Form 8-K SUN COMMUNITIES INC For: Nov 14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8‑K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report: November 14, 2016

(Date of earliest event reported)

SUN COMMUNITIES, INC.

(Exact name of registrant as specified in its charter)

Maryland | 1-12616 | 38-2730780 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||

27777 Franklin Rd. | ||

Suite 200 | ||

Southfield, Michigan | 48034 | |

(Address of Principal Executive Offices) | (Zip Code) | |

248 208-2500 |

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01 | Regulation FD Disclosure |

Attached as Exhibit 99.1, and incorporated by reference, to this report is an investor presentation of Sun Communities, Inc. that will be used at REITWorld: NAREIT’s Annual Convention for All Things REIT on November 15-17, 2016. The presentation also will be posted on Sun Communities, Inc.'s website, www.suncommunities.com, on November 14, 2016.

The information contained in this Item 7.01 on Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed to be “filed” for purposes of the United States Securities Exchange Act of 1934, as amended (the "Exchange Act").

This report contains various “forward-looking statements” within the meaning of the United States Securities Act of 1933, as amended, and the Exchange Act, and we intend that such forward-looking statements will be subject to the safe harbors created thereby. For this purpose, any statements contained in this filing that relate to expectations, beliefs, projections, future plans and strategies, trends or prospective events or developments and similar expressions concerning matters that are not historical facts are deemed to be forward-looking statements. Words such as “forecasts,” “intends,” “intend,” “intended,” “goal,” “estimate,” “estimates,” “expects,” “expect,” “expected,” “project,” “projected,” “projections,” “plans,” “predicts,” “potential,” “seeks,” “anticipates,” “anticipated,” “should,” “could,” “may,” “will,” “designed to,” “foreseeable future,” “believe,” “believes,” “scheduled,” "guidance" and similar expressions are intended to identify forward-looking statements, although not all forward looking statements contain these words. These forward-looking statements reflect our current views with respect to future events and financial performance, but involve known and unknown risks and uncertainties, both general and specific to the matters discussed in this filing. These risks and uncertainties may cause our actual results to be materially different from any future results expressed or implied by such forward-looking statements. In addition to the risks disclosed under “Risk Factors” contained in our Annual Report on Form 10-K for the year ended December 31, 2015 and our other filings with the SEC from time to time, such risks and uncertainties include:

• | changes in general economic conditions, the real estate industry and the markets in which we operate; |

• | difficulties in our ability to evaluate, finance, complete and integrate acquisitions, developments and expansions successfully; |

• | our liquidity and refinancing demands; |

• | our ability to obtain or refinance maturing debt; |

• | our ability to maintain compliance with covenants contained in our debt facilities; |

• | availability of capital; |

• | our ability to maintain rental rates and occupancy levels; |

• | our failure to maintain effective internal control over financial reporting and disclosure controls and procedures; |

• | increases in interest rates and operating costs, including insurance premiums and real property taxes; |

• | risks related to natural disasters; |

• | general volatility of the capital markets and the market price of shares of our capital stock; |

• | our failure to maintain our status as a REIT; |

• | changes in real estate and zoning laws and regulations; |

• | legislative or regulatory changes, including changes to laws governing the taxation of REITs; |

• | litigation, judgments or settlements; |

• | competitive market forces; |

• | the ability of manufactured home buyers to obtain financing; and |

• | the level of repossessions by manufactured home lenders. |

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made. We undertake no obligation to publicly update or revise any forward-looking statements included or incorporated by reference into this filing, whether as a result of new information, future events, changes in our expectations or otherwise, except as required by law.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. All written and oral forward-looking statements attributable to us or persons acting on our behalf are qualified in their entirety by these cautionary statements.

Item 9.01 | Financial Statements and Exhibits |

(d) | Exhibits. |

99.1 | Investor Presentation |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

SUN COMMUNITIES, INC. | |||

Dated: November 14, 2016 | By: | /s/ Karen J. Dearing | |

Karen J. Dearing, Executive Vice President, Chief Financial Officer, Secretary and Treasurer | |||

EXHIBIT INDEX

Exhibit No. | Description | |

99.1 | Investor Presentation | |

REITWorld 2016: NAREIT's Annual Convention

Phoenix, AZ | November 15-17, 2016

Gary Shiffman

Chief Executive Officer

Karen Dearing

Chief Financial Officer

John McLaren

Chief Operating Officer

Fernando Castro-Caratini

SVP, Finance & Capital Markets

FORWARD-LOOKING STATEMENTS

This presentation has been prepared for informational purposes only from information supplied by Sun Communities, Inc. (the "Company") and

from third-party sources indicated herein. Such third-party information has not been independently verified. The Company makes no

representation or warranty, expressed or implied, as to the accuracy or completeness of such information.

This presentation contains various “forward-looking statements” within the meaning of the United States Securities Act of 1933, as amended,

and the United States Securities Exchange Act of 1934, as amended, and we intend that such forward-looking statements will be subject to the

safe harbors created thereby. For this purpose, any statements contained in this presentation that relate to expectations, beliefs, projections,

future plans and strategies, trends or prospective events or developments and similar expressions concerning matters that are not historical

facts are deemed to be forward-looking statements. Words such as “forecasts,” “intends,” “intend,” “intended,” “goal,” “estimate,”

“estimates,” “expects,” “expect,” “expected,” “project,” “projected,” “projections,” “plans,” “predicts,” “potential,” “seeks,” “anticipates,”

“anticipated,” “should,” “could,” “may,” “will,” “designed to,” “foreseeable future,” “believe,” “believes,” “scheduled,” “guidance” and similar

expressions are intended to identify forward-looking statements, although not all forward looking statements contain these words. These

forward-looking statements reflect our current views with respect to future events and financial performance, but involve known and unknown

risks and uncertainties, both general and specific to the matters discussed in this presentation. These risks and uncertainties may cause our

actual results to be materially different from any future results expressed or implied by such forward-looking statements. In addition to the risks

disclosed under “Risk Factors” contained in our Annual Report on Form 10-K for the year ended December 31, 2015, and our other filings with the

Securities and Exchange Commission from time to time, such risks and uncertainties include:

changes in general economic conditions, the real estate industry and the markets in which we operate;

difficulties in our ability to evaluate, finance, complete and integrate acquisitions, developments and expansions successfully;

our liquidity and refinancing demands;

our ability to obtain or refinance maturing debt;

our ability to maintain compliance with covenants contained in our debt facilities;

availability of capital;

our failure to maintain effective internal control over financial reporting and disclosure controls and procedures;

increases in interest rates and operating costs, including insurance premiums and real property taxes;

risks related to natural disasters;

general volatility of the capital markets and the market price of shares of our capital stock;

our failure to maintain our status as a REIT;

changes in real estate and zoning laws and regulations;

legislative or regulatory changes, including changes to laws governing the taxation of REITs;

litigation, judgments or settlements;

our ability to maintain rental rates and occupancy levels;

competitive market forces; and

the ability of manufactured home buyers to obtain financing and the level of repossessions by manufactured home lenders.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was

made. We undertake no obligation to publicly update or revise any forward-looking statements included in this presentation, whether as a

result of new information, future events, changes in our expectations or otherwise, except as required by law. Although we believe that the

expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or

achievements. All written and oral forward-looking statements attributable to us or persons acting on our behalf are qualified in their entirety by

these cautionary statements.

1

227 manufactured housing only communities

27 manufactured housing and recreational vehicle communities

85 recreational vehicle only communities

339 communities

consisting of

approximately

117,000 sites across 29

states and Ontario

79,945

manufactured

housing sites

37,307

recreational

vehicle

sites

20,833

(56%)

annual /

seasonal

16,474

(44%)

transient

Source: Company Information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter-ended September 30, 2016 for additional information.

Current Portfolio

As of September 30, 2016

4,938

1,521

682

149

1,370

24,591

3,009

1,277

916

1,187

2,913

549

1,652

698

237

672

418

1,150

404

413

976

226

2,335

473

7,534

43,348

4,614

324

5,275

2

SUN COMMUNITIES, INC. (NYSE: SUI)

895 total homes sold, an increase of 43.0%,

as compared to the third quarter of 2015

Revenue producing sites increased by 292

sites for the quarter bringing total portfolio

occupancy to 96.2%1, up ~250 basis points

from the third quarter of 2015

Same-community Net Operating Income

grew to $86.6 million, an increase of 6.0% as

compared to the third quarter of 2015

Subsequent to the Carefree acquisition, 4

communities with 964 sites located in CO, MI,

NY and VA were acquired for $41 million

$330.7 million of net proceeds were raised in

equity offerings, with the majority of these

proceeds used to pay down the line of credit

Q3 2016 HIGHLIGHTS

9/30/16 6/30/16 9/30/15

Revenue $249.7 $190.8 $185.4

EPS

(Diluted)

$0.27 -$0.12 $0.53

FFO/Share

(Diluted)

$1.13 $0.85 $1.05

Petoskey Motorcoach Resort

Petoskey, MI

Acquired September 2016

Source: Company Information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended September 30, 2016 for additional information. Refer to information regarding

non-GAAP financial measures starting on page 20 of the attached Appendix.

1 Inclusive of 100% occupancy for annual RV rentals and 95.2% occupancy for MH

Financial Data – Three Months Ended

(in millions except for EPS)

4 3

5

Royal Palm Village

Haines City, FL

6

Resident Resales Home Move-out

1 Source: Company Information. 5 year average.

4.9% 5.1% 4.7% 4.9% 4.6%

5.0%

5.9%

6.5%

2.8%

2.3% 2.3% 2.5% 2.6% 2.6% 2.0% 1.9%

2009 2010 2011 2012 2013 2014 2015 Q3 2016

Sun’s Resident Move-out Trends

SUN’S FAVORABLE REVENUE DRIVERS

Cost to move a home ranges from $4K-10K,

resulting in low move-out of homes

Tenure of homes in our communities is ~43 years1

Tenure of residents in our communities is ~13

years1

5

Castaways RV Resort

Berlin, MD

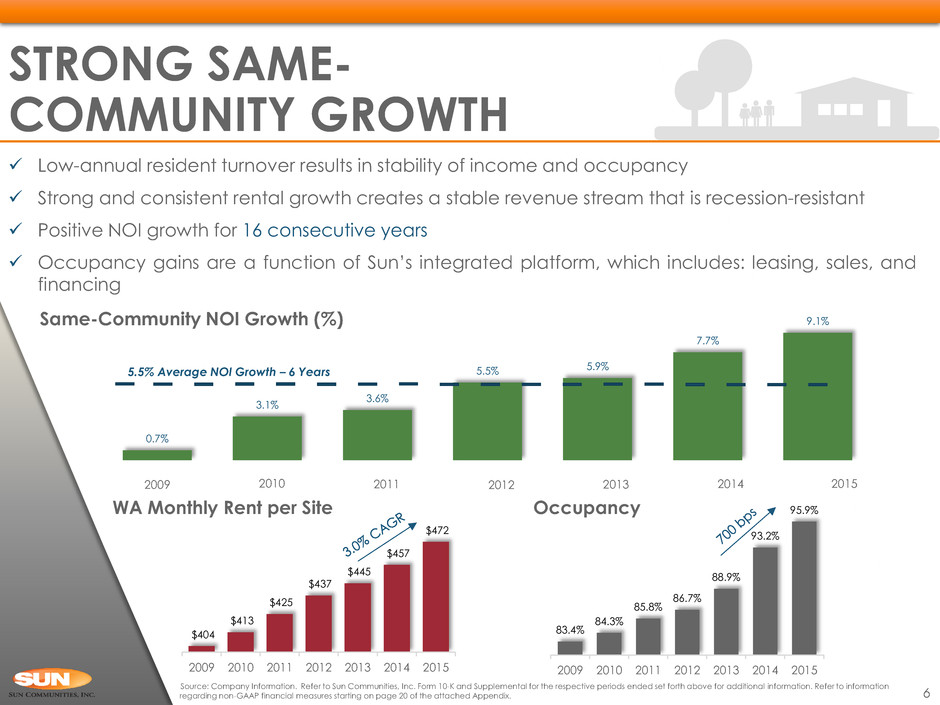

Low-annual resident turnover results in stability of income and occupancy

Strong and consistent rental growth creates a stable revenue stream that is recession-resistant

Positive NOI growth for 16 consecutive years

Occupancy gains are a function of Sun’s integrated platform, which includes: leasing, sales, and

financing

Source: Company Information. Refer to Sun Communities, Inc. Form 10-K and Supplemental for the respective periods ended set forth above for additional information. Refer to information

regarding non-GAAP financial measures starting on page 20 of the attached Appendix.

Same-Community NOI Growth (%)

Occupancy WA Monthly Rent per Site

0.7%

3.1%

3.6%

5.5% 5.9%

7.7%

9.1%

$404

$413

$425

$437

$445

$457

$472

2009 2010 2011 2012 2013 2014 2015

83.4%

84.3%

85.8%

86.7%

88.9%

93.2%

95.9%

2009 2010 2011 2012 2013 2014 2015

2009 2010 2011 2012 2013 2014 2015

5.5% Average NOI Growth – 6 Years

STRONG SAME-

COMMUNITY GROWTH

6

Inventory of approximately 10,500 zoned and entitled sites available for

expansion at 66 communities in 18 states and Ontario

Approximately 750 sites are expected to be developed by the end of 2016

A 100 site expansion at a $25,000 cost per site, that is leased up in a year (8

sites/month), results in an unlevered return of 13%-15%

1

Primarily building in communities with strong demand evidenced by

occupancies >95%

Expansion lease-up is driven by sales, rental and relocation programs

SSource: Company Information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended September 30, 2016 for additional information. on most

Friendly Village Simi

Simi Valley, CA

The Reserve at Fox Creek

Bullhead City, AZ

EXPANSIONS PROVIDE STRONG GROWTH

AND ATTRACTIVE RETURNS

7

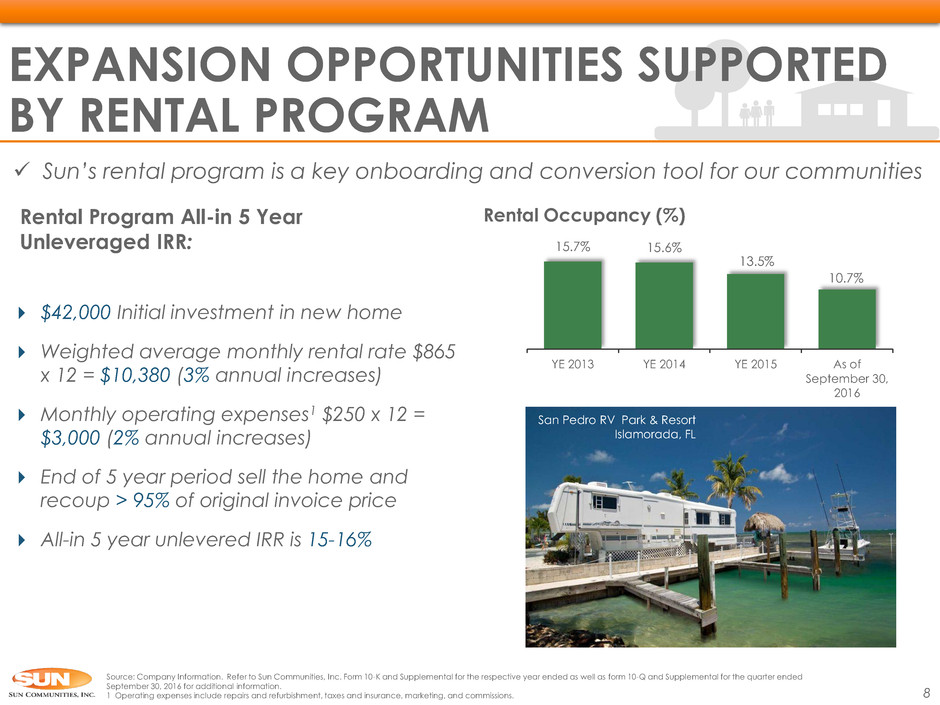

Rental Program All-in 5 Year

Unleveraged IRR:

$42,000 Initial investment in new home

Weighted average monthly rental rate $865

x 12 = $10,380 (3% annual increases)

Monthly operating expenses1 $250 x 12 =

$3,000 (2% annual increases)

End of 5 year period sell the home and

recoup > 95% of original invoice price

All-in 5 year unlevered IRR is 15-16%

EXPANSION OPPORTUNITIES SUPPORTED

BY RENTAL PROGRAM

Source: Company Information. Refer to Sun Communities, Inc. Form 10-K and Supplemental for the respective year ended as well as form 10-Q and Supplemental for the quarter ended

September 30, 2016 for additional information.

1 Operating expenses include repairs and refurbishment, taxes and insurance, marketing, and commissions.

Sun’s rental program is a key onboarding and conversion tool for our communities

15.7% 15.6%

13.5%

10.7%

YE 2013 YE 2014 YE 2015 As of

September 30,

2016

Rental Occupancy (%)

San Pedro RV Park & Resort

Islamorada, FL

8

STRATEGIC ACQUISITIONS

PROFESSIONAL

OPERATIONAL

MANAGEMENT

CALL CENTER /

DIGITAL

MARKETING

OUTREACH

INCREASING

MARKET RENT

ADDING VALUE

WITH

EXPANSIONS

REPOSITIONING

WITH

ADDITIONAL

CAPEX

SKILLED EXPENSE

MANAGEMENT

EXTRACTING VALUE FROM ACQUISITIONS

HOME SALES /

RENTAL

PROGRAM

9

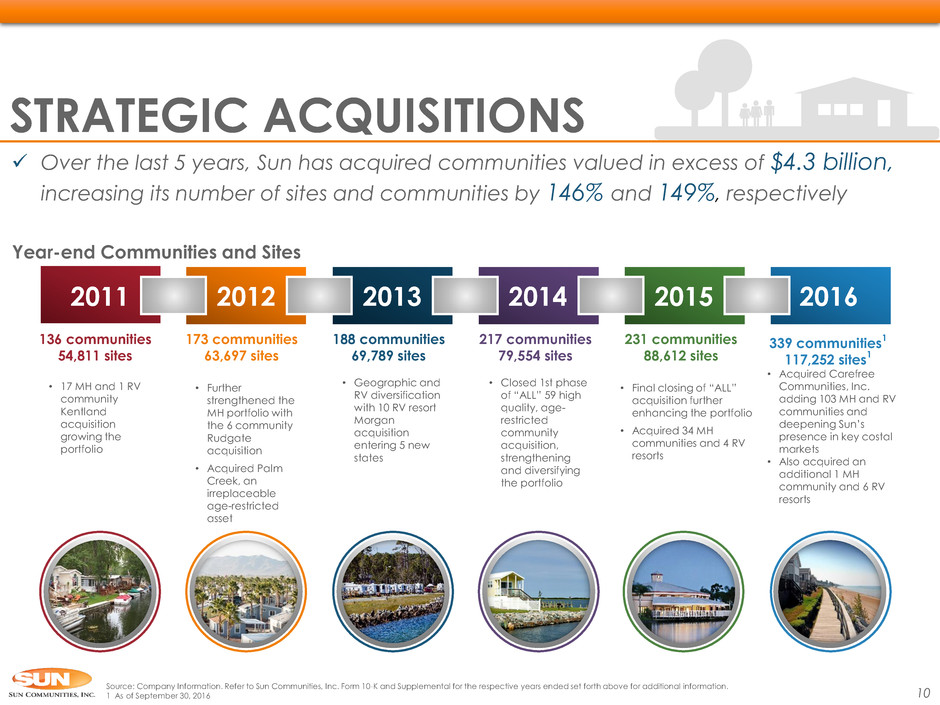

2011 2012 2013 2014 2015 2016

136 communities

54,811 sites

• 17 MH and 1 RV

community

Kentland

acquisition

growing the

portfolio

173 communities

63,697 sites

• Further

strengthened the

MH portfolio with

the 6 community

Rudgate

acquisition

• Acquired Palm

Creek, an

irreplaceable

age-restricted

asset

188 communities

69,789 sites

• Geographic and

RV diversification

with 10 RV resort

Morgan

acquisition

entering 5 new

states

217 communities

79,554 sites

• Closed 1st phase

of “ALL” 59 high

quality, age-

restricted

community

acquisition,

strengthening

and diversifying

the portfolio

231 communities

88,612 sites

• Final closing of “ALL”

acquisition further

enhancing the portfolio

• Acquired 34 MH

communities and 4 RV

resorts

Source: Company Information. Refer to Sun Communities, Inc. Form 10-K and Supplemental for the respective years ended set forth above for additional information.

1 As of September 30, 2016

Over the last 5 years, Sun has acquired communities valued in excess of $4.3 billion,

increasing its number of sites and communities by 146% and 149%, respectively

339 communities1

117,252 sites1

• Acquired Carefree

Communities, Inc.

adding 103 MH and RV

communities and

deepening Sun’s

presence in key costal

markets

• Also acquired an

additional 1 MH

community and 6 RV

resorts

STRATEGIC ACQUISITIONS

Year-end Communities and Sites

10

ONTARIO, CANADA

4,888

189

757

15,909

5,032

92

398

307

With the Carefree acquisition Sun has

deepened its presence in key high-barrier

markets

Carefree Property Additions

Sun Communities Properties

POST-TRANSACTION

FL 43,438 37.0%

TX 7,534 6.4%

CA 5,275 4.5%

ON 4,938 4.2%

AZ 4,614 3.9%

NJ 3,009 2.6%

MA 682 0.6%

NC 672 0.6%

Other 47,090 40.2%

TOTAL 117,252 100.0%

Increased

Age-restricted

Portfolio

by over

60%

Source: Company Information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter-ended September 30, 2016 for additional information

KEY MARKET PENETRATION FROM

CAREFREE ACQUISITION

11

Sherkston Shores

Ontario, Canada

Sunset Harbor

Key West, FL

ACQUISITION PROFITABILITY

13

Source: Company Information. Refer to Sun Communities, Inc. Form 10-K and Supplemental for the respective periods ended set forth above for additional information. Refer to information regarding non-GAAP

financial measures starting on page 20 of the attached Appendix.

1 Inclusive of ancillary and home sale operations

2011 Acquisitions

(26 Communities)

640 bps increase in occupancy

to 97.6% in 3 years

28.9

32.7

35.6

15.6

20.0

22.8

YEAR 1 YEAR 2 YEAR 3

Revenue NOI

36.4

38.8

42.0

24.0

26.3

29.1

YEAR 1 YEAR 2 YEAR 3

Revenue NOI

11.0

13.3

14.6

4.5

6.1

7.0

YEAR 1 YEAR 2 YEAR 3

Revenue NOI

1

2012 Acquisitions

(11 Communities)

2013 RV Acquisitions

(10 Communities)

110 bps increase in

occupancy to 97.9% in 3

years

($ in millions)

Jellystone Western NY

North Java, NY

Lake in Wood RV Resort

Narvon, PA

Jellystone Park at Birchwood

Greenfield Park, NY

1 1 1

2

14

Sun’s annual mortgage maturities average 4.2% over the next 4 years

WEIGHTED AVERAGE

INTEREST RATE

CMBS $531,366 5.23%

Fannie Mae $1,095,397 4.36%

Freddie Mac $334,059 3.95%

Life Companies $894,009 3.80%

Total $2,854,831 4.30%

PRINCIPAL

OUTSTANDING

1

$11.4

$140.6

$102.5

$118.3

YE 2016 YE 2017 YE 2018 YE 2019 YE 2020

Life Companies Freddie Mac Fannie Mae Commercial Mortgage-backed Securities

$112.6

Palos Verdes Shores

San Pedro, CA

Castaways RV Resort & Campground

Berlin, MD

MORTGAGE DEBT MATURITY PROFILE

Source: Company Information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended September 30, 2016 for additional information.

1 Includes premium / discount on debt and financing costs 14

($ in thousands as of September 30, 2016) ($ in millions as of September 30, 2016)

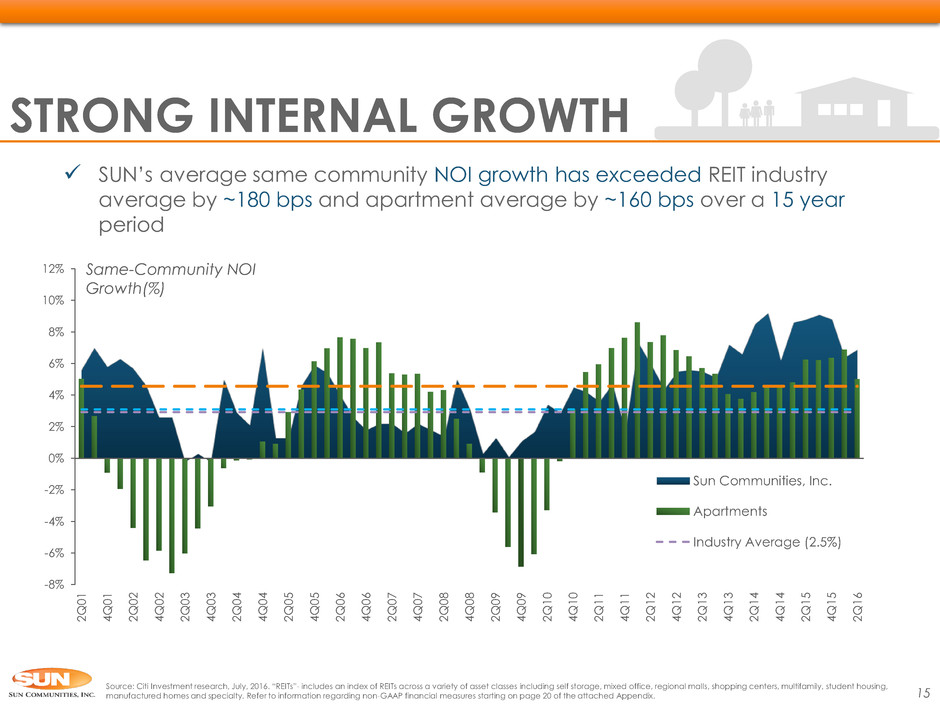

Source: Citi Investment research, July, 2016. “REITs”- includes an index of REITs across a variety of asset classes including self storage, mixed office, regional malls, shopping centers, multifamily, student housing,

manufactured homes and specialty. Refer to information regarding non-GAAP financial measures starting on page 20 of the attached Appendix.

SUN’s average same community NOI growth has exceeded REIT industry

average by ~180 bps and apartment average by ~160 bps over a 15 year

period

-8%

-6%

-4%

-2%

0%

2%

4%

6%

8%

10%

12%

2

Q

0

1

4

Q

0

1

2

Q

0

2

4

Q

0

2

2

Q

0

3

4

Q

0

3

2

Q

0

4

4

Q

0

4

2

Q

0

5

4

Q

0

5

2

Q

0

6

4

Q

0

6

2

Q

0

7

4

Q

0

7

2

Q

0

8

4

Q

0

8

2

Q

0

9

4

Q

0

9

2

Q

1

0

4

Q

1

0

2

Q

1

1

4

Q

1

1

2

Q

1

2

4

Q

1

2

2

Q

1

3

4

Q

1

3

2

Q

1

4

4

Q

1

4

2

Q

1

5

4

Q

1

5

2

Q

1

6

Sun Communities, Inc.

Apartments

Industry Average (2.5%)

Same-Community NOI

Growth(%)

STRONG INTERNAL GROWTH

15

5-Year Total Return Percentage

Source: SNL Financial as of September 30, 2016.

10-Year Total Return Percentage

+191%

+108%

+113%

+467%

+101%

+83%

Sun has significantly outperformed major REIT and broader

market indices over the last ten years

STRATEGY-DRIVEN

OUTPERFORMANCE

-50

0

50

100

150

200

250

SUI S&P 500 RMS

-100

0

100

200

300

400

500

600

SUI S&P 500 RMS

16

APPENDIX

Lakeside Crossing

Conway, SC

Gwynn’s Island RV Resort

Gwynn Island, VA

Palm Creek Golf & RV Resort

Casa Grande, AZ

Ocean Breeze Resort

Jensen Beach, FL

CONSISTENT NOI

GROWTH

Manufactured housing is one of the most recession-resistant sectors of

the housing and commercial real estate sectors and has consistently

outperformed multi-family in same-site NOI growth since 20001

Source: SNL Financial as of September 30, 2016. Refer to information regarding non-GAAP financial measures starting on page 20 of the attached Appendix.

$90

$110

$130

$150

$170

$190

$210

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

SUI

Manufactured

Housing

Apartment

Industrial

Mall

17

Sun’s

Manufactured

Homes

VS.

Sun’s manufactured homes provide nearly 15% more space at over 30% less

cost per square foot

RENT

~$860

1 per month

Multi-Family

Housing

~$1,1002 per month

SQUARE FOOTAGE

PRICE

~1,2501 sq. ft. ~1,1002 sq. ft.

$0.69 per sq. ft. $1.00 per sq. ft.

1 Source: Company Information. Refer to Sun Communities, Inc. Form 10-K and supplemental for the year ended December 31, 2015 for additional information.

2 Source: The RentPath Network. Represents average rent for a 2 bedroom apartment in major metropolitan areas Sun operates in as of February 2016.

MANUFACTURED HOUSING VS.

MULTI-FAMILY

18

1 Source: Manufactured Housing Institute, Quick Facts: “Trends and Information About the Manufactured Housing Industry, 2016.” Represents average 2 bedroom household in major

metropolitan areas Sun operates in as of September 2016.

2 Source: US Census Bureau - 2010-2014 American Community Survey 5-Year Estimates. $54,900 represents the median household income in major metropolitan areas Sun operates in.

Single-family Homes Manufactured Homes

Average cost of Single Family1 is $276,284 or

roughly 5 years median income

Sun’s communities offer affordable options in attractive locations

Average cost of a new Manufactured Home is

$68,000 or roughly 1 years median income

$206,560 $207,950

$223,085

$249,429 $261,172

$276,284

$-

$50,000

$100,000

$150,000

$200,000

$250,000

$300,000

$350,000

$400,000

$450,000

$500,000

Single-family Portion of purchase price attributable to land

$62,800 $60,500 $62,200 $64,000 $65,300 $68,000

Manufactured

Median

Household

Income2

2010 2011 2012 2013 2014 2015

MANUFACTURED HOUSING VS.

SINGLE FAMILY

19

Funds from operations (FFO) represents net income (loss) (computed in accordance with GAAP) and gain (loss) on sales of depreciable

property, plus real estate related depreciation and amortization (excluding amortization of financing costs), and after adjustments for

unconsolidated partnerships and joint ventures, as defined by the National Association of Real Estate Investment Trusts (NAREIT). We

consider FFO an appropriate supplemental measure of the financial and operational performance of an equity REIT. Under the definition,

management also uses FFO excluding certain items, a non-GAAP financial measure, which excludes certain gain and loss items that

management considers unrelated to the operational and financial performance of our core business. We believe that this provides

investors with another financial measure of our operating performance that is more comparable when evaluating period over period

results.

Net operating income (NOI) is derived from revenues minus property operating and maintenance expenses and real estate taxes. We use

NOI as the primary basis to evaluate the performance of our operations. We believe that NOI is helpful to investors and analysts as a

measure of operating performance because it is an indicator of the return on property investment and provides a method of comparing

property performance over time. We use NOI as a key management tool when evaluating performance and growth of particular

properties and/or groups of properties. The principal limitation of NOI is that it excludes depreciation, amortization, interest expense, and

non-property specific expenses such as general and administrative expenses, all of which are significant costs, and therefore, NOI is a

measure of the operating performance of our properties rather than of the Company overall. We believe that these costs included in net

income often have no effect on the market value of our property and therefore limit its use as a performance measure. In addition, such

expenses are often incurred at a parent company level and therefore are not necessarily linked to the performance of a real estate asset.

Recurring earnings before interest, tax, depreciation and amortization (Recurring EBITDA) is defined as NOI plus other income, plus (minus)

equity earnings (loss) from affiliates, minus general and administrative expenses. EBITDA includes EBITDA from discontinued operations.

Recurring EBITDA provides a further tool to evaluate ability to incur and service debt and to fund dividends and other cash needs.

FFO, NOI, and Recurring EBITDA do not represent cash generated from operating activities in accordance with GAAP and are not

necessarily indicative of cash available to fund cash needs, including the repayment of principal on debt and payment of dividends and

distributions. FFO, NOI, and Recurring EBITDA should not be considered as alternatives to net income (loss) (calculated in accordance with

GAAP) for purposes of evaluating our operating performance, or cash flows (calculated in accordance with GAAP) as a measure of

liquidity. FFO, NOI, and Recurring EBITDA as calculated by us may not be comparable to similarly titled, but differently calculated,

measures of other REITs or to the definition of FFO published by NAREIT.

NON-GAAP TERMS DEFINED

20

Reconciliation of Net Income Attributable to Sun Communities, Inc. Common Stockholders to Funds from Operations

(amounts in thousands except for per share data)

2016 2015 2016 2015 2015 2014 2013

Net income attributable to Sun Communities, Inc. common stockholders 18,897$ 28,763$ 18,969$ 47,926$ 137,325$ 22,376$ 10,610$

Adjustments:

Preferred return to preferred OP units 616 — 1,858 — 2,612 281 2,764

Amounts attributable to noncontrolling interests 685 1,174 255 1,554 9,644 1,086 718

Preferred distribution to Series A-4 preferred stock 683 1,666 — — — 76 —

Depreciation and amortization 61,809 45,014 159,225 130,247 178,048 134,252 111,083

Asset impairment charge — — — — — 837 —

Gain on disposition of properties, net — (18,190) — (26,946) (125,376) (17,654) —

Gain on disposition of assets, net (4,667) (2,937) (12,226) (7,065) (10,125) (6,705) (7,592)

Funds from operations (FFO) attributable to Sun Communities, Inc. common

stockholders and dilutive convertible securities 78,023 55,490 168,081 145,716 192,128 134,549 117,583

Adjustments:

Transaction costs 4,191 1,664 27,891 13,150 17,803 18,259 3,928

Other acquisition related costs 1,467 — 1,467 — — — —

Income from affiliate transactions (500) — (500) (7,500) (7,500) — —

Gain on settlement — — — — — (4,452) —

Preferred stock redemption costs — 4,328 — 4,328 4,328 — —

Extinguishment of debt — — — 2,800 2,800 — —

Income tax expense - reduction of deferred tax asset — — — — 1,000 — —

FFO attributable to Sun Communities, Inc. common stockholders and dilutive

convertible securities excluding certain items 83,181$ 61,482$ 196,939$ 158,494$ 210,559$ 148,356$ 121,511$

Weighted average common shares outstanding - basic 68,655 53,220 63,716 52,855 53,686 41,337 34,228

Weighted average common shares outstanding - fully diluted 73,667 58,365 68,031 56,054 57,979 44,022 37,657

FFO attributable to Sun Communities, Inc. common stockholders and dilutive

convertible securities per Share - fully diluted 1.06$ 0.95$ 2.47$ 2.60$ 3.31$ 3.06$ 3.12$

FFO attributable to Sun Communities, Inc. common stockholders and dilutive

convertible securities per Share excluding certain items - fully diluted 1.13$ 1.05$ 2.89$ 2.83$ 3.63$ 3.37$ 3.22$

Three Months Ended Nine Months Ended

September 30, September 30,

Year Ended

December 31,

21

Reconciliation of Net Operating Income to Net Income Attributable to Sun Communities, Inc. Common Stockholders

(amounts in thousands)

2016 2015 2016 2015 2015 2014 2013

Real Property NOI 114,851$ 90,312$ 296,081$ 254,438$ 335,567$ 232,478$ 203,176$

Rental Program NOI 21,213 20,587 64,223 62,805 83,232 70,232 58,481

Home Sales NOI/Gross profit 9,276 5,605 23,184 14,914 20,787 13,398 14,555

Ancillary NOI/Gross profit 7,907 5,575 11,194 7,325 7,013 5,217 1,151

Site rent from Rental Program (included in Real Property NOI) (15,532) (15,762) (46,164) (46,440) (61,952) (54,289) (46,416)

NOI/Gross profit 137,715 106,317 348,518 293,042 384,647 267,036 230,947

Adjustments to arrive at net income:

Other revenues 5,689 4,449 15,459 13,592 18,157 15,498 13,622

Home selling expenses (3,553) (1,910) (8,689) (5,397) (7,476) (5,235) (4,546)

General and administrative (16,575) (12,670) (46,910) (36,944) (47,455) (37,387) (31,308)

Transaction costs (4,191) (1,664) (27,891) (13,150) (17,803) (18,259) (3,928)

Depreciation and amortization (61,483) (44,695) (159,565) (130,107) (177,637) (133,726) (110,078)

Asset impairment charge — — — — — (837) —

Extinguishment of debt — — — (2,800) (2,800) — —

Interest expense (34,589) (28,243) (90,885) (82,022) (110,878) (76,981) (76,577)

Gain on disposition of properties, net — 18,190 — 26,946 125,376 17,654 —

Gain on settlement — — — — — 4,452 —

Provision for state income taxes (283) (77) (567) (229) (158) (219) (234)

Income tax expense - reduction of deferred tax asset — — — — (1,000) — —

Income from affiliate transactions 500 — 500 7,500 7,500 1,200 2,250

Net income 23,230 39,697 29,970 70,431 170,473 33,196 20,148

Less: Preferred return to preferred OP units 1,257 1,302 3,793 3,692 4,973 2,935 2,764

Less: Amounts attributable to noncontrolling interests 879 2,125 460 3,132 10,054 1,752 718

Net income attributable to Sun Communities, Inc. 21,094 36,270 25,717 63,607 155,446 28,509 16,666

Less: Preferred stock distributions 2,197 3,179 6,748 11,353 13,793 6,133 6,056

Less: Preferred stock redemption costs — 4,328 — 4,328 4,328 — —

Net income attributable to Sun Communities, Inc., common stockholders 18,897$ 28,763$ 18,969$ 47,926$ 137,325$ 22,376$ 10,610$

Year Ended

December 31, September 30, September 30,

Three Months Ended Nine Months Ended

22

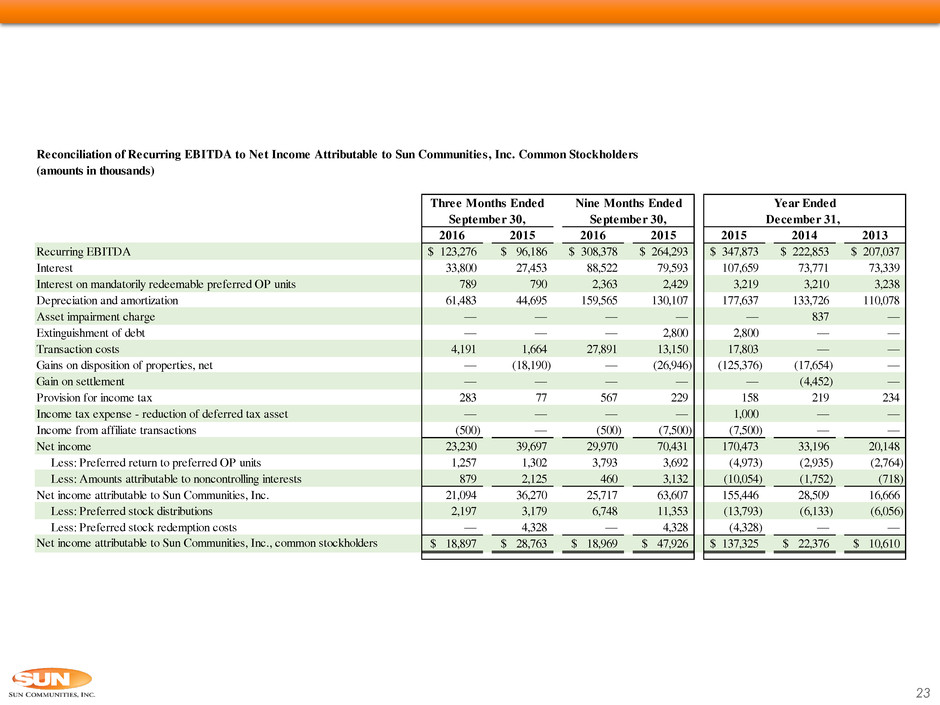

Reconciliation of Recurring EBITDA to Net Income Attributable to Sun Communities, Inc. Common Stockholders

(amounts in thousands)

2016 2015 2016 2015 2015 2014 2013

Recurring EBITDA 123,276$ 96,186$ 308,378$ 264,293$ 347,873$ 222,853$ 207,037$

Interest 33,800 27,453 88,522 79,593 107,659 73,771 73,339

Interest on mandatorily redeemable preferred OP units 789 790 2,363 2,429 3,219 3,210 3,238

Depreciation and amortization 61,483 44,695 159,565 130,107 177,637 133,726 110,078

Asset impairment charge — — — — — 837 —

Extinguishment of debt — — — 2,800 2,800 — —

Transaction costs 4,191 1,664 27,891 13,150 17,803 — —

Gains on disposition of properties, net — (18,190) — (26,946) (125,376) (17,654) —

Gain on settlement — — — — — (4,452) —

Provision for income tax 283 77 567 229 158 219 234

Income tax expense - reduction of deferred tax asset — — — — 1,000 — —

Income from affiliate transactions (500) — (500) (7,500) (7,500) — —

Net income 23,230 39,697 29,970 70,431 170,473 33,196 20,148

Less: Preferred return to preferred OP units 1,257 1,302 3,793 3,692 (4,973) (2,935) (2,764)

Less: Amounts attributable to noncontrolling interests 879 2,125 460 3,132 (10,054) (1,752) (718)

Net income attributable to Sun Communities, Inc. 21,094 36,270 25,717 63,607 155,446 28,509 16,666

Less: Preferred stock distributions 2,197 3,179 6,748 11,353 (13,793) (6,133) (6,056)

Less: Preferred stock redemption costs — 4,328 — 4,328 (4,328) — —

Net income attributable to Sun Communities, Inc., common stockholders 18,897$ 28,763$ 18,969$ 47,926$ 137,325$ 22,376$ 10,610$

September 30,

Three Months Ended Nine Months Ended

September 30,

Year Ended

December 31,

23

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Agents Win Again! Epique Realty Amazes with Incredible Last Benefit Reveal at PowerCON: Delta Dental and Vision

- Robbins LLP Reminds LYFT Stockholders of Pending May 6, 2024 Lead Plaintiff Deadline

- DiCello Levitt LLP Announces Investor Class Action Lawsuit Filed Against Perion Network Ltd. (Nasdaq: Peri) and Lead Plaintiff Deadline

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share