Form 8-K USG CORP For: Apr 21

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form 8-K

CURRENT

REPORT

PURSUANT TO

SECTION 13 OR 15(d)

OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of

earliest event reported): April

21, 2016 (April

21, 2016)

|

USG Corporation |

|

(Exact name of registrant as specified in its charter) |

Commission File Number: 1-8864

|

Delaware |

36-3329400 |

|

|

(State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

|

550 West Adams Street, Chicago, Illinois |

60661-3676 |

|

|

(Address of principal executive offices) |

(Zip Code) |

|

(312) 436-4000 |

||

|

Registrant’s telephone number, including area code |

||

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

⃞ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

⃞ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

⃞ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

⃞ Pre-commencement communications pursuant to Rule 13c-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Section 2 – Financial Information

Item 2.02 Results of Operations and Financial Condition.

On April 21, 2016, USG Corporation issued a press release containing earnings information for the quarter ended March 31, 2016. A copy of the press release is furnished as Exhibit 99.1 hereto. As previously announced, a conference call and webcast to discuss first quarter 2016 results will be held at 8:00 a.m. Central Time on April 21, 2016. A copy of the slides to be presented as part of the webcast is furnished as Exhibit 99.2 hereto.

The information contained in this report, including the Exhibits hereto, shall not be deemed to be filed for purposes of the Securities Exchange Act of 1934, as amended, and it shall not be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such filing.

Section 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit 99.1 – USG Corporation press release dated April 21, 2016.

Exhibit 99.2 – USG Corporation presentation slides dated April 21, 2016.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

USG CORPORATION |

||||

|

Registrant |

||||

|

Date: |

April 21, 2016 |

By: |

/s/ Matthew F. Hilzinger |

|

|

Matthew F. Hilzinger, |

||||

|

Executive Vice President |

||||

|

and Chief Financial Officer |

||||

|

|

|

|||

EXHIBIT INDEX

|

Exhibit No. |

Exhibit |

|

| 99.1 |

USG Corporation press release dated April 21, 2016 |

|

|

99.2 |

USG Corporation presentation slides dated April 21, 2016 |

Exhibit 99.1

USG Corporation Reports First Quarter 2016 Results

First Quarter 2016 vs. First Quarter 2015

Business Highlights

- Net sales increase to $970 million from $909 million

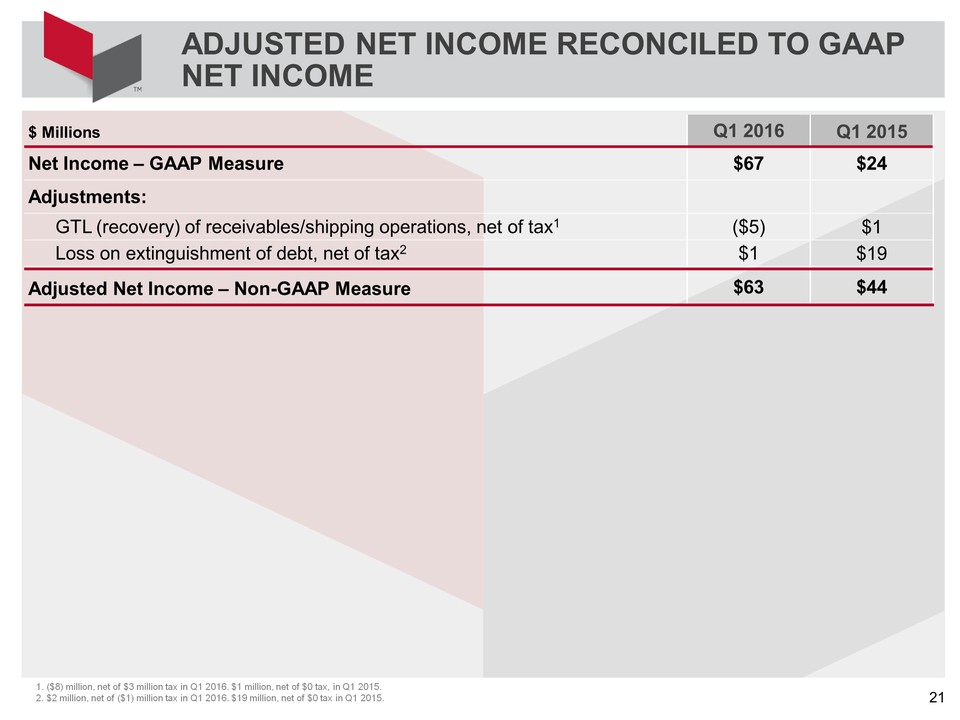

- Net income increases to $67 million from $24 million; adjusted net income increases to $63 million from $44 million

- US Gypsum operating profit margin improvement to 19.0% from 13.8%

- US Ceilings operating profit margin improvement to 22.7% from 16.5%

CHICAGO--(BUSINESS WIRE)--April 21, 2016--USG Corporation (NYSE: USG), a leading building products company, today reported results for the first quarter of 2016. “We’re off to a strong start in 2016, with arguably the best quarter we’ve had in almost a decade,” said James S. Metcalf, Chairman, President, and CEO. “We realized significant operating margin expansion in all of our US operations, led by our Ceilings business which turned in an all-time record quarter.”

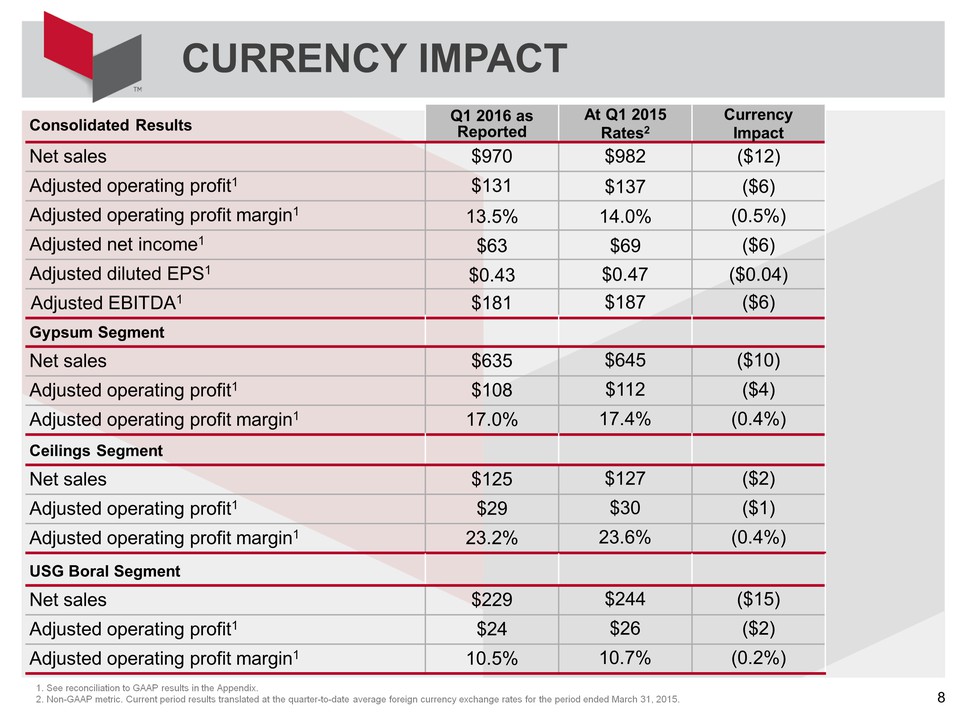

On a consolidated basis in the first quarter of 2016, net sales were $970 million, compared to $909 million in the first quarter of 2015. Foreign currency unfavorably impacted net sales by $12 million in the first quarter of 2016.

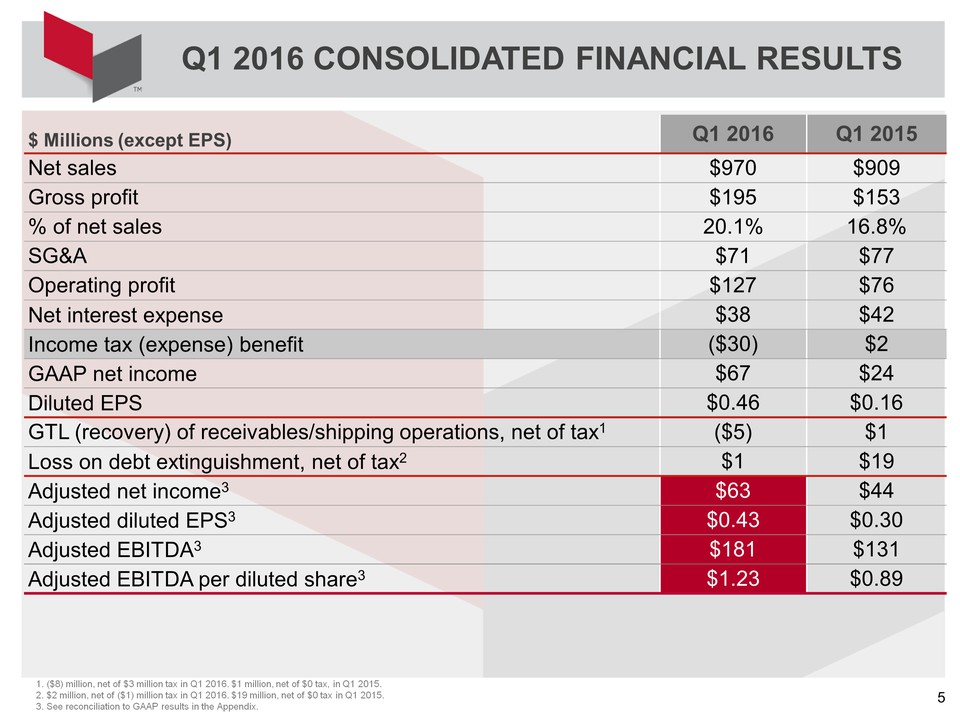

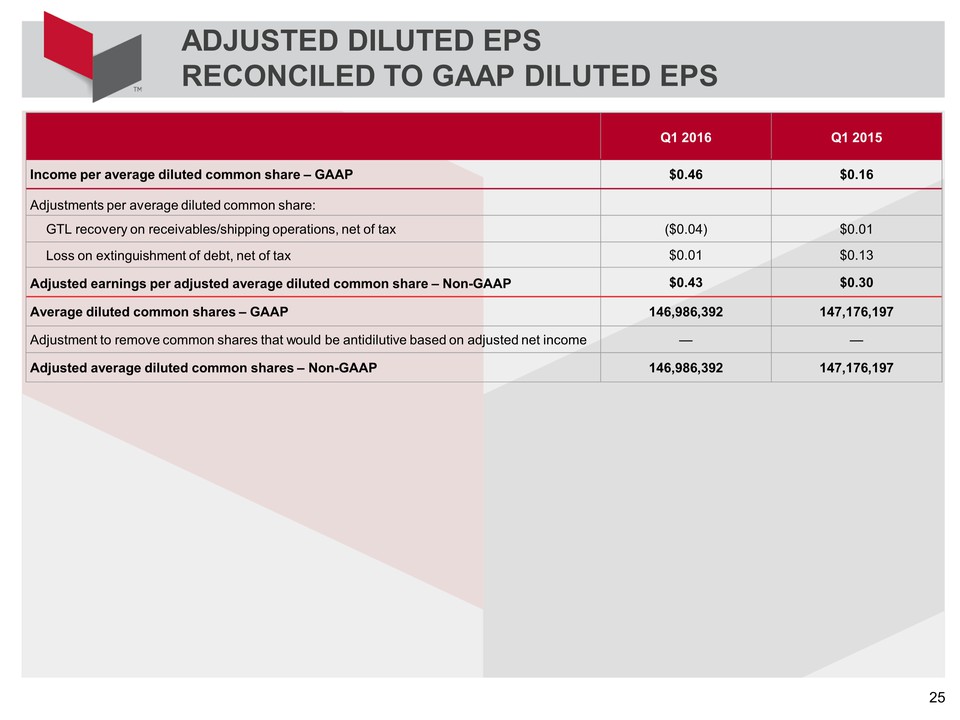

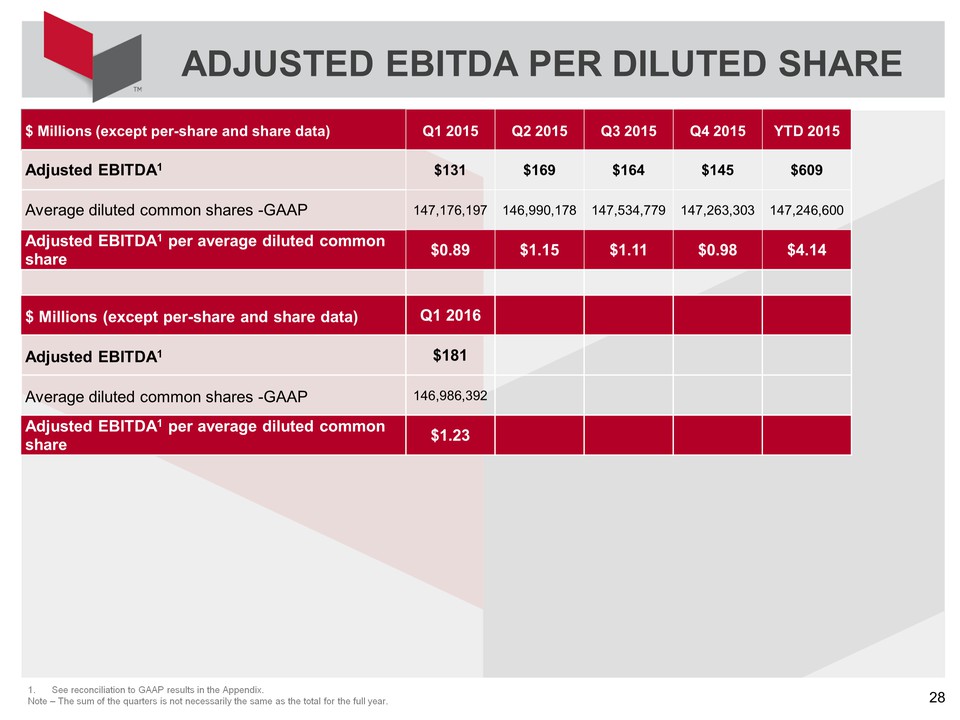

USG generated $67 million in net income and $0.46 per diluted share in the first quarter of 2016, compared to $24 million and $0.16 per diluted share in the first quarter of 2015. On an adjusted basis, net income of $63 million and diluted earnings per share of $0.43 in the first quarter of 2016 increased from $44 million and $0.30, respectively, in the first quarter of 2015. After an income tax valuation allowance release in the fourth quarter of 2015, net income and adjusted net income in the first quarter of 2016 include $29 million of US tax expense. Foreign currency also unfavorably impacted net income and adjusted net income by $6 million in the first quarter of 2016. Additionally, adjusted EBITDA per diluted share increased to $1.23 in the first quarter of 2016 from $0.89 in the first quarter of 2015. A full reconciliation of GAAP to adjusted metrics is set forth on a schedule attached hereto.

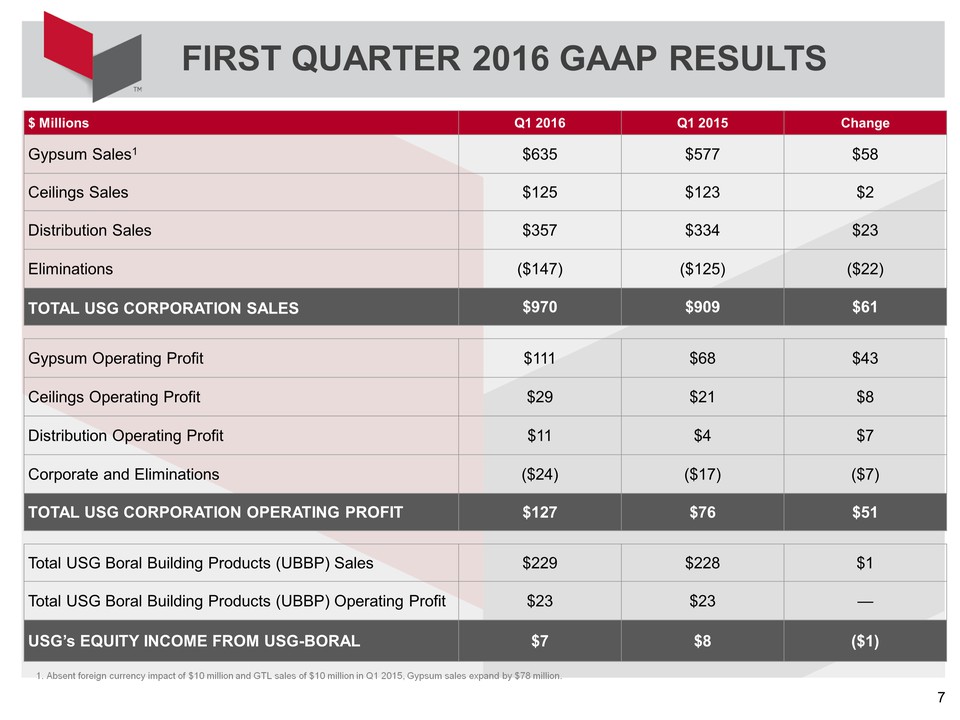

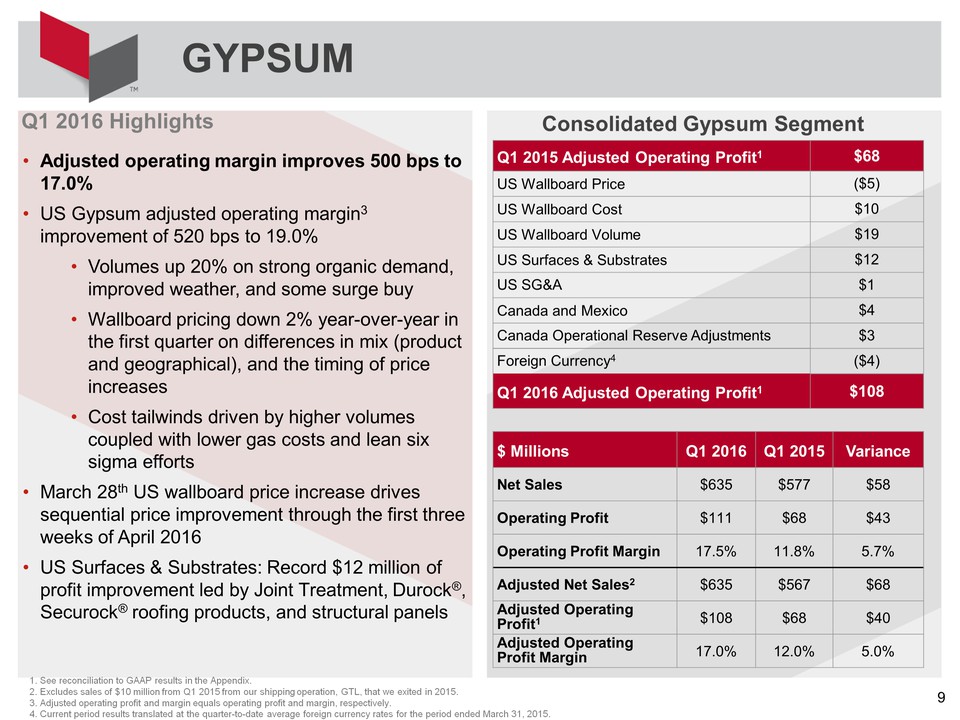

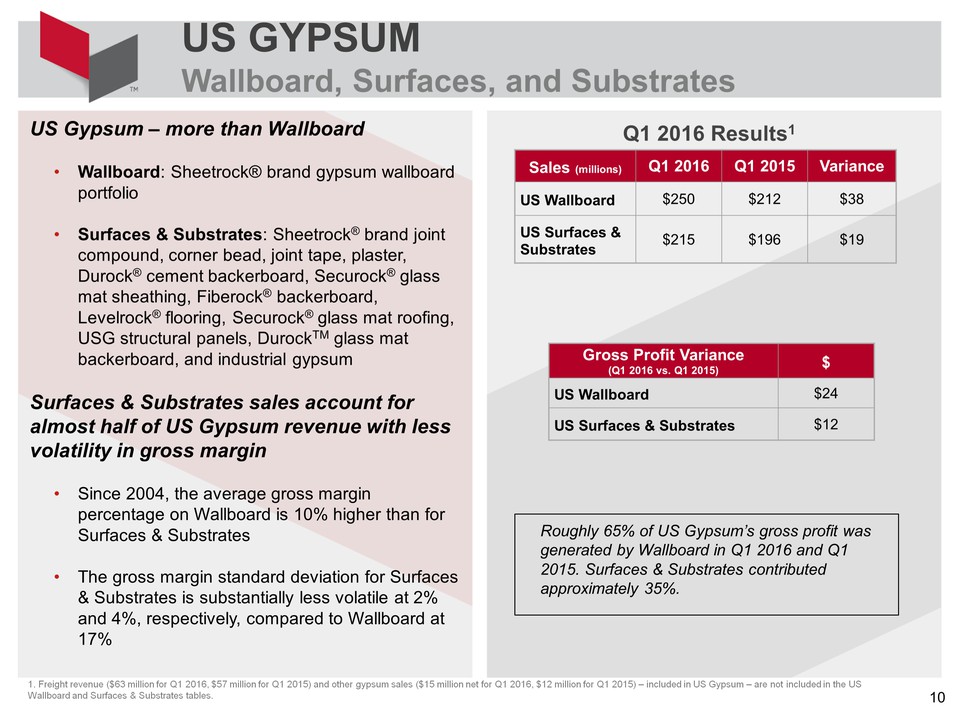

The corporation’s Gypsum segment generated $111 million of operating profit in the first quarter of 2016. On an adjusted basis, operating profit of $108 million in the Gypsum segment improved by $40 million over the first quarter of 2015, led by the US Gypsum business which realized 520 basis points of improved operating margins to 19%. Wallboard products provided $24 million of this improvement, and surfaces and substrates drove a record $12 million of incremental profit. Wallboard volumes were up 20% while wallboard price was down roughly 2% on differences in mix and the timing of price increases. The corporation reported that a March 28, 2016 wallboard price increase has driven price improvement in wallboard through the first three weeks of the second quarter of 2016.

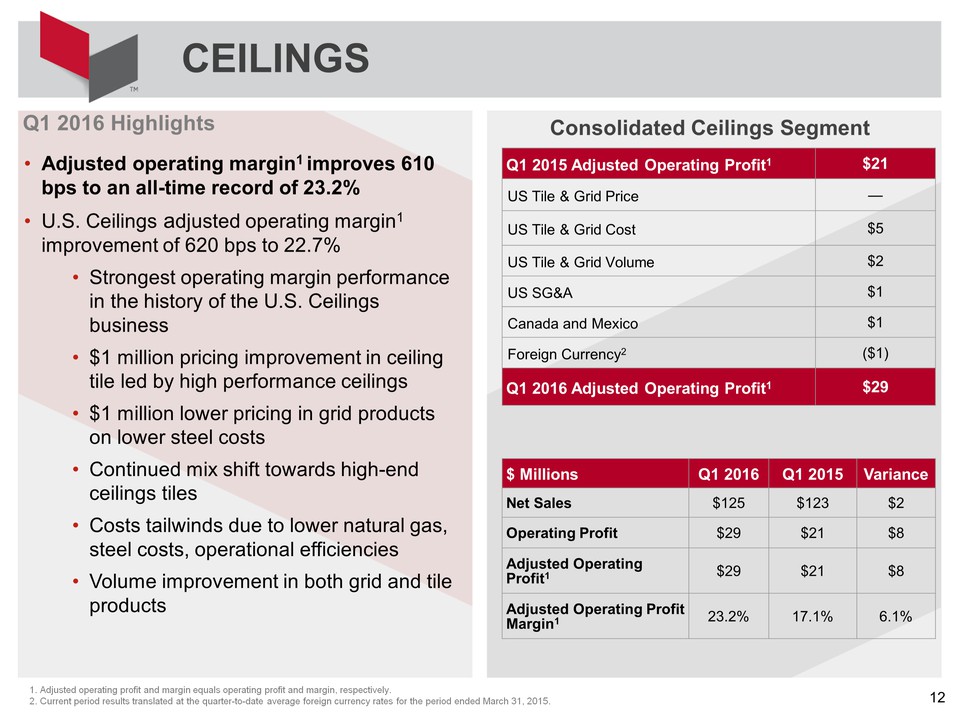

The Ceilings segment earned $29 million of operating profit in the first quarter of 2016 compared to $21 million in the first quarter of 2015. Stronger pricing in tile products, and improved volumes and lower costs in all ceilings products drove first quarter margins up 620 basis points to 22.7%, the best in the history of the US Ceilings business.

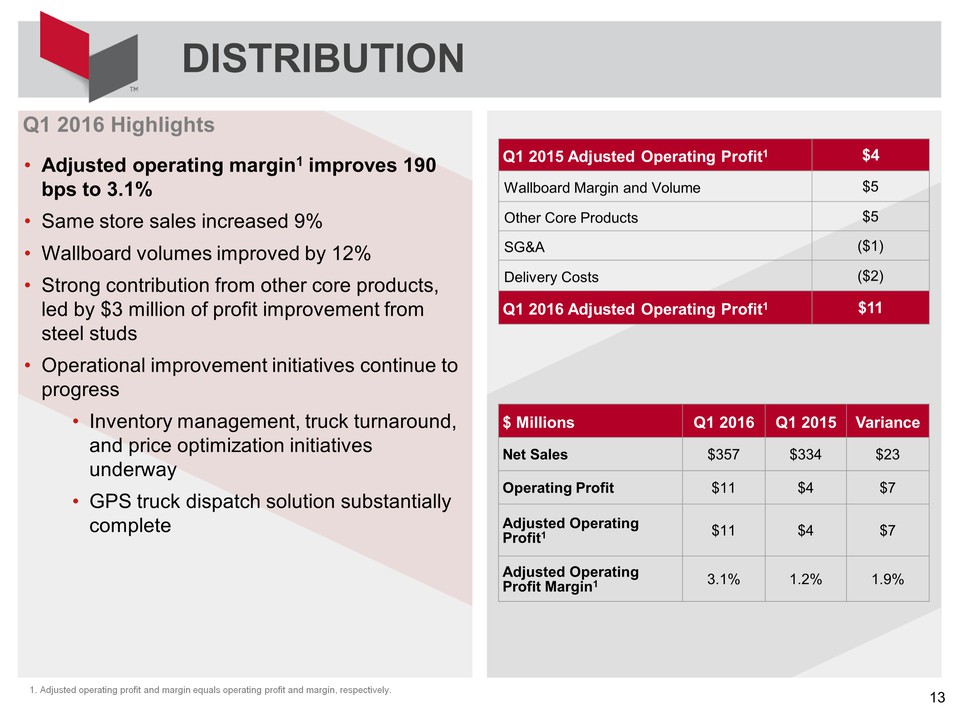

The Distribution segment earned $11 million of operating profit in the first quarter of 2016 compared to $4 million in the first quarter of 2015. Operating margins improved 190 basis points to 3.1%, with same store sales and wallboard volumes increasing 9% and 12%, respectively.

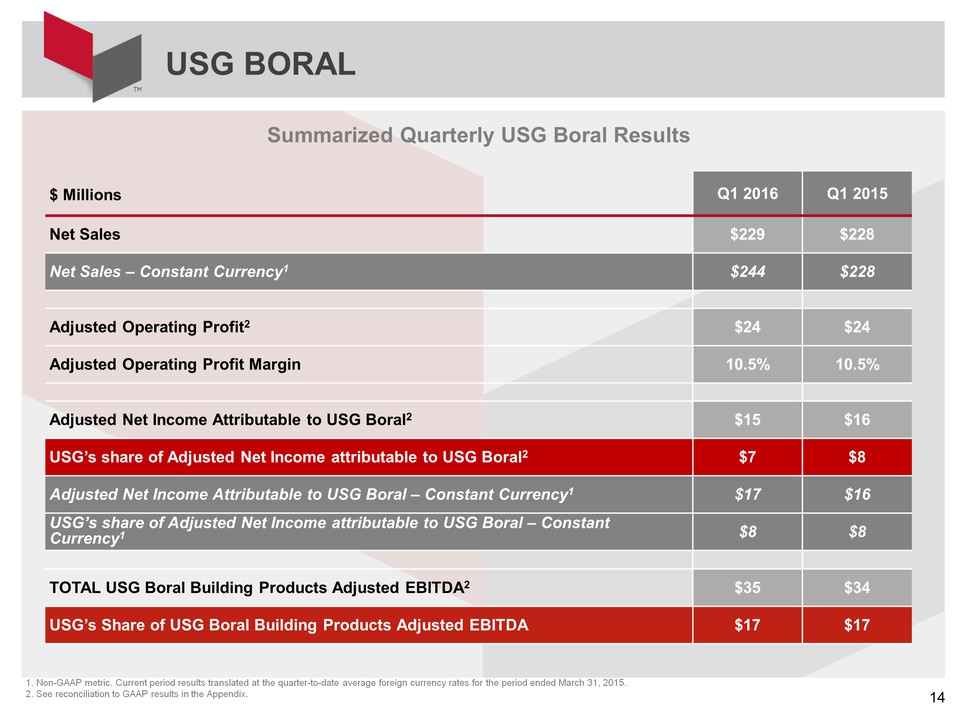

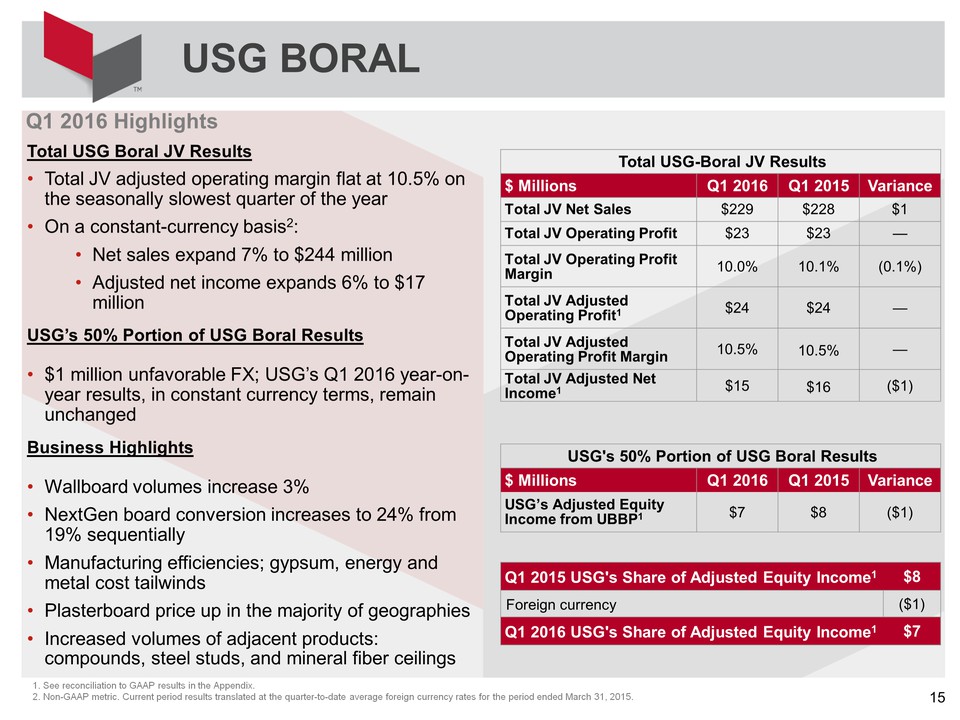

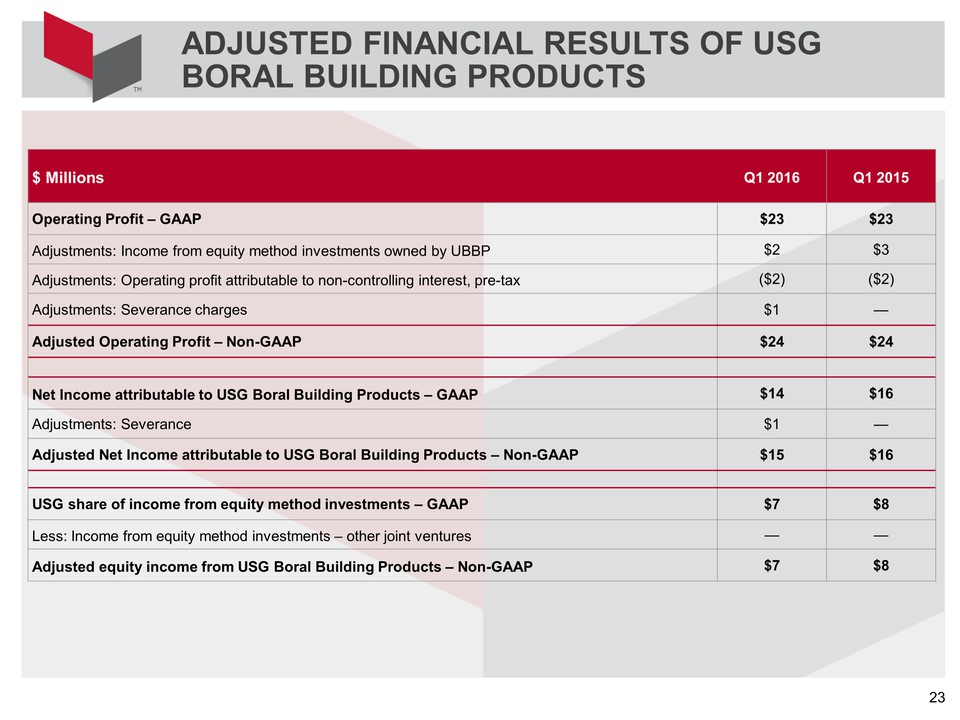

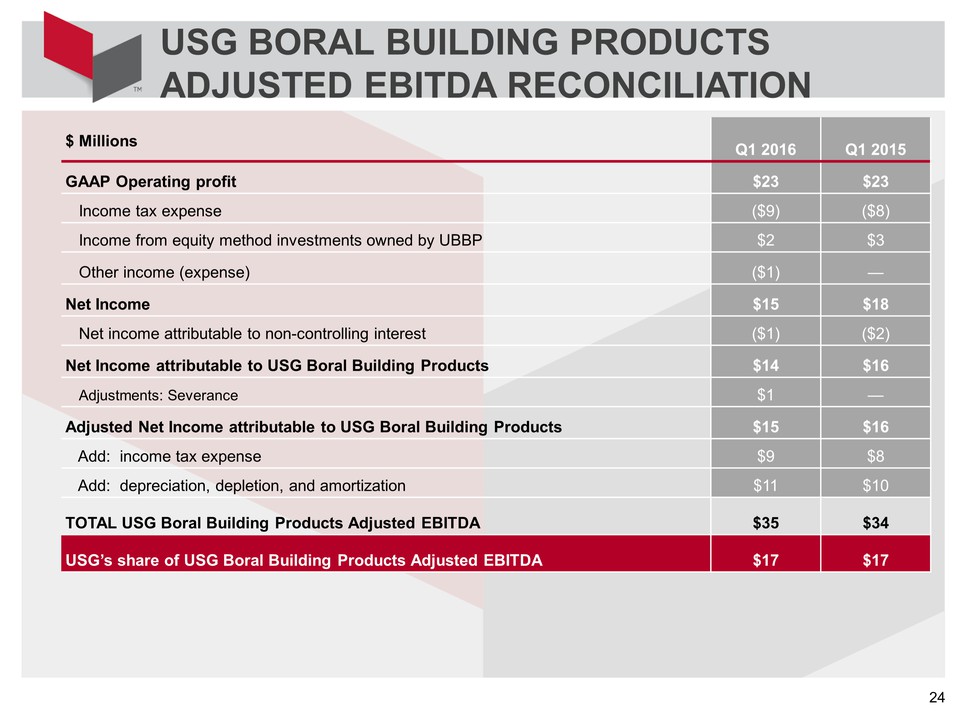

The USG Boral business generated $7 million of equity method income in the first quarter of 2016, down $1 million from the first quarter of 2015 due to the unfavorable impact of foreign currency.

“We’ve started off 2016 by generating positive momentum that we can build on the rest of the year,” Mr. Metcalf said. “We’ll advance our Plan to Win throughout 2016 by strengthening our core businesses, diversifying our earnings, and differentiating USG through innovation.”

A conference call is being held today at 9:00 a.m. Eastern time (8:00 a.m. Central time) during which USG senior management will discuss the corporation’s operating results. The conference call will be webcast on the USG website, www.usg.com, in the Investor Relations section. The dial-in number for the conference call is 1-800-315-2944 in the United States and Canada (1-847-413-2929 for other international callers), and the pass code is 42125066. After the live webcast, a replay of the webcast will be available on the USG website. In addition, a telephonic replay of the call will be available until Friday, May 6, 2016. The replay dial-in number is 1-888-843-7419 (1-630-652-3042 for international callers), and the pass code is 42125066.

USG Corporation

USG Corporation is a manufacturer and distributor of innovative, high-performance building systems through its United States Gypsum Company, USG Interiors, LLC, and L&W Supply Corporation subsidiaries and its USG Boral Building Products joint ventures. Headquartered in Chicago, USG's worldwide operations serve the commercial, residential, and repair and remodel construction markets, enabling our customers to build the outstanding spaces where people live, work and play. USG wall, ceiling, exterior sheathing, flooring underlayment and roofing systems provide leading-edge building solutions, while L&W Supply branch locations efficiently stock and deliver building materials throughout the United States. USG Boral Building Products is a leading plasterboard & ceilings joint venture across Asia, Australasia, and the Middle East. USG and its subsidiaries are proud sponsors of the U.S. Olympic and Paralympic teams and the Canadian Olympic team. For additional information, visit www.usg.com.

Non-GAAP Financial Measures

In this press release, the corporation’s financial results are provided both in accordance with accounting principles generally accepted in the United States of America (GAAP) and using certain non-GAAP financial measures. In particular, the corporation presents the non-GAAP financial measures adjusted operating profit, impacts of foreign currency on current period results using prior period translation rates, adjusted net income, adjusted net sales, adjusted earnings per diluted share, and adjusted EBITDA per diluted share, which exclude certain items. The non-GAAP financial measures are included as a complement to results provided in accordance with GAAP because management believes these non-GAAP financial measures help investors’ ability to analyze underlying trends in the corporation’s business, evaluate its performance relative to other companies in its industry and provide useful information to both management and investors by excluding certain items that may not be indicative of the corporation’s core operating results. In addition, adjusted operating profit includes the income from the corporation's equity method investments, including USG Boral Building Products, because management views the joint ventures as a business unit, even though the corporation’s share of the joint venture is 50%. In addition, the corporation uses adjusted operating profit and adjusted net income as components in the measurement of incentive compensation. Adjusted EBITDA per diluted share is presented to aid in the comparability of results on a per share basis after an income tax valuation allowance release in the fourth quarter of 2015. Adjusted results also exclude results from Gypsum Transportation Limited (GTL), a shipping operation that the corporation has exited. Adjustments to net earnings are shown net of the tax effect computed at applicable statutory rates. The non-GAAP measures should not be considered a substitute for or superior to GAAP results and may vary from others in the industry. For further information related to the corporation’s use of non-GAAP financial measures, and reconciliations to the nearest GAAP measures, see the schedules attached hereto.

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 related to management’s expectations about future conditions, including but not limited to, management's expectation about performance in 2016. Actual business, market or other conditions may differ materially from management’s expectations and, accordingly, may affect our sales and profitability or other results and liquidity. Any forward-looking statements represent our views only as of today and should not be relied upon as representing our views as of any subsequent date. Actual results may differ materially due to various other factors, including: economic conditions, such as the levels of new home and other construction activity, employment levels, the availability of mortgage, construction and other financing, mortgage and other interest rates, housing affordability and supply, the levels of foreclosures and home resales, currency exchange rates and consumer confidence; our ability to maintain or achieve price increases; our substantial indebtedness and our ability to incur substantial additional indebtedness; capital markets conditions and the availability of borrowings under our credit agreement or other financings; competitive conditions, such as price, service and product competition; certain of our customers having significant buying power; the loss of one or more major customers and our customers’ ability to meet their financial obligations to us; shortages in raw materials or changes in raw material and energy costs; our ability to successfully operate the joint venture with Boral Limited, including risks that our joint venture partner, Boral Limited, may not fulfill its obligations as an investor or may take actions that are inconsistent with our objectives; volatility in the assumptions used to determine the funded status of our pension plans; our ability to protect our intellectual property and other proprietary rights; a security breach of company information; changes in laws or regulations, including environmental and safety regulations; the outcome in legal and governmental proceedings; the occurrence of an “ownership change” within the meaning of the Internal Revenue Code; the effects of acts of terrorism or war upon domestic and international economies and financial markets; and acts of God. We assume no obligation to update any forward-looking information contained in this press release. Additional information concerning these and other factors may be found in our filings with the Securities and Exchange Commission, including the “Risk Factors” in our most recent Annual Report on Form 10-K.

| USG CORPORATION | |||||||||

| CONSOLIDATED STATEMENTS OF INCOME | |||||||||

| (dollars in millions, except share and per share data) | |||||||||

| (Unaudited) | |||||||||

| Three months ended March 31, | |||||||||

| 2016 | 2015 | ||||||||

| Net sales | $ | 970 | $ | 909 | |||||

| Cost of products sold | 775 | 756 | |||||||

| Gross profit | 195 | 153 | |||||||

| Selling and administrative expenses | 71 | 77 | |||||||

| Recovery of receivable | (3 | ) | — | ||||||

| Operating profit | 127 | 76 | |||||||

| Income from equity method investments | 7 | 8 | |||||||

| Interest expense | (40 | ) | (43 | ) | |||||

| Interest income | 2 | 1 | |||||||

| Loss on extinguishment of debt | (2 | ) | (19 | ) | |||||

| Other income (expense), net | 3 | (1 | ) | ||||||

| Income before income taxes | 97 | 22 | |||||||

| Income tax (expense) benefit | (30 | ) | 2 | ||||||

| Net income | 67 | 24 | |||||||

| Basic earnings per common share | $ | 0.46 | $ | 0.16 | |||||

| Diluted earnings per common share | $ | 0.46 | $ | 0.16 | |||||

| Average common shares | 145,819,026 | 145,381,269 | |||||||

| Average diluted common shares | 146,986,392 | 147,176,197 | |||||||

|

USG CORPORATION |

||||||||

| CONSOLIDATED BALANCE SHEETS | ||||||||

| (dollars in millions) | ||||||||

| (Unaudited) | ||||||||

| As of | As of | |||||||

| March 31, 2016 | December 31, 2015 | |||||||

| Assets | ||||||||

| Cash and cash equivalents | $ | 347 | $ | 442 | ||||

| Short-term marketable securities | 206 | 194 | ||||||

| Restricted cash | — | 9 | ||||||

| Receivables (net of reserves - $11 and $14) | 459 | 391 | ||||||

| Inventories | 318 | 314 | ||||||

| Income taxes receivable | 4 | 5 | ||||||

| Other current assets | 36 | 45 | ||||||

| Total current assets | 1,370 | 1,400 | ||||||

| Long-term marketable securities | 20 | 36 | ||||||

| Property, plant and equipment (net of accumulated | ||||||||

| depreciation and depletion - $1,974 and $1,936) | 1,770 | 1,788 | ||||||

| Deferred income taxes | 698 | 728 | ||||||

| Equity method investments | 706 | 682 | ||||||

| Other assets | 98 | 102 | ||||||

| Total assets | $ | 4,662 | $ | 4,736 | ||||

| Liabilities and Stockholders' Equity | ||||||||

| Accounts payable | $ | 267 | $ | 259 | ||||

| Accrued expenses | 198 | 214 | ||||||

| Current portion of long-term debt | 438 | 500 | ||||||

| Income taxes payable | 6 | 9 | ||||||

| Litigation settlement accrual | — | 9 | ||||||

| Total current liabilities | 909 | 991 | ||||||

| Long-term debt | 1,676 | 1,675 | ||||||

| Deferred income taxes | 3 | 5 | ||||||

| Pension and other postretirement benefits | 341 | 392 | ||||||

| Other liabilities | 215 | 237 | ||||||

| Total liabilities | 3,144 | 3,300 | ||||||

| Stockholders' Equity: | ||||||||

| Preferred stock | — | — | ||||||

| Common stock | 15 | 15 | ||||||

| Additional paid-in capital | 3,027 | 3,027 | ||||||

| Accumulated other comprehensive loss | (299 | ) | (314 | ) | ||||

| Retained earnings (accumulated deficit) | (1,225 | ) | (1,292 | ) | ||||

| Stockholders' equity of parent | 1,518 | 1,436 | ||||||

| Noncontrolling interest | — | — | ||||||

| Total stockholders' equity including noncontrolling interest | 1,518 | 1,436 | ||||||

| Total liabilities and stockholders' equity | $ | 4,662 | $ | 4,736 | ||||

| Other Information: | ||||||||

| Total cash and cash equivalents and marketable securities | $ | 573 | $ | 672 | ||||

| Borrowing availability under existing credit facilities | 347 | 295 | ||||||

| Total Liquidity | $ | 920 | $ | 967 | ||||

| USG CORPORATION | ||||||||

| CONSOLIDATED STATEMENTS OF CASH FLOWS | ||||||||

| (dollars in millions) | ||||||||

| (Unaudited) | ||||||||

| Three months ended March 31, | ||||||||

| 2016 | 2015 | |||||||

| Operating Activities | ||||||||

| Net income | $ | 67 | $ | 24 | ||||

| Adjustments to reconcile income from continuing operations to net cash: | ||||||||

| Depreciation, depletion and amortization | 36 | 36 | ||||||

| Loss on extinguishment of debt | 2 | 19 | ||||||

| Recovery on receivable | (3 | ) | — | |||||

| Share-based compensation expense | 4 | 3 | ||||||

| Deferred income taxes | 29 | 1 | ||||||

| Income from equity method investments | (7 | ) | (8 | ) | ||||

| Pension settlement | 2 | — | ||||||

| (Increase) decrease in working capital: | ||||||||

| Receivables | (65 | ) | (54 | ) | ||||

| Income taxes receivable | 1 | (1 | ) | |||||

| Inventories | (3 | ) | (2 | ) | ||||

| Other current assets | 5 | 1 | ||||||

| Payables | 5 | (43 | ) | |||||

| Accrued expenses | (42 | ) | (23 | ) | ||||

| Decrease in other assets | 1 | — | ||||||

| (Decrease) increase in pension and other postretirement benefits | (56 | ) | 6 | |||||

| Decrease in other liabilities | (1 | ) | (4 | ) | ||||

| Other, net | (5 | ) | 3 | |||||

| Net cash used for operating activities | $ | (30 | ) | $ | (42 | ) | ||

| Investing Activities | ||||||||

| Purchases of marketable securities | (79 | ) | (21 | ) | ||||

| Sales or maturities of marketable securities | 84 | 87 | ||||||

| Capital expenditures | (15 | ) | (29 | ) | ||||

| Net proceeds from asset dispositions | — | 1 | ||||||

| Return (deposit) of restricted cash | 9 | (39 | ) | |||||

| Net cash used for investing activities | $ | (1 | ) | $ | (1 | ) | ||

| Financing Activities | ||||||||

| Issuance of debt | — | 350 | ||||||

| Repayment of debt | (64 | ) | (368 | ) | ||||

| Payment of debt issuance fees | — | (6 | ) | |||||

| Issuance of common stock | — | 3 | ||||||

| Repurchases of common stock to satisfy employee tax withholding obligations | (1 | ) | (8 | ) | ||||

| Net cash used for financing activities | $ | (65 | ) | $ | (29 | ) | ||

| Effect of exchange rate changes on cash | 1 | (3 | ) | |||||

| Net decrease in cash and cash equivalents | $ | (95 | ) | $ | (75 | ) | ||

| Cash and cash equivalents at beginning of period | 442 | 228 | ||||||

| Cash and cash equivalents at end of period | $ | 347 | $ | 153 | ||||

| (continued) | ||||||||

| USG CORPORATION | ||||||||

| CONSOLIDATED STATEMENTS OF CASH FLOWS (Continued) | ||||||||

| (dollars in millions) | ||||||||

| (Unaudited) | ||||||||

| Three months ended March 31, | ||||||||

| 2016 | 2015 | |||||||

| Supplemental Cash Flow Disclosures: | ||||||||

| Interest paid, net of interest capitalized | $ | 47 | $ | 50 | ||||

| Income taxes paid, net of refunds received | 3 | 1 | ||||||

| Noncash Investing and Financing Activities: | ||||||||

| Amount in accounts payable for capital expenditures | 3 | 8 | ||||||

| USG CORPORATION | ||||||||

| CORE BUSINESS RESULTS | ||||||||

| (dollars in millions) | ||||||||

| (Unaudited) | ||||||||

| Three months ended March 31, | ||||||||

| 2016 | 2015 | |||||||

|

Net Sales: |

||||||||

| Gypsum: | ||||||||

| United States | $ | 543 | $ | 477 | ||||

| Canada | 82 | 76 | ||||||

| Mexico / Latin America | 44 | 48 | ||||||

| Canadian Mining | — | — | ||||||

| Gypsum Transportation Limited | — | 10 | ||||||

| Eliminations | (34 | ) | (34 | ) | ||||

| Total | 635 | 577 | ||||||

| Ceilings: | ||||||||

| United States | 119 | 115 | ||||||

| Canada | 13 | 14 | ||||||

| Mexico / Latin America | 8 | 9 | ||||||

| Eliminations | (15 | ) | (15 | ) | ||||

| Total | 125 | 123 | ||||||

| Distribution: | ||||||||

| L&W Supply | 357 | 334 | ||||||

| Eliminations | (147 | ) | (125 | ) | ||||

| Total USG Corporation Net Sales(a) | $ | 970 | $ | 909 | ||||

|

Operating Profit (Loss): |

||||||||

| Gypsum: | ||||||||

| United States | $ | 103 | $ | 66 | ||||

| Canada | 6 | 1 | ||||||

| Mexico / Latin America | 2 | 4 | ||||||

| Canadian Mining | (3 | ) | (3 | ) | ||||

| Gypsum Transportation Limited | 3 | — | ||||||

| Total | 111 | 68 | ||||||

| Ceilings: | ||||||||

| United States | 27 | 19 | ||||||

| Canada | 1 | 1 | ||||||

| Mexico / Latin America | 1 | 1 | ||||||

| Total | 29 | 21 | ||||||

| Distribution: | ||||||||

| L&W Supply | 11 | 4 | ||||||

| Corporate | (21 | ) | (23 | ) | ||||

| Eliminations | (3 | ) | 6 | |||||

| Total USG Corporation Operating Profit | $ | 127 | $ | 76 | ||||

| USG Boral Building Products (UBBP): | ||||||||

| Net sales | $ | 229 | $ | 228 | ||||

| Operating profit | 23 | 23 | ||||||

| Net income attributable to UBBP | 14 | 16 | ||||||

| USG share of income from UBBP | 7 | 8 | ||||||

| (a) Foreign currency unfavorably impacted net sales by $12 million for the three months March 31, 2016. |

| USG CORPORATION | ||||

| ROLLFORWARD OF QUARTERLY ADJUSTED OPERATING PROFIT | ||||

| (dollars in millions) | ||||

| (Unaudited) | ||||

| Adjusted operating profit - Non-GAAP measure - Three months ended March 31, 2015 | $ | 84 | ||

| US Wallboard | 24 | |||

| US Surfaces and Substrates | 12 | |||

| US Gypsum Selling, General, and Administrative Expenses | 1 | |||

| US Ceilings | 8 | |||

| Distribution | 7 | |||

| Canada, Mexico, and Mining | 3 | |||

| USG Boral Equity Method Income | (1 | ) | ||

| Corporate and Eliminations | (7 | ) | ||

| Adjusted operating profit - Non-GAAP measure - Three months ended March 31, 2016 | $ | 131 | ||

| USG CORPORATION | ||||||||

| RECONCILIATION OF NON-GAAP MEASURES TO GAAP MEASURES | ||||||||

| (dollars in millions, except share and per share data) | ||||||||

| (Unaudited) | ||||||||

| Three months ended March 31, | ||||||||

| 2016 | 2015 | |||||||

| Net sales - GAAP measure | $ | 970 | $ | 909 | ||||

| GTL - Shipping operations | — | (10 | ) | |||||

| Adjusted net sales - Non-GAAP measure | $ | 970 | $ | 899 | ||||

| Operating profit - GAAP measure | $ | 127 | $ | 76 | ||||

| GTL (recovery) of receivable / shipping operations | (3 | ) | — | |||||

| Income from equity method investments | 7 | 8 | ||||||

| Adjusted operating profit - Non-GAAP measure | $ | 131 | $ | 84 | ||||

| Gypsum operating profit - GAAP measure | $ | 111 | $ | 68 | ||||

| GTL (recovery) of receivable / shipping operations | (3 | ) | — | |||||

| Gypsum adjusted operating profit - Non-GAAP measure | $ | 108 | $ | 68 | ||||

| Net income - GAAP measure | $ | 67 | $ | 24 | ||||

| GTL (recovery) of receivable / shipping operations, net of tax | (5 | ) | 1 | |||||

| Loss on extinguishment of debt, net of tax | 1 | 19 | ||||||

| Adjusted net income - Non-GAAP measure | $ | 63 | $ | 44 | ||||

| Earnings per average diluted common share - GAAP measure | $ | 0.46 | $ | 0.16 | ||||

| Adjustments per average diluted common share: | ||||||||

| GTL (recovery) of receivable / shipping operations, net of tax | (0.04 | ) | 0.01 | |||||

| Loss on extinguishment of debt, net of tax | 0.01 | 0.13 | ||||||

| Adjusted earnings per adjusted average diluted common share – Non-GAAP measure | $ | 0.43 | $ | 0.30 | ||||

| USG CORPORATION | ||||||||

| RECONCILIATION OF NON-GAAP MEASURES TO GAAP MEASURES | ||||||||

| (dollars in millions, except share and per share data) | ||||||||

| (Unaudited) | ||||||||

| Three months ended March 31, | ||||||||

| 2016 | 2015 | |||||||

| Net income - GAAP measure | $ | 67 | $ | 24 | ||||

| Add: Interest expense, net | 38 | 42 | ||||||

| Add: Income tax (expense) benefit | 30 | (2 | ) | |||||

| Add: Depreciation, depletion, and amortization | 35 | 35 | ||||||

| EBITDA | 170 | 99 | ||||||

| Add: Share-based compensation expense | 4 | 3 | ||||||

| Add: ARO accretion expense | 2 | 2 | ||||||

| Add: Loss on extinguishment of debt | 2 | 19 | ||||||

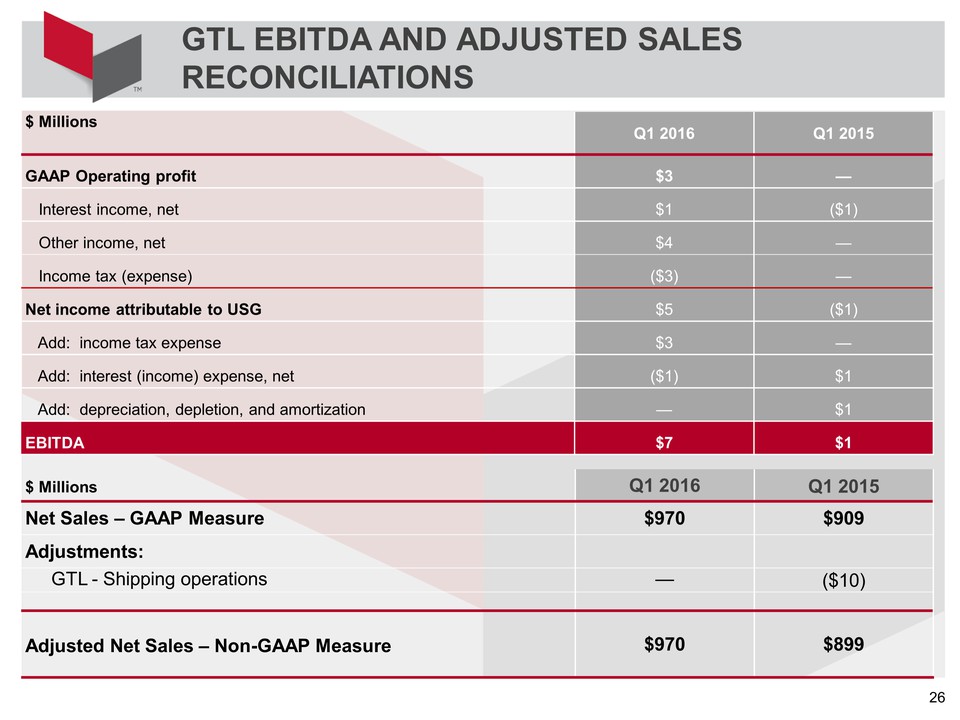

| Subtract: GTL EBITDA | (7 | ) | (1 | ) | ||||

| Subtract: USG's equity method investment income from UBBP | (7 | ) | (8 | ) | ||||

| Add: USG's share of UBBP adjusted EBITDA | 17 | 17 | ||||||

| Adjusted EBITDA | 181 | 131 | ||||||

| Adjusted EBITDA per adjusted average diluted common share | 1.23 | 0.89 | ||||||

| Average diluted common shares – GAAP | 146,986,392 | 147,176,197 | ||||||

| Adjustment to add common shares that would be dilutive based on adjusted net income | — | — | ||||||

| Adjusted average diluted common shares – Non-GAAP | 146,986,392 | 147,176,197 | ||||||

|

Currency impacts on consolidated and segment results have been derived by translating current period results at the quarter-to-date average foreign currency rates for the period ending March 31, 2015, as applicable. |

CONTACT:

USG Corporation

Media

Sasha Bigda

(312) 436-6511

[email protected]

or

Investors

Ryan

Flanagan

(312) 436-5304

[email protected]

Exhibit 99.2

April 21, 2016 USG CorporationFirst Quarter 2016 EarningsConference Call and Webcast

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 related to management’s expectations about future conditions, including but not limited to, management’s outlook for 2016. Actual business, market or other conditions may differ materially from management’s expectations and, accordingly, may affect our sales and profitability or other results and liquidity. Any forward-looking statements represent our views only as of today and should not be relied upon as representing our views as of any subsequent date. Actual results may differ materially due to various other factors, including: economic conditions, such as the levels of new home and other construction activity, employment levels, the availability of mortgage, construction and other financing, mortgage and other interest rates, housing affordability and supply, the levels of foreclosures and home resales, currency exchange rates and consumer confidence; our ability to maintain or achieve price increases; our substantial indebtedness and our ability to incur substantial additional indebtedness; capital markets conditions and the availability of borrowings under our credit agreement or other financings; competitive conditions, such as price, service and product competition; certain of our customers having significant buying power; the loss of one or more major customers and our customers’ ability to meet their financial obligations to us; shortages in raw materials or changes in raw material and energy costs; our ability to successfully operate the joint venture with Boral Limited, including risks that our joint venture partner, Boral Limited, may not fulfill its obligations as an investor or may take actions that are inconsistent with our objectives; volatility in the assumptions used to determine the funded status of our pension plans; our ability to protect our intellectual property and other proprietary rights; a security breach of company information; changes in laws or regulations, including environmental and safety regulations; the outcome in legal and governmental proceedings; the occurrence of an “ownership change” within the meaning of the Internal Revenue Code; the effects of acts of terrorism or war upon domestic and international economies and financial markets; and acts of God. We assume no obligation to update any forward-looking information contained in this presentation. Additional information concerning these and other factors may be found in our filings with the Securities and Exchange Commission, including the “Risk Factors” in our most recent Annual Report on Form 10-K. CAUTIONARY STATEMENTS 2

USG Corporation First Quarter 2016 Agenda Overview and StrategyFinancial ResultsMarket OutlookQuestionsClosing Remarks James S. MetcalfChairman, President and CEOMatthew F. HilzingerExecutive VP, Chief Financial OfficerJames S. MetcalfChairman, President and CEOJames S. MetcalfChairman, President and CEO 3

Q1 2016 HIGHLIGHTS Adjusted EBITDA per diluted share1 increases almost 40% to $1.23Adjusted operating profit1 increases to $131 million from $84 millionAdjusted operating margin expansion in most of our businessesU.S. Gypsum – 520 bps improvement to 19.0%, best margin since Q3 2006U.S. Ceilings – 620 bps improvement to 22.7%, best margin in the history of the businessDistribution – 190 bps improvement to 3.1%, best margin since Q4 2007USG Boral – Adjusted operating margins unchanged at 10.5%1Surfaces and Substrates – $12 million of improved profit, highest incremental profit contribution everSG&A of $71 million – lowest level of first quarter SG&A in 15 yearsAdjusted EBITDA1 of $181 million – highest quarterly adjusted EBITDA in 9 yearsRetired $109 million2 of 6.3% notes due November 2016 via open market purchases through April 21st Foreign currency – Unfavorable impact to net income ($6 million) and sales ($12 million)3 4 1. See reconciliation to GAAP results in the Appendix.2. $62 million of debt retired through March 31, 2016 and $47 million retired between April 1, 2016 and April 21, 2016.3. Current period results translated at the quarter to date average foreign currency rates for the period ended March 31, 2015.

$ Millions (except EPS) Q1 2016 Q1 2015 Net sales $970 $909 Gross profit $195 $153 % of net sales 20.1% 16.8% SG&A $71 $77 Operating profit $127 $76 Net interest expense $38 $42 Income tax (expense) benefit ($30) $2 GAAP net income $67 $24 Diluted EPS $0.46 $0.16 GTL (recovery) of receivables/shipping operations, net of tax1 ($5) $1 Loss on debt extinguishment, net of tax2 $1 $19 Adjusted net income3 $63 $44 Adjusted diluted EPS3 $0.43 $0.30 Adjusted EBITDA3 $181 $131 Adjusted EBITDA per diluted share3 $1.23 $0.89 1. ($8) million, net of $3 million tax in Q1 2016. $1 million, net of $0 tax, in Q1 2015.2. $2 million, net of ($1) million tax in Q1 2016. $19 million, net of $0 tax in Q1 2015.3. See reconciliation to GAAP results in the Appendix. Q1 2016 CONSOLIDATED FINANCIAL RESULTS 5

PLAN TO WIN Strengthen the core- North American manufacturing and distribution - De-lever our balance sheetDiversify the sources of our earnings- Strategic geographic extensions- USG Boral Building Products- Adjacent products/systemsDifferentiate through innovation- Differentiate USG in the market - Focus on high performance products and solutions that improve energy efficiency, sustainability, and speed of construction 6

FIRST QUARTER 2016 GAAP RESULTS $ Millions Q1 2016 Q1 2015 Change Gypsum Sales1 $635 $577 $58 Ceilings Sales $125 $123 $2 Distribution Sales $357 $334 $23 Eliminations ($147) ($125) ($22) TOTAL USG CORPORATION SALES $970 $909 $61 Gypsum Operating Profit $111 $68 $43 Ceilings Operating Profit $29 $21 $8 Distribution Operating Profit $11 $4 $7 Corporate and Eliminations ($24) ($17) ($7) TOTAL USG CORPORATION OPERATING PROFIT $127 $76 $51 Total USG Boral Building Products (UBBP) Sales $229 $228 $1 Total USG Boral Building Products (UBBP) Operating Profit $23 $23 — USG’s EQUITY INCOME FROM USG-BORAL $7 $8 ($1) 1. Absent foreign currency impact of $10 million and GTL sales of $10 million in Q1 2015, Gypsum sales expand by $78 million. 7

CURRENCY IMPACT Consolidated Results Q1 2016 as Reported At Q1 2015 Rates2 Currency Impact Net sales $970 $982 ($12) Adjusted operating profit1 $131 $137 ($6) Adjusted operating profit margin1 13.5% 14.0% (0.5%) Adjusted net income1 $63 $69 ($6) Adjusted diluted EPS1 $0.43 $0.47 ($0.04) Adjusted EBITDA1 $181 $187 ($6) Gypsum Segment Net sales $635 $645 ($10) Adjusted operating profit1 $108 $112 ($4) Adjusted operating profit margin1 17.0% 17.4% (0.4%) Ceilings Segment Net sales $125 $127 ($2) Adjusted operating profit1 $29 $30 ($1) Adjusted operating profit margin1 23.2% 23.6% (0.4%) USG Boral Segment Net sales $229 $244 ($15) Adjusted operating profit1 $24 $26 ($2) Adjusted operating profit margin1 10.5% 10.7% (0.2%) 1. See reconciliation to GAAP results in the Appendix.2. Non-GAAP metric. Current period results translated at the quarter-to-date average foreign currency exchange rates for the period ended March 31, 2015. 8

Q1 2016 HighlightsAdjusted operating margin improves 500 bps to 17.0% US Gypsum adjusted operating margin3 improvement of 520 bps to 19.0%Volumes up 20% on strong organic demand, improved weather, and some surge buyWallboard pricing down 2% year-over-year in the first quarter on differences in mix (product and geographical), and the timing of price increasesCost tailwinds driven by higher volumes coupled with lower gas costs and lean six sigma effortsMarch 28th US wallboard price increase drives sequential price improvement through the first three weeks of April 2016US Surfaces & Substrates: Record $12 million of profit improvement led by Joint Treatment, Durock®, Securock® roofing products, and structural panels GYPSUM 1. See reconciliation to GAAP results in the Appendix.2. Excludes sales of $10 million from Q1 2015 from our shipping operation, GTL, that we exited in 2015.3. Adjusted operating profit and margin equals operating profit and margin, respectively.4. Current period results translated at the quarter-to-date average foreign currency rates for the period ended March 31, 2015. Q1 2015 Adjusted Operating Profit1 $68 US Wallboard Price ($5) US Wallboard Cost $10 US Wallboard Volume $19 US Surfaces & Substrates $12 US SG&A $1 Canada and Mexico $4 Canada Operational Reserve Adjustments $3 Foreign Currency4 ($4) Q1 2016 Adjusted Operating Profit1 $108 $ Millions Q1 2016 Q1 2015 Variance Net Sales $635 $577 $58 Operating Profit $111 $68 $43 Operating Profit Margin 17.5% 11.8% 5.7% Adjusted Net Sales2 $635 $567 $68 Adjusted Operating Profit1 $108 $68 $40 Adjusted Operating Profit Margin 17.0% 12.0% 5.0% Consolidated Gypsum Segment 9

US GYPSUMWallboard, Surfaces, and Substrates 1. Freight revenue ($63 million for Q1 2016, $57 million for Q1 2015) and other gypsum sales ($15 million net for Q1 2016, $12 million for Q1 2015) – included in US Gypsum – are not included in the US Wallboard and Surfaces & Substrates tables. US Gypsum – more than WallboardWallboard: Sheetrock® brand gypsum wallboard portfolio Surfaces & Substrates: Sheetrock® brand joint compound, corner bead, joint tape, plaster, Durock® cement backerboard, Securock® glass mat sheathing, Fiberock® backerboard, Levelrock® flooring, Securock® glass mat roofing, USG structural panels, DurockTM glass mat backerboard, and industrial gypsumSurfaces & Substrates sales account for almost half of US Gypsum revenue with less volatility in gross margin Since 2004, the average gross margin percentage on Wallboard is 10% higher than for Surfaces & SubstratesThe gross margin standard deviation for Surfaces & Substrates is substantially less volatile at 2% and 4%, respectively, compared to Wallboard at 17% Sales (millions) Q1 2016 Q1 2015 Variance US Wallboard $250 $212 $38 US Surfaces & Substrates $215 $196 $19 Q1 2016 Results1 Gross Profit Variance (Q1 2016 vs. Q1 2015) $ US Wallboard $24 US Surfaces & Substrates $12 Roughly 65% of US Gypsum’s gross profit was generated by Wallboard in Q1 2016 and Q1 2015. Surfaces & Substrates contributed approximately 35%. 10

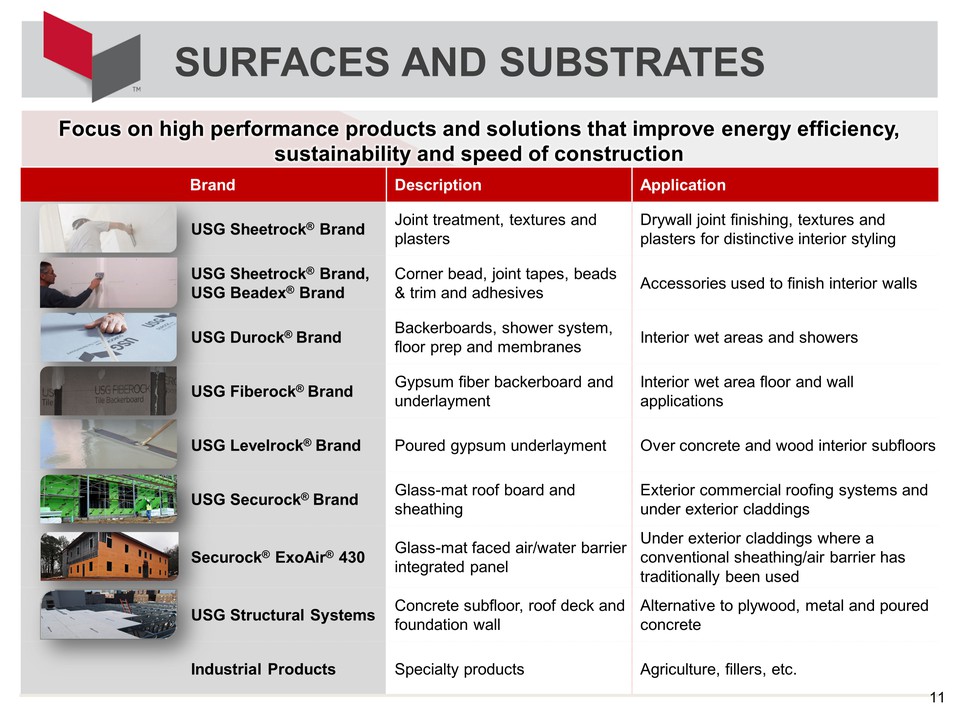

Brand Description Application USG Sheetrock® Brand Joint treatment, textures and plasters Drywall joint finishing, textures and plasters for distinctive interior styling USG Sheetrock® Brand, USG Beadex® Brand Corner bead, joint tapes, beads & trim and adhesives Accessories used to finish interior walls USG Durock® Brand Backerboards, shower system, floor prep and membranes Interior wet areas and showers USG Fiberock® Brand Gypsum fiber backerboard and underlayment Interior wet area floor and wall applications USG Levelrock® Brand Poured gypsum underlayment Over concrete and wood interior subfloors USG Securock® Brand Glass-mat roof board and sheathing Exterior commercial roofing systems and under exterior claddings Securock® ExoAir® 430 Glass-mat faced air/water barrier integrated panel Under exterior claddings where a conventional sheathing/air barrier has traditionally been used USG Structural Systems Concrete subfloor, roof deck and foundation wall Alternative to plywood, metal and poured concrete Industrial Products Specialty products Agriculture, fillers, etc. 11 SURFACES AND SUBSTRATES Focus on high performance products and solutions that improve energy efficiency, sustainability and speed of construction

Q1 2016 HighlightsAdjusted operating margin1 improves 610 bps to an all-time record of 23.2% U.S. Ceilings adjusted operating margin1 improvement of 620 bps to 22.7%Strongest operating margin performance in the history of the U.S. Ceilings business$1 million pricing improvement in ceiling tile led by high performance ceilings$1 million lower pricing in grid products on lower steel costsContinued mix shift towards high-end ceilings tilesCosts tailwinds due to lower natural gas, steel costs, operational efficienciesVolume improvement in both grid and tile products Q1 2015 Adjusted Operating Profit1 $21 US Tile & Grid Price — US Tile & Grid Cost $5 US Tile & Grid Volume $2 US SG&A $1 Canada and Mexico $1 Foreign Currency2 ($1) Q1 2016 Adjusted Operating Profit1 $29 $ Millions Q1 2016 Q1 2015 Variance Net Sales $125 $123 $2 Operating Profit $29 $21 $8 Adjusted Operating Profit1 $29 $21 $8 Adjusted Operating Profit Margin1 23.2% 17.1% 6.1% CEILINGS 1. Adjusted operating profit and margin equals operating profit and margin, respectively.2. Current period results translated at the quarter-to-date average foreign currency rates for the period ended March 31, 2015. Consolidated Ceilings Segment 12

Q1 2015 Adjusted Operating Profit1 $4 Wallboard Margin and Volume $5 Other Core Products $5 SG&A ($1) Delivery Costs ($2) Q1 2016 Adjusted Operating Profit1 $11 $ Millions Q1 2016 Q1 2015 Variance Net Sales $357 $334 $23 Operating Profit $11 $4 $7 Adjusted Operating Profit1 $11 $4 $7 Adjusted Operating Profit Margin1 3.1% 1.2% 1.9% DISTRIBUTION 13 Q1 2016 HighlightsAdjusted operating margin1 improves 190 bps to 3.1%Same store sales increased 9%Wallboard volumes improved by 12%Strong contribution from other core products, led by $3 million of profit improvement from steel studsOperational improvement initiatives continue to progressInventory management, truck turnaround, and price optimization initiatives underwayGPS truck dispatch solution substantially complete 1. Adjusted operating profit and margin equals operating profit and margin, respectively.

USG BORAL $ Millions Q1 2016 Q1 2015 Net Sales $229 $228 Net Sales – Constant Currency1 $244 $228 Adjusted Operating Profit2 $24 $24 Adjusted Operating Profit Margin 10.5% 10.5% Adjusted Net Income Attributable to USG Boral2 $15 $16 USG’s share of Adjusted Net Income attributable to USG Boral2 $7 $8 Adjusted Net Income Attributable to USG Boral – Constant Currency1 $17 $16 USG’s share of Adjusted Net Income attributable to USG Boral – Constant Currency1 $8 $8 TOTAL USG Boral Building Products Adjusted EBITDA2 $35 $34 USG’s Share of USG Boral Building Products Adjusted EBITDA $17 $17 1. Non-GAAP metric. Current period results translated at the quarter-to-date average foreign currency rates for the period ended March 31, 2015. 2. See reconciliation to GAAP results in the Appendix. Summarized Quarterly USG Boral Results 14

Q1 2016 HighlightsTotal USG Boral JV ResultsTotal JV adjusted operating margin flat at 10.5% on the seasonally slowest quarter of the yearOn a constant-currency basis2:Net sales expand 7% to $244 millionAdjusted net income expands 6% to $17 millionUSG’s 50% Portion of USG Boral Results$1 million unfavorable FX; USG’s Q1 2016 year-on-year results, in constant currency terms, remain unchanged Business HighlightsWallboard volumes increase 3%NextGen board conversion increases to 24% from 19% sequentiallyManufacturing efficiencies; gypsum, energy and metal cost tailwindsPlasterboard price up in the majority of geographiesIncreased volumes of adjacent products: compounds, steel studs, and mineral fiber ceilings USG BORAL Total USG-Boral JV Results $ Millions Q1 2016 Q1 2015 Variance Total JV Net Sales $229 $228 $1 Total JV Operating Profit $23 $23 — Total JV Operating Profit Margin 10.0% 10.1% (0.1%) Total JV Adjusted Operating Profit1 $24 $24 — Total JV Adjusted Operating Profit Margin 10.5% 10.5% — Total JV Adjusted Net Income1 $15 $16 ($1) Q1 2015 USG's Share of Adjusted Equity Income1 $8 Foreign currency ($1) Q1 2016 USG's Share of Adjusted Equity Income1 $7 1. See reconciliation to GAAP results in the Appendix.2. Non-GAAP metric. Current period results translated at the quarter-to-date average foreign currency rates for the period ended March 31, 2015. 15 USG's 50% Portion of USG Boral Results $ Millions Q1 2016 Q1 2015 Variance USG’s Adjusted Equity Income from UBBP1 $7 $8 ($1)

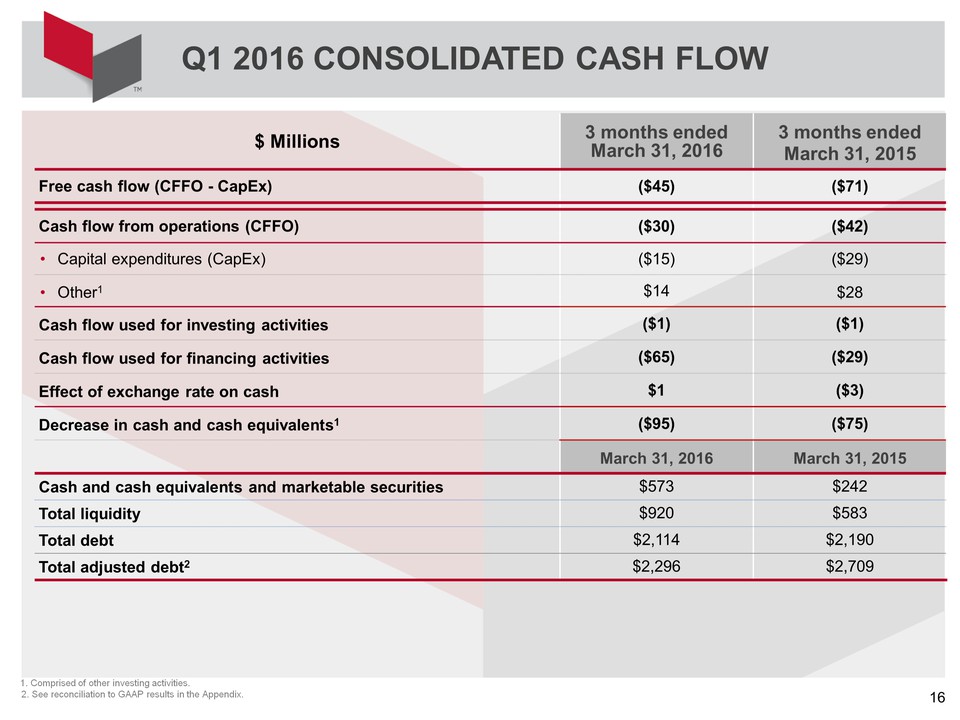

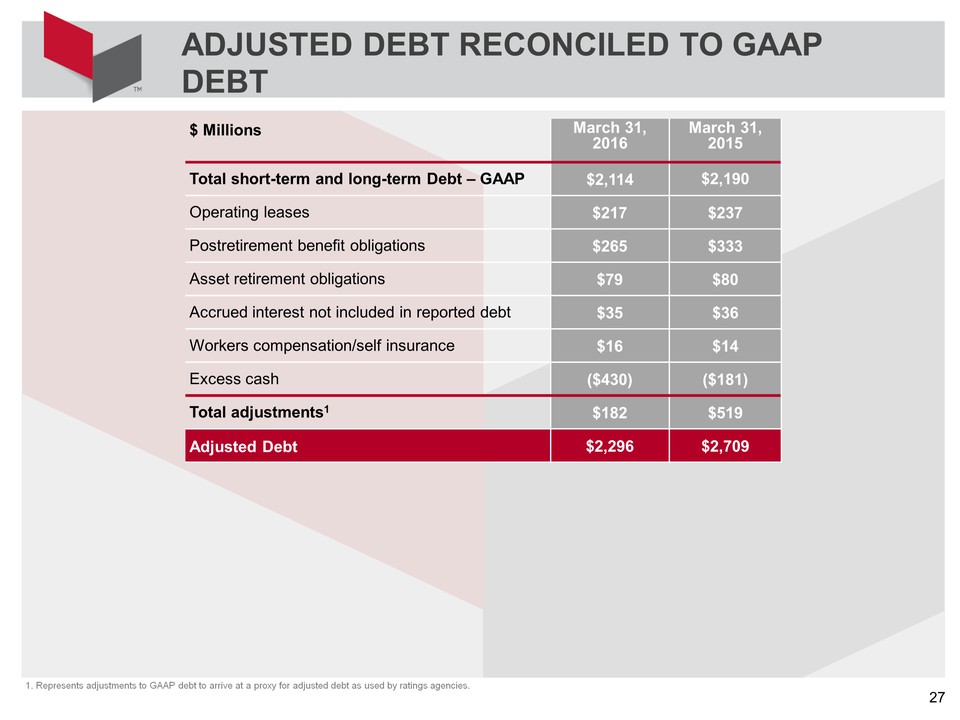

Q1 2016 CONSOLIDATED CASH FLOW 16 $ Millions 3 months ended March 31, 2016 3 months ended March 31, 2015 Free cash flow (CFFO - CapEx) ($45) ($71) Cash flow from operations (CFFO) ($30) ($42) Capital expenditures (CapEx) ($15) ($29) Other1 $14 $28 Cash flow used for investing activities ($1) ($1) Cash flow used for financing activities ($65) ($29) Effect of exchange rate on cash $1 ($3) Decrease in cash and cash equivalents1 ($95) ($75) March 31, 2016 March 31, 2015 Cash and cash equivalents and marketable securities $573 $242 Total liquidity $920 $583 Total debt $2,114 $2,190 Total adjusted debt2 $2,296 $2,709 1. Comprised of other investing activities.2. See reconciliation to GAAP results in the Appendix.

APPENDIX 17

In this presentation, the corporation’s financial results are provided both in accordance with accounting principles generally accepted in the United States of America (GAAP) and using certain non-GAAP financial measures. In particular, the corporation presents the non-GAAP financial measures adjusted operating profit, adjusted equity income from USG Boral Building Products, impacts of foreign currency on current period results using prior period translation rates, adjusted net income, adjusted net sales, EBITDA, adjusted EBITDA, adjusted operating margin, adjusted earnings per diluted share, adjusted debt, and adjusted EBITDA per diluted share, which exclude certain items. The non-GAAP financial measures are included as a complement to results provided in accordance with GAAP because management believes these non-GAAP financial measures help investors’ ability to analyze underlying trends in the corporation’s business, evaluate its performance relative to other companies in its industry and provide useful information to both management and investors by excluding certain items that may not be indicative of the corporation’s core operating results. In addition, adjusted operating profit includes the income from the corporation's equity method investments, including USG Boral Building Products, because management views the joint ventures as a business unit, even though the corporation’s share of the joint venture is 50%. In addition, the corporation uses adjusted operating profit and adjusted net income as components in the measurement of incentive compensation. Adjusted EBITDA per diluted share is presented to aid in the comparability of results on a per share basis after an income tax valuation allowance release in the fourth quarter of 2015. Adjusted results also exclude results from Gypsum Transportation Limited (GTL), a shipping operation that the corporation has exited. Adjustments to net earnings are shown net of the tax effect computed at applicable statutory rates. The non-GAAP measures should not be considered a substitute for or superior to GAAP results and may vary from others in the industry. For further information related to the corporation’s use of non-GAAP financial measures, and reconciliations to the nearest GAAP measures, see the schedules attached hereto. NON-GAAP FINANCIAL MEASURES 18

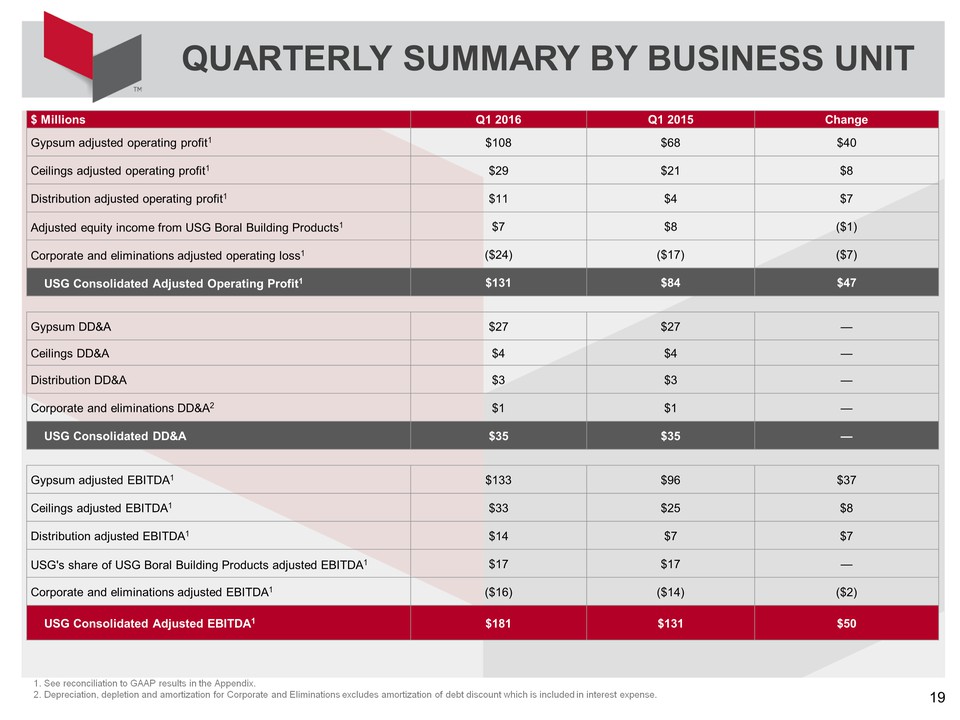

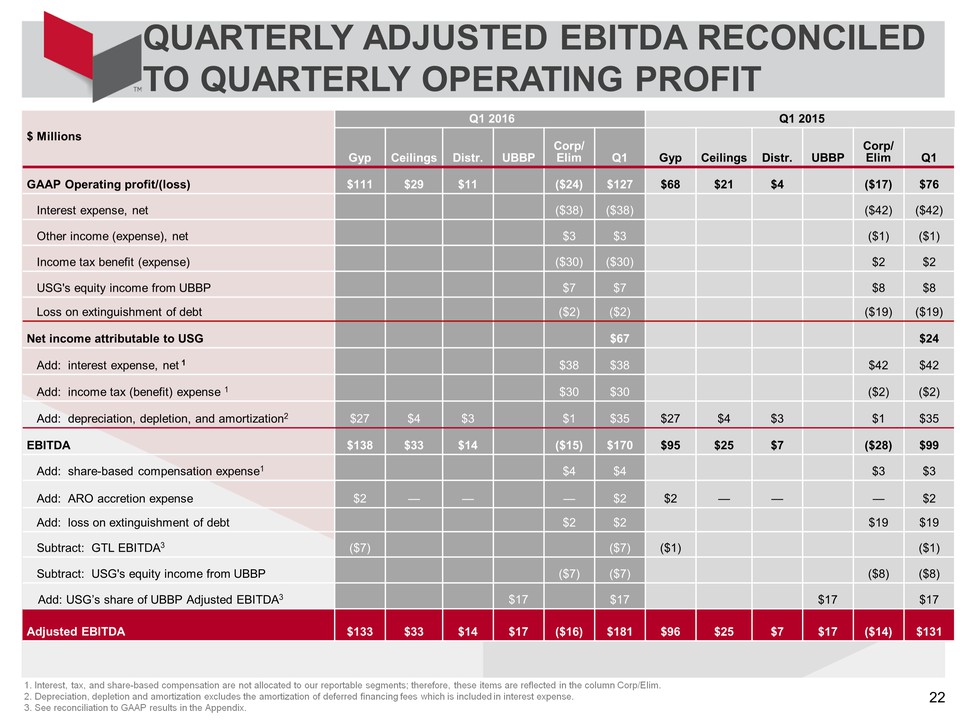

$ Millions Q1 2016 Q1 2015 Change Gypsum adjusted operating profit1 $108 $68 $40 Ceilings adjusted operating profit1 $29 $21 $8 Distribution adjusted operating profit1 $11 $4 $7 Adjusted equity income from USG Boral Building Products1 $7 $8 ($1) Corporate and eliminations adjusted operating loss1 ($24) ($17) ($7) USG Consolidated Adjusted Operating Profit1 $131 $84 $47 Gypsum DD&A $27 $27 — Ceilings DD&A $4 $4 — Distribution DD&A $3 $3 — Corporate and eliminations DD&A2 $1 $1 — USG Consolidated DD&A $35 $35 — Gypsum adjusted EBITDA1 $133 $96 $37 Ceilings adjusted EBITDA1 $33 $25 $8 Distribution adjusted EBITDA1 $14 $7 $7 USG's share of USG Boral Building Products adjusted EBITDA1 $17 $17 — Corporate and eliminations adjusted EBITDA1 ($16) ($14) ($2) USG Consolidated Adjusted EBITDA1 $181 $131 $50 1. See reconciliation to GAAP results in the Appendix.2. Depreciation, depletion and amortization for Corporate and Eliminations excludes amortization of debt discount which is included in interest expense. QUARTERLY SUMMARY BY BUSINESS UNIT 19

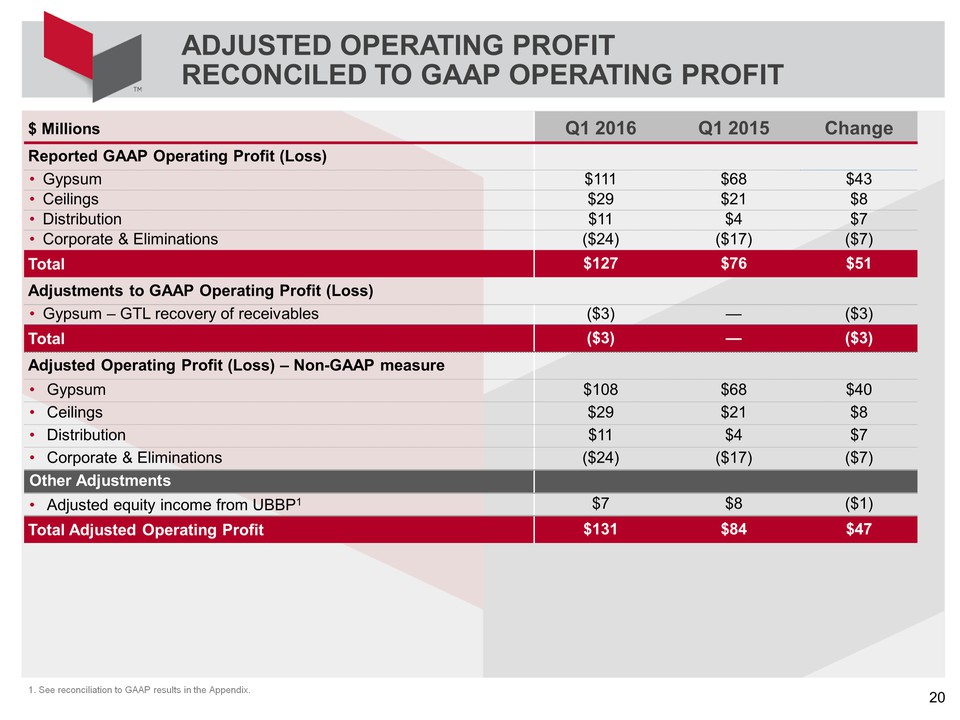

ADJUSTED OPERATING PROFITRECONCILED TO GAAP OPERATING PROFIT $ Millions Q1 2016 Q1 2015 Change Reported GAAP Operating Profit (Loss) Gypsum $111 $68 $43 Ceilings $29 $21 $8 Distribution $11 $4 $7 Corporate & Eliminations ($24) ($17) ($7) Total $127 $76 $51 Adjustments to GAAP Operating Profit (Loss) Gypsum – GTL recovery of receivables ($3) — ($3) Total ($3) — ($3) Adjusted Operating Profit (Loss) – Non-GAAP measure Gypsum $108 $68 $40 Ceilings $29 $21 $8 Distribution $11 $4 $7 Corporate & Eliminations ($24) ($17) ($7) Other Adjustments Adjusted equity income from UBBP1 $7 $8 ($1) Total Adjusted Operating Profit $131 $84 $47 1. See reconciliation to GAAP results in the Appendix. 20

ADJUSTED NET INCOME RECONCILED TO GAAP NET INCOME $ Millions Q1 2016 Q1 2015 Net Income – GAAP Measure $67 $24 Adjustments: GTL (recovery) of receivables/shipping operations, net of tax1 ($5) $1 Loss on extinguishment of debt, net of tax2 $1 $19 Adjusted Net Income – Non-GAAP Measure $63 $44 21 1. ($8) million, net of $3 million tax in Q1 2016. $1 million, net of $0 tax, in Q1 2015.2. $2 million, net of ($1) million tax in Q1 2016. $19 million, net of $0 tax in Q1 2015.

QUARTERLY ADJUSTED EBITDA RECONCILED TO QUARTERLY OPERATING PROFIT Q1 2016 Q1 2015 $ Millions Gyp Ceilings Distr. UBBP Corp/Elim Q1 Gyp Ceilings Distr. UBBP Corp/Elim Q1 GAAP Operating profit/(loss) $111 $29 $11 ($24) $127 $68 $21 $4 ($17) $76 Interest expense, net ($38) ($38) ($42) ($42) Other income (expense), net $3 $3 ($1) ($1) Income tax benefit (expense) ($30) ($30) $2 $2 USG's equity income from UBBP $7 $7 $8 $8 Loss on extinguishment of debt ($2) ($2) ($19) ($19) Net income attributable to USG $67 $24 Add: interest expense, net 1 $38 $38 $42 $42 Add: income tax (benefit) expense 1 $30 $30 ($2) ($2) Add: depreciation, depletion, and amortization2 $27 $4 $3 $1 $35 $27 $4 $3 $1 $35 EBITDA $138 $33 $14 ($15) $170 $95 $25 $7 ($28) $99 Add: share-based compensation expense1 $4 $4 $3 $3 Add: ARO accretion expense $2 — — — $2 $2 — — — $2 Add: loss on extinguishment of debt $2 $2 $19 $19 Subtract: GTL EBITDA3 ($7) ($7) ($1) ($1) Subtract: USG's equity income from UBBP ($7) ($7) ($8) ($8) Add: USG’s share of UBBP Adjusted EBITDA3 $17 $17 $17 $17 Adjusted EBITDA $133 $33 $14 $17 ($16) $181 $96 $25 $7 $17 ($14) $131 1. Interest, tax, and share-based compensation are not allocated to our reportable segments; therefore, these items are reflected in the column Corp/Elim. 2. Depreciation, depletion and amortization excludes the amortization of deferred financing fees which is included in interest expense.3. See reconciliation to GAAP results in the Appendix. 22

ADJUSTED FINANCIAL RESULTS OF USG BORAL BUILDING PRODUCTS 23 $ Millions Q1 2016 Q1 2015 Operating Profit – GAAP $23 $23 Adjustments: Income from equity method investments owned by UBBP $2 $3 Adjustments: Operating profit attributable to non-controlling interest, pre-tax ($2) ($2) Adjustments: Severance charges $1 — Adjusted Operating Profit – Non-GAAP $24 $24 Net Income attributable to USG Boral Building Products – GAAP $14 $16 Adjustments: Severance $1 — Adjusted Net Income attributable to USG Boral Building Products – Non-GAAP $15 $16 USG share of income from equity method investments – GAAP $7 $8 Less: Income from equity method investments – other joint ventures — — Adjusted equity income from USG Boral Building Products – Non-GAAP $7 $8

USG BORAL BUILDING PRODUCTS ADJUSTED EBITDA RECONCILIATION 24 $ Millions Q1 2016 Q1 2015 GAAP Operating profit $23 $23 Income tax expense ($9) ($8) Income from equity method investments owned by UBBP $2 $3 Other income (expense) ($1) — Net Income $15 $18 Net income attributable to non-controlling interest ($1) ($2) Net Income attributable to USG Boral Building Products $14 $16 Adjustments: Severance $1 — Adjusted Net Income attributable to USG Boral Building Products $15 $16 Add: income tax expense $9 $8 Add: depreciation, depletion, and amortization $11 $10 TOTAL USG Boral Building Products Adjusted EBITDA $35 $34 USG’s share of USG Boral Building Products Adjusted EBITDA $17 $17

ADJUSTED DILUTED EPS RECONCILED TO GAAP DILUTED EPS Q1 2016 Q1 2015 Income per average diluted common share – GAAP $0.46 $0.16 Adjustments per average diluted common share: GTL recovery on receivables/shipping operations, net of tax ($0.04) $0.01 Loss on extinguishment of debt, net of tax $0.01 $0.13 Adjusted earnings per adjusted average diluted common share – Non-GAAP $0.43 $0.30 Average diluted common shares – GAAP 146,986,392 147,176,197 Adjustment to remove common shares that would be antidilutive based on adjusted net income — — Adjusted average diluted common shares – Non-GAAP 146,986,392 147,176,197 25

GTL EBITDA AND ADJUSTED SALES RECONCILIATIONS $ Millions Q1 2016 Q1 2015 GAAP Operating profit $3 — Interest income, net $1 ($1) Other income, net $4 — Income tax (expense) ($3) — Net income attributable to USG $5 ($1) Add: income tax expense $3 — Add: interest (income) expense, net ($1) $1 Add: depreciation, depletion, and amortization — $1 EBITDA $7 $1 $ Millions Q1 2016 Q1 2015 Net Sales – GAAP Measure $970 $909 Adjustments: GTL - Shipping operations — ($10) Adjusted Net Sales – Non-GAAP Measure $970 $899 26

ADJUSTED DEBT RECONCILED TO GAAP DEBT $ Millions March 31, 2016 March 31, 2015 Total short-term and long-term Debt – GAAP $2,114 $2,190 Operating leases $217 $237 Postretirement benefit obligations $265 $333 Asset retirement obligations $79 $80 Accrued interest not included in reported debt $35 $36 Workers compensation/self insurance $16 $14 Excess cash ($430) ($181) Total adjustments1 $182 $519 Adjusted Debt $2,296 $2,709 27 1. Represents adjustments to GAAP debt to arrive at a proxy for adjusted debt as used by ratings agencies.

ADJUSTED EBITDA PER DILUTED SHARE $ Millions (except per-share and share data) Q1 2015 Q2 2015 Q3 2015 Q4 2015 YTD 2015 Adjusted EBITDA1 $131 $169 $164 $145 $609 Average diluted common shares -GAAP 147,176,197 146,990,178 147,534,779 147,263,303 147,246,600 Adjusted EBITDA1 per average diluted common share $0.89 $1.15 $1.11 $0.98 $4.14 $ Millions (except per-share and share data) Q1 2016 Adjusted EBITDA1 $181 Average diluted common shares -GAAP 146,986,392 Adjusted EBITDA1 per average diluted common share $1.23 28 See reconciliation to GAAP results in the Appendix.Note – The sum of the quarters is not necessarily the same as the total for the full year.

USG’s Stockholder Rights Plan and Protective Amendment restricts beneficial ownership in excess of 4.9% We have a stockholder rights plan, or the Rights Plan, established under the terms of a rights agreement dated December 21, 2006, as amended, with Computershare Trust Company N.A., as Rights Agent, or the Rights Agreement. The Rights Plan was initially intended to protect our stockholders from coercive takeover practices or takeover bids that are inconsistent with their best interests. However, in 2013 and 2015, the Board adopted amendments to the Rights Agreement, discussed below, intended to protect our substantial net operating losses, or NOL carryforwards and related tax benefits. The Board also recommended, and on May 9, 2013 our stockholders approved, an amendment to our Restated Certificate of Incorporation, or the Protective Amendment, also intended to protect our NOL carryforwards and related tax benefits. On March 22, 2013, our Board approved an amendment to the Rights Agreement in an effort to protect our NOL carryforwards and related tax benefits. Our ability to use our NOLs could be substantially reduced if we experience an “ownership change,” as defined under Section 382 of the Internal Revenue Code of 1986, as amended, or the Code, and the Rights Agreement has been designed to prevent such an “ownership change.” “Ownership changes” generally relate to the cumulative change in ownership among stockholders with an ownership interest of 5% or more (as determined under the Code’s rules) over a rolling three-year period. Our stockholders ratified, on an advisory basis, the March 22, 2013 amendment to our Rights Agreement at our 2013 annual meeting of stockholders. The Rights Agreement, as amended, provides that if any person becomes the beneficial owner of 4.9% or more of our common stock, stockholders other than the 4.9% triggering stockholder will have the right to purchase additional shares of our common stock at half the market price, thereby diluting the triggering stockholder; provided that stockholders whose beneficial ownership, as defined in Section 383 of the Code, exceeded 4.9% of our common stock outstanding on February 11, 2015 will not be deemed to have triggered the Rights Agreement, as amended, so long as they do not thereafter acquire additional common stock other than in certain specified exempt transactions. The Board approved an amendment to the Rights Agreement in February 2015 to align the definition of “Beneficial Owner” and “Beneficially Own” with Section 382 of the Code. The NOL protective provisions in the Rights Agreement adopted in 2013 were scheduled to expire on March 22, 2016 and the Rights Agreement was scheduled to expire on January 2, 2017. In connection with a required triennial review of the Rights Agreement, the Board approved, and on November 16, 2015 we entered into, another amendment to the Rights Agreement to extend the term of the Rights Agreement, as well as the NOL protective provisions adopted in 2013, to May 31, 2019, subject to other earlier termination events as described therein. Accordingly, the 4.9% threshold described above is now effective until the earlier of (i) May 31, 2019, (ii) the date on which our Board determines that the amendment is no longer necessary for the provision of certain tax benefits because of the repeal of Section 382 of the Code, (iii) the first day of a taxable year as to which our Board determines that no tax benefits may be carried forward, or (iv) such other date as our Board determines that the amendment is no longer necessary for the preservation of tax benefits. The rights issued pursuant to the Rights Agreement will expire on May 31, 2019. However, our Board has the power to accelerate or extend the expiration date of the rights. In addition, a board committee composed solely of independent directors reviews the Rights Agreement at least once every three years to determine whether to modify the Rights Plan in light of all relevant factors. This review was most recently conducted in November 2015. The next review is required by the end of 2018. On May 9, 2013, we filed an amendment to our Restated Certificate of Incorporation, or the Protective Amendment, that restricts certain transfers of our common stock. The Protective Amendment is intended to protect the tax benefits of our NOL carryforwards. Subject to certain limited exceptions, the Protective Amendment's transfer restrictions restrict any person from transferring our common stock (or any interest in our common stock) if the transfer would result in a stockholder (or several stockholders, in the aggregate, who hold their stock as a “group” under Section 382 of the Code) owning 4.9% or more of our common stock. Any direct or indirect transfer attempted in violation of the Protective Amendment would be void as of the date of the prohibited transfer as to the purported transferee, and the purported transferee would not be recognized as the owner of the shares attempted to be owned in violation of the Protective Amendment for any purpose, including for purposes of voting and receiving dividends or other distributions in respect of that common stock, or in the case of options, receiving our common stock in respect of their exercise. The Protective Amendment is effective until the earlier of (i) May 9, 2016, (ii) the repeal of Section 382 of the Code if our Board determines that the Protective Amendment is no longer necessary for the preservation of tax benefits, (iii) the first day of a taxable year as to which our Board determines that no tax benefits may be carried forward, or (iv) such other date as determined by our Board pursuant to the Protective Amendment. On November 12, 2015, our Board also recommended that stockholders vote to extend the Protective Amendment until May 31, 2019 (subject to other earlier termination events as described in the Protective Amendment). Berkshire Hathaway and certain of its affiliates may acquire beneficial ownership of up to 50% of our voting stock on a fully-diluted basis without triggering the ownership thresholds in the Protective Amendment or Rights Agreement, and may acquire beneficial ownership of more than 50% of our voting stock on a fully-diluted basis without triggering the ownership thresholds in the Protective Amendment or Rights Agreement through an offer to purchase all of our common stock that remains open for at least 60 days, in each case subject to specified exceptions. STOCKHOLDER RIGHTS PLAN AND PROTECTIVE AMENDMENT 29

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- UIICore unveiling / ECCMID announcement Analyst Targets

- Form 8.5 (EPT/RI) - Mattioli Woods

- UIICore unveiling / ECCMID announcement Analyst Targets

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share