Form 8-K STURM RUGER & CO INC For: May 03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

May 3, 2016

STURM, RUGER & COMPANY, INC.

(Exact Name of Registrant as Specified in its Charter)

|

DELAWARE (State or Other Jurisdiction of Incorporation) |

001-10435 (Commission File Number) |

06-0633559 (IRS Employer Identification Number) |

| ONE LACEY PLACE, SOUTHPORT, CONNECTICUT | 06890 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code (203) 259-7843

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Page 1 of 4

| Item 8.01 | Other Events. |

The Company is furnishing its presentation delivered at its 2016 Annual Meeting of Stockholders on Tuesday, May 3, 2016 (the “Annual Meeting Presentation”). The Annual Meeting Presentation is attached as Exhibit 99.1 to this Current Report on Form 8-K and shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section. The disclosure of the Annual Meeting Presentation on this Current Report on Form 8-K will not be deemed an admission as to the materiality of any information in this Current Report on Form 8-K that is required to be disclosed by Regulation FD.

The Company does not have, and expressly disclaims, any obligation to release publicly any updates or any changes in the Annual Meeting Presentation or its expectations or any change in events, conditions, or circumstances on which any forward-looking statement is based.

The Annual Meeting Presentation is available on the Company’s website at www.ruger.com/corporate. The Company reserves the right to discontinue that availability at any time.

| Item 9.01 | Financial Statements and Exhibits. |

| Exhibit No. | Description |

| 99.1 | The Annual Meeting Presentation, delivered at the Company’s Annual Meeting of Stockholders on May 3, 2016. |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| STURM, RUGER & COMPANY, INC. | |||

| By: | /S/ THOMAS A. DINEEN | ||

| Name: | Thomas A. Dineen | ||

| Title: | Principal Financial Officer, | ||

| Principal Accounting Officer, | |||

| Vice President, Treasurer and | |||

| Chief Financial Officer | |||

Dated: May 3, 2016

3

EXHIBIT 99.1

Caution: Forward Looking Statements Statements made in the course of this meeting that state the Company’s or Management’s intentions, hopes, beliefs, expectations or predictions of the future are forward - looking statements. It is important to note that the Company’s actual results could differ materially from those projected in such forward - looking statements. Additional information concerning factors that could cause actual results to differ materially from those in the forward - looking statements is contained from time to time in the Company’s SEC filings, including but not limited to the Company’s reports on Form 10 - K for the year ended December 31, 2015 and Form 10 - Q for the fiscal quarter ended April 2, 2016. Copies of these documents may be obtained by contacting the Company or the SEC or on the Company website at www.ruger.com /corporate/ or the SEC website at www.sec.gov . We reference non - GAAP EBITDA. Please note that the reconciliation of GAAP net income to non - GAAP EBITDA can be found in our Form 10 - K for the year ended December 31, 2015 and our Form 10 - Q for the quarter ended April 2 , 2016, which are also posted on our website . Furthermore , the Company disclaims all responsibility to update forward - looking statements .

- 100 200 300 400 500 600 700 2012 2011 2010 2009 2008 2007 2013 Q1 2016 2014 2015 Quarterly Sell - Through (in Thousands of Units)

Quarterly Financial Results (in Millions, Except EPS) 2016 2015 Q1 Q4 Q3 Q2 Q1 Revenues $173.1 $152.4 $120.9 $140.9 $137.0 Gross Margin $59.1 $48.2 $34.0 $48.5 $41.4 Operating Profit $36.2 $26.0 $18.0 $26.7 $23.8 21% 17% 15% 19% 17% EPS $1.21 $0.88 $0.62 $0.91 $0.81 EBITDA $44.8 $36.0 $27.1 $36.2 $33.2 26% 24% 22% 26% 24% Trailing 12 - Months Ending April 2, 2016 Sales $581 Million Operating Profit 18% EBITDA 23% EPS $3.61 EBITDA PER SHARE $7.12

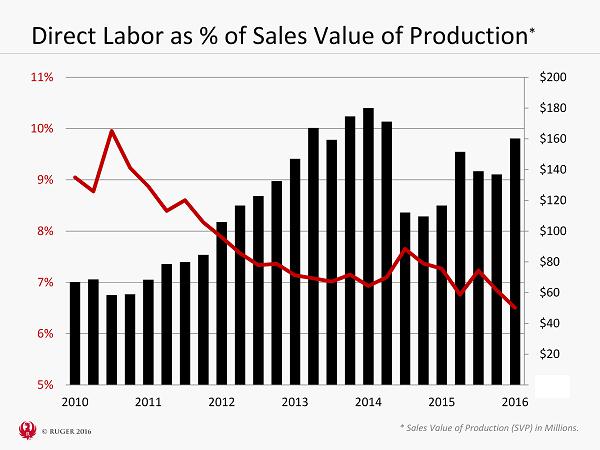

Direct Labor as % of Sales Value of Production * $- $20 $40 $60 $80 $100 $120 $140 $160 $180 $200 5% 6% 7% 8% 9% 10% 11% 2010 2011 2012 2013 2014 2015 2016 * Sales Value of Production (SVP) in Millions.

Non - Personnel Overhead as a % of SVP * $- $20 $40 $60 $80 $100 $120 $140 $160 $180 $200 0% 5% 10% 15% 20% 25% 2010 2011 2012 2013 2014 2015 2016 * Sales Value of Production (SVP) in Millions.

U.S. Firearm Availability (In Millions of Units) 0 2 4 6 8 10 12 14 16 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Interim

Monthly Adjusted NICS (In Thousands) - 500 1,000 1,500 2,000 2,500 December 2011 December 2010 December 2012 December 2013 December 2014 December 2015

Trends in Retail Demand The adjusted National Instant Criminal Background Check System data presented above was adjusted by the National Shooting Sports Foundation to eliminate background checks associated with permit checks rather than firearm sales. 600 800 1,000 1,200 1,400 1,600 1,800 2,000 2,200 8 10 12 14 16 18 20 22 24 Distributor Sell - Through NICS Checks Ruger 184% Growth Since 2008 NICS 58% Growth Since 2008 2012 2011 2010 2009 2008 2013 2014 2015

Raw & WIP Inventory Turns (Based on Cost of SVP) - 1 2 3 4 5 6 7 8 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 I mprovement in i nventory t urns has a llowed us to avoid the growth in Raw & WIP inventory. Over the past 5 years, we avoided growth in $19 m illion in Raw & WIP inventory. Over the past 10 years, we avoided growth in $175 m illion in Raw & WIP inventory.

- 100 200 300 400 500 600 700 2012 2011 2010 2009 2008 2007 2013 Q1 2016 2014 2015 Quarterly Sell - Through (in Thousands of Units) Q1 2014 Q3 2014 Q3 2015 Sell - Through 9,100/day

Quarterly Finished Goods Unit Inventory (in Thousands) 0 50 100 150 200 250 300 350 400 Ruger 72,800 2014 2013 2012 2011 2010 2015 Q1 2016

Quarterly Finished Goods Unit Inventory (in Thousands) 0 50 100 150 200 250 300 350 400 Ruger 72,800 Distributors 216,700 2014 2013 2012 2011 2010 2015 Q1 2016

Quarterly Finished Goods Unit Inventory (in Thousands) 0 50 100 150 200 250 300 350 400 Ruger 72,800 Target Distributor Inventory At 6 turns = 315,000 Distributors 216,700 2014 2013 2012 2011 2010 2015 Q1 2016

Disciplined Stock Repurchases Total Dollars Total Shares Price Per Share Q3 2006 $25.2 4,272,000 $5.90 Q4 2007 $20.0 2,216,000 $8.99 Q3 & Q4 2008 $10.2 1,535,000 $6.57 Q3 2010 to Q1 2011 $7.7 545,400 $14.10 Q4 2015 & Q1 2015 $26.7 762,100 $35.15 Total $89.8 9,330,500 $9.62

Disciplined Stock Repurchases $- $10 $20 $30 $40 $50 $60 $70 $80 - 2 4 6 8 10 12 Feb-09 Jul-09 Dec-09 May-10 Oct-10 Mar-11 Aug-11 Jan-12 Jun-12 Nov-12 Apr-13 Sep-13 Feb-14 Jul-14 Dec-14 May-15 Oct-15 Mar-16 Stock Price TTM EBITDA Multiple $26.7 Million 762,100 Shares $ 35.15/Share $7.7 Million 545,400 Shares $ 14.10/Share

Cash (in Millions) -$15 $5 $25 $45 $65 $85 $105 $125 Special Dividend - $87 Million Stock Repurchase - $25 Million Stock Repurchase - $20 Million Stock Repurchase - $27 M illion 2012 2011 2010 2009 2008 2007 2013 Q1 2016 2014 2015 2006

Variable Quarterly Dividends (in Millions) $- $2 $4 $6 $8 $10 $12 $14

Recent 5 - Year Returns: Ruger vs. Russell 2000 0% 200% 400% 600% 800% 1000% 1200% 1400% 2010 2011 2012 2013 2014 2015

Investor Communications We anticipate releasing 2016 quarterly earnings and holding investor conference calls on the following dates: Earnings Release Conference Call Q2 2016 August 2, 2016 August 3, 2016 Q3 2016 November 1, 2016 November 2, 2016 Q4 2016 February 21, 2017 February 22, 2017

Caution: Forward Looking Statements Statements made in the course of this meeting that state the Company’s or Management’s intentions, hopes, beliefs, expectations or predictions of the future are forward - looking statements. It is important to note that the Company’s actual results could differ materially from those projected in such forward - looking statements. Additional information concerning factors that could cause actual results to differ materially from those in the forward - looking statements is contained from time to time in the Company’s SEC filings, including but not limited to the Company’s reports on Form 10 - K for the year ended December 31, 2015 and Form 10 - Q for the fiscal quarter ended April 2, 2016. Copies of these documents may be obtained by contacting the Company or the SEC or on the Company website at www.ruger.com /corporate/ or the SEC website at www.sec.gov . We reference non - GAAP EBITDA. Please note that the reconciliation of GAAP net income to non - GAAP EBITDA can be found in our Form 10 - K for the year ended December 31, 2015 and our Form 10 - Q for the quarter ended April 2 , 2016, which are also posted on our website . Furthermore , the Company disclaims all responsibility to update forward - looking statements .

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Sturm, Ruger & Company, Inc. to Report First Quarter 2024 Financial Results on Tuesday, May 7

- LA Wine Country Stylish Wedding Transportation, Luxury Limousines Available

- UPM Interim Report Q1 2024: A positive start to the year, growth investments contributed to earnings

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share