements.

© 2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

Valley National Bancorp

• Traded on the New York

Stock Exchange (NYSE: VLY)

• Regional Bank Holding

Company

• Headquartered in Wayne,

New Jersey

• Founded in 1927

Average Balance

Sheet Items

2Q 2016 2Q 2015

Assets $21.7 billion $19.1 billion

Interest Earning Assets $19.5 billion $17.1 billion

Loans $16.3 billion $14.1 billion

Deposits $16.5 billion $14.2 billion

Shareholders’ Equity $2.2 billion $1.9 billion

Total Employees* 2,866 2,899

3

Overview of Valley National

Bancorp

Branches 213

ATMs 227

*Total employees reflects the full-time equivalent as of the date shown

© 2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

Valley National Bancorp

• Focus on credit quality

• Measured growth strategies

• Heavily populated footprint in 3

states

• Strong customer service culture

• Experienced commercial lender

• Seasoned senior and executive

management

• Balanced institutional and retail

stock ownership

– Approximately 260 institutional

holders or 56% of all shares*

– Long-term investment approach

– Focus on cash dividends

• Large insider stock ownership,

family members, retired

employees and retired directors

• Never had a losing quarter since

founded in 1927

4

*Data as of August 2, 2016

© 2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

Strategic Vision

5

NJ NY FL

Overview

A premier commercial banking

franchise with a diversified balance

sheet

Asset generator in three (3) of the

best markets on the East Coast

Leverage current infrastructure with

particular emphasis on Florida to

drive growth

Utilize technology to enhance &

streamline operations and delivery

channels

Increase focus on non-interest

revenue to deliver solid performance

in challenging environment

Long-term Vision

Asset Size: Mid-Size Bank

Footprint: NJ / NY / FL

Growth: Organic / Opportunistic

Acquisitions

© 2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

New York & New Jersey Franchise

6

178 Branches

NJ

64%

NY

22%

Loans

NJ

61%

NY

23%

Deposits

16 Counties

Core Demographic

Overview

NJ Core

Market(1)

New York

City(2)

Long

Island

U.S.A.

Avg. Pop. / Sq. Mile 6,079 40,520 3,147 91

Avg. Household Income $103,362 $91,385 $120,590 $77,135

Avg. Deposits / Branch $118,022 $679,039 $131,442 $115,781

VLY Deposits $8.2 billion $2.3 billion $1.0 billion $15.6 billion

VLY Deposit Market Share 5.93% 0.22% 0.87% 0.15%

(1)NJ Core Market includes Passaic, Morris, Hudson, Essex and Bergen Counties

(2)New York City includes Brooklyn, Queens and Manhattan; Demographic data for 2016; Deposit data for 2015

© 2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

Florida Franchise

7

FL

14%

Loans

FL

16%

Deposits

35 Branches

14 Counties

Core Demographic

Overview

Central

Tampa(1)

Central

Orlando(2)

Southeast(3) Florida

Avg. Pop. / Sq. Mile 2,219 1,101 1,308 379

Avg. Household Income $69,745 $65,894 $72,350 $67,858

Avg. Deposits / Branch $105,895 $88,856 $137,197 $94,918

VLY Deposits $0.1 billion $0.5 billion $1.4 billion $2.5 billion

VLY Deposit Market Share 0.20% 1.30% 0.66% 0.50%

(1)Central Tampa includes Pinellas & Hillsborough Counties (2)Central Orlando includes Orange, Brevard & Indian River Counties

(3)Southeast includes Palm Beach, Broward & Miami-Dade Counties; Demographic data for 2016; Deposit data for 2015

© 2010 Valley National Bank. Member FDIC. Equal Opportunity Lender. 8

Valley’s 2Q 2016 Highlights

Year Over Year Loan Growth(1) Financial Highlights

• Net income of $39.0 million was up 16 percent

quarter over quarter

• Loans increased by $363.2 million or 9.0 percent on

an annualized basis

• 3Q 2016 events

– Restructured $405 million in high cost debt due in 2018

– Terminated a swap with a notional value of $125 million

used to hedge the fair value of our 5.125% note issuance

Operating Efficiency

• In connection with our Branch Efficiency Plan that

was announced in 3Q 2015, we closed 27 of 28

branches through 2Q 2016

• Identified 3 redundant FL branches in 2Q 2016 for

closure by September 2016

Credit Quality

• Non-performing assets decreased 21.0 percent to

$61.3 million which represented 0.28 percent of total

assets

• Recorded net recoveries for the quarter; net charge-

offs only $182 thousand year-to-date

12%

10%

2%

6%

7%

3%

3%

0%

5%

10%

15%

20%

25%

30%

Commercial &

Industrial

Commercial Real

Estate

Residential

Mortgage

Total Consumer

Valley

Valley excl CNL

7%

19%

13%

5%

1.22%

0.28%

0.25%

0.45%

0.65%

0.85%

1.05%

1.25%

Non-Performing Assets to Total Assets(2)

(1)Total loans, year over year percent change (2)Excludes Purchase Credit Impaired Loans

© 2010 Valley National Bank. Member FDIC. Equal Opportunity Lender. 9

Borrowing Strategy

Debt Modification Prudently Managing Our Funding Sources

• Prepaid $405 million of high cost debt maturing in

2018

• Prepayment penalty of $20.0 million amortized

over 60 months

• Benefit of lower interest expense will begin in 3Q

2016 supporting future NII and NIM results

• Restructuring will reduce interest expense by $4.8

million on an annualized basis

Termination of Interest Rate Swap

Prepayment Replacement

Borrowings ~$405 million

Duration*

(months)

~21 60

Weighted

Average Cost

3.69% 2.51%

Annual Interest

Expense

$15.0 million $10.2 million • Notional swap value of $125 million terminated

due to a significant valuation gain

• Purpose of the swap was to hedge changes in the

fair value of our 5.125 percent subordinated note

(convert to floating rate)

• Results in a fixed effective annual interest rate of

3.32 percent on the notes maturing in 2023

• Reduces exposure to future interest rate increases

Continuing to evaluate remaining high cost borrowings for opportunity to

enhance net interest income

*Duration of prepaid amount is based on a weighted average of the respective borrowings

© 2010 Valley National Bank. Member FDIC. Equal Opportunity Lender. 10

Branch Efficiency & Cost Reduction Plans

1. Expected Impact of Branch Efficiency Plan 2. Cost Reduction Plan to Yield Added Efficiencies

• Realized $9 million reduction in annual operating

expense through end of 2Q 2016 compared to

$4.5 million expected at date of announcement(1)

• Closed a total of 27 branches through June 30,

2016 (13 closed in 2Q 2016)

• Identified 3 Florida branches for closure by end of

September 2016

• Continued evaluation of customer delivery

channels, branch usage patterns, and other factors

Cumulative Net Reduction in Annual

Operating Expense by Announced Plan(1)

Expense Discipline to Improve Efficiency(2)

• Realized $6 million reduction in annual operating

expense through end of 2Q 2016 compared to $5

million expected at date of announcement(1)

• Streamline various aspects of Valley’s business

model, staff reductions and further utilization of

technological enhancements

• Efficiency ratio declined approximately 160 basis

points from 65.4% last quarter to 63.8% in 2Q

2016(2)

$9.5

$8.5

$1.5

~$15

~$4.5

2Q '15 Branch

Efficiency

2Q '15 Cost

Reduction

2Q '16 Branch

Reduction

Progress

Unrealized

Realized

Reduction

in Op Ex

through

2Q 2016

74%

65%

60% 60%

58%

62%

66%

70%

74%

FY 2015 1H 2016 2H 2016 FY 2017

(1)Operating expense presented on a pre-tax basis (2)Actual and estimated efficiency ratio is total non-interest expense less

amortization of tax credit investments divided by net interest income plus non-interest income

~

~

~ ~

$19.5 million

© 2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

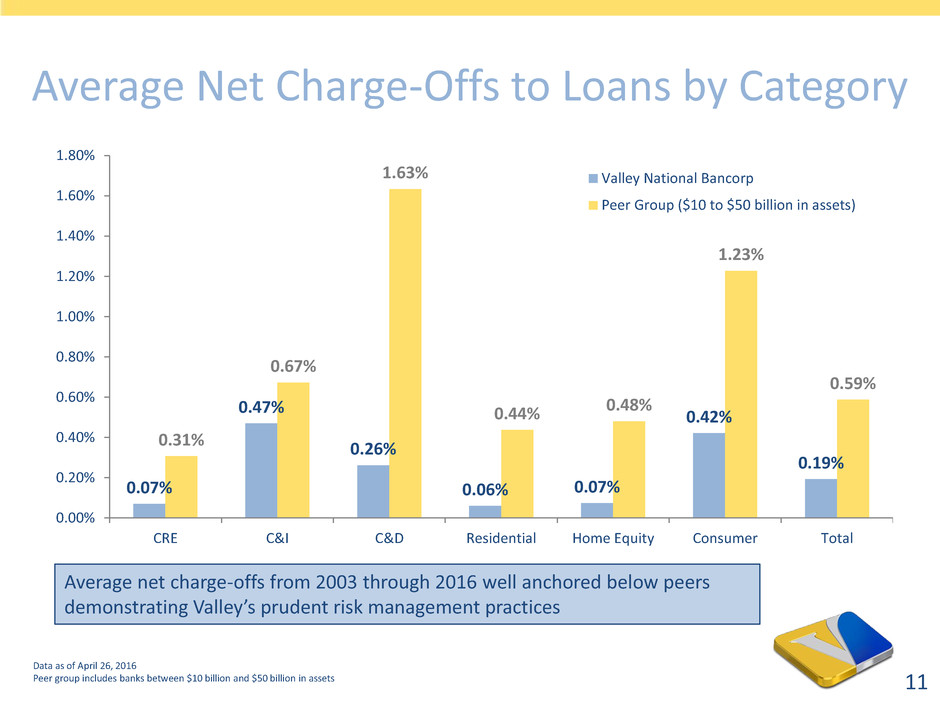

Average Net Charge-Offs to Loans by Category

0.07%

0.47%

0.26%

0.06% 0.07%

0.42%

0.19%

0.31%

0.67%

1.63%

0.44% 0.48%

1.23%

0.59%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

1.40%

1.60%

1.80%

CRE C&I C&D Residential Home Equity Consumer Total

Valley National Bancorp

Peer Group ($10 to $50 billion in assets)

11

Data as of April 26, 2016

Peer group inc udes banks between $10 billion and $50 billion in assets

Average net charge-offs from 2003 through 2016 well anchored below peers

demonstrating Valley’s prudent risk management practices

© 2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

Capital Profile

1

0

4.

9

1

0

6

.7

1

0

8

.4

1

0

7

.7

1

1

0

.4

9

1

.5

8

7

.3

1

1

7

.0

1

1

4

.2

1

1

0

.5

50

60

70

80

90

100

110

120

6/30/15 9/30/15 12/31/15 3/31/16 6/30/16

Allowance for Credit Loss Fair Value Adjustment

Millions

0.72% 0.71% 0.68% 0.67% 0.67%

0.63% 0.58%

0.73% 0.71% 0.67%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

1.40%

1.60%

6/30/15 9/30/15 12/31/15 3/31/16 6/30/16

Allowance for Credit Loss Fair Value Adjustment

1

2

.6

2

%

1

2

.4

3

%

1

2

.0

2

%

1

1

.7

9

%

1

1

.6

9

%

1

0

.0

7

%

9

.9

3

%

9

.7

2

%

9

.4

6

%

9

.3

9

%

9

.3

1

%

9

.1

8

%

9

.0

1

%

8

.8

1

%

8

.7

4

%

4%

6%

8%

10%

12%

6/30/15 9/30/15 12/31/15 3/31/16 6/30/16

Total RBC Tier 1 CET1

• Capital ratios reflect strong regulatory

capital position

• Solid loan growth negatively impacted

capital ratios in the quarter

12

PCI Fair Value Adjustment & ACL* PCI FVA & ACL as Percent of Total Loans

Bancorp Regulatory Capital Ratios Capital Highlights

*Allowance for credit losses (ACL)

Purchased credit impaired (PCI) loans; Fair value adjustment (FVA); Allocated by pool and cannot be utilized across pools

© 2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

Valley National Bancorp

Appendix

© 2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

Loans,

75%

Securities,

14%

Cash,

1%

Intangible

Assets, 3% Total

Other

Assets,

6%

Asset & Loan Composition

14

Commercial

Real Estate,

49%

Residential

Mortgages,

19%

Commercial

Loans, 15% Auto Loans,

7%

Other

Consumer,

6%

Construction,

5%

*Total Other Assets include bank owned branch locations carried at a cost estimated by management to be less than the

current market value. Totals may not qual 100 percent due to rounding.

2Q 2016 Balance Sheet Mix ($21.8 billion) Composition of Loan Portfolio ($16.5 billion)

© 2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

Total Commercial Real Estate - $8 Billion

(Includes both Covered and Non-Covered Loans)

17%

13%

12%

12%

12%

4%

4%

3%

2% 2%

19%

-Average LTV based on current balances and most recent appraised value.

-The total CRE loan balance is based on Valley’s internal loan hierarchy structure and does not reflect loan classifications reported in Valley’s

SEC and bank regulatory reports.

-The chart above does not include $692 Million in Construction loans. Construction composition displayed separately in presentation.

*The average LTV columns do not include CNL Bank CRE portfolio collateral values.

Commercial Real Estate

15

Primary Property Type

$ Amount

(Millions) % of Total

Avg

2012 2Q

Avg LTV* LTV*

Retail 1,550 19% 53% 50%

Apartments 1,326 17% 55% 39%

Mixed Use 1,054 13% 52% 46%

Coop Mortgages 929 12% 11% N/A

Industrial 966 12% 52% 50%

Office 969 12% 55% 52%

Healthcare 322 4% 57% 59%

Specialty 344 4% 46% 49%

Other 254 3% 45% 40%

Residential 194 2% 55% 54%

Land Loans 128 2% 55% 67%

Total $8,036 100% 48%

As of June 30, 2016

© 2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

Total Retail Property Types - $1.55 Billion

28%

27%

23%

8%

6%

4%

3%

1%

-Average LTV based on current balances and most recent appraised value

-The chart above excludes construction loans. Construction composition displayed separately in

presentation

-*The average LTV’s does not include CNL Bank CRE portfolio collateral values.

Composition of CRE Retail

16

As of June 30, 2016

Retail Property Type

% of Avg

2012 2Q

Avg LTV* Total LTV*

Single Tenant 28% 54% 52%

Multi-Tenanted - Anchor 27% 53% 53%

Multi-Tenanted – No

Anchor

23% 55% 52%

Auto Dealership 8% 51% 49%

Other 6% N/A N/A

Food Establishments 4% 51% 52%

Entertainment Facilities 3% 48% 55%

Auto Servicing 1% 48% 48%

© 2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

31%

20%

17%

18%

5%

4%

3%

2%

Composition of Construction

17

Total Construction Loans - $692 Million

-Construction loan balance is based on Valley’s internal loan hierarchy structure

and does not reflect loan classifications reported in Valley’s SEC and bank regulatory

reports.

As of June 30, 2016

Primary Property Type $ Amount

(Millions)

% of

Total

2012 2Q

% of Total

Apartments 214 31% 12%

Residential 137 20% 36%

Land Loans 118 17% 13%

Mixed Use 127 18% 10%

Retail 35 5% 16%

Healthcare 27 4% 2%

Other 19 3% 2%

Specialty 15 2% 4%

Total $692 100%

© 2010 Valley National Bank. Member FDIC. Equal Opportunity Lender. 18

For More Information

Log onto our web site: www.valleynationalbank.com

E-mail requests to: [email protected]

Call Shareholder Relations at: (973) 305-3380

Write to: Valley National Bank

1455 Valley Road

Wayne, New Jersey 07470

Attn: Tina Cortes, Shareholder Relations Specialist

Log onto our website above or www.sec.gov to obtain free copies of documents

filed by Valley with the SEC

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Clorox to Present at Goldman Sachs Global Staples Forum

- Mueller Water Products Announces Quarterly Dividend

- GOODRX ALERT: Bragar Eagel & Squire, P.C. Announces that a Class Action Lawsuit Has Been Filed Against GoodRx Holdings, Inc. and Encourages Investors to Contact the Firm

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share