Form 8-K SYKES ENTERPRISES INC For: May 02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 2, 2016

Sykes Enterprises, Incorporated

(Exact name of registrant as specified in its charter)

| Florida | 0-28274 | 56-1383460 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) | ||

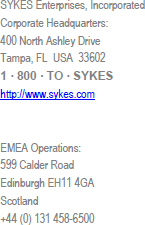

| 400 N. Ashley Drive, Suite 2800, Tampa, Florida |

33602 | |||

| (Address of principal executive offices) | (Zip Code) | |||

Registrant’s telephone number, including area code: (813) 274-1000

(Former name or former address if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition.

On May 2, 2016, Sykes Enterprises, Incorporated issued a press release announcing its financial results for the three months ended March 31, 2016. The press release is attached as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

| (d) | The following exhibit is included with this Report: |

| Exhibit 99.1 | Press release, dated May 2, 2016, announcing the financial results for the three months ended March 31, 2016. | |

(Remainder of page intentionally left blank.)

-2-

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| SYKES ENTERPRISES, INCORPORATED | ||||

| By: | /s/ John Chapman | |||

| John Chapman Executive Vice President and | ||||

| Chief Financial Officer | ||||

| Date: May 2, 2016 |

||||

-3-

EXHIBIT INDEX

| Exhibit No. | Description | |

| 99.1 |

Press release dated May 2, 2016, announcing the financial results for the three months ended March 31, 2016. | |

-4-

Exhibit 99.1

| SYKES ENTERPRISES, INCORPORATED REPORTS FIRST QUARTER 2016 FINANCIAL RESULTS | ||

| --First quarter diluted earnings per share performance exceeds business outlook --Agent productivity gains drive operating results as program ramps continue --5 million additional share repurchase authorization underscores continued strong underlying cash generation & balance sheet strength --Reaffirming underlying 2016 business outlook | ||

| TAMPA, FL – May 2, 2016 - Sykes Enterprises, Incorporated (“SYKES” or the “Company”) (NASDAQ: SYKE), a global business process outsourcing (BPO) leader in providing comprehensive inbound customer engagement services to Global 2000 companies, announced today its financial results for the first-quarter ended March 31, 2016. | ||

| First Quarter 2016 Financial Highlights | ||

|

● First quarter 2016 revenues of $320.8 million decreased $2.9 million, or 0.9%, from $323.7 million in the comparable quarter last year; on a constant currency and organic basis, which excludes the $1.5 million in revenue contribution from the acquisition of Qelp, which was acquired in the third quarter of 2015, first quarter 2016 revenues increased 1.1% comparably, with the increased demand driven broadly by program expansion and wins with new and existing clients across the financial services, transportation and leisure, healthcare, technology, and other verticals (“other vertical” reflects the contribution from the retail vertical, among others) | ||

|

|

● First quarter 2016 operating margin was 6.3% versus 7.0% in the same period last year, which reflects the partial impact of certain transaction costs (i.e., M&A and legal fees, etc. of $1.4 million on a pre-tax basis) associated with the acquisition of Clearlink, which closed in the second quarter of 2016; on a non-GAAP basis (see section titled “Non-GAAP Financial Measures” for an explanation and see Exhibit 6 for reconciliation), first quarter 2016 operating margin was 7.9% versus 8.1% in the same period last year with the delta driven by costs associated with capacity additions and the corresponding program ramps for higher projected demand

● First quarter 2016 diluted earnings per share were $0.33 versus $0.37 in the comparable quarter last year, with the decline due to a higher effective comparable tax rate in the first quarter of 2016 coupled with costs associated with the Clearlink transaction, capacity additions and ramps

● On a non-GAAP basis, first quarter 2016 diluted earnings per share were $0.42 versus $0.43 in the comparable quarter last year (see Exhibit 6 for reconciliation) due to costs associated with the capacity additions and ramps. First quarter 2016 diluted earnings per share, however, were higher relative to the Company’s March 2016 business outlook range of $0.36 to $0.39, driven by agent productivity gains, coupled with lower-than-forecasted effective tax rate and other expenses | |

|

● Consolidated capacity utilization rate decreased to 78% in the first quarter of 2016 from 80% in the same period last year due to a significant increase in the comparable seat count related to projected client demand | ||

| Americas Region | ||

| Revenues from the Company’s Americas region, including operations in North America and offshore (Latin America, South Asia and the Asia Pacific region), decreased 0.8% to $262.1 million, or 81.7% of total revenues, for the first quarter of 2016 compared to $264.2 million, or 81.6% of total revenues, in the same prior year period. On a constant currency basis, first quarter 2016 Americas revenues increased 1.5% comparably, with the increased demand driven broadly by program expansion and wins with new and existing clients across the financial services, transportation and leisure, healthcare, technology, and other verticals (“other vertical” reflects the contribution from the retail vertical, among others). | ||

| Sequentially, revenues generated from the Americas region decreased 4.4% to $262.1 million from $274.1 million, or 81.3% of total revenues, in the fourth quarter of 2015. On a constant currency basis, first quarter 2016 Americas revenues decreased 3.8% over fourth quarter driven largely by program seasonality within the retail and technology verticals more than offsetting the increases in the communications and transportation and leisure verticals. | ||

| The Americas income from operations for the first quarter of 2016 increased 1.4% to $33.0 million, with an operating margin of 12.6% versus 12.3% in the comparable quarter last year. On a non-GAAP basis, the Americas operating margin increased to 13.9% from 13.7% in the comparable quarter last year, driven by agent productivity gains, more than offsetting the costs associated with capacity additions and ramps (see Exhibit 7 for reconciliation). | ||

| Sequentially, the Americas income from operations for the first quarter of 2016 decreased 18.9% to $33.0 million, with an operating margin of 12.6% versus 14.8% in the fourth quarter of 2015. On a non-GAAP basis, the Americas operating margin was 13.9% versus 16.1% in the fourth quarter of 2015, with the decrease due mostly to seasonality (see Exhibit 7 for reconciliation). | ||

| EMEA Region | ||

| Revenues from the Company’s Europe, Middle East and Africa (EMEA) region decreased 1.5% to $58.6 million, representing 18.3% of total revenues, for the first quarter of 2016, compared to $59.5 million, or 18.4% of total revenues, in the same prior year period. On an organic and constant currency basis, which excludes the revenue contribution from the acquisition of Qelp, EMEA revenues decreased 0.8% on a comparable basis due to demand softness principally in the communications and technology verticals driven by program completions, which was partially offset by increases in the financial services and transportation and leisure verticals. | ||

| Sequentially, revenues from the Company’s EMEA region decreased 7.1% to $58.6 million, or 18.3% of SYKES’ total revenues, versus $63.1 million, or 18.7% of SYKES’ total revenues, in the fourth quarter of 2015. On a constant currency basis, EMEA revenues decreased 6.4% sequentially, driven mostly by factors discussed above. | ||

| The EMEA region’s income from operations for the first quarter of 2016 was $3.4 million, or 5.8% of EMEA revenues, versus $3.8 million, or 6.4% of revenues, in the comparable quarter last year. On a non-GAAP basis, the operating margin was unchanged at 6.4% (see Exhibit 7 for reconciliation). | ||

| Sequentially, the EMEA region’s income from operations for the first quarter of 2016 was $3.4 million, or 5.8% of EMEA revenues, versus $4.0 million, or 6.3% of revenues, in the fourth quarter of 2015. On a non-GAAP basis, the EMEA operating margin was 6.4% versus 6.9% in the fourth quarter of 2015 due mostly to a reduction in capacity utilization driven by program completions (see Exhibit 7 for reconciliation). | ||

2

| Other G&A Expenses Other G&A expenses, which include corporate and other costs, increased to $16.2 million, or 5.0% of revenues in the first quarter of 2016, compared to $13.8 million, or 4.3% of revenues in the prior year period, with the increase partly a result of certain transaction costs related to the acquisition of Clearlink. On a non-GAAP basis, other G&A expenses increased to 4.6% of revenues in the first quarter of 2016 from 4.3% in the year ago period due to a combination of professional services fees related to the on-going upgrade of the Company’s financial system, an increase in performance based compensation coupled with some investment in personnel across functional groups (see Exhibit, 7 for reconciliation).

Sequentially, other G&A expenses increased to $16.2 million, or 5.0% of revenues, from $15.6 million, or 4.6% of revenues, in the fourth quarter of 2015, with the increase partly a result of aforementioned factors. On a non-GAAP basis, other G&A expenses remained unchanged at 4.6% on a comparable basis (see Exhibit 7 for reconciliation).

Other Income (Expense) and Taxes Total other income (expense), net for the first quarter of 2016 was ($0.1) million compared to ($1.1) million for the same period in the prior year, with decrease principally due to foreign currency transaction gains in the first quarter of 2016 while the prior year period recorded losses. These gains and losses result primarily from exchange rate fluctuations in U.S. dollar denominated assets and liabilities held by the Company’s foreign subsidiaries. Other income (expense), net for the first quarter for 2016 reflects approximate ($0.2) million in interest accretion associated with the contingent purchase price of Qelp. This accretion is the present value of the contingent consideration with the resulting spread between the present value and the contingent consideration amortized over a three-year life (see Exhibit 6 for reconciliation).

The Company recorded an effective tax rate of 30.8% for the first quarter of 2016 versus 27.1% in the same period last year and below the estimated 33% provided in the Company’s March 2016 business outlook. The rate differential compared to the same period last year and compared to the business outlook was due to fluctuations in the geographic mix of earnings to higher and lower tax rate jurisdictions.

On a non-GAAP basis, the first quarter 2016 effective tax rate was 31.7% compared to 28.3% in the same period last year and slightly below the estimated 33% provided in the Company’s March 2016 business outlook (see Exhibit 11 for reconciliation) was due to the above-mentioned factors.

Liquidity and Capital Resources The Company’s balance sheet at March 31, 2016 remained strong with cash and cash equivalents of $259.9 million, of which approximately 91.3%, or $237.4 million, was held in international operations and is deemed to be indefinitely reinvested offshore. Separately, the Company’s Board of Directors authorized five million shares of common stock for repurchase. This amount is in addition to the initial five million share repurchase plan authorized in August 2011, of which approximately one-hundred thousand shares remain to be repurchased. At quarter end, the Company had $70.0 million in borrowings outstanding, with $370.0 million available under its $440.0 million credit facility. Subsequent to quarter end, however, on April 1, 2016, the Company announced that it had closed the acquisition of Clearlink for cash consideration of $209.5 million. The Company borrowed approximately $216 million against its credit facility to fund the acquisition and provide additional working capital. | ||

3

| Business Outlook

The assumptions driving the business outlook for the second quarter and full-year 2016 are as follows:

● The Company’s second quarter and full year 2016 business outlook as discussed below does not reflect the revenue and earnings contributions, including the impact of interest and incremental transaction expenses, associated with the Clearlink acquisition, which closed April 1, 2016. The Company’s full-year 2016 outlook, however, does reflect only the $1.4 million in transaction costs incurred in the first quarter of 2016. As stated previously, the Company plans to update for the Clearlink revenue and earnings contribution when it reports its second quarter 2016 results;

● The Company continues to experience demand trends consistent with what was discussed in its previous business outlook. The forecasted increase in the full-year revenue ranges to between $1,348 million and $1,362 million from between $1,336 million and $1,354 million previously reflects principally the impact of favorable foreign exchange rate movements relative to the U.S. dollar, which are expected to be relatively neutral to full-year diluted earnings per share. The Company’s second quarter revenue outlook relative to the first quarter of 2016 and compared to the same period last year reflects the favorable revenue contribution from the on-going ramps. However, the combination of costs associated with the capacity additions and agent ramps, which are heavily first-half weighted as stated previously, coupled with traditional second quarter seasonality, are expected to impact operating margins in the second quarter of 2016 relative to the first quarter of 2016 and compared to the same period last year;

● The Company added roughly 2,400 seats on a gross basis in the first quarter, with the total gross seats planned for the full year still expected to be around 5,700 seats. The Company plans to add another 1,900 in gross seats in the second quarter. The Company, however, still plans to rationalize around 1,600 seats in 2016, with roughly 700 of which is expected in the second quarter of 2016, in addition to the approximately 500 already rationalized in the first quarter of 2016. The Company anticipates a net seat count increase of approximately 4,100 in 2016 versus 2015;

● The Company’s revenues and earnings per share assumptions for the second quarter and full year 2016 are based on foreign exchange rates as of April 2016. Therefore, the continued volatility in foreign exchange rates between the U.S. dollar and the functional currencies of the markets the Company serves could have a further impact, positive or negative, on revenues and both GAAP and non-GAAP earnings per share relative to the business outlook for the second quarter and full-year as discussed above; and

● The Company anticipates total other interest income (expense), net of approximately ($1.0) million for the second quarter and ($2.9) million for the full year 2016. These amounts include the accretion of the Qelp contingent consideration, which is expected to be $0.2 million in the second quarter of 2016 and approximately $1.0 million for the year. The amounts, however, exclude the potential impact of any future foreign exchange gains or losses in other income (expense).

Considering the above factors, the Company anticipates the following financial results for the three months ending June 30, 2016:

● Revenues in the range of $322.0 million to $326.0 million ● Effective tax rate of approximately 35.0%; **on a non-GAAP basis, an effective tax rate of approximately 35.0% ● Fully diluted share count of approximately 42.1 million ● Diluted earnings per share of approximately $0.23 to $0.25 ● **Non-GAAP diluted earnings per share in the range of $0.29 to $0.31 ● Capital expenditures in the range of $20.0 million to $25.0 million | ||

4

| For the twelve months ending December 31, 2016, the Company anticipates the following financial results: | ||

|

● Revenues in the range of $1,348.0 million to $1,362.0 million | ||

|

● Effective tax rate of approximately 31.0%; **on a non-GAAP basis, an effective tax rate of approximately 31.0% | ||

|

● Fully diluted share count of approximately 42.4 million | ||

|

● Diluted earnings per share of approximately $1.50 to $1.57 | ||

|

● **Non-GAAP diluted earnings per share in the range of $1.76 to $1.83 | ||

|

● Capital expenditures in the range of $65.0 million to $70.0 million | ||

| **See exhibits 7 & 8 for second quarter and full-year 2016 non-GAAP diluted earnings per share and tax rate reconciliations. | ||

| Conference Call | ||

| The Company will conduct a conference call regarding the content of this release tomorrow, May 3, 2016, at 10:00 a.m. Eastern Time. The conference call will be carried live on the Internet. Instructions for listening to the call over the Internet are available on the Investors page of SYKES’ website at www.sykes.com. A replay will be available at this location for two weeks. This press release is also posted on the SYKES website at http://investor.sykes.com/investor-relations/Investor-Resources/Investor-Relations-Home/default.aspx. | ||

| Non-GAAP Financial Measures | ||

| Non-GAAP income from operations, non-GAAP operating margins, non-GAAP tax rate, non-GAAP net income, non-GAAP net income per diluted share and non-GAAP income from operations by segment are important indicators of performance as these non-GAAP financial measures assist readers in further understanding the Company’s results from operations and how management evaluates and measures such performance. These non-GAAP indicators of performance are not measures of financial performance under U.S. Generally Accepted Accounting Principles (“GAAP”) and should not be considered a substitute for measures determined in accordance with GAAP. Refer to the exhibits in the release for detailed reconciliations. | ||

| About Sykes Enterprises, Incorporated | ||

| SYKES is a global business process outsourcing (BPO) leader in providing comprehensive inbound customer engagement services to Global 2000 companies, primarily in the communications, financial services, healthcare, technology, transportation and retail industries. SYKES’ differentiated end-to-end service platform effectively engages consumers at every touch point in their customer lifecycle, starting from digital marketing and acquisition to customer support, technical support, up-sell/cross-sell and retention. Headquartered in Tampa, Florida, with customer contact engagement centers throughout the world, SYKES provides its services through multiple communication channels encompassing phone, e-mail, web, chat, social media and digital self-service. Utilizing its integrated onshore/offshore and virtual at-home agent delivery models, SYKES serves its clients through two geographic operating segments: the Americas (United States, Canada, Latin America, India and the Asia Pacific region) and EMEA (Europe, Middle East and Africa). SYKES also provides various enterprise support services in the Americas and fulfillment services in EMEA, which include order processing, inventory control, product delivery and product returns handling. For additional information please visit www.sykes.com. | ||

| Forward-Looking Statements | ||

| This press release may contain “forward-looking statements,” including SYKES’ estimates of future business outlook, prospects or financial results, statements regarding SYKES’ objectives, expectations, intentions, beliefs or strategies, or statements containing words such as “believe,” “estimate,” “project,” “expect,” “intend,” “may,” “anticipate,” “plans,” “seeks,” “implies,” or similar expressions. It is important to note that SYKES’ actual results could differ materially from those in such forward-looking statements, and undue reliance should not be placed on such statements. | ||

5

| Among the important factors that could cause such actual results to differ materially are (i) the impact of economic recessions in the U.S. and other parts of the world, (ii) fluctuations in global business conditions and the global economy, ability of maintaining margins offshore (iii) SYKES’ ability to continue the growth of its support service revenues through additional technical and customer contact centers, (iv) currency fluctuations, (v) the timing of significant orders for SYKES’ products and services, (vi) loss or addition of significant clients, (vii) the early termination of contracts by clients, (viii) SYKES’ ability to recognize deferred revenue through delivery of products or satisfactory performance of services, (ix) construction delays of new or expansion of existing customer support centers, (x) difficulties or delays in implementing SYKES’ bundled service offerings, (xi) failure to achieve sales, marketing and other objectives, (xii) variations in the terms and the elements of services offered under SYKES’ standardized contract including those for future bundled service offerings, (xiii) changes in applicable accounting principles or interpretations of such principles, (xiv) delays in the Company’s ability to develop new products and services and market acceptance of new products and services, (xv) rapid technological change, (xvi) political and country-specific risks inherent in conducting business abroad, (xvii) SYKES’ ability to attract and retain key management personnel, (xviii) SYKES’ ability to further penetrate into vertically integrated markets, (xix) SYKES’ ability to expand its global presence through strategic alliances and selective acquisitions, (xx) SYKES’ ability to continue to establish a competitive advantage through sophisticated technological capabilities, (xxi) the ultimate outcome of any lawsuits or penalties (regulatory or otherwise), (xxii) SYKES’ dependence on trends toward outsourcing, (xxiii) risk of interruption of technical and customer contact management center operations due to such factors as fire, earthquakes, inclement weather and other disasters, power failures, telecommunications failures, unauthorized intrusions, computer viruses and other emergencies, (xxiv) the existence of substantial competition, (xxv) the ability to obtain and maintain grants and other incentives, including tax holidays or otherwise, (xxvi) risks related to the integration of the businesses of SYKES, Qelp and Clearlink and (xxvii) other risk factors listed from time to time in SYKES’ registration statements and reports as filed with the Securities and Exchange Commission. All forward-looking statements included in this press release are made as of the date hereof, and SYKES undertakes no obligation to update any such forward-looking statements, whether as a result of new information, future events, or otherwise. | ||

| For additional information contact: | ||

| Subhaash Kumar | ||

| Sykes Enterprises, Incorporated | ||

| (813) 233-7143 | ||

6

Sykes Enterprises, Incorporated

Consolidated Statements of Operations

(in thousands, except per share data)

(Unaudited)

Exhibit 1

| Three Months Ended | ||||||||||||

| March 31, 2016 |

March 31, 2015 |

December 31, 2015 |

||||||||||

| Revenues |

$ | 320,746 | $ | 323,685 | $ | 337,278 | ||||||

| Direct salaries and related costs |

(205,555 | ) | (213,927 | ) | (214,307 | ) | ||||||

| General and administrative |

(80,510 | ) | (72,727 | ) | (79,558 | ) | ||||||

| Depreciation, net |

(10,784 | ) | (11,059 | ) | (10,748 | ) | ||||||

| Amortization of intangibles |

(3,627 | ) | (3,431 | ) | (3,666 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Income from operations |

20,270 | 22,541 | 28,999 | |||||||||

| Total other income (expense), net |

(102 | ) | (1,102 | ) | (1,366 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Income before income taxes |

20,168 | 21,439 | 27,633 | |||||||||

| Income taxes |

(6,214 | ) | (5,800 | ) | (7,597 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net income |

$ | 13,954 | $ | 15,639 | $ | 20,036 | ||||||

|

|

|

|

|

|

|

|||||||

| Net income per common share: |

||||||||||||

| Basic |

$ | 0.33 | $ | 0.37 | $ | 0.48 | ||||||

|

|

|

|

|

|

|

|||||||

| Diluted |

$ | 0.33 | $ | 0.37 | $ | 0.48 | ||||||

|

|

|

|

|

|

|

|||||||

| Weighted average common shares outstanding: |

||||||||||||

| Basic |

41,704 | 42,181 | 41,630 | |||||||||

| Diluted |

42,023 | 42,440 | 42,117 | |||||||||

7

Sykes Enterprises, Incorporated

Segment Results

(in thousands, except per share data)

(Unaudited)

Exhibit 2

| Three Months Ended | ||||||||||||

| March 31, 2016 |

March 31, 2015 |

December 31, 2015 |

||||||||||

| Revenues: |

||||||||||||

| Americas |

$ | 262,076 | $ | 264,173 | $ | 274,139 | ||||||

| EMEA |

58,625 | 59,495 | 63,098 | |||||||||

| Other |

45 | 17 | 41 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 320,746 | $ | 323,685 | $ | 337,278 | ||||||

|

|

|

|

|

|

|

|||||||

| Operating Income: |

||||||||||||

| Americas |

$ | 32,987 | $ | 32,541 | $ | 40,692 | ||||||

| EMEA |

3,410 | 3,788 | 3,950 | |||||||||

| Other |

(16,127 | ) | (13,788 | ) | (15,643 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Income from operations |

20,270 | 22,541 | 28,999 | |||||||||

| Total other income (expense), net |

(102 | ) | (1,102 | ) | (1,366 | ) | ||||||

| Income taxes |

(6,214 | ) | (5,800 | ) | (7,597 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net income |

$ | 13,954 | $ | 15,639 | $ | 20,036 | ||||||

|

|

|

|

|

|

|

|||||||

8

Sykes Enterprises, Incorporated

Consolidated Balance Sheets

(in thousands, except seat data)

(Unaudited)

Exhibit 3

| March 31, 2016 |

December 31, 2015 |

|||||||||||

| Assets: |

||||||||||||

| Current assets |

$ | 580,664 | $ | 563,037 | ||||||||

| Property and equipment, net |

118,116 | 111,962 | ||||||||||

| Goodwill & intangibles, net |

246,923 | 246,629 | ||||||||||

| Other noncurrent assets |

41,577 | 26,144 | ||||||||||

|

|

|

|

|

|||||||||

| Total assets |

$ | 987,280 | $ | 947,772 | ||||||||

|

|

|

|

|

|||||||||

| Liabilities & Shareholders’ Equity: |

||||||||||||

| Current liabilities |

$ | 160,283 | $ | 153,175 | ||||||||

| Noncurrent liabilities |

120,254 | 115,917 | ||||||||||

| Shareholders’ equity |

706,743 | 678,680 | ||||||||||

|

|

|

|

|

|||||||||

| Total liabilities and shareholders’ equity |

$ | 987,280 | $ | 947,772 | ||||||||

|

|

|

|

|

|||||||||

| Sykes Enterprises, Incorporated | ||||||||||||

| Supplementary Data | ||||||||||||

| Q1 2016 | Q1 2015 | |||||||||||

| Geographic Mix (% of Total Revenues): |

||||||||||||

| Americas (1) |

82% | 82% | ||||||||||

| Europe, Middle East & Africa (EMEA) |

18% | 18% | ||||||||||

| Other |

0% | 0% | ||||||||||

|

|

|

|

|

|||||||||

| Total |

100% | 100% | ||||||||||

|

|

|

|

|

|||||||||

| (1) Includes the United States, Canada, Latin America, South Asia and the Asia Pacific (APAC) Region. Latin America, South Asia and APAC are included in the Americas due to the nature of the business and client profile, which is primarily made up of U.S. based clients. | ||||||||||||

| Q1 2016 | Q1 2015 | |||||||||||

| Vertical Industry Mix (% of Total Revenues): |

||||||||||||

| Communications |

33% | 37% | ||||||||||

| Financial Services |

25% | 23% | ||||||||||

| Technology / Consumer |

19% | 19% | ||||||||||

| Transportation & Leisure |

8% | 7% | ||||||||||

| Healthcare |

6% | 6% | ||||||||||

| Other |

9% | 8% | ||||||||||

|

|

|

|

|

|||||||||

| Total |

100% | 100% | ||||||||||

|

|

|

|

|

|||||||||

| Seat Capacity (2) | ||||||||||||

| Q1 2016 | Q1 2015 | Q4 2015 | ||||||||||

| Americas |

37,000 | 33,200 | 35,100 | |||||||||

| EMEA |

6,100 | 6,700 | 6,000 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

43,100 | 39,900 | 41,100 | |||||||||

|

|

|

|

|

|

|

|||||||

| Capacity Utilization | ||||||||||||

| Q1 2016 | Q1 2015 | Q4 2015 | ||||||||||

| Americas |

77% | 78% | 79% | |||||||||

| EMEA |

82% | 88% | 85% | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

78% | 80% | 79% | |||||||||

|

|

|

|

|

|

|

|||||||

| (2) The seat capacity and capacity utilization data are related to the Company’s brick-and-mortar call centers. At the end of the first quarter 2016, the Company had approximately 3,000 agent FTEs working virtually from home. There are no seats associated with Qelp. | ||||||||||||

9

Sykes Enterprises, Incorporated

Cash Flow from Operations

(in thousands)

(Unaudited)

Exhibit 4

| Three Months Ended | ||||||||||||

| March 31, 2016 |

March 31, 2015 |

December 31, 2015 |

||||||||||

| Cash Flow From Operating Activities: |

||||||||||||

| Net income |

$ | 13,954 | $ | 15,639 | $ | 20,036 | ||||||

| Depreciation |

10,954 | 11,255 | 10,922 | |||||||||

| Amortization of intangibles |

3,627 | 3,431 | 3,666 | |||||||||

| Amortization of deferred grants |

(226 | ) | (199 | ) | (273 | ) | ||||||

| Changes in assets and liabilities and other |

(2,792 | ) | (1,484 | ) | (8,800 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net cash provided by operating activities |

$ | 25,517 | $ | 28,642 | $ | 25,551 | ||||||

|

|

|

|

|

|

|

|||||||

| Capital expenditures |

$ | 16,205 | $ | 10,869 | $ | 13,346 | ||||||

| Cash paid during period for interest |

$ | 406 | $ | 368 | $ | 379 | ||||||

| Cash paid during period for income taxes |

$ | 3,781 | $ | 5,606 | $ | 9,707 | ||||||

10

Sykes Enterprises, Incorporated

Reconciliation of Non-GAAP Financial Information

(in thousands, except per share data)

(Unaudited)

Exhibit 5

| Three Months Ended | ||||||||||||

| March 31, 2016 |

March 31, 2015 |

December 31, 2015 |

||||||||||

| GAAP income from operations |

$ | 20,270 | $ | 22,541 | $ | 28,999 | ||||||

| Adjustments: |

||||||||||||

| Acquisition-related depreciation & amortization of property & equipment and intangible write-ups |

3,726 | 3,745 | 3,788 | |||||||||

| Merger & integration costs |

1,442 | - | - | |||||||||

| Other |

- | - | - | |||||||||

|

|

|

|

|

|

|

|||||||

| Non-GAAP income from operations |

$ | 25,438 | $ | 26,286 | $ | 32,787 | ||||||

|

|

|

|

|

|

|

|||||||

| Three Months Ended | ||||||||||||

| March 31, 2016 |

March 31, 2015 |

December 31, 2015 |

||||||||||

| GAAP net income |

$ | 13,954 | $ | 15,639 | $ | 20,036 | ||||||

| Adjustments, net of taxes: |

||||||||||||

| Acquisition-related depreciation & amortization of property & equipment and intangible write-ups |

2,437 | - | 2,501 | |||||||||

| Merger & integration costs |

894 | - | - | |||||||||

| Other |

160 | - | 810 | |||||||||

|

|

|

|

|

|

|

|||||||

| Non-GAAP net income |

$ | 17,445 | $ | 15,639 | $ | 23,347 | ||||||

|

|

|

|

|

|

|

|||||||

| Three Months Ended | ||||||||||||

| March 31, 2016 |

March 31, 2015 |

December 31, 2015 |

||||||||||

| GAAP net income, per diluted share |

$ | 0.33 | $ | 0.37 | $ | 0.48 | ||||||

| Adjustments: |

||||||||||||

| Acquisition-related depreciation & amortization of property & equipment and intangible write-ups |

0.07 | 0.06 | 0.06 | |||||||||

| Merger & integration costs |

0.02 | - | - | |||||||||

| Other |

- | - | 0.01 | |||||||||

|

|

|

|

|

|

|

|||||||

| Non-GAAP net income, per diluted share |

$ | 0.42 | $ | 0.43 | $ | 0.55 | ||||||

|

|

|

|

|

|

|

|||||||

11

Sykes Enterprises, Incorporated

Reconciliation of Non-GAAP Financial Information By Segment

(in thousands)

(Unaudited)

Exhibit 6

| Americas | EMEA | Other (1) | ||||||||||||||||||||||

| Three Months Ended | Three Months Ended | Three Months Ended | ||||||||||||||||||||||

| March 31, | March 31, | March 31, | March 31, | March 31, | March 31, | |||||||||||||||||||

| 2016 | 2015 | 2016 | 2015 | 2016 | 2015 | |||||||||||||||||||

| GAAP income (loss) from operations |

$ | 32,987 | $ | 32,541 | $ | 3,410 | $ | 3,788 | $ | (16,127 | ) | $ | (13,788 | ) | ||||||||||

| Adjustments: |

||||||||||||||||||||||||

| Acquisition-related depreciation & amortization of property & equipment and intangible write-ups |

3,380 | 3,745 | 346 | - | - | - | ||||||||||||||||||

| Merger & integration costs |

- | - | - | - | 1,442 | - | ||||||||||||||||||

| Other |

- | - | - | - | - | - | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Non-GAAP income (loss) from operations |

$ | 36,367 | $ | 36,286 | $ | 3,756 | $ | 3,788 | $ | (14,685 | ) | $ | (13,788 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Americas | EMEA | Other (1) | ||||||||||||||||||||||

| Three Months Ended | Three Months Ended | Three Months Ended | ||||||||||||||||||||||

| March 31, | December 31, | March 31, | December 31, | March 31, | December 31, | |||||||||||||||||||

| 2016 | 2015 | 2016 | 2015 | 2016 | 2015 | |||||||||||||||||||

| GAAP income (loss) from operations |

$ | 32,987 | $ | 40,692 | $ | 3,410 | $ | 3,950 | $ | (16,127 | ) | $ | (15,643 | ) | ||||||||||

| Adjustments: |

||||||||||||||||||||||||

| Acquisition-related depreciation & amortization of property & equipment and intangible write-ups |

3,380 | 3,415 | 346 | 373 | - | - | ||||||||||||||||||

| Merger & integration costs |

- | - | - | - | 1,442 | - | ||||||||||||||||||

| Other |

- | - | - | - | - | - | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Non-GAAP income (loss) from operations |

$ | 36,367 | $ | 44,107 | $ | 3,756 | $ | 4,323 | $ | (14,685 | ) | $ | (15,643 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

(1) Other includes corporate and other costs.

12

Sykes Enterprises, Incorporated

Reconciliation of Non-GAAP Financial Information

(Unaudited)

Exhibit 7

| Business Outlook | ||||

| Second Quarter | ||||

| 2016 | ||||

| GAAP net income, per diluted share |

$0.23 - $0.25 | |||

| Adjustments: |

||||

| Acquisition-related depreciation & amortization of property & equipment and intangible write-ups |

0.06 | |||

| Merger & integration costs |

- | |||

| Other |

- | |||

|

|

|

|||

| Non-GAAP net income, per diluted share |

$0.29 - $0.31 | |||

|

|

|

|||

| Business Outlook | ||||

| Full Year | ||||

| 2016 | ||||

| GAAP net income, per diluted share |

$1.50 - $1.57 | |||

| Adjustments: |

||||

| Acquisition-related depreciation & amortization of property & equipment and intangible write-ups |

0.22 | |||

| Merger & integration costs |

0.02 | |||

| Other |

0.02 | |||

|

|

|

|||

| Non-GAAP net income, per diluted share |

$1.76 - $1.83 | |||

|

|

|

|||

13

Sykes Enterprises, Incorporated

Reconciliation of Non-GAAP Financial Information

(Unaudited)

Exhibit 8

| Three Months Ended | ||||

| March 31, | March 31, | |||

| 2016 | 2015 | |||

| GAAP tax rate |

31% | 27% | ||

| Adjustments: |

||||

| Acquisition-related depreciation & amortization of property & equipment and intangible write-ups |

1% | 1% | ||

| Merger & integration costs |

- | - | ||

| Other |

- | - | ||

|

|

| |||

| Non-GAAP tax rate |

32% | 28% | ||

|

|

| |||

| Three Months Ended |

Year Ended | |||

| June 30, | December 31, | |||

| 2016 | 2016 | |||

| GAAP tax rate |

35% | 31% | ||

| Adjustments: |

||||

| Acquisition-related depreciation & amortization of property & equipment and intangible write-ups |

- | - | ||

| Merger & integration costs |

- | - | ||

| Other |

- | - | ||

|

|

| |||

| Non-GAAP tax rate |

35% | 31% | ||

|

|

| |||

14

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Unisys Announces First-Quarter 2024 Financial Results and Conference Call Date and Participation in Upcoming Investor Conferences

- Teradyne Reports First Quarter 2024 Results

- Airline Passengers Score Two Major Victories Following Two DOT Final Rules, Reports FlyersRights

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share