Form 8-K Sanchez Production Partn For: Nov 13

�

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

�

�

FORM 8-K

�

�

CURRENT REPORT

Pursuant to Section�13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report �(Date of earliest event reported): �November 12, 2014�

�

�

Sanchez Production Partners LLC

(Exact name of registrant as specified in its charter)

�

�

�

|

� |

� |

� |

� |

� |

|

Delaware |

� |

001-33147 |

� |

11-3742489 |

|

(State or other jurisdiction of incorporation) |

� |

(Commission File Number) |

� |

(IRS Employer Identification No.) |

�

|

� |

� |

� |

|

1801 Main Street, Suite 1300 Houston, TX |

� |

77002 |

|

(Address of principal executive offices) |

� |

(Zip Code) |

Registrant’s telephone number, including area code: (832)�308-3700

Constellation Energy Partners LLC�

(Former name or former address, if changed since last report.)

�

�

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

�

|

◻ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

�

|

◻ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

�

|

◻ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

�

|

◻ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

�

�

�

�

�

�

�

�

�

�

Item�2.02. Results of Operations and Financial Condition. �

On November 12, 2014, �Sanchez Production Partners LLC �(the “Company”) �issued a press release announcing its financial results for the quarter ended September 30, 2014, and held a webcast conference call on November 13, 2014, to discuss those results.

A copy of the press release is furnished as a part of this Current Report on Form 8-K as Exhibit 99.1 but is not deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934.��The webcast conference call will be available for replay on the Company’s website at www.sanchezpp.com. �

Item�9.01 Financial Statements and Exhibits.

(d) Exhibits.

�

|

� |

� |

� |

|

Exhibit |

�� |

Description |

|

99.1 |

�� |

Press Release dated November 12, 2014, publicly announcing third quarter 2014 financial results. |

|

99.2 |

�� |

Earnings presentation materials from November 12, 2014. |

|

� |

� |

� |

�

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

�

|

� |

� |

� |

� |

� |

� |

� |

|

� |

� |

� |

� |

SANCHEZ PRODUCTION PARTNERS LLC |

||

|

Date: November 13, 2014 |

� |

� |

� |

By: |

� |

/s/ Charles C. Ward |

|

� |

� |

� |

� |

� |

� |

Charles C. Ward Chief Financial Officer and Treasurer |

EXHIBIT INDEX

�

|

� |

� |

� |

|

Exhibit Number |

�� |

Description |

|

99.1 |

�� |

Press Release dated November 12, 2014, publicly announcing third quarter 2014 financial results. |

|

99.2 |

�� |

Earnings presentation materials from November 12, 2014. |

|

� |

� |

� |

�

Exhibit 99.1

�������������������������������������

News Release

�

�

General Inquiries: (877) 847-0008

www.sanchezpp.com

Investor Contact: Charles C. Ward

������������������������ ������ (877) 847-0009

�

�

Sanchez Production Partners

Reports Third Quarter 2014 Results

|

· |

SPP’s year-to-date production up 16% when compared to the same nine month period of 2013 |

|

· |

�SPP year-to-date 2014 Adjusted EBITDA up 13% when compared to the same nine month period of 2013� |

|

· |

Sponsor-led strategy targets production growth of more than 5,000 BOE/d for SPP over time |

�

HOUSTON--(BUSINESS WIRE)—Nov. 12, 2014—Sanchez Production Partners LLC (NYSE MKT: SPP) today reported third quarter 2014 results.

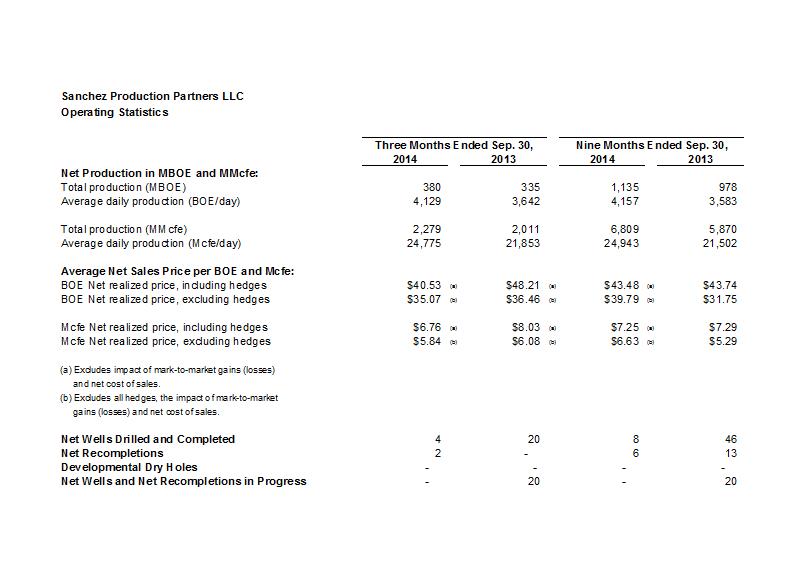

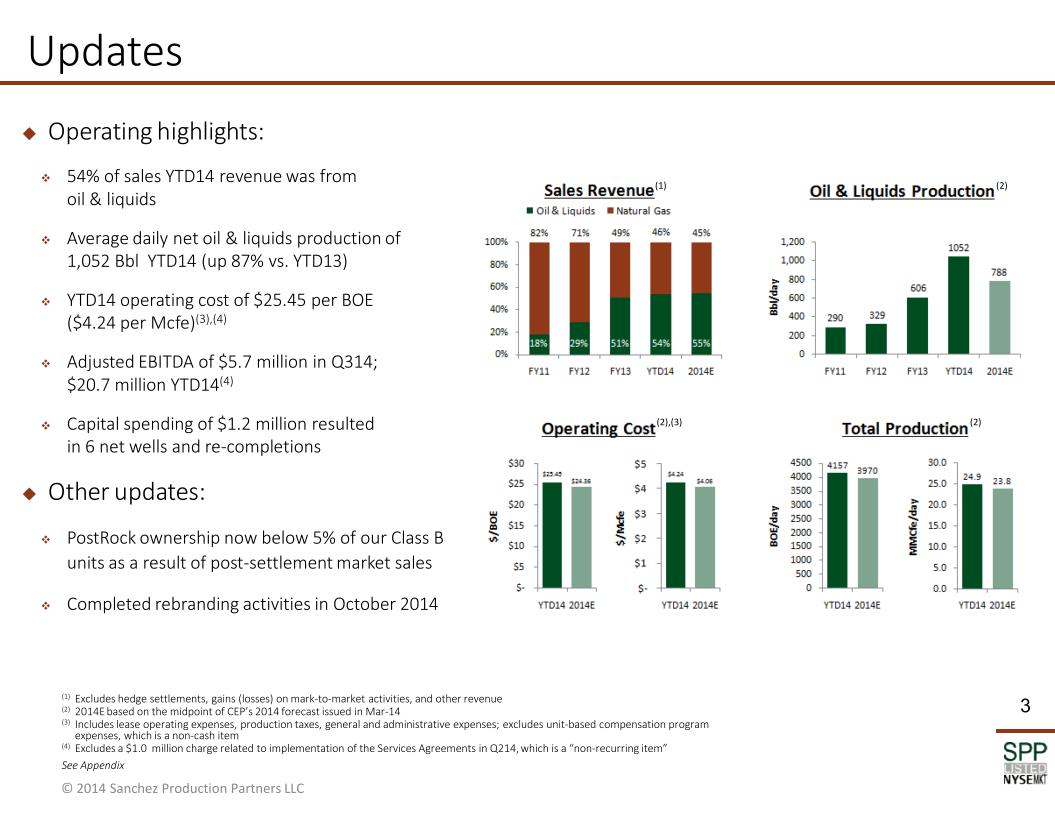

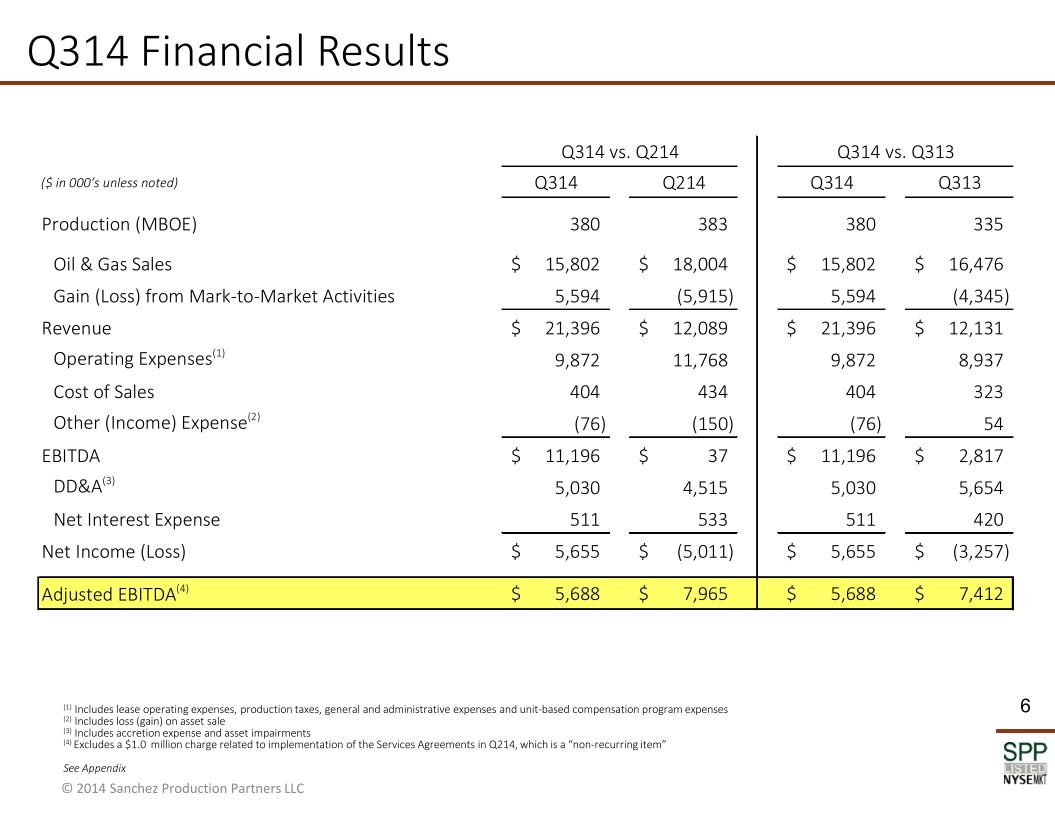

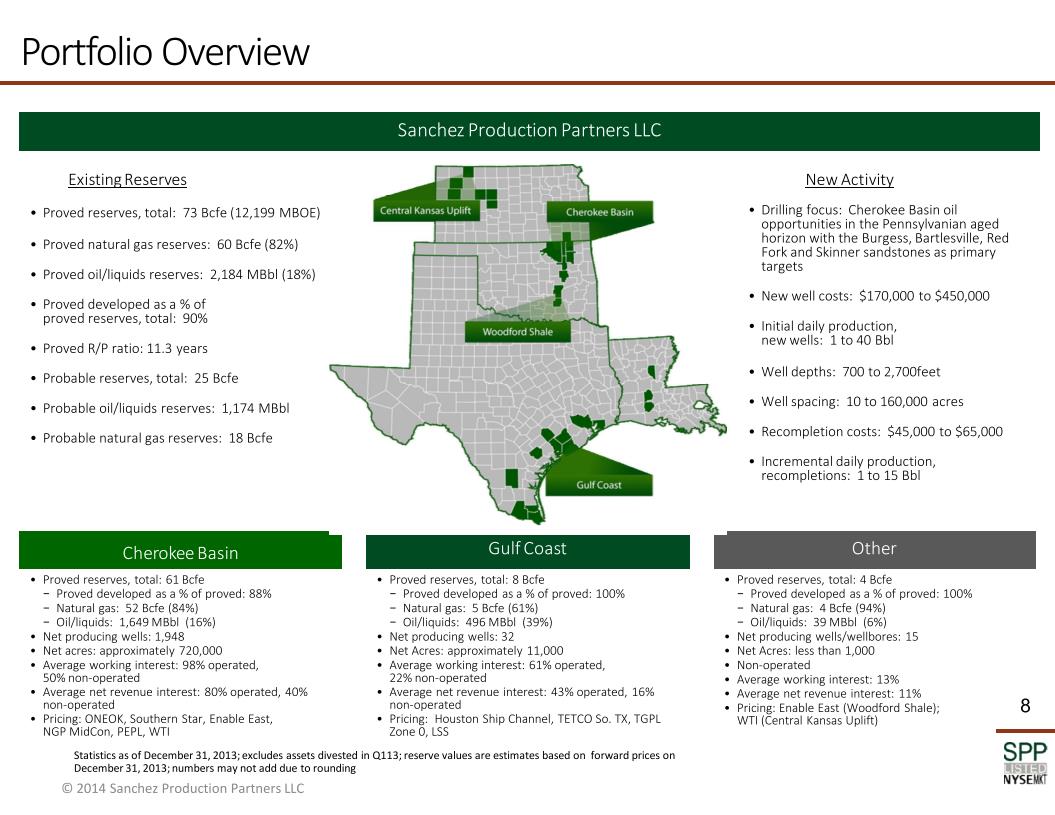

The company produced 380 MBOE during the third quarter for average net production of 4,129 BOE per day for the quarter, a decrease of approximately 2% when compared to the second quarter 2014 and an increase of approximately 13% when compared to the third quarter 2013.��Net oil and liquids production for the second quarter, which accounted for approximately 27% of the company’s total production during the quarter, was 1,102 barrels per day.��For the year-to-date ended Sep. 30, 2014, the company produced 1,135 MBOE for average net production of 4,157 BOE per day, which represents an increase of 16% when compared to the same nine month period of 2013.��Net oil and liquids production for the year-to-date was 1,052 barrels per day, which is an increase of 87% versus the same nine month period of 2013.

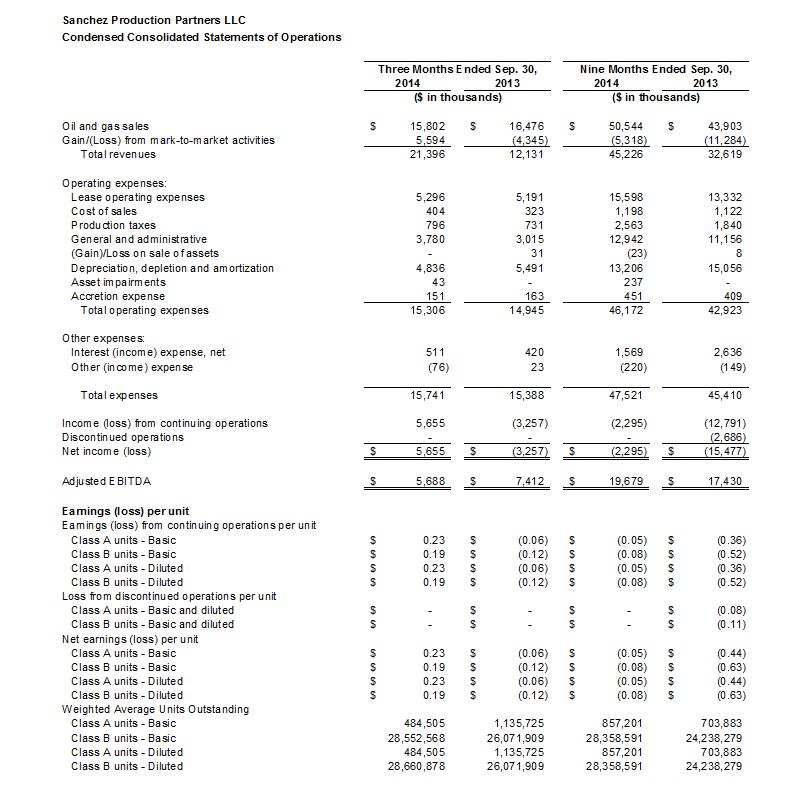

�

Revenue of $21.4 million for the third quarter 2014 includes revenue from sales of $12.9 million, of which approximately 43% was from natural gas sales and 57% was from oil and liquids sales.��The balance of the company’s third quarter 2014 revenue came from hedge settlements ($2.1 million), services provided to third parties ($0.8 million), and gains on mark-to-market activities ($5.6 million), which is a non-cash item.��For the year-to-date, revenue from sales and hedge settlements totaled $48.1 million, which is 16% higher than the same nine month period of 2013.

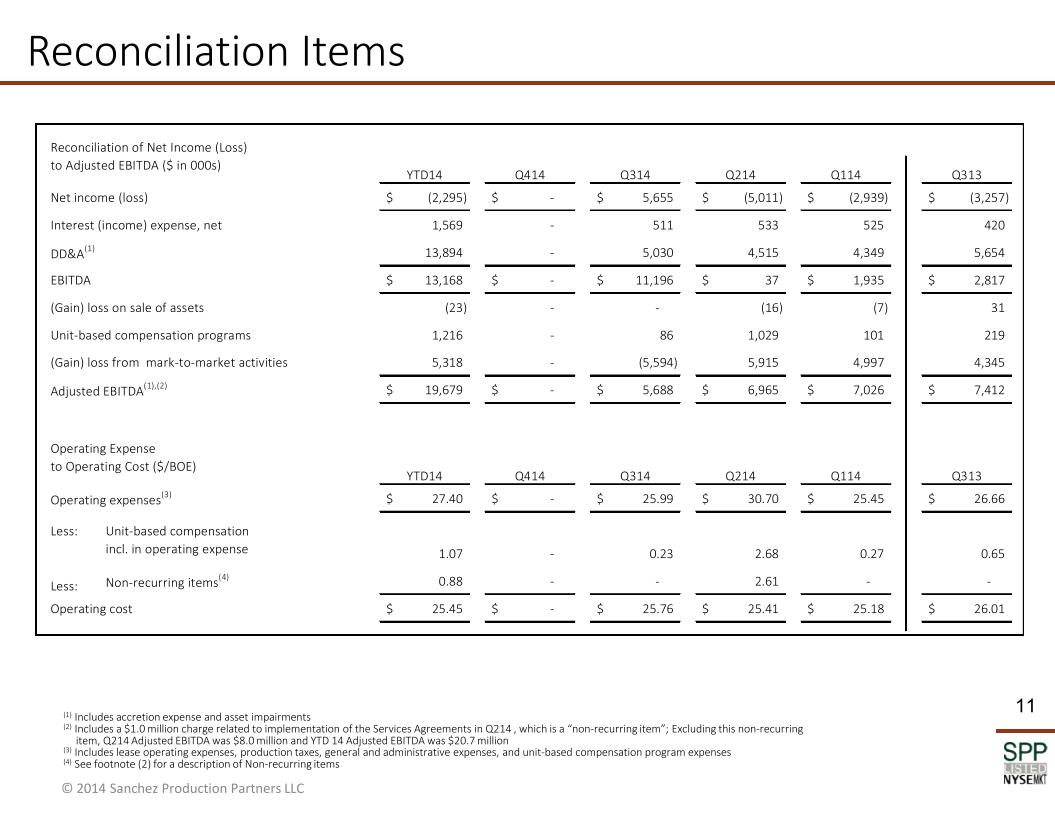

Operating costs, which include lease operating expenses, production taxes and general and administrative expenses, net of certain non-cash items, averaged $25.76 per BOE for the third quarter 2014.��For the year-to-date, operating costs net of a charge in the second quarter of $1.0 million related to implementation of a series of agreements (the “Services Agreements”) with affiliates of Sanchez Oil & Gas Corporation (“SOG”), which is a non-recurring item, averaged $25.45 per BOE.��This represents an increase of approximately 1% versus operating costs, adjusted for non-recurring items, for the same nine month period of 2013.

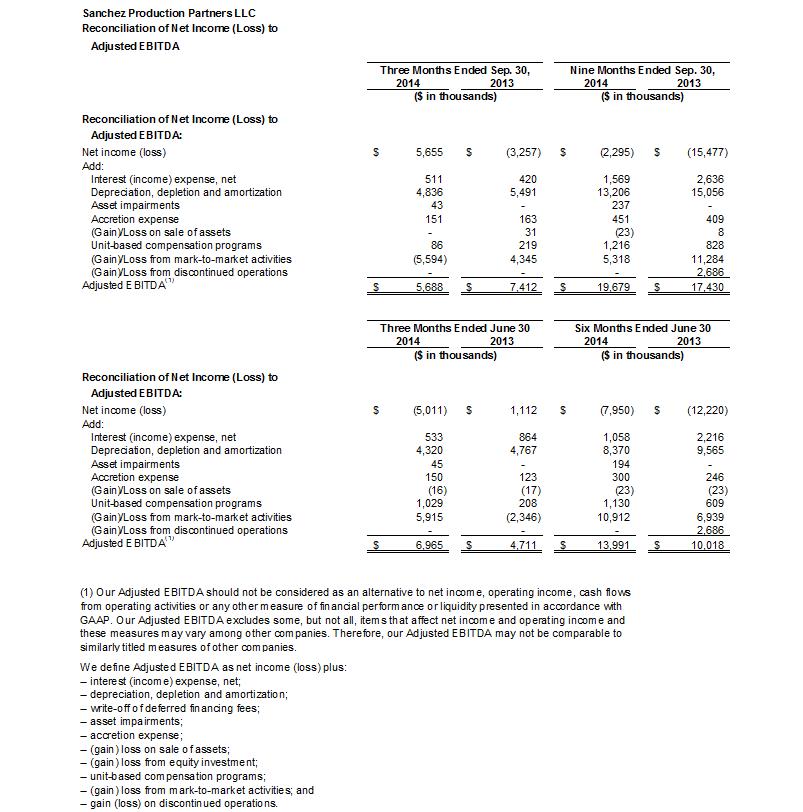

Adjusted EBITDA for the third quarter 2014 was approximately $5.7 million. For the year-to-date, Adjusted EBITDA excluding the non-recurring item related to implementation of the Services Agreements was approximately $20.7 million.��This compared to $18.3 million, adjusted for non-recurring items, for the same nine month period of 2013.

On a GAAP basis, the company recorded net income of $5.7 million for the third quarter 2014 and a net loss of $2.3 million for the year-to-date.

Capital expenditures during the third quarter 2014 totaled $1.2 million.��The company completed six net wells and recompletions during the quarter.

“Our third quarter performance keeps SPP on pace to achieve the results we forecast for 2014,” said Stephen R. Brunner, President and Chief Executive Officer of Sanchez Production Partners.��“As we look ahead, our sponsor-led strategy targets production growth of more than 5,000 BOE/d for SPP over time.��We believe this goal is achievable primarily through acquisitions, which may source from joint bid opportunities with SOG and its affiliates, opportunities to acquire assets from SOG-affiliated companies, and independent, “right-sized” transactions with third parties.��As we manage SPP through its next phase of corporate development, we see sponsorship as the key to our ability to balance distributions and growth with financial stability over time.”

�

Reserve-Based Credit Facility and Hedging Update

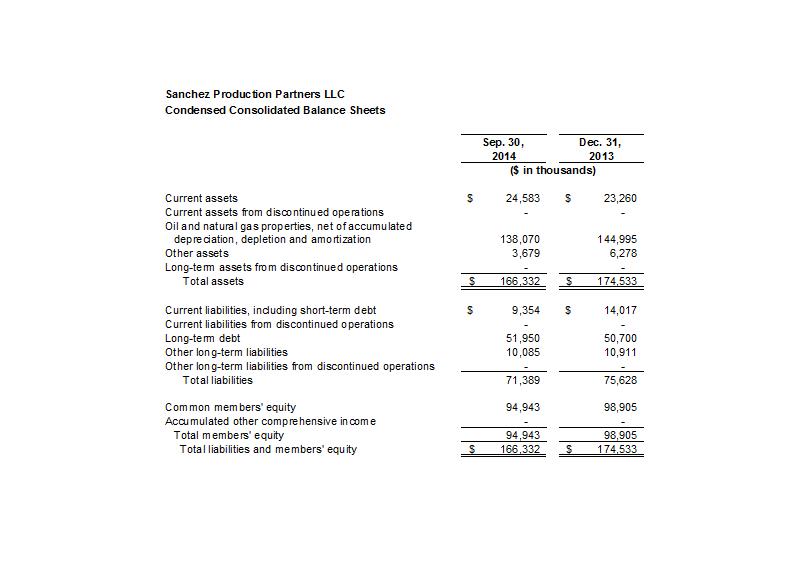

The company currently has $52.0 million in debt outstanding under its reserve-based credit facility, which has a borrowing base of $70.0 million.��The company had cash and cash equivalents totaling $9.7 million at Sep. 30, 2014.

�

Financial Outlook for 2014

�

Net production is forecast to range between 1,346 MBOE and 1,552 MBOE for 2014, with operating costs forecast to range between $33.3 million and $37.3 million for the year.

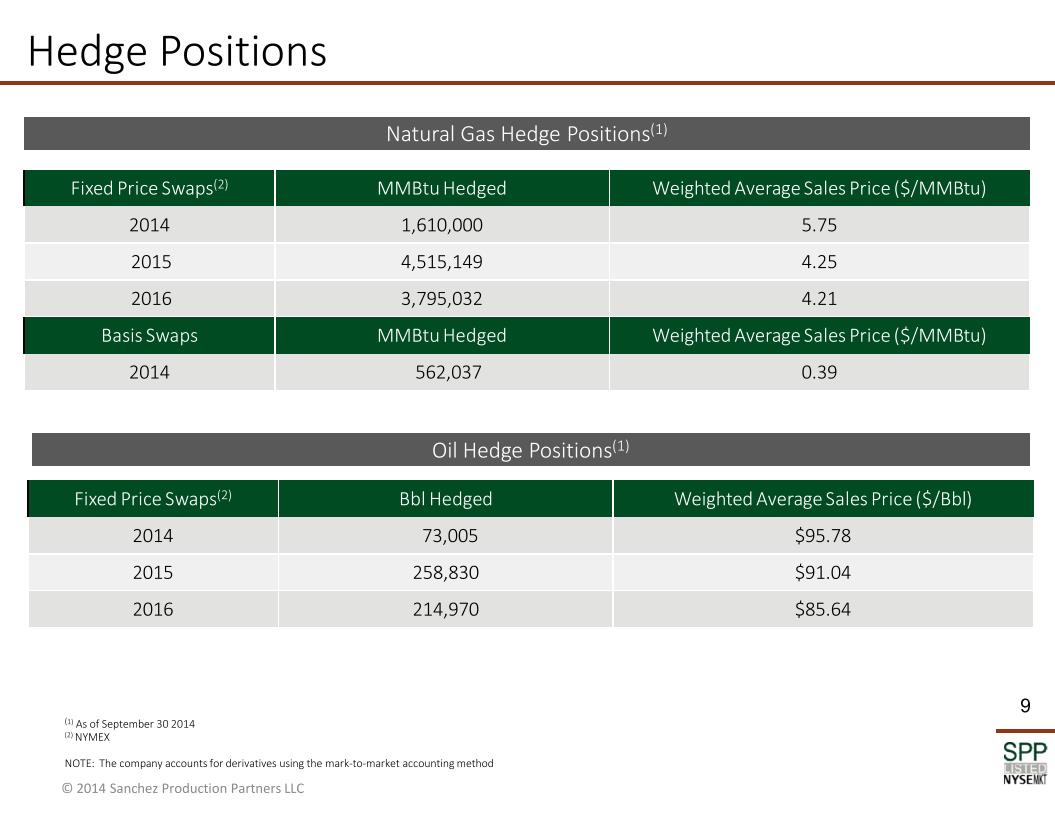

For the remainder of 2014, the company has hedged approximately 1.6 Bcfe of its natural gas production at an effective NYMEX fixed price of $5.75 per Mcfe with basis hedges on 0.6 Bcfe of its Mid-Continent production at an average differential of $0.39 per Mcfe.��The company also has hedges in place on approximately 73 MBbl of its 2014 oil production at a fixed price of $95.78 per barrel.

Additional detail on the company’s 2014 forecast can be found in the tables included with the company’s fourth quarter and full year 2013 news release dated March 25, 2014.

�

Conference Call Information

The company will host a conference call at 8:30 a.m. (CST) on Thursday, Nov. 13, 2014 to discuss third quarter 2014 results.�

To participate in the conference call, analysts, investors, media and the public in the U.S. may dial (800) 857-0653 shortly before 8:30 a.m. (CST).��The international phone number is (773) 799-3268.��The conference password is PARTNERS.

A replay will be available beginning approximately one hour after the end of the call by dialing (888) 662-6639 or (402) 220-6410 (international).��A live audio webcast of the conference call, presentation slides and the earnings release will be available on Sanchez Production Partners’ Web site (www.sanchezpp.com) under the Investor Relations page.��The call will also be recorded and archived on the site.

�

About the Company

Sanchez Production Partners LLC is a publicly-traded limited liability company focused on the acquisition, development and production of oil and natural gas properties and other integrated assets.

�

SEC Filings

The company intends to file its second quarter 2014 Form 10-Q on Nov. 13, 2014.

�

Non-GAAP Measures

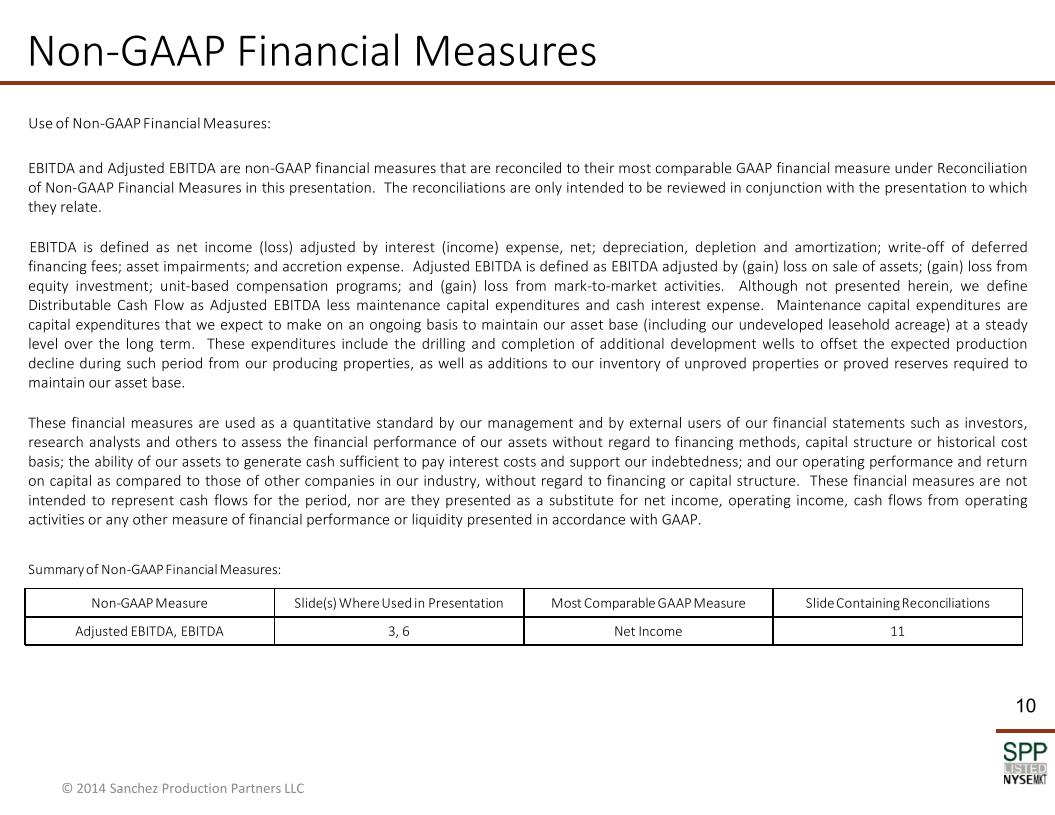

We present Adjusted EBITDA in addition to our reported net income (loss) in accordance with GAAP.��Adjusted EBITDA is a non-GAAP financial measure that is defined as net income (loss) adjusted by interest (income) expense, net; depreciation, depletion and amortization; write-off of deferred financing fees; asset impairments; accretion expense; (gain) loss on sale of assets; (gain) loss from equity investment; unit-based compensation programs; (gain) loss from mark-to-market activities; and gain (loss) on discontinued operations.

�

Adjusted EBITDA is used as a quantitative standard by our management and by external users of our financial statements such as investors, research analysts and others to assess the financial performance of our assets without regard to financing methods, capital structure or historical cost basis; the ability of our assets to generate cash sufficient to pay interest costs and support our indebtedness; and our operating performance and return on capital as compared to those of other companies in our industry, without regard to financing or capital structure.��Adjusted EBITDA is not intended to represent cash flows for the period, nor is it presented as a substitute for net income, operating income, cash flows from operating activities or any other measure of financial performance or liquidity presented in accordance with GAAP.

�

Forward-Looking Statements

We make statements in this news release that are considered forward-looking statements within the meaning of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended.��These forward-looking statements are largely based on our expectations, which reflect estimates and assumptions made by our management.��These estimates and assumptions reflect our best judgment based on currently known market conditions and other factors.��Although we believe such estimates and assumptions to be reasonable, they are inherently uncertain and involve a number of risks and uncertainties that are beyond our control.��In addition, management's assumptions about future events may prove to be inaccurate.��Management cautions all readers that the forward-looking statements contained in this news release are not guarantees of future performance, and we cannot assure you that such statements will be realized or the forward-looking events and circumstances will occur.��Actual results may differ materially from those anticipated or implied in the forward-looking statements due to factors listed in the "Risk Factors" section in our SEC filings and elsewhere in those filings.��All forward-looking statements speak only as of the date of this news release.��We do not intend to publicly update or revise any forward-looking statements as a result of new information, future events or otherwise.� These cautionary statements qualify all forward-looking statements attributable to us or persons acting on our behalf.

�

�

�

�

�

�

��

�����

�

�

�

�

�

�

�

��������

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Residents, Community Officials Celebrate Aya Tower in East Point following $24 Million Redevelopment

- Utility Concierge Rebrands as Move Concierge

- CF BANKSHARES INC., PARENT OF CFBANK, NA, ANNOUNCES 3 KEY COMMERCIAL LEADERSHIP ADDITIONS TO CFBANK

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share