Form 8-K SUN BANCORP INC /NJ/ For: Aug 02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

|

|

|

CURRENT REPORT

FORM 8-K

|

|

|

|

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) August 2, 2016

|

|

|

|

CURRENT REPORT

SUN BANCORP, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

CURRENT REPORT

| New Jersey | 0-20957 | 52-1382541 | ||

|

(State or other jurisdiction of incorporation) |

(SEC Commission File No.) |

(I.R.S. Employer Identification No) |

|

350 Fellowship Road, Suite 101, Mount Laurel, New Jersey |

08054 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (856) 691 - 7700

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

| Item 7.01 |

Regulation FD Disclosure

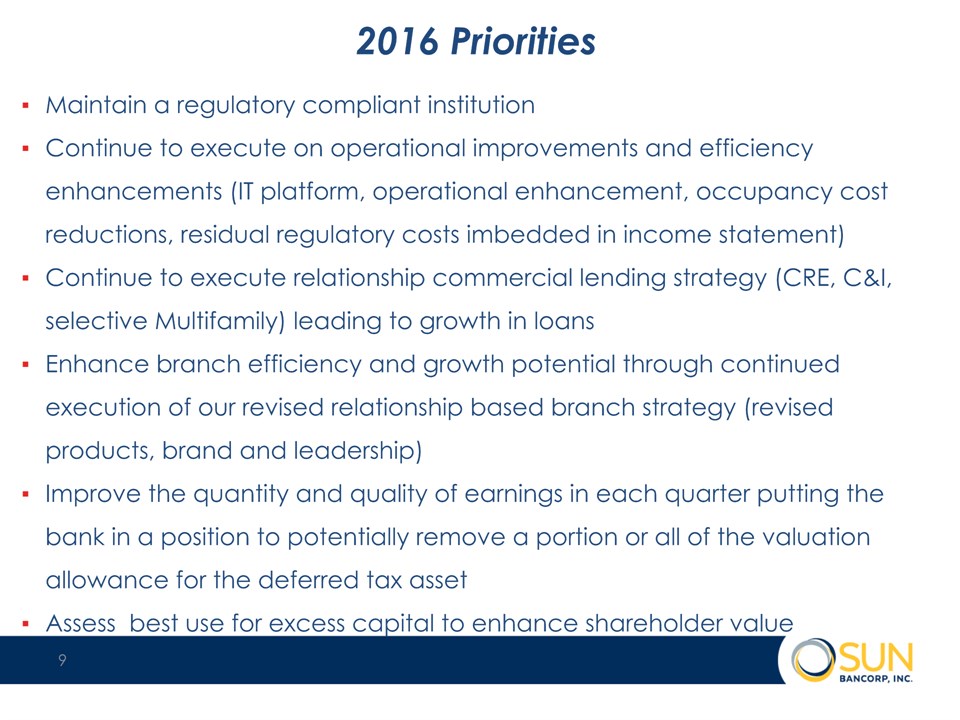

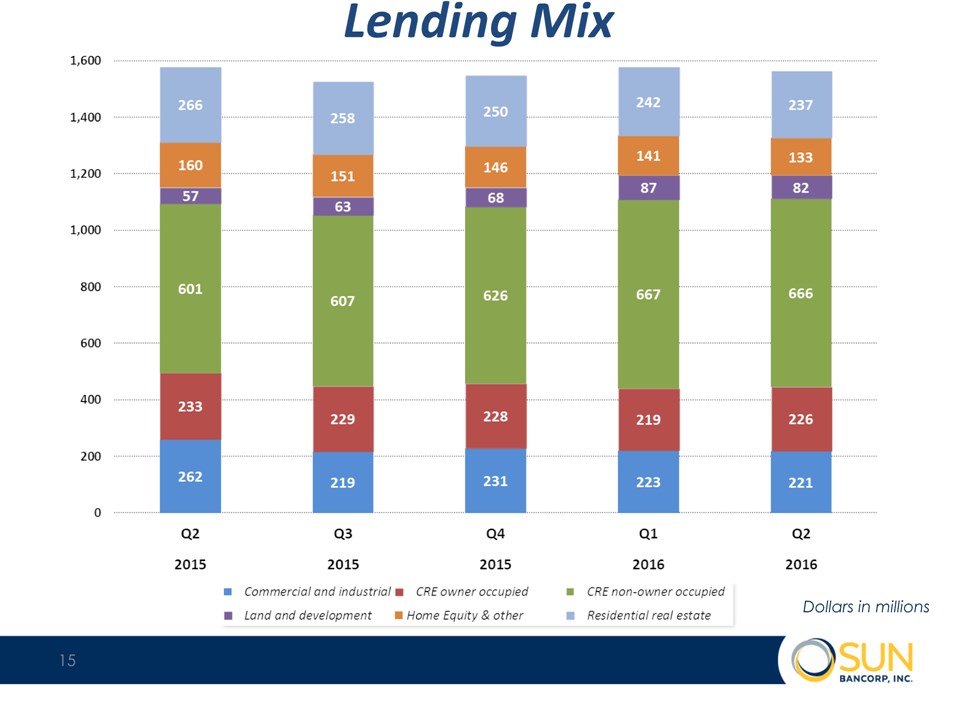

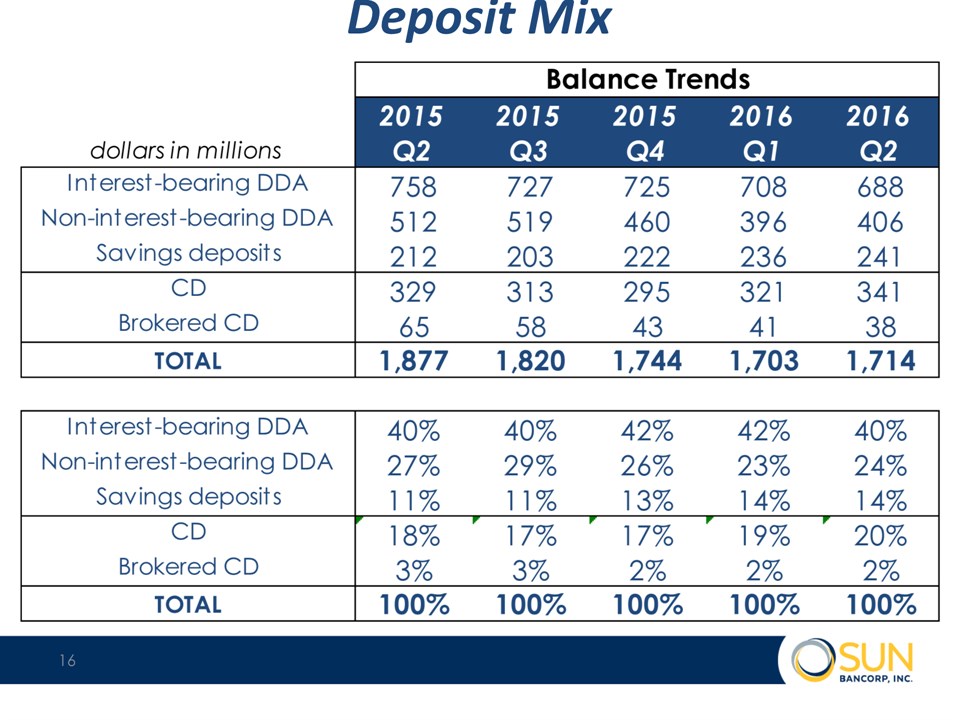

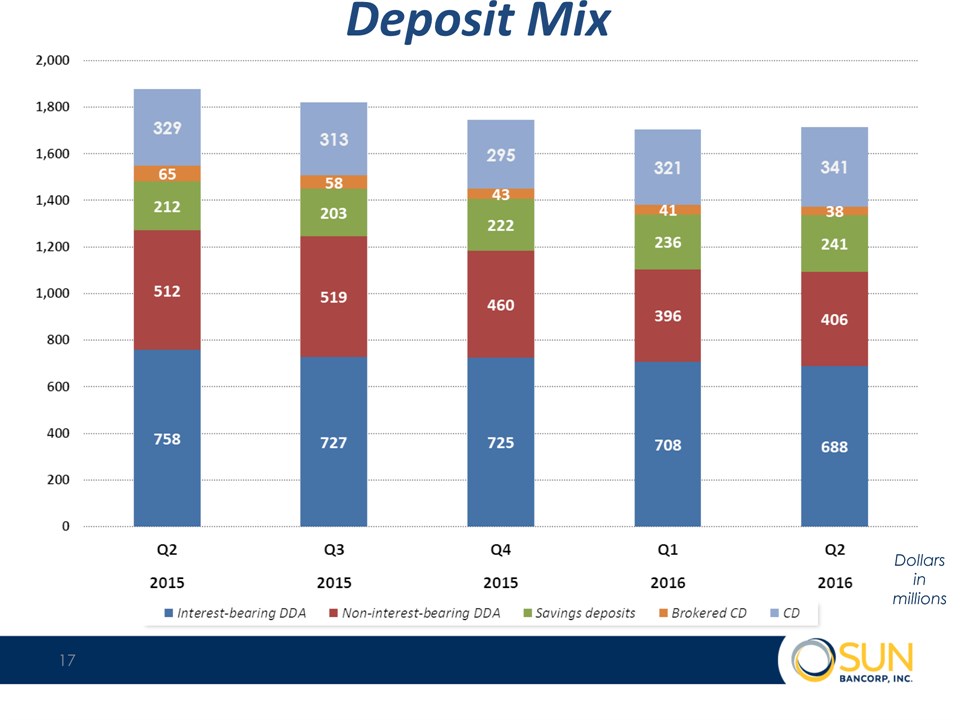

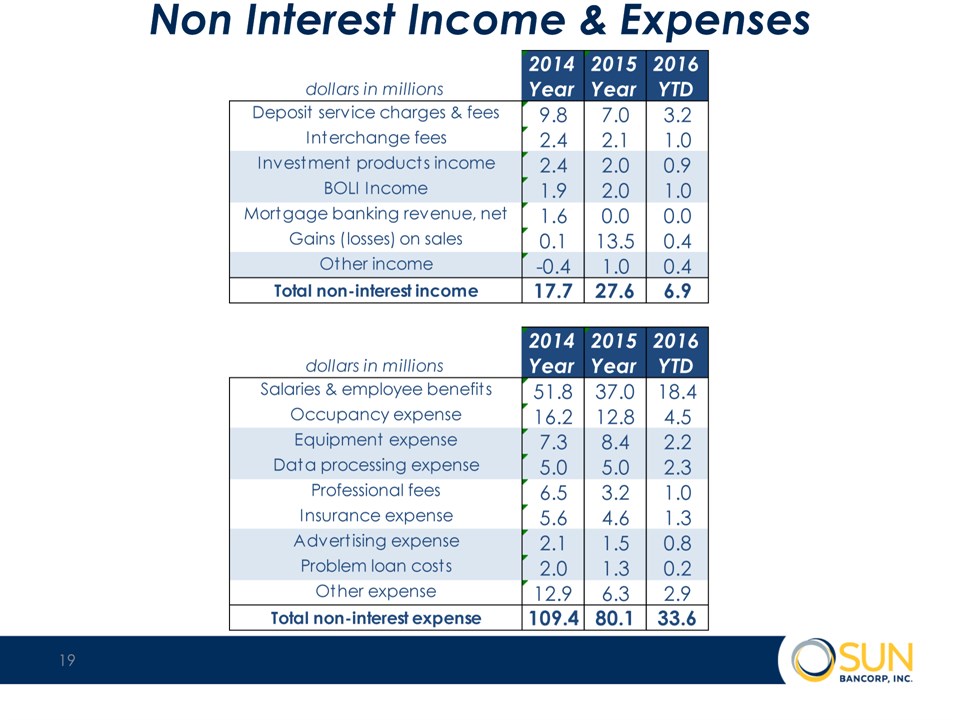

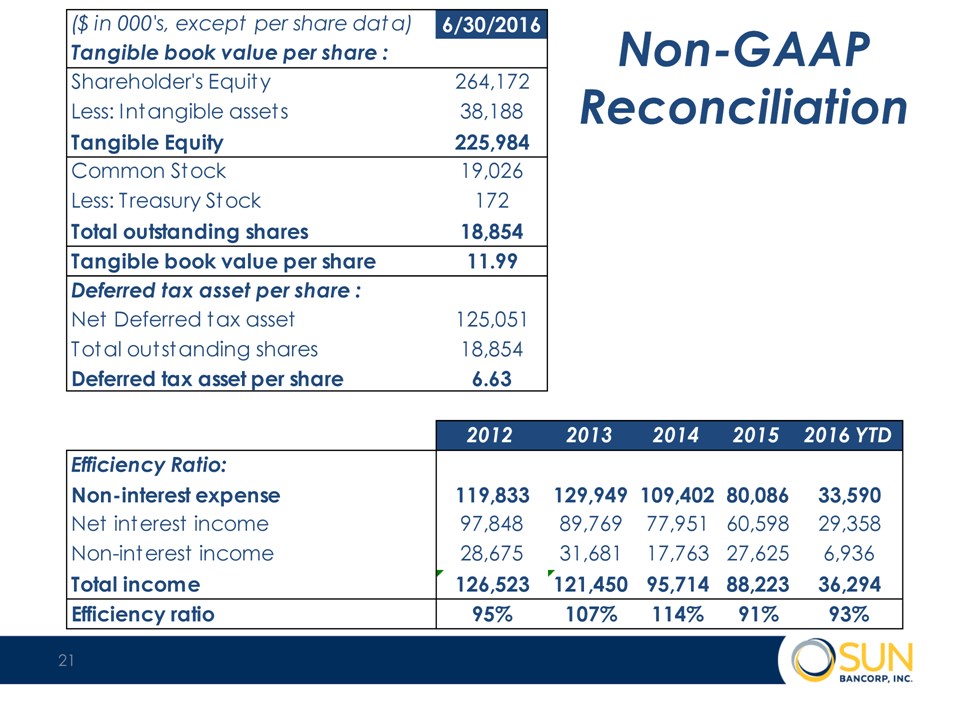

On August 2, 2016, Sun Bancorp, Inc. (the "Company") will distribute copies of a presentation regarding the Company to investors and analysts at the Keefe, Bruyette & Woods 2016 Community Bank Investor Conference in New York City. A copy of the presentation is attached hereto as Exhibit 99 and is incorporated herein by reference.

The information contained under Item 7.01 of this Current Report on Form 8-K, including the attached presentation, is being furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall such information be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as shall be specifically set forth in such filing.

|

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits:

Exhibit 99 KBW Presentation

-1-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, hereunto duly authorized.

| SUN BANCORP, INC. | ||||||

| Date: August 2, 2016 |

/s/ Patricia M. Schaubeck |

|||||

| Patricia M. Schaubeck | ||||||

| Executive Vice President and General Counsel | ||||||

-2-

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Glow Announces Late Filing of Financial Statements

- SPACEMOBILE ALERT: Bragar Eagel & Squire, P.C. Announces that a Class Action Lawsuit Has Been Filed Against AST SpaceMobile, Inc. and Encourages Investors to Contact the Firm

- Telescope Innovations Presents Results of Second Fiscal Quarter 2024

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share