Form 8-K TESORO LOGISTICS LP For: May 20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) May 20, 2015

TESORO LOGISTICS LP

(Exact name of registrant as specified in its charter)

Delaware | 1-35143 | 27-4151603 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||

19100 Ridgewood Pkwy San Antonio, Texas | 78259-1828 | |

(Address of principal executive offices) | (Zip Code) | |

(210) 626-6000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |

Item 7.01 | Regulation FD Disclosure. | |

On May 20, 2015, Tesoro Logistics LP (the “Partnership”) will present to certain investors at the May 2015 National Association of Publicly Traded Partnerships MLP Conference the information in the attached slides (the “Slide Presentation”). The Slide Presentation, available on our website at www.tesorologistics.com, is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The Slide Presentation is being furnished, not filed, pursuant to Item 7.01 of Form 8-K. Accordingly, the information in Item 7.01 of this Current Report will not be subject to liability under Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and will not be incorporated by reference into any registration statement or other document filed by the Partnership under the Securities Act of 1933, as amended, or the Exchange Act, unless specifically identified therein as being incorporated by reference.

Item 9.01 | Financial Statements and Exhibits. | |

(d) Exhibits.

99.1 | Slide Presentation dated May 20, 2015. | ||

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

Date: May 20, 2015

TESORO LOGISTICS LP | |||

By: | Tesoro Logistics GP, LLC | ||

Its general partner | |||

By: | /s/ STEVEN M. STERIN | ||

Steven M. Sterin | |||

Vice President and Chief Financial Officer | |||

3

Index to Exhibits

Exhibit Number | Description of the Exhibit | ||

99.1 | Slide Presentation dated May 20, 2015. | ||

4

NAPTP 2015 MLP Conference May 2015 Driving Distinctive Growth Exhibit 99.1

2 Forward Looking Statements This Presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to, among other things, the following: execution of our strategy and vision, including organic investments for growth and expansion projects , acquisition opportunities and commercial opportunities; our ability to improve operational efficiency and maximize asset utilization; potential growth in our third-party business and revenues; possible logistics asset acquisition opportunities from Tesoro Corporation and its affiliates and the potential EBITDA generated by such assets; EBITDA estimates for Tesoro Logistics and various portions of our businesses and the relative contribution of these businesses; the timing and amount of capital expenditures and the effect on those expenditures on our financial position and EBITDA; expected timeframe for construction projects; our ability to capture new business opportunities and maintain our existing customer base; pricing projections; our ability to maintain a credit-worthy customer base; our ability to reduce risk, including commodity price exposure; our ability to integrate our businesses effectively and increase utilization; the outlook for natural gas production and related pricing; expectations regarding our liquidity, leverage ratio and target debt to EBITDA level; expectations regarding unitholder distribution growth and coverage levels; and other aspects of future performance. We have used the words “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “should,” “will,“ “potential” and similar terms and phrases to identify forward-looking statements in this Presentation. Although we believe the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. Our operations involve risks and uncertainties, many of which are outside of our control, and any one of which, or a combination of which, could materially affect our results of operations and whether the forward-looking statements ultimately prove to be correct. Actual results and trends in the future may differ materially from those suggested or implied by the forward-looking statements depending on a variety of factors which are described in greater detail in our filings with the SEC. Please see our Risk Factor disclosures included in our 2014 Annual Report on Form 10-K and our quarterly reports on Form 10-Q. All future written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the previous statements. We undertake no obligation to update any information contained herein or to publicly release the results of any revisions to any forward-looking statements that may be made to reflect events or circumstances that occur, or that we become aware of, after the date of this Presentation. We have included EBITDA, adjusted EBITDA, and distributable cash flow and results of operations excluding Predecessors, each of which is a non-GAAP financial measure, for the company. Please see the Appendix for the definition and reconciliation of these amounts.

3 • Leading provider of upstream and downstream logistics services in western United States • Growth driven by integrated value chain from wellhead to end users • Capturing opportunities from asset optimization, organic growth and strategic acquisitions • Tesoro supports strategic growth as largest refining and marketing company in TLLP’s strategic footprint 16 consecutive quarters of distribution growth of approximately 4% or more Key Investment Highlights

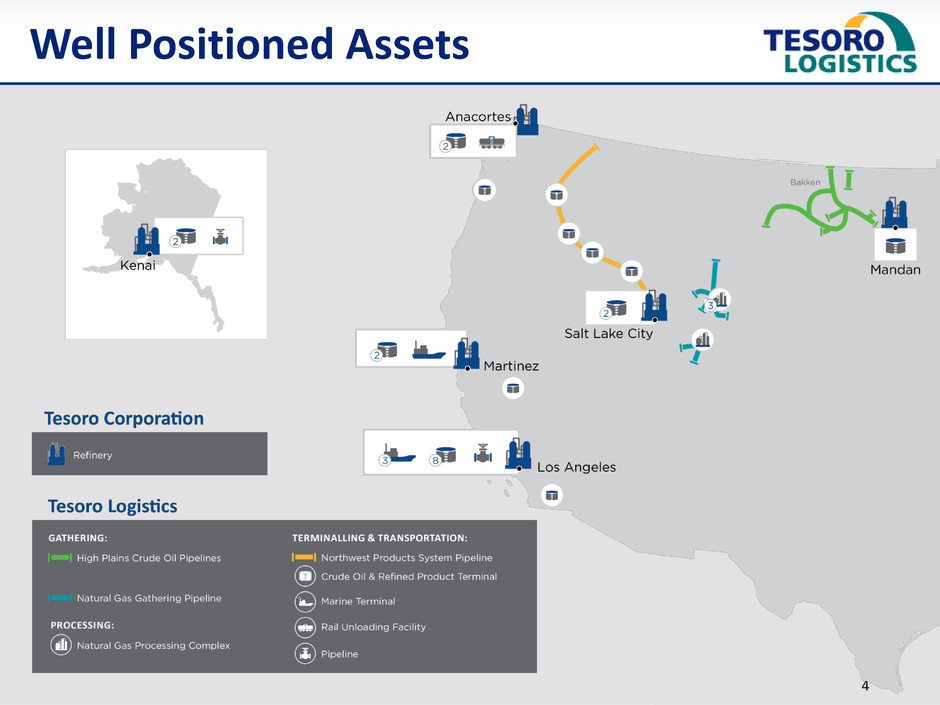

4 Well Positioned Assets

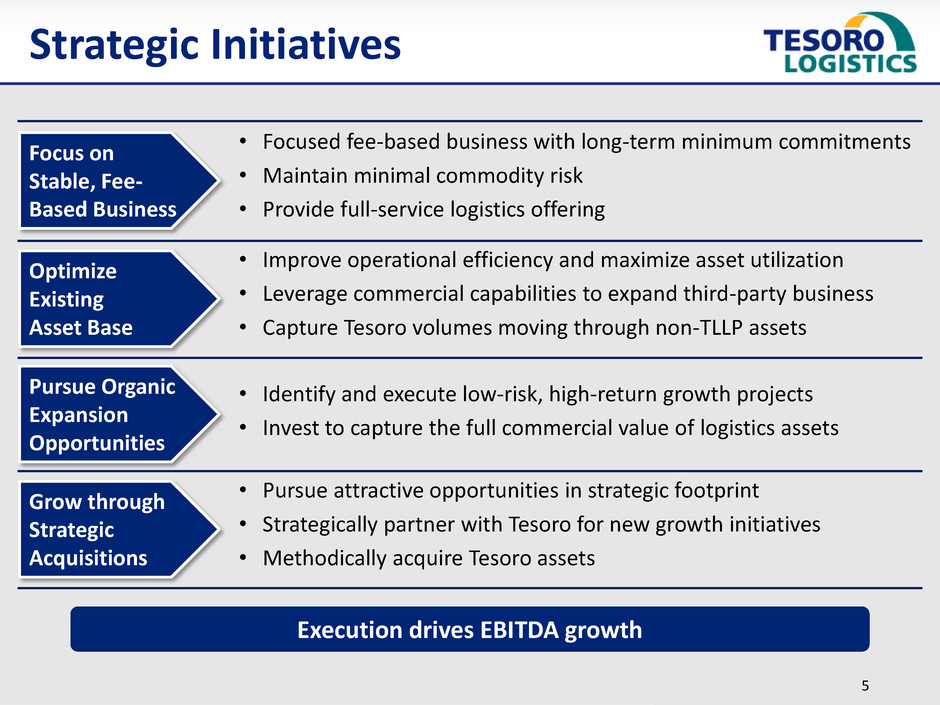

5 Focus on Stable, Fee- Based Business • Focused fee-based business with long-term minimum commitments • Maintain minimal commodity risk • Provide full-service logistics offering Optimize Existing Asset Base • Improve operational efficiency and maximize asset utilization • Leverage commercial capabilities to expand third-party business • Capture Tesoro volumes moving through non-TLLP assets Pursue Organic Expansion Opportunities • Identify and execute low-risk, high-return growth projects • Invest to capture the full commercial value of logistics assets Grow through Strategic Acquisitions • Pursue attractive opportunities in strategic footprint • Strategically partner with Tesoro for new growth initiatives • Methodically acquire Tesoro assets Execution drives EBITDA growth Strategic Initiatives

6 • Integration with Tesoro’s value chain provides competitive advantage and strategic support • Tesoro provides anchor demand to move advantaged crude oil to western U.S locations • Supporting increasing domestic and export market demand for refined products Product Sales Feedstock Acquisition Inbound Logistics Refining Outbound Logistics Strong Sponsor Support

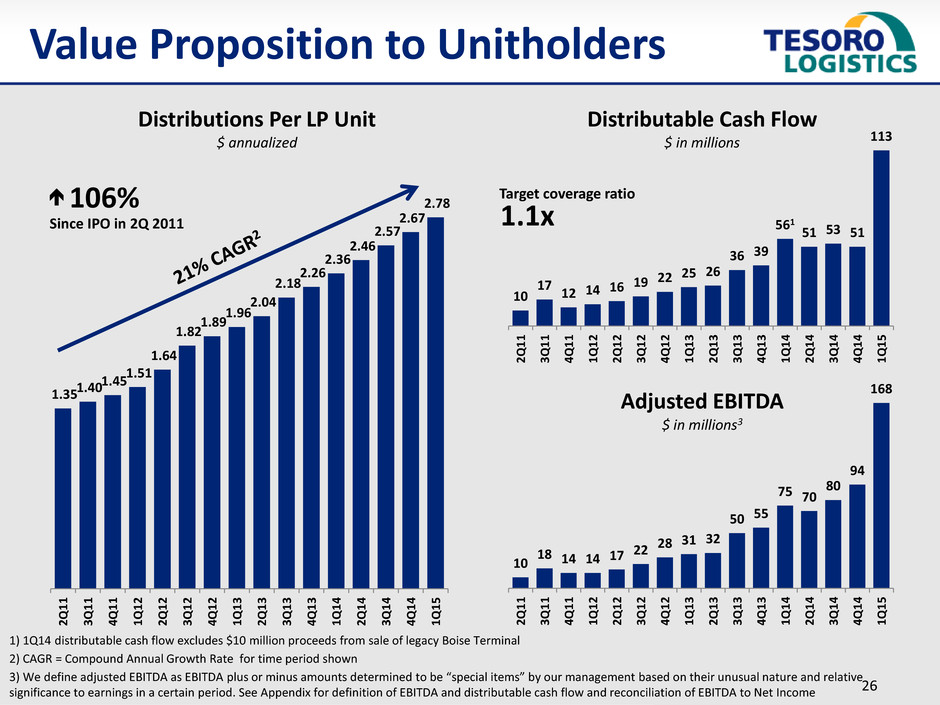

7 42 39 87 2011 EBITDA 2012 2013 2014 2014 EBITDA 2015 First Call Distribution growth of over 106% since IPO 1) CAGR = Compound Annual Growth Rate for time periods shown Note: EBITDA shown is Adjusted EBITDA, which we define as EBITDA plus or minus amounts determined to be “special items” by our management based on their unusual nature and relative significance to earnings in a certain period. See Appendix for definition of EBITDA and distributable cash flow and reconciliation of EBITDA to Net Income 319 151 Distributions Per LP Unit $ annualized EBITDA Growth $ in millions 1.35 2.78 2Q1 1 3 Q1 1 4 Q1 1 1 Q1 2 2 Q1 2 3 Q1 2 4 Q1 2 1 Q1 3 2 Q1 3 3 Q1 3 4 Q1 3 1 Q1 4 2 Q1 4 3 Q1 4 4 Q1 4 1 Q1 5 680 Track Record of Delivering Value

8 2015E Business Mix by EBITDA Terminalling & Transportation 45% Rockies Natural Gas Business 40% Crude Oil Gathering 15% Strong, committed business model with diversified earning streams 1Q 2015 Revenue Covered By Minimum Volume Commitments or Acreage Dedications Covered by MVCs or Acreage Dedications 70% Above MVCs or Acreage Dedications 30% Committed and Diversified Business Model

9 Asset Overview • 700 miles of crude oil gathering and trunk line pipeline • High Plains Pipeline throughput capacity of 190MBD • BASH storage capacity of 780MBD Strategy • Support Tesoro’s demand for advantaged Bakken crude oil • Expand High Plains Pipeline system supporting growing 3rd party demand for transportation services • Capture new business opportunities in crude oil and natural gas gathering and storage Crude Oil Gathering

10 Source: North Dakota Pipeline Authority, January 2015 0 250 500 750 1000 1250 1500 1750 2000 2250 Ja n -0 7 Ja n -0 8 Ja n -0 9 Ja n -1 0 Ja n -1 1 Ja n -1 2 Ja n -1 3 Ja n -1 4 Ja n -1 5 Ja n -1 6 Ja n -1 7 Ja n -1 8 Ja n -1 9 Ja n -2 0 Ja n -2 1 Ja n -2 2 Ja n -2 3 Ja n -2 4 Ja n -2 5 Ja n -2 6 Ja n -2 7 Ja n -2 8 Ja n -2 9 Ja n -3 0 Ja n -3 1 Ja n -3 2 Ja n -3 3 North Dakota Pipeline Authority Williston Basin Production Outlook January 2015 MMBD 37% slowdown in well completions 50% slowdown in well completions Actual ND Pipeline Authority forecasts flat to slight growth in production through 2033 North Dakota Production Outlook

11 Tier 3 $50+ Bakken Core $30 - $40 Tier 2 $40 - $50 High Plains Pipeline well positioned within Bakken’s core acreage Source: North Dakota Department of Mineral Resources, January 2015 Bakken Breakeven Prices within High Plains Pipeline Footprint $/barrel High Plains Pipeline Well Positioned

12 Investing approximately $260 million in crude oil gathering opportunities in 2015 • Expand Bakken Area Storage Hub to over 1 million barrels • Focused expansions to enhance capacity and connectivity in McKenzie County, ND • Complete Connolly Gathering System with 60MBD committed capacity Attractive projects targeted in core production areas of the Bakken Total Rigs 0 1 – 5 5 – 10 11 – 20 21 – 30 31 – 40 Source: North Dakota Department of Mineral Resources, May 2015 May 2015 North Dakota Rigs by county Crude Oil Gathering Growth

13 1Q 2015 Revenue by Customer Credit Rating 1Q 2015 Revenue Covered Under Minimum Volume Commitments Covered Under Minimum Volume Commitments 70%1 Above Minimum Volume Commitments 30% Investment Grade 15% Tesoro 65% High Yield 20% Strong minimum volume commitments and customers with stable balance sheets 1) Includes Shortfall revenue equivalent to approximately 10% Crude Oil Gathering Committed Customers

14 Asset Overview • Approximately 2,000 miles of natural gas gathering pipeline • Natural gas gathering capacity of over 2,900 MMcf/d • Four natural gas processing complexes and one fractionation facility • Over 1,500 MMcf/d of processing capacity and over 15MBD of fractionation capacity Strategy • Focus on long-term, fee-based contracts with strong, diversified customer base • Leverage Tesoro’s commercial capabilities to minimize any direct commodity exposure • Develop projects supporting production growth and drilling efficiencies • TLLP development capabilities to drive installed asset base utilization Rockies Natural Gas Business

15 2.05 2.33 2.60 2.84 3.13 3.27 3.53 3.65 3.76 4.01 4.12 4.25 5.03 5.24 5.37 5.67 SW Marcellus Wet Horn River Haynesville - Core Pinedale - Lance Jonah - Lance Red Wash - Mesaverde Moxa Arch - Frontier Haynesville- Tier 1 Barnett Core Wet Vermillion - Mesaverde Vermillion - Almond Bernett Core Dry Natural Buttes - Mesaverde Eagle Ford- Dry Gas San Juan CBM Marcellus WV Tier 2 Natural Gas Prices Required for 10% Single Well IRR 2020 NYMEX $3.71 Source: MHA Petroleum Consultants Natural gas business in primarily low-cost basins Latest producer comments indicate $2.45/MMbtu for Pinedale and $2.60/MMbtu for Mesaverde Basins in which TLLP operates 2015 NYMEX $2.68 Rockies Basins Well Positioned

16 • Investing approximately $90 million in natural gas gathering opportunities in 2015 • $400 to $500 million in additional opportunities currently under evaluation • Focused on increasing utilization and expanding natural gas gathering and processing business Rockies Natural Gas Growth

17 Credit Rating by Number of Customers Investment Grade 80% High Yield 20% Volume tied to acreage dedications and customers with stable balance sheets Covered Under Acreage Dedications 65% Above Acreage Dedications and MVCs 10% 1Q 2015 Revenue Covered Under Acreage Dedications and MVCs Covered Under MVCs 25% Natural Gas Committed Customers

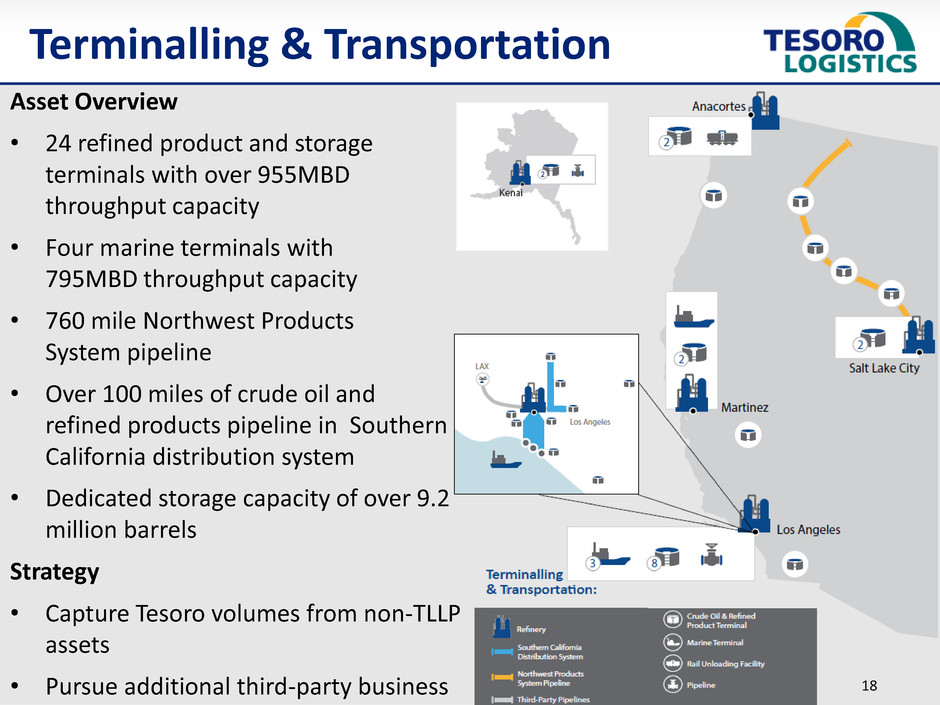

18 Asset Overview • 24 refined product and storage terminals with over 955MBD throughput capacity • Four marine terminals with 795MBD throughput capacity • 760 mile Northwest Products System pipeline • Over 100 miles of crude oil and refined products pipeline in Southern California distribution system • Dedicated storage capacity of over 9.2 million barrels Strategy • Capture Tesoro volumes from non-TLLP assets • Pursue additional third-party business Terminalling & Transportation

19 1,300 1,400 1,500 1,600 1,700 1,800 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec PADD5 Gasoline Demand (MBD) 5 Yr Range 2015 2014 5 Yr Avg. 65 70 75 80 85 90 95 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec PADD5 Operable Utilization (%) 5 Yr Range 2015 2014 5 Yr Avg. West Coast market indicators reflect growing product market demand Source: U.S. Energy Information Administration, May 2015 Refined Products Market Outlook

20 Investing approximately $40 million in 2015 • New Anacortes, WA products truck-loading terminal • Adding additional Tesoro volumes in Southern California through new pipeline interconnects • Increasing third party utilization of marketing terminals in Southern California • Evaluating new renewable fuels unit train facility in Southern California Targeted expansions supported by Tesoro and third-party growing demand Terminalling & Transportation Growth

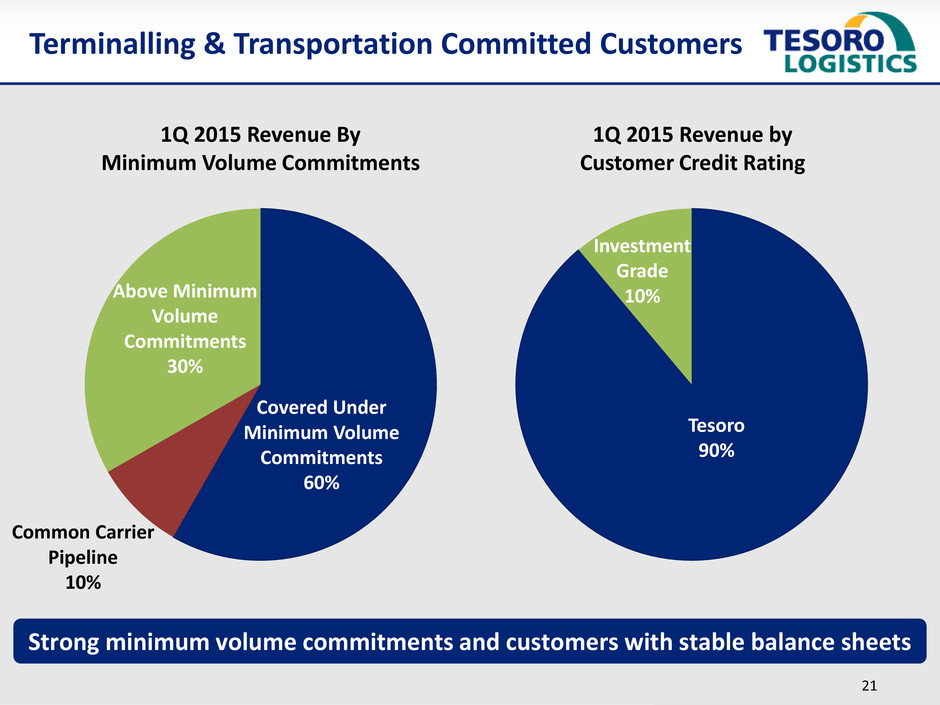

21 Covered Under Minimum Volume Commitments 60% Above Minimum Volume Commitments 30% Common Carrier Pipeline 10% Strong minimum volume commitments and customers with stable balance sheets Tesoro 90% Investment Grade 10% 1Q 2015 Revenue By Minimum Volume Commitments 1Q 2015 Revenue by Customer Credit Rating Terminalling & Transportation Committed Customers

22 37 40 50 50 200 390 370 350 2014 2015E 2016E 2017E Consolidated Capital Spend Net Maintenance Capital Gross Growth Capital Note: All maintenance capital spend is net of any Tesoro reimbursements 70 150 200 225 2015E 2016E 2017E 2018E Organic Investment and Optimization Drives EBITDA Growth Organic investment of $1.3 billion drives over $200 million of growth $ in millions Capital Plan Overview

23 • Marine terminals • Crude oil pipelines • Marine barges • Railcars • Refinery tank terminals • Marine terminals • Rail terminals • Petroleum Coke handling • Refined products distribution terminals • Refined products pipelines • Rail unloading terminals • Truck unloading terminals • Marine terminals Potential drop downs of at least $500 million of EBITDA; Expect drop down of at least $50 million of EBITDA in second half of 2015 Product Sales Feedstock Acquisition Inbound Logistics Refining Outbound Logistics • Wholesale distribution system Tesoro Driven Logistics Opportunities

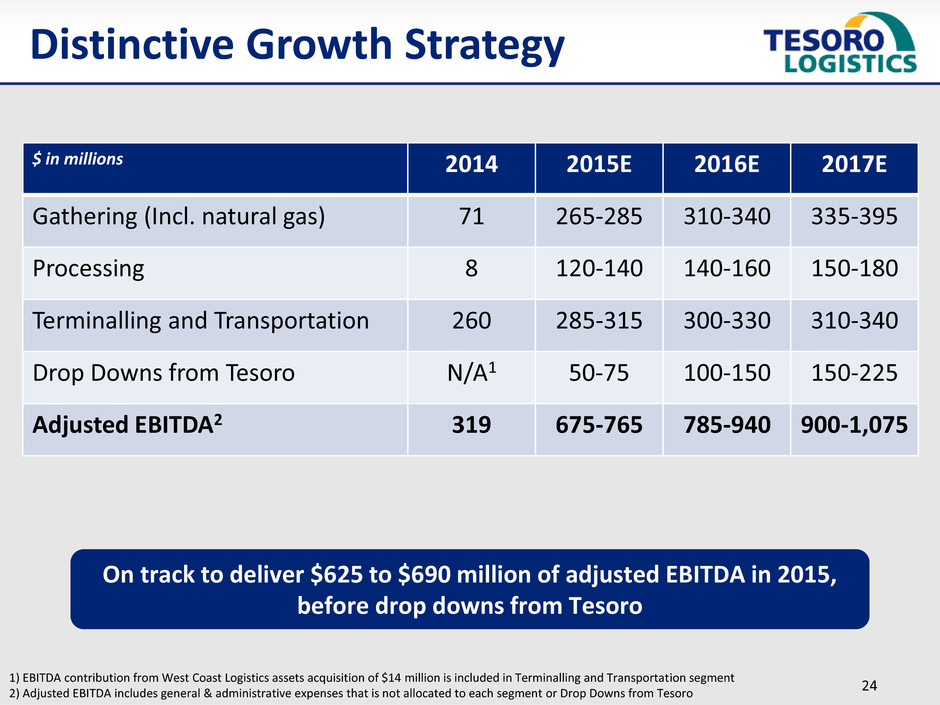

24 $ in millions 2014 2015E 2016E 2017E Gathering (Incl. natural gas) 71 265-285 310-340 335-395 Processing 8 120-140 140-160 150-180 Terminalling and Transportation 260 285-315 300-330 310-340 Drop Downs from Tesoro N/A1 50-75 100-150 150-225 Adjusted EBITDA2 319 675-765 785-940 900-1,075 1) EBITDA contribution from West Coast Logistics assets acquisition of $14 million is included in Terminalling and Transportation segment 2) Adjusted EBITDA includes general & administrative expenses that is not allocated to each segment or Drop Downs from Tesoro On track to deliver $625 to $690 million of adjusted EBITDA in 2015, before drop downs from Tesoro Distinctive Growth Strategy

25 Conservative leverage and ample liquidity • $900 million revolver, expandable to $1.5 billion • Expect leverage ratio to return to target range by end of 2015 • Leverage target of 3x to 4x EBITDA Pursue balanced capital structure • Maximize flexibility to fund growth • Issue equity and/or permanent debt to reload revolver Protect and grow distribution • Target prudent distribution coverage of 1.1x • Financial flexibility for continued distribution growth • Intend to continue historical distribution rate Maintain flexibility to achieve strategic objectives and grow distributions Financial Discipline

26 10 17 12 14 16 19 22 25 26 36 39 561 51 53 51 113 2Q 1 1 3Q 1 1 4Q 1 1 1Q 1 2 2Q 1 2 3Q 1 2 4Q 1 2 1Q 1 3 2Q 1 3 3Q 1 3 4Q 1 3 1Q 1 4 2Q 1 4 3Q 1 4 4Q 1 4 1Q 1 5 10 18 14 14 17 22 28 31 32 50 55 75 70 80 94 168 2Q 1 1 3Q 1 1 4Q 1 1 1Q 1 2 2Q 1 2 3Q 1 2 4Q 1 2 1Q 1 3 2Q 1 3 3Q 1 3 4Q 1 3 1Q 1 4 2Q 1 4 3Q 1 4 4Q 1 4 1Q 1 5 Adjusted EBITDA $ in millions3 1.35 1.40 1.45 1.51 1.64 1.82 1.89 1.96 2.04 2.18 2.26 2.36 2.46 2.57 2.67 2.78 2Q 1 1 3Q 1 1 4Q 1 1 1Q 1 2 2Q 1 2 3Q 1 2 4Q 1 2 1Q 1 3 2Q 1 3 3Q 1 3 4Q 1 3 1Q 1 4 2Q 1 4 3Q 1 4 4Q 1 4 1Q 1 5 106% Since IPO in 2Q 2011 1.1x Target coverage ratio 1) 1Q14 distributable cash flow excludes $10 million proceeds from sale of legacy Boise Terminal 2) CAGR = Compound Annual Growth Rate for time period shown 3) We define adjusted EBITDA as EBITDA plus or minus amounts determined to be “special items” by our management based on their unusual nature and relative significance to earnings in a certain period. See Appendix for definition of EBITDA and distributable cash flow and reconciliation of EBITDA to Net Income Distributions Per LP Unit $ annualized Distributable Cash Flow $ in millions Value Proposition to Unitholders

27 Well-Positioned Assets Stable Cash Flow Experienced Management Team Strong Sponsorship Attractive, Visible Growth Opportunities Continuing to Drive Unitholder Value

Appendix

29 Non-GAAP Financial Measures (In millions) Tesoro Logistics LP 1Q 2Q 3Q 4Q Year 1Q 2Q 3Q 4Q Year 1Q 2Q 3Q 4Q Year 1Q 2Q 3Q 4Q Year 1Q Reconciliation of EBITDA and Distributable Cash Flow to Net Income: Net income (loss) —$ 5$ 12$ 9$ 26$ 5$ 13$ 16$ 14$ 48$ 17$ 11$ 1$ 6$ 35$ 42$ 31$ 33$ (8)$ 98$ 74$ Loss attributable to Predecessor — 3 3 2 8 6 — — 3 9 2 7 21 15 45 1 3 — — 4 — Depreciation and amortization expenses, net of Predecessor expense — 2 2 2 6 2 2 3 4 11 4 6 13 14 37 16 16 18 26 76 44 Interest and financing costs, net — — 1 1 2 1 1 2 5 9 6 7 12 15 40 18 17 28 46 109 37 Interest income — — — — — — — — — — — (1) — — (1) — — — — — — EBITDA (a) — 10 18 14 42 14 16 21 26 77 29 30 47 50 156 77 67 79 64 287 155 Loss (gain) on asset disposals and impairments — — — — — — — — 1 1 — — — — — (4) — — — (4) — Acquisition costs included in general and administrative expense — — — — — — 1 1 1 3 2 2 1 2 7 — — 1 18 19 — Billing of deficiency payment (b) — — — — — — — — — — — — — — — — — — 10 10 13 Inspection and maintenance costs associated with the Northwest Products System — — — — — — — — — — — — 2 3 5 2 3 — 2 7 — Adjusted EBITDA (a) — 10 18 14 42 14 17 22 28 81 31 32 50 55 168 75 70 80 94 319 168 Interest and financing costs, net (c) — — (1) (1) (2) (1) (1) (2) (5) (9) (6) (7) (12) (15) (40) (18) (17) (21) (30) (86) (37) Net income attributable to noncontrolling interest — — — — — — — — — — — — — — — — — — (3) (3) (10) Maintenance capital expenditures (d) — — — (1) (1) — (1) (4) (4) (9) (2) (4) (4) (4) (14) (2) (5) (13) (24) (44) (9) Other adjustments for noncontrolling interest (e) — — — — — — — — — — — — — — — — — — 8 8 (8) Reimbursement for maintenance capital expenditures (d) — — — — — — 1 2 3 6 1 2 1 1 5 — 1 3 3 7 1 Unit-based compensation expense — — — — — 1 — — — 1 — — 1 1 2 — — 1 1 2 1 Change in deferred revenue — — — — — — — — — — — 1 — 1 2 — 1 — 1 2 5 Interest income — — — — — — — — — — — 1 — — 1 — — — — — — Proceeds from sale of assets — — — — — — — — — — — — — — — 10 — — — 10 — Amortization of debt issuance costs and other — — — — — — — 1 — 1 1 1 — — 2 1 1 3 1 6 2 Distributable Cash Flow (a) (f) —$ 10$ 17$ 12$ 39$ 14$ 16$ 19$ 22$ 71$ 25$ 26$ 36$ 39$ 126$ 66$ 51$ 53$ 51$ 221$ 113$ 2015 RECONCILIATION OF AMOUNTS REPORTED UNDER U.S. GAAP 2011 2012 2013 2014

30 (a) (b) (c) (d) (e) (f) Maintenance capital expenditures include expenditures required to ensure the safety, reliability, integrity and regulatory compliance of our assets. Maintenance capital expenditures, net included in the Distributable Cash Flow are presented net of Predecessor amounts. Adjustments represent cash distributions in excess of (or less than) income attributable to noncontrolling interest and other adjustments for depreciation and maintenance capital expenditures applicable to the noncontrolling interests obtained in the December 2, 2014 Rockies Natural Gas Business Acquisition. Certain prior year balances in the calculation of Distributable Cash Flow have been updated to conform to the current year presentation. Several of our contracts contain minimum volume commitments that allow us to charge the customer a deficiency payment if the customer’s actual throughput volumes are less than its minimum volume commitments for the applicable period. In certain contracts, if a customer makes a deficiency payment, that customer may be entitled to offset gathering fees or processing fees in one or more subsequent periods to the extent that such customer's throughput volumes in those periods exceed its minimum volume commitment. Depending on the specific terms of the contract, revenue under these agreements may be classified as deferred revenue and recognized once all contingencies or potential performance obligations associated with these related volumes have either been satisfied through the gathering or processing of future excess volumes of natural gas, or are expected to expire or lapse through the passage of time pursuant to terms of the applicable agreement. During the three month periods ended December 31, 2014 and March 31, 2015, we invoiced customers for deficiency payments. We do not recognize revenue related to the billing periods as these represent opening balance sheet assets for the Rockies Natural Gas Business Acquisition; however, TLLP is entitled to the cash receipt from such billings. Interest and financing costs, net exclude capitalized interest, reimbursed premiums from Tesoro and acquisition related costs. We define EBITDA as net income attributable to partners before depreciation and amortization expenses, net interest and financing costs and interest income. We define adjusted EBITDA as EBITDA plus or minus amounts determined to be “special items” by our management based on their unusual nature and relative significance to earnings in a certain period. We define Distributable Cash Flow as adjusted EBITDA plus or minus amounts determined to be “special items” by our management based on their relative significance to cash flow in a certain period. EBITDA, adjusted EBITDA and Distributable Cash Flow are not measures prescribed by accounting principles generally accepted in the United States of America (“U.S. GAAP”) but are supplemental financial measures that are used by management and may be used by external users of our combined consolidated financial statements, such as industry analysts, investors, lenders and rating agencies, to assess: – our operating performance as compared to other publicly traded partnerships in the midstream energy industry, without regard to historical cost basis or financing methods; – the ability of our assets to generate sufficient cash flow to make distributions to our unitholders; – our ability to incur and service debt and fund capital expenditures; and – the viability of acquisitions and other capital expenditure projects and the returns on investment of various investment opportunities. We believe that the presentation of EBITDA and adjusted EBITDA will provide useful information to investors in assessing our results of operations. The U.S. GAAP measures most directly comparable to EBITDA and adjusted EBITDA are net income and net cash from operating activities. The amounts included in the calculation of EBITDA are derived from amounts separately presented in our combined consolidated financial statements. EBITDA and adjusted EBITDA should not be considered as an alternative to U.S. GAAP net income or net cash from operating activities. EBITDA and adjusted EBITDA have important limitations as analytical tool, because they exclude some, but not all, items that affect net income and net cash from operating activities. Non-GAAP Financial Measures

31 (In millions) Tesoro Logistics LP Distinctive Growth Strategy Annual EBITDA 2014A Gathering(1) Processing(1) Terminalling and Transportation(1) Net earnings $ 49 $ 4 $ 196 Add depreciation and amortization expense 11 4 61 Add equity in earnings of unconsolidated affiliates 1 - - EBITDA $ 61 $ 8 $ 257 Gain on asset disposals and impairments - - (4) Billing of deficiency payment 10 - - Inspection and maintenance costs associated with the Northwest Products System - - 7 Adjusted EBITDA $ 71 $ 8 $ 260 Non-GAAP Financial Measures 1) For the purposes of the Gathering, Terminalling & Transportation, and Processing segments, interest expense is only recorded at a consolidated level and is excluded from these reconciliations (In millions) West Coast Logistics Assets Acquisition EBITDA 2014 (1) Net earnings $13 Add depreciation and amortization expense 1 EBITDA $14

32 (In millions) Gathering: Reconciliation of Forecasted EBITDA to Forecasted Net Income Tesoro Logistics LP Gathering Segment Forecasted EBITDA 2015E 2016E 2017E Forecasted Net Income $158 - 178 $195 - 225 $206 - 266 Add: Depreciation and amortization expense 107 115 129 Forecasted Annual Segment EBITDA (1) $265 - 285 $310 - 340 $335 - 395 Terminalling and Transportation: Reconciliation of Forecasted EBITDA to Forecasted Net Income Tesoro Logistics LP Terminalling and Transportation Segment Forecasted EBITDA 2015E 2016E 2017E Forecasted Net Income $220 - 250 $231 - 261 $238 - 268 Add: Depreciation and amortization expense 65 69 72 Forecasted Annual Segment EBITDA (1) $285 - 315 $300 - 330 $310 - 340 Processing: Reconciliation of Forecasted EBITDA to Forecasted Net Income Tesoro Logistics LP Processing Segment Forecasted EBITDA 2015E 2016E 2017E Forecasted Net Income $90 - 110 $110 - 130 $120 - 150 Add: Depreciation and amortization expense 30 30 30 Forecasted Annual Segment EBITDA (1) $120 - 140 $140 - 160 $150 - 180 1) For the purposes of the Gathering, Terminalling & Transportation, and Processing segments, interest expense is only recorded at a consolidated level and is excluded from these reconciliations. Non-GAAP Financial Measures

33 (In millions) Reconciliation of Forecasted annual EBITDA to Forecasted Net Income: Annual EBITDA Contributions from Drop Downs from Tesoro 2015E 2016E 2017E Forecasted Net Income $28 - 53 $56 - 106 $84 - 159 Add: Depreciation and amortization expenses 2 4 6 Add: Interest and financing costs, net 20 40 60 Forecasted Annual EBITDA $50 - 75 $100 - 150 $150 - 225 Annual Expected EBITDA: Reconciliation of Forecasted EBITDA to Forecasted Net Income Tesoro Logistics LP Annual Expected EBITDA 2015E 2016E 2017E Forecasted Net Income $285 - 375 $361 - 516 $437 - 612 Add depreciation and amortization expense 204 218 237 Add interest and financing costs, net 186 206 226 Forecasted Annual Segment EBITDA (1) $675 - 765 $785 - 940 $900 - 1,075 Reconciliation of Forecasted EBITDA to Forecasted Net Income EBITDA from Potential Drop Downs Forecasted Net Income $344 Add depreciation and amortization expense 23 Add interest and financing costs, net 133 Forecasted Annual EBITDA $500 1) For the purposes of the Gathering, Terminalling & Transportation, and Processing segments, interest expense is only recorded at a consolidated level and is excluded from these reconciliations. Reconciliation of Forecasted annual EBITDA to Forecasted Net Income: Cumulative EBITDA from Organic Investments 2015E 2016E 2017E 2018E Forecasted Net Income $ 59 $ 110 $ 133 $ 133 Add: Depreciation and amortization expenses 7 25 42 58 Add: Interest and financing costs, net 4 15 25 34 Forecasted Annual EBITDA $ 70 $ 150 $ 200 $ 225 Non-GAAP Financial Measures

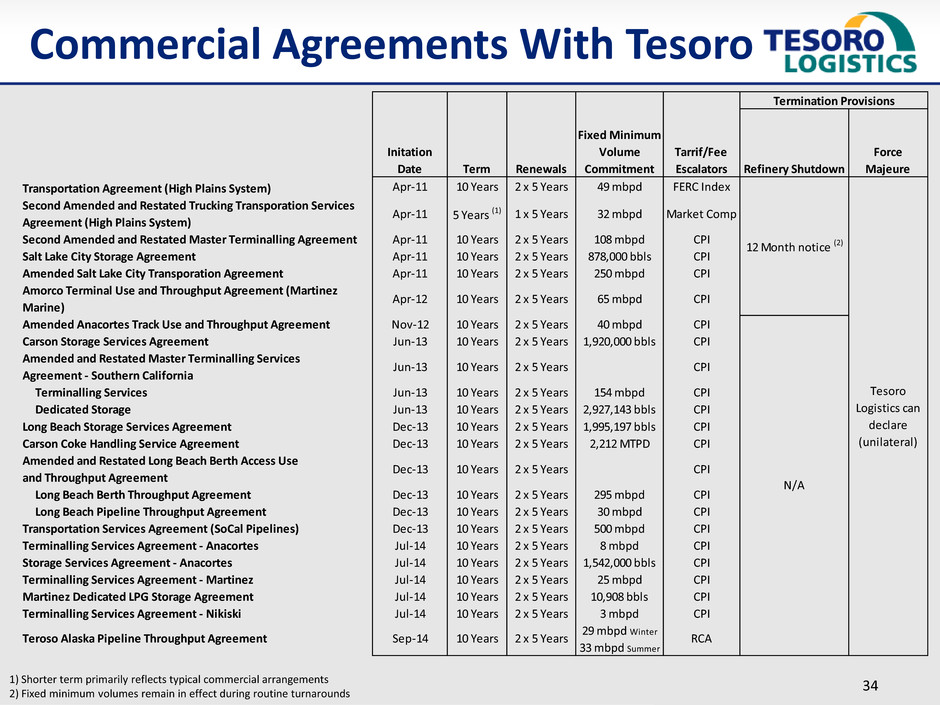

34 1) Shorter term primarily reflects typical commercial arrangements 2) Fixed minimum volumes remain in effect during routine turnarounds Commercial Agreements With Tesoro Refinery Shutdown Force Majeure Transportation Agreement (High Plains System) Apr-11 10 Years 2 x 5 Years 49 mbpd FERC Index Second Amended and Restated Trucking Transporation Services Agreement (High Plains System) Apr-11 5 Years (1) 1 x 5 Years 32 mbpd Market Comp Second Amended and Restated Master Terminalling Agreement Apr-11 10 Years 2 x 5 Years 108 mbpd CPI Salt Lake City Storage Agreement Apr-11 10 Years 2 x 5 Years 878,000 bbls CPI Amended Salt Lake City Transporation Agreement Apr-11 10 Years 2 x 5 Years 250 mbpd CPI Amorco Terminal Use and Throughput Agreement (Martinez Marine) Apr-12 10 Years 2 x 5 Years 65 mbpd CPI Amended Anacortes Track Use and Throughput Agreement Nov-12 10 Years 2 x 5 Years 40 mbpd CPI Carson Storage Services Agreement Jun-13 10 Years 2 x 5 Years 1,920,000 bbls CPI Amended and Restated Master Terminalling Services Agreement - Southern California Jun-13 10 Years 2 x 5 Years CPI Terminalling Services Jun-13 10 Years 2 x 5 Years 154 mbpd CPI Dedicated Storage Jun-13 10 Years 2 x 5 Years 2,927,143 bbls CPI Long Beach Storage Services Agreement Dec-13 10 Years 2 x 5 Years 1,995,197 bbls CPI Carson Coke Handling Service Agreement Dec-13 10 Years 2 x 5 Years 2,212 MTPD CPI Amended and Restated Long Beach Berth Access Use and Throughput Agreement Dec-13 10 Years 2 x 5 Years CPI Long Beach Berth Throughput Agreement Dec-13 10 Years 2 x 5 Years 295 mbpd CPI Long Beach Pipeline Throughput Agreement Dec-13 10 Years 2 x 5 Years 30 mbpd CPI Transportation Services Agreement (SoCal Pipelines) Dec-13 10 Years 2 x 5 Years 500 mbpd CPI Terminalling Services Agreement - Anacortes Jul-14 10 Years 2 x 5 Years 8 mbpd CPI Storage Services Agreement - Anacortes Jul-14 10 Years 2 x 5 Years 1,542,000 bbls CPI Terminalling Services Agreement - Martinez Jul-14 10 Years 2 x 5 Years 25 mbpd CPI Martinez Dedicated LPG Storage Agreement Jul-14 10 Years 2 x 5 Years 10,908 bbls CPI Terminalling Services Agreement - Nikiski Jul-14 10 Years 2 x 5 Years 3 mbpd CPI 29 mbpd Winter 33 mbpd Summer N/A Tesoro Logistics can declare (unilateral) 12 Month notice (2) Termination Provisions Initation Date Term Renewals Fixed Minimum Volume Commitment Tarrif/Fee Escalators Teroso Alaska Pipeline Throughput Agreement RCASep-14 10 Years 2 x 5 Years

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Hanryu Holdings, Inc. Announces Receipt of a Delinquency Compliance Alert Notice from Nasdaq

- Arizona Governor Hobbs Attends Ceremony at Longroad Energy's Sun Streams Complex, Celebrating Expansion of Renewable Energy, Family Supporting Jobs and Community Benefits

- COOLA Celebrates 20 Years of Innovation With a Modern New Look

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share