Form 8-K UQM TECHNOLOGIES INC For: Oct 20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 20, 2015

UQM Technologies, Inc.

(Exact name of registrant as specified in its charter)

|

Colorado |

1-10869 |

84-0579156 |

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

4120 Specialty Place

Longmont, Colorado 80504

(Address of principal executive offices, including zip code)

(303) 682-4900

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ]Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ]Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a‑12)

[ ]Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ]Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01Entry into a Material Definitive Agreement

On October 26, 2015, UQM Technologies, Inc. (“UQM”) announced that it had entered into a ten-year Supply Agreement (the “Supply Agreement”) with ITL Efficiency Energy Tech CO. Ltd. (“ITL”), a bus manufacturing company headquartered in Beijing, China. Under the Supply Agreement, which was executed October 20, 2015, ITL agreed to exclusively purchase all of its required electric motor and controller products from UQM for ten years (the “Term”), so long as UQM can meet ITL’s electric motor and controller product needs.

Pursuant to the terms of Supply Agreement, ITL’s purchase obligations become binding upon execution of “release authorizations,” specifying the products ordered, quantity to be purchased, delivery dates and other logistical matters. On October 23, 2015, ITL issued a purchase order under the Supply Agreement for 3,000 units of UQM products.

The Supply Agreement provides for specified pricing per product, with price decreasing as a cumulative quantity ordered increases. A portion of the payment is due immediately upon issuance of a release authorization with a remaining balance due prior to shipment. UQM will warrant the products supplied under the terms of the Supply Agreement for five years. UQM maintains its rights to its intellectual property pursuant to the terms of the Agreement.

The parties expect that UQM will manufacture products to be supplied under the Supply Agreement at its Colorado facility through at least 2017, with plans to produce future product for ITL in China thereafter.

A copy of the Supply Agreement is attached hereto as Exhibit 10.1. A copy of UQM’s press release is attached hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

Exhibit No.Description of Exhibit

10.1Supply Agreement dated October 20, 2015 by and between ITL and UQM. (Portions omitted pursuant to request for confidential treatment filed separately with the Commission.)

99.1Press Release of UQM dated October 26, 2015.

1

SIGNATURES

Pursuansig pt to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

UQM TECHNOLOGIES, INC. |

|

Dated: October 26, 2015 |

By: /s/ DAVID I. ROSENTHAL |

|

|

David I. Rosenthal |

|

|

Treasurer, Secretary and Chief Financial Officer |

2

EXHIBIT INDEX

Exhibit No.Description of Exhibit

10.1Supply Agreement dated October 20, 2015 by and between ITL and UQM. (Portions omitted pursuant to request for confidential treatment filed separately with the Commission.)

99.1Press Release of UQM dated October 26, 2015.

3

THIS DOCUMENT IS PARTIALLY REDACTED PURSUANT TO CONFIDENTIAL TREATMENT REQUEST LETTER DATED OCTOBER [26], 2015 FROM SHERMAN & HOWARD, L.L.C., IN CONNECTION WITH A FORM 8-K SUBMISSION BY UQM TECHNOLOGIES, INC.

REDACTED PORTIONS ARE BOLDED AND BRACKETED AS [***]

|

UQM/ITL Supply Agreement |

||

|

SUPPLY AGREEMENT |

||

This Supply Agreement (this “Agreement”) is dated as of October 20, 2015 (the “Effective Date”), between ITL Efficiency Energy Tech,, CO. Ltd., a China company, having its principal place of business at Building 13A Duzu Enterprise, 2nd Street; Liangshuihe, BDA, Beijing 100176 (“ITL”), and UQM Technologies, Inc., a Colorado corporation with a principal place of business at 4120 Specialty Place, Longmont CO 80504 (“UQM”). UQM and ITL are each referred to herein by name or, individually, as a “Party” or, collectively, as “Parties.” This Agreement will become effective only upon the occurrence of the actions and upon the date specified in Section 7.1 below.

Recitals

WHEREAS, UQM is engaged in the business of manufacturing and selling electric motors, controllers, and inverters and wishes to sell Products to ITL (the “UQM Business”);

WHEREAS, ITL is engaged in the business of manufacturing electric vehicles and wishes to purchase Products from the UQM (the “ITL Business”);

WHEREAS, this Agreement is also intended to supersede and replace any terms and conditions of purchase orders between the Parties other than the purchase orders delivered pursuant to the terms of this Agreement; and

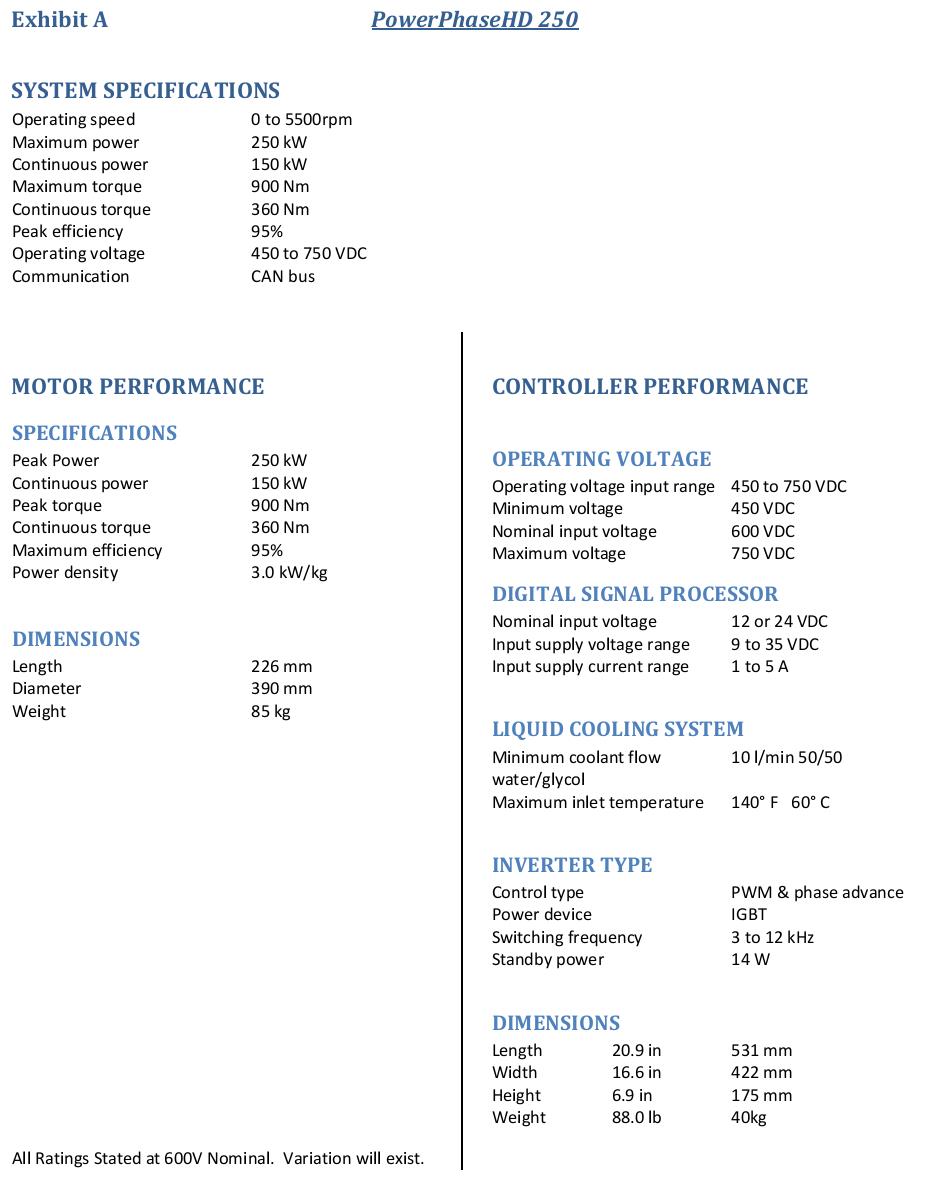

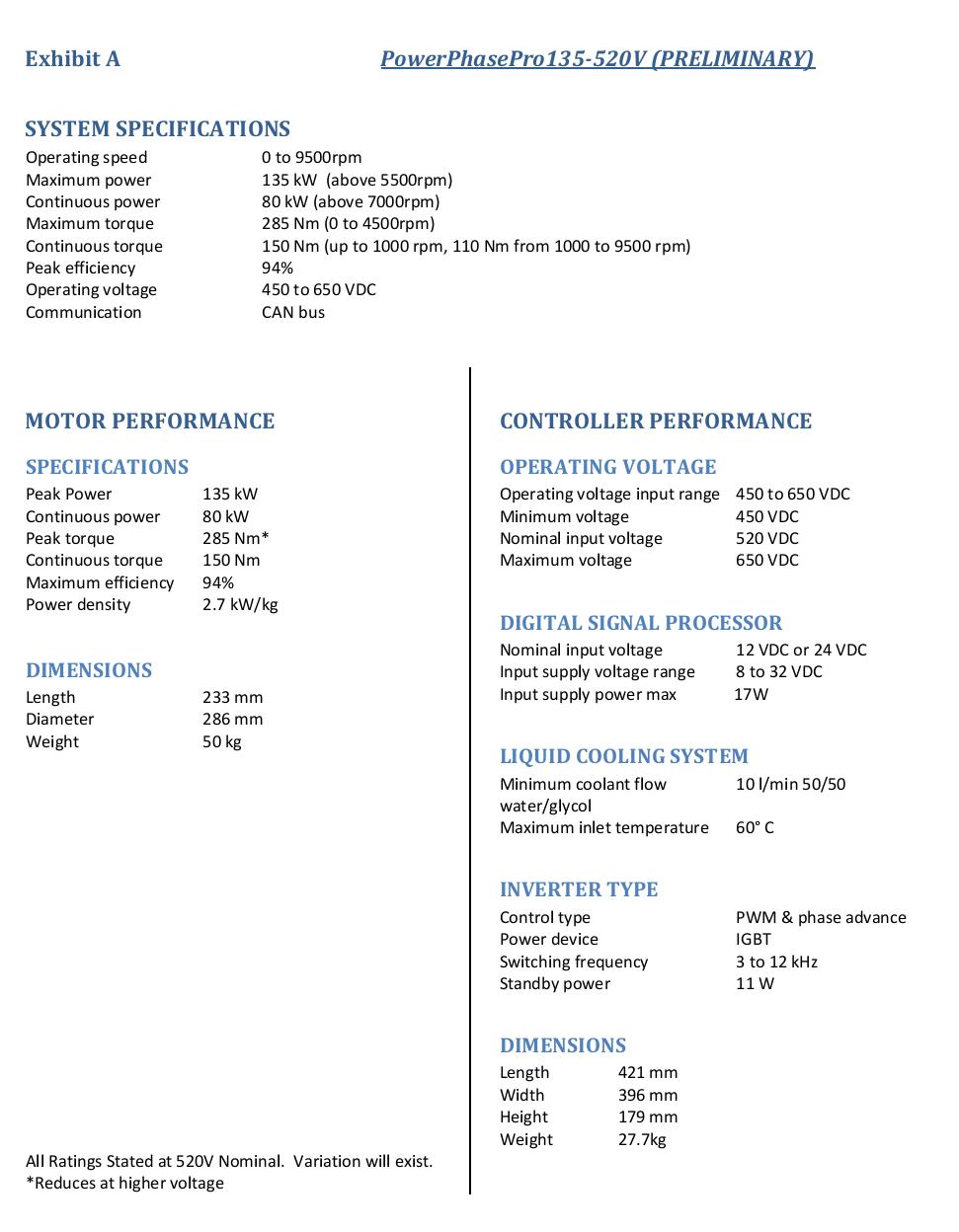

WHEREAS, concurrently with the execution of this Agreement, ITL has issued to UQM a non-cancellable Release Authorization (the “Initial Release Authorization”) with a guaranteed order quantity of [***] units of the UQM HD250 or equivalent Product and [***] units of the UQM PP135 or equivalent product (as described in Exhibit A).

Agreement

NOW, THEREFORE, in consideration of the mutual promises contained herein, the Parties agree as follows:

|

ARTICLE 1

|

PARTIALLY REDACTED PURSUANT TO CONFIDENTIAL TREATMENT REQUEST

The following terms shall have the following respective meanings for purposes of this Agreement:

|

1.1 “Affiliate” shall mean any entity that controls, is controlled by or is under common control with another person. For purposes of this definition, “control” shall mean ownership of at least 50% of the voting securities of an entity. |

|

1.2 “Defective” when used with respect to Products shall mean any Products that fail to comply with the Specifications. |

|

1.3 “Intellectual Property Rights” means all trade secrets, patents and patent applications, trademarks (whether registered or unregistered and including any goodwill acquired in such trade marks), service marks, trade names, business names, internet domain names, e-mail address names, copyrights (including rights in computer software), moral rights, database rights, design rights, rights in know-how, rights in confidential information, rights in inventions (whether patentable or not) and all other intellectual property and proprietary rights (whether registered or unregistered, and any application for the foregoing), and all other equivalent or similar rights which may subsist anywhere in the world. |

|

1.4 “Lead Time” shall mean, with respect to each Product, the time needed by UQM to deliver the respective Product after receiving a Release Order from ITL. The Parties shall agree in writing to an appropriate Lead Time for the specific Product. |

|

1.5 “Products” shall mean the motor, controller, inverter, traction motor systems and components manufactured by UQM and any other products to be supplied by UQM to ITL under this Agreement to be delivered hereunder in accordance with the Specifications, or any other specifications agreed to by the Parties in writing, including the Products set forth on Exhibit A. |

|

1.6 “Blanket Purchase Order” shall mean orders issued by ITL to purchase Product from UQM during the term of this Agreement. |

|

1.7 “Personnel” of a Party means any agents, employees, contractors or subcontractors engaged or appointed by such Party. |

|

1.8 “Release Authorizations” shall mean firm, non-cancellable orders instructing UQM to release Products under the initial and subsequent Blanket Purchase Orders on specified dates subject to Lead Times. |

|

1.9 “Specifications” shall mean the specifications described in Exhibit A, as may be supplemented or otherwise modified by mutual written agreement of the parties hereto. |

|

ARTICLE 2

|

|

2.1 Product. UQM agrees to supply the Products set forth on the Product Specifications attached hereto as Exhibit A to ITL and to carry out the other obligations set forth herein and therein. |

2

PARTIALLY REDACTED PURSUANT TO CONFIDENTIAL TREATMENT REQUEST

|

2.2 Purchase and Sale. Each purchase of Products by ITL (“Purchaser”) shall be subject to the terms and conditions attached hereto as Exhibit B (the “Purchase Terms and Conditions”). Business terms and conditions conflicting with or deviating from the Purchase Terms and Conditions of Purchase are only recognized insofar as the Parties expressly agreed to them in writing. |

|

2.3 Exclusivity. (a) ITL agrees to exclusively purchase all of its required electric motor and controller Products from UQM during the term of this Agreement, provided that UQM can meet all of ITL’s needs. (b) UQM agrees to reserve primary capacity exclusively for ITL usage and will ensure that it can meet the volume requirements of ITL as outlined in the 12 month rolling forecast during the term of this Agreement. Intellectual Property Rights. Each party will retain all rights it possessed prior to the date of this Agreement in any of its Intellectual Property Rights, including all ideas, concepts, designs, know-how, development tools, techniques or any other proprietary material or information that may be used by such party in connection with its performance under this Agreement. All Intellectual Property Rights that are licensed by a Party from a third party vendor will be and remain the property of such vendor. Each Party represents and warrants that if it provides third party Intellectual Property Rights or information to the other party it will have the right to do so. |

|

2.4 Priority Rights. ITL warrants that none of ITL or its Affiliates will (and ITL and its Affiliates will require their respective representatives not to) reverse engineer, re-engineer or disclose any data or information relating to the design, detailed specification or method of manufacture of UQM’s Products. ITL and its Affiliates will use commercially reasonable best efforts to enforce the foregoing provisions against their representatives and to cooperate with UQM in any legal action instituted by UQM against any representative that has reverse engineered, re-engineered or disclosed any data or information relating to the design, detailed specification or method of manufacture of UQM’s Products. |

|

ARTICLE 3

|

|

3.1 Blanket Purchase Order and Release Authorizations. ITL shall issue a Blanket Purchase Order for the first [***] systems to be shipped in Years 1 and 2 as specified on Exhibit B, including delivery schedules to be specified through Release Authorizations. The Release Authorizations will trigger the commitment from ITL to buy the Products and secure any advance payment. Each Release Authorization shall include: (a) identification of Products ordered; (b) quantity to be purchased; (c) price of Products ordered; (d) delivery dates and location; and (e) shipping instructions. The Initial Release Authorization with the guaranteed order quantity of 3,000 units has been delivered concurrently with the execution of this Agreement. Following the Initial Release Authorization for 3,000 units, as part of ITL’s 12-month planning forecast pursuant to Section 3.3, ITL will provide a firm commitment for each coming 4-month period supported by firm Release Authorizations. This Agreement contains the exclusive terms and conditions and applies to all purchases. Accordingly, no other terms or conditions set forth in ITL purchase orders, UQM’s acknowledgements or other means of acceptance or in any future correspondence between UQM and ITL shall alter or supplement these terms and conditions unless both Parties have agreed in writing to modify these terms and conditions, and notice of objection is hereby given to any such terms or conditions. ITL may

3

|

PARTIALLY REDACTED PURSUANT TO CONFIDENTIAL TREATMENT REQUEST

issue a subsequent Blanket Purchase Order for an additional number of systems beyond the number specified on Exhibit B, with delivery schedule to be specified through Release Authorizations. ITL will be committed to the quantity specified in the subsequent Blanket Purchase Order within the validity period of the Blanket Purchase Order. |

|

3.2 Acceptance of Orders. UQM shall accept Blanket Purchase Orders and Release Authorizations for Product for the delivery dates requested if they comply with Section 5.1 (Delivery Dates). UQM shall send an acknowledgment of confirmation or rejection of each Purchase Order within five (5) days after receipt. If UQM fails to send an acknowledgment or rejection within five (5) days, UQM will be deemed to have accepted the Purchase Order. |

|

3.3 Forecasts. ITL agrees to use commercially reasonable efforts to provide to UQM each quarter during the term of this Agreement a written, non-binding twelve (12) month rolling Product purchase forecast (the “Forecast”), indicating the total quantity of Product expected to be ordered by ITL from UQM during the following twelve (12) months, with a firm commitment for each coming 4-month period. The Forecasts shall be provided by ITL for informational and capacity planning purposes only and are not binding on ITL (other than with respect to the 4-month period for which ITL has provided Release Authorizations pursuant to Section 3.1) and do not create any obligation or commitment to purchase Products in quantities greater than the volume specified in the Initial Release Authorization or as otherwise set forth in this Agreement. |

3.4Initial Release Authorization. If UQM is unable to deliver pursuant to Article 5 of this Agreement any portion of the 3,000 units of conforming Product covered by the Initial Release Authorization within 60 days of the applicable delivery date specified in the Initial Release Authorization, except because of a Force Majeure Event (as such term is defined in Section 4 of the Purchase Terms and Conditions), ITL shall not be obligated to purchase those units or the remaining portion of units to be delivered under the Initial Release Authorization (collectively, the “Late Units”). As used in the immediate preceding sentence, “conforming Product” means Products that conform to the warranties given by UQM in connection with this Agreement.

|

ARTICLE 4

|

|

4.1 Price for Product. The prices for Products sold pursuant to this Agreement are set out in Exhibit B to this Agreement (the “Prices”). Prices shall be in U.S. dollars ($). Any change in the Prices shall be effective on a date to be agreed by ITL and UQM and reflected in an amendment to Exhibit B. |

|

4.2 Payment. Purchase terms and conditions are standard with [***]% of total purchase price due immediately upon issuance of the Release Authorization with the remaining balance due prior to shipment. With respect to the Initial Release Authorization, the payments shall be made on a monthly basis, with [***]% of the total purchase price for the first month’s quantity (the “Order Payment Portion”) due upon execution of the Initial Release Authorization and the remaining balance due (the “Shipping Payment Portion”) for that month’s quantity payable prior to shipping; subsequent Order Payment Portions and Shipping Payment Portions under the Initial Release Authorization will be done in this manner on a

4

|

PARTIALLY REDACTED PURSUANT TO CONFIDENTIAL TREATMENT REQUEST

rolling basis each month. For Initial Release Authorization, an irrevocable letter of credit may be utilized to pay for the full sales value of those systems. Credit terms can be negotiated by both Parties at a future date. UQM shall submit the invoices to the address indicated by ITL. Invoices must be sent within five (5) business days of shipment. No provision in any invoice shall constitute part of the Agreement between the Parties. |

|

ARTICLE 5

|

|

5.1 Delivery Dates. The delivery dates shall be those specified in an accepted Blanket Purchase Order or Release Authorization. |

|

5.2 Shipping Terms. UQM shall deliver Products FOB UQM Facility. Title and risk of loss passes to ITL upon shipment from UQM’s manufacturing facility. |

|

ARTICLE 6

|

|

6.1 Product Warranty. UQM warrants that the Products (a) will be new and unused, (b) will perform in accordance with the applicable Specifications (including related documentation provided by UQM and will achieve any function described therein), (c) will comply with all power, torque and key electrical and mechanical specifications listed in Exhibit A, (d) will be of merchantable quality, and (e) will be free from material defects in materials, workmanship, design and assembly. |

|

6.2 Warranty Life. Products manufactured by UQM are warranted to be free from material defects in workmanship and material for a period of five (5) years from date of shipment. An application duty cycle review and sign-off will be required for warranty purposes. |

|

6.3 Title Warranty. UQM warrants that title to all Products delivered under this Agreement shall be free and clear of all liens, mortgages, encumbrances, security interests or other claims or rights. |

|

6.4 Changes in Product. UQM will notify ITL of any significant proposed changes to the Product at least thirty (30) days prior to any proposed substitution under this Agreement. UQM shall receive ITL’s consent to any such substitution, which consent shall not be unreasonably withheld, and Exhibit A to this Agreement shall be amended to reflect the specifications of the modified Product. |

|

6.5 Validation Testing. The Product is “off-the-shelf” which assumes all validation testing is acceptable and complete. Additional testing or requirements must be negotiated and mutually agreed upon. |

5

PARTIALLY REDACTED PURSUANT TO CONFIDENTIAL TREATMENT REQUEST

|

ARTICLE 7

|

|

7.1 Term. This Agreement shall be effective on the Effective Date and continue for an initial period of ten (10) years after the Effective Date, unless earlier terminated under this Article 7. |

|

7.2 Termination. Either Party may terminate this Agreement upon written notice to the other (i) upon any material breach hereof by the other Party, if the breaching Party has not cured such breach for a period of thirty (30) days after receipt of written notice from the non-breaching Party, provided that if such breach may not reasonably be cured within such thirty (30) day period, then the breach must be cured as soon as may be reasonably possible by the breaching party using diligent efforts but in no event more than sixty (60) days after receipt of written notice from the non-breaching Party; (ii) either Party ceases to do business as a going concern, or otherwise terminates its business operations; (iii) either Party makes an assignment for the benefit of its creditors; (iv) proceedings (whether voluntary or involuntary) are commenced against either Party under any bankruptcy, insolvency or debtor’s relief law and such proceedings are not terminated or set aside within sixty (60) days from the date of commencement thereof; or (v) if the other Party repeatedly violates a material law and/or violates repeatedly an applicable law despite being given respective advice, and fails to evidence that the violation of the law has been cured as far as possible and that appropriate precautions have been taken to avoid violations of the applicable law in future. |

|

7.3 Termination Payment. If this Agreement is terminated by ITL, other than as a result of a material breach on the part of UQM, ITL shall pay UQM an amount equal to the sum of (a) the purchase price for [***] units (less any units previously purchased under the Initial Release Authorization and less any Late Units) at the pricing specified above, and (b) for the cost of all inventory (including raw material, WIP and finished goods) then on hand and dedicated to supply ITL under this Agreement pursuant to outstanding purchase orders or Release Authorizations, provided that such inventory, raw materials, WIP and finished goods cannot be used by UQM to satisfy other UQM customer obligations (excluding the Initial Release Authorization for [***] units). Notwithstanding the final clause of the immediate preceding sentence, if despite its reasonable commercial efforts to do so, UQM is unable to re-deploy or otherwise use for other customers any inventory, raw materials, WIP and finished goods within six (6) months of the Agreement’s effective date of termination, then ITL shall be responsible to UQM for the cost of such items pursuant to clause (b) of this Section 7.4. |

|

7.4 Survival. The obligations in the following sections will survive any expiration or termination of this Agreement: Articles 1 (Definitions), 6 (Warranty), 7 (Term and Termination), 8 (Indemnification), 9 (Confidential Information) and 10 (General Provisions). |

|

ARTICLE 8

|

|

8.1 Mutual Indemnification. Subject to the terms and conditions of this Agreement, each Party (as “Indemnifying Party”) shall indemnify, defend and hold harmless the other Party and its officers, directors, employees, agents, affiliates, successors and permitted assigns

6

|

PARTIALLY REDACTED PURSUANT TO CONFIDENTIAL TREATMENT REQUEST

(collectively, “Indemnified Party”) against any and all losses, damages, liabilities, deficiencies, claims, actions, judgments, settlements, interest, awards, penalties, fines, costs, or expenses of whatever kind, including reasonable attorneys’ fees, fees and the costs of enforcing any right to indemnification under this Agreement and the cost of pursuing any insurance providers, incurred by Indemnified Party (collectively, “Losses”), relating to/arising out or resulting from any third-party claim or any direct claim against Indemnified Party (other than a claim by the Indemnifying Party) alleging: |

|

(a) a breach or non-fulfillment of any representation, warranty or covenant set forth in this Agreement by Indemnifying Party; |

|

(b) any grossly negligent or willful misconduct of Indemnifying Party or its Personnel (including any recklessness) in connection with the performance of this Agreement; |

|

(c) any bodily injury, death of any Person or damage to real or tangible personal property caused by the negligent acts or omissions or willful misconduct of Indemnifying Party or its Personnel; |

|

(d) any bodily injury, death or any Person or damage to real or tangible personal property due to any defects in the Products introduced during the manufacturing, assembly, production or testing of the Product; or |

|

(e) any Products or the manufacture, use, marketing or sale thereof infringe upon, misappropriate or violate any patents, copyrights, or trade secret rights or other Intellectual Property Rights of persons, firms or entities who are not parties to this Agreement, provided that the Indemnifying Party has been notified that such potential infringement, misappropriation or other violation and the Indemnifying Party has not cured within thirty (30) days of such notice the alleged infringement, misappropriation or violation within. |

|

8.2 Exceptions and Limitations on Indemnification. Notwithstanding anything to the contrary in this Agreement, an Indemnifying Party is not obligated to indemnify or defend (if applicable) an Indemnified Party against any Claim if such Claim or corresponding losses arise out of or result from, in whole or in part, the Indemnified Party’s or its Personnel’s: |

|

(a) gross negligence or willful misconduct (including recklessness or willful misconduct); |

|

(b) bad faith failure to materially comply with any of its obligations set forth in this Agreement; |

|

(c) use of the Product in any manner not otherwise authorized under this Agreement or that does not materially conform with any usage specifications provided by UQM; |

|

(d) any modification or changes made to the Products by or on behalf of any person other than UQM or without UQM knowledge, if infringement would have been avoided but for such modification or change. |

7

PARTIALLY REDACTED PURSUANT TO CONFIDENTIAL TREATMENT REQUEST

|

8.3 Any indemnification provided by Indemnifying Party is contingent on the prompt notification by Indemnified Party in writing of any such claim and reasonable cooperation by Indemnified Party in the defense of the claim. Indemnifying Party will have sole control of the defense and all related settlement negotiations. Indemnifying Party will have the right to be represented by its own counsel at its own expense. |

|

8.4 |

Exclusive Remedy. EXCEPT AS EXPRESSLY PROVIDED IN THIS AGREEMENT, THIS ARTICLE 8 SETS FORTH THE ENTIRE LIABILITY AND OBLIGATION OF EACH INDEMNIFYING PARTY AND THE SOLE AND EXCLUSIVE REMEDY FOR EACH INDEMNIFIED PARTY FOR ANY DAMAGES COVERED BY THIS ARTICLE 8. For the avoidance of doubt, nothing will preclude ITL from lodging any warranty claim against UQM as pursuant to Article 6. |

|

ARTICLE 9

|

|

9.1 Definitions. “Confidential Information” means, with respect to either Party, any confidential business or technical information, including know-how, whether or not patentable or copyrightable, that the disclosing Party identifies either orally or in writing as confidential or proprietary at the time it is disclosed or delivered to the receiving Party. Confidential Information does not include any information that the receiving Party can demonstrate by written records: (a) was known to the receiving Party prior to its disclosure hereunder by the disclosing Party; (b) is independently developed by the receiving Party; (c) is or becomes publicly known through no wrongful act of the receiving Party; (d) has been rightfully received from a third party whom the receiving Party has reasonable grounds to believe, after due inquiry, is authorized to make such disclosure without restriction; or (e) has been approved for public release by the disclosing Party’s prior written authorization. |

|

9.2 Confidentiality Obligations. Each Party may disclose any Confidential Information as required to be produced or disclosed pursuant to applicable law, regulation or court order, provided that the receiving Party provides prompt advance notice thereof to enable the disclosing Party to seek a protective order or otherwise prevent such disclosure. Each Party will: (a) not use any Confidential Information of the other Party except as permitted by this Agreement; (b) not disclose any such Confidential Information to any person or entity other than its own employees, consultants and subcontractors who have a need to know and who have executed in advance of receiving such Confidential Information a suitable nondisclosure and restricted use agreement that comports with the applicable provisions of this Agreement; and (c) use all reasonable efforts to keep such Confidential Information strictly confidential. Each Party will use reasonable efforts to enforce such nondisclosure and restricted use agreements. Each Party agrees that the terms and conditions shall be treated as the other Party’s Confidential Information; provided, however, that each Party may disclose the terms and conditions of this Agreement as required by law or in confidence to its advisors. |

8

PARTIALLY REDACTED PURSUANT TO CONFIDENTIAL TREATMENT REQUEST

|

ARTICLE 10

|

|

10.1 Notices. All notices and requests in connection with this Agreement shall be given in writing and shall be deemed given as of the day they are received either by messenger, delivery service, or by e-mail to the addresses set forth below. |

|

10.2 Amendments and Waivers. No alteration, amendment, waiver, cancellation or any other change in any term or condition of this Agreement shall be valid or binding on either Party unless mutually assented to in writing by both Parties. No provision of this Agreement may be waived except by a writing executed by the Party against whom the waiver is to be effective. Neither a Party’s failure to enforce any provision of this Agreement nor ITL’s acceptance of or payment for Products shall be construed as a waiver of the provision nor prevent the Party from enforcing any other provision of this Agreement. The rights and remedies herein provided shall be cumulative and not exclusive of any rights or remedies provided by law. |

|

10.3 Assignment. Other than as expressly otherwise provided herein, this Agreement shall not be assignable or otherwise transferable by any Party without the prior written consent of the other Party. Notwithstanding the foregoing, either Party may freely assign this Agreement to an Affiliate or to a third party that acquires all or substantially all of the assets of the assigning Party or that merges with the assigning party and is the surviving party in such merger; provided, that in the case of such an assignment, the assigning Party shall give the non-assigning Party reasonable advance notice of the assignment. The provisions of this Agreement shall be binding upon and inure to the benefit of the Parties and their respective successors and assigns. Any assignment or transfer of this Agreement in violation of this Section 10.3 (Assignment) shall be null and void. |

|

10.4 Entire Agreement; Severability. This Agreement and the Stock Purchase Agreement contain the entire agreement between the Parties with respect to the subject matter hereof and supersedes all prior written and oral agreements between the Parties regarding the subject matter of this Agreement, including any terms and conditions of any Purchase Orders. If any provision of this Agreement is found to be illegal or unenforceable, the other provisions shall remain effective and enforceable to the greatest extent permitted by law. |

|

10.5 Independent Contractors. The Parties are independent contractors. Nothing contained herein or done pursuant to this Agreement shall constitute either Party the agent of the other Party for any purpose or in any sense whatsoever, or constitute the Parties as partners or joint venturers. |

|

10.6 Governing Law. This Agreement shall be construed in accordance with and governed by the laws of China without reference to conflict of laws principles. |

|

10.7 Arbitration. Any controversy or claim arising out of or relating to this Agreement, or the breach thereof, shall be determined by arbitration administered by China International Economic and Trade Arbitration Commission for arbitration in Beijing that shall be conducted in accordance with the Commission’s arbitration rules in effect at the time of

9

|

PARTIALLY REDACTED PURSUANT TO CONFIDENTIAL TREATMENT REQUEST

applying for arbitration. The arbitration language should be Chinese and English. The Claimant shall appoint an arbitrator when it commences the arbitration, and the Respondent shall appoint an arbitrator within 30 days thereafter. The two party-appointed arbitrators shall appoint the third arbitrator within 20 days after appointment of the second arbitrator, and the third arbitrator shall serve as the chair of the arbitral tribunal. If, by the time limits agreed herein, a party fails to appoint an arbitrator or if the two party-appointed arbitrators are unable to appoint the third arbitrator, that arbitrator shall be selected as provided in the Rules. The award of the arbitrators shall be final and binding, and judgment upon the arbitrators’ award may be entered in any court of competent jurisdiction. |

10

PARTIALLY REDACTED PURSUANT TO CONFIDENTIAL TREATMENT REQUEST

IN WITNESS WHEREOF, the Parties have caused this Agreement to be duly executed by their respective authorized officers as of the day and year first above written.

|

UQM Technologies, Inc. |

ITL Efficiency Energy Tech. CO., Ltd |

|

|

|

|

By: /s/Joseph R. Mitchell |

By: /s/Huang Lee |

|

Name: Joseph Mitchell |

Name: Huang Lee |

|

Title: Chief Operating Officer |

Title: Chief Executive Officer |

|

Date: October 20, 2015 |

Date: October 20, 2015 |

|

|

|

|

Address:UQM Technologies, Inc. Attention: CEO 4120 Specialty Place Longmont CO 80504 U.S.A. |

Address: ITL Efficient Energy Tech CO., Ltd Attention: CEO Building 13A Dazu Enterprise, 2nd Street Liangshuihe, BDA, Beijing 100176

|

|

Fax: 303-682-4901 E-mail:[ __ ] |

Fax: 0086 67892095 E-mail: [ __ ]

|

11

PARTIALLY REDACTED PURSUANT TO CONFIDENTIAL TREATMENT REQUEST

EXHIBIT A

PRODUCT SPECIFICATIONS

A-1

PARTIALLY REDACTED PURSUANT TO CONFIDENTIAL TREATMENT REQUEST

2

PARTIALLY REDACTED PURSUANT TO CONFIDENTIAL TREATMENT REQUEST

3

PARTIALLY REDACTED PURSUANT TO CONFIDENTIAL TREATMENT REQUEST

|

|

EXHIBIT B |

|

|

|

|

|

|

|

PURCHASE TERMS AND CONDITIONS |

|

Volume Commitments and Pricing

Volume Commitments (annual; during Term)

|

|

|

|

Annual Minimum Volumes |

|

|

Year 1: [***] units |

|

|

Year 2: [***] units |

|

|

Year 3:[***] units Year 4-10: Minimum [***] units per year |

|

|

|

|

|

|

|

Year 1 is the contractual year beginning upon execution of the Agreement and Year 2 to Year 10 are the subsequent contractual years beginning at each anniversary date of the execution of the Agreement.

Production of the first [***] systems will be completed at UQM’s facility in Colorado. Subsequent manufacturing will be done at UQM or UQM Partner facility in China. The breakdown of the first [***] systems is [***] HD 250 systems and [***] PP 135 systems.

Pricing

|

Item |

Quantity |

Description |

UM |

Price |

|

1 |

First [***] |

UQM HD250 Motor and Controller Assembly |

ea. |

$[***] |

|

2 |

[***] - [***] |

UQM HD250 Motor and Controller Assembly |

ea. |

$[***] |

|

3 |

[***] |

UQM PP135 Motor and Controller Assembly |

ea. |

$[***] |

|

|

|

|

|

|

Included in these prices is warranty coverage for a period of five (5) years.

UQM’s total price includes motors, controllers, standard DC and signal cables application hardware, software, testing and packaging. Additional pricing may be applied to non-stock requirements.

1

|

For Immediate Release |

|

|

|

|

|

For more information contact: |

Shawn Severson |

|

|

The Blueshirt Group |

|

|

415-489-2198 |

|

|

or |

|

|

David I. Rosenthal |

|

|

UQM Technologies, Inc. |

|

|

303-682-4900 |

|

UQM Technologies Signs Ten Year Supply Agreement |

|

With Chinese Customer |

|

· |

The Agreement could generate revenue in excess of $400 million over a ten year period based on projected orders |

|

· |

The first purchase order for 3,000 units has been issued |

|

· |

Development, test and certification programs are set for 2016, ramping up to start of production in 2017 |

|

· |

First year production will take place in Colorado with plans to manufacture UQM products in China thereafter |

|

· |

The Agreement provides electric propulsion system for three market segments: 6-8 meter shuttle buses, light- to medium-duty delivery trucks, and 10-12 meter transit buses |

|

· |

6-8 meter bus platforms manufactured in Colorado will utilize existing PowerPhase Pro® 135 inventory enhancing UQM’s liquidity position |

|

· |

UQM will host a conference call to discuss this announcement tomorrow morning, October 27, 2015 at 8:00 a.m. EDT |

LONGMONT, COLORADO, OCTOBER 26, 2015 - UQM Technologies Inc. (NYSE MKT: UQM) today announced the signing of a ten year supply agreement (“Agreement”) with ITL Efficiency Corporation (“ITL”) in China, a subsidiary of Eastlake New Energy (“Eastlake”). Over the term of the Agreement, revenues could exceed $400 million based on projected volume shipments. Production is expected to begin in early 2017 following development, test and certification programs during 2016, and timing will be dependent on the successful completion of the test and certification processes, followed by orders under the Agreement. The Company has received the first purchase order under the Agreement for the initial 3,000 units which are expected to ship in 2017. UQM will manufacture its electric propulsion systems in Colorado through 2017 with plans to produce product in China beginning in 2018. Initially, the PowerPhase Pro® 135 electric propulsion system will

UQM TECHNOLOGIES, INC. 4120 SPECIALTY PLACE, LONGMONT, COLORADO 80504 (303) 682-4900 FAX (303) 682-4901

be sold to address the 6-8 meter shuttle bus market in China, with larger delivery truck and transit bus applications slated to begin in early 2017 with the PowerPhase HD® 250 system.

ITL, based in Beijing, China, is a subsidiary of Eastlake New Energy and responsible for the entire electric drive supply to Eastlake and its subsidiaries. Because of its operational independence from Eastlake, ITL’s goal is to become a major e-drive system supplier to the entire China market. ITL has a preferred supplier relationship with Wuhan Public Transport Group (“Wuhan Bus”), a China state-owned operator of public buses, operating over 330 bus lines with a fleet of almost 7,000 buses with a goal to convert much of the fleet to new energy and electric buses. ITL’s parent company, Eastlake, is a holding company based in Wuhan, China whose subsidiaries include, in addition to ITL, three vehicle manufacturers (Yixing, Yangtse and Speka), which combined have over 1.6 million square feet of manufacturing facilities and capacity to produce over 15,000 vehicles a year. With over one thousand hybrid and pure electric trucks and buses already on the road, ITL will partner with Eastlake to bring anticipated significant volume of new UQM powered electric vehicles to the China market.

“The signing of this supply agreement with ITL is a major milestone for UQM, and is the result of many years of focused attention to the China market,” said Joe Mitchell, Chief Operating Officer and Interim President and CEO. “This achievement solidifies our long-term strategy to become a major global provider of electric propulsion systems; particularly in China, the largest market in the world for electric vehicles. Attaining this agreement is testimony to the quality and performance of our products that are second to none. We are excited to partner with ITL and become a dominant player in the New Energy Vehicle market in China. We believe this agreement is a game changer for UQM and puts us on a realistic and timely path to long term viability and profitability.”

Mr. Frank Lee, President of ITL, said, “We have looked extensively for the most reliable and efficient electric drive technology, and after careful consideration, we have chosen UQM Technologies as the correct partner for long term success in the China market.”

The Company will file with the Securities and Exchange Commission a copy of the Supply Agreement as an exhibit to its Report on Form 8-K.

Conference Call

The Company will host a conference call tomorrow, October 27, 2015 at 8:00 a.m. Eastern Time to discuss this announcement. To attend the conference call, please dial 1-888-241-0326 approximately 10 minutes before the conference is scheduled to begin and provide the passcode “68512509” to access the call. International callers should dial 1-647-427-3411. For anyone who is unable to participate in the conference, a recording will be available for seven days beginning at 10:00 a.m. Eastern Time tomorrow. To access the playback call 1-800-585-8367 or 1-855-859-2056 and enter replay code “68512509#.” International callers should dial +1-404-537-3406.

About UQM

UQM Technologies is a developer and manufacturer of power-dense, high-efficiency electric motors, generators, power electronic controllers and fuel cell compressors for the commercial truck, bus, automotive, marine, military and industrial markets. A major emphasis for UQM is developing propulsion systems for electric, hybrid electric, plug-in hybrid electric and fuel cell electric vehicles. UQM is TS 16949 and ISO 14001 certified and located in Longmont, Colorado. For more information, please visit www.uqm.com

UQM TECHNOLOGIES, INC. 4120 SPECIALTY PLACE, LONGMONT, COLORADO 80504 (303) 682-4900 FAX (303) 682-4901

About ITL

ITL is a subsidiary of Eastlake New Energy and responsible for the entire electric drive supply to Eastlake and its subsidiaries. Because of its operational independence from Eastlake, its goal is to become a major e-drive system supplier to the entire China market. Beyond the UQM supplied propulsion systems, ITL is responsible for the supply of Transmissions, vehicle control units (VCU’s), DC/DC converters and other related components along with vehicle system integration, application and certification support.

About Eastlake New Energy

Eastlake New Energy (Group) was set up by the Eastlake Industrial Investment Management in September 2013. The company is focused on the R&D, manufacture and sale of new energy vehicles. Products include pure EV buses, airport shuttle buses, pure electric SUVs, and auto parts. Eastlake owns multiple subsidiary brands, including: Yixing, Yangtse Bus and Speka, which were acquired after establishment. For more information, please visit http://eastlakenea.net/.

This Release contains statements that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act. These statements appear in a number of places in this Release and include statements regarding our plans, beliefs or current expectations; including those plans, beliefs and expectations of our management with respect to, among other things, the amount of revenue that could potentially be generated over the term of this agreement, the timing and success of completing necessary test and certification processes for ITL to order UQM products, the number of units ordered by ITL under the supply agreement, the timing of beginning manufacturing operations in China, the success of ITL in introducing its electric drive systems (including UQM products) into the vehicles produced by itself and its affiliates, and the continued growth of the electric-powered vehicle industry in the Chinese market. Important factors that could cause actual results to differ from those contained in the forward-looking statements include the ability to timely resolve any technical challenges of integrating UQM products into ITL electric drive systems, the responsiveness of customers to ITL’s products, the timing and quantity at which ITL issues binding purchase orders under the long-term supply agreement and other factors described in our Form 10-K and Form 10-Q’s under the heading “Risk Factors”, which are available through our website at www.uqm.com or at www.sec.gov.

UQM TECHNOLOGIES, INC. 4120 SPECIALTY PLACE, LONGMONT, COLORADO 80504 (303) 682-4900 FAX (303) 682-4901

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- 420 with CNW — Study Enumerates Therapeutic Effects, Quality of Life Benefits of Medical Cannabis

- Phillips Edison & Company Reports First Quarter 2024 Results and Affirms Full Year Earnings Guidance

- Inspirato to Announce First Quarter 2024 Results Tuesday, May 7

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share