Form 8-K TTM TECHNOLOGIES INC For: Nov 18

�

�

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

�

�

FORM 8-K

�

�

CURRENT REPORT

Pursuant to Section�13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November�18, 2014

�

�

TTM TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

�

�

�

| Delaware | � | 0-31285 | � | 91-1033443 |

| (State or other Jurisdiction of Incorporation) |

� | (Commission File Number) |

� | (IRS Employer Identification No.) |

�

| 1665 Scenic Avenue, Suite 250 Costa Mesa, California |

� | 92626 |

| (Address of Principal Executive Offices) | � | (Zip Code) |

Registrant�s telephone number, including area code: (714)�327-3000

(Former name or former address if changed since last report.)

�

�

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

�

| � | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

�

| � | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

�

| � | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

�

| � | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

�

�

�

| Item�7.01. | Regulation FD Disclosure. |

Beginning on November�18, 2014, executives of TTM Technologies, Inc. (the �Company� or �TTM�) will present information about the Company, including the information described in the slides furnished as Exhibit 99.1 to this Current Report on Form 8-K, to various potential lenders in connection with the proposed financing arrangements related to the Company�s proposed acquisition of Viasystems Group, Inc. (�Viasystems�).

The information in this Current Report (including the exhibit) is furnished pursuant to Item�7.01 and shall not be deemed to be �filed� for the purpose of Section�18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. This Current Report will not be deemed an admission as to the materiality of any information in this Current Report that is required to be disclosed solely by Regulation FD.

The Company does not have, and expressly disclaims, any obligation to release publicly any updates or any changes in its expectations or any change in events, conditions, or circumstances on which any forward-looking statement is based.

�

| Item�9.01. | Financial Statements and Exhibits. |

�

| (d) | Exhibits. |

�

| Exhibit |

�� | Description |

| 99.1 | �� | Slides presented to potential lenders, dated November�18, 2014 |

�

Forward-Looking Statements

Certain statements in this communication may constitute �forward-looking statements� within the meaning of the Private Securities Litigation Reform Act of 1995. The Company cautions you that such statements are simply predictions and actual events or results may differ materially. These statements reflect the Company�s current expectations, and the Company does not undertake to update or revise these forward-looking statements, even if experience or future changes make it clear that any projected results expressed or implied in this or other Company statements will not be realized. Further, these statements involve risks and uncertainties, many of which are beyond the Company�s control, which could cause actual results to differ materially from the forward-looking statements. These risks and uncertainties include, but are not limited to, general market and economic conditions, including interest rates, currency exchange rates and consumer spending, the ability of the Company and Viasystems to consummate the proposed Merger and realize anticipated synergies, demand for the Company�s products, market pressures on prices of the Company�s products, warranty claims, changes in product mix, contemplated significant capital expenditures and related financing requirements, and the Company�s dependence upon a small number of customers. Additional factors that may cause results to differ materially from those described in the forward-looking statements are set forth in the Annual Report on Form 10-K of the Company for the year ended December�30, 2013, which was filed with the SEC on February�21, 2014, under the heading �Item 1A. Risk Factors� and in the Company�s other filings made with the SEC available at the SEC�s website at www.sec.gov.

The Company does not undertake any obligation to update any such forward-looking statements to reflect any new information, subsequent events or circumstances, or otherwise, except as may be required by law.

Use of Non-GAAP Financial Measures

In addition to the financial statements presented in accordance with U.S. GAAP, TTM and Viasystems use certain non-GAAP financial measures, including �adjusted EBITDA.��The companies present non-GAAP financial information to enable investors to see each company through the eyes of management and to provide better insight into its ongoing financial performance.

Adjusted EBITDA is defined by TTM as earnings before interest expense, income taxes, depreciation, amortization of intangibles, stock-based compensation expense, gain on sale of assets, asset impairments, restructuring, costs related to acquisitions, and other charges. Adjusted EBITDA is defined by Viasystems as earnings before interest expense, income taxes, depreciation and amortization, stock-based compensation, restructuring and impairment charges, costs relating to acquisitions and equity registrations, and other non-recurring items. For a reconciliation of adjusted EBITDA to net income, please see the Appendix included in Exhibit 99.1 to this Current Report on Form 8-K.�Adjusted EBITDA is not a recognized financial measure under U.S. GAAP, and it does not purport to be an alternative to operating income or an indicator of operating performance.�Adjusted EBITDA is presented to enhance an understanding of operating results and is not intended to represent cash flows or results of operations.�The Boards of Directors, lenders, and management of TTM and Viasystems use adjusted EBITDA primarily as an additional measure of operating performance for matters including executive compensation and competitor comparisons.�The use of this non-GAAP measure provides an indication of each company�s ability to service debt, and management considers it an appropriate measure to use because of the companies� leveraged positions.

Adjusted EBITDA has certain material limitations, primarily due to the exclusion of certain amounts that are material to each company�s consolidated results of operations, such as interest expense, income tax expense, and depreciation and amortization.�In addition, adjusted EBITDA may differ from the adjusted EBITDA calculations reported by other companies in the industry, limiting its usefulness as a comparative measure.

The companies use adjusted EBITDA to provide meaningful supplemental information regarding operating performance and profitability by excluding from EBITDA certain items that each company believes are not indicative of its ongoing operating results or will not impact future operating cash flows, which include stock-based compensation expense, gain on sale of assets, asset impairments, restructuring, costs related to acquisitions, and other charges.

Additional Information and Where to Find It

This communication may be deemed to be solicitation material in respect of the proposed Merger between the Company and Viasystems. The Company has filed with the SEC a registration statement on Form S-4, which includes a prospectus with respect to the Company�s shares of common stock to be issued in the proposed Merger and a proxy statement of Viasystems in connection with the proposed Merger (the �Proxy Statement/Prospectus�). The Proxy Statement/Prospectus was sent or given to Viasystems� stockholders when the Proxy Statement/Prospectus was declared effective by the SEC, and it contains important information about the proposed Merger and related matters. VIASYSTEMS SECURITY HOLDERS ARE ADVISED TO READ THE PROXY STATEMENT/PROSPECTUS CAREFULLY BECAUSE IT CONTAINS IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. The Proxy Statement/Prospectus and other relevant materials (when they become available) and any other documents filed by the Company or Viasystems with the SEC may be obtained free of charge at the SEC�s website at www.sec.gov. In addition, security holders will be able to obtain free copies of the Proxy Statement/Prospectus from the Company or Viasystems by contacting either (1)�Investor Relations by mail at TTM Technologies, Inc., 1665 Scenic Avenue, Suite 250, Costa Mesa, CA 92626, Attn: Investor Relations Department, by telephone at 714-327-3000, or by going to the Company�s Investor Relations page on its corporate website at www.ttmtech.com, or (2)�Investor Relations by mail at Viasystems Group, Inc., 101 South Hanley Road, Suite 1800, St. Louis, MO 63105, Attn: Investor Relations Department, by telephone at 314-727-2087, or by going to Viasystems� Investor Info page on its corporate website at www.viasystems.com.

No Offer or Solicitation

The information in this communication is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed transactions or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section�10 of the Securities Act of 1933, as amended.

Participants in the Solicitation

The Company and Viasystems and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Viasystems� stockholders in connection with the proposed Merger and may have direct or indirect interests in the proposed Merger. Information about the Company�s directors and executive officers is set forth in the Company�s Proxy Statement on Schedule 14A for its 2014 Annual Meeting of Stockholders, which was filed with the SEC on March�14, 2014, and its Annual Report on Form 10-K for the fiscal year ended December�30, 2013, which was filed with the SEC on February�21, 2014. These documents are available free of charge at the SEC�s website at www.sec.gov, and from the Company by contacting Investor Relations by mail at TTM Technologies, Inc., 1665 Scenic Avenue, Suite 250, Costa Mesa, CA 92626, Attn: Investor Relations Department, by telephone at 714-327-3000, or by going to the Company�s Investor Relations page on its corporate website at www.ttmtech.com. Information about Viasystems� directors and executive officers is set forth in Viasystems� Proxy Statement on Schedule 14A for its 2014 Annual Meeting of Stockholders, which was filed with the SEC on March�14, 2014, and its Annual Report on Form 10-K for the fiscal year ended December�31, 2013, which was filed with the SEC on February�14, 2014. These documents are available free of charge at the SEC�s website at www.sec.gov, and from Viasystems by contacting Investor Relations by mail at Viasystems Group, Inc., 101 South Hanley Road, Suite 1800, St. Louis, MO 63105, Attn: Investor Relations Department, by telephone at 314-727-2087, or by going to Viasystems� Investor Info page on its corporate website at www.viasystems.com. Additional information regarding the interests of participants in the solicitation of proxies in connection with the proposed Merger is included in the Proxy Statement/Prospectus that the Company filed with the SEC.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

�

| Date: November�18, 2014 | � | � | TTM TECHNOLOGIES, INC. | |||

| � | � | By: | � | /s/ Todd B. Schull | ||

| � | � | � | Todd B. Schull | |||

| � | � | � | Executive Vice President, Chief Financial Officer, Treasurer and Secretary | |||

EXHIBIT INDEX

�

| Exhibit |

�� | Description |

| 99.1 | �� | Slides presented to potential lenders, dated November�18, 2014 |

| Exhibit 99.1 �

|

�

Lender Presentation November�18, 2014

|

|

�

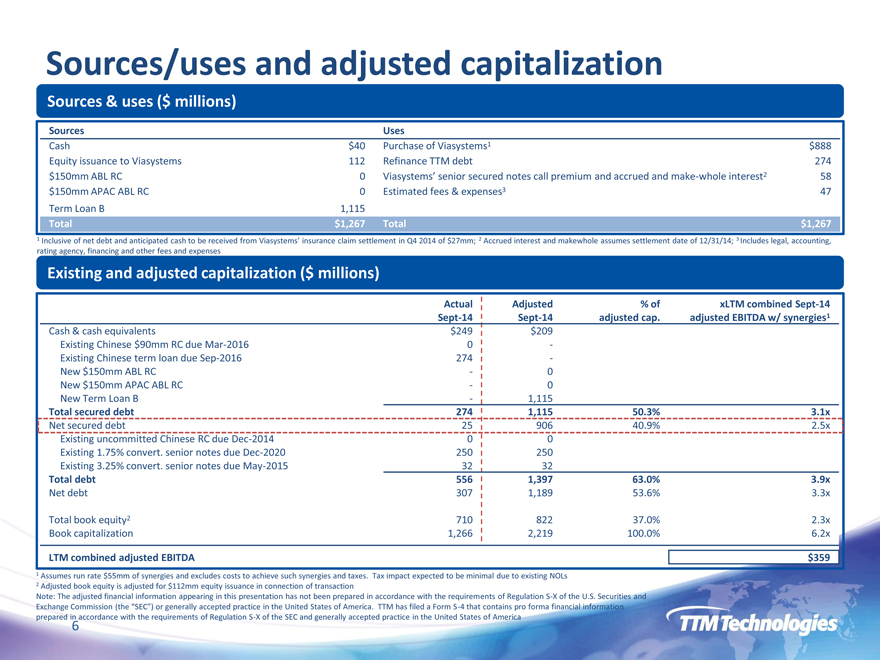

Sources/uses and adjusted capitalization

Sources�& uses ($ millions)

Sources Uses

Cash $40 Purchase of Viasystems1 $888

Equity issuance to Viasystems 112 Refinance TTM debt 274

$150mm ABL RC 0 Viasystems� senior secured notes call premium and accrued and make-whole interest2 58

$150mm APAC ABL RC 0 Estimated fees�& expenses3 47

Term Loan B 1,115

Total $1,267 Total $1,267

1 Inclusive of net debt and anticipated cash to be received from Viasystems� insurance claim settlement in Q4 2014 of $27mm; 2 Accrued interest and makewhole assumes settlement date of 12/31/14; 3 Includes legal, accounting, rating agency, financing and other fees and expenses

Existing and adjusted capitalization ($ millions)

Actual Adjusted% of xLTM combined Sept-14

Sept-14 Sept-14 adjusted cap. adjusted EBITDA w/ synergies1

Cash�& cash equivalents $249 $209

Existing Chinese $90mm RC due Mar-2016 0 -

Existing Chinese term loan due Sep-2016 274 -

New $150mm ABL RC�0

New $150mm APAC ABL RC�0

New Term Loan B�1,115

Total secured debt 274 1,115 50.3% 3.1x

Net secured debt 25 906 40.9% 2.5x

Existing uncommitted Chinese RC due Dec-2014 0 0

Existing 1.75% convert. senior notes due Dec-2020 250 250

Existing 3.25% convert. senior notes due May-2015 32 32

Total debt 556 1,397 63.0% 3.9x

Net debt 307 1,189 53.6% 3.3x

Total book equity2 710 822 37.0% 2.3x

Book capitalization 1,266 2,219 100.0% 6.2x

LTM combined adjusted EBITDA $359

1 Assumes run rate $55mm of synergies and excludes costs to achieve such synergies and taxes. Tax impact expected to be minimal due to existing NOLs

2 Adjusted book equity is adjusted for $112mm equity issuance in connection of transaction

Note: The adjusted financial information appearing in this presentation has not been prepared in accordance with the requirements of Regulation S-X of the U.S. Securities and

Exchange Commission (the �SEC�) or generally accepted practice in the United States of America. TTM has filed a Form S-4 that contains pro forma financial information prepared in accordance with the requirements of Regulation S-X of the SEC and generally accepted practice in the United States of America

6

|

|

�

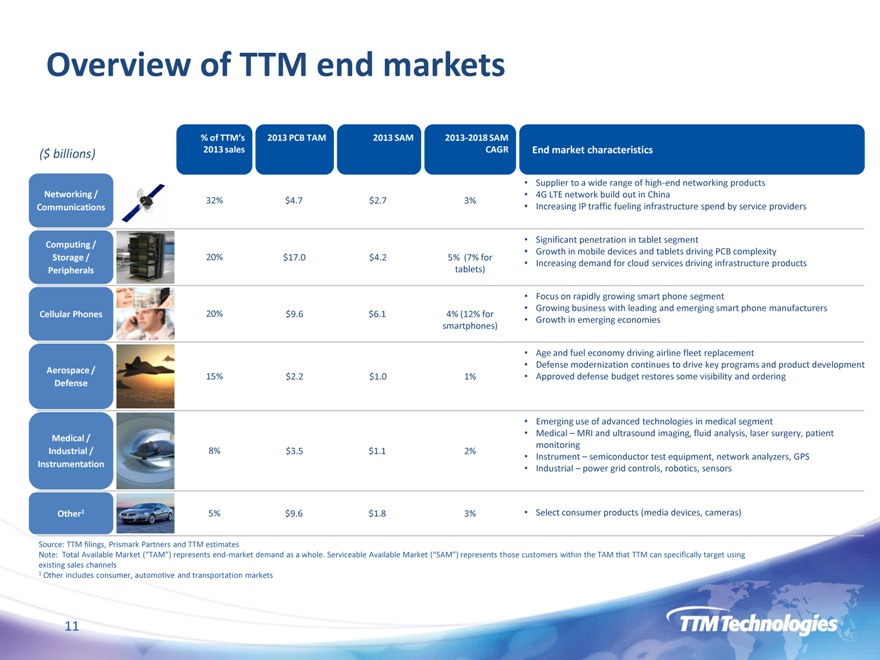

Overview of TTM end markets

% of TTM�s 2013 PCB TAM 2013 SAM 2013-2018 SAM

($ billions) 2013 sales CAGR End market characteristics

Supplier to a wide range of high-end networking products

Networking / 4G LTE network build out in China

32% $4.7 $2.7 3%

Communications Increasing IP traffic fueling infrastructure spend by service providers

Computing / Significant penetration in tablet segment

Growth in mobile devices and tablets driving PCB complexity

Storage / 20% $17.0 $4.2 5% (7% for Increasing demand for cloud services driving infrastructure products

Peripherals tablets)

Focus on rapidly growing smart phone segment

Growing business with leading and emerging smart phone manufacturers

Cellular Phones 20% $9.6 $6.1 4% (12% for Growth in emerging economies

smartphones)

Age and fuel economy driving airline fleet replacement

Defense modernization continues to drive key programs and product development

Aerospace / 15% $2.2 $1.0 1% Approved defense budget restores some visibility and ordering

Defense

Emerging use of advanced technologies in medical segment

Medical / Medical � MRI and ultrasound imaging, fluid analysis, laser surgery, patient

monitoring

Industrial / 8% $3.5 $1.1 2% Instrument � semiconductor test equipment, network analyzers, GPS

Instrumentation Industrial � power grid controls, robotics, sensors

Other1 5% $9.6 $1.8 3% Select consumer products (media devices, cameras)

Source: TTM filings, Prismark Partners and TTM estimates

Note: Total Available Market (�TAM�) represents end-market demand as a whole. Serviceable Available Market (�SAM�) represents those customers within the TAM that TTM can specifically target using

existing sales channels

1 Other includes consumer, automotive and transportation markets

11

|

|

�

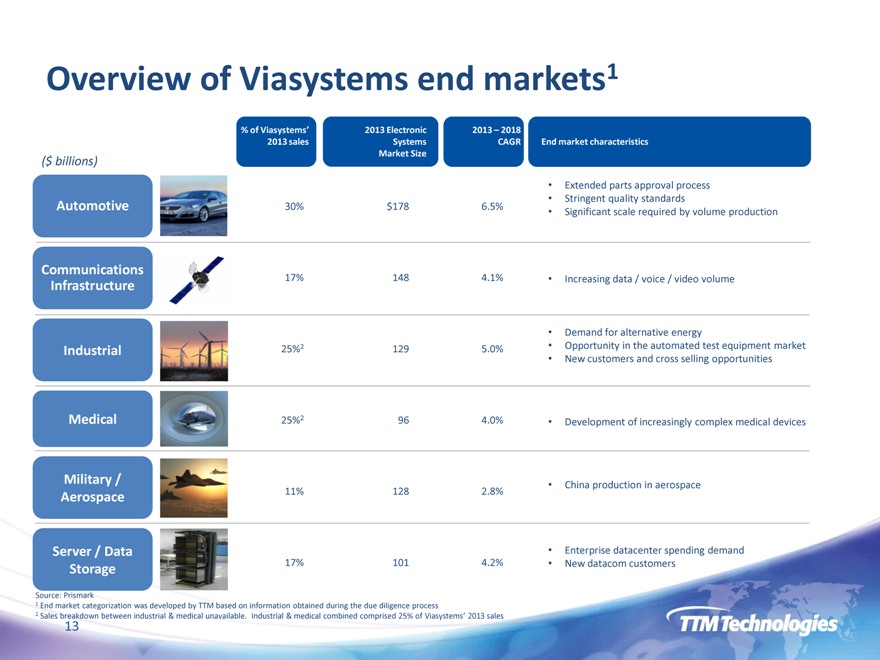

Overview of Viasystems end markets1

% of Viasystems� 2013 Electronic 2013 � 2018

2013 sales Systems CAGR End market characteristics

Market Size

($ billions)

Extended parts approval process

Stringent quality standards

Automotive 30% $178 6.5% Significant scale required by volume production

Communications

Infrastructure 17% 148 4.1% Increasing data / voice / video volume

Demand for alternative energy

Industrial 25%2 129 5.0% Opportunity in the automated test equipment market

New customers and cross selling opportunities

Medical 25%2 96 4.0% Development of increasingly complex medical devices

Military / China production in aerospace

Aerospace 11% 128 2.8%

Server / Data Enterprise datacenter spending demand

Storage 17% 101 4.2% New datacom customers

Source: Prismark

1 End market categorization was developed by TTM based on information obtained during the due diligence process

2 Sales breakdown between industrial & medical unavailable. Industrial & medical combined comprised 25% of Viasystems� 2013 sales

13

|

|

�

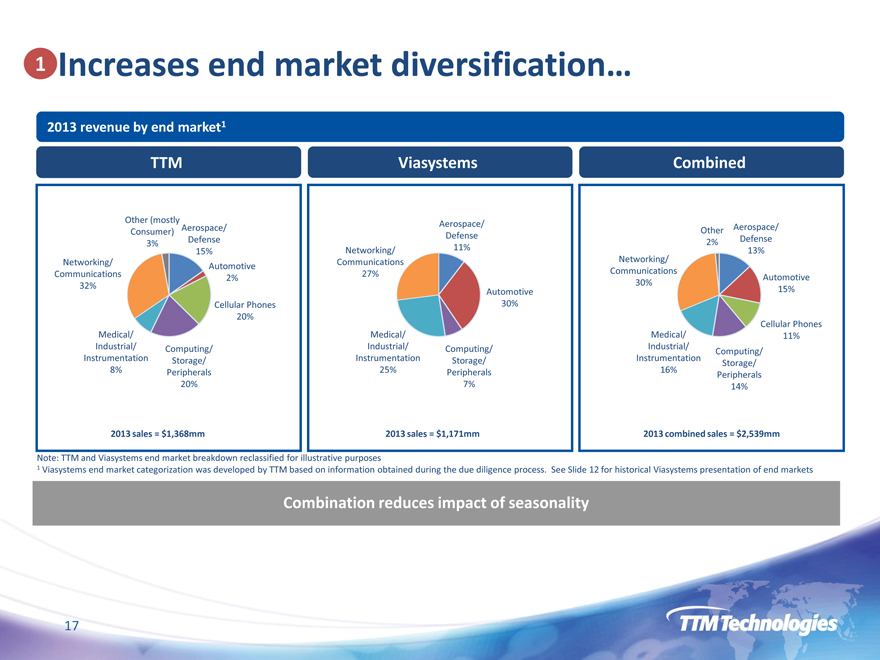

1 Increases end market diversification�

2013 revenue by end market1

TTM Viasystems Combined

Other (mostly

Consumer) Aerospace/

3% Defense

15%

Networking/ Automotive

Communications 2%

32%

Cellular Phones

20%

Medical/

Industrial/ Computing/

Instrumentation Storage/

8% Peripherals

20%

2013 sales = $1,368mm

Aerospace/

Defense

Networking/ 11%

Communications

27%

Automotive

30%

Medical/

Industrial/ Computing/

Instrumentation Storage/

25% Peripherals

7%

2013 sales = $1,171mm

Other Aerospace/

2% Defense

13%

Networking/

Communications

30% Automotive

15%

Cellular Phones

Medical/ 11%

Industrial/ Computing/

Instrumentation Storage/

16% Peripherals

14%

2013 combined sales = $2,539mm

Note: TTM and Viasystems end market breakdown reclassified for illustrative purposes

1 Viasystems end market categorization was developed by TTM based on information obtained during the due diligence process. See Slide 12 for historical Viasystems presentation of end markets

Combination reduces impact of seasonality

17

|

|

�

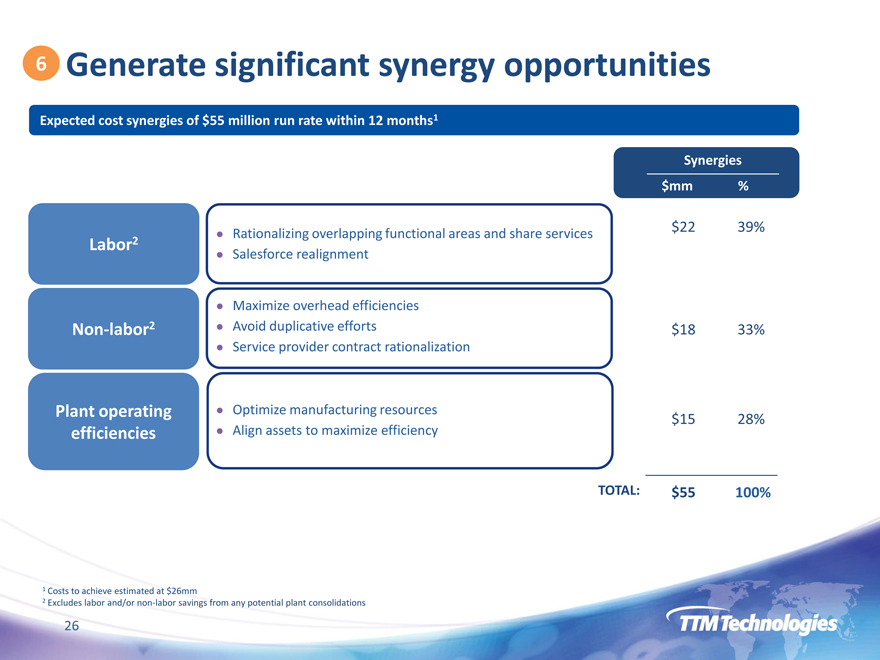

6 Generate significant synergy opportunities

Expected cost synergies of $55 million run rate within 12 months1

Labor2

Non-labor2

Plant operating

efficiencies

Rationalizing overlapping functional areas and share services

Salesforce realignment

Maximize overhead efficiencies

Avoid duplicative efforts

Service provider contract rationalization

Optimize manufacturing resources

Align assets to maximize efficiency

Synergies

$mm%

$22 39%

$18 33%

$15 28%

TOTAL: $55 100%

1 Costs to achieve estimated at $26mm

2 Excludes labor and/or non-labor savings from any potential plant consolidations

26

|

|

�

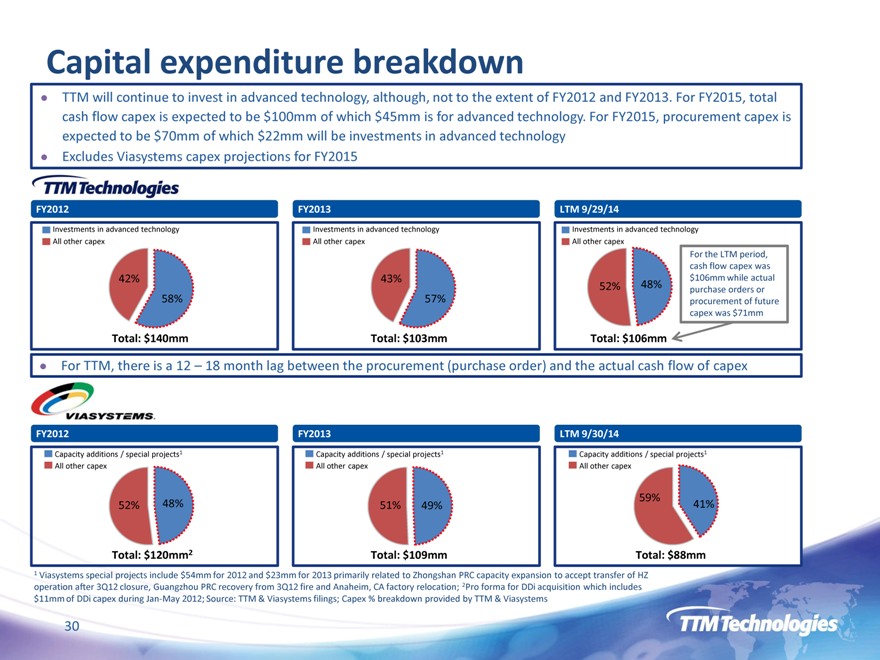

Capital expenditure breakdown

TTM will continue to invest in advanced technology, although, not to the extent of FY2012 and FY2013. For FY2015, total

cash flow capex is expected to be $100mm of which $45mm is for advanced technology. For FY2015, procurement capex is

expected to be $70mm of which $22mm will be investments in advanced technology

Excludes Viasystems capex projections for FY2015

FY2012 FY2013 LTM 9/29/14

Investments in advanced technology Investments in advanced technology Investments in advanced technology

All other capex All other capex All other capex

For the LTM period,

cash flow capex was

42% 43% $106mm while actual

52% 48% purchase orders or

58% 57% procurement of future

capex was $71mm

Total: $140mm Total: $103mm Total: $106mm

For TTM, there is a 12 � 18 month lag between the procurement (purchase order) and the actual cash flow of capex

FY2012 FY2013 LTM 9/30/14

Capacity additions / special projects1 Capacity additions / special projects1 Capacity additions / special projects1

All other capex All other capex All other capex

59%

52% 48% 51% 49% 41%

Total: $120mm2 Total: $109mm Total: $88mm

1 Viasystems special projects include $54mm for 2012 and $23mm for 2013 primarily related to Zhongshan PRC capacity expansion to accept transfer of HZ

operation after 3Q12 closure, Guangzhou PRC recovery from 3Q12 fire and Anaheim, CA factory relocation; 2Pro forma for DDi acquisition which includes

30

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Danske Bank A/S, transactions by persons discharging managerial responsibilities

- West Red Lake Gold CEO Shane Williams: “Putting A Mine into Production is Something I’ve Done Before.”

- Siili Solutions Plc: Business review, 1 January–31 March 2024

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share