Form 8-K UNITED STATES STEEL CORP For: Jan 28

UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

----------------------- |

FORM 8-K |

CURRENT REPORT |

Pursuant to Section 13 or 15(d) of |

The Securities Exchange Act of 1934 |

----------------------- |

Date of Report (Date of earliest event reported): |

January 28, 2015 |

United States Steel Corporation |

----------------------------------------------------------------------------------- |

(Exact name of registrant as specified in its charter) |

Delaware | 1-16811 | 25-1897152 |

--------------- | ------------------------ | ------------------- |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

600 Grant Street, Pittsburgh, PA | 15219-2800 |

--------------------------------------- | ---------- |

(Address of principal executive offices) | (Zip Code) |

412 433-1121 |

------------------------------ |

(Registrant's telephone number, |

including area code) |

-----------------------------------------------------------------------------------

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01. Other Events.

On January 28, 2015, United States Steel Corporation conducted a conference call to discuss its results for the fourth quarter of 2014. The slides that were discussed during that call are attached hereto as Exhibit 99.1. Also, a question and answer document that was posted to the Companys website on January 28, 2015 is attached as Exhibit 99.2.

Item 9.01����Financial Statements and Exhibits.

(d) Exhibits

99.1. Slides provided in connection with the fourth quarter 2014 earnings call of United States Steel Corporation.

99.2. Question and Answer document.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

UNITED STATES STEEL CORPORATION

����

By | /s/ Colleen M. Darragh |

----------------------------------- | |

Colleen M. Darragh | |

Acting Controller | |

Dated: January 28, 2015

Exhibit 99.1 United States Steel Corporation Fourth Quarter 2014 Earnings Conference Call and Webcast January 28, 2015 � 2011 United States Steel Corporation

�

2 Forward-looking Statements United States Steel Corporation This release contains forward-looking statements with respect to economic and market conditions, operating costs, shipments and prices. Factors that could affect economic and market conditions, costs, shipments and prices for both North American and European operations include: (a) foreign currency fluctuations and related activities; (b) global product demand, prices and mix (which are influenced by, among other things, the prices of commodities such as oil, iron ore and steel scrap); (c) global and company steel production levels; (d) plant operating performance; (e) natural gas, electricity, raw materials and transportation prices, usage and availability; (f) international trade developments, including court decisions, legislation and agency decisions on petitions and sunset reviews; (g) the impact of fixed prices in energy and raw materials contracts (many of which have terms of one year or longer) as compared to short-term contract and spot prices of steel products; (h) changes in environmental, tax, pension and other laws; (i) the terms of collective bargaining agreements; (j) employee strikes or other labor issues; and (k) U.S. and global economic performance and political developments. Domestic steel shipments and prices could be affected by import levels and actions taken by the U.S. Government and its agencies, including those related to CO2 emissions, climate change and shale gas development. Economic conditions and political factors in Europe that may affect U. S. Steel Europe's results include, but are not limited to: (l) taxation; (m) nationalization; (n) inflation; (o) fiscal instability; (p) political issues; (q) regulatory actions; and (r) quotas, tariffs, and other protectionist measures. We present adjusted net income (loss), adjusted net income (loss) per diluted share, EBITDA, Adjusted EBITDA and net debt, which are non- GAAP measures, as additional measurements to enhance the understanding of our operating performance and facilitate a comparison with that of our competitors. In accordance with

safe harbor

provisions of the Private Securities Litigation Reform Act of 1995, cautionary statements identifying important factors, but not necessarily all factors, that could cause actual results to differ materially from those set forth in the forward- looking statements have been included in U. S. Steels Annual Report on Form 10-K for the year ended December 31, 2013, and in subsequent filings for U. S. Steel.

�

Income from Operations Reportable Segments and Other Businesses $ Millions Adjusted EBITDA $ Millions Adjusted Diluted EPS $ / Share 4Q 2014 3Q 2014 4Q 2013 4Q 2013 3Q 2014 4Q 2014 Strong operating performance and Carnegie Way progress in the second half of 2014 Note: For reconciliation of non-GAAP amounts see Appendix 3Q 2014 4Q 2013 4Q 2014 Adjusted Fourth Quarter 2014 Results Strong 3 United States Steel Corporation Adjusted Net Income $ Millions 4Q 2013 3Q 2014 4Q 2014 Strong performance in second half of 2014

�

Income from Operations Reportable Segments and Other Businesses $ Millions Adjusted EBITDA $ Millions Adjusted Diluted EPS $ / Share 2014 2013 2012 2012 2013 2014 Carnegie Way impacting the bottom line significantly in 2014 Note: For reconciliation of non-GAAP amounts see Appendix 2013 2012 2014 Adjusted 2014 Results Strong 4 United States Steel Corporation Adjusted Net Income $ Millions 2012 2013 2014 Significantly improved margins for each segment Best year since 2008

�

Cash from Operations $ Millions 2013 2012 2014 Free Cash Flow $ Millions 2013 2012 2014 Strong cash generation and liquidity position in 2014 Strong Cash Flows 5 United States Steel Corporation Cash and Cash Equivalents $ Millions Cash increased $750 million, despite $320 million used to redeem convertible notes in May 2014 Strong cash position

�

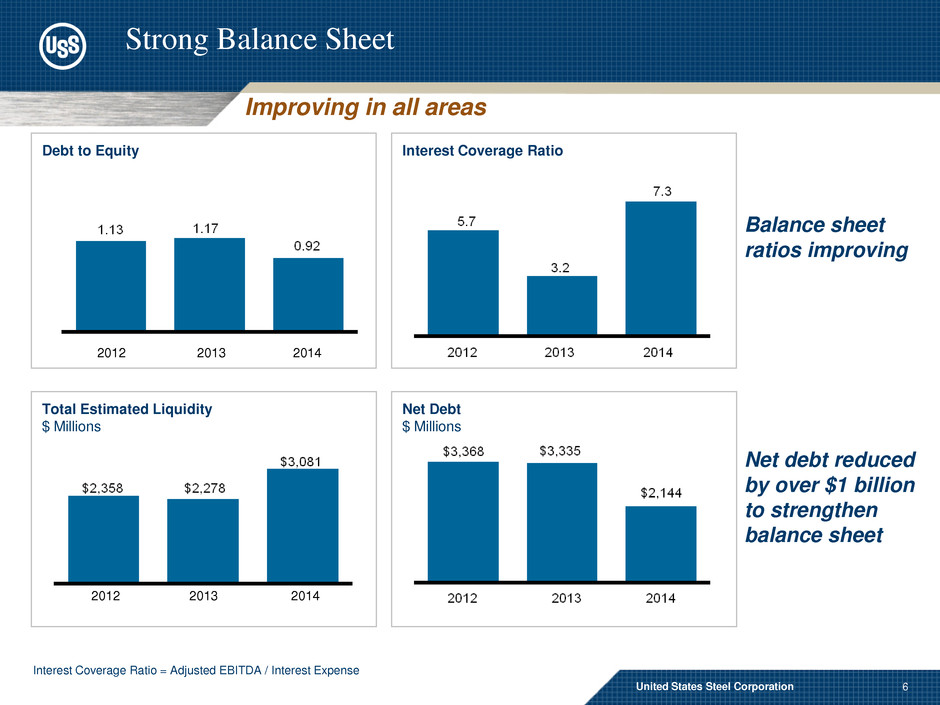

Total Estimated Liquidity $ Millions 2013 2012 2014 Debt to Equity 2013 2012 2014 Balance sheet ratios improving Strong Balance Sheet 6 United States Steel Corporation Net Debt $ Millions Interest Coverage Ratio Net debt reduced by over $1 billion to strengthen balance sheet Interest Coverage Ratio = Adjusted EBITDA / Interest Expense Improving in all areas

�

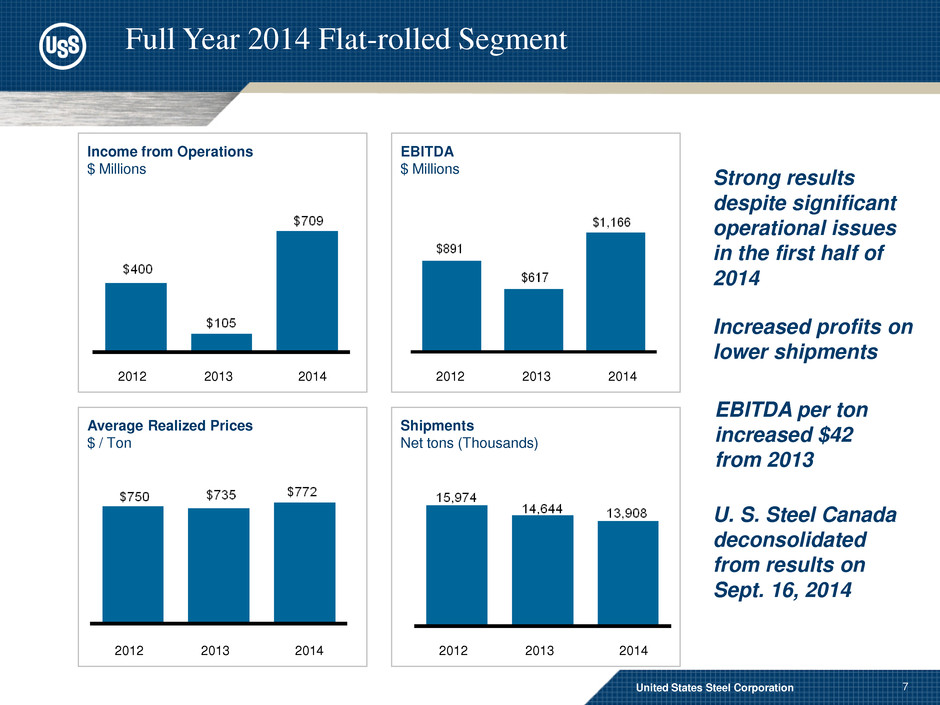

Income from Operations $ Millions Average Realized Prices $ / Ton 2012 2013 2014 Full Year 2014 Flat-rolled Segment 2012 2013 2014 Shipments Net tons (Thousands) 2012 2013 2014 Increased profits on lower shipments 7 United States Steel Corporation EBITDA $ Millions 2012 2013 2014 Strong results despite significant operational issues in the first half of 2014 U. S. Steel Canada deconsolidated from results on Sept. 16, 2014 EBITDA per ton increased $42 from 2013

�

Income from Operations $ Millions Average Realized Prices $ / Ton 2014 2013 2012 Full Year 2014 Tubular Segment 2014 2013 2012 Shipments Net tons (Thousands) 2014 2013 2012 8 United States Steel Corporation EBITDA per ton increased $44 from 2013 EBITDA $ Millions 2012 2013 2014 Indefinitely idled McKeesport and Bellville in 2014 Increased pricing in the second half of 2014 after OCTG trade case win

�

Income from Operations $ Millions Average Realized Prices $ / Ton 2012 2013 2014 Full Year 2014 U. S. Steel Europe Segment 2012 2013 2014 Shipments Net tons (Thousands) 2012 2013 2014 EBITDA per ton increased $24 from 2013 The early adoption of Carnegie Way propelled earnings throughout the year 9 United States Steel Corporation EBITDA $ Millions 2012 2013 2014

�

10 United States Steel Corporation Pension and OPEB (Includes affects of the deconsolidation of U. S. Steel Canada, Inc. on September 16, 2014) Expense and funded status Major Assumptions: Discount rate: 5.00% for 2011, 4.50% for 2012, 3.75% for 2013, 4.50% for 2014, and 3.75% for 2015E Expected rate of return on assets: 8.00% in U.S. & 7.50% in Canada for 2011 Expected rate of return on assets: 7.75% in U.S. & 7.25% in Canada for 2012 through 2014 Expected rate of return on assets: 7.50% in U.S. for 2015E $602

�

11 2015 Carnegie Way 55% 12% United States Steel Corporation Benefits continue to grow $575 million of Carnegie Way benefits realized in 2014 2014 is now the new base year for comparison $150 million of carryover impact in 2015 from projects that were implemented at various points throughout 2014

�

12 Carnegie Way transformation Phase 1: Earning the right to grow in search of: " Economic profits " Customer satisfaction and loyalty " Process improvements and focused investment Phase 2: Driving profitable growth with: " Advanced high strength steel " Premium connections " Operational excellence " Focused M&A Strategic Approach United States Steel Corporation

�

13 United States Steel Corporation Business Update Operating updates " Blast furnaces " Flat-rolled finishing facilities " Tubular facilities Strategic initiatives " Commercial entity management structure " Reliability centered maintenance " Operational excellence Recent activity

�

14 United States Steel Corporation Flat-rolled 2015 U.S. light vehicle sales forecast is approximately 17 million units, up 1% year-over- year Recent OEM shipment forecasts indicated 4% - 5% growth in the appliance market versus 2014 Construction indices expect 6% spending growth year-over-year Service center shipments will trend with small market demand increase U. S. Steel Europe V4* car production expected to outpace the average EU in 2015 Appliance growth in V4 expected to outperform average EU growth in 2015 EU construction output expected to grow slightly in 2015, with residential continuing to be the primary driver Tubular Imports remain challenging Oil directed rig counts currently down 16% from 4Q average Natural gas directed rig counts increased 5% over 3Q, but are currently down 7% from 4Q average Oil prices remain uncertain Market Updates Major industry summary and market fundamentals * Visegrad Group Czech Republic, Hungary, Poland and Slovakia

�

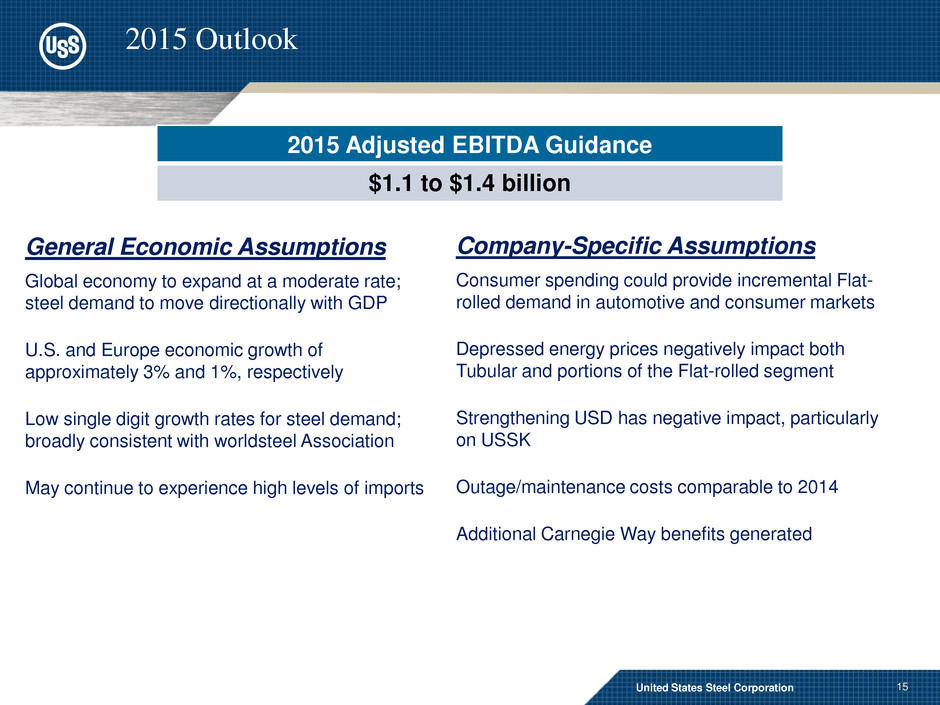

15 United States Steel Corporation 2015 Outlook General Economic Assumptions Global economy to expand at a moderate rate; steel demand to move directionally with GDP U.S. and Europe economic growth of approximately 3% and 1%, respectively Low single digit growth rates for steel demand; broadly consistent with worldsteel Association May continue to experience high levels of imports Company-Specific Assumptions Consumer spending could provide incremental Flat- rolled demand in automotive and consumer markets Depressed energy prices negatively impact both Tubular and portions of the Flat-rolled segment Strengthening USD has negative impact, particularly on USSK Outage/maintenance costs comparable to 2014 Additional Carnegie Way benefits generated 2015 Adjusted EBITDA Guidance $1.1 to $1.4 billion

�

United States Steel Corporation Fourth Quarter 2014 Earnings Conference Call and Webcast Q & A January 28, 2015 � 2011 United States Steel Corporation United States Steel Corporation 16

�

� 2011 United States Steel Corporation Appendix 17 United States Steel Corporation

�

18 Major industry summary North American Flat-rolled Segment Automotive 2015 NAFTA light vehicle production forecast is ~17 million units, +1% from 2014. 2015 US light vehicle sales forecast of 16.9 million units represents 3% y-o-y growth. Industrial Equipment Further y-o-y declines expected for mining equipment manufacturers. Agricultural equipment sales expected to soften from 2014 levels. Construction equipment sales projected to benefit from improved construction market. Railcar backlog at end of Q3 was the highest backlog level since Oct.1979, suggesting good 2015. Tin Plate AISI YTD domestic shipments totaled down 6% through November, with imports up 30% YTD. Expect import pressure to remain significant in 2015. Appliance 2015 OEM industry shipment forecasts suggest 4% to 5% growth over 2014. Pipe and Tube Structural tubing demand expected to improve in line with construction market. Line Pipe and OCTG demand dependent on recovery from depressed energy price environment; inventory and imports remain an issue. Construction Construction spending is expected to register y-o-y growth of 6% in 2015. Dodge Construction contract index expected to continue to show y-o-y improvement. ABI index in expansion for the last seven months, suggesting 2015 construction acceleration. Service Center Service Centers heading into 2015 with highest carbon flat-rolled inventory level since August 2008; Inventory level of 6.2 million NT +24% from end of 2013 level (4.98 million NT). 2015 carbon flat-rolled service center shipments will trend with small market demand increase. United States Steel Corporation Sources: Wards / Customer Dodge / Customer Financial Reports / MSCI / AISI / Railway Age / OCTG Situation Report

�

19 Market fundamentals Oil Directed Rig Count The oil directed rig count averaged 1,564 during 4Q, a decrease of 1% over 3Q. There are currently 1,317 active oil rigs. Gas Directed Rig Count The natural gas directed rig count averaged 340 during 4Q, an increase of 5% over 3Q. There are currently 316 active natural gas rigs. Natural Gas Storage Level Currently 2.6 Tcf, 8% above last year and 5% below the five year average. The U.S. Energy Information Administration projects inventories to end the withdrawal season (end of March) above 1.6 Tcf, 94% above last year. Oil Price The West Texas Intermediate oil price averaged $73 per barrel during 4Q, down $25 or 26% from 3Q. U.S. Energy Information Administration forecasts an average 2015 price of $55 per barrel. Natural Gas Price The Henry Hub natural gas price averaged $3.80 per MMBtu during 4Q, down $0.16 or 4% from 3Q. The U.S. Energy Information Administration forecasts an average 2015 natural gas price of $3.44 per MMBtu. Imports During 4Q, import share of OCTG apparent market demand averaged roughly 50%. OCTG Inventory December 2014 OCTG inventory is estimated to be about 2.8 million tons, approximately 5 months of supply. Tubular Segment United States Steel Corporation Sources: Baker Hughes, US Energy Information Administration, Preston Publishing, Internal

�

20 Major industry summary United States Steel Corporation Automotive Total EU car production is forecasted to grow by 2.1% to 17 million units in 2015. Better performance is anticipated in the South European countries; production in Italy is projected to grow by 20% and in Spain by 10%. In Germany, the biggest EU car producer, a slight decrease of 0.9% in car production is expected. V4 car production for 2015 is anticipated to increase by 3% y-o-y to 3 million units. Significant growth is expected in plants located in our home market, mainly in Opel Poland, Audi Hungary and TPC Czech Republic. Appliance The appliance sector in 2015 is expected to rise in the EU as a whole by 3% y-o-y and by 4% y-o-y in V4. The V4 appliance market is driven mainly by Slovakia (Whirlpool washing machines) and Poland (Samsung, LG, BSH). Tin Plate After strong destocking at the end of 2014, customers are anticipated to restock their warehouses. The positive trend in consumption should continue until the end of Q3 2015. 2015 consumption is expected to grow by 2% y-o-y; after growing 3.5% in 2014. Construction Total EU construction activity is expected to increase by almost 2% in 2015. The key driver will remain the residential sector, although civil engineering is also expected to gain some strength. Several EU countries are looking to boost their economies via a �315 billion investment plan of the European Commission to stimulate infrastructure activity over the next three years. This should give a boost to large civil engineering projects and as a consequence to construction steel demand. Service Centers Sales activity in 2015 is foreseen to be in line with the activity of major steel consuming sectors. Inventory in 2015 is expected to remain in line with demand. U. S. Steel Europe Segment Sources: Eurofer, USSK Marketing, EASSC, IHS, Euroconstruct, ESTA, ACEA

�

U. S. Steel Commercial Contract vs. Spot Contract vs spot mix by segment twelve months ended December 31, 2014 Firm 29% Market Based Quarterly * 19% Flat-rolled ** Market Based Monthly * 10% Tubular U. S. Steel Europe Spot 30% Cost Based 11% Contract: 70% Spot: 30% Firm 37% Market Based Quarterly 1% Spot 50% Cost Based 1% Program 52% Contract: 50% Spot: 50% Market Based Monthly 11% Spot 48% Program: 52% Spot: 48% United States Steel Corporation 21 Market Based Semi-annual * 1% *Annual contract volume commitments with price adjustments in stated time frame ** Excludes shipments for U. S. Steel Canada, Inc.

�

22 United States Steel Corporation Other Items Capital Spending Fourth quarter actual $137 million, full year 2014 actual $419 million, 2015 estimate $650 million Depreciation, Depletion and Amortization Fourth quarter actual $138 million, full year 2014 actual $627 million, 2015 estimate $555 million Pension and Other Benefits Costs Fourth quarter actual $70 million, full year 2014 actual $312 million, 2015 estimate $244 million Pension and Other Benefits Cash Payments (excluding any VEBA contributions and voluntary pension contributions) Fourth quarter actual $40 million, full year 2014 actual $406 million, 2015 estimate $300 million

�

23 Days Away From Work Injury Rate (Frequency Rates per 200,000 Hours Worked) Global Safety Performance Safety Performance United States Steel Corporation

�

24 United States Steel Corporation Adjusted Results ($ millions) FY 2014 4Q 2014 3Q 2014 FY 2013 4Q 2013 FY 2012 Reported net income (loss) $102 $275 ($207) ($1,645) $297 ($124) Loss on deconsolidation of U. S. Steel Canada and other charges 385 1 384 � � � Impairment of carbon alloy facilities at Gary Works 161 (2) 163 � � � Loss on sale of U. S. Steel Serbia � � � � � 399 Write-off of pre-engineering costs at Keetac 30 � 30 � � � Gain on sale of real estate assets (45) � (45) � � � Gain on sale of transportation assets � � � � � (58) Litigation reserves 46 � � � � � Loss on assets held for sale 9 � � � � � Curtailment gain (12) � � � � � Impairment of goodwill � � � 1,795 23 � Tax benefits � � � (561) (561) � Repurchase premium charge � � � 22 � 11 Write-off of equity investment � � � 15 � � Supplier contract dispute settlement � � � (15) � (9) Property tax settlements � � � � � (12) Labor agreement lump sum payments � � � � � 22 Restructuring and other charges � � � 279 279 � Adjusted net income (loss) $676 $274 $325 ($110) $38 $229 Reconciliation of reported and adjusted net income

�

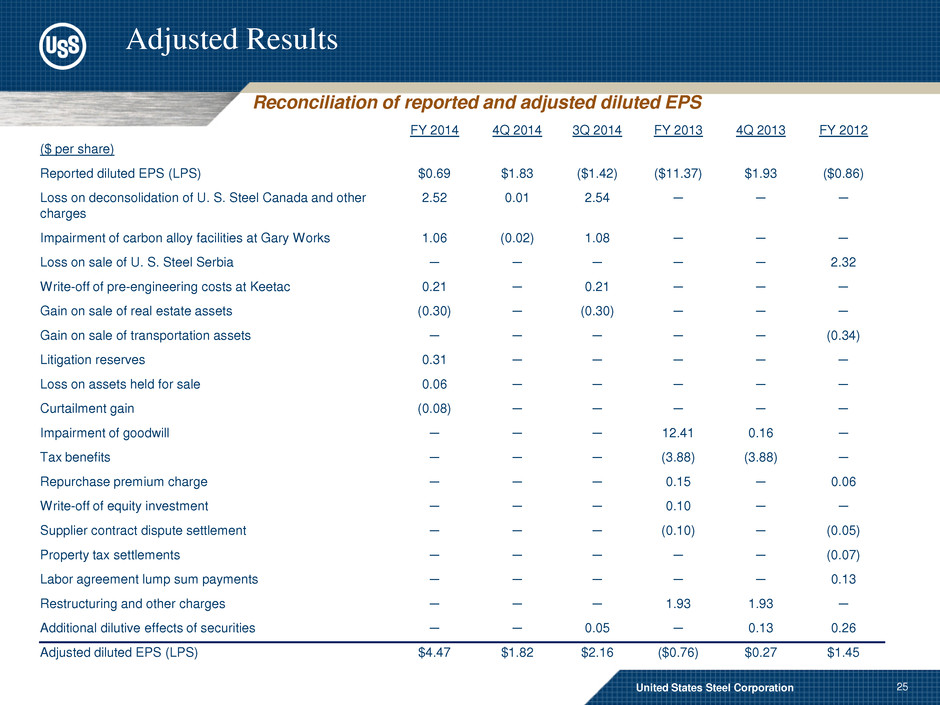

25 United States Steel Corporation Adjusted Results ($ per share) FY 2014 4Q 2014 3Q 2014 FY 2013 4Q 2013 FY 2012 Reported diluted EPS (LPS) $0.69 $1.83 ($1.42) ($11.37) $1.93 ($0.86) Loss on deconsolidation of U. S. Steel Canada and other charges 2.52 0.01 2.54 � � � Impairment of carbon alloy facilities at Gary Works 1.06 (0.02) 1.08 � � � Loss on sale of U. S. Steel Serbia � � � � � 2.32 Write-off of pre-engineering costs at Keetac 0.21 � 0.21 � � � Gain on sale of real estate assets (0.30) � (0.30) � � � Gain on sale of transportation assets � � � � � (0.34) Litigation reserves 0.31 � � � � � Loss on assets held for sale 0.06 � � � � � Curtailment gain (0.08) � � � � � Impairment of goodwill � � � 12.41 0.16 � Tax benefits � � � (3.88) (3.88) � Repurchase premium charge � � � 0.15 � 0.06 Write-off of equity investment � � � 0.10 � � Supplier contract dispute settlement � � � (0.10) � (0.05) Property tax settlements � � � � � (0.07) Labor agreement lump sum payments � � � � � 0.13 Restructuring and other charges � � � 1.93 1.93 � Additional dilutive effects of securities � � 0.05 � 0.13 0.26 Adjusted diluted EPS (LPS) $4.47 $1.82 $2.16 ($0.76) $0.27 $1.45 Reconciliation of reported and adjusted diluted EPS

�

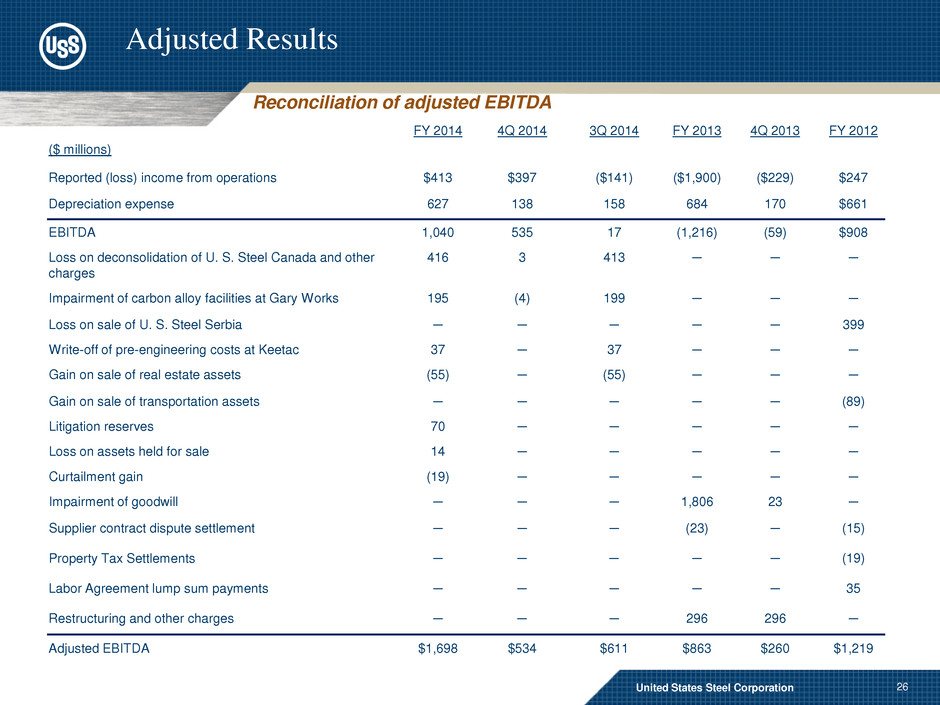

26 United States Steel Corporation Adjusted Results ($ millions) FY 2014 4Q 2014 3Q 2014 FY 2013 4Q 2013 FY 2012 Reported (loss) income from operations $413 $397 ($141) ($1,900) ($229) $247 Depreciation expense 627 138 158 684 170 $661 EBITDA 1,040 535 17 (1,216) (59) $908 Loss on deconsolidation of U. S. Steel Canada and other charges 416 3 413 � � � Impairment of carbon alloy facilities at Gary Works 195 (4) 199 � � � Loss on sale of U. S. Steel Serbia � � � � � 399 Write-off of pre-engineering costs at Keetac 37 � 37 � � � Gain on sale of real estate assets (55) � (55) � � � Gain on sale of transportation assets � � � � � (89) Litigation reserves 70 � � � � � Loss on assets held for sale 14 � � � � � Curtailment gain (19) � � � � � Impairment of goodwill � � � 1,806 23 � Supplier contract dispute settlement � � � (23) � (15) Property Tax Settlements � � � � � (19) Labor Agreement lump sum payments � � � � � 35 Restructuring and other charges � � � 296 296 � Adjusted EBITDA $1,698 $534 $611 $863 $260 $1,219 Reconciliation of adjusted EBITDA

�

27 United States Steel Corporation Adjusted Results Net Debt ($ millions) FY 2014 FY 2013 FY 2012 Short-term debt and current maturities of long-term debt $378 $323 $2 Long-term debt, less unamortized discount 3,120 3,616 3,936 Total Debt $3,498 $3,939 $3,938 Less: Cash and cash equivalents 1,354 604 570 Net Debt $2,144 $3,335 $3,368 Reconciliation of net debt and free cash flow Free Cash Flow ($ millions) FY 2014 FY 2013 FY 2012 Cash provided by operating activities $1,492 $414 $1,135 Cash provided by (used in) investing activities (366) (393) (602) Dividends paid (29) (29) (29) Free Cash Flow $1,097 ($8) $504

�

Page 1 of 6 Fourth Quarter 2014 Questions and Answers Exhibit 99.2

�

Page 2 of 6 Forward-Looking Statements This release contains forward-looking statements with respect to economic and market conditions, operating costs, shipments and prices. Factors that could affect economic and market conditions, costs, shipments and prices for both North American and European operations include: (a) foreign currency fluctuations and related activities; (b) global product demand, prices and mix (which are influenced by, among other things, the prices of commodities such as oil, iron ore and steel scrap); (c) global and company steel production levels; (d) plant operating performance; (e) natural gas, electricity, raw materials and transportation prices, usage and availability; (f) international trade developments, including court decisions, legislation and agency decisions on petitions and sunset reviews; (g) the impact of fixed prices in energy and raw materials contracts (many of which have terms of one year or longer) as compared to short-term contract and spot prices of steel products; (h) changes in environmental, tax, pension and other laws; (i) the terms of collective bargaining agreements; (j) employee strikes or other labor issues; and (k) U.S. and global economic performance and political developments. Domestic steel shipments and prices could be affected by import levels and actions taken by the U.S. Government and its agencies, including those related to CO2 emissions, climate change and shale gas development. Economic conditions and political factors in Europe that may affect U. S. Steel Europe's results include, but are not limited to: (l) taxation; (m) nationalization; (n) inflation; (o) fiscal instability; (p) political issues; (q) regulatory actions; and (r) quotas, tariffs, and other protectionist measures. We present adjusted net income (loss), adjusted net income (loss) per diluted share, EBITDA, Adjusted EBITDA and net debt, which are non- GAAP measures, as additional measurements to enhance the understanding of our operating performance and facilitate a comparison with that of our competitors. In accordance with

safe harbor

provisions of the Private Securities Litigation Reform Act of 1995, cautionary statements identifying important factors, but not necessarily all factors, that could cause actual results to differ materially from those set forth in the forward- looking statements have been included in U. S. Steels Annual Report on Form 10-K for the year ended December 31, 2013, and in subsequent filings for U. S. Steel.

�

Page 3 of 6 1. Is the Carnegie Way just a cost cutting initiative? No - the Carnegie Way transformation is not just a cost cutting initiative. The Carnegie Way transformation is a purposeful and deliberate focus on delivering customer solutions that reward our stockholders through superior performance with the best talent available. While there has been and will be sustainable cost improvements through process efficiency and investments in reliability centered maintenance, the focus of the Carnegie Way is not just cost cutting. The Carnegie Way focuses on our strengths and where we can create the most value for our stockholders and best serve our customers. If we find we cannot implement changes to our current operating and business practices that create value for our customers which then delivers value to our stockholders, we will exit those underperforming areas of our business. We believe opportunities are greatest where we make money for our stockholders and our customers. When we deliver value for them, we can afford great jobs and benefits for our employees and the communities where we do business. 2. What are the sustainable benefits to U. S. Steel from the Carnegie Way transformation and how much additional upside remains? We are still in the early stages of a multi-year transformation and continue to implement new projects on an ongoing basis. As of the end of the fourth quarter of 2014 we implemented projects that had a favorable impact on operating income in 2014 of $575 million compared with 2013. Realizing the full year impact of projects implemented at various points throughout 2014 will provide an additional $150 million of operating income benefits for 2015 versus 2014. 3. U. S. Steel has mentioned that there is increased focus on earning economic profit. What is the definition of economic profit? The term profit typically refers to any positive income for a business enterprise. Economic profit is a higher threshold that refers to income in excess of an enterprises weighted average cost of capital, which includes the cost of equity in addition to the cost of debt. Economic profit is true value creation as it provides stockholder returns above and beyond the weighted average cost of capital. 4. Why is U. S. Steel moving to annual guidance? We are introducing quantitative annual earnings guidance for 2015 to better align with our Carnegie Way transformation. Carnegie Way is focused on value creation from sustained improvement in earnings power throughout the business cycle and to achieve our ultimate goal of delivering economic profit. A short-term, quarter-to-quarter mentality is contrary to the foundations of our multi-year Carnegie Way journey. By guiding long-term we can provide all of our stakeholders with a more informed view of our earnings potential.

�

Page 4 of 6 5. Does the current oil price environment change your tubular market strategy? Our market strategy in the tubular segment remains the same. We will continue to work closely with our distributors and customers to meet their tubular needs while continuing our development of a full suite of premium and semi-premium connections. Our relationships with customers remain strong and support on-going development which will allow us to be prepared when market conditions improve. 6. What are the pros and cons of low oil prices for U. S. Steel? Low energy prices are negatively impacting some of our customers in North America. U.S. drillers are dropping rig counts in an attempt to balance drilling budgets. Subsequently, distributors are scaling back purchases as they align inventories with lower future demand projections. There are also energy oriented hot rolled customers in our flat-rolled segment who are scaling back purchases as they also align order rates and inventories with lower future demand projections. The positive side of the story relates to lower energy prices potentially translating to higher consumer spending. This could directly benefit our flat-rolled segment, which supplies major consumer spending-related industries, such as automotive, appliances, and containers & packaging. Lower oil prices also positively impact energy and fuel costs for our manufacturing and mining operations, respectively. 7. Are iron ore and coal levels at the plants adequate to withstand a winter similar to last year? U. S. Steel has taken precautionary steps over the past few months to ensure that our facilities are adequately prepared for another harsh winter. Last year, the seasonal lockdown of the SOO locks, connecting Lake Superior to Lake Huron, was closed for double the normal winter length of time. As a result, U. S. Steel had to curtail operations due to a shortage of raw materials. In response, we have met our target of placing additional materials on the ground at our mills ahead of the scheduled January 15th SOO locks closure. 8. How is U. S. Steel responding to the threat from aluminum in the auto industry? We are focused on providing value-added solutions for our automotive customers. The continuing development of advanced high strength steels (AHSS), particularly those grades commonly referred to as Generation 1 Plus and Generation 3 AHSS, will enable us to continue to provide our automotive customers with a steel intensive total vehicle solution that will enable them to meet the increasing CAF� and safety standards for future vehicles at a very attractive and competitive value proposition compared with potential alternative materials.

�

Page 5 of 6 9. What can we expect to see regarding Reliability Centered Maintenance in its first year? We are in the beginning stages of a multi-year implementation plan of Reliability Centered Maintenance (RCM) at our facilities. We are deploying dedicated resources and RCM principles to all U. S. Steel facilities. The deployment in its first year will entail multiple months of training of our employees as well as the beginning phases of RCM process implementation into our facilities. The RCM process is intended to improve reliability of our facilities, which will in turn improve safety, quality, and service to our customers. 10. What is U. S. Steels approach to trade cases and how do you determine if one should be filed? The process by which we consider whether to file a potential trade case is complex and constant, informed by the requirements set forth in the Tariff Act of 1930, which provides for the right of American industries to petition for relief from imports that are sold in the United States at less than fair value ("dumped") or which benefit from subsidies provided through foreign government programs. Under the law, the U.S. Department of Commerce determines whether the dumping or subsidizing exists and, if so, the margin of dumping or amount of the subsidy; the US International Trade Commissions determines whether there is material injury or threat of material injury to the domestic industry by reason of the dumped or subsidized imports. The law also requires that the petitioners must represent at least 25% of domestic production and 50% of the domestic production produced by that portion of the industry expressing support for the petition. The petition itself requires the disclosure of all relevant economic factors, including the domestic industry's output, sales, market share, employment, and profits. Accordingly, managed by our internal international trade lawyers, a multifaceted, diverse U. S. Steel team continuously: Surveys the relevant markets; Triangulates market intelligence; Assesses market trends and data; Integrates and interprets prevailing legal and political concerns; then, based on a comprehensive review of all factors and considerations, renders an informed, sanguine decision as to the likelihood of success and whether to proceed. 11. The conflict in the Ukraine has been in the news again recently. Has anything changed in USSKs supply chain for raw materials that should concern investors? We monitor the situation daily and are in constant communications with our suppliers and customers. Our supply of raw materials continues to flow on a normal basis. We have also put several risk mitigation measures into place.

�

Page 6 of 6 12. How is a stronger dollar impacting U. S. Steels results? A stronger U.S. dollar attracts imports to the U.S. market, threatening domestic prices and volumes. In addition, a stronger dollar versus the euro negatively impacts our reported earnings attributable to our European segment. 13. U. S. Steel's stock has been very volatile. Why is this so and what is U. S. Steel doing to reduce cyclicality? The global steel industry is a cyclical industry and steel selling prices tend to fluctuate fairly quickly. Our current cost structure is more fixed and stable than many of our competitors. Additionally, our operating configuration has significant leverage to steel selling price changes to both the upside and the downside resulting in significant earnings volatility on a quarter to quarter basis. The volatility of our earnings is also affected by the consistency and reliability of our operations. The objective of our Carnegie Way transformation is to create a lower and more flexible cost structure and more flexible and reliable operations. While we cannot control or reduce the cyclicality of the global steel industry, we can create a lower cost and more flexible business model that will produce stronger and more consistent earnings across industry cycles.

�

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Cleveland Cliffs CEO Lourenco Goncalves on US Steel-Nippon Deal: The Deal Will Fail - CNBC Interview

- Pre-Investor Call Presentation available to shareholders

- LA Wine Country Stylish Wedding Transportation, Luxury Limousines Available

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share