Form 8-K Synchrony Financial For: Jul 17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

July 17, 2015

Date of Report

(Date of earliest event reported)

SYNCHRONY FINANCIAL

(Exact name of registrant as specified in its charter)

Delaware | 001-36560 | 51-0483352 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) | ||

777 Long Ridge Road, Stamford, Connecticut | 06902 | |

(Address of principal executive offices) | (Zip Code) | |

(203) 585-2400

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On July 17, 2015, Synchrony Financial (the “Company”) issued a press release setting forth the Company’s second quarter 2015 earnings. A copy of the Company’s press release is being furnished as Exhibit 99.1 and hereby incorporated by reference. The information furnished pursuant to this Item 2.02, including Exhibits, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933 or the Exchange Act.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following exhibits are being furnished as part of this report:

Number | Description | |

99.1 | Press release, dated July 17, 2015, issued by Synchrony Financial | |

99.2 | Financial Data Supplement of the Company for the quarter ended June 30, 2015 | |

99.3 | Financial Results Presentation of the Company for the quarter ended June 30, 2015 | |

99.4 | Explanation of Non-GAAP Measures | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

SYNCHRONY FINANCIAL | ||||||

Date: July 17, 2015 | By: | /s/ Jonathan Mothner | ||||

Name: | Jonathan Mothner | |||||

Title: | Executive Vice President, General Counsel and Secretary | |||||

EXHIBIT INDEX

Number | Description | |

99.1 | Press release, dated July 17, 2015, issued by Synchrony Financial | |

99.2 | Financial Data Supplement of the Company for the quarter ended June 30, 2015 | |

99.3 | Financial Results Presentation of the Company for the quarter ended June 30, 2015 | |

99.4 | Explanation of Non-GAAP Measures | |

Exhibit 99.1

Contact:

Investor Relations Media Relations

Greg Ketron Samuel Wang

(203) 585-6291 (203) 585-2933

For Immediate Release: July 17, 2015

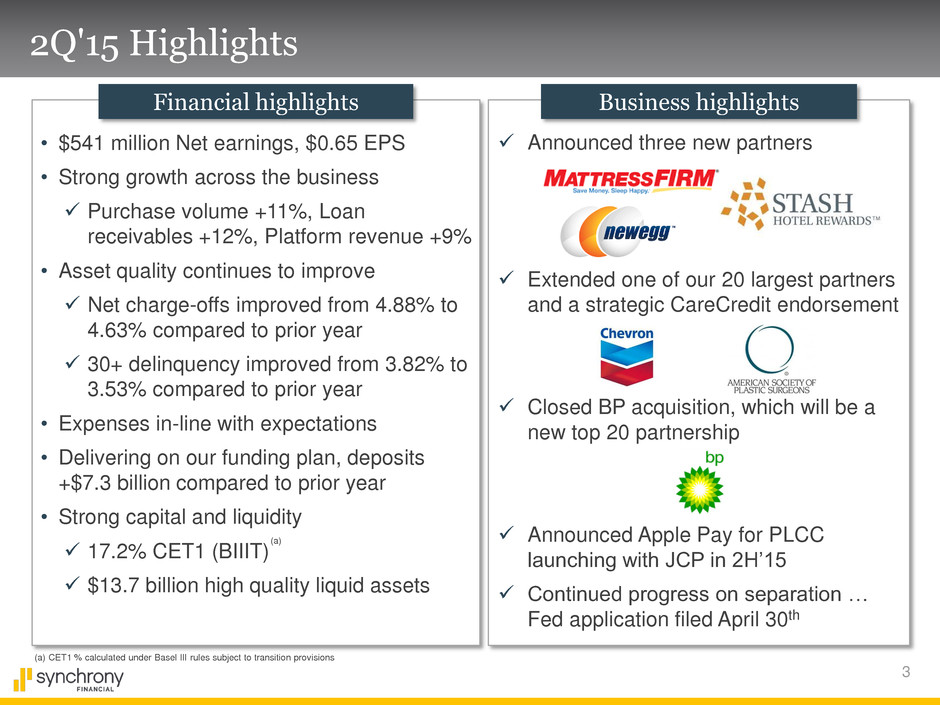

Synchrony Financial Reports Second Quarter Net Earnings of $541 Million or $0.65 Per Diluted Share

STAMFORD, Conn. – Synchrony Financial (NYSE: SYF) today announced second quarter 2015 net earnings of $541 million, or $0.65 per diluted share. Highlights for the quarter included:

• | Total platform revenue increased 9% from the second quarter of 2014 to $2.7 billion |

• | Loan receivables grew $7 billion, or 12%, from the second quarter of 2014 to $61 billion |

• | Purchase volume increased 11% from the second quarter of 2014 |

• | Announced new partners—Mattress Firm, Newegg, and Stash Hotel Rewards |

• | Extended Chevron, a top 20 partnership, and renewed a strategic CareCredit endorsement with American Society of Plastic Surgeons |

• | Will be one of the first issuers to offer private label credit cards in Apple Pay |

• | Strong deposit growth continued, up $7 billion, or 24%, over the second quarter of 2014 |

• | Continued progress on separation—Federal Reserve application to separate filed April 30th |

“We continue to grow our industry-leading consumer finance business on several fronts. We have signed new partners across our platforms, extended key contracts, and made technology investments which are yielding innovative, value added services for our partners and customers. We also continued to deliver strong receivables, deposit, and revenue growth,” said Margaret Keane, President and Chief Executive Officer of Synchrony Financial. “We are focused on driving growth, delivering value to our partners and customers, and remaining at the forefront of the emerging digital payments and data analytics landscape.”

1

Business and Financial Highlights for the Second Quarter of 2015

All comparisons below are for the second quarter of 2015 compared to the second quarter of 2014, unless otherwise noted.

Earnings

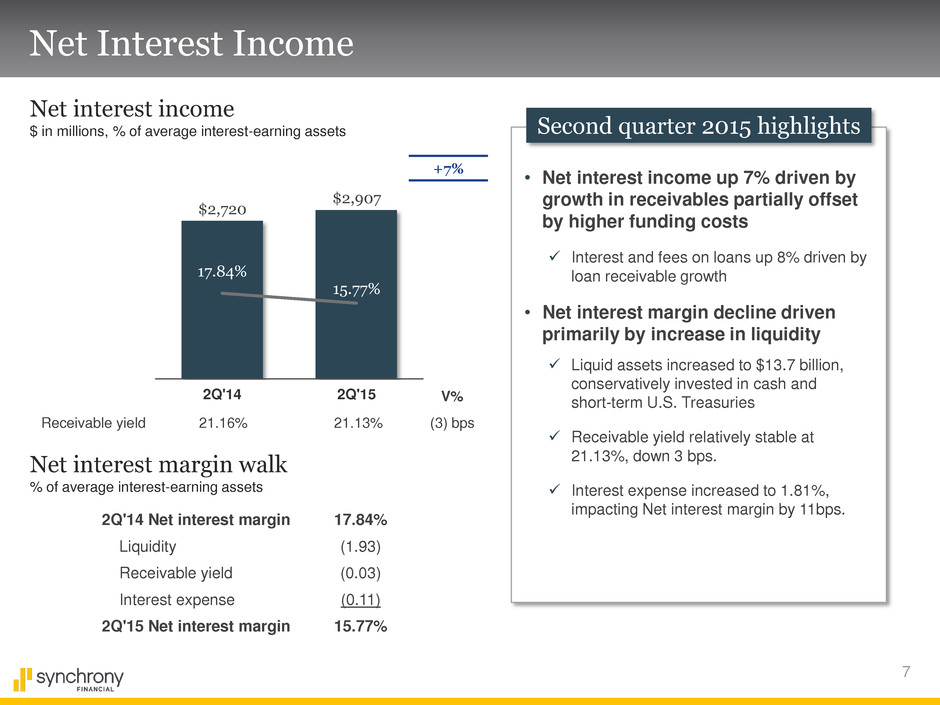

• | Net interest income increased $187 million, or 7%, to $2.9 billion, driven by strong loan receivables growth, partially offset by higher interest expense from funding issued to increase liquidity in 2014. Net interest income after retailer share arrangements increased 7%. |

• | Total platform revenue increased $223 million, or 9%. |

• | Provision for loan losses increased $59 million to $740 million largely due to loan receivables growth. |

• | Other income increased $8 million to $120 million, driven by strong growth in interchange revenue and a pre-tax gain of $20 million due to portfolio sales, which were partially offset by higher loyalty and rewards costs associated with program initiatives. |

• | Other expense increased $8 million to $805 million, primarily driven by investments in growth and infrastructure build in preparation for separation from the General Electric Company (GE). The increase is partially offset by consumer remediation expense in the second quarter of 2014. |

• | Net earnings totaled $541 million for the quarter compared to $472 million in the second quarter of 2014. |

Balance Sheet

• | Period-end loan receivables growth remained strong at 12%, primarily driven by purchase volume growth of 11% and average active account growth of 4%, and included the acquisition of the BP portfolio during the quarter. |

• | Deposits grew to $38 billion, up $7 billion, or 24%, from the second quarter of 2014, and now comprise 61% of funding compared to 57% last year. |

• | The Company’s balance sheet remained strong with total liquidity (liquid assets and undrawn securitization capacity) at $20 billion, or 26% of total assets. |

• | The estimated Common Equity Tier 1 ratio under Basel III subject to transition provisions was 17.2% and the estimated fully phased-in Common Equity Tier 1 ratio under Basel III was 16.4%. |

Key Financial Metrics

• | Return on assets was 2.9% and return on equity was 19.2%. |

• | Net interest margin declined 207 basis points to 15.77% primarily due to the impact from the significant increase in liquidity. |

• | Efficiency ratio was 33.5%. |

2

Credit Quality

• | Loans 30+ days past due as a percentage of period-end loan receivables improved 29 basis points to 3.53%. |

• | Net charge-offs as a percentage of total average loan receivables improved 25 basis points to 4.63%. |

• | The allowance for loan losses as a percentage of total period-end receivables was 5.38%. |

Sales Platforms

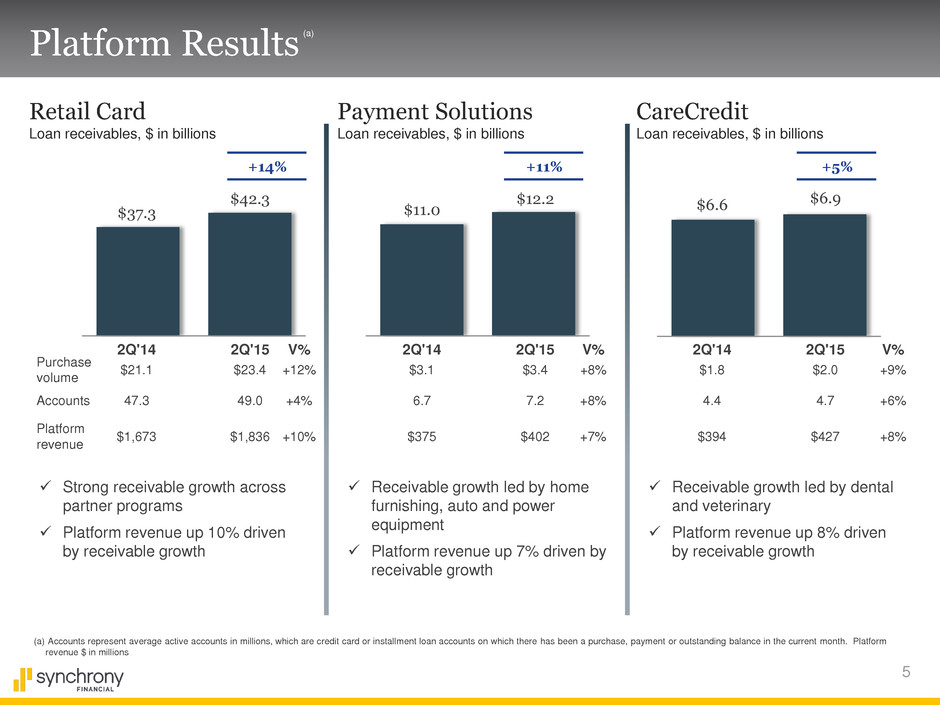

• | Retail Card platform revenue increased 10%, driven primarily by purchase volume growth of 12% and period-end loan receivables growth of 14%, which included the acquisition of the BP portfolio. Loan receivables growth was broad-based across partner programs. |

• | Payment Solutions platform revenue increased 7%, driven primarily by purchase volume growth of 8% and period-end loan receivables growth of 11%, with growth across industry segments led by home furnishing, automotive products, and power equipment. |

• | CareCredit platform revenue increased 8%, driven primarily by purchase volume growth of 9% and period-end receivables growth of 5%, with growth led by dental and veterinary specialties. |

Corresponding Financial Tables and Information

No representation is made that the information in this news release is complete. Investors are encouraged to review the foregoing summary and discussion of Synchrony Financial's earnings and financial condition in conjunction with the detailed financial tables and information that follow and in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014, as filed February 23, 2015, and in the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2015, as filed May 1, 2015. The detailed financial tables and other information are also available on the Investor Relations page of the Company’s website at www.investors.synchronyfinancial.com. This information is also furnished in a Current Report on Form 8-K filed with the SEC today.

Conference Call and Webcast Information

On Friday, July 17, 2015, at 10:30 a.m. Eastern Time, Margaret Keane, President and Chief Executive Officer, and Brian Doubles, Executive Vice President and Chief Financial Officer, will host a conference call to review the financial results and outlook for certain business drivers. The conference call can be accessed via an audio webcast through the Investor Relations page of our website, www.investors.synchronyfinancial.com, under Events and Presentations. A replay will be available on the website or by dialing (888) 843-7419 (U.S. domestic) or (630) 652-3042 (international), passcode 22015#, and can be accessed beginning approximately two hours after the event through August 1, 2015.

About Synchrony Financial

Synchrony Financial (NYSE: SYF), formerly GE Capital Retail Finance, is one of the nation’s premier consumer financial services companies. Our roots in consumer finance trace back to 1932, and today we are the largest provider of private label credit cards in the United States based on purchase volume and receivables*. We provide a range of credit products through programs we have established with a diverse group of national and regional retailers, local merchants, manufacturers, buying groups, industry

3

associations, and healthcare service providers to help generate growth for our partners and offer financial flexibility to our customers. Through our partners’ over 300,000 locations across the United States and Canada, and their websites and mobile applications, we offer our customers a variety of credit products to finance the purchase of goods and services. Our offerings include private label and co-branded Dual Card credit cards, promotional financing and installment lending, loyalty programs and FDIC-insured savings products through Synchrony Bank. More information can be found at www.synchronyfinancial.com and twitter.com/SYFNews.

*Source: The Nilson Report (April, 2015, Issue # 1062) - based on 2014 data.

Cautionary Statement Regarding Forward-Looking Statements

This news release contains certain forward-looking statements as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the "safe harbor" created by those sections. Forward-looking statements may be identified by words such as “outlook,” “expects,” “intends,” “anticipates,” “plans,” “believes,” “seeks,” “targets,” “estimates,” “will,” “should,” “may” or words of similar meaning, but these words are not the exclusive means of identifying forward-looking statements. Forward-looking statements are based on management’s current expectations and assumptions, and are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. As a result, actual results could differ materially from those indicated in these forward-looking statements. Factors that could cause actual results to differ materially include global political, economic, business, competitive, market, regulatory and other factors and risks, such as: the impact of macroeconomic conditions and whether industry trends we have identified develop as anticipated; retaining existing partners and attracting new partners, concentration of our platform revenue in a small number of Retail Card partners, promotion and support of our products by our partners, and financial performance of our partners; our need for additional financing, higher borrowing costs and adverse financial market conditions impacting our funding and liquidity, and any reduction in our credit ratings; our ability to securitize our loans, occurrence of an early amortization of our securitization facilities, loss of the right to service or subservice our securitized loans, and lower payment rates on our securitized loans; our reliance on dividends, distributions and other payments from Synchrony Bank; our ability to grow our deposits in the future; changes in market interest rates and the impact of any margin compression; effectiveness of our risk management processes and procedures, reliance on models which may be inaccurate or misinterpreted, our ability to manage our credit risk, the sufficiency of our allowance for loan losses and the accuracy of the assumptions or estimates used in preparing our financial statements; our ability to offset increases in our costs in retailer share arrangements; competition in the consumer finance industry; our concentration in the U.S. consumer credit market; our ability to successfully develop and commercialize new or enhanced products and services; our ability to realize the value of strategic investments; reductions in interchange fees; fraudulent activity; cyber-attacks or other security breaches; failure of third parties to provide various services that are important to our operations; disruptions in the operations of our computer systems and data centers; international risks and compliance and regulatory risks and costs associated with international operations; alleged infringement of intellectual property rights of others and our ability to protect our intellectual property; litigation and regulatory actions; damage to our reputation; our ability to attract, retain and motivate key officers and employees; tax legislation initiatives or challenges to our tax positions and state sales tax rules and regulations; significant and extensive regulation, supervision, examination and enforcement of our business by governmental authorities, the impact of the Dodd-Frank Act and the impact of the CFPB’s regulation of our business; changes to our methods of offering our CareCredit products; impact of capital adequacy rules; restrictions that limit Synchrony Bank’s ability to

4

pay dividends; regulations relating to privacy, information security and data protection; use of third-party vendors and ongoing third-party business relationships; failure to comply with anti-money laundering and anti-terrorism financing laws; effect of General Electric Capital Corporation being subject to regulation by the Federal Reserve Board both as a savings and loan holding company and as a systemically important financial institution; GE not completing the separation from us as planned or at all, GE’s inability to obtain savings and loan holding company deregistration (GE SLHC Deregistration) and GE continuing to have significant control over us; completion by the Federal Reserve Board of a review (with satisfactory results) of our preparedness to operate on a standalone basis, independently of GE, and Federal Reserve Board approval required for us to continue to be a savings and loan holding company, including the timing of the approval and the imposition of any significant additional capital or liquidity requirements; our need to establish and significantly expand many aspects of our operations and infrastructure; delays in receiving or failure to receive Federal Reserve Board agreement required for us to be treated as a financial holding company after the GE SLHC Deregistration; loss of association with GE’s strong brand and reputation; limited right to use the GE brand name and logo and need to establish a new brand; GE’s significant control over us; terms of our arrangements with GE may be more favorable than what we will be able to obtain from unaffiliated third parties; obligations associated with being a public company; our incremental cost of operating as a standalone public company could be substantially more than anticipated; GE could engage in businesses that compete with us, and conflicts of interest may arise between us and GE; and failure caused by us of GE’s distribution of our common stock to its stockholders in exchange for its common stock to qualify for tax-free treatment, which may result in significant tax liabilities to GE for which we may be required to indemnify GE.

For the reasons described above, we caution you against relying on any forward-looking statements, which should also be read in conjunction with the other cautionary statements that are included elsewhere in this news release and in our public filings, including under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014, as filed on February 23, 2015. You should not consider any list of such factors to be an exhaustive statement of all of the risks, uncertainties, or potentially inaccurate assumptions that could cause our current expectations or beliefs to change. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, except as otherwise may be required by law.

Non-GAAP Measures

The information provided herein includes measures we refer to as “platform revenue”, “platform revenue excluding retailer share arrangements” and “tangible common equity” and certain capital ratios, which are not prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). For a reconciliation of these non-GAAP measures to the most directly comparable GAAP measures, please see the detailed financial tables and information that follow. For a statement regarding the usefulness of these measures to investors, please see the Company’s Current Report on Form 8-K filed with the SEC today.

5

Exhibit 99.2

SYNCHRONY FINANCIAL | |||||||||||||||||||||||||||||||||||||||

FINANCIAL SUMMARY | |||||||||||||||||||||||||||||||||||||||

(unaudited, in millions, except per share statistics) | |||||||||||||||||||||||||||||||||||||||

Quarter Ended | Six Months ended | ||||||||||||||||||||||||||||||||||||||

Jun 30, 2015 | Mar 31, 2015 | Dec 31, 2014 | Sep 30, 2014 | Jun 30, 2014 | 2Q'15 vs. 2Q'14 | Jun 30, 2015 | Jun 30, 2014 | YTD'15 vs. YTD'14 | |||||||||||||||||||||||||||||||

EARNINGS | |||||||||||||||||||||||||||||||||||||||

Net interest income | $ | 2,907 | $ | 2,875 | $ | 2,978 | $ | 2,879 | $ | 2,720 | $ | 187 | 6.9 | % | $ | 5,782 | $ | 5,463 | $ | 319 | 5.8 | % | |||||||||||||||||

Retailer share arrangements | (621 | ) | (660 | ) | (698 | ) | (693 | ) | (590 | ) | (31 | ) | 5.3 | % | (1,281 | ) | (1,184 | ) | (97 | ) | 8.2 | % | |||||||||||||||||

Net interest income, after retailer share arrangements | 2,286 | 2,215 | 2,280 | 2,186 | 2,130 | 156 | 7.3 | % | 4,501 | 4,279 | 222 | 5.2 | % | ||||||||||||||||||||||||||

Provision for loan losses | 740 | 687 | 797 | 675 | 681 | 59 | 8.7 | % | 1,427 | 1,445 | (18 | ) | (1.2 | )% | |||||||||||||||||||||||||

Net interest income, after retailer share arrangements and provision for loan losses | 1,546 | 1,528 | 1,483 | 1,511 | 1,449 | 97 | 6.7 | % | 3,074 | 2,834 | 240 | 8.5 | % | ||||||||||||||||||||||||||

Other income | 120 | 101 | 162 | 96 | 112 | 8 | 7.1 | % | 221 | 227 | (6 | ) | (2.6 | )% | |||||||||||||||||||||||||

Other expense | 805 | 746 | 792 | 728 | 797 | 8 | 1.0 | % | 1,551 | 1,407 | 144 | 10.2 | % | ||||||||||||||||||||||||||

Earnings before provision for income taxes | 861 | 883 | 853 | 879 | 764 | 97 | 12.7 | % | 1,744 | 1,654 | 90 | 5.4 | % | ||||||||||||||||||||||||||

Provision for income taxes | 320 | 331 | 322 | 331 | 292 | 28 | 9.6 | % | 651 | 624 | 27 | 4.3 | % | ||||||||||||||||||||||||||

Net earnings | $ | 541 | $ | 552 | $ | 531 | $ | 548 | $ | 472 | $ | 69 | 14.6 | % | $ | 1,093 | $ | 1,030 | $ | 63 | 6.1 | % | |||||||||||||||||

Net earnings attributable to common stockholders | $ | 541 | $ | 552 | $ | 531 | $ | 548 | $ | 472 | $ | 69 | 14.6 | % | $ | 1,093 | $ | 1,030 | $ | 63 | 6.1 | % | |||||||||||||||||

COMMON SHARE STATISTICS | |||||||||||||||||||||||||||||||||||||||

Basic EPS | $ | 0.65 | $ | 0.66 | $ | 0.64 | $ | 0.70 | $ | 0.67 | $ | (0.02 | ) | (3.0 | )% | $ | 1.31 | $ | 1.46 | $ | (0.15 | ) | (10.3 | )% | |||||||||||||||

Diluted EPS | $ | 0.65 | $ | 0.66 | $ | 0.64 | $ | 0.70 | $ | 0.67 | $ | (0.02 | ) | (3.0 | )% | $ | 1.31 | $ | 1.46 | $ | (0.15 | ) | (10.3 | )% | |||||||||||||||

Common stock price | $ | 32.93 | $ | 30.35 | $ | 29.75 | $ | 24.55 | n/a | $ | 32.93 | n/a | $ | 32.93 | n/a | $ | 32.93 | n/a | |||||||||||||||||||||

Book value per share | $ | 13.89 | $ | 13.24 | $ | 12.57 | $ | 11.92 | $ | 9.06 | $ | 4.83 | 53.3 | % | $ | 13.89 | $ | 9.06 | $ | 4.83 | 53.3 | % | |||||||||||||||||

Tangible book value per share(1) | $ | 12.06 | $ | 11.43 | $ | 10.81 | $ | 10.25 | $ | 7.06 | $ | 5.00 | 70.8 | % | $ | 12.06 | $ | 7.06 | $ | 5.00 | 70.8 | % | |||||||||||||||||

Beginning common shares outstanding | 833.8 | 833.8 | 833.8 | 705.3 | 705.3 | 128.5 | 18.2 | % | 833.8 | 705.3 | 128.5 | 18.2 | % | ||||||||||||||||||||||||||

Issuance of common shares through initial public offering | — | — | — | 128.5 | — | — | NM | — | — | — | NM | ||||||||||||||||||||||||||||

Shares repurchased | — | — | — | — | — | — | NM | — | — | — | NM | ||||||||||||||||||||||||||||

Ending common shares outstanding | 833.8 | 833.8 | 833.8 | 833.8 | 705.3 | 128.5 | 18.2 | % | 833.8 | 705.3 | 128.5 | 18.2 | % | ||||||||||||||||||||||||||

Weighted average common shares outstanding | 833.8 | 833.8 | 833.8 | 781.8 | 705.3 | 128.5 | 18.2 | % | 833.8 | 705.3 | 128.5 | 18.2 | % | ||||||||||||||||||||||||||

Weighted average common shares outstanding (fully diluted) | 835.4 | 835.0 | 834.3 | 781.9 | 705.3 | 130.1 | 18.4 | % | 835.2 | 705.3 | 129.9 | 18.4 | % | ||||||||||||||||||||||||||

(1) Tangible Common Equity ("TCE") is a non-GAAP measure. For corresponding reconciliation of TCE to a GAAP financial measure, see Reconciliation of Non-GAAP Measures and Calculations of Regulatory Measures. | |||||||||||||||||||||||||||||||||||||||

1

SYNCHRONY FINANCIAL | |||||||||||||||||||||||||||||||||||||||

SELECTED METRICS | |||||||||||||||||||||||||||||||||||||||

(unaudited, $ in millions, except account data) | |||||||||||||||||||||||||||||||||||||||

Quarter Ended | Six Months ended | ||||||||||||||||||||||||||||||||||||||

Jun 30, 2015 | Mar 31, 2015 | Dec 31, 2014 | Sep 30, 2014 | Jun 30, 2014 | 2Q'15 vs. 2Q'14 | Jun 30, 2015 | Jun 30, 2014 | YTD'15 vs. YTD'14 | |||||||||||||||||||||||||||||||

PERFORMANCE METRICS | |||||||||||||||||||||||||||||||||||||||

Return on assets(1) | 2.9 | % | 3.0 | % | 2.7 | % | 3.2 | % | 3.1 | % | (0.2 | )% | 3.0 | % | 3.5 | % | (0.5 | )% | |||||||||||||||||||||

Return on equity(2) | 19.2 | % | 20.8 | % | 20.2 | % | 26.8 | % | 29.9 | % | (10.7 | )% | 20.0 | % | 32.4 | % | (12.4 | )% | |||||||||||||||||||||

Return on tangible common equity(3) | 22.2 | % | 24.1 | % | 23.4 | % | 32.4 | % | 38.5 | % | (16.3 | )% | 23.1 | % | 40.9 | % | (17.8 | )% | |||||||||||||||||||||

Net interest margin(4) | 15.77 | % | 15.79 | % | 15.60 | % | 17.11 | % | 17.84 | % | (2.07 | )% | 15.75 | % | 18.29 | % | (2.54 | )% | |||||||||||||||||||||

Efficiency ratio(5) | 33.5 | % | 32.2 | % | 32.4 | % | 31.9 | % | 35.5 | % | (2.0 | )% | 32.8 | % | 31.2 | % | 1.6 | % | |||||||||||||||||||||

Other expense as a % of average loan receivables, including held for sale | 5.37 | % | 5.06 | % | 5.16 | % | 5.09 | % | 5.77 | % | (0.40 | )% | 5.20 | % | 5.13 | % | 0.07 | % | |||||||||||||||||||||

Effective income tax rate | 37.2 | % | 37.5 | % | 37.7 | % | 37.7 | % | 38.2 | % | (1.0 | )% | 37.3 | % | 37.7 | % | (0.4 | )% | |||||||||||||||||||||

CREDIT QUALITY METRICS | |||||||||||||||||||||||||||||||||||||||

Net charge-offs as a % of average loan receivables, including held for sale | 4.63 | % | 4.53 | % | 4.32 | % | 4.05 | % | 4.88 | % | (0.25 | )% | 4.56 | % | 4.85 | % | (0.29 | )% | |||||||||||||||||||||

30+ days past due as a % of period-end loan receivables | 3.53 | % | 3.79 | % | 4.14 | % | 4.26 | % | 3.82 | % | (0.29 | )% | 3.53 | % | 3.82 | % | (0.29 | )% | |||||||||||||||||||||

90+ days past due as a % of period-end loan receivables | 1.52 | % | 1.81 | % | 1.90 | % | 1.85 | % | 1.65 | % | (0.13 | )% | 1.52 | % | 1.65 | % | (0.13 | )% | |||||||||||||||||||||

Net charge-offs | $ | 693 | $ | 668 | $ | 663 | $ | 579 | $ | 673 | $ | 20 | 3.0 | % | $ | 1,361 | $ | 1,331 | $ | 30 | 2.3 | % | |||||||||||||||||

Loan receivables delinquent over 30 days | $ | 2,171 | $ | 2,209 | $ | 2,536 | $ | 2,416 | $ | 2,097 | $ | 74 | 3.5 | % | $ | 2,171 | $ | 2,097 | $ | 74 | 3.5 | % | |||||||||||||||||

Loan receivables delinquent over 90 days | $ | 933 | $ | 1,056 | $ | 1,162 | $ | 1,051 | $ | 908 | $ | 25 | 2.8 | % | $ | 933 | $ | 908 | $ | 25 | 2.8 | % | |||||||||||||||||

Allowance for loan losses (period-end) | $ | 3,302 | $ | 3,255 | $ | 3,236 | $ | 3,102 | $ | 3,006 | $ | 296 | 9.8 | % | $ | 3,302 | $ | 3,006 | $ | 296 | 9.8 | % | |||||||||||||||||

Allowance coverage ratio(6) | 5.38 | % | 5.59 | % | 5.28 | % | 5.46 | % | 5.48 | % | (0.10 | )% | 5.38 | % | 5.48 | % | (0.10 | )% | |||||||||||||||||||||

BUSINESS METRICS | |||||||||||||||||||||||||||||||||||||||

Purchase volume(7) | $ | 28,810 | $ | 23,139 | $ | 30,081 | $ | 26,004 | $ | 25,978 | $ | 2,832 | 10.9 | % | $ | 51,949 | $ | 47,064 | $ | 4,885 | 10.4 | % | |||||||||||||||||

Period-end loan receivables | $ | 61,431 | $ | 58,248 | $ | 61,286 | $ | 56,767 | $ | 54,873 | $ | 6,558 | 12.0 | % | $ | 61,431 | $ | 54,873 | $ | 6,558 | 12.0 | % | |||||||||||||||||

Credit cards | $ | 58,827 | $ | 55,866 | $ | 58,880 | $ | 54,263 | $ | 52,406 | $ | 6,421 | 12.3 | % | $ | 58,827 | $ | 52,406 | $ | 6,421 | 12.3 | % | |||||||||||||||||

Consumer installment loans | $ | 1,138 | $ | 1,062 | $ | 1,063 | $ | 1,081 | $ | 1,047 | $ | 91 | 8.7 | % | $ | 1,138 | $ | 1,047 | $ | 91 | 8.7 | % | |||||||||||||||||

Commercial credit products | $ | 1,410 | $ | 1,295 | $ | 1,320 | $ | 1,404 | $ | 1,405 | $ | 5 | 0.4 | % | $ | 1,410 | $ | 1,405 | $ | 5 | 0.4 | % | |||||||||||||||||

Other | $ | 56 | $ | 25 | $ | 23 | $ | 19 | $ | 15 | $ | 41 | NM | $ | 56 | $ | 15 | $ | 41 | NM | |||||||||||||||||||

Average loan receivables, including held for sale | $ | 60,094 | $ | 59,775 | $ | 59,547 | $ | 57,391 | $ | 55,363 | $ | 4,731 | 8.5 | % | $ | 60,124 | $ | 55,593 | $ | 4,531 | 8.2 | % | |||||||||||||||||

Period-end active accounts (in thousands)(8) | 61,718 | 59,761 | 64,286 | 60,489 | 59,248 | 2,470 | 4.2 | % | 61,718 | 59,248 | 2,470 | 4.2 | % | ||||||||||||||||||||||||||

Average active accounts (in thousands)(8) | 60,923 | 61,604 | 61,667 | 59,907 | 58,386 | 2,537 | 4.3 | % | 61,478 | 59,080 | 2,398 | 4.1 | % | ||||||||||||||||||||||||||

LIQUIDITY | |||||||||||||||||||||||||||||||||||||||

Liquid assets | |||||||||||||||||||||||||||||||||||||||

Cash and equivalents | $ | 10,621 | $ | 11,218 | $ | 11,828 | $ | 14,808 | $ | 6,782 | $ | 3,839 | 56.6 | % | $ | 10,621 | $ | 6,782 | $ | 3,839 | 56.6 | % | |||||||||||||||||

Total liquid assets | $ | 13,660 | $ | 13,813 | $ | 12,942 | $ | 14,077 | $ | 6,119 | $ | 7,541 | 123.2 | % | $ | 13,660 | $ | 6,119 | $ | 7,541 | 123.2 | % | |||||||||||||||||

Undrawn credit facilities | |||||||||||||||||||||||||||||||||||||||

Undrawn committed securitization financings | $ | 6,125 | $ | 6,600 | $ | 6,100 | $ | 5,650 | $ | 5,650 | $ | 475 | 8.4 | % | $ | 6,125 | $ | 5,650 | $ | 475 | 8.4 | % | |||||||||||||||||

Total liquid assets and undrawn credit facilities | $ | 19,785 | $ | 20,413 | $ | 19,042 | $ | 19,727 | $ | 11,769 | $ | 8,016 | 68.1 | % | $ | 19,785 | $ | 11,769 | $ | 8,016 | 68.1 | % | |||||||||||||||||

Liquid assets % of total assets | 18.03 | % | 18.99 | % | 17.09 | % | 19.16 | % | 9.69 | % | 8.34 | % | 18.03 | % | 9.69 | % | 8.34 | % | |||||||||||||||||||||

Liquid assets including undrawn committed securitization financings % of total assets | 26.12 | % | 28.07 | % | 25.15 | % | 26.85 | % | 18.63 | % | 7.49 | % | 26.12 | % | 18.63 | % | 7.49 | % | |||||||||||||||||||||

(1) Return on assets represents net earnings as a percentage of average total assets. | |||||||||||||||||||||||||||||||||||||||

(2) Return on equity represents net earnings as a percentage of average total equity. | |||||||||||||||||||||||||||||||||||||||

(3) Return on tangible common equity represents net earnings as a percentage of average tangible common equity. Tangible Common Equity ("TCE") is a non-GAAP measure. For corresponding reconciliation of TCE to a GAAP financial measure, see Reconciliation of Non-GAAP Measures and Calculations of Regulatory Measures. | |||||||||||||||||||||||||||||||||||||||

(4) Net interest margin represents net interest income divided by average interest-earning assets. | |||||||||||||||||||||||||||||||||||||||

(5) Efficiency ratio represents (i) other expense, divided by (ii) net interest income, after retailer share arrangements, plus other income. | |||||||||||||||||||||||||||||||||||||||

(6) Allowance coverage ratio represents allowance for loan losses divided by total period-end loan receivables. | |||||||||||||||||||||||||||||||||||||||

(7) Purchase volume, or net credit sales, represents the aggregate amount of charges incurred on credit cards or other credit product accounts less returns during the period. | |||||||||||||||||||||||||||||||||||||||

(8) Active accounts represent credit card or installment loan accounts on which there has been a purchase, payment or outstanding balance in the current month. | |||||||||||||||||||||||||||||||||||||||

2

SYNCHRONY FINANCIAL | |||||||||||||||||||||||||||||||||||||||

STATEMENTS OF EARNINGS | |||||||||||||||||||||||||||||||||||||||

(unaudited, $ in millions) | |||||||||||||||||||||||||||||||||||||||

Quarter Ended | Six Months ended | ||||||||||||||||||||||||||||||||||||||

Jun 30, 2015 | Mar 31, 2015 | Dec 31, 2014 | Sep 30, 2014 | Jun 30, 2014 | 2Q'15 vs. 2Q'14 | Jun 30, 2015 | Jun 30, 2014 | YTD'15 vs. YTD'14 | |||||||||||||||||||||||||||||||

Interest income: | |||||||||||||||||||||||||||||||||||||||

Interest and fees on loans | $ | 3,166 | $ | 3,140 | $ | 3,252 | $ | 3,116 | $ | 2,920 | $ | 246 | 8.4 | % | $ | 6,306 | $ | 5,848 | $ | 458 | 7.8 | % | |||||||||||||||||

Interest on investment securities | 11 | 10 | 8 | 7 | 6 | 5 | 83.3 | % | 21 | 11 | 10 | 90.9 | % | ||||||||||||||||||||||||||

Total interest income | 3,177 | 3,150 | 3,260 | 3,123 | 2,926 | 251 | 8.6 | % | 6,327 | 5,859 | 468 | 8.0 | % | ||||||||||||||||||||||||||

Interest expense: | |||||||||||||||||||||||||||||||||||||||

Interest on deposits | 146 | 137 | 139 | 126 | 109 | 37 | 33.9 | % | 283 | 205 | 78 | 38.0 | % | ||||||||||||||||||||||||||

Interest on borrowings of consolidated securitization entities | 53 | 52 | 57 | 57 | 54 | (1 | ) | (1.9 | )% | 105 | 101 | 4 | 4.0 | % | |||||||||||||||||||||||||

Interest on third-party debt | 71 | 82 | 78 | 46 | — | 71 | NM | 153 | — | 153 | NM | ||||||||||||||||||||||||||||

Interest on related party debt | — | 4 | 8 | 15 | 43 | (43 | ) | (100.0 | )% | 4 | 90 | (86 | ) | (95.6 | )% | ||||||||||||||||||||||||

Total interest expense | 270 | 275 | 282 | 244 | 206 | 64 | 31.1 | % | 545 | 396 | 149 | 37.6 | % | ||||||||||||||||||||||||||

Net interest income | 2,907 | 2,875 | 2,978 | 2,879 | 2,720 | 187 | 6.9 | % | 5,782 | 5,463 | 319 | 5.8 | % | ||||||||||||||||||||||||||

Retailer share arrangements | (621 | ) | (660 | ) | (698 | ) | (693 | ) | (590 | ) | (31 | ) | 5.3 | % | (1,281 | ) | (1,184 | ) | (97 | ) | 8.2 | % | |||||||||||||||||

Net interest income, after retailer share arrangements | 2,286 | 2,215 | 2,280 | 2,186 | 2,130 | 156 | 7.3 | % | 4,501 | 4,279 | 222 | 5.2 | % | ||||||||||||||||||||||||||

Provision for loan losses | 740 | 687 | 797 | 675 | 681 | 59 | 8.7 | % | 1,427 | 1,445 | (18 | ) | (1.2 | )% | |||||||||||||||||||||||||

Net interest income, after retailer share arrangements and provision for loan losses | 1,546 | 1,528 | 1,483 | 1,511 | 1,449 | 97 | 6.7 | % | 3,074 | 2,834 | 240 | 8.5 | % | ||||||||||||||||||||||||||

Other income: | |||||||||||||||||||||||||||||||||||||||

Interchange revenue | 123 | 100 | 120 | 101 | 92 | 31 | 33.7 | % | 223 | 168 | 55 | 32.7 | % | ||||||||||||||||||||||||||

Debt cancellation fees | 61 | 65 | 67 | 68 | 70 | (9 | ) | (12.9 | )% | 126 | 140 | (14 | ) | (10.0 | )% | ||||||||||||||||||||||||

Loyalty programs | (94 | ) | (78 | ) | (91 | ) | (84 | ) | (63 | ) | (31 | ) | 49.2 | % | (172 | ) | (106 | ) | (66 | ) | 62.3 | % | |||||||||||||||||

Other | 30 | 14 | 66 | 11 | 13 | 17 | 130.8 | % | 44 | 25 | 19 | 76.0 | % | ||||||||||||||||||||||||||

Total other income | 120 | 101 | 162 | 96 | 112 | 8 | 7.1 | % | 221 | 227 | (6 | ) | (2.6 | )% | |||||||||||||||||||||||||

Other expense: | |||||||||||||||||||||||||||||||||||||||

Employee costs | 250 | 239 | 227 | 239 | 207 | 43 | 20.8 | % | 489 | 400 | 89 | 22.3 | % | ||||||||||||||||||||||||||

Professional fees(1) | 156 | 162 | 139 | 149 | 145 | 11 | 7.6 | % | 318 | 275 | 43 | 15.6 | % | ||||||||||||||||||||||||||

Marketing and business development | 108 | 82 | 165 | 115 | 97 | 11 | 11.3 | % | 190 | 180 | 10 | 5.6 | % | ||||||||||||||||||||||||||

Information processing | 74 | 63 | 60 | 47 | 53 | 21 | 39.6 | % | 137 | 105 | 32 | 30.5 | % | ||||||||||||||||||||||||||

Other(1) | 217 | 200 | 201 | 178 | 295 | (78 | ) | (26.4 | )% | 417 | 447 | (30 | ) | (6.7 | )% | ||||||||||||||||||||||||

Total other expense | 805 | 746 | 792 | 728 | 797 | 8 | 1.0 | % | 1,551 | 1,407 | 144 | 10.2 | % | ||||||||||||||||||||||||||

Earnings before provision for income taxes | 861 | 883 | 853 | 879 | 764 | 97 | 12.7 | % | 1,744 | 1,654 | 90 | 5.4 | % | ||||||||||||||||||||||||||

Provision for income taxes | 320 | 331 | 322 | 331 | 292 | 28 | 9.6 | % | 651 | 624 | 27 | 4.3 | % | ||||||||||||||||||||||||||

Net earnings attributable to common shareholders | $ | 541 | $ | 552 | $ | 531 | $ | 548 | $ | 472 | $ | 69 | 14.6 | % | $ | 1,093 | $ | 1,030 | $ | 63 | 6.1 | % | |||||||||||||||||

(1) We have reclassified certain amounts within Professional fees to Other for all periods in 2014 to conform to the current period classifications. | |||||||||||||||||||||||||||||||||||||||

3

SYNCHRONY FINANCIAL | |||||||||||||||||||||||||

STATEMENTS OF FINANCIAL POSITION | |||||||||||||||||||||||||

(unaudited, $ in millions) | |||||||||||||||||||||||||

Quarter Ended | |||||||||||||||||||||||||

Jun 30, 2015 | Mar 31, 2015 | Dec 31, 2014 | Sep 30, 2014 | Jun 30, 2014 | Jun 30, 2015 vs. Jun 30, 2014 | ||||||||||||||||||||

Assets | |||||||||||||||||||||||||

Cash and equivalents | $ | 10,621 | $ | 11,218 | $ | 11,828 | $ | 14,808 | $ | 6,782 | $ | 3,839 | 56.6 | % | |||||||||||

Investment securities | 3,682 | 3,121 | 1,598 | 325 | 298 | 3,384 | NM | ||||||||||||||||||

Loan receivables: | |||||||||||||||||||||||||

Unsecuritized loans held for investment | 36,019 | 33,424 | 34,335 | 30,474 | 28,280 | 7,739 | 27.4 | % | |||||||||||||||||

Restricted loans of consolidated securitization entities | 25,412 | 24,824 | 26,951 | 26,293 | 26,593 | (1,181 | ) | (4.4 | )% | ||||||||||||||||

Total loan receivables | 61,431 | 58,248 | 61,286 | 56,767 | 54,873 | 6,558 | 12.0 | % | |||||||||||||||||

Less: Allowance for loan losses | (3,302 | ) | (3,255 | ) | (3,236 | ) | (3,102 | ) | (3,006 | ) | (296 | ) | 9.8 | % | |||||||||||

Loan receivables, net | 58,129 | 54,993 | 58,050 | 53,665 | 51,867 | 6,262 | 12.1 | % | |||||||||||||||||

Loan receivables held for sale | — | 359 | 332 | 1,493 | 1,458 | (1,458 | ) | (100.0 | )% | ||||||||||||||||

Goodwill | 949 | 949 | 949 | 949 | 949 | — | — | % | |||||||||||||||||

Intangible assets, net | 575 | 557 | 519 | 449 | 463 | 112 | 24.2 | % | |||||||||||||||||

Other assets | 1,794 | 1,524 | 2,431 | 1,780 | 1,358 | 436 | 32.1 | % | |||||||||||||||||

Total assets | $ | 75,750 | $ | 72,721 | $ | 75,707 | $ | 73,469 | $ | 63,175 | $ | 12,575 | 19.9 | % | |||||||||||

Liabilities and Equity | |||||||||||||||||||||||||

Deposits: | |||||||||||||||||||||||||

Interest-bearing deposit accounts | $ | 37,629 | $ | 34,788 | $ | 34,847 | $ | 32,480 | $ | 30,258 | $ | 7,371 | 24.4 | % | |||||||||||

Non-interest-bearing deposit accounts | 143 | 162 | 108 | 209 | 204 | (61 | ) | (29.9 | )% | ||||||||||||||||

Total deposits | 37,772 | 34,950 | 34,955 | 32,689 | 30,462 | 7,310 | 24.0 | % | |||||||||||||||||

Borrowings: | |||||||||||||||||||||||||

Borrowings of consolidated securitization entities | 13,948 | 13,817 | 14,967 | 15,091 | 15,114 | (1,166 | ) | (7.7 | )% | ||||||||||||||||

Bank term loan | 5,151 | 5,651 | 8,245 | 7,495 | — | 5,151 | NM | ||||||||||||||||||

Senior unsecured notes | 4,593 | 4,592 | 3,593 | 3,593 | — | 4,593 | NM | ||||||||||||||||||

Related party debt | — | — | 655 | 1,405 | 7,859 | (7,859 | ) | (100.0 | )% | ||||||||||||||||

Total borrowings | 23,692 | 24,060 | 27,460 | 27,584 | 22,973 | 719 | 3.1 | % | |||||||||||||||||

Accrued expenses and other liabilities | 2,708 | 2,675 | 2,814 | 3,255 | 3,347 | (639 | ) | (19.1 | )% | ||||||||||||||||

Total liabilities | 64,172 | 61,685 | 65,229 | 63,528 | 56,782 | 7,390 | 13.0 | % | |||||||||||||||||

Equity: | |||||||||||||||||||||||||

Parent’s net investment | — | — | — | — | — | — | NM | ||||||||||||||||||

Common stock | 1 | 1 | 1 | 1 | 1 | — | — | % | |||||||||||||||||

Additional paid-in capital | 9,422 | 9,418 | 9,408 | 9,401 | 6,399 | 3,023 | 47.2 | % | |||||||||||||||||

Retained earnings | 2,172 | 1,631 | 1,079 | 548 | — | 2,172 | NM | ||||||||||||||||||

Accumulated other comprehensive income: | (17 | ) | (14 | ) | (10 | ) | (9 | ) | (7 | ) | (10 | ) | 142.9 | % | |||||||||||

Total equity | 11,578 | 11,036 | 10,478 | 9,941 | 6,393 | 5,185 | 81.1 | % | |||||||||||||||||

Total liabilities and equity | $ | 75,750 | $ | 72,721 | $ | 75,707 | $ | 73,469 | $ | 63,175 | $ | 12,575 | 19.9 | % | |||||||||||

4

SYNCHRONY FINANCIAL | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

AVERAGE BALANCES, NET INTEREST INCOME AND NET INTEREST MARGIN | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

(unaudited, $ in millions) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Quarter Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

June 30, 2015 | March 31, 2015 | December 31, 2014 | September 30, 2014 | June 30, 2014 | ||||||||||||||||||||||||||||||||||||||||||||||||||

Interest | Average | Interest | Average | Interest | Average | Interest | Average | Interest | Average | |||||||||||||||||||||||||||||||||||||||||||||

Average | Income/ | Yield/ | Average | Income/ | Yield/ | Average | Income/ | Yield/ | Average | Income/ | Yield/ | Average | Income/ | Yield/ | ||||||||||||||||||||||||||||||||||||||||

Balance | Expense | Rate | Balance | Expense | Rate | Balance | Expense | Rate | Balance | Expense | Rate | Balance | Expense | Rate | ||||||||||||||||||||||||||||||||||||||||

Assets | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Interest-earning assets: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Interest-earning cash and equivalents | $ | 10,728 | $ | 6 | 0.22 | % | $ | 11,331 | $ | 6 | 0.21 | % | $ | 13,631 | $ | 7 | 0.20 | % | $ | 9,793 | $ | 4 | 0.16 | % | $ | 5,489 | $ | 3 | 0.22 | % | ||||||||||||||||||||||||

Securities available for sale | 3,107 | 5 | 0.65 | % | 2,725 | 4 | 0.60 | % | 962 | 1 | 0.40 | % | 309 | 3 | 3.89 | % | 285 | 3 | 4.22 | % | ||||||||||||||||||||||||||||||||||

Loan receivables: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Credit cards, including held for sale | 57,588 | 3,106 | 21.63 | % | 57,390 | 3,079 | 21.76 | % | 57,075 | 3,186 | 21.68 | % | 54,891 | 3,054 | 22.32 | % | 52,957 | 2,860 | 21.66 | % | ||||||||||||||||||||||||||||||||||

Consumer installment loans | 1,101 | 26 | 9.47 | % | 1,057 | 25 | 9.59 | % | 1,072 | 27 | 9.78 | % | 1,070 | 25 | 9.37 | % | 1,004 | 24 | 9.59 | % | ||||||||||||||||||||||||||||||||||

Commercial credit products | 1,372 | 34 | 9.94 | % | 1,305 | 36 | 11.19 | % | 1,379 | 38 | 10.70 | % | 1,412 | 37 | 10.51 | % | 1,387 | 36 | 10.41 | % | ||||||||||||||||||||||||||||||||||

Other | 33 | — | — | % | 23 | — | — | % | 21 | 1 | NM | 18 | — | — | % | 15 | — | — | % | |||||||||||||||||||||||||||||||||||

Total loan receivables, including held for sale | 60,094 | 3,166 | 21.13 | % | 59,775 | 3,140 | 21.30 | % | 59,547 | 3,252 | 21.21 | % | 57,391 | 3,116 | 21.78 | % | 55,363 | 2,920 | 21.16 | % | ||||||||||||||||||||||||||||||||||

Total interest-earning assets | 73,929 | 3,177 | 17.24 | % | 73,831 | 3,150 | 17.30 | % | 74,140 | 3,260 | 17.07 | % | 67,493 | 3,123 | 18.56 | % | 61,137 | 2,926 | 19.20 | % | ||||||||||||||||||||||||||||||||||

Non-interest-earning assets: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Cash and due from banks | 583 | 497 | 1,220 | 1,260 | 637 | |||||||||||||||||||||||||||||||||||||||||||||||||

Allowance for loan losses | (3,285 | ) | (3,272 | ) | (3,160 | ) | (3,058 | ) | (3,005 | ) | ||||||||||||||||||||||||||||||||||||||||||||

Other assets | 2,916 | 2,802 | 2,831 | 2,605 | 2,446 | |||||||||||||||||||||||||||||||||||||||||||||||||

Total non-interest-earning assets | 214 | 27 | 891 | 807 | 78 | |||||||||||||||||||||||||||||||||||||||||||||||||

Total assets | $ | 74,143 | $ | 73,858 | $ | 75,031 | $ | 68,300 | $ | 61,215 | ||||||||||||||||||||||||||||||||||||||||||||

Liabilities | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Interest-bearing liabilities: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Interest-bearing deposit accounts | $ | 35,908 | $ | 146 | 1.63 | % | $ | 34,981 | $ | 137 | 1.59 | % | $ | 33,980 | $ | 139 | 1.59 | % | $ | 31,459 | $ | 126 | 1.61 | % | $ | 28,568 | $ | 109 | 1.53 | % | ||||||||||||||||||||||||

Borrowings of consolidated securitization entities | 14,026 | 53 | 1.52 | % | 14,101 | 52 | 1.50 | % | 14,766 | 57 | 1.50 | % | 15,102 | 57 | 1.51 | % | 14,727 | 54 | 1.47 | % | ||||||||||||||||||||||||||||||||||

Bank term loan(1) | 5,401 | 32 | 2.38 | % | 6,531 | 47 | 2.92 | % | 8,057 | 46 | 2.22 | % | 3,747 | 28 | 3.00 | % | — | — | — | % | ||||||||||||||||||||||||||||||||||

Senior unsecured notes(1) | 4,592 | 39 | 3.41 | % | 4,093 | 35 | 3.47 | % | 3,593 | 32 | 3.46 | % | 1,797 | 18 | 4.02 | % | — | — | — | % | ||||||||||||||||||||||||||||||||||

Related party debt(1) | — | — | — | % | 407 | 4 | 3.99 | % | 843 | 8 | 3.68 | % | 4,582 | 15 | 1.31 | % | 7,959 | 43 | 2.17 | % | ||||||||||||||||||||||||||||||||||

Total interest-bearing liabilities | 59,927 | 270 | 1.81 | % | 60,113 | 275 | 1.86 | % | 61,239 | 282 | 1.79 | % | 56,687 | 244 | 1.73 | % | 51,254 | 206 | 1.61 | % | ||||||||||||||||||||||||||||||||||

Non-interest-bearing liabilities | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Non-interest-bearing deposit accounts | 166 | 142 | 182 | 206 | 221 | |||||||||||||||||||||||||||||||||||||||||||||||||

Other liabilities | 2,750 | 2,854 | 3,382 | 3,208 | 3,412 | |||||||||||||||||||||||||||||||||||||||||||||||||

Total non-interest-bearing liabilities | 2,916 | 2,996 | 3,564 | 3,414 | 3,633 | |||||||||||||||||||||||||||||||||||||||||||||||||

Total liabilities | 62,843 | 63,109 | 64,803 | 60,101 | 54,887 | |||||||||||||||||||||||||||||||||||||||||||||||||

Equity | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Total equity | 11,300 | 10,749 | 10,228 | 8,199 | 6,328 | |||||||||||||||||||||||||||||||||||||||||||||||||

Total liabilities and equity | $ | 74,143 | $ | 73,858 | $ | 75,031 | $ | 68,300 | $ | 61,215 | ||||||||||||||||||||||||||||||||||||||||||||

Net interest income | $ | 2,907 | $ | 2,875 | $ | 2,978 | $ | 2,879 | $ | 2,720 | ||||||||||||||||||||||||||||||||||||||||||||

Interest rate spread(2) | 15.43 | % | 15.44 | % | 15.28 | % | 16.83 | % | 17.59 | % | ||||||||||||||||||||||||||||||||||||||||||||

Net interest margin(3) | 15.77 | % | 15.79 | % | 15.60 | % | 17.11 | % | 17.84 | % | ||||||||||||||||||||||||||||||||||||||||||||

(1) Interest on liabilities calculated above utilizes monthly average balances. The effective interest rates for the Bank term loan for the quarters ended June 30, 2015, March 31, 2015, December 31, 2014 and September 30, 2014, were 2.21%, 2.21%, 2.19% and 2.21%, respectively. The Bank term loan effective rate excludes the impact of charges incurred in connection with prepayments of the loan. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) Interest rate spread represents the difference between the yield on total interest-earning assets and the rate on total interest-bearing liabilities. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

(3) Net interest margin represents net interest income divided by average interest-earning assets. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

5

SYNCHRONY FINANCIAL | |||||||||||||||||||||

AVERAGE BALANCES, NET INTEREST INCOME AND NET INTEREST MARGIN | |||||||||||||||||||||

(unaudited, $ in millions) | |||||||||||||||||||||

Six Months Ended Jun 30, 2015 | Six Months Ended Jun 30, 2014 | ||||||||||||||||||||

Interest | Average | Interest | Average | ||||||||||||||||||

Average | Income/ | Yield/ | Average | Income/ | Yield/ | ||||||||||||||||

Balance | Expense | Rate | Balance | Expense | Rate | ||||||||||||||||

Assets | |||||||||||||||||||||

Interest-earning assets: | |||||||||||||||||||||

Interest-earning cash and equivalents | $ | 11,006 | $ | 12 | 0.22 | % | $ | 4,710 | $ | 5 | 0.22 | % | |||||||||

Securities available for sale | 2,887 | 9 | 0.63 | % | 268 | 6 | 4.54 | % | |||||||||||||

Loan receivables: | |||||||||||||||||||||

Credit cards, including held for sale | 57,670 | 6,185 | 21.63 | % | 53,238 | 5,727 | 21.81 | % | |||||||||||||

Consumer installment loans | 1,081 | 51 | 9.51 | % | 984 | 47 | 9.69 | % | |||||||||||||

Commercial credit products | 1,345 | 70 | 10.50 | % | 1,356 | 74 | 11.07 | % | |||||||||||||

Other | 28 | — | — | % | 15 | — | — | % | |||||||||||||

Total loan receivables, including held for sale | 60,124 | 6,306 | 21.15 | % | 55,593 | 5,848 | 21.33 | % | |||||||||||||

Total interest-earning assets | 74,017 | 6,327 | 17.24 | % | 60,571 | 5,859 | 19.61 | % | |||||||||||||

Non-interest-earning assets: | |||||||||||||||||||||

Cash and due from banks | 578 | 611 | |||||||||||||||||||

Allowance for loan losses | (3,282 | ) | (2,964 | ) | |||||||||||||||||

Other assets | 2,870 | 2,253 | |||||||||||||||||||

Total non-interest-earning assets | 166 | (100 | ) | ||||||||||||||||||

Total assets | $ | 74,183 | $ | 60,471 | |||||||||||||||||

Liabilities | |||||||||||||||||||||

Interest-bearing liabilities: | |||||||||||||||||||||

Interest-bearing deposit accounts | $ | 35,538 | $ | 283 | 1.61 | % | $ | 27,488 | $ | 205 | 1.51 | % | |||||||||

Borrowings of consolidated securitization entities | 14,099 | 105 | 1.50 | % | 14,799 | 101 | 1.38 | % | |||||||||||||

Bank term loan(1) | 6,011 | 79 | 2.65 | % | — | — | — | % | |||||||||||||

Senior unsecured notes(1) | 4,307 | 74 | 3.46 | % | — | — | — | % | |||||||||||||

Related party debt(1) | 232 | 4 | 3.48 | % | 8,131 | 90 | 2.24 | % | |||||||||||||

Total interest-bearing liabilities | 60,187 | 545 | 1.83 | % | 50,418 | 396 | 1.59 | % | |||||||||||||

Non-interest-bearing liabilities | |||||||||||||||||||||

Non-interest-bearing deposit accounts | 153 | 282 | |||||||||||||||||||

Other liabilities | 2,820 | 3,319 | |||||||||||||||||||

Total non-interest-bearing liabilities | 2,973 | 3,601 | |||||||||||||||||||

Total liabilities | 63,160 | 54,019 | |||||||||||||||||||

Equity | |||||||||||||||||||||

Total equity | 11,023 | 6,452 | |||||||||||||||||||

Total liabilities and equity | $ | 74,183 | $ | 60,471 | |||||||||||||||||

Net interest income | $ | 5,782 | $ | 5,463 | |||||||||||||||||

Interest rate spread(2) | 15.41 | % | 18.02 | % | |||||||||||||||||

Net interest margin(3) | 15.75 | % | 18.29 | % | |||||||||||||||||

(1) Interest on liabilities calculated above utilizes monthly average balances. The effective interest rate for the Bank term loan for the 6 months ended June 30, 2015 was 2.21%. The Bank term loan effective rate excludes the impact of charges incurred in connection with the prepayments of the loan. | |||||||||||||||||||||

(2) Interest rate spread represents the difference between the yield on total interest-earning assets and the rate on total interest-bearing liabilities. | |||||||||||||||||||||

(3) Net interest margin represents net interest income divided by average interest-earning assets. | |||||||||||||||||||||

6

SYNCHRONY FINANCIAL | |||||||||||||||||||||||||

BALANCE SHEET STATISTICS | |||||||||||||||||||||||||

(unaudited, $ in millions, except per share statistics) | |||||||||||||||||||||||||

Quarter Ended | |||||||||||||||||||||||||

Jun 30, 2015 | Mar 31, 2015 | Dec 31, 2014 | Sep 30, 2014 | Jun 30, 2014 | Jun 30, 2015 vs. Jun 30, 2014 | ||||||||||||||||||||

BALANCE SHEET STATISTICS | |||||||||||||||||||||||||

Total common equity | $ | 11,578 | $ | 11,036 | $ | 10,478 | $ | 9,941 | $ | 6,393 | $ | 5,185 | 81.1 | % | |||||||||||

Total common equity as a % of total assets | 15.28 | % | 15.18 | % | 13.84 | % | 13.53 | % | 10.12 | % | 5.16 | % | |||||||||||||

Tangible assets | $ | 74,226 | $ | 71,215 | $ | 74,239 | $ | 72,071 | $ | 61,763 | $ | 12,463 | 20.2 | % | |||||||||||

Tangible common equity(1) | $ | 10,054 | $ | 9,530 | $ | 9,010 | $ | 8,543 | $ | 4,981 | $ | 5,073 | 101.8 | % | |||||||||||

Tangible common equity as a % of tangible assets(1) | 13.55 | % | 13.38 | % | 12.14 | % | 11.85 | % | 8.06 | % | 5.49 | % | |||||||||||||

Tangible common equity per share(1) | $ | 12.06 | $ | 11.43 | $ | 10.81 | $ | 10.25 | $ | 7.06 | $ | 5.00 | 70.8 | % | |||||||||||

REGULATORY CAPITAL RATIOS(2) | |||||||||||||||||||||||||

Basel III Transition | Basel I | ||||||||||||||||||||||||

Total risk-based capital ratio(3)(8) | 18.5 | % | 18.2 | % | 16.2 | % | 16.4 | % | |||||||||||||||||

Tier 1 risk-based capital ratio(4)(8) | 17.2 | % | 16.9 | % | 14.9 | % | 15.1 | % | |||||||||||||||||

Tier 1 common ratio(5)(8) | n/a | 16.9 | % | 14.9 | % | 15.1 | % | ||||||||||||||||||

Tier 1 leverage ratio(6)(8) | 14.6 | % | 13.7 | % | 12.5 | % | 12.2 | % | |||||||||||||||||

Common equity Tier 1 capital ratio(7)(8) | 17.2 | % | n/a | n/a | n/a | ||||||||||||||||||||

Basel III Fully Phased-in | |||||||||||||||||||||||||

Common equity Tier 1 capital ratio(7) | 16.4 | % | 16.4 | % | 14.5 | % | 14.6 | % | |||||||||||||||||

(1) Tangible common equity ("TCE") is a non-GAAP measure. We believe TCE is a more meaningful measure of the net asset value of the Company to investors. For corresponding reconciliation of TCE to a GAAP financial measure, see Reconciliation of Non-GAAP Measures and Calculations of Regulatory Measures. | |||||||||||||||||||||||||

(2) Regulatory capital metrics at June 30, 2015 are preliminary and therefore subject to change. As a new savings and loan holding company, the Company historically has not been required by regulators to disclose capital ratios, and therefore these ratios are non-GAAP measures. See Reconciliation of Non-GAAP Measures and Calculation of Regulatory Measures for components of capital ratio calculations. | |||||||||||||||||||||||||

(3) Total risk-based capital ratio is the ratio of total risk-based capital divided by risk-weighted assets. | |||||||||||||||||||||||||

(4) Tier 1 risk-based capital ratio is the ratio of Tier 1 capital divided by risk-weighted assets. | |||||||||||||||||||||||||

(5) Tier 1 common ratio is the ratio of common equity Tier 1 capital divided by risk-weighted assets. | |||||||||||||||||||||||||

(6) Tier 1 leverage ratio reported under Basel III transition rules is calculated based on Tier 1 capital divided by total average assets, after certain adjustments. Total assets, after certain adjustments is used as the denominator for prior periods calculated under Basel I rules. | |||||||||||||||||||||||||

(7) Common equity Tier 1 capital ratio is the ratio of common equity Tier 1 capital to total risk-weighted assets, each as calculated under Basel III rules. Common equity Tier 1 capital ratio (fully phased-in) is a preliminary estimate reflecting management’s interpretation of the final Basel III rules adopted in July 2013 by the Federal Reserve Board, which have not been fully implemented, and our estimate and interpretations are subject to, among other things, ongoing regulatory review and implementation guidance. | |||||||||||||||||||||||||

(8) Beginning June 30, 2015, regulatory capital ratios are calculated under Basel III rules subject to transition provisions. The Company reported under Basel I rules for periods prior to June 30, 2015. | |||||||||||||||||||||||||

7

SYNCHRONY FINANCIAL | |||||||||||||||||||||||||||||||||||||||

PLATFORM RESULTS AND RECONCILIATION OF NON-GAAP MEASURES | |||||||||||||||||||||||||||||||||||||||

(unaudited, $ in millions) | |||||||||||||||||||||||||||||||||||||||

Quarter Ended | Six Months Ended | ||||||||||||||||||||||||||||||||||||||

Jun 30, 2015 | Mar 31, 2015 | Dec 31, 2014 | Sep 30, 2014 | Jun 30, 2014 | 2Q'15 vs. 2Q'14 | Jun 30, 2015 | Jun 30, 2014 | YTD'15 vs. YTD'14 | |||||||||||||||||||||||||||||||

RETAIL CARD | |||||||||||||||||||||||||||||||||||||||

Purchase volume(1),(2) | $ | 23,452 | $ | 18,410 | $ | 24,855 | $ | 20,991 | $ | 21,032 | $ | 2,420 | 11.5 | % | $ | 41,862 | $ | 37,745 | $ | 4,117 | 10.9 | % | |||||||||||||||||

Period-end loan receivables | $ | 42,315 | $ | 39,685 | $ | 42,308 | $ | 38,466 | $ | 37,238 | $ | 5,077 | 13.6 | % | $ | 42,315 | $ | 37,238 | $ | 5,077 | 13.6 | % | |||||||||||||||||

Average loan receivables, including held for sale | $ | 41,303 | $ | 40,986 | $ | 40,929 | $ | 39,411 | $ | 38,047 | $ | 3,256 | 8.6 | % | $ | 41,302 | $ | 38,273 | $ | 3,029 | 7.9 | % | |||||||||||||||||

Average active accounts (in thousands)(2),(3) | 48,981 | 49,617 | 49,871 | 48,433 | 47,248 | 1,733 | 3.7 | % | 49,513 | 47,918 | 1,595 | 3.3 | % | ||||||||||||||||||||||||||

Interest and fees on loans(2) | $ | 2,335 | $ | 2,337 | $ | 2,405 | $ | 2,299 | $ | 2,158 | $ | 177 | 8.2 | % | $ | 4,672 | $ | 4,336 | $ | 336 | 7.7 | % | |||||||||||||||||

Other income(2) | 107 | 86 | 141 | 78 | 92 | 15 | 16.3 | % | 193 | 188 | 5 | 2.7 | % | ||||||||||||||||||||||||||

Platform revenue, excluding retailer share arrangements(2) | 2,442 | 2,423 | 2,546 | 2,377 | 2,250 | 192 | 8.5 | % | 4,865 | 4,524 | 341 | 7.5 | % | ||||||||||||||||||||||||||

Retailer share arrangements(2) | (606 | ) | (651 | ) | (686 | ) | (683 | ) | (577 | ) | (29 | ) | 5.0 | % | (1,257 | ) | (1,161 | ) | (96 | ) | 8.3 | % | |||||||||||||||||

Platform revenue(2) | $ | 1,836 | $ | 1,772 | $ | 1,860 | $ | 1,694 | $ | 1,673 | $ | 163 | 9.7 | % | $ | 3,608 | $ | 3,363 | $ | 245 | 7.3 | % | |||||||||||||||||

PAYMENT SOLUTIONS | |||||||||||||||||||||||||||||||||||||||

Purchase volume(1) | $ | 3,371 | $ | 2,948 | $ | 3,419 | $ | 3,226 | $ | 3,115 | $ | 256 | 8.2 | % | $ | 6,319 | $ | 5,802 | $ | 517 | 8.9 | % | |||||||||||||||||

Period-end loan receivables | $ | 12,194 | $ | 11,833 | $ | 12,095 | $ | 11,514 | $ | 11,014 | $ | 1,180 | 10.7 | % | $ | 12,194 | $ | 11,014 | $ | 1,180 | 10.7 | % | |||||||||||||||||

Average loan receivables | $ | 11,971 | $ | 11,970 | $ | 11,772 | $ | 11,267 | $ | 10,785 | $ | 1,186 | 11.0 | % | $ | 11,990 | $ | 10,799 | $ | 1,191 | 11.0 | % | |||||||||||||||||

Average active accounts (in thousands)(3) | 7,231 | 7,271 | 7,113 | 6,892 | 6,692 | 539 | 8.1 | % | 7,251 | 6,718 | 533 | 7.9 | % | ||||||||||||||||||||||||||

Interest and fees on loans | $ | 412 | $ | 403 | $ | 426 | $ | 405 | $ | 379 | $ | 33 | 8.7 | % | $ | 815 | $ | 751 | $ | 64 | 8.5 | % | |||||||||||||||||

Other income | 4 | 5 | 9 | 7 | 8 | (4 | ) | (50.0 | )% | 9 | 16 | (7 | ) | (43.8 | )% | ||||||||||||||||||||||||

Platform revenue, excluding retailer share arrangements | 416 | 408 | 435 | 412 | 387 | 29 | 7.5 | % | 824 | 767 | 57 | 7.4 | % | ||||||||||||||||||||||||||

Retailer share arrangements | (14 | ) | (8 | ) | (11 | ) | (9 | ) | (12 | ) | (2 | ) | 16.7 | % | (22 | ) | (21 | ) | (1 | ) | 4.8 | % | |||||||||||||||||

Platform revenue | $ | 402 | $ | 400 | $ | 424 | $ | 403 | $ | 375 | $ | 27 | 7.2 | % | $ | 802 | $ | 746 | $ | 56 | 7.5 | % | |||||||||||||||||

CARECREDIT | |||||||||||||||||||||||||||||||||||||||

Purchase volume(1) | $ | 1,987 | $ | 1,781 | $ | 1,807 | $ | 1,787 | $ | 1,831 | $ | 156 | 8.5 | % | $ | 3,768 | $ | 3,517 | $ | 251 | 7.1 | % | |||||||||||||||||

Period-end loan receivables | $ | 6,922 | $ | 6,730 | $ | 6,883 | $ | 6,787 | $ | 6,621 | $ | 301 | 4.5 | % | $ | 6,922 | $ | 6,621 | $ | 301 | 4.5 | % | |||||||||||||||||

Average loan receivables | $ | 6,820 | $ | 6,819 | $ | 6,846 | $ | 6,713 | $ | 6,531 | $ | 289 | 4.4 | % | $ | 6,832 | $ | 6,521 | $ | 311 | 4.8 | % | |||||||||||||||||

Average active accounts (in thousands)(3) | 4,711 | 4,716 | 4,683 | 4,582 | 4,446 | 265 | 6.0 | % | 4,714 | 4,444 | 270 | 6.1 | % | ||||||||||||||||||||||||||

Interest and fees on loans | $ | 419 | $ | 400 | $ | 421 | $ | 412 | $ | 383 | $ | 36 | 9.4 | % | $ | 819 | $ | 761 | $ | 58 | 7.6 | % | |||||||||||||||||

Other income | 9 | 10 | 12 | 11 | 12 | (3 | ) | (25.0 | )% | 19 | 23 | (4 | ) | (17.4 | )% | ||||||||||||||||||||||||

Platform revenue, excluding retailer share arrangements | 428 | 410 | 433 | 423 | 395 | 33 | 8.4 | % | 838 | 784 | 54 | 6.9 | % | ||||||||||||||||||||||||||

Retailer share arrangements | (1 | ) | (1 | ) | (1 | ) | (1 | ) | (1 | ) | — | — | % | (2 | ) | (2 | ) | — | — | % | |||||||||||||||||||

Platform revenue | $ | 427 | $ | 409 | $ | 432 | $ | 422 | $ | 394 | $ | 33 | 8.4 | % | $ | 836 | $ | 782 | $ | 54 | 6.9 | % | |||||||||||||||||

TOTAL SYF | |||||||||||||||||||||||||||||||||||||||

Purchase volume(1),(2) | $ | 28,810 | $ | 23,139 | $ | 30,081 | $ | 26,004 | $ | 25,978 | $ | 2,832 | 10.9 | % | $ | 51,949 | $ | 47,064 | $ | 4,885 | 10.4 | % | |||||||||||||||||

Period-end loan receivables | $ | 61,431 | $ | 58,248 | $ | 61,286 | $ | 56,767 | $ | 54,873 | $ | 6,558 | 12.0 | % | $ | 61,431 | $ | 54,873 | $ | 6,558 | 12.0 | % | |||||||||||||||||

Average loan receivables, including held for sale | $ | 60,094 | $ | 59,775 | $ | 59,547 | $ | 57,391 | $ | 55,363 | $ | 4,731 | 8.5 | % | $ | 60,124 | $ | 55,593 | $ | 4,531 | 8.2 | % | |||||||||||||||||

Average active accounts (in thousands)(2),(3) | 60,923 | 61,604 | 61,667 | 59,907 | 58,386 | 2,537 | 4.3 | % | 61,478 | 59,080 | 2,398 | 4.1 | % | ||||||||||||||||||||||||||

Interest and fees on loans(2) | $ | 3,166 | $ | 3,140 | $ | 3,252 | $ | 3,116 | $ | 2,920 | $ | 246 | 8.4 | % | $ | 6,306 | $ | 5,848 | $ | 458 | 7.8 | % | |||||||||||||||||

Other income(2) | 120 | 101 | 162 | 96 | 112 | 8 | 7.1 | % | 221 | 227 | (6 | ) | (2.6 | )% | |||||||||||||||||||||||||

Platform revenue, excluding retailer share arrangements(2) | 3,286 | 3,241 | 3,414 | 3,212 | 3,032 | 254 | 8.4 | % | 6,527 | 6,075 | 452 | 7.4 | % | ||||||||||||||||||||||||||

Retailer share arrangements(2) | (621 | ) | (660 | ) | (698 | ) | (693 | ) | (590 | ) | (31 | ) | 5.3 | % | (1,281 | ) | (1,184 | ) | (97 | ) | 8.2 | % | |||||||||||||||||

Platform revenue(2) | $ | 2,665 | $ | 2,581 | $ | 2,716 | $ | 2,519 | $ | 2,442 | $ | 223 | 9.1 | % | $ | 5,246 | $ | 4,891 | $ | 355 | 7.3 | % | |||||||||||||||||

(1) Purchase volume, or net credit sales, represents the aggregate amount of charges incurred on credit cards or other credit product accounts less returns during the period. | |||||||||||||||||||||||||||||||||||||||

(2) Includes activity and balances associated with loan receivables held for sale. | |||||||||||||||||||||||||||||||||||||||

(3) Active accounts represent credit card or installment loan accounts on which there has been a purchase, payment or outstanding balance in the current month. | |||||||||||||||||||||||||||||||||||||||

8

SYNCHRONY FINANCIAL | |||||||||||||||||||

RECONCILIATION OF NON-GAAP MEASURES AND CALCULATIONS OF REGULATORY MEASURES | |||||||||||||||||||

(unaudited, $ in millions, except per share statistics) | |||||||||||||||||||

Quarter Ended | |||||||||||||||||||

Jun 30, 2015 | Mar 31, 2015 | Dec 31, 2014 | Sep 30, 2014 | Jun 30, 2014 | |||||||||||||||

COMMON EQUITY MEASURES | |||||||||||||||||||

GAAP Total common equity | $ | 11,578 | $ | 11,036 | $ | 10,478 | $ | 9,941 | $ | 6,393 | |||||||||

Less: Goodwill | (949 | ) | (949 | ) | (949 | ) | (949 | ) | (949 | ) | |||||||||

Less: Intangible assets, net | (575 | ) | (557 | ) | (519 | ) | (449 | ) | (463 | ) | |||||||||

Tangible common equity | $ | 10,054 | $ | 9,530 | $ | 9,010 | $ | 8,543 | $ | 4,981 | |||||||||

Adjustments for certain other intangible assets, deferred tax liabilities and certain items in accumulated comprehensive income (loss) | 293 | 287 | 292 | ||||||||||||||||

Basel I - Tier 1 capital and Tier 1 common equity | $ | 9,823 | $ | 9,297 | 8,835 | ||||||||||||||

Adjustments for certain other intangible assets and deferred tax liabilities | (12 | ) | (20 | ) | (24 | ) | |||||||||||||

Adjustments for certain deferred tax liabilities and certain items in accumulated comprehensive income (loss) | 293 | ||||||||||||||||||

Basel III - Common equity Tier 1 (fully phased-in) | $ | 10,347 | $ | 9,811 | $ | 9,277 | $ | 8,811 | |||||||||||

Adjustment related to capital components during transition | 331 | ||||||||||||||||||

Basel III - Common equity Tier I (transition) | $ | 10,678 | |||||||||||||||||

RISK-BASED CAPITAL | |||||||||||||||||||

Tier 1 capital and Tier 1 common equity(1) | $ | 10,678 | $ | 9,823 | $ | 9,297 | $ | 8,835 | |||||||||||

Add: Allowance for loan losses includible in risk-based capital | 806 | 759 | 809 | 760 | |||||||||||||||

Risk-based capital(1) | $ | 11,484 | $ | 10,582 | $ | 10,106 | $ | 9,595 | |||||||||||

ASSET MEASURES | |||||||||||||||||||

Total assets(2) | $ | 74,143 | $ | 72,721 | $ | 75,707 | $ | 73,469 | |||||||||||

Adjustments for: | |||||||||||||||||||

Disallowed goodwill and other disallowed intangible assets, net of related deferred tax liabilities | (903 | ) | (1,213 | ) | (1,181 | ) | (1,110 | ) | |||||||||||

Other | 60 | 136 | 79 | 4 | |||||||||||||||

Total assets for leverage purposes(1) | $ | 73,300 | $ | 71,644 | $ | 74,605 | $ | 72,363 | |||||||||||

Risk-weighted assets - Basel I | n/a | $ | 58,184 | $ | 62,270 | $ | 58,457 | ||||||||||||

Risk-weighted assets - Basel III (fully phased-in)(3) | $ | 62,970 | $ | 59,926 | $ | 64,162 | $ | 60,300 | |||||||||||

Risk-weighted assets - Basel III (transition)(3) | $ | 61,985 | n/a | n/a | n/a | ||||||||||||||

TANGIBLE COMMON EQUITY PER SHARE | |||||||||||||||||||

GAAP book value per share | $ | 13.89 | $ | 13.24 | $ | 12.57 | $ | 11.92 | $ | 9.06 | |||||||||

Less: Goodwill | (1.14 | ) | (1.14 | ) | (1.14 | ) | (1.14 | ) | (1.34 | ) | |||||||||

Less: Intangible assets, net | (0.69 | ) | (0.67 | ) | (0.62 | ) | (0.53 | ) | (0.66 | ) | |||||||||

Tangible common equity per share | $ | 12.06 | $ | 11.43 | $ | 10.81 | $ | 10.25 | $ | 7.06 | |||||||||

(1) Beginning June 30, 2015, regulatory capital amounts are calculated under Basel III rules subject to transition provisions. The company reported under Basel I rules for periods prior to June 30, 2015. | |||||||||||||||||||

(2) Represents total average assets at June 30, 2015 and total assets for all other periods presented. | |||||||||||||||||||

(3) Key differences between Basel III transitional rules and fully phased-in Basel III rules in the calculation of risk-weighted assets include, but not limited to, risk weighting of deferred tax assets and adjustments for certain intangible assets. | |||||||||||||||||||

9

2Q’15 Financial Results July 17, 2015 Exhibit 99.3

2 Cautionary Statement Regarding Forward-Looking Statements The following slides are part of a presentation by Synchrony Financial in connection with reporting quarterly financial results. No representation is made that the information in these slides is complete. For additional information, see the earnings release and financial supplement included as exhibits to our Current Report on Form 8-K filed today and available on our website (www.synchronyfinancial.com) and the SEC’s website (www.sec.gov). All references to net earnings and net income are intended to have the same meaning. This presentation contains certain forward-looking statements as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. Forward-looking statements may be identified by words such as “outlook,” “expects,” “intends,” “anticipates,” “plans,” “believes,” “seeks,” “targets,” “estimates,” “will,” “should,” “may” or words of similar meaning, but these words are not the exclusive means of identifying forward-looking statements. Forward-looking statements are based on management’s current expectations and assumptions, and are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. As a result, actual results could differ materially from those indicated in these forward-looking statements. Factors that could cause actual results to differ materially include global political, economic, business, competitive, market, regulatory and other factors and risks, such as: the impact of macroeconomic conditions and whether industry trends we have identified develop as anticipated; retaining existing partners and attracting new partners, concentration of our platform revenue in a small number of Retail Card partners, promotion and support of our products by our partners, and financial performance of our partners; our need for additional financing, higher borrowing costs and adverse financial market conditions impacting our funding and liquidity, and any reduction in our credit ratings; our ability to securitize our loans, occurrence of an early amortization of our securitization facilities, loss of the right to service or subservice our securitized loans, and lower payment rates on our securitized loans; our reliance on dividends, distributions and other payments from Synchrony Bank; our ability to grow our deposits in the future; changes in market interest rates and the impact of any margin compression; effectiveness of our risk management processes and procedures, reliance on models which may be inaccurate or misinterpreted, our ability to manage our credit risk, the sufficiency of our allowance for loan losses and the accuracy of the assumptions or estimates used in preparing our financial statements; our ability to offset increases in our costs in retailer share arrangements; competition in the consumer finance industry; our concentration in the U.S. consumer credit market; our ability to successfully develop and commercialize new or enhanced products and services; our ability to realize the value of strategic investments; reductions in interchange fees; fraudulent activity; cyber-attacks or other security breaches; failure of third parties to provide various services that are important to our operations; disruptions in the operations of our computer systems and data centers; international risks and compliance and regulatory risks and costs associated with international operations; alleged infringement of intellectual property rights of others and our ability to protect our intellectual property; litigation and regulatory actions; damage to our reputation; our ability to attract, retain and motivate key officers and employees; tax legislation initiatives or challenges to our tax positions and state sales tax rules and regulations; significant and extensive regulation, supervision, examination and enforcement of our business by governmental authorities, the impact of the Dodd-Frank Act and the impact of the CFPB’s regulation of our business; changes to our methods of offering our CareCredit products; impact of capital adequacy rules; restrictions that limit Synchrony Bank’s ability to pay dividends; regulations relating to privacy, information security and data protection; use of third-party vendors and ongoing third-party business relationships; failure to comply with anti-money laundering and anti-terrorism financing laws; effect of General Electric Capital Corporation being subject to regulation by the Federal Reserve Board both as a savings and loan holding company and as a systemically important financial institution; General Electric Company (GE) not completing the separation from us as planned or at all, GE’s inability to obtain savings and loan holding company deregistration (GE SLHC Deregistration) and GE continuing to have significant control over us; completion by the Federal Reserve Board of a review (with satisfactory results) of our preparedness to operate on a standalone basis, independently of GE, and Federal Reserve Board approval required for us to continue to be a savings and loan holding company, including the timing of the approval and the imposition of any significant additional capital or liquidity requirements; our need to establish and significantly expand many aspects of our operations and infrastructure; delays in receiving or failure to receive Federal Reserve Board agreement required for us to be treated as a financial holding company after the GE SLHC Deregistration; loss of association with GE’s strong brand and reputation; limited right to use the GE brand name and logo and need to establish a new brand; GE has significant control over us; terms of our arrangements with GE may be more favorable than what we will be able to obtain from unaffiliated third parties; obligations associated with being a public company; our incremental cost of operating as a standalone public company could be substantially more than anticipated; GE could engage in businesses that compete with us, and conflicts of interest may arise between us and GE; and failure caused by us of GE’s distribution of our common stock to its stockholders in exchange for its common stock to qualify for tax-free treatment, which may result in significant tax liabilities to GE for which we may be required to indemnify GE. For the reasons described above, we caution you against relying on any forward-looking statements, which should also be read in conjunction with the other cautionary statements that are included elsewhere in this presentation and in our public filings, including under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014, as filed on February 23, 2015. You should not consider any list of such factors to be an exhaustive statement of all of the risks, uncertainties, or potentially inaccurate assumptions that could cause our current expectations or beliefs to change. Further, any forward- looking statement speaks only as of the date on which it is made, and we undertake no obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, except as otherwise may be required by law. Differences between this presentation and the supplemental financials may occur due to rounding. Non-GAAP Measures The information provided herein includes measures we refer to as “platform revenue” and “platform revenue excluding retailer share arrangements” and certain capital ratios, which are not prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). The reconciliations of such measures to the most directly comparable GAAP measures are included in the appendix of this presentation. Disclaimers

3 2Q'15 Highlights Financial highlights • $541 million Net earnings, $0.65 EPS • Strong growth across the business Purchase volume +11%, Loan receivables +12%, Platform revenue +9% • Asset quality continues to improve Net charge-offs improved from 4.88% to 4.63% compared to prior year 30+ delinquency improved from 3.82% to 3.53% compared to prior year • Expenses in-line with expectations • Delivering on our funding plan, deposits +$7.3 billion compared to prior year • Strong capital and liquidity 17.2% CET1 (BIIIT) $13.7 billion high quality liquid assets Business highlights Announced three new partners Extended one of our 20 largest partners and a strategic CareCredit endorsement Closed BP acquisition, which will be a new top 20 partnership Announced Apple Pay for PLCC launching with JCP in 2H’15 Continued progress on separation … Fed application filed April 30th (a) (a) CET1 % calculated under Basel III rules subject to transition provisions

4 Growth Metrics +11% Purchase volume $ in billions Loan receivables $ in billions Active accounts Average active accounts in millions Platform revenue $ in millions 2Q'14 2Q'15 $26.0 $28.8 $54.9 $61.4 $2,665 $2,442 60.9 58.4 +4% +9% +12% 2Q'14 2Q'15 2Q'14 2Q'15 2Q'14 2Q'15

5 Platform Results Retail Card Loan receivables, $ in billions $37.3 $42.3 2Q'14 2Q'15 Strong receivable growth across partner programs Platform revenue up 10% driven by receivable growth Payment Solutions Loan receivables, $ in billions $11.0 $12.2 2Q'14 2Q'15 Receivable growth led by home furnishing, auto and power equipment Platform revenue up 7% driven by receivable growth CareCredit Loan receivables, $ in billions $6.6 $6.9 2Q'14 2Q'15 Receivable growth led by dental and veterinary Platform revenue up 8% driven by receivable growth Purchase volume Accounts $21.1 47.3 $23.4 49.0 +12% +4% $3.1 6.7 $3.4 7.2 +8% +8% $1.8 4.4 $2.0 4.7 +9% +6% Platform revenue $1,673 $1,836 +10% $375 $402 +7% $394 $427 +8% +14% +11% +5% (a) (a) Accounts represent average active accounts in millions, which are credit card or installment loan accounts on which there has been a purchase, payment or outstanding balance in the current month. Platform revenue $ in millions V% V% V%

6 Financial Results Summary earnings statement Second quarter 2015 highlights $ in millions, except ratios Total interest income $3,177 $2,926 $251 9% Total interest expense 270 206 (64) (31)% Net interest income (NII) 2,907 2,720 187 7% Retailer share arrangements (RSA) (621) (590) (31) (5)% NII, after RSA 2,286 2,130 156 7% Provision for loan losses 740 681 (59) (9)% Other income 120 112 8 7% Other expense 805 797 (8) (1)% Pre-Tax earnings 861 764 97 13% Provision for income taxes 320 292 (28) (10)% Net earnings $541 $472 $69 15% Return on assets 2.9% 3.1% (0.2)pts. 2Q'15 2Q'14 % $ B/(W) • $541 million Net earnings, 2.9% ROA • Net interest income up 7% driven by growth in loan receivables Interest and fees on loan receivables up 8% in-line with average receivable growth Interest expense increase driven by liquidity, funding mix and growth • Provision for loan losses driven largely by receivable growth Asset quality improved … 30+ delinquencies down 29bps. and NCO rate down 25bps. vs. prior year • Other income up 7% driven by gain on portfolio sales $20 million gain on portfolio sales and increased interchange due to program growth partially offset with increased loyalty cost • Other expense up 1% Driven by growth and infrastructure build partially offset by a prior year remediation expense

7 Net Interest Income Second quarter 2015 highlights • Net interest income up 7% driven by growth in receivables partially offset by higher funding costs Interest and fees on loans up 8% driven by loan receivable growth • Net interest margin decline driven primarily by increase in liquidity Liquid assets increased to $13.7 billion, conservatively invested in cash and short-term U.S. Treasuries Receivable yield relatively stable at 21.13%, down 3 bps. Interest expense increased to 1.81%, impacting Net interest margin by 11bps. Net interest income $ in millions, % of average interest-earning assets 17.84% 15.77% 2Q'14 2Q'15 +7% $2,720 $2,907 Receivable yield 21.16% 21.13% (3) bps 2Q'14 Net interest margin 17.84% Liquidity (1.93) Receivable yield (0.03) Interest expense (0.11) 2Q'15 Net interest margin 15.77% V% Net interest margin walk % of average interest-earning assets