Form 8-K Sanchez Production Partn For: Apr 15

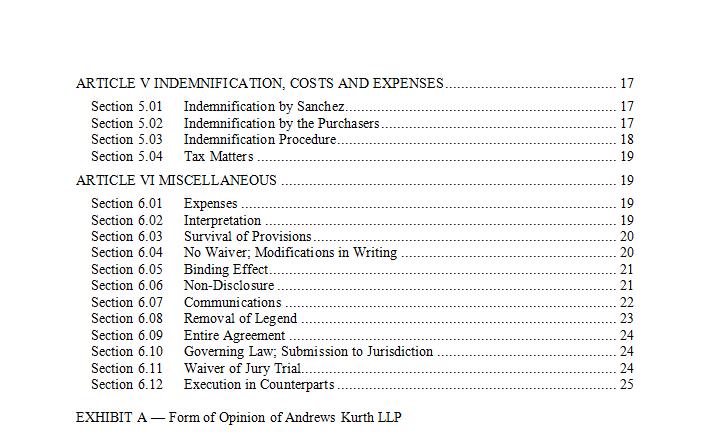

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 15, 2015

Sanchez Production Partners LP

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware |

|

001-33147 |

|

11-3742489 |

|

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

|

|

1000 Main Street, Suite 3000 Houston, TX |

|

77002 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (713) 783-8000

None

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

◻ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

◻ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

◻ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

◻ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01 Entry into a Material Definitive Agreement.

Class A Preferred Unit Purchase Agreement

A description of the Preferred Unit Purchase Agreement is included in Item 3.02 below and incorporated herein by reference.

Class A Preferred Unit Registration Rights Agreement

On April 15, 2015, Sanchez Production Partners LP (the “Partnership”) entered into a Registration Rights Agreement (the “Class A Preferred Registration Rights Agreement”) with the Purchasers (defined below in Item 3.02) relating to the registered resale of Common Units of the Partnership issuable upon conversion of the Class A Preferred Units (described below in Item 3.02). Pursuant to the Class A Preferred Registration Rights Agreement, with respect to Common Units issuable upon conversion of the Class A Preferred Units, the Partnership has agreed to (i) prepare and file a registration statement (the “Common Unit Registration Statement”) under the Securities Act of 1933, as amended (the “Securities Act”), within 120 days following the closing date and (ii) cause the Common Unit Registration Statement to be declared effective no later than 180 days after the initial filing thereof (the “Target Effective Date”).

If the Common Unit Registration Statement is not declared effective prior to the Target Effective Date, the Partnership will pay liquidated damages to each holder of converted Common Units at the rate of 0.25% of the Liquidated Damages Multiplier (as defined in the Class A Preferred Registration Rights Agreement) per 30 day period, that shall accrue daily, for the first 60 days following such Target Effective Date, increasing by an additional 0.25% of the Liquidated Damages Multiplier per 30 day period, that shall accrue daily, for each subsequent 60 days (i.e., 0.5% for 61-120 days, 0.75% for 121-180 days and 1.0% thereafter), up to a maximum of 1.00% of the Liquidated Damages Multiplier per 30 day period.

In certain circumstances, the Purchasers will have piggyback registration rights as described in the Class A Preferred Registration Rights Agreement.

The foregoing description of the Class A Preferred Registration Rights Agreement does not purport to be complete and is qualified in its entirety by reference to such document, which is filed as Exhibit 4.1 hereto and incorporated herein by reference.

Item 3.02Unregistered Sales of Equity Securities.

Issuance of Class A Preferred Units

On April 15, 2015, the Partnership entered into a Class A Preferred Unit Purchase Agreement (the “Preferred Unit Purchase Agreement”) with the purchasers named on Schedule A thereto (collectively, the “Purchasers”), pursuant to which the Partnership sold, and the Purchasers purchased, 234,375 of the Partnership’s newly created Class A Preferred Units (the “Class A Preferred Units”) in a privately negotiated transaction (the “Private Placement”) for an aggregate cash purchase price of $1.60 per Class A Preferred Unit resulting in gross proceeds to the Partnership of $375,000. The Partnership will use the proceeds for general working capital purposes.

The issuance of the Class A Preferred Units pursuant to the Preferred Unit Purchase Agreement was made in reliance upon an exemption from the registration requirements of the Securities Act pursuant to Section 4(a)(2) thereof. The Preferred Unit Purchase Agreement contains customary representations and warranties by the Partnership and the Purchasers, and the parties have agreed to indemnify each other for losses resulting from the other party’s breach of any representations, warranties or covenants.

The foregoing description of the Preferred Unit Agreement does not purport to be complete and is qualified in its entirety by reference to such document, which is filed as Exhibit 10.1 hereto and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

Exhibit |

|

Description |

|

4.1 |

|

Registration Rights Agreement, dated as of April 15, 2015, between Sanchez Production Partners LP and the purchasers named therein |

|

10.1 |

|

Class A Preferred Unit Purchase Agreement, dated as of April 15, 2015, between Sanchez Production Partners LP and the purchasers named therein |

|

|

|

|

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

SANCHEZ PRODUCTION PARTNERS LP

By: Sanchez Production Partners GP LLC, its general partner |

||

|

Date: April 15, 2015 |

|

|

|

By: |

|

/s/ Charles C. Ward |

|

|

|

|

|

|

|

Charles C. Ward Chief Financial Officer and Secretary |

EXHIBIT INDEX

|

|

|

|

|

Exhibit Number |

|

Description |

|

4.1 |

|

Registration Rights Agreement, dated as of April 15, 2015, between Sanchez Production Partners LP and the purchasers named therein |

|

10.1 |

|

Class A Preferred Unit Purchase Agreement, dated as of April 15, 2015, between Sanchez Production Partners LP and the purchasers named therein |

Exhibit 4.1

BY AND AMONG

SANCHEZ PRODUCTION PARTNERS LP

AND

THE PURCHASERS NAMED ON SCHEDULE A HERETO

This REGISTRATION RIGHTS AGREEMENT (this “Agreement”) is made and entered into as of April 15, 2015, by and among Sanchez Production Partners LP, a Delaware limited partnership (the “Partnership”), and each of the Persons set forth on Schedule A to this Agreement (each, a “Purchaser” and collectively, the “Purchasers”).

WHEREAS, this Agreement is made in connection with the closing of the issuance and sale of the Purchased Units pursuant to the Class A Preferred Unit Purchase Agreement, dated as of April 15, 2015 (the date of such closing, the “Closing Date”), by and among the Partnership and the Purchasers (the “Preferred Unit Purchase Agreement”); and

WHEREAS, the Partnership has agreed to provide the registration and other rights set forth in this Agreement for the benefit of the Purchasers pursuant to the Preferred Unit Purchase Agreement.

NOW THEREFORE, in consideration of the mutual covenants and agreements set forth herein and for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged by each party hereto, the parties hereby agree as follows:

ARTICLE I

DEFINITIONS

Section 1.01 Definitions. Capitalized terms used herein without definition shall have the meanings given to them in the Preferred Unit Purchase Agreement. The terms set forth below are used herein as so defined:

“Affiliate” means, with respect to any Person, any other Person that directly or indirectly through one or more intermediaries controls, is controlled by or is under common control with, the Person in question. As used herein, the term “control” means the possession, direct or indirect, of the power to direct or cause the direction of the management and policies of a Person, whether through ownership of voting securities, by contract or otherwise. For avoidance of doubt, for purposes of this Agreement, the Partnership, on the one hand, and the Purchasers, on the other hand, shall not be considered Affiliates.

“Agreement” has the meaning specified therefor in the introductory paragraph of this Agreement.

“Amended Partnership Agreement” means the Agreement of Limited Partnership of the Partnership, as amended by Amendment No. 1 thereto.

“Business Day” means any day other than a Saturday, Sunday, any federal legal holiday or day on which banking institutions in the State of New York or State of Texas are authorized or required by law or other governmental action to close.

“Closing Date” has the meaning specified therefor in the recitals of this Agreement.

“Commission” means the U.S. Securities and Exchange Commission.

“Common Unit Price” means the volume-weighted average closing price of the Common Units on the principal market on which the Common Units are then traded during the ten (10) Trading Days (as defined in the Amended Partnership Agreement) prior to the date of measurement.

“Common Units” has the meaning specified therefor in Article I of the Amended Partnership Agreement.

“Effectiveness Period” means the earlier of (i) the date as of which all Registrable Securities are sold by the Purchasers and (ii) one year following the Preferred Conversion Date.

“Exchange Act” means the Securities and Exchange Act of 1934, as amended.

“Existing Registration Rights Agreements” means (i) that certain Registration Rights Agreement dated as of August 9, 2013 between the Partnership and Sanchez Energy Partners I, LP and (ii) that certain Registration Rights Agreement dated as of March 31, 2015 between the Partnership and SEP Holdings III, LLC, in each case as amended, supplemented or modified from time to time.

“General Partner” means Sanchez Production Partners GP LLC, a Delaware limited liability company.

“Governmental Authority” means any federal, state, local or foreign government, or other governmental, regulatory or administrative authority, agency or commission or any court, tribunal, or judicial or arbitral body.

“Holder” means the record holder of any Registrable Securities. For the avoidance of doubt, in accordance with Section 3.05 of this Agreement, for purposes of determining the availability of any rights and applicability of any obligations under this Agreement, including calculating the amount of Registrable Securities held by a Holder, a Holder’s Registrable Securities shall be aggregated together with all Registrable Securities held by other Holders who are Affiliates of such Holder.

“In-Kind LD Amount” has the meaning specified therefor in Section 2.01(b) of this Agreement.

“Included Registrable Securities” has the meaning specified therefor in Section 2.02(a) of this Agreement.

“Launch” has the meaning specified therefor in Section 2.04 of this Agreement.

“Law” means any statute, law, ordinance, regulation, rule, order, code, governmental restriction, decree, injunction or other requirement of law, or any judicial or administrative interpretation thereof, of any Governmental Authority.

“LD Period” has the meaning specified therefor in Section 2.01(b) of this Agreement.

“LD Termination Date” has the meaning specified therefor in Section 2.01(b) of this Agreement.

“Liquidated Damages” has the meaning specified therefor in Section 2.01(b) of this Agreement.

“Liquidated Damages Multiplier” means the product of the Common Unit Price times the number of Common Units (which in the case of Common Units subject to issuance upon conversion of the Preferred Units shall be the number of Common Units issuable upon conversion of the Preferred Units at the date of determination) held by such Holder that may not be sold without restriction and without the need for current public information pursuant to any section of Rule 144 (or any successor or similar provision adopted by the Commission then in effect) under the Securities Act.

“Losses” has the meaning specified therefor in Section 2.09(a) of this Agreement.

“Managing Underwriter” means, with respect to any Underwritten Offering, the book-running lead manager of such Underwritten Offering.

“NYSE MKT” means the NYSE MKT LLC.

“Opt-Out Notice” has the meaning specified therefor in Section 2.02(a) of this Agreement.

“Parity Securities” has the meaning specified therefor in Section 2.02(b) of this Agreement.

“Partnership” has the meaning specified therefor in the introductory paragraph of this Agreement.

“Person” means an individual or a corporation, limited liability company, partnership, joint venture, trust, unincorporated organization, association, government agency or political subdivision thereof or other entity.

2

“Piggyback Threshold Amount” means $500,000.

“PIK Units” has the meaning specified therefor in Article I of the Amended Partnership Agreement.

“Post-Launch Withdrawing Selling Holders” has the meaning specified therefor in Section 2.04 of this Agreement.

“Preferred Conversion Date” has the meaning specified therefor in Article I of the Amended Partnership Agreement and means the earliest of such dates to occur.

“Preferred Units” means Class A Preferred Units (including PIK Units) representing limited partner interests of the Partnership, as described in the Amended Partnership Agreement and issued pursuant to the Preferred Unit Purchase Agreement or the Amended Partnership Agreement, as the case may be.

“Preferred Unit Purchase Agreement” has the meaning specified therefor in the recitals of this Agreement.

“Purchaser” and “Purchasers” have the meanings specified therefor in the introductory paragraph of this Agreement.

“Registrable Securities” means (i) the Common Units issued or issuable upon the conversion of the Preferred Units (including PIK Units) acquired by the Purchasers pursuant to the Preferred Unit Purchase Agreement or, in the case of PIK Units, pursuant to the Amended Partnership Agreement, and (ii) any Common Units issued as Liquidated Damages pursuant to Section 2.01(b) of this Agreement, and includes any type of interest issued to the Holder as a result of Section 3.04 of this Agreement.

“Registrable Securities Amount” means the calculation based on the product of the Common Unit Price times the number of Registrable Securities.

“Registration Expenses” has the meaning specified therefor in Section 2.08(b) of this Agreement.

“Securities Act” means the Securities Act of 1933, as amended.

“Selling Expenses” has the meaning specified therefor in Section 2.08(b) of this Agreement.

“Selling Holder” means a Holder who is selling Registrable Securities pursuant to a registration statement.

“Selling Holder Indemnified Persons” has the meaning specified therefor in Section 2.09(a) of this Agreement.

“Shelf Registration Statement” has the meaning specified therefor in Section 2.01(a) of this Agreement.

“Target Effective Date” has the meaning specified therefor in Section 2.01(a) of this Agreement.

“Underwritten Offering” means an offering (including an offering pursuant to a Shelf Registration Statement) in which Common Units are sold to one or more underwriters on a firm commitment basis for reoffering to the public or an offering that is a “bought deal” with one or more investment banks.

“Underwritten Offering Notice” has the meaning specified therefor in Section 2.04 of this Agreement.

Section 1.02 Registrable Securities. Any Registrable Security will cease to be a Registrable Security (a) when a registration statement covering such Registrable Security becomes or has been declared effective by the Commission and such Registrable Security has been sold or disposed of pursuant to such effective registration statement; (b) when such Registrable Security has been sold or disposed of (excluding transfers or assignments by a Holder to an Affiliate) pursuant to Rule 144 (or any successor or similar provision adopted by the Commission then in effect) under the Securities Act under circumstances in which all of the applicable conditions of such Rule (then in effect) are met; (c) when such Registrable Security is held by the Partnership or one of its subsidiaries or Affiliates; provided, however, that none of the Purchasers or their Affiliates shall be considered an Affiliate of the Partnership; or (d) when such Registrable Security has been sold or disposed of in a private transaction in which the transferor’s rights under this Agreement are not assigned to the transferee of such securities pursuant to Section 2.11 hereof.

3

ARTICLE II

REGISTRATION RIGHTS

Section 2.01 Registration.

(a) Effectiveness Deadline. Promptly following the date of this Agreement, but in no event later than 120 calendar days following the date of this Agreement, the Partnership shall prepare and file a registration statement under the Securities Act to permit the public resale of all Registrable Securities to be issued upon conversion of the Preferred Units (including PIK Units reasonably expected to be issued by the Partnership to the Holders of Registrable Securities) pursuant to the provisions of the Amended Partnership Agreement from time to time as permitted by Rule 415 (or any successor or similar provision adopted by the Commission then in effect) under the Securities Act, on the terms and conditions specified in this Section 2.01 (a “Shelf Registration Statement”). A Shelf Registration Statement filed pursuant to this Section 2.01 shall be on such registration form of the Commission as is permissible under the Securities Act. The Partnership shall use commercially reasonable efforts to cause the Shelf Registration Statement filed pursuant to this Section 2.01(a) to become or be declared effective as soon as practicable thereafter, but in no event later than 180 calendar days after the initial filing date of such Shelf Registration Statement (the “Target Effective Date”). The Shelf Registration Statement shall provide for the resale pursuant to any method or combination of methods legally available to, and requested by, the Holders of Registrable Securities covered by such Shelf Registration Statement, including by way of an Underwritten Offering. During the Effectiveness Period, the Partnership shall use commercially reasonable efforts to cause such Shelf Registration Statement filed pursuant to this Section 2.01(a) to remain effective, and to be supplemented and amended to the extent necessary to ensure that such Shelf Registration Statement is available or, if not available, that another registration statement is available for the resale of the Registrable Securities until all Registrable Securities have ceased to be Registrable Securities.

When effective, a Shelf Registration Statement (including the documents incorporated therein by reference) will comply as to form in all material respects with all applicable requirements of the Securities Act and the Exchange Act and will not contain an untrue statement of a material fact or omit to state a material fact required to be stated therein or necessary to make the statements therein not misleading (in the case of any prospectus contained in such Shelf Registration Statement, in the light of the circumstances under which a statement is made).

(b) Failure to Go Effective. If a Shelf Registration Statement required by Section 2.01(a) is not declared effective by the Target Effective Date, then each Holder shall be entitled to a payment (with respect to the Registrable Securities of each such Holder), as liquidated damages and not as a penalty, of 0.25% of the Liquidated Damages Multiplier per 30-day period, that shall accrue daily, for the first 60 days following such Target Effective Date, increasing by an additional 0.25% of the Liquidated Damages Multiplier per 30-day period, that shall accrue daily, for each subsequent 60 days (i.e., 0.5% for 61-120 days, 0.75% for 121-180 days and 1.0% thereafter), up to a maximum of 1.00% of the Liquidated Damages Multiplier per 30-day period (the “Liquidated Damages”). The Liquidated Damages payable pursuant to the immediately preceding sentence shall be payable within ten (10) Business Days after the end of each such 30-day period. Any Liquidated Damages shall be paid to each Holder in immediately available funds; provided, however, that if the Partnership certifies that it is unable to pay Liquidated Damages in cash because such payment would result in a breach under a credit facility or other debt instrument filed as an exhibit to the Partnership’s periodic reports filed with the Commission, then the Partnership may pay such Liquidated Damages using as much cash as permitted without breaching any such credit facility or other debt instrument and shall pay the balance of such Liquidated Damages (the “In-Kind LD Amount”) in kind in the form of the issuance of additional Common Units. Upon any issuance of Common Units as Liquidated Damages, the Partnership shall promptly (i) prepare and file an amendment to such Shelf Registration Statement prior to its effectiveness adding such Common Units to such Shelf Registration Statement as additional Registrable Securities and (ii) prepare and file a supplemental listing application with the NYSE MKT (or such other market on which the Registrable Securities are then listed and traded) to list such additional Common Units. The determination of the number of Common Units to be issued as Liquidated Damages shall be equal to the In-Kind LD Amount divided by the volume weighted average closing price of the Common Units (as reported on the NYSE MKT or the principal securities market on which the Common Units are then traded) for the consecutive ten (10) trading day period ending on the close of trading on the trading day immediately preceding the date on which the Liquidated Damages payment is due, less a discount to such average closing price of 2.00%. The accrual of Liquidated Damages to a Holder shall cease (a “LD Termination Date,” and, each such period beginning on a Target Effective Date and ending on a LD Termination Date being, a “LD Period”) at the earlier of (i) such Shelf Registration Statement

4

becoming effective, (ii) when such Holder no longer holds Registrable Securities and (iii) one year following the earlier to occur of the Partnership Optional Conversion Date (as defined in the Amended Partnership Agreement) or the Mandatory Conversion Date (as defined in the Amended Partnership Agreement). Any amount of Liquidated Damages shall be prorated for any period of less than 30 calendar days accruing during a LD Period. If the Partnership is unable to cause a Shelf Registration Statement to go effective by the Target Effective Date as a result of an acquisition, merger, reorganization, disposition or other similar transaction, then the Partnership may request a waiver of the Liquidated Damages, and each Holder may individually grant or withhold its consent to such request in its discretion. For the avoidance of doubt, nothing in this Section 2.01(b) shall relieve the Partnership from its obligations under Section 2.01(a).

Section 2.02 Piggyback Rights.

(a) Participation. If the Partnership proposes to file during the Effectiveness Period (i) a shelf registration statement other than a Shelf Registration Statement contemplated by Section 2.01(a), (ii) a prospectus supplement to an effective shelf registration statement, other than a Shelf Registration Statement contemplated by Section 2.01(a) and Holders may be included in such Underwritten Offering without the filing of a post-effective amendment thereto, or (iii) a registration statement, other than a shelf registration statement, in each case, for the sale of Common Units in an Underwritten Offering for its own account or that of another Person, or both, then as soon as practicable following the selection of the Managing Underwriter for such Underwritten Offering, the Partnership shall give notice (including, but not limited to, notification by electronic mail) of such Underwritten Offering to each Holder (together with its Affiliates) holding at least the Piggyback Threshold Amount of the then-outstanding Registrable Securities (calculated based on the Common Unit Price) and such notice shall offer such Holders the opportunity to include in such Underwritten Offering such number of Registrable Securities (the “Included Registrable Securities”) as each such Holder may request in writing; provided, however, that (A) the Partnership shall not be required to provide such opportunity to any such Holder that does not offer a minimum of the Piggyback Threshold Amount of Registrable Securities (based on the Common Unit Price), and (B) if the Partnership has been advised by the Managing Underwriter that the inclusion of Registrable Securities for sale for the benefit of the Holders will have an adverse effect on the amount, price, timing or distribution of the Common Units in the Underwritten Offering, then (i) if no Registrable Securities can be included in the Underwritten Offering in the opinion of the Managing Underwriter, the Partnership shall not be required to offer such opportunity to the Holders or (ii) if any Registrable Securities can be included in the Underwritten Offering in the opinion of the Managing Underwriter, then the amount of Registrable Securities to be offered for the accounts of Holders shall be determined based on the provisions of Section 2.02(b). Any notice required to be provided pursuant to this Section 2.02(a) to Holders shall be provided on a Business Day and receipt of such notice shall be confirmed by the Holder. Each such Holder shall then have two (2) Business Days (or one (1) Business Day in connection with any overnight or bought Underwritten Offering) after notice has been delivered to request in writing the inclusion of Registrable Securities in the Underwritten Offering. If no written request for inclusion from a Holder is received within the specified time, each such Holder shall have no further right to participate in such Underwritten Offering. If, at any time after giving written notice of its intention to undertake an Underwritten Offering and prior to the closing of such Underwritten Offering, the Partnership shall determine for any reason not to undertake or to delay such Underwritten Offering, the Partnership may, at its election, give written notice of such determination to the Selling Holders and, (x) in the case of a determination not to undertake such Underwritten Offering, shall be relieved of its obligation to sell any Included Registrable Securities in connection with such terminated Underwritten Offering, and (y) in the case of a determination to delay such Underwritten Offering, shall be permitted to delay offering any Included Registrable Securities as part of such Underwritten Offering for the same period as the delay in the Underwritten Offering. Any Selling Holder shall have the right to withdraw such Selling Holder’s request for inclusion of such Selling Holder’s Registrable Securities in such Underwritten Offering by giving written notice to the Partnership of such withdrawal at or prior to the time of pricing of such Underwritten Offering. Any Holder may deliver written notice (an “Opt-Out Notice”) to the Partnership requesting that such Holder not receive notice from the Partnership of any proposed Underwritten Offering; provided, however, that such Holder may later revoke any such Opt-Out Notice in writing. Following receipt of an Opt-Out Notice from a Holder (unless subsequently revoked), the Partnership shall not be required to deliver any notice to such Holder pursuant to this Section 2.02(a) and such Holder shall no longer be entitled to participate in Underwritten Offerings by the Partnership pursuant to this Section 2.02(a). Notwithstanding anything in this Agreement to the contrary, Holders under this Agreement shall not be entitled to participate in a demand registration or a “shelf takedown” with respect to the Existing Registration Rights Agreements in connection with registrations or offerings by “Holders” under either of the Existing Registration

5

Rights Agreements or the registration statements, prospectuses and prospectus supplements filed in connection therewith.

(b) Priority. Other than situations outlined in Section 2.01 of this Agreement, if the Managing Underwriter of any proposed Underwritten Offering of Common Units included in an Underwritten Offering involving Included Registrable Securities advises the Partnership, or the Partnership reasonably determines, that the total amount of Common Units that the Selling Holders and any other Persons intend to include in such offering exceeds the number that can be sold in such offering without being likely to have an adverse effect on the amount, price, timing or distribution of the Common Units offered or the market for the Common Units, then the Common Units to be included in such Underwritten Offering shall include the number of Registrable Securities that such Managing Underwriter advises the Partnership, or the Partnership reasonably determines, can be sold without having such adverse effect, with such number to be allocated (i) first, to the Partnership or other party requesting such registration, including “Holders” under either of the Existing Registration Rights Agreements, (ii) second, to the “Holders” under the Existing Registration Rights Agreements, (iii) third, pro rata among the Selling Holders who have requested participation in such Underwritten Offering, based, for each Selling Holder, on the percentage derived by dividing (x) the number of Registrable Securities proposed to be sold by such Selling Holder by (y) the aggregate number of Registrable Securities proposed to be sold by all Selling Holders, and (iii) fourth, to any other holder of securities of the Partnership having rights of registration that are neither expressly senior nor subordinated to the Holders in respect of the Registrable Securities (the “Parity Securities”), allocated among such holders in such manner as they may agree.

(c) Termination of Piggyback Registration Rights. Each Holder’s rights under Section 2.02 shall terminate upon such Holder (together with its Affiliates) ceasing to hold at least the Piggyback Threshold Amount of Registrable Securities (calculated based on the Common Unit Price).

Section 2.03 Delay Rights.

Notwithstanding anything to the contrary contained herein, the Partnership may, upon written notice to any Selling Holder whose Registrable Securities are included in a Shelf Registration Statement or other registration statement contemplated by this Agreement, suspend such Selling Holder’s use of any prospectus which is a part of such Shelf Registration Statement or other registration statement (in which event the Selling Holder shall discontinue sales of the Registrable Securities pursuant to such Shelf Registration Statement or other registration statement contemplated by this Agreement but may settle any previously made sales of Registrable Securities) if (i) the Partnership is pursuing an acquisition, merger, reorganization, disposition or other similar transaction and the Partnership determines in good faith that the Partnership’s ability to pursue or consummate such a transaction would be materially adversely affected by any required disclosure of such transaction in such Shelf Registration Statement or other registration statement or (ii) the Partnership has experienced some other material non-public event the disclosure of which at such time, in the good faith judgment of the Partnership, would materially adversely affect the Partnership; provided, however, that in no event shall the Selling Holders be suspended from selling Registrable Securities pursuant to such Shelf Registration Statement or other registration statement for a period that exceeds an aggregate of 60 calendar days in any 180-calendar day period or 105 calendar days in any 365-calendar day period, in each case, exclusive of days covered by any lock-up agreement executed by a Selling Holder in connection with any Underwritten Offering. Upon disclosure of such information or the termination of the condition described above, the Partnership shall provide prompt notice to the Selling Holders whose Registrable Securities are included in such Shelf Registration Statement and shall promptly terminate any suspension of sales it has put into effect and shall take such other reasonable actions to permit registered sales of Registrable Securities as contemplated in this Agreement.

If (i) the Selling Holders shall be prohibited from selling their Registrable Securities under a Shelf Registration Statement or other registration statement contemplated by this Agreement as a result of a suspension pursuant to the immediately preceding paragraph in excess of the periods permitted therein or (ii) a Shelf Registration Statement or other registration statement contemplated by this Agreement is filed and declared effective but, during the Effectiveness Period, shall thereafter cease to be effective or fail to be usable for its intended purpose without being succeeded within 20 Business Days by a post-effective amendment thereto, a supplement to the prospectus or a report filed with the Commission pursuant to Section 13(a), 13(c), 14 or l5(d) of the Exchange Act, then, until the suspension is lifted or a post-effective amendment, supplement or report is filed with the Commission, but not including any day on which a suspension is lifted or such amendment, supplement or report is filed and

6

declared effective, if applicable, the Partnership shall pay the Selling Holders an amount equal to the Liquidated Damages, following the earlier of (x) the date on which the suspension period exceeded the permitted period and (y) the twenty-first (21st) Business Day after such Shelf Registration Statement or other registration statement contemplated by this Agreement ceased to be effective or failed to be useable for its intended purposes, as liquidated damages and not as a penalty (for purposes of calculating Liquidated Damages, the date in (x) or (y) above shall be deemed the “90th day,” as used in the definition of Liquidated Damages). For purposes of this paragraph, a suspension shall be deemed lifted with respect to a Selling Holder on the date that notice that the suspension has been terminated is delivered to such Selling Holder. Liquidated Damages shall cease to accrue pursuant to this paragraph upon the earlier of (i) a suspension being deemed lifted and (ii) when such Selling Holder no longer holds Registrable Securities included in such Shelf Registration Statement.

Section 2.04 Underwritten Offerings.

(a) General Procedures. In the event that one or more Holders elects to include other than pursuant to Section 2.02 of this Agreement, at least an aggregate of $4,000,000 of Registrable Securities (calculated based on the Registrable Securities Amount) under a Shelf Registration Statement pursuant to an Underwritten Offering, the Partnership shall, upon request by such Holders (such request, an “Underwritten Offering Notice”), retain underwriters in order to permit such Holders to effect such sale through an Underwritten Offering; provided, however, that the Holders shall have the option and right, to require the Partnership to effect not more than two (2) Underwritten Offerings, pursuant to and subject to the conditions of this Section 2.04 of this Agreement. Upon delivery of such Underwritten Offering Notice to the Partnership, the Partnership shall as soon as practicable (but in no event later than one (1) calendar day following the date of delivery of the Underwritten Offering Notice to the Partnership) deliver notice of such Underwritten Offering Notice to all other Holders who shall then have two (2) calendar days from the date that such notice is given to them to notify the Partnership in writing of the number of Registrable Securities held by such Holder that they want to be included in such Underwritten Offering. For the avoidance of doubt, any Holders notified about an Underwritten Offering by the Partnership after the Partnership has received the corresponding Underwritten Offering Notice may participate in such Underwritten Offering, but shall not count toward the $4,000,000 of Registrable Securities necessary to request an Underwritten Offering pursuant to an Underwritten Offering Notice. In connection with any Underwritten Offering under this Agreement, the Holders of a majority of the Registrable Securities being disposed of pursuant to the Underwritten Offering shall be entitled to select the Managing Underwriter or Underwriters for such Underwritten Offering, subject to the reasonable consent of the Partnership. In connection with an Underwritten Offering contemplated by this Agreement in which a Selling Holder participates, each Selling Holder and the Partnership shall be obligated to enter into an underwriting agreement that contains such representations, covenants, indemnities and other rights and obligations as are customary in underwriting agreements for firm commitment offerings of securities. No Selling Holder may participate in such Underwritten Offering unless such Selling Holder agrees to sell its Registrable Securities on the basis provided in such underwriting agreement and completes and executes all questionnaires, powers of attorney, indemnities and other documents reasonably required under the terms of such underwriting agreement. Each Selling Holder may, at its option, require that any or all of the representations and warranties by, and the other agreements on the part of, the Partnership to and for the benefit of such underwriters also be made to and for such Selling Holder’s benefit and that any or all of the conditions precedent to the obligations of such underwriters under such underwriting agreement also be conditions precedent to its obligations. No Selling Holder shall be required to make any representations or warranties to or agreements with the Partnership or the underwriters other than representations, warranties or agreements regarding such Selling Holder, its authority to enter into such underwriting agreement and to sell, and its ownership of, the securities whose offer and resale will be registered, on its behalf, its intended method of distribution and any other representation required by Law. If any Selling Holder disapproves of the terms of an underwriting, such Selling Holder may elect to withdraw therefrom by notice to the Partnership and the Managing Underwriter; provided, however, that any such withdrawal must be made no later than the time of pricing of such Underwritten Offering. If all Selling Holders withdraw from an Underwritten Offering prior to the pricing of such Underwritten Offering, the events will not be considered an Underwritten Offering and will not decrease the number of available Underwritten Offerings the Selling Holders have the right and option to request under this Section 2.04. No such withdrawal or abandonment shall affect the Partnership’s obligation to pay Registration Expenses; provided, however, that if (i) certain Selling Holders withdraw from an Underwritten Offering after the public announcement at launch (the “Launch”) of such Underwritten Offering (such Selling Holders, the “Post-Launch Withdrawing Selling Holders”), and (ii) all Selling Holders withdraw from such Underwritten Offering prior to pricing, then the Post-Launch Withdrawing Selling Holders shall pay for all

7

reasonable Registration Expenses incurred by the Partnership during the period from the Launch of such Underwritten Offering until the time all Selling Holders withdraw from such Underwritten Offering.

Section 2.05 Sale Procedures.

In connection with its obligations under this Article II, the Partnership will, as expeditiously as possible:

(a) use commercially reasonable efforts to prepare and file with the Commission such amendments and supplements to a Shelf Registration Statement and the prospectus used in connection therewith as may be necessary to keep such Shelf Registration Statement effective for the Effectiveness Period and as may be necessary to comply with the provisions of the Securities Act with respect to the disposition of all Registrable Securities covered by such Shelf Registration Statement;

(b) if a prospectus supplement will be used in connection with the marketing of an Underwritten Offering from a Shelf Registration Statement and the Managing Underwriter at any time shall notify the Partnership in writing that, in the sole judgment of such Managing Underwriter, inclusion of detailed information to be used in such prospectus supplement is of material importance to the success of the Underwritten Offering of such Registrable Securities, the Partnership shall use commercially reasonable efforts to include such information in such prospectus supplement;

(c) furnish to each Selling Holder (i) as far in advance as reasonably practicable before filing a Shelf Registration Statement or any other registration statement contemplated by this Agreement or any supplement or amendment thereto, upon request, copies of reasonably complete drafts of all such documents proposed to be filed (including exhibits and each document incorporated by reference therein to the extent then required by the rules and regulations of the Commission), and provide each such Selling Holder the opportunity to object to any information pertaining to such Selling Holder and its plan of distribution that is contained therein and make the corrections reasonably requested by such Selling Holder with respect to such information prior to filing a Shelf Registration Statement or such other registration statement or supplement or amendment thereto, and (ii) such number of copies of such Shelf Registration Statement or such other registration statement and the prospectus included therein and any supplements and amendments thereto as such Selling Holder may reasonably request in order to facilitate the public sale or other disposition of the Registrable Securities covered by such Shelf Registration Statement or other registration statement;

(d) if applicable, use commercially reasonable efforts to register or qualify the Registrable Securities covered by a Shelf Registration Statement or any other registration statement contemplated by this Agreement under the securities or blue sky laws of such jurisdictions as the Selling Holders or, in the case of an Underwritten Offering, the Managing Underwriter, shall reasonably request; provided, however, that the Partnership will not be required to qualify generally to transact business in any jurisdiction where it is not then required to so qualify or to take any action that would subject it to general service of process in any such jurisdiction where it is not then so subject;

(e) promptly notify each Selling Holder, at any time when a prospectus relating thereto is required to be delivered by any of them under the Securities Act, of (i) the filing of a Shelf Registration Statement or any other registration statement contemplated by this Agreement or any prospectus or prospectus supplement to be used in connection therewith, or any amendment or supplement thereto, and, with respect to such Shelf Registration Statement or any other registration statement or any post-effective amendment thereto, when the same has become effective; and (ii) the receipt of any written comments from the Commission with respect to any filing referred to in clause (i) and any written request by the Commission for amendments or supplements to such Shelf Registration Statement or any other registration statement or any prospectus or prospectus supplement thereto;

(f) immediately notify each Selling Holder, at any time when a prospectus relating thereto is required to be delivered under the Securities Act, of (i) the happening of any event as a result of which the prospectus or prospectus supplement contained in a Shelf Registration Statement or any other registration statement contemplated by this Agreement, as then in effect, includes an untrue statement of a material fact or omits to state any material fact required to be stated therein or necessary to make the statements therein not misleading (in the case of any prospectus contained therein, in the light of the circumstances under which a statement is made); (ii) the issuance or express threat of issuance by the Commission of any stop order suspending the effectiveness of such Shelf Registration Statement or any other registration statement contemplated by this Agreement, or the initiation of any proceedings for that purpose; or (iii) the receipt by the Partnership of any notification with respect to the suspension

8

of the qualification of any Registrable Securities for sale under the applicable securities or blue sky laws of any jurisdiction. Following the provision of such notice, the Partnership agrees to as promptly as practicable amend or supplement the prospectus or prospectus supplement or take other appropriate action so that the prospectus or prospectus supplement does not include an untrue statement of a material fact or omit to state a material fact required to be stated therein or necessary to make the statements therein not misleading in the light of the circumstances then existing and to take such other commercially reasonable action as is necessary to remove a stop order, suspension, threat thereof or proceedings related thereto;

(g) upon request and subject to appropriate confidentiality obligations, furnish to each Selling Holder copies of any and all transmittal letters or other correspondence with the Commission or any other governmental agency or self-regulatory body or other body having jurisdiction (including any domestic or foreign securities exchange) relating to such offering of Registrable Securities;

(h) in the case of an Underwritten Offering, use commercially reasonable efforts to furnish upon request, (i) an opinion of counsel for the Partnership dated the date of the closing under the underwriting agreement and (ii) a “cold comfort” letter, dated the pricing date of such Underwritten Offering and a letter of like kind dated the date of the closing under the underwriting agreement, in each case, signed by the independent public accountants who have certified the Partnership’s financial statements included or incorporated by reference into the applicable registration statement, and each of the opinion and the “cold comfort” letter shall be in customary form and covering substantially the same matters with respect to such registration statement (and the prospectus and any prospectus supplement included therein) as have been customarily covered in opinions of issuer’s counsel and in accountants’ letters delivered to the underwriters in Underwritten Offerings of securities by the Partnership and such other matters as such underwriters and Selling Holders may reasonably request;

(i) otherwise use commercially reasonable efforts to comply with all applicable rules and regulations of the Commission, and make available to its security holders, as soon as reasonably practicable, an earnings statement, covering a period of twelve months beginning within three months after the effective date of such Shelf Registration Statement, which earnings statement shall satisfy the provisions of Section 11(a) of the Securities Act and Rule 158 promulgated thereunder;

(j) make available to the appropriate representatives of the Managing Underwriter and Selling Holders access to such information and Partnership and General Partner personnel as is reasonable and customary to enable such parties to establish a due diligence defense under the Securities Act; provided, that the Partnership need not disclose any non-public information to any such representative unless and until such representative has entered into a confidentiality agreement with the Partnership;

(k) use commercially reasonable efforts to cause all such Registrable Securities registered pursuant to this Agreement to be listed on each securities exchange or nationally recognized quotation system on which the Common Units issued by the Partnership are then listed;

(l) use commercially reasonable efforts to cause the Registrable Securities to be registered with or approved by such other governmental agencies or authorities as may be necessary by virtue of the business and operations of the Partnership to enable the Selling Holders to consummate the disposition of such Registrable Securities;

(m) provide a transfer agent and registrar for all Registrable Securities covered by such registration statement not later than the effective date of such registration statement;

(n) enter into customary agreements and take such other actions as are reasonably requested by the Selling Holders or the underwriters, if any, in order to expedite or facilitate the disposition of such Registrable Securities (including, making appropriate officers of the General Partner available to participate in any “road show” presentations before analysts, and other customary marketing activities (including one-on-one meetings with prospective purchasers of the Registrable Securities)), provided, however, that in the event the Partnership, using commercially reasonable efforts, is unable to make such appropriate officers of the General Partner available to participate in connection with any “road show” presentations and other customary marketing activities (whether in person or otherwise), the Partnership shall make such appropriate officers available to participate via conference call or other means of communication in connection with no more than one (1) “road show” presentation per Underwritten Offering); and

9

(o) if requested by a Selling Holder, (i) incorporate in a prospectus supplement or post-effective amendment such information as such Selling Holder reasonably requests to be included therein relating to the sale and distribution of Registrable Securities, including information with respect to the number of Registrable Securities being offered or sold, the purchase price being paid therefor and any other terms of the offering of the Registrable Securities to be sold in such offering and (ii) make all required filings of such prospectus supplement or post-effective amendment after being notified of the matters to be incorporated in such prospectus supplement or post-effective amendment.

The Partnership will not name a Holder as an underwriter as defined in Section 2(a)(11) of the Securities Act in any Shelf Registration Statement without such Holder’s consent. If the staff of the Commission requires the Partnership to name any Holder as an underwriter as defined in Section 2(a)(11) of the Securities Act, and such Holder does not consent thereto, then such Holder’s Registrable Securities shall not be included on such Shelf Registration Statement, such Holder shall no longer be entitled to receive Liquidated Damages under this Agreement with respect to such Holder’s Registrable Securities, and the Partnership shall have no further obligations hereunder with respect to Registrable Securities held by such Holder, unless such Holder has not had an opportunity to conduct customary underwriter’s due diligence (including receipt of comfort letters and opinions of counsel) with respect to the Partnership at the time such Holder’s consent is sought.

Each Selling Holder, upon receipt of notice from the Partnership of the happening of any event of the kind described in subsection (f) of this Section 2.05, shall forthwith discontinue offers and sales of the Registrable Securities by means of a prospectus or prospectus supplement until such Selling Holder’s receipt of the copies of the supplemented or amended prospectus contemplated by subsection (f) of this Section 2.05 or until it is advised in writing by the Partnership that the use of the prospectus may be resumed and has received copies of any additional or supplemental filings incorporated by reference in the prospectus, and, if so directed by the Partnership, such Selling Holder will, or will request the Managing Underwriter, if any, to deliver to the Partnership (at the Partnership’s expense) all copies in their possession or control, other than permanent file copies then in such Selling Holder’s possession, of the prospectus covering such Registrable Securities current at the time of receipt of such notice.

Section 2.06 Cooperation by Holders.

The Partnership shall have no obligation to include Registrable Securities of a Holder in a Shelf Registration Statement or in an Underwritten Offering pursuant to Section 2.02(a) who has failed to timely furnish such information that the Partnership determines, after consultation with its counsel, is reasonably required in order for the registration statement or prospectus supplement, as applicable, to comply with the Securities Act.

Section 2.07 Restrictions on Public Sale by Holders of Registrable Securities.

Each Holder of Registrable Securities agrees to enter into a customary letter agreement with underwriters providing such Holder will not effect any public sale or distribution of Registrable Securities during the 60 calendar day period beginning on the date of a prospectus or prospectus supplement filed with the Commission with respect to the pricing of any Underwritten Offering, provided that (i) the duration of the foregoing restrictions shall be no longer than the duration of the shortest restriction imposed by the underwriters on the Partnership or the officers, directors or any other Affiliate of the Partnership or the General Partner on whom a restriction is imposed and (ii) the restrictions set forth in this Section 2.07 shall not apply to any Registrable Securities that are included in such Underwritten Offering by such Holder. In addition, this Section 2.07 shall not apply to any Holder that is not entitled to participate in such Underwritten Offering, whether because such Holder delivered an Opt-Out Notice prior to receiving notice of the Underwritten Offering or because such Holder (together with its Affiliates) holds less than the Piggyback Threshold Amount of the then-outstanding Registrable Securities (calculated based on the product of the Common Unit Price times the number of Registrable Securities) or because the Registrable Securities held by such Holder may be disposed of without restriction pursuant to any section of Rule 144 (or any successor or similar provision adopted by the Commission then in effect) under the Securities Act.

Section 2.08 Expenses.

(a) Expenses. The Partnership will pay all reasonable Registration Expenses as determined in good faith, including, in the case of an Underwritten Offering, whether or not any sale is made pursuant to such Underwritten Offering. Each Selling Holder shall pay its pro rata share of all Selling Expenses in connection with any sale of its

10

Registrable Securities hereunder. For the avoidance of doubt, each Selling Holder’s pro rata allocation of Selling Expenses shall be the percentage derived by dividing (i) the number of Registrable Securities sold by such Selling Holder in connection with such sale by (ii) the aggregate number of Registrable Securities sold by all Selling Holders in connection with such sale. In addition, except as otherwise provided in Sections 2.08 and 2.09 hereof, the Partnership shall not be responsible for legal fees incurred by Holders in connection with the exercise of such Holders’ rights hereunder.

(b) Certain Definitions. “Registration Expenses” means all expenses incident to the Partnership’s performance under or compliance with this Agreement to effect the registration of Registrable Securities on a Shelf Registration Statement pursuant to Section 2.01(a) or an Underwritten Offering covered under this Agreement, and the disposition of such Registrable Securities, including, without limitation, all registration, filing, securities exchange listing and NYSE MKT fees, all registration, filing, qualification and other fees and expenses of complying with securities or blue sky laws, fees of the Financial Industry Regulatory Authority, Inc., fees of transfer agents and registrars, all word processing, duplicating and printing expenses, any transfer taxes, the fees and disbursements of counsel and independent public accountants for the Partnership, including the expenses of any special audits or “cold comfort” letters required by or incident to such performance and compliance, and, only if the Existing Registration Rights Agreements have been amended to provide for the same, the reasonable fees and disbursements of one counsel for the Selling Holders participating in such Shelf Registration Statement or Underwritten Offering to effect the disposition of such Registrable Securities, selected by the Holders of a majority of the Registrable Securities initially being registered under such Shelf Registration Statement or other registration statement as contemplated by this Agreement, subject to the reasonable consent of the Partnership. “Selling Expenses” means all underwriting discounts and selling commissions or similar fees or arrangements allocable to the sale of the Registrable Securities, and fees and disbursements of counsel to the Selling Holders, except for the reasonable fees and disbursements of counsel for the Selling Holders required to be paid by the Partnership pursuant to Sections 2.08 and 2.09, solely to the extent such fees and disbursements of counsel are required to be paid by the Partnership under the Existing Registration Rights Agreements.

Section 2.09 Indemnification.

(a) By the Partnership. In the event of a registration of any Registrable Securities under the Securities Act pursuant to this Agreement, the Partnership will indemnify and hold harmless each Selling Holder thereunder, its directors, officers, managers, employees and agents and each Person, if any, who controls such Selling Holder within the meaning of the Securities Act and the Exchange Act, and its directors, officers, employees or agents (collectively, the “Selling Holder Indemnified Persons”), against any losses, claims, damages, expenses or liabilities (including reasonable attorneys’ fees and expenses) (collectively, “Losses”), joint or several, to which such Selling Holder Indemnified Person may become subject under the Securities Act, the Exchange Act or otherwise, insofar as such Losses (or actions or proceedings, whether commenced or threatened, in respect thereof) arise out of or are based upon any untrue statement or alleged untrue statement of any material fact (in the case of any prospectus, in light of the circumstances under which such statement is made) contained in (which, for the avoidance of doubt, includes documents incorporated by reference in) such Shelf Registration Statement or any other registration statement contemplated by this Agreement, any preliminary prospectus, prospectus supplement or final prospectus contained therein, or any amendment or supplement thereof, or any free writing prospectus relating thereto or arise out of or are based upon the omission or alleged omission to state therein a material fact required to be stated therein or necessary to make the statements therein (in the case of a prospectus, in light of the circumstances under which they were made) not misleading, and will reimburse each such Selling Holder Indemnified Person for any legal or other expenses reasonably incurred by them in connection with investigating, defending or resolving any such Loss or actions or proceedings; provided, however, that the Partnership will not be liable in any such case if and to the extent that any such Loss arises out of or is based upon an untrue statement or alleged untrue statement or omission or alleged omission so made in conformity with information furnished by such Selling Holder Indemnified Person in writing specifically for use in such Shelf Registration Statement or such other registration statement, or prospectus supplement, as applicable. Such indemnity shall remain in full force and effect regardless of any investigation made by or on behalf of such Selling Holder Indemnified Person, and shall survive the transfer of such securities by such Selling Holder.

(b) By Each Selling Holder. Each Selling Holder agrees severally and not jointly to indemnify and hold harmless the Partnership, the General Partner, their respective directors, officers, employees and agents and each Person, if any, who controls the Partnership within the meaning of the Securities Act or of the Exchange Act, and its

11

directors, officers, employees and agents, to the same extent as the foregoing indemnity from the Partnership to the Selling Holders, but only with respect to information regarding such Selling Holder furnished in writing by or on behalf of such Selling Holder expressly for inclusion in such Shelf Registration Statement or any other registration statement contemplated by this Agreement, any preliminary prospectus, prospectus supplement or final prospectus contained therein, or any amendment or supplement thereof, or any free writing prospectus relating thereto; provided, however, that the liability of each Selling Holder shall not be greater in amount than the dollar amount of the proceeds (net of any Selling Expenses) received by such Selling Holder from the sale of the Registrable Securities giving rise to such indemnification.

(c) Notice. Promptly after receipt by an indemnified party hereunder of notice of the commencement of any action, such indemnified party shall, if a claim in respect thereof is to be made against the indemnifying party hereunder, notify the indemnifying party in writing thereof, but the omission so to notify the indemnifying party shall not relieve it from any liability that it may have to any indemnified party other than under this Section 2.09. In any action brought against any indemnified party, it shall notify the indemnifying party of the commencement thereof. The indemnifying party shall be entitled to participate in and, to the extent it shall wish, to assume and undertake the defense thereof with counsel reasonably satisfactory to such indemnified party and, after notice from the indemnifying party to such indemnified party of its election so to assume and undertake the defense thereof, the indemnifying party shall not be liable to such indemnified party under this Section 2.09 for any legal expenses subsequently incurred by such indemnified party in connection with the defense thereof other than reasonable costs of investigation and of liaison with counsel so selected; provided, however, that (i) if the indemnifying party has failed to assume the defense or employ counsel reasonably acceptable to the indemnified party or (ii) if the defendants in any such action include both the indemnified party and the indemnifying party and counsel to the indemnified party shall have concluded that there may be reasonable defenses available to the indemnified party that are different from or additional to those available to the indemnifying party, or if the interests of the indemnified party reasonably may be deemed to conflict with the interests of the indemnifying party, then the indemnified party shall have the right to select a separate counsel and to assume such legal defense and otherwise to participate in the defense of such action, with the reasonable expenses and fees of such separate counsel and other reasonable expenses related to such participation to be reimbursed by the indemnifying party as incurred. Notwithstanding any other provision of this Agreement, no indemnifying party shall settle any action brought against any indemnified party with respect to which such indemnified party is entitled to indemnification hereunder without the consent of the indemnified party, unless the settlement thereof imposes no liability or obligation on, and includes a complete and unconditional release from all liability of, the indemnified party.

(d) Contribution. If the indemnification provided for in this Section 2.09 is held by a court or government agency of competent jurisdiction to be unavailable to any indemnified party or is insufficient to hold them harmless in respect of any Losses, then each such indemnifying party, in lieu of indemnifying such indemnified party, shall contribute to the amount paid or payable by such indemnified party as a result of such Loss in such proportion as is appropriate to reflect the relative fault of the indemnifying party on the one hand and of such indemnified party on the other in connection with the statements or omissions that resulted in such Losses, as well as any other relevant equitable considerations; provided, however, that in no event shall such Selling Holder be required to contribute an aggregate amount in excess of the dollar amount of proceeds (net of Selling Expenses) received by such Selling Holder from the sale of Registrable Securities giving rise to such indemnification. The relative fault of the indemnifying party on the one hand and the indemnified party on the other shall be determined by reference to, among other things, whether the untrue or alleged untrue statement of a material fact or the omission or alleged omission to state a material fact has been made by, or relates to, information supplied by such party, and the parties’ relative intent, knowledge, access to information and opportunity to correct or prevent such statement or omission. The parties hereto agree that it would not be just and equitable if contributions pursuant to this paragraph were to be determined by pro rata allocation or by any other method of allocation that does not take account of the equitable considerations referred to herein. The amount paid by an indemnified party as a result of the Losses referred to in the first sentence of this paragraph shall be deemed to include any legal and other expenses reasonably incurred by such indemnified party in connection with investigating, defending or resolving any Loss that is the subject of this paragraph. No person guilty of fraudulent misrepresentation (within the meaning of Section 11(f) of the Securities Act) shall be entitled to contribution from any Person who is not guilty of such fraudulent misrepresentation.

(e) Other Indemnification. The provisions of this Section 2.09 shall be in addition to any other rights to indemnification or contribution that an indemnified party may have pursuant to law, equity, contract or otherwise.

12

Section 2.10 Rule 144 Reporting.

With a view to making available the benefits of certain rules and regulations of the Commission that may permit the sale of the Registrable Securities to the public without registration, the Partnership agrees to use its commercially reasonable efforts to:

(a) make and keep public information regarding the Partnership available, as those terms are understood and defined in Rule 144 (or any successor or similar provision adopted by the Commission then in effect) under the Securities Act, at all times from and after the date hereof;

(b) file with the Commission in a timely manner all reports and other documents required of the Partnership under the Securities Act and the Exchange Act at all times from and after the date hereof; and

(c) so long as a Holder owns any Registrable Securities, furnish, unless otherwise available electronically at no additional charge via the Commission’s EDGAR system, to such Holder forthwith upon request a copy of the most recent annual or quarterly report of the Partnership, and such other reports and documents as such Holder may reasonably request in availing itself of any rule or regulation of the Commission allowing such Holder to sell any such securities without registration.

Section 2.11 Transfer or Assignment of Registration Rights.

The rights to cause the Partnership to register Registrable Securities granted to the Purchasers by the Partnership under this Article II may be transferred or assigned by any Purchaser to one or more transferees or assignees of Registrable Securities, subject to the transfer restrictions provided in Section 4.7(e) of the Amended Partnership Agreement, provided, however, that (a) the Partnership is given written notice prior to any said transfer or assignment, stating the name and address of each of the transferee or assignee and identifying the Registrable Securities with respect to which such registration rights are being transferred or assigned and (b) each such transferee or assignee assumes in writing responsibility for its portion of the obligations of such Purchaser under this Agreement.

Section 2.12 Limitation on Subsequent Registration Rights.

From and after the date hereof, the Partnership shall not, without the prior written consent of the Holders of at least a majority of the then outstanding Registrable Securities, enter into any agreement with any current or future holder of any securities of the Partnership that would allow such current or future holder to require the Partnership to include securities in any registration statement filed by the Partnership on a basis that is superior to the rights of the Holders of Registrable Securities hereunder.

ARTICLE III

MISCELLANEOUS

Section 3.01 Communications.

All notices and other communications provided for or permitted hereunder shall be made in writing by facsimile, electronic mail, courier service or personal delivery:

(a) if to an Purchaser:

To the respective address listed in the Preferred Unit Purchase Agreement

(b) if to a transferee of a Purchaser, to such Holder at the address provided pursuant to Section 2.11 above; and

(c) if to the Partnership:

Sanchez Production Partners LP

1000 Main Street, Suite 3000

Houston, TX 7702

Attention: Charles C. Ward

Email: [email protected]

13

With a copy to (which shall not constitute notice):

Andrews Kurth LLP

600 Travis, Suite 4200

Houston, TX 77002

Attention: Scott Olson

Facsimile: 713.238.7410

Email: [email protected]

All such notices and communications shall be deemed to have been received at the time delivered by hand, if personally delivered; when receipt acknowledged, if sent via facsimile or sent via Internet electronic mail; and when actually received, if sent by courier service.

Section 3.02 Successor and Assigns.

This Agreement shall inure to the benefit of and be binding upon the successors and permitted assigns of each of the parties, including subsequent Holders of Registrable Securities to the extent permitted herein.

Section 3.03 Assignment of Rights.

All or any portion of the rights and obligations of any Purchaser under this Agreement may be transferred or assigned by such Purchaser only in accordance with Section 2.11 hereof.

Section 3.04 Recapitalization, Exchanges, Etc. Affecting the Units.

The provisions of this Agreement shall apply to the full extent set forth herein with respect to any and all units of the Partnership or any successor or assign of the Partnership (whether by merger, consolidation, sale of assets or otherwise) that may be issued in respect of, in exchange for or in substitution of, the Registrable Securities, and shall be appropriately adjusted for combinations, unit splits, recapitalizations, pro rata distributions of units and the like occurring after the date of this Agreement.

Section 3.05 Aggregation of Registrable Securities.

All Registrable Securities held or acquired by Persons who are Affiliates of one another shall be aggregated together for the purpose of determining the availability of any rights and applicability of any obligations under this Agreement.

Section 3.06 Specific Performance.

Damages in the event of breach of this Agreement by a party hereto may be difficult, if not impossible, to ascertain, and it is therefore agreed that each such Person, in addition to and without limiting any other remedy or right it may have, will have the right to an injunction or other equitable relief in any court of competent jurisdiction, enjoining any such breach, and enforcing specifically the terms and provisions hereof, and each of the parties hereto hereby waives any and all defenses it may have on the ground of lack of jurisdiction or competence of the court to grant such an injunction or other equitable relief. The existence of this right will not preclude any such Person from pursuing any other rights and remedies at law or in equity that such Person may have.

Section 3.07 Counterparts.

This Agreement may be executed in any number of counterparts and by different parties hereto in separate counterparts, including facsimile or .pdf counterparts, each of which counterparts, when so executed and delivered, shall be deemed to be an original and all of which counterparts, taken together, shall constitute but one and the same Agreement.

Section 3.08 Headings.

The headings in this Agreement are for convenience of reference only and shall not limit or otherwise affect the meaning hereof.

14

Section 3.09 Governing Law.

THIS AGREEMENT, INCLUDING ALL ISSUES AND QUESTIONS CONCERNING ITS APPLICATION, CONSTRUCTION, VALIDITY, INTERPRETATION AND ENFORCEMENT, SHALL BE CONSTRUED IN ACCORDANCE WITH, AND GOVERNED BY, THE LAWS OF THE STATE OF NEW YORK.

Section 3.10 Severability of Provisions.

Any provision of this Agreement which is prohibited or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such prohibition or unenforceability without invalidating the remaining provisions hereof or affecting or impairing the validity or enforceability of such provision in any other jurisdiction.

Section 3.11 Entire Agreement.

This Agreement is intended by the parties as a final expression of their agreement and intended to be a complete and exclusive statement of the agreement and understanding of the parties hereto in respect of the subject matter contained herein. There are no restrictions, promises, warranties or undertakings, other than those set forth or referred to herein with respect to the rights granted by the Partnership set forth herein. This Agreement supersedes all prior agreements and understandings between the parties with respect to such subject matter.

Section 3.12 Amendment.

This Agreement may be amended only by means of a written amendment signed by the Partnership and the Holders of a majority of the then outstanding Registrable Securities; provided, however, that no such amendment shall materially and adversely affect the rights of any Holder hereunder without the consent of such Holder.

Section 3.13 No Presumption.

If any claim is made by a party relating to any conflict, omission or ambiguity in this Agreement, no presumption or burden of proof or persuasion shall be implied by virtue of the fact that this Agreement was prepared by or at the request of a particular party or its counsel.

Section 3.14 Obligations Limited to Parties to Agreement.

Each of the parties hereto covenants, agrees and acknowledges that no Person other than the Purchasers (and their permitted transferees and assignees) and the Partnership shall have any obligation hereunder. Notwithstanding that one or more of the Purchasers may be a corporation, partnership or limited liability company, no recourse under this Agreement or under any documents or instruments delivered in connection herewith or therewith shall be had against any former, current or future director, officer, employee, agent, general or limited partner, manager, member, stockholder or Affiliate of any of the Purchasers or any former, current or future director, officer, employee, agent, general or limited partner, manager, member, stockholder or Affiliate thereof, whether by the enforcement of any assessment or by any legal or equitable proceeding, or by virtue of any applicable Law, it being expressly agreed and acknowledged that no personal liability whatsoever shall attach to, be imposed on or otherwise be incurred by any former, current or future director, officer, employee, agent, general or limited partner, manager, member, stockholder or Affiliate of any of the Purchasers or any former, current or future director, officer, employee, agent, general or limited partner, manager, member, stockholder or Affiliate thereof, as such, for any obligations of the Purchasers under this Agreement or any documents or instruments delivered in connection herewith or therewith or for any claim based on, in respect of or by reason of such obligation or its creation, except in each case for any transferee or assignee of a Purchaser hereunder.

Section 3.15 Independent Nature of Purchaser’s Obligations.

The obligations of each Purchaser under this Agreement are several and not joint with the obligations of any other Purchaser, and no Purchaser shall be responsible in any way for the performance of the obligations of any other Purchaser under this Agreement. Nothing contained herein, and no action taken by any Purchaser pursuant thereto, shall be deemed to constitute the Purchasers as a partnership, an association, a joint venture or any other kind of group or entity, or create a presumption that the Purchasers are in any way acting in concert or as a group with respect to such obligations or the transactions contemplated by this Agreement. Each Purchaser shall be entitled

15

to independently protect and enforce its rights, including, the rights arising out of this Agreement, and it shall not be necessary for any other Purchaser to be joined as an additional party in any proceeding for such purpose.

Section 3.16 Interpretation.